UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of: October, 2023

Commission file number: 001-38350

Lithium Americas Corp.

(Translation of Registrant's name into English)

900 West Hastings Street, Suite 300,

Vancouver, British Columbia,

Canada V6C 1E5

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F [ ] Form 40-F [X]

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Lithium Americas Corp. |

| (Registrant) |

| |

| By: |

"Jonathan Evans" |

| Name: |

Jonathan Evans |

| Title: |

Chief Executive Officer |

Dated: October 2, 2023

Amended and Restated Notice to Holders - Conversion

LITHIUM AMERICAS CORP.

1.75% Convertible Senior Notes due 2027

CUSIP No.: 53680QAA61

THIS NOTICE AMENDS AND RESTATES

THE NOTICE GIVEN BY LITHIUM AMERICAS CORP. DATED AUGUST 18, 2023

NOTE: THIS NOTICE CONTAINS IMPORTANT INFORMATION THAT IS OF INTEREST TO

THE REGISTERED AND BENEFICIAL OWNERS OF THE SUBJECT NOTES. IF

APPLICABLE, ALL DEPOSITORIES, CUSTODIANS, AND OTHER INTERMEDIARIES

RECEIVING THIS NOTICE ARE REQUESTED TO EXPEDITE RE-TRANSMITTAL TO

BENEFICIAL OWNERS OF THE NOTES IN A TIMELY MANNER.

Lithium Americas Corp. ("Company") is party to an Indenture, dated December 6, 2021 (the "Indenture"), between the Company and Computershare Trust Company N.A., as trustee (the "Trustee"), pursuant to which the Company issued its 1.75% Convertible Senior Notes due 2027 (the "Notes"). Capitalized terms used herein but not otherwise defined shall have the respective meanings given such terms in the Indenture.

On May 15, 2023, the Company's board of directors (the "Board") approved a proposed reorganization that will result in the separation of its North American and Argentine business units into two independent public companies as follows:

• The Company will become an Argentina focused lithium company owning the Company's current interest in its Argentine lithium assets, including the near-production Caucharí- Olaroz lithium brine project in Jujuy, Argentina; and

• The Company will create a new North America focused lithium company ("New LAC") owning the Thacker Pass lithium project in Humboldt County, Nevada and the Company's North American investments.

The separation is to be implemented by way of a plan of arrangement under the laws of British Columbia (the "Arrangement"). Under the Arrangement, the Company's shareholders will retain their proportionate interest in shares of the Company, and receive by way of distribution (the "Spin-Off") newly issued shares of New LAC in proportion to their then-current ownership of the Company. As part of the Arrangement, the Company will change its name to Lithium Americas (Argentina) Corp.

On July 31, 2023, the Arrangement was approved by the vote of the Company's shareholders and the Supreme Court of British Columbia subsequently approved the Arrangement by final order dated August 4, 2023. The Arrangement is subject to satisfaction or waiver, as applicable, of certain additional regulatory and third party approvals, consents and authorizations. It is presently anticipated that, if all required approvals are obtained and other conditions fulfilled, the Spin-Off will be completed on or about October 3, 2023. There are no assurances that all required approvals will be obtained, in which case the Arrangement will not close. In addition the Board may decide to delay or not proceed with the Spin-Off, even if all required approvals are obtained. Conversion of Notes is at the risk of the holders.

________________________

1 The CUSIP numbers appearing herein has been included solely for the convenience of the Holders. Neither the Company nor the Trustee assumes any responsibility for the selection or use of such CUSIP number and makes no representation as to the correctness of the CUSIP number.

The Spin-Off will result in the distribution to the Company's shareholders assets of the Company exceeding 10% of the per share value of the Last Reported Sale Price of the Company's Common Shares on the Trading Day preceding the date of announcement of the Spin-Off. As a result, pursuant to Section 14.01(b)(ii)(B) of the Indenture, Holders will be permitted to surrender Notes for conversion during the 30 Scheduled Trading Day period ending at the close of business on the Business Day immediately preceding the Ex-Dividend Date for the Spin-Off (i.e. first date on which the Company's Common Shares trade on the NYSE (or if the Company's Common Shares are not then listed on the NYSE, the principal securities exchange or market on which the Company's Common Shares are traded), regular way following the closing of the Arrangement). In accordance with Section 14.01(b)(ii)(B) of the Indenture, the Notes are subject to conversion at any time from or after August 18, 2023 (at least 30 Scheduled Trading Days prior to the anticipated Ex-Dividend Date for the Spin-Off) until 5:00 p.m. (New York City time) on October 3, 2023 (the Business Day immediately preceding the anticipated Ex-Dividend Date for the Spin-Off). The Company intends to settle any such conversions by delivering Common Shares (and cash in lieu of any fractional shares) in accordance with the terms of the Indenture. If the closing date of the Arrangement is extended, the conversion period will be automatically extended to 5:00 p.m. (New York City time) on the Business Day immediately preceding the actual Ex-Dividend Date for the Spin-Off.

The Arrangement will constitute a Make-Whole Fundamental Change under the Indenture. Pursuant to the Indenture, if a Make-Whole Fundamental Change occurs, Holders will be permitted to surrender Notes for conversion during the period commencing 30 Scheduled Trading Days prior to the anticipated effective date of the Arrangement until the 35th Trading Day after the actual effective date of the Arrangement. In accordance with Section 14.01(b)(iii) of the Indenture, the Notes are subject to conversion at any time from or after August 18, 2023 (not less than 30 Scheduled Trading Days prior to the anticipated effective date of the Arrangement) until 5:00 p.m. (New York City time) on November 21, 2023 (the 35th Trading Day after the anticipated effective date of the Arrangement). The Company intends to settle any such conversions by delivering Common Shares (and cash in lieu of any fractional shares) in accordance with the terms of the Indenture. If the closing date of the Arrangement is extended, the conversion period will be automatically extended to 5:00 p.m. (New York City time) on the 35th Trading Day after the actual effective date of the Arrangement.

Pursuant to Section 14.03 of the Indenture, if a Holder elects to convert Notes from and including the effective date of the Make-Whole Fundamental Change up to, and including, the 35th Trading Day immediately following the effective date of the Make-Whole Fundamental Change, the Company may be required to increase the Conversion Rate for the Notes so surrendered for conversion by a number of additional Common Shares of the Company. The number of additional Common Shares of the Company, if any, shall be determined based on the average of the Last Reported Sale Prices of the Company's Common Shares over the five Trading Day period ending on, and including, the Trading Day immediately preceding the effective date of the Make-Whole Fundamental Change.

Finally the Spin-Off will also result in an adjustment to the Conversion Rate for the Notes pursuant to Section 14.04(c) of the Indenture. Pursuant to Section 14.04(c) of the Indenture, the Conversion Rate is required to be adjusted as of the close of business on the last Trading Day of the 10- Trading Day period beginning on, and including, the Ex-Dividend Date for the Spin-Off based on the Last Reported Sale Prices of the Company's Common Shares and New LAC's common shares during such 10-Trading Day period.

The Company will provide additional information regarding (i) the effective date of a Make-Whole Fundamental Change as a result of the Arrangement (including the number of additional Common Shares of the Company, if any, by which the Conversion Rate shall be increased per $1,000 principal amount of Notes with respect to conversions occurring in connection with such Make-Whole Fundamental Change), and (ii) the adjustment to the Conversion Rate as a result of the Spin-Off.

The Company's August 18, 2023 Notice stated that the anticipated closing date of the Arrangement would be October 2, 2023 and therefore the last day to convert Notes pursuant to Section 14.01(b)(ii)(B) of the Indenture would be October 2, 2023 and the last day to convert Notes pursuant to Section 14.01(b)(iii) of the Indenture would be November 20, 2023. The Company expects that the closing date of the Arrangement will instead be October 3, 2023 and therefore that the last day to convert Notes pursuant to Section 14.01(b)(ii)(B) of the Indenture will be October 3, 2023 and the last day to convert Notes pursuant to Section 14.01(b)(iii) of the Indenture will be November 21, 2023, in each case as described above. This Notice is provided solely for the purpose of updating such statements.

For further information contact:

Investor Relations

Telephone: 778-656-5820

Email: ir@lithiumamericas.com

Website: www.lithiumamericas.com

Dated: October 2, 2023

By: Lithium Americas Corp.

cc: Computershare Trust Company N.A.

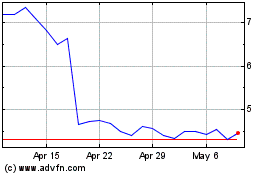

Lithium Americas (NYSE:LAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

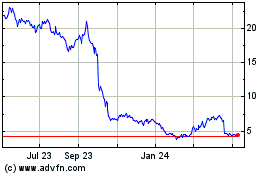

Lithium Americas (NYSE:LAC)

Historical Stock Chart

From Apr 2023 to Apr 2024