iPower Inc. (Nasdaq: IPW) (“iPower” or the “Company”), a tech and

data-driven online retailer and supplier of consumer home and

garden products, as well as a provider of value-added ecommerce

services, today announced financial results for its fiscal fourth

quarter and full fiscal year ended June 30, 2023.

Fiscal Q4 2023 Results vs. Year-Ago

Quarter

- Total revenue increased 6% to $23.4

million as compared to $22.1 million.

- Gross profit remained flat at $9.1

million, with gross margin of 38.7% as compared to 41.2%.

- Net loss attributable to iPower was

$3.0 million or $(0.10) per share, as compared to net loss of $1.3

million or $(0.05) per share.

- As of June 30, 2023, net debt

(total debt less cash) was reduced by 43% to $8.1 million as

compared to net debt of $14.2 million as of June 30, 2022.

Fiscal 2023 Results vs. Fiscal

2022

- Total revenue increased 12% to

$88.9 million as compared to $79.4 million.

- Gross profit increased 5% to $34.8

million as compared to $33.2 million, with gross margin of 39.1%

compared to 41.8%.

- Net loss attributable to iPower was

$12.0 million or $(0.40) per share, as compared to net income of

$1.5 million or $0.06 per share. The fiscal 2023 period includes

approximately $3 million related to a goodwill impairment incurred

earlier in the fiscal year.

- Cash flow from operations improved

significantly to $9.2 million as compared to cash used of $16.6

million.

Management Commentary

“Fiscal 2023 marked our third consecutive year

of double-digit revenue growth driven by consistent, strong demand

for our in-house products and continued expansion of our

non-hydroponic portfolio,” said Lawrence Tan, CEO of iPower.

“Throughout the fiscal year, we emphasized in-house products sales

which accounted for over 90% of revenue while continuing to

diversify our product offerings beyond hydroponics, which grew to

more than 75% of sales in fiscal 2023. We believe that our ability

to generate double-digit growth while shifting our product mix into

new categories demonstrates our superior product research, design

and merchandising capabilities.”

iPower CFO, Kevin Vassily, added, “During the

year, we continued to work through high-cost inventory buildup from

prior periods, which has weighed on our gross margin in recent

quarters. However, we have now sold through most of the excess

inventory and expect gross margin to improve in fiscal 2024. With

an improved supply chain, normalized inventory levels and continued

demand for our in-house products, we believe that we are well

positioned to execute on our growth and profitability objectives in

fiscal 2024.”

Fiscal Fourth Quarter 2023 Financial

Results

Total revenue in the fiscal fourth quarter of

2023 increased 6% to $23.4 million as compared to $22.1 million for

the same period in fiscal 2022. The increase was primarily driven

by greater product sales to the Company’s largest channel partner,

as well as strong demand for iPower’s non-hydroponic product

portfolio which now accounts for over 75% of revenue.

Gross profit in the fiscal fourth quarter of

2023 remained flat at $9.1 million compared to the same quarter in

fiscal 2022. As a percentage of revenue, gross margin was 38.7% as

compared to 41.2% in the year-ago period. The decrease in gross

margin was primarily driven by a higher cost of goods sold related

to inventory that previously incurred higher freight charges, as

well as normal variations in product and channel mix.

Total operating expenses in the fiscal fourth

quarter of 2023 were $12.0 million as compared to $10.6 million for

the same period in fiscal 2022. The increase was driven in part by

higher selling, fulfillment, and marketing costs related to the

sale of inventory built up in prior quarters.

Net loss attributable to iPower in the fiscal

fourth quarter of 2023 was $3.0 million or $(0.10) per share, as

compared to a net loss of $1.3 million or $(0.05) per share for the

same period in fiscal 2022. The decline was driven in part by the

aforementioned higher operating expenses.

Cash and cash equivalents were $3.7 million at

June 30, 2023, as compared to $1.8 million at June 30, 2022. Total

debt as of June 30, 2023 was $11.8 million as compared to $16.0

million as of June 30, 2022. As a result of the Company’s debt

paydown, iPower’s net debt (total debt less cash) position was

reduced by 43% to $8.1 million as compared to $14.2 million as of

June 30, 2022.

Conference Call

The Company will hold a conference call today,

September 14, 2023, at 4:30 p.m. Eastern Time to discuss the

results for its fiscal fourth quarter and full fiscal year ended

June 30, 2023.

iPower’s management will host the conference

call, which will be followed by a question-and-answer session.

The conference call details are as follows:

Date: Thursday, September 14, 2023Time: 4:30 p.m. Eastern

TimeDial-in registration link: hereLive webcast registration link:

here

Please dial into the conference call 5-10

minutes prior to the start time. If you have any difficulty

connecting with the conference call, please contact the Company’s

investor relations team at IPW@elevate-ir.com.

The conference call will also be broadcast live

and available for replay in the Events & Presentations section

of the Company’s website at www.meetipower.com.

About iPower Inc.

iPower Inc. is a tech and data-driven online

retailer and supplier of consumer home and garden products, as well

as a provider of value-added ecommerce services for third-party

products and brands. iPower offers thousands of stock keeping units

from its in-house brands as well as hundreds of other brands

through its ecommerce channel partners and its websites,

www.zenhydro.com and www.simpledeluxe.com. iPower has a diverse

customer base that includes both commercial businesses and

individuals. For more information, please visit iPower's website at

www.meetipower.com.

Forward-Looking Statements

All statements other than statements of

historical fact in this press release are forward-looking

statements. These forward-looking statements involve known and

unknown risks and uncertainties and are based on current

expectations and projections about future events and financial

trends that iPower believes may affect its financial condition,

results of operations, business strategy, and financial needs.

Investors can identify these forward-looking statements by words or

phrases such as "may," "will," "expect," "anticipate," "aim,"

"estimate," "intend," "plan," "believe," "potential," "continue,"

"is/are likely to" or other similar expressions. iPower undertakes

no obligation to update forward-looking statements to reflect

subsequent events or circumstances, or changes in its expectations,

except as may be required by law. Although iPower believes that the

expectations expressed in these forward-looking statements are

reasonable, it cannot assure you that such expectations will turn

out to be correct, and iPower cautions investors that actual

results may differ materially from the anticipated results and

encourages investors to review other factors that may affect its

future results and performance in iPower's Annual Report on Form

10-K, as filed with the SEC on September 14, 2023, and in its other

SEC filings.

Investor Relations Contact:

Sean Mansouri, CFAElevate IR(720)

330-2829IPW@elevate-ir.com

| iPower Inc. and

Subsidiaries |

| Consolidated Balance

Sheets |

| As of June 30, 2023

and 2022 |

| |

|

|

June 30, |

|

June 30, |

|

|

2023 |

|

2022 |

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalent |

$ |

3,735,642 |

|

|

$ |

1,821,947 |

|

|

Accounts receivable, net |

|

14,071,543 |

|

|

|

17,432,287 |

|

|

Inventories, net |

|

20,593,889 |

|

|

|

30,433,766 |

|

|

Other receivable - related party |

|

- |

|

|

|

51,762 |

|

|

Prepayments and other current assets |

|

2,858,196 |

|

|

|

5,444,463 |

|

|

Total current assets |

|

41,259,270 |

|

|

|

55,184,225 |

|

| |

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

Right of use - non-current |

|

7,837,345 |

|

|

|

10,453,282 |

|

|

Property and equipment, net |

|

536,418 |

|

|

|

544,633 |

|

|

Deferred tax assets |

|

2,155,250 |

|

|

|

- |

|

|

Non-current prepayments |

|

531,456 |

|

|

|

925,624 |

|

|

Goodwill |

|

3,034,110 |

|

|

|

6,094,144 |

|

|

Investment in joint venture |

|

33,113 |

|

|

|

43,385 |

|

|

Intangible assets, net |

|

4,280,071 |

|

|

|

4,929,442 |

|

|

Other non-current assets |

|

427,254 |

|

|

|

406,732 |

|

|

Total non-current assets |

|

18,835,017 |

|

|

|

23,397,242 |

|

| |

|

|

|

|

|

|

Total assets |

$ |

60,094,287 |

|

|

$ |

78,581,467 |

|

| |

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

13,244,957 |

|

|

|

9,533,408 |

|

|

Credit cards payble |

|

366,781 |

|

|

|

807,687 |

|

|

Customer deposit |

|

350,595 |

|

|

|

273,457 |

|

|

Other payables and accrued liabilities |

|

4,831,067 |

|

|

|

5,915,220 |

|

|

Advance from shareholders |

|

85,200 |

|

|

|

92,246 |

|

|

Investment payable |

|

- |

|

|

|

1,500,000 |

|

|

Lease liability - current |

|

2,159,173 |

|

|

|

2,582,933 |

|

|

Long-term promissory note payable - current portion |

|

2,017,852 |

|

|

|

1,879,065 |

|

|

Income taxes payable |

|

276,683 |

|

|

|

299,563 |

|

|

Total current liabilities |

|

23,332,308 |

|

|

|

22,883,579 |

|

| |

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

Long-term revolving loan payable, net |

|

9,791,191 |

|

|

|

12,314,627 |

|

|

Long-term promissory note payable, net |

|

- |

|

|

|

1,781,705 |

|

|

Deferred tax liabilities |

|

- |

|

|

|

939,115 |

|

|

Lease liability - non-current |

|

6,106,047 |

|

|

|

8,265,611 |

|

| |

|

|

|

|

|

|

Total non-current liabilities |

|

15,897,238 |

|

|

|

23,301,058 |

|

| |

|

|

|

|

|

|

Total liabilities |

|

39,229,546 |

|

|

|

46,184,637 |

|

| |

|

|

|

|

|

|

Commitments and contingency |

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

Stockholders' Equity |

|

|

|

|

|

|

Preferred stock, $0.001 par value; 20,000,000 shares authorized; 0

shares issued and outstanding at June 30, 2023 and 2022 |

|

- |

|

|

|

- |

|

|

Common stock, $0.001 par value; 180,000,000 shares authorized;

29,710,939 and 29,572,382 shares issued and outstanding at June 30,

2023 and 2022 |

|

29,712 |

|

|

|

29,573 |

|

|

Additional paid in capital |

|

29,624,520 |

|

|

|

29,111,863 |

|

|

(Accumulated deficits) Retained earnings |

|

(8,702,442 |

) |

|

|

3,262,948 |

|

|

Non-controlling interest |

|

(24,915 |

) |

|

|

(13,232 |

) |

|

Accumulated other comprehensive income (loss) |

|

(62,134 |

) |

|

|

5,678 |

|

|

Total equity |

|

20,864,741 |

|

|

|

32,396,830 |

|

| |

|

|

|

|

|

|

Total liabilities and equity |

$ |

60,094,287 |

|

|

$ |

78,581,467 |

|

| iPower Inc. and

Subsidiaries |

| Consolidated

Statements of Operations |

| For the Years Ended

June 30, 2023 and 2022 |

| |

|

|

For the Three Months

Ended June 30, |

|

For the Years Ended

June 30, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

| |

(Unaudited) |

|

(Unaudited) |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

REVENUES |

$ |

23,399,166 |

|

|

$ |

22,117,831 |

|

|

$ |

88,902,048 |

|

|

$ |

79,418,473 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL REVENUES |

|

23,399,166 |

|

|

|

22,117,831 |

|

|

|

88,902,048 |

|

|

|

79,418,473 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

COST OF REVENUES |

|

14,348,668 |

|

|

|

12,998,903 |

|

|

|

54,104,587 |

|

|

|

46,218,580 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

GROSS PROFIT |

|

9,050,498 |

|

|

|

9,118,928 |

|

|

|

34,797,461 |

|

|

|

33,199,893 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

Selling and fulfillment |

|

8,133,299 |

|

|

|

6,842,363 |

|

|

|

32,427,972 |

|

|

|

19,180,390 |

|

|

General and administrative |

|

3,913,672 |

|

|

|

3,767,117 |

|

|

|

12,792,998 |

|

|

|

11,707,466 |

|

|

Impairment loss - goodwill |

|

- |

|

|

|

- |

|

|

|

3,060,034 |

|

|

|

- |

|

|

Total operating expenses |

|

12,046,971 |

|

|

|

10,609,480 |

|

|

|

48,281,004 |

|

|

|

30,887,856 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

(LOSS) INCOME FROM OPERATIONS |

|

(2,996,473 |

) |

|

|

(1,490,552 |

) |

|

|

(13,483,543 |

) |

|

|

2,312,037 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expenses |

|

(265,497 |

) |

|

|

(231,017 |

) |

|

|

(1,066,280 |

) |

|

|

(458,159 |

) |

|

Other financing expenses |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(80,010 |

) |

|

Loss on equity method investment |

|

(1,376 |

) |

|

|

5,673 |

|

|

|

(10,001 |

) |

|

|

(6,616 |

) |

|

Other non-operating income |

|

(306,874 |

) |

|

|

210,893 |

|

|

|

(107,749 |

) |

|

|

296,366 |

|

|

Total other expenses, net |

|

(573,747 |

) |

|

|

(14,451 |

) |

|

|

(1,184,030 |

) |

|

|

(248,419 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

(LOSS) INCOME BEFORE INCOME TAXES |

|

(3,570,220 |

) |

|

|

(1,505,003 |

) |

|

|

(14,667,573 |

) |

|

|

2,063,618 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

PROVISION FOR INCOME TAX (BENEFIT) EXPENSE |

|

(605,374 |

) |

|

|

(146,570 |

) |

|

|

(2,690,500 |

) |

|

|

558,975 |

|

|

NET (LOSS) INCOME |

|

(2,964,846 |

) |

|

|

(1,358,433 |

) |

|

|

(11,977,073 |

) |

|

|

1,504,643 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interest |

|

(2,805 |

) |

|

|

(9,162 |

) |

|

|

(11,683 |

) |

|

|

(13,232 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

NET (LOSS) INCOME ATTRIBUTABLE TO IPOWER INC. |

$ |

(2,962,041 |

) |

|

$ |

(1,349,271 |

) |

|

$ |

(11,965,390 |

) |

|

$ |

1,517,875 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

OTHER COMPREHENSIVE LOSS |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

(21,090 |

) |

|

|

8,904 |

|

|

|

(67,812 |

) |

|

|

5,678 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE (LOSS) INCOME ATTRIBUTABLE TO IPOWER INC. |

$ |

(2,983,131 |

) |

|

$ |

(1,340,367 |

) |

|

$ |

(12,033,202 |

) |

|

$ |

1,523,553 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE NUMBER OF COMMON STOCK |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

29,747,497 |

|

|

|

29,662,448 |

|

|

|

29,713,354 |

|

|

|

27,781,493 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

29,747,497 |

|

|

|

29,662,448 |

|

|

|

29,713,354 |

|

|

|

27,781,493 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

(LOSSES) EARNINGS PER SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.100 |

) |

|

$ |

(0.045 |

) |

|

$ |

(0.403 |

) |

|

$ |

0.055 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

$ |

(0.100 |

) |

|

$ |

(0.045 |

) |

|

$ |

(0.403 |

) |

|

$ |

0.055 |

|

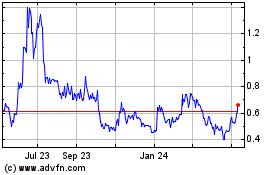

iPower (NASDAQ:IPW)

Historical Stock Chart

From Mar 2024 to Apr 2024

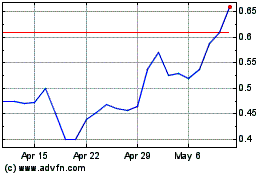

iPower (NASDAQ:IPW)

Historical Stock Chart

From Apr 2023 to Apr 2024