0000059860

false

--12-31

2023

Q1

0

0

0000059860

2023-01-01

2023-03-31

0000059860

2023-09-22

0000059860

2023-03-31

0000059860

2022-12-31

0000059860

us-gaap:SeriesAPreferredStockMember

2023-03-31

0000059860

us-gaap:SeriesAPreferredStockMember

2022-12-31

0000059860

us-gaap:SeriesBPreferredStockMember

2023-03-31

0000059860

us-gaap:SeriesBPreferredStockMember

2022-12-31

0000059860

us-gaap:SeriesCPreferredStockMember

2023-03-31

0000059860

us-gaap:SeriesCPreferredStockMember

2022-12-31

0000059860

us-gaap:SeriesDPreferredStockMember

2023-03-31

0000059860

us-gaap:SeriesDPreferredStockMember

2022-12-31

0000059860

us-gaap:SeriesEPreferredStockMember

2023-03-31

0000059860

us-gaap:SeriesEPreferredStockMember

2022-12-31

0000059860

us-gaap:SeriesFPreferredStockMember

2023-03-31

0000059860

us-gaap:SeriesFPreferredStockMember

2022-12-31

0000059860

2022-01-01

2022-03-31

0000059860

us-gaap:PreferredStockMember

2022-12-31

0000059860

us-gaap:CommonStockMember

2022-12-31

0000059860

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0000059860

us-gaap:RetainedEarningsMember

2022-12-31

0000059860

us-gaap:PreferredStockMember

2021-12-31

0000059860

us-gaap:CommonStockMember

2021-12-31

0000059860

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0000059860

us-gaap:RetainedEarningsMember

2021-12-31

0000059860

2021-12-31

0000059860

us-gaap:PreferredStockMember

2023-01-01

2023-03-31

0000059860

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0000059860

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0000059860

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0000059860

us-gaap:PreferredStockMember

2022-01-01

2022-03-31

0000059860

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0000059860

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0000059860

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0000059860

us-gaap:PreferredStockMember

2023-03-31

0000059860

us-gaap:CommonStockMember

2023-03-31

0000059860

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0000059860

us-gaap:RetainedEarningsMember

2023-03-31

0000059860

us-gaap:PreferredStockMember

2022-03-31

0000059860

us-gaap:CommonStockMember

2022-03-31

0000059860

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0000059860

us-gaap:RetainedEarningsMember

2022-03-31

0000059860

2022-03-31

0000059860

us-gaap:StockOptionMember

2023-01-01

2023-03-31

0000059860

us-gaap:StockOptionMember

2022-01-01

2022-03-31

0000059860

us-gaap:WarrantMember

2023-01-01

2023-03-31

0000059860

us-gaap:WarrantMember

2022-01-01

2022-03-31

0000059860

us-gaap:ConvertiblePreferredStockMember

2023-01-01

2023-03-31

0000059860

us-gaap:ConvertiblePreferredStockMember

2022-01-01

2022-03-31

0000059860

grmc:ConvertibleInterestPayableMember

2023-01-01

2023-03-31

0000059860

grmc:ConvertibleInterestPayableMember

2022-01-01

2022-03-31

0000059860

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

2023-03-31

0000059860

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

2022-12-31

0000059860

srt:ChiefExecutiveOfficerMember

2022-12-31

0000059860

srt:ChiefExecutiveOfficerMember

2021-12-31

0000059860

srt:ChiefExecutiveOfficerMember

2023-01-01

2023-03-31

0000059860

srt:ChiefExecutiveOfficerMember

2022-01-01

2022-12-31

0000059860

srt:ChiefExecutiveOfficerMember

2023-03-31

0000059860

srt:ChiefFinancialOfficerMember

2022-12-31

0000059860

srt:ChiefFinancialOfficerMember

2021-12-31

0000059860

srt:ChiefFinancialOfficerMember

2023-01-01

2023-03-31

0000059860

srt:ChiefFinancialOfficerMember

2022-01-01

2022-12-31

0000059860

srt:ChiefFinancialOfficerMember

2023-03-31

0000059860

srt:DirectorMember

2023-01-01

2023-03-31

0000059860

grmc:NotesPayableInGoldMember

2023-01-01

2023-03-31

0000059860

grmc:NotesPayableInGoldMember

2023-03-31

0000059860

grmc:NotesPayableInGoldMember

2022-01-01

2022-03-31

0000059860

grmc:NotesPayableInGoldMember

2022-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

| x |

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

|

| For

the quarterly period ended March 31, 2023 |

| |

| OR |

| |

| o |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from to

Commission

file number: 001-06412

GOLDRICH MINING COMPANY

(Exact

Name of Registrant as Specified in its Charter)

| alaska |

|

91-0742812 |

| (State

of other jurisdiction of incorporation or organization) |

|

(I.R.S.

Employer Identification No.) |

| |

|

|

| 2525 E. 29th Ave. Ste. 10B-160 |

|

|

| Spokane, WA |

|

99223 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

(509)

535-7367

(Registrant’s

Telephone Number, including Area Code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

Trading

Symbol(s) |

Name

of Each Exchange on Which

Registered |

| Common

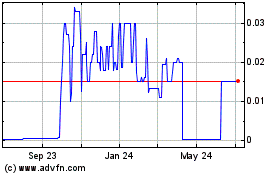

Stock, $0.10 par value |

GRMC |

OTC Expert Market |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. o Yes x

No

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files). x Yes o

No

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”,

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large

Accelerated Filer o |

Accelerated

Filer o |

Non-Accelerated Filer x

|

Small Reporting Company x

Emerging Growth Company o |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate

by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) o Yes x No

Number

of shares of issuer’s common stock outstanding at September 22, 2023: 196,559,523

TABLE

OF CONTENTS

PART

I – FINANCIAL INFORMATION

Item

1. Financial Statements

| Goldrich

Mining Company |

| Condensed

Consolidated Balance Sheets (Unaudited) |

| | |

March 31, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 3,866 | | |

$ | 3,969 | |

| Prepaid expenses | |

| 75,651 | | |

| 106,527 | |

| Total current assets | |

| 79,517 | | |

| 110,496 | |

| | |

| | | |

| | |

| Mineral interests: | |

| | | |

| | |

| Mineral interests | |

| 626,428 | | |

| 626,428 | |

| Total mineral interests | |

| 626,428 | | |

| 626,428 | |

| | |

| | | |

| | |

| Other assets: | |

| | | |

| | |

| Investment in CGL LLC | |

| 25,000 | | |

| 25,000 | |

| Total other assets | |

| 25,000 | | |

| 25,000 | |

| Total assets | |

$ | 730,945 | | |

$ | 761,924 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 1,584,653 | | |

$ | 1,534,863 | |

| Interest payable | |

| 779,200 | | |

| 720,111 | |

| Convertible interest payable – related party | |

| 2,308,993 | | |

| 2,151,466 | |

| Related party payable | |

| 1,323,988 | | |

| 1,264,216 | |

| Notes payable | |

| 1,250,169 | | |

| 1,250,169 | |

| Notes payable – related party | |

| 4,211,769 | | |

| 4,195,979 | |

| Notes payable in gold | |

| 528,161 | | |

| 483,514 | |

| Dividends payable on preferred stock | |

| 30,618 | | |

| 30,618 | |

| Total current liabilities | |

| 12,017,551 | | |

| 11,630,936 | |

| | |

| | | |

| | |

| Long-term liabilities: | |

| | | |

| | |

| Subscription payable | |

| 40,000 | | |

| 70,000 | |

| Remediation and asset retirement obligation | |

| 277,178 | | |

| 275,424 | |

| Total long-term liabilities | |

| 317,178 | | |

| 345,424 | |

| Total liabilities | |

| 12,334,729 | | |

| 11,976,360 | |

| | |

| | | |

| | |

| Commitments and contingencies (Notes 8) | |

| | | |

| | |

| Stockholders’ deficit: | |

| | | |

| | |

| Preferred stock; no par value, 8,998,700 shares authorized; no shares issued or outstanding | |

| - | | |

| - | |

| Convertible preferred stock series A; 5% cumulative dividends, no par value, 1,000,000 shares authorized; 475,000 issues and 150,000 shares outstanding, $300,000 liquidation preferences | |

| 150,000 | | |

| 150,000 | |

| Convertible preferred stock series B; no par value, 300 shares authorized, 200 shares issued and outstanding, $200,000 liquidation preference | |

| 57,758 | | |

| 57,758 | |

| Convertible preferred stock series C; no par value, 250 shares authorized, issued and outstanding, $250,000 liquidation preference | |

| 52,588 | | |

| 52,588 | |

| Convertible preferred stock series D; no par value, 150 shares authorized, 90 shares outstanding, $90,000 liquidation preference | |

| - | | |

| - | |

| Convertible preferred stock series E; no par value, 300 shares authorized, issued and outstanding, $300,000 liquidation preference | |

| 10,829 | | |

| 10,829 | |

| Convertible preferred stock series F; no par value, 300 shares authorized, 153 shares issued and outstanding, $50,000 liquidation preference | |

| - | | |

| - | |

| Common stock; $0.10 par value, 750,000,000 shares authorized; 188,448,412 and 185,448,412 issued and outstanding, respectively | |

| 18,844,841 | | |

| 18,544,841 | |

| Additional paid-in capital | |

| 10,177,652 | | |

| 10,447,652 | |

| Accumulated deficit | |

| (40,897,452 | ) | |

| (40,478,104 | ) |

| Total stockholders’ deficit | |

| (11,603,784 | ) | |

| (11,214,436 | ) |

| Total liabilities and stockholders’ deficit | |

$ | 730,945 | | |

$ | 761,924 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

| Goldrich

Mining Company |

Condensed

Consolidated Statements of Operations

(Unaudited) |

| |

|

|

|

|

|

| |

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2023 | | |

2022 | |

| Operating expenses: | |

| | | |

| | |

| Mine preparation costs | |

$ | 3,263 | | |

$ | 8,830 | |

| Management fees and salaries | |

| 47,700 | | |

| 51,525 | |

| Professional services | |

| 10,088 | | |

| 38,211 | |

| General and administration | |

| 48,536 | | |

| 52,360 | |

| Office supplies and other | |

| 1,366 | | |

| 8,570 | |

| Directors’ fees | |

| - | | |

| 3,600 | |

| Mineral property maintenance | |

| 31,486 | | |

| 31,486 | |

| Arbitration and settlement costs (Note 3) | |

| 19,256 | | |

| 7,775 | |

| Total operating expenses | |

| 161,695 | | |

| 202,357 | |

| | |

| | | |

| | |

| Other (income) expense: | |

| | | |

| | |

| Miscellaneous income | |

| (5,787 | ) | |

| - | |

| Change in fair value of notes payable in gold | |

| 44,647 | | |

| 36,363 | |

| Interest expense and finance costs – related party | |

| 157,527 | | |

| 152,408 | |

| Interest expense and finance costs | |

| 61,266 | | |

| 73,663 | |

| Total other (income) expense | |

| 257,653 | | |

| 262,434 | |

| | |

| | | |

| | |

| Net loss | |

| 419,348 | | |

| 464,791 | |

| | |

| | | |

| | |

| Preferred dividends | |

| 1,875 | | |

| 1,875 | |

| Net loss available to common stockholders | |

$ | 421,223 | | |

$ | 466,666 | |

| | |

| | | |

| | |

| Net loss per common share – basic and diluted | |

$ | (nil) | | |

$ | (nil) | |

| | |

| | | |

| | |

| Weighted average common shares outstanding – basic and diluted | |

| 186,615,079 | | |

| 181,423,786 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

| Goldrich

Mining Company |

| Condensed

Consolidated Statements of Changes in Stockholders’ Deficit (Unaudited) |

| |

| 2023

Stockholders’ Deficit |

| |

|

|

|

|

|

| | |

|

|

|

|

|

| | |

| | |

| | |

| |

| | |

Preferred Stock | | |

Common Stock | | |

Additional | | |

| | |

| |

| | |

Shares | | |

Par Value | | |

Shares | | |

No Par Value | | |

Paid-in

Capital

| | |

Accumulated

Deficit

| | |

Total | |

| Balance, December 31, 2022 | |

| 150,993 | | |

$ | 271,175 | | |

| 185,448,412 | | |

$ | 18,544,841 | | |

$ | 10,447,652 | | |

$ | (40,478,104 | ) | |

$ | (11,214,436 | ) |

| Common shares issued for subscription payable | |

| - | | |

| - | | |

| 3,000,000 | | |

| 300,000 | | |

| (270,000 | ) | |

| - | | |

| 30,000 | |

| Net Loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (419,348 | ) | |

| (419,348 | ) |

| Balance, March 31, 2023 | |

| 150,993 | | |

$ | 271,175 | | |

| 188,448,412 | | |

$ | 18,844,841 | | |

$ | 10,177,652 | | |

$ | (40,897,452 | ) | |

$ | (11,603,784 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| 2022 Stockholders’ Deficit | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

Preferred Stock | | |

Common Stock | | |

Additional | | |

| | |

| |

| | |

Shares | | |

Par Value | | |

Shares | | |

No Par Value | | |

Paid-in

Capital

| | |

Accumulated

Deficit | | |

Total | |

| Balance, December 31, 2021 | |

| 151,053 | | |

$ | 271,175 | | |

| 179,787,595 | | |

$ | 17,978,760 | | |

$ | 10,880,576 | | |

$ | (39,422,474 | ) | |

$ | (10,291,963 | ) |

| Warrants Exercised | |

| - | | |

| - | | |

| 2,660,817 | | |

| 266,081 | | |

| (162,924 | ) | |

| - | | |

| 103,157 | |

| Net Loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (464,791 | ) | |

| (464,791 | ) |

| Balance, March 31, 2022 | |

| 151,053 | | |

$ | 271,175 | | |

| 182,448,412 | | |

$ | 18,244,841 | | |

$ | 10,717,652 | | |

$ | (39,887,265 | ) | |

$ | (10,653,597 | ) |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

| Goldrich

Mining Company |

| Condensed

Consolidated Statements of Cash Flows (Unaudited) |

| |

|

|

|

|

|

| |

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (419,348 | ) | |

$ | (464,791 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Finance costs | |

| 790 | | |

| - | |

| Change in fair value of notes payable in gold | |

| 44,647 | | |

| 36,363 | |

| Accretion of asset retirement obligation | |

| 1,754 | | |

| 1,686 | |

| | |

| | | |

| | |

| Change in: | |

| | | |

| | |

| Prepaid expenses | |

| 30,876 | | |

| 13,377 | |

| Accounts payable and accrued liabilities | |

| 49,790 | | |

| 36,779 | |

| Interest payable | |

| 59,089 | | |

| 57,719 | |

| Interest payable – related party | |

| 157,527 | | |

| 152,408 | |

| Related party payable | |

| 59,772 | | |

| 62,422 | |

| Net cash used - operating activities | |

| (15,103 | ) | |

| (104,037 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from warrant exercises, net | |

| - | | |

| 103,157 | |

| Proceeds from notes payable and warrants – related party, net | |

| 15,000 | | |

| - | |

| Net cash provided - financing activities | |

| 15,000 | | |

| 103,157 | |

| | |

| | | |

| | |

| Net decrease in cash and cash equivalents | |

| (103 | ) | |

| (880 | ) |

| | |

| | | |

| | |

| Cash and cash equivalents, beginning of period | |

| 3,969 | | |

| 3,762 | |

| Cash and cash equivalents, end of period | |

$ | 3,866 | | |

$ | 2,882 | |

| | |

| | | |

| | |

| Non-cash investing and financing activities: | |

| | | |

| | |

| Common shares issued for subscription payable | |

$ | 30,000 | | |

$ | - | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

| Goldrich

Mining Company |

| Notes

to the Condensed Consolidated Financial Statements (unaudited) |

| |

The

unaudited financial statements have been prepared by the Company in accordance with accounting principles generally accepted in the United

States of America for interim financial information, as well as the instructions to Form 10-Q. Accordingly, they do not include all of

the information and footnotes required by accounting principles generally accepted in the United States of America for complete financial

statements and as a result, they are condensed. In the opinion of the Company’s management, all adjustments (consisting of only

normal recurring accruals) considered necessary for a fair presentation of the interim financial statements have been included. Operating

results for the three-month period ended March 31, 2023 are not necessarily indicative of the results that may be expected for the fiscal

year ending December 31, 2023.

For

further information refer to the financial statements and footnotes thereto in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2022.

Going

Concern

The

accompanying condensed consolidated financial statements have been prepared under the assumption that the Company will continue as a

going concern. The Company has incurred losses since its inception and does not have sufficient cash to fund normal operations and meet

debt obligations for the next 12 months without deferring payment on certain current liabilities and/or raising additional funds.

The

Company currently has no historical recurring source of revenue, negative working capital of $11,938,034, and an accumulated deficit

of $40,897,452 at March 31, 2023. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

The Company may profitably execute a production business plan, and thereby, its ability to continue as a going concern may improve and

become less dependent on the Company’s ability to raise capital to fund its future exploration and working capital requirements.

The Company’s plans for the long-term return to and continuation as a going concern include the profitable exploitation of its

mining properties and financing the Company’s future operations through sales of its common stock and/or debt. The condensed consolidated

financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern.

If the going concern basis were not appropriate for these financial statements, adjustments would be necessary in the carrying value

of assets and liabilities, the reported expenses and the balance sheet classifications used.

| 2. | SUMMARY

OF SIGNIFICANT ACCOUNTING POLICIES |

Earnings

(Loss) Per Share

We

are authorized to issue 750,000,000 shares of common stock, $0.10 par value per share. At March 31, 2023, there were 188,448,412 shares

of our common stock issued and outstanding.

For

the three-month periods ended March 31, 2023 and 2022, potentially dilutive shares including outstanding stock options, warrants, convertible

interest, and convertible preferred stock were excluded from the computation of diluted loss per share because they were anti-dilutive

due to net losses in those periods. For the periods ended March 31, 2023 and 2022, potentially dilutive common stock equivalents excluded

from the calculation of diluted earnings per share are as follows:

Schedule of Anti-Dilutive Stock Common Stock Equivalent

| | |

March 31, 2023 | | |

March 31, 2022 | |

| Stock options | |

| 1,025,000 | | |

| 1,050,000 | |

| Warrants | |

| 18,114,446 | | |

| 19,667,077 | |

| Convertible Preferred Stock | |

| 30,190,475 | | |

| 32,190,475 | |

| Convertible interest payable | |

| 153,932,841 | | |

| 112,240,467 | |

| Total | |

| 203,262,762 | | |

| 165,148,019 | |

| Goldrich

Mining Company |

| Notes

to the Condensed Consolidated Financial Statements (unaudited) |

| |

Fair

Value Measurements

When

required to measure assets or liabilities at fair value, the Company uses a fair value hierarchy based on the level of independent, objective

evidence surrounding the inputs used. The Company determines the level within the fair value hierarchy in which the fair value measurements

in their entirety fall. The categorization within the fair value hierarchy is based upon the lowest level of input that is significant

to the fair value measurement. Level 1 uses quoted prices in active markets for identical assets or liabilities, Level 2 uses significant

other observable inputs, and Level 3 uses significant unobservable inputs. The amount of the total gains or losses for the period are

included in earnings that are attributable to the change in unrealized gains or losses relating to those assets and liabilities still

held at the reporting date.

During

2023 and 2022, the Company determined fair value on a recurring basis and non-recurring basis as follows:

Schedule

of Fair Value On Recurring and Non-Recurring Basis

| | |

Balance

March 31, 2023 | | |

Balance

December 31, 2022 | | |

Fair Value

Hierarchy level | |

| Liabilities | |

| | | |

| | | |

| | |

| Recurring: Notes payable in gold (Note 7) | |

$ | 528,161 | | |

$ | 483,514 | | |

| 2 | |

The

carrying amounts of financial instruments, including notes payable and notes payable – related party, approximate fair value at

March 31, 2023 and December 31, 2022. The inputs to the valuation of Level 2 liabilities are described in Note 6 Notes Payable in

Gold.

On

April 3, 2012, Goldrich Placer, LLC (“GP”), a subsidiary of Goldrich, entered into a term sheet for a joint venture with

NyacAU, LLC (“NyacAU”), an Alaskan private company, to bring Goldrich’s Chandalar placer gold properties into production

as defined in the joint venture agreement (the “Operating Agreement”), which was subsequently signed and made effective April

2, 2012. In each case as used herein in reference to the JV, ‘production’ is as defined by the Operating Agreement. As part

of the Operating Agreement, GP and NyacAU (together the “Members”) formed a 50:50 joint venture company, Goldrich NyacAU

Placer LLC (“GNP”), to operate the Chandalar placer mines, with NyacAU acting as managing partner.

Arbitration

In

December 2017, the Company filed an arbitration statement of claim against NyacAU and other parties. The claim challenged certain accounting

treatment of capital leases, allocations of tax losses, charges to the JV for funding costs related to the JV manager’s financing,

related-party transactions, and other items of dispute in a previous mediation that was unsuccessful in reaching an agreement. As a result,

the Company participated in an arbitration before a panel of three independent arbitrators during 2018 through 2022 to address these

items.

Settlement

Agreement

On

March 31, 2023, the Company signed a settlement agreement between the Company, NyacAU, LLC (“NyacAU”), Goldrich Placer, LLC

(“GP”), Goldrich NyacAU Placer, LLC (“GNP”), Dr. J. Michael James, individually (“Dr. James”), and

Bear Leasing, LLC (“Bear Leasing”) (each a “Party” and, collectively, the “Parties”).

| Goldrich

Mining Company |

| Notes

to the Condensed Consolidated Financial Statements (unaudited) |

| |

In

April 2023, all outstanding arbitration issues were resolved with a settlement agreement whereby Goldrich paid $105,000 to NyacAU. The

resolution includes all outstanding arbitration issues, awards, and orders including mutual release of all outstanding issues before

the Alaska superior court and all court-entered judgments. The agreement also terminates and supersedes all prior agreements between

all Parties except a security agreement between NyacAU and GNP to secure repayment of fifty percent (50%) of a funding mechanism known

as Line of Credit 1 (LOC1), which was advanced by NyacAU to GNP. GNP was formally dissolved in 2019.

Even

though the settlement agreement was consummated subsequent to the end of the 2022 year, the arbitration claim was filed and has been

open since 2018; therefore, the event requires the financial effects to be reflected in the financial statement for the year ended December

31, 2022. As a result, the previous expense accruals of $638,193 for arbitration awards and interest made in 2021 and prior years were

removed and the settlement amount of $105,000 was recorded. This resulted in a gain on settlement being recorded at December 31, 2022

of $533,193.

Option

Agreement

Concurrent

with signing the settlement agreement, Goldrich also signed an option agreement with the Parties. The option agreement, among other things,

grants Goldrich, or its designee, the right, but not the obligation, to become operator of the Chandalar placer mining permit. If the

option is exercised, Goldrich or its designee would also obtain ownership of all camp facilities and mining equipment remaining at the

Chandalar placer mine site owned by NyacAU and its affiliates. Currently Goldrich owns the claims but NyacAU is the named operator on

the mining permits.

To

exercise the option, Goldrich, or its designee, must give written and electronic notice of its intent to do so by April 30, 2024 and

pay $1,000,000 into escrow within five business days of giving notice. Upon exercise of the option, Goldrich or its designee would assume

all reclamation responsibilities and liability and NyacAU would be released from any reclamation liability. Also, NyacAU would be entitled

to limited payments out of the production of placer gold at the Chandalar placer mine up to the greater of $8,500,000 or 4,860 ounces

of fine gold (the Maximum Amount). No production payment shall be due to NyacAU on the first 5,000 ounces of fine gold production. Thereafter,

NyacAU would receive at least 5% of all production from the Chandalar placer mine until the Maximum Amount is paid. Additionally, after

the first 5,000 ounces of fine gold production, NyacAU would be entitled to a minimum annual payment equal to the value of $120,000 or

68 fine gold ounces, whichever is greater, and such payment would apply towards the satisfaction of the Maximum Amount.

| 4. | RELATED

PARTY TRANSACTIONS |

In

addition to related party transactions described in Note 5, the Company has accrued amounts to the Company’s Chief Executive Officer

(“CEO”), Chief Financial Officer (“CFO”), and board of directors fees for amounts earned but not yet paid. Beginning

in January 2016 and through March 31, 2023, the CEO’s salary has not been paid in full. Salary due to the CFO has been accrued

and remains unpaid, as have board of directors’ fees.

Schedule

of Related Party Transactions

| CEO | |

Three Months ended

3/31/23 | | |

Year ended

12/31/22 | |

| Balance at beginning of period | |

$ | 994,017 | | |

$ | 793,720 | |

| Deferred salary | |

| 45,000 | | |

| 180,000 | |

| Deferred expenses | |

| 3,899 | | |

| 20,297 | |

| Payments | |

| - | | |

| - | |

| Ending Balance | |

$ | 1,042,916 | | |

$ | 994,017 | |

| | |

| | | |

| | |

| CFO | |

| | | |

| | |

| Balance at beginning of period | |

$ | 104,844 | | |

$ | 91,981 | |

| Deferred fees | |

| 2,700 | | |

| 12,863 | |

| Payments | |

| - | | |

| - | |

| Ending Balance | |

$ | 107,544 | | |

$ | 104,844 | |

| | |

| | | |

| | |

| Board fees payable and expenses payable (1, 2, 3) | |

| 173,528 | | |

| 165,355 | |

| Total Related party payables | |

$ | 1,323,988 | | |

$ | 1,264,216 | |

| Goldrich

Mining Company |

| Notes

to the Condensed Consolidated Financial Statements (unaudited) |

| |

| 5. | NOTES

PAYABLE & NOTES PAYABLE – RELATED PARTY |

At

March 31, 2023 and December 31, 2022, the Company had outstanding notes payable of $1,250,169, respectively, and outstanding notes payable

– related party of $4,211,769 and $4,195,979, respectively. The notes payable and notes payable – related party and accrued

interest of 15% are due within 10 days of a demand notice of the holders. There has been no notice of default or demand issued by any

holder.

During

the three months ended March 31, 2023, the Company issued additional notes payable of $15,790, discounted at 5%, or $790, resulting in

net proceeds of $15,000 from a related party, Nicholas Gallagher, a shareholder and director of the Company, who also holds the full

balance of the notes payable – related party described above. During the three months ended March 31, 2022, the Company received

no additional tranches of the notes payable and notes payable - related party. The notes are due upon demand; therefore, all discounts

have been immediately expensed to finance costs.

During

the three months ended March 31, 2023 and March 31, 2022, the Company paid no finder fees to related party entities, and incurred $450

and $nil, respectively, of other finance and placement costs. Interest of $204,408 and $193,224 was expensed during the three-month periods

ended March 31, 2023 and March 31, 2022, respectively, of which $157,527 and $152,408 was to related parties, respectively, which is

included in interest expense and finance costs on the condensed consolidated statements of operations. Interest and finders fees are

included in accounts payable and accrued liabilities, interest payable and interest payable – related party on the condensed consolidated

balance sheet at March 31, 2023 and December 31, 2022.

Inter-Creditor

Agreement

As

a result of an Amended and Restated Loan, Security, and Intercreditor Agreement (the “Amended Agreement”) dated November

1, 2019 and a First Amendment dated August 25, 2021, for each holder of the notes payable, whether or not a related party:

| 1. | The

borrower and holder entered into a Deed of Trust where under the notes are secured by a security

interest in all real property, claims, contracts, agreements, leases, permits and the like. |

| 2. | The

Company entered into a written Guaranty (“Guaranty”) where under, among other

conditions, the Company unconditionally guarantees and promises to pay to the order of each

holder the principal sum and all interest payable on each note payable held by such holder

when and as the same becomes due, whether at the stated maturity thereof, by acceleration,

call for redemption, tender, or otherwise. The Company is not in default as no demand

has been made for payment or delivery. |

| Goldrich

Mining Company |

| Notes

to the Condensed Consolidated Financial Statements (unaudited) |

| |

| 3. | Mr.

Gallagher, at his option, has the right to convert outstanding but unpaid and future interest

on his note into shares of the Company’s common stock at $0.015 per share. At March

31, 2023, Mr. Gallagher’s interest would convert to 153,932,841 common shares. |

| 4. | All

loans by Mr. Gallagher and any additional loans made by Mr. Gallagher are designated as Senior

Notes and accounted for as Notes payable – related party and all loans by the other

holders made prior to August 25, 2021 were designated as Junior Notes. Additionally, notes

arising in the future to certain unrelated parties are also designated as Senior notes. Senior

Notes, which include principal and interest are entitled to be repaid in full before any

of the Junior Notes are repaid. |

| 5. | The

Company confirmed that the written Guaranty extends to the repayment of additional loans

made by the holders. |

| 6. | The

Company confirmed that repayment of additional loans will be and remain secured by the Deed

of Trust. |

During

2013, the Company issued notes payable in gold totaling $820,000, less a discount of $205,000, for net proceeds of $615,000. Under the

terms of the notes, the Company agreed to deliver gold to the holders at the lesser of $1,350 per ounce of fine gold or a 25% discount

to market price as calculated on the contract date and specify delivery of gold in November 2014. The notes bear interest at a rate of

10% per annum and penalty interest of 10% per annum on any due and unpaid interest.

After

several amendments to the terms of the note agreements, through the date of the issuance of these financial statements, the gold notes

have not been paid and the note holders have not demanded payment or delivery of gold. At March 31, 2023 and December 31, 2022, 266.788

ounces of fine gold was due and deliverable to the holder of the notes.

The

Company estimates the fair value of the notes based on the market approach with Level 2 inputs of gold delivery contracts based upon

previous contractual delivery dates, using the market price of gold on March 31, 2023 of approximately $1,980 per ounce as quoted on

the London PM Fix market or $528,161 in total. The valuation resulted in an increase in gold notes payable of $44,647 during the three

months ended March 31, 2023. At March 31, 2023 and 2022, this resulted in a loss on change in fair value of notes payable in gold of

$44,647 and $36,363, respectively on the condensed consolidated statement of operations.

At

December 31, 2022, the fair value was calculated using the market approach with Level 2 inputs of gold delivery contracts based upon

previous contractual delivery dates. At December 31, 2022, the Company had outstanding total notes payable in gold of $483,514.

Interest

of $12,208 was expensed during the three months ended March 31, 2023, and $151,847 is accrued at March 31, 2023 and is included in interest

payable. Interest of $10,981 was expensed during the three months ended March 31, 2022, and $139,639 is accrued at December 31, 2022

and is included in interest payable.

During

the year ended December 31, 2022, the Company received cash of $30,000 which is included in stock subscription payable at December 31,

2022, for a private placement of common shares priced at $0.01 per share, of which $5,000 was from William Orchow, a related party. During

the three months ended March 31, 2023, the Company reduced stock subscription payable by $30,000 and issued 3,000,000 common shares.

| Goldrich

Mining Company |

| Notes

to the Condensed Consolidated Financial Statements (unaudited) |

| |

During

the three months ended March 31, 2022, the Company received $103,157 cash as a result of the exercise of Class R warrants at an exercise

price of $0.045 and T warrants at an exercise price of $0.03 per common share, resulting in the issuance of 2,660,817 common shares.

Of that amount, 1,555,555 of the warrants exercised were owned by Mr. Gallagher and were transferred to unrelated parties. The unrelated

parties then exercised the warrants for cash.

During

the year ended December 31, 2021, the Company received $40,000 for the exercise of Class T warrants which are included in stock subscription

payable at March 31, 2023 and December 31, 2022. Once the exercise is complete, the Company will issue 1,333,333 common shares for the

exercise. These warrants were exercised subsequent to March 31, 2023.

| 8. | COMMITMENTS

AND CONTINGENCIES |

The

Company has entered into a consulting contract for $46,500 for which the services have not yet been received.

The

Company is subject to Alaska state annual claims rental fees in order to maintain its non-patented claims. In addition to the annual

claims rental fees of $125,945 due November 30 of each year, the Company is also required to meet annual labor requirements of approximately

$61,100 due November 30 of each year. The Company can carry forward costs for annual labor that exceed the required yearly totals for

four years. The Company has significant carryovers to 2023 to satisfy its annual labor requirements. This carryover expires in the years

2023 through 2027 if unneeded to satisfy requirements in those years.

Subsequent

to March 31, 2023, the Company received $162,667 cash as a result of exercise of Class R warrants at an exercise price of $0.024 per

common share. Ownership of these warrants had been in the hands of Mr. Gallagher and were sold by him personally to unrelated parties.

The unrelated parties then exercised the warrants for cash, resulting in the issuance of 6,777,778 common shares.

Subsequent

to March 31, 2023, the Company received cash of $12,500 of additional notes payable – related party from Mr. Nicholas Gallagher,

and cash of $122,000 of additional notes payable from unrelated parties.

Item

2. Management’s Discussion and Analysis of Financial Condition or Plan of Operation

As

used in herein, the terms “Goldrich,” the “Company,” “we,” “us,” and “our”

refer to Goldrich Mining Company.

This

discussion and analysis contains forward-looking statements that involve known or unknown risks, uncertainties and other factors that

may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance

or achievements expressed or implied by the forward-looking statements. Except for historical information, the matters set forth herein,

which are forward-looking statements, involve certain risks and uncertainties that could cause actual results to differ. Potential risks

and uncertainties include, but are not limited to, unexpected changes in business and economic conditions; significant increases or decreases

in gold prices; changes in interest and currency exchange rates; unanticipated grade changes; metallurgy, processing, access, availability

of materials, equipment, supplies and water; results of current and future exploration and production activities; local and community

impacts and issues; timing of receipt and maintenance of government approvals; accidents and labor disputes; environmental costs and

risks; competitive factors, including competition for property acquisitions; and availability of external financing at reasonable rates

or at all, and those set forth under the heading “Risk Factors” in our Form 10-K filed with the United States Securities

and Exchange Commission (the “SEC”) on July 5, 2023. Forward- looking statements can be identified by terminology such as

“may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,”

“believes,” “estimates,” “predicts,” “potential,” “continues” or the negative

of these terms or other comparable terminology. Although the Company believes that the expectations reflected in the forward-looking

statements are reasonable, it cannot guarantee future results, levels of activity, performance or achievements. Forward-looking statements

are made based on management’s beliefs, estimates, and opinions on the date the statements are made, and the Company undertakes

no obligation to update such forward-looking statements if these beliefs, estimates, and opinions should change, except as required by

law.

This

discussion and analysis should be read in conjunction with the accompanying unaudited condensed consolidated financial statements and

related notes. The discussion and analysis of the financial condition and results of operations are based upon the unaudited condensed

consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United

States of America. The preparation of financial statements in conformity with accounting principles generally accepted in the United

States of America requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities,

disclosure of any contingent liabilities at the financial statement date and reported amounts of revenue and expenses during the reporting

period. On an on-going basis the Company reviews its estimates and assumptions. The estimates were based on historical experience

and other assumptions that the Company believes to be reasonable under the circumstances. Actual results are likely to differ from those

estimates under different assumptions or conditions, but the Company does not believe such differences will materially affect our condensed

consolidated financial position or results of operations. Critical accounting policies, the policies the Company believes are most important

to the presentation of its condensed consolidated financial statements and require the most difficult, subjective and complex judgments

are outlined below in “Critical Accounting Policies” and have not changed significantly.

General

Our

Chandalar, Alaska gold mining property contains both hard-rock (lode) targets and placer deposits and has seen over a hundred years of

intermittent mining exploration and extraction history. There has been extraction of gold from several alluvial, or placer gold streams,

and from an array of small quartz veins that dot the property. However, only in very recent times is the primary source of the gold becoming

evident. As a result of our exploration, considering structural geology, petrographic, geochemical and geophysical evidence, we have

realized that all of the gold is sourced within a system of magmatic hydrothermal alteration features such as small pegmatitic dikes

and chloritized schist. We believe these features are common to and link all of the hard-rock (lode) prospects, the weathering of which

generated the gold placer deposits, and furthermore are an outlying expression of an underlying gold bearing pluton.

We

have defined drilling targets for a hard-rock (lode) gold deposit in an area of interest approximately 1,800 feet wide and over five

miles long, possibly underlain by a series of mineralized magmatic intrusions (plutons). Exploration therefore has taken on two directions;

one toward defining a low-grade, large tonnage body of mineralization running beneath the headwaters of Little Squaw Creek where dense

swarms of gold mineralized pegmatitic dikelets are seen, the other a deeper, larger mineralized plutonic body(ies) from which the district’s

mineralizing fluids may have emanated and migrated through Chandalar country rock.

In

December 2021, Goldrich submitted a permit application to the Alaska Department of Natural Resources (“DNR”) to carry out

a multi-year, 25,000-foot diamond core drill program at the Company’s Chandalar Property. The permit was received in February 2022.

The target zone of this hard-rock (lode) drill program, located on the Little Squaw Creek (“LSC”) drainage, is immediately

above and partially overlapping the LSC placer deposit and mine. The target zone sits at the heart of a zone surrounded by historic placer

workings in every creek and four historic hard-rock gold mines. Previous exploration, including drill programs, soil and rock samples,

airborne magnetic and radiometric studies, and advanced petrographic studies in addition to the angularity of the placer gold nuggets

indicates close proximity of the LSC placer deposit to a hard-rock source. Subject to financing, Goldrich plans to commence the program

in May 2024.

Although

our main focus continues to be the exploration of these hard-rock targets, we also endeavor to develop our placer properties as a source

of internal cash to protect us from future market fluctuations and to provide funds for future exploration. In 2012, Goldrich and NyacAU

LLC (“NyacAU”) formed Goldrich NyacAU Placer LLC (“GNP”), a 50/50 joint-venture company, managed by NyacAU, to

mine Goldrich’s various placer properties at Chandalar.

As

shown below, the placer gold extracted by GNP increased each year from 2015 through 2018, trending toward production figures that were

anticipated by a preliminary economic assessment authored by qualified geologists for us:

| Year | |

Ounces of

Placer Gold | | |

Ounces of

Fine Gold | |

| 2015 | |

| 4,400 | | |

| 3,900 | |

| 2016 | |

| 10,200 | | |

| 8,200 | |

| 2017 | |

| 15,000 | | |

| 12,300 | |

| 2018 | |

| 20,900 | | |

| 17,100 | |

Although

GNP’s extraction increased over the years, ultimately the extraction numbers attained over those years fell short of the Minimum

Production Requirements required in the GNP Operating Agreement. According to the terms of the agreement, GNP was required to pay a Minimum

Production Requirement of 1,100 ounces for 2016, 1,200 ounces for 2017, and 1,300 ounces for 2018 to both Goldrich and NyacAU by October

31, 2018. This payment was not made. Under the joint venture Operating Agreement, GNP would be dissolved if GNP failed to meet the Minimum

Production Requirement. On August 20, 2018, we announced the intended dissolution of the GNP joint venture. GNP was formally dissolved

in May 2019.

Subsequent

to 2019, Goldrich commissioned an independent third-party mining engineering firm to complete a mining plan and initial assessment for

the Company’s Chandalar Mine. In June, 2021, Goldrich released the results of an independent Initial Assessment Report (the “IA”),

prepared in accordance with the new SEC Subpart 1300 property disclosure requirements, for the Company’s Chandalar placer mine.

The IA was prepared by Global Resources Engineering (“GRE”), a widely-respected mining engineering firm in Denver, Colorado.

After

the release of the IA, a Revised and Amended Initial Assessment Report (the “RAIA”) was prepared by GRE and has a revised

and amended date of February 24, 2023 and an effective date of May 31, 2021. The RAIA did not change the results of the economic analysis.

Both

the IA and RAIA completed the economic analysis based on a 0.004 raw troy ounce per bank cubic yard cutoff pit constrained mineral resource

that utilized a 0.002 raw troy ounce per bank cubic yard grade shell for grade estimation so there was no change in the economic analysis.

However, the RAIA reported the pit constrained mineral resources at a 0.004 raw troy ounce per bank cubic yard cutoff while the IA pit

constrained mineral resource used a 0.002 raw troy ounce per bank cubic yard cutoff. This difference caused measured and indicated mineral

resources to decrease from 120,000 ounces of fine gold in the IA to 119,000 ounces of fine gold in the RAIA and inferred mineral resources

to decrease from 17,000 ounces of fine gold in the IA to 16,000 ounces of fine gold in the RAIA. The RAIA was also revised to include

additional information requested by the SEC and to add statements of opinions of qualified persons on the adequacy of sample preparation,

security, analytical procedures, and the adequacy of the data.

Using

a base case gold price of $1,650, the key economic results of the RAIA with a summarized gold price sensitivity analysis were as follows

(A complete copy of the RAIA may be downloaded at https://www.goldrichmining.com/chandalar-gold-district/technical-reports.html).

| | |

Base Case | |

Gold Price Sensitivity Analysis |

| Parameter | |

$1,650 Gold | |

$1,500 | |

$2,000 | |

$2,500 |

| Undiscounted Pre-Tax Net Cash Flow: | |

$75 million | |

$57 million | |

$116 million | |

$175 million |

| After-tax NPV@5%(1): | |

$64 million | |

$50 million | |

$92 million | |

$129 million |

| After-tax IRR(1): | |

139% | |

112% | |

195% | |

275% |

| Undiscounted After-tax Net Cash Flow(1): | |

$72 million | |

$57 million | |

$103 million | |

$145 million |

| After-tax Payback Period (years): | |

1.3 | |

1.44 | |

1.19 | |

1.1 |

| All-in Sustaining Costs: | |

$799/Au oz. | |

| |

| |

|

| All-in Costs: | |

$1,064/Au oz. | |

| |

| |

|

| Total Operating Costs: | |

$646/Au oz. | |

| |

| |

|

The

RAIA pit-constrained mineral resources for the Little Squaw Creek Placer deposit at a 0.004 raw troy ounce per bank cubic yard cutoff

is as follows:

| Classification | |

Resource Volume

(1000s bcy) | |

Raw(1)

Gold Grade

(troy oz./bcy) | |

Raw(1) Gold

(troy oz) | |

Fine(2) Gold

(troy oz) |

| Measured | |

2,609 | |

0.0302 | |

79,000 | |

69,000 |

| Indicated | |

2,188 | |

0.0265 | |

58,000 | |

50,000 |

| Measured & Indicated | |

4,797 | |

0.0285 | |

137,000 | |

119,000 |

| Inferred | |

771 | |

0.0245 | |

19,000 | |

16,000 |

| (1) | Raw

Gold - Gold as recovered from the placer deposit, historically 84% gold and 16% other metals like silver and copper (referred to as 840

fine). The Mineral Resource is constrained by a 0.002 raw troy ounce per bank cubic yard grade shell and a 0.004 raw troy ounce per bank

cubic yard cutoff (840 fineness) at an assumed gold price of 1,600 $/tr oz, assumed mining cost of 4.50 $/bcy, assumed processing and

administrative cost of 7.25 $/bcy, an assumed gold purity of 84%, and pit slopes of 45 degrees. These costs are preliminary estimates

(prior to economic analysis). |

| (2) | Fine

Gold - Gold that is 99.99% pure (referred to as 9999 fine). |

Goldrich

will decide if a preliminary feasibility study should also be prepared for the Chandalar Mine. A preliminary feasibility study would

allow Goldrich to disclose any reserves of the Chandalar Mine. The Company is encouraged by the results of the IA as it helps establish

the value of the placer deposit, shows a large geochemical anomaly indicative of a potential large hard-rock (lode) gold source, and

may provide financing opportunities.

Looking

forward, our ability to develop either hard-rock (lode) targets or placer deposits is subject to financing. The on-going development

of the hard-rock gold targets, the recent change in SEC regulations which allow us to release the new information in the IA, and significant

increases in the price of gold since 2019, and the settlement of the arbitration appear to have increased the availability of funds so

we are hopeful to secure sufficient funds for a major exploration program and for reopening the placer mine.

Liquidity

and Capital Resources

We

are an exploration stage company and have incurred losses since our inception. We currently do not have sufficient cash to support the

Company through 2023 and beyond. We anticipate that we will incur approximately $700,000 for general operating expenses and property

maintenance, $275,000 for interest, and $630,000 for interest – related party, over the next 12 months, in addition to the current

liabilities on the balance sheet at March 31, 2023 of $12,017,551. Additional funds will be needed for any exploration expenditures,

should any be undertaken. We plan to raise the financing through a combination of debt and/or equity placements, sale of mining property

interests, and revenue from placer operations.

On

March 31, 2023, we signed a settlement agreement between the Company, NyacAU, LLC (“NyacAU”), Goldrich Placer, LLC (“GP”),

Goldrich NyacAU Placer, LLC (“GNP”), Dr. J. Michael James, individually (“Dr. James”), and Bear Leasing, LLC

(“Bear Leasing”) (each a “Party” and, collectively, the “Parties”).

Subject

to Goldrich making a payment of $105,000 to NyacAU by April 30, 2023, which was made on April 27, 2023, the settlement agreement, among

other things, resolved all outstanding arbitration issues, awards, and orders including mutual release of all outstanding issues before

the Alaska superior court and all court-entered judgments. The agreement also terminated and superseded all prior agreements between

all Parties except a security agreement between NyacAU and GNP to secure repayment of fifty percent (50%) of a funding mechanism known

as Line of Credit 1 (LOC1), which was advanced by NyacAU to GNP. GNP was formally dissolved in 2019.

Even

though the settlement agreement was consummated subsequent to the end of the 2022 year, the nature and magnitude of the event requires

the financial effects to be reflected in the financial statement for the year ended December 31, 2022. As a result, the previous expense

accruals of $638,193 made in 2021 and prior years were removed and the settlement amount of $105,000 was recorded, resulting in a gain

on settlement of $533,193 at December 31, 2022.

Because

the exercise of the option agreement is at the election of the Company, no financial effects of the option have been recognized at March

31, 2023. If the option agreement is exercised by April 2024, the $1,000,000 payment would be recorded for the purchase of equipment,

Goldrich would become the named operator on the Chandalar placer mining permits, the $8,500,000 liability would be recognized and a reclamation

liability would be recognized. While the GRE Revised and Amended Initial Assessment Report reflects ample resources to justify a mining

activity at the Chandalar Mine, the option would only be exercised if we were able to secure financing sufficient to start up a mining

operation or secure a mining partner to economically extract the gold in a mining operation.

The

audit opinion and notes that accompany our consolidated financial statements for the year ended December 31, 2022, disclose a ‘going

concern’ qualification to our ability to continue in business. The accompanying consolidated financial statements have been prepared

under the assumption that we will continue as a going concern. We are an exploration stage company and we have incurred losses since

our inception. We do not have sufficient cash to fund normal operations and meet debt obligations for the next 12 months without deferring

payment on certain current liabilities and raising additional funds. We believe that the going concern condition cannot be removed with

confidence until the Company has entered into a business climate where funding of its activities is more assured.

We

currently have only a brief, recent history of a recurring source of revenue and in 2016 received our first cash distribution from the

joint venture. If we profitably execute a production business plan, our ability to continue as a going concern may improve and become

less dependent on our ability to raise capital to fund our future exploration and working capital requirements. Our plans for the long-term

include the profitable exploitation of our mining properties and financing our future operations through sales of our common stock and/or

debt. Additionally, the capital markets and general economic conditions in the United States are constantly changing and may present

significant obstacles to raising the required funds. These factors raise substantial doubt about our ability to continue as a going concern.

During

the three months ended March 31, 2023, we completed financings of $15,000 compared to $103,157 net cash for note financings and placements

of our securities during the three months ended March 31, 2022. On November 1, 2019, the Company and lenders entered into the Amended

and Restated Loan Security and Intercreditor Agreement (the “Agreement”). Under the Agreement, the borrower and holders entered

into a Deed of Trust whereunder the Notes are secured by a security interest in all real property, claims, contracts, agreements, leases,

permits and the like.

If

we are unable to timely satisfy our obligations under these secured senior notes payable, the notes payable in gold, originally due November

2018 and subsequently amended to be on demand, and the interest on both the secured senior note due quarterly and the notes payable in

gold, and we are not able to re-negotiate the terms of such agreements, the holders will have rights against us, including potentially

seizing or selling our assets. The notes payable in gold are secured against our right to future distributions of gold extracted by our

joint venture with NyacAU. At March 31, 2023, we had outstanding total notes payable in gold of $528,161, representing 266.788 ounces

of fine gold due on demand. During the year ended December 31, 2019, the Company renegotiated terms with the holders. The Fourth Delayed

Delivery Required Quantity shall be delivered to the Purchaser at the Delivery Point on the date that is sixty (60) days after the date

that the Purchaser gives notice to the Company. To date, the gold notes have not been paid, the note holders have not demanded payment

and have indicated willingness to work with the Company to extend the due date.

At

March 31, 2023, the Company had outstanding Notes payable of $1,250,169 and outstanding Notes payable – related party of $4,211,769.

The Notes payable and Notes payable – related party had matured on October 31, 2018. In November 2019, the Company and the holders

of the notes amended the notes, and the notes are now due within 10 days of a demand notice of the holders. There has been no notice

of default or demand issued by any holder.

We

believe we will be able to secure sufficient financing for further operations and exploration activities of our Company, but we cannot

give assurance we will be successful in attracting financing on terms acceptable to us, if at all. Additionally, anticipating continued

placer production after dissolution of GNP, we look forward to internal cash flow and additional options for financing. A successful

mining operation may provide the long-term financial strength for the Company to remove the going concern condition in future years.

To increase its access to financial markets, Goldrich, which is currently on the OTC Expert Market, intends to requalify to be quoted

on the OTCQB of the OTC Markets and intends to also seek a listing of its shares on a recognized stock exchange in Canada.

The

consolidated financial statements do not include any adjustments that might be necessary should the Company be unable to continue as

a going concern. If the going concern basis were not appropriate for these financial statements, adjustments would be necessary in the

carrying value of assets and liabilities, the reported expenses and the balance sheet classifications used.

Results

of Operations

On

March 31, 2023, we had total liabilities of $12,334,729 and total assets of $730,945. This compares to total liabilities of $11,976,360

and total assets of $761,924 on December 31, 2022. As of March 31, 2023, our liabilities consist of $277,178 for remediation and asset

retirement obligations, $528,161 of notes payable in gold, $1,250,169 of notes payable, $4,211,769 of notes payable – related party,

$1,584,653 of trade payables and accrued liabilities, $779,200 of accrued interest payable, $2,308,993 of accrued convertible interest

payable – related party, $1,323,988 due to related parties, $40,000 of subscriptions payable and $30,618 for dividends payable.

Of these liabilities, $12,017,551 is due within 12 months. The increase in liabilities compared to December 31, 2022 is due to an increase

in trade and related party payables, an increase in interest payable and convertible interest payable – related party, an increase

in notes payable – related party and an increase in the notes payable in gold. Total assets and its components did not experience

significant changes, with the exception of a decrease in cash and a decrease in prepaid expenses during the quarter ended March 31, 2023.

On

March 31, 2023, we had negative working capital of $11,938,034 and a stockholders’ deficit of $11,603,784 compared to negative

working capital of $11,520,440 and stockholders’ deficit of $11,214,436 for the year ended December 31, 2022. Working capital decreased

during the quarter ended March 31, 2023 due to the accruals of accounts and trade payables that exceeded cash proceeds from Notes payable

and Notes payable – related party, and the reduction of prepaid expenses. Stockholders’ equity decreased due to an operating

loss for the period ended March 31, 2023.

During

the three months ended March 31, 2023, the Company reported total operating expense of $161,695, compared to $202,357 for the three months

ended March 31, 2022. With the exception of arbitration expenses and mineral property maintenance, all expenses are lower year over year.

Total other (income) expense for the three months ended March 31, 2023 was $257,653 compared to $262,434 for the same period of 2022,

mainly due to a decrease in interest expense and $5,787 in miscellaneous income during the three months ended March 31, 2023.

During

the three months ended March 31, 2023, we used cash from operating activities of $15,103 compared to $104,037 for the period ended March

31, 2022. Net losses were slightly lower year over year mainly due to a decrease in mine prep costs, management fees and salaries, professional

services, general and administrative expenses, office supplies, directors’ fees, and interest expense. Net losses were $419,348

and $464,791 for the three months ended March 31, 2023 and 2022, respectively.

During

the three months ended March 31, 2023 and 2022 respectively, we used no cash in investing activities.

During

the three months ended March 31, 2023, cash of $15,000 was provided by financing activities, compared to $103,157 provided during the

same period of 2022.

Private

Placement Offerings

During

the year ended December 31, 2022, the Company raised $30,000 from investors for a private placement of common stock at a price of $0.01

per share, and is included in stock subscription payable at December 31, 2022. During the three months ended March 31, 2023, stock subscription

payable was reduced by $30,000 and the Company issued 3,000,000 shares of common stock. No private placement offerings occurred during

the three months ended March 31, 2023.

Notes

Payable in Gold, Notes Payable & Notes Payable – Related Party

At

March 31, 2023, we owed $528,161 for Notes payable in Gold, $1,250,169 for Notes payable and $4,211,769 for Notes payable – related

party. Interest payable on these borrowings totaled $3,088,193. These borrowings have matured beyond their original due dates and have

been amended to be due upon demand.

Effective

November 1, 2019, we entered into an Amended and Restated Loan, Security, and Intercreditor Agreement (the “Amended Agreement”)

and effective August 25, 2021, we entered into First Amendment to the Amended and Restated Loan, Security, and Intercreditor Agreement

dated November 1, 2019 (“First Amendment”) with Nicholas Gallagher, a related party and member of our Board of Directors,

in his capacity as agent for and on behalf of the holders of the Notes payable.

As

a result of the borrowings under the Notes payable in gold, Notes payable and Notes payable – related party (collectively, the

“Notes”), we are faced with a significant hurdle in financing the Company going forward, whether to conduct exploration programs

or initiate a mining program at the Chandalar mine. Our near-term cash requirements are greater than the assets we have available to

satisfy them, and the holders of the Notes could choose to exercise their rights to demand payment, which would result in a default situation

relative to the Notes. Mr. Gallagher is secured in his lending to the Company by means of the Amended Agreement, and if he were to demand

payment, the Company would not be able to pay him the amounts due and he would be entitled to sell the assets secured under his deed

of trust in order to pay his debt. We believe these holders to be friendly to the Company and that they will refrain from demanding payment,

but the Company cannot control the potential demands nor the consequences that would be extracted as a result of default on the Notes.

Subsequent

Events

Subsequent

to March 31, 2023, the Company received $162,667 cash as a result of exercise of Class R warrants at an exercise price of $0.024 per

common share. Ownership of these warrants had been in the hands of a related party and were sold by him personally to unrelated parties.

The unrelated parties then exercised the warrants for cash, resulting in the issuance of 6,777,778 common shares.

Subsequent

to March 31, 2023, the Company received cash of $12,500 of additional notes payable – related party from Mr. Nicholas Gallagher,

and $122,000 of additional notes payable from unrelated parties.

Mining

Permit and Future Mining Activities

The

recent upward movements in the price of gold to a range of $1,800 to $2,000 per ounce or higher during the past few years have created

renewed interest in gold mining, gold exploration and investments in companies engaging in those activities, including the junior mining/exploration

sector in which we participate. Additionally, the fact that we own a mine that has produced over 44,000 ounces in recent years along

an annual increasing trend has caught the interest of placer mining companies and investors who support placer mining operations. We

believe we have the fundamentals to raise capital and continue our primary strategy of exploration and secondarily placer mining.

If

we can attract sufficient financing to reinstate the placer mining operation, we may have a viable and productive path forward toward

obtaining financing in the short-term to achieve long-term profitability. To effectively pursue this strategy, we have negotiated the

option agreement described above to provide for facilities, equipment and mining permit to commence work, while taking on the reclamation

liability for the Chandalar placer mine. While the GRE Revised and Amended Initial Assessment Report reflects ample resources to justify

a mining activity at the Chandalar placer mine, the option would only be exercised if we were able to secure financing sufficient to

start up a mining operation or secure a mining partner to economically extract the gold in a mining operation.

We

do believe there are investors motivated to provide funding for exploration programs to locate and exploit the hard rock deposits from

which the placer mineralization is coming from. This strategy can be pursued independent of any mining activities.

Off-Balance

Sheet Arrangements

We

have no off-balance sheet arrangements.

Inflation

We

do not believe that inflation has had a significant impact on our condensed consolidated results of operations or financial condition.

Contractual

Obligations

See

Subsequent Events above.

Critical

Accounting Policies

We

have identified our critical accounting policies, the application of which may materially affect the financial statements, either because

of the significance of the financials statement item to which they relate, or because they require management’s judgment in making

estimates and assumptions in measuring, at a specific point in time, events which will be settled in the future. The critical accounting

policies, judgments and estimates which management believes have the most significant effect on the financial statements are set forth

below:

| ● | Estimates

of the recoverability of the carrying value of our mining and mineral property assets. We

use publicly available pricing or valuation estimates of comparable property and equipment

to assess the carrying value of our mining and mineral property assets. However, if future

results vary materially from the assumptions and estimates used by us, we may be required

to recognize an impairment in the assets’ carrying value. |

| ● | Estimates

of our environmental liabilities. Our potential obligations in environmental remediation,

asset retirement obligations or reclamation activities are considered critical due to the

assumptions and estimates inherent in accruals of such liabilities, including uncertainties

relating to specific reclamation and remediation methods and costs, the application and changing

of environmental laws, regulations and interpretations by regulatory authorities. |

Item

3. Quantitative and Qualitative Disclosures about Market Risk

Not

applicable.

Item

4. Controls and Procedures

Evaluation

of Disclosure Controls and Procedures

At

the end of the period covered by this Quarterly Report on Form 10-Q, an evaluation was carried out under the supervision of, and with

the participation of, our management, including the Chief Executive Officer and Chief Financial Officer, of the effectiveness of the

design and operation of our disclosure controls and procedures (as defined in Rule 13a – 15(e) and Rule 15d – 15(e) of the

Securities and Exchange Act of 1934, as amended (the “Exchange Act”)). Based on that evaluation, the Chief Executive Officer

and Chief Financial Officer have concluded that as of the end of the period covered by this Quarterly Report on Form 10-Q, our disclosure

controls and procedures were not effective due to the size of our staff and the resulting inability to segregate duties; however, material

information required to be disclosed by the Company in reports that it files or submits to the SEC under the Exchange Act, is recorded,

processed, summarized and reported within the time period specified in applicable rules and forms.

Changes

in internal controls over financial reporting

During

the quarter ended March 31, 2023, there have been no changes in the Company’s internal control over financial reporting that have

materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

PART

II – OTHER INFORMATION

Item

1. Legal Proceedings

In

2018, we filed a claim before an Arbitration panel consisting of 3 independent arbitrators against our joint venture partner to obtain

relief from certain accounting practices employed by the manager of the joint venture. In response to our filing, the managing partner,

NyacAU LLC, filed an Arbitration Counter Claim against us, naming the officers and directors of the Company as they were constituted

in 2012, at the time the JV’s Operating Agreement was signed by the respective partners. On March 31, 2023, the Company signed

a settlement agreement between the Company, NyacAU, LLC (“NyacAU”), Goldrich Placer, LLC (“GP”), Goldrich NyacAU

Placer, LLC (“GNP”), Dr. J. Michael James, individually (“Dr. James”), and Bear Leasing, LLC (“Bear Leasing”)

(each a “Party” and, collectively, the “Parties”).

Goldrich

made a payment of $105,000 to NyacAU by April 30, 2023, and the settlement agreement, among other things, resolved all outstanding arbitration

issues, awards, and orders including mutual release of all outstanding issues before the Alaska superior court and all court-entered

judgments. The agreement also terminates and supersedes all prior agreements between all Parties except a security agreement between

NyacAU and GNP to secure repayment of fifty percent (50%) of a funding mechanism known as Line of Credit 1 (LOC1), which was advanced

by NyacAU to GNP. GNP was formally dissolved in 2019.

Item

1A. Risk Factors

There