Form 425 - Prospectuses and communications, business combinations

September 13 2023 - 5:16PM

Edgar (US Regulatory)

Filed by Aegon N.V.

Pursuant to Rule 425 Under the Securities Act of 1933

Subject Company: Aegon N.V.

Commission File No.: 1-10882

Form

F-4 Registration No.: 333-273041

The Hague, 13 September 2023

Response to 2023 ISS Proxy Analysis and Benchmark Policy Voting Recommendations dated 12 September 2023

Dear Shareholders,

Aegon N.V. has taken note of the ISS Proxy

Analysis and Benchmark Policy Voting Recommendations dated 12 September 2023 relating to the Aegon EGMs on 29/30 September 2023. By means of this rebuttal, Aegon would like to express its strong disagreement with the recommendation

contained therein to shareholders to vote ‘against’ the proposal to redomicile Aegon N.V. from the Netherlands to Bermuda.

Aegon believes that

there is a compelling rationale for Aegon changing its domicile to Bermuda, and believes that a full appreciation of both the strategic rationale and the proposed governance is in the interest of Aegon and its stakeholders, including its

shareholders.

| |

• |

|

Following the closing of the transaction with a.s.r. on July 4th Aegon no longer has a regulated insurance

activity in the Netherlands. At the same time, the combination with a.s.r. has resulted in a transformational shift in the geographical footprint of Aegon Group. While Aegon continues to have a part of its global asset management activities in the

Netherlands, the overwhelming majority of its business activities (more than 99% of Shareholders’ equity) is outside of the Netherlands. The reality is that Aegon today is an international insurance & asset management company and no

longer a Dutch company. |

| |

• |

|

The transaction also has had significant regulatory implications. As a consequence of the fact that Aegon no

longer has a regulated insurance business in the Netherlands, there is no legal basis for the Dutch Central Bank to continue as Aegon’s group regulator. At the same time, as long as Aegon N.V. keeps its legal seat in the European Union,

Solvency II will apply to Aegon Group. Since over 99.5% of Aegon’s insurance businesses – as measured by total assets – are not located in jurisdictions where Solvency II is the governing capital framework, Aegon does not believe that

it is appropriate to continue to be subject to group supervision under that framework. |

| |

• |

|

If Aegon would not take action according to Solvency II regulation the role of group supervisor would be

allocated to Aegon’s largest business in the EU, i.e. Spain (DGSFP). For multiple reasons we believe this alternative is not suitable. First, Aegon does not believe Solvency II is the appropriate framework for our group. Second, Spain

(which represents less than 1% of Aegon’s balance sheet) is not appropriate as group supervisor. DGSFP has issued a clear statement which you can find on our website supporting supervision by the Bermuda Monetary Authority (BMA)

and clarifying why it does not find itself suitable as group regulator. Third, in its statement DGSFP indicated it would revisit a number of key items of our capital management processes including the application of the internal model, which

would lead to material uncertainty as to Aegon’s capital management approach. |

| |

• |

|

It is for this reason that after intensive discussions with our college of supervisors and after exploring

various alternatives, Aegon has decided that moving our legal seat to Bermuda to facilitate group supervision by the BMA is the most appropriate way of enabling effective group supervision compatible with the geographic footprint of Aegon Group.

Aegon has agreed transitional arrangements with the BMA providing shareholders with the necessary stability in Aegon’s capital management framework while setting Aegon up for continued future success. In this context, the Aegon boards have

proposed what Aegon firmly believes is a robust governance framework befitting a company with the profile and geographic footprint of Aegon based on Bermuda. |

|

|

|

|

|

|

|

| Aegon N.V. +31 70 344 32 10

www.aegon.nl |

|

Aegonplein 50 2591 TV The Hague

The Netherlands |

|

PO Box 85 2591 CB The Hague

The Netherlands |

|

Registered seat The Hague trade register number

27076669 |

| |

• |

|

Aegon has engaged in an intensive engagement regarding the proposed governance with its shareholders and

representative organizations throughout the summer. This has resulted in Aegon making two meaningful adjustments in order to address the concerns of some of these organizations. The response from shareholders received so far has been positive.

|

| |

• |

|

Despite this transformational shift in the geographical footprint of the Aegon Group and the reality of the

regulatory complexity Aegon has to navigate, ISS continues to measure the governance of Aegon Ltd against typical Dutch governance arrangements and uses that as the basis for its recommendation. Aegon strongly disagrees with this approach as it is

of the view a more international governance standard is a better fit for the more international profile of Aegon. Several, typically Dutch, governance items as mentioned by ISS are not compatible with the laws of our new proposed domicile Bermuda or

use legal concepts that are not recognized on Bermuda. |

| |

• |

|

The implied suggestion from ISS is to reverse all governance proposals that they view as detrimental and to apply

the existing Dutch governance to a Bermuda based entity. In doing so, ISS does not appear to recognize the importance of the changes in the footprint of the Aegon group nor the inability or impracticability to apply Dutch legal concepts in a Bermuda

context. In other words, ISS highlights a number of limited changes to shareholder rights as being negative, the totality of which, in Aegon’s view, do not warrant an “against” recommendation. This is especially true when balanced

against the importance of continuity of and certainty around supervision and capital management for Aegon. |

Aegon will

continue the active engagement with its stakeholders, including shareholders, in preparation for the EGMs on 29 and 30 September.

In conclusion, we

believe that the proposed resolution is in the best interest of all shareholders. We urge shareholders to support all resolutions put forward at the Extraordinary General Meetings to be held on 29 and 30 September 2023. We welcome any further

views and discussion on this agenda item ahead of, and during the upcoming EGM. If you would like to discuss the EGM proposals with us, please contact:

Mr Hielke Hielkema (Head of Investor Relations – ad interim)

Direct: +31 6 3028 8436

Email:

Hielke.hielkema@aegon.com

2

Notice to U.S. shareholders In connection with the proposed Redomiciliation, Aegon N.V. has filed with the

U.S. Securities and Exchange Commission (“SEC”) a registration statement on Form F-4 (Registration No. 333-273041), which became effective on

July 21, 2023, that includes a U.S. Shareholder Circular that you are encouraged to review carefully before making any decisions regarding the proposed Redomiciliation. This Convocation and Agenda with Explanatory Notes does not constitute an

offer to sell or the solicitation of an offer to buy any securities and is not a substitute for the U.S. Shareholder Circular or any other document that Aegon N.V. may file with the SEC or send to U.S. shareholders in connection with the proposed

Redomiciliation. U.S. SHAREHOLDERS OF AEGON N.V. ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE FINAL U.S. SHAREHOLDER CIRCULAR, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT AEGON LTD. AND THE PROPOSED

REDOMICILIATION. This information is available to you without charge upon your written or oral request. You will be able to obtain the documents free of charge at the SEC’s website, http://www.sec.gov. In addition, the documents may be obtained

in hard copy free of charge by directing a request in writing or by telephone to Aegon N.V. at Aegonplein50; 2591 TV The Hague; the Netherlands; Attention: Investor Relations or by email at ir@aegon.com, or by calling our agent for service in the

United States of America Andrew S. Williams Telephone: +1 443 475 3243

3

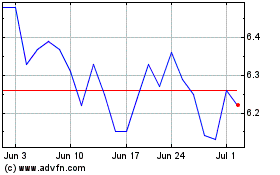

Aegon (NYSE:AEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

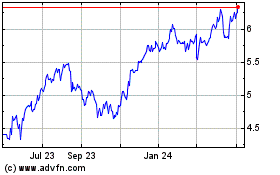

Aegon (NYSE:AEG)

Historical Stock Chart

From Apr 2023 to Apr 2024