0001805284false00018052842023-11-022023-11-02

| | | | | | | | |

| | |

| | |

| UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 | |

FORM 8-K |

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of report (Date of earliest event reported) November 2, 2023 |

Rocket Companies, Inc. |

| (Exact name of registrant as specified in its charter) | |

| Delaware | 001-39432 | 84-4946470 |

| (State or other jurisdiction | (Commission | (I.R.S. Employer |

| of incorporation) | File Number) | Identification No.) |

| 1050 Woodward Avenue | |

| Detroit, MI 48226 | |

| (Address of principal executive offices) (Zip Code) | |

| (313) 373-7990 | |

| (Registrant’s Telephone Number, Including Area Code) | |

| | |

| (Former Name or Former Address, if Changed Since Last Report) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Class A common stock, par value $0.00001 per share | | RKT | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 2, 2023, Rocket Companies, Inc. (the "Company") issued a press release announcing its results for the third quarter ended September 30, 2023, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference in its entirety.

Item 7.01 Regulation FD.

On November 2, 2023, the Company made available on its website at https://ir.rocketcompanies.com/home/default.aspx supplemental financial information with respect to the results for the third quarter ended September 30, 2023.

The information furnished pursuant to Item 2.02, including Exhibit 99.1, and Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 2, 2023

| | | | | | | | | | | | | | |

| ROCKET COMPANIES, INC. | |

| | | | |

| By: | /s/ Tina V. John | |

| Name: | Tina V. John | |

| Title: | General Counsel and Secretary | |

Rocket Companies Announces Third Quarter 2023 Results

•Generated Q3'23 net revenue of $1.203 billion and adjusted revenue of $1.002 billion. Adjusted revenue exceeded the high end of guidance range

•Reported GAAP net income of $115 million, or $0.04 per GAAP diluted earnings per share

•Delivered profitability across GAAP net income, adjusted net income and adjusted EBITDA metrics

DETROIT, November 2, 2023 – Rocket Companies, Inc. (NYSE: RKT) (“Rocket Companies” or the “Company”), a Detroit-based fintech platform company consisting of tech-driven mortgage, real estate and financial services businesses – including Rocket Mortgage, Rocket Homes, Rocket Loans and Rocket Money – today announced results for the quarter ended September 30, 2023.

“I am very proud of our team for delivering strong results against a challenging economic backdrop,” said Varun Krishna, CEO of Rocket Companies. “In today's climate, innovation is essential. With the incredible amount of data in our ecosystem, paired with the transformative power of AI, Rocket is uniquely positioned to disrupt the industry. We’re just getting started and can’t wait to show you what we are building to revolutionize homeownership.”

Third Quarter 2023 Financial Summary1

ROCKET COMPANIES

($ amounts in millions, except per share)

| | | | | | | | | | | | | | | | | | | | | | | |

| Q3-23 | | Q3-22 | | YTD 23 | | YTD 22 |

| (Unaudited) | | (Unaudited) |

| Total Revenue, net | $ | 1,203 | | | $ | 1,295 | | | $ | 3,105 | | | $ | 5,358 | |

| Total Expenses | $ | 1,086 | | | $ | 1,188 | | | $ | 3,265 | | | $ | 4,110 | |

| GAAP Net Income (Loss) | $ | 115 | | | $ | 96 | | | $ | (157) | | | $ | 1,193 | |

| | | | | | | |

| Adjusted Revenue | $ | 1,002 | | | $ | 888 | | | $ | 2,886 | | | $ | 3,945 | |

| Adjusted Net Income (Loss) | $ | 7 | | | $ | (166) | | | $ | (137) | | | $ | 60 | |

| Adjusted EBITDA | $ | 73 | | | $ | (160) | | | $ | 12 | | | $ | 263 | |

| | | | | | | |

| GAAP Diluted Earnings (Loss) Per Share | $ | 0.04 | | | $ | 0.04 | | | $ | (0.06) | | | $ | 0.47 | |

| Adjusted Diluted Earnings (Loss) Per Share | $ | 0.00 | | | $ | (0.08) | | | $ | (0.07) | | | $ | 0.03 | |

1 "GAAP" stands for Generally Accepted Accounting Principles in the U.S. Please see the sections of this document titled "Non-GAAP Financial Measures" and "GAAP to non-GAAP Reconciliations" for more information on the Company's non-GAAP measures and its share count. Certain figures in the tables throughout this document may not foot due to rounding.

(Units in '000s, $ amounts in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q3-23 | | Q3-22 | | YTD 23 | | YTD 22 |

| Select Metrics | | (Unaudited) | | (Unaudited) |

| Closed loan origination volume | | $ | 22,191 | | | $ | 25,578 | | | $ | 61,451 | | | $ | 114,099 | |

| Gain on sale margin | | 2.76 | % | | 2.69 | % | | 2.61 | % | | 2.91 | % |

| Net rate lock volume | | $ | 20,815 | | | $ | 23,746 | | | $ | 62,594 | | | $ | 102,745 | |

Third Quarter 2023 Financial Highlights

•Generated total revenue, net of $1.203 billion and GAAP net income of $115 million, or $0.04 per diluted share. Generated total adjusted revenue of $1.002 billion and adjusted net income of $7 million, or an adjusted income of $0.00 per diluted share.

•Rocket Mortgage generated $22.2 billion in mortgage origination closed loan volume. Gain on sale margin was 2.76%, the third consecutive quarter of gain on sale margin increase.

•Rocket gained purchase market share in the quarter, both year-over-year and quarter-over-quarter.

•Total liquidity was approximately $8.7 billion, as of September 30, 2023, which includes $1.0 billion of cash on-hand, $2.8 billion of corporate cash used to self-fund loan originations, $3.3 billion of undrawn lines of credit, and $1.7 billion of undrawn MSR lines.

•Servicing book unpaid principal balance, which includes subserviced loans, was $506 billion at September 30, 2023. As of September 30, 2023, our servicing portfolio includes 2.4 million loans serviced. The portfolio generates approximately $1.4 billion of recurring servicing fee income on an annualized basis. During the quarter, we acquired mortgage servicing rights on certain agency loans for total consideration of $103 million. The MSR acquisition added $6.2 billion of unpaid principal balance for loans with a weighted average coupon well above that of our current portfolio, providing a compelling refinance opportunity when rates decline.

•Rocket Mortgage net client retention rate was 97% for the 12 months ended September 30, 2023. There is a strong correlation between this metric and client lifetime value. We believe our net client retention rate is unmatched among mortgage companies and on par with some of the best performing subscription business models in the world.

Company Highlights

•Since launching in April, BUY+, our Rocket-exclusive collaboration between Rocket Mortgage and Rocket Homes, our 50-state home search platform and real estate agent referral network, has continued to exceed expectations, as we saw attachment rate, defined as clients who use both Rocket Mortgage and Rocket Homes, nearly double. BUY+ helps clients save thousands of dollars in upfront costs if they work with a Rocket Homes Partner Real Estate Agent and obtain financing with Rocket Mortgage.

•ONE+, our 1% down home loan program, has gained traction since our launch in May, with closing volume and loan units more than tripling from June to September. ONE+ increases access to home ownership for low-to-moderate-income Americans facing home affordability challenges.

•Our home equity loan product continued to resonate with clients, as volume more than doubled in the third quarter, compared to the beginning of this year. Our home equity loan product enables homeowners to tap record levels of home equity without impacting the lower rate on their first lien mortgage, a particularly compelling value proposition in the current market environment.

•In August of this year, we delivered 20% faster purchase turn times and reduced manual touches by over 20%, compared to the same time last year. Our vast scale of data assets provides a strong foundation to automate routine and complex tasks, enhance productivity and operational efficiency, and transform the client experience through generative AI.

•In October, we unveiled enhancements to our Pathfinder tool, a proprietary AI and machine learning-powered search engine that helps loan officers easily obtain answers to complex underwriting qualification or loan processing questions. Current testing of an AI chat interface within Pathfinder has shown a 69% improvement in speed to resolutions compared to the existing process. Building on this success, we are enhancing the Pathfinder experience by integrating large language models (LLM) to encompass over 3,300 new loan scenarios. Pathfinder, trained on 400,000 pieces of content and 75,000 daily data points, is utilized by over 40,000 mortgage professionals, generating 1.5 million monthly page views and automated actions. Launched in 2020, Pathfinder, an industry-first tool, has continually evolved, incorporating a machine learning framework, custom Google AI search, and now, generative AI.

•Lendesk Technologies, our Canadian technology services company offering a suite of products to digitize the Canadian mortgage experience, launched Lender Spotlight AI Assistant, a tool that helps brokers easily and seamlessly obtain accurate answers from a database of over 7,000 mortgage policies.

•We expect annualized cost savings of approximately $200 million, the high end of the original $150 to $200 million range, as a result of company-wide prioritization and cost reduction efforts across expense categories, including a voluntary career transition program conducted in July. These cost savings will take full quarter effect in Q4'23.

Rocket Environmental, Social, Governance: For-More-Than-Profit

•Rocket Companies placed #2 on Fortune’s ‘Best Workplaces in Financial Services & Insurance’ list. This marks the third straight year that the Company has finished in the top two for this award.

•Rocket Companies ranked #2 in People’s ‘100 Companies That Care in 2023: Employers Putting Their Communities First’ list, highlighting the Company’s longstanding efforts to support the residents and communities of Detroit, particularly in the area of safe and stable housing.

•In September, the Rocket Community Fund, our philanthropic partner company, and MKE United, an initiative of the Greater Milwaukee Committee, announced a $300,000 investment to support the Anti-Displacement Fund program. The program aims to protect homeowners in downtown-adjacent neighborhoods from displacement caused by increasing property taxes. This investment expands the Rocket Community Fund’s national housing stability coverage to Milwaukee, in addition to Detroit, Atlanta and Cleveland.

•Since 2018, Rocket Companies has been the anchor employer for the Urban Alliance program in Detroit. Urban Alliance connects high school students to equitable, inclusive careers through paid work experiences, mentorship, and professional development. To date, 300 Detroit high school students have graduated from the program, with over half of the students taking internship roles at Rocket Companies.

Fourth Quarter 2023 Outlook

In Q4 2023, we expect adjusted revenue of between $650 million to $800 million.

Direct to Consumer

In the Direct to Consumer segment, clients have the ability to interact with Rocket Mortgage online and/or with the Company’s mortgage bankers. The Company markets to potential clients in this segment through various brand campaigns and performance marketing channels. The Direct to Consumer segment derives revenue from originating, closing, selling and servicing predominantly agency-conforming loans, which are pooled and sold to the secondary market. The segment also includes title insurance, appraisals and settlement services complementing the Company’s end-to-end mortgage origination experience. Servicing activities are fully allocated to the Direct to Consumer segment and are viewed as an extension of the client experience. Servicing enables Rocket Mortgage to establish and maintain long term relationships with our clients, through multiple touchpoints at regular engagement intervals.

DIRECT TO CONSUMER2

($ amounts in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Q3-23 | | Q3-22 | | YTD 23 | | YTD 22 |

| (Unaudited) | | (Unaudited) |

| Sold loan volume | $ | 11,981 | | | $ | 16,520 | | $ | 33,238 | | $ | 72,223 |

| Sold loan gain on sale margin | 4.03 | % | | 4.47 | % | | 3.81 | % | | 4.15 | % |

| Revenue, net | $ | 979 | | | $ | 1,114 | | $ | 2,491 | | $ | 4,455 |

| Adjusted Revenue | $ | 778 | | | $ | 708 | | $ | 2,271 | | $ | 3,042 |

| Contribution margin | $ | 299 | | | $ | 149 | | $ | 757 | | $ | 1,005 |

Partner Network

The Rocket Professional platform supports our Partner Network segment, where we leverage our superior client service and widely recognized brand to grow marketing and influencer relationships, and our mortgage broker partnerships through Rocket Pro TPO ("third party origination"). Our marketing partnerships consist of well-known consumer-focused companies that find value in our award-winning client experience and want to offer their clients mortgage solutions with our trusted, widely recognized brand. These organizations connect their clients directly to us through marketing channels and a referral process. Our influencer partnerships are typically with companies that employ licensed mortgage professionals that find value in our client experience, technology and efficient mortgage process, where mortgages may not be their primary offering. We also enable clients to start the mortgage process through the Rocket platform in the way that works best for them, including through a local mortgage broker.

PARTNER NETWORK2

($ amounts in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Q3-23 | | Q3-22 | | YTD 23 | | YTD 22 |

| (Unaudited) | | (Unaudited) |

| Sold loan volume | $ | 10,278 | | $ | 11,754 | | $ | 26,433 | | $ | 51,367 |

| Sold loan gain on sale margin | 1.22 | % | | 1.17 | % | | 1.02 | % | | 1.07 | % |

| Revenue, net | $ | 123 | | $ | 98 | | $ | 344 | | $ | 567 |

| Adjusted Revenue | $ | 123 | | $ | 98 | | $ | 344 | | $ | 567 |

| Contribution margin | $ | 64 | | $ | 11 | | $ | 152 | | $ | 265 |

2 We measure the performance of the Direct to Consumer and Partner Network segments primarily on a contribution margin basis. Contribution margin is intended to measure the direct profitability of each segment and is calculated as Adjusted Revenue less directly attributable expenses. Directly attributable expenses include salaries, commissions and team member benefits, general and administrative expenses, and other expenses, such as direct servicing costs and origination costs. A loan is considered "sold" when it is sold to investors on the secondary market. See "Summary Segment Results" section later in this document and the footnote on "Segments" in the "Notes to Consolidated Financial Statements" in the Company's forthcoming filing on Form 10-Q for more information.

Balance Sheet and Liquidity

We remain in a strong liquidity position, with total liquidity of $8.7 billion, which includes $1.0 billion of cash on-hand, $2.8 billion of corporate cash used to self-fund loan originations, a portion of which could be transferred to funding facilities (warehouse lines) at our discretion, $3.3 billion of undrawn lines of credit from financing facilities, and $1.7 billion of undrawn MSR lines. As of September 30, 2023 our available cash position was $3.8 billion, which includes cash on-hand and corporate cash used to self-fund loan originations, combined with the $6.7 billion of mortgage servicing rights, representing a total of $10.4 billion of asset value on our balance sheet. As of September 30, 2023, our total equity was $8.5 billion.

BALANCE SHEET HIGHLIGHTS

($ amounts in millions)

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| (Unaudited) | | |

| Cash and cash equivalents | $ | 957 | | | $ | 722 | |

| Mortgage servicing rights (“MSRs”), at fair value | $ | 6,678 | | | $ | 6,947 | |

| Funding facilities | $ | 4,670 | | | $ | 3,549 | |

| Other financing facilities and debt | $ | 4,289 | | | $ | 4,701 | |

| Total equity | $ | 8,506 | | | $ | 8,476 | |

Third Quarter Earnings Call

Rocket Companies will host a live conference call at 4:30 p.m. ET on November 2, 2023 to discuss its results for the quarter ended September 30, 2023. A live webcast of the event will be available online by clicking on the "Investor Info" section of our website. The webcast will also be available via rocketcompanies.com.

A replay of the webcast will be available on the Investor Relations site following the conclusion of the event.

Condensed Consolidated Statements of Income (Loss)

($ In Thousands, Except Shares and Per Share Amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (Unaudited) | | (Unaudited) |

| Revenue | | | | | | | |

| Gain on sale of loans | | | | | | | |

| Gain on sale of loans excluding fair value of MSRs, net | $ | 241,496 | | | $ | 139,733 | | | $ | 786,128 | | | $ | 1,174,268 | |

| Fair value of originated MSRs | 330,627 | | | 426,278 | | | 850,027 | | | 1,682,366 | |

| Gain on sale of loans, net | 572,123 | | | 566,011 | | | 1,636,155 | | | 2,856,634 | |

| Loan servicing income | | | | | | | |

| Servicing fee income | 344,061 | | | 364,211 | | | 1,054,037 | | | 1,088,004 | |

| Change in fair value of MSRs | 12,765 | | | 150,304 | | | (343,137) | | | 592,162 | |

| Loan servicing income, net | 356,826 | | | 514,515 | | | 710,900 | | | 1,680,166 | |

| Interest income | | | | | | | |

| Interest income | 93,868 | | | 95,753 | | | 241,369 | | | 265,490 | |

| Interest expense on funding facilities | (55,924) | | | (46,173) | | | (129,056) | | | (130,576) | |

| Interest income, net | 37,944 | | | 49,580 | | | 112,313 | | | 134,914 | |

| Other income | 236,275 | | | 164,580 | | | 646,095 | | | 685,987 | |

| Total revenue, net | 1,203,168 | | | 1,294,686 | | | 3,105,463 | | | 5,357,701 | |

| Expenses | | | | | | | |

| Salaries, commissions and team member benefits | 589,584 | | | 670,804 | | | 1,772,498 | | | 2,278,844 | |

| General and administrative expenses | 199,399 | | | 204,290 | | | 595,214 | | | 709,853 | |

| Marketing and advertising expenses | 193,406 | | | 210,701 | | | 593,853 | | | 770,281 | |

| Depreciation and amortization | 27,636 | | | 24,211 | | | 83,678 | | | 70,033 | |

| Interest and amortization expense on non-funding debt | 38,354 | | | 38,317 | | | 115,021 | | | 115,263 | |

| Other expenses | 37,164 | | | 40,008 | | | 105,191 | | | 166,098 | |

| Total expenses | 1,085,543 | | | 1,188,331 | | | 3,265,455 | | | 4,110,372 | |

| Income (loss) before income taxes | 117,625 | | | 106,355 | | | (159,992) | | | 1,247,329 | |

| (Provision for) benefit from income taxes | (2,680) | | | (10,131) | | | 2,606 | | | (54,741) | |

| Net income (loss) | 114,945 | | | 96,224 | | | (157,386) | | | 1,192,588 | |

| Net (income) loss attributable to non-controlling interest | (108,739) | | | (89,314) | | | 152,507 | | | (1,128,551) | |

| Net income (loss) attributable to Rocket Companies | $ | 6,206 | | | $ | 6,910 | | | $ | (4,879) | | | $ | 64,037 | |

| | | | | | | |

| Earnings (loss) per share of Class A common stock | | | | | | | |

| Basic | $ | 0.05 | | | $ | 0.06 | | | $ | (0.04) | | | $ | 0.53 | |

| Diluted | $ | 0.04 | | | $ | 0.04 | | | $ | (0.06) | | | $ | 0.47 | |

| | | | | | | |

| Weighted average shares outstanding | | | | | | | |

| Basic | 129,390,501 | | | 119,020,520 | | | 126,971,718 | | | 120,156,494 | |

| Diluted | 1,983,992,350 | | | 1,970,665,767 | | | 1,979,203,982 | | | 1,972,263,268 | |

Condensed Consolidated Balance Sheets

($ In Thousands)

| | | | | | | | | | | |

| September 30,

2023 | | December 31,

2022 |

| Assets | (Unaudited) | | |

| Cash and cash equivalents | $ | 957,254 | | | $ | 722,293 | |

| Restricted cash | 34,668 | | | 66,806 | |

| Mortgage loans held for sale, at fair value | 8,012,552 | | | 7,343,475 | |

| Interest rate lock commitments (“IRLCs”), at fair value | 92,568 | | | 90,635 | |

| Mortgage servicing rights (“MSRs”), at fair value | 6,678,165 | | | 6,946,940 | |

| Notes receivable and due from affiliates | 10,759 | | | 10,796 | |

| Property and equipment, net | 256,411 | | | 274,192 | |

| Deferred tax asset, net | 531,509 | | | 537,963 | |

| Lease right of use assets | 355,412 | | | 366,189 | |

| Forward commitments, at fair value | 168,561 | | | 22,444 | |

| Loans subject to repurchase right from Ginnie Mae | 1,381,127 | | | 1,642,392 | |

| Goodwill and intangible assets, net | 1,242,218 | | | 1,258,928 | |

| Other assets | 927,535 | | | 799,159 | |

| Total assets | $ | 20,648,739 | | | $ | 20,082,212 | |

| Liabilities and equity | | | |

| Liabilities: | | | |

| Funding facilities | $ | 4,670,403 | | | $ | 3,548,699 | |

| Other financing facilities and debt: | | | |

| | | |

| Senior Notes, net | 4,032,078 | | | 4,027,970 | |

| Early buy out facility | 256,749 | | | 672,882 | |

| Accounts payable | 199,917 | | | 116,331 | |

| Lease liabilities | 408,009 | | | 422,769 | |

| Forward commitments, at fair value | 16,287 | | | 25,117 | |

| Investor reserves | 95,567 | | | 110,147 | |

| Notes payable and due to affiliates | 30,749 | | | 33,463 | |

| Tax receivable agreement liability | 577,996 | | | 613,693 | |

| Loans subject to repurchase right from Ginnie Mae | 1,381,127 | | | 1,642,392 | |

| Other liabilities | 473,484 | | | 393,200 | |

| Total liabilities | $ | 12,142,366 | | | $ | 11,606,663 | |

| Equity | | | |

| Class A common stock | $ | 1 | | | $ | 1 | |

| Class B common stock | — | | | — | |

| Class C common stock | — | | | — | |

| Class D common stock | 19 | | | 19 | |

| Additional paid-in capital | 317,004 | | | 276,221 | |

| Retained earnings | 294,770 | | | 300,394 | |

| Accumulated other comprehensive income | 68 | | | 69 | |

| Non-controlling interest | 7,894,511 | | | 7,898,845 | |

| Total equity | 8,506,373 | | | 8,475,549 | |

| Total liabilities and equity | $ | 20,648,739 | | | $ | 20,082,212 | |

Summary Segment Results for the Three and Nine Months Ended September 30, 2023 and 2022,

($ amounts in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 | Direct to

Consumer | | Partner

Network | | Segments Total | | All Other | | Total |

| Total U.S. GAAP Revenue, net | $ | 979 | | | $ | 123 | | | $ | 1,103 | | | $ | 101 | | | $ | 1,203 | |

| Change in fair value of MSRs due to valuation assumptions, net of hedges | (201) | | | — | | | (201) | | | — | | | (201) | |

| Adjusted Revenue | $ | 778 | | | $ | 123 | | | $ | 901 | | | $ | 101 | | | $ | 1,002 | |

| Less: Directly attributable expenses | 479 | | | 60 | | | 539 | | | 96 | | | 635 | |

| Contribution margin (1) | $ | 299 | | | $ | 64 | | | $ | 362 | | | $ | 5 | | | $ | 367 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2022 | Direct to Consumer | | Partner Network | | Segments Total | | All Other | | Total |

| Total U.S. GAAP Revenue, net | $ | 1,114 | | | $ | 98 | | | $ | 1,213 | | | $ | 82 | | | $ | 1,295 | |

| Change in fair value of MSRs due to valuation assumptions, net of hedges | (406) | | | — | | | (406) | | | — | | | (406) | |

| Adjusted Revenue | $ | 708 | | | $ | 98 | | | $ | 806 | | | $ | 82 | | | $ | 888 | |

| Less: Directly attributable expenses | 559 | | | 87 | | | 646 | | | 82 | | | 728 | |

| Contribution margin (1) | $ | 149 | | | $ | 11 | | | $ | 161 | | | $ | — | | | $ | 160 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 | Direct to Consumer | | Partner Network | | Segments Total | | All Other | | Total |

| Total U.S. GAAP Revenue, net | $ | 2,491 | | | $ | 344 | | | $ | 2,834 | | | $ | 271 | | | $ | 3,105 | |

| Less: Increase in MSRs due to valuation assumptions (net of hedges) | (220) | | | — | | | (220) | | | — | | | (220) | |

| Adjusted Revenue | $ | 2,271 | | | $ | 344 | | | $ | 2,615 | | | $ | 271 | | | $ | 2,886 | |

| Less: Directly attributable expenses | 1,514 | | | 191 | | | 1,706 | | | 242 | | | 1,948 | |

Contribution margin(1) | $ | 757 | | | $ | 152 | | | $ | 909 | | | $ | 29 | | | $ | 938 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2022 | Direct to Consumer | | Partner Network | | Segments Total | | All Other | | Total |

| Total U.S. GAAP Revenue, net | $ | 4,455 | | | $ | 567 | | | $ | 5,022 | | | $ | 335 | | | $ | 5,358 | |

| Less: Increase in MSRs due to valuation assumptions (net of hedges) | (1,413) | | | — | | | (1,413) | | | — | | | (1,413) | |

| Adjusted Revenue | $ | 3,042 | | | $ | 567 | | | $ | 3,610 | | | $ | 335 | | | $ | 3,945 | |

| Less: Directly attributable expenses | 2,037 | | | 302 | | | 2,340 | | | 305 | | | 2,645 | |

Contribution margin(1) | $ | 1,005 | | | $ | 265 | | | $ | 1,270 | | | $ | 30 | | | $ | 1,300 | |

| | | | | | | | | |

(1) We measure the performance of the segments primarily on a contribution margin basis. Contribution margin is intended to measure the direct profitability of each segment and is calculated as Adjusted Revenue less directly attributable expenses. Adjusted Revenue is a non-GAAP financial measure described below. Directly attributable expenses include salaries, commissions and team member benefits, general and administrative expenses, marketing and advertising expenses and other expenses, such as direct servicing costs and origination costs.

GAAP to non-GAAP Reconciliations

Adjusted Revenue Reconciliation

($ amounts in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (Unaudited) | | (Unaudited) |

| Total revenue, net | $ | 1,203 | | | $ | 1,295 | | | $ | 3,105 | | | $ | 5,358 | |

| Change in fair value of MSRs due to valuation assumptions (net of hedges) (1) | (201) | | | (406) | | | (220) | | | (1,413) | |

| Adjusted Revenue | $ | 1,002 | | | $ | 888 | | | $ | 2,886 | | | $ | 3,945 | |

(1) Reflects changes in assumptions including discount rates and prepayment speed assumptions, mostly due to changes in market interest rates, and the effects of contractual prepayment protection associated with sales or purchases of MSRs.

Adjusted Net Income (Loss) Reconciliation

($ amounts in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (Unaudited) | (Unaudited) |

| Net income (loss) attributable to Rocket Companies | $ | 6 | | | $ | 7 | | | $ | (5) | | | $ | 64 | |

| Net income (loss) impact from pro forma conversion of Class D common shares to Class A common shares (1) | 109 | | | 90 | | | (151) | | | 1,130 | |

| Adjustment to the (provision for) benefit from income tax (2) | (26) | | | (16) | | | 36 | | | (259) | |

| Tax-effected net income (loss) (2) | 89 | | | 81 | | | (120) | | | 936 | |

| Share-based compensation expense (3) | 39 | | | 58 | | | 142 | | | 186 | |

| Change in fair value of MSRs due to valuation assumptions (net of hedges) (4) | (201) | | | (406) | | | (220) | | | (1,413) | |

| | | | | | | |

| | | | | | | |

| Career transition program (5) | 51 | | | 20 | | | 51 | | | 81 | |

| Change in Tax receivable agreement liability (6) | — | | | — | | | — | | | (24) | |

| Tax impact of adjustments (7) | 27 | | | 81 | | | 6 | | | 291 | |

| Other tax adjustments (8) | 1 | | | 1 | | | 3 | | | 3 | |

| Adjusted Net Income (Loss) | $ | 7 | | | $ | (166) | | | $ | (137) | | | $ | 60 | |

(1) Reflects net income (loss) to Class A common stock from pro forma exchange and conversion of corresponding shares of our Class D common shares held by non-controlling interest holders as of September 30, 2023 and 2022.

(2) Rocket Companies is subject to U.S. Federal income taxes, in addition to state, local and Canadian taxes with respect to its allocable share of any net taxable income (loss) of Holdings. The Adjustment to the (provision for) benefit from income tax reflects the difference between (a) the income tax computed using the effective tax rates below applied to the Income (loss) before income taxes assuming Rocket Companies, Inc. owns 100% of the non-voting common interest units of Holdings and (b) the Provision for (benefit from) income taxes. The effective income tax rate was 24.29% for the three and nine months ended September 30, 2023, 24.51% for three months ended September 30, 2022, and 25.11% for the nine months ended September 30, 2022.

(3) The three and nine months ended September 30, 2023, and the nine months ended September 30, 2022 amounts exclude the impact of the career transition program.

(4) Reflects changes in assumptions including discount rates and prepayment speed assumptions, mostly due to changes in market interest rates, and the effects of contractual prepayment protection associated with sales or purchases of MSRs.

(5) Reflects net expenses associated with compensation packages, healthcare coverage, career transition services, and accelerated vesting of certain equity awards.

(6) Reflects changes in estimates of tax rates and other variables of the Tax receivable agreement liability.

(7) Tax impact of adjustments gives effect to the income tax related to share-based compensation expense, the change in fair value of MSRs due to valuation assumptions, career transition program, and the change in Tax receivable agreement liability, at the effective tax rates for each quarter.

(8) Represents tax benefits due to the amortization of intangible assets and other tax attributes resulting from the purchase of Holdings units, net of payment obligations under Tax Receivable Agreement.

Adjusted Diluted Weighted Average Shares Outstanding Reconciliation

($ in millions, except shares and per share)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (Unaudited) | | (Unaudited) |

| Diluted weighted average Class A Common shares outstanding | 1,983,992,350 | | 1,970,665,767 | | 1,979,203,982 | | | 1,972,263,268 | |

| Assumed pro forma conversion of Class D shares (1) | — | | — | | — | | | — | |

| Adjusted diluted weighted average shares outstanding | 1,983,992,350 | | 1,970,665,767 | | 1,979,203,982 | | | 1,972,263,268 | |

| | | | | | | |

| Adjusted Net Income (Loss) | $ | 7 | | $ | (166) | | | $ | (137) | | | $ | 60 | |

| Adjusted Diluted Earnings (Loss) Per Share | $ | 0.00 | | $ | (0.08) | | | $ | (0.07) | | | $ | 0.03 | |

(1) Reflects the proforma exchange and conversion of non-dilutive Class D common stock to Class A common stock. For the three and nine months ended September 30, 2023 and 2022, Class D common shares were dilutive and are included in the diluted weighted average Class A common shares outstanding in the table above.

Adjusted EBITDA Reconciliation

($ amounts in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (Unaudited) | | (Unaudited) |

| Net income (loss) | $ | 115 | | | $ | 96 | | | $ | (157) | | | $ | 1,193 | |

| Interest and amortization expense on non-funding debt | 38 | | | 38 | | | 115 | | | 115 | |

| Provision for (benefit from) income taxes | 3 | | | 10 | | | (3) | | | 55 | |

| Depreciation and amortization | 28 | | | 24 | | | 84 | | | 70 | |

| Share-based compensation expense (1) | 39 | | | 58 | | | 142 | | | 186 | |

| Change in fair value of MSRs due to valuation assumptions (net of hedges) (2) | (201) | | | (406) | | | (220) | | | (1,413) | |

| | | | | | | |

| Career transition program (3) | 51 | | | 20 | | | 51 | | | 81 | |

| Change in Tax receivable agreement liability (4) | — | | | — | | | — | | | (24) | |

| Adjusted EBITDA | $ | 73 | | | $ | (160) | | | $ | 12 | | | $ | 263 | |

(1) The three and nine months ended September 30, 2023 and the nine months ended September 30, 2022, amounts exclude the impact of the career transition program.

(2) Reflects changes in assumptions including discount rates and prepayment speed assumptions, mostly due to changes in market interest rates, and the effects of contractual prepayment protection associated with sales or purchases of MSRs.

(3) Reflects net expenses associated with compensation packages, healthcare coverage, career transition services, and accelerated vesting of certain equity awards.

(4) Reflects changes in estimates of tax rates and other variables of the Tax receivable agreement liability.

Non-GAAP Financial Measures

To provide investors with information in addition to our results as determined by GAAP, we disclose Adjusted Revenue, Adjusted Net Income (Loss), Adjusted Diluted Earnings (Loss) Per Share and Adjusted EBITDA (collectively “our non-GAAP financial measures”) as non-GAAP measures. We believe that the presentation of our non-GAAP financial measures provides useful information to investors regarding our results of operations because each measure assists both investors and management in analyzing and benchmarking the performance and value of our business. Our non-GAAP financial measures are not calculated in accordance with GAAP and should not be considered as a substitute for Total revenue, net, Net income (loss), or any other operating performance measure calculated in accordance with GAAP. Other companies may define non-GAAP financial measures differently, and as a result, our measures of our non-GAAP financial measures may not be directly comparable to those of other companies. Our non-GAAP financial measures provide indicators of performance that are not affected by fluctuations in certain costs or other items. Accordingly, management believes that these measurements are useful for comparing general operating performance from period to period, and management relies on these measures for planning and forecasting of future periods. Additionally, these measures allow management to compare our results with those of other companies that have different financing and capital structures.

We define “Adjusted Revenue” as total revenues net of the change in fair value of mortgage servicing rights (“MSRs”) due to valuation assumptions (net of hedges). We define “Adjusted Net Income (Loss)” as tax-effected earnings (losses) before share-based compensation expense, the change in fair value of MSRs due to valuation assumptions (net of hedges), career transition program, change in Tax receivable agreement liability, and the tax effects of those adjustments as applicable. We define “Adjusted Diluted Earnings (Loss) Per Share” as Adjusted Net Income (Loss) divided by the diluted weighted average number of Class A common stock outstanding for the applicable period, which assumes the pro forma exchange and conversion of all outstanding Class D common stock for Class A common stock. We define “Adjusted EBITDA” as earnings (losses) before interest and amortization expense on non-funding debt, income tax, depreciation and amortization, share-based compensation expense, change in fair value of MSRs due to valuation assumptions (net of hedges), career transition program, and change in Tax receivable agreement liability.

We exclude from each of our non-GAAP financial measures the change in fair value of MSRs due to valuation assumptions (net of hedges) as this represents a non-cash non-realized adjustment to our total revenues, reflecting changes in assumptions including discount rates and prepayment speed assumptions, mostly due to changes in market interest rates, which is not indicative of our performance or results of operation. We also exclude effects of contractual prepayment protection associated with sales of MSRs. Adjusted EBITDA includes Interest expense on funding facilities, which are recorded as a component of Interest income, net, as these expenses are a direct cost driven by loan origination volume. By contrast, interest and amortization expense on non-funding debt is a function of our capital structure and is therefore excluded from Adjusted EBITDA.

Our definitions of each of our non-GAAP financial measures allow us to add back certain cash and non-cash charges, and deduct certain gains that are included in calculating Total revenue, net, Net income (loss) attributable to Rocket Companies or Net income (loss). However, these expenses and gains vary greatly, and are difficult to predict. From time to time in the future, we may include or exclude other items if we believe that doing so is consistent with the goal of providing useful information to investors.

Although we use our non-GAAP financial measures to assess the performance of our business, such use is limited because they do not include certain material costs necessary to operate our business. Our non-GAAP financial measures can represent the effect of long-term strategies as opposed to short-term results. Our presentation of our non-GAAP financial measures should not be construed as an indication that our future results will be unaffected by unusual or nonrecurring items. Our non-GAAP financial measures have limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. Because of these limitations, our non-GAAP financial measures should not be considered as measures of discretionary cash available to us to invest in the growth of our business or as measures of cash that will be available to us to meet our obligations.

Forward Looking Statements

Some of the statements contained in this document are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are generally identified by the use of words such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "plan," "potential," "predict," "project," "should," "target," "will," "would" and, in each case, their negative or other various or comparable terminology. These forward-looking statements reflect our views with respect to future events as of the date of this document and are based on our management’s current expectations, estimates, forecasts, projections, assumptions, beliefs and information. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been correct. All such forward-looking statements are subject to risks and uncertainties, many of which are outside of our control, and could cause future events or results to be materially different from those stated or implied in this document. It is not possible to predict or identify all such risks. These risks include, but are not limited to, the risk factors that are described under the section titled “Risk Factors” in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other filings with the Securities and Exchange Commission. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this document and in our SEC filings. We expressly disclaim any obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law.

About Rocket Companies

Founded in 1985, Rocket Companies is a Detroit-based fintech platform company consisting of personal finance and consumer technology brands including Rocket Mortgage, Rocket Homes, Amrock, Rocket Money, Rocket Loans, Rocket Mortgage Canada, Lendesk, Core Digital Media, Rocket Central and Rocket Connections.

Rocket Companies' mission is to be the best at creating certainty in life's most complex moments so its clients can pursue their financial dreams. The Company helps clients achieve the goal of home ownership and financial freedom through industry-leading client experiences powered by its simple, fast and trusted digital solutions. J.D. Power has ranked Rocket Mortgage, part of Rocket Companies, #1 in client satisfaction for both primary mortgage origination and servicing 21 times – the most of any mortgage lender.

For more information, please visit our Corporate Website or Investor Relations Website.

Investor Relations Contact:

Sharon Ng

ir@rocketcompanies.com

(313) 769-2058

Media Contact:

Aaron Emerson

aaronemerson@rocketcentral.com

(313) 373-3035

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

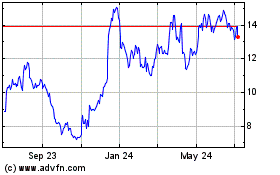

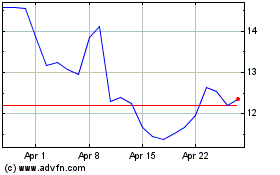

Rocket Companies (NYSE:RKT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rocket Companies (NYSE:RKT)

Historical Stock Chart

From Apr 2023 to Apr 2024