0000050292

false

0000050292

2023-10-11

2023-10-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

October 11, 2023

IEH

Corporation

(Exact Name of Registrant as Specified in Charter)

| |

|

|

|

|

| New York |

|

0-5278 |

|

13-5549348 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

| |

|

140 58th Street, Suite 8E

Brooklyn, New York 11220

(Address of Principal Executive Offices, and Zip

Code)

(718) 492-4440

Registrant’s Telephone Number, Including

Area Code

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Securities registered pursuant to Section 12(b) of

the Act: None

Securities registered pursuant to Section 12(g) of

the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

IEHC |

OTC Pink Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors;

Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On October 11,

2023, the Board met via conference telephone call and elected Mr. Brian Glenn to the Board of Directors to fill a newly created directorship

previously authorized by the Board. Mr. Glenn will serve for an initial term expiring at the Company’s next annual meeting to be

held and until his successor has been elected and qualified, or until his earlier resignation or removal. Mr. Glenn was designated as

a Class II Director. The Board has determined that Mr. Glenn is an “independent director” in accordance with the listing standards

of the OTC Pink Market. The Board also appointed Mr. Glenn to its Audit Committee. The Board also authorized designating Mr. Gottlieb

to transfer from the Audit Committee to the Board’s Compensation Committee.

As of the date

of this report, neither Mr. Glenn, nor any of his immediate family members, is a party, either directly or indirectly, to any transaction

that would be required to be reported pursuant to Item 404(a) of Regulation S-K. Mr. Glenn will be compensated consistent with the Company’s

compensation programs for non-employee directors as previously disclosed in the Company’s definitive proxy statement dated November

23, 2020, as amended.

After receiving his MBA from Massachusetts Institute of Technology’s

Sloan School of Management, Mr. Glenn joined W.R. Huff Asset Management, an alternative investment management firm that employed a rigorous,

primary research process managing concentrated investment strategies across the capital structure. He helped steer investments in public

equities, high-yield bonds, and leveraged loans. During his 10 years with the firm, Mr. Glenn also earned direct responsibilities within

the firm’s private equity funds, working on businesses that operated in the food, media, real estate, and energy industries. He

served in director and officer capacities for certain of these entities and helped execute capital investment programs, financial reporting,

business development, recapitalizations, and joint ventures.

In 2018, Mr. Glenn then founded Olcott Square Investment Partners, an investment

firm with a focus on small and micro capitalization companies that demonstrate durable advantages and secular growth prospects. In 2023,

Mr. Glenn merged the operations of Olcott Square Investment Partners into Premier Path Wealth Partners, a newly-formed independent SEC-registered

investment advisory firm in Madison, New Jersey managing more than $700 million in assets on behalf of business owners, high net worth

families, trusts, and charities. Mr. Glenn currently serves as the Director of Investments for Premier Path Wealth Partners. He holds

the Chartered Financial Analyst designation and is a member of CFA Society New York.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

The following exhibit is attached to this Current Report on Form 8-K:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

IEH Corporation

By: /s/ Dave Offerman

Name: Dave Offerman

Title: Chairman of the Board, President and Chief Executive Officer

Date: October 16, 2023

EXHIBIT 99.1

IEH CORP ANNOUNCES ADDITION OF BRIAN GLENN TO ITS BOARD OF DIRECTORS

BROOKLYN, N.Y., OCTOBER 16, 2023 – IEH Corporation (OTC: IEHC)

announced today that Brian Glenn has joined its board of directors. Dave Offerman, Chairman of the Board, President and CEO of IEH Corporation

commented, “We’re very excited to welcome Brian Glenn to IEH’s board of directors. Brian brings an intimate understanding

of the investment community and in-depth operating and financial experience across industries.”

After receiving his MBA from Massachusetts Institute of Technology’s

Sloan School of Management, Mr. Glenn joined W.R. Huff Asset Management, an alternative investment management firm that employed a rigorous,

primary research process managing concentrated investment strategies across the capital structure. He helped steer investments in public

equities, high-yield bonds, and leveraged loans. During his 10 years with the firm, Mr. Glenn also earned direct responsibilities within

the firm’s private equity funds, working on businesses that operated in the food, media, real estate, and energy industries. He

served in director and officer capacities for certain of these entities and helped execute capital investment programs, financial reporting,

business development, recapitalizations, and joint ventures.

In 2018, Mr. Glenn then founded Olcott Square Investment Partners, an investment

firm with a focus on small and micro capitalization companies that demonstrate durable advantages and secular growth prospects. In 2023,

Mr. Glenn merged the operations of Olcott Square Investment Partners into Premier Path Wealth Partners, a newly-formed independent SEC-registered

investment advisory firm in Madison, New Jersey managing more than $700 million in assets on behalf of business owners, high net worth

families, trusts, and charities. Mr. Glenn currently serves as the Director of Investments for Premier Path Wealth Partners. He holds

the Chartered Financial Analyst designation and is a member of CFA Society New York.

Michael Lehman, CEO and Founder of Premier Path Wealth Partners, said:

“Brian will bring invaluable perspective and insight to the IEH Board of Directors, just as he demonstrates every day as part of

our Premier Path team. His vast industry knowledge, strategic vision, and unwavering commitment to operational excellence will serve the

company’s shareholders well. We look forward to Brian’s contributions and insight.”

About IEH Corporation

For 80 years and 4 generations of family-run management, IEH Corporation

has designed, developed, and manufactured printed circuit board (PCB) connectors, custom interconnects and contacts for high performance

applications. With its signature Hyperboloid technology, IEH supplies the most durable, reliable connectors for the most demanding environments.

The company markets primarily to companies in defense, aerospace, space and industrial applications, in the United States, Canada, Europe,

Southeast and Central Asia and the Mideast. The company was founded in 1941 and is headquartered in Brooklyn, New York.

Safe Harbor Statement under the Private Securities Litigation Reform

Act of 1995

Certain statements contained in this press release, and in related

comments by the Company’s management, include “forward-looking statements.” All statements, other than statements

of historical facts, including, without limitation, statements or expectations regarding our financial condition, statements or

expectations regarding our revenues, cash and backlog, expectations regarding future cash requirements, revenue and revenue

recovery, including for fiscal year 2024, projected timelines for making our SEC filings or successfully preventing our registration

from suspension or revocation and expectations regarding our efforts and ability to resolve our inventory accounting issues are

forward-looking statements. These statements often include words such as “believe,” “expect,”

“estimate,” “plan,” “will,” “may,” “would,” “should,”

“could,” or similar expressions, although not all forward-looking statements contain such identifying words. These

statements are based on certain assumptions that the Company has made on its current expectations and projections about future

events. The Company believes these judgments are reasonable, but you should understand that these statements are not guarantees of

performance or results, and you should not place undue reliance on any forward-looking statements. The Company’s actual

performance or results could differ materially from those expressed in the forward-looking statements due to a variety of important

factors, both positive and negative, as they will depend on many factors about which we are unsure, including many factors beyond

our control. Among other items, such factors could include: any claims, investigations or proceedings arising as a result of our

past due Securities and Exchange Commission (“SEC”) periodic reports, including changes in the proceedings related to

the SEC’s Order Instituting Administrative Proceedings and Notice of Hearing pursuant to Section 12(j) of the Securities and

Exchange Act of 1934, as amended; our ability to remediate our inventory accounting issue; our ability to reduce costs or increase

revenue; changes in the macroeconomic environment or in the finances of our customers; changes in accounting principles, or their

application or interpretation, and our ability to make accurate estimates and the assumptions underlying the estimates; our ability

to attract and retain key employees and key resources; and other risk factors discussed from time to time in our filings with the

SEC, including those factors discussed under the caption “Risk Factors” in our most recent annual report on Form 10-K,

filed with the SEC on October 6, 2023, and in subsequent reports filed with or furnished to the SEC. Additional information

concerning these and other factors can be found in our filings with the SEC. All forward-looking statements attributable to the

Company or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. Except as

may be required by applicable law, we do not undertake or intend to update or revise our forward-looking statements, and we assume

no obligation to update any forward-looking statements contained in this press release as a result of new information or future

events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed

or implied in such forward-looking statements. You should carefully review and consider the various disclosures we make in our

filings with the SEC that attempt to advise interested parties of the risks, uncertainties and other factors that may affect our

business.

Contact:

Dave Offerman

IEH Corporation

dave@iehcorp.com

718-492-4448

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

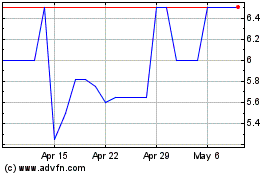

IEH (PK) (USOTC:IEHC)

Historical Stock Chart

From Apr 2024 to May 2024

IEH (PK) (USOTC:IEHC)

Historical Stock Chart

From May 2023 to May 2024