UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6 - K

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d -16

Under the Securities Exchange Act of 1934

For the Month of September 2023

Commission file number 001-14184

B.O.S. Better Online Solutions Ltd.

(Translation of Registrant’s Name into English)

20 Freiman Street, Rishon LeZion, 7535825, Israel

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

B.O.S. Better Online Solutions Ltd.

This Form 6-K, including the exhibits, is hereby

incorporated by reference into all effective registration statements, filed by us under the Securities Act of 1933, as amended, to the

extent not superseded by documents or reports subsequently filed or furnished.

Attached hereto are the following exhibits:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

B.O.S. Better Online Solutions Ltd. |

| |

(Registrant) |

| |

|

|

| |

By: |

/s/ Moshe Zeltzer |

| |

|

Moshe Zeltzer |

| |

|

Chief Financial Officer |

Dated: September 29, 2023

EXHIBIT INDEX

3

6-K

BOS BETTER ONLINE SOLUTIONS LTD

Exhibit 99.1

B.O.S. BETTER ONLINE SOLUTIONS LTD.

AND ITS SUBSIDIARIES

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2023

IN U.S. DOLLARS

UNAUDITED

INDEX

- - - - - - - - - -

B.O.S. BETTER ONLINE SOLUTIONS LTD.

AND ITS SUBSIDIARIES

CONDENSED

INTERIM CONSOLIDATED BALANCE SHEETS

U.S. dollars in thousands

| | |

June 30,

2023 | | |

December 31,

2022 | |

| | |

Unaudited | | |

Audited | |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 1,931 | | |

$ | 1,763 | |

| Restricted bank deposits | |

| 144 | | |

| 130 | |

| Trade receivables (net of allowance for doubtful accounts of $148 and $82 at June 30, 2023 and December 31 2022, respectively) | |

| 11,011 | | |

| 10,834 | |

| Other accounts receivable and prepaid expenses | |

| 1,167 | | |

| 1,414 | |

| Inventories | |

| 7,667 | | |

| 6,433 | |

| | |

| | | |

| | |

| Total current assets | |

| 21,920 | | |

| 20,574 | |

| | |

| | | |

| | |

| NON-CURRENT ASSETS: | |

| | | |

| | |

| Long-term assets | |

| 244 | | |

| 260 | |

| Property and equipment, net | |

| 3,341 | | |

| 3,270 | |

| Operating lease right-of-use assets, net | |

| 955 | | |

| 1,110 | |

| Intangible assets, net | |

| 1,174 | | |

| 486 | |

| Goodwill | |

| 4,895 | | |

| 4,895 | |

| | |

| | | |

| | |

| Total non-current assets | |

| 10,609 | | |

| 10,021 | |

| | |

| | | |

| | |

| Total assets | |

$ | 32,529 | | |

$ | 30,595 | |

The accompanying notes are an integral part of

the condensed interim consolidated financial statements.

B.O.S. BETTER ONLINE SOLUTIONS LTD.

AND ITS SUBSIDIARIES

CONDENSED

INTERIM CONSOLIDATED BALANCE SHEETS

U.S. dollars in thousands (except share and

per share data)

| | |

June 30,

2023 | | |

December 31,

2022 | |

| | |

Unaudited | | |

Audited | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | |

| |

| | |

| | |

| |

| CURRENT LIABILITIES: | |

| | |

| |

| Current maturities of non-current loans | |

$ | 391 | | |

$ | 586 | |

| Operating lease liabilities, current | |

| 235 | | |

| 301 | |

| Trade payables | |

| 7,801 | | |

| 7,984 | |

| Employees and payroll accruals | |

| 980 | | |

| 1,016 | |

| Deferred revenues | |

| 1,550 | | |

| 542 | |

| Advances net of inventory in progress | |

| 79 | | |

| 47 | |

| Accrued expenses and other liabilities | |

| 812 | | |

| 719 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 11,848 | | |

| 11,195 | |

| | |

| | | |

| | |

| NON-CURRENT LIABILITIES: | |

| | | |

| | |

| Loans, net of current maturities | |

| 1,209 | | |

| 1,294 | |

| Operating lease liabilities, non-current | |

| 674 | | |

| 827 | |

| Deferred revenues | |

| 401 | | |

| 241 | |

| Accrued severance pay | |

| 363 | | |

| 404 | |

| | |

| | | |

| | |

| Total non-current liabilities | |

| 2,647 | | |

| 2,766 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENT LIABILITIES | |

| | | |

| | |

| | |

| | | |

| | |

| SHAREHOLDERS’ EQUITY: | |

| | | |

| | |

| Share capital | |

| | | |

| | |

| Ordinary shares: Authorized; 11,000,000 shares at June 30, 2023 and December 31, 2022; Issued and outstanding: 5,740,518 and 5,701,518 shares at June 30, 2023 and December 31, 2022, respectively | |

| 84,915 | | |

| 84,830 | |

| Additional paid-in capital | |

| 1,228 | | |

| 1,179 | |

| Accumulated other comprehensive loss | |

| (243 | ) | |

| (243 | ) |

| Accumulated deficit | |

| (67,866 | ) | |

| (69,132 | ) |

| | |

| | | |

| | |

| Total equity | |

| 18,034 | | |

| 16,634 | |

| | |

| | | |

| | |

| Total liabilities and shareholders’ equity | |

$ | 32,529 | | |

$ | 30,595 | |

The accompanying notes are an integral part of

the condensed interim consolidated financial statements.

B.O.S. BETTER ONLINE SOLUTIONS LTD.

AND ITS SUBSIDIARIES

CONDENSED

INTERIM CONSOLIDATED STATEMENTS OF OPERATIONS

U.S. dollars in thousands (except share and

per share data)

| | |

Six months period ended

June 30, | |

| | |

2023 | | |

2022 | |

| | |

Unaudited | | |

Unaudited | |

| | |

| | |

| |

| Revenues | |

$ | 23,478 | | |

$ | 21,138 | |

| Cost of revenues | |

| 18,409 | | |

| 16,667 | |

| | |

| | | |

| | |

| Gross profit | |

$ | 5,069 | | |

$ | 4,471 | |

| | |

| | | |

| | |

| Operating costs and expenses: | |

| | | |

| | |

| Research and development | |

| 78 | | |

| 87 | |

| Sales and marketing | |

| 2,470 | | |

| 2,384 | |

| General and administrative | |

| 912 | | |

| 999 | |

| | |

| | | |

| | |

| Total operating costs and expenses | |

| 3,460 | | |

| 3,470 | |

| | |

| | | |

| | |

| Operating income | |

| 1,609 | | |

| 1,001 | |

| Financial expenses, net | |

| (343 | ) | |

| (529 | ) |

| Income before taxes on income | |

| 1,266 | | |

| 472 | |

| Taxes on income | |

| - | | |

| - | |

| Net income | |

$ | 1,266 | | |

$ | 472 | |

| | |

| | | |

| | |

Basic and diluted net income per share | |

$ | 0.22 | | |

$ | 0.09 | |

| | |

| | | |

| | |

| Weighted average number of shares used in computing net income per share: | |

| | | |

| | |

| Basic | |

| 5,707 | | |

| 5,395 | |

| | |

| | | |

| | |

| Diluted | |

| 5,767 | | |

| 5,438 | |

The accompanying notes are an integral part of

the condensed interim consolidated financial statements.

B.O.S. BETTER ONLINE SOLUTIONS LTD.

AND ITS SUBSIDIARIES

CONSOLIDATED

INTERIM CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

U.S. dollars in thousands, except per share data

| | |

Six months period ended

June 30, | |

| | |

2023 | | |

2022 | |

| | |

Unaudited | | |

Unaudited | |

| | |

| | |

| |

| Net income | |

$ | 1,266 | | |

$ | 472 | |

| Cash flow hedging instruments: | |

| | | |

| | |

| Change in unrealized gains and losses | |

| - | | |

| - | |

| Gain in respect of derivative instruments designated for cash flow hedge, net of taxes | |

| - | | |

| - | |

| | |

| | | |

| | |

| Other comprehensive gain | |

| - | | |

| - | |

| | |

| | | |

| | |

| Comprehensive income | |

$ | 1,266 | | |

$ | 472 | |

The accompanying notes are an integral part of

the consolidated financial statements.

B.O.S. BETTER ONLINE SOLUTIONS LTD.

AND ITS SUBSIDIARIES

CONDENSED

INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

U.S. dollars in thousands (except share data)

| | |

Ordinary

shares | | |

Share capital

and additional

paid-in

capital | | |

Accumulated

other

comprehensive

loss | | |

Accumulated

deficit | | |

Total shareholders’

equity | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance as of January 1, 2022 | |

| 5,250,518 | | |

$ | 84,854 | | |

$ | (243 | ) | |

$ | (70,264 | ) | |

$ | 14,347 | |

| Issuance of ordinary shares and warrants, net | |

| 450,000 | | |

| 911 | | |

| - | | |

| - | | |

| 911 | |

| Exercise of options into ordinary shares | |

| 1,000 | | |

| 2 | | |

| - | | |

| - | | |

| 2 | |

| Share-based compensation expense | |

| - | | |

| 51 | | |

| - | | |

| - | | |

| 51 | |

| Net income | |

| - | | |

| - | | |

| - | | |

| 472 | | |

| 472 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of June 30, 2022 (unaudited) | |

| 5,701,518 | | |

$ | 85,818 | | |

$ | (243 | ) | |

$ | (69,792 | ) | |

$ | 15,783 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of January 1, 2023 | |

| 5,701,518 | | |

$ | 86,009 | | |

$ | (243 | ) | |

$ | (69,132 | ) | |

$ | 16,634 | |

| Issuance of ordinary shares and warrants, net | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Exercise of options into ordinary shares | |

| 39,000 | | |

| 85 | | |

| - | | |

| - | | |

| 85 | |

| Share-based compensation expense | |

| - | | |

| 49 | | |

| - | | |

| - | | |

| 49 | |

| Net income | |

| - | | |

| - | | |

| - | | |

| 1,266 | | |

| 1,266 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of June 30, 2023 (unaudited) | |

| 5,740,518 | | |

$ | 86,143 | | |

$ | (243 | ) | |

$ | (67,866 | ) | |

$ | 18,034 | |

The accompanying notes are an integral part of

the condensed interim consolidated financial statements.

B.O.S. BETTER ONLINE SOLUTIONS LTD.

AND ITS SUBSIDIARIES

CONDENSED

INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

U.S. dollars in thousands

| | |

Six months period ended

June 30, | |

| | |

2023 | | |

2022 | |

| | |

Unaudited | |

| Cash flows from operating activities: | |

| | |

| |

| | |

| | |

| |

| Net income | |

$ | 1,266 | | |

$ | 472 | |

| Adjustments required to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 239 | | |

| 164 | |

| Interest and exchange rate of loans | |

| (83 | ) | |

| (133 | ) |

| Severance pay, net | |

| (41 | ) | |

| (31 | ) |

| Share-based compensation expenses | |

| 49 | | |

| 51 | |

| Increase in trade receivables, net | |

| (177 | ) | |

| (830 | ) |

| Decrease (Increase) in other accounts receivable and other long term assets | |

| 263 | | |

| (357 | ) |

| Increase in inventories | |

| (1,202 | ) | |

| (156 | ) |

| Increase (decrease) in trade payables | |

| (183 | ) | |

| 831 | |

| Decrease in operating lease liabilities | |

| (64 | ) | |

| (124 | ) |

| Decrease (Increase) in employees and payroll accruals, deferred revenues, accrued expenses and other liabilities | |

| 809 | | |

| (218 | ) |

| | |

| | | |

| | |

| Net cash provided by (used in) operating activities | |

$ | 876 | | |

$ | (331 | ) |

| | |

| | | |

| | |

| Cash flows to investing activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Purchase of property and equipment | |

| (237 | ) | |

| (394 | ) |

| Acquisition of assets (b) | |

| (344 | ) | |

| (656 | ) |

| | |

| | | |

| | |

| Net cash used in investing activities | |

$ | (581 | ) | |

$ | (1,050 | ) |

The accompanying notes are an integral part of

the condensed interim consolidated financial statements.

B.O.S. BETTER ONLINE SOLUTIONS LTD.

AND ITS SUBSIDIARIES

CONDENSED

INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

U.S. dollars in thousands

| | |

Six months period ended

June 30, | |

| | |

2023 | | |

2022 | |

| | |

Unaudited | |

| Cash flows from financing activities: | |

| | |

| |

| | |

| | |

| |

| Proceeds received from issuance units that consist of ordinary shares and warrants, net | |

| - | | |

| 913 | |

| Proceeds received from issuance of shares upon options exercised, net | |

| 85 | | |

| - | |

| Proceeds received from loans | |

| 88 | | |

| - | |

| Repayment of loans | |

| (286 | ) | |

| (399 | ) |

| | |

| | | |

| | |

| Net cash provided by (used in) financing activities | |

$ | (113 | ) | |

$ | 514 | |

| | |

| | | |

| | |

| Change in cash and cash equivalents, and restricted cash | |

| 182 | | |

| (867 | ) |

| Cash, cash equivalents and restricted cash at the beginning of the period | |

| 1,893 | | |

| 2,117 | |

| | |

| | | |

| | |

| Cash, cash equivalents and restricted cash at the end of the period | |

$ | 2,075 | | |

$ | 1,250 | |

| | |

| | | |

| | |

| Supplementary cash flow activities: | |

| | | |

| | |

| | |

| | | |

| | |

| (a) Cash paid during the period for: | |

| | | |

| | |

| Interest | |

$ | 198 | | |

$ | 19 | |

(b) Net cash used to pay for the acquisition of

assets (see Note 5):

| | |

April 02,

2023 | |

| Suppliers relationship | |

| 761 | |

| Accrued expenses | |

| (417 | ) |

| Amount of cash paid | |

| 344 | |

The accompanying notes are an integral part of the condensed interim

consolidated financial statements.

B.O.S. BETTER ONLINE SOLUTIONS LTD.

AND ITS SUBSIDIARIES

NOTES TO

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands

| |

A. |

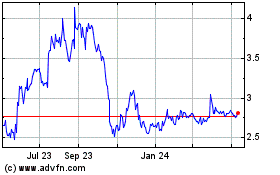

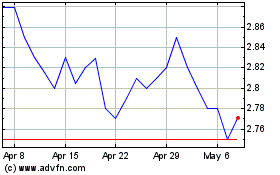

B.O.S. Better Online Solutions Ltd. (“BOS” or the “Company”) is an Israeli corporation. The Company’s shares are listed on NASDAQ under the ticker BOSC. |

| | B. | As of June 30, 2023, the Company has three operating segments that include Intelligent Robotics, RFID and Supply Chain Solutions. |

| |

C. |

The Company’s wholly owned subsidiaries include: |

| |

1. |

BOS-Dimex Ltd., (“BOS-Dimex”), is an Israeli company that comprises the RFID segment. BOS-Dimex provides comprehensive turn-key solutions for Automatic Identification and Data Collection (AIDC), combining a mobile infrastructure with software applications of manufacturers that we represent. BOS-Dimex also offers on-site inventory count services in the fields of apparel, food, convenience and pharma as well as asset tagging and counting services for corporate and governmental entities. |

| |

2. |

BOS-Odem Ltd. (“BOS-Odem”), an Israeli company, is a distributor of electronic components to customers worldwide, mainly in the aerospace and defense industries. BOS-Odem is also a supply chain service provider for aviation customers that prefer to consolidate their component acquisitions through a supplier that is able to provide a comprehensive solution to their components-supply needs. BOS-Odem is part of the Supply Chain Solutions segment; and |

| |

3. |

Ruby-Tech Inc., a New York corporation, is a wholly owned subsidiary of BOS-Odem and a part of the Supply Chain Solutions segment. |

B.O.S. BETTER ONLINE SOLUTIONS LTD.

AND ITS SUBSIDIARIES

NOTES TO

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands

| NOTE 2:– |

SIGNIFICANT ACCOUNTING POLICIES |

The significant accounting policies

applied in the financial statements of the Company as of December 31, 2022, were applied consistently in these financial statements.

| | A. | Use of estimates in the preparation of financial statements |

The preparation of consolidated financial

statements in conformity with accounting principles generally accepted in the United States (“U.S. GAAP”) requires management

to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and

liabilities at the dates of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting

periods. Actual results could differ from those estimates. As applicable to these consolidated financial statements, the most significant

estimates and assumptions include (i) net realizable value of the inventory, (ii) impairment analysis of goodwill and intangible assets,

(iii) allowance for doubtful accounts; and (vi) revenue recognition.

The Company computes net income per share

in accordance with ASC 260, “Earnings per share”. Basic income per share is computed by dividing net loss attributable to

ordinary shareholders by the weighted-average number of ordinary shares outstanding during the period, net of the weighted average number

of treasury shares (if any).

Diluted income per ordinary share is computed

similar to basic income per share, except that the denominator is increased to include the number of additional potential ordinary shares

that would have been outstanding if the potential ordinary shares had been issued and if the additional ordinary shares were dilutive.

Potential ordinary shares are excluded from the computation for a period in which a net income is reported or if their effect is anti-dilutive.

An amount of 570,000 and 1.2 million weighted

average outstanding options and warrants have been excluded from the calculation of the diluted net income per share for the period of

six months ended June 30, 2023 and 2022, respectively, because the effect of the ordinary shares issuable as a result of the exercise

or conversion of these instruments was determined to be anti-dilutive.

Certain prior year amounts have been reclassified

for consistency with the current year presentation. These reclassifications did not have material effect on the reported results of operations,

shareholder’s equity or cash flows.

| | D. | Recently issued accounting pronouncements |

There are currently no accounting standards

that have been issued but not yet adopted that we believe will have a significant impact on our consolidated financial position, results

of operations or cash flows.

B.O.S. BETTER ONLINE SOLUTIONS LTD.

AND ITS SUBSIDIARIES

NOTES TO

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands

| NOTE 3:– |

UNAUDITED CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS |

These accompanying unaudited condensed

interim consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United

States for interim financial information. Accordingly, they do not include all the information and footnotes required by generally accepted

accounting principles in the United States for complete financial statements. In the opinion of management, all adjustments (consisting

of normal recurring accruals) considered necessary for a fair presentation of the Company’s financial position as of June 30, 2023

have been included. Operating results for the six-month period ended June 30, 2023 are not necessarily indicative of the results that

may be expected for the year ended December 31, 2023, or any other interim period in the future.

The consolidated balance sheet at December

31, 2022 has been derived from the audited consolidated financial statements at that date but does not include all of the information

and footnotes required by generally accepted accounting principles in the United States for complete financial statements.

The unaudited interim financial statements

should be read in conjunction with the Company’s annual financial statements and accompanying notes as of December 31, 2022 included

in the Company’s Annual Report on Form 20-F, filed with the Securities Exchange Commission on March 30, 2023.

Composition:

| | |

June 30,

2023 | | |

December 31,

2022 | |

| | |

Unaudited | | |

Audited | |

| Raw materials | |

$ | 31 | | |

$ | 177 | |

| Inventory in progress | |

| 955 | | |

| 1,750 | |

| Finished goods | |

| 6,973 | | |

| 5,788 | |

| Net – advances from customers | |

| (292 | ) | |

| (1,282 | ) |

| | |

| | | |

| | |

| | |

$ | 7,667 | | |

$ | 6,433 | |

B.O.S. BETTER

ONLINE SOLUTIONS LTD.

AND ITS SUBSIDIARIES

NOTES TO

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands

| NOTE 5:– |

INTANGIBLE ASSETS, NET |

A. Composition:

| | |

June

30,

2023 | | |

December 31,

2022 | | |

Weighted

average

amortization

period | |

| | |

Unaudited | | |

Audited | | |

| |

| Cost: | |

| | |

| | |

| |

| Customer relationship | |

| 1,032 | | |

| 1,032 | | |

| 7-8.84 | |

| Suppliers relationship* | |

| 761 | | |

| - | | |

| 8.84 | |

| Non-competition | |

| 270 | | |

| 270 | | |

| 4 | |

| | |

| | | |

| | | |

| | |

| | |

| 2,063 | | |

| 1,302 | | |

| | |

| Accumulated amortization and impairments: | |

| | | |

| | | |

| | |

| Customer relationship | |

| 776 | | |

| 758 | | |

| | |

| Suppliers relationship | |

| 20 | | |

| - | | |

| | |

| Non-competition | |

| 93 | | |

| 58 | | |

| | |

| | |

| | | |

| | | |

| | |

| | |

| 889 | | |

| 816 | | |

| | |

| | |

| | | |

| | | |

| | |

| Amortized cost | |

$ | 1,174 | | |

$ | 486 | | |

| | |

| | B. | Amortization expenses amounting to $73 and $108 were recorded during the period of six months ended June 30, 2023 and the year ended December 31, 2022, respectively. |

On April 2, 2023, Proteus sold to the Company

its share in the joint activity in consideration of $723, of which $138 was paid on signing and the rest is paid in monthly installments

during a two year period.

Pursuant to the sale agreement, Proteus will gradually

phase out its marketing and sale of the products until the end of 2023.

On May 31, 2023, the Company entered into an agreement

with Microwave Ltd. for the purchase of its distribution rights for certain products, in consideration of $38, paid at signing.

B.O.S. BETTER ONLINE SOLUTIONS LTD.

AND ITS SUBSIDIARIES

NOTES TO

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands

We have entered into several non-cancellable

operating lease agreements for our offices and vehicles. Our leases have original lease periods expiring between 2023 and 2034. Payments

due under such lease contracts include primarily fix payments. We assume renewals in our determination of the lease term. Our lease agreements

do not contain any material residual value guarantees or material restrictive covenants.

The components of lease costs, lease

term and discount rate are as follows:

| | |

Six Months

Ended | |

| | |

June 30,

2023 | |

| | |

(unaudited) | |

| Operating lease cost: | |

| |

| Vehicles | |

| 91 | |

| Facilities rent | |

| 107 | |

| | |

| 198 | |

| Remaining Lease Term | |

| | |

| Vehicles | |

| 0.58 -2.34 years | |

| Facilities rent | |

| 2.27-11.1 years | |

| | |

| | |

| Weighted Average Discount Rate | |

| | |

| Vehicles | |

| 2.02 | % |

| Facilities rent | |

| 5.27 | % |

The following is a schedule, by years,

of maturities of operating lease liabilities as of June 30, 2023:

| | |

June 30,

2023 | |

| | |

(unaudited) | |

| Period: | |

| |

| The remainder of 2023 | |

| 178 | |

| 2024 | |

| 206 | |

| 2025 | |

| 140 | |

| 2026 | |

| 97 | |

| 2027 | |

| 63 | |

| 2028-2034 | |

| 467 | |

| Total operating lease payments | |

| 1,151 | |

| Less: imputed interest | |

| 242 | |

| Present value of lease liabilities | |

| 909 | |

B.O.S. BETTER ONLINE SOLUTIONS LTD.

AND ITS SUBSIDIARIES

NOTES TO

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands

| NOTE 7:– |

SEGMENTS AND GEOGRAPHICAL INFORMATION |

Commencing January 1, 2020 the Company

presents its business operations in three reportable segments, consisting of the RFID segment, Supply Chain Solutions segment and the

Intelligent Robotics segment.

The Company’s management makes

financial decisions and allocates resources, based on the information it receives from its internal management system. The Company allocates

resources and assesses performance for each operating segment using information about revenues and gross profit.

| | a. | Information about the operating segments for the six months ended June 30, 2023 and 2022 is as follows: |

| | |

RFID | | |

Supply

Chain Solutions | | |

Intelligent Robotics | | |

Intercompany | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| |

| Six months ended June 30, 2023: | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 6,948 | | |

$ | 15,351 | | |

$ | 1,257 | | |

$ | (77 | ) | |

$ | 23,478 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

$ | 1,796 | | |

$ | 3,253 | | |

$ | 20 | | |

$ | - | | |

$ | 5,069 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Allocated operating expenses | |

$ | 1,097 | | |

$ | 1,859 | | |

$ | 130 | | |

$ | - | | |

$ | 3,086 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Acquisition expenses | |

$ | - | | |

| - | | |

| - | | |

| - | | |

$ | - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Unallocated operating expenses | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | 374 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating Income (loss) | |

$ | 699 | | |

$ | 1,394 | | |

$ | (110 | ) | |

$ | - | | |

$ | 1,609 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial expenses | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | (343 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Income before tax | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | 1,266 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tax on income | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Income | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | 1,266 | |

B.O.S. BETTER ONLINE SOLUTIONS LTD.

AND ITS SUBSIDIARIES

NOTES TO

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands

| NOTE 7:– | SEGMENTS AND GEOGRAPHICAL INFORMATION – Cont. |

| | |

RFID | | |

Supply

Chain

Solutions | | |

Intelligent Robotics | | |

Intercompany | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| |

| Six months ended June 30, 2022: | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 7,693 | | |

$ | 12,873 | | |

$ | 572 | | |

$ | - | | |

$ | 21,138 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

$ | 1,915 | | |

$ | 2,575 | | |

$ | (19 | ) | |

$ | - | | |

$ | 4,471 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Allocated operating expenses | |

$ | 1,209 | | |

$ | 1,585 | | |

$ | 271 | | |

$ | - | | |

$ | 3,065 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Acquisition expenses | |

$ | 44 | | |

| - | | |

| - | | |

| - | | |

$ | 44 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Unallocated operating expenses | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | 361 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating Income (loss) | |

$ | 662 | | |

$ | 990 | | |

$ | (290 | ) | |

$ | - | | |

$ | 1,001 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial expenses | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | (529 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Income before tax | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | 472 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tax on income | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Income | |

| - | | |

| - | | |

| - | | |

| - | | |

$ | 472 | |

| | b. | The following presents total revenues for the six months ended June 30, 2023 and 2022 based on the location of customers: |

| | |

June 30, | |

| | |

2023 | | |

2022 | |

| | |

Unaudited | |

| | |

| | |

| |

| Israel | |

$ | 19,765 | | |

$ | 16,686 | |

| Far East | |

| 707 | | |

| 1,536 | |

| India | |

| 1,060 | | |

| 641 | |

| Europe | |

| 838 | | |

| 399 | |

| United States | |

| 1,080 | | |

| 1,733 | |

| Others | |

| 28 | | |

| 143 | |

| | |

| | | |

| | |

| | |

$ | 23,478 | | |

$ | 21,138 | |

B.O.S. BETTER ONLINE SOLUTIONS LTD.

AND ITS SUBSIDIARIES

NOTES TO

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except for per share

prices)

| NOTE

8:– | SHAREHOLDERS’

EQUITY |

| a. | In June 2023, a total of 39,000 options were exercised for

the amount of $85. |

| b. | On May 2, 2022, the Company entered into a definitive agreement with several investors for the sale of

450,000 units, each consisting of one ordinary share and one half warrant to purchase an ordinary share, at a unit purchase price of $2.2.

The warrants have an exercise price of $2.2 per ordinary share and are immediately exercisable into ordinary shares over a five-year term.

The sale was made in a registered direct offering with a total gross amount of $990 or $911 net of incremental and direct issuance expenses. |

| c. | In April 2022, a total of 1,000 options were

exercised for the amount of $2. |

| NOTE

9:– | SUBSEQUENT

EVENTS |

In July 2023, a total of 17,853 options

were exercised for the amount of $18.

F-16

0.09

0.22

false

--12-31

Q2

2023-06-30

0001005516

0001005516

2023-01-01

2023-06-30

0001005516

2023-06-30

0001005516

2022-12-31

0001005516

2022-01-01

2022-06-30

0001005516

us-gaap:CommonStockMember

2021-12-31

0001005516

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001005516

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001005516

us-gaap:RetainedEarningsMember

2021-12-31

0001005516

2021-12-31

0001005516

us-gaap:CommonStockMember

2022-01-01

2022-06-30

0001005516

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-06-30

0001005516

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-06-30

0001005516

us-gaap:RetainedEarningsMember

2022-01-01

2022-06-30

0001005516

us-gaap:CommonStockMember

2022-06-30

0001005516

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001005516

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-06-30

0001005516

us-gaap:RetainedEarningsMember

2022-06-30

0001005516

2022-06-30

0001005516

us-gaap:CommonStockMember

2022-12-31

0001005516

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001005516

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001005516

us-gaap:RetainedEarningsMember

2022-12-31

0001005516

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-06-30

0001005516

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-06-30

0001005516

us-gaap:RetainedEarningsMember

2023-01-01

2023-06-30

0001005516

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001005516

us-gaap:CommonStockMember

2023-06-30

0001005516

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001005516

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0001005516

us-gaap:RetainedEarningsMember

2023-06-30

0001005516

2023-04-02

2023-04-02

0001005516

2022-01-01

2022-12-31

0001005516

2023-04-02

0001005516

2023-05-31

2023-05-31

0001005516

us-gaap:CustomerRelationshipsMember

2023-06-30

0001005516

us-gaap:CustomerRelationshipsMember

2022-12-31

0001005516

srt:MinimumMember

us-gaap:CustomerRelationshipsMember

2023-01-01

2023-06-30

0001005516

srt:MaximumMember

us-gaap:CustomerRelationshipsMember

2023-01-01

2023-06-30

0001005516

bosc:SuppliersRelationshipMember

2023-06-30

0001005516

bosc:SuppliersRelationshipMember

2022-12-31

0001005516

bosc:SuppliersRelationshipMember

2023-01-01

2023-06-30

0001005516

bosc:NoncompetitionMember

2023-06-30

0001005516

bosc:NoncompetitionMember

2022-12-31

0001005516

bosc:NoncompetitionMember

2023-01-01

2023-06-30

0001005516

srt:MinimumMember

2023-01-01

2023-06-30

0001005516

srt:MaximumMember

2023-01-01

2023-06-30

0001005516

2020-01-01

2020-01-01

0001005516

bosc:RFIDMember

2023-01-01

2023-06-30

0001005516

bosc:SupplyChainSolutionsMember

2023-01-01

2023-06-30

0001005516

bosc:IntelligentRoboticsMember

2023-01-01

2023-06-30

0001005516

bosc:IntercompanyMember

2023-01-01

2023-06-30

0001005516

bosc:ConsolidatedMember

2023-01-01

2023-06-30

0001005516

bosc:RFIDMember

bosc:AllocatedOperatingExpensesMember

2023-01-01

2023-06-30

0001005516

bosc:SupplyChainSolutionsMember

bosc:AllocatedOperatingExpensesMember

2023-01-01

2023-06-30

0001005516

bosc:IntelligentRoboticsMember

bosc:AllocatedOperatingExpensesMember

2023-01-01

2023-06-30

0001005516

bosc:IntercompanyMember

bosc:AllocatedOperatingExpensesMember

2023-01-01

2023-06-30

0001005516

bosc:ConsolidatedMember

bosc:AllocatedOperatingExpensesMember

2023-01-01

2023-06-30

0001005516

bosc:RFIDMember

bosc:AcquisitionExpensesMember

2023-01-01

2023-06-30

0001005516

bosc:SupplyChainSolutionsMember

bosc:AcquisitionExpensesMember

2023-01-01

2023-06-30

0001005516

bosc:IntelligentRoboticsMember

bosc:AcquisitionExpensesMember

2023-01-01

2023-06-30

0001005516

bosc:IntercompanyMember

bosc:AcquisitionExpensesMember

2023-01-01

2023-06-30

0001005516

bosc:ConsolidatedMember

bosc:AcquisitionExpensesMember

2023-01-01

2023-06-30

0001005516

bosc:RFIDMember

bosc:UnallocatedOperatingExpensesMember

2023-01-01

2023-06-30

0001005516

bosc:SupplyChainSolutionsMember

bosc:UnallocatedOperatingExpensesMember

2023-01-01

2023-06-30

0001005516

bosc:IntelligentRoboticsMember

bosc:UnallocatedOperatingExpensesMember

2023-01-01

2023-06-30

0001005516

bosc:IntercompanyMember

bosc:UnallocatedOperatingExpensesMember

2023-01-01

2023-06-30

0001005516

bosc:ConsolidatedMember

bosc:UnallocatedOperatingExpensesMember

2023-01-01

2023-06-30

0001005516

bosc:RFIDMember

2022-01-01

2022-06-30

0001005516

bosc:SupplyChainSolutionsMember

2022-01-01

2022-06-30

0001005516

bosc:IntelligentRoboticsMember

2022-01-01

2022-06-30

0001005516

bosc:IntercompanyMember

2022-01-01

2022-06-30

0001005516

bosc:ConsolidatedMember

2022-01-01

2022-06-30

0001005516

bosc:RFIDMember

bosc:AllocatedOperatingExpensesMember

2022-01-01

2022-06-30

0001005516

bosc:SupplyChainSolutionsMember

bosc:AllocatedOperatingExpensesMember

2022-01-01

2022-06-30

0001005516

bosc:IntelligentRoboticsMember

bosc:AllocatedOperatingExpensesMember

2022-01-01

2022-06-30

0001005516

bosc:IntercompanyMember

bosc:AllocatedOperatingExpensesMember

2022-01-01

2022-06-30

0001005516

bosc:ConsolidatedMember

bosc:AllocatedOperatingExpensesMember

2022-01-01

2022-06-30

0001005516

bosc:RFIDMember

bosc:AcquisitionExpensesMember

2022-01-01

2022-06-30

0001005516

bosc:SupplyChainSolutionsMember

bosc:AcquisitionExpensesMember

2022-01-01

2022-06-30

0001005516

bosc:IntelligentRoboticsMember

bosc:AcquisitionExpensesMember

2022-01-01

2022-06-30

0001005516

bosc:IntercompanyMember

bosc:AcquisitionExpensesMember

2022-01-01

2022-06-30

0001005516

bosc:ConsolidatedMember

bosc:AcquisitionExpensesMember

2022-01-01

2022-06-30

0001005516

bosc:RFIDMember

bosc:UnallocatedOperatingExpensesMember

2022-01-01

2022-06-30

0001005516

bosc:SupplyChainSolutionsMember

bosc:UnallocatedOperatingExpensesMember

2022-01-01

2022-06-30

0001005516

bosc:IntelligentRoboticsMember

bosc:UnallocatedOperatingExpensesMember

2022-01-01

2022-06-30

0001005516

bosc:IntercompanyMember

bosc:UnallocatedOperatingExpensesMember

2022-01-01

2022-06-30

0001005516

bosc:ConsolidatedMember

bosc:UnallocatedOperatingExpensesMember

2022-01-01

2022-06-30

0001005516

country:IL

2023-01-01

2023-06-30

0001005516

country:IL

2022-01-01

2022-06-30

0001005516

bosc:FarEastMember

2023-01-01

2023-06-30

0001005516

bosc:FarEastMember

2022-01-01

2022-06-30

0001005516

country:IN

2023-01-01

2023-06-30

0001005516

country:IN

2022-01-01

2022-06-30

0001005516

srt:EuropeMember

2023-01-01

2023-06-30

0001005516

srt:EuropeMember

2022-01-01

2022-06-30

0001005516

country:US

2023-01-01

2023-06-30

0001005516

country:US

2022-01-01

2022-06-30

0001005516

bosc:OthersMember

2023-01-01

2023-06-30

0001005516

bosc:OthersMember

2022-01-01

2022-06-30

0001005516

2022-05-02

2022-05-02

0001005516

2022-05-02

0001005516

2022-04-01

2022-04-30

0001005516

us-gaap:SubsequentEventMember

2023-07-01

2023-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Exhibit 99.2

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

RESULTS OF OPERATIONS AND FINANCIAL CONDITION FOR THE SIX MONTHS ENDED JUNE 30,

2023 AND JUNE 30, 2022

The following discussion

and analysis of the results of BOS Better Online Solutions Ltd. (sometimes referred to herein as, “BOS”, the “Company”,

“we”, “us” or “our’) should be read in conjunction with our interim condensed consolidated financial

statements as of and for the six months ended June 30, 2023, appearing elsewhere in this Form 6-K, our audited consolidated financial

statements and other financial information as of and for the year ended December 31, 2022 appearing in our Annual Report on Form 20-F

for the year ended December 31, 2022 and Item 5—”Operating and Financial Review and Prospects” of that Annual Report.

Forward-Looking Statements

Statements in this Report

on Form 6-K may constitute “forward-looking statements” within the meaning of the United States Federal securities laws that

are based on our beliefs and assumptions as well as information currently available to us. Such forward-looking statements may be identified

by the use of the words “anticipate”, “believe”, “estimate”, “expect”, “plan”,

“intend”, “should”, “predict”, “potential”, “opinion” or the negative of these

terms or similar expressions. Such statements reflect our current views with respect to future events and are subject to certain risks

and uncertainties. While we believe such forward-looking statements are based on reasonable assumptions, should one or more of the underlying

assumptions prove incorrect, or these risks or uncertainties materialize, our actual results may differ materially from those described

herein. Forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially

from those stated in such statements. Factors that could cause or contribute to such differences include, but are not limited to, those

set forth under “Risk Factors” in our Annual Report on Form 20-F for the year ended December 31, 2022,

as well as those discussed elsewhere in that Annual Report and in our other filings with the Securities and Exchange Commission.

Overview

BOS empowers inventory processes through its

three business divisions:

| ● | The Intelligent Robotics division automates industrial and logistic inventory processes; |

| ● | The RFID division marks and tracks inventory; and |

| ● | The Supply Chain division manages inventory. |

Results of Operation

Revenues for the six months

ended June 30, 2023 were $23.5 million, compared to $21.14 million in the six months ended June 30, 2022. The increase is mainly attributed

to the Supply Chain division.

Gross profit for the six

months ended June 30, 2023 amounted to $5.07 million (a gross margin of 21.6%), compared to $4.48 million (a gross margin of 21.1%) for

the six months ended June 30, 2022.

Sales and marketing expenses

for the six months ended June 30, 2023 were $2.47 million or 10.5% of revenues, compared to $2.38 million or 11.2% of revenues in the

six months ended June 30, 2022.

General and administrative

expenses for the six months ended June 30, 2023 were $0.91 million, compared to $1 million in the six months ended June 30, 2022.

Operating income in the

six months ended June 30, 2023 amounted to $1.6 million, compared to an operating income of $1 million in the six months ended June 30,

2022.

Financial expenses for the

six months ended June 30, 2023 were $343,000, compared to $529,000 in the six months ended June 30, 2022. This decrease in expenses is

attributed to foreign exchange differences between the Israeli NIS and the US dollar.

Net income in the six months

ended June 30, 2023 amounted to $1.27 million, compared to a net income of $472,000 in the six months ended June 30, 2022. On a per share

basis, the basic and diluted net income per share in the six months ended June 30, 2023 was $0.22, compared to a $0.09 net income per

share in the six months ended June 30, 2022.

Liquidity and Capital Resources

As of June 30, 2023, we

had $1.21 million in long-term bank loans, and current maturities of $391,000. Cash and cash equivalents as of June 30, 2023 amounted

to $1.9 million.

The Company had a positive

working capital of $10.1 million as of June 30, 2023, and it is the Company's opinion that the current working capital is sufficient for

the Company's present requirements. Working capital requirements will vary from time-to-time and will depend on numerous factors, including

but not limited to, the operating results, scope of sales, supplier and customer credit terms, and acquisition activities.

We have in-balance sheet

financial instruments and off-balance sheet contingent commitments. Our in-balance sheet financial instruments consist of our assets and

liabilities. As of June 30, 2023, our trade receivables' and trade payables' aging days were 85 and 98 days, respectively. The fair value

of our financial instruments is similar to their book value. Our off-balance sheet contingent commitments consist of: (a) royalty commitments

that are directly related to our future revenues, and (b) directors' and officers' indemnities, in excess of the proceeds received from

liability insurance, which we obtain.

Cash Flows

Net cash provided by operating

activities in the six months ended June 30, 2023 was $876,000, compared to $331,000 used in in the six months ended June 30, 2022.

Net cash used in investing

activities in the six months ended June 30, 2023 amounted to $581,000. Net cash used in investing activities in the six months ended June

30, 2022 amounted to $1,050,000.

On July 7, 2013, the Company

entered into a profit sharing agreement with Proteus Ltd, providing for the joint market and sale of certain products.

On April 2, 2023, Proteus

sold to the Company its share in the joint activity in consideration of $723, of which $138 was paid on signing and the rest is paid in

monthly installments during a two year period. Pursuant to the sale agreement, Proteus will gradually phase out its marketing and sale

of the products until the end of 2023.

On May 31, 2023, the Company

entered into an agreement with Microwave Ltd. for the purchase of its distribution rights for certain products, in consideration of $38,

paid at signing.

On March 09, 2022, the Company's

RFID division acquired the activities of the Dagesh Company, which provides inventory counting services in Israel, mainly for retail stores.

In consideration for the acquisition, BOS shall pay NIS 2.7 million (approximately $US 820,000) of which NIS 1.5 million was paid at the

closing, NIS 650,000 was paid in April 2022, NIS 450,000 was paid in April 2023, and NIS 150,000 shall be paid by March 2024.

On May 09, 2022, the Company

entered into an agreement to purchase 546 square meters of offices, 495 square meters of warehouse space and nine parking spaces in Rishon

Lezion. The purchased real estate is part of the facilities leased by BOS in Rishon Lezion. BOS was paid for this acquisition NIS 6.5

million (approximately $1.9 million).

Net cash used in financing

activities in the six months ended June 30, 2023 was $113,000, compared to $514,000 provided by in the six months ended June 30, 2022.

On May 2, 2022, the Company

entered into a definitive agreement with several investors for the sale of 450,000 units, each consisting of one ordinary share and one

half warrant to purchase an ordinary share, at a unit purchase price of $2.2. The warrants have an exercise price of $2.2 per ordinary

share and are immediately exercisable into ordinary shares over a five-year term. The sale was made in a registered direct offering with

a total gross amount of $990 or $911 net of incremental and direct issuance expenses.

2

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.23.3

Condensed Interim Consolidated Balance Sheets - USD ($)

$ in Thousands |

Jun. 30, 2023 |

Dec. 31, 2022 |

| CURRENT ASSETS: |

|

|

| Cash and cash equivalents |

$ 1,931

|

$ 1,763

|

| Restricted bank deposits |

144

|

130

|

| Trade receivables (net of allowance for doubtful accounts of $148 and $82 at June 30, 2023 and December 31 2022, respectively) |

11,011

|

10,834

|

| Other accounts receivable and prepaid expenses |

1,167

|

1,414

|

| Inventories |

7,667

|

6,433

|

| Total current assets |

21,920

|

20,574

|

| NON-CURRENT ASSETS: |

|

|

| Long-term assets |

244

|

260

|

| Property and equipment, net |

3,341

|

3,270

|

| Operating lease right-of-use assets, net |

955

|

1,110

|

| Intangible assets, net |

1,174

|

486

|

| Goodwill |

4,895

|

4,895

|

| Total non-current assets |

10,609

|

10,021

|

| Total assets |

32,529

|

30,595

|

| CURRENT LIABILITIES: |

|

|

| Current maturities of non-current loans |

391

|

586

|

| Operating lease liabilities, current |

235

|

301

|

| Trade payables |

7,801

|

7,984

|

| Employees and payroll accruals |

980

|

1,016

|

| Deferred revenues |

1,550

|

542

|

| Advances net of inventory in progress |

79

|

47

|

| Accrued expenses and other liabilities |

812

|

719

|

| Total current liabilities |

11,848

|

11,195

|

| NON-CURRENT LIABILITIES: |

|

|

| Loans, net of current maturities |

1,209

|

1,294

|

| Operating lease liabilities, non-current |

674

|

827

|

| Deferred revenues |

401

|

241

|

| Accrued severance pay |

363

|

404

|

| Total non-current liabilities |

2,647

|

2,766

|

| COMMITMENTS AND CONTINGENT LIABILITIES |

|

|

| SHAREHOLDERS’ EQUITY: |

|

|

| Ordinary shares: Authorized; 11,000,000 shares at June 30, 2023 and December 31, 2022; Issued and outstanding: 5,740,518 and 5,701,518 shares at June 30, 2023 and December 31, 2022, respectively |

84,915

|

84,830

|

| Additional paid-in capital |

1,228

|

1,179

|

| Accumulated other comprehensive loss |

(243)

|

(243)

|

| Accumulated deficit |

(67,866)

|

(69,132)

|

| Total equity |

18,034

|

16,634

|

| Total liabilities and shareholders’ equity |

$ 32,529

|

$ 30,595

|

| X |

- DefinitionRepresents the amount of advances net of inventory in progress.

| Name: |

bosc_AdvancesNetOfInventoryInProgress |

| Namespace Prefix: |

bosc_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- References

+ Details

| Name: |

bosc_NonCurrentAssetsAbstract |

| Namespace Prefix: |

bosc_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

bosc_NonCurrentLiabilitiesAbstract |

| Namespace Prefix: |

bosc_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAmount of liabilities incurred to vendors for goods and services received, and accrued liabilities classified as other, payable within one year or the normal operating cycle, if longer.

| Name: |

us-gaap_AccountsPayableAndOtherAccruedLiabilitiesCurrent |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionCarrying value as of the balance sheet date of obligations incurred (and for which invoices have typically been received) and payable to vendors for goods and services received that are used in an entity's business. Used to reflect the current portion of the liabilities (due within one year or within the normal operating cycle if longer). Reference 1: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.19(a))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

Reference 2: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section 45

-Paragraph 8

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483467/210-10-45-8

| Name: |

us-gaap_AccountsPayableTradeCurrent |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionAmount, after allowance for credit loss, of right to consideration from customer for product sold and service rendered in normal course of business, classified as current. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Topic 310

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 2

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481990/310-10-45-2

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 310

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 9

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481990/310-10-45-9

| Name: |

us-gaap_AccountsReceivableNetCurrent |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- DefinitionAmount, after tax, of accumulated increase (decrease) in equity from transaction and other event and circumstance from nonowner source. Reference 1: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Topic 220

-SubTopic 10

-Section 45

-Paragraph 14A

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482790/220-10-45-14A

Reference 2: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 220

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 11

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482790/220-10-45-11

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 944

-SubTopic 40

-Name Accounting Standards Codification

-Section 65

-Paragraph 2

-Subparagraph (g)(2)(ii)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480016/944-40-65-2

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Topic 944

-SubTopic 40

-Name Accounting Standards Codification

-Section 65

-Paragraph 2

-Subparagraph (h)(2)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480016/944-40-65-2

Reference 5: http://www.xbrl.org/2003/role/disclosureRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02(30)(a)(4))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

Reference 6: http://www.xbrl.org/2003/role/disclosureRef

-Topic 944

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.7-03(a)(23)(a)(3))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479440/944-210-S99-1

Reference 7: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Topic 220

-SubTopic 10

-Section 45

-Paragraph 14

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482790/220-10-45-14

| Name: |

us-gaap_AccumulatedOtherComprehensiveIncomeLossNetOfTax |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionValue received from shareholders in common stock-related transactions that are in excess of par value or stated value and amounts received from other stock-related transactions. Includes only common stock transactions (excludes preferred stock transactions). May be called contributed capital, capital in excess of par, capital surplus, or paid-in capital. Reference 1: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02(30)(a)(1))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

| Name: |

us-gaap_AdditionalPaidInCapitalCommonStock |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionSum of the carrying amounts as of the balance sheet date of all assets that are recognized. Assets are probable future economic benefits obtained or controlled by an entity as a result of past transactions or events. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Topic 810

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (bb)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481203/810-10-50-3

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 810

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 25

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481231/810-10-45-25

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 235

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.4-08(g)(1)(ii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480678/235-10-S99-1

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Topic 323

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (c)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481687/323-10-50-3

Reference 5: http://www.xbrl.org/2003/role/disclosureRef

-Topic 825

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 28

-Subparagraph (f)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482907/825-10-50-28

Reference 6: http://www.xbrl.org/2003/role/exampleRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481372/852-10-55-10

Reference 7: http://www.xbrl.org/2003/role/exampleRef

-Topic 946

-SubTopic 830

-Name Accounting Standards Codification

-Section 55

-Paragraph 12

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480167/946-830-55-12

Reference 8: http://www.xbrl.org/2003/role/disclosureRef

-Topic 944

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.7-03(a)(12))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479440/944-210-S99-1

Reference 9: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 22

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-22

Reference 10: http://www.xbrl.org/2003/role/disclosureRef

-Topic 946

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.6-04(8))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479617/946-210-S99-1

Reference 11: http://www.xbrl.org/2003/role/disclosureRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02(18))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

Reference 12: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(i))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 13: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(ii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 14: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(iii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 15: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(iii)(A))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 16: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(iv))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 17: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(5))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 18: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(i))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 19: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iii)(A))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 20: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iii)(B))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 21: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iv))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 22: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(5))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 23: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 7

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481404/852-10-50-7

Reference 24: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 30

-Subparagraph (c)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-30

Reference 25: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 32

-Subparagraph (d)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-32

Reference 26: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 942

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.9-03(11))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479853/942-210-S99-1

| Name: |

us-gaap_Assets |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- DefinitionSum of the carrying amounts as of the balance sheet date of all assets that are expected to be realized in cash, sold, or consumed within one year (or the normal operating cycle, if longer). Assets are probable future economic benefits obtained or controlled by an entity as a result of past transactions or events. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Topic 810

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (bb)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481203/810-10-50-3

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 810

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 25

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481231/810-10-45-25

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 235

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.4-08(g)(1)(ii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480678/235-10-S99-1

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Topic 323

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (c)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481687/323-10-50-3

Reference 5: http://www.xbrl.org/2003/role/disclosureRef

-Topic 825

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 28

-Subparagraph (f)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482907/825-10-50-28

Reference 6: http://www.xbrl.org/2003/role/exampleRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481372/852-10-55-10

Reference 7: http://www.xbrl.org/2003/role/disclosureRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 1

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483467/210-10-45-1

Reference 8: http://www.xbrl.org/2003/role/disclosureRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02(9))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

Reference 9: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(i))