0001016504

INTEGRATED BIOPHARMA INC

false

--06-30

FY

2023

2,477,939

2,061

1,839

0

72

772

503

1,289

1,338

0.002

0.002

50,000,000

50,000,000

29,984,510

29,984,510

29,949,610

29,949,610

34,900

34,900

0

3

2016 2017 2018 2019

2

533

842

85

1

5

4

10

5

3

5

10

2.5

1

1

3

5

10

2

00010165042022-07-012023-06-30

iso4217:USD

00010165042022-12-31

xbrli:shares

00010165042023-09-15

thunderdome:item

00010165042021-07-012022-06-30

iso4217:USDxbrli:shares

00010165042023-06-30

00010165042022-06-30

0001016504inbp:VitaminRealtyLLCMember2023-06-30

0001016504inbp:VitaminRealtyLLCMember2022-06-30

0001016504us-gaap:CommonStockMember2021-06-30

0001016504us-gaap:AdditionalPaidInCapitalMember2021-06-30

0001016504us-gaap:RetainedEarningsMember2021-06-30

0001016504us-gaap:TreasuryStockCommonMember2021-06-30

00010165042021-06-30

0001016504us-gaap:CommonStockMember2021-07-012022-06-30

0001016504us-gaap:AdditionalPaidInCapitalMember2021-07-012022-06-30

0001016504us-gaap:RetainedEarningsMember2021-07-012022-06-30

0001016504us-gaap:TreasuryStockCommonMember2021-07-012022-06-30

0001016504us-gaap:CommonStockMember2022-06-30

0001016504us-gaap:AdditionalPaidInCapitalMember2022-06-30

0001016504us-gaap:RetainedEarningsMember2022-06-30

0001016504us-gaap:TreasuryStockCommonMember2022-06-30

0001016504us-gaap:CommonStockMember2022-07-012023-06-30

0001016504us-gaap:AdditionalPaidInCapitalMember2022-07-012023-06-30

0001016504us-gaap:RetainedEarningsMember2022-07-012023-06-30

0001016504us-gaap:TreasuryStockCommonMember2022-07-012023-06-30

0001016504us-gaap:CommonStockMember2023-06-30

0001016504us-gaap:AdditionalPaidInCapitalMember2023-06-30

0001016504us-gaap:RetainedEarningsMember2023-06-30

0001016504us-gaap:TreasuryStockCommonMember2023-06-30

0001016504inbp:BrandedProductsMember2022-07-012023-06-30

0001016504inbp:BrandedProductsMember2021-07-012022-06-30

0001016504us-gaap:ShippingAndHandlingMember2021-07-012023-06-30

0001016504us-gaap:ShippingAndHandlingMember2021-07-012022-06-30

utr:Y

0001016504us-gaap:StateAndLocalJurisdictionMemberus-gaap:NewJerseyDivisionOfTaxationMemberinbp:MDCMember2021-07-012022-06-30

0001016504us-gaap:StateAndLocalJurisdictionMemberus-gaap:NewJerseyDivisionOfTaxationMemberinbp:CIIMember2021-07-012022-06-30

0001016504us-gaap:BuildingAndBuildingImprovementsMember2022-06-30

0001016504us-gaap:MachineryAndEquipmentMember2022-06-30

0001016504us-gaap:AirTransportationEquipmentMember2022-06-30

00010165042020-07-012021-06-30

xbrli:pure

00010165042008-08-31

0001016504us-gaap:LandAndBuildingMember2023-06-30

0001016504us-gaap:LandAndBuildingMember2022-06-30

0001016504us-gaap:LeaseholdImprovementsMember2023-06-30

0001016504us-gaap:LeaseholdImprovementsMember2022-06-30

0001016504us-gaap:MachineryAndEquipmentMember2023-06-30

0001016504us-gaap:TransportationEquipmentMember2023-06-30

0001016504us-gaap:TransportationEquipmentMember2022-06-30

0001016504inbp:FullyDepreciatedPropertyMember2022-07-012023-06-30

0001016504inbp:FullyDepreciatedPropertyMember2021-07-012022-06-30

0001016504inbp:PropertyNotFullyDepreciatedMember2022-07-012023-06-30

0001016504inbp:PropertyNotFullyDepreciatedMember2021-07-012022-06-30

0001016504us-gaap:EquipmentMember2022-07-012023-06-30

0001016504us-gaap:EquipmentMember2021-07-012022-06-30

0001016504inbp:RevolvingAdvancesMember2023-06-30

0001016504inbp:RevolvingAdvancesMember2022-06-30

0001016504inbp:AmendedLoanAgreementMember2019-05-15

0001016504us-gaap:RevolvingCreditFacilityMemberinbp:AmendedLoanAgreementMember2019-05-15

0001016504inbp:AmendedLoanAgreementMemberinbp:TermLoanMember2019-05-15

0001016504us-gaap:RevolvingCreditFacilityMemberinbp:AmendedLoanAgreementMember2023-06-30

0001016504us-gaap:RevolvingCreditFacilityMemberinbp:AmendedLoanAgreementMember2022-06-30

0001016504us-gaap:RevolvingCreditFacilityMemberinbp:AmendedLoanAgreementMemberus-gaap:EurodollarMember2019-05-152019-05-15

0001016504inbp:AmendedLoanAgreementMemberinbp:TermLoanMember2022-06-30

0001016504inbp:AmendedLoanAgreementMemberinbp:TermLoanMemberus-gaap:EurodollarMember2019-05-152019-05-15

0001016504us-gaap:RevolvingCreditFacilityMemberinbp:AmendedLoanAgreementMember2023-05-11

0001016504inbp:AmendedLoanAgreementMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-03-31

0001016504inbp:AmendedLoanAgreementMember2019-05-152019-05-15

0001016504inbp:AmendedLoanAgreementMemberinbp:TermLoanMember2019-05-152019-05-15

0001016504us-gaap:RevolvingCreditFacilityMemberinbp:AmendedLoanAgreementMember2019-05-152019-05-15

0001016504inbp:AmendedLoanAgreementMember2021-06-30

0001016504inbp:iBioStockMember2020-07-012021-06-30

0001016504us-gaap:SeniorNotesMember2022-07-012023-06-30

0001016504us-gaap:SeniorNotesMember2021-07-012022-06-30

0001016504inbp:DebtRelatedToInterestExpenseMember2023-06-30

0001016504inbp:DebtRelatedToInterestExpenseMember2022-06-30

0001016504us-gaap:DomesticCountryMember2023-06-30

0001016504us-gaap:StateAndLocalJurisdictionMember2023-06-30

0001016504us-gaap:CapitalLossCarryforwardMember2023-07-10

0001016504us-gaap:CapitalLossCarryforwardMemberinbp:TaxYear2025Member2021-06-30

0001016504us-gaap:CapitalLossCarryforwardMemberinbp:TaxYear2026Member2021-06-30

0001016504us-gaap:CapitalLossCarryforwardMemberinbp:TaxYear2028Member2021-06-30

0001016504inbp:DeferredTaxAssetsRelatedToNetOperatingLossMember2022-07-012023-06-30

0001016504us-gaap:StateAndLocalJurisdictionMemberus-gaap:NewJerseyDivisionOfTaxationMemberinbp:CIIMember2019-07-012020-06-30

0001016504us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberinbp:TwoCustomersMember2022-07-012023-06-30

0001016504us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberinbp:TwoCustomersMember2021-07-012022-06-30

0001016504us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-07-012022-06-30

0001016504us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberinbp:MajorCustomer1Memberinbp:ContractManufacturingMember2022-07-012023-06-30

0001016504us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberinbp:MajorCustomer2Memberinbp:ContractManufacturingMember2022-07-012023-06-30

0001016504us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberinbp:MajorCustomer1Memberinbp:ContractManufacturingMember2021-07-012022-06-30

0001016504us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberinbp:MajorCustomer2Memberinbp:ContractManufacturingMember2021-07-012022-06-30

0001016504us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberinbp:TwoCustomersMember2022-07-012023-06-30

0001016504us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberinbp:TwoCustomersMember2021-07-012022-06-30

0001016504us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberinbp:MajorCustomer1Memberinbp:OtherNutraceuticalBusinessMember2022-07-012023-06-30

0001016504us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberinbp:MajorCustomer2Memberinbp:OtherNutraceuticalBusinessMember2022-07-012023-06-30

0001016504us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberinbp:MajorCustomer3Memberinbp:OtherNutraceuticalBusinessMember2022-07-012023-06-30

0001016504us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberinbp:MajorCustomer1Memberinbp:OtherNutraceuticalBusinessMember2021-07-012022-06-30

0001016504us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberinbp:MajorCustomer2Memberinbp:OtherNutraceuticalBusinessMember2021-07-012022-06-30

0001016504us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberinbp:MajorCustomer3Memberinbp:OtherNutraceuticalBusinessMember2021-07-012022-06-30

0001016504us-gaap:SalesRevenueSegmentMemberus-gaap:CustomerConcentrationRiskMemberinbp:MajorCustomer1Memberinbp:BrandedNutraceuticalMember2022-07-012023-06-30

0001016504us-gaap:NumberOfEmployeesGeographicAreaMemberus-gaap:UnionizedEmployeesConcentrationRiskMember2022-07-012023-06-30

0001016504srt:MinimumMember2022-07-012023-06-30

0001016504srt:MaximumMember2022-07-012023-06-30

0001016504inbp:VitaminRealtyLLCMember2022-07-012023-06-30

0001016504inbp:UnrelatedPartyMember2022-07-012023-06-30

0001016504inbp:VitaminRealtyLLCMember2021-07-012022-06-30

0001016504inbp:UnrelatedPartyMember2021-07-012022-06-30

0001016504inbp:ChairmanChiefExecutiveOfficeAndMajorStockholderMember2021-07-012022-06-30

0001016504inbp:ManhattanDrugCompanyMember2012-01-04

0001016504inbp:ManhattanDrugCompanyMember2012-01-05

0001016504inbp:ManhattanDrugCompanyMember2012-01-052012-01-05

0001016504inbp:ManhattanDrugCompanyMember2022-07-15

0001016504inbp:ManhattanDrugCompanyMember2022-07-012022-07-01

0001016504inbp:AgrolabsMember2014-05-19

0001016504inbp:AgrolabsMember2014-05-192014-05-19

0001016504us-gaap:AccountsPayableMemberinbp:VitaminRealtyLLCMember2023-06-30

0001016504us-gaap:AccountsPayableMemberinbp:VitaminRealtyLLCMember2022-06-30

0001016504inbp:WarehouseLeaseMember2023-06-30

0001016504inbp:OfficeEquipmentLeasesMember2023-06-30

0001016504inbp:OfficeEquipmentLeasesMember2022-06-30

0001016504inbp:UnrelatedPartyMember2023-06-30

0001016504inbp:UnrelatedPartyMember2022-06-30

0001016504inbp:UnrelatedPartyMember2022-06-15

0001016504inbp:UnrelatedPartyMember2022-06-152022-06-15

0001016504inbp:OperatingLeaseRenewedForOfficeSpaceMember2023-03-31

0001016504inbp:ThirdAmendmentWithVitaminRealtyMember2023-03-31

utr:acre

0001016504inbp:FifthYearOfFinanceLeaseMember2023-03-31

0001016504us-gaap:TransportationEquipmentMemberus-gaap:SubsequentEventMember2023-08-04

0001016504us-gaap:AccountsPayableMember2023-06-30

0001016504inbp:StockOption2001PlanMember2022-06-30

0001016504inbp:StockOption2001PlanMember2021-07-012022-06-30

0001016504inbp:StockOption1997PlanMember2022-06-30

0001016504us-gaap:EmployeeStockOptionMembersrt:MaximumMember2021-07-012022-06-30

0001016504us-gaap:EmployeeStockOptionMembersrt:MinimumMember2021-07-012022-06-30

0001016504inbp:StockOption2022PlanMember2023-06-30

0001016504inbp:StockOption2022PlanMember2022-07-012023-06-30

0001016504us-gaap:EmployeeStockOptionMember2022-07-012023-06-30

0001016504us-gaap:EmployeeStockOptionMembersrt:MinimumMember2022-07-012023-06-30

0001016504us-gaap:EmployeeStockOptionMembersrt:MaximumMember2022-06-30

0001016504us-gaap:EmployeeStockOptionMemberus-gaap:SubsequentEventMembersrt:DirectorMember2023-07-31

0001016504us-gaap:EmployeeStockOptionMemberus-gaap:SubsequentEventMemberinbp:EachDirectorMember2023-07-31

0001016504us-gaap:EmployeeStockOptionMemberus-gaap:SubsequentEventMembersrt:DirectorMember2023-07-012023-07-31

0001016504us-gaap:EmployeeStockOptionMemberus-gaap:SubsequentEventMembersrt:DirectorMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2023-07-012023-07-31

0001016504srt:DirectorMember2022-07-012023-06-30

0001016504srt:MinimumMembersrt:DirectorMember2022-07-012023-06-30

0001016504srt:MaximumMembersrt:DirectorMember2022-07-012023-06-30

0001016504us-gaap:EmployeeStockOptionMembersrt:MinimumMember2020-11-012020-11-30

0001016504us-gaap:EmployeeStockOptionMembersrt:MaximumMember2020-11-012020-11-30

0001016504us-gaap:EmployeeStockOptionMember2021-07-012022-06-30

0001016504inbp:RangeOneMember2022-07-012023-06-30

0001016504inbp:RangeOneMember2023-06-30

0001016504inbp:RangeTwoMember2022-07-012023-06-30

0001016504inbp:RangeTwoMember2023-06-30

0001016504inbp:RangeThreeMember2022-07-012023-06-30

0001016504inbp:RangeThreeMember2023-06-30

0001016504inbp:RangeFourMember2022-07-012023-06-30

0001016504inbp:RangeFourMember2023-06-30

0001016504inbp:RangeFiveMember2022-07-012023-06-30

0001016504inbp:RangeFiveMember2023-06-30

0001016504inbp:RangeSixMember2022-07-012023-06-30

0001016504inbp:RangeSixMember2023-06-30

0001016504inbp:RangeSevenMember2022-07-012023-06-30

0001016504inbp:RangeSevenMember2023-06-30

0001016504inbp:RangeEightMember2022-07-012023-06-30

0001016504inbp:RangeEightMember2023-06-30

0001016504inbp:RangeNineMember2022-07-012023-06-30

0001016504inbp:RangeNineMember2023-06-30

0001016504inbp:EuropeAndCanadaMember2022-07-012023-06-30

0001016504inbp:EuropeAndCanadaMember2021-07-012022-06-30

0001016504inbp:ContractManufacturingMembercountry:US2022-07-012023-06-30

0001016504inbp:ContractManufacturingMemberus-gaap:NonUsMember2022-07-012023-06-30

0001016504inbp:ContractManufacturingMember2022-07-012023-06-30

0001016504inbp:ContractManufacturingMember2023-06-30

0001016504inbp:ContractManufacturingMembercountry:US2021-07-012022-06-30

0001016504inbp:ContractManufacturingMemberus-gaap:NonUsMember2021-07-012022-06-30

0001016504inbp:ContractManufacturingMember2021-07-012022-06-30

0001016504inbp:ContractManufacturingMember2022-06-30

0001016504inbp:OtherNutraceuticalBusinessMembercountry:US2022-07-012023-06-30

0001016504inbp:OtherNutraceuticalBusinessMemberus-gaap:NonUsMember2022-07-012023-06-30

0001016504inbp:OtherNutraceuticalBusinessMember2022-07-012023-06-30

0001016504inbp:OtherNutraceuticalBusinessMember2023-06-30

0001016504inbp:OtherNutraceuticalBusinessMembercountry:US2021-07-012022-06-30

0001016504inbp:OtherNutraceuticalBusinessMemberus-gaap:NonUsMember2021-07-012022-06-30

0001016504inbp:OtherNutraceuticalBusinessMember2021-07-012022-06-30

0001016504inbp:OtherNutraceuticalBusinessMember2022-06-30

0001016504country:US2022-07-012023-06-30

0001016504us-gaap:NonUsMember2022-07-012023-06-30

0001016504country:US2021-07-012022-06-30

0001016504us-gaap:NonUsMember2021-07-012022-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

____________

FORM 10-K

__ __________

| ☒ Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

| For the fiscal year ended June 30, 2023 | |

| ☐ Transition Report Pursuant to Section 13 Or 15(d) of the Securities Exchange Act Of 1934 | |

| For the transition period from to | |

Commission File Number 001-31668

INTEGRATED BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 22-2407475 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 225 Long Ave., Hillside, New Jersey | 07205 |

| (Address of principal executive offices) | (Zip code) |

Registrant’s telephone number: (888) 319-6962

Securities registered under Section 12(b) of the Exchange Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| None | N/A | None |

Securities registered under Section 12(g) of the Exchange Act: Common Stock, $.002 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, a non-accelerated filer, an accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “accelerated filer,” “large accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated Filer ☐ | Accelerated Filer ☐ | Non-accelerated Filer ☒ | Emerging Growth Company ☐ | Smaller reporting company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant based on the last sale price of the registrant’s Common Stock on December 31, 2022 was $3,258,720.

The number of shares outstanding of each of the registrant’s classes of common equity, as of the latest practicable date:

| Class | Outstanding at September 15, 2023 |

| Common Stock, $.002 par value | 29,949,610 Shares |

DOCUMENTS INCORPORATED BY REFERENCE

The information required by part III will be incorporated by reference from certain portions of a definitive Proxy Statement which is expected to be filed by the Registrant within 120 days after the close of its fiscal year.

INTEGRATED BIOPHARMA, INC. AND SUBSIDIARIES

FORM 10-K ANNUAL REPORT

INDEX

| Part I |

|

Page |

| |

|

|

| Item 1. |

Description of Business |

4 |

| Item 1A. |

Risk Factors |

9 |

| Item 1B. |

Unresolved Staff Comments |

14 |

| Item 2. |

Properties |

14 |

| Item 3. |

Legal Proceedings |

14 |

| Item 4. |

Mine Safety Disclosure |

14 |

| |

|

|

| Part II |

|

|

| |

|

|

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

15 |

| Item 6. |

[Reserved] |

16 |

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

16 |

| Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk |

24 |

| Item 8. |

Financial Statements and Supplementary Data |

24 |

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

24 |

| Item 9A. |

Controls and Procedures |

24 |

| Item 9B. |

Other Information |

25 |

| Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

25 |

| |

|

|

| Part III |

|

|

| |

|

|

| Item 10. |

Directors, Executive Officers and Corporate Governance |

25 |

| Item 11. |

Executive Compensation |

25 |

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

25 |

| Item 13. |

Certain Relationships and Related Transactions and Director Independence |

26 |

| Item 14. |

Principal Accountant Fees and Services |

26 |

| |

|

|

| Part IV |

|

|

| |

|

|

| Item 15. |

Exhibits and Financial Statement Schedules |

27 |

| Item 16. |

Form10-K Summary |

28 |

| |

|

|

| Signatures |

|

52 |

| |

|

|

| |

|

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this Annual Report on Form 10-K may constitute forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Private Securities Litigation Reform Act of 1995 (the “PSLRA”) or in releases made by the Securities and Exchange Commission (“SEC”), all as may be amended from time to time. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements of Integrated BioPharma, Inc. and its subsidiaries (collectively, the “Company”) or industry results, to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, changes in general economic and business conditions; loss of market share through competition; introduction of competing products by other companies; the timing of regulatory approval and the introduction of new products by the Company; changes in industry capacity; pressure on prices from competition or from purchasers of the Company's products; regulatory changes in the pharmaceutical manufacturing industry and nutraceutical industry; regulatory obstacles to the introduction of new technologies or products that are important to the Company; availability of qualified personnel; the loss of any significant customers or suppliers; the impact of the war in Ukraine; the tightened labor markets and inflation; and other factors both referenced and not referenced in this Annual Report. Statements that are not historical fact are forward-looking statements. Forward looking-statements can be identified by, among other things, the use of forward-looking language, such as the words “plan”, “believe”, “expect”, “anticipate”, “intend”, “estimate”, “project”, “may”, “will”, “would”, “could”, “should”, “seeks”, or “scheduled to”, or other similar words, or the negative of these terms or other variations of these terms or comparable language, or by discussion of strategy or intentions. These cautionary statements are being made pursuant to the Securities Act, the Exchange Act and the PSLRA with the intention of obtaining the benefits of the “safe harbor” provisions of such laws. The Company cautions investors that any forward-looking statements made by the Company are not guarantees or indicative of future performance. Important assumptions and other important factors that could cause actual results to differ materially from those forward-looking statements with respect to the Company include, but are not limited to, the risks and uncertainties affecting their businesses described in Item 1A of this Annual Report on Form 10-K and in other filings by the Company with the SEC.

Although the Company believes that its plans, intentions and expectations reflected in or suggested by such forward-looking statements are reasonable, actual results could differ materially from a projection or assumption in any of its forward-looking statements. The Company’s future financial condition and results of operations, as well as any forward-looking statements, are subject to change and inherent risks and uncertainties. The forward-looking statements contained in this Annual Report on Form 10-K are made only as of the date hereof and the Company does not have or undertake any obligation to update or revise any forward-looking statements whether as a result of new information, subsequent events or otherwise, unless otherwise required by law.

PART I

Item 1. Description of Business

General

Integrated BioPharma, Inc., a Delaware corporation (together with its subsidiaries, the “Company”), is engaged primarily in manufacturing, distributing, marketing and sales of vitamins, nutritional supplements and herbal products. The Company’s customers are located primarily in the United States and Luxembourg. The Company was originally incorporated in the state of Delaware on August 31, 1995 under the name Chem International, Inc., on December 5, 2000, changed its name to Integrated Health Technologies, Inc. and, on January 29, 2003, changed its name to Integrated BioPharma, Inc. The Company restated its certificate of incorporation in Delaware in June 2006. The Company continues to do business as Chem International, Inc. with certain of its customers and certain vendors.

The Company’s business segments include: (a) Contract Manufacturing operated by Manhattan Drug Company, Inc. (“MDC”), which manufactures vitamins and nutritional supplements for sale to distributors, multilevel marketers and specialized health-care providers and (b) Other Nutraceutical Businesses which includes the operations of (i) AgroLabs, Inc. (“AgroLabs”), which distributed healthful nutritional products for sale through major mass market, grocery and drug and vitamin retailers under the following brands: Peaceful Sleep, and Wheatgrass and other products introduced into the market using the AgroLabs name (these are referred to as our branded products); (ii) The Vitamin Factory (the “Vitamin Factory”), which sells private label MDC products, as well as our AgroLabs products, through the Internet, (iii) IHT Health Products, Inc. (“IHT”) a distributor of fine natural botanicals, including multi minerals produced under a license agreement, (iv) MDC Warehousing and Distribution, Inc., a service provider for warehousing and fulfilment services and (v) Chem International, Inc., a distributor of certain raw materials for DSM Nutritional Products LLC. The Vitamin Factory had no products available for sale and AgroLabs had no sales of its branded products in each of the fiscal years ended June 30, 2023 and 2022.

Significant Revenues from Major Customers

In the fiscal years ended June 30, 2023 and 2022, a significant portion of our consolidated net sales, approximately 89% and 90%, respectively, were concentrated among two customers, Life Extension Quality Supplements and Vitamins, Inc. (“Life Extension”) and Herbalife Nutrition LTD (“Herbalife”), both customers in our Contract Manufacturing Segment. Life Extension and Herbalife represented approximately 70% and 24% and 67% and 26%, respectively, of our Contract Manufacturing Segment’s net sales in the fiscal years ended June 30, 2023 and 2022, respectively. Thermosource Tooling and Manufacturing, HotPack Global Inc. and ThermoFisher Scientific (customers of our Other Nutraceutical Businesses Segment), while not significant customers of our consolidated net sales, represented approximately 56%, 16% and 9% and 40%, 1% and 19%, respectively, of the Other Nutraceutical Businesses net sales in the fiscal years ended June 30, 2023 and 2022, respectively. The loss of any of these customers could have a significant adverse impact on our financial condition and results of operations.

Raw Materials

The principal raw materials used in the manufacturing process in the Company’s business are natural and synthetic vitamins, minerals, herbs, related nutritional supplements, vegetable and gelatin capsules, coating materials, organic and natural fruit extracts, fruit juices and the necessary components for packaging the finished products. The raw materials are available from numerous sources within the United States and abroad. The vegetable and gelatin capsules, coating materials and packaging materials are similarly widely available. The Company generally purchases its raw materials, on a purchase order basis, without long-term commitments in each of its operating segments. We have one principal supplier for our Other Nutraceutical Businesses segment, DSM Nutritional Products LLC and several suppliers in our Contract Manufacturing Segment.

Development and Supply Agreement

Effective July 15, 2009, the Company entered into development and supply agreements with Herbalife International of America, Inc. and Herbalife International of Luxembourg S.à.R.L, subsidiaries of Herbalife, pursuant to which the Company develops, manufactures and supplies certain nutritional products to Herbalife. This agreement is in the process of being extended through December 31, 2025. This agreement does not, however, obligate the Company to supply any particular amount of goods to Herbalife, nor does it obligate Herbalife to commit to a minimum order, if any. In its ordinary course of business, the Company enters into similar agreements with other customers in connection with its contract manufacturing business.

Seasonality

The nutraceutical business tends to be seasonal. We have found that in our first fiscal quarter ending on September 30th of each year, orders for our branded proprietary nutraceutical products usually slow (absent the addition of new customers or a new product launch with a significant first time order), as buyers in various markets may have purchased sufficient inventory to carry them through the summer months. Conversely, in our second fiscal quarter, ending on December 31st of each year, orders for our products increase as the demand for our branded nutraceutical products, as well as sales orders from our customers in our contract manufacturing segment, seem to increase in late December to early January as consumers become health conscious as they enter the new year.

The Company believes that there are other non-seasonal factors that also may influence the variability of quarterly results including, but not limited to, general economic and industry conditions that affect consumer spending, changing consumer demands and current news on nutritional supplements. Accordingly, a comparison of the Company’s results of operations from consecutive periods is not necessarily meaningful, and the Company’s results of operations for any period are not necessarily indicative of future periods.

Government Regulations

The manufacturing, processing, formulation, packaging, labeling and advertising of our products are subject to regulation by a number of federal agencies, including the Food and Drug Administration (“FDA”), the Federal Trade Commission (“FTC”), the United States Postal Service, the Consumer Product Safety Commission and the United States Department of Agriculture. Our activities are also regulated by various state and local agencies in states where our products are sold. The FDA is primarily responsible for the regulation of the manufacturing, labeling and sale of our products. The operation of our vitamin manufacturing facility is subject to regulation by the FDA as a dietary supplement manufacturing facility. The United States Postal Service and the FTC regulate advertising claims with respect to the Company’s products. In addition, we manufacture and market certain of our products in compliance with the guidelines promulgated by the United States Pharmacopoeia Convention, Inc. (“USP”) and other voluntary standards organizations.

The Dietary Supplement Health and Education Act of 1994 (“DSHEA”) was enacted on October 25, 1994. The Dietary Supplement Act amends the U.S. Federal Food, Drug and Cosmetic Act (“FFD&CA”) by defining dietary supplements, which include vitamins, minerals, nutritional supplements and herbs, and by providing a regulatory framework to ensure safe, quality dietary supplements and the dissemination of accurate information about such products. The FDA is generally prohibited from regulating the active ingredients in dietary supplements as food additives, or as drugs unless product claims trigger drug status. The DSHEA requires the FDA to regulate dietary supplements so as to guarantee consumer access to beneficial dietary supplements, allowing only truthful and proven claims. Generally, dietary ingredients that were on the market before October 15, 1994 may be sold without FDA pre-approval and without notifying the FDA. However, new dietary ingredients (those not used in dietary supplements marketed before October 15, 1994) require pre-market submission to the FDA of evidence of a history of their safe use, or other evidence establishing that they are reasonably expected to be safe. There can be no assurance that the FDA will accept the evidence of safety for any new dietary ingredient we may decide to use. The FDA’s refusal to accept such evidence could result in regulation of such dietary ingredients as food additives, requiring the FDA pre-approval based on newly conducted, costly safety testing.

DSHEA provides for specific nutritional labeling requirements for dietary supplements effective January 1, 1997. The Dietary Supplement Act permits substantiated, truthful and non-misleading statements of nutritional support to be made in labeling, such as statements describing general well-being from consumption of a dietary ingredient or the role of a nutrient or dietary ingredient in affecting or maintaining the structure or function of the body. The FDA requires the Company to notify the FDA of such statements. There can be no assurance that the FDA will not consider particular labeling statements used by us to be drug claims rather than acceptable statements of nutritional support, necessitating approval of a costly new drug application, or re-labeling to delete such statements. It is also possible that the FDA could allege false statements were submitted to it if structure/function claim notifications were either non-existent or so lacking in scientific support as to be plainly false.

As authorized by DSHEA, the FDA adopted Good Manufacturing Practices (“GMP”) specifically for dietary supplements (21 CFR Part 111). These GMP regulations, which became effective in June 2008, are more detailed than the GMPs that previously applied to dietary supplements and require, among other things, dietary supplements to be prepared, packaged and held in compliance with specific rules, and require quality controls similar to those required by GMP regulations for drugs. We believe our manufacturing and distribution practices comply with these rules.

Dietary supplements are also subject to the Nutrition, Labeling and Education Act (“NLEA”), which regulates health claims, ingredient labeling and nutrient content claims characterizing the level of a nutrient in a product. NLEA prohibits the use of any health claim for dietary supplements unless the health claim is supported by significant agreement within the scientific community and is pre-approved by the FDA.

In certain markets, including the United States, claims made with respect to dietary supplements may change the regulatory status of our products. For example, in the United States, the FDA could possibly take the position that claims made for some of our products classify those products as new drugs requiring pre-approval by the FDA. The FDA could also place those products within the scope of its over-the-counter (“OTC”) drug regulations and require us to comply with a published FDA OTC monograph. OTC monographs dictate permissible ingredients, appropriate labeling language and require the marketer or supplier of the products to register and file annual drug listing information with the FDA. We do not, at present, sell OTC drug products. If the FDA were to assert that our product claims cause them to be considered new drugs or to fall within the scope of OTC regulations, we would be required to either; file a new drug application, comply with the applicable monographs, or change the claims made in connection with those products.

The FTC regulates the marketing practices and advertising of all our products. In recent years, the FTC instituted enforcement actions against several dietary supplement companies for false and misleading marketing practices and advertising of certain products. These enforcement actions have resulted in consent decrees and monetary payments by the companies involved. Under FTC standards, the dissemination of any false advertising constitutes an unfair or deceptive act or practice actionable under Section 45 of the Fair Trade Commission Act and a false advertisement actionable under Section 52 of that Act. A false advertisement is one that is “misleading in a material respect.” In determining whether an advertisement or labeling information is misleading in a material respect, the FTC determines not only whether overt and implied representations are false but also whether the advertisement fails to reveal material facts. Under the FTC’s standards, any health benefit representation made in advertising must be backed by “competent and reliable scientific evidence” by which the FTC means: “tests, analyses, research studies, or other evidence based upon the expertise of professionals in the relevant area, that have been conducted and evaluated in an objective manner by persons qualified to do so, using procedures generally accepted by the profession to yield accurate and reliable results.”

The FTC has increased its review of the use of the type of testimonials that may be used to market our products. The FTC requires competent and reliable evidence substantiating claims and testimonials at the time that such claims of health benefit are first made. The failure to have this evidence when product claims are first made violates the Federal Trade Commission Act. Although the FTC has never threatened an enforcement action against the Company for the advertising of its products, there can be no assurance that the FTC will not question the advertising for our products in the future.

We believe we are currently in compliance with all applicable government regulations. We cannot predict what new legislation or regulations governing our operations will be enacted by legislative bodies or promulgated by agencies that regulate its activities. The FDA is expected to increase its enforcement activity against dietary supplements that it considers to be in violation of FFD&CA. In particular, the FDA is increasing its enforcement of DSHEA provisions. Those activities will be enhanced by the appropriation for increased FDA budgets for dietary supplement regulation enforcement.

We believe we may become subject to additional laws or regulations administered by the FDA or other federal, state, or foreign regulatory authorities. We also believe the laws or regulations which are considered favorable may be repealed, or more stringent interpretations of current laws or regulations may be implemented. Any or all of such requirements could be a burden to us. Future regulations could require us to:

● change the way we conduct business;

● use expanded or different labeling;

● recall, reformulate or discontinue certain products;

● keep additional records;

● increase the available documentation of the properties of its products; and/or

● increase the scientific proof of product ingredients, safety, and/or usefulness.

Competition

The business of manufacturing, distributing and marketing vitamins and nutritional supplements is highly competitive. Many of our competitors are substantially larger and have greater financial resources with which to manufacture and market their products. In particular, the retail segment is highly competitive. Many direct marketers not only focus on selling their own branded products, but offer national brands at discounts as well. Many competitors have established brand names recognizable to consumers. In addition, major pharmaceutical companies offer nationally advertised multivitamin products.

Many of our competitors in the retailing segment have the financial resources to advertise freely, to promote sales and to produce sophisticated catalogs and websites. In many cases, such competitors are able to offer price incentives for retail purchasers and to offer participation in frequent buyers programs. Some retail competitors also manufacture their own products whereby they have the ability and financial incentive to sell their own product.

We intend to compete by stressing the quality of our manufactured products, providing prompt service, competitive pricing of products in our marketing segment and by focusing on niche products in international retail markets.

Research and Development Activities

We do not conduct any significant research and development activities.

Environmental Compliance

We are subject to regulation under Federal, state and local environmental laws. While we believe we are in material compliance with applicable environmental laws, continued compliance may require substantial capital expenditures. We have not incurred any major costs for any environmental compliance during the years ended June 30, 2023 and 2022.

Employees

As of September 15, 2023, we had approximately 141 full time employees, including 106 who are members of the local unit of the Teamsters Union and are covered by a collective bargaining agreement which expires on August 31, 2027. The remaining 35 employees, not covered by a collective bargaining agreement, consist of approximately 15 administrative and professional personnel, 12 laboratory and quality assurance personnel, 3 sales and marketing personnel and 5 production and shipping personnel. We consider our relations with our employees to be good.

In December 2022, we entered into an agreement with a Professional Employer Organization (“PEO”) and terminated our agreement with the previous PEO. The PEO agreements established a three-way relationship between our non-union employees, the PEO and us. We and the PEO are co-employers of our non-union employees. The PEO has taken responsibility for our Human Resources administration and compliance, which allows us to continue to exercise control over our business while accessing quality employee benefits. We have been using PEOs since January 2007.

Available Information

We file annual, quarterly and current reports, proxy statements and other information with the SEC. These filings are available to the public via the Internet at the SEC's website located at http://www.sec.gov.

Our website is located at ir.ibiopharma.com. You may request a copy of our filings with the SEC (excluding exhibits) at no cost by writing or telephoning us at the following address or telephone number:

Integrated BioPharma, Inc.

225 Long Avenue, Bldg. 15

Hillside, New Jersey 07205

Attn: Investor Relations

Tel: 888-319-6962

Item 1A. Risk Factors

Please carefully consider the following risk factors which could materially adversely affect our business, financial condition, operating results and cash flows. The risk factors described below are not the only ones we face. Risks and uncertainties not known to us currently, or that we currently deem immaterial, also may materially adversely affect our business, financial condition, operating results and cash flows.

Our revenue could decline significantly if we lose one or more of our most significant customers, which could have a significant adverse impact on us.

A significant portion of our revenues are concentrated among four customers, Life Extension, Herbalife (customers in our Contract Manufacturing Segment), and Thermosource Tooling and Manufacturing and Hotpack Global, Inc. (customers of our Other Nutraceutical Businesses Segment). In the fiscal years ended June 30, 2023 and 2022, approximately 89% and 90% of our consolidated net sales, respectively, were derived from the two major customers in our Contract Manufacturing Segment. The loss of any of these customers could have a significant adverse impact on our financial condition and results of operations.

Supply chain disruptions resulting from geo-political events could have an impact on our financial results and ability to timely ship products to our customers.

These issues first arose as result of the COVID-19 pandemic and other geo-political events. Transportation, in general, continues to be an issue in the delay of receiving raw materials and our ability to meet promised delivery dates to our customers in the Contract Manufacturing Segment.

While we haven’t, to date, seen a significant negative impact in our margins resulting from the geo-political events, we are experiencing a slight negative impact on our margins due to inflation and tightened labor markets.

During the first quarter of calendar 2022, the war in Ukraine affected our customer’s business operations in Ukraine and Russia, resulting in the cancelation of some future orders. The war resulted in the imposition of sanctions by the United States, the United Kingdom and the European Union that affect the cross-border operations of businesses operating in Russia. In addition, many multinational companies ceased or suspended their operations in Russia. Therefore, the ability to continue operations in Russia by our customers is uncertain. Also, there may be a shortage of Sunflower Oil products in the near future and this may cause delays in production of certain raw materials and may require reformulation of products.

We have indebtedness, which may decrease our flexibility, increase our borrowing costs and adversely affect our liquidity.

We currently have $11.6 million in senior secured financing (the “Senior Credit Facility”) available under the Loan Agreement, dated as of June 27, 2012 and as amended on May 15, 2019 (the "Amended Loan Agreement"), by and among the Company, MDC, AgroLabs, IHT Health Products, Inc., IHT Properties Corp. (“IHT Properties”), and Vitamin Factory (collectively, the “Borrowers”) and PNC Bank, National Association ("PNC") and $2,623 in operating lease obligations. As of June 30, 2023, we have no amounts outstanding with PNC under the Senior Credit Facility.

Our level of indebtedness can have important consequences. For example, it may require a substantial portion of our cash flow from operations for the payment of principal of, and interest on, our indebtedness and reduce our ability to use our cash flow to fund working capital, capital expenditures and general corporate requirements or to pay dividends; and limit our flexibility to adjust to changing business and market conditions and make us more vulnerable to a downturn in general economic conditions as compared to our competitors.

There are various financial covenants and other restrictions in the Senior Credit Facility. If we fail to comply with any of these requirements, any related indebtedness (and other unrelated indebtedness) could become due and payable prior to its stated maturity. A default under the Senior Credit Facility may also significantly affect our ability to obtain additional or alternative financing. For example, PNC's ongoing obligation to extend credit under the Amended Loan Agreement is dependent upon our compliance with these covenants and restrictions.

To the extent we draw down additional funds under the Senior Credit Facility, our ability to make scheduled payments or to refinance our obligations with respect to indebtedness will depend on our operating and financial performance, which, in turn, is subject to prevailing economic conditions and to financial, business and other factors beyond our control. Our inability to refinance our indebtedness when necessary or to do so upon attractive terms would materially and adversely affect our liquidity and our ongoing results of operations.

Complying with new and existing government regulation, both in the U.S. and abroad, could increase our costs significantly and adversely affect our financial results.

The processing, formulation, manufacturing, packaging, labeling, advertising, distribution and sale of our products are subject to regulation by several U.S. federal agencies, including the FDA, the FTC, the Consumer Product Safety Commission, the Department of Agriculture and the EPA, as well as various state, local and international laws and agencies of the localities in which our products are sold. Government regulations may prevent or delay the introduction, or require the reformulation, of our products. Some agencies, such as the FDA or state agencies, could require us to remove a particular product from the market, delay or prevent the import of raw materials for the manufacture of our products, or otherwise disrupt the marketing of our products. Any such government actions would result in additional costs to us, including lost revenues from any additional products that we are required to remove from the market, which additional costs could be material. Any such government actions also could lead to liability, substantial costs and reduced growth prospects. Moreover, there can be no assurance that new laws or regulations imposing more stringent regulatory requirements on the dietary supplement industry will not be enacted or issued. In addition, complying with adverse event reporting requirements imposes additional costs on us, which costs could become significant in the event more demanding reporting requirements are put into place.

Additional or more stringent regulations of dietary supplements and other products have been considered from time to time. These developments could require reformulation of certain products to meet new standards, recalls or discontinuance of certain products that cannot be reformulated, additional record-keeping requirements, increased documentation of the properties of certain products, additional or different labeling, additional scientific substantiation, adverse event reporting or other new requirements. These developments also could increase our costs significantly. For example, the FDA issued rules which became effective in 2008 that imposed substantial new regulatory requirements for dietary supplements, including GMPs. Congress also passed legislation requiring adverse event reporting and related record keeping which imposed additional costs on us. See Item 1. "Description of Business—Government Regulations" for additional information.

We may be exposed to or the target of legal proceedings initiated by regulators or third parties either in the United States or abroad which could increase our costs and adversely affect our reputation, revenues and operating income.

In the United States and abroad, non-compliance with relevant legislation can result in regulators bringing administrative or, in some cases, criminal proceedings. As manufacturers of nutraceutical products, our products are regulated by various governments and it is common for regulators to prosecute retailers and manufacturers for non-compliance with legislation governing foodstuffs and medicines. Failures by us or our subsidiaries to comply with applicable legislation could occur from time to time and prosecution for any such violations could have a material adverse effect on our business, results of operations, financial condition and cash flows. Additionally, we are subject, from time to time, to claims by third parties under various legal theories. The defense of such claims, or any adverse outcome relating to any such claims, could have a material adverse effect on our liquidity, financial condition and cash flows.

We depend on our senior management, the loss of whom would have an adverse effect on us.

We presently are dependent upon the executive abilities of our Co-Chief Executive Officers, Christina Kay and Riva Sheppard, our Chief Financial Officer, Dina L. Masi and the Vice President of Operations for Manhattan Drug Company, Inc. Mireille Antinozzi. Our business and operations to date chiefly have been implemented under the direction of these individuals, who presently are, and in the future will be, responsible for the implementation of our anticipated plans and programs. The loss or unavailability of the services of one or more of our principal executives would have an adverse effect on us. We may encounter difficulty in our ability to recruit and ultimately hire any replacement or additional executive officers having similar background, experience and qualifications as those of our current executive officers.

We could be the target of a cybersecurity breach which could have an adverse effect on us.

A cybersecurity breach could result in the loss or theft of investor data or funds, the inability to access electronic systems, loss or theft of proprietary information or corporate data, disruption of our operations, physical damage to a computer or network system, or costs associated with system repairs. Such incidents could cause the Company to incur regulatory penalties, reputational damage, remediation costs, litigation costs, additional compliance costs, or financial loss. Intentional cybersecurity breaches include: unauthorized access to systems, networks, or devices (such as through “hacking” activity); infection from computer viruses or other malicious software code; and attacks that shut down, disable, slow, or otherwise disrupt operations, business processes, or website access or functionality. In addition, unintentional incidents can occur, such as the inadvertent release of confidential information (possibly resulting in the violation of applicable privacy laws.

There is no assurance that we will remain quoted or listed on an active trading market.

As of January 22, 2022, the Company’s common stock was upgraded to the OTCQX® Best Market of the OTC Markets Group, Inc. and commenced quotation under the symbol “INBP.” In order to maintain quotation on the OTCQX, the Company will be required to comply with certain minimum qualitative and quantitative requirements, including with respect to corporate governance. There can be no assurances that the Company will be able to comply with these qualitative and quantitative requirements for continued quotation of its common stock on the OTCQX. If the Company doesn’t maintain compliance with the OTCQX rules, the Company’s common stock may resume listing on the OTCQB and holders of the Company’s common stock may find it more difficult to sell their shares.

From September 23, 2009 until January 21, 2022, our common stock was quoted on the OTQB. From February 27, 2009 through September 22, 2009, our common stock was quoted on the Pink Sheets. Prior to February 27, 2009, our common stock was listed on the NASDAQ Global Market, and there can be no assurance that we will, in the future, be able to meet all the requirements for reinstatement on that or any other national securities exchange. The delisting of our common stock from the NASDAQ Global Market has adversely affected, and may in the future continue to adversely affect, the liquidity and trading of our common stock.

We have entered into several transactions with entities controlled by some of our officers and directors, which could pose a conflict of interest.

We have several agreements and arrangements, described in our previous SEC filings and to be described in our proxy statement for our 2023 annual meeting of stockholders, including the lease of real property from Vitamin Realty Associates, L.L.C. (“Vitamin Realty”), the sale of our financial debt securities, and issuance of our common stock, which involved transactions with entities owned, in whole or in part, by the Estate of the former Executive Chairman and our Co-Chief Executive Officers and other of our significant shareholders and/or directors, who collectively own a majority of our shares of common stock. Although we believe that these transactions were advantageous to us and were on terms no less favorable to us than could have been obtained from unaffiliated third parties, transactions with related parties can potentially pose a conflict of interest.

Our Executive Officers and Directors have majority voting power and may take actions that may not be in the best interest of other stockholders, but in their own interest.

Collectively, our Executive Officers, Directors and two other significant stockholders, beneficially own approximately 72% of our outstanding shares of common stock as of September 15, 2023. If these stockholders act together, they would be able to exert significant control over our management and affairs since significant corporate transactions require stockholder approval. This concentration of ownership may have the effect of delaying or preventing a change in control and might adversely affect the market price of our common stock. This concentration of ownership may not be in the best interests of all our stockholders.

We have a staggered Board of Directors, which could impede an attempt to acquire the Company or remove our management.

Our Board of Directors is divided into three classes, each of which serves for a staggered term of three years. This division of our Board of Directors could have the effect of impeding an attempt to take over our company or change or remove management, since only one class will be elected annually. Thus, only approximately one-third of the existing Board of Directors could be replaced at any election of directors.

Our product liability insurance may be insufficient to cover possible claims against us.

Our company, like other manufacturers, wholesalers and distributors of vitamin and nutritional supplement products, faces an inherent risk of exposure to product liability claims if, among other things, the use or ingestion of our products, results in sickness or injury. We currently maintain a product liability insurance policy that provides a total of $5.0 million of coverage per occurrence and $5.0 million of coverage in the aggregate. However, there can be no assurance that existing or future insurance coverage will be sufficient to cover any possible product liability risks or that such insurance will continue to be available to us on economically feasible terms.

Our nutraceutical products are manufactured using various raw materials consisting of vitamins, minerals, herbs, fruit extracts and other ingredients that we regard as safe when taken as recommended by us and that various scientific studies have suggested may provide health benefits. We could be adversely affected if any of our products or any similar products distributed by other companies should prove or be asserted to be harmful to consumers or should scientific studies provide unfavorable findings regarding the effectiveness of our products.

We may not be able to obtain raw materials used in certain of our manufactured products.

The principal raw materials used in the manufacturing process in the Company’s nutraceutical business are natural and synthetic vitamins, minerals, herbs, related nutritional supplements, vegetable and gelatin capsules, coating materials, fruit extracts, fruit juices and the necessary components for packaging the finished products. The raw materials are available from numerous sources within the United States and abroad. The vegetable and gelatin capsules, coating materials and packaging materials are similarly widely available. We generally purchase our raw materials, on a purchase order basis, without long-term commitments.

We have one principal supplier for our Other Nutraceutical Businesses Segment, DSM Nutritional Products LLC and several suppliers in our Contract Manufacturing Segment. If we are unable to maintain our relationships with our suppliers, we may not be able to find alternate sourcing of our raw materials or at the same pricing that we receive from our current suppliers and/or quickly enough to make timely shipments to our customers. This could decrease our sales and/or increase our cost of sales.

Current economic conditions may cause a decline in business and consumer spending which could adversely affect our business and financial performance.

Our operating results are impacted by the health of the North American economies. Our business and financial performance, including collection of our accounts receivable, recoverability of assets including investments, may be adversely affected by current and future economic conditions, such as a reduction in the availability of credit, financial market volatility, recession, etc. Additionally, we may experience difficulties in scaling our operations to react to economic pressures in the United States.

We may incur significant professional service fees and other control costs that impact our financial condition.

As a publicly traded corporation, we incur certain costs to comply with regulatory requirements. If regulatory requirements were to become more stringent or if controls thought to be effective later fail, we may be forced to make additional expenditures, the amounts of which could be material. Some of our competitors are privately owned so their accounting and control costs can be a competitive disadvantage for us. Should our sales decline or if we are unsuccessful at increasing prices to cover higher expenditures for internal controls, audits, consultants and legal, our costs associated with regulatory compliance will rise as a percentage of sales.

Other issues and uncertainties may include:

● New accounting pronouncements or changes in accounting policies; and

● Legislation or other governmental action that detrimentally impacts our expenses or reduces sales by adversely affecting our customers.

If we discover material weaknesses and other deficiencies in our internal control and accounting procedures, our stock price could decline significantly and raising capital could be more difficult.

If we fail to comply with the rules under the Sarbanes-Oxley Act, related to disclosure controls and procedures, or if we discover material weaknesses and other deficiencies in our internal control and accounting procedures, our stock price could decline significantly and raising capital could be more difficult. Moreover, effective internal controls are necessary for us to produce reliable financial reports and are important in helping prevent financial fraud. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock could drop significantly. While we have not identified any material weakness in our internal control over financial reporting, we cannot be certain that material weaknesses or significant deficiencies in our internal controls will not be discovered in the future.

We have not paid dividends on our common stock in the past and do not expect to pay dividends on our common stock for the foreseeable future. Any return on investment may be limited to the value of our common stock.

We have never paid any cash dividends on our common stock. We expect that any income received from operations will be devoted to our future operations and growth. We do not expect to pay cash dividends on our common stock in the near future. Payment of dividends would depend upon our profitability at the time, cash available for those dividends, and other factors that our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on an investor’s investment will only occur if our stock price appreciates. Investors in our common stock should not rely on an investment in our company if they require dividend income.

A sale of a substantial number of shares of our common stock may cause the price of our common stock to decline and may impair our ability to raise capital in the future.

Our common stock is quoted on the OTCQX® Best Market and could be considered “thinly-traded,” meaning that the number of investors interested in purchasing our common stock at or near bid prices at any given time may be relatively small or non-existent. Finance transactions resulting in a large amount of newly issued shares that become readily tradable, or other events that cause current stockholders to sell shares, could place downward pressure on the trading price of our common stock. In addition, the lack of a robust resale market may require a stockholder who desires to sell a large number of shares of common stock to sell the shares in increments over time to mitigate any adverse impact of the sales on the market price of our stock.

If our stockholders sell, or the market perceives that our stockholders may sell for various reasons, including the ending of restriction on resale, substantial amounts of our common stock in the public market, including shares issued upon the exercise of outstanding options or warrants, the market price of our common stock could fall. Sales of a substantial number of shares of our common stock may make it more difficult for us to sell equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 2. Properties

Warehouse and office facilities are leased from Vitamin Realty, which is 100% owned by the estate of our former Executive Chairman of the Board, President and major stockholder of the Company and our Co-Chief Executive Officers who are also directors of the Company. On January 5, 2012, MDC, a wholly-owned subsidiary of the Company, entered into a second amendment of the lease (the “Second Lease Amendment”) with Vitamin Realty for its office and warehouse space in Hillside, New Jersey increasing its rentable square footage from an aggregate of 74,898 square feet to 76,161 square feet and extending the expiration date to January 31, 2026. On July 15, 2022, MDC entered into a third amendment of the lease (the “Third Lease Amendment”) with Vitamin Realty, increasing its rentable square footage to 116,175. This Third Lease Amendment provides for minimum annual rental payments of $842, plus increases in real estate taxes and the building operating expenses allocation percentage and was effective as of July 1, 2022.

We also own a 40,000 square foot manufacturing facility in Hillside, New Jersey. The space is utilized for MDC’s tablet and capsule manufacturing operations.

In December 2022, MDC Warehousing and Distribution, Inc. entered into a lease agreement for 12,500 square feet of warehouse space in Elizabeth, New Jersey. This lease provides for minimum annual rent payments starting at $134 in year one, with a gradual increase to $150 by year 5. The lease expiration date is November 30, 2027.

On October 22, 2014, AgroLabs entered into a lease agreement for an office suite located in Miami, Florida. On December 18, 2022, AgroLabs renewed this lease with minimum annual payments of approximately $10. This renewed lease will expire in February 2024.

Item 3. Legal Proceedings

From time to time, we may become involved in various lawsuits and legal proceedings that arise in the ordinary course of business. However, litigation is subject to inherent uncertainties and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have a material adverse effect on our business, financial condition or operating results.

Item 4. Mine Safety Disclosure

Not Applicable

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Effective January 22, 2021, our common stock was upgraded to the OTCQX® Best Market of the OTC Markets Group, Inc. and commenced quotation under the symbol “INBP” on the OTCQX® Best Market. Prior to January 22, 2021, our common stock was quoted on the OTCQB under the symbol INBP.

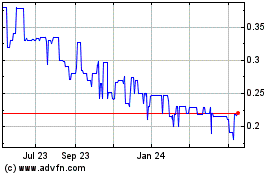

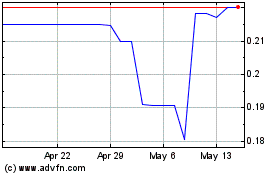

Set forth below are the high and low bid quotation of the Company’s common stock as quoted on the OTCQX® Best Market, for each of the fiscal quarters in the fiscal years ended June 30, 2023 and 2022. Such quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| COMMON STOCK |

|

HIGH |

|

|

LOW |

|

| |

|

|

|

|

|

|

|

|

| FISCAL YEAR ENDED June 30, 2022 |

|

|

|

|

|

|

|

|

| First Quarter |

|

$ |

1.150 |

|

|

$ |

0.900 |

|

| Second Quarter |

|

$ |

1.090 |

|

|

$ |

0.880 |

|

| Third Quarter |

|

$ |

1.020 |

|

|

$ |

0.750 |

|

| Fourth Quarter |

|

$ |

0.800 |

|

|

$ |

0.410 |

|

| |

|

|

|

|

|

|

|

|

| FISCAL YEAR ENDED June 30, 2023 |

|

|

|

|

|

|

|

|

| First Quarter |

|

$ |

0.5500 |

|

|

$ |

0.4300 |

|

| Second Quarter |

|

$ |

0.4400 |

|

|

$ |

0.3502 |

|

| Third Quarter |

|

$ |

0.3800 |

|

|

$ |

0.2605 |

|

| Fourth Quarter |

|

$ |

0.3720 |

|

|

$ |

0.2200 |

|

| July 1, 2023 to September 8, 2023 |

|

$ |

0.3325 |

|

|

$ |

0.2600 |

|

Holders

As of September 15, 2023, there were approximately 71 holders of record of the Company’s common stock. This number does not include beneficial owners holding shares through nominee names.

Dividends

We have not declared or paid a dividend with respect to our common stock during the fiscal years ended June 30, 2023 and 2022, nor do we anticipate paying dividends in the foreseeable future.

Equity Compensation Plans

The following table provides information, as of June 30, 2023, about the Company's equity compensation plans:

| |

|

Equity Compensation Plan Information |

|

| |

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

|

|

Weighted-average exercise price of outstanding options, warrants and rights |

|

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities |

|

| |

|

(a) |

|

|

(b) |

|

|

reflected in column (a)) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Equity compensation plans approved by security holders |

|

|

4,376,284 |

|

|

$ |

0.35 |

|

|

|

6,874,718 |

|

| Equity compensation plans not approved by security holders |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Totals |

|

|

4,376,284 |

|

|

$ |

0.35 |

|

|

|

6,874,718 |

|

Recent Sales of Unregistered Securities

None.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

During the quarter ended June 30, 2023, neither we nor any “affiliated purchaser,” as that term is defined in Rule 10b-18(a)(3) under the Exchange Act, purchased any of our common stock or other securities.

Item 6. [Reserved]

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (dollars in thousands).

Certain statements set forth under this caption constitute “forward-looking statements.” See “Cautionary Statement Regarding Forward-Looking Statements” on page 3 of this Annual Report on Form 10-K for additional factors relating to such statements.

The Company is engaged primarily in the business of manufacturing, distributing, marketing and sale of vitamins, nutritional supplements and herbal products. The Company’s customers are located primarily throughout the United States and Luxembourg.

Our financial results are substantially dependent on net sales. Net sales are partly dependent on the mix of contract manufactured products and other nutraceutical sales, which are difficult to forecast. Factors that could cause demand to be different from our expectations include: customer acceptance of our pricing and our competitors’ pricing; changes in customer order patterns; changes in the level of customer inventory; and changes in business and economic conditions, including conditions in the credit market that could affect consumer confidence and result in lower than expected demand for our manufactured products and to a lesser extent, our other nutraceutical business products and services.

We believe that we have established and developed business relationships, facilities, personnel, product offerings, and competitive and financial resources in place for business success; however, future revenue, costs, gross margins, and profits are all influenced by a number of factors, including those discussed above, all of which are inherently difficult to forecast. Except as otherwise noted, all dollar amounts below are “in thousands”.

In the fiscal year ended June 30, 2023, our net sales from operations decreased by $5,574 to approximately $50,672 from approximately $56,246 in the fiscal year ended June 30, 2022. Our net sales in the Contract Manufacturing Segment decreased by $5,814 and net sales in our Other Nutraceuticals Segment increased by $240. Net sales decreased in our Contract Manufacturing Segment primarily due to decreased sales volumes to Life Extension and Herbalife, our two significant customers, in the amount of $2,571 and $2,708, respectively. In the fiscal year ended June 30, 2023, our gross profit decreased by approximately $2,491 to $4,061 from approximately $6,552 for the fiscal year ended June 30, 2022. Our profit margins decreased by 3.7% in the fiscal year ended June 30, 2023, from 11.7% in the fiscal year ended June 30, 2022 to 8.0% in the fiscal year ended June 30, 2023, primarily as a result of the decreased sales volume in the fiscal year ended June 30, 2023 compared to the fiscal year ended June 30, 2022. We had consolidated selling and administrative expenses of approximately $3,941 and $3,807 in the fiscal years ended June 30, 2023 and 2022, respectively. The increase in the consolidated selling and administrative expenses of $134, or approximately 3.5%, was primarily from the increase professional and consulting fees of $71 and office rent of $55. We had additional legal fees of $23, auditing fees of $20 and all other consulting of $28 in the fiscal year ended June 30, 2023 as compared to the fiscal year ended June 30, 2022. The increase in office rent was from the allocation of office space from the Third Lease Amendment with Vitamin Realty. In the fiscal years ended June 30, 2023 and 2022, we had operating income of approximately $120 and $2,745, respectively.

Our revenue from our two significant customers in our Contract Manufacturing Segment is dependent on their demand within their respective distribution channels for the products we manufacture for them. As in any competitive market, our ability to match or beat other contract manufacturers pricing for the same items may also alter our outlook and the ability to maintain or increase revenues. We will continue to focus on our core businesses and push forward in maintaining our cost structure in line with our sales and expanding our customer base.

We are currently experiencing negative impacts on our margins due to inflation and tightened labor markets. We may not be able to timely increase our selling prices to our customers resulting from price increases from our suppliers due to various economic factors, including inflation, labor and shipping costs and our own increases in shipping, labor and other operating costs. Our results of operations may also be affected by economic conditions, including inflationary pressures, that can impact consumer disposable income levels and spending habits, thereby reducing the orders we may receive from our significant customers.

We continue to experience minimal supply chain disruptions relating to fuel refinery and transportation issues as it pertains to shipping. These issues first arose as result of the COVID-19 pandemic and other geo-political events.

During the first quarter of calendar 2022, the war in Ukraine affected our customer’s business operations in Ukraine and Russia, resulting in the cancelation of some future orders. The war resulted in the imposition of sanctions by the United States, the United Kingdom, and the European Union, that affect the cross-border operations of businesses operating in Russia. In addition, many multinational companies ceased or suspended their operations in Russia. Therefore, the ability to continue operations in Russia by our customers remains uncertain.

Critical Accounting Policies and Estimates

Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Management bases its estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. The most significant estimates include:

● sales returns and allowances;