UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of The Securities Exchange Act of 1934

Sky Century Investment, Inc.

(Exact name of registrant as specified in its charter)

State of Nevada

| 45-5243254

|

(State or other jurisdiction of

incorporation or organization)

| (I.R.S. Employer Identification No.)

|

|

|

220 Emerald Vista Way #233, Las Vegas, NV

| 89144

|

(Address of principal executive offices)

| (Zip Code)

|

Registrant’s telephone number, including area code: + 1 (205) 23 877 35

Securities to be registered pursuant to Section 12(b) of the Act: None

Securities to be registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 Par Value

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer

| ☐

| Accelerated filer

| ☐

|

Non-accelerated filer

| ☒

| Smaller reporting company

| ☒

|

|

| Emerging growth company

| ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

i

TABLE OF CONTENTS

ii

ITEM 1. DESCRIPTION OF BUSINESS

Some of the statements contained in this registration statement on Form 10 of Sky Century Investment, Inc., (hereinafter the “Company”, “we” or “our”) discuss future expectations, contain projections of our plan of operation or financial condition or state other forward-looking information. In this registration statement, forward-looking statements are generally identified by the words such as “anticipate”, “plan”, “believe”, “expect”, “estimate”, and the like. Forward-looking statements involve future risks and uncertainties, there are factors that could cause actual results or plans to differ materially from those expressed or implied. These statements are subject to known and unknown risks, uncertainties, and other factors that could cause the actual results to differ materially from those contemplated by the statements. The forward-looking information is based on various factors and is derived using numerous assumptions. A reader, whether investing in the Company’s securities or not, should not place undue reliance on these forward-looking statements, which apply only as of the date of this Registration Statement. Important factors that may cause actual results to differ from projections include, for example:

·the success or failure of Management’s efforts to implement the Company’s plan of operation;

·the ability of the Company to fund its operating expenses;

·the ability of the Company to compete with other companies that have a similar plan of operation;

·the effect of changing economic conditions impacting our plan of operation;

·the ability of the Company to meet the other risks as may be described in future filings with the SEC.

General Background of the Company

The Company was incorporated in the state of Nevada as Band Rep Management, Inc., a for-profit entity on May 4, 2012. The Company was renamed to the Sky Century Investment, Inc. on December 15, 2015. On February 29, 2020, Sky Century Investment, Inc. acquired the complete proprietorship of Cannabis News LLC, a business situated at 30 N Gould St, Ste R, Sheridan, WY 82801, USA, with Mr. Alimzhanov personally funding the software development expenses.

Cannabis News LLC possesses ownership of the Cannabis News Application, a mobile application designed to aggregate and synthesize cannabis-related news from diverse sources, subsequently delivering this compiled information to users in a convenient way. The Cannabis News Application functions as a platform enabling users to access a wide range of news content concerning cannabis, thoroughly gathered from diverse online sources.

The Cannabis News Application is a news source focused on cannabis-related information, offering various features such as continuous monitoring and filtering of cannabis news and breakthroughs. It ensures users are informed of developments in a timely manner by consolidating data from numerous sources, delivering a comprehensive and current knowledge base. Presented by Sky Century Investment, Inc., the application's primary feature is its ability to compile and distribute cannabis industry news from diverse sources. These sources need not be exclusively cannabis-focused platforms; the application adeptly locates cannabis-related articles from general news outlets. With each page refresh, users are greeted with real-time updates to their news feed.

The Cannabis News Application's functionality features are customizable filters and settings, enabling users to receive news updates based on their subscriptions. This feature ensures users focus solely on essential content, preventing information overload. Creating a personalized news feed is a straightforward process: users select preferred news sources and incorporate them into their curated list. With broad coverage and a comprehensive approach, Cannabis News is a valuable solution for those deeply involved in the cannabis industry, individuals seeking pertinent information from diverse sources. The application is compatible with both Apple and Android platforms, catering to a wide user demographic. The Cannabis News Application is flexible to accommodate changing user needs. It is relevant for cannabis investors using the app to track industry trends and allocate funds wisely.

Sky Century Investment, Inc. employs sophisticated techniques and methodologies to optimize online visibility, engage target audiences, and drive meaningful interactions. It`s prowess in Search Engine Optimization (SEO) enhances the discoverability of clients' digital assets, securing them a prominent place within search engine rankings and consequently, increased online traction. Through examination of performance metrics and user behavior, the company furnishes clients with insightful reports illuminating strengths, weaknesses, and areas ripe for optimization.

1

The company crafts visually appealing and functionally optimized websites mirroring clients' values and ambitions, providing users with seamless and captivating online experiences.

Business Objectives of the Company

Sky Century Investment, Inc. is committed to the following key business objectives by driving growth, innovation, and customer satisfaction:

App Enhancement and Feature Implementation: We are committed to refining our existing application, leveraging the latest technological advancements to deliver an improved user experience. Concurrently, we will introduce new and innovative features to the app, ensuring that it remains at the forefront of industry trends and user expectations.

App Scaling: Our strategic roadmap includes scaling our application to accommodate a larger user base. This entails optimizing infrastructure, enhancing server capacity, and fine-tuning the app's performance to ensure seamless usage, even as our user community grows.

RSS Feed Monetization: Recognizing the evolving landscape of information consumption, we are venturing into the sale of RSS feeds tailored to provide valuable insights into the cannabis industry. This new revenue stream will cater to a niche audience while capitalizing on the demand for specialized content.

Expanded Online Services: We plan to expand the range of online services to cater to the diverse needs of our clientele. These services include:

Digital Marketing and SEO: We will provide comprehensive assistance in crafting effective digital marketing strategies, enhancing online visibility, and optimizing search engine performance.

Analytics and Reporting: We are committed to equipping our clients with data-driven insights. Our services will include sophisticated analytics and comprehensive reporting to inform strategic decision-making.

Web Design and Email Marketing: With a focus on user-centric design, we will offer web design services that captivate visitors and foster engagement. Additionally, our email marketing strategies will enable effective communication and customer retention.

IT Services: Recognizing the growing importance of IT in business operations, we are expanding our services to encompass IT solutions that empower organizations to harness technology efficiently.

Competition

Sky Century Investment, Inc. is involved in operations and development across several diverse sectors. Each sector is characterized by its unique competitive landscape. The company systematically faces competition from a diverse array of entities. Our commitment to excellence and innovation enables us to navigate these challenges and leverage them as opportunities for growth. Our competition can be categorized into the following segments:

Cannabis Industry: Within the cannabis sector, Sky Century Investment, Inc competes with a range of companies involved in various aspects of Cannabis industry. These include established players and emerging startups, each with their unique value propositions and market presence. As the demand for reliable information and specialized services within the cannabis industry increases.

IT Solutions: In the realm of IT solutions, Sky Century Investment, Inc encounters competition from both specialized IT service providers and technology giants. These competitors offer services spanning software development, cybersecurity, cloud solutions, and more. By continuously innovating our IT services and adopting the latest technological advancements, we aim to distinguish ourselves as a reliable partner for businesses seeking tailored IT solutions that align with their strategic objectives.

Marketing Strategy and Consulting: Within the sphere of marketing strategy and consulting, Sky Century Investment, Inc faces competition from agencies and consultancies that offer a wide range of services, including digital marketing,

2

branding, and market research. Our commitment to delivering comprehensive, data-driven strategies tailored to our clients' specific needs positions us to stand out in this competitive landscape. Furthermore, our integrated approach that combines technology and creativity sets us apart as an innovative marketing partner.

RSS Feed Services: In the domain of RSS feed services, the competition of the Sky Century Investment, Inc includes entities providing general and niche content syndication. Our focus on delivering curated, insightful, and industry-specific RSS feeds about the cannabis sector gives us a unique competitive edge. By consistently offering high-quality content that informs and educates our audience, we aim to position ourselves as a preferred source for specialized information.

Employees

As of May 31, 2023, our team comprises a single employee, Nataliia Petranetska, who assumes the roles of Chief Executive Officer, President, Treasurer, Secretary, and Director as per the stipulations outlined within the Employment Agreement.

ITEM 1A. RISK FACTORS

Forward-Looking Statements

This registration statement on Form 10 contains forward-looking statements that are based on current expectations, estimates, forecasts and projections about us, our future performance, the market in which we operate, our beliefs and our Management’s assumptions. In addition, other written or oral statements that constitute forward-looking statements may be made by us or on our behalf. Words such as “expects”, “anticipates”, “targets”, “goals”, “projects”, “intends”, “plans”, “believes”, “seeks”, “estimates”, variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict or assess. Therefore, actual outcomes and results may differ materially from what is expressed or forecast in such forward-looking statements.

Any investment in our shares of common stock involves a high degree of risk. You should carefully consider the following information about these risks, together with the other information contained in this annual report before you decide to invest in our common stock. Each of the following risks may materially and adversely affect our business objective, plan of operation and financial condition. These risks may cause the market price of our common stock to decline, which may cause you to lose all or a part of the money you invested in our common stock. We provide the following cautionary discussion of risks, uncertainties and possible inaccurate assumptions relevant to our business plan. In addition to other information included in this annual report, the following factors should be considered in evaluating the Company’s business and future prospects.

Our business operates in a highly competitive industry.

We operate in a global, competitive marketplace and face substantial competition from a limited number of established competitors, some of which may have greater financial resources than we do. Price competition is strong and, coupled with the existence of a number of cost conscious customers, has historically limited our ability to increase prices. In addition to price, competition is based on product performance and technological leadership, quality, reliability of delivery and customer service and support. There can be no assurance that competition in one or more of our markets will not adversely affect us and our results of operations.

As we introduce our new products and services, a failure to predict and react to customer demand could adversely affect our business.

We have dedicated significant resources to the development, manufacturing and marketing of our products and services. There can be no assurance that any new products and services that we develop will gain widespread acceptance in the marketplace or will be able to compete successfully with other new products or services that may be introduced by competitors. In addition, we may incur additional warranty or other costs as new products are tested and used by customers.

3

Operating in multiple focus areas can introduce operational complexity that might impact our company's efficiency, effectiveness, and overall performance.

Each area of activities may have unique operational requirements, customer needs, and industry dynamics, which could strain management's ability to effectively oversee all aspects, potentially leading to inefficiencies, misaligned strategies, and communication breakdowns. Serving multiple customer segments with differing needs can be challenging. The company needs to ensure consistent quality and customer satisfaction across all segments, which might necessitate tailored strategies for each group. Allocating resources-such as finances, human resources, and technology-across different activities requires careful consideration. A lack of clear prioritization could lead to suboptimal resource allocation and reduced performance in one or more areas. Different activities could have varying financial cycles, revenue recognition methods, and cash flow patterns. Managing financial reporting, budgeting, and forecasting across these diverse areas might be more intricate.

Juggling multiple areas might make it challenging to create a cohesive and motivated workforce, leading to potential talent shortages or high turnover rates.

Juggling multiple areas of expertise within an organization can make it challenging to create a cohesive and motivated workforce. When an organization operates across various areas, each with their unique technical requirements, it can be difficult to foster a sense of cohesion among employees. This lack of cohesion can impact collaboration, communication, and overall team dynamics. Without a unified vision and shared goals, employees may struggle to work effectively together. Given the specific nature of expertise required in each area, talent shortages can occur. With multiple areas to manage, it can be challenging to find and attract individuals with the necessary skill sets. This can result in difficulties in filling open positions or requiring specialized talent recruitment strategies that may be more time-consuming and costly.

We may incur costs or suffer reputational damage due to improper conduct of our associates, agents or business partners.

We are subject to a variety of domestic and foreign laws, rules and regulations relating to improper payments to government officials, bribery, anti-kickback and false claims rules, competition, export and import compliance, money laundering and data privacy. If our associates, agents or business partners engage in activities in violation of these laws, rules or regulations, we may be subject to civil or criminal fines or penalties or other sanctions, may incur costs associated with government investigations, or may suffer damage to our reputation.

Our company faces competition in the markets we serve, which could materially and adversely affect our operating results.

Our company actively competes with many companies producing similar products. Depending on the particular application, we experience competition based on a number of factors, including price, quality, performance and availability. We compete against many companies, including divisions of larger companies with greater financial resources than we possess. As a result, these competitors may be both domestically and internationally better able to withstand a change in conditions within the markets in which we compete and throughout the global economy as a whole.

In addition, our ability to compete effectively depends on how successfully we anticipate and respond to various competitive factors, including new competitors entering our markets, new products and services that may be introduced by competitors, changes in customer preferences, pricing pressures and new government regulations. If we are unable to anticipate our competitors’ development of new products and services, identify customer needs and preferences on a timely basis, or successfully introduce new products and services or modify existing products and service offerings in response to such competitive factors, we could lose customers to competitors. If we cannot compete successfully, our sales and operating results could be materially and adversely affected.

Credit and counterparty risks could harm our business.

The financial condition of our customers could affect our ability to market our products and services or collect receivables. In addition, financial difficulties faced by our customers as a result of an adverse economic event or other

4

market factors may lead to cancellation or delay of orders. Our customers may suffer financial difficulties that make them unable to pay for a product or solution when payments become due, or they may decide not to pay us, either as a matter of corporate decision-making or in response to changes in local laws and regulations. Although historically not material, we cannot be certain that, in the future, expenses or losses for uncollectible amounts will not have a material adverse effect on our revenues, earnings and cash flows.

Our success depends on our executive management and other key personnel and our ability to attract and retain top talent throughout our company.

Our future success depends to a significant degree on the skills, experience and efforts of our executive management and other key personnel and their ability to provide us with uninterrupted leadership and direction. The failure to retain our executive officers and other key personnel or a failure to provide adequate succession plans could have an adverse impact. Our future success also depends on our ability to attract, retain and develop qualified personnel at all levels of the organization. The availability of highly qualified talent is limited in a number of the jurisdictions in which we operated, and the competition for talent is robust. A failure to attract, retain and develop new qualified personnel throughout the organization could have an adverse effect on our operations and implementation of our strategic plan.

Information systems failure may disrupt our business and result in financial loss and liability to our customers.

Our business is also dependent on other data-processing systems, communications and information systems. If any of these systems fail, whether caused by fire, other natural disaster, power or telecommunications failure, acts of cyber terrorism or war or otherwise, or they do not function correctly, we could suffer financial loss, business disruption, liability to our customers, regulatory intervention or damage to our reputation. If any of these risks materialize, our reputation and our ability to conduct our business may be materially adversely affected.

We face risks relating to cybersecurity attacks that could cause loss of confidential information and other business disruptions.

We rely extensively on computer systems to manage our business, and our business is at risk from and may be impacted by cybersecurity attacks. These could include attempts to gain unauthorized access to our data and computer systems. Attacks can be both individual and/or highly organized attempts organized by very sophisticated hacking organizations. We employ a number of measures to prevent, detect and mitigate these threats, which include employee education, password encryption, frequent password change events, firewall detection systems, anti-virus software in-place and frequent backups; however, there is no guarantee such efforts will be successful in preventing a cyber-attack. A cybersecurity attack could compromise the confidential information of our employees, customers and supplier, and potentially violate certain domestic and international privacy laws. Furthermore, a cybersecurity attack on our customers and suppliers could compromise our confidential information in the possession of our customers and suppliers. A successful attack could disrupt and otherwise adversely affect our business operations.

The effects of the outbreak of the COVID-19 pandemic have had and may continue to have an adverse impact on our business, financial condition, operations, and prospects.

The COVID-19 pandemic has had and continues to have widespread, rapidly evolving, and unpredictable impacts on global society, economies, financial markets, and business practices. Federal and state governments have implemented measures in an effort to contain the virus, including social distancing, travel restrictions, border closures, limitations on public gatherings, work from home policies, supply chain logistical changes, and closure of non-essential businesses.

The COVID-19 pandemic has impacted and may continue to impact our business operations, including our employees, customers, partners, and communities. There is substantial uncertainty as to the nature and degree of the continued effects of the pandemic over time. Our business, financial condition, operations, and prospects have been and may continue to be adversely affected by the COVID-19 pandemic, which has adversely impacted our advertising and marketing partners, consumers, and the markets in which we operate.

5

Unspecified and unascertainable risks

There is no basis for shareholders to evaluate the possible merits or risks of potential business combination. To the extent that the Company effects a business combination with a financially unstable operating company or an entity that is in its early stage of development or growth, the Company will become subject to numerous risks. If the Company effects a business combination with an entity in a high-risk industry, the Company will become subject to the currently unascertainable risks of that industry. Although Management will endeavor to evaluate the risks inherent in a particular business or industry, there can be no assurance that Management will properly ascertain or assess all such risks that the Company perceived at the time of the consummation of a business combination.

Rule 144 Related Risks

The SEC adopted amendments to Rule 144 which became effective on February 15, 2008. These Rule 144 amendments apply to securities acquired both before and after that date. Generally, under the Rule 144 amendments, a person who has beneficially owned restricted shares for at least three months would be entitled to sell their securities provided that: (i) such person is not deemed to have been an affiliate at the time of, or at any time during the three months preceding, a sale; (ii) we are subject to and are current in the Exchange Act periodic reporting requirements for at least 90 days before the sale; and (iii) if the sale occurs prior to satisfaction of a one-year holding period, provided current information is available at the time of sale.

Persons who have beneficially owned restricted shares for at least three months but who are affiliates at the time of, or at any time during the three months preceding a sale, would be subject to additional restrictions, by which such person would be entitled to sell within any three-month period only a number of securities that does not exceed the greater of either of the following: (i) 1% of the total number of securities of the same class then outstanding; or (ii) the average weekly trading volume of such securities during the four calendar weeks preceding the filing of a notice on Form 144 with respect to the sale; provided, in each case, that we are subject to the Exchange Act periodic reporting requirements for at least three months before the sale. Such sales by affiliates must also comply with the manner of sale, current public information and notice provisions of Rule 144.

These Rule 144 related risks are subject to further restrictions in the event that the Exchange Act reporting company is deemed to be a Shell Company, such as the Company.

Possible Issuance of Additional Securities.

Our Articles of Incorporation authorize the issuance of 500,000,000 shares of common stock, no par value. As of May 31, 2023 there were shares 199,731,320 issued and outstanding. We may be expected to issue additional shares in connection with our pursuit of new business opportunities and new business operations. To the extent that additional shares of common stock are issued, our shareholders would experience dilution of their respective ownership interests. If we issue shares of common stock in connection with our intent to pursue new business opportunities, a change in control of the Company may be expected to occur. The issuance of additional shares of common stock may adversely affect the market price of our common stock, if an active trading market commences.

Dividends unlikely

The Company does not expect to pay dividends for the foreseeable future because it has no revenues or cash resources. The payment of dividends will be contingent upon the Company’s future revenues and earnings, if any, capital requirements and overall financial conditions. The payment of any future dividends will be within the discretion of the Company’s board of directors as then constituted. The Company expects that future Management following a business combination will determine to retain any earnings for use in its business operations and accordingly, the Company does not anticipate declaring any dividends in the foreseeable future.

6

ITEM 2. FINANCIAL INFORMATION

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read in conjunction with our consolidated financial statements and related notes in “Item 15. Financial Statements and Exhibits.” The following discussion includes forward-looking statements about our business, financial condition and results of operations, including discussions about management’s expectations for our business. These statements represent projections, beliefs and expectations based on current circumstances and conditions and in light of recent events and trend and should not be construed either as assurances of performance or as promises of a given course of action. Instead, various known and unknown factors are likely to cause our actual performance and management’s actions to vary, and the results of these variances may be both material and adverse. See “Forward-Looking Statements” and “Item 1A. Risk Factors.”

Overview

The Company was incorporated in the state of Nevada as Band Rep Management, Inc., a for-profit entity on May 4, 2012. The Company was renamed to the Sky Century Investment, Inc. on December 15, 2015. On February 29, 2020, Sky Century Investment, Inc. acquired the complete proprietorship of Cannabis News LLC, a business situated at 30 N Gould St, Ste R, Sheridan, WY 82801, USA, with Mr. Alimzhanov personally funding the software development expenses.

Cannabis News LLC possesses ownership of the Cannabis News Application, a mobile application designed to aggregate and synthesize cannabis-related news from diverse sources, subsequently delivering this compiled information to users in a convenient way. The Cannabis News Application functions as a platform enabling users to access a wide range of news content concerning cannabis, thoroughly gathered from diverse online sources.

The Cannabis News Application is a news source focused on cannabis-related information, offering various features such as continuous monitoring and filtering of cannabis news and breakthroughs. It ensures users are informed of developments in a timely manner by consolidating data from numerous sources, delivering a comprehensive and current knowledge base. Presented by Sky Century Investment, Inc., the application's primary feature is its ability to compile and distribute cannabis industry news from diverse sources. These sources need not be exclusively cannabis-focused platforms; the application adeptly locates cannabis-related articles from general news outlets. With each page refresh, users are greeted with real-time updates to their news feed.

The Cannabis News Application's functionality features are customizable filters and settings, enabling users to receive news updates based on their subscriptions. This feature ensures users focus solely on essential content, preventing information overload. Creating a personalized news feed is a straightforward process: users select preferred news sources and incorporate them into their curated list. With broad coverage and a comprehensive approach, Cannabis News is a valuable solution for those deeply involved in the cannabis industry, individuals seeking pertinent information from diverse sources. The application is compatible with both Apple and Android platforms, catering to a wide user demographic. The Cannabis News Application is flexible to accommodate changing user needs. It is relevant for cannabis investors using the app to track industry trends and allocate funds wisely.

Sky Century Investment, Inc. employs sophisticated techniques and methodologies to optimize online visibility, engage target audiences, and drive meaningful interactions. It`s prowess in Search Engine Optimization (SEO) enhances the discoverability of clients' digital assets, securing them a prominent place within search engine rankings and consequently, increased online traction. Through examination of performance metrics and user behavior, the company furnishes clients with insightful reports illuminating strengths, weaknesses, and areas ripe for optimization. The company crafts visually appealing and functionally optimized websites mirroring clients' values and ambitions, providing users with seamless and captivating online experiences.

Business Objectives of the Company

Sky Century Investment, Inc. is committed to the following key business objectives by driving growth, innovation, and customer satisfaction:

7

App Enhancement and Feature Implementation: We are committed to refining our existing application, leveraging the latest technological advancements to deliver an improved user experience. Concurrently, we will introduce new and innovative features to the app, ensuring that it remains at the forefront of industry trends and user expectations.

App Scaling: Our strategic roadmap includes scaling our application to accommodate a larger user base. This entails optimizing infrastructure, enhancing server capacity, and fine-tuning the app's performance to ensure seamless usage, even as our user community grows.

RSS Feed Monetization: Recognizing the evolving landscape of information consumption, we are venturing into the sale of RSS feeds tailored to provide valuable insights into the cannabis industry. This new revenue stream will cater to a niche audience while capitalizing on the demand for specialized content.

Expanded Online Services: We plan to expand the range of online services to cater to the diverse needs of our clientele. These services include:

Digital Marketing and SEO: We will provide comprehensive assistance in crafting effective digital marketing strategies, enhancing online visibility, and optimizing search engine performance.

Analytics and Reporting: We are committed to equipping our clients with data-driven insights. Our services will include sophisticated analytics and comprehensive reporting to inform strategic decision-making.

Web Design and Email Marketing: With a focus on user-centric design, we will offer web design services that captivate visitors and foster engagement. Additionally, our email marketing strategies will enable effective communication and customer retention.

IT Services: Recognizing the growing importance of IT in business operations, we are expanding our services to encompass IT solutions that empower organizations to harness technology efficiently.

RESULTS OF OPERATIONS

Results of Operations for the years ended May 31, 2023 and 2022

Results of Operations during the year ended May 31, 2023 as compared to the year ended May 31, 2022

During the years ended May 31, 2023 and 2022, we have generated total revenues of $74,760 and $61,000, respectively. We had total operating expenses of $211,377 and $285,423, during the years ended May 31, 2023 and 2022, respectively. Total other income for the years ended May 31, 2023 and 2022 were $0 and $3,177. Total other expense for the years ended May 31, 2023 and 2022 were $0 and $132,000.

During the years ended May 31, 2023 and 2022, we had net losses of $136,617 and $353,246, respectively.

Liquidity and Capital Resources

As of May 31, 2023, the Company had cash of $0. The Company had a working capital deficit of $175,093 and $429,976 as of May 31, 2023 and 2022, respectively.

During the year ended May 31, 2023, the Company used $79,324 of cash in operating activities due to its net loss of $136,617; depreciation and amortization of $16,812; accounts receivable of $21,000; prepaid expenses of $74,880; raw materials inventory of $509; accounts payable and accrued liabilities of $102,740.

During the year ended May 31, 2022, the Company used $55,584 of cash in operating activities due to its net loss of $353,246; write-off of intangible assets of $198,000; accounts receivable of $21,000; prepaid expenses of $74,880; accounts payable and accrued liabilities of $195,542.

During the year ended May 31, 2023 the Company had $100,875 of cash in investing activities.

8

During the year ended May 31, 2022 the Company did not have cash in investing activities.

During the year ended May 31, 2023, the Company generated $21,176 of cash in financing activities, which came from advances from related parties.

During the year ended May 31, 2022, the Company generated $53,643. of cash in financing activities, which came from advances from related parties.

Our auditors have issued a “going concern” opinion, meaning that there is substantial doubt we can continue as an on-going business for the next twelve months unless we obtain additional capital. Our only sources for cash during the period were selling our services and loans from our director.

Off-Balance Sheet Arrangements

The Company does not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on the Company’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

Critical Accounting Policies

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. A change in managements’ estimates or assumptions could have a material impact on our financial condition and results of operations during the period in which such changes occurred. Actual results could differ from those estimates. Our financial statements reflect all adjustments that management believes are necessary for the fair presentation of their financial condition and results of operations for the periods presented.

ITEM 3. PROPERTIES.

The Company does not hold any leased office spaces.

ITEM 4. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT.

The following table sets forth information regarding the beneficial ownership of our common stock as of May 31, 2023. The information in this table provides the ownership information for: each person known by us to be the beneficial owner of more than 5% of our common stock; each of our directors; each of our executive officers; and our executive officers and directors as a group.

Beneficial ownership has been determined in accordance with the rules and regulations of the SEC and includes voting or investment power with respect to the shares. Unless otherwise indicated, the persons named in the table below have sole voting and investment power with respect to the number of shares indicated as beneficially owned by them.

9

Name of Beneficial Owner

|

| Common Stock

Beneficially

Owned (1)

|

| Percentage of

Common Stock

Owned (1)

|

Nataliia Petranetska

220 Emerald Way #233

Las Vegas, NV 89144

President, Director, Treasurer, Secretary and Officer

|

| 15,116,279

|

| 7.57%

|

|

|

|

|

|

Khamijon Alimzhanov

17 Bogenbai Batyr Street

Almaty 050000, Kazakhstan

|

| 49,592,469

|

| 24.83%

|

|

|

|

|

|

Cede&Co

PO Box 20 Bowling Green Station

New York, NY 10004

|

| 45,617,942

|

| 22.84%

|

|

|

|

|

|

Yan Tie Ying

Panshan Road 5-37.

Shanghai 200433, China

|

| 28,687,572

|

| 14.36%

|

|

|

|

|

|

Zhang Yu

25-17 Siping Village, Erpengdian Town

Huanren Manchu Autonomous County

Liaoning Prov, China

|

| 15,100,000

|

| 7.56%

|

(1)Applicable percentage ownership is based on 199,731,320 shares of common stock outstanding as of May 31, 2023. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of common stock that are currently exercisable or exercisable within 60 days of May 31, 2023 are deemed to be beneficially owned by the person holding such securities for the purpose of computing the percentage of ownership of such person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

ITEM 5. DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

The following table sets forth the names and ages of the member of our Board of Director and our executive officers and the positions held by each.

Name

|

| Age

|

| Title

|

Nataliia Petranetska

|

| 56

|

| President, Director, Treasurer, Secretary and CEO

|

Nataliia Petranetska obtained a Master's Degree in Economics from Kyiv National University of Economics in 1989. Mrs. Petranetska held the position of Financial Controller at Scale LLC from March 1998 to April 2007. Nataliia Petranetska assumed the role of Chief Specialist within the Financial Control Department at Z-Group Company Group from April 2007 until December 2019.

Since July 30, 2020, Nataliia Petranetska serves as the President, Director, Treasurer and Secretary of Sky Century Investment, Inc. On December 5, 2020, she was appointed as the Chief Executive Officer of Sky Century Investment, Inc.

Section 16(a) Compliance

Section 16 (a) of the Securities and Exchange Act of 1934 requires the Company’s directors and executive officers, and persons who own beneficially more than ten percent (10%) of the Company’s Common Stock, to file reports of ownership and changes of ownership with the Securities and Exchange Commission. Copies of all filed reports are

10

required to be furnished to the Company pursuant to Section 16(a). Once the Company becomes subject to the Exchange Act of 1934, our office and director has informed us that he intends to file reports required to be filed under Section 16(a).

ITEM 6. EXECUTIVE COMPENSATION

The Company has an Employment Agreement with Nataliia Petranetska dated July 30, 2020. The Company has entered into the Compensation Agreement with Nataliia Petranetska on December 1, 2020.

ITEM 7. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE

As of May 31, 2023, Nataliia Petranetska, the sole executive officer and director of the Company, provided an interest-free demand loan to the Company, amounting to $100,000.

ITEM 8. LEGAL PROCEEDING

None.

ITEM 9. MARKET PRICE OF AND DIVIDENDS ON THE COMPANY’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market Information

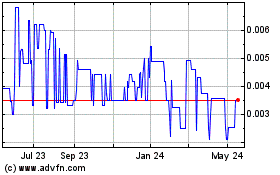

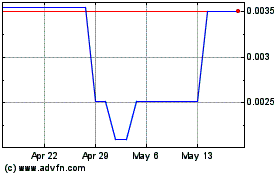

Our common stock is currently quoted on the OTC market “Pink Sheets” under the symbol SKYI. For the periods indicated, the following table sets forth the high and low bid prices per share of common stock. The below prices represent inter-dealer quotations without retail markup, markdown, or commission and may not necessarily represent actual transactions.

|

| Price Range

|

Period

|

| High

|

|

| Low

|

Year Ended May 31, 2022:

|

|

|

|

|

|

First Quarter

|

| $

| 0.0155

|

|

| $

| 0.0056

|

Second Quarter

|

| $

| 0.0123

|

|

| $

| 0.0037

|

Third Quarter

|

| $

| 0.1999

|

|

| $

| 0.01

|

Fourth Quarter

|

| $

| 0.1908

|

|

| $

| 0.0321

|

Year Ended May 31, 2023:

|

|

|

|

|

|

|

|

First Quarter

|

| $

| 0.0155

|

|

| $

| 0.0071

|

Second Quarter

|

| $

| 0.0119

|

|

| $

| 0.0041

|

Third Quarter

|

| $

| 0.0068

|

|

| $

| 0.0026

|

Fourth Quarter

|

| $

| 0.0062

|

|

| $

| 0.0030

|

As of May 31, 2023, our shares of common stock were held by 67 stockholders of record. The transfer agent of our common stock is VStock Transfer, LLC. Phone (212) 828-8436.

ITEM 10. RECENT SALES OF UNREGISTERED SECURITIES

None.

ITEM 11. DESCRIPTION OF COMPANY’S SECURITIES TO BE REGISTERED

The following statements relating to the capital stock set forth the material terms of the Company’s securities; however, reference is made to the more detailed provisions of our Certificate of Incorporation and by-laws, copies of which are filed herewith.

11

Common Stock

Our Certificate of Incorporation authorize the issuance of 500,000,000 shares of common stock, no par value. Our holders of shares of common stock are entitled to one vote for each share on all matters to be voted on by the shareholders. Holders of common stock do not have cumulative voting rights. Holders of common stock are entitled to share ratably in dividends, if any, as may be declared from time to time by the board of directors in its discretion from legally available funds. In the event of a liquidation, dissolution or winding up of the Company, the holders of common stock are entitled to share pro rata all assets remaining after payment in full of all liabilities. Holders of common stock have no preemptive rights to purchase the Company’s common stock. There are no conversion or redemption rights or sinking fund provisions with respect to the common stock.

Dividends

Dividends, if any, will be contingent upon our revenues and earnings, if any, capital requirements and financial conditions. The payment of dividends, if any, will be within the discretion of our board of directors. We intend to retain earnings, if any, for use in our business operations and accordingly, the board of directors does not anticipate declaring any dividends prior to a business combination transaction, nor can there be any assurance that any dividends will be paid following any business combination.

ITEM 12. INDEMNIFICATION OF DIRECTORS AND OFFICERS

Our directors and officers are indemnified as provided by the NRS and our Bylaws. We have agreed to indemnify each of our directors and certain officers against certain liabilities, including liabilities under the Securities Act. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers, and controlling persons pursuant to the provisions described above, or otherwise, we have been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and, therefore, is unenforceable. In the event that a claim for indemnification against such liabilities (other than our payment of expenses incurred or paid by our director, officer, or controlling person in the successful defense of any action, suit, or proceeding) is asserted by such director, officer, or controlling person in connection with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

ITEM 13. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

INDEX TO FINANCIAL STATEMENTS FOR THE YEARS MONTHS ENDED MAY 31, 2023 AND 2022

12

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To:The Board of Directors and Stockholders of Sky Century Investment, Inc.

Qualified Opinion on the Financial Statements

We have audited the accompanying balance sheets of Sky Century Investment, Inc. (the Company) as of May 31, 2022, and May 31, 2023, and the related statements of operations, stockholders’ equity, and cash flows for each of the two years in the period ended May 31, 2023, and the related notes (collectively referred to as the financial statements). In our opinion, except for the effects of the adjustments, if any, as might have been determined to be necessary, had we been able to examine evidence regarding the revenue accounts and bank statements, as described below, the financial statements present fairly, in all material respects, the financial position of the Company as of May 31, 2022, and May 31, 2023, and the results of its operations and its cash flows for each of the two years in the period ended May 31, 2023, in conformity with accounting principles generally accepted in the United States of America.

Basis for Qualified Opinion

We were unable to obtain sufficient appropriate audit evidence and comfort over the completeness and accuracy of revenues (sales) recognized in the years ended May 31, 2022, and May 31, 2023. This is due to the fact that the Company does not have its own bank account and uses the personal bank accounts of its directors, which leads to the commingling of the Company’s and personal funds and lack of visibility over the Company’s transactions. We have not been provided with complete bank statements and were only provided screenshots of bank transactions to confirm transactions reported by Management.

Material Uncertainty Related to Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has suffered a loss from operations of US$353,246 the period ended May 31, 2022, and US$136,617 the period ended May 31, 2023, and has a net capital deficiency of US$175,093 as of May 31, 2023 that raises substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Other Information

Management is responsible for Other Information. Other Information received by the auditor at the date of this audit opinion issuance is disclosed in Form 10 General Form for Registration of Securities furnished by Management. We only express our opinion in relation to the financial statements and the notes to the financial statements for years ended May 31, 2022, and May 31, 2023, of the Company. We do not express any opinion in relation to Other Information supplied by Management in Form 10.

In connection with our audit of the financial statements and Other Information supplied by the Company, our responsibility is only to read the Other Information and consider whether the other information is materially inconsistent with the financial statements and the notes to the financial statements, or our knowledge obtained in the audit and whether the other information is otherwise likely to be contain any material misstatements or inconsistencies.

If, based on our work on other information obtained prior to the date of this auditor’s report, we conclude that such other information contains a material misstatement, we are required to report that fact. We have not identified any facts that need to be reflected in our conclusion.

Responsibilities of Management and Those Charged with Governance for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error. In preparing the financial statements, management is responsible for assessing the

F-1

Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so. Those charged with governance are responsible for overseeing the Company’s financial reporting process.

Auditor’s Responsibilities for the Audit of the Financial Statements

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

Except as discussed above, we conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matter

The Critical Audit Matter communicated below is a matter arising from the current period audit of the financial statements that was communicated or required to be communicated to the audit committee and that: (1) relates to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matter below, providing a separate opinion on the critical audit matter or on the accounts or disclosures to which it relates. We determined the following critical audit matters:

1.As of May 31, 2022, and May 31, 2023, Internal Controls over Financial Reporting (ICFR) and SOX controls and procedures were not effective as required by SEC. The matters involving internal controls and procedures considered to be material weaknesses under the standards of the Public Company Accounting Oversight Board were: (1) lack of a functioning audit committee due to a lack of a majority of independent members and a lack of a majority of outside directors on our board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; (2) inadequate segregation of duties consistent with control objectives; (3) ineffective controls over period end financial disclosure and reporting processes; and (4) lack of internal audit function due to the fact that the Company lacks qualified resources to perform the internal audit functions properly and that the scope and effectiveness of the internal audit function are yet to be developed.

2.On February 29, 2020, Sky Century Investment, Inc. acquired 100% of proprietorship of Cannabis News LLC which owned Cannabis News Application. Considering that the accounts of Cannabis News LLC as of May 31, 2022, and May 31, 2023, were not material and as such Company’s management did not prepare consolidated financial statements as per requirements of ASC 805-10-05-4 (business combination).

F-2

/s/ MAINOR AUDIT JA PARTNERID OÜ

We have served as the Company’s auditor since 2023.

MAINOR AUDIT JA PARTNERID OÜ.

Kadaka pst 85a, Tallinn, Harju maakond 10922

PCAOB ID Number 2333

October 26, 2023

F-3

SKY CENTURY INVESTMENT, INC.

BALANCE SHEETS

| May 31, 2023

|

| May 31, 2022

|

ASSETS

|

|

|

|

|

|

Cash on Hand

| $

| -

|

|

| $

| 375

|

|

Accounts Receivable

|

| -

|

|

|

| 21,000

|

|

Prepaid Expenses

|

| -

|

|

|

| 74,880

|

|

Inventory

|

| -

|

|

|

| 509

|

|

Total Current Assets

|

| -

|

|

|

| 96,764

|

|

|

|

|

|

|

|

|

|

Intangible Assets, Net

|

| 84,063

|

|

|

| -

|

|

|

|

|

|

|

|

|

|

Total Assets

| $

| 84,063

|

|

| $

| 96,764

|

|

|

|

|

|

|

|

|

|

Liabilities And Stockholders’ Equity

|

|

|

|

|

|

|

|

Accounts Payable and Accrued Liabilities

| $

| 18,000

|

|

| $

| 118,760

|

|

Amount Due to a Related Party (Note 5)

|

| 160,619

|

|

|

| 234,443

|

|

Amount Due to a Third Party (Note 6)

|

| 80,537

|

|

|

| 173,537

|

|

Total Current Liabilities

|

| 259,156

|

|

|

| 526,740

|

|

|

|

|

|

|

|

|

|

Total Liabilities

|

| 259,156

|

|

|

| 526,740

|

|

|

|

|

|

|

|

|

|

Commitments and Contingencies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity

|

|

|

|

|

|

|

|

Common Stock, $0.001 Par Value, 500,000,000 Shares Authorized;

199,731,320 And 110,022,572 Common Shares Issued and Outstanding Respectively

|

| 199,732

|

|

|

| 110,023

|

|

Preferred Stock, $0.001 Par Value, 30,000,000 Shares Authorized;

5,000,000 And 0 Common Shares Issued and Outstanding Respectively

|

| 5,000

|

|

|

| -

|

|

Additional Paid in Capital

|

| 322,621

|

|

|

| 25,830

|

|

Accumulated Deficit

|

| (702,446)

|

|

|

| (565,829)

|

|

Total Stockholders’ Equity

|

| (175,093)

|

|

|

| (429,976)

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders’ Equity

| $

| 84,063

|

|

| $

| 96,764

|

|

The accompanying notes are an integral part of these financial statements.

F-4

SKY CENTURY INVESTMENT, INC.

STATEMENTS OF OPERATIONS

| Year Ended

May 31,

|

| 2023

|

| 2022

|

Revenues

|

|

|

|

|

|

Sales

| $

| 74,760

|

| $

| 61,000

|

Gross Profit

| $

| 74,760

|

| $

| 61,000

|

|

|

|

|

|

|

Operating Expenses

|

|

|

|

|

|

General and Administrative Expense

| $

| 171,618

|

| $

| 196,190

|

Depreciation Expense

|

| 16,812

|

|

| 66,000

|

Professional Fees

|

| 22,947

|

|

| 23,233

|

Total Operating Expenses

|

| 211,377

|

| $

| 285,423

|

|

|

|

|

|

|

Other Income

|

| -

|

|

| 3,177

|

|

|

|

|

|

|

Other Expenses

|

| -

|

|

| 132,000

|

|

|

|

|

|

|

Income (Loss) Before Income Taxes

| $

| (136,617)

|

| $

| (353,246)

|

Income Tax Expense

|

| -

|

|

| -

|

Net Income (Loss)

| $

| (136,617)

|

| $

| (353,246)

|

|

|

|

|

|

|

Net Loss Per Share - Basic and Diluted

| $

| 0.00

|

| $

| 0.00

|

|

|

|

|

|

|

Weighted Average Common Shares Outstanding - Basic and Diluted

|

| 199,731,320

|

|

| 110,022,572

|

The accompanying notes are an integral part of these financial statements.

F-5

SKY CENTURY INVESTMENT, INC.

STATEMENTS OF STOCKHOLDERS’ EQUITY

| Common stock

|

| Preferred stock

|

| Additional

paid-in capital

|

| Accumulated

deficit

|

| Total

stockholders’

deficit

|

| No. of shares

|

| Amount

|

| No. of shares

|

| Amount

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of June 1, 2022

| 110,022,572

|

| $

| 110,023

|

| -

|

| $

| -

|

| $

| 25,830

|

| $

| (565,829)

|

| $

| (429,976)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exchange of Restricted Common

Stock to Preferred Stock

| (5,000,000)

|

|

| (5,000)

|

| 5,000,000

|

|

| 5,000

|

|

| -

|

|

| -

|

|

| -

|

Conversion of Convertible Notes

to Common Stock

| 94,708,748

|

|

| 94,709

|

| -

|

|

| -

|

|

| 296,791

|

|

| -

|

|

| 391,500

|

Net Income (Loss) for the Period

| -

|

|

| -

|

| -

|

|

| -

|

|

| -

|

|

| (136,617)

|

|

| (136,617)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of May 31, 2023

| 199,731,320

|

| $

| 199,732

|

| 5,000,000

|

| $

| 5,000

|

| $

| 322,621

|

| $

| (702,446)

|

| $

| (175,093)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of June 1, 2021

| 110,022,572

|

| $

| 110,023

|

| -

|

|

| -

|

| $

| 25,830

|

| $

| (212,583)

|

| $

| (76,730)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss) for the Period

| -

|

|

| -

|

| -

|

|

| -

|

|

| -

|

|

| (353,246)

|

|

| (353,246)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of May 31, 2022

| 110,022,572

|

| $

| 110,023

|

| -

|

| $

| -

|

| $

| 25,830

|

| $

| (565,829)

|

| $

| (429,976)

|

The accompanying notes are an integral part of these financial statements.

F-6

SKY CENTURY INVESTMENT, INC.

STATEMENTS OF CASH FLOWS

| Year Ended

May 31,

|

| 2023

|

| 2022

|

|

|

|

|

|

|

Cash Flow from Operating Activities:

|

|

|

|

|

|

Net Income/Loss

| $

| (136,617)

|

| $

| (353,246)

|

Adjustments to Reconcile Net Loss to Net Cash Provided by Operations:

|

|

|

|

|

|

Depreciation

|

| 16,812

|

|

| -

|

Write-off of Intangible Assets

|

| -

|

|

| 198,000

|

Changes in Operating Assets and Liabilities:

|

|

|

|

|

|

Accounts Receivable

|

| 21,000

|

|

| (21,000)

|

Prepaid Expenses

|

| 74,880

|

|

| (74,880)

|

Raw Materials Inventory

|

| 509

|

|

| -

|

Accounts Payable and Accrued Liabilities

|

| 102,740

|

|

| 195,542

|

Net Cash Used in Operating Activities

|

| 79,324

|

|

| (55,584)

|

|

|

|

|

|

|

Cash Flow from Investing Activities:

|

|

|

|

|

|

Database Purchase

| $

| (100,875)

|

| $

| -

|

Net Cash Used in Investing Activities

|

| (100,875)

|

|

| -

|

|

|

|

|

|

|

Cash Flow from Financing Activities:

|

|

|

|

|

|

Loan from Related Party

| $

| 21,176

|

| $

| 53,643

|

Net Cash Used in Financing Activities

|

| 21,176

|

|

| 53,643

|

|

|

|

|

|

|

Net Change in Cash and Cash Equivalents

|

| (375)

|

|

| (1,941)

|

|

|

|

|

|

|

Cash and Cash Equivalents, Beginning of Period

|

| 375

|

|

| 2,316

|

|

|

|

|

|

|

Cash and Cash Equivalents, End of Period

| $

| -

|

| $

| 375

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION

|

|

|

|

|

|

Cash Paid for Income Taxes

| $

| -

|

| $

| -

|

Cash Paid for Interest

| $

| -

|

| $

| -

|

The accompanying notes are an integral part of these financial statements.

F-7

SKY CENTURY INVESTMENT, INC.

NOTES TO THE FINANCIAL STATEMENTS

Years Ended May 31, 2023 and 2022

NOTE 1 - ORGANIZATION AND BASIS OF PRESENTATION

Sky Century Investment, Inc. (“SKYI” or the “Company”) was incorporated in the State of Nevada as a for-profit Company on May 4, 2012 and established a fiscal year end of May 31. The Company has evolved in the direction of IT services recently.

On February 29, 2020, Sky Century Investment, Inc. assumed full ownership of Cannabis News LLC with Khamijon Alimzhanov personally financing the software development.

The Company is in start-up stage and has incurred losses since inception.

NOTE 2 - GOING CONCERN

These financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and the discharge of liabilities in the normal course of business for the foreseeable future.

For the year ended May 31, 2023, the Company has generated a net loss of $136,617 with an accumulated deficit of $702,446 as of that date. The continuation of the Company is dependent upon the continuing financial support of its shareholders. Management believes this funding will continue, and is also actively seeking new investors. Management believes the existing stockholders will provide the additional cash to meet the Company’s obligations as they become due. However, there is no assurance that the Company will be successful in securing sufficient funds to sustain the operations.

These and other factors raise substantial doubt about the Company’s ability to continue as a going concern. These financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification

NOTE 3 - SUMMARY OF SIGNIFCANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America.

The Company’s year-end is May 31.

Use of Estimates and Assumptions

In preparing these financial statements, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheet and revenues and expenses during the period reported. Actual results may differ from these estimates.

The Company has not prepared consolidated financial statements with Cannabis News LLC as per requirements of ASC 805-10-05-4 due to that fact that Cannabis News LLC does not have any amounts that could be included in these consolidated financial statements.

Cash and Cash Equivalents

The Company considers all highly liquid investments with the original maturities of three months or less to be cash equivalents.

F-8

Income Taxes

The Company adopted the provisions of paragraph 740-10-25-13 of the FASB Accounting Standards Codification. Paragraph 740-10-25-13 addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under paragraph 740-10-25-13, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent (50%) likelihood of being realized upon ultimate settlement. Paragraph 740-10-25-13 also provides guidance on de-recognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures. The Company had no material adjustments to its liabilities for unrecognized income tax benefits according to the provisions of paragraph 740-10-25-13.

The estimated future tax effects of temporary differences between the tax basis of assets and liabilities are reported in the accompanying balance sheets, as well as tax credit carry-backs and carry-forwards. The Company periodically reviews the recoverability of deferred tax assets recorded on its balance sheets and provides valuation allowances as management deems necessary.

Uncertain Tax Positions

The Company did not take any uncertain tax positions and had no adjustments to its income tax liabilities or benefits pursuant to the provisions of Section 740-10-25 for the years ended May 31, 2023 and 2022.

Net Loss per Share

The Company calculates net loss per share in accordance with ASC Topic 260, “Earnings per Share.” Basic loss per share is computed by dividing the net income by the weighted-average number of common shares outstanding during the period. Diluted loss per share is computed similar to basic loss per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common stock equivalents had been issued and if the additional common shares were dilutive.

There were no potentially outstanding dilutive shares for the years ended May 31, 2023 and 2022.

Intangible Assets

The Company follows the provisions of ASC 985, “Software”, which requires that all costs relating to the purchase or internal development and production of software products to be sold, leased or otherwise marketed, be expensed in the period incurred unless the requirements for technological feasibility have been established. The Company capitalizes all eligible software costs incurred once technological feasibility is established.

The Cannabis News Application was transferred to Sky Century Investment, Inc. through the execution of the Intellectual Property Assignment Agreement signed by Khamijon Alimzhanov. In May 2022 the Company impaired Cannabis News Application in accordance with ASC 985-20-35-4 because the amount of unamortized capitalized costs exceeded the net realizable value of that asset.

As of May 31, 2023, the total amount of intangible assets was $100,875, comprised of databases. Depreciation expense of databases was $16,812 as of May 31, 2023.

Prepaid Expenses

Prepaid expenses are amounts paid to secure the use of assets or the receipt of services at a future date or continuously over one or more future periods. When the prepaid expenses are eventually consumed, they are charged to expense.

As of May 31, 2023 and 2022, there were $0 and $74,880 in prepaid expenses, respectively.

F-9

Related Parties

The Company follows subtopic 850-10 of the FASB Accounting Standards Codification for the identification of related parties and disclosure of related party transactions.

Pursuant to section 850-10-20 the related parties include a) affiliates of the Company; b) entities for which investments in their equity securities would be required, absent the election of the fair value option under the Fair Value Option Subsection of section 825-10-15, to be accounted for by the equity method by the investing entity; c) trusts for the benefit of employees, such as pension and Income-sharing trusts that are managed by or under the trusteeship of management; d) principal owners of the Company; e) management of the Company; f) other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests; and g) other parties that can significantly influence the management or operating policies of the transacting parties or that have an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests.

The financial statements shall include disclosures of material related party transactions, other than compensation arrangements, expense allowances, and other similar items in the ordinary course of business. However, disclosure of transactions that are eliminated in the preparation of consolidated or combined financial statements is not required in those statements. The disclosures shall include: a) the nature of the relationship(s) involved; b) a description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to an understanding of the effects of the transactions on the financial statements; c) the dollar amounts of transactions for each of the periods for which income statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period; and d) amount due from or to related parties as of the date of each balance sheet presented and, if not otherwise apparent, the terms and manner of settlement.

Commitments and Contingencies

The Company follows subtopic 450-20 of the FASB Accounting Standards Codification to report accounting for contingencies. Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur.

The Company assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or un-asserted claims that may result in such proceedings, the Company evaluates the perceived merits of any legal proceedings or un-asserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein. If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s financial statements. If the assessment indicates that a potentially material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, and an estimate of the range of possible losses, if determinable and material, would be disclosed.