0001610682false00016106822023-10-062023-10-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 6, 2023

USD Partners LP

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | | 001-36674 | | 30-0831007 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

811 Main Street, Suite 2800

Houston, Texas 77002

(Address of principal executive offices) (Zip Code)

(281) 291-0510

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Units Representing Limited Partner Interests | | USDP | | New York Stock Exchange |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 1.01 | Entry into a Material Definitive Agreement |

On October 6, 2023, USD Partners LP (the “Partnership”) entered into an agreement (the “Waiver Extension Agreement”) with (i) all the Lenders under the secured Credit Agreement (as amended from time to time, the “Credit Agreement”) among the Partnership, USD Terminals Canada ULC, an indirect, wholly-owned subsidiary of the Partnership (together with the Partnership, the “Borrowers”), the subsidiary guarantors party thereto, the lenders party thereto and Bank of Montreal, as administrative agent (the “Administrative Agent”), and (ii) the Administrative Agent.

As previously disclosed, on August 8, 2023, the Partnership entered into an amendment to the Credit Agreement (the “Fourth Amendment”), pursuant to which the Lenders agreed to forebear through and including October 10, 2023 (the “Expiration Date”), from exercising any rights or remedies arising from certain defaults or events of default asserted by the Administrative Agent, which the Partnership disputed, or certain prospective defaults or events of default under the Credit Agreement and other loan documents arising from, among other things, any failure to disclose certain events that give or may give rise to a Material Adverse Effect.

Pursuant to the Waiver Extension Agreement, the Lenders and Administrative Agent have agreed to, among other things, (i) extend the Expiration Date to November 3, 2023 (the “New Expiration Date”) and (ii) waive the event of default arising from the non-payment of the interest due on October 10, 2023 until the New Expiration Date. As a condition to the Waiver Extension Agreement, among other things, the Borrowers have agreed to terminate certain hedge agreements and swap contracts and apply all proceeds thereof to repayment of the obligations then outstanding under the Credit Agreement. In addition, the Waiver Extension Letter reduces the aggregate commitments under the Credit Agreement and the sublimit for letters of credit under the Credit Agreement, which reduced amounts are equal to outstanding borrowings. As provided for in the Fourth Amendment, the Partnership has agreed not to make any additional requests for new borrowings or letters of credit, or convert outstanding loans from one type to another, in each case under the Credit Agreement, which may further impact its liquidity. As of October 6, 2023, there was $195.9 million of borrowings outstanding under the Credit Agreement.

The above description of the terms of the Waiver Extension Agreement does not purport to be complete and is qualified in its entirety by the full text of the Waiver Extension Agreement, which is attached as an exhibit hereto and incorporated herein by reference, and the full text of the Fourth Amendment, which is attached as an exhibit to the Partnership’s Quarterly Report on Form 10-Q for the three months ended June 30, 2023. Capitalized terms used but not defined herein have the meaning set forth in the Waiver Extension Agreement. The above information is also qualified by reference to the “Risk Factors” provided in the Partnership’s Quarterly Report on Form 10-Q for the three months ended June 30, 2023, which shall be deemed updated for the information provided herein, and Annual Report on Form 10-K for the year ended December 31, 2022.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On October 9, 2023, the Partnership issued a press release announcing certain of the matters described in this Current Report on Form 8-K. A copy of this press release is attached hereto as Exhibit 99.1 to this Current Report. The information set forth in this Item 7.01 and in Exhibit 99.1 shall not be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | | |

Exhibit Number | | Description | | | |

| 10.1 | | | | | | |

| 99.1 | | | | | | |

| 104 | | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | USD Partners LP

(Registrant) |

| | |

| | By: | | USD Partners GP LLC, |

| | | | its general partner |

| | |

| Date: October 10, 2023 | | By: | | /s/ Adam Altsuler |

| | Name: | | Adam Altsuler |

| | Title: | | Executive Vice President, Chief Financial Officer |

Exhibit 10.1

Execution Version

FRE 408 -- Privileged Settlement Communication

AGREEMENT TO EXTEND TEMPORARY WAIVER PERIOD AND WAIVER OF EVENT OF DEFAULT FOR MISSED INTEREST PAYMENT

October 6, 2023

USD Partners LP

811 Main St. #2800

Houston, TX 77002

Attn: Adam Altsuler

Re: Agreement to Extend Temporary Waiver Period and Waiver of Event of Default for Missed Interest Payment (this “Agreement”)

Ladies and Gentlemen:

Reference is made to that certain Credit Agreement dated as of November 2, 2018, among USD Partners LP, a Delaware partnership, as a borrower (the “US Borrower”), USD Terminals Canada ULC, an unlimited liability company subsisting under the laws of the Province of British Colombia, Canada, as a borrower (the “Canadian Borrower”, and together with the US Borrower, the “Borrowers” and each a “Borrower”), the lenders party thereto, and Bank of Montreal as administrative agent (in such capacity, the “Administrative Agent”) (as amended by that certain Master Assignment, Assignment of Liens, and Amendment No. 1 to Amended and Restated Credit Agreement dated as of October 29, 2021, Amendment No. 2 to Amended and Restated Credit Agreement dated as of April 6, 2022, Amendment No. 3 to Amended and Restated Credit Agreement dated as of January 31, 2023, and Amendment No. 4 to Amended and Restated Credit Agreement dated as of August 8, 2023 (“Amendment No. 4”), and as further amended, restated, modified or otherwise supplemented from time to time prior to the date hereof, the “Credit Agreement”). Capitalized terms used herein and not otherwise defined herein shall have the respective meanings ascribed to them in the Credit Agreement.

A. The Borrowers and Guarantors have requested that the Expiration Date (as defined in Amendment No. 4) of October 10, 2023, be extended to November 3, 2023 (the “Extension Request”). Pursuant to the definition of the Expiration Date in Amendment No. 4, the Borrowers and the Guarantors, on the one hand, and the Administrative Agent and the Required Lenders, on the other hand, may extend the Expiration Date.

B. The Borrowers will fail to make the next interest payment due under the Credit Agreement on October 10, 2023 (the “Interest Payment”). Pursuant to the terms of the Credit Agreement, failure to make the Interest Payment will result in an Event of Default under Section 8.01(a)(ii) of the Credit Agreement (the “Interest Payment Default”). The Borrowers have requested that the Administrative Agent and the Lenders temporarily waive the Interest Payment Default. Each Borrower and each Guarantor hereby agrees that the Administrative Agent and the Lenders, absent the temporary waiver of the Interest Payment Default granted hereunder, have certain rights, remedies, powers and privileges provided to them under the Credit Agreement and the Loan Documents resulting from the occurrence of the Interest Payment Default, and that upon the Expiration Date, the Administrative Agent and the Lenders shall have the ability to exercise of any of such rights, remedies, powers and privileges resulting from the occurrence of the Interest Payment Default.

C. Each Borrower and each Guarantor hereby agrees that the Administrative Agent and the Lenders are entering into this Agreement in reliance on the representations and warranties herein by the Borrowers and the Guarantors.

1. Extension Request and Limited Waiver. At the request of the Borrowers and the Guarantors, and for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, and in consideration of the agreements herein contained, including the conditions precedent set forth in Section 5 below, the Administrative Agent and the Lenders hereby agree (a) to extend the Expiration Date to November 3, 2023, and (b) to waive the Interest Payment Default on a temporary basis until the Expiration Date (as extended herein) (the period from the Effective Date (defined below) until the Expiration Date shall herein be called, “Short Term Waiver Period”), INSOFAR AS AND ONLY FOR SO LONG AS no Default or Event of Default (other than the Interest Payment Default and the Specified Events of Default as defined in Amendment No. 4, together the “Subject Defaults”) has occurred and is continuing on the date hereof or at any time during the Short Term Waiver Period. The Lenders hereby direct the Administrative Agent to not take any action or enforce any remedies under the Loan Documents or applicable law against the Borrowers or Guarantors solely with respect to the Subject Defaults through the Expiration Date and the expiration of the Short Term Waiver Period. The Lenders shall not direct the Administrative Agent to take any action or enforce any remedies under the Loan Documents or applicable law against the Borrowers or Guarantors solely with respect to the Subject Defaults through the Expiration Date and the expiration of the Short Term Waiver Period.

2. Reduction of Commitments. In consideration for the Administrative Agent and the Lenders agreeing to the Extension Request and agreeing to a limited waiver of the Interest Payment Default for the Short Term Waiver Period, the Borrowers and the Guarantors hereby agree that as of the Effective Date (defined below) (a) the Aggregate Commitments shall be reduced as reflected on Schedule I attached hereto, and the Commitment of each Lender shall be in the amount set forth opposite its name on such Schedule I, (b) the Letter of Credit Sublimit amount and the L/C Issuer Sublimit amounts for each L/C Issuer shall be permanently reduced to zero, (c) the Swing Line Sublimit amount shall be permanently reduced to zero, and (d) any prepayment of principal (including any prepayment of principle resulting from the Hedge Terminations (defined below)) shall automatically reduce the Aggregate Commitments by such prepayment amount, and the Commitment of each Lender shall be reduced by such Lender’s Applicable Percentage of such prepayment amount. The amount of all outstanding Loans shall be reallocated among the Lenders in accordance with their respective Commitments. Schedule 2.01 of the Credit Agreement shall be amended and restated with Schedule I attached hereto.

3. [Reserved].

4. Termination of Hedge Agreements. In consideration for the Administrative Agent and the Lenders agreeing to the Extension Request and agreeing to a limited waiver of the Interest Payment Default for the Short Term Waiver Period, each of the Borrowers and Guarantors hereby consents and agrees to (i) the commencement of the termination of those certain Secured Hedge Agreements between such Borrower, Guarantor and U.S. Bank National Association listed on Schedule II attached hereto (the “Hedge Terminations”) or any other Swap Agreement of the Borrowers or the Guarantors with the corresponding swap counterparty, and (ii) consents and authorizes any Hedge Bank (including but not limited to U.S. Bank National Association) or any other swap counterparty to a Swap Contract to send the payment of all funds otherwise payable to the Borrowers or the Guarantors resulting from the Hedge Terminations or termination of other Swap Contract to the Administrative Agent. For the avoidance of doubt, all such funds shall be distributed to the Lenders in accordance with the terms and conditions of the Credit Agreement, as if an Event of Default has occurred and is continuing.

5. Conditions Precedent to Effectiveness. The effectiveness of this Agreement is subject to the satisfaction of the following conditions precedent (the first date of satisfaction of all such conditions herein, the “Effective Date”):

(a) The Administrative Agent shall have received duly executed counterparts of this Agreement from the Borrowers, the Guarantors, the Administrative Agent, and the Required Lenders.

(b) Each of the Borrowers and the Guarantors shall have confirmed and acknowledged to the Administrative Agent and the Lenders, that by its execution and delivery of this Agreement that they do hereby confirm and acknowledge to the Administrative Agent and the Lenders, that (i) the execution, delivery and performance of this Agreement has been duly authorized by all requisite corporate action on its part; (ii) the Credit Agreement and each other Loan Document to which it is a party constitute valid and legally binding agreements enforceable against it, in accordance with their respective terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer or other similar laws relating to or affecting the enforcement of creditors’ rights generally and by general principles of equity; (iii) after giving effect to this Agreement, the representations and warranties by the Borrowers or the Guarantors as applicable, contained in the Credit Agreement, Amendment No. 4 and in the other Loan Documents, to which it is a party, are true and correct on and as of the date hereof in all material respects as though made as of the date hereof; (v) all of its obligations under Section 5 of Amendment No. 4 are hereby ratified and confirmed by such Borrower or Guarantor; and (vi) no Default or Event of Default (other than the Subject Defaults) exists under the Credit Agreement or any of the other Loan Documents after giving effect to this Agreement.

(c) The Borrowers shall have paid (i) all reasonable and documented fees and out-of-pocket expenses incurred by the Administrative Agent (ii) all reasonable and documented fees, and out-of-pocket charges and disbursements of Mayer Brown LLP, US counsel to the Administrative Agent (directly to such counsel if requested by the Administrative Agent), (iii) all reasonable and documented fees, and out-of-pocket charges and disbursements of Blake’s, Cassels & Graydon LLP, Canadian counsel to the Administrative Agent (directly to such counsel if requested by the Administrative Agent) incurred in connection with this Agreement, and (iv) all reasonable and documented fees, out-of-pocket charges and disbursements incurred by PA Consulting Group, Inc., in connection with this Agreement.

6. Post-Closing Conditions.

(a) The Borrowers will deliver to the Administrative Agent by not later than three (3) Business Days after the Effective Date (or such later date as the Administrative Agent may decide in its sole discretion): (i) a duly executed Collateral Assignment of that certain Lease of Property (Industrial Lease – Unimproved -Year to Year) dated as of July 17, 2009, between Union Pacific Railroad Company, as the lessor, and West Colton Rail Terminal LLC, as the lessee, in form and substance reasonably satisfactory to the Administrative Agent (provided that such assignment shall not be recorded without the Borrowers’ advance written consent and that the deadline for delivery of such assignment shall be extended so that in no event is it less than three (3) Business Days after Lender’s delivery of the form of such Collateral Assignment); and (ii) evidence that the transactions required for the Hedge Terminations have been finalized.

(b) The settlement and payment of all funds otherwise payable to the Borrowers or the Guarantors resulting from the Hedge Terminations shall be delivered to the Administrative Agent by not later than three (3) Business Days (or such later date as the Administrative Agent may decide in its sole discretion) after the effectiveness of such terminations; provided that such deadline shall be extended to the extent the delay is not a result of any action or inaction by the Borrower or any Guarantor.

7. Release. The Borrowers and the Guarantors hereby reaffirm and ratify the terms of the Release provision set forth in Section 11 of Amendment No. 4, as to any and all acts or inactions of the Lenders and the Administrative Agent though the Effective Date (as

defined in Amendment No. 4), and upon the Borrowers’ and the Guarantors’ execution of this Agreement, each such Release is being granted anew by each signatory hereunder upon the execution date of this Agreement (for the avoidance of doubt these Releases are in addition to the Release having already been granted with the execution of Amendment No. 4), and each of the Borrowers and the Guarantors, on behalf of themselves and each of their respective successors, legal representatives and assigns, as well as any other party claiming by, through or under each such entity (each a “Releasing Party” and collectively, the “Releasing Parties”) hereby release, waive, forever relinquish and agree to hold harmless from and against any and all claims, demands, obligations, liabilities and causes of action of whatever kind or nature, whether known or unknown, liquidated or unliquidated, contingent or certain, and asserted or unasserted, which any of the Releasing Parties have, had, or may have or might assert from the beginning of time up through and including the date of execution of this Agreement against the Administrative Agent, the Lenders and/or their respective parents, affiliates, participants, officers, directors, employees, agents, attorneys, accountants, representatives, consultants, successors and assigns, directly or indirectly, which occurred, existed, was taken, permitted or begun at any time prior to and up to the execution of this Agreement, arising out of, based upon, or in any manner connected with (i) any transaction, event, circumstance, action, failure to act or occurrence of any sort of type, whether known or unknown, including without limitation any and all such claims arising out of or related, in any respect, to the Credit Agreement, any other Loan Document and/or the administration thereof or the Obligations created thereby, or (ii) any matter related to, in any respect, the foregoing, in each case, prior to the execution of this Agreement.

7. Reservation of Rights. Notwithstanding anything contained in this Agreement to the contrary, the Borrowers and the Guarantors acknowledge that the Administrative Agent and the Lenders do not waive, and expressly reserve, the right to exercise, at any time during the Short Term Waiver Period, any and all of their rights and remedies under the Credit Agreement (as amended or modified by this Agreement), any other Loan Document and applicable law, in each case, in respect of any Default or Event of Default other than the Subject Defaults.

Without limiting the generality of the foregoing, the Borrowers and the Guarantors hereby agree that (i) none of the Administrative Agent, the Lenders or the L/C Issuers, as applicable, has waived or does waive the Interest Payment Default past the Expiration Date, or any other current or future Default, Event of Default or other event of default that may now or hereafter exist (other than the Specified Events of Default defined in Amendment No. 4 but only during the Temporary Waiver Period), (ii) any forbearance of any rights, powers, privileges and other remedies by the Administrative Agent, the Lenders or the L/C Issuers, as applicable, under the Loan Documents, or at law or in equity, with respect to any of the Events of Default or event of default identified above or any other current or future Default, Event of Default or other event of default shall not be, and shall not be construed as, a waiver thereof, and the Administrative Agent, the Lenders or L/C Issuers, as applicable, reserve their rights to invoke fully any and all such rights, powers, privileges and other remedies under the Loan Documents, or at law or in equity, at any time the Administrative Agent, the Lenders or the L/C Issuers, as applicable, deem appropriate in respect thereof, in accordance with the Loan Documents, as applicable, and without further notice, (iii) the Administrative Agent, the Lenders or the L/C Issuers, as applicable, reserve the right to identify and assert additional Defaults or Events of Default that may now or hereafter exist under the Loan Documents and demand any sums that may be, or become, due under the Loan Documents, including, without limitation, accrued and unpaid late charges and costs of collection (including, without limitation, attorneys’ fees and expenses) and other costs and (iv) nothing contained herein, or in any other correspondence with you or your representatives, shall constitute, or be deemed to constitute, a modification of, or waiver under, the Loan Documents, or acceptance of any event, occurrence or circumstance that may constitute a Default or an Event of Default under the Loan Documents.

8. Severability. Any provision of this Agreement held by a court of competent jurisdiction to be invalid or unenforceable shall not impair or invalidate the remainder of this Agreement and the effect thereof shall be confined to the provisions so held to be invalid.

9. Counterparts and Governing Law. The counterpart execution provisions set forth in Section 11.10 or the Credit Agreement and the governing law provisions set forth in Section 11.15 of the Credit Agreement are incorporated herein by reference mutatis mutandis.

[The remainder of this page is intentionally left blank; signature pages to follow]

This Agreement is executed as of the day and year first above written.

ADMINISTRATEIVE AGENT, L/C ISSUER, SWING LINE LENDER AND LENDER:

BANK OF MONTREAL,

as Administrative Agent, L/C Issuer, Swing Line Lender, and a Lender

By: /s/ Radhika Kapur

Name: Radhika Kapur

Title: Director

LENDERS:

U.S. BANK NATIONAL ASSOCIATION,

as L/C Issuer and a Lender

By: /s/ Tim Hill

Name: Tim Hill

Title: Vice President

CITIBANK, N.A.,

as L/C Issuer and a Lender

By: /s/ Gabe Juarez

Name: Gabe Juarez

Title: Vice President

FIRST HORIZON BANK,

as a Lender

By: /s/ Mike Smith

Name: Mike Smith

Title: Vice President

GOLDMAN SACHS BANK USA,

as a Lender

By: /s/ Andrew Vernon

Name: Andrew Vernon

Title: Authorized Signatory

SUMITOMO MITSUI BANKING CORPORATION, as a Lender

By: /s/ Valery Amourous

Name: Valery Amourous

Title: Director

MUFG BANK, LTD.,

as a Lender

By: /s/ David Helffrich

Name: David Helffrich

Title: Director

Acknowledged and agreed to by:

BORROWERS AND GUARANTORS:

USD PARTNERS LP

By: USD PARTNERS GP LLC, its general partner

By: /s/ Adam Altsuler

Name: Adam Altsuler

Title: Executive Vice President and Chief Financial Officer

USD TERMINALS CANADA ULC

By: /s/ Adam Altsuler

Name: Adam Altsuler

Title: Senior Vice President and Chief Financial Officer

USD LOGISTICS OPERATIONS GP LLC

By: /s/ Adam Altsuler

Name: Adam Altsuler

Title: Executive Vice President and Chief Financial Officer

USD LOGISTICS OPERATIONS LP

By: USD LOGISTICS OPERATIONS GP LLC, its general partner

By: /s/ Adam Altsuler

Name: Adam Altsuler

Title: Executive Vice President and Chief Financial Office

WEST COLTON RAIL TERMINAL LLC

By: /s/ Adam Altsuler

Name: Adam Altsuler

Title: Executive Vice President and Chief Financial Officer

USD TERMINALS LLC

By: /s/ Adam Altsuler

Name: Adam Altsuler

Title Executive Vice President and Chief Financial Officer

USD RAIL LP

By: /s/ Adam Altsuler

Name: Adam Altsuler

Title: Executive Vice President and Chief Financial Officer

USD RAIL CANADA ULC

By: /s/ Adam Altsuler

Name: Adam Altsuler

Title: Senior Vice President and Chief Financial Officer

USD TERMINALS CANADA II ULC

By: /s/ Adam Altsuler

Name: Adam Altsuler

Title: Senior Vice President and Chief Financial Officer

USD TERMINALS CANADA III ULC

By: /s/ Adam Altsuler

Name: Adam Altsuler

Title: Senior Vice President and Chief Financial Officer

USDP FINANCE CORP.

By: /s/ Adam Altsuler

Name: Adam Altsuler

Title: Chief Financial Officer

STROUD CRUDE TERMINAL LLC

By: /s/ Adam Altsuler

Name: Adam Altsuler

Title: Senior Vice President and Chief Financial Officer

SCT PIPELINE LLC

By: /s/ Adam Altsuler

Name: Adam Altsuler

Title: Senior Vice President and Chief Financial Officer

USDP CCR LLC

By: /s/ Adam Altsuler

Name: Adam Altsuler

Title: Senior Vice President and Chief Financial Officer

USD TERMINALS LLC (as successor to USD Terminals International S.a.r.l.)

By: /s/ Adam Altsuler

Name: Adam Altsuler

Title: Executive Vice President and Chief Financial Officer

Schedule I

Commitment Schedule

SCHEDULE 2.01

Commitments and Applicable Percentages

At no time shall any Lender’s aggregate Commitment exceed the Commitment set forth for such Lender in the Commitment column below.

| | | | | | | | |

| Lender | Commitment | Applicable Percentage |

| Bank of Montreal | $49,865,519.78 | 25.4545454545% |

| U.S. Bank National Association | $49,865,519.78 | 25.4545454545% |

| Citibank, N.A. | $30,631,676.44 | 15.6363636364% |

| MUFG Bank Ltd. | $20,302,309.20 | 10.3636363636% |

| Sumitomo Mitsui Banking Corporation | $20,302,390.20 | 10.3636363636% |

| First Horizon Bank | $14,247,291.37 | 7.2727272727% |

| Goldman Sachs Bank USA | $10,685,468.52 | 5.4545454545% |

| Total | 195,900,256.28 | 100% |

Schedule II

Secured Hedge Agreements and Swap Contracts

| | | | | |

| Unique Swap Identifier: | ****************************************** |

| Type of Transaction: | Interest Rate Swap |

| Notional Amount: | USD 175,000,000.00 |

| Trade Date: | October 12, 2022 |

| Effective Date | October 17, 2022 |

| Termination Date | October 17, 2027, subject to adjustment in accordance with the Modified Following Business Day Convention. |

October 9, 2023

USD Partners Announces Waiver Extension Agreement Under Credit Agreement

Houston, TX – USD Partners LP (NYSE: USDP) (the “Partnership”) announced today that it has entered into an agreement (the “Waiver Extension Agreement”) with the lenders and administrative agent under its existing Credit Agreement to, among other things, extend the forbearance period as provided in the previously announced amendment to the Credit Agreement, dated as of August 8, 2023, from its original expiration date of October 10, 2023 to November 3, 2023 (the “New Expiration Date”). Pursuant to the Waiver Extension Agreement, the lenders and administrative agent have agreed to continue to forbear until the New Expiration Date from exercising any rights or remedies arising from certain defaults or events of defaults asserted by the administrative agent and to temporarily waive certain events of default arising from the non-payment of interest due on October 10, 2023 until the New Expiration Date.

“We are pleased to have worked cooperatively with our lenders to achieve a further extension of the forbearance under our Credit Agreement,” said Adam Altsuler, the Partnership’s Chief Financial Officer. “We look forward to working constructively with our bank group to secure a longer-term solution over the next few weeks while also advancing several ongoing commercial discussions that could benefit the Partnership in the near future.”

Additional details regarding the terms of the Waiver Extension Agreement will be provided in the Partnership’s related Current Report on Form 8-K that will be filed with the SEC. .

About USD Partners LP

USD Partners LP is a fee-based, growth-oriented master limited partnership formed in 2014 by US Development Group, LLC (“USD”) to acquire, develop and operate midstream infrastructure and complementary logistics solutions for crude oil, biofuels and other energy-related products. The Partnership generates substantially all of its operating cash flows from multi-year, take-or-pay contracts with primarily investment grade customers, including major integrated oil companies, refiners and marketers. The Partnership’s principal assets include a network of crude oil terminals that facilitate the transportation of heavy crude oil from Western Canada to key demand centers across North America. The Partnership’s operations include railcar loading and unloading, storage and blending in on-site tanks, inbound and outbound pipeline connectivity, truck transloading, as well as other related logistics services. In addition, the Partnership provides customers with leased railcars and fleet services to facilitate the transportation of liquid hydrocarbons and biofuels by rail.

USD, which owns the general partner of USD Partners LP, is engaged in designing, developing, owning, and managing large-scale multi-modal logistics centers and energy-related infrastructure across North America. USD’s solutions create flexible market access for customers in significant growth areas and key demand centers, including Western Canada, the U.S. Gulf Coast and Mexico. Among other projects, USD is currently pursuing the development of a premier energy logistics terminal on the Houston Ship Channel with capacity for substantial tank storage, multiple docks (including barge and deepwater), inbound and outbound pipeline connectivity, as well as a rail terminal with unit train capabilities. For additional information, please visit texasdeepwater.com. Information on websites referenced in this release is not part of this release.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of U.S. federal securities laws, including statements with respect to the impact of the waiver extension agreement, future events relating to our credit agreement, and the business prospects of the Partnership. Words and phrases such as “plans,” “will,” “could” and similar expressions are used to identify such forward-looking statements. However, the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements relating to the Partnership are based on management’s expectations, estimates and projections about the Partnership, its interests and the energy industry in general on the date this press release was issued. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecast in such forward-looking statements. Factors that could cause actual results or events to differ materially from those described in the forward-looking statements include those as set forth under the heading “Risk Factors” in the Partnership’s most recent Annual Report on Form 10-K and in its subsequent filings with the Securities and Exchange Commission. The Partnership is under no obligation (and expressly disclaims any such obligation) to update or alter its forward-looking statements, whether as a result of new information, future events or otherwise.

Investor Relations Contacts:

Adam Altsuler, (281) 291-3995

Executive Vice President and Chief Financial Officer

Jennifer Waller, (832) 991-8383

Senior Director, Financial Reporting and Investor Relations

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

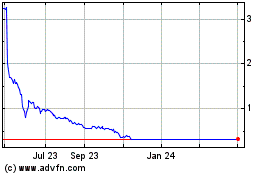

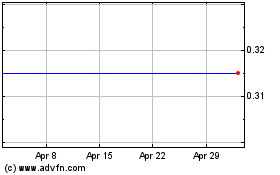

USD Partners (NYSE:USDP)

Historical Stock Chart

From Mar 2024 to Apr 2024

USD Partners (NYSE:USDP)

Historical Stock Chart

From Apr 2023 to Apr 2024