0001558740

false

0001558740

2023-09-28

2023-09-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report: September 28, 2023

(Date of earliest event reported)

Winvest Group Ltd.

(Exact name of registrant as specified in its charter)

|

Nevada |

|

000-56204 |

|

27-2052033 |

| (State of Incorporation) |

|

Commission File Number |

|

(IRS EIN) |

50 West Liberty Street, Suite 880

Reno, NV 89501

(Address of principal executive offices)

(775) 996-0288

(Registrant’s telephone number, including area code)

(Former name, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter):

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of exchange on which Registered. |

| Winvest Group Ltd, Common Stock |

|

WNLV |

|

OTC Markets: PINK |

|

Item 1.01 |

Entry into a Material Definitive Agreement |

On September 28, 2023, Winvest Group Ltd, a Nevada corporation (the “Company”) entered into a Securities Exchange Agreement (the “Agreement”) with Infinity Fund Australia Pty Ltd, an Australian corporation (“IFA”). Pursuant to the terms of the Agreement, the Company acquired 800,000 shares IFA Series A Preferred stock in exchange for 800,000 shares of WNLV Common stock registered under the S-1 Registration Statement declared effective on July 20, 2023. The share exchange was valued at $1,200,000 ($1.50 per share) and resulted in the Company owning less than 20% of IFA.

In addition to the terms set forth above, the Agreement grants IFA the option to exchange up to an additional 9,200,000 shares of its Series A Preferred stock for an equivalent number of shares of the Company’s Common stock. This option may be exercised by IFA at any time, by written notice to the Company, so long as the Company’s S-1 Registration Statement remains effective and IFA’s ownership of the Company does not exceed 4.99% as a result of the share exchange. Furthermore, the Agreement grants IFA (i) the right to repurchase its Series A Preferred stock from the Company at a purchase price to be determined by IFA’s valuation at the time of repurchase; and (ii) anti-dilution protection in the event the Company issues any shares of its Common stock below $1.50 per share.

A copy of the Agreement is attached as Exhibit 9.1 and incorporated by reference therein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Winvest Group Ltd. |

| |

|

| Dated: October 10, 2023 |

By: |

/s/

Jeffrey Wong |

| |

|

Jeffrey Wong, CEO |

Exhibit 9.1

SECURITIES EXCHANGE AGREEMENT

THIS SECURITIES EXCHANGE AGREEMENT (the “Agreement”) is made as of 28th day of Sept 2023, among (i) Winvest Group Ltd. (the “Company”), a company incorporated under the law of the State of Nevada, and (ii) Infinity Fund Australia Pty Ltd, a company incorporated under the law of Australia. (the “IFA”).

WHEREAS, Winvest Group Ltd. is an investment holding company specifically focused on media and entertainment, production and filming, as well as marketing and distribution for all projects on domestic and/or international streaming platforms and media channels.

WHEREAS, Infinity Fund Australia Pty Ltd is an independent, privately held alternative investment firm in Melbourne, Australia.

WHEREAS, the Company desire to exchange their registered shares of WNLV, for shares of Preferred A Class shares of IFA, and IFA has agreed to offer the IFA Shares (as defined below) in connection with such exchange, upon the terms and conditions set forth in this Agreement.

WHEREAS, for United States federal income tax purposes, it is intended that the Exchange does not result gaining control (80%), the Company may recognize capital gain or loss from the transaction.

WHEREAS, following the Exchange (as defined below), the Company will own 800,000 Preferred A Class shares of IFA, and IFA will own 800,000 registered common shares of the Company.

WHEREAS, the Company grants IFA the option to exchange, and upon the basis of the representations and warranties and subject to the terms and conditions herein set forth, additional 9,200,000 registered common shares of the Company, for shares of Preferred A Class shares of IFA.

This option may be exercised by IFA at any time, by written notice to the company as far as the Company’s S1 registration remains effective, provided the aggregate IFA shareholding of the Company is no more than 4.99% of the Company before or after the share issuances.

Exchange. On the terms and subject to the conditions set forth in this Agreement, at the Closing

|

(i) |

The Company will issue, and transfer to IFA, free and clear of all liens, pledges, encumbrances, changes, restrictions or known claims of any kind, nature or description, and IFA will purchase and accept from the Company, eight hundred thousand (800,000) newly issued and outstanding shares of registered common stock of WNLV, (the “WNLV Shares”), at price of USD 1.5/Share |

and

|

(ii) |

in exchange for the issue and transfer of such securities by the Company, IFA will issue and transfer to the Company, and the Company will purchase and accept from IFA, eight hundred thousand (800,000) shares of newly-issued shares of Preferred A Class shares of IFA, (the “IFA Shares”), at price of USD 1.5/Share |

|

2. |

Deliveries at or Prior to Closing |

2.1 Prior to acceptance of this Agreement by the Company, IFA must complete, sign and return to the Company, an executed copy of this Agreement.

2.2 IFA shall complete, sign and return to the Company as soon as possible, on request by the Company, any documents, questionnaires, notices and undertakings as may be required by regulatory authorities or by applicable law.

2.3 The Company shall deliver to IFA the following:

|

(a) |

a counterpart of this Agreement, duly executed by an authorized signatory of the Company; |

|

(b) |

within ten (10) business days of the Closing Date (as defined below), a certificate or evidence of electronic book entry representing the Shares in the amount set forth on the signature page hereto. |

3.1 The Company shall authorise and reserve, Form S-1 registered common stock that was in effect on July 21st 2023, of the Company, $0.001 par value per share, and in an amount of 800,000 shares (the “Shares”) to IFA, on or before Oct 6th, 2023, or on a such date to be mutually agreed upon by the Company and the Company (the “Closing Date”),

3.2 The Company shall issue the Shares to IFA immediately upon receiving NOTICE OF ISSUANCE from IFA, or in compliance with terms and conditions outlined in Exhibit C of the contract.

3.3 IFA shall authorise and issue, ordinary stock of IFA, that is registered with Australian Securities & Investment Commission, and in an amount of 800,000 Preferred A Class shares (the “Shares”) to the Company, on or before Oct 6th, 2023, or on a such date to be mutually agreed upon by IFA and the Company (the “Closing Date”),

4.1 Upon acceptance of this Agreement, the obligations of the Company to issue the Shares on the Closing Date are subject to the following conditions:

|

(a) |

that all of the representations and warranties of IFA made in this Agreement are accurate in all material respects when made and on the Closing Date; and |

|

(b) |

that all of the obligations, covenants and agreements of IFA required to be performed at or prior to the Closing Date shall have been performed. |

4.2 The obligations of IFA hereunder to make issuances on the Closing Date are subject to the following conditions:

|

(a) |

that all of the representations and warranties of the Company made in this Agreement are accurate in all material respects when made and on the Closing Date; and |

|

(b) |

that all of the obligations, covenants and agreements of the Company required to be performed at or prior to the Closing Date shall have been performed. |

|

5. |

IFA’s Right to Buy back IFA Shares |

5.1 Within the next thirty six (36) months of the Closing Date, IFA shall be granted a right to buy back IFA shares from the Company, at a purchase price equals to the price set forth in connection with IFA’s latest valuation.

6.1 In

the event the Company sells additional shares for consideration per share less than the consideration per share paid by IFA (as adjusted

for stock splits, stock dividends, reclassifications, reorganizations or other similar transactions), then the Company shall issue IFA,

concurrently with such issue, the number of shares of common stock to ensure that IFA has the number of shares that it would have

had if it purchased common stock in such subsequent offering at such lower purchase price. However, such adjustment shall not apply

to issuances of (i) shares issued upon exercise of options, warrants or convertible securities existing on the Closing Date; (ii) shares

or options, warrants or other rights issued to employees, consultants or directors in accordance with plans, agreements or similar arrangements;

(iii) shares issued as a dividend or for which adjustment is otherwise made pursuant to the certificate of incorporation (e.g.,

stock splits); (iv) shares issued in connection with a registered public offering; (v) shares issued or issuable pursuant to an acquisition

of another corporation or a joint venture agreement approved by the board; (vi) shares issued or issuable to banks, equipment lessors

or other financial institutions pursuant to debt financing or commercial transactions approved by the board; (vii) shares issued or issuable

in connection with any settlement approved by the board; (viii) shares issued or issuable in connection with sponsored research, collaboration,

technology license, development, OEM, marketing or other similar arrangements or strategic partnerships approved by the board; or (ix)

shares issued to suppliers of goods or services in connection with the provision of goods or services pursuant to transactions approved

by the board.

|

7. |

Representations, Warranties, Acknowledgements and Covenants of IFA |

7.1 IFA hereby acknowledges and agrees as of the date hereof and as of the Closing Date that:

|

(a) |

the Shares have been registered under the Securities Act of 1933, as amended, or under any state securities or “blue sky” laws of any state of the United States or any other jurisdiction; |

|

(b) |

the decision to execute this Agreement and acquire the Shares hereunder has not been based upon any oral or written representation (other than representations set out in this Agreement) as to fact or otherwise made by or on behalf of the Company; |

|

(c) |

there are risks associated with an investment in the Company and the Shares; |

|

(d) |

it has received all the information it considers necessary or appropriate for purposes of deciding whether to purchase the Shares. IFA further represents that it has had an opportunity to ask questions and receive answers from the Company regarding the terms and conditions of the Shares and regarding the business, properties, prospects and financial condition of the Company, and to obtain additional information (to the extent the Company possessed such information or could acquire it without unreasonable effort or expense) necessary to verify the accuracy of any information furnished to it or to which it had access; |

|

(e) |

it has been advised to consult its own legal, tax and other advisors with respect to the merits and risks of an investment in the Shares and with respect to applicable resale restrictions; |

|

(f) |

it understands that the Company is making no representations and warranties regarding tax consequences for your investment in the Shares, the U.S. Foreign Corrupt Practices Act or the securities law of the home or residential jurisdiction of any IFA. |

7.2 IFA hereby represents and warrants to, and covenants with, the Company (which representations, warranties and covenants shall survive the Closing) as of the date hereof and as of the Closing Date that:

|

(a) |

it has the legal capacity and competence to enter into and execute this Agreement and to take all actions required hereby and, if IFA is a corporation, it is duly incorporated and validly existing under the laws of its jurisdiction of incorporation and all necessary approvals by its directors, shareholders and others have been obtained to authorize execution and performance of this Agreement on its behalf; |

|

(b) |

the entering into of this Agreement and the transactions contemplated hereby do not result in the violation of any of the terms and provisions of any law or regulation applicable to IFA or of any agreement, written or oral, to which IFA may be a party or by which IFA is or may be bound; |

|

(c) |

IFA has duly executed and delivered this Agreement and it constitutes a valid and binding agreement of IFA enforceable against IFA in accordance with its terms; |

|

(d) |

IFA is not a “U.S. Person” as defined in Rule 902 under the 1933 Act and is resident in the jurisdiction set out under the heading “Name and Address of IFA” on the signature page of this Agreement; |

|

(e) |

At the time IFA executed and delivered this Agreement, IFA was outside the United States and is outside of the United States as of the date of the execution and delivery of this Agreement; |

|

(f) |

IFA is acquiring the Shares for its own account and not on behalf of any U.S. person, and the sale has not been pre-arranged with a IFA in the United States; |

|

(g) |

IFA (i) has such knowledge and experience in business matters as to be capable of evaluating the merits and risks of its prospective investment in the Shares; and (ii) has the ability to bear the economic risks of its prospective investment and can afford the complete loss of such investment; |

|

(h) |

IFA is not aware of any advertisement of any of the Shares and is not acquiring any of the Shares as a result of any form of general solicitation or general advertising including advertisements, articles, notices or other communications published in any newspaper, magazine or similar media or broadcast over radio or television, or any seminar or meeting whose attendees have been invited by general solicitation or general advertising; |

|

(i) |

no person has made any written or oral representations to IFA: |

|

(i) |

that any person will resell or repurchase any of the Shares; |

|

(ii) |

that any person will refund the purchase price of any of the Shares; or |

|

(iii) |

as to the future price or value of any of the Shares; and |

|

(j) |

IFA will indemnify and hold harmless the Company and, where applicable, its directors, officers, employees, agents, advisors and shareholders, from and against any and all loss, liability, claim, damage and expense whatsoever (including, but not limited to, any and all fees, costs and expenses whatsoever reasonably incurred in investigating, preparing or defending against any claim, lawsuit, administrative proceeding or investigation whether commenced or threatened) arising out of or based upon any representation or warranty of IFA contained herein or in any document furnished by IFA to the Company in connection herewith being untrue in any material respect or any breach or failure by IFA to comply with any covenant or agreement made by IFA to the Company in connection therewith. |

7.3 Between the date of this Agreement and the Closing, IFA shall notify the Company if any of the above representations and warranties ceases to be true.

7.4 IFA acknowledges that the representations and warranties contained herein are made by it with the intention that they may be relied upon by the Company and its legal counsel in determining such IFA’s eligibility to purchase the Shares for which it is subscribing under applicable securities legislation. IFA further agrees that by accepting delivery of the certificates representing the Shares on the Closing Date, it will be representing and warranting that the representations and warranties contained herein are true and correct as at the Closing Date with the same force and effect as if they had been made by IFA at the Closing Date and that they will survive the transaction by IFA of Shares and will continue in full force and effect notwithstanding any subsequent disposition by IFA of such Shares.

|

8. |

Representations and Warranties of the Company |

8.1 The Company acknowledges and agrees that IFA is entitled to rely upon the representations and warranties of the Company, contained in this Agreement and further acknowledges that IFA will be relying upon such representations and warranties in purchasing the Shares. The Company represents and warrants as follows:

|

(a) |

The Company is duly incorporated, validly existing and in good standing under the laws of the State of Nevada. |

|

(b) |

The Company has the requisite power and authority to own and use its properties and assets and to carry on its business as currently conducted. |

|

(c) |

The Company is not in violation or default of any of the provisions of its articles of incorporation or bylaws. The Company is duly qualified to conduct its business and is in good standing as a foreign corporation or other entity in each jurisdiction in which the nature of the business conducted or property owned by it makes such qualification necessary, except where the failure to be so qualified or in good standing, as the case may be, could not reasonably be expected to result in (i) a material adverse effect on the legality, validity or enforceability of this Agreement, (ii) a material adverse effect on the results of operations, assets, business or financial condition of the Company, taken as a whole, or (iii) a material adverse effect on the Company’s ability to perform in any material respect on a timely basis its obligations under this Agreement (any of (i), (ii) or (iii) being hereafter referred to as a “Material Adverse Effect”), and no proceeding has been instituted in any such jurisdiction revoking, limiting or curtailing or seeking to revoke, limit or curtail such power and authority or qualification. |

|

(d) |

The Company has the requisite corporate power and authority to enter into and to consummate the transactions contemplated by this Agreement and to carry out its obligations hereunder. The execution and delivery of this Agreement by the Company and the consummation by it of the transactions contemplated hereby have been duly authorized by all necessary action on the part of the Company and no further corporate authorization is required by the Company in connection therewith. |

|

(e) |

Upon delivery, this Agreement will have been duly executed by the Company and will constitute the valid and binding obligation of the Company enforceable against the Company in accordance with its terms except (i) as limited by applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting enforcement of creditors’ rights generally and (ii) as limited by laws relating to the availability of specific performance, injunctive relief or other equitable remedies. |

|

(f) |

The execution and delivery of this Agreement and the performance by the Company of the obligations imposed on it in this Agreement, including the issuance and sale of the Shares, do not and will not (i) conflict with or violate any provision of the Company’s certificate or articles of incorporation, bylaws or other organizational or charter documents, or (ii) conflict with, or constitute a default (or an event that with notice or lapse of time or both would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation (with or without notice, lapse of time or both) of, any material agreement, credit facility, debt or other instrument (evidencing a Company debt or otherwise) or other agreement to which the Company is a party or by which any material property or material asset of the Company, or (iii) conflict with or result in a violation of any law, rule, regulation, order, judgment, injunction, decree or other restriction of any court or governmental authority to which the Company is subject, or by which any material property or material asset of the Company is bound, except, in each case, as could not reasonably be expected to result in a Material Adverse Effect. |

|

(g) |

The Company is not required to obtain any consent, waiver, authorization or order of, give any notice to, or make any filing or registration with, any court or other federal, state, local or other governmental authority or other person in connection with the execution, delivery and performance by the Company of this Agreement. |

|

(h) |

The Shares are duly authorized and, when issued and paid for in accordance with this Agreement, will be validly issued as fully paid and non-assessable, free and clear of all liens and encumbrances other than restrictions provided for in this Agreement and applicable law. |

|

9. |

Legending of Subject Securities. |

9.1 IFA hereby acknowledges that upon the issuance thereof, under the applicable securities laws and regulations, any certificates representing the Shares are free from restrictive legend pursuant to applicable laws and are free trading immediately.

10.1 IFA acknowledges and agrees that all costs and expenses incurred by IFA (including any fees and disbursements of any special counsel retained by IFA) relating to the purchase of the Shares shall be borne by IFA.

11.1 This Agreement is governed by the laws of the State of Victoria and the Federal laws of Australia applicable therein.

12.1 This Agreement, including without limitation the representations, warranties and covenants contained herein, shall survive and continue in full force and effect and be binding upon the parties hereto notwithstanding the completion of the purchase of the Shares by IFA pursuant hereto.

13.1 This Agreement is not transferable or assignable.

14.1 If any provision of this Agreement is held to be invalid or unenforceable in any respect, the validity and enforceability of the remaining terms and provisions of this Agreement shall not in any way be affected or impaired thereby and the parties will attempt to agree upon a valid and enforceable provision that is a reasonable substitute therefor, and upon so agreeing, shall incorporate such substitute provision in this Agreement.

15.1 Except as expressly provided in this Agreement and in the agreements, instruments and other documents contemplated or provided for herein, this Agreement contains the entire agreement between the parties with respect to the sale of the Shares and there are no other terms, conditions, representations or warranties, whether expressed, implied, oral or written, by statute or common law, by the Company or by anyone else.

16.1 All notices and other communications hereunder shall be in writing and shall be deemed to have been duly given at the date received if mailed or transmitted by any standard form of telecommunication (including email, but not including facsimile). Notices to IFA shall be directed to the address on the signature page of this Agreement and notices to the Company shall be directed to it at

MS. Ting Yin

Infinity Fund Australia Pty Ltd, (IFA)

2205, 18 Yarra St

South Yarra, VIC, 3141, Australia

Email: ting@infinityfund.com.au

|

17. |

Counterparts and Electronic Means |

17.1 This Agreement may be executed in any number of counterparts, each of which, when so executed and delivered, shall constitute an original and all of which together shall constitute one instrument. Delivery of an executed copy of this Agreement by electronic facsimile transmission or other means of electronic communication capable of producing a printed copy will be deemed to be execution and delivery of this Agreement as of the date hereinafter set forth.

18.1 No provision of this Agreement may be waived or amended except in a written instrument signed, in the case of an amendment, by the Company and IFA or, in the case of a waiver, by the party against whom enforcement of any such waiver is sought. No waiver of any default with respect to any provision, condition or requirement of this Agreement shall be deemed to be a continuing waiver in the future or a waiver of any subsequent default or a waiver of any other provision, condition or requirement hereof, nor shall any delay or omission of either party to exercise any right hereunder in any manner impair the exercise of any such right.

|

19. |

Exhibits, and if any, Additional Promises and Representations: |

19.1 EXHIBIT A. The Company hereby represents that attached is a letter of confirmation and representation by the individual who is the chief principal officer of the COMPANY executed or to be executed and delivered this date.

19.2 EXHIBIT B. The Company hereby represents that attached is a duly authorized and effective irrevocable resolution of the Board of Directors of the COMPANY confirming this Agreement as valid and binding on the COMPANY, executed or to be executed this date. (Whether or not attached, or executed, the Company represents all corporate authorization has been obtained).

19.3 EXHIBIT C. Form of Issuance

19.4 EXHIBIT D. Irrevocable Letter from Transfer Agent

19.5 EXHIBIT E. Transfer Agent Share Statement

[SIGNATURE PAGES TO FOLLOW]

IN WITNESS WHEREOF IFA has duly executed this Securities Exchange Agreement as of the date of acceptance by the Company.

| |

|

|

(Name of IFA – Please type or print) |

| |

|

| |

|

|

(Signature and, if applicable, Office) |

| |

|

| |

|

|

(Address of IFA) |

| |

|

| |

|

|

(City,

State/Province, Postal Code of IFA) |

| |

|

| |

|

|

(Country of IFA) |

A C C E P T A N C E

The above-mentioned Securities Exchange Agreement in respect of the Shares is hereby accepted by Winveset Group Ltd.

DATED at ____________________________, 2023.

Winvest Group Ltd.

| By: |

|

|

| Name: |

|

|

| Title: |

Chief Executive Officer |

|

EXHIBIT

A

Representation of Individual Officer of Winvest Group Ltd,

VIA ELECTRONIC MAIL

Infinity Fund Australia Pty Ltd

Attn: Ting Yin, Managing Director

2205, 18 Yarra St, South Yarra, VIC, 3141, Australia

|

Re: |

Securities Exchange Agreement Between Winvest Group Ltd. and Infinity Fund Australia Pty Ltd. |

Dated Sept 28th, 2023

Dear Ting:

In connection with the above referenced agreement and exhibits and related agreements and instruments, herein the Agreement, and any present and any future issuances requests of Infinity Fund Australia Pty Ltd. (“IFA”) we irrevocably confirm:

1. Winvest Group Ltd. (“WNLV”) is not, and has not been, a shell issuer as described in Rule 144 promulgated with reference to the Securities Act of 1933, as amended (the “Securities Act”) nor is or was a “shell” as otherwise commonly understood;

2. Winvest Group Ltd is, unless noted “Not Applicable,” subject to the reporting requirements of Section 13 or Section 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

3. Winvest Group Ltd has to the extent it has been subject to Exchange Act requirements for filing reports, filed all reports and other materials required to be filed by Section 13 or 15(d) of the Exchange Act, as applicable, during the preceding 12 months and or has filed with the trading exchange or over the counter disclosure system all such reports and information to be deeded current in all public reporting;

4. Winvest Group Ltd is now and will remain current with all obligations with its stock transfer agent and the U.S. Securities and Exchange Commission and the state/country of incorporation or will be in a timely fashion.

5. Any and all approvals needed in relation to the above referenced Agreement, this letter, for the assistance of our transfer agent, etc., is obtained. The Agreement reflects, among other things, issuance rights we otherwise offered to the non-affiliate investors.

Representations herein survive the issuance or closing of any instrument or matter, and we will cooperate as needed to give effect to and protect your rights including as to the transfer agent and you may rely upon these promises and representations.

EXHIBIT

B

Resolution approved by the Board of Directors of Winvest Group Ltd.

BOARD MINUTES FOR RESOLUTION MEETING OF DIRECTORS OF

Winvest Group Ltd.

The undersigned, being all of the directors of Winvest Group Ltd. a corporation of the State of Nevada, (the “Corporation”), do hereby authorize and approve the actions set forth in the following resolutions without the formally of convening a meeting, and do hereby consent to the following actions of this Corporation, which actions are hereby deemed affective as of the date hereof:

RESOLVED: that the officers of this Corporation are authorized and directed to enter into a Securities Exchange Agreement in the amount of 10,000,000 registered shares from Form S-1 registration that was in effect on July 21st, 2023, with Infinity Fund Australia Pty Ltd, dated Sept 28th, 2023, which allows IFA to Exchange shares from the company for shares, at a purchase price of US$1.5 per share.

RESOLVED: that the officers of this Corporation herby certify this corporation has never been a blank check shell; and

FURTHER RESOLVED, that each of the officers of the Corporation be, and they hereby are authorized and empowered to execute and deliver such documents, instruments and papers and to take any and all other action as they or any of them may deem necessary or appropriate of the purpose of carrying out the intent of the foregoing resolutions and the transactions contemplated thereby; and that the authority of such officers to execute and deliver any such documents, instruments and papers and to take any such other action shall be conclusively evidenced by their execution and delivery thereof or their taking thereof.

The undersigned, by affixing their signatures hereto, do hereby consent to, authorize and approve the foregoing actions in their capacity as a majority of the direction of Winvest Group Ltd.

Dated: Sept 28th, 2023

Signed:

Name:

Secretary or Chairman

Exhibit

C

NOTICE OF ISSUANCE

The undersigned hereby elects to registered shares to be issued under the Securities Exchange Agreement of Winvest Group Ltd. (“WNLV”) dated Sept 28th, 2023, 0.001 par value per share,(the “Common Stock”) according to the conditions hereof, as of the date written below. If shares are to be issued in the name of a person other than the undersigned, the undersigned will pay a reasonable transfer expense payable with respect thereto. No fee will be charged to IFA for any issuances, except for such transfer expense, if any.

| Company Name: |

Infinity Fund Australia Pty Ltd |

| Date to Effect Issuances: |

|

|

| Issuance Price: |

$

1.5/Share |

|

| Total Amount of Agreement to be issued: |

800,000 shares. |

|

| Remaining shares Balance after this issued: |

9,200,000 share |

|

Signature:

Director:

Infinity Fund Australia Pty Ltd

2205, 18 Yarra St, South Yarra, VIC, 3141

Australia

ACN: 671 062 276

Email: ting@infinityfund.com.au

EXHIBIT

D

Winvest Group Ltd

50 West Liberty Street, Suite 880, Reno, NV 89501

Pacific Stock Transfer Co. (a Securitize Company)

6725 Via Austi Parkway

Suite 300, Las Vegas, NV 89119

Ladies and Gentlemen:

Sep, 15th, 2023

Winvest Group Ltd. a Nevada corporation (the “Company”) and Infinity Fund Australia Pty Ltd. (the “IFA”) have entered into a Securities Exchange Agreement dated Sep 28th, 2023 (the “SPA”) providing for, among other things, the issuance of Form S-1 registered common stock that was in effect on July 21st 2023, of the Company, $0.001 par value per share, and in an amount of up to 10,000,000 shares (the “Shares”) at a purchase price of US$1.5 per share.

A copy of the Security Exchange Agreement is attached hereto. You should familiarize yourself with your issuance and delivery obligations, as Transfer Agent, contained therein. The shares to be issued are to be booked in the names of the registered holder of the securities submitted for issuance.

You are hereby irrevocably authorized and instructed to reserve a sufficient number of shares of registered common stock (“Common Stock”) of the company (initial shares) for issuance upon full issuance in accordance with the terms thereof. The amount of registered Common Stock to be initially reserved is 10 Million shares. The reserve is in addition to any share issuance pursuant to the Securities Exchange dated Sept 28th, 2023.

The ability to issue the shares in a timely manner is a material obligation of the Company pursuant to the Securities Exchange Agreement. Your firm is hereby authorized and instructed to issue shares of registered Common Stock of the Company (without any restrictive legend) to IFA. (A) upon your receipt from IFA of: (i) a notice of Issuance (“Issuance Notice”) executed by IFA;(ii) the number of shares to be issued is less than 4.99% of the total issued common stock of the Company.

Your firm will not delay in processing any Issuance notices owing to the fact the Company is in arrears of its fees and other monies owed to your firm, provided that IFA agrees that each time a Issuance Notice is delivered to your firm, and the Company is in arrears or has otherwise been placed on financial hold, the Company authorizes your firm to notify IFA that the Company is currently on financial hold and IFA agrees to pre-pay the full cost of processing the issuance notice. The fees charged will be the normal fees charged according to the schedule then in force.

The Company hereby requests that your firm act immediately, without delay and with the need for by the Company with respect to the issuance of Common Stock pursuant to any Issuance Notices received from IFA.

The Company shall indemnify you and your officers, directors, principals, partners, agents and representatives, and hold each of them harmless from and against any and all loss, liability, damage, claim or expense (including the reasonable fees and disbursements of its attorneys) incurred by or asserted against you or any of them arising out of or in connection with the instructions set forth herein, the performance of your duties hereunder and otherwise in respect hereof, including the costs and expenses of defending yourself or themselves against any claim or liability hereunder, except that the Company shall not be liable hereunder as to matters in respect of which it is determined that you have acted with gross negligence or in bad faith. IFA shall have no liability to the Company in respect to any action taken or any failure to act in respect of this if such action was taken or omitted to be taken in good faith, and you shall be entitled to rely in this regard on the advice of counsel.

The Board of Directors of the Company has approved the foregoing instructions and does hereby extend the Company’s agreement to indemnify your firms for all loss, liability or expense in carrying out the authority and direction herein contained on the terms herein set forth.

The Company agrees that in the event that you resign as the Company’s transfer agent, the Company shall engage a suitable replacement transfer agent that will agree to serve as transfer agent for the Company and be bound by the terms and conditions of these Instructions within five (5) business days.

IFA is intended to be and is a third party beneficiary hereof, and no amendment or modification to the instructions set forth herein may be made without the consent of IFA.

IFA and Company expressly understand and agree that nothing in this Transfer instruction Agreement shall require or be construed in any way to require the transfer agent to do, take or not do take any action that would be contrary to any Federal or State law, rule, or regulation including but expressly not limited to both the Securities Act of 1933 and the Securities and Exchange Act of 1934 as amended and the rules and regulations promulgated there under.

Very truly yours,

Winvest Group Ltd.

Name:

Title:

Acknowledged and Agreed:

TA

By:

Name:

Title:

EXHIBIT

E

VIA ELECTRONIC MAIL

Infinity Fund Australia Pty Ltd.

Unit 2205, 18 Yarra St, South Yarra

VIC, Australia, 3141

| Re: | Share

Structure of Winvest Group Ltd. |

To whom it may concern:

The

purpose of this letter is to confirm the share structure of Winvest Group Ltd.. (the “Company”). By execution below, I hereby

verify that the information provided is current and accurate as of the date of this document.

Shares authorized: __________________ issued and outstanding: ___________________________

Furthermore, prior to finalizing this issuance I agree to provide Infinity Fund Australia Pty Ltd. (via email) with:

i) A copy of the certificate(s) to be issued pursuant to the Agreement(s) as of the date Hereof (if physical shares are to be issued in lieu of DWAC);

ii) The FedEx Priority Overnight tracking number (or a copy of the slip if available) for any physical certificate(s) to be issued.

iii) A transfer record showing the shares set in reserve for Infinity Fund Australia Pty Ltd.

| Very truly yours, |

| |

| |

|

| Name: |

|

|

| Title: |

|

|

| |

|

|

| |

|

|

| Acknowledged and Agreed: |

| |

| |

|

| Name: |

|

|

| Title: |

|

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

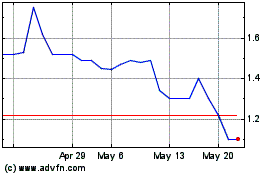

Winvest (PK) (USOTC:WNLV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Winvest (PK) (USOTC:WNLV)

Historical Stock Chart

From Apr 2023 to Apr 2024