UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of September 2023

Commission

File Number: 001-41467

Magic

Empire Global Limited

3/F,

8 Wyndham Street

Central,

Hong Kong

(Address

of Principal Executive Offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Financial

Statements and Exhibits.

The

following exhibits are being filed herewith:

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

Magic Empire Global Limited |

| |

|

| Date: September 8, 2023 |

By: |

/s/

Sze Hon, Johnson Chen |

| |

|

Sze Hon, Johnson Chen |

| |

|

Chief Executive Officer |

Exhibit

99.1

Magic

Empire Global Limited Announces First Half 2023 Unaudited Financial Results

HONG

KONG, September 8, 2023 — Magic Empire Global Limited (“MEGL” or the “Company”) (NASDAQ: MEGL), a financial

services provider in Hong Kong which principally engages in the provision of corporate finance advisory services, today announced its

unaudited financial results for the six months ended June 30, 2023.

Overview:

| |

● |

Revenue was approximately

HK$6.1 million (US$0.8 million) for the six months ended June 30, 2023, representing a decrease of approximately 22.5% from the same

period in 2022. |

| |

|

|

| |

● |

Net income was approximately

HK$0.7 million (US$0.1 million) for the six months ended June 30, 2023 (2022: approximately HK$1.5 million). |

Six

Month Financial Results Ended June 30, 2023

Revenue.

Revenue decreased by approximately 22.5% from approximately HK$7.8 million for the six months ended June 30, 2022 to approximately

HK$6.1 million (US$0.8 million) for the six months ended June 30, 2023. During the six months ended June 30, 2023, we completed one IPO

sponsorship project and recognized relevant income. The increase in revenue from IPO sponsorship services was offset by a decrease in

revenue from financial advisory and independent financial advisory services due to delay in several financial advisory projects for clients

pursuing a listing in Nasdaq. Revenue from compliance advisory services decreased due to completion of several of our compliance advisory

projects during the six months ended June 30, 2023.

Selling,

general and administrative expenses. Selling, general and administrative expenses increased by approximately 15.6% from approximately

HK$6.3 million for the six months ended June 30, 2022 to approximately HK$7.2 million (US$0.9 million) for the six months ended June

30, 2023, which was mainly due to (i) increase in staff costs from increase in payroll to our staff and fees to our independent directors;

(ii) increase in travelling, accommodation and entertainment expenses due to increase in travelling for business development following

the removal of travel restriction measures; (iii) increase in legal fee and other listing-related expenses.

Other

income, net. Other net income increased by approximately HK$1.9 million from approximately HK$16,800 for the six months ended June

30, 2022 to approximately HK$1.9 million (US$0.2 million) for the six months ended June 30, 2023, which was mainly due to the increase

in interest income resulting from the increase in bank interest rates and average cash balance.

Income

tax expense. Income tax expense decreased to nil for the for the six months ended June 30, 2023 (six months ended June 30, 2022:

approximately HK$133,000) as we have available tax losses brought forward.

Net

income. Net income decreased by approximately HK$0.7 million to approximately HK$0.7 million (US$0.1 million), which was mainly due

to the decrease in revenue.

Basic

and diluted EPS. Basic and diluted EPS were approximately HK$0.04 (US$0.005) per ordinary share for the six months ended June 30,

2023, as compared to HK$0.1 (US$0.01) per ordinary share for the six months ended June 30, 2022, respectively.

About

Magic Empire Global Limited

Magic

Empire Global Limited is a financial services provider in Hong Kong which principally engage in the provision of corporate finance advisory

services and underwriting services. Its service offerings mainly comprise (i) IPO sponsorship services; (ii) financial advisory and independent

financial advisory services; (iii) compliance advisory services; and (iv) underwriting services. For more information, visit the Company’s

website at http://www.meglmagic.com.

Exchange

Rate Information

This

announcement contains translations of certain HK$ amounts into U.S. dollars (“US$”) at specified rates solely for the convenience

of the reader. Unless otherwise stated, all translations from HK$ to US$ were made at the rate of HK$7.8363 to US$1.00, the exchange

rate on June 30, 2023 set forth in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that

the HK$ or US$ amounts referred could be converted into US$ or HK$, as the case may be, at any particular rate or at all.

Safe

Harbor Statement

Certain

statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and

uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes

may affect its financial condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking

statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,”

“estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,”

“continue” or other similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking

statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law.

Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you

that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from

the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s registration

statement and other filings with the SEC, which are available for review at www.sec.gov.

Hong

Kong:

Magic

Empire Global Limited

Ms.

Vivien Tai

Tel:

+852 3577 8770

E-mail:

meglir@giraffecap.com

MAGIC

EMPIRE GLOBAL LIMITED

UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

As of | |

| | |

December 31, 2022 | | |

June 30, 2023 | | |

June 30, 2023 | |

| | |

HK$ | | |

HK$ | | |

US$ | |

| ASSETS | |

| | | |

| | | |

| | |

| Current assets: | |

| | | |

| | | |

| | |

| Cash | |

| 121,814,233 | | |

| 94,348,363 | | |

| 12,039,912 | |

| Accounts receivable | |

| 1,988,403 | | |

| 881,562 | | |

| 112,497 | |

| Interest receivables | |

| 515,287 | | |

| 522,065 | | |

| 66,621 | |

| Deposits and prepayments | |

| 1,050,694 | | |

| 2,571,444 | | |

| 328,145 | |

| Other receivables – related parties | |

| 96,700 | | |

| — | | |

| — | |

| Tax recoverable | |

| 587,834 | | |

| 587,834 | | |

| 75,014 | |

| | |

| | | |

| | | |

| | |

| Total current assets | |

| 126,053,151 | | |

| 98,911,268 | | |

| 12,622,189 | |

| | |

| | | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | | |

| | |

| Property and equipment, net | |

| — | | |

| 369,903 | | |

| 47,204 | |

| Right-of-use assets | |

| 3,553,677 | | |

| 2,606,030 | | |

| 332,559 | |

| Long-term investment | |

| 14,500,000 | | |

| 40,610,739 | | |

| 5,182,387 | |

| | |

| | | |

| | | |

| | |

| Total non-current assets | |

| 18,053,677 | | |

| 43,586,672 | | |

| 5,562,150 | |

| Total assets | |

| 144,106,828 | | |

| 142,497,940 | | |

| 18,184,339 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Accruals and other payables | |

| 1,068,185 | | |

| 109,794 | | |

| 14,010 | |

| Contract liabilities | |

| 3,054,032 | | |

| 2,616,832 | | |

| 333,937 | |

| Operating lease liabilities | |

| 1,904,725 | | |

| 1,952,842 | | |

| 249,205 | |

| | |

| | | |

| | | |

| | |

| Total current liabilities | |

| 6,026,942 | | |

| 4,679,468 | | |

| 597,152 | |

| | |

| | | |

| | | |

| | |

| Non-current liabilities: | |

| | | |

| | | |

| | |

| Operating lease liabilities | |

| 1,746,317 | | |

| 757,716 | | |

| 96,693 | |

| Total non-current liabilities | |

| 1,746,317 | | |

| 757,716 | | |

| 96,693 | |

| Total liabilities | |

| 7,773,259 | | |

| 5,437,184 | | |

| 693,845 | |

| | |

| | | |

| | | |

| | |

| COMMITMENTS AND CONTINGENCIES | |

| | | |

| | | |

| | |

| SHAREHOLDERS’ EQUITY | |

| | | |

| | | |

| | |

| Ordinary shares, US$0.0001 par value, 300,000,000 shares authorized, and 20,256,099 shares outstanding as of December 31, 2022 and June 30, 2023 respectively | |

| 15,826 | | |

| 15,826 | | |

| 2,020 | |

| Additional paid-in capital | |

| 138,662,858 | | |

| 138,662,858 | | |

| 17,694,940 | |

| Accumulated deficits | |

| (2,345,115 | ) | |

| (1,617,928 | ) | |

| (206,466 | ) |

| Total shareholders’ equity | |

| 136,333,569 | | |

| 137,060,756 | | |

| 17,490,494 | |

| Total liabilities and shareholders’ equity | |

| 144,106,828 | | |

| 142,297,940 | | |

| 18,184,339 | |

MAGIC

EMPIRE GLOBAL LIMITED

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

| | |

For the six months ended | |

| | |

June 30, 2022 | | |

June 30, 2023 | | |

June 30, 2023 | |

| | |

HK$ | | |

HK$ | | |

US$ | |

| REVENUE | |

| 7,849,116 | | |

| 6,081,430 | | |

| 776,059 | |

| | |

| | | |

| | | |

| | |

| OPERATING EXPENSES: | |

| | | |

| | | |

| | |

| Selling, general and administrative expenses | |

| (6,257,023 | ) | |

| (7,230,225 | ) | |

| (922,658 | ) |

| Total operating expenses | |

| (6,257,023 | ) | |

| (7,230,225 | ) | |

| (922,658 | ) |

| | |

| | | |

| | | |

| | |

| INCOME FROM OPERATIONS | |

| 1,592,093 | | |

| (1,148,795 | ) | |

| (146,599 | ) |

| | |

| | | |

| | | |

| | |

| OTHER INCOME (EXPENSE) | |

| | | |

| | | |

| | |

| Interest income | |

| 97 | | |

| 1,957,509 | | |

| 249,800 | |

| Other income | |

| 144,000 | | |

| - | | |

| - | |

| Other expenses | |

| (127,299 | ) | |

| (81,527 | ) | |

| (10,404 | ) |

| Total other income, net | |

| 16,798 | | |

| 1,875,982 | | |

| 239,396 | |

| | |

| | | |

| | | |

| | |

| INCOME BEFORE INCOME TAXES | |

| 1,608,891 | | |

| 727,187 | | |

| 92,797 | |

| INCOME TAX EXPENSES | |

| (132,734 | ) | |

| - | | |

| - | |

| NET INCOME | |

| 1,476,157 | | |

| 727,187 | | |

| 92,797 | |

| | |

| | | |

| | | |

| | |

| WEIGHTED AVERAGE NUMBER OF ORDINARY SHARES | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 15,000,000 | | |

| 20,256,099 | | |

| 20,256,099 | |

| | |

| | | |

| | | |

| | |

| EARNINGS PER SHARE | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 0.10 | | |

| 0.04 | | |

| 0.005 | |

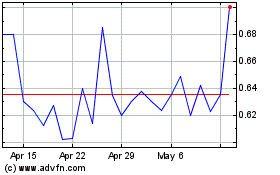

Magic Empire Global (NASDAQ:MEGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Magic Empire Global (NASDAQ:MEGL)

Historical Stock Chart

From Apr 2023 to Apr 2024