Filed Pursuant to Rule 424(b)(5)

Registration No. 333-272954

PROSPECTUS SUPPLEMENT

(To Prospectus dated August 11, 2023)

Kaixin Auto Holdings

10,500,000 Class A Ordinary Shares

Pursuant to this prospectus supplement and the

accompanying prospectus and a securities purchase agreement dated October 30, 2023 (the “Securities Purchase Agreement”),

we are offering 10,500,000 Class A Ordinary Shares of the Company, par value of US$0.00075 per share, at a purchase price of US$0.87

per share to Mr. Long Li, Hermann Limited and Aslan Family Limited (together, the “Investors”). In a concurrent private placement,

we are also selling to such investors the warrants to purchase up to 10,500,000 shares of our Class A Ordinary Shares at an exercise

price of US$1.00 per warrant (the “Warrants”). The Warrants and the shares of our Class A Ordinary Shares issuable upon the

exercise of the Warrants (the “Warrant Shares”) are not being registered at this time pursuant to the exemption provided

in Section 4(a)(2) under the Securities Act of 1933, as amended (the “Securities Act”), and they are not being offered pursuant

to this prospectus supplement and the accompanying prospectus. Nothing contained herein shall constitute an offer to sell or the solicitation

of an offer to buy any Warrant Shares.

For a more detailed description of the Ordinary

Shares and the Warrants, see the section entitled “Description Of Securities We Are Offering” on page S-20.

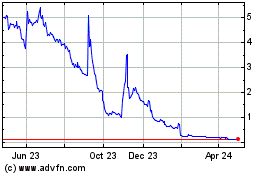

Our Ordinary Shares are listed on the Nasdaq Capital

Market under the symbol “KXIN.” On October 25, 2023, the closing price of our Ordinary Shares on the Nasdaq Capital Market

was US$1.12 per Ordinary Share.

In this prospectus supplement, “we,”

“us,” “our company,” “the Company” and “our” refer to Kaixin Auto Holdings and its subsidiaries

and consolidated affiliated entities, and in the context of describing our consolidated financial information.

Investing in our securities involves a significant

degree of risk. See “Risk Factors” beginning on page S-6 of this prospectus supplement and in our other filings with the

Securities and Exchange Commission incorporated by reference in this prospectus supplement and the accompanying prospectus to read about

factors you should consider before purchasing our Ordinary Shares.

We are not an operating company in China, but

a Cayman Islands holding company. We conduct our operations in China through our PRC subsidiaries. Investors of our ordinary shares are

not purchasing equity interest in our operating entities in China but instead are purchasing equity interest in a Cayman Islands holding

company.

We face various legal and operational risks and

uncertainties associated with being based in or having our operations primarily in China and the complex and evolving PRC laws and regulations.

For instance, we face risks associated with regulatory approvals on offerings conducted overseas by and foreign investment in China-based

issuers, anti-monopoly regulatory actions, and oversight on cybersecurity and data privacy. These risks could result in a material adverse

change in our operations and the value of our ordinary shares, significantly limit or completely hinder our ability to offer or continue

to offer securities to investors, or cause the value of such securities to significantly decline. For a detailed description of risks

related to doing business in China, see “Item 3. Key Information — D. Risk Factors — Risks Related to Doing Business

in China” on page 34 to 54 of our most recent annual report on Form 20-F.

PRC government’s significant authority in

regulating our operations and its oversight and control over offerings conducted overseas by, and foreign investment in, China-based

issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors. Implementation

of industry-wide regulations in this nature may cause the value of such securities to significantly decline or be of little or no value.

For more details, see “Item 3. Key Information — D. Risk Factors — Risks Related to Doing Business in China —

The Chinese government exerts substantial influence over the manner in which we must conduct our business activities. We are currently

not required to obtain approval from Chinese authorities to issue securities to foreign investors, however, if our subsidiaries or the

holding company were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges,

we will not be able to continue listing on U.S. exchange, which would materially affect the interest of the investors.” included

in our most recent annual report on Form 20-F.

As of the date of this prospectus

supplement, our Company and the subsidiaries have not been involved in any investigations or review initiated by any PRC regulatory authority,

not has any of them received any inquiry, notice or sanction for the business operation, accepting foreign investment or listing on the

Nasdaq Stock Market. However, since these statements and regulatory actions by China’s government are newly published, official

guidance and related implementation rules have not been issued. It is highly uncertain what future impact such modified or new laws and

regulations will have on our daily business operations, the ability to accept foreign investments and our continued listing on the Nasdaq

Stock Market. There are also substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations

and rules regarding the status of the rights of us with respect to our assets and business operations in China. If we are found to be

in violation of any existing or future PRC laws or regulations, or fail to obtain or maintain any of the required permits or approvals,

the relevant PRC regulatory authorities would have broad discretion to take action in dealing with such violations or failures. See “Item

3. Key Information — D. Risk Factors — Risks Related to Our Corporate Structure — Substantial uncertainties exist with

respect to the interpretation and implementation of the PRC Foreign Investment Law, and it may materially and adversely affect the viability

of our current corporate structure, corporate governance and business operations.” on page 33 of our most recent annual report

on Form 20-F.

In addition, as of the date

of this prospectus supplement, except for business license, foreign investment information report to the commerce administrative authority

and foreign exchange registration or filing, our consolidated affiliated Chinese entities do not have to obtain any requisite licenses

and permits from the PRC government authorities that are material for the business operations of our holding company and our subsidiaries

in China. However, given the uncertainties of interpretation and implementation of relevant laws and regulations and the enforcement

practice by government authorities, we may be required to obtain certain licenses, permits, filings or approvals for the functions and

services that we provided in the future.

Our subsidiaries are subject to certain legal

and operational risks associated with being based in China. PRC laws and regulations governing the subsidiaries’ current business

operations are sometimes vague and uncertain, and as a result these risks may result in material change in the operations of our subsidiaries,

significant depreciation of the value of our ordinary shares, a complete hindrance of our ability to offer or continue to offer our securities

to investors, or cause the value of such securities to significantly decline or be worthless. See “Item 3. Key Information - D.

Risk Factors - Risks Related to Doing Business in China - Uncertainties with respect to the PRC legal system could adversely affect us.”

on page 40 of our most recent annual report on Form 20-F. In the past few years, PRC government adopted a series of regulatory actions

and issued statements to regulate business operations in China, including those related to data security, and anti-monopoly concerns.

For example, On June 10, 2021, the Standing Committee of the National People’s Congress of China (the “SCNPC”), promulgated

the PRC Data Security Law, which took effect in September 2021. The PRC Data Security Law imposes data security and privacy obligations

on entities and individuals carrying out data activities, and introduces a data classification and hierarchical protection system based

on the importance of data in economic and social development, and the degree of harm it will cause to national security, public interests,

or legitimate rights and interests of individuals or organizations when such data is tampered with, destroyed, leaked, illegally acquired

or used. The PRC Data Security Law also provides for a national security review procedure for data activities that may affect national

security and imposes export restrictions on certain data an information. Moreover, the Anti-monopoly Law promulgated by the SCNPC requires

that transactions which are deemed concentrations and involve parties with specified turnover thresholds must be cleared by the anti-monopoly

enforcement agency before they can be completed. Furthermore, the Measures for the Security Review of Foreign Investment promulgated

by the NDRC and the Ministry of Commerce in December 2020 specify that foreign investments in military, national defense-related areas

or in locations in proximity to military facilities, or foreign investments that would result in acquiring the actual control of assets

in certain key sectors, such as critical agricultural products, energy and resources, equipment manufacturing, infrastructure, transport,

cultural products and services, information technology, Internet products and services, financial services and technology sectors, are

required to obtain approval from designated governmental authorities in advance.

Our subsidiaries that operate online platforms

in the PRC will be recognized as online platform operators. Therefore, the Revised Measures of Cybersecurity Review shall apply to such

online platform operators. As of the date of this prospectus supplement, for an “online platform operator” that is in possession

of personal data of more than one million users intends to list in a foreign country, it must apply for a cybersecurity review. See “Item

3. Key Information - D. Risk Factors - Risks Related to Doing Business in China - The Chinese government exerts substantial influence

over the manner in which we must conduct our business activities. We are required to file with the CSRC within 3 working days after the

subsequent securities offering is completed and we might face warnings or fines if we fail to fulfill related filing procedure. We may

become subject to more stringent requirements with respect to matters including cross-border investigation and enforcement of legal claims.”

on page 34 to 37 of our most recent annual report on Form 20-F.

Historically, as a Cayman Islands holding company,

we conduct our operations in China through our PRC subsidiaries and the VIEs (as defined in the accompanying prospectus). We had relied

on contractual arrangements among our PRC subsidiaries, the VIEs and their shareholders to receive economic benefits from the business

operations of the VIEs in PRC in which we have no equity ownership. To mitigate the uncertainties in our corporate structure and exert

full control on our operating entities, we transferred the operations in the VIEs to our wholly-owned entities and terminated all the

contractual arrangements relating to the VIEs in 2022. As a result, there is no VIE entity in our corporate structure and as of the date

of this prospectus supplement, we conduct our operations exclusively through our wholly-owned subsidiaries.

In addition, our Ordinary Shares may be prohibited

from trading on a national exchange or over-the-counter under the Holding Foreign Companies Accountable Act (“HFCA Act”)

if the Public Company Accounting Oversight Board (United States) (the “PCAOB”) is unable to inspect our auditor for three

consecutive years. Our current auditor, Onestop Assurance PAC (“Onestop”), and our prior auditor for the 2020 and 2021 annual

reports, Marcum Asia CPAs LLP (Formerly known as Marcum Bernstein & Pinchuk LLP), or Marcum Asia, the independent registered public

accounting firms that issued our financial reports incorporated by reference in this prospectus supplement or included in our most recent

annual report on Form 20-F, are registered with the PCAOB. The PCAOB conducts regular inspections to assess their compliance with the

applicable professional standards. Onestop and Marcum Asia are headquartered in Singapore and New York, respectively. On December 16,

2021, the PCAOB issued a report notifying the SEC of its determinations (the “PCAOB Determinations”) that they are unable

to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong. The report

sets forth lists identifying the registered public accounting firms headquartered in mainland China and Hong Kong, respectively, that

the PCAOB is unable to inspect or investigate completely, and as of the date of this prospectus supplement, Onestop and Marcum Asia are

not included in the list of PCAOB Identified Firms in the PCAOB Determinations issued on December 16, 2021. On August 26, 2022, the China

Securities Regulatory Commission (the “CSRC”), the Ministry of Finance of the PRC (the “MOF”), and the PCAOB

signed a Statement of Protocol (the “Protocol”), governing inspections and investigations of audit firms based in China and

Hong Kong. Pursuant to the Protocol, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation

and has the unfettered ability to transfer information to the U.S. Securities and Exchange Commission. On December 15, 2022, the PCAOB

announced that it was able to secure complete access to inspect and investigate completely registered public accounting firms headquartered

in mainland China and Hong Kong and voted to vacate its previous determinations issued in December 2021. As such, we do not expect to

be identified as a “Commission-Identified Issuer” under the HFCA Act for the fiscal year ended December 31, 2022. Notwithstanding

the foregoing, in the event it is later determined that the PCAOB is unable to inspect or investigate completely our auditor, then such

lack of inspection could cause our securities to be delisted from Nasdaq Stock Market. In addition, whether the PCAOB will continue be

able to conduct inspections and investigations completely to its satisfaction of PCAOB-registered public accounting firms headquartered

in mainland China and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditors’ control,

including positions taken by authorities of the PRC. The PCAOB is expected to continue to demand complete access to inspections and investigations

against accounting firms headquartered in mainland China and Hong Kong in the future and states that it has already made plans to resume

regular inspections in early 2023 and beyond. The PCAOB is required under the HFCA Act to make its determination on an annual basis with

regards to its ability to inspect and investigate completely accounting firms based in the mainland China and Hong Kong. The possibility

of being a “Commission-Identified Issuer” and risk of delisting could continue to adversely affect the trading price of our

securities. Should the PCAOB again encounter impediments to inspections and investigations in mainland China or Hong Kong as a result

of positions taken by any authority in either jurisdiction, the PCAOB will make determinations under the HFCA Act as and when appropriate.

On December 29, 2022, the Accelerating Holding Foreign Companies Accountable Act was enacted, which amended the Holding Foreign Companies

Accountable Act, by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor

is not subject to PCAOB inspections for two consecutive years instead of three. See “Risk Factors—Risks Related to Doing

Business in China—If the PCAOB is unable to inspect our auditors as required under the Holding Foreign Companies Accountable Act,

the SEC will prohibit the trading of our shares. A trading prohibition for our shares, or the threat of a trading prohibition, may materially

and adversely affect the value of your investment. Additionally, the inability of the PCAOB to conduct inspections of our auditors, if

any, would deprive our investors of the benefits of such inspections.” of the accompanying prospectus.

We transfer cash to our wholly-owned Hong Kong

subsidiaries, by making capital contributions or providing loans, and the Hong Kong subsidiaries transfer cash to the subsidiaries in

China by making capital contributions or providing loans to them. See “Item 18—Financial Statements” on page 138 of

our most recent annual report on Form 20-F. No dividends or distributions have been declared to pay to the Company from our subsidiaries.

No dividends or distributions were made by the Company to any U.S. investors. The Company does not have any present plan to pay any cash

dividends on its ordinary shares in the foreseeable future. We currently intend to retain most, if not all, of our available funds and

any future earnings to operate and expand our business.

Under PRC laws and regulations, our PRC subsidiaries

are subject to certain restrictions with respect to paying dividends or otherwise transferring any of their net assets to us. Remittance

of dividends by a wholly foreign-owned enterprise out of China is also subject to examination by the banks designated by SAFE. The majority

of the Company’s and our PRC subsidiaries’ income is received in RMB and shortages in foreign currencies may restrict our

ability to pay dividends or other payments, or otherwise satisfy our foreign currency denominated obligations, if any. Under existing

PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures

from trade-related transactions, can be made in foreign currencies without prior approval from SAFE as long as certain procedural requirements

are met. Approval from appropriate government authorities is required if RMB is converted into foreign currency and remitted out of China

to pay capital expenses such as the repayment of loans denominated in foreign currencies. The Chinese government may, at its discretion,

impose restrictions on access to foreign currencies for current account transactions and if this occurs in the future, we may not be

able to pay dividends in foreign currencies to our shareholders. See “Summary of Risk Factors — Risks Related to Doing Business

in China — We may rely on dividends and other distributions on equity paid by our PRC subsidiaries to fund any cash and financing

requirements that we may have, and any limitation on the ability of our PRC subsidiaries to make payments to us could have a material

and adverse effect on our ability to conduct our business.” of the accompanying prospectus; and “Risk Factors — Risks

Related to Doing Business in China — We may rely on dividends and other distributions on equity paid by our PRC subsidiaries to

fund any cash and financing requirements that we may have, and any limitation on the ability of our PRC subsidiaries to make payments

to us could have a material and adverse effect on our ability to conduct our business. Moreover, the Chinese government may, at its discretion,

impose restrictions on access to foreign currencies for current account transactions and if this occurs in the future, we may not be

able to pay dividends in foreign currencies to our shareholders.” of the accompanying prospectus; and “Item 3. Key Information

— D. Risk Factors — Risks Related to Doing Business in China — We may rely on dividends and other distributions on

equity paid by our PRC subsidiaries to fund any cash and financing requirements that we may have, and any limitation on the ability of

our PRC subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business.” on

page 41 of our annual report on Form 20-F for the fiscal year ended December 31, 2022. The Company has not made any dividend payments

in the past and is not planning to make dividend payments in the near future in order to preserve capital to fund business growth. The

amounts restricted include the paid-up capital and the statutory reserve funds of our PRC subsidiaries and historically owned VIEs, totaling

US$7.6 million, US$117.1 million and US$121.7 million as of December 31, 2020, 2021, and 2022, respectively. See “Dividend Distributions

and Cash Transfers within our Organization”.

Moreover, to the extent cash or assets in the

business are in the PRC/Hong Kong or a PRC/Hong Kong entity, the funds or assets may not be available to fund operations or for other

use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of the holding

company or its subsidiaries by the PRC government to transfer cash or assets. See “Summary of Risk Factors—Risks Related

to Our Corporate Structure—Investing in our securities is highly speculative and involves a significant degree of risk as we are

a holding company incorporated in the Cayman Islands and historically operate our business through VIE structure. To the extent cash

or assets in the business are in the PRC/Hong Kong or a PRC/Hong Kong entity, funds or assets may not be available to fund operations

or for other use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability

of the holding company or its subsidiaries by the PRC government to transfer cash or assets.” of the accompanying prospectus; and

“Item 3. Key Information—D. Risk Factors—Our adjustment of corporate structure and business operations and the termination

of contractual arrangement with the VIEs may not be liability-free.” on page 32 of our most recent annual report on Form 20-F.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the

accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus Supplement dated November 7, 2023

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part

is the prospectus supplement, which describes the specific terms of this offering of securities and also adds to and updates information

contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying

prospectus. The second part is the accompanying prospectus included in the registration statement on Form F-3 (No. 333-272954), which was declared effective on August 22, 2023 by the SEC, including the documents incorporated by reference therein, which provides more

general information, some of which may not be applicable to this offering.

This prospectus supplement provides specific details

regarding the offering of our Ordinary Shares. If the description of the offering varies between this prospectus supplement and the accompanying

prospectus, you should rely on the information in this prospectus supplement.

You should rely only on the information contained

or incorporated by reference in this prospectus supplement and the accompanying prospectus or any free writing prospectus provided in

connection with this offering. We have not authorized any other person to provide you with different information. If anyone provides

you with different or inconsistent information, you should not rely on it. You should assume that the information appearing in this prospectus

supplement, the accompanying prospectus and the documents incorporated by reference is accurate only as of their respective dates, regardless

of the time of delivery of this prospectus supplement, the accompanying prospectus or any other offering materials, or any sale of the

Ordinary Shares. Our business, financial condition, results of operations and prospects may have changed since those dates. We are not

making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. Neither this prospectus supplement

nor the accompanying prospectus constitutes an offer, or an invitation on behalf of us to subscribe for and purchase, any of the Ordinary

Shares and may not be used for or in connection with an offer or solicitation by anyone, in any jurisdiction in which such an offer or

solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

It is important for you to read and consider all

the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus in making your investment

decision.

In this prospectus supplement and the accompanying

prospectus, unless otherwise indicated or unless the context otherwise requires, references to:

| |

● |

“we,” “us,” “our company,” “the Company” and “our”

are to Kaixin Auto Holdings, its subsidiaries and its consolidated affiliated entities, as the context requires; |

| |

● |

“China” or the “PRC” are to the People’s Republic of China, excluding,

for the purposes of this prospectus supplement and the accompanying prospectus, Hong Kong, Macau and Taiwan; |

| |

● |

“Ordinary Shares” are to our ordinary shares, including Class A ordinary shares and

Class B ordinary shares, of a par value of US$0.00075 per share; |

| |

● |

“RMB” and “Renminbi” are to the legal currency of China; and |

| |

● |

“US$,” “U.S. dollars” and “dollars” are to the legal currency

of the United States. |

All discrepancies in any table between the amounts

identified as total amounts and the sum of the amounts listed therein are due to rounding.

SPECIAL NOTES REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus supplement,

the accompanying prospectus and the information incorporated by reference herein and therein may contain forward-looking statements that

involve risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. These statements

are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. You can identify

these forward-looking statements by terminology such as “may,” “will,” “expect,” “anticipate,”

“future,” “intend,” “plan,” “believe,” “estimate,” “is/are likely to”

or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections

about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy

and financial needs. These forward-looking statements include statements relating to, among other things:

| · | our

goals and strategies; |

| · | our

future business development, financial conditions and results of operations; |

| · | the

expected growth of our industry in China; |

| · | competition

in our industry; |

| · | relevant

government policies and regulations relating to our industry; |

| · | the

outcome of any current and future litigation or legal or administrative proceedings; and |

| · | other

factors described under “Risk Factors.” |

The forward-looking statements

included in this prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein

are subject to risks, uncertainties and assumptions about our company. Our actual results of operations may differ materially from the

forward-looking statements as a result of the risk factors under “Risk Factors” included elsewhere in this prospectus supplement,

the accompanying prospectus, or the information incorporated by reference herein and therein.

We would like to caution

you not to place undue reliance on these forward-looking statements and you should read these statements in conjunction with the risk

factors disclosed in the documents incorporated by reference herein for a more complete discussion of the risks of an investment in our

securities and other risks outlined in our other filings with the SEC. The forward-looking statements included in this prospectus supplement

or incorporated by reference into this prospectus supplement are made only as of the date of this prospectus supplement or the date of

the incorporated document, and we do not undertake any obligation to update the forward-looking statements except as required under applicable

law.

PROSPECTUS SUPPLEMENT SUMMARY

This prospectus supplement summary highlights

selected information included elsewhere in or incorporated by reference into this prospectus supplement and the accompanying prospectus

and does not contain all the information that you should consider before making an investment decision. You should read this entire prospectus

supplement and the accompanying prospectus carefully, including the “Risk Factors” sections and the financial statements

and related notes and other information incorporated by reference, before making an investment decision.

Our Business

Through our PRC subsidiaries, we are primarily

engaged in the sales of domestic and imported automobiles in the PRC. We are committed to providing a superior car purchase and ownership

experiences to customers.

We are a leading premium used auto dealership

group in China. As of the date of this prospectus supplement, we have three active used car Dealerships covering three cities in China.

On average, our Dealership operators have over ten years of experiences in the used car industry. We provide used car buyers in China

with access to a wide selection of used vehicles across our network of Dealerships, with a focus on premium brands, such as Audi, BMW,

Mercedes-Benz, Land Rover, Bentley, Rolls-Royce, and Porsche. In addition to auto sales, for the convenience of our customers, we also

provide financing channels to customers and other in-network dealers through partnerships with financial institutions.

China is the world’s largest automotive

market both in demand and supply in 2022. China’s used car market is characterized by the lack of brand differentiation and limited

industry consolidation. By integrating the operations and resources of Haitaoche with the used car dealership business, we are engaged

in the sales of both new and used, domestic and imported automobiles. We sourced, marketed and sold approximately 697, 1,814, and 879

vehicles to customers across China in 2020, 2021 and 2022, respectively.

We are actively looking for opportunities to expand

into the business area of electronic vehicles. We have set up the New Energy Vehicles Department in 2021 and delivered the new NEV prototype

to our customer at the end of 2022. We released our new energy vehicle strategic plan on December 1, 2021, and we target to quickly expand

our new energy vehicle team and start with developing commercial new energy vehicles for intra-city and inter-city logistics applications

in the initial stage. In 2023, through acquisition of Morning Star Auto Inc., we further expand our business into new energy vehicle

industry. The POCCO EV business under Morning Star produces the MeiMei and DuoDuo brands of mini electric passenger vehicles. The total

sales volume has exceeded 40,000 units since its start of operations in June 2021, which makes POCCO EV among the top 6 producers of

mini electric vehicles in China.

In addition, we have reached into a strategic

partnership with Beijing Bujia Technology Co., Ltd. (“Bujia”) and obtained a sales order for 5,000 new energy logistics vehicles

with Bujia, a leading automobile logistics service provider in China. It will order a total of RMB1 billion (equivalent to around US$156

million) worth of new energy vehicles from our Company in the next few years. The first model vehicle was delivered to Bujia in July

2022. We aim to continuously establish strategic partnerships with platforms that have big sales potentials and to make customized production

according to customer needs.

The following diagram illustrates

our corporate structure of our principal subsidiaries as of the date of this prospectus supplement:

Corporate Information

Our principal executive office is located at 9/F,

Tower A, Dongjin International Center, Huagong Road, Chaoyang District, Beijing 100015, People’s Republic of China. We maintain

a website at https://ir.kaixin.com/ that contains information about our Company, though no information

contained on our website is part of this prospectus supplement.

Our Risks and Challenges

Investing in our securities entails a significant

level of risk. Before investing in our Ordinary Shares, you should carefully consider all of the risks and uncertainties mentioned in

the section titled “Risk Factors,” as well as all of the other information in this prospectus supplement. The occurrence

of one or more of the events or circumstances described in the section titled “Risk Factors,” alone or in combination with

other events or circumstances, may adversely affect our business, results of operations and financial condition.

Below please find a summary of the principal risks

we face, organized under relevant headings. For a detailed description of the risk factors we may face, see “Item 3. Key Information

— D. Risk Factors” section of our most recent annual report on Form 20-F, which is incorporated by reference in this prospectus

supplement, and the section titled “Risk Factors” in this prospectus supplement.

Risks Related to Our Business and Industry

Risks and uncertainties related to our business and industry include,

but are not limited to, the following:

| · | We

have a history of losses and negative cash flows from operating activities, and we may not

achieve or maintain profitability in the future; |

| · | We

have a limited operating history in the automobile sales business. Our historical financial

and operating performance may not be indicative of, or comparable to, its future prospects

and results of operations; |

| · | Our

Dealerships conduct various aspects of our business, and we face risks associated with our

Dealerships, their employees and other personnel; |

| · | We

may not be able to successfully expand or maintain our network of Dealerships; |

| · | Any

difficulties in identifying, consummating and integrating acquisitions, investments or alliances

may expose us to potential risks and have an adverse effect on our business, results of operations

or financial condition; |

| · | The

quality of the premium used automobiles that our subsidiaries offer is critical to the success

of our business; |

| · | Our

success depends upon the continued contributions of our sales representatives; and |

| · | We

may need additional capital to pursue our business objectives and respond to business opportunities,

challenges or unforeseen circumstances, and financing may not be available on terms acceptable

to us, or at all. |

Risks Related to Our Corporate Structure

Risks and uncertainties related to our corporate structure include,

but are not limited to, the following:

| · | Investing

in our securities is highly speculative and involves a significant degree of risk as we are

a holding company incorporated in the Cayman Islands and historically operate our business

through VIE structure. To the extent cash or assets in the business are in the PRC/Hong Kong

or a PRC/Hong Kong entity, funds or assets may not be available to fund operations or for

other use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions

and limitations on the ability of the holding company or its subsidiaries by the PRC government

to transfer cash or assets. |

| · | Our

adjustment of corporate structure and business operations and the termination of contractual

arrangements with the VIEs may not be liability-free. |

| · | If

the custodians or authorized users of our controlling non-tangible assets, including chops

and seals, fail to fulfill their responsibilities, or misappropriate or misuse these assets,

our business and operations may be materially and adversely affected. |

| · | Substantial

uncertainties exist with respect to the interpretation and implementation of the PRC Foreign

Investment Law, and it may materially and adversely affect the viability of our current corporate

structure, corporate governance and business operations. |

Risks Related to Our Ordinary Shares

Risks and uncertainties related to our Shares include, but are not

limited to, the following:

| · | The

market price movement of our ordinary shares may be volatile; |

| · | The

sale or availability for sale of substantial amounts of our ordinary shares could adversely

affect their market price; and |

| · | Because

we do not expect to pay dividends in the foreseeable future, you must rely on price appreciation

of our ordinary shares for return on your investment. |

Risks Related to Doing Business in China

Risks and uncertainties related to conducting business in China include,

but are not limited to, the following:

| · | The

Chinese government may exercise significant oversight and discretion over the conduct of

business in the PRC and may intervene in or influence our operations at any time, which could

result in a material change in our operations and/or the value of our securities. |

| · | Uncertainties

with respect to the PRC legal system could adversely affect us. The Chinese government may

intervene or influence our operations at any time, or may exert more control over offerings

conducted overseas and foreign investment in China-based issuers, which could result in a

material change in our operations and/or the value of our ordinary shares. In addition, there

are significant risks and uncertainties regarding enforcement of laws in China and rules

and regulations in China can change quickly with little advance notice. |

| · | If

the PCAOB is unable to inspect our auditors as required under the Holding Foreign Companies

Accountable Act, the SEC will prohibit the trading of our shares. A trading prohibition for

our shares, or the threat of a trading prohibition, may materially and adversely affect the

value of your investment. Additionally, the inability of the PCAOB to conduct inspections

of our auditors, if any, would deprive our investors of the benefits of such inspections. |

| · | Chinese

government exerts substantial influence over the manner in which we must conduct our business

activities. We are required to file with the CSRC within 3 working days after the subsequent

securities offering is completed and we might face warnings or fines if we fail to fulfill

related filing procedure. We may become subject to more stringent requirements with respect

to matters including cross-border investigation and enforcement of legal claims. |

| · | PRC

regulation of loans to and direct investment in PRC entities by offshore holding companies

and governmental control of currency conversion may cause a delay in or prevent us from using

offshore funds to make loans or additional capital contributions to our PRC subsidiaries,

which could materially and adversely affect our liquidity and our ability to fund and expand

our business. |

| · | PRC

regulations relating to offshore investment activities by PRC residents may limit the ability

of our PRC subsidiaries to increase their registered capital or distribute profits to us

or otherwise expose us or our PRC resident beneficial owners to liability and penalties under

PRC laws. |

| · | We

face uncertainty with respect to indirect transfers of equity interests in PRC resident enterprises

by their non-PRC holding companies, and heightened scrutiny over acquisition transactions

by the PRC tax authorities may have a negative impact on potential acquisitions that we may

pursue in the future. |

Risks Related to this Offering

In addition to the risks described above, we are subject to risks

related to this offering, including, but are not limited to, the following:

| · | Since

our management will have broad discretion in how we use the proceeds from this offering,

we may use the proceeds in ways with which you disagree. |

| · | Future

sales or the potential for future sales of our securities may cause the trading price of

our ordinary shares to decline and could impair our ability to raise capital through subsequent

equity offerings. |

| · | If

you purchase the securities sold in this offering, you may experience dilution if we issue

additional equity securities in future financing transactions. |

| · | We

do not intend to pay dividends for the foreseeable future. |

| · | As

a company incorporated in the Cayman Islands, we adopted certain home country practices in

relation to corporate governance matters that differ significantly from the Nasdaq Stock

Market listing standards (the “Nasdaq Rules”); these practices may afford less

protection to shareholders than they would enjoy if we complied fully with the relevant listing

standards. |

THE OFFERING

| Issuer |

|

Kaixin Auto Holdings, an exempted company incorporated under the laws of Cayman

Islands. |

| |

|

|

| Securities Offered |

|

10,500,000 Class A Ordinary Shares of the Company, par value of US$0.00075

per share, includes (i) 3,500,000 Class A Ordinary Shares to Mr. Long Li, (ii) 3,500,000 Class A Ordinary Shares to Hermann Limited, and

(iii) 3,500,000 Class A Ordinary Shares to Aslan Family Limited. |

| |

|

|

| Offering Price Per Share |

|

US$0.87. |

| |

|

|

| Ordinary Shares Outstanding Immediately Before the Offering |

|

26,640,013 Ordinary Shares. |

| |

|

|

| Ordinary Shares Outstanding Immediately After the Offering (assuming

no exercise of the Warrants offered by us) |

|

37,140,013 Ordinary Shares. |

| |

|

|

| Concurrent Private Placement on the Warrants Offered |

|

In a concurrent private placement, we shall issue

and sell to the Investors in this offering the Warrants to purchase up to an aggregate of up to 10,500,000 shares of our Class A Ordinary

Shares, which includes (i) the Warrants to purchase a total of 3,500,000 Class A Ordinary Shares to Mr. Long Li, (ii) the Warrants to

purchase a total of 3,500,000 Class A Ordinary Shares to Hermann Limited, and (iii) the Warrants to purchase a total of 3,500,000 Class

A Ordinary Shares to Aslan Family Limited, at an exercise price equal to US$1.00 per share.

We will receive gross proceeds from the concurrent private

placement transaction solely to the extent that such Warrants are exercised. The Warrants will be exercisable immediately commencing

on the closing date of the Securities Purchase Agreement and will expire on the second anniversary of the closing date. The Warrants

and the shares of our Class A Ordinary Shares issuable upon the exercise of the Warrants are not being registered, and are not being

offered pursuant to this prospectus supplement and the accompanying prospectus.

|

| |

|

|

| Proceeds, before expenses, to us |

|

US$9,135,000. |

| |

|

|

| Net Proceeds to us |

|

US$9,104,500. |

| |

|

|

| Use of Proceeds |

|

We anticipate using the net proceeds of this offering primarily for

general corporate purposes and working capital. |

| |

|

|

| Risk Factors |

|

Investing in our securities involves a high degree of risk. For a discussion of factors you should

consider carefully before deciding to invest in our securities, see the information contained in or incorporated by reference under

the heading “Risk Factors” beginning on page S-6 of this prospectus supplement and on page 14 of the accompanying prospectus

and in the other documents incorporated by reference into this prospectus supplement and the accompanying prospectus. |

RISK FACTORS

The following is a summary of certain risks

that should be carefully considered along with the other information contained or incorporated by reference in this prospectus supplement

and the accompanying prospectus. You should carefully consider the risks described below together with the risk factors incorporated

by reference to our annual report on Form 20-F for the fiscal year ended December 31,2022 and the other information contained in this

prospectus supplement and the accompanying prospectus, as updated by our subsequent filings under the Exchange Act. If any of the

following events actually occurs, our business, operating results, prospects, or financial condition could be materially and adversely

affected. The risks described below are not the only ones that we face. Additional risks not presently known to us or that we currently

deem immaterial may also significantly impair our business operations and could result in a complete loss of your investment.

Risks Relating to Doing Business in the PRC

Our business involves the collection, storage,

processing and transmission of a large amount of data, and we are required to comply with PRC and international laws relating to data

privacy and cyber security. The improper use or disclosure of data could have a material and adverse effect on our business and prospects.

Our business collects, storages, processes and

transmits a large quantity of our customers’ business data. We face risks inherent in handling and protecting large volume of data.

In particular, we face a number of challenges relating to unauthorized disclosure, destruction or modification of data, through cybersecurity

breaches, computer viruses.

The PRC regulatory and enforcement regime with

regard to data security and data protection is evolving. We may be required by Chinese governmental authorities to share personal information

and data that we collect to comply with PRC laws relating to cybersecurity. All these laws and regulations may result in additional expenses

to us and subject us to negative publicity which could harm our reputation and negatively affect the trading price of the Securities.

There are also uncertainties with respect to how these laws will be implemented in practice. PRC regulators have been increasingly focused

on regulation in the areas of data security and data protection. For example, in October 2020, the Standing Committee of the National

People’s Congress of China released a draft personal information protection law, or the Draft PI Protection Law, for public comment.

The Draft PI Protection Law provides for various requirements on personal information protection, including legal bases for data collection

and processing, requirements on data localization and cross-border data transfer, requirements for consent and requirements on processing

of sensitive personal information. As the Draft PI Protection Law remains subject to change, we may be required to make further adjustments

to our business practices to comply with the enacted form of the law.

Moreover, different regulatory bodies in China,

including the Ministry of Industry and Information Technology, or the MIIT, the Cyberspace Administration of China, or CAC, the Ministry

of Public Security and the SAMR, have enforced data privacy and protection laws and regulations with various standards and applications.

These various standards in enforcing data privacy and protection laws may create difficulties in ensuring full compliance and increase

our operating cost, as we need to spend time and resources to deal with various inspections for compliance.

Cybersecurity and Data Security

PRC authorities have promulgated a number of laws

and regulations relating to cybersecurity and data security in the past year. In June 2021, the Standing Committee of the National People’s

Congress or the NPC promulgated the Data Security Law, which took effect on September 1, 2021. In July 2021, the state council promulgated

the Regulations on the Protection of Critical Information Infrastructure, which became effective on September 1, 2021. In December 2021,

the CAC, together with other authorities, jointly promulgated the Cybersecurity Review Measures, which became effective on February 15,

2022. These laws and regulations impose cybersecurity review obligations on critical information infrastructure operators and network

platform operators. Under the Regulations on the Protection of Critical Information Infrastructure, “critical information infrastructure”

is defined as those network facilities or information systems that may endanger national security, people’s livelihoods and the

public interest if such facilities or systems were to experience data breaches, damage, or system malfunctions. In particular, the network

facilities or information systems used in certain critical industries or sectors (such as telecommunications, energy, transportation,

finance, public services and national defense) are considered critical information infrastructure. Critical information infrastructure

operators, as determined and notified by the applicable governing authorities, are required to undergo cybersecurity reviews if they

procure network products and services which could affect the security of their information infrastructure, network or data.

In addition to the currently effective laws and

regulations described above, PRC authorities may adopt additional laws and regulations in the future that further heighten the regulation

of data security. For example, in November 2021, the CAC released a consultation draft of the Regulations on Network Data Security Management,

or the Draft Network Data Security Regulations, for public comment. These regulations create cybersecurity review obligations for data

processors, which are broadly defined as individuals or organizations that have discretion in deciding the objectives and means of their

data processing activities, such as data collection, storage, utilization, transmission, publication and deletion. In particular, pursuant

to the Draft Network Data Security Regulations, a data processor must apply for cybersecurity review if, among others, it (i) seeks a

public offering on a foreign stock exchange and processes the data of more than one million users and (ii) any data processing activity

affects or may affect national security. However, as of the date of this prospectus supplement, there have been no clarifications from

the relevant authorities as to the standards for determining whether an activity is one that “affects or may affect national security.”

In addition to the foregoing cybersecurity review obligations, the Draft Network Data Security Regulations also proposed to create a

system of annual data security self-assessments, whereby data processors that (i) process “important data” or (ii) are listed

overseas must conduct an annual data security assessment, and submit the annual assessment report to the applicable municipal cybersecurity

department by the end of January in the following year. As of the date of this prospectus supplement, the Draft Network Data Security

Regulations was released for public comment only, and its respective provisions and anticipated adoption or effective date may be subject

to change with uncertainty.

In July 2022, the CAC promulgated the Measures

on Security Assessment of Cross-border Data Transfer, which became effective on September 1, 2022. These measures outline the requirements

and procedures for security assessments on export of important data or personal information collected or generated within the territory

of mainland China. Furthermore, these measures provide that the security assessment shall combine pre-assessment and continuous supervision,

and risk self-assessment and security assessment to prevent data export security risks. Specifically, security assessment is required

before any cross-border data can be transferred out of mainland China if: (i) the data transferred out of mainland China is important

data; (ii) the data processor is a critical information infrastructure operator or data processor that processes personal information

of more than one million individuals; (iii) cross-border data transfer of personal information by a data processor who has made cross-border

transfer of aggregately more than 100,000 individuals’ personal information or more than 10,000 individuals’ sensitive personal

information since January 1st of the previous year; or (iv) otherwise required by the CAC.

In September 2022, the CAC promulgated the Decision

to Amend the Cybersecurity Law of the People’s Republic of China (Draft for Comments), which mainly involves amendments in the

following aspects: (i) improving the legal liability system for violating the general provisions of network operation security, (ii)

modifying the legal liability system for security protection of critical information infrastructure, (iii) adjusting the legal liability

system for network information security, and (iv) revising the legal liability system for personal information protection.

Personal Data and Privacy

The Anti-monopoly Guidelines for the Platform

Economy Sector published by the Anti-monopoly Committee of the State Council, effective February 7, 2021, prohibit collection of user

information through coercive means by online platforms operators.

In August 2021, the Standing Committee of the

NPC promulgated the Personal Information Protection Law, which unified a number of hitherto separate rules with respect to personal information

rights and privacy protection, and took effect on November 1, 2021. The Personal Information Protection Law strengthened the protection

of personal information. As a general principle, the processing of personal data must be directly related to a specific and reasonable

purpose and the related collection of personal information must be tailored to what is necessary to meet that purpose. The Personal Information

Protection Law also created a number of specific requirements for the processing of personal data. For example, the law prohibits any

person that processes personal data from engaging in price discrimination or otherwise applying unreasonable differential treatment to

individuals based on automated analysis of collected personal information. To meet the latest regulatory requirements of the PRC authorities,

we adopt technical measures to protect data and ensure that we systematically protect personal information rights. However, many of the

specific requirements of the Personal Information Protection Law remain to be clarified by the CAC, other regulatory authorities, and

courts in practice.

In addition, we may need to comply with increasingly

complex and rigorous regulatory standards enacted to protect business and personal data in the U.S., Europe and elsewhere. For example,

the European Union adopted the General Data Protection Regulation, or the GDPR, which became effective on May 25, 2018. The GDPR imposes

additional obligations on companies regarding the handling of personal data and provides certain individual privacy rights to persons

whose data is stored. Compliance with existing, proposed and recently enacted laws (including implementation of the privacy and process

enhancements called for under GDPR) and regulations can be costly; any failure to comply with these regulatory standards could subject

us to legal and reputational risks.

Although our current encryption of data and other

protective measures are in place, we cannot assure that the procedures and controls that we employ will be sufficient to prevent security

breaches from occurring and we could be subject to manipulation or improper use of our systems and networks or financial losses from

remedial actions, any of which could have a material adverse effect on our business, financial condition and results of operations. Failure

to protect customers’ data, or any restriction on or liability as a result of, our use of data, could have a material adverse effect

on our business.

Uncertainties with respect to the evolving

laws and regulations in China could materially and adversely affect us.

We conduct our business primarily through our

subsidiaries in China. PRC laws and regulations govern our operations in China. Our subsidiaries are generally subject to laws and regulations

applicable to foreign investments in China, which may not sufficiently cover all of the aspects of our economic activities in China.

In addition, the implementation of laws and regulations may be subject to future interpretations. Due to the evolving nature of the laws

and regulations in China, we cannot predict the future developments in PRC laws and regulations in general. Such unpredictability regarding

our contractual, property and procedural rights could adversely affect our business and impede our ability to continue our operations.

In January 2015, the Ministry of Commerce,

or MOFCOM, published a discussion draft of the proposed Foreign Investment Law, or the 2015 Draft Foreign Investment Law. The National

People’s Congress published another discussion draft of the Foreign Investment Law and its amendment, or the 2018 Draft Foreign

Investment Law, on December 2018 and January 2019 respectively. On March 15, 2019, the National People’s Congress

approved the Foreign Investment Law, which has come into effect since January 1, 2020, or the 2019 Foreign Investment Law. Among

other things, the 2015 Draft Foreign Investment Law expands the definition of foreign investment and introduces the principle of “actual

control” in determining whether a company should be treated as a foreign invested enterprise, or FIE. Once an entity falls within

the definition of FIE, it may be subject to foreign investment “restrictions” or “prohibitions” set forth in

a “negative list” to be separately issued by the State Council. If an FIE proposes to conduct business in an industry subject

to foreign investment “restrictions” in the “negative list,” the FIE must go through a pre-approval process.

The 2019 Foreign Investment Law have revised the definition of “foreign investment” and removed all references to the definitions

of “actual control” or “variable interest entity structure” under the 2015 Draft Foreign Investment Law, and

have further specified that all “foreign investments” shall be conducted pursuant to the negative list issued or approved

to be issued by the State Council.

Given recent statements by the Chinese government

indicating an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based

issuers, any such action could significantly limit or completely hinder our ability to offer or continue to offer securities to investors

and cause the value of such securities to significantly decline or become worthless.

The General Office of the

Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the Opinions on Severely

Cracking Down on Illegal Securities Activities According to Law, or the Opinions, which was made available to the public on July 6, 2021.

The Opinions emphasized the need to strengthen the administration over illegal securities activities, and the need to strengthen the

supervision over overseas listings by Chinese companies. Effective measures, such as promoting the construction of relevant regulatory

systems, will be taken to deal with the risks and incidents of China-concept overseas listed companies. As of the date of this prospectus

supplement, we have not received any inquiry, notice, warning, or sanctions from PRC government authorities in connection with the Opinions.

As such, the Company’s business segment

may be subject to various government and regulatory interference in the provinces in which they operate. We could be subject to regulation

by various political and regulatory entities, including various local and municipal agencies and government sub-divisions. We incur increased

costs necessary to comply with existing and newly adopted laws and regulations or penalties for any failure to comply. Additionally,

the governmental and regulatory interference could significantly limit or completely hinder our ability to offer or continue to offer

securities to investors and cause the value of such securities to significantly decline or be worthless.

Furthermore, it is uncertain when and whether

we will be required to obtain permission from the PRC government to list on U.S. exchanges in the future, and even when such permission

is obtained, whether it will be denied or rescinded. Although we are currently not required to obtain permission from any of the PRC

federal or local government to obtain such permission and has not received any denial to list on the U.S. exchange, our operations could

be adversely affected, directly or indirectly, by existing or future laws and regulations relating to its business or industry.

On December 24, 2021, the CSRC, together with

other relevant government authorities in China issued the Provisions of the State Council on the Administration of Overseas Securities

Offering and Listing by Domestic Companies (Draft for Comments), and the Measures for the Filing of Overseas Securities Offering and

Listing by Domestic Companies (Draft for Comments) (collectively, the “Draft Overseas Listing Regulations”). The Draft Overseas

Listing Regulations requires that a PRC domestic enterprise seeking to issue and list its shares overseas (“Overseas Issuance and

Listing”) shall complete the filing procedures of and submit the relevant information to CSRC. The Overseas Issuance and Listing

includes direct and indirect issuance and listing. Where an enterprise whose principal business activities are conducted in PRC seeks

to issue and list its shares in the name of an overseas enterprise (“Overseas Issuer”) on the basis of the equity, assets,

income or other similar rights and interests of the relevant PRC domestic enterprise, such activities shall be deemed an indirect overseas

issuance and listing (“Indirect Overseas Issuance and Listing”) under the Draft Overseas Listing Regulations.

On February 17, 2023, the CSRC issued the Trial

Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies and five supporting guidelines, or, collectively,

the Filing Measures, effective on March 31, 2023. Pursuant to the Filing Measures, PRC domestic companies that directly or indirectly

offer or list their securities in an overseas market, which include (i) any PRC company limited by shares, and (ii) any offshore company

that conducts its business operations primarily in China and contemplates an offering or listing of its securities in an overseas market

based on its onshore equities, assets or similar interests, are required to file with the CSRC within three business days after submitting

their listing application documents.

As of the date of this prospectus

supplement, we have not received any inquiry or notice or any objection to this offering from the CSRC, the CAC or any other PRC governmental

authorities that have jurisdiction over our operations. However, given the current regulatory environment in the PRC, there remains uncertainty

regarding the interpretation and enforcement of PRC laws.

We have been closely monitoring the development

in the regulatory landscape in China, particularly regarding the requirement of approvals, including on a retrospective basis, from the

CSRC, the CAC or other PRC authorities, as well as regarding any annual data security review or other procedures that may be imposed

on us. If any approval, review or other procedure is in fact required, we are not able to guarantee that we will obtain such approval

or complete such review or other procedure timely or at all. For any approval that we may be able to obtain, it could nevertheless be

revoked and the terms of its issuance may impose restrictions on our operations and offerings relating to our securities.

The PRC government’s significant

oversight and discretion over our business operations could result in a material change in our operations and the value of our securities.

The PRC government’s authority in regulating our operations, our overseas offerings of securities and foreign investment in us

could limit our ability or prevent us from conducting future offerings of securities to investors, which may cause the value of our securities

to significantly decline.

We conduct our business primarily in China. Our

operations in China are governed by PRC laws and regulations. The PRC government has significant oversight and discretion over our business

operations. The PRC government has released regulations and policies that have significantly impacted various industries in general and

specific operators within such industries, and may in the future release new regulations or policies that could intervene in or influence

our operations or the industry sectors in which we operate. The PRC government may also require us to obtain new permits or approvals

to continue our operations or further offer our securities to investors. If we fail to comply with these regulations, policies or requirements,

it could result in a material change in our operations or the value of our securities. Therefore, investors of our company and our business

face uncertainty from potential actions taken by regulators that may affect our business.

The approval of, or report and fillings

with the CSRC or other PRC government authorities may be required in connection with our offshore offerings under PRC law, and, if required,

we cannot predict whether or for how long we will be able to obtain such approval or complete such filing and report process.

The Regulations on Mergers and Acquisitions of

Domestic Enterprises by Foreign Investors, or the M&A Rules, adopted by six PRC regulatory agencies in 2006 and amended in 2009,

requires an overseas special purpose vehicle formed for listing purposes through acquisitions of PRC domestic companies and controlled

by PRC persons or entities to obtain the approval of the CSRC prior to the listing and trading of such special purpose vehicle’s

securities on an overseas stock exchange. The interpretation and application of the regulations remain unclear, and our offshore offerings

may ultimately require approval of the CSRC. If the CSRC approval is required, it is uncertain whether we can or how long it will take

us to obtain the approval and, even if we obtain such CSRC approval, the approval could be rescinded. Any failure to obtain or delay

in obtaining the CSRC approval for any of our offshore offerings, or a rescission of such approval is obtained by us, would subject us

to sanctions imposed by the CSRC or other PRC regulatory authorities, which could include fines and penalties on our operations in China,

restrictions or limitations on our ability to pay dividends outside of China, and other forms of sanctions that may materially and adversely

affect our business, financial condition, and results of operations.

On July 6, 2021, the relevant PRC government authorities

issued Opinions on Strictly Cracking Down Illegal Securities Activities in Accordance with the Law. These opinions emphasized the need

to strengthen the administration over illegal securities activities and the supervision on overseas listings by China-based companies

and proposed to take effective measures, such as promoting the construction of relevant regulatory systems to deal with the risks and

incidents faced by China-based overseas-listed companies. As a follow-up, on December 24, 2021, the CSRC issued a draft of the Provisions

of the State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies, and a draft of Administration

Measures for the Filing of Overseas Securities Offering and Listing by Domestic Companies for public comments. These draft measures propose

to establish a new filing-based regime to regulate overseas offerings and listings by domestic companies. Specifically, an overseas offering

and listing by a PRC company, whether directly or indirectly, an initial or follow-on offering, must be filed with the CSRC. The examination

and determination of an indirect offering and listing will be conducted on a substance-over-form basis, and an offering and listing shall

be deemed as a PRC company’s indirect overseas offering and listing if the issuer meets the following conditions: (i) any of the

operating income, gross profit, total assets, or net assets of the PRC enterprise in the most recent fiscal year was more than 50% of

the relevant line item in the issuer’s audited consolidated financial statement for that year; and (ii) senior management personnel

responsible for business operations and management are mostly PRC citizens or are ordinarily resident in the PRC, and the principal place

of business is in the PRC or carried out in the PRC. The issuer or its affiliated PRC entity, as the case may be, shall file with the

CSRC for its initial public offering, follow-on offering and other equivalent offing activities. Particularly, the issuer shall submit

the filing with respect to its initial public offering and listing within three business days after its initial filing of the listing

application, and submit the filing with respect to its follow-on offering within three business days after the completion of the follow-on

offering. Failure to comply with the filing requirements may result in fines to the relevant PRC companies, suspension of their businesses,

revocation of their business licenses and operation permits and fines on the controlling shareholder and other responsible persons. Theses

draft measures also set forth certain regulatory red lines for overseas offerings and listings by PRC enterprises. On April 2, 2022,

the CSRC promulgated Provisions on Strengthening the Confidentiality and Archives Administration of Overseas Securities Issuance and

Listing by Domestic Enterprises (Draft for Comments), according to which, a domestic company that plans to, either directly or through

its overseas listed entity, publicly disclose or provide to relevant entities or individuals including securities companies, securities

service providers, and overseas regulators, documents and materials that contain state secrets or government work secrets, shall first

obtain approval from competent authorities according to law, and file with the secrecy administrative department at the same level. A

domestic company that plans to, either directly or through its overseas listed entity, publicly disclose or provide to relevant entities

or individuals including securities companies, securities service providers, and overseas regulators, other documents and materials that,

if divulged, will jeopardize national security or public interest, shall strictly fulfil relevant procedures stipulated by applicable

national regulations.

On February 17, 2023, the CSRC promulgated Trial Administrative Measures

of Overseas Securities Offering and Listing by Domestic Companies, or the Overseas Listing Trial Measures, and five supporting guidelines,

which became effective on March 31, 2023. According to the Overseas Listing Trial Measures, PRC domestic companies that seek to offer

and list securities in overseas markets, either in direct or indirect means, are required to fulfill the filing procedure with the CSRC

and report relevant information. The Overseas Listing Trial Measures provides that an overseas listing or offering is explicitly prohibited,

if any of the following circumstances exists: (1) such securities offering and listing is explicitly prohibited by provisions in laws,

administrative regulations and relevant state rules; (2) the intended securities offering and listing may endanger national security

as reviewed and determined by competent authorities under the State Council in accordance with law; (3) the domestic company intending

to make the securities offering and listing, or its controlling shareholder(s) and the actual controller, have committed relevant crimes

such as corruption, bribery, embezzlement, misappropriation of property or undermining the order of the socialist market economy during

the latest three years; (4) the domestic company intending to make the securities offering and listing is currently under investigations

for suspicion of criminal offenses or major violations of laws and regulations, and no conclusion has yet been made thereof; or (5) there

are material ownership disputes over equity held by the domestic company’s controlling shareholder(s) or by other shareholder(s)

that are controlled by the controlling shareholder(s) and/or actual controller.

The Overseas Listing Trial Measures also provides

that if the issuer meets both the following criteria, the overseas securities offering and listing conducted by such issuer will be deemed

as indirect overseas offering by PRC domestic companies: (1) 50% or more of any of the issuer’s operating revenue, total profit,

total assets or net assets as documented in its audited consolidated financial statements for the most recent fiscal year is accounted

for by domestic companies; and (2) the main parts of the issuer’s business activities are conducted in mainland China, or its main

place(s) of business are located in mainland China, or the majority of senior management staff in charge of its business operations and

management are PRC citizens or have their usual material events in mainland China.

The Overseas Listing Trial Measures further provides

that, initial public offerings or listings in overseas markets by domestic companies, either in direct or indirect form shall be filed

with the CSRC pursuant to the requirements of the Overseas Listing Trial Measures within three business days after the relevant application

is submitted overseas. On the same day when the Overseas Listing Trial Measures are issued, the CSRC also issued a notice in relation

to the management arrangement of above-mentioned filing. The Overseas Listing Trial Measures, together with such notice issued by the

CSRC, provide that the companies that had already been listed on overseas stock exchanges prior to March 31, 2023 or the companies that

had obtained the approval from overseas supervision administrations or stock exchanges for its offering and listing prior to March 31,

2023 and will complete their overseas offering and listing prior to September 30, 2023 are not required to make immediate filings for

its listing, but are required make filings for subsequent offerings in accordance with the Overseas Listing Trial Measures. Companies

that had already submitted an application for an initial public offering to overseas supervision administrations but had not yet obtained

the approval from overseas supervision administrations or stock exchanges for the offering and listing prior to March 31, 2023 may arrange

for the filing within a reasonable time period and should complete the filing procedure before such companies’ overseas issuance