SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE

13D

(Rule 13d-101)

INFORMATION

TO BE INCLUDED IN STATEMENTS FILED PURSUANT TO RULE 13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO RULE 13d-2(a)

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

| OCEAN POWER TECHNOLOGIES, INC. |

|

(Name of Issuer)

|

| Common Stock, $0.001 par value per share |

|

(Title of Class of Securities)

|

| 674870506 |

|

(CUSIP Number)

|

|

Hesham M. Gad

c/o Paragon Technologies, Inc.

101 Larry Holmes Drive, Suite 500

Easton, Pennsylvania 18042

(610) 252-3205 |

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications) |

| |

| September 12, 2023 |

| (Date of Event Which Requires Filing of this Statement) |

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§

240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. □

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom

copies are to be sent.

_______________

* The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes)

| CUSIP Number 674870506 |

SCHEDULE 13D |

Page 2 of 6 Pages |

1 |

NAME OF REPORTING PERSON

Paragon Technologies, Inc. |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

WC |

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM

2(d) or 2(e)

|

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE VOTING POWER

2,258,076 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

2,258,076 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

2,258,076 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.8% |

|

| 14 |

TYPE OF REPORTING PERSON

CO |

|

| |

|

|

|

|

| CUSIP Number 674870506 |

SCHEDULE 13D |

Page 3 of 6 Pages |

This Amendment No. 2 to Statement of Beneficial

Ownership on Schedule 13D (this “Amendment No. 2”) amends the Statement of Beneficial Ownership on Schedule 13D filed by Paragon

Technologies, Inc. (the “Reporting Person”) on July 7, 2023 and amended by Amendment No. 1 (as amended, the “Schedule

13D” or this “Statement”). Capitalized terms used but not defined in this Amendment No. 2 shall have the meanings set

forth in the Schedule 13D. Except as amended and supplemented by this Amendment No. 2, the Schedule 13D remains unchanged.

Item 3. Source and Amount of Funds or Other Consideration.

The total cost for purchasing

the Common Stock reported as owned by the Reporting Person, including brokerage commissions, was approximately $1,207,167. The source

of funds was the Reporting Person’s working capital.

Item 4. Purpose of Transaction.

Item 4 is hereby amended to

add the following:

On August 25, 2023, the Reporting

Person submitted notice of its intent to nominate five directors (Hesham M. Gad, Shawn M. Harpen, Jack H. Jacobs, Robert J. Tannor and

Samuel S. Weiser) to the Company’s six-person board of directors at the Company’s 2023 annual meeting of shareholders. The

Reporting Person’s nomination notice is subject to the review and potential rejection by the Company, in which case the Reporting

Person could determine to challenge any rejection, including through litigation against the Company.

On August 29, 2023, the Reporting

Person submitted a second request to the Company’s board of directors for an exemption pursuant to the “Section 382 Tax Benefits

Preservation Plan” (also known as an NOL poison pill) adopted by the board on June 29, 2023, subject to a condition that the Reporting

Person would not exceed ownership of 19.9% of the Company’s outstanding shares of common stock. The Reporting Person made its

original request for an exemption on July 20, 2023. The Company’s board has not provided notice to the Reporting Person regarding

any determination made by the board with respect to the exemption requests.

On July 27, 2023, the Reporting

Person filed a complaint in the Delaware Court of Chancery to enforce its rights, pursuant to Section 220 of the Delaware General Corporation

Law, to inspect the books and records of the Company. On July 17, 2023, the Reporting Person sent a demand letter to the Company requesting

to inspect the Company’s books and records for the purpose of investigating alleged wrongdoing and/or mismanagement by the Company’s

board and/or members of management, inquiring into the independence of the members of the Company’s board, assessing possible breaches

of fiduciary duty by the Company’s directors and officers, and communicating with other stockholders of the Company regarding matters

relating to their interests as stockholders. The Company denied the Reporting Person’s inspection demand in its entirety.

As disclosed in a press release

issued by the Reporting Person and filed with the SEC on August 11, 2023, if the Reporting Person’s nominees are elected to

the Company’s board of directors, the Reporting Person intends to take immediate steps to: significantly reduce the expenses

of the Company; develop a measurable plan that will bring the Company to cash flow break even; implement a disciplined and focused capital

allocation strategy; and focus on the potential growth of the Company’s intelligence data and leverage the possible market

opportunities of Marine Advanced Robotics.

Item 5. Interest in Securities of the Issuer.

(a) The

Reporting Person beneficially holds in the aggregate 2,258,076 shares of Common Stock, which represents approximately 3.8% of the Company’s

outstanding shares of Common Stock. Paragon holds 100 of these shares directly as a record holder. The Reporting Person directly holds

the shares of Common Stock disclosed as beneficially owned by it in this Statement.

| CUSIP Number 674870506 |

SCHEDULE 13D |

Page 4 of 6 Pages |

Mr. Tannor beneficially owns

204,843 shares of the Company’s common stock through Tannor Partners Credit Fund LP, which is controlled by Mr. Tannor. Tannor Capital

Advisors LLC is the general partner and investment manager of Tannor Partners Credit Fund LP, and Mr. Tannor is the sole officer and manager

of Tannor Capital Advisors LLC. Mr. Tannor has the sole power to direct the voting and disposition of those shares. Mr. Gad, Executive

Chairman of the Board of the Reporting Person and Chief Executive Officer of the Reporting Person, and Messrs. Jacobs and Weiser,

directors of Paragon, may be deemed to beneficially own the shares of common stock of the Company held by the Reporting Person.

The percentage ownership of

shares of Common Stock set forth in this Statement is based on the 58,787,578 shares of Common

Stock reported by the Company as outstanding as of August 23, 2023 in the Company’s Form 10-K/A filed with the Securities and Exchange

Commission on August 28, 2023.

(c) Transactions

effected by the Reporting Person in the Common Stock since the filing of Amendment No. 1 to the Schedule 13D on July 14, 2023 are set

forth on Schedule A to this Statement. Each of these transactions was effected through the open market.

| CUSIP Number 674870506 |

SCHEDULE 13D |

Page

5 of 6 Pages |

SIGNATURE

After reasonable inquiry and

to the best of the undersigned’s knowledge and belief, the undersigned certifies that the information set forth in this Statement

is true, complete and correct.

Dated: September 12, 2023

PARAGON TECHNOLOGIES, INC.

/s/ Hesham M. Gad

Name: Hesham M. Gad

Title: Executive Chairman and Chief Executive Officer

| CUSIP Number 674870506 |

SCHEDULE 13D |

Page

6 of 6 Pages |

Schedule A

Transactions in the Common Stock by Paragon

Technologies, Inc.

| Transaction Date |

|

Number of Shares Bought (Sold) |

|

|

Price per Share(1) |

| 09/08/2023 |

|

3,533 |

|

|

$ |

0.413 |

| 08/23/2023 |

|

25,000 |

|

|

$ |

0.455 |

| (1) | The price per share reported may be a weighted average price. The Reporting Person undertakes to provide

to the Company, any security holder of the Company, or the staff of the Securities and Exchange Commission, upon request, full information

regarding the number of shares purchased at each separate price. |

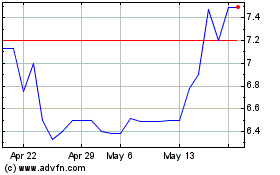

Paragon Technologies (PK) (USOTC:PGNT)

Historical Stock Chart

From Apr 2024 to May 2024

Paragon Technologies (PK) (USOTC:PGNT)

Historical Stock Chart

From May 2023 to May 2024