As filed with the Securities and Exchange Commission

on September 11, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM F-3

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Kamada Ltd.

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of registrant’s name into English)

| Israel |

|

Not Applicable |

| (State or other jurisdiction of |

|

(I.R.S. Employer Identification No.) |

| incorporation or organization) |

|

|

2 Holzman Street

Science Park, P.O. Box 4081

Rehovot 7670402

Israel +972 8 9406472

(Address and Telephone Number of Registrant’s Principal

Executive Offices)

Puglisi & Associates

850 Library Avenue, Suite 204

P.O. Box 885, Newark, Delaware 19715

(302) 738-6680

(Name, Address, and Telephone Number of Agent for

Service)

Copies to:

|

Jaclyn Liu, Esq.

Morrison & Foerster LLP

425 Market Street

San Francisco, CA 94105

(415) 268-7000 |

Sharon Rosen

FISCHER (FBC & Co.)

146 Menachem Begin Street

Tel Aviv 6492103, Israel

+972 3 6944111 |

Approximate date of commencement of proposed

sale to the public: From time to time after the effective date of this Registration Statement.

If only securities being registered on this Form

are being offered pursuant to dividend or interest reinvestment plans, please check the following box.☐

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

☐ Emerging growth company.

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☐

† The term “new

or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting

Standards Codification after April 5, 2012.

The registrant hereby amends this registration statement on such

date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states

that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this

registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section

8(a), may determine.

The information in this prospectus is not complete and may be changed.

We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This

prospectus is not an offer to sell securities and it is not soliciting an offer to buy securities in any state where the offer or sale

is not permitted.

Subject to Completion, Dated September 11, 2023

Prospectus

$50,000,000

Ordinary Shares Offered by the Company

We may offer and sell from time to time in one

or more offerings up to a total amount of $50,000,000 of our ordinary shares. Each time we sell ordinary shares pursuant to this prospectus,

we will provide in a supplement to this prospectus the price and any other material terms of any such offering. We may also authorize

one or more free writing prospectuses to be provided to you in connection with each offering. Any prospectus supplement and related free

writing prospectuses may also add, update or change information contained in the prospectus. You should read this prospectus, any applicable

prospectus supplement and related free writing prospectuses, as well as the documents incorporated by reference or deemed incorporated

by reference into this prospectus, carefully before you invest in our ordinary shares.

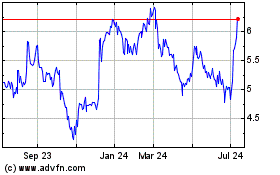

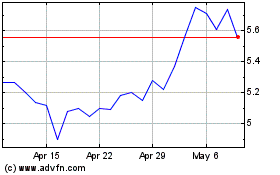

Our ordinary shares are traded on the Nasdaq Global

Select Market and the Tel Aviv Stock Exchange under the symbol “KMDA.”

Investing in our ordinary shares involves a

high degree of risk. Risks associated with an investment in our ordinary shares will be described in any applicable prospectus supplement

and are and will be described in certain of our filings with the Securities and Exchange Commission, as described in “Risk Factors”

on page 4.

The ordinary shares may be sold directly by us

to investors, through agents designated from time to time or to or through underwriters or dealers, or through a combination of such methods,

on a continuous or delayed basis. For additional information on the methods of sale, you should refer to the section entitled “Plan

of Distribution” in this prospectus. If any agents or underwriters are involved in the sale of our ordinary shares with respect

to which this prospectus is being delivered, the names of such agents or underwriters and any applicable fees, commissions, discounts

and over-allotment options will be set forth in a prospectus supplement. The price to the public of our ordinary shares and the net proceeds

that we expect to receive from such sale will also be set forth in a prospectus supplement.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed on completeness or the adequacy or accuracy

of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is .

TABLE

OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement on Form F-3 that we filed with the Securities and Exchange Commission, or the SEC, utilizing a “shelf”

registration process. Under this shelf registration process, we may offer from time to time up to an aggregate of $50,000,000 of our ordinary

shares in one or more offerings. We sometimes refer to our ordinary shares as the “securities” throughout this prospectus.

Each time we sell ordinary

shares, we will provide you with a prospectus supplement that will describe the specific amounts, prices and terms of such offering. We

may also authorize one or more free writing prospectuses to be provided to you in connection with such offering. The prospectus supplement

and any related free writing prospectuses may also add, update or change information contained in this prospectus. You should read carefully

both this prospectus, the applicable prospectus supplement and any related free writing prospectus together with additional information

described below under “Where You Can Find More Information and Incorporation by Reference” before buying the ordinary shares

being offered.

This prospectus does not contain

all of the information provided in the registration statement that we filed with the SEC. For further information about us or our ordinary

shares, you should refer to that registration statement, which you can obtain from the SEC as described below under “Where You Can

Find More Information and Incorporation by Reference.”

You should rely only on the

information contained or incorporated by reference in this prospectus, a prospectus supplement and related free writing prospectuses.

We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. This prospectus is not an offer to sell these securities and it is not soliciting an offer to

buy these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained

in this prospectus and the accompanying prospectus supplement or related free writing prospectuses is accurate on any date subsequent

to the date set forth on the front of the document or that any information that we have incorporated by reference is correct on any date

subsequent to the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects

may have changed since those dates.

PROSPECTUS SUMMARY

This summary highlights

information contained in the documents incorporated herein by reference. Before making an investment decision, you should read the entire

prospectus, and our other filings with the SEC, including those filings incorporated herein by reference, carefully, including the sections

entitled “Risk Factors” and “Special Note Regarding Forward-Looking Statements.” Unless the context indicates

otherwise, references in this prospectus to “NIS” are to the legal currency of Israel, “U.S. dollars,” “$”

or “dollars” are to United States dollars, and the terms “we,” “us,” “our company,” “our,”

and “Kamada” refer to Kamada Ltd., along with its consolidated subsidiaries.

Overview

We

are a commercial stage global biopharmaceutical company with a portfolio of marketed products indicated for rare and serious conditions

and a leader in the specialty plasma-derived field focused on diseases of limited treatment alternatives. We are also advancing an innovative

development pipeline targeting areas of significant unmet medical need. Our strategy is focused on driving profitable growth from our

significant commercial catalysts as well as our manufacturing and development expertise in the plasma-derived and biopharmaceutical markets.

We

operate in two segments: (i) the Proprietary Products segment, which includes our six U.S. Food

and Drug Administration (“FDA”)-approved plasma-derived biopharmaceutical products - CYTOGAM®,

KEDRAB®, WINRHO SDF®,

VARIZIG®, HEPGAM B® and GLASSIA®, as well as KAMRAB®, KAMRHO (D)®, and two types of equine-based anti-snake venom

products; all of which we market internationally in more than 30 countries. We manufacture our proprietary products at our current

Good Manufacturing Practice compliant FDA-approved production facility located in Beit Kama, Israel, using our proprietary platform

technology and know-how for the extraction and purification of proteins and hyperimmune immunoglobulins (“IgGs”) from human

plasma, as well as at third party contract manufacturing facilities; and (ii) the Distribution segment, in which we leverage our expertise

and presence in the Israeli market by distributing, for use in Israel, more than 25 pharmaceutical products supplied by international

manufacturers and have recently added eleven biosimilar products to our portfolio, which, subject to European

Medicines Agency (“EMA”) and the Israeli Ministry of Health (“IMOH”)

approvals, are expected to be launched in Israel through 2028.

As

part of our Proprietary Products segment, we sell CYTOGAM, a Cytomegalovirus Immune Globulin Intravenous (Human) (CMV-IGIV), indicated

for prophylaxis of CMV disease associated with solid organ transplantation in the United States and Canada. Total revenues from sales

of CYTOGAM for the year ended December 31, 2022, the first full year during which we sold the product, was $22.6 million.

We

market KEDRAB, a human rabies immune globulin (HRIG), in the United States through a strategic distribution and supply agreement with

Kedrion Biopharma Inc. (“Kedrion”). Our 2022 revenues from sales of KEDRAB to Kedrion totaled $16.2 million as compared to

$11.9 million and $18.3 million during 2021 and 2020, respectively. Sales of KEDRAB by Kedrion in the United States during the years 2022,

2021 and 2020 totaled $36.2 million, $24.7 million, and $23.7 million, respectively. Based on the information provided by Kedrion, these

sales represent approximately 32%, 27% and 23% share of the relevant U.S. market in each of these years, respectively. KEDRAB in-market

sales by Kedrion during 2022 grew in comparison to the pre-COVID-19 pandemic sales and we anticipate this trend to continue during 2023

and beyond.

We

believe that sales of CYTGOM and KEDRAB in the U.S. market, which generated more than 50% of gross profitability in the year ended December

31, 2022, will continue to increase in the coming years and will be a major growth catalyst for the foreseeable future.

We

sell WINRHO SDF, VARIZIG and HEPGAM B, in the United States, Canada and several other international markets, mainly in the Middle East

and North Africa (“MENA”) regions. Total revenues from sales of these products for the year ended December 31, 2022, the first

full year during which we sold these products, was $29.5 million.

For

the year ended December 31, 2022, we generated combined revenues of $52.1 million through sales of CYTOGAM, WINRHO SDF, VARIZIG and HEPGAM

B, the portfolio of four FDA-approved products that we acquired in November 2021. The 2022 revenues from this portfolio represent a 24%

year over year increase compared to the $41.9 million of total revenues generated by this portfolio during the year ended December 31,

2021.

We

market GLASSIA in the United States through a strategic partnership with Takeda Pharmaceuticals Company Limited (“Takeda”).

During 2021, Takeda completed the technology transfer of GLASSIA manufacturing to its facility in Belgium and received the required FDA

approval and initiated its own production of GLASSIA for the U.S. market. In addition, during 2021, Takeda obtained a marketing authorization

approval for GLASSIA from Health Canada. During the first quarter of 2022, Takeda began to pay us royalties on sales of GLASSIA manufactured

by Takeda, at a rate of 12% on net sales through August 2025 and at a rate of 6% thereafter until 2040, with a minimum of $5 million annually

for each of the years from 2022 to 2040. In 2022, we received a total of $14.2 million from Takeda, of which $12.2 of sales-based royalty

income (for the period between March and December of 2022) and a $2.0 million one-time payment on account of the transfer, to Takeda,

of the GLASSIA U.S. Biologics License Application. Based on current GLASSIA sales in the U.S. and forecasted future growth, we expect

to receive royalties from Takeda in the range of $10 million to $20 million per year for 2023 to 2040 on GLASSIA sales. Historically,

we generated revenues on sales of GLASSIA, manufactured by us, to Takeda for further distribution in the United States. Our revenues from

sales of GLASSIA to Takeda totaled $26.2 million and $64.9 million during 2021 and 2020, respectively. During 2021, we also recognized

revenues of $5.0 million on account of a sales milestone associated with GLASSIA sales by Takeda.

We

also market GLASSIA in other counties through local distributors. Total revenues derived from sales of GLASSIA in all other countries

during 2022 was $5.9 million, as compared to $7.6 million and $5.5 million during 2021 and 2020, respectively. These ex-U.S. market sales

of GLASSIA generated approximately 40% gross margin in the year ended December 31, 2022.

Our

2022 revenues from the sales of the remaining Proprietary products, including KAMRAB (a human rabies immune globulin (HRIG) sold by us

outside the U.S. market) and KAMRHO (D) IM (for prophylaxis of hemolytic disease of newborns), as well as our anti-snake venoms, totaled

$13.9 million, as compared to $18.4 million and $11.2 million during 2021 and 2020, respectively.

We

own an FDA licensed plasma collection center that we acquired in March 2021 from the privately held Blood and Plasma Research, Inc (“B&PR”)

based in Beaumont, Texas, which currently specializes in the collection of hyper-immune plasma used in the manufacture of KAMRHO (D).

For the year ended December 31, 2022, we generated $0.4 million in revenues from this plasma collection center, which were included in

our Proprietary Products revenues. We are in the process of significantly expanding our hyper-immune plasma collection capacity in this

center. We obtained FDA approval for the collection of hyper-immune plasma to be used in the manufacture of KEDRAB, which is plasma that

contains high levels of antibodies from donors who have been previously vaccinated by an active rabies vaccine and plan to start collections

of such plasma during 2023. We also intend to leverage our FDA license to establish additional plasma collection centers in the United

States, with the intention of collecting normal source plasma to be sold for manufacturing by third parties, as well as hyper-immune specialty

plasma required for manufacturing of our proprietary products. We believe that the expansion of our plasma collection capabilities will

allow us to better support our plasma needs as well as generate additional revenues through sales of collected normal source plasma. To

that end, during March 2023, we entered into a lease for a new plasma collection center in Uvalde, Houston, Texas, and the construction

activities have been initiated. We expect that operations at the new center shall commence following the completion of its construction

and obtaining the required regulatory approvals.

Our

Distribution segment is comprised of sales in Israel of pharmaceutical products manufactured by third parties. Sales generated by our

Distribution segment during 2022 totaled $26.7 million, as compared to $28.1 million and $32.3 million during 2021 and 2020, respectively.

The majority of the revenues generated in our Distribution segment are from plasma-derived products manufactured by European companies,

and its sales represented approximately 75%, 84% and 89% of our Distribution segment revenues for the years ended December 31, 2022, 2021

and 2020, respectively. Over the past several years we continued to extend our Distribution segment products portfolio to non-plasma derived

products, including recently entering into an agreement with Alvotech and two additional companies for the distribution in Israel of eleven

different biosimilar products which, subject to EMA and subsequently IMOH approvals, are expected to be launched in Israel through 2028.

We believe that sales generated by the launch of the biosimilar products portfolio will become a major growth catalyst. We currently estimate

the potential aggregate peak revenues, achievable within several years of launch, generated by the distribution of all eleven biosimilar

products to be approximately $40 million annually.

In

addition to our commercial operation, we invest in research and development of new product candidates. Our leading investigational product

is Inhaled Alpha-1 antitrypsin (“AAT”) for Alpha-1 Deficiency (AATD), for which

we are continuing to progress the InnovAATe clinical trial, a randomized, double-blind, placebo-controlled, pivotal Phase 3 trial. We

also have three new early-stage development programs of plasma derived product candidates that we initiated during 2022. These programs

include: (i) a human plasma-based eye drop for potential treatment of several conditions; (ii) an automated portable small scale system

for extraction and purification of hyperimmune IgG from convalescent plasma to be used in the hospital or blood bank setting, as an immediate

response to a variety of unmet medical needs, including pandemic outbreaks, as well as possible treatment of currently neglected or untreated

viral diseases; and (iii) a hyperimmune anti-tuberculosis IgG as a potential complementary treatment to existing standards of care, which

is developed in collaboration with the Clinical Microbiology and Immunology department of the Medicine-Sackler Faculty of Tel Aviv University

and is partially funded by the Israel Innovation Authority.

We

plan to advance these programs until completion of proof-of-concept, at which point we plan to evaluate continued internal development,

partnering or out-licensing.

We

continue to focus on driving profitable growth through expanding our growth catalysts which include: investment in the commercialization

and life cycle management of our commercial Proprietary products, led by CYTOGAM and KEDRAB sales in the U.S. market; continued growth

of our Proprietary hyper-immune portfolio’s revenues in existing and new geographic markets through registration and launch of the

products in new territories; expanding sales of GLASSIA in ex-U.S. markets; generating royalties from GLASSIA sales by Takeda; expanding

our plasma collection capabilities in support of our growing demand for hyper-immune plasma as well as sales of normal source plasma to

other plasma-derived manufacturers; continued increase of our Distribution segment revenues specifically through launching the eleven

biosimilar products in Israel; and leveraging our FDA-approved IgG platform technology, manufacturing, research and development expertise

to advance development and commercialization of additional product candidates, including our investigational Inhaled AAT product, and

identify potential commercial partners for this product.

We

currently expect to generate total revenues for the fiscal year 2023 in the range of $138 million to $146 million and EBITDA in the range

of $22 million to $26 million. The mid- range points of the projected 2023 revenue and EBITDA forecast represent a 10% and 35% growth

over fiscal year 2022, respectively.

Recent Development

On

May 24, 2023, we entered into a share purchase agreement (the “Purchase Agreement”) with FIMI Opportunity Funds (“FIMI”),

the leading private equity firm in Israel and a major shareholder of the Company, to purchase $60 million of our ordinary shares in a

private placement (the “Private Placement”). Under the terms of the Purchase Agreement, Kamada will issue an aggregate of

approximately 12.6 million ordinary shares to FIMI at a price of $4.75 per share (which represents the average closing price of the Company’s

shares on NASDAQ during the 20 trading days prior to the date of the Purchase Agreement). Upon the closing of the transaction, FIMI is

expected to beneficially own approximately 38% of Kamada’s outstanding ordinary shares and will become a controlling shareholder

of the Company, within the meaning of the Israeli Companies Law, 1999 (the “Israeli Companies Law”). Proceeds from the Private

Placement are expected to be used to support the Company’s growth plans and execution of strategic business development opportunities.

At

the extraordinary general meeting of the shareholders of the Company held on August 29, 2023, the Company’s shareholders approved (among

other items), (i) the Private Placement; and (ii) the election of Prof. Benjamin Dekel and Assaf Itshayek as external directors, within

the meaning of the Israeli Companies Law, for an initial three-year term, subject to the closing of the Private Placement. On September

7, 2023, the closing of the Private Placement took place. In connection therewith and unrelated to the registration statement

of which this prospectus forms a part, we agreed to file a registration statement with the SEC registering the resale

of all the ordinary shares held by FIMI, per its request, at any time after the lapse of six months following the closing of the Private

Placement.

On

July 12, 2023, we announced that Kedrion has exercised its option to extend the distribution agreement between the parties in the U.S.

for KEDRAB®. The current agreement now extends through March 2026, and the companies are in discussions to potentially further expand

the scope of the collaboration.

On

August 16, 2023, we announced that we received positive scientific advice from the European Medicines Agency (EMA) regarding the ongoing

pivotal Inhaled AAT study that reconfirms the overall design of the study and acknowledges certain positive results demonstrated in the

previously completed Phase 2/3 study.

Corporate Information

The address of our principal executive office is

2 Holzman St., Science Park, P.O. Box 4081, Rehovot 7670402, Israel, and our telephone number is +972 8 9406472.

RISK FACTORS

Investing in our securities

involves significant risks. Before making an investment decision, you should carefully consider the risks described under “Risk

Factors” in the applicable prospectus supplement and under “Item 3. Key Information – D. Risk Factors” in our

most recent Annual Report on Form 20-F, or any updates in our Reports on Form 6-K, together with all of the other information appearing

in this prospectus or incorporated by reference into this prospectus and any applicable prospectus supplement, in light of your particular

investment objectives and financial circumstances. The risks so described are not the only risks facing us. Additional risks not presently

known to us or that we currently deem immaterial may also impair our business operations. Our business, financial condition and results

of operations could be materially adversely affected by any of these risks. The trading price of our securities could decline due to any

of these risks, and you may lose all or part of your investment. The discussion of risks includes or refers to forward-looking statements;

you should read the explanation of the qualifications and limitations on such forward-looking statements discussed elsewhere in this prospectus.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents

incorporated in it by reference contain forward-looking statements that relate to future events or our future financial performance, which

express the current beliefs and expectations of our management in light of the information currently available to it. Such statements

involve a number of known and unknown risks, uncertainties and other factors that could cause our actual future results, performance or

achievements to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements.

Forward-looking statements include all statements that are not historical facts and can be identified by words such as, but without limitation,

“believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,”

“target,” “likely,” “may,” “will,” “would,” or “could,” or other

words, expressions or phrases of similar substance or the negative thereof. We have based these forward-looking statements largely on

our management’s current expectations and future events and financial trends that we believe may affect our financial condition,

results of operation, business strategy and financial needs. You should not rely upon forward-looking statements as predictors of future

events. The occurrence of the events described, and the achievement of the expected results, depend on many events and factors, some or

all of which may not be predictable or within our control. Actual results may differ materially from expected results. See the sections

“Risk Factors” in the applicable prospectus supplement and “Item 3. Key Information – D. Risk Factors” in

our most recent Annual Report on Form 20-F for a more complete discussion of these risks, assumptions and uncertainties and for other

risks, assumptions and uncertainties. These risks, assumptions and uncertainties are not necessarily all of the important factors that

could cause actual results to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable

factors also could harm our results. All of the forward-looking statements we have included in this prospectus and the documents incorporated

in it by reference are based on information available to us on the date of this prospectus. We undertake no obligation, and specifically

decline any obligation, to update publicly or revise any forward-looking statements, whether as a result of new information, future events

or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this prospectus and the

documents incorporated in it by reference might not occur.

REASONS FOR THE OFFER AND USE OF PROCEEDS

Unless otherwise set forth

in the related prospectus supplement or, if applicable, the pricing supplement, we intend to use the net proceeds from the sale of securities

offered through this prospectus for general corporate purposes. The specific purpose of any individual issuance of securities will be

described in the related prospectus supplement.

CAPITALIZATION AND INDEBTEDNESS

Information about our capitalization

and indebtedness will be included in future prospectus supplements (as applicable).

DESCRIPTION OF OUR ORDINARY SHARES

As of September 10, 2023, our authorized share capital consists of

NIS 70,000,000 divided into 70,000,000 Ordinary Shares of a nominal value of NIS 1.0 each, of which 57,474,417 ordinary shares were issued

and outstanding. Under the 2011 Israeli Share Award Plan, as of such date, there were outstanding options for the purchase of an aggregate

of 3,041,971 ordinary shares at a weighted average exercise price of NIS 19.77 (or approximately $5.20) per share and an aggregate of

5,625 restricted share units granted to certain managers of the Company. Under the U.S. Taxpayers Appendix to the 2011 Israeli Share Award

Plan, as of such date, there were outstanding options for the purchase of an aggregate of 240,383 ordinary shares at a weighted average

exercise price of $5.47.

All of our outstanding ordinary

shares are validly issued, fully paid and non-assessable and have equal rights. Our ordinary shares are not redeemable and do not have

any preemptive rights. Pursuant to the Israeli Securities Law, 5728-1968 (“Israeli Securities Law”), a company whose shares

are traded on the Tel Aviv Stock Exchange (the “TASE”) may not have more than one class of shares except for preferred shares

(which may have a dividend preference but may not have any voting rights), all outstanding shares must be validly issued and fully paid

and must be registered for trading on the TASE. The ownership or voting of ordinary shares by non-residents of Israel is not restricted

in any way by our articles of association or the laws of the State of Israel, except for anti-terror legislation and legislation prohibiting

citizens of countries that are, or have been, in a state of war with Israel from being recognized as owners of ordinary shares.

The description below is a

summary of the material provisions of our articles of association and of related material provisions of the Israeli Companies Law.

Ordinary Shares

Voting

Holders of our ordinary shares

have one vote per ordinary share on all matters submitted to a vote of shareholders at a shareholders’ meeting. Shareholders may

vote at shareholder meetings either in person, by proxy or, with respect to certain resolutions, by a voting instrument.

Israeli law does not allow

public companies to adopt shareholder resolutions by means of written consent in lieu of a shareholder meeting.

Transfer of Shares

Fully paid ordinary shares

are issued in registered form and may be freely transferred under our articles of association unless the transfer is restricted or prohibited

by another instrument, Israeli law or the rules of a stock exchange on which the shares are traded.

Election of Directors

Our ordinary shares do not

have cumulative voting rights for the election of directors. Rather, under our articles of association, directors (other than external

directors, if any) are elected by the holders of a simple majority of our ordinary shares at a general shareholder meeting (excluding

abstentions). As a result, the holders of our ordinary shares that represent more than 50% of the voting power represented at a shareholder

meeting and voting thereon (excluding abstentions) have the power to elect any or all of our directors (other than external directors,

if any) whose positions are being filled at that meeting. Directors (other than external directors) serve until the annual meeting of

shareholders following the shareholder meeting at which they were elected (or until such director ceases to serve in such capacity, if

earlier).

External directors are elected

for three-year terms each and their election requires the affirmative vote of the holders of a majority of the ordinary shares represented

at a meeting of shareholders, subject to the fulfillment of one of the following additional voting requirements: (i) the shares voting

in favor of the election of an external director (excluding abstentions) include at least a majority of the shares voted by shareholders

who are not controlling shareholders and shareholders who do not have a personal interest (within the meaning of the Israeli Companies

Law) in such election (excluding a personal interest that is not related to a relationship with a controlling shareholder), or (ii) the

total number of shares voted against the election by shareholders referred to in clause (i) does not exceed two-percent (2%) of our outstanding

voting rights.

In addition, under our articles

of association, vacancies on our board of directors, including vacancies resulting from there being fewer than the maximum number of directors

permitted by our articles of association, may be filled by a vote of a simple majority of the directors then in office, and such appointment

shall be valid until the next annual general meeting (or until such director ceases to serve in such capacity, if earlier).

Dividend and Liquidation Rights

Under Israeli law, we may

declare and pay dividends only if, upon the determination of our board of directors, there is no reasonable concern that the distribution

will prevent us from being able to meet the terms of our existing and foreseeable obligations as they become due. Under the Israeli Companies

Law, the distribution amount is further limited to the greater of retained earnings or earnings generated over the two most recent years

legally available for distribution according to our then last reviewed or audited financial statements, after subtracting earlier distributions

if they have not yet been subtracted from the earnings, provided that the date of the financial statements is not more than six months

prior to the date of distribution. In the event that we do not have retained earnings or earnings generated over the two most recent years

legally available for distribution, we may seek the approval of the court in order to distribute a dividend. The court may approve our

request if it is convinced that there is no reasonable concern that the payment of a dividend will prevent us from satisfying our existing

and foreseeable obligations as they become due.

In the event of our liquidation,

after satisfaction of liabilities to creditors, our assets will be distributed to the holders of ordinary shares in proportion to the

nominal value of their shareholdings. Dividend and liquidation rights may be affected by the grant of preferential dividend or distribution

rights to the holders of a class of shares with preferential rights that may be authorized in the future (subject to applicable law and

applicable stock exchange rules).

Shareholder Meetings

Under the Israeli Companies

Law, we are required to convene an annual general meeting of our shareholders at least once every calendar year and within a period of

not more than 15 months following the preceding annual general meeting. Our board of directors may convene a special general meeting of

our shareholders whenever it sees fit and is required to do so upon the written request of two directors or one quarter of the serving

members of our board of directors, or one or more holders of 5% or more of our outstanding share capital and 1% of our voting power, or

the holder or holders of 5% or more of our voting power.

The Israeli Companies Law

requires that resolutions regarding the following matters (among others) be approved by our shareholders at a general meeting: amendments

to our articles of association; appointment, terms of service and termination of service of our auditors; election of external directors;

approval of certain related party transactions; increases or reductions of our authorized share capital; mergers; and the exercise of

our board of director’s powers by a general meeting, if our board of directors is unable to exercise its powers and the exercise

of any of its powers is essential for our proper management.

The

chairman of our board of directors presides over our general meetings. However, if at any general meeting the chairman is not present

within 15 minutes after the appointed time, or is unwilling to act as chairman of such meeting, then the shareholders present will choose

any other person present to be chairman of the meeting. Subject to the provisions of the Israeli Companies Law and the regulations promulgated

thereunder, shareholders entitled to participate and vote at general meetings are the shareholders of record on a date to be decided by

the board of directors, which, as company listed also on an exchange outside of Israel, may be between four and 40 days prior to the date

of the meeting.

Israeli

law requires that a notice of any annual general meeting or special general meeting be provided to shareholders at least 21 days prior

to the meeting and if the agenda of the meeting includes, among other things, the appointment or removal of directors, the approval of

transactions with office holders or interested or related parties, an approval of a merger or the approval of the compensation policy,

notice must be provided at least 35 days prior to the meeting.

Quorum

Pursuant

to our articles of association, the quorum required for a meeting of our shareholders is

the presence of two or more shareholders present in person, by proxy or by a voting instrument, who hold at least 25% of our voting power.

A meeting adjourned for lack of a quorum is generally adjourned to one week thereafter at the same time and place, or to such other day,

time and place, as our board of directors may indicate in the notice of the meeting to the shareholders. Pursuant to our articles of association,

at the reconvened meeting, the meeting will take place with whatever number of participants present.

Resolutions

Under

the Israeli Companies Law, unless otherwise provided in our articles of association or applicable law, all resolutions of the shareholders

require a simple majority of the voting rights represented at the meeting, in person, by proxy or, with respect to certain resolutions,

by a voting instrument, and voting on the resolution (excluding abstentions). Under Israeli law, a resolution for the voluntary winding

up of the company requires the approval by the holders of 75% of the voting rights represented at the meeting, in person or by proxy and

voting on the resolution (excluding abstentions). Under our articles of association, a merger shall require the approval of a special

majority of the shareholders, as described below under “Merger.”

Access to Corporate Records

Under

the Israeli Companies Law, all shareholders generally have the right to review minutes of

our general meetings, our shareholder register and register of significant shareholders (as defined in the Israeli Companies Law), our

articles of association, our financial statements and any document we are required by law to file publicly with the Israeli Companies

Registrar or with the Israel Securities Authority. In addition, any shareholder who specifies the purpose of its request may request to

review any document in our possession that relates to: (i) any action or transaction with a related party which requires shareholder approval

under the Israeli Companies Law; or (ii) the approval, by the board of directors, of an action in which an office holder has a personal

interest. We may deny a request to review a document if we determine that the request was not made in good faith, that the document contains

a commercial or technological secret or that the document’s disclosure may otherwise impair our interests.

Acquisitions Under Israeli Law

Full Tender Offer

A

person wishing to acquire shares of an Israeli public company and who would, as a result, hold over 90% of the target company’s

issued and outstanding share capital (or over 90% of the issued and outstanding share capital of a certain class of shares) is required

by the Israeli Companies Law to make a tender offer to all of the company’s shareholders (or all of the shareholders who hold shares

of the same class) for the purchase of all of the issued and outstanding shares of the company or of a certain class. If the shareholders

who do not respond to or accept the offer hold less than 5% of the issued and outstanding share capital of the company or of the applicable

class of the shares, and more than half of the shareholders who do not have a personal interest in the offer accept the offer, all of

the shares that the acquirer offered to purchase will be transferred to the acquirer by operation of law. However, a tender offer will

also be accepted if the shareholders who do not accept it hold less than 2% of the issued and outstanding share capital of the company

or of the applicable class of the shares.

Upon

a successful completion of such a full tender offer, any shareholder that was an offeree in such tender offer, whether such shareholder

accepted the tender offer or not, may, within six months from the date of acceptance of the tender offer, petition an Israeli court to

determine whether the tender offer was for less than fair value and that the fair value should be paid as determined by the court. However,

under certain conditions, the offeror may include in the terms of the tender offer that an offeree who accepted the offer will not be

entitled to petition the Israeli court as described above.

If

(a) the shareholders who did not respond or accept the tender offer hold at least 5% of the issued and outstanding share capital of the

company or of the applicable class or the shareholders who accept the offer constitute less than a majority of the offerees that do not

have a personal interest in the acceptance of the tender offer, or (b) the shareholders who did not

accept the tender offer hold 2% or more of the issued and outstanding share capital of the company (or of the applicable class), the acquirer

may not acquire shares of the company that will increase its holdings to more than 90% of the company’s issued and outstanding share

capital or of the applicable class from shareholders who accepted the tender offer.

Special Tender Offer

The

Israeli Companies Law provides that an acquisition of shares of an Israeli public company must be made by means of a special tender offer

if as a result of the acquisition the purchaser would become a holder of 25% or more of the voting rights in the company. This rule does

not apply if there is already another holder of 25% or more of the voting rights in the company.

Similarly,

the Israeli Companies Law provides that an acquisition of shares in a public company must be made by means of a special tender offer if

as a result of the acquisition the purchaser would become a holder of more than 45% of the voting rights in the company, provided there

is no other shareholder of the company who holds more than 45% of the voting rights in the company.

These

requirements do not apply if the acquisition (i) occurs in the context of a private placement, that was approved by the company’s

shareholders and whose purpose is to give the acquirer at least 25% of the voting rights in the company if there is no person who holds

25% or more of the voting rights in the company, or as a private placement whose purpose is to give the acquirer 45% of the voting rights

in the company, if there is no person who holds 45% of the voting rights in the company; (ii) was from a shareholder holding 25% or more

of the voting rights in the company and resulted in the acquirer becoming a holder of 25% or more of the voting rights in the company;

or (iii) was from a holder of more than 45% of the voting rights in the company and resulted in the acquirer becoming a holder of more

than 45% of the voting rights in the company.

A

special tender offer must be extended to all shareholders of a company. The special tender offer may be consummated only if (i) at least

5% of the voting power attached to the company’s outstanding shares will be acquired by the offeror, and (ii) the number of shares

tendered in the offer exceeds the number of shares whose holders objected to the offer (excluding controlling shareholders, holders of

25% or more of the voting rights in the company and any person having a personal interest in the acceptance of the tender offer).

In

the event that a special tender offer is made, a company’s board of directors is required to express its opinion on the advisability

of the offer or it may abstain from expressing any opinion if it is unable to do so, provided that it gives the reasons for its abstention.

An

office holder in a target company who, in his or her capacity as an office holder, performs an action the purpose of which is to cause

the failure of an existing or foreseeable special tender offer or is to impair the chances of its acceptance, is liable to the potential

purchaser and shareholders for damages resulting from his acts, unless such office holder acted in good faith and had reasonable grounds

to believe he or she was acting for the benefit of the company. However, office holders of the target company may negotiate with the potential

purchaser in order to improve the terms of the special tender offer, and may further negotiate with third parties in order to obtain a

competing offer.

If

a special tender offer is accepted, then shareholders who did not respond to the special offer or had objected to the special tender offer

may accept the offer within four days of the last day set for the acceptance of the offer.

In

the event that a special tender offer is accepted, then the purchaser or any person or entity controlling it and any corporation controlled

by them must refrain from making a subsequent tender offer for the purchase of shares of the target company and may not effect a merger

with the target company for a period of one year from the date of the offer, unless the purchaser or such person or entity undertook to

effect such an offer or merger in the initial special tender offer.

Merger

The

Israeli Companies Law permits merger transactions if approved by each party’s board of directors and, unless certain requirements

described under the Israeli Companies Law are met, a majority of each party’s shareholders. Under our articles of association, a

merger shall require the approval of 66.6% of the voting rights represented at a meeting of our shareholders and voting on the matter,

in person or by proxy, and any amendment to such provision shall require the approval of 60% of the voting rights represented at a meeting

of our shareholders and voting on the matter, in person or by proxy.

The

board of directors of a merging company is required pursuant to the Israeli Companies Law to discuss and determine whether in its opinion

there exists a reasonable concern that as a result of a proposed merger, the surviving company will not be able to satisfy its obligations

towards its creditors, taking into account the financial condition of the merging companies. If the board of directors has determined

that such a concern exists, it may not approve a proposed merger. Following the approval of the board of directors of each of the merging

companies, the boards of directors must jointly prepare a merger proposal for submission to the Israeli Registrar of Companies.

For purposes of the shareholder

vote, unless a court rules otherwise, the merger will not be deemed approved if a majority of the shares voting at the shareholders meeting

(excluding abstentions) that are held by parties other than the other party to the merger, any person who holds 25% or more of the outstanding

shares or the right to appoint 25% or more of the directors of the other party, or any one on their behalf including their relatives or

corporations controlled by any of them, vote against the merger.

In addition, if the non-surviving

entity of the merger has more than one class of shares, the merger must be approved by each class of shareholders.

If the transaction would have

been approved but for the separate approval of each class of shares or the exclusion of the votes of certain shareholders as provided

above, a court may still rule that the company has approved the merger upon the request of holders of at least 25% of the voting rights

of a company, if the court holds that the merger is fair and reasonable, taking into account the appraisal of the merging companies’

value and the consideration offered to the shareholders.

Under the Israeli Companies

Law, a merging company must send a copy of the proposed merger plan to its secured creditors no later than three days after the date on

which the merger proposal was submitted to the Israeli Companies Registrar. Unsecured creditors are entitled to receive notice of the

merger, as provided by the regulations promulgated under the Israeli Companies Law. Upon the request of a creditor of a merging company,

the court may delay or prevent the merger if it concludes that there exists a reasonable concern that, as a result of the merger, the

surviving company will be unable to satisfy the obligations of the target company. The court may also give instructions in order to secure

the rights of creditors.

In addition, a merger may

not be completed unless at least 50 days have passed from the date that a proposal for approval of the merger was filed with the Israeli

Registrar of Companies and 30 days from the date that shareholder approval of both merging companies was obtained.

Anti-Takeover Measures under Israeli Law

The

Israeli Companies Law allows us to create and issue shares having rights different from those attached to our ordinary shares, including

shares providing certain preferred or additional rights to voting, distributions or other matters and shares having preemptive rights.

We do not have any authorized or issued shares other than ordinary shares. In the future, if we do create and issue a class of shares

other than ordinary shares, such class of shares, depending on the specific rights that may be attached to them, may delay or prevent

a takeover or otherwise prevent our shareholders from realizing a potential premium over the market value of their ordinary shares. The

authorization of a new class of shares will require an amendment to our articles of association which requires the prior approval of a

majority of our shares represented and voting at a general meeting. Shareholders voting at such

a meeting will be subject to the restrictions under the Israeli Companies Law described above in “— Ordinary Shares —

Voting.” Pursuant to the Israeli Securities Law, a company whose shares are traded on the TASE may not have more than one

class of shares except for preferred shares which may have a dividend preference but may not have any voting rights.

Tax Law

Israeli tax law treats some

acquisitions, such as stock-for-stock swaps between an Israeli company and a foreign company, less favorably than U.S. tax law. For example,

Israeli tax law may subject a shareholder who exchanges ordinary shares in an Israeli company for shares in a non-Israeli corporation

to immediate taxation unless such shareholder receives authorization from the Israel Tax Authority for different tax treatment.

Modification of Class Rights

The Israeli Companies Law

and our articles of association provide that the rights of a particular class of shares may not be modified without the affirmative vote

at a separate meeting of such class of a majority of shares actually participating in such class meeting.

Establishment

We

were incorporated under the laws of the State of Israel on December 13, 1990 under the name

Kamada Ltd. We are registered with the Israeli Registrar of Companies in Jerusalem. Our registration number is 51-152460-5. Our purpose

as set forth in our amended and restated articles of association is to engage in any lawful business.

Transfer Agent and Registrar

The

transfer agent and registrar for our ordinary shares is American Stock Transfer & Trust

Company, LLC. The nominee company to the TASE in whose name most of our outstanding shares are held of record is Mizrahi Tefahot Registration

Company Ltd.

Listing

Our ordinary shares are

listed on the TASE and Nasdaq Global Select Market under the symbol “KMDA.”

PLAN OF DISTRIBUTION

We may sell the ordinary

shares from time to time pursuant to underwritten public offerings, “at-the-market” offerings as defined in Rule 415 at negotiated

prices, negotiated transactions, block trades or a combination of these methods or through underwriters or dealers, through agents and/or

directly to one or more purchasers. The ordinary shares may be distributed from time to time in one

or more transactions:

| ● | at

a fixed price or prices, which may be changed; |

| | | |

| ● | at

market prices prevailing at the time of sale; |

| | | |

| ● | at

prices related to such prevailing market prices; or |

| | | |

Each time that we sell ordinary

shares covered by this prospectus, we will provide a prospectus supplement or supplements that will describe the method of distribution

and set forth the terms and conditions of the offering of such ordinary shares, including to the extent applicable:

| ● | the

name or names of any underwriters, dealers or agents, if any; |

| | | |

| ● | the

purchase price of the securities and the proceeds we received from the sale; |

| | | |

| ● | any

over-allotment options under which underwriters may purchase additional securities from us; |

| | | |

| ● | any

agency fees or underwriting discounts and other items constituting agents’ or underwriters’

compensation; |

| | | |

| ● | any

public offering price; |

| | | |

| ● | any

discounts or concessions allowed or reallowed or paid to dealers; and |

| ● | any

securities exchange or market on which the securities may be listed. |

Offers to purchase the ordinary

shares being offered by this prospectus may be solicited directly. Agents may also be designated to solicit offers to purchase the securities

from time to time.

Offers to purchase the ordinary

shares being offered by this prospectus may be solicited directly. Agents may also be designated to solicit offers to purchase the securities

from time to time.

If a dealer is utilized in

the sale of the ordinary shares being offered by this prospectus, the ordinary shares will be sold to the dealer, as principal. The dealer

may then resell the securities to the public at varying prices to be determined by the dealer at the time of resale.

If an underwriter is utilized

in the sale of the ordinary shares being offered by this prospectus, an underwriting agreement will be executed with the underwriter at

the time of sale and the name of any underwriter will be provided in the prospectus supplement that the underwriter will use to make resales

of the securities to the public. In connection with the sale of the ordinary shares, we or the purchasers of ordinary shares for whom

the underwriter may act as agent, may compensate the underwriter in the form of underwriting discounts or commissions. The underwriter

may sell the ordinary shares to or through dealers, and those dealers may receive compensation in the form of discounts, concessions or

commissions from the underwriters and/or commissions from the purchasers for which they may act as agent. We may offer the securities

to the public through underwriting syndicates represented by managing underwriters or underwriters without a syndicate. Subject to certain

conditions, the underwriters will be obligated to purchase all of the securities offered by a prospectus supplement. Any public offering

price and any discounts or concessions allowed or reallowed or paid to dealers may change from time to time. We may use underwriters with

whom we have a material relationship. We will describe in the prospectus supplement, naming the underwriter, the nature of any such relationship.

Unless otherwise indicated in a prospectus supplement, an agent will be acting on a best efforts basis and a dealer will purchase ordinary

shares as a principal, and may then resell the ordinary shares at varying prices to be determined by the dealer.

Any compensation paid to underwriters,

dealers or agents in connection with the offering of the securities, and any discounts, concessions or commissions allowed by underwriters

to participating dealers will be provided in the applicable prospectus supplement. Underwriters, dealers and agents participating in the

distribution of the securities may be deemed to be underwriters within the meaning of the Securities Act, and any discounts and commissions

received by them and any profit realized by them on resale of the ordinary shares may be deemed to be underwriting discounts and commissions.

We may enter into agreements to indemnify underwriters, dealers and agents against civil liabilities, including liabilities under the

Securities Act, or to contribute to payments they may be required to make in respect thereof and to reimburse those persons for certain

expenses.

Our ordinary shares are traded

on the Nasdaq Global Select Market and the TASE under the symbol “KMDA.” To facilitate the offering of securities, certain

persons participating in the offering may engage in transactions that stabilize, maintain or otherwise affect the price of the securities.

This may include over-allotments or short sales of the securities, which involve the sale by persons participating in the offering of

more securities than were sold to them. In these circumstances, these persons would cover such over-allotments or short positions by making

purchases in the open market or by exercising their over-allotment option, if any. In addition, these persons may stabilize or maintain

the price of the ordinary shares by bidding for or purchasing ordinary shares in the open market or by imposing penalty bids, whereby

selling concessions allowed to dealers participating in the offering may be reclaimed if ordinary shares sold by them are repurchased

in connection with stabilization transactions. The effect of these transactions may be to stabilize or maintain the market price of the

ordinary shares at a level above that which might otherwise prevail in the open market. These transactions may be discontinued at any

time.

We may authorize agents or

underwriters to solicit offers by certain types of institutional investors to purchase securities from us at the public offering price

set forth in the prospectus supplement pursuant to delayed delivery contracts providing for payment and delivery on a specified date in

the future. We will describe the conditions to these contracts and the commissions we must pay for solicitation of these contracts in

the prospectus supplement.

We may engage in at the market

offerings into an existing trading market in accordance with Rule 415(a)(4) under the Securities Act. In addition, we may enter into derivative

transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions.

If the applicable prospectus supplement so indicates, in connection with those derivatives, the third parties may sell securities covered

by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, the third party may use securities

pledged by us or borrowed from us or others to settle those sales or to close out any related open borrowings of stock, and may use securities

received from us in settlement of those derivatives to close out any related open borrowings of stock. The third party in such sale transactions

will be an underwriter and, if not identified in this prospectus, will be named in the applicable prospectus supplement (or a post-effective

amendment). In addition, we may otherwise loan or pledge securities to a financial institution or other third party that in turn may sell

the securities short using this prospectus and an applicable prospectus supplement. Such financial institution or other third party may

transfer its economic short position to investors in our securities or in connection with a concurrent offering of other securities.

We may provide agents, underwriters

and dealers with indemnification against civil liabilities, including liabilities under the Securities Act, or contribution with respect

to payments that the agents, underwriters or dealers may make with respect to these liabilities. Agents, underwriters and dealers, or

their respective affiliates, may engage in transactions with, or perform services for, us in the ordinary course of business.

The underwriters, dealers

and agents may engage in transactions with us, or perform services for us, in the ordinary course of business for which they receive compensation.

EXPENSES

We are paying all of the expenses of the registration

of our securities under the Securities Act, including, to the extent applicable, registration and filing fees, printing and duplication

expenses, administrative expenses, accounting fees and the legal fees of our counsel. We estimate these expenses to be approximately $34,010

which at the present time include the following categories of expenses:

| SEC registration fee | |

$ | 5,510 | |

| Legal fees and expenses | |

$ | 18,500 | |

| Accounting fees and expenses | |

$ | 10,000 | |

| Miscellaneous expenses | |

$ | 600 | |

| Total | |

$ | 34,610 | |

In addition, we anticipate incurring additional

expenses in the future in connection with the offering of our securities pursuant to this prospectus. Any such additional expenses will

be disclosed in a prospectus supplement.

LEGAL

MATTERS

The

validity of the ordinary shares and certain other legal matters as to Israeli law will be passed upon for us by FISCHER (FBC & Co.),

Tel Aviv, Israel. Certain legal matters as to United States law will be passed upon for us by Morrison & Foerster LLP, San Francisco,

California.

EXPERTS

The

consolidated financial statements of Kamada Ltd. appearing in Kamada Ltd.’s Annual Report (Form 20-F) for the year ended December

31, 2022 and the effectiveness of Kamada Ltd.’s internal control over financial reporting as of December 31, 2022, have been audited

by Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, an independent registered public accounting firm, as set forth

in their reports thereon, included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated

herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed with the SEC a registration statement on Form F-3 under the Securities Act, with respect to the securities offered by this

prospectus. This prospectus and any accompanying prospectus supplement do not contain all the information contained in the registration

statement, including its exhibits and schedules. You should refer to the registration statement, including the exhibits and schedules,

for further information about us and the securities we may offer. Statements we make in this prospectus and any accompanying prospectus

supplement about certain contracts or other documents are not necessarily complete. When we make such statements, we refer you to the

copies of the contracts or documents that are filed as exhibits to the registration statement, because those statements are qualified

in all respects by reference to those exhibits. The registration statement, including exhibits and schedules, is on file at the office

of the SEC and may be inspected without charge.

We

are subject to the information reporting requirements of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”)

applicable to foreign private issuers. Under the Exchange Act, we are required to file reports, including annual reports, and other information

with the SEC. As a foreign private issuer, we are exempt from the rules under the Exchange Act prescribing the furnishing and content

of proxy statements and our officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery

provisions contained in Section 16 of the Exchange Act. In addition, we are not required under the Exchange Act to file annual, quarterly

and current reports and financial statements as frequently or as promptly as U.S. companies whose securities are registered under the

Exchange Act. However, we file with the SEC, within 120 days after the end of each fiscal year, or such applicable time as required by

the SEC, an annual report on Form 20-F containing financial statements audited by an independent registered public accounting firm, and

we submit to the SEC, on Form 6-K, unaudited quarterly financial information. The SEC maintains a website that contains reports and other

information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

Our

website address is www.kamada.com. The reference to our website is intended to be an inactive

textual reference and the information on, or accessible through, our website is not intended to be part of this prospectus.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” into this prospectus the information in documents we file with it. This means

that we can disclose important information to you by referring you another document filed by us with the SEC. Each document incorporated

by reference is current only as of the date of such document, and the incorporation by reference of such documents shall not create any

implication that there has been no change in our affairs since the date thereof or that the information contained therein is current

as of any time subsequent to its date. The information incorporated by reference is considered to be a part of this prospectus and should

be read with the same care. When we update the information contained in documents that have been incorporated by reference by making

future filings with the SEC, the information incorporated by reference in this prospectus is considered to be automatically updated and

superseded. In other words, in the case of a conflict or inconsistency between information contained in this prospectus and information

incorporated by reference into this prospectus, you should rely on the information contained in the document that was filed later.

We

incorporate by reference into this prospectus documents listed below and any future filings made with the SEC under Sections 13(a), 13(c),

14 or 15(d) of the Exchange Act, and, to the extent specifically designated therein, reports on Form 6-K we furnish to the SEC on or

after the date on which this registration statement is first filed with the SEC, and until the termination or completion of that offering

under this prospectus:

| ● | our

annual report on Form 20-F for the fiscal year ended December 31, 2022; |

| ● | our

report on Form 6-K furnished to the SEC on March 15,2023, May 3, 2023, May 16, 2023, May 24, 2023 (three reports), July 12, 2023, July 13, 2023, August 9, 2023, August 16, 2023 and

August 30, 2023; |

| ● | our

report on Form 6-K/A furnished to the SEC on May 24, 2023; and |

| ● | the

description of our ordinary shares contained under the heading “Item 1. Description

of Registrant’s Securities to be Registered” in our registration statement on

Form 8-A, as filed with the SEC on May 28, 2013, including any subsequent amendment or any

report filed for the purpose of updating such description. |

Any

statement contained herein or in a document all or a portion of which is incorporated or deemed to be incorporated by reference herein

shall be deemed to be modified or superseded for purposes of this registration statement to the extent that a statement contained herein

or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes

such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute

a part of this registration statement.

Unless

expressly incorporated by reference, nothing in this prospectus shall be deemed to incorporate by reference information furnished to,

but not filed with, the SEC. Copies of all documents incorporated by reference in this prospectus, other than exhibits to those documents

unless such exhibits are specially incorporated by reference in this prospectus, will be provided at no cost to each person, including

any beneficial owner, who receives a copy of this prospectus on the written or oral request of that person made to:

Kamada

Ltd.

c/o

Amir London, Chief Executive Officer

2

Holzman Street

Science

Park

P.O.

Box 4081

Rehovot

7670402

Tel:

+972 8 9406472

ENFORCEABILITY

OF CIVIL LIABILITIES

We

are incorporated under the laws of the State of Israel. Service of process upon us and upon our directors and officers and the Israeli

experts named in this prospectus, substantially all of whom reside outside the United States, may be difficult to obtain within the United

States. Furthermore, because the majority of our assets and substantially all of our directors and officers and the Israeli experts named

in this prospectus are located outside the United States, any judgment obtained in the United States against us or any of these persons

may be difficult to collect within the United States.

We

have irrevocably appointed Puglisi & Associates as our agent to receive service of process in any action against us in any United

States federal or state court. The address of Puglisi & Associates is 850 Library Avenue, Suite 204, P.O. Box 885, Newark, Delaware

19715.

We

have been informed by our legal counsel in Israel, FISCHER (FBC & Co.), that it may be difficult to initiate an action with

respect to U.S. securities laws in Israel. Israeli courts may refuse to hear a claim based on an alleged violation of U.S. securities

laws, on the grounds that Israel is not the most appropriate forum to hear such a claim. In addition, even if an Israeli court agrees

to hear a claim, it may determine that Israeli law and not U.S. law is applicable to the claim. If U.S. law is found to be applicable,

the content of applicable United States law must be proved as a fact by expert witnesses, which can be a time-consuming and costly process.

Certain matters of procedure may also be governed by Israeli law.

Subject

to certain time limitations, legal procedures and exceptions, Israeli courts may enforce a U.S. judgment in a civil matter which is non-appealable,

including a judgment based upon the civil liability provisions of the Securities Act and the Exchange Act and including a monetary or

compensatory judgment in a non-civil matter, provided that, among other things:

| ● | the

judgment was rendered by a court which was, according to the laws of the state of the court,

competent to render the judgment; |

| ● | the

obligation imposed by the judgment is enforceable according to the rules relating to the

enforceability of judgments in Israel and the substance of the judgment is not contrary to

public policy; and |

| ● | the

judgment is executory in the state in which it was given. |

Even

if such conditions are met, an Israeli court may not declare a foreign civil judgment enforceable if:

| ● | the

judgment was given in a state whose laws do not provide for the enforcement of judgments

of Israeli courts (subject to exceptional cases); |

| ● | the

enforcement of the judgment is likely to prejudice the sovereignty or security of the State

of Israel; |

| ● | the

judgment was obtained by fraud; |

| ● | the

opportunity given to the defendant to bring its arguments and evidence before the court was

not reasonable in the opinion of the Israeli court; |

| ● | the

judgment was rendered by a court not competent to render it according to the laws of private

international law as they apply in Israel; |

| ● | the

judgment is contradictory to another judgment that was given in the same matter between the

same parties and that is still valid; or |

| ● | at

the time the action was brought in the foreign court, a lawsuit in the same matter and between

the same parties was pending before a court or tribunal in Israel. |

If

a foreign judgment is enforced by an Israeli court, it generally will be payable in Israeli currency, which can then be converted into

non-Israeli currency and transferred out of Israel. The usual practice in an action before an Israeli court to recover an amount in a

non-Israeli currency is for the Israeli court to render a judgment for the equivalent amount in Israeli currency at the rate of exchange

in force on the date of the judgment, but the judgment debtor may make payment in foreign currency. Pending collection, the amount of

the judgment of an Israeli court stated in Israeli currency ordinarily will be linked to the Israeli consumer price index plus interest

at the annual statutory rate set by Israeli regulations prevailing at the time. Judgment creditors must bear the risk of unfavorable

exchange rates.

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item 8.

Exculpation, Insurance and Indemnification of Directors and Officers

Under

the Israeli Companies Law, 5759-7999 (the “Israeli Companies Law”), a company may not exculpate an office holder from liability

for a breach of the duty of loyalty. An Israeli company may exculpate an office holder in advance from liability to the company, in whole

or in part, for damages caused to the company as a result of a breach of duty of care, but only if a provision authorizing such exculpation

is included in the company’s articles of association. Our articles of association include such a provision. However, pursuant our