UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Section 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of, October 2023

Commission File Number: 001-14534

Precision Drilling Corporation

(Exact name of registrant as specified in its charter)

800, 525 - 8 Avenue S.W.

Calgary, Alberta

Canada T2P 1G1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or

will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F Form 40-F X

SIGNATURE

Pursuant to the requirements of Section 12 of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Dated: October 27, 2023 |

PRECISION DRILLING CORPORATION |

| |

|

| |

|

| |

By: /s/Carey T Ford |

| |

Name: Carey

T Ford |

| |

Title: Chief Financial Officer |

Exhibit 31.1

FORM 52-109F2

CERTIFICATION OF INTERIM FILINGS

I, Kevin A. Neveu, President and Chief Executive Officer of Precision Drilling

Corporation, certify the following:

| 1. | Review: I have reviewed the interim financial report and interim MD&A (together, the

"interim filings") of Precision Drilling Corporation (the "issuer"), for the interim period ended September 30, 2023. |

| 2. | No misrepresentations: Based on my knowledge, having exercised reasonable diligence, the

interim filings do not contain any untrue statement of a material fact or omit to state a material fact required to be stated or that

is necessary to make a statement not misleading in light of the circumstances under which it was made, with respect to the period covered

by the interim filings. |

| 3. | Fair presentation: Based on my knowledge, having exercised reasonable diligence, the interim

financial report together with the other financial information included in the interim filings fairly present in all material respects

the financial condition, financial performance and cash flows of the issuer, as of the date of and for the periods presented in the interim

filings. |

| 4. | Responsibility: The issuer’s other certifying officer and I are responsible for establishing

and maintaining disclosure controls and procedures (DC&P) and internal control over financial reporting (ICFR), as those terms are

defined in National Instrument 52-109 Certification of Disclosure in Issuers' Annual and Interim Filings, for the issuer. |

| 5. | Design: Subject to the limitations, if any, described in paragraphs 5.2 and 5.3, the issuer's

other certifying officer and I have, as at the end of the period covered by the interim filings |

| (a) | designed DC&P, or caused it to be designed under our supervision, to provide reasonable assurance

that |

| (i) | material information relating to the issuer is made known to us by others, particularly during the period

in which the interim filings are being prepared; and |

| (ii) | information required to be disclosed by the issuer in its annual filings, interim filings or other reports

filed or submitted by it under securities legislation is recorded, processed, summarized and reported within the time periods specified

in securities legislation; and |

| (b) | designed ICFR, or caused it to be designed under our supervision, to provide reasonable assurance regarding

the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with the issuer’s

GAAP. |

| 5.1 | Control framework: The control framework the issuer's other certifying officer and I used

to design the issuer's ICFR is the Committee of Sponsoring Organizations of the Treadway Commission (COSO) (1992) and the Control Objectives

for Information and Related Technologies (COBIT). |

| 5.2 | ICFR – material weakness relating to design: N/A. |

| 5.3 | Limitation on scope of design: N/A. |

| 6. | Reporting changes in ICFR: The issuer has disclosed in its interim MD&A any change in

the issuer’s ICFR that occurred during the period beginning on July 1, 2023 and ended on September 30, 2023 that has

materially affected, or is reasonably likely to materially affect, the issuer’s ICFR. |

Date: October 27, 2023

| By: |

/s/Kevin A Neveu |

| |

Name: Kevin A. Neveu

Title: President and Chief Executive Officer |

Exhibit 31.2

FORM 52-109F2

CERTIFICATION OF INTERIM FILINGS

I, Carey T. Ford, Chief Financial Officer of Precision Drilling Corporation,

certify the following:

| 1. | Review: I have reviewed the interim financial report and interim MD&A (together, the

"interim filings") of Precision Drilling Corporation (the "issuer"), for the interim period ended September 30, 2023. |

| 2. | No misrepresentations: Based on my knowledge, having exercised reasonable diligence, the

interim filings do not contain any untrue statement of a material fact or omit to state a material fact required to be stated or that

is necessary to make a statement not misleading in light of the circumstances under which it was made, with respect to the period covered

by the interim filings. |

| 3. | Fair presentation: Based on my knowledge, having exercised reasonable diligence, the interim

financial report together with the other financial information included in the interim filings fairly present in all material respects

the financial condition, financial performance and cash flows of the issuer, as of the date of and for the periods presented in the interim

filings. |

| 4. | Responsibility: The issuer’s other certifying officer and I are responsible for establishing

and maintaining disclosure controls and procedures (DC&P) and internal control over financial reporting (ICFR), as those terms are

defined in National Instrument 52-109 Certification of Disclosure in Issuers' Annual and Interim Filings, for the issuer. |

| 5. | Design: Subject to the limitations, if any, described in paragraphs 5.2 and 5.3, the issuer's

other certifying officer and I have, as at the end of the period covered by the interim filings |

| (a) | designed DC&P, or caused it to be designed under our supervision, to provide reasonable assurance

that |

| (i) | material information relating to the issuer is made known to us by others, particularly during the period

in which the interim filings are being prepared; and |

| (ii) | information required to be disclosed by the issuer in its annual filings, interim filings or other reports

filed or submitted by it under securities legislation is recorded, processed, summarized and reported within the time periods specified

in securities legislation; and |

| (b) | designed ICFR, or caused it to be designed under our supervision, to provide reasonable assurance regarding

the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with the issuer’s

GAAP. |

| 5.1 | Control framework: The control framework the issuer's other certifying officer and I used

to design the issuer's ICFR is the Committee of Sponsoring Organizations of the Treadway Commission (COSO) (1992) and the Control Objectives

for Information and Related Technologies (COBIT). |

| 5.2 | ICFR – material weakness relating to design: N/A. |

| 5.3 | Limitation on scope of design: N/A. |

| 6. | Reporting changes in ICFR: The issuer has disclosed in its interim MD&A any change in

the issuer’s ICFR that occurred during the period beginning on July 1, 2023 and ended on September 30, 2023 that has

materially affected, or is reasonably likely to materially affect, the issuer’s ICFR. |

Date: October 27, 2023

| By: |

/s/Carey T. Ford |

| |

Name: Carey T. Ford

Title: Chief Financial Officer

|

Exhibit 99.1

PRECISION DRILLING ANNOUNCES 2023 THIRD QUARTER UNAUDITED FINANCIAL RESULTS

This report contains “forward-looking information and statements”

within the meaning of applicable securities laws. For a full disclosure of the forward-looking information and statements and the risks

to which they are subject, see the “Cautionary Statement Regarding Forward-Looking Information and Statements” later in this

report. This report contains references to certain Financial Measures and Ratios, including Adjusted EBITDA (earnings before income taxes,

loss (gain) on investments and other assets, gain on repurchase of unsecured senior notes, finance charges, foreign exchange, gain on

asset disposals and depreciation and amortization), Funds Provided by (Used in) Operations, Net Capital Spending and Working Capital.

These terms do not have standardized meanings prescribed under International Financial Reporting Standards (IFRS) and may not be

comparable to similar measures used by other companies, see “Financial Measures and Ratios” later in this report.

Precision Drilling announces strong 2023 third quarter financial results:

| · | Revenue increased to $447 million compared with $429 million in the third quarter of 2022 driven by higher

drilling day rates, offset in part by lower drilling and service activity. |

| · | Revenue per utilization day continues to be strong and grew 20% in Canada to $32,224 and 26% in the U.S.

to US$35,135 compared to the same quarter last year. |

| · | We continued to scale our AlphaTM digital technologies and EverGreenTM suite of

environmental solutions across our Super Triple rig fleet, increasing revenue from these offerings by 30% year over year. Approximately

75% of our Super Triple rig fleet is equipped with AlphaTM and at least one EverGreenTM product. |

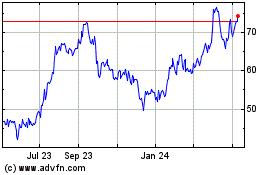

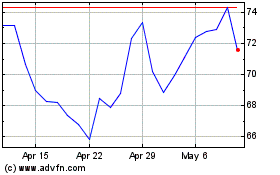

| · | Adjusted EBITDA(1) was $115 million and included $31 million of share-based compensation as

our share price increased 41% during the quarter, bringing our year to date share-based compensation to $22 million. In the third quarter

of 2022, Adjusted EBITDA was $120 million and included a $6 million charge for share-based compensation. |

| · | Net earnings were $20 million or $1.45 per share compared to $31 million or $2.26 per share in 2022. For

the first nine months of the year, we have generated net earnings of $10.45 per share. |

| · | During the quarter, we generated cash from operations of $89 million and repurchased and cancelled US$18

million of 2026 unsecured senior notes. |

| · | As at September 30, 2023, we have reduced total debt by $126 million since the beginning of the year and

remain on track to meet our 2023 debt reduction target of $150 million. |

| · | We ended the quarter with $49 million of cash and more than $600 million of available liquidity. |

| · | In Canada, we averaged 57 active rigs in the third quarter, similar to our activity for the same quarter

last year. Demand for our Super Triple and Super Single pad-capable fleets continues to exceed supply and we expect these

rigs to remain fully utilized well into 2024. |

| · | In the U.S., we averaged 41 active rigs compared to 57 in the third quarter of 2022 due to lower industry

activity year over year. |

| · | Internationally, we activated our seventh rig in late September and expect to activate our eighth rig

in the next few weeks. In 2024, we expect to have eight rigs working under long-term contracts, increasing our international earnings

approximately 50% over 2023. |

| · | Completion and Production Services generated revenue of $58 million and Adjusted EBITDA of $14 million,

largely consistent with the third quarter of 2022. |

| · | We expect the acquisition of CWC Energy Service Corp. (CWC) to be completed in the fourth quarter

and provide accretive cash flow on a per share basis in 2024. |

| · | In response to increased customer-funded rig upgrades and to facilitate the strategic purchase of certain

long-lead items, we have increased our 2023 capital spending budget from $195 million to $215 million. |

| (1) | See “FINANCIAL

MEASURES AND RATIOS.” |

SELECT FINANCIAL AND OPERATING INFORMATION

Financial Highlights

| | |

For the three months ended September 30, | |

For the nine months ended September 30, |

| (Stated in thousands of Canadian dollars, except per share amounts) | |

|

2023 |

| |

|

2022 |

| |

|

% Change |

| |

|

2023 |

| |

|

2022 |

| |

|

% Change |

|

| Revenue | |

| 446,754 | | |

| 429,335 | | |

| 4.1 | | |

| 1,430,983 | | |

| 1,106,690 | | |

| 29.3 | |

| Adjusted EBITDA(1) | |

| 114,575 | | |

| 119,561 | | |

| (4.2 | ) | |

| 459,887 | | |

| 220,515 | | |

| 108.6 | |

| Net earnings (loss) | |

| 19,792 | | |

| 30,679 | | |

| (35.5 | ) | |

| 142,522 | | |

| (37,776 | ) | |

| (477.3 | ) |

| Cash provided by operations | |

| 88,500 | | |

| 8,142 | | |

| 987.0 | | |

| 330,316 | | |

| 78,022 | | |

| 323.4 | |

| Funds provided by operations(1) | |

| 91,608 | | |

| 81,327 | | |

| 12.6 | | |

| 388,220 | | |

| 171,655 | | |

| 126.2 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash used in investing activities | |

| 34,278 | | |

| 31,711 | | |

| 8.1 | | |

| 157,157 | | |

| 98,836 | | |

| 59.0 | |

| Capital spending by spend category(1) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Expansion and upgrade | |

| 13,479 | | |

| 25,461 | | |

| (47.1 | ) | |

| 39,439 | | |

| 50,606 | | |

| (22.1 | ) |

| Maintenance and infrastructure | |

| 38,914 | | |

| 25,642 | | |

| 51.8 | | |

| 108,463 | | |

| 76,335 | | |

| 42.1 | |

| Proceeds on sale | |

| (6,698 | ) | |

| (22,337 | ) | |

| (70.0 | ) | |

| (20,724 | ) | |

| (32,033 | ) | |

| (35.3 | ) |

| Net capital spending(1) | |

| 45,695 | | |

| 28,766 | | |

| 58.9 | | |

| 127,178 | | |

| 94,908 | | |

| 34.0 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net earnings (loss) per share: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 1.45 | | |

| 2.26 | | |

| (35.8 | ) | |

| 10.45 | | |

| (2.79 | ) | |

| (474.6 | ) |

| Diluted | |

| 1.45 | | |

| 2.03 | | |

| (28.6 | ) | |

| 9.84 | | |

| (2.79 | ) | |

| (452.7 | ) |

| (1) | See “FINANCIAL

MEASURES AND RATIOS.” |

Operating Highlights

| | |

For the three months ended September 30, | |

For the nine months ended September 30, |

| | |

|

2023 |

| |

|

2022 |

| |

|

% Change |

| |

|

2023 |

| |

|

2022 |

| |

|

% Change |

|

| Contract drilling rig fleet | |

| 224 | | |

| 225 | | |

| (0.4 | ) | |

| 224 | | |

| 225 | | |

| (0.4 | ) |

| Drilling rig utilization days: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| U.S. | |

| 3,815 | | |

| 5,287 | | |

| (27.8 | ) | |

| 13,823 | | |

| 14,914 | | |

| (7.3 | ) |

| Canada | |

| 5,284 | | |

| 5,432 | | |

| (2.7 | ) | |

| 15,247 | | |

| 14,461 | | |

| 5.4 | |

| International | |

| 554 | | |

| 552 | | |

| 0.4 | | |

| 1,439 | | |

| 1,638 | | |

| (12.1 | ) |

| Revenue per utilization day: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| U.S. (US$) | |

| 35,135 | | |

| 27,847 | | |

| 26.2 | | |

| 35,216 | | |

| 25,864 | | |

| 36.2 | |

| Canada (Cdn$) | |

| 32,224 | | |

| 26,927 | | |

| 19.7 | | |

| 32,583 | | |

| 25,843 | | |

| 26.1 | |

| International (US$) | |

| 51,570 | | |

| 50,216 | | |

| 2.7 | | |

| 51,306 | | |

| 51,687 | | |

| (0.7 | ) |

| Operating costs per utilization day: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| U.S. (US$) | |

| 21,655 | | |

| 18,220 | | |

| 18.9 | | |

| 20,217 | | |

| 18,484 | | |

| 9.4 | |

| Canada (Cdn$) | |

| 18,311 | | |

| 16,893 | | |

| 8.4 | | |

| 19,239 | | |

| 16,803 | | |

| 14.5 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Service rig fleet | |

| 121 | | |

| 135 | | |

| (10.4 | ) | |

| 121 | | |

| 135 | | |

| (10.4 | ) |

| Service rig operating hours | |

| 46,894 | | |

| 52,340 | | |

| (10.4 | ) | |

| 144,944 | | |

| 120,994 | | |

| 19.8 | |

Financial Position

| (Stated in thousands of Canadian dollars, except ratios) | |

|

September 30, 2023 |

| |

|

December 31, 2022 |

|

| Working capital(1) | |

| 177,740 | | |

| 60,641 | |

| Cash | |

| 49,065 | | |

| 21,587 | |

| Long-term debt | |

| 963,827 | | |

| 1,085,970 | |

| Total long-term financial liabilities | |

| 1,054,661 | | |

| 1,206,619 | |

| Total assets | |

| 2,808,201 | | |

| 2,876,123 | |

| Long-term debt to long-term debt plus equity ratio (1) | |

| 0.41 | | |

| 0.47 | |

| (1) | See “FINANCIAL

MEASURES AND RATIOS.” |

Summary for the three months ended September 30, 2023:

| · | Revenue of $447 million was 4% higher than 2022 due to the further strengthening of drilling and service

revenue rates, partially offset by lower activity. Drilling rig utilization days decreased 28% and 3% in the U.S. and Canada, respectively,

while international activity remained consistent. Our service rig operating hours decreased 10% as compared with 2022. |

| · | Adjusted EBITDA was $115 million as compared with $120 million in 2022. Our lower 2023 Adjusted EBITDA

was primarily the result of increased share-based compensation charges and lower activity, partially offset by higher revenue rates. Share-based

compensation was $31 million as compared with $6 million in 2022. Please refer to “Other Items” later in this report for additional

information on share-based compensation charges. |

| · | Adjusted EBITDA as a percentage of revenue was 26% as compared with 28% in 2022. |

| · | Our U.S. revenue per utilization day was US$35,135 compared with US$27,847 in 2022. The increase was primarily

the result of higher fleet average day rates and higher idle but contracted rig revenue. We recognized revenue from idle but contracted

rigs of US$6 million as compared with US$1 million in 2022. Consistent with 2022, we did not recognize revenue from turnkey projects during

the quarter. Revenue per utilization day, excluding the impact of idle but contracted rigs was US$33,543, compared to US$27,682 in 2022,

an increase of US$5,861 or 21%. Revenue per utilization day, excluding idle but contracted rigs, decreased US$1,014 from the second quarter

of 2023. |

| · | Our U.S. operating costs per utilization day increased to US$21,655

compared with US$18,220 in 2022. The increase was primarily due to higher rig operating costs, repairs and maintenance and the impact

of fixed costs being spread over fewer activity days. Our higher rig operating costs in the current period pertained to field rate increases

completed in the fourth quarter of 2022. U.S. operating costs per utilization day, excluding turnkey, was US$21,623 compared with US$18,236

in 2022. Sequentially, excluding the impact of turnkey activity, operating costs per utilization day increased US$2,677. The increase

was primarily due to higher repairs and maintenance and the impact of fixed costs being spread over fewer activity days. |

| · | In Canada, revenue per utilization day was $32,224 compared with $26,927 in 2022. The increase was a result

of higher average day rates and customer cost recoveries. Sequentially, revenue per utilization day decreased $1,311 due to lower customer

cost recoveries. |

| · | Our Canadian operating costs per utilization day increased to $18,311, compared with $16,893 in 2022,

due to higher field wages, repairs and maintenance and costs that were recovered from our customers. Sequentially, our daily operating

costs decreased $3,021 due to lower repairs and maintenance, customer cost recoveries and operating overheads being spread over a higher

activity base. |

| · | Completion and Production Services revenue and Adjusted EBITDA were $58 million and $14 million, respectively, compared with $57 million

and $15 million in 2022. |

| · | We realized US$29 million of international contract drilling revenue compared with US$28 million in 2022. |

| · | General and administrative expenses were $44 million as compared with $25 million in 2022. The increase

was primarily due to higher share-based compensation charges. |

| · | Net finance charges were $20 million, a decrease of $3 million compared with 2022 and was the result of

lower outstanding long-term debt. |

| · | Cash provided by operations was $89 million compared with $8 million in 2022. We generated $92 million of funds provided by operations

compared with $81 million in 2022. Our increased day rates, revenue efficiency and operational leverage continued to drive higher cash

generation in the current quarter. |

| · | Capital expenditures were $52 million compared with $51 million in 2022. Capital spending by spend category (see “FINANCIAL

MEASURES AND RATIOS”) included $13 million for expansion and upgrades and $39 million for the maintenance of existing assets, infrastructure,

and intangible assets. |

| · | We repaid $26 million of debt, repurchasing and cancelling US$18 million of 2026 unsecured senior notes, and ended the quarter with

$49 million of cash and more than $600 million of available liquidity. |

Summary for the nine months ended September 30, 2023:

| · | Revenue for the first nine months of 2023 was $1,431 million, an increase of 29% from 2022. |

| · | Adjusted EBITDA was $460 million as compared with $221 million in 2022. Our higher Adjusted EBITDA was

attributable to increased revenue rates, higher Canadian drilling and service activity and lower share-based compensation, partially offset

by lower U.S. and international drilling activity. |

| · | General and administrative costs were $83 million, a decrease of $19 million from 2022 primarily due to

lower share-based compensation, partially offset by higher labour-related costs and the impact of the weakening Canadian dollar on our

translated U.S. dollar-denominated costs. |

| · | Net finance charges were $64 million, consistent with 2022, as the impact of our lower debt balance was

offset by higher variable debt interest rates and higher translated U.S. dollar-denominated interest expense due to the weakening of the

Canadian dollar. |

| · | Cash provided by operations was $330 million as compared with $78 million in 2022. Funds provided by operations

in 2023 were $388 million, an increase of $217 million from the comparative period. |

| · | Capital expenditures were $148 million in 2023, an increase of $21 million from 2022. Capital spending

by spend category included $39 million for expansion and upgrades and $108 million for the maintenance of existing assets, infrastructure,

and intangible assets. |

| · | Year to date, we have reduced our total debt by $126 million through the full repayment of our Senior

Credit Facility and the repurchase and cancellation of US$48 million of our 2026 unsecured senior notes. In addition, we repurchased and

cancelled 193,616 common shares for $13 million under our Normal Course Issuer Bid (NCIB). |

STRATEGY

Precision’s vision is to be globally recognized as the High Performance,

High Value provider of land drilling services. We work toward this vision by defining and measuring our results against strategic

priorities that we establish at the beginning of every year.

Precision’s 2023 strategic priorities and the progress made during

the third quarter and year to date are as follows:

| 1. | Deliver High Performance, High Value service through operational excellence. |

| · | Year to date, we have increased our Canadian drilling rig utilization days and well servicing rig operating

hours, maintaining our position as the leading provider of high-quality and reliable services in Canada. |

| · | Activated our seventh rig in the Middle East and expect to have an eighth rig working in the next few

weeks. These eight rigs represent over US$500 million in backlog revenue that stretches into 2028. |

| · | Announced the acquisition of CWC, expanding our Canadian well servicing business and our drilling fleets

in both the U.S. and Canada. The proposed transaction is expected to provide approximately $20 million in annual synergies and be accretive

on a 2024 cash flow per share basis. |

| · | Reinvested $148 million year to date into our equipment and infrastructure as we progress toward our total

expected 2023 investment of $215 million. |

| 2. | Maximize free cash flow by increasing Adjusted EBITDA margins, revenue efficiency, and growing revenue

from AlphaTM technologies and EverGreenTM suite of environmental solutions. |

| · | Realized third quarter daily operating margins (revenue per utilization day less operating costs per utilization

day) of $13,913 in Canada and US$13,480 in the U.S., representing increases of 39% and 40%, respectively, compared with the third quarter

of 2022. |

| · | Grew combined AlphaTM technologies and EverGreenTM suite of environmental solutions

third quarter revenue by 30% compared with the same quarter last year. |

| · | At September 30, we had 74 of our AC Super Triple rigs equipped with AlphaTM technologies,

representing a 19% increase over the third quarter of 2022. |

| · | Continued to scale our EverGreenTM suite of environmental solutions. Approximately 75% of our

Super Triple fleet is equipped with at least one EverGreenTM product, including 11 field deployed EverGreenTM

Battery Energy Storage Systems (BESS). |

| 3. | Reduce debt by at least $150 million and allocate 10% to 20% of free cash flow before debt repayments

for share repurchases. Long-term debt reduction target of $500 million between 2022 and 2025 and sustained Net Debt to Adjusted EBITDA

ratio(1) of below 1.0 times by the end of 2025. |

| · | Generated significant third quarter cash from operations of $89 million which allowed us to repurchase

and cancel US$18 million of 2026 unsecured senior notes. |

| · | As of September 30, 2023, we have reduced debt by $126 million and remain committed to reducing debt by

at least $150 million in 2023. |

| · | We have allocated $13 million of free cash flow to share repurchases for the first nine months of the

year and in September we renewed our NCIB for an additional year as we believe it continues to be another tool to enhance shareholder

value. |

| · | We

remain committed to our long-term debt reduction target and reaching a sustained Net Debt to Adjusted EBITDA ratio of below 1.0 times

by the end of 2025. |

| | (1)

See “FINANCIAL MEASURES AND RATIOS.” |

OUTLOOK

Energy industry fundamentals continue to support drilling activity for

oil and natural gas despite economic uncertainty and geopolitical instability. During the third quarter, persistent challenges and stresses

from interest rate hikes and recessionary risks began to weaken, and commodity prices moved higher. While the recent conflict in the Middle

East has had little direct impact on global oil and natural gas supply, an escalation of events and involvement from additional regional

powers could disrupt supply in the world’s top oil producing region.

Today, oil prices are supported by increasing global demand and limited

supply growth as OPEC continues to honour its lower production quotas and producers remain committed to returning capital to shareholders

versus increasing production. Natural gas has demonstrated short-term price weaknesses; however, this lower-carbon energy source is becoming

increasingly favored as countries around the world stress the importance of sustainability, decarbonization and energy security. With

demand for Liquefied Natural Gas (LNG) exports growing and the next wave of North American LNG projects expected to begin coming

online in 2025 (including LNG Canada), we anticipate a sustained period of elevated natural gas drilling activity in both the U.S. and

Canada.

In Canada, Precision’s year to date drilling activity has surpassed

2022 levels and we expect high activity levels to continue into 2024, due to strong oil prices and increases in hydrocarbon export capacity.

The Trans Mountain oil pipeline expansion and the Coastal GasLink pipeline are each expected to begin operations in the first quarter

of 2024. Northwestern Alberta and Northeastern British Columbia natural gas developments are prime beneficiaries of the LNG Canada project

and the January 2023 agreement between the Government of British Columbia and the Blueberry River First Nation, which has facilitated

a significant increase in drilling license approvals and should lead to more drilling activity in the region. Large pad drilling programs

are ideally suited for our Super Triple rigs, resulting in strong customer interest for these rigs for the next several years.

Our Super Triple fleet is currently fully utilized and we expect customer demand to continue to exceed supply, driving higher day

rates, daily operating margins and longer-term take-or-pay contracts. We are currently upgrading one of our Canadian rigs and expect to

add it to our Super Triple Canadian fleet in January 2024 on a three-year term contract, bringing our fleet size to 30.

In the Canadian heavy oil market, we expect activity levels to remain strong

as Canadian producers are benefiting from favorable oil pricing due to a weaker Canadian dollar exchange rate and improving heavy oil

differentials. Precision’s Super Single rigs are well suited for long-term conventional heavy oil development in the oil

sands and Clearwater formation. We expect our Super Single pad-capable rigs to be fully utilized well into 2024, driving higher

day rates.

In the U.S., drilling activity had been increasing since mid-2020 but began

to weaken in early 2023 due to lower natural gas prices and oil price volatility. As at October 25, 2023, the Baker Hughes’ active

U.S. land rig count declined 21% from the start of the year. If oil prices remain stable and around today’s level, we expect demand

to improve late in the fourth quarter and gain momentum in 2024 as customers embark on a new budget cycle and seek to maintain or possibly

increase production levels and replenish inventories.

Our AlphaTM technologies and EverGreenTM suite of

environmental solutions continue to gain momentum and have become key competitive differentiators for our rigs as these offerings deliver

exceptional value to our customers by reducing risks, well construction costs and carbon footprint. We currently have 11 EverGreenTM

BESS deployed in the field and have commitments for two additional deployments by year end. Precision’s EverGreenTM BESS

have proven to be an economically viable emissions reduction solution for our customers and we anticipate continued demand for additional

deployments in 2024.

Internationally, we currently have seven rigs working on term contracts,

four in Kuwait and three in the Kingdom of Saudi Arabia, increasing to eight in the next few weeks. In 2024, our international earnings

are expected to increase approximately 50% over 2023 levels and provide stable and predictable cash flow that stretches into 2028. We

continue to bid our remaining idle rigs within the region and remain optimistic about our ability to secure rig reactivations.

Precision is the leading provider of high-quality and reliable well services

in Canada and the outlook for this business is positive. High customer demand for well maintenance and completion services is expected

to add tightness to the availability of staffed service rigs, supporting healthy activity and pricing into the foreseeable future. In

September, Precision announced the acquisition of CWC, which will allow us to enhance our Canadian well service offering with high-quality

rigs in complementary geographic regions. The acquisition is expected to close in the fourth quarter of 2023 and provide accretive cash

flow on a per share basis in 2024.

Commodity Prices

Third quarter average West Texas Intermediate and Western Canadian Select

oil prices decreased 10% and 3%, respectively, from 2022. Average Henry Hub and AECO natural gas prices declined 66% and 42%, respectively

from 2022.

| | |

|

For

the three months ended

September 30, |

| |

|

Year ended

December 31, |

|

| | |

|

2023 |

| |

|

2022 |

| |

|

2022 |

|

| Average oil and natural gas prices | |

| | | |

| | | |

| | |

| Oil | |

| | | |

| | | |

| | |

| West Texas Intermediate (per barrel) (US$) | |

| 82.18 | | |

| 91.66 | | |

| 94.23 | |

| Western Canadian Select (per barrel) (US$) | |

| 69.39 | | |

| 71.56 | | |

| 78.15 | |

| Natural gas | |

| | | |

| | | |

| | |

| United States | |

| | | |

| | | |

| | |

| Henry Hub (per MMBtu) (US$) | |

| 2.66 | | |

| 7.89 | | |

| 6.51 | |

| Canada | |

| | | |

| | | |

| | |

| AECO (per MMBtu) (CDN$) | |

| 2.61 | | |

| 4.47 | | |

| 5.43 | |

Contracts

The following chart outlines the average number of drilling rigs under

term contract by quarter as at October 25, 2023. For those quarters ending after September 30, 2023, this chart represents the minimum

number of term contracts from which we will earn revenue. We expect the actual number of contracted rigs to vary in future periods as

we sign additional term contracts.

| | |

Average for the quarter ended 2022 | |

Average for the quarter ended 2023 |

| | |

|

Mar. 31 |

| |

|

June 30 |

| |

|

Sept. 30 |

| |

|

Dec. 31 |

| |

|

Mar. 31 |

| |

|

June 30 |

| |

|

Sept. 30 |

| |

|

Dec. 31 |

|

| Average rigs under term contract as of October 25, 2023: | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | U.S. | | |

| 27 | | |

| 29 | | |

| 31 | | |

| 35 | | |

| 40 | | |

| 37 | | |

| 32 | | |

| 28 | |

| | Canada | | |

| 6 | | |

| 8 | | |

| 10 | | |

| 16 | | |

| 19 | | |

| 23 | | |

| 23 | | |

| 21 | |

| | International | | |

| 6 | | |

| 6 | | |

| 6 | | |

| 6 | | |

| 4 | | |

| 5 | | |

| 7 | | |

| 8 | |

| Total | | |

| 39 | | |

| 43 | | |

| 47 | | |

| 57 | | |

| 63 | | |

| 65 | | |

| 62 | | |

| 57 | |

The following chart outlines the average number of drilling rigs that we

had under term contract for 2022 and the average number of rigs we have under term contract as at October 25, 2023.

| | |

|

Average for the year ended |

|

| | |

|

2022 |

| |

|

2023 |

|

Average rigs under term contract

as of October 25, 2023: | |

| |

|

| | U.S. | | |

| 31 | | |

| 34 | |

| | Canada | | |

| 10 | | |

| 22 | |

| | International | | |

| 6 | | |

| 6 | |

| Total | | |

| 47 | | |

| 62 | |

In Canada, term contracted rigs normally

generate 250 utilization days per year because of the seasonal nature of well site access. Accordingly, our anticipated Canadian rigs

under term contract may fluctuate as customers complete their commitments earlier than projected. In most regions in the U.S. and

internationally, term contracts normally generate 365 utilization days per year. Internationally, we expect to have eight rigs operating

under long-term contract by the end of 2023.

Drilling Activity

The following chart outlines the average number of drilling rigs that we

had working or moving by quarter for the periods noted.

| | |

|

Average for the quarter ended

2022 |

| |

|

Average for the quarter ended

2023 |

|

| | |

|

Mar. 31 |

| |

|

June 30 |

| |

|

Sept. 30 |

| |

|

Dec. 31 |

| |

|

Mar. 31 |

| |

|

June 30 |

| |

|

Sept. 30 |

|

| Average Precision active rig count: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| U.S. | |

| 51 | | |

| 55 | | |

| 57 | | |

| 60 | | |

| 60 | | |

| 51 | | |

| 41 | |

| Canada | |

| 63 | | |

| 37 | | |

| 59 | | |

| 66 | | |

| 69 | | |

| 42 | | |

| 57 | |

| International | |

| 6 | | |

| 6 | | |

| 6 | | |

| 6 | | |

| 5 | | |

| 5 | | |

| 6 | |

| Total | |

| 120 | | |

| 98 | | |

| 122 | | |

| 132 | | |

| 134 | | |

| 98 | | |

| 104 | |

According to industry sources, as at October 25, 2023, the U.S. active

land drilling rig count has decreased 21% from the same point last year while the Canadian active land drilling rig count has decreased

6%. To date in 2023, approximately 79% of the U.S. industry’s active rigs and 59% of the Canadian industry’s active rigs were

drilling for oil targets, compared with 79% for the U.S. and 63% for Canada at the same time last year.

Capital Spending and Free Cash Flow Allocation

We remain committed to disciplined cash flow management, capital spending

and returning capital to shareholders. In response to increased customer contracted rig upgrades and to facilitate the strategic purchase

of certain long-lead items, capital spending in 2023 is expected to increase by $20 million to $215 million. By spend category, we expect

to incur $155 million for sustaining, infrastructure and intangibles and $60 million for expansion and upgrades. We expect that the $215

million will be split as follows: $201 million in the Contract Drilling Services segment, $11 million in the Completion and Production

Services segment, and $3 million in the Corporate segment. As at September 30, 2023, Precision had capital commitments of approximately

$229 million with payments expected through 2026.

SEGMENTED FINANCIAL RESULTS

Precision’s operations are reported in two segments: Contract Drilling

Services, which includes our drilling rig, oilfield supply and manufacturing divisions; and Completion and Production Services, which

includes our service rig, rental and camp and catering divisions.

| | For the three months ended September 30, |

For the nine months ended September 30, |

| (Stated in thousands of Canadian dollars) | |

|

2023 |

| |

|

2022 |

| |

|

% Change |

| |

|

2023 |

| |

|

2022 |

| |

|

% Change |

|

| Revenue: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Contract Drilling Services | |

| 390,728 | | |

| 374,465 | | |

| 4.3 | | |

| 1,257,762 | | |

| 982,909 | | |

| 28.0 | |

| Completion and Production Services | |

| 57,573 | | |

| 56,642 | | |

| 1.6 | | |

| 178,257 | | |

| 127,921 | | |

| 39.3 | |

| Inter-segment eliminations | |

| (1,547 | ) | |

| (1,772 | ) | |

| (12.7 | ) | |

| (5,036 | ) | |

| (4,140 | ) | |

| 21.6 | |

| | |

| 446,754 | | |

| 429,335 | | |

| 4.1 | | |

| 1,430,983 | | |

| 1,106,690 | | |

| 29.3 | |

| Adjusted EBITDA:(1) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Contract Drilling Services | |

| 131,701 | | |

| 118,599 | | |

| 11.0 | | |

| 468,302 | | |

| 260,202 | | |

| 80.0 | |

| Completion and Production Services | |

| 14,118 | | |

| 14,788 | | |

| (4.5 | ) | |

| 39,031 | | |

| 26,166 | | |

| 49.2 | |

| Corporate and Other | |

| (31,244 | ) | |

| (13,826 | ) | |

| 126.0 | | |

| (47,446 | ) | |

| (65,853 | ) | |

| (28.0 | ) |

| | |

| 114,575 | | |

| 119,561 | | |

| (4.2 | ) | |

| 459,887 | | |

| 220,515 | | |

| 108.6 | |

| (1) | See “FINANCIAL

MEASURES AND RATIOS.” |

SEGMENT REVIEW OF CONTRACT DRILLING SERVICES

| | |

For the three months ended September 30, | |

For the nine months ended September 30, |

| (Stated in thousands of Canadian dollars, except where noted) | |

|

2023 |

| |

|

2022 |

| |

|

% Change |

| |

|

2023 |

| |

|

2022 |

| |

|

% Change |

|

| Revenue | |

| 390,728 | | |

| 374,465 | | |

| 4.3 | | |

| 1,257,762 | | |

| 982,909 | | |

| 28.0 | |

| Expenses: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating | |

| 247,937 | | |

| 246,442 | | |

| 0.6 | | |

| 759,750 | | |

| 692,169 | | |

| 9.8 | |

| General and administrative | |

| 11,090 | | |

| 9,424 | | |

| 17.7 | | |

| 29,710 | | |

| 30,538 | | |

| (2.7 | ) |

| Adjusted EBITDA(1) | |

| 131,701 | | |

| 118,599 | | |

| 11.0 | | |

| 468,302 | | |

| 260,202 | | |

| 80.0 | |

Adjusted EBITDA as a percentage of revenue(1) | |

| 33.7 | % | |

| 31.7 | % | |

| | | |

| 37.2 | % | |

| 26.5 | % | |

| | |

| (1) | See “FINANCIAL

MEASURES AND RATIOS.” |

| United States onshore drilling statistics:(1) | |

2023 | |

2022 |

| | |

|

Precision |

| |

|

Industry(2) |

| |

|

Precision |

| |

|

Industry(2) |

|

| Average number of active land rigs for quarters ended: | |

| | | |

| | | |

| | | |

| | |

| March 31 | |

| 60 | | |

| 744 | | |

| 51 | | |

| 603 | |

| June 30 | |

| 51 | | |

| 700 | | |

| 55 | | |

| 687 | |

| September 30 | |

| 41 | | |

| 631 | | |

| 57 | | |

| 746 | |

| Year to date average | |

| 51 | | |

| 692 | | |

| 54 | | |

| 679 | |

| (1) | United States lower 48 operations only. |

| (2) | Baker Hughes rig counts. |

| Canadian onshore drilling statistics:(1) | |

2023 | |

2022 |

| | |

|

Precision |

| |

|

Industry(2) |

| |

|

Precision |

| |

|

Industry(2) |

|

| Average number of active land rigs for quarters ended: | |

| | | |

| | | |

| | | |

| | |

| March 31 | |

| 69 | | |

| 221 | | |

| 63 | | |

| 205 | |

| June 30 | |

| 42 | | |

| 117 | | |

| 37 | | |

| 113 | |

| September 30 | |

| 57 | | |

| 188 | | |

| 59 | | |

| 199 | |

| Year to date average | |

| 56 | | |

| 175 | | |

| 53 | | |

| 172 | |

| (1) | Canadian operations only. |

| (2) | Baker Hughes rig counts. |

Revenue from Contract Drilling Services was $391 million, 4% higher than

2022, while Adjusted EBITDA increased 11% to $132 million. The increase in revenue and Adjusted EBITDA was primarily due to higher day

rates, partially offset by lower North America drilling activity.

Drilling rig utilization days (drilling days plus move days) in the U.S.

were 3,815, 28% lower than 2022. Drilling rig utilization days in Canada were 5,284, 3% lower than 2022. The movement in utilization days

in both the U.S. and Canada was consistent with changes in industry activity. Drilling rig utilization days in our international business

were 554, consistent with 2022.

Revenue per utilization day in the U.S. increased 26% from 2022 and was

primarily the result of higher fleet average day rates and higher idle but contracted rig revenue. We recognized revenue from idle but

contracted rigs of US$6 million as compared with US$1 million in 2022. Consistent with 2022, we did not recognize revenue from turnkey

projects during the quarter. Drilling rig revenue per utilization day in Canada increased 20% due to higher average day rates and customer

cost recoveries. Our international revenue per utilization day for the quarter was 3% higher than 2022 as our rigs commenced drilling

under renewed long-term contracts.

In the U.S., 63% of utilization days were generated from rigs under term

contract as compared with 54% in 2022. In Canada, 37% of our utilization days were generated from rigs under term contract, compared with

14% in 2022.

U.S. operating costs per utilization

day increased 19% from 2022 and was primarily due to higher rig operating costs, repairs and maintenance and the impact of fixed costs

being spread over fewer activity days. Our higher rig operating costs in the current period pertained to field rate increases completed

in the fourth quarter of 2022. U.S. operating costs per utilization day, excluding turnkey, was US$21,623 compared with US$18,236 in 2022.

Our Canadian operating costs per utilization day increased 8% as compared with 2022 and was due to higher field wages, repairs and maintenance

and costs that were recovered from our customers.

Our general and administrative expenses increased $2 million as compared

with 2022 and was primarily the result of higher share-based compensation charges and higher translated U.S. dollar-denominated costs.

SEGMENT REVIEW OF COMPLETION AND PRODUCTION SERVICES

| | |

For the three months ended September 30, | |

For the nine months ended September 30, |

| (Stated in thousands of Canadian dollars, except where noted) | |

|

2023 |

| |

|

2022 |

| |

|

% Change |

| |

|

2023 |

| |

|

2022 |

| |

|

| Revenue | |

| 57,573 | | |

| 56,642 | | |

| 1.6 | | |

| 178,257 | | |

| 127,921 | | |

| 39.3 | |

| Expenses: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating | |

| 41,612 | | |

| 40,198 | | |

| 3.5 | | |

| 133,325 | | |

| 96,365 | | |

| 38.4 | |

| General and administrative | |

| 1,843 | | |

| 1,656 | | |

| 11.3 | | |

| 5,901 | | |

| 5,390 | | |

| 9.5 | |

| Adjusted EBITDA(1) | |

| 14,118 | | |

| 14,788 | | |

| (4.5 | ) | |

| 39,031 | | |

| 26,166 | | |

| 49.2 | |

| Adjusted EBITDA as a percentage of revenue(1) | |

| 24.5 | % | |

| 26.1 | % | |

| | | |

| 21.9 | % | |

| 20.5 | % | |

| | |

| Well servicing statistics: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Number of service rigs (end of period) | |

| 121 | | |

| 135 | | |

| (10.4 | ) | |

| 121 | | |

| 135 | | |

| (10.4 | ) |

| Service rig operating hours | |

| 46,894 | | |

| 52,340 | | |

| (10.4 | ) | |

| 144,944 | | |

| 120,994 | | |

| 19.8 | |

| Service rig operating hour utilization | |

| 42 | % | |

| 47 | % | |

| | | |

| 44 | % | |

| 43 | % | |

| | |

| (1) | See “FINANCIAL

MEASURES AND RATIOS.” |

Completion and Production Services revenue increased to $58 million, an

increase of $1 million from 2022. Our increased revenue was due to higher service rates, offset by lower activity. Our third quarter service

rig operating hours decreased 10% compared with 2022. Completion and Production Services generated 7% of its revenue from U.S. operations

compared with 8% in 2022.

Operating costs as a percentage of revenue were 72% as compared with 71%

in 2022. The increased percentage in 2023 was the result of higher labour-related costs. As compared to 2022, our third quarter general

and administrative expenses increased 11%, primarily due to higher share-based compensation charges.

Adjusted EBITDA was $14 million as compared with $15 million in 2022. Our

lower Adjusted EBITDA in 2023 was due to decreased activity, higher labour-related costs and higher share-based compensation, partially

offset by increased service rates.

SEGMENT REVIEW OF CORPORATE AND OTHER

Our Corporate and Other segment provides support functions to our operating

segments. The Corporate and Other segment had negative Adjusted EBITDA of $31 million as compared with $14 million in 2022. Our higher

current quarter Adjusted EBITDA was impacted by higher share-based compensation charges and higher translated U.S. dollar-denominated

costs.

OTHER ITEMS

Share-based Incentive Compensation Plans

We have several cash and equity-settled share-based incentive plans for

non-management directors, officers, and other eligible employees. Our accounting policies for each share-based incentive plan can be found

in our 2022 Annual Report.

A summary of expense amounts under these plans during the reporting periods

are as follows:

| | |

For the three months ended September 30, | |

For the nine months ended September 30, |

| (Stated in thousands of Canadian dollars) | |

|

2023 |

| |

|

2022 |

| |

|

2023 |

| |

|

2022 |

|

| Cash settled share-based incentive plans | |

| 30,105 | | |

| 5,543 | | |

| 20,091 | | |

| 57,802 | |

| Equity settled share-based incentive plans | |

| 701 | | |

| — | | |

| 1,834 | | |

| 427 | |

| Total share-based incentive compensation plan expense | |

| 30,806 | | |

| 5,543 | | |

| 21,925 | | |

| 58,229 | |

| | |

| | | |

| | | |

| | | |

| | |

| Allocated: | |

| | | |

| | | |

| | | |

| | |

| Operating | |

| 7,692 | | |

| 1,922 | | |

| 6,732 | | |

| 14,694 | |

| General and Administrative | |

| 23,114 | | |

| 3,621 | | |

| 15,193 | | |

| 43,535 | |

| | |

| 30,806 | | |

| 5,543 | | |

| 21,925 | | |

| 58,229 | |

Cash settled share-based compensation expense for the quarter was $30 million

as compared with $6 million in 2022. The higher expense in 2023 was primarily due to our improved share price performance as compared

with 2022.

During the first quarter of 2023, we issued Executive Restricted Share

Units (Executive RSUs) to certain senior executives. Accordingly, our equity-settled share-based compensation expense for the quarter

was $1 million as compared with nil in 2022.

As at September 30, 2023, the majority of our share-based compensation

plans were classified as cash-settled and will be impacted by changes in our share price. Although accounted for as cash-settled, Precision

retains the ability to settle certain vested units in common shares at its discretion.

Finance Charges

Net finance charges were $20 million, a decrease of $3 million compared

with 2022 and the result of lower outstanding long-term debt. Interest charges on our U.S. dollar-denominated long-term debt were US$13

million ($17 million) as compared with US$16 million ($20 million) in 2022.

Income Tax

Income tax expense for the quarter was $8 million as compared with $6 million

in 2022. During the third quarter, we continued to not recognize deferred tax assets on certain Canadian and international operating losses.

Normal Course Issuer Bid

During the quarter, the Toronto Stock Exchange (TSX) approved the

renewal of our Normal Course Issuer Bid. Pursuant to the NCIB, we are authorized to repurchase and cancel up to a maximum of 1,326,321

common shares. Purchases under the renewed NCIB may commence on September 19, 2023 and will terminate no later than September 18, 2024,

or such earlier time as we complete our maximum purchases pursuant to the NCIB or provide notice of termination.

Cathedral Energy Services Ltd.

During the third quarter of 2023, we exercised 2 million warrants for $1

million in exchange for 2 million common shares of Cathedral Energy Services Ltd. (Cathedral). In addition, we divested 11 million

common shares of Cathedral for net proceeds of $10 million.

LIQUIDITY AND CAPITAL RESOURCES

The oilfield services business is inherently cyclical in nature. To manage

this, we focus on maintaining a strong balance sheet in order to have the financial flexibility to manage our growth and cash flow regardless

of where we are in the business cycle. We maintain a variable operating cost structure so we can be responsive to changes in demand.

Our maintenance capital expenditures are tightly governed and highly responsive

to activity levels with additional cost savings leverage provided through our internal manufacturing and supply divisions. Term contracts

on expansion capital provide more certainty of future revenues and return on our capital investments.

Liquidity

| Amount |

|

Availability |

|

Used for |

|

Maturity |

| Senior Credit Facility (secured) |

|

|

|

|

|

|

US$447 million (extendible, revolving

term credit facility with US$353 million accordion feature) |

|

Nil drawn and US$55 million in outstanding letters of credit |

|

General corporate purposes |

|

June 18, 2025 |

| Real estate credit facilities (secured) |

|

|

|

|

|

|

| US$9 million |

|

Fully drawn |

|

General corporate purposes |

|

November 19, 2025 |

| $17 million |

|

Fully drawn |

|

General corporate purposes |

|

March 16, 2026 |

| Operating facilities (secured) |

|

|

|

|

|

|

| $40 million |

|

Undrawn, except $20 million in

outstanding letters of credit |

|

Letters of credit and general

corporate purposes |

|

|

| US$15 million |

|

Undrawn |

|

Short-term working capital

requirements |

|

|

| Demand letter of credit facility (secured) |

|

|

|

|

|

|

| US$40 million |

|

Undrawn, except US$21 million in

outstanding letters of credit |

|

Letters of credit |

|

|

| Unsecured senior notes (unsecured) |

|

|

|

|

|

|

| US$299 million – 7.125% |

|

Fully drawn |

|

Debt redemption and repurchases |

|

January 15, 2026 |

| US$400 million – 6.875% |

|

Fully drawn |

|

Debt redemption and repurchases |

|

January 15, 2029 |

As at September 30, 2023, we had $978 million outstanding under our Senior

Credit Facility, Real Estate Credit Facilities and unsecured senior notes as compared with $1,103 million at December 31, 2022. The current

blended cash interest cost of our debt is approximately 7.0%.

During the quarter, we repurchased and cancelled US$18 million principal

amount of our 2026 unsecured senior notes.

Senior Credit Facility

Our Senior Credit Facility requires that we comply with certain covenants

including a leverage ratio of consolidated senior debt to consolidated Covenant EBITDA of less than 2.5:1. For purposes of calculating

the leverage ratio, consolidated senior debt only includes secured indebtedness. The Senior Credit Facility limits the redemption and

repurchase of junior debt subject to a pro forma senior net leverage covenant test of less than or equal to 1.75:1.

The Senior Credit Facility matures on June 18, 2025.

Unsecured Senior Notes

The unsecured senior notes require that we comply with certain restrictive

and financial covenants, including an incurrence based consolidated interest coverage ratio test of consolidated cash flow, as defined

in the senior note agreements, to consolidated interest expense of greater than 2.0:1 for the most recent four consecutive fiscal quarters.

In the event our consolidated interest coverage ratio is less than 2.0:1 for the most recent four consecutive fiscal quarters, the unsecured

senior notes restrict our ability to incur additional indebtedness.

For further information, please see the unsecured senior note indentures

which are available on SEDAR and EDGAR.

Covenants

As at September 30, 2023, we were in compliance with the covenants of our

Senior Credit Facility and Real Estate Credit Facilities.

| | |

|

Covenant |

| |

|

At September 30, 2023 |

|

| Senior Credit Facility | |

| | | |

| | |

| Consolidated senior debt to consolidated covenant EBITDA(1) | |

| <2.50 | | |

| 0.05 | |

| Consolidated covenant EBITDA to consolidated interest expense | |

| >2.50 | | |

| 6.74 | |

| Real Estate Credit Facilities | |

| | | |

| | |

| Consolidated covenant EBITDA to consolidated interest expense | |

| >2.50 | | |

| 6.74 | |

| (1) | For purposes of calculating the leverage

ratio consolidated senior debt only includes secured indebtedness. |

Impact of foreign exchange rates

The following table summarizes the average and closing Canada-U.S. foreign

exchanges rates.

| | |

|

For the three months ended September 30, |

| |

|

For the nine months ended September 30, |

| |

|

At December 31, |

|

| | |

|

2023 |

| |

|

2022 |

| |

|

2023 |

| |

|

2022 |

| |

|

2022 |

|

| Canada-U.S. foreign exchange rates | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average | |

| 1.34 | | |

| 1.31 | | |

| 1.35 | | |

| 1.28 | | |

| — | |

| Closing | |

| 1.36 | | |

| 1.38 | | |

| 1.36 | | |

| 1.38 | | |

| 1.36 | |

Hedge of investments in foreign operations

We utilize foreign currency long-term debt to hedge our exposure to changes

in the carrying value of our net investment in certain foreign operations as a result of changes in foreign exchange rates.

We have designated our U.S. dollar-denominated long-term debt as a net

investment hedge in our U.S. operations and other foreign operations that have a U.S. dollar functional currency. To be accounted for

as a hedge, the foreign currency denominated long-term debt must be designated and documented as such and must be effective at inception

and on an ongoing basis. We recognize the effective amount of this hedge (net of tax) in other comprehensive income. We recognize ineffective

amounts (if any) in net earnings (loss).

QUARTERLY FINANCIAL SUMMARY

| (Stated in thousands of Canadian dollars, except per share amounts) | |

|

2022 |

| |

|

2023 |

|

| Quarters ended | |

|

December 31 |

| |

|

March 31 |

| |

|

June 30 |

| |

|

September 30 |

|

| Revenue | |

| 510,504 | | |

| 558,607 | | |

| 425,622 | | |

| 446,754 | |

| Adjusted EBITDA(1) | |

| 91,090 | | |

| 203,219 | | |

| 142,093 | | |

| 114,575 | |

| Net earnings | |

| 3,483 | | |

| 95,830 | | |

| 26,900 | | |

| 19,792 | |

| Net earnings per basic share | |

| 0.27 | | |

| 7.02 | | |

| 1.97 | | |

| 1.45 | |

| Net earnings per diluted share | |

| 0.27 | | |

| 5.57 | | |

| 1.63 | | |

| 1.45 | |

| Funds provided by operations(1) | |

| 111,339 | | |

| 159,653 | | |

| 136,959 | | |

| 91,608 | |

| Cash provided by operations | |

| 159,082 | | |

| 28,356 | | |

| 213,460 | | |

| 88,500 | |

| (Stated in thousands of Canadian dollars, except per share amounts) | |

|

2021 |

| |

|

2022 |

|

| Quarters ended | |

|

December 31 |

| |

|

March 31 |

| |

|

June 30 |

| |

|

September 30 |

|

| Revenue | |

| 295,202 | | |

| 351,339 | | |

| 326,016 | | |

| 429,335 | |

| Adjusted EBITDA(1) | |

| 63,881 | | |

| 36,855 | | |

| 64,099 | | |

| 119,561 | |

| Net earnings (loss) | |

| (27,336 | ) | |

| (43,844 | ) | |

| (24,611 | ) | |

| 30,679 | |

| Net earnings (loss) per basic share | |

| (2.05 | ) | |

| (3.25 | ) | |

| (1.81 | ) | |

| 2.26 | |

| Net earnings (loss) per diluted share | |

| (2.05 | ) | |

| (3.25 | ) | |

| (1.81 | ) | |

| 2.03 | |

| Funds provided by operations(1) | |

| 62,681 | | |

| 29,955 | | |

| 60,373 | | |

| 81,327 | |

| Cash provided by (used in) operations | |

| 59,713 | | |

| (65,294 | ) | |

| 135,174 | | |

| 8,142 | |

| (1) | See “FINANCIAL

MEASURES AND RATIOS.” |

CRITICAL ACCOUNTING JUDGEMENTS AND ESTIMATES

Because of the nature of our business, we are required to make judgements

and estimates in preparing our Condensed Consolidated Interim Financial Statements that could materially affect the amounts recognized.

Our judgements and estimates are based on our past experiences and assumptions we believe are reasonable in the circumstances. The critical

judgements and estimates used in preparing the Condensed Consolidated Interim Financial Statements are described in our 2022 Annual Report.

EVALUATION OF CONTROLS AND PROCEDURES

Based on their evaluation as at September 30, 2023, Precision’s Chief

Executive Officer and Chief Financial Officer concluded that the Corporation’s disclosure controls and procedures (as defined in

Rules 13a-15(e) and 15d-15(e) under the United States Securities Exchange Act of 1934, as amended (the Exchange Act)), are effective

to ensure that information required to be disclosed by the Corporation in reports that are filed or submitted to Canadian and U.S. securities

authorities is recorded, processed, summarized and reported within the time periods specified in Canadian and U.S. securities laws. In

addition, as at September 30, 2023, there were no changes in the internal control over financial reporting (as defined in Exchange Act

Rules 13a-15(f) and 15d-15(f)) that occurred during the three months ended September 30, 2023 that have materially affected, or are reasonably

likely to materially affect, the Corporation’s internal control over financial reporting. Management will continue to periodically

evaluate the Corporation’s disclosure controls and procedures and internal control over financial reporting and will make any modifications

from time to time as deemed necessary.

Based on their inherent limitations, disclosure controls and procedures

and internal control over financial reporting may not prevent or detect misstatements, and even those controls determined to be effective

can provide only reasonable assurance with respect to financial statement preparation and presentation.

FINANCIAL MEASURES AND RATIOS

Non-GAAP Financial Measures

|

We reference certain additional Non-Generally Accepted Accounting Principles (Non-GAAP) measures that are not defined terms under IFRS to assess performance because we believe they provide useful supplemental information to investors.

|

| Adjusted EBITDA |

We believe Adjusted EBITDA (earnings before income taxes, loss (gain) on

investments and other assets, gain on repurchase of unsecured senior notes, finance charges, foreign exchange, gain on asset disposals

and depreciation and amortization), as reported in our Condensed Interim Consolidated Statements of Net Earnings (Loss) and our reportable

operating segment disclosures, is a useful measure because it gives an indication of the results from our principal business activities

prior to consideration of how our activities are financed and the impact of foreign exchange, taxation and depreciation and amortization

charges.

The most directly comparable financial measure is net earnings (loss). |

| | |

For the three months ended September 30, | |

For the nine months ended September 30, |

| (Stated in thousands of Canadian dollars) | |

|

2023 |

| |

|

2022 |

| |

|

2023 |

| |

|

2022 |

|

| Adjusted EBITDA by segment: | |

| | | |

| | | |

| | | |

| | |

| Contract Drilling Services | |

| 131,701 | | |

| 118,599 | | |

| 468,302 | | |

| 260,202 | |

| Completion and Production Services | |

| 14,118 | | |

| 14,788 | | |

| 39,031 | | |

| 26,166 | |

| Corporate and Other | |

| (31,244 | ) | |

| (13,826 | ) | |

| (47,446 | ) | |

| (65,853 | ) |

| Adjusted EBITDA | |

| 114,575 | | |

| 119,561 | | |

| 459,887 | | |

| 220,515 | |

| Depreciation and amortization | |

| 73,192 | | |

| 69,448 | | |

| 218,823 | | |

| 207,662 | |

| Gain on asset disposals | |

| (2,438 | ) | |

| (8,238 | ) | |

| (15,586 | ) | |

| (22,152 | ) |

| Foreign exchange | |

| 363 | | |

| 1,344 | | |

| (894 | ) | |

| 1,362 | |

| Finance charges | |

| 19,618 | | |

| 22,521 | | |

| 63,946 | | |

| 64,294 | |

| Gain on repurchase of unsecured notes | |

| (37 | ) | |

| — | | |

| (137 | ) | |

| — | |

| Loss (gain) on investments and other assets | |

| (3,813 | ) | |

| (2,515 | ) | |

| 6,075 | | |

| (3,738 | ) |

| Incomes taxes | |

| 7,898 | | |

| 6,322 | | |

| 45,138 | | |

| 10,863 | |

| Net earnings (loss) | |

| 19,792 | | |

| 30,679 | | |

| 142,522 | | |

| (37,776 | ) |

| Funds Provided by (Used in) Operations |

We believe funds provided by (used in) operations, as reported in our Condensed

Interim Consolidated Statements of Cash Flows, is a useful measure because it provides an indication of the funds our principal business

activities generate prior to consideration of working capital changes, which is primarily made up of highly liquid balances.

The most directly comparable financial measure is cash provided by (used

in) operations.

|

| Net Capital Spending |

We believe net capital spending is a useful measure as it provides an indication

of our primary investment activities.

The most directly comparable financial measure is cash provided by (used

in) investing activities.

Net capital spending is calculated as follows:

|

| | |

For the three months ended September 30, | |

For the nine months ended September 30, |

| (Stated in thousands of Canadian dollars) | |

|

2023 |

| |

|

2022 |

| |

|

2023 |

| |

|

2022 |

|

| Capital spending by spend category | |

| | | |

| | | |

| | | |

| | |

| Expansion and upgrade | |

| 13,479 | | |

| 25,461 | | |

| 39,439 | | |

| 50,606 | |

| Maintenance, infrastructure and intangibles | |

| 38,914 | | |

| 25,642 | | |

| 108,463 | | |

| 76,335 | |

| | |

| 52,393 | | |

| 51,103 | | |

| 147,902 | | |

| 126,941 | |

| Proceeds on sale of property, plant and equipment | |

| (6,698 | ) | |

| (22,337 | ) | |

| (20,724 | ) | |

| (32,033 | ) |

| Net capital spending | |

| 45,695 | | |

| 28,766 | | |

| 127,178 | | |

| 94,908 | |

| Business acquisitions | |

| — | | |

| 10,200 | | |

| 28,000 | | |

| 10,200 | |

| Proceeds from sale of investments and other assets | |

| (10,013 | ) | |

| — | | |

| (10,013 | ) | |

| — | |

| Purchase of investments and other assets | |

| 3,211 | | |

| 73 | | |

| 5,282 | | |

| 609 | |

| Receipt of finance lease payments | |

| (64 | ) | |

| — | | |

| (64 | ) | |

| — | |

| Changes in non-cash working capital balances | |

| (4,551 | ) | |

| (7,328 | ) | |

| 6,774 | | |

| (6,881 | ) |

| Cash used in investing activities | |

| 34,278 | | |

| 31,711 | | |

| 157,157 | | |

| 98,836 | |

| Working Capital |

We define working capital as current assets less current liabilities, as

reported in our Condensed Interim Consolidated Statements of Financial Position.

Working capital is calculated as follows:

|

| | |

|

September 30, |

| |

|

December 31, |

|

| (Stated in thousands of Canadian dollars) | |

|

2023 |

| |

|

2022 |

|

| Current assets | |

| 477,396 | | |

| 470,670 | |

| Current liabilities | |

| 299,656 | | |

| 410,029 | |

| Working capital | |

| 177,740 | | |

| 60,641 | |

Non-GAAP Ratios

|

We reference certain additional Non-GAAP ratios that are not defined terms under IFRS to assess performance because we believe they provide useful supplemental information to investors.

|

| Adjusted EBITDA % of Revenue |

We believe Adjusted EBITDA as a percentage of consolidated revenue, as reported in our Condensed Interim Consolidated Statements of Net Earnings (Loss), provides an indication of our profitability from our principal business activities prior to consideration of how our activities are financed and the impact of foreign exchange, taxation and depreciation and amortization charges.

|

Long-term debt to long-term debt plus equity |

We believe that long-term debt (as reported in our Condensed Interim Consolidated Statements of Financial Position) to long-term debt plus equity (total shareholders’ equity as reported in our Condensed Interim Consolidated Statements of Financial Position) provides an indication of our debt leverage.

|

| Net Debt to Adjusted EBITDA |

We believe that the Net Debt (long-term debt less cash, as reported in our Condensed Interim Consolidated Statements of Financial Position) to Adjusted EBITDA ratio provides an indication of the number of years it would take for us to repay our debt obligations.

|

Supplementary Financial Measures

|

We reference certain supplementary financial measures that are not defined terms under IFRS to assess performance because we believe they provide useful supplemental information to investors.

|

| Capital Spending by Spend Category |

We provide additional disclosure to better depict the nature of our capital spending. Our capital spending is categorized as expansion and upgrade, maintenance and infrastructure, or intangibles. |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION AND STATEMENTS

Certain statements contained in this report, including statements that

contain words such as "could", "should", "can", "anticipate", "estimate", "intend",

"plan", "expect", "believe", "will", "may", "continue", "project",

"potential" and similar expressions and statements relating to matters that are not historical facts constitute "forward-looking

information" within the meaning of applicable Canadian securities legislation and "forward-looking statements" within the

meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995 (collectively,

"forward-looking information and statements").

In particular, forward-looking information and statements include, but

are not limited to, the following:

| · | our strategic priorities for 2023; |

| · | our capital expenditures, free cash flow allocation and debt reduction plan for 2023; |

| · | anticipated activity levels, demand for our drilling rigs, day rates and daily operating margins in 2023; |

| · | the average number of term contracts in place for 2023; |

| · | customer adoption of AlphaTM technologies and EverGreenTM suite of environmental

solutions; |

| · | timing and amount of accretive cash flow from acquired drilling and well servicing assets; |

| · | potential commercial opportunities and rig contract renewals; and |

| · | our future debt reduction plans. |

These forward-looking information and statements are based on certain assumptions

and analysis made by Precision in light of our experience and our perception of historical trends, current conditions, expected future

developments and other factors we believe are appropriate under the circumstances. These include, among other things:

| · | our ability to react to customer spending plans as a result of changes in oil and natural gas prices; |

| · | the status of current negotiations with our customers and vendors; |

| · | customer focus on safety performance; |

| · | existing term contracts are neither renewed nor terminated prematurely; |

| · | our ability to deliver rigs to customers on a timely basis; |

| · | the impact of an increase/decrease in capital spending; and |

| · | the general stability of the economic and political environments in the jurisdictions where we operate. |

Undue reliance should not be placed on forward-looking information and

statements. Whether actual results, performance or achievements will conform to our expectations and predictions is subject to a number

of known and unknown risks and uncertainties which could cause actual results to differ materially from our expectations. Such risks and

uncertainties include, but are not limited to:

| · | volatility in the price and demand for oil and natural gas; |

| · | fluctuations in the level of oil and natural gas exploration and development activities; |

| · | fluctuations in the demand for contract drilling, well servicing and ancillary oilfield services; |

| · | our customers’ inability to obtain adequate credit or financing to support their drilling and production

activity; |