0001275014false00012750142023-10-252023-10-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 25, 2023 |

Ultra Clean Holdings, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

000-50646 |

61-1430858 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

26462 Corporate Avenue |

|

Hayward, California |

|

94545 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 510 576-4400 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value |

|

UCTT |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry Into a Material Definitive Agreement.

On October 25, 2023, Ultra Clean Holdings, Inc. (“UCT”) entered into a stock purchase agreement (the “Stock Purchase Agreement”) by and among UCT, Hoffman Instrumentation Supply, Inc. d/b/a HIS Innovations Group, an Oregon corporation (“HIS”), the stockholders of HIS and LVL3 Instrumentation LLC, an Oregon limited liability company, solely in its capacity as representative of the equity holders of HIS. On October 25, 2023, UCT announced that it closed the acquisition of HIS.

Under the terms of the Stock Purchase Agreement, UCT paid $50.0 million in upfront cash consideration for HIS, subject to customary post-closing adjustments. UCT is required to pay up to an additional $50.0 million in cash earn-out consideration based on HIS’ achievement of adjusted EBITDA for the 2023 fiscal year (the “2023 Earn-out Consideration”). UCT may also be required to pay up to an amount equal to any unearned portion of the 2023 Earn-out Consideration plus an additional $20.0 million, based on HIS’ achievement of certain financial performance metrics in 2024 and 2025.

The Stock Purchase Agreement contains customary representations and warranties of UCT and HIS. The parties have agreed to indemnify each other for certain breaches of representations, warranties, covenants and other specified matters. UCT also obtained representation and warranty insurance with respect to losses that arise due to breaches by HIS or the selling stockholders of certain representations and warranties contained in the Stock Purchase Agreement.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Forward Looking Statements

This report includes forward-looking statements regarding the Stock Purchase Agreement and related transactions that are not historical or current facts and deal with potential future circumstances and developments, in particular statements regarding whether and when any of the contingent earn-out consideration provided for in the Stock Purchase Agreement will be earned or paid. Forward-looking statements are qualified by the inherent risk and uncertainties surrounding future expectations generally and may materially differ from actual future experience. There are a number of important factors that could cause actual results or events to differ materially from those indicated by such forward-looking statements, including: (1) unexpected costs, charges or expenses resulting from the transaction; (2) UCT’s ability to successfully grow its or HIS’ business; (3) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; (4) the retention of key employees, customers or suppliers; and (5) legislative, regulatory and economic developments, including changing business conditions in the semiconductor industry markets overall and the economy in general. These risks and other factors also include, among others, those identified in “Risk Factors,” “Management's Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in UCT's Form 10-K, Forms 10-Q and other reports and statements filed with the Securities and Exchange Commission. Forward-looking statements are made and based on information available to UCT on the date of this report. UCT assumes no obligation to update the information in this report, except as required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

ULTRA CLEAN HOLDINGS, INC. |

|

|

|

|

Date: |

October 31, 2023 |

By: |

/s/ Paul Y. Cho |

|

|

|

Name: Paul Y. Cho

Title: General Counsel and Corporate Secretary

|

Exhibit 99.1

|

|

Press Release |

Source: Ultra Clean Holdings, Inc. |

UCT Acquires HIS Innovations Group

•Expands UCT’s semiconductor addressable market by $1.5 billion

•Increases UCT’s vertical capabilities

•Further penetrates UCT’s position in sub-fab solutions

•Adds higher gross margin, high value product offering

Ultra Clean Holdings, Inc. (Nasdaq: UCTT), today announced that it has closed the acquisition of HIS Innovations Group, a privately held company based in Hillsboro, Oregon. HIS is a leading supplier to the semiconductor sub-fab segment including the design, manufacturing, and integration of components, process solutions, and fully integrated sub-systems.

“This acquisition aligns with UCT’s long-term strategy to pursue sustained and profitable growth by offering a more diversified portfolio of high-quality, high-value solutions to our customers,” said Jim Scholhamer, CEO. “This acquisition increases our vertical capabilities and synergies, extends our reach into the sub-fab area, and expands our addressable market by approximately $1.5 billion. With more than 60 new fabs being built, this represents a meaningful growth opportunity.”

“I am thrilled to join forces with UCT, a clear leader in the semiconductor manufacturing sector,” said Jason Frank, CEO, HIS Innovations Group. “This combination provides a unique advantage in the sub-fab market enabling HIS to accelerate its growth into new geographies and expanding UCT deeper into the semiconductor manufacturing market. This is a tremendous opportunity to bring new value to our customers and other key partners.”

Under the terms of the stock purchase agreement, UCT paid $50 million in upfront cash consideration for HIS, subject to customary post-closing adjustments. UCT would be required to pay up to an additional $50 million in cash earn-out consideration based on HIS’ achievement of adjusted EBITDA for the 2023 fiscal year. The upfront cash consideration, together with this earn-out consideration, will equate to a price multiple of 8.3x HIS’ 2023 adjusted EBITDA. UCT may also be required to pay up to an amount equal to any unpaid portion of the 2023 earn-out consideration plus an additional $20 million, based on HIS’ achievement of certain financial performance metrics in 2024 and 2025.

UCT anticipates the acquisition to be accretive to shareholders on an adjusted basis. The HIS team will continue to be based in Hillsboro and will report into UCT’s Products division.

Needham & Company, LLC served as financial advisor to UCT in the acquisition and Davis Polk & Wardwell LLP served as legal advisor to UCT.

|

|

($ in Millions) |

HIS Innovations Group |

|

2023 [1] |

Revenue |

$56.7 |

Non-GAAP Gross Margin |

38.4% |

Non-GAAP Operating Income |

$8.4 |

Non-GAAP Operating Margin |

14.7% |

Adjusted EBITDA [2] |

$10.0 |

Adjusted EBITDA Margin |

17.6% |

[1] 2023E figures reflect HIS Innovations Group management provided estimates.

[2] Adjusted EBITDA (unaudited) is defined as HIS’ net income (loss) plus provisions for (benefit from) taxes, interest expense, other expense (income), other infrequent or unusual items and depreciation.

Use of Non-GAAP Measures

This release and the accompanying table include a discussion of HIS’ estimated Non-GAAP Gross Margin, Non-GAAP Operating Income, Non-GAAP Operating Margin, Adjusted EBITDA and Adjusted EBITDA Margin, which are non-GAAP financial measures that are used by management to evaluate HIS’ financial performance and should not be considered a substitute for results provided in accordance with accounting principles generally accepted in the United States of America ("GAAP"). HIS’ "Adjusted EBITDA" is defined as net income (loss) plus provisions for (benefit from) taxes, interest expense, other expense (income), other infrequent or unusual items and depreciation. The definition of HIS’ Adjusted EBITDA used in this press release may not be comparable to the definitions as reported by other companies. We believe these non-GAAP measures are relevant and useful information because it provides investors with certain measurements to analyze operating performance and enterprise value. A reconciliation of HIS’ estimated 2023 non-GAAP metrics disclosed above is not available due to the uncertainty of the timing of the one-time transaction costs and other items associated with the acquisition and cannot be reasonably predicted or determined. As a result, such reconciliation is not available without unreasonable efforts and we are unable to determine the probable significance of the unavailable information.

Safe Harbor Statement

This press release contains, or may be deemed to contain, "forward-looking statements" (as defined in the US Private Securities Litigation Reform Act of 1995) which reflect our current views with respect to future events and financial performance. We use words such as "anticipates," "projection," "outlook," "forecast," "believes," "plan," "expect," "future," "intends," "may," "will," "estimates," "see," "predicts," "should" and similar expressions to identify these forward-looking statements.

Forward looking statements included in this press release include, without limitation, statements regarding the acquisition of HIS by UCT, the expected benefits of the transaction and future opportunities for the combined company and HIS’ estimated 2023 financial results. Forward-looking statements are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. There are a number of important factors that could cause actual results or events to differ materially from those indicated by such forward-looking statements, including: (1) unexpected costs, charges or expenses resulting from the transaction; (2) UCT's ability to successfully grow its or HIS’ business; (3) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; (4) the retention of key employees, customers or suppliers; and (5) legislative, regulatory and economic developments, including changing business conditions in the semiconductor industry markets overall and the economy in general as well. These risks and other factors also include, among others, those identified in "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations'' and elsewhere in UCT's Form 10-K, Forms 10-Q and other reports and statements filed with the Securities and Exchange Commission. Forward-looking statements are made and based on information available to the company on the date of this press release. The company assumes no obligation to update the information in this press release, except as required by law.

About Ultra Clean Holdings, Inc.

Ultra Clean Holdings, Inc. is a leading developer and supplier of critical subsystems, components, parts, and ultra-high purity cleaning and analytical services, primarily for the semiconductor industry. Under its Products division, UCT offers its customers an integrated outsourced solution for major subassemblies, improved design-to-delivery cycle times, design for manufacturability, prototyping, and high-precision manufacturing. Under its Services Division, UCT offers its customers tool chamber parts cleaning and coating, as well as micro-contamination analytical services. UCT is headquartered in Hayward, California. Additional information is available at www.uct.com.

About HIS

HIS is a market leading, ISO9001:2015 certified semiconductor sub-system supplier and equipment integrator. HIS designs and manufactures custom and off-the-shelf components, process solutions, and fully integrated systems used throughout the semiconductor ecosystem from Tier 1 OEMs to semiconductor manufacturing and advanced packaging facilities. Offering early-stage R&D, solution-driven engineering services, rapid prototyping, fabrication, and high-volume production of components, weldments, and electro-mechanical systems, HIS integrates a wide variety of components and equipment into flexible and modular platforms that aim to provide the best value for customers and a one-stop-shop for a variety of applications.

Contact:

Rhonda Bennetto

SVP Investor Relations

rbennetto@uct.com

v3.23.3

Document And Entity Information

|

Oct. 25, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 25, 2023

|

| Entity Registrant Name |

Ultra Clean Holdings, Inc.

|

| Entity Central Index Key |

0001275014

|

| Entity Emerging Growth Company |

false

|

| Securities Act File Number |

000-50646

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

61-1430858

|

| Entity Address, Address Line One |

26462 Corporate Avenue

|

| Entity Address, City or Town |

Hayward

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94545

|

| City Area Code |

510

|

| Local Phone Number |

576-4400

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

UCTT

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

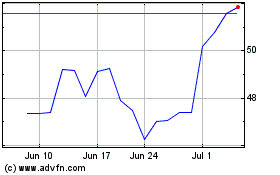

Ultra Clean (NASDAQ:UCTT)

Historical Stock Chart

From Apr 2024 to May 2024

Ultra Clean (NASDAQ:UCTT)

Historical Stock Chart

From May 2023 to May 2024