As

filed with the Securities and Exchange Commission on October 26, 2023

Registration

No. 333-●

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BARFRESH

FOOD GROUP INC.

(Exact

Name of Registrant as Specified in Its Charter)

| Delaware |

|

27-1994406 |

(State

or other jurisdiction

of

incorporation or organization) |

|

(I.R.S.

Employer

Identification

Number) |

3600

Wilshire Boulevard, Suite 2730

Los

Angeles, California 90010

(310)

598-7113

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Riccardo

Delle Coste, Chief Executive Officer

3600

Wilshire Blvd., Suite 1720

Los

Angeles, California 90010

(310)

598-7113

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copy

to:

Fay

Matsukage, Esq.

Doida

Crow Legal LLC

7979

E. Tufts Ave. Suite 1750

Denver,

CO 80237

(720)

306-1001

Approximate

date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act. (Check one):

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☐

(Do not check if a smaller reporting company) |

Smaller

reporting company |

☒ |

| Emerging

growth company ☒ |

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective

on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting

an offer to buy these securities in any state where the offer or sale is not permitted.

Subject

to Completion, Dated October 26, 2023

PROSPECTUS

$5,000,000

BARFRESH

FOOD GROUP INC.

Common

Stock, Preferred Stock, Warrants, Rights,

Debt

Securities and Units

We

may offer and sell, from time to time in one or more offerings the following securities:

| |

● |

shares

of common stock, par value $0.000001 per share; |

| |

|

|

| |

● |

shares

of preferred stock, par value $0.000001 per share; |

| |

|

|

| |

● |

warrants

to purchase shares of our common stock, preferred stock and/or debt securities; |

| |

|

|

| |

● |

rights

to purchase shares of our common stock, preferred stock, warrants and/or debt securities; |

| |

|

|

| |

● |

debt

securities consisting of senior notes, subordinated notes or debentures; |

| |

|

|

| |

● |

units

consisting of a combination of the foregoing securities; or |

| |

|

|

| |

● |

any

combination of these securities. |

We

may offer and sell up to $5,000,000 in the aggregate of the securities identified above from time to time in one or more offerings.

The securities may be distributed at a fixed price or prices, which may be changed, market

prices prevailing at the time of sale, prices related to the prevailing market prices, or negotiated

prices. This prospectus provides a general description of the securities that we may offer. However, this prospectus may not be

used to offer or sell our securities unless accompanied by a prospectus supplement relating to the offered securities. Each time that

we offer securities under this prospectus, we will provide the specific terms of the securities offered, including the public offering

price, in a related prospectus supplement. Such prospectus supplement may add to, update or change information contained in this prospectus.

To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained

in any prospectus supplement, on the other hand, you should rely on the information in the prospectus supplement. You should read this

prospectus and any applicable prospectus supplement together with additional information described under the headings “Where You

Can Find More Information” and “Information Incorporated by Reference” before making your investment decision.

These

securities may be sold directly by us, through dealers or agents designated from time to time, to or through underwriters or through

a combination of these methods. See “Plan of Distribution” in this prospectus for additional information on methods of sale.

We may also describe the plan of distribution for any particular offering of our securities in a prospectus supplement. If any agents,

underwriters or dealers are involved in the sale of any securities in respect of which this prospectus is being delivered, we will disclose

their names and the nature of our arrangements with them in that prospectus supplement. The net proceeds we expect to receive from any

such sale will also be included in the prospectus supplement.

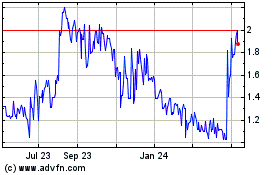

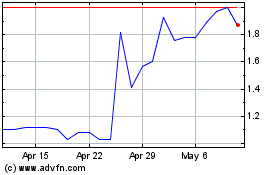

Our

common stock is quoted on the Nasdaq Capital Market under the ticker symbol “BRFH.” The closing price of our common stock

on October 25, 2023 was $1.84 per share.

As

of October 25, 2023, the aggregate market value of our outstanding common equity held by non-affiliates, or public float, was

$15,042,228 based on 13,924,774 shares of common stock outstanding, of which 6,996,385 shares are held by non-affiliates,

and a per share price of $2.15 based on the average of the bid and asked prices of our common stock on the Nasdaq Capital

Market on October 10, 2023 (within 60 days prior to the date of filing). Therefore, as of October 25, 2023, the amount

being offered is no more than one-third of the aggregate market value of our common equity held by non-affiliates, as calculated

in accordance with General Instruction I.B.6 of Form S-3.

An

investment in our securities involves a high degree of risk. See the sections entitled “Risk Factors” included in our most

recent Annual Report on Form 10-K and in any subsequent Quarterly Report on Form 10-Q, which are incorporated by reference into this

prospectus, as well as in any prospectus supplement related to a specific offering we make pursuant to this prospectus. You should carefully

read this entire prospectus together with any related prospectus supplement and the information incorporated by reference into both before

you make your investment decision.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This

prospectus may not be used to sell securities unless accompanied by a prospectus supplement.

The

date of this prospectus is , 2023

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) using

a “shelf” registration process. Under this shelf registration process, we may offer from time to time securities having a

maximum aggregate offering price of no more than one-third of the aggregate market value of the voting and non-voting common equity held

by non-affiliated stockholders, during the period of twelve months immediately prior to and including the subject offer. This prospectus

provides you with a general description of the securities we may offer. Each time we sell securities, we will prepare and file with the

SEC a prospectus supplement that describes the specific amounts, prices and terms of the securities offered. The prospectus supplement

also may add, update or change information contained in this prospectus or the documents incorporated herein by reference. You should

read carefully both this prospectus and any prospectus supplement together with additional information described below under “Risk

Factors,” “Where You Can Find More Information” and “Information Incorporated by Reference.”

This

prospectus does not contain all the information provided in the registration statement we filed with the SEC. For further information

about us or our securities offered hereby, you should refer to that registration statement, which you can obtain from the SEC or directly

from us as described below under “Where You Can Find More Information.”

You

should rely only on the information contained or incorporated by reference in this prospectus or any prospectus supplement. Neither we,

our affiliates nor any underwriters have authorized anyone to provide any information other than that contained or incorporated by reference

in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. If anyone provides

you with different or inconsistent information, you should not rely on it. We and our affiliates take no responsibility for, and can

provide no assurance as to the reliability of, any other information that others may give you. This prospectus is not an offer to sell

securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. We and/or

our affiliates, are not making an offer of these securities in any state where the offer is not permitted. You should not assume that

the information contained in or incorporated by reference in this prospectus or any prospectus supplement or in any such free writing

prospectus is accurate as of any date other than their respective dates. You should assume that the information appearing in this prospectus

or any prospectus supplement, as well as information we have previously filed with the SEC and incorporated by reference, is accurate

as of the date of those documents only. Our business, financial condition, results of operations and prospects may have changed since

those dates.

We

may sell securities through underwriters or dealers, through agents, directly to purchasers or through any combination of these methods.

We and our agents reserve the sole right to accept or reject in whole or in part any proposed purchase of securities. The prospectus

supplement, which we will prepare and file with the SEC each time we offer securities, will set forth the names of any underwriters,

agents or others involved in the sale of securities, and any applicable fee, commission or discount arrangements with them. See “Plan

of Distribution.”

In

this prospectus, references to “Barfresh”, “we,” “us,” “our”, “the registrant”

and “our company” refer, collectively, to Barfresh Food Group Inc., a Delaware corporation, the issuer of the securities

offered hereby, and its consolidated subsidiaries.

We

have filed or incorporated by reference exhibits to the registration statement of which this prospectus forms a part. You should read

the exhibits carefully for provisions that may be important to you.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statement

in this prospectus and in documents incorporated by reference in this prospectus contain certain statements that may be deemed to be

forward-looking statements. The forward-looking statements included or incorporated by reference in this prospectus and those documents

address activities, events or developments that we expect or anticipate will or may occur in the future. Any statements in this document

about expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking

statements. These statements are often, but not always, made through the use of words or phrases such as “may”, “should”,

“could”, “predict”, “potential”, “believe”, “will likely result”, “expect”,

“will continue”, “anticipate”, “seek”, “estimate”, “intend”, “plan”,

“projection”, “would”, “outlook” and similar expressions. Accordingly, these statements involve estimates,

assumptions and uncertainties, which could cause actual results to differ materially from those expressed in them. Any forward-looking

statements are qualified in their entirety by reference to the factors discussed throughout this document. All forward-looking statements

concerning economic conditions, rates of growth, rates of income or values as may be included in this document are based on information

available to us on the dates noted, and we assume no obligation to update any such forward-looking statements.

Management

cautions that forward-looking statements are qualified by their terms and/or important factors, many of which are outside of our control,

involve a number of risks, uncertainties and other factors that could cause actual results and events to differ materially from the statements

made, including, but not limited to, the following risk factors. Although we believe that the expectations reflected in the forward-looking

statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements.

Certain

risks and uncertainties could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements

made by us, and you should not place undue reliance on any such forward-looking statements. Actual results or outcomes may differ materially

from those expressed in any forward-looking statements made by us, and you should not place undue reliance on any such forward-looking

statements. Any forward-looking statement speaks only as of the date on which it is made and we do not undertake any obligation to update

any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect

the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which will arise.

In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors,

may cause actual results to differ materially from those contained in any forward-looking statements.

PROSPECTUS

SUMMARY

This

prospectus summary highlights certain information about our company and other information contained elsewhere in this prospectus or in

documents incorporated by reference. This summary does not contain all of the information that you should consider before making an investment

decision. You should carefully read the entire prospectus, any prospectus supplement, including the section entitled “Risk Factors”

and the documents incorporated by reference into this prospectus, before making an investment decision.

THE

OFFERING

This

prospectus is part of a registration statement that we filed with the SEC utilizing a shelf registration process. Under this shelf registration

process, we may sell any combination of:

| |

● |

common

stock; |

| |

|

|

| |

● |

preferred

stock; |

| |

|

|

| |

● |

debt

securities, in one or more series; |

| |

|

|

| |

● |

warrants

to purchase any of the securities listed above; |

| |

|

|

| |

● |

rights

to purchase any of the securities listed above; and/or |

| |

|

|

| |

● |

units

consisting of one or more of the foregoing. |

in

one or more offerings up to a total dollar amount of $5,000,000. This prospectus provides you with a general description of the

securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information

about the terms of that specific offering and include a discussion of any risk factors or other special considerations that apply to

those securities. The prospectus supplement may also add, update or change information contained in this prospectus. You should read

both this prospectus and any prospectus supplement together with the additional information described under the heading “Risk Factors”

and “Where You Can Find More Information.”

THE

COMPANY

Business

Overview

Barfresh

is a leader in the creation, manufacturing and distribution of ready-to-drink and ready-to-blend frozen beverages. The current portfolio

of products includes smoothies, shakes and frappes.

Some

of the key benefits of the products for the end consumers that drink the products include:

| |

● |

From

as little as 125-130 calories (per serving) |

| |

|

|

| |

● |

Real

fruit in every smoothie |

| |

|

|

| |

● |

Dairy

free options |

| |

|

|

| |

● |

Kosher

approved |

| |

|

|

| |

● |

Gluten

Free |

Products

Products

are packaged in three distinct formats.

The

Company’s ready-to-drink smoothie, “Twist & Go”™, has initially been focused towards the USDA national school

meal program, including the School Breakfast Program, the National School Lunch Program and Smart Snacks in Schools Program. This sweet

fruit and creamy yogurt smoothie contains four ounces of yogurt and a half-cup of fruit/fruit juice and comes in three different flavors:

strawberry banana, peach and mango pineapple. The product was originally launched in a bottled packaging format. The Company introduced

Twist & Go™ cartons in 2022. Twist & Go™ contains no added sugars, preservatives, artificial flavors or colors. At

only 125 -130 calories and with 5 grams of protein, it makes the perfect start to any day or on-the-go snack.

The

Company’s bulk “Easy Pour” format, which contains all the ingredients necessary to make the beverage, is packaged in

gallon containers in a concentrated formula that is mixed in beverage dispensing equipment 1:1 with water. The Company has a “no

sugar added” version of the bulk “Easy Pour” format, WHIRLZ 100% Juice Concentrate, that is specifically targeted for

the aforementioned USDA national school meal programs. In addition, the Company received approval from the United States Defense Logistics

Agency (“DLA”) to sell its smoothie products into all branches of the U.S. Armed Forces and is currently in contract with

and selling its bulk Easy Pour products into over one hundred military bases in the United States and abroad. In 2023, the Company

introduced a more concentrated version of its bulk product, sold to specific target markets in half-gallon containers.

The

Company’s single serve format features portion controlled and ready-to-blend beverage ingredient packs or “beverage packs”.

The beverage packs contain all the ingredients necessary to make the beverage, including the base (either sorbet, frozen yogurt, or ice

cream), real fruit pieces, juices, and ice – five ounces of water are added before blending.

Distribution

The

Company conducts sales through several channels, including National Accounts, Regional Accounts, and Broadline Distributors.

Manufacturing

Barfresh

utilizes contract manufacturers to manufacture all of its products in the United States.

Corporate

Information

Our

current business was established following a 2012 reverse merger into an inactive Delaware corporation, formed on February 25, 2010.

We have two direct subsidiaries: Barfresh Corporation, Inc. (formerly known as Smoothie, Inc.) and Barfresh, Inc. Our corporate office

is located at 3600 Wilshire Boulevard Suite 1720, Los Angeles, 90010. Our telephone number is (310) 598-7113 and our website is www.barfresh.com.

The information contained on, or accessible through, our website is not incorporated in, and shall not be part of, this prospectus.

On

January 20, 2022, our shares of Common Stock began trading on the Nasdaq Capital Market under the symbol, “BRFH.”

RISK

FACTORS

Investing

in our securities involves substantial risks. Before purchasing any of the securities, you should carefully consider and evaluate all

of the information included and incorporated by reference or deemed to be incorporated by reference in this prospectus or the applicable

prospectus supplement, including the risk factors incorporated by reference herein from our Annual Report on Form 10-K for the fiscal

year ended December 31, 2022, as updated by annual, quarterly and other reports and documents we file with the SEC after the date of

this prospectus and that are incorporated by reference herein or in the applicable prospectus supplement. The risks and uncertainties

that we have described are not the only ones facing our company. Additional risks and uncertainties not presently known to us or that

we currently deem immaterial may also affect us. The occurrence of any of these risks could materially and adversely impact our business,

cash flows, condition (financial or otherwise), liquidity, prospects and/or results of operations. Please also refer to the sections

below entitled “Special Note on Forward-Looking Statements” and “Where You Can Find More Information.”

USE

OF PROCEEDS

Unless

otherwise indicated in a prospectus supplement, the net proceeds from the sale of the securities will be used for general corporate purposes,

including, but not limited to, working capital, acquisitions, and other business opportunities.

RATIO

OF EARNINGS TO FIXED CHARGES

Any

time debt securities are offered pursuant to this prospectus, we will provide a table setting forth our ratio of earnings to fixed charges

on a historical basis in the applicable prospectus supplement, if required.

DESCRIPTION

OF SECURITIES

We

may sell from time to time, in one or more offerings:

| |

● |

shares

of our common stock; |

| |

|

|

| |

● |

shares

of our preferred stock; |

| |

|

|

| |

● |

debt

securities consisting of senior notes, subordinated notes or debentures; |

| |

|

|

| |

● |

warrants

to purchase shares of our common stock, shares of our preferred stock and/or debt securities; |

| |

|

|

| |

● |

rights

to purchase shares of our common stock, preferred stock, warrants and/or debt securities; |

| |

|

|

| |

● |

units

consisting of a combination of the foregoing securities. |

The

descriptions of the securities contained in this prospectus, together with any applicable prospectus supplement, summarize all the material

terms and provisions of the various types of securities that we may offer. We will describe in the applicable prospectus supplement relating

to a particular offering the specific terms of the securities offered by that prospectus supplement. We will indicate in the applicable

prospectus supplement if the terms of the securities differ from the terms we have summarized below. We will also include in the prospectus

supplement information, where applicable, material United States federal income tax considerations relating to the securities.

DESCRIPTION

OF CAPITAL STOCK

The

following descriptions of common and preferred stock, together with the additional information we include in any applicable prospectus

supplement, summarizes the material terms and provisions of the common stock and preferred stock that we may offer under this prospectus

but is not intended to be complete. For the full terms of our common and preferred stock, please refer to our certificate of incorporation,

as amended from time to time, and our bylaws, as amended from time to time. The Delaware General Corporation Law (“DGCL”)

may also affect the terms of these securities. While the terms we have summarized below will apply generally to any future common or

preferred stock that we may offer, we will describe the specific terms of any series of these securities in more detail in the applicable

prospectus supplement. If we so indicate in a prospectus supplement, the terms of any common or preferred stock we offer under that prospectus

supplement may differ from the terms of our outstanding capital stock that we describe below.

As

of October 25, 2023, our authorized capital stock consists of 23,400,000 shares of capital stock with a par value of $0.000001

per share, consisting of 23,000,000 shares of Common Stock, par value of $0.000001 per share, and 400,000 shares of preferred stock,

par value of $0.000001 per share, which may, at the sole discretion of the Board of Directors be issued in one or more series (the “Preferred

Stock”). As of October 25, 2023, there were 13,924,774 shares of Common Stock issued and outstanding, held by 88

holders of record. No shares of Preferred Stock were issued or outstanding as of October 25, 2023. The authorized and unissued

shares of both Common and Preferred Stock are available for issuance without further action by our stockholders, unless such action is

required by applicable law or the rules of any stock exchange on which our securities may be listed. Unless approval of our stockholders

is so required, our board of directors will not seek stockholder approval for the issuance and sale of either our common stock or preferred

stock.

The

Board may from time to time authorize by resolution the issuance of any or all shares of the Common Stock and the Preferred Stock authorized

in accordance with the terms and conditions set forth in the certificate of incorporation for such purposes, in such amounts, to such

persons, corporations, or entities, for such consideration and in the case of the Preferred Stock, in one or more series, all as the

Board in its discretion may determine and without any vote or other action by the stockholders, except as otherwise required by law.

Common

Stock

Holders

of our Common Stock are entitled to one vote for each share on all matters submitted to a stockholder vote. Holders of Common Stock do

not have cumulative voting rights. Therefore, holders of a majority of the votes of holders of the Common Stock voting for the election

of directors can elect all of the directors. Holders of our Common Stock representing a majority of the voting power of our capital stock

issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of stockholders.

Holders

of our Common Stock are entitled to share in all dividends that our Board of Directors, in its discretion, declares from legally available

funds. In the event of a liquidation, dissolution or winding up, each outstanding share entitles its holder to participate pro rata in

all assets that remain after payment of liabilities and after providing for each class of stock, if any, having preference over the Common

Stock. Our Common Stock has no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our capital

stock.

Preferred

Stock

The

Board of Directors is authorized at any time, and from time to time, to provide the for the issuance of shares of Preferred Stock in

one or more series, and to determine the designations, preferences, limitations and relative or other rights of the Preferred Stock or

any series thereof. For each series, the Board of directors shall determine, by resolution or resolutions adopted prior to the issuance

of any shares thereof, the designations, preferences, limitations and relative or other rights thereof. The issuance of preferred stock

may have the effect of delaying, deferring or preventing a change in control of our company without further action by stockholders and

could adversely affect the rights and powers, including voting rights, of the holders of common stock.

Options

to Purchase Common Stock and Performance Share Unit Grants

As

of October 25, 2023, there are 650,000 shares of

Common Stock reserved for issuance pursuant to the 2023 Equity Incentive Plan, 480,000 reserved for issuance pursuant to the 2015

Equity Incentive Plan and 172,253 reserved for issuance outside of our plans. As of October 25, 2023, there are outstanding

options to purchase 598,632 shares of our Common Stock issuable upon the exercise of stock options granted to key employees, officers

and directors at a weighted average exercise price of $6.62, and 32,606 issuable pursuant to restricted stock awards and restricted

stock units.

As

of October 25, 2023, there are outstanding grants of 312,438 performance share units

pursuant to the Company’s 2023 and 2015 Equity Incentive Plans to the Company’s officers and employees.

Anti-Takeover

Effects of Various Provisions of Delaware Law and our Certificate of Incorporation

Provisions

of the DGCL and our Certificate of Incorporation and Bylaws could make it more difficult to acquire us by means of a tender offer, a

proxy contest or otherwise, or to remove incumbent officers and directors. These provisions, summarized below, would be expected to discourage

certain types of coercive takeover practices and takeover bids our board of directors may consider inadequate and to encourage persons

seeking to acquire control of us to first negotiate with us. We believe that the benefits of increased protection of our ability to negotiate

with the proponent of an unfriendly or unsolicited proposal to acquire or restructure us will outweigh the disadvantages of discouraging

takeover or acquisition proposals because, among other things, negotiation of these proposals could result in an improvement of their

terms.

Effects

of authorized but unissued common stock and blank check preferred stock. One of the effects of the existence of authorized

but unissued common stock and undesignated preferred stock may be to enable our board of directors to make more difficult or to discourage

an attempt to obtain control of our company by means of a merger, tender offer, proxy contest or otherwise, and thereby to protect the

continuity of management. If, in the due exercise of its fiduciary obligations, the board of directors were to determine that a takeover

proposal was not in our best interest, such shares could be issued by the board of directors without stockholder approval in one or more

transactions that might prevent or render more difficult or costly the completion of the takeover transaction by diluting the voting

or other rights of the proposed acquirer or insurgent stockholder group, by putting a substantial voting bloc in institutional or other

hands that might undertake to support the position of the incumbent board of directors, by effecting an acquisition that might complicate

or preclude the takeover, or otherwise.

In

addition, our certificate of incorporation grants our board of directors broad power to establish the rights and preferences of authorized

and unissued shares of preferred stock. The issuance of shares of preferred stock could decrease the amount of earnings and assets available

for distribution to holders of shares of common stock. The issuance also may adversely affect the rights and powers, including voting

rights, of those holders and may have the effect of delaying, deterring or preventing a change in control of our company.

Prohibition

on Cumulative Voting. Our certificate of incorporation does not provide for cumulative voting in the election of directors.

Authorized

but Unissued Shares. Our authorized but unissued shares of Common Stock and Preferred Stock are available for future issuance

without shareholder approval. The existence of authorized but unissued shares of Common Stock and Preferred Stock could render more difficult

or discourage an attempt to obtain control of us by means of a proxy contest, tender offer, merger or otherwise.

Limitations

on Liability and Indemnification of Officers and Directors. Our certificate of incorporation limits or eliminates the personal

liability of directors to the Company or its stockholders for monetary damages for breach of fiduciary duty as a director, except in

the cases of breach of the duty of loyalty to the Company or its stockholders; acts or omissions not in good faith or which involve intentional

misconduct or a knowing violation of law; the unlawful payment of dividends, or unlawful stock purchases or redemptions; transactions

from which the director derived an improper personal benefit; or actions by or in the right of the Company. Our certificate of incorporation

include provisions that require us to indemnify, to the fullest extent allowable under the DGCL, our directors or officers against monetary

damages for actions taken as a director or officer of our company, or for serving at our request as a director or officer or another

position at another corporation or enterprise, as the case may be. Our certificate of incorporation also provide that we must indemnify

and advance reasonable expenses to our directors and officers, subject to our receipt of an undertaking from the indemnified party as

may be required under the DGCL. We are also expressly authorized to carry directors’ and officers’ insurance to protect our

company, our directors, officers and certain employees for some liabilities.

The

limitation of liability and indemnification provisions under the DGCL and in our certificate of incorporation and bylaws may discourage

stockholders from bringing a lawsuit against directors for breach of their fiduciary duties. These provisions may also have the effect

of reducing the likelihood of derivative litigation against directors and officers, even though such an action, if successful, might

otherwise benefit us and our stockholders. However, these provisions do not limit or eliminate our rights, or those of any stockholder,

to seek non-monetary relief such as injunction or rescission in the event of a breach of a director’s fiduciary duties. Moreover,

the provisions do not alter the liability of directors under the federal securities laws.

Transfer

Agent

The

transfer agent for our Common Stock is Securities Transfer Corporation, located at 2901 Dallas Parkway, Suite 380, Plano, Texas and its

telephone number is (469) 633-0101.

DESCRIPTION

OF DEBT SECURITIES

The

debt securities will be our direct unsecured general obligations. The debt securities will be either senior debt securities or subordinated

debt securities. The debt securities will be issued under one or more separate indentures the forms of which are filed as exhibits to

the registration statement of which this prospectus forms a part. Senior debt securities will be issued under a senior indenture. Subordinated

debt securities will be issued under a subordinated indenture. Each of the senior indenture and the subordinated indenture is referred

to as an indenture.

The

applicable prospectus supplement and/or other offering materials will describe the material terms of the debt securities offered through

that prospectus supplement as well as any general terms described in this section that will not apply to those debt securities. To the

extent the applicable prospectus supplement or other offering materials relating to an offering of debt securities are inconsistent with

this prospectus, the terms of that prospectus supplement or other offering materials will supersede the information in this prospectus.

The

prospectus supplement relating to any series of debt securities that we may offer will contain the specific terms of the debt securities.

These terms may include the following:

| |

● |

the

title and principal aggregate amount of the debt securities; |

| |

|

|

| |

● |

whether

the debt securities will be senior, subordinated or junior subordinated; |

| |

|

|

| |

● |

whether

the debt securities will be secured or unsecured; |

| |

|

|

| |

● |

whether

the debt securities are convertible or exchangeable into other securities; |

| |

|

|

| |

● |

the

percentage or percentages of principal amount at which such debt securities will be issued; |

| |

|

|

| |

● |

the

interest rate(s) or the method for determining the interest rate(s); |

| |

|

|

| |

● |

the

dates on which interest will accrue or the method for determining dates on which interest will accrue and dates on which interest

will be payable; |

| |

|

|

| |

● |

the

person to whom any interest on the debt securities will be payable; |

| |

|

|

| |

● |

the

places where payments on the debt securities will be payable; |

| |

|

|

| |

● |

the

maturity date; |

| |

● |

redemption

or early repayment provisions; |

| |

|

|

| |

● |

authorized

denominations; |

| |

|

|

| |

● |

form;

|

| |

|

|

| |

● |

amount

of discount or premium, if any, with which such debt securities will be issued; |

| |

|

|

| |

● |

whether

such debt securities will be issued in whole or in part in the form of one or more global securities; |

| |

|

|

| |

● |

the

identity of the depositary for global securities; |

| |

|

|

| |

● |

whether

a temporary security is to be issued with respect to such series and whether any interest payable prior to the issuance of definitive

securities of the series will be credited to the account of the persons entitled thereto; |

| |

|

|

| |

● |

the

terms upon which the beneficial interests in a temporary global security may be exchanged in whole or in part for beneficial interests

in a definitive global security or for individual definitive securities; |

| |

|

|

| |

● |

any

covenants applicable to the particular debt securities being issued; |

| |

|

|

| |

● |

any

defaults and events of default applicable to the particular debt securities being issued; |

| |

|

|

| |

● |

the

guarantors of each series, if any, and the extent of the guarantees (including provisions relating to seniority, subordination, security

and release of the guarantees), if any; |

| |

|

|

| |

● |

any

applicable subordination provisions for any subordinated debt securities; |

| |

|

|

| |

● |

any

restriction or condition on the transferability of the debt securities; |

| |

● |

the

currency, currencies, or currency units in which the purchase price for, the principal of and any premium and any interest on, such

debt securities will be payable; |

| |

|

|

| |

● |

the

time period within which, the manner in which and the terms and conditions upon which we or the purchaser of the debt securities

can select the payment currency; |

| |

|

|

| |

● |

the

securities exchange(s) on which the securities will be listed, if any; |

| |

|

|

| |

● |

whether

any underwriter(s) will act as market maker(s) for the securities; |

| |

|

|

| |

● |

the

extent to which a secondary market for the securities is expected to develop; |

| |

|

|

| |

● |

our

obligations or right to redeem, purchase or repay debt securities under a sinking fund, amortization or analogous provision; |

| |

|

|

| |

● |

provisions

relating to covenant defeasance and legal defeasance; |

| |

|

|

| |

● |

provisions

relating to satisfaction and discharge of the indenture; |

| |

|

|

| |

● |

provisions

relating to the modification of the indenture both with and without consent of holders of debt securities issued under the indenture;

|

| |

|

|

| |

● |

the

law that will govern the indenture and debt securities; and |

| |

|

|

| |

● |

additional

terms not inconsistent with the provisions of the indenture. |

General

We

may sell the debt securities, including original issue discount securities, at par or at a substantial discount below their stated principal

amount. Unless we inform you otherwise in a prospectus supplement, we may issue additional debt securities of a particular series without

the consent of the holders of the debt securities of such series outstanding at the time of issuance. Any such additional debt securities,

together with all other outstanding debt securities of that series, will constitute a single series of securities under the applicable

indenture. In addition, we will describe in the applicable prospectus supplement material U.S. federal income tax considerations and

any other special considerations for any debt securities we sell which are denominated in a currency or currency unit other than U.S.

dollars. Unless we inform you otherwise in the applicable prospectus supplement, the debt securities will not be listed on any securities

exchange.

We

expect most debt securities to be issued in fully registered form without coupons and in denominations of $1,000 and integral multiples

thereof. Subject to the limitations provided in the indenture and in the prospectus supplement, debt securities that are issued in registered

form may be transferred or exchanged at the corporate office of the trustee or the principal corporate trust office of the trustee, without

the payment of any service charge, other than any tax or other governmental charge payable in connection therewith.

If

specified in the applicable prospectus supplement, certain of our subsidiaries will guarantee the debt securities. The particular terms

of any guarantee will be described in the related prospectus supplement.

Governing

Law

The

Indentures and the debt securities will be construed in accordance with and governed by the laws of the State of Delaware.

DESCRIPTION

OF WARRANTS

We

may issue warrants to purchase our debt or equity securities. Warrants may be issued independently or together with any other securities

and may be attached to, or separate from, such securities. Each series of warrants will be issued under a separate warrant agreement

to be entered into between us and a warrant agent. The terms of any warrants to be issued and a description of the material provisions

of the applicable warrant agreement will be set forth in the applicable prospectus supplement.

The

applicable prospectus supplement will describe the following terms of any warrants in respect of which this prospectus is being delivered:

| |

●

|

the

title of such warrants; |

| |

|

|

| |

● |

the

aggregate number of such warrants; |

| |

|

|

| |

● |

the

price or prices at which such warrants will be issued; |

| |

|

|

| |

● |

the

currency or currencies in which the price of such warrants will be payable; |

| |

|

|

| |

● |

the

securities purchasable upon exercise of such warrants; |

| |

|

|

| |

● |

the

price at which and the currency or currencies in which the securities purchasable upon exercise of such warrants may be purchased;

|

| |

|

|

| |

● |

the

date on which the right to exercise such warrants shall commence and the date on which such right shall expire; |

| |

● |

if

applicable, the minimum or maximum amount of such warrants which may be exercised at any one time; |

| |

|

|

| |

● |

if

applicable, the designation and terms of the securities with which such warrants are issued and the number of such warrants issued

with each such security; |

| |

|

|

| |

● |

if

applicable, the date on and after which such warrants and the related securities will be separately transferable; |

| |

|

|

| |

● |

information

with respect to book-entry procedures, if any; |

| |

|

|

| |

● |

if

applicable, a discussion of any material United States federal income tax considerations; and |

| |

|

|

| |

● |

any

other terms of such warrants, including terms, procedures and limitations relating to the exchange and exercise of such warrants. |

DESCRIPTION

OF RIGHTS

We

may issue rights to purchase debt securities, preferred stock, common stock or warrants. These rights may be issued independently or

together with any other security offered hereby and may or may not be transferable by the shareholder receiving the rights in such offering.

The applicable prospectus supplement may add, update or change the terms and conditions of the rights as described in this prospectus.

The

applicable prospectus supplement will describe the specific terms of any offering of rights for which this prospectus is being delivered,

including the following:

| |

●

|

the

price, if any, per right; |

| |

|

|

| |

● |

the

exercise price payable for debt securities, preferred stock, common stock, or warrants upon the exercise of the rights; |

| |

|

|

| |

● |

the

number of rights issued or to be issued to each shareholder; |

| |

|

|

| |

● |

the

number and terms of debt securities, preferred stock, common stock, or warrants which may be purchased per right; |

| |

|

|

| |

● |

the

extent to which the rights are transferable; |

| |

|

|

| |

● |

any

other terms of the rights, including the terms, procedures and limitations relating to the exchange and exercise of the rights; |

| |

|

|

| |

● |

the

date on which the holder’s ability to exercise the rights shall commence, and the date on which the rights shall expire; |

| |

|

|

| |

● |

the

extent to which the rights may include an over-subscription privilege with respect to unsubscribed securities; and |

| |

|

|

| |

● |

if

applicable, the material terms of any standby underwriting or purchase arrangement entered into by us in connection with the offering

of such rights. |

Holders

may exercise rights as described in the applicable prospectus supplement. Upon receipt of payment and the rights certificate properly

completed and duly executed at the corporate trust office of the rights agent or any other office indicated in the prospectus supplement,

we will, as soon as practicable, forward the applicable securities purchased upon exercise of the rights. If less than all of the rights

issued in any rights offering are exercised, we may offer any unsubscribed securities directly to persons other than shareholders, to

or through agents, underwriters or dealers or through a combination of such methods, including pursuant to standby arrangements with

one or more underwriters or other purchasers, pursuant to which the underwriters or other purchasers may be required to purchase any

securities remaining unsubscribed for after such offering, as described in the applicable prospectus supplement.

The

description in the applicable prospectus supplement of any rights that we may offer will not necessarily be complete and will be qualified

in its entirety by reference to the applicable rights certificate, which will be filed with the SEC.

DESCRIPTION

OF UNITS

As

specified in the applicable prospectus supplement, we may issue units consisting of one or more warrants, rights, debt securities, shares

of preferred stock, shares of common stock or any combination of such securities. The applicable supplement will describe:

| |

● |

the

terms of the units and of the warrants, rights, debt securities, preferred stock and common stock comprising the units, including

whether and under what circumstances the securities comprising the units may be traded separately; |

| |

|

|

| |

● |

a

description of the terms of any unit agreement governing the units; and |

| |

|

|

| |

● |

a

description of the provisions for the payment, settlement, transfer or exchange of the units. |

FORMS

OF SECURITIES

Each

debt security, warrant, right and unit will be represented either by a certificate issued in definitive form to a particular investor

or by one or more global securities representing the entire issuance of securities. Certificated securities in definitive form and global

securities will be issued in registered form. Definitive securities name you or your nominee as the owner of the security, and in order

to transfer or exchange these securities or to receive payments other than interest or other interim payments, you or your nominee must

physically deliver the securities to the trustee, registrar, paying agent or other agent, as applicable. Global securities name a depositary

or its nominee as the owner of the debt securities, warrants or units represented by these global securities. The depositary maintains

a computerized system that will reflect each investor’s beneficial ownership of the securities through an account maintained by

the investor with its broker/dealer, bank, trust company or other representative, as we explain more fully below.

Registered

Global Securities

We

may issue the registered debt securities, warrants, rights and units in the form of one or more fully registered global securities that

will be deposited with a depositary or its nominee identified in the applicable prospectus supplement and registered in the name of that

depositary or nominee. In those cases, one or more registered global securities will be issued in a denomination or aggregate denominations

equal to the portion of the aggregate principal or face amount of the securities to be represented by registered global securities. Unless

and until it is exchanged in whole for securities in definitive registered form, a registered global security may not be transferred

except as a whole by and among the depositary for the registered global security, the nominees of the depositary or any successors of

the depositary or those nominees.

If

not described below, any specific terms of the depositary arrangement with respect to any securities to be represented by a registered

global security will be described in the prospectus supplement relating to those securities. We anticipate that the following provisions

will apply to all depositary arrangements.

Ownership

of beneficial interests in a registered global security will be limited to persons, called participants, that have accounts with the

depositary or persons that may hold interests through participants. Upon the issuance of a registered global security, the depositary

will credit, on its book-entry registration and transfer system, the participants’ accounts with the respective principal or face

amounts of the securities beneficially owned by the participants. Any dealers, underwriters or agents participating in the distribution

of the securities will designate the accounts to be credited. Ownership of beneficial interests in a registered global security will

be shown on, and the transfer of ownership interests will be effected only through, records maintained by the depositary, with respect

to interests of participants, and on the records of participants, with respect to interests of persons holding through participants.

The laws of some states may require that some purchasers of securities take physical delivery of these securities in definitive form.

These laws may impair your ability to own, transfer or pledge beneficial interests in registered global securities.

So

long as the depositary, or its nominee, is the registered owner of a registered global security, that depositary or its nominee, as the

case may be, will be considered the sole owner or holder of the securities represented by the registered global security for all purposes

under the applicable indenture, warrant agreement or unit agreement. Except as described below, owners of beneficial interests in a registered

global security will not be entitled to have the securities represented by the registered global security registered in their names,

will not receive or be entitled to receive physical delivery of the securities in definitive form and will not be considered the owners

or holders of the securities under the applicable indenture, warrant agreement, rights agreement or unit agreement. Accordingly, each

person owning a beneficial interest in a registered global security must rely on the procedures of the depositary for that registered

global security and, if that person is not a participant, on the procedures of the participant through which the person owns its interest,

to exercise any rights of a holder under the applicable indenture, warrant agreement, rights agreement or unit agreement. We understand

that under existing industry practices, if we request any action of holders or if an owner of a beneficial interest in a registered global

security desires to give or take any action that a holder is entitled to give or take under the applicable indenture, warrant agreement,

rights agreement or unit agreement, the depositary for the registered global security would authorize the participants holding the relevant

beneficial interests to give or take that action, and the participants would authorize beneficial owners owning through them to give

or take that action or would otherwise act upon the instructions of beneficial owners holding through them.

Principal,

premium, if any, and interest payments on debt securities, and any payments to holders with respect to warrants, rights or units, represented

by a registered global security registered in the name of a depositary or its nominee will be made to the depositary or its nominee,

as the case may be, as the registered owner of the registered global security. None of Barfresh, the trustees, the warrant agents, the

rights agents, the unit agents or any other agent of Barfresh, agent of the trustees or agent of the warrant agents, rights agents or

unit agents will have any responsibility or liability for any aspect of the records relating to payments made on account of beneficial

ownership interests in the registered global security or for maintaining, supervising or reviewing any records relating to those beneficial

ownership interests.

We

expect that the depositary for any of the securities represented by a registered global security, upon receipt of any payment of principal,

premium, interest or other distribution of underlying securities or other property to holders on that registered global security, will

immediately credit participants’ accounts in amounts proportionate to their respective beneficial interests in that registered

global security as shown on the records of the depositary. We also expect that payments by participants to owners of beneficial interests

in a registered global security held through participants will be governed by standing customer instructions and customary practices,

as is now the case with the securities held for the accounts of customers in bearer form or registered in “street name,”

and will be the responsibility of those participants.

If

the depositary for any of these securities represented by a registered global security is at any time unwilling or unable to continue

as depositary or ceases to be a clearing agency registered under the Exchange Act, and a successor depositary registered as a clearing

agency under the Exchange Act is not appointed by us within 90 days, we will issue securities in definitive form in exchange for the

registered global security that had been held by the depositary. Any securities issued in definitive form in exchange for a registered

global security will be registered in the name or names that the depositary gives to the relevant trustee, warrant agent, unit agent

or other relevant agent of ours or theirs. It is expected that the depositary’s instructions will be based upon directions received

by the depositary from participants with respect to ownership of beneficial interests in the registered global security that had been

held by the depositary.

PLAN

OF DISTRIBUTION

We

may sell the securities in one or more of the following ways (or in any combination) from time to time:

| |

● |

through

underwriters or dealers; |

| |

|

|

| |

● |

directly

to a limited number of purchasers or to a single purchaser; |

| |

|

|

| |

● |

through

agents; |

| |

|

|

| |

● |

through

a combination of any such methods; or |

| |

|

|

| |

● |

through

any other methods described in a prospectus supplement. |

The

prospectus supplement will state the terms of the offering of the securities, including:

| |

● |

the

name or names of any underwriters, dealers or agents; |

| |

|

|

| |

● |

the

purchase price of such securities and the proceeds to be received by Barfresh, if any; |

| |

|

|

| |

● |

any

underwriting discounts or agency fees and other items constituting underwriters’ or agents’ compensation; |

| |

|

|

| |

● |

any

public offering price; |

| |

|

|

| |

● |

any

discounts or concessions allowed or reallowed or paid to dealers; and |

| |

|

|

| |

● |

any

securities exchanges on which the securities may be listed. |

Any

public offering price and any discounts or concessions allowed or reallowed or paid to dealers may be changed from time to time.

If

we use underwriters in the sale, the securities may be acquired by the underwriters for their own account or as selling agent and may

be resold from time to time in one or more transactions, including:

| |

● |

negotiated

transactions, |

| |

|

|

| |

● |

at

a fixed public offering price or prices, which may be changed, |

| |

|

|

| |

● |

at

market prices prevailing at the time of sale, |

| |

|

|

| |

● |

at

prices related to prevailing market prices or |

| |

|

|

| |

● |

at

negotiated prices. |

Unless

otherwise stated in a prospectus supplement, the obligations of the underwriters to purchase any securities will be conditioned on customary

closing conditions and the underwriters will be obligated to purchase all of such series of securities, if any are purchased.

We

may sell the securities through agents from time to time. The prospectus supplement will name any agent involved in the offer or sale

of the securities and any commissions we pay to them. Generally, any agent will be acting on a best efforts basis for the period of its

appointment.

We

may authorize underwriters, dealers or agents to solicit offers by certain purchasers to purchase the securities from us at the public

offering price set forth in the prospectus supplement pursuant to delayed delivery contracts providing for payment and delivery on a

specified date in the future. The contracts will be subject only to those conditions set forth in the prospectus supplement, and the

prospectus supplement will set forth any commissions we pay for solicitation of these contracts.

Underwriters

and agents may be entitled under agreements entered into with us to indemnification by us against certain civil liabilities, including

liabilities under the Securities Act, or to contribution with respect to payments which the underwriters or agents may be required to

make. Underwriters and agents may be customers of, engage in transactions with, or perform services for us and its affiliates in the

ordinary course of business.

Each

series of securities will be a new issue of securities and will have no established trading market other than the common stock, which

is quoted on the Nasdaq Capital Market. Any underwriters to whom securities are sold for public offering and sale may make a market in

the securities, but such underwriters will not be obligated to do so and may discontinue any market making at any time without notice.

The securities, other than the common stock, may or may not be listed on a national securities exchange.

LEGAL

OPINIONS

The

validity of the securities in respect of which this prospectus is being delivered will be passed on for us by Doida Crow Legal LLC, Denver,

Colorado 80237.

EXPERTS

The

financial statements incorporated in this prospectus by reference to the Annual Report on Form 10-K for the year ended December 31, 2022

have been so incorporated in reliance on the report of Eide Bailly LLP, an independent registered public accounting firm, given on the

authority of said firm as experts in auditing and accounting.

LIMITATION

ON LIABILITY AND DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

Our

directors and officers are indemnified by our bylaws against amounts actually and necessarily incurred by them in connection with the

defense of any action, suit or proceeding in which they are a party by reason of being or having been directors or officers of the company.

Our articles of incorporation provide that none of our directors or officers shall be personally liable for damages for breach of any

fiduciary duty as a director or officer involving any act or omission of any such director or officer. Insofar as indemnification for

liabilities arising under the Securities Act may be permitted to such directors, officers and controlling persons pursuant to the foregoing

provisions, or otherwise, we have been advised that in the opinion of the SEC such indemnification is against public policy as expressed

in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities, other

than the payment by us of expenses incurred or paid by such director, officer or controlling person in the successful defense of any

action, lawsuit or proceeding, is asserted by such director, officer or controlling person in connection with the securities being registered,

we will, unless in the opinion of counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction

the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the

final adjudication of such issue.

WHERE

YOU CAN FIND MORE INFORMATION

This

prospectus and any subsequent prospectus supplements do not contain all of the information in the registration statement. We have omitted

from this prospectus some parts of the registration statement as permitted by the rules and regulations of the SEC. Statements in this

prospectus concerning any document we have filed as an exhibit to the registration statement or that we otherwise filed with the SEC

are not intended to be comprehensive and are qualified in their entirety by reference to these filings. In addition, we file annual,

quarterly and current reports, proxy statements and other information with the SEC. The SEC also maintains a website that contains reports,

proxy and information statements and other information that we file electronically with the SEC, including us. The SEC’s website

can be found at http://www.sec.gov. In addition, we make available on or through our website copies of these reports as soon as reasonably

practicable after we electronically file or furnished them to the SEC. Our website can be found at http://www.barfresh.com. The content

contained in, or that can be accessed through, our website is not a part of this prospectus.

INFORMATION

INCORPORATED BY REFERENCE

The

SEC allows us to “incorporate by reference” in this prospectus certain information we have filed and will file with the SEC,

which means that we may disclose important information in this prospectus by referring you to the document that contains the information.

The information incorporated by reference is considered to be an integral part of this prospectus, and information that we file later

with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below:

| |

● |

our

Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on March 2, 2023; |

| |

|

|

| |

● |

our

Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2023, June 30, 2023, and September 30, 2023 filed with the

SEC on April 27, 2023, August 14, 2023, and October 26, 2023, respectively; |

| |

|

|

| |

● |

our

Current Reports on Form 8-K for April 27, 2023, May 3, 2023, June 13, 2023, June 14, 2023, August 14, 2023, and October 26, 2023

filed with the SEC on April 27, 2023, May 5, 2023, June 16, 2023, June 21, 2023, August 14, 2023, and October 26, 2023, respectively; |

| |

|

|

| |

● |

the

description of our common stock which is included in our Form 8-A12B filed with the SEC on January 14, 2022, including any amendment

or report filed for the purpose of updating that description; and |

| |

|

|

| |

● |

all

documents filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date of this

prospectus and before we stop offering the securities covered by this prospectus and any accompanying prospectus supplement. |

Notwithstanding

the foregoing, information and documents that we elect to furnish, but not file, or have furnished, but not filed, with the SEC in accordance

with SEC rules and regulations is not incorporated into this prospectus and does not constitute a part hereof.

You

may access these filings on our website at www.barfresh.com. The information on our website is not incorporated by reference and

is not considered part of this prospectus. Also, upon written or oral request, at no cost we will provide to each person, including any

beneficial owner, to whom a prospectus is delivered, a copy of any or all of the information that has been incorporated by reference

in the prospectus but not delivered with the prospectus. Inquiries should be directed to:

Barfresh

Food Group Inc.

3600

Wilshire Boulevard, Suite 1720

Los

Angeles, CA 90010

(469)

598-7113

$5,000,000

BARFRESH

FOOD GROUP INC.

Common

Stock, Preferred Stock, Warrants, Rights

Debt

Securities and Units

PROSPECTUS

,

2023

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

14. Other Expenses of Issuance and Distribution.

Set

forth below is an estimate (except in the case of the SEC registration fee) of the amount of fees and expenses to be incurred in connection

with the issuance and distribution of the offered securities registered hereby, other than underwriting discounts and commission, if

any, incurred in connection with the sale of the offered securities. All such amounts will be borne by Barfresh Food Group Inc., a Delaware

corporation (the “Company”).

| |

|

AMOUNT |

|

| SEC

Registration Fee |

|

$ |

|

|

| FINRA

Filing Fees |

|

|

|

(1) |

| Legal

Fees and Expenses |

|

|

|

(1) |

| Accounting

Fees and Expenses |

|

|

|

(1) |

| Trustees’

Fees and Expenses |

|

|

|

(1) |

| Warrant

Agent Fees and Expenses |

|

|

|

(1) |

| Printing

Expenses |

|

|

|

(1) |

| Miscellaneous

Expenses |

|

|

|

(1) |

| Total

|

|

$ |

|

(1) |

| (1) |

These

fees will be calculated based on the securities offered and the number of issuances and accordingly cannot be estimated at this time. |

Item

15. Indemnification of Directors and Officers.

Section

145 of the Delaware General Corporation Law provides that a corporation may indemnify directors and officers as well as other employees

and individuals against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably

incurred by such person in connection with any threatened, pending or completed actions, suits or proceedings in which such person is

made a party by reason of such person being or having been a director, officer, employee or agent of the corporation. Section 145 of

the Delaware General Corporation Law also provides that expenses (including attorneys’ fees) incurred by a director or officer

in defending an action may be paid by a corporation in advance of the final disposition of an action if the director or officer undertakes

to repay the advanced amounts if it is determined such person is not entitled to be indemnified by the corporation. The Delaware General

Corporation Law provides that Section 145 is not exclusive of other rights to which those seeking indemnification may be entitled under

any bylaw, agreement, vote of shareholders or disinterested directors or otherwise. The provision does not affect directors’ responsibilities

under any other laws, such as the federal securities laws. The Company’s Certificate of Incorporation provides for such indemnification

to the fullest extent of Section 145 and states that the indemnification is not exclusive of other rights of those seeking indemnification

may be entitled.

Section

102(b)(7) of the Delaware General Corporation Law permits a corporation to provide in its certificate of incorporation that a director

of the corporation shall not be personally liable to the corporation or its shareholders for monetary damages for breach of fiduciary

duty as a director, except for liability (i) for any breach of the director’s duty of loyalty to the corporation or its shareholders,

(ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) for unlawful

payments of dividends or unlawful stock repurchases, redemptions or other distributions, or (iv) for any transaction from which the director

derived an improper personal benefit. The Company’s Certificate of Incorporation provides for such limitation of liability.

The

Company has entered into agreements with its directors and executive officers, that require the Company to indemnify such persons to

the fullest extent permitted by law, against expenses, judgments, fines, settlements and other amounts incurred (including attorneys’

fees), and advance expenses if requested by such person, in connection with investigating, defending, being a witness in, participating,

or preparing for any threatened, pending, or completed action, suit, or proceeding or any alternative dispute resolution mechanism, or

any inquiry, hearing or investigation (collectively, a “Proceeding”), relating to any event or occurrence that takes place

either prior to or after the execution of the indemnification agreement, related to the fact that such person is or was a director or

officer of the Company, or while a director or officer is or was serving at the request of the Company as a director, officer, employee,

trustee, agent or fiduciary of another foreign or domestic corporation, partnership, joint venture, employee benefit plan, trust or other