UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2023

Commission File Number: 001-41324

AKANDA CORP.

(Name of registrant)

1a, 1b Learoyd Road

New Romney TN28 8XU, United Kingdom

(Address of

principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

On September 19, 2023, Akanda Corp (the

“Company”) entered into an option to purchase agreement with 1107385 B.C. LTD. (the “Owner”) to purchase certain

land property (as defined therein) from the Owner (the “Prior Agreement”). Pursuant to the Prior Agreement, the First Option

Payment (USD600,000) shall be paid either in cash or by the issuance of common shares of the Company (the “Shares”), and

if the Company elects to issue any Shares to the Owner, the total number of the Shares shall not exceed 4.99% of the total outstanding

common shares of the Company (the “Share Cap”) on the date of such issuance.

On September 22, 2023, the Company and the

Owner amended and restated the Prior Agreement (the “Amended and Restated Agreement”) to remove the cash payment option and

Share Cap for the First Option Payment, and agreed to issue the Owner 879,895 Shares in full consideration for the First Option Payment.

Pursuant to the Amended and Restated Agreement, the Company shall issue such Shares to the Owner after fifteen (15) days of the execution

and delivery of the Amended and Restated Agreement and written notice to the Nasdaq Capital Market. The remaining terms and conditions

of the Prior Agreement remain in full force and effect.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

AKANDA CORP. |

| |

(Registrant) |

| |

|

|

| Date: September 25, 2023 |

By: |

/s/ Katie Field |

| |

|

Name: |

Katie Field |

| |

|

Title: |

Executive Director |

Exhibit Index

Exhibit 99.1

Execution

Copy

AMENDED

AND RESTATED

OPTION

TO PURCHASE

THIS AMENDED AND RESTATED OPTION TO PURCHASE (THIS “AGREEMENT”)

is made as of September 22, 2023.

AMONG:

1107385

B.C. LTD., a British Columbia company having a mailing address of 800-1199 West Hastings St., Vancouver, BC V6E 3T5

(the “Owner”)

AND:

AKANDA

CORP., an Ontario company having a mailing address of 1A, 1B Learoyd Road, New Romney, United Kingdom, TN28 8XU

(the “Optionee”)

WHEREAS:

| A. | The parties previously entered into an option to purchase agreement dated September 19, 2023 (the “Prior Agreement”),

and the parties desire to amend and restate the Prior Agreement as set forth herein; and |

| B. | The Owner is the registered and beneficial owner of the Lands in fee simple (as described in this Agreement); and |

| C. | The Owner has agreed to grant to the Optionee an option to purchase the Lands on the terms and conditions set forth in this Agreement. |

NOW THEREFORE THIS AGREEMENT WITNESSES that in consideration Ten United

States Dollars (USD10) now paid by the Optionee to the Owner and other good and valuable consideration, the receipt and sufficiency of

which are acknowledged by each of the parties, the Owner, and the Optionee agree as follows:

Article 1

INTERPRETATION

1.1 Definitions.

In this Agreement:

| (a) | “Akanda Shares” means the common shares in the capital of the Optionee, Akanda Corp., which for certainty are publicly

traded on the NASDAQ stock exchange in the United States (the “Exchange”); |

| (b) | “ALCA” means the Agricultural Land Commission Act S.B.C. 2002, c. 36 and all applicable regulations thereunder; |

| (c) | “Business Day” means any day that is not a Saturday, Sunday or statutory holiday in British Columbia; |

| (d) | “CBD Cultivation Approval” means approval or a licence for cannabidiol (CBD) cultivation on the Lands from the

applicable Governmental Body; |

| (e) | “CBD Cultivation Approval Payment” means Seven Hundred and Fifty Thousand United States Dollars (USD750,000) to

be paid by the Optionee to the Owner in accordance with this Agreement; |

| (f) | “Closing Date” means the first Business day that is thirty (30) days after the Exercise Date, or such other date

as the Owner, and the Optionee may otherwise agree in writing; |

| (g) | “Exercise Date” means the date on which notice of the exercise of the Option is delivered by the Optionee to the

Owner under section 2.4; |

| (h) | “First Option Payment” means Six Hundred Thousand United States Dollars (USD600,000), which will be satisfied by

the issuance of Akanda Shares in the name of the Owner in accordance with this Agreement; |

| (i) | “Freehold Transfer” has the meaning given to it in subsection 5.1(a); |

| (j) | “Governmental Body” means any domestic or foreign, national, federal, provincial, state, municipal or other local

government or body and any division, agent, commission, board, or authority of any quasi-governmental or private body exercising any statutory,

regulatory, expropriation or taxing authority under the authority of any of the foregoing, and any domestic, foreign, international, judicial,

quasi-judicial, arbitration or administrative court, tribunal, commission, board or panel acting under the authority of any of the foregoing; |

| (k) | “GST” has the meaning given in subsection 4.4(d); |

| (l) | “Hemp Cultivation Approval” means approval or a licence for hemp cultivation on the Lands from the applicable Governmental

Body; |

| (m) | “Hemp Cultivation Approval Payment” means Seven Hundred and Fifty Thousand United States Dollars (USD750,000) to

be paid by the Optionee to the Owner in accordance with this Agreement; |

| (n) | “Initial Payment” means One Million Eight Hundred Thousand United States Dollars (USD1,800,000) in the aggregate

to be satisfied by the issuance of Akanda Shares or the payment of cash on account of the First Option Payment, the Second Option Payment

and the Third Option Payment, all as further set out in this Agreement; |

| (o) | “Lands” means the real property described in Schedule “A”, together with all improvements on the

Lands and all rights and benefits appurtenant to the Lands; |

| (p) | “Laws” means all constitutions, treaties, laws, statutes, codes, ordinances, orders, decrees, rules, regulations

and municipal bylaws, whether domestic, foreign or international, any judgments, orders, writs, injunctions, decisions, rulings, decrees,

and awards of any Governmental Body, and any published policies or guidelines of any Governmental Body and including, without limitation,

any principles of common law and equity; |

| (q) | “Milestones” means collectively the Hemp Cultivation Approval, the CBD Cultivation Approval, the THC Cultivation

Approval and the THC Sales Approval, as the context requires, and “Milestone” means any one of them; |

| (r) | “Non-refundable Sum” means a portion of the Option Fee equal to One Million Eight Hundred Thousand United States

Dollars (USD1,800,000); |

| (s) | “Option” means the option granted by the Owner in favour of the Optionee under section 2.1; |

| (t) | “Option Fee” means collectively, the Initial Payment, and if applicable, the Hemp Cultivation Approval Payment,

the CBD Cultivation Approval Payment, the THC Cultivation Approval Payment and the THC Sales Approval Payment, or any one or more of the

foregoing as the context requires; |

| (u) | “Optionee’s Solicitors” means Rimon, P.C. or such other lawyer or law firm designated by the Optionee; |

| (v) | “Owner’s Solicitors” means Farris LLP or such other lawyer or law firm designated by the Owner; |

| (w) | “Permitted Encumbrances” means, collectively, the legal notations, the charges liens and interests and the other

permitted encumbrances described in Schedule “B”; |

| (x) | “Person” includes an individual, partnership, corporation, trust, unincorporated association, pension plan, joint

venture or other entity; |

| (y) | “Project Documents” means all documents and information, including studies, tests, surveys, investigations, reports

(including environmental, geotechnical and engineering reports), plans, specifications, drawings, applications and permits, relating to

the condition, development, operation or ownership of the Lands that now or hereafter are within the possession or control of the Owner; |

| (z) | “Purchase Price” means the amount set out in section 2.2; |

| (aa) | “Second Option Payment” means Six Hundred Thousand United States Dollars (USD600,000), which will be satisfied

by the issuance of Akanda Shares in the name of the Owner or payment in cash in accordance with this Agreement; |

| (bb) | “THC Cultivation Approval” means approval or a licence for Tetrahydrocannabinol (THC) cultivation on the Lands

from the applicable Governmental Body; |

| (cc) | “THC Cultivation Approval Payment” means One Million United States Dollars (USD500,000) to be paid by the Optionee

to the Owner in accordance with this Agreement; and |

| (dd) | “THC Sales Approval” means approval to sell Tetrahydrocannabinol (THC) from product cultivated from the Lands from

the applicable Governmental Body; |

| (ee) | “THC Sales Approval Payment” means One Million United States Dollars (USD500,000) to be paid by the Optionee to

the Owner in accordance with this Agreement; and |

| (ff) | “Third Option Payment” means Six Hundred Thousand United States Dollars (USD600,000), which will be satisfied by

the issuance of Akanda Shares in the name of the Owner or payment in cash in accordance with this Agreement. |

1.2 Currency.

All dollar amounts referred to in this Agreement are United States Dollars (USD).

1.3 Governing

Law. This Agreement shall be governed by and construed in accordance with the Laws of the Province of British Columbia and of Canada

applicable in the Province of British Columbia.

1.4 Schedules.

The following are Schedules to this Agreement:

| |

Schedule “A” — Lands

Schedule “B” — Permitted Encumbrances |

Article 2

GRANT AND EXERCISE OF OPTION

2.1 Option.

The Owner hereby grants to the Optionee the sole and exclusive option, irrevocable within the time herein limited for exercise by the

Optionee, to purchase the Lands free and clear of all encumbrances except for the Permitted Encumbrances for the Purchase Price, on the

Closing Date, upon and subject to the terms and conditions of this Agreement, including the Optionee paying the Option Fee to the Owner.

2.2 Purchase

Price. The purchase price for the Lands shall be Four Million Three Hundred Thousand United States Dollars (USD4,300,000), provided

that any amounts paid pursuant to Section 2.3 below as part of the Option Fee shall be credited towards such purchase price as further

described in Section 2.5 (the “Purchase Price”).

2.3 Option

Fee. The Optionee will pay the Option Fee as follows:

| (a) | Fifteen (15) days after the execution and delivery of this Agreement and written notice to the Nasdaq Capital Market, the Optionee

will issue to the Owner the First Option Payment of 879,895 Akanda Shares. |

| (b) | On or before the date that is fifteen (15) days after the execution and delivery of this Agreement (the “Second Option Payment

Date”), the Optionee will pay to the Owner the Second Option Payment by wire transfer in immediately available funds to the

Owner or as the Owner may otherwise direct in writing. |

| (c) | On or before the date that is thirty (30) days after the execution and delivery of this Agreement (the “Third Option Payment

Date”), the Optionee will pay to the Owner the Third Option Payment by wire transfer in immediately available funds to the Owner’s

Solicitors (in trust for the Owner). |

| (d) | On or before the date that is ten (10) Business Days after the Owner gives the Optionee notice and evidence that the Hemp Cultivation

Approval has been issued or obtained, as appliable, the Optionee will pay to the Owner the Hemp Cultivation Approval Payment by wire transfer

in immediately available funds to the Owner or as the Owner may otherwise direct in writing. |

| (e) | On or before the date that is ten (10) Business Days after the Owner gives the Optionee notice and evidence that the CBD Cultivation

Approval has been issued or obtained, as appliable, the Optionee will pay to the Owner the CBD Cultivation Approval Payment by wire transfer

in immediately available funds to the Owner or as the Owner may otherwise direct in writing. |

| (f) | On or before the date that is ten (10) Business Days after the Owner gives the Optionee notice and evidence that the THC Cultivation

Approval has been issued or obtained, as appliable, the Optionee will pay to the Owner the THC Cultivation Approval Payment by wire transfer

in immediately available funds to the Owner or as the Owner may otherwise direct in writing. |

| (g) | On or before the date that is ten (10) Business Days after the Owner gives the Optionee notice and evidence that the THC Sales

Approval has been issued or obtained, as appliable, the Optionee will pay to the Owner the THC Sales Approval Payment by wire transfer

in immediately available funds to the Owner or as the Owner may otherwise direct in writing. |

| (h) | If the Optionee fails to make a payment on account of the Option Fee as contemplated by this section 2.3, which failure to pay is

not cured by payment in full of such amount that the Optionee has failed to pay (the “Shortfall”) within ten (10) Business

Days after the Owner’s written notice to Optionee of such failure, and so long as the Optionee has not contested in good faith that

such payment is due, the Option shall upon notice by the Owner to the Optionee be null and void and no longer binding upon the parties

and for avoidance of doubt the Owner will be entitled to keep the Non-refundable Sum to the extent paid and will return the balance of

the Option Fees paid, if any, to the Optionee. |

| (i) | If any of the milestones contemplated by Subsections 2.3(d), (e), (f) or (g) above have not been achieved within 24 months

after the date of this Agreement, the Option shall upon notice by the Optionee to the Owner be null and void and no longer binding upon

the parties and the Owner shall immediately return to the Optionee any and all cash payments of Option Fees and Purchase Price which has

been previously paid to the Owner. |

| (j) | If the Optionee exercises the Option prior to payment of all of the payments of which the Option Fee is comprised, provided that the

Optionee satisfies its obligation to pay the Purchase Price in full on the Closing Date as contemplated by this Agreement, the Optionee

will not be required to pay the balance of the Option Fee. |

The Owner and the Optionee covenant and agree with each other to, immediately

after the execution and delivery of this Agreement, take all reasonable steps to cause each of the Milestones to be reached for the Lands

in a timely manner. In connection with the foregoing, the Owner and the Optionee will cooperate with each other and with all requests

from Governmental Bodies, including providing such information, documents and applications reasonably required by the other and such Governmental

Authorities. Each of the Owner and the Optionee will bear their own costs and expenses in connection with satisfying the Milestones.

2.4 Exercise

of Option. The Optionee may exercise the Option at any time until 5:00 pm on the day that is thirty (30) days after the Owner

and Optionee have mutually agreed in writing, in good faith, that all the milestones contemplated by Subsections 2.3(d), (e), (f) and

(g) above have been achieved by delivering to the Owner written notice of the exercise of the Option. If the Option is exercised

as set forth in this section 2.4, this Agreement for the purchase and sale of the Lands shall be completed upon the terms and conditions

contained in this Agreement on the Closing Date.

2.5 Application

of Option Fee. The Option Fee (or parts thereof paid by the Optionee) shall be applied on account of the Purchase Price on the Closing

Date.

2.6 Licence

for Early Access. The Owner hereby grants to the Optionee a licence, during the Option Term, for it and its authorized representatives

to enter upon the Lands from time to time during business hours to carry out, at the Optionee's expense, such tests and inspections as

the Optionee or its authorized representatives may deem necessary, provided that (a) the Optionee shall promptly repair any resulting

damage to the Lands; (b) the Optionee and its authorized representatives shall comply with all rules and regulations regarding

such access, tests and inspections as the Owner may establish from time to time; and (c) prior to accessing the Lands the Owner shall

obtain such insurance as the Owner may reasonably require and provide evidence of same on request of the Owner.

2.7 Short

Form of Option. After the Optionee has paid (or satisfied its obligation to pay) the Option Fee in full, the Owner will execute

and deliver to the Optionee a registrable short form of this Agreement in a form acceptable to the Optionee, acting reasonably. The Optionee

may, at its cost, register such short form of this Agreement against title to the Lands and the Owner will execute any documents reasonably

required to effect such registration at the request of the Optionee. If there is any conflict or inconsistency between the terms and conditions

of this Agreement and the terms and conditions of the short form of this Agreement, the terms and conditions of this Agreement shall govern

and take precedence. If this Agreement is terminated or the Optionee does not exercise the Option within the time and in the manner set

forth in section 2.4, the Optionee will, at its sole cost, discharge such short form of this Agreement from title to the Lands promptly

upon request by the Owner.

Article 3

ADJUSTMENTS AND POSSESSION

3.1 Adjustments.

All adjustments with respect to taxes, utilities and licences, and all other items normally adjusted between a vendor and purchaser on

the sale of similar commercial property shall be made with respect to the Lands as of 12:01 a.m, the Closing Date. The Owner shall

receive the benefit of all income and shall be responsible for all expenses relating to the Lands up to 11:59 p.m. on the day

preceding the Closing Date, and the Optionee shall receive the benefit of all income and be responsible for all expenses from and including

the Closing Date. Any adjustments which are not capable of being adjusted on the Closing Date shall be adjusted between the Owner and

the Optionee as soon as possible after the Closing Date.

3.2 Possession.

Subject to completion of the transaction as set out in Article 6, the Optionee shall be entitled to vacant possession of the

Lands on the Closing Date, subject to the Permitted Encumbrances.

3.3 Risk.

The Lands shall be at the risk of the Owner until acceptance of the Freehold Transfer for registration in the Land Title Office, and thereafter

the Lands shall be at the risk of the Optionee.

3.4 Expropriation.

If the Lands or any material part thereof is expropriated prior to the Closing Date, the Optionee will have the option, in its sole discretion,

of (i) completing the purchase and sale of the Lands, in which event the Owner shall assign to the Optionee all proceeds and right

to receive proceeds of any expropriation award or other compensation; or (ii) not completing the purchase and sale of the Lands,

in which event neither party will have any further obligations to the other under this Agreement and the Owner will have no claims against

the Optionee hereunder.

3.5 Damage.

If, prior to the time of submission for registration of the Freehold Transfer on the Closing Date, any loss or damage occurs to the

Lands (other than as a result of any act of the Owner or Owner’s agents, or any breach by Owner of any representation, warranty

or covenant of the Owner contained in this Agreement), the Optionee may choose, at its sole discretion to either (a) complete the

transaction contemplated by this Agreement and receive any insurance proceeds (which shall be assigned by the Owner to the Optionee) pursuant

to any policy of insurance carried by the Owner or (b) terminate the Option, at which time the Owner shall immediately return to

the Optionee any and all Option Fees and Purchase Price which has been previously paid to the Owner. There will be no further compensation

to the Optionee to the extent insurance proceeds are inadequate to repair any damage.

Article 4

REPRESENTATIONS, WARRANTIES and covenants

4.1 Representations

and Warranties of the Owner. The Owner represents and warrants to the Optionee, regardless of any independent investigations that

the Optionee may cause to be made, that:

| (a) | the Owner is a company duly incorporated and validly existing under the laws of British Columbia and duly qualified to carry on business

in British Columbia and has the corporate power and capacity to own its interest in its assets, and to enter into and to carry out the

transactions contemplated in this Agreement; |

| (b) | the execution and delivery of this Agreement and the completion of the transactions contemplated in this Agreement have been duly

authorized by all necessary corporate action on the part of the Owner; |

| (c) | the Owner is not a non-resident of Canada for the purposes of the Income Tax Act (Canada); |

| (d) | the Owner is the registered and beneficial owner of the Lands and had good and marketable title to the Lands in fee simple free and

clear of all liens, charges, and encumbrances except for the Permitted Encumbrances (and those encumbrances to be discharged by the Owner

in conjunction with the closing of the transactions contemplated herein); |

| (e) | the Owner’s ownership and use of the Lands has been in compliance with the requirements of the ALCA at all times, and the Owner

is not in contravention of the requirements of the ALCA; |

| (f) | the Owner has the authority to grant the option to the Optionee under this Agreement and to complete the transactions contemplated

by this Agreement; |

| (g) | there are no unpaid taxes, rates, levies and assessments of any nature and kind assessed or imposed against the Lands or any part

of the Lands; |

| (h) | at the date of this Agreement, the Permitted Encumbrances have been duly observed and performed by the Owner and are in good standing

and in full force and effect, and there are no defaults thereunder; |

| (i) | the Owner is not aware of and has not received notice of: |

| (i) | adverse soil conditions existing on the Lands; |

| (ii) | contraventions of environmental laws affecting the Lands; and/or |

| (iii) | any underground storage tanks located on the Lands; |

| (j) | no Person, other than the Optionee, has any right, agreement, privilege or option to acquire, own, lease, licence, occupy, or use

all or any part of the Lands; |

| (k) | the Owner has not received any notice of and does not have any knowledge of: |

| (i) | any pending or threatened action or proceeding relating to expropriation of the Lands or any part thereof by any Governmental Body;

or |

| (ii) | any application for any Governmental Body, or intention of any Governmental Body, to alter any applicable zoning bylaws or official

community plan so as to affect or potentially affect the Lands or the zoning or permitted uses thereof; |

| (l) | there is no action, suit, claim, litigation or proceeding pending or, to the knowledge of the Owner, threatened before any court,

arbitrator, arbitration panel or administrative tribunal or agency with respect to: |

| (i) | the Lands or the zoning, subdivision, development, occupation, use or condition thereof; or |

| (ii) | the Owner which, if decided adversely to the Owner, would materially affect the ability of the Owner or either of them to perform

any of its obligations under this Agreement; and |

| (m) | there is no rezoning, development permit, development variance permit or building permit, or any application therefor, outstanding

with respect to the Lands or any part thereof. |

| (n) | To the Owner’s knowledge, the Project Documents are accurate, complete, up-to-date and not misleading. |

4.2 The

Owner’s Warranties and Representations as of the Closing Date. The Owner covenants and agrees that all representations and warranties

of the Owner set forth in this Agreement or in any document delivered in connection with the Option and the purchase and sale contemplated

by this Agreement will be true and correct in all material respects at and as of the closing (as if such representations and warranties

were made on the Closing Date).

4.3 Survival

of the Owner’s Representations and Warranties. The representations and warranties of the Owner set forth in this Agreement or

in any document delivered in connection with the purchase and sale contemplated by this Agreement shall survive the closing of the purchase

and sale of the Lands provided for in this Agreement for one (1) year following the Closing Date and, notwithstanding such closing

nor any investigation made by or on behalf of the Optionee, shall continue in full force and effect for the benefit of the Optionee. The

Owner acknowledges that the Optionee is relying upon such representations and warranties in entering into this Agreement.

4.4 The

Owner's Covenants. The Owner undertakes and agrees, during the Option Term:

| (a) | not to change or apply to change the zoning for the Lands except as consented to in writing by the Optionee; |

| (b) | to maintain the Lands in their existing condition and not make any major removals, alterations, or changes thereto, except as may

be required by law, and then by providing notice thereof to the Optionee; |

| (c) | to promptly provide the Optionee with copies of notices of default, violation, deficiency, or change affecting the Lands sent to or

received by the Owner; |

| (d) | to comply with the requirements of the ALCA at all times in respect of the Lands; and |

| (e) | to promptly notify the Optionee if there is any change in the condition of the Lands. |

4.5 Further

Encumbrances. The Owner agrees that during the Option Term, it will not grant any charge, easement, right, licence, tenancy, or other

encumbrance, or amend any Permitted Encumbrances affecting the Lands that will not be discharged on the Closing Date without the Optionee's

prior written consent, which consent may be withheld at the Optionee’s discretion.

4.6 Optionee’s

Representations and Warranties. The Optionee represents and warrants to the Owner, regardless of any independent investigation that

the Owner may cause to be made, that:

| (a) | the Optionee is a corporation incorporated and validly existing under the laws of Ontario and is duly qualified to carry on business

in British Columbia; |

| (b) | the Optionee has the corporate power and capacity to enter into and carry out the transactions contemplated in this Agreement; |

| (c) | the execution and delivery of this Agreement and the completion of the transactions contemplated in this Agreement have been duly

authorized by all necessary corporate action on the part of the Optionee and by all necessary Governmental Bodies; and |

| (d) | the Optionee is registered for Harmonized Sales Tax/Goods and Service Tax (“GST”) purposes, its GST registration

number is [•], and it will remit or account for GST payable in respect of the payment of the Option Fee, the Purchase Price

and its purchase of the Lands in accordance with the Excise Tax Act (Canada). |

4.7 Optionee’s

Warranties and Representations as of the Closing Date. The Optionee covenants and agrees that all representations and warranties of

the Optionee set forth in this Agreement or in any document delivered in connection with the purchase and sale contemplated by this Agreement

will be true and correct at and as of the closing in all material respects (as if such representations and warranties were made on the

Closing Date).

4.8 Survival

of Optionee’s Representations and Warranties. The representations and warranties of the Optionee set forth in this Agreement

or in any document delivered in connection with the purchase and sale contemplated by this Agreement shall survive the closing of the

purchase and sale of the Lands provided for in this Agreement for one (1) year following the Closing Date and, notwithstanding such

closing nor any investigation made by or on behalf of the Owner, shall continue in full force and effect for the benefit of the Owner.

The Optionee acknowledges that the Owner are relying upon such representations and warranties in entering into this Agreement.

4.9 Project

Documents; Confidentiality. The Owner covenants to maintain and deliver to the Optionee on request copies of all Project Documents

that are or may hereafter be in the possession or control of the Owner. The Owner further covenants that it will until the Closing Date

provide the Optionee, on reasonable prior notice, reasonable access to its files for the Lands during regular business hours and the Optionee

shall be entitled, at its cost, to make photocopies of such of the material in those files as the Optionee may request. The Optionee acknowledges

that the Owner shall not have any liability for any errors, omissions or inaccuracies in any such information or materials provided by

the Owner to the Optionee pursuant to this section, except to the extent of any express representation, warranty, covenant or agreement

of the Owner contained in this Agreement. All such materials, whether made available to the Optionee before, on or after the date of this

Agreement, may be retained by the Optionee and used as part of its due diligence before and after completion of the purchase and sale

of the Lands pursuant to this Agreement. From the date of this Agreement to the Closing Date, the Optionee covenants agrees to keep the

contents of all Project Documents and all material non-public information regarding the Owner and/or the Lands (collectively, the “Confidential

Information”) confidential and only to use same for the purposes of evaluating the Lands and the transactions contemplated by

this Agreement and obtaining financing in respect of same, provided however that nothing in this Agreement will prevent the Optionee from

disclosing the Confidential Information on the same confidential basis to its own directors, officers, employees, professional advisors

or consultants who need to know such information or from disclosing the Confidential Information in any filings or notices. If the Optionee

does not complete the purchase of the Lands as contemplated by this Agreement, the Optionee will on demand return all such materials to

the Owner, or destroy same and provide certification and such reasonable evidence as the Owner may require of such destruction.

4.10 Authorizations.

The Owner shall provide to the Optionee on request all written authorizations that the Optionee may reasonably request for the purposes

of the Optionee’s due diligence enquiries of Governmental Bodies with respect to the Owner and the Lands, and shall otherwise co-operate

with and assist the Optionee with its due diligence in respect of the Owner, the Lands and the transactions contemplated by this Agreement.

4.11 Site

Profile. The Optionee waives, to the extent permitted by law, any requirement for the Owner to obtain or provide to the Optionee

a “site profile” or any other environmental report for the Lands under the Environmental Management Act (British Columbia)

or ay regulations in respect thereto.

Article 5

PREPARATION OF CLOSING DOCUMENTS

5.1 Delivery

of Documents – the Owner. On or before the Closing Date, the Owner shall cause the Owner’s Solicitors to deliver to the

Optionee’s Solicitors the following items, in form and content satisfactory to the Optionee’s Solicitors, acting reasonably,

and duly executed by the Owner and the other parties thereto and in registrable form wherever appropriate, to be dealt with under Article 6:

| (a) | a Land Title Act Form A Freehold Transfer conveying the Lands to the Optionee, subject only to the Permitted Encumbrances

(the “Freehold Transfer”); |

| (b) | a statutory declaration declaring that it is not a non-resident of Canada within the meaning of the Income Tax Act (Canada)

and providing all such additional information as is necessary for the completion of the Property Transfer Tax Application to be filed

by the Optionee on closing; |

| (c) | if applicable, an assignment of any leases and service contracts with respect to the Lands that are being assumed by the Optionee; |

| (d) | an assignment to the Optionee of all of the Owner’s rights under any warranties and guarantees which entitle the Owner to any

rights against a contractor or supplier engaged in the construction, repair, maintenance, renovation or modification of any improvements

on the Lands or any part thereof, to the extent that such rights can be assigned; |

| (e) | a certificate of an authorized officer of the Owner dated the Closing Date certifying that each of the warranties and representations

of the Owner set out in this Agreement is true and accurate on the Closing Date in all material respects or, to the extent any such representation

or warranty is untrue or inaccurate, setting out in reasonable detail a description of the facts which give rise to such untruthfulness

or inaccuracy; |

| (f) | a statement of adjustments; and |

| (g) | such further deeds, acts, things, certificates and assurances as may be requisite in the reasonable opinion of the Optionee’s

Solicitors for more perfectly and absolutely assigning, transferring, conveying and assuring to and vesting in the Optionee, all right,

title and interest of the Owner in and to the Lands free and clear of any lien, charge, encumbrance or legal notation other than the Permitted

Encumbrances as contemplated in this Agreement. |

5.2 Delivery

of Documents – Optionee. On or before the Closing Date, the Optionee shall deliver to the Optionee’s Solicitors the following

items, in form and content satisfactory to the Owner’s Solicitors, acting reasonably, and duly executed by the Optionee, and in

registrable form where appropriate, to be dealt with under Article 6:

| (a) | a statement of adjustments; |

| (b) | a certificate of an authorized officer of the Optionee confirming the registration status of the Optionee under the Excise Tax

Act (Canada); and |

| (c) | a certificate of an authorized officer of the Optionee dated the Closing Date certifying that each of the representations and warranties

of the Optionee set out in this Agreement is true and accurate on the Closing Date in all material respects or, to the extent any such

representation or warranty is untrue or inaccurate, setting out in reasonable detail a description of the facts which give rise to such

untruthfulness or inaccuracy. |

5.3 Preparation

of Documents. The documents contemplated in sections 5.1 and 5.2 will be prepared by the Optionee’s Solicitors,

to the extent that preparation is required, and delivered to the Owner’s Solicitors at least two Business Days before the Closing

Date.

Article 6

CLOSING PROCEDURE

6.1 Payment

in Trust. On or before the Closing Date the Optionee shall pay to the Optionee’s Solicitors in trust the balance of the Purchase

Price (adjusted in accordance with section 3.1), after deducting the Option Fee (or part thereof paid by the Optionee to the Owner). The

Owner irrevocably directs the Optionee to cause the Optionee’s Solicitors to pay the adjusted Purchase Price to the Owner’s

Solicitors to the extent contemplated in this Article 6 and this shall be its good and sufficient authority for so doing.

6.2 Registration.

Forthwith following the payment in section 6.1 and after receipt by the Optionee’s Solicitors of the documents and items

referred to in sections 5.1 and 5.2, if applicable, the Optionee shall cause the Optionee’s Solicitors to file the

Freehold Transfer in the applicable Land Title Office.

6.3 Payment.

Forthwith following the filing referred to in section 6.2 and upon the Optionee’s Solicitors being satisfied as to the

priority of the Freehold Transfer, after conducting a post-filing for registration check of the property title for the Lands disclosing

only the following:

| (a) | the existing title number to the Lands; |

| (b) | the Permitted Encumbrances; |

| (c) | any charges with respect to which the Owner’s Solicitors have extended to the Optionee’s Solicitors satisfactory undertakings

for the discharge and release of such charges; |

| (d) | pending numbers assigned to the Freehold Transfer, if applicable; and |

| (e) | pending number assigned to charges granted by the Optionee or in connection with the Optionee’s financing on closing, if applicable; |

the Optionee

shall cause the Optionee’s Solicitors to deliver to the Owner’s Solicitors a solicitor’s trust cheque or bank draft

for the adjusted Purchase Price, less the Option Fee applied on account of the Purchase Price, and to release the items referred to in

sections 5.1 and 5.2 to the Optionee and the Owner, as the case may be. The Optionee’s Solicitors shall undertake

to forthwith apply to withdraw the registrations referred to in sections 6.3(f) and (g) if a solicitor’s trust

cheque or bank draft for the adjusted Purchase Price is not delivered to the Owner’s Solicitors on the Closing Date.

6.4 Concurrent

Requirements. It is a condition of this Agreement that all requirements of this Article 6 are concurrent requirements and

it is specifically agreed that nothing shall be completed on the Closing Date until everything required to be paid, executed and delivered

on the Closing Date has been so paid, executed and delivered and until the Optionee’s Solicitors have satisfied themselves as to

the registration and priority of the Freehold Transfer.

6.5 Discharge

of Lender’s Security. If on the Closing Date there are any judgments, liens, claims of lien or any other encumbrances of a financial

nature against title to the Lands which are not Permitted Encumbrances, then the Owner will not be required to clear the title to the

Lands prior to the receipt of the net sales proceeds of the Lands but will be obligated to do so forthwith following receipt of the net

sale proceeds to the Owner’s Solicitors on the condition that the Owner’s Solicitors undertake to discharge any such judgment,

lien, claim of lien or other Encumbrance of a financial nature within a reasonable period of time after the Closing Date in an undertaking

substantially in the form of the CBA standard undertakings used for the purchase and sale of real estate in British Columbia with such

amendments as the Optionee’s Solicitors and the Owner’s Solicitors agree, each acting reasonably.

6.6 Optionee’s

Financing. If the Optionee is relying upon a new mortgage or mortgages to finance part of the Purchase Price, the Optionee while still

required to pay the amount due to the Owner pursuant to sections 2.2 and 6.3 on the Closing Date, may wait to pay the amount

due to the Owner pursuant to sections 2.2 and 6.3 to the Owner until after the new mortgage documents have been submitted for

registration in the applicable Land Title Office, but only if, before such submission, the Optionee has:

| (a) | deposited with the Optionee’s Solicitors that portion of the amount

due to the Owner pursuant to sections 2.2 and 6.3 not secured by the new mortgage(s); |

| (b) | fulfilled all the new mortgagee(s)’ conditions for funding except submitting the mortgage(s) for registration; and |

| (c) | made available to the Owner, a lawyer’s undertaking to pay the Purchase Price due on the Closing Date upon the submission for

registration of the new mortgage documents and the advance by the Optionee’s mortgagee(s) of the mortgage proceeds. |

Article 7

MISCELLANEOUS

7.1 Time.

Time will be of the essence of this Agreement and will remain of the essence notwithstanding the extension of any of the dates under this

Agreement.

7.2 No

Waiver. No failure or delay on the part of either party in exercising any right, power or privilege under this Agreement shall operate

as a waiver thereof, nor will any single or partial exercise of any right, power or privilege preclude any other or further exercise thereof

or the exercise of any other right, power or privilege. Except as may be limited in this Agreement, either party may, in its sole discretion,

exercise any and all rights, powers, remedies and recourses available to it under this Agreement or any other remedy available to it and

such rights, powers, remedies and recourses may be exercised concurrently or individually without the necessity of making any election.

7.3 Tender.

It is agreed that any tender of documents or money may be made upon the respective solicitors for the parties and that it will be sufficient

to tender a solicitor’s trust cheque, or a bank draft drawn on or wire transfer from a Canadian chartered bank, rather than cash.

7.4 Legal

Fees. Each party shall pay its own legal fees. The Optionee shall be responsible for all registration fees and property transfer tax

payable in connection with the registration of the Option and the Freehold Transfer.

7.5 Goods

and Services Tax and Property Transfer Tax. The Optionee is

responsible to pay applicable GST and the property transfer tax (if any) in accordance with the Property Transfer Tax Act (British

Columbia) on the Option Fee and the Purchase Price. If the Optionee is a registrant for GST on the Closing Date, the Optionee

covenants to account for GST directly with the taxing authority in accordance with the Excise Tax Act (Canada). The Optionee hereby

coveants and agrees to pay, indemnify and hold harmless the Owner from and against all claims or losses incurred by the Owner directly

or indirectly arising in connection with the payment of GST and property transfer tax with respect to the completion of the transactions

contemplated by this Agreement, including without limitation all penalties and interest thereon.

7.6 Entire

Agreement. This Agreement, the registrable short form of this Agreement contemplated by section 2.7, and the agreements, instruments

and other documents entered into under this Agreement set forth the entire agreement and understanding of the parties with respect to

the subject matter of this Agreement and supersede all prior agreements and understandings among the parties with respect to the matters

herein and there are no oral or written agreements, promises, warranties, terms, conditions, representations or collateral agreements,

express or implied, other than those contained in this Agreement.

7.7 Amendment.

This Agreement may be altered or amended only by an agreement in writing signed by the parties.

7.8 Further

Assurances. Each of the parties shall at all times and from time to time and upon reasonable request do, execute and deliver all further

assurances, acts and documents for the purpose of evidencing and giving full force and effect to the covenants, agreements and provisions

in this Agreement.

7.9 Notices.

Any demand or notice which may be given under this Agreement shall be in writing and delivered or telecopied addressed to the parties

as follows:

1A, 1B Learoyd Road

New Romney, United Kingdom,

TN28 8XU

Attention: President

with a copy to:

Rimon, P.C.

423 Washington Street, Suite 600

San Francisco, CA 94111

Attention: Mark C. Lee

Email: mark.c.lee@rimonlaw.com

800-1199 West Hastings St.

Vancouver, BC V6E 3T5

CANADA

Attention: President

with a copy to:

Farris LLP

2500-700 West Georgia St.

Vancouver, BC V7Y 1B3

CANADA

Fax: 604-661-9349

Attention: Peter Roth

or at such other address or facsimile number as

either party may specify in writing to the other. The time of giving and receiving any such notice shall be deemed to be on the day of

delivery or transmittal.

7.10 Agency

Disclosure. The Owner and the Optionee represent to each other that neither has engaged, or become obligated to a real estate broker,

in respect of this Agreement or any purchase and sale of the Lands pursuant hereto.

7.11 Assignment.

The Optionee may not assign its interest in this Agreement (including without limitation the rights under the Option or the rights to

acquire the Lands) to any other Person without the prior written consent of the Owner.

7.12 Counterparts.

This Agreement may be executed in any number of original counterparts, with the same effect as it all the parties had signed the same

document, and will become effective when one or more counterparts have been signed by all of the parties and delivered to each of the

parties. All counterparts shall be construed together and evidence only one agreement, which, notwithstanding the dates of execution of

any counterparts, shall be deemed to be dated the reference date set out above, and only one of which need be produced for any purpose.

7.13 Binding

Effect. This Agreement shall enure to the benefit of and be binding upon the heirs, executors, administrators, legal and personal

representatives, successors and permitted assigns of the parties, as applicable.

7.14 Electronic

Execution. This Agreement may be executed by the parties and transmitted by electronic facsimile transmission and when it is executed

and transmitted this Agreement shall be for all purposes as effective as if the parties had delivered an executed original Agreement.

7.15 Joint

and Several Liability. If a party is comprised of two or more persons, the representations, warranties, covenants, agreements and

obligations of that party are joint and several representations, warranties, covenants, agreements and obligations of the persons who

comprise that party except where otherwise specifically provided.

7.16 Prior

Agreement. The Prior Agreement shall be deemed null and void.

[REMAINDER OF THIS PAGE INTENTIONALLY LEFT BLANK]

IN WITNESS WHEREOF the parties have executed this Agreement as of the

date first above written.

| |

1107385 B.C. LTD. |

| |

|

| |

Per: |

|

| |

|

Authorized Signatory |

| |

AKANDA CORP. |

| |

|

| |

Per: |

|

| |

|

Authorized Signatory |

Signature Page to Amended and Restated Option

to Purchase Agreement

SCHEDULE “A”

SCHEDULE “B”

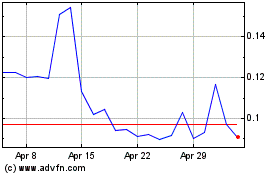

Akanda (NASDAQ:AKAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Akanda (NASDAQ:AKAN)

Historical Stock Chart

From Apr 2023 to Apr 2024