0001722731

false

0001722731

2023-06-30

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report: June 30, 2023

(Date

of earliest event reported)

FDCTECH,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

000-56338 |

|

81-1265459 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS.

Employer

Identification

No.) |

200

Spectrum Center Drive, Suite 300

Irvine,

CA 92618

(Address

of principal executive offices, including zip code)

(877)

445-6047

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| ☐ |

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| ☐ |

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| ☐ |

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common |

|

FDCT |

|

OTCQB |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K contains forward-looking

statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements relate to anticipated future

events, future results of operations or future financial performance. These forward-looking statements include but are not limited to,

statements related to our ability to raise sufficient capital to finance our planned operations. In some cases, you can identify forward-looking

statements by terminology such as “may,” “might,” “will,” “should,” “intends,”

“expects,” “plans,” “goals,” “projects,” “anticipates,” “believes,”

“estimates,” “predicts,” “potential,” or “continue” or the negative of these terms or

other comparable terminology.

These forward-looking statements are only predictions,

are uncertain, and involve substantial known and unknown risks, uncertainties, and other factors that may cause our (or our industry’s)

actual results, levels of activity, or performance to be materially different from any future results, levels of activity or performance

expressed or implied by these forward-looking statements. The “Risk Factors” section of this Current Report on Form 8-K sets

forth detailed risks, uncertainties, and cautionary statements regarding our business and these forward-looking statements.

We cannot guarantee future results, levels of activity, or performance.

You should not place undue reliance on these forward-looking statements, which speak only as of the date that they were made. These cautionary

statements should be considered with any written or oral forward-looking statements we may issue. Except as required by applicable law,

including the securities laws of the United States, we do not intend to update any forward-looking statements to conform these statements

to reflect actual results, later events, or circumstances or to reflect the occurrence of unanticipated events.

| ITEM

9.01 |

Financial

Statements and Exhibits |

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

|

FDCTECH,

INC. |

| |

|

|

|

| September 6, 2023 |

|

By: |

/s/

Imran Firoz |

| Date |

|

|

Imran

Firoz |

| |

|

|

Chief

Financial Officer |

| |

|

|

(Principal

Executive Officer) |

Exhibit

99.1

UNAUDITED

PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

Introduction

The

following unaudited pro forma combined financial statements of FDCTech, Inc. (the “Company,” “FDCTech,” “we,”

or “us”) and Alchemy Markets Limited [“Alchemy (Malta) or “NSFX”)] present the historical financial information

of FDCtech adjusted with Alchemy (Malta) to give effect to the acquisition of 50.10% of Alchemy (Malta) by the FDCTech.

We have prepared the following unaudited pro forma combined financial information following Article 11 of Regulation S-X.

The

unaudited pro forma condensed combined balance sheet as of June 30, 2023, incorporates the historical unaudited condensed balance sheet

of FDCTech and the historical unaudited condensed consolidated balance sheet of Alchemy (Malta) as of June 30, 2023, on a pro forma basis

as if the acquisition and related transactions, summarized below, had been consummated on June 30, 2023, which is the actual Acquisition

Date.

The

unaudited pro forma condensed combined statement of operations for the six months ended June 30, 2023, combines the historical unaudited

condensed statement of operations of FDCTech and the historical unaudited condensed consolidated statement of operations of Alchemy (Malta)

for the six months ended June 30, 2023, on a pro forma basis as if the acquisition and related transaction summarized below, had been

consummated on January 1, 2022.

The

unaudited pro forma combined statement of operations for the fiscal year ended December 31, 2022, combines the historical audited statement

of operations of FDCTech and the historical unaudited consolidated statement of operations of Alchemy (Malta) for such period on a pro

forma basis assuming FDCTech consummated the acquisition and related transactions on January 1, 2022.

The unaudited pro forma

combined financial statements have been developed and should be read in conjunction with:

| |

● |

the

accompanying notes to the unaudited pro forma combined financial statements; |

| |

|

|

| |

● |

the

audited consolidated financial statements of FDCTech as of December 31, 2022, and the related notes thereto; |

| |

|

|

| |

● |

the

unaudited six months condensed consolidated financial statements of FDCTech as of June 30, 2023, and the related notes thereto; |

| |

|

|

| |

● |

the

audited consolidated financial statements of Alchemy (Malta) as of November 30, 2022, and the related notes thereto; |

| |

|

|

| |

● |

the

unaudited six months condensed consolidated financial statements of Alchemy (Malta) as of June 30, 2023, and the related notes thereto; |

| |

|

|

| |

● |

the

section entitled “FDCTech Management’s Discussion and Analysis of Financial Condition and Results of Operations”

and other financial information relating to FDCTech included reports filed with the SEC or elsewhere or incorporated by reference

in this 8-K; and |

The

unaudited pro forma combined financial information has been presented for illustrative purposes only. It does not necessarily reflect

what the combined entity’s financial condition or results of operations would have been had the acquisition occurred on

the dates indicated. Further, the unaudited pro forma combined financial information also may not be useful in predicting the future

financial condition and results of operations of the combined entity. The actual financial position and results of operations

may differ significantly from the pro forma amounts reflected herein due to various factors. Assumptions and estimates underlying the

unaudited pro forma adjustments outlined in the unaudited pro forma combined financial statements are described in the accompanying notes.

FDCTech believes that its assumptions and methodologies provide a reasonable basis for presenting all of the significant effects of the

acquisition based on information available to Management at this time and that the transaction accounting adjustments give appropriate

effect to those assumptions and are properly applied in the unaudited pro forma combined financial information, including but not limited

to the following:

FDCTech

has been determined to be the accounting acquirer based on the evaluation of the following facts and circumstances concerning Alchemy

(Malta) immediately after the Closing;

| |

● |

The

relative voting rights. FDCTech holds the majority of Alchemy (Malta) ‘s voting rights; therefore, we are the accounting

acquirer. |

| |

|

|

| |

● |

The

composition of the governing body. FDCTech is the governing body of Alchemy (Malta), and we are the accounting acquirer. |

| |

|

|

| |

● |

The

composition of the senior Management. If the senior Management comprises primarily the management personnel from one of the combining

entities, that entity is likely the accounting acquirer. |

We

have determined the method of accounting for the business combination. The accounting acquirer applies the acquisition method and recognizes

the acquiree’s identifiable assets, liabilities, and any noncontrolling interest in the acquiree at their fair values as of the

acquisition date. The fair values of Alchemy (Malta) ‘s assets and liabilities equal their carrying amounts. Therefore, we did

not need any adjustments to the carrying amounts of these assets and liabilities on FDCTech’s balance sheet.

FDCTECH,

INC

UNAUDITED

PROFORMA CONDENSED COMBINED BALANCE SHEET AS OF JUNE 30, 2023

(Currency

expressed in United States Dollars)

| | |

FDCTech | | |

Alchemy (Malta) | | |

Total | | |

Pro Forma Adjustments (Note 3) | |

Pro Forma Combined | |

| | |

(USD) | | |

(USD) | | |

(USD) | | |

| |

(USD) | |

| Assets | |

| | | |

| | | |

| | | |

| |

| | |

| Current assets: | |

| | | |

| | | |

| | | |

| |

| | |

| Cash | |

$ | 127,057 | | |

$ | 24,510 | | |

$ | (24,510 | ) | |

A | |

$ | 127,057 | |

| Accounts receivable, net | |

| 2,857,581 | | |

| 2,715,888 | | |

| (2,715,888 | ) | |

B | |

| 2,857,581 | |

| Other current assets | |

| 1,142,499 | | |

| 741,231 | | |

| (741,231 | ) | |

C | |

| 1,142,499 | |

| Total Current assets | |

| 4,127,137 | | |

| 3,481,629 | | |

| (3,481,629 | ) | |

| |

| 4,127,137 | |

| Fixed assets, net | |

| 3,096 | | |

| 3,096 | | |

| (3,096 | ) | |

D | |

| 3,096 | |

| Capitalized software, net | |

| 895,748 | | |

| - | | |

| - | | |

| |

| 895,748 | |

| Acquired tangible assets | |

| 35,953 | | |

| - | | |

| - | | |

| |

| 35,953 | |

| Acquired intangible assets | |

| 2,600,800 | | |

| - | | |

| - | | |

| |

| 2,600,800 | |

| Total assets | |

$ | 7,662,734 | | |

$ | 3,484,725 | | |

$ | (3,484,725 | ) | |

| |

$ | 7,662,734 | |

| Liabilities and Stockholders’ Deficit | |

| | | |

| | | |

| | | |

| |

| | |

| Current liabilities: | |

| | | |

| | | |

| | | |

| |

| | |

| Accounts payable | |

$ | 519,450 | | |

$ | - | | |

$ | | | |

| |

$ | 519,450 | |

| Line of credit | |

| 50,310 | | |

| - | | |

| | | |

| |

| 50,310 | |

| Payroll tax payable | |

| 226,779 | | |

| - | | |

| | | |

| |

| 226,779 | |

| Business acquisition loan | |

| 350,000 | | |

| - | | |

| | | |

| |

| 350,000 | |

| Cares act - PPP advance | |

| 32,644 | | |

| - | | |

| | | |

| |

| 32,644 | |

| Other current liabilities | |

| 640,632 | | |

| 482,022 | | |

| (482,022 | ) | |

E | |

| 640,632 | |

| Total Current liabilities | |

| 1,819,815 | | |

| 482,022 | | |

| (482,022 | ) | |

| |

| 1,819,815 | |

| SBA loan – non-current | |

| 126,941 | | |

| - | | |

| - | | |

| |

| 126,941 | |

| Deferred tax liabilities | |

| 349,326 | | |

| 349,326 | | |

| (349,326 | ) | |

F | |

| 349,326 | |

| Accrued interest – non-current | |

| 17,386 | | |

| - | | |

| - | | |

| |

| 17,386 | |

| Total liabilities | |

| 2,313,468 | | |

| 831,348 | | |

| (831,348 | ) | |

| |

| 2,313,468 | |

| Commitments and Contingencies (Note 9) | |

| | | |

| | | |

| | | |

| |

| | |

| Stockholders’ Deficit: | |

| | | |

| | | |

| | | |

| |

| | |

| Preferred stock, par value $0.0001 | |

| 400 | | |

| - | | |

| - | | |

| |

| 400 | |

| Common stock, par value $0.0001 | |

| 33,358 | | |

| - | | |

| - | | |

| |

| 33,358 | |

| Additional paid-in capital | |

| 6,349,824 | | |

| - | | |

| - | | |

| |

| 6,349,824 | |

| Accumulated other comprehensive income | |

| (8,933 | ) | |

| - | | |

| - | | |

| |

| (8,933 | ) |

| Accumulated deficit | |

| (3,649,885 | ) | |

| 878,733 | | |

| (878,733 | ) | |

G | |

| (3,649,885 | ) |

| Total FDCTech stockholders’ equity (deficit) | |

| 2,724,764 | | |

| 878,733 | | |

| (878,733 | ) | |

| |

| 2,724,764 | |

| Noncontrolling interest | |

| 2,624,502 | | |

| 1,774,644 | | |

| 1,774,644 | ) | |

H | |

| 2,624,502 | |

| Total liabilities and stockholders’ deficit | |

$ | 7,662,734 | | |

$ | 3,484,725 | | |

$ | (3,484,725 | ) | |

| |

$ | 7,662,734 | |

See

accompanying notes to unaudited proforma condensed combined financial statements

FDCTECH

INC.

UNAUDITED

PROFORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

FOR

THE SIX MONTHS ENDED JUNE 30, 2023

(Currency

expressed in United States Dollars)

| | |

FDCTech | | |

Alchemy (Malta) | | |

Total | | |

Proforma Adjustments (Note 3) | |

Proforma Combined | |

| | |

(USD) | | |

(USD) | | |

(USD) | | |

| |

(USD) | |

| Revenues | |

| | | |

| | | |

| | | |

| |

| | |

| Technology & software | |

$ | 474,565 | | |

$ | - | | |

| (90,000 | ) | |

I | |

| 384,565 | |

| Wealth management | |

| 2,836,271 | | |

| - | | |

| - | | |

| |

| 2,836,271 | |

| Trading | |

| - | | |

| 1,621,345 | | |

| - | | |

| |

| 1,621,345 | |

| Total revenue | |

| 3,310,836 | | |

| 1,621,345 | | |

| (90,000 | ) | |

| |

| 4,842,181 | |

| Cost of sales | |

| | | |

| | | |

| | | |

| |

| | |

| Technology & software | |

| 22,503 | | |

| - | | |

| - | | |

| |

| 22,503 | |

| Wealth management | |

| 2,549,135 | | |

| - | | |

| - | | |

| |

| 2,549,135 | |

| Total cost of sales | |

| 2,571,638 | | |

| - | | |

| - | | |

| |

| 2,571,638 | |

| Gross Profit | |

| 739,198 | | |

| 1,621,345 | | |

| (90,000 | ) | |

| |

| 2,270,543 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| |

| | |

| General and administrative | |

| 979,709 | | |

| 1,537,367 | | |

| (90,000 | ) | |

J | |

| 2,427,076 | |

| Sales and marketing | |

| 41,823 | | |

| - | | |

| - | | |

| |

| 41,823 | |

| Total operating expenses | |

| 1,021,532 | | |

| 1,537,367 | | |

| (90,000 | ) | |

| |

| 2,468,899 | |

| Operating loss | |

| (282,334 | ) | |

| 83,978 | | |

| - | | |

| |

| (198,356 | ) |

| Other income (expense): | |

| | | |

| | | |

| | | |

| |

| | |

| Gain on purchase | |

| 979,342 | | |

| - | | |

| (979,342 | ) | |

K | |

| - | |

| Other interest expense | |

| (10,852 | ) | |

| - | | |

| - | | |

| |

| (10,852 | ) |

| Other income (expense) | |

| (988 | ) | |

| - | | |

| - | | |

| |

| (988 | ) |

| Total other expense | |

| 967,502 | | |

| - | | |

| (979,342 | ) | |

| |

| (11,840 | ) |

| Income (loss) before provision for income taxes | |

| 685,168 | | |

| 83,978 | | |

| (979,342 | ) | |

| |

| (210,196 | ) |

| Provision for income taxes | |

| - | | |

| - | | |

| - | | |

| |

| - | |

| Net loss | |

$ | 685,168 | | |

$ | 83,978 | | |

| (979,342 | ) | |

| |

| (210,196 | ) |

| Less: Net income attributable to noncontrolling interest | |

| (43,525 | ) | |

| - | | |

| - | | |

| |

| (43,525 | ) |

| Net income attributable to FDCTech’s shareholders | |

$ | 728,693 | | |

$ | 83,978 | | |

$ | (979,342 | ) | |

| |

$ | (166,671 | ) |

| Net loss per common share, basic and diluted | |

$ | (0.01 | ) | |

$ | - | | |

| | | |

| |

| (0.00 | ) |

| Weighted average number of common shares outstanding basic and diluted | |

| 316,587,950 | | |

| - | | |

| - | | |

| |

| 316,587,950 | |

See

accompanying notes to unaudited proforma condensed combined financial statements

FDCTECH

INC.

UNAUDITED

PROFORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

FOR

THE YEAR ENDED DECEMBER 31, 2022

(Currency

expressed in United States Dollars)

| | |

FDCTech | | |

Alchemy (Malta) | | |

Total | | |

Proforma Adjustments (Note 3) | |

Proforma Combined | |

| | |

(USD) | | |

(USD) | | |

(USD) | | |

| |

(USD) | |

| Revenues | |

| | | |

| | | |

| | | |

| |

| | |

| Technology & software | |

$ | 626,000 | | |

$ | - | | |

| (132,000 | ) | |

L | |

| 626,000 | |

| Wealth management | |

| 5,827,732 | | |

| - | | |

| - | | |

| |

| 5,827,732 | |

| Trading | |

| - | | |

| 5,519,388 | | |

| - | | |

| |

| 5,387,388 | |

| Total revenue | |

| 6,453,732 | | |

| 5,519,388 | | |

| (132,000 | ) | |

| |

| 11,841,120 | |

| Cost of sales | |

| | | |

| | | |

| | | |

| |

| | |

| Technology & software | |

| 159,051 | | |

| - | | |

| - | | |

| |

| 159,051 | |

| Wealth management | |

| 5,275,741 | | |

| - | | |

| - | | |

| |

| 5,275,741 | |

| Total cost of sales | |

| 5,434,792 | | |

| - | | |

| - | | |

| |

| 5,434,792 | |

| Gross Profit | |

| 1,018,940 | | |

| 5,519,388 | | |

| (132,000 | ) | |

| |

| 6,406,328 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| |

| | |

| General and administrative | |

| 1,679,121 | | |

| 5,193,843 | | |

| (132,000 | ) | |

M | |

| 6,740,964 | |

| Sales and marketing | |

| 382,864 | | |

| - | | |

| - | | |

| |

| 382,864 | |

| Total operating expenses | |

| 2,061,985 | | |

| 5,193,843 | | |

| (132,000 | ) | |

| |

| 7,123,828 | |

| Operating loss | |

| (1,043,045 | ) | |

| 325,545 | | |

| - | | |

| |

| (717,500 | ) |

| Other income (expense): | |

| | | |

| | | |

| | | |

| |

| | |

| Other interest expense | |

| (61,533 | ) | |

| - | | |

| - | | |

| |

| (61,533 | ) |

| Other income (expense) | |

| 204 | | |

| - | | |

| - | | |

| |

| (988 | ) |

| Total other expense | |

| (61,329 | ) | |

| - | | |

| - | | |

| |

| (61,329 | ) |

| Income (loss) before provision for income taxes | |

| (1,104,374 | ) | |

| 325,545 | | |

| - | | |

| |

| (778,829 | ) |

| Provision for income taxes | |

| - | | |

| - | | |

| - | | |

| |

| - | |

| Net loss | |

$ | (1,104,374 | ) | |

$ | 325,545 | | |

| - | | |

| |

| (778,829 | ) |

| Less: Net income attributable to noncontrolling interest | |

| (1,360 | ) | |

| - | | |

| - | | |

| |

| (1,360 | ) |

| Net income attributable to FDCTech’s shareholders | |

$ | (1,103,014 | ) | |

$ | 325,545 | | |

$ | - | | |

| |

$ | (777,469 | ) |

| Net loss per common share, basic and diluted | |

$ | (0.01 | ) | |

$ | - | | |

| | | |

| |

| (0.00 | ) |

| Weighted average number of common shares outstanding basic and diluted | |

| 158,048,019 | | |

| - | | |

| - | | |

| |

| 158,048,019 | |

See

accompanying notes to unaudited proforma condensed combined financial statements

FDCTECH,

INC

NOTES

TO UNAUDITED PROFORMA CONDENSED COMBINED FINANCIAL STATEMENTS

(Currency

expressed in United States Dollars)

(Unaudited)

We

have based the following unaudited proforma condensed combined financial statements on the historical financial statements of FDCTech,

Inc. (“FDCTech” or the “Company”) and Alchemy Markets Limited (“Alchemy (Malta)”) after giving effect

to our Acquisition of Alchemy (Malta) (“the Acquisition”) and the assumptions and adjustments described in the accompanying

notes to the unaudited proforma condensed combined financial statements.

Note

1. Description of Acquisition

On

December 31, 2022, FDCTech announced the sales purchase agreement (“Agreement”) under which FDCTech acquired a 50.10%

equity interest in New Star Capital Trading Ltd., a British Virgin Island company (“New Star”) and its operating subsidiary

Alchemy Markets Ltd. or Alchemy (Malta) formerly known as NSFX Ltd. Alchemy (Malta) is an online trading brokerage firm regulated by

the Malta Financial Services Authority (MFSA). FDCTech will assume a business acquisition loan liability of $350,000 to purchase the

controlling interest in Alchemy (Malta).

FDCtech

amended the Agreement to February 28, 2023, to comply with the BVI Companies Act requirement for the change of ownership. FDCTech consolidated

the fair value of Alchemy (Malta) ‘s assets and liabilities on or on June 30, 2023 (“the Acquisition Date”). FDCTech

closed Alchemy (Malta) transactions as of June 30, 2023.

Alchemy

(Malta) is authorized to deal with its account (market maker) as a Category 3 licensed entity by the MFSA, receive and transmit orders

for retail and professional clients, and hold and control clients’ money and assets. Alchemy (Malta) services its customers in

the English, French, German, Italian, and Arabic-speaking markets. The customers can trade in currency, commodity, equity, and other

derivatives in real-time.

Note

1. Basis of Proforma Presentation

The

unaudited proforma condensed combined financial statements do not reflect what FDCTech’s operational results or financial status

would have been if the acquisition had taken place on the given dates. These proformas should not be viewed as predictors of future operational

outcomes or FDCTech’s financial standing.

The

unaudited proforma financial statements, including its notes, do not reflect any potential operating efficiencies and cost savings that

FDCTech may achieve concerning the combined companies. You should read the unaudited proforma condensed combined financial statements

and corresponding notes in conjunction with the historical financial statements of FDCTech included in the annual report on Form 10-K/A

for the year ended December 31, 2022, filed with the Securities and Exchange Commission (the “SEC “) on May 5, 2023, and

the subsequent quarterly report on Form 10-Q for the six months ended June 30, 2023, filed with the SEC on August 11, 2023, and in conjunction

with the historical financial statements of Alchemy (Malta) included in this Form 8-K.

The

unaudited pro forma condensed combined balance sheet as of June 30, 2023, incorporates the historical unaudited condensed balance sheet

of FDCTech and the historical unaudited condensed consolidated balance sheet of Alchemy (Malta) as of June 30, 2023, on a pro forma basis

as if the acquisition and related transactions, summarized below, had been consummated on June 30, 2023, which is the actual Acquisition

Date.

The

unaudited pro forma condensed combined statement of operations for the six months ended June 30, 2023, combines the historical unaudited

condensed statement of operations of FDCTech and the historical unaudited condensed consolidated statement of operations of Alchemy (Malta)

for the six months ended June 30, 2023, on a pro forma basis as if the acquisition and related transaction summarized below, had been

consummated on January 1, 2022.

The

unaudited pro forma combined statement of operations for the fiscal year ended December 31, 2022, combines the historical audited statement

of operations of FDCTech and the historical unaudited consolidated statement of operations of Alchemy (Malta) for such period on a pro

forma basis assuming FDCTech consummated the acquisition and related transactions on January 1, 2022.

Note

3. Adjustments to Unaudited Pro Forma Combined Financial Information.

Foreign

Currency Translation and Re-measurement

FDCTech

translates its foreign operations to US dollar (“USD”)

following ASC 830, “Foreign Currency Matters.”

We

have translated amounts from the local currency, Euro (“EUR”) of Alchemy (Malta), into US$1.00 at the following exchange

rates for the respective dates:

The

exchange rate at the reporting end date:

| | |

June 30, 2023 | |

| USD: EUR | |

$ | 0.9222 | |

Average

exchange rate for the period:

| | |

January 1, 2023, to June 30, 2023 | | |

January 1, 2022, to December 31, 2022 | |

| USD: EUR | |

$ | 0.9244 | | |

$ | 0.9510 | |

FDCTech

subsidiary’s functional currency is EUR, and

the reporting currency is the USD.

FDCTech

translates its records into USD as follows:

| |

● |

Assets

and liabilities at the rate of exchange in effect at the balance sheet date |

| |

● |

Equities

at the historical rate |

| |

● |

Revenue

and expense items at the average rate of exchange prevailing during the period |

Purchase

Price Allocation

On

December 31, 2022, FDCTech announced the sales purchase agreement (“Agreement”) under which FDCTech acquired a 50.10%

equity interest in New Star Capital Trading Ltd., a British Virgin Island company (“New Star”) and its operating subsidiary

Alchemy Markets Ltd. or Alchemy (Malta) formerly known as NSFX Ltd. Alchemy (Malta) is an online trading brokerage firm regulated by

the Malta Financial Services Authority (MFSA). FDCTech will assume a business acquisition loan liability of $350,000 to purchase the

controlling interest in Alchemy (Malta).

Alchemy

(Malta) ‘s Balance Sheet as of June 30, 2023 (Acquisition Date):

| Description | |

Fair value, $ | |

| Cash and cash equivalents (1) | |

| 24,510 | |

| Financial assets at fair value through profit and loss (2) | |

| 741,231 | |

| Receivables (3) | |

| 2,715,888 | |

| Fixed assets (4) | |

| 3,096 | |

| - Current liabilities (5) | |

| (482,022 | ) |

| - Deferred tax liabilities (6) | |

| (349,326 | ) |

| Net assets (A) | |

| 2,653,377 | |

| Purchase Price 50.10% (B) | |

| 350,000 | |

| Noncontrolling interest (C), 49.90% | |

| 1,324,035 | |

| FDCTech gain on bargain purchase (A) – (B) – (C) | |

| 979,342 | |

| |

(1) |

We

recognize cash and cash equivalents held by Alchemy (Malta) and deposits in bank accounts that can be accessed on demand or within

90 days. They are included in our cash and cash equivalents in the consolidated balance sheet as of June 30, 2023. We hold client

funds held by Alchemy (Malta) in the normal course of business in a fiduciary capacity; we do not include such funds in these financial

statements. |

| |

|

|

| |

(2) |

Financial

assets at fair values (or other current assets) for Alchemy (Malta) through profit and loss are derivative contracts in favor of

Alchemy (Malta). They are included in our other current assets in the consolidated balance sheet as of June 30, 2023. We determine

financial assets at fair values by reference to market prices or rates quoted at the end of the reporting period. Observable market

prices or rates support the valuation techniques since their variables include only data from observable markets. We categorize Alchemy

(Malta) ‘s derivative financial instruments as level 2. |

| |

|

|

| |

(3) |

Alchemy

(Malta) ‘s receivables mostly consist of amounts due from previous shareholders of New Star and are included in our accounts

receivable in the consolidated balance sheet as of June 30, 2023. |

| |

|

|

| |

(4) |

All

property and equipment are initially recorded at historical cost and included in our fixed assets, net in the consolidated balance

sheet as of June 30, 2023. Historical cost includes expenditures directly attributable to the acquisition of the items. We calculate

depreciation using the straight-line method to allocate their cost or revalued amounts to their residual values over their estimated

useful lives. |

| |

|

|

| |

(5) |

We

recognize deferred tax using the liability method on temporary differences between the tax bases of assets and liabilities and their

carrying amounts in the financial statements. We include deferred tax liabilities in our consolidated balance sheet as of June 30,

2023. However, deferred tax liabilities are not recognized if they arise from the initial recognition of goodwill; deferred tax is

not accounted for if it stems from the initial recognition of an asset or liability in a transaction other than a business combination

that at the time of the transaction affects neither accounting nor taxable profit or loss. Deferred tax is determined using tax rates

(and Malta laws) that have been enacted or substantially enacted by the end of the reporting period and are expected to apply when

the related deferred tax asset is realized, or the deferred tax liability is settled. |

The

adjustments included in the unaudited pro forma combined balance sheet as of June 30, 2023, are as follows:

| |

A.

|

As

the acquisition date and historical reporting date are June 30, 2023, we have credited $24,510 as cash since FDCTech’s balance

sheet already includes Alchemy’s (Malta) cash. |

| |

|

|

| |

B.

|

As

the acquisition date and historical reporting date are June 30, 2023, we have credited $2,715,888 as accounts receivable since FDCTech’s

balance sheet already includes Alchemy’s (Malta) receivable. |

| |

|

|

| |

C.

|

As

the acquisition date and historical reporting date are June 30, 2023, we have credited $741,231 as other current assets (Financial

assets at fair value through profit and loss) since FDCTech’s balance sheet already includes Alchemy’s (Malta) other

current assets. |

| |

|

|

| |

D.

|

As

the acquisition date and historical reporting date are June 30, 2023, we have credited $3,096 as fixed assets since FDCTech’s

balance sheet already includes Alchemy’s (Malta) fixed assets. |

| |

|

|

| |

E.

|

As

the acquisition date and historical reporting date are June 30, 2023, we have debited $482,022 as other current liabilities since

FDCTech’s balance sheet already includes Alchemy’s (Malta) other current liabilities. |

| |

|

|

| |

F.

|

As

the acquisition date and historical reporting date are June 30, 2023, we have debited $349,326 as deferred tax liabilities since

FDCTech’s balance sheet already includes Alchemy’s (Malta) deferred tax liabilities. |

| |

|

|

| |

G.

|

As

the acquisition date and historical reporting date are June 30, 2023, we have eliminated $878,733 Alchemy’s (Malta) retained

earnings.

|

| |

|

|

| |

H.

|

As

the acquisition date and historical reporting date are June 30, 2023, we have eliminated $1,774,644 Alchemy’s (Malta) paid-in-capital. |

The

adjustments included in the unaudited pro forma combined statement of operations for the six months ended June 30, 2023, are as follows:

| |

I.

|

In

an inter-company transaction, we have debited $90,000 as technology revenue from revenues received from Alchemy (Malta) during the

six months ended June 30, 2023. |

| |

|

|

| |

J.

|

In

an inter-company transaction, we have credited $90,000 as technology support expenses paid to FDCTech by Alchemy (Malta) during the

six months ended June 30, 2023. |

| |

|

|

| |

K.

|

As

the acquisition date and historical reporting date are June 30, 2023, we have eliminated the gain on purchase recorded due to the

difference (bargain purchase) between the book value of Alchemy (Malta) and the purchase price. |

The

adjustments included in the unaudited pro forma combined statements of operation for the fiscal year ended December 31, 2022, are as

follows:

| |

L.

|

In

an inter-company transaction, we have debited $132,000 as technology revenue from revenues from Alchemy (Malta) during the fiscal

year ending December 31, 2022. |

| |

|

|

| |

M.

|

In

an inter-company transaction, we have credited $132,000 as technology support expenses paid to FDCTech by Alchemy (Malta) during

the fiscal year ending December 31, 2022. |

Exhibit 99.2

Audited

Financial Statement of Alchemy Markets Ltd. for the period ending November 30, 2022, And 2021

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

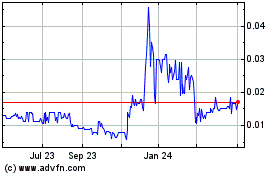

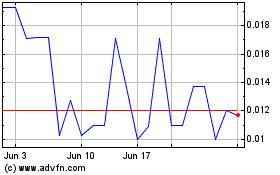

FDCTech (PK) (USOTC:FDCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

FDCTech (PK) (USOTC:FDCT)

Historical Stock Chart

From Apr 2023 to Apr 2024