0001808997false00018089972023-09-272023-09-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): September 27, 2023 |

American Outdoor Brands, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39366 |

84-4630928 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1800 North Route Z, Suite A |

|

Columbia, Missouri |

|

65202 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (800) 338-9585 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, Par Value $0.001 per Share |

|

AOUT |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 8.01 Other Events.

On October 2, 2023, we announced that our Board of Directors has approved a program to repurchase up to $10.0 million of our outstanding shares of common stock commencing on October 2, 2023 and ending on September 30, 2024. The amount and timing of any repurchases will depend on a number of factors, including price, trading volume, general market conditions, legal requirements, and other factors. The repurchases may be made on the open market, in block trades, or in privately negotiated transactions. Any shares of common stock repurchased under the program will be considered issued but not outstanding shares of our common stock. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference to this Item 8.01.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

AMERICAN OUTDOOR BRANDS, INC. |

|

|

|

|

Date: |

October 2, 2023 |

By: |

/s/ H. Andrew Fulmer |

|

|

|

H. Andrew Fulmer

Executive Vice President, Chief Financial Officer, and Treasurer |

|

|

|

Exhibit 99.1 |

1800 N Route Z, Suite A |

Columbia, MO 65202 |

(800) 338-9585 |

NASDAQ: AOUT |

Contact: Liz Sharp, VP, Investor Relations

lsharp@aob.com

(573) 303-4620

American Outdoor Brands Board of Directors

Approves $10 Million Share Repurchase Program

COLUMBIA, Mo., October 2, 2023 – American Outdoor Brands, Inc. (NASDAQ Global Select: AOUT), an industry leading provider of products and accessories for outdoor enthusiasts, today announced that its Board of Directors has approved the repurchase of up to $10 million of the Company’s outstanding common stock (“shares”) commencing on October 2, 2023, and ending on September 30, 2024.

The program follows the company’s prior share repurchase program, which authorized the Company to repurchase up to $10.0 million of its common stock, was initiated in 2022 and, as of its expiration on September 29, 2023, resulted in approximately 752,000 shares, or approximately 5.6% of the Company’s outstanding shares, repurchased at an average price of $9.05 per share, or over $6.8 million in the aggregate.

President and Chief Executive Officer, Brian Murphy, said, “Today’s announcement conveys our board’s ongoing confidence in our business and dedication to stockholder value creation. Given our strong, debt-free balance sheet, we are able to prioritize investing for growth, both organically and through opportunistic and accretive M&A activity, while maintaining our commitment to returning capital to our stockholders. As we regularly evaluate our opportunities, we believe it is important to have the authority to repurchase stock at our discretion.”

The shares may be repurchased from time to time on the open market, in block trades, or in privately negotiated transactions. The amount and timing of any shares repurchased under the program will be determined at the discretion of management and will depend on a number of factors, including the market price of the company’s stock, trading volume, general market and economic conditions, the Company’s capital position, legal requirements, and other factors. The repurchase program does not obligate the Company to acquire any particular number of shares, and the repurchase program may be discontinued at any time at the Company’s discretion.

Statement Regarding Forward-Looking Information

The statements contained in this release that are not historical are forward-looking statements within the meaning of the U.S. federal securities laws and we intend that such forward-looking statements be subject to the safe harbor created thereby. Statements that are not historical facts, including statements about anticipated financial outcomes, and share repurchases, as well as other statements about our expectations, beliefs, intentions, or strategies regarding the future, or other characterizations of future events or circumstances, are forward-looking statements. These statements relate to future events and our future results and involve a number of risks and uncertainties. Actual results, performance or achievement could differ materially from those contained in these forward-looking statements. Specific forward-looking statements in this press release include our belief that our strong balance sheet and anticipated positive cash flow enable us to prioritize investing for growth, both organically and through opportunistic and accretive M&A activity, while maintaining our commitment to returning capital to our stockholders; and our belief that it is important to have the authority to repurchase stock at our discretion. Forward-looking statements are based on our beliefs as well as assumptions made by, and information currently available to, us. The risks and uncertainties to which forward-looking statements are subject include, without limitation, changes in price and volume and the volatility of our common stock, unexpected or otherwise unplanned or alternative requirements with respect to the capital investments of the Company, changes in general economic, business and political conditions, and other risks detailed in the “Statement Regarding Forward-Looking Information,” “Risk Factors” and other sections of the Company’s Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. Except as required by applicable law or regulation, we disclaim any obligation and do not intend to publicly update or review any of our forward-looking statements, whether as a result of new information, future events or otherwise.

About American Outdoor Brands, Inc.

American Outdoor Brands, Inc. (NASDAQ Global Select: AOUT) is an industry leading provider of outdoor products and accessories, including hunting, fishing, camping, outdoor cooking, shooting, and personal security and defense products, for rugged outdoor enthusiasts. The company produces innovative, top quality products under its brands BOG®; BUBBA®; Caldwell®; Crimson Trace®; Frankford Arsenal®; Grilla Grills®; Hooyman®; Imperial®; LaserLyte®; Lockdown®; MEAT!; Old

Timer®; Schrade®; Tipton®; Uncle Henry®; ust®; and Wheeler®. For more information about all the brands and products from American Outdoor Brands, Inc., visit www.aob.com.

v3.23.3

Document And Entity Information

|

Sep. 27, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 27, 2023

|

| Entity Registrant Name |

American Outdoor Brands, Inc.

|

| Entity Central Index Key |

0001808997

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

001-39366

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

84-4630928

|

| Entity Address, Address Line One |

1800 North Route Z, Suite A

|

| Entity Address, City or Town |

Columbia

|

| Entity Address, State or Province |

MO

|

| Entity Address, Postal Zip Code |

65202

|

| City Area Code |

(800)

|

| Local Phone Number |

338-9585

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

true

|

| Title of 12(b) Security |

Common Stock, Par Value $0.001 per Share

|

| Trading Symbol |

AOUT

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

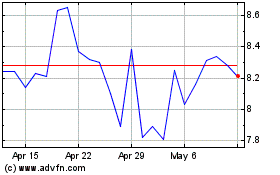

American Outdoor Brands (NASDAQ:AOUT)

Historical Stock Chart

From Mar 2024 to Apr 2024

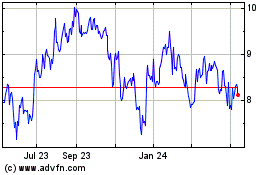

American Outdoor Brands (NASDAQ:AOUT)

Historical Stock Chart

From Apr 2023 to Apr 2024