UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A

(RULE

14A-101)

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed

by the Registrant ☒ |

|

| Filed

by a Party other than the Registrant ☐ |

|

Check

the appropriate box:

| ☒ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2) |

| ☐ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Pursuant to §240.14a-12 |

BLUE

STAR FOODS CORP.

(Name

of Registrant as Specified in Its Charter)

N/A

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required |

| |

|

| ☐ |

Fee paid previously with

preliminary materials |

| |

|

| ☐ |

Fee computed on table in exhibit required

by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

BLUE

STAR FOODS CORP.

3000

NW 109th Avenue

Miami,

Florida 33172

November

__, 2023

To

our Stockholders:

It

is my pleasure to invite you to attend the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of Blue Star Foods

Corp. (the “Company”) to be held on December 27, 2023, at 10:00 a.m., Eastern Standard Time, at the offices of the Company

located at 3000 NW 109th Avenue, Miami, Florida 33172.

The

enclosed Notice of the 2023 Annual Meeting of Stockholders and Proxy Statement includes information about the matters to be acted upon

by stockholders at the Annual Meeting. You may vote by completing, signing and returning your completed proxy card (or a voting instruction

form, if you hold your shares through a broker). If you decide to attend the Annual Meeting of Stockholders, you may revoke your proxy

at that time and vote your shares at such meeting.

Stockholders

of record at the close of business on October 30, 2023, are entitled to notice of and to vote at the Annual Meeting.

Copies

of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with the Securities and Exchange

Commission (“SEC”), will be furnished without charge to any stockholder upon written request to Blue Star Foods Corp., 3000

NW 109th Avenue, Miami, Florida 33172, Attention: Silvia Alana, Secretary. This proxy statement and the Company’s 2022 Annual Report

on Form 10-K for the fiscal year ended December 31, 2022, as filed with the SEC on April 17, 2023, are available on the SEC’s website

at www.sec.gov and on the Company’s website at www.bluestarfoods.com.

| |

Sincerely, |

| |

|

| |

/s/

John R. Keeler |

| |

John

R. Keeler |

| |

Executive

Chairman and Chief Executive Officer |

BLUE

STAR FOODS CORP.

NOTICE

OF THE 2023 ANNUAL MEETING OF STOCKHOLDERS

TO

BE HELD DECEMBER 27, 2023

To

the Stockholders of Blue Star Foods Corp.:

The

2023 Annual Meeting of Stockholders (the “Annual Meeting”) of Blue Star Foods Corp. (the “Company”) will be held

on December 27, 2023, at 10:00 a.m., eastern standard time, at the offices of the Company located at 3000 NW 109th Avenue, Miami, Florida

33172.

At

the Annual Meeting, stockholders will be asked to vote on the following matters (as more fully described in the Proxy Statement accompanying

this Notice):

| |

1. |

To

approve the issuance of shares in a non-public offering where the maximum number of shares of Common Stock to be issued may exceed

20% of the Company’s issued and outstanding capital stock, as required by and in accordance with Nasdaq Marketplace Rule 5635

(“Proposal One” or “Share Issuance Proposal No. 1”); |

| |

|

|

| |

2. |

To

approve the issuance of shares in a non-public offering where the maximum number of shares

of Common Stock to be issued may exceed 20% of the Company’s issued and outstanding

capital stock, as required by and in accordance with Nasdaq Marketplace Rule 5635 (“Proposal Two” or “Share

Issuance Proposal No. 2”); |

| |

|

|

| |

3. |

To

elect six (6) directors of the Company for a three-year term to serve until the 2026 annual meeting of stockholders or until their

successors are duly elected and qualified (“Proposal Three” or the “Election of

Directors”); |

| |

|

|

| |

4. |

To

ratify the appointment of MaloneBailey, LLP as the Company’s independent registered public accounting firm for the year ending

December 31, 2023 (“Proposal Four” or “Ratification of the Appointment of our Independent Registered Public

Accounting Firm”); and |

| |

|

|

| |

5. |

To

transact such other business that properly comes before the Annual Meeting or any adjournment or postponement thereof. |

| The

Board of Directors recommends that you vote in favor of each director nominee and each of the other proposals. Please refer to the

Proxy Statement for detailed information about the Annual Meeting, each director nominee, and each of the proposals, as well as voting

instructions. Your vote is important, and we strongly urge you to cast your vote as soon as possible even if you plan to attend

the Annual Meeting. |

| |

By

Order of the Board of Directors, |

| |

|

| |

/s/

John Keeler |

| |

Executive

Chairman and Chief Executive Officer |

BLUE

STAR FOODS CORP.

3000

NW 109th AVENUE

MIAMI,

FLORIDA 33172

PROXY

STATEMENT FOR THE 2023 ANNUAL MEETING OF STOCKHOLDERS

December

27, 2023

GENERAL

INFORMATION

This

Proxy Statement is being furnished to the stockholders of Blue Star Foods Corp. (the “Company”) in connection with the solicitation

of proxies by the Board of Directors of the Company (the “Board”). The proxies are for use at the 2023 Annual Meeting of

Stockholders of the Company to be held on December 27, 2023, at 10:00 a.m. eastern standard time, or at any adjournment thereof (the

“Annual Meeting”).

The

shares represented by your proxy will be voted as indicated on your properly executed and returned proxy. If no directions are given

on the proxy, the shares represented by your proxy will be voted:

FOR

the approval of the issuance of more than 20% of our issued and outstanding Common Stock pursuant to the terms of the Securities

Purchase Agreement (the “May Purchase Agreement”) dated May 30, 2023, by and between the Company and Lind Global Fund II

LP, a Delaware limited partnership (the “Investor”), as amended by the First Amendment to Purchase Agreement dated July 27,

2023 (the “Purchase Agreement Amendment” together with the May Purchase Agreement, are herein referred to as the “Purchase

Agreement”), so that such issuances are made in accordance with Nasdaq Listing Rule 5635 of the Nasdaq Capital Market (“Proposal

One” or “Share Issuance Proposal No. 1”);

FOR

the approval of the issuance of more than 20% of our issued and outstanding Common Stock pursuant to the terms of the Securities

Purchase Agreement (the “ELOC Purchase Agreement”) dated May 16, 2023, by and between the Company and ClearThink

Capital Partners, LLC (“ClearThink”), so that such issuances are made in accordance with Nasdaq Listing Rule

5635 of the Nasdaq Capital Market (“Proposal Two” or “Share Issuance Proposal No. 2”);

FOR

the election of the director nominees named herein (“Proposal Three” or the “Election of Directors”) unless

you specifically withhold authority to vote for one or more of the director nominees; and

FOR

ratifying the appointment of MaloneBailey, LLP as our independent registered public accounting firm for the fiscal year ending December

31, 2023 (“Proposal Four” or “Ratification of the Appointment of our Independent Registered Public Accounting Firm”).

The

Company knows of no other matters to be submitted to the Annual Meeting. If any other matters properly come before the Annual Meeting,

it is the intention of the persons named in the accompanying form of proxy to vote the shares they represent as the Board may recommend.

These

proxy solicitation materials are first being mailed to stockholders on or about November __, 2023.

VOTING

SECURITIES

Stockholders

of record at the close of business on October 30, 2023 (the “Record Date”) are entitled to notice of and to vote at the Annual

Meeting. As of the Record Date, 11,631,048 shares of the Company’s common stock, $0.0001 par value (“Common Stock”),

were issued and outstanding.

Each

holder of Common Stock is entitled to one vote for each share of Common Stock held as of the Record Date.

RESULTS

Voting

results will be tabulated and certified by the Inspector of Elections appointed for the Annual Meeting. The preliminary voting results

will be announced at the Annual Meeting. The final results will be filed with the SEC on a Current Report on Form 8-K within four business

days of the Annual Meeting.

QUORUM;

ABSTENTIONS; BROKER NON-VOTES

A

majority of the aggregate voting power of the outstanding shares of Common Stock as of the Record Date must be present, in person or

by proxy, at the Annual Meeting in order to have the required quorum for the transaction of business. If the aggregate voting power of

the shares of Common Stock present, in person and by proxy, at the Annual Meeting does not constitute the required quorum, the Annual

Meeting may be adjourned to a subsequent date for the purpose of obtaining a quorum.

Shares

of Common Stock that are voted “FOR,” “AGAINST” or “ABSTAIN” are treated as being present at the

Annual Meeting for purposes of establishing a quorum. Shares that are voted “FOR,” “AGAINST” or “ABSTAIN”

with respect to a matter will also be treated as shares entitled to vote at the Annual Meeting (the “Votes Cast”) with respect

to such matter. Abstentions will be counted for purposes of quorum and will have the same effect as a vote “AGAINST” a proposal.

Broker

non-votes (i.e., votes for shares of Common Stock held as of the Record Date by brokers or other custodians as to which the beneficial

owners have given no voting instructions) will be counted as “shares present” at the Annual Meeting for purposes of determining

the presence or absence of a quorum for the transaction of business so long as the broker can vote on any proposal being considered.

However, brokers cannot vote on their clients’ behalf on “non-routine” proposals for which they have not received voting

instructions from their clients for such proposals. The vote on Proposals One Two and Three are considered “non-routine.”

Accordingly, broker non-votes will not have any effect with respect to Proposals One, Two and Three as shares that constitute

broker non-votes are not considered entitled to vote on these matters.

Brokers

do have authority to vote uninstructed shares for or against “routine” proposals. Proposal Four constitutes a “routine”

proposal. Accordingly, a broker may vote uninstructed shares “FOR” or “AGAINST” Proposal Four.

STOCKHOLDER

PROPOSALS FOR 2024 ANNUAL MEETING

In

order for any stockholder proposal submitted pursuant to Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), to be included in the Company’s Proxy Statement to be issued in connection with the 2024 Annual

Meeting of Stockholders, such stockholder proposal must be received by the Company not less than 120 calendar days prior to November

8, 2024. Accordingly, stockholder proposals must be received no later than July 12, 2024. In order for stockholders to give timely notice

of nominations for directors, other than those nominated by the Company, for inclusion on a universal proxy card in connection with the

2024 Annual Meeting, notice must be submitted no later than October 28, 2024, and include all of the information required by Rule 14a-19

under the Exchange Act and the Company’s bylaws. All stockholder proposals must be made in writing addressed to John Keeler, the

Company’s Executive Chairman, at 3000 NW 109th Avenue, Miami, Florida 33172 and be in compliance with the Company’s

bylaws.

REVOCABILITY

OF PROXY

Any

proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to John Keeler,

the Company’s Executive Chairman, a written notice of revocation, a duly executed proxy bearing a later date or by attending the

Annual Meeting and voting. Attending the Annual Meeting in and of itself will not constitute a revocation of a proxy.

DISSENTERS’

RIGHT OF APPRAISAL

Under

Delaware General Corporation Law stockholders are not entitled to any appraisal or similar rights of dissenters with respect to any of

the proposals to be acted upon at the Annual Meeting.

SOLICITATION

Proxies

may be solicited by certain of the Company’s directors, executive officers and regular employees, without additional compensation,

in person, or by telephone, mail, e-mail or facsimile. The cost of soliciting proxies will be borne by the Company. The Company expects

to reimburse brokerage firms, banks, custodians and other persons representing beneficial owners of shares of Common Stock for their

reasonable out-of-pocket expenses in forwarding solicitation material to such beneficial owners.

Some

banks, brokers and other record holders have begun the practice of “householding” notices, proxy statements and annual reports.

“Householding” is the term used to describe the practice of delivering a single set of notices, proxy statements and annual

reports to any household at which two or more stockholders reside if a company reasonably believes the stockholders are members of the

same family. This procedure reduces the volume of duplicate information stockholders receive and also reduces a company’s printing

and mailing costs. The Company will promptly deliver an additional copy of any such document to any stockholder who writes or calls the

Company. Alternatively, if you share an address with another stockholder and have received multiple copies of our notices, proxy statements

and annual reports, you may contact us to request delivery of a single copy of these materials. Any such written request should be directed

to Silvia Alana, Secretary, at 3000 NW 109th Avenue, Miami, Florida 33172. If you receive more than one proxy card because your shares

are registered in different accounts follow the instructions included on each proxy card and vote each proxy card.

AVAILABILITY

OF PROXY MATERIALS

This

Proxy Statement and form of proxy, together with our Annual Report on Form 10-K (the “Annual Report”), are first being made

available to stockholders beginning approximately November __, 2023. The Annual Report is not a part of the proxy solicitation

materials. These documents are also included in our filings with the SEC, which you can access electronically at the SEC’s website

at http://www.sec.gov and on the Company’s website at http://www.bluestarfoods.com.

A

complete list of the stockholders entitled to vote at the Annual Meeting will be available for inspection for any purpose germane to

the Annual Meeting ten days prior to the Annual Meeting at the Company’s offices at 3000 NW 109th Avenue, Miami, Florida 33172

during ordinary business hours.

VOTING

AND STOCK OWNERSHIP

If

shares are registered directly in a stockholder’s name with the Company’s transfer agent, you are a record holder with respect

to those shares and the Proxy Statement and form of Proxy are sent directly to you. You can vote your shares by completing, dating and

signing the proxy card that is included with this proxy statement.

If

your shares are held in a brokerage account or by a bank or other nominee, you are the beneficial owner of shares held in “street

name.” The Proxy Statement and the form of voting instruction card are sent to you by your broker, trustee, or other nominee who

is considered, with respect to those shares, the stockholder of record.

If

you are a stockholder of record as of the close of business on the Record Date, you may attend the Annual Meeting and vote your shares

of Common Stock in person instead of returning your signed proxy card. If you are a beneficial owner of shares of Common Stock registered

in the name of your broker, bank, or other nominee, you must follow the instructions provided to you and obtain a valid proxy from your

broker, bank or other nominee to vote your shares of Common Stock in person at the Annual Meeting.

PROPOSAL

ONE

APPROVAL OF SHARE ISSUANCE PROPOSAL NO.1

To

approve the issuance of more than 20% of our issued and outstanding Common Stock pursuant to the terms of the Purchase Agreement, so

that such issuances are made in accordance with Nasdaq Listing Rule 5635 of the Nasdaq Capital Market.

Background

and Overview

Our

Common Stock is currently listed on The Nasdaq Stock Market LLC and, as such, we are subject to Nasdaq Marketplace Rules (the “Nasdaq

Listing Rules”). We are seeking stockholder approval of Share Issuance Proposal No.1 in order to comply with Nasdaq

Rule 5635.

Under

Nasdaq Rule 5635, stockholder approval is required for a transaction involving the sale, issuance or potential issuance by an issuer

of Common Stock (or securities convertible into or exercisable for Common Stock) in connection with a transaction other than a public

offering at a price less than the minimum price (the “Nasdaq Minimum Price”) which either alone or together with sales by

our officers, directors or substantial stockholders of the Company equals 20% or more of the Common Stock or 20% or more of the voting

power outstanding before the issuance. Nasdaq Minimum Price means a price that is the lower of: (i) the Nasdaq official closing price

(as reflected on Nasdaq.com) immediately preceding the signing of a binding agreement to issue such Common Stock; or (ii) the average

Nasdaq official closing price of the Common Stock (as reflected on Nasdaq.com) for the five trading days immediately preceding the signing

of a binding agreement. Stockholder approval of Share Issuance Proposal No. 1 will constitute stockholder approval for purposes

of Nasdaq Listing Rule 5635.

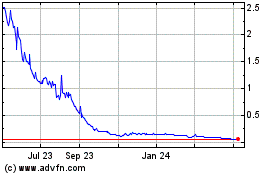

Pursuant

to the May Purchase Agreement, the Company issued to the Investor a secured, two-year, interest free convertible promissory note in the

principal amount of $1,200,000 (the “May 2023 Note”) and a common stock purchase warrant (the “May 2023 Warrant”)

to acquire 435,035 shares of common stock of the Company, for the aggregate funding amount of $1,000,000. In connection with the issuance

of the May 2023 Note and the May 2023 Warrant, the Company paid a $50,000 commitment fee to the Investor. The proceeds from the sale

of the May 2023 Note and May 2023 Warrant were for general working capital.

The

Investor will not be entitled to purchase such an amount of shares, which, when added to the sum of the number of shares of Common Stock

beneficially owned (as such term is defined under Section 13(d) and Rule 13d-3 of the Exchange Act) by

the Investor, would exceed 4.99% of the number of shares of the Company’s Common Stock outstanding.

The

maximum number of shares of common stock to be issued in connection with the conversion of the May 2023 Note and the exercise of the

May 2023 Warrant, in the aggregate, will not, without the prior approval of the shareholders of the Company, exceed a number of shares

equal to 19.9% of the outstanding shares of Common Stock of the Company immediately prior to the date of the Note, per

Nasdaq rules and guidance.

The

May 2023 Note contains certain negative covenants, including restricting the Company from certain distributions, stock repurchases, borrowing,

sale of assets, loans and exchange offers.

Upon

the occurrence of an event of default as described in the May 2023 Note, the May 2023 Note will become immediately due and payable at

a default interest rate of 120% of the then outstanding principal amount of the Note. Events of default include a change of control,

a default in any indebtedness in excess of $100,000, the failure of the Company to instruct its transfer agent to issue unlegended certificates,

the shares no longer publicly being traded, if after the applicable time the shares are not available for immediate resale under Rule

144 and the Company’s market capitalization is below $2.5 million for 10 days.

The

May 2023 Warrant entitles the Investor to purchase up to 435,035 shares of Common Stock of the Company during the exercise

period commencing on the date that is six (6) months after the issue date (“Exercise Period Commencement”) and ending on

the date that is sixty (60) months from the Exercise Period Commencement at an exercise price of $0.1227 per share, subject to customary

adjustments. The May 2023 Warrant includes cashless exercise and full ratchet anti-dilution provisions.

On

July 27, 2023, the Company entered into the Purchase Agreement Amendment, pursuant to which the Company amended the May Purchase Agreement

in order to permit the issuance of further senior convertible promissory notes in the aggregate principal amount of up to $1,800,000

and common stock purchase warrants in such aggregate amount as the Company and the Investor shall mutually agree.

Pursuant

to the Purchase Agreement Amendment, the Company issued to the Investor a secured, two-year, interest free convertible promissory

note in the principal amount of $300,000 (the “July 2023 Note” together with the May 2023 Note, are referred to herein

as the “Notes”) and a common stock purchase warrant to acquire 175,234 shares of common stock of the Company (the

“July 2023 Warrant”, together with the May 2023 Warrant, are referred to herein as the “Warrants”), for the

aggregate funding amount of $250,000. The conversion price of the July 2023 Note is equal to the lesser of: (i) $1.34; or (ii) 90%

of the lowest single VWAP during the 20-trading day period ending on the last trading day immediately preceding the

applicable conversion date, subject to customary adjustments. The July 2023 Warrant is exercisable at an exercise price of $1.34 per

share, subject to customary adjustments. In connection with the issuance of the July 2023 Note and the July 2023 Warrant, the

Company paid a $12,500 commitment fee to the Investor. The proceeds from the sale of the July 2023 Note and July 2023 Warrant are

for general working capital. The Purchase Agreement, Notes and Warrants are collectively referred to herein as the May

Transaction Documents.

The

Company filed a registration statement on Form S-1, filed with the SEC on July 28, 2023, as amended, which became effective on September

7, 2023, covering the shares issuable to the Investor pursuant to the terms of the Purchase Agreement.

We

cannot predict the market price of our Common Stock at any future date. Under certain circumstances, it is possible that we may need

to issue shares of Common Stock to the Investor at a price that is less than the Nasdaq Minimum Price, which may result in an issuance

equal to 20% or more of the Common Stock outstanding before the issuance.

Accordingly,

we must obtain stockholder approval to comply with the Nasdaq Listing Rules to issue shares of 20% or more of the Common Stock and to

satisfy the conditions of the Purchase Agreement.

Consequences

of Non-Approval

The

May Transaction Documents are binding obligations on us. The failure of our stockholders to approve Share Issuance Proposal No.1

will not negate the existing terms or the Company’s binding obligation under the May Transaction Documents. However,

if Share Issuance Proposal No.1 is not approved by our stockholders, we may be required to repay our obligations under the May

Transaction Documents in cash, rather than by the conversion of the Notes into shares of Common Stock.

If

we are required to repay our obligations to the Investor in cash rather than Common Stock, we may not have the capital necessary

to fully satisfy our ongoing business needs, the effect of which would adversely impact future operating results. Additionally, it may

be necessary for the Company to acquire additional financing in order to repay the obligations to the Investor under the May

Transaction Documents in cash, which may result in additional transaction expenses. Failure to acquire additional financing in order

to repay these obligations may result in a default on such obligations.

In

addition, if we default on our obligations under the Notes, the

Investor could file claims against us, or possibly take possession of some of the assets of the

Company and its subsidiaries, which would harm our business, financial condition and results of operations and could require us to curtail,

or even to cease our operations.

Effect

on Current Stockholders

The

issuance of shares of Common Stock to the Investor pursuant to the terms of the Purchase Agreement, including any shares that may be

issued below the Nasdaq Minimum Price, would result in an increase in the number of shares of Common Stock outstanding, and our stockholders

will incur dilution of their percentage ownership. Because the number of shares of Common Stock that may be issued to the Investor pursuant

to the Purchase Agreement is determined based on the market price at the time of issuance, the exact magnitude of the dilutive effect

cannot be conclusively determined. However, the dilutive effect may be material to our current stockholders.

Our

ability to successfully implement our business plans and ultimately generate value for our stockholders is dependent upon our ability

to raise capital and satisfy our ongoing business needs.

Vote

Required

Approval

of Share Issuance Proposal No.1 requires the majority of the total votes cast at the Annual Meeting. Abstentions and broker

non-votes have the same effect as a vote “AGAINST” Share Issuance Proposal No.1.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF SHARE ISSUANCE PROPOSAL NO.1.

PROPOSAL

TWO

APPROVAL

OF SHARE ISSUANCE PROPOSAL NO.2

To

approve the issuance of more than 20% of our issued and outstanding Common Stock pursuant to the terms of the ELOC Purchase Agreement, so that such issuances are made in accordance with Nasdaq Listing Rule 5635 of the Nasdaq Capital Market.

Background

and Overview

Our

Common Stock is currently listed on The Nasdaq Stock Market LLC. We are seeking stockholder approval of the Share Issuance Proposal No.2

in order to comply with Nasdaq Rule 5635.

Under

Nasdaq Rule 5635, stockholder approval is required for a transaction involving the sale, issuance or potential issuance by an issuer

of Common Stock (or securities convertible into or exercisable for Common Stock) in connection with a transaction other than a public

offering at a price less the Nasdaq Minimum Price, which either alone or together with sales by our officers, directors or substantial

stockholders of the Company equals 20% or more of the Common Stock or 20% or more of the voting power outstanding before the issuance.

Nasdaq Minimum Price means a price that is the lower of: (i) the Nasdaq official closing price (as reflected on Nasdaq.com) immediately

preceding the signing of a binding agreement to issue such Common Stock; or (ii) the average Nasdaq official closing price of the

Common Stock (as reflected on Nasdaq.com) for the five trading days immediately preceding the signing of a binding agreement. Stockholder

approval of Share Issuance Proposal No.2 will constitute stockholder approval for purposes of Nasdaq Listing Rule 5635.

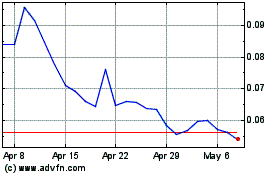

On

May 16, 2023, the Company entered into a Purchase Agreement (the “ELOC Purchase Agreement”) with ClearThink, pursuant to

which ClearThink has agreed to purchase from the Company, from time to time upon delivery by the Company to ClearThink of request notices

(each a “Request Notice”), and subject to the other terms and conditions set forth in the ELOC Purchase Agreement, up to

an aggregate of $10,000,000 of the Company’s Common Stock. The purchase price of the shares of Common Stock to be purchased under

the ELOC Purchase Agreement will be equal to 80% of the two lowest daily VWAPs during a valuation period of six trading days, beginning

three trading days preceding the draw down or put notice to three trading days commencing on the first trading day following delivery

and clearing of the delivered shares. Each purchase under the ELOC Purchase Agreement will be in a minimum amount of $25,000 and a maximum

amount equal to the lesser of (i) $1,000,000 and (ii) 300% of the average daily trading value of the common stock over the ten days preceding

the Request Notice date. In addition, pursuant to the ELOC Purchase Agreement, the Company agreed to issue to ClearThink 62,500 restricted

shares of the Company’s Common Stock as a “Commitment Fee.”

In

connection with the ELOC Purchase Agreement, the Company entered into a Registration Rights Agreement with ClearThink under which the

Company agreed to file a registration statement with the SEC covering the shares of common stock issuable under the ELOC Purchase Agreement.

Such registration statement was filed with the SEC on July 28, 2023, as amended, and became effective on September 7, 2023.

We

cannot predict the market price of our Common Stock at any future date. Under certain circumstances, it is possible that we may need

to issue shares of Common Stock to ClearThink at a price that is less than the Nasdaq Minimum Price, which may result in an issuance

equal to 20% or more of the Common Stock outstanding before the issuance.

Accordingly,

we must obtain stockholder approval to comply with the Nasdaq Listing Rules to issue shares of 20% or more of the Common Stock and to

satisfy the conditions of the ELOC Purchase Agreement.

Consequences

of Non-Approval

The

ELOC Purchase Agreement is a binding obligation on us. The failure of our stockholders to approve Share Issuance Proposal

No.2 will not negate the existing terms or the Company’s binding obligation under the ELOC Purchase Agreement. However,

if Share Issuance Proposal No.2 is not approved by our stockholders, we may be required to repay our obligations under the ELOC Purchase

Agreement in cash, rather than by the issuance of shares of Common Stock.

If

we are required to repay our obligations to ClearThink in cash rather than Common Stock, we may not have the capital necessary to fully

satisfy our ongoing business needs, the effect of which would adversely impact future operating results. Additionally, it may be necessary

for the Company to acquire additional financing in order to repay the obligations to ClearThink under the ELOC Purchase Agreement in cash, which may result in additional transaction expenses. Failure to acquire additional financing in order to repay these

obligations may result in a default on such obligations.

In

addition, if we default on our obligations under the ELOC Purchase Agreement, ClearThink could file claims against us, or possibly take possession of

some of the assets of the Company and its subsidiaries, which would harm our business, financial condition and results of operations

and could require us to curtail, or even to cease our operations.

Effect

on Current Stockholders

The

issuance of shares of Common Stock to ClearThink pursuant to the terms of the ELOC Purchase Agreement, including any shares

that may be issued below the Nasdaq Minimum Price, would result in an increase in the number of shares of Common Stock outstanding, and

our stockholders will incur dilution of their percentage ownership. Because the number of shares of Common Stock that may be issued to

ClearThink pursuant to the ELOC Purchase Agreement is determined based on the market price at the time of issuance, the

exact magnitude of the dilutive effect cannot be conclusively determined. However, the dilutive effect may be material to our current

stockholders.

Our

ability to successfully implement our business plans and ultimately generate value for our stockholders is dependent upon our ability

to raise capital and satisfy our ongoing business needs.

Vote

Required

Approval

of Share Issuance Proposal No.2 requires the majority of the total votes cast at the Annual Meeting. Abstentions and broker non-votes

have the same effect as a vote “AGAINST” Share Issuance Proposal No.2.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF SHARE ISSUANCE PROPOSAL NO. 2.

PROPOSAL

THREE

ELECTION

OF DIRECTORS

The

Board currently consists of six (6) directors. All of the current members of the Board have been nominated for re-election. Stockholders

and their proxies cannot vote for more than six (6) nominees at the Annual Meeting. Each nominee has consented to being named as a nominee

for election as a director and has agreed to serve if elected; however, if a nominee should withdraw his or her name from consideration

for any reason or otherwise become unable to serve before the Annual Meeting, the Board reserves the right to substitute another person

as nominee, and the persons named on your proxy card as proxies will vote for any substitute nominated by the Board. At the Annual Meeting,

directors will be elected to serve for three-year terms expiring at the 2026 annual meeting of stockholders or until their successors

are elected and qualified or until their earlier resignation or removal. This Proposal three relates to the election of directors

to take effect immediately upon the Annual Meeting.

The

directors shall be elected by a majority of the Votes Cast at the Annual Meeting (with abstentions and broker non-votes not counted as

a Vote Cast with respect to that director) in accordance with our by-laws.

If

any nominee is not available for election at the time of the Annual Meeting (which is not anticipated), the proxy holders named in the

proxy, unless specifically instructed otherwise in the proxy, will vote for the election of such other person as the existing Board may

recommend, unless the Board decides to reduce the number of directors of the Company. Certain information about the nominees to the Board

is set forth below.

John

Keeler, 52, has been Executive Chairman of the Board since November 8, 2018 and Chief Executive Officer since August 1,

2019. Mr. Keeler founded John Keeler & Co., d/b/a Blue Star Foods in May 1995 and served as its Executive Chairman of the Board since

inception during which time he grew the company to become one of the leading marketers of imported blue swimming crab meat in the United

States. Mr. Keeler built sales over the past 20 years to $35+ million annually through 2017. Mr. Keeler oversees procurement as well

as operating facilities in the Philippines and Indonesia. Mr. Keeler is an executive committee member of the National Fisheries Institute-Crab

Council and a founding member of the Indonesia and Philippines crab meat processors associations. Mr. Keeler received his BS in Economics

from Rutgers University in 1995 and attended Harvard Business School executive programs in supply chain management, negotiations and

marketing in 2005. Mr. Keeler’s extensive experience in the industry led to the decision to appoint him to the Board.

Nubar

Herian, 54, has been a director since November 8, 2018. Since 2014, Mr. Herian has been the chief executive officer of Monaco

Group Holdings, a privately-held company headquartered in Miami, Florida, which owns and operates Monaco Foods, Inc., an importer, exporter

and distributor of premium gourmet foods from around the world. Since 1995, Mr. Herian has been the commercial director of Casa de Fruta

Caracas, a privately-held company based in Caracas, Venezuela, that focuses on importing foods. Mr. Herian is also the president of Lunar

Enterprises, Corp. (“Lunar”), a holding company for his family’s public and private equity investments and real estate

holdings. Mr. Herian received his BS in Mechanical Engineering from Florida Atlantic University in 1994 and an Executive M.B.A. from

the University of Miami in 2014. Mr. Herian’s experience in the food import industry led to the decision to appoint him to the

Board.

Jeffrey

J. Guzy, 72, has been a director since April 12, 2021. Mr. Guzy has served as a director of Leatt Corp. (OTC: LEAT), since April

2007 and from October 2007 to August 2010, as its President. Mr. Guzy has served as an independent director and chairman of the audit

committee of Capstone Companies, Inc. (OTC: CAPC), a public holding company, since April 2007, as an independent director and chairman

of the audit committee of Purebase Corporation (OTC: PUBC), a diversified resource company, since April 2020 and as Chairman of CoJax

Oil and Gas Corporation (OTCPK: CJAX), an early stage oil and gas exploration and production company, since May 2018, and was appointed

as its chief executive officer in January 2020. Mr. Guzy has served as an executive manager or consultant for business development, sales,

customer service, and management in the telecommunications industry, specifically, with IBM Corp., Sprint International, Bell Atlantic

Video Services, Loral CyberStar, and FaciliCom International. Mr. Guzy has also started his own telecommunications company providing

Internet services in Western Africa. Mr. Guzy has an M.B.A in Strategic Planning and Management from The Wharton School of the University

of Pennsylvania, an M.S. in Systems Engineering from the University of Pennsylvania, a B.S. in Electrical Engineering from Penn State

University, and a Certificate in Theology from Georgetown University. Mr. Guzy’s extensive public company board experience led

to the decision to appoint him to the Board.

Timothy

McLellan, 66, has been a director since April 12, 2021. Mr. McLellan has more than 35 years of operating experience and has served

as a seafood executive in both the U.S. and Asia. Mr. McLellan is currently managing director of Maijialin Consulting Company Ltd. which

provides international business development consulting services for import/export cold chain supply logistics and foodservice distribution.

Prior thereto from April 2009 until February 2019, Mr. McLellan was managing director, business development for Preferred Freezer Services

(Shanghai) Co. Ltd, a Singapore-based logistics and industrial infrastructure provider. Between 2019 and 2020, Mr. McLellan served as

a private equity operating partner for CITIC Capital Partners (Shanghai) Ltd. Prior to that, from 2009 through 2019, Mr. McLellan served

in various executive capacities, including Chairman for SinotransPFS Cold Chain Logistics Company, Ltd., a logistics company. Between

2004 and 2009, Mr. McLellan served as President of Empress International, a division of Thai Union Group. Between 2003 and 2004, he served

in a senior manager position with the seafood division of ConAgra Foods. Mr. McLellan’s knowledge and background with regard to

seafood operations management led to the decision to appoint him to the Board.

Trond

Ringstad, 57, has been a director since April 12, 2021. Mr. Ringstad has more than 20 years of operating experience as a seafood

executive in both the U.S. and Europe. Since April 2017, Mr. Ringstad has been managing partner of American Sea, LLC, a seafood processing

and sales company, and since October 2013, Mr. Ringstad has been an independent consultant for AGR Partners, a private equity fund. From

December 2016 through January 2018, Mr. Ringstad was an independent consultant for Maritech LLC, a seafood software provider. Between

2003 and 2007, he served as president of Pacific Supreme Seafoods, a global importing and wholesaling seafood company. Between 2001 and

2003, he served as vice president of sales and marketing for Royal Supreme Seafoods, a Norwegian /Chinese seafood importer and sales

company. Mr. Ringstad graduated from the BI Norwegian Business School with a Degree in International Marketing and has a BA in Business

Management from Washington State University. Mr. Ringstad’s knowledge and background with regard to seafood operations management

led to the decision to appoint him to the Board.

Silvia

Alana, 40, has been a director since April 20, 2022, and has been chief financial officer of the Company since May 2021. Ms.

Alana was the corporate controller of the Company from August 2020 to May 2021. Prior thereto, Ms. Alana was Global Technical Accounting

Manager at Brightstar Corporation from July 2018 to August 2020 and Audit Manager at Crowe Horwath, LLP from July 2016 to July 2018.

Ms. Alana was a Senior Accountant in Global Accounting and Reporting Services at Carnival Corporation & Plc., from May 2013 to February

2015, and an Auditor in Assurance at Pricewaterhouse Coopers, LLP, from January 2010 to May 2013. Ms. Alana graduated from Florida International

University with a bachelor’s degree in accounting in 2008 and a Master of Accounting in 2009. Ms. Alana is a Certified Public Accountant.

Ms. Alana’s experience with the Company’s operations led to the decision to appoint her to the Board.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES NAMED ABOVE.

PROPOSAL

FOUR

RATIFICATION

OF THE APPOINTMENT OF OUR

INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The

Board has selected the firm of MaloneBailey, LLP as our independent registered public accounting firm for the fiscal year ending December

31, 2023, subject to ratification by our stockholders at the Annual Meeting. MaloneBailey, LLP has been our independent registered public

accounting firm since the fiscal year ended December 31, 2018. A representative of MaloneBailey, LLP is expected to be present at the

Annual Meeting.

This

Proposal Four requires approval by a majority of the Votes Cast at the Annual Meeting.

More

information about our independent registered public accounting firm is available under the heading “Independent Registered Public

Accounting Firm” on page __ below.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF MALONEBAILEY, LLP AS

OUR INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING DECEMBER 31, 2023.

OTHER

MATTERS

The

Board does not know of any other matters that may be brought before the Annual Meeting. However, if any such other matters are properly

brought before the Annual Meeting, the proxies may use their own judgment to determine how to vote your shares.

GOVERNANCE

MATTERS

Board

Composition

The

Board currently consists of six members who hold office for three-year terms or until their successors have been elected and qualified

or until the earlier of their death, resignation or removal. There are no family relationships among any of our directors or executive

officers. The Company is not aware of any of its directors or executive officers being involved in any legal proceedings in the past

ten years relating to any matters in bankruptcy, insolvency, criminal proceedings (other than traffic and other minor offenses) or being

subject to any of the items set forth under Item 401(f) of Regulation S-K.

Board

of Directors Risk Oversight

The

Board oversees the Company’s risk management including understanding the risks the Company faces and what steps management is taking

to manage those risks, as well as understanding what level of risk is appropriate for the Company. The Board’s role in the Company’s

risk oversight process includes receiving regular updates from members of senior management on areas of material risk to the Company,

including operational, financial, legal and regulatory, human resources, employment, and strategic risks. Management discusses strategic

and operational risks at regular management meetings and conducts strategic planning and review sessions during the year that include

a discussion and analysis of the risks.

Board

of Directors Leadership Structure

The

Company’s leadership structure currently consists of the combined role of Chairman of the Board and Chief Executive Officer. The

Board has determined that it is in the best interests of the Company and its shareholders to combine these roles. Due to the small size

and early stage of the Company, the Board believes it is currently most effective to have the Chairman and Chief Executive Officer positions

combined. In addition, having one person serve as both Chairman and Chief Executive Officer provides clear leadership for the Company,

with a single person setting the tone and managing our operations. Currently, John Keeler serves as Chairman and Chief Executive Officer.

The Company does not have a separate lead independent director.

Director

Meeting Attendance

During

the year ended December 31, 2022 (the “Last Fiscal Year”), the Board held meetings and acted six (6) times by unanimous written

consent in lieu of holding a meeting.

Director

Independence

Jeffrey

Guzy, Trond Ringstad and Timothy McLellan are considered “independent” under the rules of the SEC and the NASDAQ Capital

Market as determined by the Board. In making this determination, the Board considered the current and prior relationships that each non-employee

director has with the Company and all other facts and circumstances the Board deemed relevant in determining their independence, including

the beneficial ownership of our capital stock by each non-employee director. The Company’s independent directors conduct executive

sessions at regularly scheduled meetings as required by NASDAQ Listing Rule 5605(b)(2).

The

Company does not currently have a policy in place regarding attendance by Board members at the Company’s annual meetings of stockholders.

Board

Committees

The

Board has three standing committees, consisting of an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance

Committee.

Audit

Committee

The

Audit Committee consists of Jeffrey Guzy, Trond Ringstad and Timothy McLellan. Mr. Guzy is the chairman of the Audit Committee. We have

determined that Messrs. Guzy, Ringstad and McLellan each satisfy the “independence” requirements of NASDAQ Listing Rule 5605(a)(2)

and meet the independence standards under Rule 10A-3 under the Exchange Act. We have determined that Mr. Guzy qualifies as a “financial

expert” as such term is defined under the Sarbanes-Oxley Act of 2002.

The

Audit Committee oversees our accounting and financial reporting processes and the audits of the financial statements of our company.

The Audit Committee is responsible for: (a) representing and assisting the Board in its oversight responsibilities regarding the Company’s

accounting and financial reporting processes, the audits of the Company’s financial statements, including the integrity of the

financial statements, and the independent auditors’ qualifications and independence; (b) overseeing the preparation of the report

required by SEC rules for inclusion in the Company’s annual proxy statement; (c) retaining and terminating the Company’s

independent auditors; (d) approving in advance all audit and permissible non-audit services to be performed by the independent auditors;

(e) reviewing related party transactions; and (f) performing such other functions as the Board may from time to time assign to the Committee.

The Audit Committee did not hold formal meetings but conducted internal discussions and the Chairman corresponded with the Company’s

auditors in the Last Fiscal Year. The Audit Committee has adopted a formal written charter which is available on the Company’s

Internet website at www.bluestarfoods.com.

Compensation

Committee

The

Compensation Committee consists of Jeffrey Guzy, Trond Ringstad and Timothy McLellan. Mr. Guzy is the chairman of the Compensation Committee.

The Compensation Committee is responsible for: (a) assisting the Board in seeing that a proper system of long-term and short-term compensation

is in place to provide performance oriented incentives to attract and retain management, and that compensation plans are appropriate

and competitive and properly reflect the objectives and performance of management and the Company; (b) assisting the Board in discharging

its responsibilities relating to compensation of the Company’s executive officers; (c) evaluating the Company’s Chief Executive

Officer compensation and setting a remuneration package; (d) making recommendations to the Board with respect to incentive compensation

plans and equity-based plans; and (e) performing such other functions as the Board may from time to time assign to the Committee. The

Compensation Committee did not hold formal meetings in the Last Fiscal Year. The full Board approved officer compensation by unanimous

written consent. The Compensation Committee has adopted a formal written charter which is available on the Company’s Internet website

at www.bluestarfoods.com.

In

determining the amount, form, and terms of such compensation, the Compensation Committee will consider the annual performance of such

officers in light of company goals and objectives relevant to executive officer compensation, competitive market data pertaining to executive

officer compensation at comparable companies, and such other factors as it deems relevant, and is guided by, and seeks to promote, the

best interests of the Company and its shareholders.

During

the Last Fiscal Year, there were no compensation consultants engaged to determine or recommend the amount or form of executive and director

compensation.

Nominating

and Corporate Governance Committee

The

Nominating and Corporate Governance Committee consists of Jeffrey Guzy, Trond Ringstad and Timothy McLellan. Mr. Guzy is the chairman

of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is responsible for: (a) assisting

the Board in determining the desired experience, mix of skills and other qualities to provide for appropriate Board composition, taking

into account the current Board members and the specific needs of the Company and the Board; (b) identifying qualified individuals meeting

those criteria to serve on the Board; (c) proposing to the Board the Company’s slate of director nominees for election by the shareholders

at the annual meeting of stockholders and nominees to fill vacancies and newly created directorships; (d) reviewing candidates recommended

by shareholders for election to the Board and shareholder proposals submitted for inclusion in the Company’s proxy materials; (e)

advising the Board regarding the size and composition of the Board and its committees; (f) proposing to the Board directors to serve

as chairpersons and members on committees of the Board; (g) coordinating matters among committees of the Board; (h) proposing to the

Board the slate of corporate officers of the Company and reviewing the succession plans for the executive officers; (i) recommending

to the Board and monitoring matters with respect to governance of the Company; (j) overseeing the Company’s compliance program;

and performing such other functions as the Board may from time to time assign to the Committee. The Nominating Committee did not hold

formal meetings in the Last Fiscal Year. The Nominating Committee has adopted a formal written charter which is available on the Company’s

Internet website at www.bluestarfoods.com.

The

Nominating Committee will consider any director candidates recommended by stockholders, although there is no formal policy with regard

to directors recommended by stockholders, when considering a candidate submitted by stockholders, the Nominating Committee will take

into consideration the needs of the Board and the qualifications of the candidate. Nevertheless, the Board may choose not to consider

an unsolicited recommendation if no vacancy exists on the Board and/or the Board does not perceive a need to increase the size of the

Board.

There

are no specific minimum qualifications that the Nominating Committee believes must be met by a Nominating Committee-recommended director

nominee. However, the Nominating Committee believes that director candidates should, among other things, possess high degrees of integrity

and honesty; have literacy in financial and business matters; have no material affiliations with direct competitors, suppliers or vendors

of the Company; and preferably have experience in the Company’s business and other relevant business fields (for example, finance,

accounting, law and banking). The Nominating Committee considers diversity together with the other factors considered when evaluating

candidates but does not have a specific policy in place with respect to diversity.

Members

of the Nominating Committee plans to meet in advance of each of the Company’s annual meetings of stockholders to identify and evaluate

the skills and characteristics of each director candidate for nomination for election as a director of the Company. The Nominating Committee

reviews the candidates in accordance with the skills and qualifications set forth in the Nominating Committee’s charter and the

rules of the Nasdaq. There are no differences in the manner in which the Nominating Committee plans to evaluate director nominees based

on whether or not the nominee is recommended by a stockholder.

Changes

in Nominating Process

There

are no material changes to the procedures by which stockholders may recommend nominees to the Board.

Board

Diversity

The

Board is committed to diversity of experience, gender, race and ethnicity, and seek to ensure that there is diversity among the directors.

The Company believes that its directors should be of a diverse group of individuals who have broad experience and the ability to exercise

sound business judgment from many factors including professional experience, life experience, socio-economic background, gender, race,

ethnicity, religion, skill set and geographic representation.

In

August 2021, the SEC approved a Nasdaq Stock Market proposal to adopt new listing rules relating to board diversity and disclosure. As

approved by the SEC, the new Nasdaq listing rules require all Nasdaq listed companies to disclose consistent, transparent diversity statistics

regarding their boards of directors. The Board Diversity Matrix below presents the Board’s diversity statistics in the format prescribed

by the Nasdaq rules.

Board

Diversity Matrix (as of November __, 2023)

| Total

Number of Directors |

6 |

|

| |

|

|

|

|

|

| |

|

Female

|

|

Male |

|

| Part

I: Gender Identity |

|

|

|

|

|

| Directors |

|

1 |

|

5 |

|

| Part

II: Demographic Background |

|

|

|

|

|

| Hispanic

or Latinx |

|

1 |

|

2 |

|

| White |

|

0 |

|

3 |

|

Code

of Ethics

We

have adopted a code of ethics that applies to our executive officers, directors and employees. We have filed a copy of our Code of Ethics

as an exhibit to our Current Report on Form 8-K filed with the SEC on July 19, 2021. Our Code of

Ethics is available on the Company’s website at www.bluestarfoods.com. In addition, a copy of the Code of Ethics will be provided

without charge upon written request to the Company’s Secretary, Silvia Alana, at 3000 NW 109th Avenue, Miami, Florida 33172.

Stockholder

Communications

The

Board currently does not provide a formal process for stockholders to send communications to the Board. In the opinion of the Board,

it is appropriate for the Company not to have such a process in place because the Board believes there is currently not a need for a

formal policy due to, among other things, the number of stockholders of the Company. While the Board will, from time to time, review

the need for a formal policy, at the present time, stockholders who wish to contact the Board may do so by submitting any communications

to the Company’s Secretary, Silvia Alana, at 3000 NW 109th Avenue, Miami, Florida 33172, with an instruction to forward the communication

to a particular director or the Board as a whole.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As

of November __, 2023, the Company’s directors and executive officers beneficially own, directly or indirectly, in the

aggregate, approximately __% of its outstanding Common Stock. These stockholders have significant influence over the

Company’s business affairs, with the ability to control matters requiring approval by the Company’s

stockholders.

The

following table sets forth, as of November __, 2023, the number of shares of common stock beneficially owned by (i) each person, entity

or group (as that term is used in Section 13(d)(3) of the Exchange Act) known to the Company to be the beneficial

owner of more than 5% of its outstanding shares of Common Stock; (ii) each of the Company’s directors (iii) each Named Executive

Officer and (iv) all of the Company’s executive officers and directors as a group. The information relating to beneficial ownership

of Common Stock by our principal stockholders and management is based upon information furnished by each person using “beneficial

ownership” concepts under the rules of the SEC. Under these rules, a person is deemed to be a beneficial owner of a security if

that person directly or indirectly has or shares voting power, which includes the power to vote or direct the voting of the security,

or investment power, which includes the power to dispose or direct the disposition of the security. The person is also deemed to be a

beneficial owner of any security of which that person has a right to acquire beneficial ownership within 60 days. Under the SEC rules,

more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner

of securities as to which he or she may not have any pecuniary interest. Unless otherwise indicated below, each person has sole voting

and investment power with respect to the shares beneficially owned and each stockholder’s address is c/o Blue Star Foods Corp.,

3000 NW 109th Avenue, Miami, Florida 33172.

The

percentages below are calculated based on ____ shares of common stock issued and outstanding as of November ___, 2023.

| Name and

Address of Beneficial Owner | |

Number

of

Shares

Beneficially

Owned | | |

Percentage

of Beneficial

Ownership | |

| Named Executive Officers

and Directors | |

| | | |

| | |

| John Keeler | |

| 755,563 | (1) | |

| [__] | % |

| Nubar Herian | |

| 10,500 | (2) | |

| * | |

| Jeffrey Guzy | |

| 14,858 | (3) | |

| * | |

| Timothy McLellan | |

| 11,130 | (4) | |

| * | |

| Trond Ringstad | |

| 11,390 | (4) | |

| * | |

| Silvia Alana | |

| 6,407 | (5) | |

| * | |

| Miozotis Ponce | |

| 10,754 | (6) | |

| * | |

| All current directors and executive officers

as a group 7 persons) | |

| 820,602 | | |

| [__] | % |

*

Less than 1%

(1) |

750,190

of such shares are held with Mr. Keeler’s wife as tenants in the entirety and are subject to the terms of a lock-up agreement

pursuant to which Mr. Keeler may not sell more than one-third of the common stock held by him in any two-month period. Includes 5,375

shares underlying a stock option which are exercisable within 60 days. |

(2)

|

Includes

5,375 shares underlying stock options which are exercisable within 60 days. |

| (3) |

Includes

(i) 625 shares underlying a warrant and (ii) 5,375 shares underlying stock options exercisable within 60 days. |

| (4) |

Includes

5,375 shares underlying stock options which are exercisable within 60 days. |

| (5) |

Includes

4,233 shares underlying stock options which are exercisable within 60 days. |

| (6) |

Includes

10,729 shares underlying a stock option which is exercisable in 60 days.

|

EXECUTIVE

OFFICER AND DIRECTOR COMPENSATION

Executive

Officers

The

Company’s executive officers are John Keeler, Chief Executive Officer and Executive Chairman, Silvia Alana, Chief Financial Officer

and Miozotis Ponce, Chief Operating Officer. Biographical information for Mr. Keeler and Ms. Alana is included above. The Company’s

officers are appointed by the Board of Directors and serve at its discretion.

Miozotis

Ponce, 52, has been the Company’s Chief Operating Officer since April 19, 2022, and the Company’s Vice President

of Operations since May 2012, where she led sales and marketing and operations. Prior thereto, from June 2005, Ms. Ponce served as Operations

Manager. Ms. Ponce joined the Company in June 2004 as Customer Service Director and has over 25 years of experience in the food industry.

Ms. Ponce holds an AA in Business from Miami Dade Community College.

There

are no arrangements or understandings between Ms. Ponce and any other person pursuant to which she was appointed as an officer. Ms. Ponce

does not have any family relationships with any of the Company’s directors or executive officers. There are no transactions and

no proposed transactions between Ms. Ponce and the Company that would be required to be disclosed pursuant to Item 404(a) of Regulation

S-K.

Related

Party Transactions

The

Audit Committee, pursuant to its charter, is responsible for the review and approval of all related party transactions. The Audit Committee

charter does not set forth specific standards to be applied rather, the Audit Committee reviews each transaction individually on a case-by-case,

facts and circumstances basis.

From

January 2006 through May 2017, Keeler & Co issued an aggregate of $2,910,000, 6% demand promissory notes to John Keeler, our Chief

Executive Officer, Executive Chairman and a director. We may prepay the notes at any time first against interest due thereunder. If an

event of default occurs under the notes, interest will accrue at 18% per annum and if not paid within 10 days of payment becoming due,

the holder of the note is entitled to a late fee of 5% of the amount of payment not timely received. On December 30, 2020, we entered

into a debt repayment agreement with Mr. Keeler pursuant to which we issued 1,991 shares of common stock to a third party designated

by Mr. Keeler as repayment for an aggregate principal amount of $1,593,300 due under four such notes. All interest due on the notes had

previously been paid on a monthly basis. As of December 31, 2022, the Company remains indebted to Mr. Keeler under the remaining promissory

notes in the aggregate principal amount of $893,000.

John

Keeler, our Chief Executive Officer, Executive Chairman and director owns 95% of Bacolod, an exporter of pasteurized crab meat from the

Philippines.

John

Keeler, our Chief Executive Officer, Executive Chairman and director, owns 95% of Bicol, a Philippine company, and an indirect supplier

of crab meat via Bacolod to the Company.

The

Company’s transactions with Bacolod were $0 and $1,280,589 for the years ended December 31, 2022 and 2021, respectively. There

were no transactions between the Company and Bicol for the years ended December 31, 2022, and 2021.

John

Keeler, our Chief Executive Officer, Executive Chairman and director, and Christopher Constable, our former Chief Financial Officer and

director, own 80% and 20%, respectively, of Strike the Gold Foods, Ltd., a UK company, which sold the Company’s packaged crab meat

in the United Kingdom in 2019.

Keeler

& Co leased approximately 16,800 square feet of office/warehouse space for our executive offices and distribution facility for $16,916

per month from John Keeler Real Estate Inc., a Florida corporation, 33% owned by a trust for each of John Keeler III, Andrea Keeler and

Sarah Keeler, each of whom is a child of John Keeler, our Chief Executive Officer. On December 31, 2020, this facility was sold to an

unrelated third-party purchaser and the lease was terminated. In connection with the sale, the Company retained approximately 4,756 square

feet of such space, rent-free, for 12 months.

From

time to time, we may prepay Bacolod for future shipments of product which may represent five to six months of purchases. There was $1,299,984

due as of December 31, 2022 for future shipments from Bacolod.

John

Keeler, our Executive Chairman, was a party to an Unconditional and Continuing Guaranty, dated August 31, 2016, with ACF, pursuant to

which Mr. Keeler guaranteed the Company’s obligations under its Loan and Security Agreement with ACF. On March 31, 2021, John Keeler,

Executive Chairman and Chief Executive Officer, provided a personal guaranty of up to $1,000,000 to Lighthouse in connection with its

revolving credit facility.

John

Keeler, pledged 250,000 shares of common stock to secure the Company’s obligations under the $1,000,000 Kenar Note issued on March

26, 2019. On May 21, 2020, the Kenar Note was amended to, among other things, reduce the number of pledged shares by Mr. Keeler to 10,000.

The Kenar Note was paid off and the pledged shares released as of July 6, 2021. Marcos Herian,

President of Kenar, a former 5% stockholder, is the brother of Nubar Herian, a director of our Company.

On

March 31, 2021, we issued 136 shares of common stock to a company owned by the stepmother of John Keeler, our Executive Chairman, as

a quarterly dividend on the Series A Stock acquired by such company in connection with the Company Settlement. On

June 30, 2021, all Series A Stock held by such company were converted into 400 shares of common stock. On November 2, 2021 and November

3, 2021, we issued an aggregate of 10 shares of common stock to a company owned by the stepmother of John Keeler upon the exercise

of warrants for total proceeds of $9,600.

On

March 31, 2021, we issued 254 shares of common stock to Lunar, as a quarterly dividend on the Series A Stock acquired by Lunar in the

Offering. Nubar Herian, a director, is the President of Lunar. On June 30, 2021, all 600 shares

of such Series A Stock were converted into 750 shares of common stock. On November 5, 2021, a total of 375 shares were issued

upon the exercise of warrants for total proceeds of $360,000.

On

February 25, 2020, Christopher Constable, the Company’s former Chief Financial Officer entered into a Separation and Mutual Release

Agreement pursuant to which Mr. Constable resigned as Chief Financial Officer, Secretary, Treasurer and a director of the Company. The

Agreement contained mutual general releases, a two-year confidentiality provision and provides for Mr. Constable’s outstanding

stock options to remain in effect until November 8, 2028.

On

March 25, 2021, the Company entered into one-year director service agreements with each of Messrs. Guzy, McLellan, Ringstad, Herian and

Keeler, the then current directors. In consideration for their services, each director was issued $25,000 of shares of Common Stock for

each year’s service based upon the closing sale price of the Common Stock, on the principal market on which it is then traded,

on the final trading day of the calendar year. On April 12, 2021, the Company granted each director an option to purchase 250 shares

of common stock at an exercise price of $2.00 per share, which option vests in equal monthly installments over the course of the year

and expires three years from the date they are fully vested. Pursuant to the terms of the director service agreement, on December 31,

2021, the Company issued 27 shares of common stock to Nubar Herian, 37 shares of common stock to Timothy McLellan, 27 shares of common

stock to John Keeler, 37 shares of common stock to Trond Ringstad, and 49 shares of common stock to Jeffrey Guzy for serving as a director

of the Company.

On

April 20, 2022, the Company entered into new one-year director service agreements (which replaced the agreements entered into in March

2021) with each of the current members of the Board. The agreement will automatically renew for successive one-year terms unless either

party notifies the other of its desire not to renew the agreement at least 30 days prior to the end of the then current term, or unless

earlier terminated in accordance with the terms of the agreement. As compensation for serving on the Board, each director will be entitled

to a $25,000 annual stock grant and for serving on a committee of the Board, an additional $5,000 annual stock grant, both based upon

the closing sales price of the Common Stock on the last trading day of the calendar year. Each director who serves as chairman of the

Audit Committee, Compensation Committee and Nominating and Governance Committee will be entitled to an additional $15,000, $10,000 and

$7,500 annual stock grant, respectively. As additional consideration for such Board service, each director was granted a five-year option

to purchase 1,250 shares of the Company’s common stock at an exercise price of $2.00 per share, which shares vest in equal quarterly

installments of 62 shares during the term of the option.

On

June 30, 2021, MO7 Boats LLC, invested $275,000 in a private offering and was issued 6,875 shares of common stock and a warrant to purchase

6,875 shares of common stock. Marcos Herian, managing member and President of MO7 Boats LLC, is the brother of Nubar Herian, a director

of our Company.

On

June 30, 2021, Promarine Boats LLC, invested $250,000 in a private offering and was issued 6,250 shares of common stock and a warrant

to purchase 6,875 shares of common stock. Marcos Herian, managing member of Promarine Boats LLC, is the brother of Nubar Herian, a director

of our Company.

On

June 30, 2021, R&N Ocean Inc., invested $250,000 in a private offering and was issued 6,250 shares of common stock and a warrant

to purchase 6,875 shares of common stock. Marcos Herian, President of Kenar, a former 10% stockholder, is the brother of Nubar Herian,

a director of our Company.

On

August 3, 2021, the Company issued a stock option to purchase an aggregate of 351 shares of common stock at an exercise price of $6.00

per share to Silvia Alana, its chief financial officer.

On

February 14, 2023, each of the Company’s executive officers and directors entered into the Aegis Lock-Up.

In

connection with a settlement agreement between Nubar Herian, a director, and certain stockholders of the Company, on November 23, 2023,

Mr. Herian, paid $43,446 to the Company in full satisfaction of any stockholder claims.

The

table below sets forth certain information about the compensation awarded to, earned by or paid to our Chief Executive Officer and our

other executive officer receiving annual remuneration in excess of $100,000 during 2022 (each, a “Named Executive Officer”).

Summary

Compensation Table

| Name and

Principal Position | |

Year | | |

Salary | | |

Stock

Awards | |

|

Option

Awards | | |

All

Other Compensation | | |

Total | |

| John Keeler | |

| 2022 | | |

$ | 79,409 | | |

$ | 25,000 | (2) |

|

$ | 50,000 | (3) | |

$ | 38,543 | (3) | |

$ | 192,952 | |

| Executive Chairman and | |

| 2021 | | |

$ | 79,409 | | |

| 17,917- | (5) |

|

$ | 200,000 | (6) | |

$ | 23,704 | (3) | |

$ | 321,030 | |

| Chief Executive Officer | |

| | | |

| | | |

| | |

|

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

|

| | | |

| | | |

| | |

| Silvia Alana | |

| 2022 | | |

$ | 150,000 | | |

| 17,361 | (7) |

|

$ | 50,000 | (3) | |

$ | 5,400 | (8) | |

$ | 222,761 | |

| Chief Financial Officer | |

| 2021 | | |

$ | 143,2505 | | |

| | |

|

$ | 42,075 | (9) | |

$ | 5,400 | (8) | |

$ | 190,725 | |

| | |

| | | |

| | | |

| | |

|

| | | |

| | | |

| | |

| Miozotis Ponce | |

| 2022 | | |

$ | 170,000 | | |

| | |

|

| | | |

$ | 5,400 | (8) | |

$ | 175,400 | |

| Chief Operating Officer | |

| 2021 | | |

$ | 147,581 | | |

| | |

|

| | | |

$ | 5,400 | (8) | |

$ | 152,981 | |

(1)

All option grants are calculated at the grant date fair value computed in accordance with FASB ASC Topic 718.

(2)

Represents 3,125 shares of common stock at $0.40 per share issued on December 31, 2022. (3) Represents an option to purchase 1,250 shares

of common stock at $2.00 per share granted on December 31, 2022.

(4)

Represents health insurance premiums paid on behalf of Mr. Keeler by the Company.

(5)

Represents 546 shares of common stock at $1.63 per share issued on December 31, 2021.

(6)

Represents an option to purchase 5,000 shares of common stock at $2.00 per share granted on December 31, 2021.

(7)

Represents 2,170 shares of common stock at $0.40 per share issued on December 31, 2022.

(8)

Represents health insurance premiums paid by the Company.

(9)

Represents an option to purchase 350 shares of common stock at $6.00 per share granted on August 3, 2021.

We

offer a 401(k) plan to eligible employees, including our executive officer. In accordance with this plan, all eligible employees may

contribute a percentage of compensation up to a maximum of the statutory limits per year. We intend for the 401(k) plan to qualify, depending

on the employee’s election, under Section 401(a) of the Code, so that contributions by employees, and income earned on those contributions,

are not taxable to employees until withdrawn from the 401(k) plan.

Employment

Agreement

We

do not currently have employment agreements with our executive officers, other than with Silvia Alana, our Chief Financial Officer. Ms.

Alana is party to a three-year employment agreement, dated August 3, 2020, with the Company for an annual base salary of $127,500, which

increased to $150,000 in August 2021. The agreement provides for the grant on the first anniversary of the agreement of a three-year

option to purchase that number of shares equal to 30% of Ms. Alana’s then current salary at the market price of the Company’s

common stock. The agreement also includes a non-competition provision for 12 months following employment with the Company.

OUTSTANDING

EQUITY AWARDS AT DECEMBER 31, 2022

Outstanding

Equity Awards

The

table below reflects all equity awards made to each Named Executive Officer that were outstanding on December 31, 2022.

| Name | |

Grant

Date | |

Number

of

Securities

Underlying

Unexercised