As filed with the Securities and Exchange Commission on October 11, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

EXPRESS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | | | 26-2828128 |

(State or other jurisdiction

of incorporation or organization) | | | | (I.R.S. Employer

Identification No.) |

1 Express Drive

Columbus, Ohio 43230

(Address of principal executive offices, including zip code)

| | |

| Employment Inducement Award Agreement |

| (Performance-Based Restricted Stock Units) with Stewart Glendinning |

| (Full Title of the Plan) |

|

| Laurel Krueger |

| Chief Legal Officer & Corporate Secretary |

| Express Inc. |

| 1 Express Drive |

| Columbus, Ohio 43230 |

| (Name and address of agent for service) |

|

| (614) 474-4001 |

| (Telephone number, including area code, of agent of service) |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| | | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| | | |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act . ☐

EXPLANATORY NOTE

Express, Inc. (the “Registrant”) is filing this Registration Statement (the “Registration Statement”) with the Securities and Exchange Commission (the “Commission”) to register 300,000 shares of the Registrant’s common stock, par value $0.01 per share (“Common Stock”), eligible for issuance upon the vesting and settlement of an inducement grant consisting of performance-based restricted stock units. The performance-based restricted stock units will be granted to Mr. Stewart Glendinning outside of the Express, Inc. Second Amended and Restated 2018 Incentive Compensation Plan and were approved by the Registrant’s Board of Directors as a material inducement to his acceptance of employment with the Registrant as Chief Executive Officer in compliance with and in reliance on Rule 303A.08 of the New York Stock Exchange Listed Company Manual, which exempts “employment inducement grants” from the general requirement of the New York Stock Exchange that equity-based compensation plans and arrangements be approved by a listed company’s stockholders.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information specified in Part I of Form S-8 is omitted from this Registration Statement in accordance with Rule 428 under the Securities Act of 1933, as amended (the “Securities Act”), and the introductory note to Part I of Form S-8. The documents containing the information specified in Part I of Form S-8 will be delivered to Mr. Glendinning as required by Rule 428(b)(1). Such documents are not being filed with the Commission either as part of this Registration Statement or as prospectuses or prospectus supplements filed pursuant to Rule 424. These documents and the documents incorporated by reference into this Registration Statement pursuant to Item 3 of Part II of this Registration Statement, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents are hereby incorporated by reference in this Registration Statement:

a.the Registrant’s Annual Report on Form 10-K for the fiscal year ended January 28, 2023 (“Annual Report”), filed with the Commission on March 31, 2023;

b.the information specifically incorporated by reference into the Annual Report from the Registrant’s definitive proxy statement on Schedule 14A, filed with the Commission on April 28, 2023;

c.the Registrant’s Quarterly Reports on Form 10-Q for the quarter ended April 29, 2023, filed with the Commission on June 8, 2023, and the quarter ended July 29, 2023, filed with the Commission on September 6, 2023;

d.the Registrant’s Current Reports on Form 8-K filed with the Commission on April 13, 2023 (excluding Item 7.01), May 24, 2023 (excluding Item 2.02 and Item 7.01), June 8, 2023, July 14, 2023, August 17, 2023 (excluding Item 2.02 and Item 7.01), September 1, 2023, September 6, 2023 (Item 1.01 and Item 2.03) and September 11, 2023 (excluding Item 7.01); and

e.the description of the Common Stock set forth under the caption “Description of Capital Stock” in the Registrant’s Registration Statement on Form S-1 (File No. 333-172988), filed with the Commission on April 4, 2011, including any amendments or reports filed for the purpose of updating such description.

The Registrant also incorporates by reference the information contained in all reports and other documents the Registrant subsequently files with the Commission pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (other than any portions of these documents that are furnished under Item 2.02 or Item 7.01 of a Current Report on Form 8-K, including any exhibits included with such Items, unless otherwise indicated therein), after the date of this Registration Statement and prior to the filing of a post-effective amendment that indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold. The information contained in any such document will be considered part of this Registration Statement from the date the document is filed with the Commission.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

The Registrant is incorporated under the laws of the State of Delaware. Section 102(b)(7) of the General Corporation Law of the State of Delaware (the “DGCL”) allows a corporation to provide in its certificate of incorporation that a director of the corporation shall not be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, except where the director breached the duty of loyalty, failed to act in good faith, engaged in intentional misconduct or knowingly violated a law, authorized the payment of a dividend or approved a stock repurchase in violation of the DGCL or obtained an improper personal benefit. The Registrant’s certificate of incorporation provides for this limitation of liability.

Section 145 of the DGCL (“Section 145”) provides that a Delaware corporation may indemnify any person, including an officer or director, who was, is or is threatened to be made, party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of such corporation), by reason of the fact that such person is or was an officer, director, employee or agent of such corporation or is or was serving at the request of such corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise. The indemnity may include expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding, provided such person acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the corporation’s best interests and, with respect to any criminal action or proceeding, had no reasonable cause to believe that his or her conduct was illegal. Where an officer or director is successful on the merits or otherwise in the defense of any action referred to above, the corporation must indemnify him or her against the expenses which such officer or director has actually and reasonably incurred.

Section 145 also provides that a corporation has the power to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against any liability asserted against him or her and incurred by him or her in any such capacity, or arising out of his or her status as such, whether or not the corporation would have the power to indemnify him or her against such liability under Section 145.

Article VIII of the Registrant’s certificate of incorporation provides that to the fullest extent permitted by the DGCL as it now exists or may hereafter be amended (but, in the case of any such amendment, only to the extent that such amendment permits the Registrant to provide broader rights than permitted prior thereto), no director of the Registrant shall be liable to the Registrant or its stockholders for monetary damages arising from a breach of fiduciary duty owed to the Registrant or its stockholders. Article VII of the Registrant’s bylaws provides for indemnification of the Registrant’s directors and officers to the fullest extent authorized by the DGCL, as the same exists or may hereafter be amended (but, in the case of any such amendment, only to the extent that such amendment permits the Registrant to provide broader indemnification rights than permitted prior thereto).

The Registrant has entered into indemnification agreements with each of its executive officers and directors, including Mr. Glendinning. The indemnification agreements provide the executive officers and directors with contractual rights to indemnification, expense advancement and reimbursement, to the fullest extent permitted under the DGCL.

The indemnification rights set forth above shall not be exclusive of any other right which an indemnified person may have or hereafter acquire under any statute, provision of the Registrant’s certificate of incorporation, bylaws, agreement, vote of stockholders or disinterested directors or otherwise.

The Registrant maintains standard policies of insurance that provide coverage (1) to its executive officers and directors against loss rising from claims made by reason of breach of duty or other wrongful acts and (2) to the Registrant with respect to indemnification payments that the Registrant may make to such executive officers and directors.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

The exhibits filed as part of this Registration Statement are as follows:

| | | | | | | | |

| Exhibit Number | | Description |

| | Certificate of Incorporation of Express, Inc. (incorporated by reference to Exhibit 4.1 to the Registration Statement on Form S-8, filed with the Commission on July 14, 2010). |

| | Certificate of Amendment of Certificate of Incorporation of Express, Inc. (incorporated by reference to Exhibit 3.1 to the Current Report on Form 8-K, filed with the Commission on June 11, 2013). |

| | Certificate of Amendment of Certificate of Incorporation of Express, Inc. (incorporated by reference to Exhibit 3.1 to the Current Report on Form 8-K, filed with the Commission on September 1, 2023). |

| | Bylaws of Express, Inc. (incorporated by reference to Exhibit 3.1 to the Current Report on Form 8-K, filed with the Commission on January 24, 2023). |

| | Opinion of Kirkland & Ellis LLP, special counsel to the Registrant. |

| | Consent of PricewaterhouseCoopers LLP, independent registered public accounting firm. |

| | Consent of Kirkland & Ellis LLP (included in Exhibit 5.1). |

| | Powers of Attorney (included on the signature page of this Registration Statement). |

| | Form of Employment Inducement Award Agreement (Performance-Based Restricted Stock Units). |

| | Filing Fee Table. |

* Filed herewith

Item 9. Undertakings.

(a) The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate,

the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Filing Fee Table” in the effective Registration Statement;

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement;

provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the Registration Statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; and

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act to any purchaser, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Columbus, State of Ohio, on the 11th day of October, 2023.

| | | | | | | | | | | |

| | EXPRESS, INC. |

| | | |

| | By: | /s/ Jason Judd |

| | | Name: Jason Judd |

| | | Title: Senior Vice President, Chief Financial Officer and Treasurer |

POWER OF ATTORNEY AND SIGNATURES

Each person whose signature appears below constitutes and appoints Laurel Krueger and Jason Judd, or either of them, his or her attorneys-in-fact, with the power of substitution, for him or her in any and all capacities, to sign any amendments to this Registration Statement and to file the same, with exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, hereby ratifying and confirming all that said attorneys-in-fact or their substitute or substitutes, may do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | |

| Signature | | Title(s) | | Date |

| | | | |

| /s/ Stewart Glendinning | | Chief Executive Officer (Principal Executive Officer) and Director | | October 11, 2023 |

| Stewart Glendinning | | | | |

| | | | |

| /s/ Jason Judd | | Senior Vice President, Chief Financial Officer and Treasurer (Principal Financial Officer and Principal Accounting Officer) | | October 11, 2023 |

| Jason Judd | | | | |

| | | | |

| /s/ Michael G. Archbold | | Director | | October 11, 2023 |

| Michael G. Archbold | | | | |

| | | | |

| /s/ Terry Davenport | | Director | | October 11, 2023 |

| Terry Davenport | | | | |

| | | | |

| /s/ Karen Leever | | Director | | October 11, 2023 |

| Karen Leever | | | | |

| | | | |

/s/ Patricia E. Lopez | | Director | | October 11, 2023 |

Patricia E. Lopez | | | | |

| | | | |

| /s/ Antonio J. Lucio | | Director | | October 11, 2023 |

| Antonio J. Lucio | | | | |

| | | | |

| /s/ Mylle H. Mangum | | Director | | October 11, 2023 |

| Mylle H. Mangum | | | | |

| | | | |

| /s/ Satish Mehta | | Director | | October 11, 2023 |

| Satish Mehta | | | | |

| | | | |

| /s/ Yehuda Shmidman | | Director | | October 11, 2023 |

| Yehuda Shmidman | | | | |

| | | | |

| /s/ Peter Swinburn | | Director | | October 11, 2023 |

| Peter Swinburn | | | | |

Exhibit 107

Calculation of Filing Fee Table

Form S-8

(Form Type)

Express, Inc.

(Exact Name of Registrant as Specified in its Charter)

Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title | Fee Calculation Rule | Amount Registered(1) | Proposed Maximum Offering Price Per Unit(2) | Maximum

Aggregate

Offering

Price | Fee Rate | Amount of Registration Fee |

| Equity | Common Stock, par value $0.01 per share | 457(c) and 457(h) | 300,000 | $8.62 | $2,586,000 | $0.00014760 | $381.69 |

| Total Offering Amounts | | | | | $2,586,000 | | $381.69 |

| Total Fee Offsets | | | | | | | — |

| Net Fee Due | | | | | | | $381.69 |

1.Represents the maximum shares of the common stock, par value $0.01 per share (“Common Stock”) of Express, Inc. (the “Registrant”) eligible for issuance upon the vesting and settlement of performance-based restricted stock units to be granted to Mr. Stewart Glendinning in accordance with Rule 303A.08 of the New York Stock Exchange Listed Company Manual. Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement also covers an indeterminate number of securities as may become issuable by reason of any stock dividend, stock split, recapitalization or any other similar transaction effected without the Registrant’s receipt of consideration which results in an increase in the number of outstanding shares of Common Stock.

2.Estimated solely for the purpose of calculating the registration fee in accordance with Rules 457(c) and 457(h) under the Securities Act. The amount of the registration fee is based on a price of $8.62 per share, which is the average of the high ($8.80) and low ($8.45) trading prices per share of the Common Stock as reported by the New York Stock Exchange on October 4, 2023.

Exhibit 5.1 300 North LaSalle Chicago, IL 60654 United States +1 312 862 2000 www.kirkland.com Facsimile: +1 312 862 2200 Austin Bay Area Beijing Boston Brussels Dallas Hong Kong Houston London Los Angeles Miami Munich New York Paris Salt Lake City Shanghai Washington, D.C. October 11, 2023 Express, Inc. 1 Express Drive Columbus, Ohio 43230 Re: Registration Statement on Form S-8 Ladies and Gentlemen: We are acting as special counsel to Express, Inc., a Delaware corporation (the “Company”), in connection with the proposed filing by the Company of a Registration Statement on Form S-8 (the “Registration Statement”) with the Securities and Exchange Commission (the “Commission”) on the date hereof under the Securities Act of 1933, as amended (the “Act”), for the purpose of registering 300,000 shares (the “Shares”) of the Company’s common stock, par value $0.01 per share (“Common Stock”), eligible for issuance upon the vesting and settlement of an inducement award consisting of performance-based restricted stock units to be granted to Mr. Stewart Glendinning as a material inducement to his acceptance of employment with the Company as Chief Executive Officer in compliance with and in reliance on Rule 303A.08 of the New York Stock Exchange (“NYSE”) Listed Company Manual, which exempts “employment inducement grants” from the general requirement of the NYSE that equity-based compensation plans and arrangements be approved by stockholders (the “Inducement Grant”). In connection therewith, we have examined originals, or copies certified or otherwise identified to our satisfaction, of such documents, corporate records and other instruments as we have deemed necessary for the purposes of this opinion, including (i) the organizational documents of the Company, including its Certificate of Incorporation, as amended (the “Charter”), and Bylaws, (ii) minutes and records of the corporate proceedings of the Company, (iii) the form of award agreement applicable to the Inducement Grant (the “Award Agreement”) and (iv) the Registration Statement and each of the other exhibits to be filed therewith. We have relied, without independent investigation, upon, among other things, an assurance from the Company that the number of shares of Common Stock which the Company is authorized to issue pursuant to the Charter exceeds the number of shares of Common Stock outstanding and the number of shares of Common Stock which the Company is obligated to

Express, Inc. October 11, 2023 Page 2 issue (or had otherwise reserved for issuance) for any purposes other than issuances in connection with the Award Agreement by at least the number of Shares which are being registered for issuance pursuant to the Registration Statement, and we have assumed that such condition will remain true at all future times relevant to this opinion. For purposes of this opinion, we have assumed the authenticity of all documents submitted to us as originals, the conformity to the originals of all documents submitted to us as copies and the authenticity of the originals of all documents submitted to us as copies. We have also assumed the legal capacity of all natural persons, the genuineness of the signatures of persons signing all documents in connection with which this opinion is rendered, the authority of such persons signing on behalf of the parties thereto other than the Company and the due authorization, execution and delivery of all documents by the parties thereto other than the Company. We have not independently established or verified any facts relevant to the opinion expressed herein but have relied upon statements and representations of officers and other representatives of the Company and others. Based upon and subject to the foregoing qualifications, assumptions and limitations and the further limitations set forth below, we advise you that the Shares are duly authorized, and when (i) the Registration Statement related to the Shares becomes effective under the Act, (ii) the Shares have been duly issued pursuant to and in accordance with the terms and conditions of the Award Agreement and payment of due consideration therefor, and (iii) the Shares are duly countersigned by the Company’s registrar, the Shares will be validly issued, fully paid and non- assessable. Our opinions expressed above are subject to the qualification that we express no opinion as to the applicability of, compliance with, or effect of any laws except the General Corporation Law of the State of Delaware and the federal laws of the United States (including the statutory provisions, all applicable provisions of the Delaware constitution and reported judicial decisions interpreting the foregoing). We hereby consent to the filing of this opinion with the Commission as Exhibit 5.1 to the Registration Statement. In giving this consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission. We do not find it necessary for the purposes of this opinion, and accordingly we do not purport to cover herein, the application of the securities or “Blue Sky” laws of the various states to the issuance and sale of the Shares. This opinion is limited to the specific issues addressed herein, and no opinion may be inferred or implied beyond that expressly stated herein. We assume no obligation to revise or

Express, Inc. October 11, 2023 Page 3 supplement this opinion after the date of effectiveness should the General Corporation Law of the State of Delaware or the federal laws of the United States be changed by legislative action, judicial decision or otherwise after the date hereof. This opinion is furnished to you in connection with the filing of the Registration Statement in accordance with the requirements of Item 601(b)(5) of Regulation S-K under the Act, and is not to be used, circulated, quoted or otherwise relied upon for any other purpose. Sincerely, /s/ Kirkland & Ellis LLP KIRKLAND & ELLIS LLP

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of Express, Inc. of our report dated March 31, 2023, relating to the financial statements and the effectiveness of internal control over financial reporting, which appears in Express, Inc.’s Annual Report on Form 10-K for the year ended January 28, 2023.

/s/ PricewaterhouseCoopers LLP

Columbus, Ohio

October 11, 2023

Exhibit 99.1

EXPRESS, INC. EMPLOYMENT INDUCEMENT AWARD AGREEMENT

PERFORMANCE-BASED RESTRICTED STOCK UNITS

Participant: Stewart Glendinning

Grant Date: October 15, 2023

Number of Performance-Based Restricted Stock Units Granted: 150,000

Vesting Terms: See Section 3 below

THIS EMPLOYMENT INDUCEMENT AWARD AGREEMENT (this “Agreement”), is entered into by and between Express, Inc., a Delaware corporation (the “Company”), and the Participant specified above, as of the Grant Date specified above as a material inducement to Mr. Glendinning’s acceptance of employment with the Company as evidenced by that certain Employment Agreement, dated as of September 6, 2023, by and between the Company, Express LLC, and Participant (the “Employment Agreement”). This Agreement documents the grant by the Company to Participant of the Number of Performance-Based Restricted Stock Units specified above, subject to the terms of this Agreement (the “PSUs”). This grant of PSUs constitutes an “Employment Inducement Award” under Section 303A.08 of the NYSE Listed Company Manual. Any shares of Common Stock issued in connection with the PSUs shall not be issued under the Second Amended and Restated Express, Inc. 2018 Incentive Compensation Plan (the “Plan”) or any other stockholder-approved equity compensation plan of the Company; provided, however, that all of the other terms of the Plan shall apply to the PSUs as though the PSUs were an Award under the Plan.

1.Grant and Acceptance of PSUs and Agreement.

a.The Company hereby grants to Participant the PSUs as of the Grant Date. Each PSU shall entitle Participant to receive one share of Common Stock at such future date or dates and subject to such terms, including as to vesting, as set forth in this Agreement. Except as otherwise specifically provided for in the Plan, nothing in this Agreement provides, or is intended to provide, Participant with any protection against potential future dilution of Participant’s interest in the Company for any reason. Except as set forth in Section 5 below, Participant shall not have any rights of a stockholder in respect of the shares underlying the PSUs until such shares are delivered to Participant in accordance with Section 4 below.

b.Participant must accept the terms of this Agreement within sixty days after the Agreement is presented to Participant for review. If Participant does not timely accept this Agreement, the Company shall automatically accept this Agreement on Participant’s behalf.

2.Plan Terms.

a.This Agreement is subject in all respects to the terms of the Plan (including any amendments thereto adopted at any time and from time to time unless such amendments are expressly intended not to apply to the PSUs), and all of the terms of the Plan are made a part of and incorporated into this Agreement as if they were each expressly set forth herein; provided, however, that any shares of Common Stock issued in connection with the PSUs shall not be issued under the Plan or any other stockholder-approved equity compensation plan of the Company and any such shares shall not impact the Plan’s or any other plan’s share pool in any way. Any capitalized terms not defined in this Agreement shall have the same meaning as is ascribed under the Plan.

b.Participant acknowledges receipt of a true copy of the Plan (which is also filed publicly) and a prospectus describing the material terms of the Plan. Participant has read the Plan carefully and fully understands its content, including the Committee’s broad authority to administer the Plan (as set forth under Article III of the Plan).

3.Vesting.

a.Vesting. The PSUs shall become eligible to vest on the last day of fiscal 2026 (i.e., January 30, 2027) based on the Average Stock Price in accordance with the schedule set forth below, subject to (i) Participant’s continued employment through the last day of fiscal 2026 and (ii) Section 3(b), Section 3(c) or Section 3(d) below. For purposes of this Agreement, “Average Stock Price” means

the highest volume-weighted average closing price per share of Common Stock as published by Bloomberg, L.P. and as measured over any sixty (60) consecutive trading day period between the Grant Date and the last day of fiscal 2026.

| | | | | |

| Average Stock Price | Vested Percentage of Inducement Grant* |

| ˂$60.00 | 0% |

| $60.00 | 50% |

| $100.00 | 100% |

| $160.00 | 150% |

>$200.00 | 200% |

*To be calculated based on linear interpolation between targets.

b.Forfeiture. Subject to Section 3(c) and Section 3(d), upon Participant’s Termination for any reason prior to the last day of fiscal 2026, all PSUs shall be immediately forfeited.

c.Change in Control. This Section 3(c) shall apply if there is a Termination of Participant’s employment (i) by the Company other than for Cause, death or Disability or (ii) by Participant for Good Reason (as defined in the Employment Agreement), in each case, either (A) during the one-year period following a Change in Control or (B) during the six (6) month period preceding a Change in Control (a "Qualifying Termination"). If any Qualifying Termination described in this Section 3(c) occurs, Participant (or Participant’s estate, if Participant dies after such Termination and execution of a release but before receiving such amount) shall receive immediate accelerated vesting of the PSUs based on the greater of (I) the highest volume-weighted average closing price per share of Common Stock as published by Bloomberg, L.P. and as measured over any sixty (60) consecutive trading day period between the Grant Date and the date of the consummation of the Change in Control and (II) the Change in Control Price; provided, however, that (x) upon a Change in Control on or prior to the first anniversary of the Grant Date, Participant, in the event of a Qualifying Termination, shall receive immediate accelerated vesting of the PSUs based on no less than the Target Stock Price, and (y) upon a Change in Control between the first anniversary of the Grant Date and the second anniversary of the Grant Date, Participant, in the event of a Qualifying Termination, shall receive immediate accelerated vesting of the PSUs based on no less than an Average Stock Price of $60.00. The award will be paid as soon as practicable following the date on which Participant delivers to the Company and does not revoke a general release of claims in favor of the Company in a form reasonably satisfactory to the Company or, if later, the date of the consummation of the Change in Control. In the event following a Change in Control, the PSUs are to be settled in equity securities of the acquiror in such Change in Control (or its Affiliate or successor) or property other than cash, Participant may elect to satisfy applicable withholding taxes through a net settlement of the applicable equity securities or property.

d.Death or Disability. In the event of Participant’s Termination due to (i) Participant’s death or (ii) Participant’s Disability, in each case, prior to the last day of fiscal 2026, Participant (or Participant’s estate, in the event of Participant’s Termination due to Participant’s death) shall receive immediate accelerated vesting of the PSUs based on the Target Stock Price. “Target Stock Price” means an Average Stock Price of $100.00.

e.Effect of Detrimental Activity. For the avoidance of doubt, Section 10.4 of the Plan, regarding Detrimental Activity, shall apply to the PSUs.

f.Recoupment. For the avoidance of doubt, Section 14.23 of the Plan, regarding recoupment and clawback of Awards under the Plan, shall apply to the PSUs.

4.Delivery of Shares.

a.General. Subject to the terms of the Plan, the Company shall deliver to Participant on the applicable vesting date the number of shares of Common Stock equal to the portion of the PSUs that vested on such date. Any PSUs that do not vest in accordance with Section 3 shall be forfeited for no consideration. In no event shall Participant be entitled to receive any shares with respect to any

unvested or forfeited portion of the PSUs. In the event of a distribution in connection with Participant’s Termination, such distribution may be delayed pursuant to Section 14.16 of the Plan if Participant is a “specified employee” at the time of such Termination.

b.Fractional Shares. In lieu of delivering any fractional shares of Common Stock to Participant pursuant to this Agreement, the Company shall round down for fractional amounts less than one-half and round up for fractional amounts equal to or greater than one-half. No cash settlements shall be made with respect to fractional shares eliminated by rounding.

5.Dividends and Other Distributions. Participant, as a holder of PSUs, shall be entitled to receive all dividends and other distributions paid with respect to the shares of Common Stock underlying the PSUs; provided, that, any such dividends or other distributions shall be subject to the same vesting requirements as the underlying PSUs not to exceed 100% of such dividends, and shall be paid at the time such PSUs become vested pursuant to Section 3 above; and, provided, further, that such dividends or distributions shall be accumulated and deemed reinvested in additional shares of Common Stock based on the Fair Market Value of Common Stock at the time of the dividend or distribution and shall be paid only in shares of Common Stock. Any such shares shall be subject to the same restrictions on transferability and forfeitability as the PSUs with respect to which they were paid.

6.Non-transferability. Neither the PSUs nor any rights or interests with respect thereto shall be sold, exchanged, transferred, assigned, or otherwise disposed of in any way by Participant (or any beneficiary(ies) of Participant), other than by testamentary disposition by Participant or the laws of descent and distribution. Any attempt to sell, exchange, transfer, assign, pledge, encumber, or otherwise dispose of or hypothecate the PSUs in any way, or the levy of any execution, attachment, or similar legal process upon the PSUs contrary to the terms of this Agreement shall be null and void and without legal force or effect.

7.Governing Law. All questions concerning the construction, validity, and interpretation of this Agreement shall be governed by, and construed in accordance with, the laws of the State of Delaware, without regard to the choice of law principles thereof.

8.Withholding of Tax. The Company shall have the power and the right to deduct or withhold, or require Participant to remit to the Company, an amount sufficient to satisfy any federal, state, local, and foreign taxes of any kind (including Participant’s FICA and SDI obligations) which the Company, in its sole discretion, deems necessary to be withheld or remitted to comply with the Code or any other applicable law, rule, or regulation with respect to the PSUs and, if Participant fails to do so, the Company may otherwise refuse to issue or transfer any shares of Common Stock otherwise required to be issued under this Agreement. Any statutorily required minimum withholding obligation with regard to Participant may, unless not permitted by the Committee, be satisfied by reducing the amount of cash or shares of Common Stock otherwise deliverable to Participant hereunder, and any additional tax withholding up to the maximum permissible withholding may be satisfied similarly provided such reduction or shares would not cause adverse accounting or tax consequences to the Company.

9.Entire Agreement; Amendment. This Agreement, together with applicable terms of the Plan, contains the entire agreement between the parties hereto with respect to the subject matter contained herein, and supersedes all prior agreements or prior understandings, whether written or oral, between the parties relating to such subject matter. The Committee shall have the right to modify or amend this Agreement from time to time in accordance with and as provided in the Plan. This Agreement may also be modified or amended by a writing signed by both the Company and Participant. The Company shall give written notice to Participant of any such modification or amendment of this Agreement as soon as practicable after the adoption thereof.

10.Notices. Any notice hereunder by Participant shall be given to the Company in writing and such notice shall be deemed duly given only upon receipt thereof by the General Counsel of the Company. Any notice hereunder by the Company shall be given to Participant in writing and such notice shall be deemed duly given only upon receipt thereof at such address as Participant may have on file with the Company.

11.No Right to Employment. Any questions as to whether and when there has been a Termination and the cause of such Termination shall be determined in the sole discretion of the Company. Nothing in this Agreement shall interfere with or limit in any way the right of the Company or its Affiliates to terminate Participant’s employment or service at any time, for any reason, and with or without cause.

12.Transfer of Personal Data. Participant authorizes, agrees, and unambiguously consents to the transmission by the Company (or any Affiliate) of any personal data information related to the PSUs for legitimate business purposes (including the administration of the Plan). This authorization and consent is freely given by Participant.

13.Compliance with Laws. The grant of the PSUs and the issuance of any shares of Common Stock underlying the PSUs shall be subject to, and shall comply with, any applicable requirements of any foreign and U.S. federal and state securities laws, rules, and regulations (including the Exchange Act and the Securities Act) and any other law or regulation applicable thereto. The Company shall not be obligated to grant the PSUs or issue any of share of Common Stock in connection with the PSUs if such grant or issuance would violate any such requirements.

14.Binding Agreement; Assignment. This Agreement shall inure to the benefit of, be binding upon, and be enforceable by the Company and its successors and assigns. Participant shall not assign (except as provided by Section 6 above) any part of this Agreement without the prior express written consent of the Company.

15.Headings. The titles and headings of the various sections of this Agreement have been inserted for convenience of reference only and shall not be deemed to be a part of this Agreement.

16.Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed to be an original, but all of which shall constitute one and the same instrument.

17.Further Assurances. Participant shall do and perform (or shall cause to be done and performed) all such further acts and shall execute and deliver all such other agreements, certificates, instruments, and documents as the Company reasonably may request in order to carry out the intent and accomplish the purposes of this Agreement.

18.Severability; Waiver. The invalidity or unenforceability of any term of this Agreement in any jurisdiction shall not affect the validity, legality, or enforceability of the remainder of this Agreement in such jurisdiction or the validity, legality, or enforceability of any term of this Agreement in any other jurisdiction, it being intended that all rights and obligations of the parties hereunder shall be enforceable to the fullest extent permitted by law. The waiver by any party to this Agreement of a breach of any term of the Agreement shall not operate or be construed as a waiver of any other subsequent breach.

19.Acquired Rights. Participant acknowledges and agrees that: (i) the Company may terminate or amend the Plan at any time; (ii) the grant of the PSUs is completely independent of any other award or grant and is made at the sole discretion of the Company; (iii) no past grants or awards (including the PSUs) give Participant any right to any grants or awards in the future whatsoever; and (iv) any benefits granted under this Agreement are not part of Participant’s ordinary salary, and shall not be considered as part of such salary in the event of severance, redundancy, or resignation.

20.Electronic Delivery. The Company may deliver any documents related to current or future participation in the Plan by electronic means. Participant consents to receive those documents by electronic delivery and to participate in the Plan through any on-line or electronic system established and maintained by the Company or a third party designated by the Company.

By signing below, Participant agrees that the PSUs are granted under and governed by the terms of this Agreement, as of the Grant Date.

PARTICIPANT

Sign name: /s/ Stewart Glendinning

Print name: Stewart Glendinning

EXPRESS, INC.

Sign name: /s/ Mike Reese

Print name: Mike Reese

Title: Chief Human Resources Officer

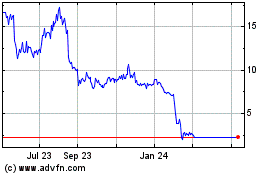

Express (NYSE:EXPR)

Historical Stock Chart

From Apr 2024 to May 2024

Express (NYSE:EXPR)

Historical Stock Chart

From May 2023 to May 2024