Form 8-K - Current report

October 18 2023 - 4:34PM

Edgar (US Regulatory)

0001599489

false

0001599489

2023-10-18

2023-10-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 18, 2023

VERITIV

CORPORATION

(Exact name of registrant as specified in its

charter)

Delaware

(State or other

jurisdiction of incorporation)

| 001-36479 |

|

46-3234977 |

| (Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| 1000 Abernathy

Road NE |

|

|

| Building 400,

Suite 1700 |

|

|

| Atlanta,

Georgia |

|

30328 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (770) 391-8200

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

stock, $0.01 par value |

VRTV |

New

York Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02. |

Results of Operations and Financial Condition. |

On October 18, 2023, Veritiv Corporation (the “Company”,

“Veritiv”, “we” or “our”) announced certain unaudited preliminary financial information for the nine

months ended September 30, 2023 and the twelve-month period ended September 30, 2023 set forth below. The unaudited preliminary

financial information set forth below for the nine months ended September 30, 2023 and the twelve-month period ended September 30,

2023 is preliminary because our financial closing procedures for the quarter ended September 30, 2023 are not yet complete. Such

preliminary information is inherently uncertain and subject to change, and we undertake no obligation to update or revise this unaudited

preliminary financial information as a result of new information, future events or otherwise, except as otherwise required by law. This

unaudited preliminary financial information may differ from actual amounts, potentially materially. Actual amounts remain subject to the

completion of our quarter-end financial closing procedures, which include a final review by our management and Audit and Finance Committee,

and the preparation of condensed financial statements and related notes. During the completion of such procedures and preparation, we

may identify additional items that require material adjustments to the unaudited preliminary financial information presented below for

the nine months ended September 30, 2023 and the twelve-month period ended September 30, 2023. Therefore, you should not place

undue reliance upon this information. The summary historical consolidated financial data for the twelve-month period ended September 30,

2023 have been derived by subtracting the Company’s historical unaudited consolidated financial data for the nine months ended September 30,

2022 from the Company’s historical audited consolidated financial data for the year ended December 31, 2022 and then adding

the Company’s unaudited preliminary financial information for the nine months ended September 30, 2023.

| | |

Three Months Ended

December 31, 2022 | |

Preliminary

Nine Months Ended

September 30, 2023 | |

Preliminary

Twelve Months Ended

September 30, 2023 | |

| | |

| |

($ in millions, unaudited) | |

| |

| Reported Net Sales | |

| 1,663 | |

| 4,429 | |

| 6,092 | |

| Business Divestitures | |

| – | |

| – | |

| – | |

| Organic Sales | |

| 1,663 | |

| 4,429 | |

| 6,092 | |

| | |

| | |

| | |

| | |

| Capital Expenditures | |

| 4 | |

| 11 | |

| 15 | |

| | |

| | |

| | |

| | |

| Net income (loss) | |

| 72 | |

| 200 | |

| 272 | |

| Interest expense, net | |

| 5 | |

| 13 | |

| 18 | |

| Income tax expense (benefit) | |

| 26 | |

| 68 | |

| 94 | |

| Depreciation and amortization | |

| 11 | |

| 29 | |

| 40 | |

| EBITDA | |

| 114 | |

| 310 | |

| 424 | |

| | |

| | |

| | |

| | |

| Restructuring charges, net | |

| (4 | ) |

| 0 | |

| (4 | ) |

| | |

| | |

| | |

| | |

| Gain on sale of businesses | |

| (1 | ) |

| 0 | |

| (1 | ) |

| Facility closure charges, including (gain) loss from asset disposition | |

| (1 | ) |

| 0 | |

| (1 | ) |

| Stock-based compensation | |

| 2 | |

| 10 | |

| 12 | |

| | |

| | |

| | |

| | |

| LIFO reserve (decrease) increase | |

| 2 | |

| (9 | ) |

| (7 | ) |

| Non-restructuring severance charges | |

| 2 | |

| 1 | |

| 3 | |

| Non-restructuring pension charges (benefits) | |

| 5 | |

| (5 | ) |

| 0 | |

| Other | |

| 2 | |

| 17 | |

| 19 | |

| Adjusted EBITDA | |

| 121 | |

| 324 | |

| 445 | |

In addition, the Company announced that Adjusted EBITDA margin, defined as Adjusted EBITDA as a percentage of net sales, for the Packaging

segment for the three months ended September 30, 2023 was 12.1%.

We supplement our financial information

prepared in accordance with U.S. GAAP with certain non-GAAP measures including organic sales (net sales on an average daily sales basis,

excluding revenue from sold businesses and revenue from acquired businesses for a period of 12 months after we complete the acquisition)

and Adjusted EBITDA (earnings before interest, income taxes, depreciation and amortization, restructuring charges, net, integration and

acquisition expenses and other similar charges including any severance costs, costs associated with warehouse and office openings or closings,

consolidation, and relocation and other business optimization expenses, stock-based compensation expense, changes in the LIFO reserve,

non-restructuring asset impairment charges, non-restructuring severance charges, non-restructuring pension charges (benefits), fair value

adjustments related to contingent liabilities assumed in mergers and acquisitions and certain other adjustments). We believe investors

commonly use Adjusted EBITDA and these other non-GAAP measures as key financial metrics for valuing companies; we also present organic

sales to help investors better compare period-over-period results.

| Item 7.01. |

Regulation FD Disclosure. |

The

disclosure contained in Item 2.02 of this Current Report is incorporated into this Item 7.01 by reference.

The information in this Current Report will

not be incorporated by reference into any registration statement or other document filed by the Company under the Securities Act of 1933,

as amended, unless specifically identified therein as being incorporated by reference.

Cautionary Forward-Looking Statements

This Current Report contains certain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended, which include all statements that do not relate solely to historical or current facts,

such as statements regarding the Company’s expectations, intentions or strategies regarding the future. These forward-looking statements

are and will be, subject to many risks, uncertainties and factors which may cause future events to be materially different from these

forward-looking statements or anything implied therein. For a detailed discussion of these factors, see the information under the captions

“Risk Factors” and/or “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

in Veritiv’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”)

on February 28, 2023 (“2022 Form 10-K”), and in Veritiv’s Quarterly Report(s) on Form 10-Q for quarterly

period(s) ended during 2023 and filed with the SEC subsequent to the 2022 Form 10-K. While the list of risks and uncertainties

presented therein are considered representative, no such list or discussion should be considered a complete statement of all potential

risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements.

Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among

other things, business disruption, operational problems, financial loss, and legal liability to third parties and similar risks, any of

which could have a material adverse effect on the Company’s consolidated financial condition, results of operations, credit rating

or liquidity. In light of the significant uncertainties in these forward-looking statements, the Company cannot assure you that the forward-looking

statements in this Current Report will prove to be accurate, and you should not regard these statements as a representation or warranty

by the Company, its directors, officers or employees or any other person that the Company will achieve its objectives and plans in any

specified time frame, or at all. Any forward-looking statements in this Current Report are based upon information available to the Company

on the date of this Current Report. Subject to applicable law, the Company does not undertake to publicly update or revise its forward-looking

statements.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

The following exhibits are included with this report:

| Exhibit No. |

|

Exhibit Description |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

VERITIV CORPORATION |

| |

|

|

|

|

| |

Dated: |

October 18, 2023 |

|

/s/ Susan B. Salyer |

| |

|

|

|

Susan B. Salyer |

| |

|

|

|

Senior Vice President, General Counsel & Corporate Secretary |

v3.23.3

Cover

|

Oct. 18, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 18, 2023

|

| Entity File Number |

001-36479

|

| Entity Registrant Name |

VERITIV

CORPORATION

|

| Entity Central Index Key |

0001599489

|

| Entity Tax Identification Number |

46-3234977

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1000 Abernathy

Road NE

|

| Entity Address, Address Line Two |

Building 400

|

| Entity Address, Address Line Three |

Suite 1700

|

| Entity Address, City or Town |

Atlanta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30328

|

| City Area Code |

770

|

| Local Phone Number |

391-8200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, $0.01 par value

|

| Trading Symbol |

VRTV

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

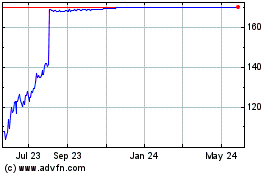

Veritiv (NYSE:VRTV)

Historical Stock Chart

From Apr 2024 to May 2024

Veritiv (NYSE:VRTV)

Historical Stock Chart

From May 2023 to May 2024