false0001006837TRUE222 Lakeview AvenueSuite 1660West Palm BeachFL212235-269100010068372023-10-062023-10-060001006837hchc:CommonStockParValue0001PerShareMember2023-10-062023-10-060001006837hchc:PreferredStockPurchaseRightsMember2023-10-062023-10-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of Earliest Event Reported): | October 6, 2023 |

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-35210 | 54-1708481 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | |

222 Lakeview Avenue, Suite 1660 | | |

West Palm Beach, FL | | 33401 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | | | | | |

| Registrant’s telephone number, including area code: | | (212) 235-2691 |

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | VATE | New York Stock Exchange |

Preferred Stock Purchase Rights | N/A | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | |

| Emerging growth company | ☐ | |

| | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Employment Agreement with Paul K. Voigt, Interim Chief Executive Officer

On July 25, 2023, INNOVATE Corp. (the “Company”) filed a Current Report on Form 8-K reporting the appointment of Mr. Paul K. Voigt as interim Chief Executive Officer of the Company, effective as of July 25, 2023 (the “Effective Date”). The Company entered into an employment agreement with Mr. Voigt dated as of October 6, 2023, setting forth the terms of his employment with the Company, effective as of the Effective Date (the “Employment Agreement”).

Pursuant to the Employment Agreement, Mr. Voigt will receive an annual base salary of $500,000, and will be eligible to receive an annual discretionary bonus as determined by the Compensation Committee. The Employment Agreement further provides that Mr. Voigt shall receive (i) a one-time restricted stock award of shares of the Company's common stock, par value $0.001 per share (“Common Stock”), with a fair market value of $1,500,000, which will be one hundred percent (100%) vested on the first (1st) anniversary of the issuance and subject to the terms of the Company’s equity incentive plan; and (ii) in each year of Mr. Voigt's employment, a stock option award to purchase one million (1,000,000) shares of Common Stock, with an exercise price to be determined by the Compensation Committee, which will be one hundred percent (100%) vested on the first (1st) anniversary of the issuance and subject to the terms of the Company’s equity incentive plan.

The foregoing summary of the Employment Agreement is not complete and is subject to, qualified in its entirety by, and should be read in conjunction with, the full text of the Employment Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| 10.1^ | |

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document). |

| | | | | |

| ^ | Indicates management contract or compensatory plan or arrangement. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 11, 2023

| | | | | | | | | | | | | | | | | |

| | | | | |

| INNOVATE Corp. (Registrant) |

| | | | | |

| By: | /s/ Michael J. Sena |

| | Name: Michael J. Sena |

| | Title: Chief Financial Officer |

October 6, 2023

Paul Voigt

62 Allwood Road

Darien, Connecticut 06820

Re: Terms of Employment as Interim Chief Executive Officer

Dear Mr. Voigt,

This letter sets forth the terms and conditions of employment of Paul Voigt ("Executive") by INNOVATE Corp., a Delaware corporation (the "Company") as its Interim Chief Executive Officer.

1.Duties. As Interim Chief Executive Officer, Executive will render such services to the Company as are customarily rendered by the Chief Executive Officer of comparable companies and as required by the articles and by-laws of the Company. Executive accepts such employment and, consistent with fiduciary standards which exist between and employer and an employee, shall perform and discharge the duties commensurate with his position that may be assigned to him from time to time by the Company. Executive will report directly to the Board of Directors of the Company (the "Board").

2.Location. Executive's principal place of employment shall be at the Company's corporate headquarters in West Palm Beach, Florida, subject to business travel as needed to properly fulfill Executive's employment duties and responsibilities. Notwithstanding the foregoing, the Company acknowledges that Executive plans to work primarily remotely from his home in Connecticut.

3.Start Date. Executive's employment with the Company began on July 25, 2023 ("Start Date").

4.Base Salary. In consideration of Executive's services, Executive will be paid an initial base salary of $500,000.00 per year, subject to review from time to time (your "Base Salary"), payable in regular installments in accordance with the standard payroll practices of the Company and subject to all withholdings and deductions as required by law.

5.Annual Bonus. During Executive's employment, Executive will be eligible to receive a discretionary annual bonus, payable at such times and in such amounts, as determined by the Compensation Committee of the Board (the "Compensation Committee"). Nothing herein should be interpreted as a guarantee of any discretionary bonus.

6.Equity Grants. Executive will be granted the following awards, subject to Section 6(c) below:

a.Effective as of October 6, 2023, the Company will grant Executive a one-time grant of restricted stock units with an aggregate value of $1,500,000 based on the 10-day VWAP of the Company's shares on the date of grant (the "Equity Award"). The Equity Award will be one hundred percent (100%) vested on the first (1st) anniversary of the Start Date, and will be subject to the terms and conditions of the Plan and the form of the Award agreement under the Plan applicable to senior executives. The Equity Award shall also be governed by the terms of the of the Company’s Executive Severance Guidelines as of October 21, 2021 (the "Severance Guidelines") with respect to any Qualifying Termination (as defined therein).

INNOVATE Corp.

Paul Voigt Employment Letter Agreement

October 6, 2023

Page 2

b.On September 15, 2023, Executive was granted, and on the same date in the 2024 calendar year and each subsequent year provided that Executive is still employed on the applicable date of grant (and if during a black out period under the Company’s insider trading plan on any such date, on the first allowable trading day of the next window under such plan), Executive will be granted, a stock option award to purchase 1,000,000 shares of the Company's common stock, par value $0.001 per share, with an exercise price determined by the Compensation Committee in its discretion (the “Option Awards”). The September 15, 2023 grant has an exercise price of $2.50 per share. The Option Awards will be one hundred percent (100%) vested on the first (1st) anniversary of the Start Date, and will be subject to the terms and conditions of the Plan and an award agreement.

c. The issuance of shares in respect of each grant pursuant to Section 6(a) and 6(b) above (each, an “Award”), and the vesting schedule of such Awards, is expressly conditioned upon and subject to receipt of the necessary approval of the stockholders of the Company of one or more amendments to the Company’s 2014 Omnibus Equity Award Plan or a successor equity plan (the “Plan”), if and as required, to provide for a sufficient increase in the shares reserved under the Plan to grant any such Award. In the event that the vesting schedule of any such Award does not receive the necessary approval, the vesting shall revert to 100% vesting on the first anniversary of the date of grant of such Award, subject to the terms of the Plan and the Severance Guidelines.

7.Severance. Executive shall be deemed to the Chief Executive Officer for purposes of the Severance Guidelines and shall be entitled to receive the severance benefits provided to the Chief Executive Officer pursuant and subject to the terms of the Severance Guidelines. For the avoidance of doubt, none of the Awards shall be deemed an annual bonus for purposes of the Severance Guidelines.

8.Benefits and Perquisites. Executive will be eligible to participate in the employee benefit plans and programs generally available to the Company's senior executives from time to time, subject to the terms and conditions of such plans and programs. Executive will be entitled to paid vacation in accordance with the Company's policies in effect from time to time. You will also be entitled to the fringe benefits and perquisites that are made available to other similarly situated executives of the Company, each in accordance with and subject to the eligibility and other provisions of such plans and programs. The Company reserves the right to amend, modify or terminate any of its benefit plans or programs at any time and for any reason.

9.Withholding. All forms of compensation paid to Executive as an employee of the Company shall be less all applicable withholdings.

10.At-will Employment Executive's employment with the Company will be for no specific period of time. Rather, Executive's employment will be at-will, meaning that Executive or the Company may terminate the employment relationship at any time, with or without cause, and with or without notice and for any reason or no particular reason. Although Executive's compensation and benefits may change from time to time, the at-will nature of Executive's employment may only be changed by an express written agreement signed by an authorized officer of the Company.

INNOVATE Corp.

Paul Voigt Employment Letter Agreement

October 6, 2023

Page 3

11.Restrictive Covenants.

a.Covenant not to Solicit. Executive agrees that, for a period of one (1) year following his termination of employment with the Company, Executive will not directly or indirectly solicit for employment or employ any person, who is or was employed by the Company within (6) six months prior to his termination date, in any business in which the Executive has a material interest, direct or indirect, as an officer, partner, shareholder or beneficial owner. Further, Executive will not assist any other person or entity, in hiring or soliciting such employees, even if Executive does not have a material interest or is an officer, partner, shareholder or owner.

b.Confidentiality and Nondisclosure. The Executive will not use or disclose to any individual or entity any Confidential Information (as defined below) except (i) in the performance of Executive's duties for the Company, (ii) as authorized in writing by the Company, or (iii) as required by subpoena or court order, provided that, prior written notice of such required disclosure is provided to the Company and, provided further that all reasonable efforts to preserve the confidentiality of such information shall be made. As used in this Agreement, “Confidential Information” shall mean information that (i) is used or potentially useful in the business of the Company, (ii) the Company treats as proprietary, private or confidential, and (iii) is not generally known to the public. “Confidential Information” includes, without limitation, information relating to the Company's products or services, processing, manufacturing, marketing, selling, customer lists, call lists, customer data, memoranda, notes, records, technical data, sketches, plans, drawings, chemical formulae, trade secrets, composition of products, research and development data, sources of supply and material, operating and cost data, financial information, personal information and information contained in manuals or memoranda. “Confidential Information” also includes proprietary and/or confidential information of the Company's customers, suppliers and trading partners who may share such information with the Company pursuant to a confidentiality agreement or otherwise. The Executive agrees to treat all such customer, supplier or trading partner information as “Confidential Information” hereunder. The foregoing restrictions on the use or disclosure of Confidential Information shall continue after Executive's employment terminates for any reason for so long as the information is not generally known to the public.

c.Non-Disparagement. The Executive will not at any time during his employment with the Company, or after the termination of his employment with the Company, directly or indirectly (i) disparage, libel, or defame, or encourage or induce others to disparage, libel, or defame, the Company, or any of the Company's officers, directors, employees or agents, or the Company's products, services, business plans or methods; or (ii) engage in any conduct or encourage or induce any other person to engage in any conduct that is in any way injurious or potentially injurious to the reputation or interests of the Company.

d.Restrictions Reasonable. Executive acknowledges that the restrictions under this Article II are substantial, and may effectively prohibit him from working for a period of one year in the

INNOVATE Corp.

Paul Voigt Employment Letter Agreement

October 6, 2023

Page 4

field of his experience and expertise. Executive further acknowledges that he has been given access and shall continue to be given access to all of the Confidential Matters and trade secrets described above during the course of his employment, and therefore, the restrictions are reasonable and necessary to protect the competitive business interests and goodwill of the Company and do not cause Executive undue hardship.

e.Survival of Restrictive Covenants. Executive’s obligations under this Agreement shall survive Executive's termination of employment with the Company and the termination of this Agreement by either party for any reason.

f.Equitable Relief. Executive hereby acknowledges and agrees that the Company and its goodwill would be irreparably injured by, and that damages at law are an insufficient remedy for, a breach or violation of the provisions of this Agreement, and agrees that the Company, in addition to other remedies available to it for such breach shall be entitled to a preliminary injunction, temporary restraining order, or other equivalent relief, restraining Executive from any actual breach of the provisions hereof, and that the Company’s rights to such equitable relief shall be cumulative and in addition to any other rights or remedies to which the Company may be entitled.

12.Clawback. Any amounts payable hereunder are subject to any policy (whether currently in existence or later adopted) established by the Company providing for clawback or recovery of amounts that were paid to you. The Company will make any determination for clawback or recovery in its sole discretion and in accordance with any applicable law or regulation.

13.Section 409A.

a.It is intended that compensation paid or delivered pursuant to this Agreement is either paid in compliance with, or is exempt from, Section 409A of the Internal Revenue Code of 1986, as amended, and the regulations promulgated thereunder (together, "Section 409A"), and this Agreement shall be interpreted and administered accordingly. The Severance under the Agreement is intended to be exempt from section 409A of the Code under the “short-term deferral” exception, to the maximum extent applicable, and then under the “separation pay” exception, to the maximum extent applicable. For purposes of Section 409A, all payments to be made upon a termination of employment under this Agreement may only be made upon a “separation from service” within the meaning of such term under Section 409A, and each payment made under this Agreement shall be treated as a separate payment and the right to a series of installment payments under this Agreement is to be treated as a right to a series of separate payments. Notwithstanding any provision of this Agreement to the contrary, in no event shall the timing of Executive’s execution of the Release, directly or indirectly, result in Executive designating the calendar year of payment, and if a payment that is deferred compensation subject to Section 409A and subject to execution of the Release could be made in more than one taxable year, payment shall be made in the later taxable year.

INNOVATE Corp.

Paul Voigt Employment Letter Agreement

October 6, 2023

Page 5

b.Notwithstanding any provision in this Agreement to the contrary, if at the time of Executive’s separation from service with the Company, the Company (or a company that is aggregated with the Company for this purpose under Section 409A) has securities which are publicly-traded on an established securities market and Executive is a “specified employee” (as defined in Section 409A) and it is necessary to postpone the commencement of any Severance payments otherwise payable pursuant to this Agreement as a result of such separation from service to prevent any accelerated or additional tax under Section 409A, then the Company will postpone the commencement of the payment of any such Severance payments hereunder (without any reduction in such payments ultimately paid or provided to Executive) that are not otherwise exempt from Section 409A, until the first payroll date that occurs after the date that is six (6) months following Executive’s separation from service with the Company. If any payments are postponed due to such requirements, such postponed amounts will be paid in a lump sum to Executive on the first payroll date that occurs after the date that is six (6) months following Executive’s separation from service with the Company. If Executive dies during the postponement period prior to the payment of the postponed amount, the amounts withheld on account of Section 409A shall be paid to the personal representative of Executive’s estate within sixty (60) days after the date of Executive’s death.

c.The Company makes no representation or warranty and shall have no liability to Executive or any other person if any provisions of this Agreement are determined to constitute deferred compensation subject to Section 409A but do not satisfy an exemption from, or the conditions of, such Section 409A.

14.Governing Law; Disputes. This offer letter shall be governed by the laws of the State of New York, without regard to conflict of law principles. All disputes regarding this letter or otherwise relating to or arising out of Executive's employment with the Company shall resolved by arbitration to be administered by the American Association of Arbitration, with arbitration venued exclusively in New York, New York.

15. Counterparts. This letter may be executed in one or more counterparts, each of which shall be deemed and original and all of which together shall be deemed a single instrument. Each counterpart may be delivered by PDF or other electronic means.

[SIGNATURE PAGE FOLLOWS]

INNOVATE Corp.

Paul Voigt Employment Letter Agreement

October 6, 2023

Page 6

Sincerely,

INNOVATE Corp.

| | | | | |

| By: | /s/ Michael Sena |

| Michael Sena |

| Chief Financial Officer |

Acceptance of Employment Terms and Conditions

The undersigned Executive has read and understood and accepts all the terms of the offer of employment as set forth in this letter. The undersigned Executive has not relied on any agreements or representations, express or implied, that are not set forth expressly in this letter, and this letter supersedes all prior and contemporaneous understandings, agreements, representations and warranties, both written and oral, with respect to the subject matter of this letter.

| | | | | |

| /s/ Paul Voigt |

| Paul Voigt |

| Date: | October 6, 2023 |

INNOVATE Corp.

Paul Voigt Employment Letter Agreement

October 6, 2023

Page 7

EXHIBIT A

Form of Release

The following form of release may be signed separately or as part of a larger agreement with Employee:

1. Waiver and Release. For valuable consideration from the Employer, the sufficiency of which Employee hereby acknowledges, Employee, on behalf of Employee and Employee’s executors, administrators, successors and assigns (collectively, “Releasors”) waives, releases, and forever discharges the Employer and its current and former affiliates and subsidiaries, together with each of their respective owners, investors, board members, officers, attorneys, partners, representatives, agents, and employees, and together with each of their respective affiliates, estates, predecessors, successors and assigns (collectively, the “Employer Releasees”) from any and all rights, causes of action, claims or demands, whether express or implied, known or unknown, that arise on or before the date that Employee executes or re-executes this Agreement, which Employee has or may have against the Employer and/or the other Employer Releasees, including, but not limited to, any rights, causes of action, claims, or demands relating to or arising out of the following*:

(a) anti-discrimination, anti-harassment, and anti-retaliation laws, including, without limitation, the Age Discrimination in Employment Act of 1967 and the Older Worker Benefit Protection Act, which prohibit discrimination on the basis of age; Title VII of the Civil Rights Act of 1964, the Civil Rights Act of 1866 (42 U.S.C. § 1981), the Equal Pay Act, and Executive Order 11246, which prohibit discrimination based on race, color, national origin, religion, or sex; the Genetic Information Nondiscrimination Act, which prohibits discrimination on the basis of genetic information; the Americans With Disabilities Act and Sections 503 and 504 of the Rehabilitation Act of 1973, which prohibit discrimination based on disability; the New York State Human Rights Law, as amended, and the New York City Human Rights Law, as amended, which prohibit discrimination based on age, disability, race, color, national origin, citizenship, religion, pregnancy, sex, sexual orientation, and marital status; and any other federal, state, or local laws prohibiting employment or wage discrimination, or retaliation;

(b) other employment laws, including, without limitation, the Worker Adjustment and Retraining Notification Act, which requires that advance notice be given of certain workforce reductions; the Employee Retirement Income Security Act of 1974, which, among other things, protects employee benefits; the Family and Medical Leave Act, which requires employers to provide leaves of absence under certain circumstances; the New York Labor Law, as amended; the New York Civil Rights Law, as amended and any other federal, state, or local laws relating to employment;

(c) tort, contract, and quasi-contract claims, including, without limitation, claims for wrongful discharge, physical or personal injury, intentional or negligent infliction of emotional distress, fraud, fraud in the inducement, negligent misrepresentation, defamation, invasion of privacy, interference with contract or with prospective economic advantage, breach of express or implied contract, unjust enrichment, promissory estoppel, breach of covenants of good faith and fair dealing, negligent hiring, negligent supervision, negligent retention, and similar or related claims; and

(d) all remedies of any type, including, without limitation, damages and injunctive relief, in any action that may be brought on Employee’s behalf against the Employer and/or the Employer Releasees by any government agency or other entity or person.

Employee understands that Employee is releasing claims about which Employee may not know anything at the time Employee executes or re-executes this Agreement. Employee acknowledges that it is Employee’s intent to release such unknown claims, even though Employee recognizes that someday

INNOVATE Corp.

Paul Voigt Employment Letter Agreement

October 6, 2023

Page 8

Employee might learn new facts relating to Employee’s employment or learn that some or all of the facts Employee currently believes to be true are untrue, and even though Employee might then regret having executed or re-executed this Agreement. Nevertheless, Employee acknowledges Employee’s awareness of that risk and agrees that this Agreement shall remain effective in all respects in any such case. Employee expressly waives all rights Employee might have under any laws intended to protect Employee from waiving unknown claims.

2. Excluded Claims. Notwithstanding anything to the contrary in this Agreement, the waiver and release contained in this Agreement shall exclude any rights or claims that (a) may arise after the date on which Employee executes or re-executes this Agreement; (b) cannot be released under applicable law (such as worker’s compensation benefits and unemployment compensation claims); or (c) any rights Employee may have to bring any claim for indemnification or legal defense under any applicable directors and officers liability insurance policy, prior agreements or policies, by-laws or applicable common, state or federal law in accordance with the terms and conditions of the Indemnification Agreement, dated [______], between Employee and the Company. Moreover, nothing in this Agreement shall prevent or preclude Employee from challenging in good faith the validity of this Agreement, nor does it impose any conditions precedent, penalties, or costs for doing so, unless specifically authorized by applicable law.

3. No Other Claims. Except to the extent previously disclosed by Employee in writing to the Employer, Employee represents and warrants that Employee has (a) filed no claims, lawsuits, charges, grievances, or causes of action of any kind against the Employer and/or the other Employer Releasees and, to the best of Employee’s knowledge, Employee possesses no claims (including Fair Labor Standards Act “FLSA” and worker’s compensation claims); (b) received any and all compensation (including overtime compensation), meal periods, and rest periods to which Employee may have been entitled, and Employee is not currently aware of any facts or circumstances constituting a violation by the Employer and/or the other Employer Releasees of the FLSA or other applicable wage, hour, meal period, and/or rest period laws; and (c) not suffered any work-related injury or illness while employed by the Employer, and Employee is not currently aware of any facts or circumstances that would give rise to any worker’s compensation claim against the Employer and/or the other Employer Releasees; provided, however, that nothing in this Paragraph 3 shall be interpreted as requiring Employee to disclose any complaints he has made, or information he has disclosed, to government regulatory agencies concerning actual or suspected violations of law.

* The parties agree that this list may be updated to reflect current laws and/or the jurisdiction of Employee's employment or residence as applicable.

v3.23.3

Cover

|

Oct. 06, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 06, 2023

|

| Entity Registrant Name |

INNOVATE CORP.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35210

|

| Entity Tax Identification Number |

54-1708481

|

| Entity Address, Address Line One |

222 Lakeview Avenue

|

| Entity Address, Address Line Two |

Suite 1660

|

| Entity Address, City or Town |

West Palm Beach

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33401

|

| City Area Code |

212

|

| Local Phone Number |

235-2691

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001006837

|

| Common Stock, par value $0.001 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

VATE

|

| Security Exchange Name |

NYSE

|

| Preferred Stock Purchase Rights |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock Purchase Rights

|

| Security Exchange Name |

NYSE

|

| No Trading Symbol Flag |

true

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=hchc_CommonStockParValue0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=hchc_PreferredStockPurchaseRightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

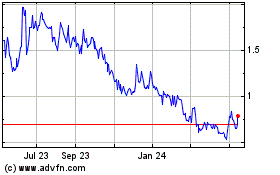

INNOVATE (NYSE:VATE)

Historical Stock Chart

From Mar 2024 to Apr 2024

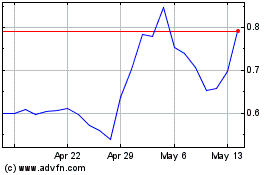

INNOVATE (NYSE:VATE)

Historical Stock Chart

From Apr 2023 to Apr 2024