0001374881false00013748812023-08-182023-08-18iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 18, 2023

Kingfish Holding Corporation |

(Exact name of registrant as specified in charter) |

Delaware | | 000-52375 | | 20-4838580 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

822 62nd Street Circle East, Bradenton, Florida | | 34208 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (941) 487-3653

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

None | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Second Amendment to Agreement and Plan of Merger

On August 18, 2023, Kingfish Holding Corporation, a Delaware corporation (the “Company”), and Renovo Resource Solutions, Inc., a Florida corporation (“Renovo”), entered into the Second Amendment (“Second Amendment”) to the Agreement and Plan of Merger, dated October 28, 2022 by and between the parties (the “Original Merger Agreement”), as previously amended by the First Amendment to the Merger Agreement, dated March 31, 2023 (“First Amendment”), whereby, among other things, Renovo will be merged with and into the Company (the “Merger”) in accordance with the provisions of the Delaware General Corporation Law (the “DGCL”) and the separate corporate existence of Renovo shall thereupon cease. The Company will be the legal surviving corporation in the Merger (“Surviving Corporation”). The Original Merger Agreement, the First Amendment, and the Second Amendment are referred to collectively herein as the “Merger Agreement”.

Pursuant to the terms and conditions of the Original Merger Agreement, Renovo had agreed to take all steps necessary to acquire 6 LLC, a Florida limited liability company owned and controlled by the shareholders of Renovo and which owns the real property located at 3324 63rd Avenue East, Bradenton, Florida 34203, including without limitation, the building located on the real property and all other structures and improvements located on the real property (“Property”) on which Renovo conducts its operations (“6 LLC”), pursuant to a merger transaction (“LLC Acquisition”) prior to the closing of the Original Merger Agreement (the “Acquisition Condition”). Each shareholder of Renovo owns an identical percentage of the outstanding equity of 6 LLC as they hold in Renovo.

On March 31, 2023, the parties entered into the First Amendment to, among other things, (a) extend the outside termination date for the closing of the Merger Agreement from March 31, 2023 to May 31, 2023 (“Outside Termination Date”), (b) change the exchange ratio (the “Exchange Ratio”) so as to reduce the number of shares of the Company’s common stock, par value $0.0001 per share (“Company Stock”), to be exchanged for each issued and outstanding share of Renovo common stock, no par value per share (“Renovo Stock”), at the effective time of the Merger (“Effective Time”) from 7,200 shares to 6,000 shares of the Company Stock for each share of Renovo Stock, after giving effect to the Reverse Stock Split, as defined in the Merger Agreement (“New Exchange Ratio”), and (c) to change those persons currently serving on the Renovo board of directors who will be appointed to serve as directors on the Company’s Board of Directors, effective immediately after the Effective Time.

Subsequent to the date of the First Amendment, the Company was advised by the shareholders of Renovo (“Renovo Owners”) that, as the sole equity holders of 6 LLC, compliance with the Acquisition Condition would have unanticipated material adverse tax consequences to the Renovo Owners. In particular, the acquisition of 6 LLC (which is a limited liability company currently taxed as a partnership) by Renovo would cause each owner of 6 LLC to recognize income tax gain to the extent that Renovo assumes the debt obligations and other liabilities of 6 LLC pursuant to the LLC Acquisition. The potential tax impact of the LLC Acquisition on each owner of 6 LLC (and, consequently, each Renovo Owner) would substantially exceed the value of the merger consideration received by each Renovo Owner pursuant to the Merger (“Adverse Tax Impact”).

As a result of the unanticipated Adverse Tax Impact, on May 18, 2023, the Renovo Owners proposed the following as an alternative to the Acquisition Condition (the “Renovo Proposal”) in an effort to reduce the Adverse Tax Impact whereby (a) instead of completing the LLC Acquisition prior to the Closing, the Company instead would be given an exclusive option to purchase 6 LLC for a period of years following the closing of the Merger (“Purchase Option”) and (b) Renovo and 6 LLC would enter into a new lease agreement (the “Lease”), with an initial term of two years for the Property on terms reasonably satisfactory to the Company. The Lease would be assumed by the Surviving Corporation as a result of the Merger.

In reviewing the Renovo Proposal, the Company noted that the Merger likely would not be able to close prior to the Outside Termination Date under the First Amendment and, although the continuing delays in the closing of the Merger were due to the lengthy period of time for completing the audit and the preparation of the other required disclosures relating to Renovo to be included in the Company’s post-Merger Form 8-K, under the terms of the Merger Agreement each party had certain rights to terminate the Merger Agreement after the Outside Termination Date.

In view of the potentially significant Adverse Tax Impact of the Acquisition Condition on the Renovo Owners and the passage of the Outside Termination Date, on June 2, 2023, the board of directors of the Company concluded that it would be in the best interests of the Company and its stockholders to negotiate the terms and conditions of the Second Amendment adopting and incorporating a purchase option agreement (“Purchase Option Agreement”) and the proposed Lease.

Commencing at the end of May 2023 and continuing through August 17, 2023, the Company and Renovo negotiated the terms and conditions of the Second Amendment and, together with 6 LLC, the terms and conditions of the Purchase Option Agreement and the proposed Lease attached as exhibits thereto.

During these negotiations, the details of the Renovo Proposal were specified and various revisions were made whereby, among other things:

| · | the period of time to exercise the Purchase Option was extended from two (2) years to five (5) years following the closing of the Merger. |

| | |

| · | the purchase price for the exercise of the Purchase Option was set at a price equal to the fair market value of 6 LLC as determined under the Purchase Option Agreement (described in greater detail below) plus a premium equal to 15% of such fair market value. |

| | |

| · | the Company was provided the option to pay the purchase price in cash, stock, or a combination thereof in either an asset purchase transaction or merger, or in a direct transaction with the equity owners of 6 LLC (“6 LLC Owners”). |

| | |

| · | the purchase price would be required to contain sufficient cash proceeds to satisfy the repayment of 6 LLC’s outstanding bank loan (“Bank Loan”) with Hancock Whitney Bank (the “Bank”) or, to the extent that the Company should assume the Bank Loan, the purchase price would be reduced by the amount of Bank Loan so assumed. |

| | |

| · | the Surviving Corporation was granted an option to extend the Lease for a period of five (5) following the initial two (2) year term. |

| | |

| · | the rental payments under the Lease during the initial term would be a set amount, the proceeds thereof to be applied to the payment of the debt obligations under the Bank Loan and to maintain the property, with 3% annual increases during any extension term. |

On August 17, 2023 the Company’s board of directors approved and the Company entered into the Second Amendment with Renovo.

Second Amendment

Pursuant to the Second Amendment, a copy of which is attached hereto as Exhibit 2.1, the parties have agreed to revise the Merger Agreement to, among other things:

| · | eliminate the Acquisition Condition, |

| | |

| · | require as a condition to the closing of the Merger that Renovo takes all steps necessary to cause: |

| (a) | 6 LLC to enter into the Lease with Renovo effective concurrently with or immediately after the closing of the Merger; and |

| | |

| (b) | 6 LLC and all of the 6 LLC Owners to enter into a Purchase Option Agreement with the Surviving Corporation. |

| · | require delivery of the executed Purchase Option Agreement and Lease at the closing of the Merger. |

| | |

| · | extending the Outside Termination Date to October 31, 2023. |

In reviewing the Second Amendment, the Company first considered a number of factors in deciding whether entering into the Second Amendment is in the best interests of the Company and its stockholders, including, without limitation:

| · | the fact that it no longer would receive ownership of an interest in fee simple in the Property on which its operations would be conducted post-Merger; |

| | |

| · | by not acquiring the Property, the Company, however, also would not (a) be assuming 6 LLC’s current debt obligations of approximately $5.7 million (the “6 LLC Debt”), which otherwise would have been assumed by the Surviving Corporation pursuant to the Merger, and (b) be required to pay certain upkeep costs and various taxes on the assets of 6 LLC; |

| | |

| · | that in lieu of the ownership of the Property, Renovo would be required to enter into a Lease with 6 LLC in the annual amount of $480,000 per year (“Rent Payment”) in order to continue using the Property for the Surviving Corporation’s business operations; |

| | |

| · | the Rent Payment is set at an amount that will permit 6 LLC to service its debt obligations under the Bank Loan and to pay the costs necessary to maintain the Property; |

| | |

| · | that the Purchase Option Agreement would afford the Surviving Corporation with the right to purchase the assets of 6 LLC, including the Property, on a debt free basis (unless the Surviving Corporation assumes the Bank Loan with the consent of the Bank), at the Purchase Price (as defined below); |

| | |

| · | if the Purchase Price is paid all or in part in shares of Common Stock, the value of shares so issued would be based on the reported price of the Common Stock prior to the acquisition of 6 LLC or its assets (which market value would reflect the post-Merger acquisition and operation of Renovo); |

| | |

| · | that the Premium payable for the 6 LLC assets is reasonable and fair to the Company and its stockholders for a strategic acquisition of the Property on which its operations are being conducted; and |

| | |

| · | that the New Exchange Ratio continued to be appropriate for the reasons set forth below. |

In considering these factors, the Company also specifically considered and determined that the New Exchange Ratio agreed to by the parties as set forth in the First Amendment should not be revised. In particular, the Company noted that:

| · | Due to the amount of the outstanding 6 LLC Debt (which includes the Bank Loan and various loans made to 6 LLC by affiliates of the 6 LLC Owners (“6 LLC Affiliate Debt”)) and other costs associated with the ownership of the Property, the elimination of the Acquisition Condition and the LLC Acquisition at the time of the Merger would not adversely affect the impact of the Merger transaction on the Company so long as the Surviving Corporation has the right to lease the Property on the terms set forth in the Lease and to purchase the 6 LLC Property and certain other assets in the future on the terms set forth in the Purchase Option Agreement. |

| | |

| · | The benefits of acquiring 6 LLC at the time of the Merger were offset by the savings achieved by not acquiring 6 LLC, and the Company concluded that no change in the New Exchange Ratio was warranted for deleting the Acquisition Condition, particularly when considering the risks and additional costs associated with deferring the potential purchase of the 6 LLC assets pursuant to the Purchase Option Agreement, |

| · | Although the original Exchange Ratio was previously reduced by the First Amendment due, in part, to increased interest rate and fees and costs associated with the Bank Debt as a result in the failure to consummate the Merger on the date set forth in the Original Merger Agreement (which Bank Loan originally was to be assumed by the Surviving Corporation pursuant to Merger), the Company concluded that the elimination of the assumption of the Bank Loan was offset by the fact that the Rent Payments that it will now be required to pay are set at an amount necessary to service 6 LLC’s debt obligations under Bank Loan and the 6 LLC Affiliate Debt, and as a result, the increased costs associated with the Bank Debt would continue to be indirectly passed to the Surviving Corporation in the form of the increased Rent Payments. |

| | |

| | In recognition of the new Rent Payment obligations to be incurred by the Surviving Corporation under the Lease, as well as the additional delay and expense associated with entering into the Lease and the Purchase Option Agreement, together with the expense of exercising the Purchase Option, the Company determined that there should be no increase in the exchange ratio for the Merger and the New Exchange Ratio set forth in the First Amendment continued to be appropriate. |

Purchase Option Agreement

Under the terms of the Purchase Option Agreement to be executed in connection with the closing of the Merger transaction, a copy of which is attached hereto as Exhibit B to the Second Amendment, the Surviving Corporation shall have the exclusive option, subject to certain conditions, in its sole discretion, exercisable at any time within five (5) years after the closing of the Merger (the “Expiration Time”), to acquire 6 LLC in a post-Merger transaction (the “Future Acquisition”) at a purchase price (“Purchase Price”) equal to (i) the fair market value of 6 LLC, as determined in accordance with the terms of the Purchase Option Agreement (“Fair Market Value”) plus (ii) a 15% premium equal to [fifteen] percent) of the Fair Market Value (“Premium”). It is a condition to the exercise of the Purchase Option that the Surviving Corporation either repay the Bank Loan or negotiate the assumption of the Bank Loan by the Surviving Corporation at the closing of the Future Acquisition.

The Fair Market Value will be determined by an independent appraisal of the fair market value of the 6 LLC assets (or, upon a bona fide offer with a firm price made by an unaffiliated third party within 12 months of an exercise of the Purchase Option by the Company).

Under the terms of the Purchase Option Agreement, the Surviving Corporation shall have the option to structure the Future Acquisition in any of the following structures:

| · | a purchase in cash by the Surviving Corporation or any wholly-owned subsidiary of the Surviving Corporation of all of the outstanding equity interests of 6 LLC (“6 LLC Equity Interests”), including, without limitation, all units of membership interest, directly from all of the 6 LLC Owners (an “Equity Purchase”); |

| | |

| · | an exchange transaction by the Surviving Corporation or any wholly-owned subsidiary of the Surviving Corporation to the 6 LLC Owners (“Exchange Transfer”) whereby all of the outstanding 6 LLC Equity Interests will be exchanged for shares of the Surviving Corporation’s shares of common stock (“SC Common Stock”) or a combination of cash and SC Common Stock; |

| | |

| · | engage in a merger transaction by and between the 6 LLC and the Surviving Corporation or any wholly-owned subsidiary of the Surviving Corporation (with the surviving subsidiary entity to be determined by the Surviving Corporation) whereby 6 LLC Owners will receive their prorated share of the aggregate Purchase Price from the payment of the merger consideration, which merger consideration shall be payable in cash or shares of SC Common Stock, as determined by the Surviving Corporation (“Company Merger”); or |

| | |

| · | a purchase by the Surviving Corporation or any wholly-owned subsidiary of the Surviving Corporation of all or substantially all of the assets of 6 LLC, which Purchase Price shall be payable in cash or shares of Common Stock, as determined by the Surviving Corporation (“Asset Acquisition”). |

To the extent that any portion of the Bank Loan remains outstanding at the time of the Future Acquisition, either (i) the cash portion of the Purchase Price must be sufficient to payoff any such amount or (ii) if the Company negotiates a Bank Loan Assumption, the dollar amount of the outstanding Bank Loan so assumed shall be applied to the payment of the Purchase Price. In each case, remaining Purchase Price proceeds (“Remaining Proceeds”) would be paid to the 6 LLC Owners or 6 LLC, depending on the structure of the transaction.

In the event that the Surviving Corporation should determine to use an acquisition structure whereby it will pay the Remaining Proceeds in Common Stock, the value of the Common Stock will be the average of the last daily sales price of Common Stock as reported by OTC Markets (otcmarkets.com), or if not reported thereby, another authoritative source selected by Surviving Corporation) for the ten (10) consecutive full trading days in which such shares are traded ending at the close of trading on the fifth business day preceding the LLC Acquisition closing.

The Purchase Option Agreement contains customary representations, warranties and covenants made by 6 LLC, including, among other things, covenants (i) to conduct its business in the ordinary course consistent with past practice during the option period and consummation of an Acquisition transaction; (ii) not to engage in certain kinds of transactions during such period; (iii) not to amend or propose to amend any of its organizational documents; (iv) not to incur any additional debt obligations and (v) not to enter into, amend or modify any material contract. The Purchase Option Agreement also is subject to a number of customary closing conditions. For a more detailed description of the conditions to the closing of an Acquisition and the representations, warranties and covenants made by 6 LLC, please review the Purchase Option Agreement attached as an exhibit to the Second Amendment filed herewith.

In reviewing the Purchase Price, the Company noted that (a) the Fair Market Value of 6 LLC would be determined by an independent appraisal of the fair market value of the 6 LLC assets (or, upon a bona fide offer with a firm price made by an unaffiliated third party within 12 months of an exercise of the Purchase Option by the Company), (b) the Premium paid as part of the Purchase Price was reasonable for a strategic acquisition of this type, (c) subject to the conditions described below, the Company has the option to pay all or a portion of the purchase price in cash and/or shares of Company Stock, (d) the exercise of the Purchase Option will be conditioned on the ability of the Company to either repay the Bank Loan at the closing of the Future Acquisition or to negotiate the assumption of the Bank Loan by the Company (“Bank Loan Assumption”) at the closing of the Future Acquisition (with the dollar amount of such assumption being applied as a payment of a portion of the Purchase Price), and (e) that any such purchase would be on debt free basis (unless the Company assumes the Bank Loan), meaning that all outstanding debt obligations of 6 LLC (including the 6 LLC Affiliate Debt) would need to be repaid and all liens on such assets would need to be extinguished as a condition to the purchase of such assets.

Lease

Under the terms of the Lease to be executed in connection with the closing of the Merger transaction, a copy of which is attached hereto as Exhibit A to the Second Amendment, Renovo (and following the Merger, the Surviving Corporation) will lease the Property from 6 LLC for annual rent of $480,000 paid in twelve (12) monthly payments of $40,000, which is inclusive of electrical, water, sewer, and other utilities. The Lease has an initial term of two years, and may be extended for a period of up to five (5) years by the Surviving Corporation. The terms of the Lease include customary terms regarding alterations to the Property, maintenance by 6 LLC (for purposes of the Lease, 6 LLC shall be referred to as the “Landlord”), insurance, and indemnification and generally reflect terms that would be typically negotiated in an at arm’s length transaction with modification to the termination provisions of the Lease to limit 6 LLC’s ability to terminate the Lease in light of the Purchase Option Agreement.

During the term of the Lease, the Landlord will be required to maintain the structural elements of the Property, which include, certain walls, the roof of the building, structural support and the foundation of the building. The Surviving Corporation will be require to otherwise maintain and repair the Property as needed, including maintenance related to plumbing, heating or electrical. The Surviving Corporation will be permitted to make any non-structural alterations as desired to the Property and has the right to install any equipment on the Property, which equipment will remain the sole property of the Surviving Corporation.

Interested Parties

Due to the ownership and other positions held by the Toomey Stockholders in the Company, Renovo and 6 LLC, the Company’s review of the Renovo Proposal and the negotiation of the Purchase Option Agreement, the Lease and the Second Amendment were not negotiated at arm’s-length. Because of the potential conflicts of interests, as a protection to unaffiliated stockholders of the Surviving Corporation, Renovo negotiated specific limitations on 6 LLC’s ability to assign the Lease while expanding Renovo’s assignment rights and limiting 6 LLC’s ability to terminate the Lease whether without cause or for cause. The Company considers these changes to be beneficial to Renovo and therefore beneficial to the Surviving Corporation following the Merger and assumption of the Lease. However, out of an abundance of caution, the Lease also was reviewed and approved by our CEO, Mr. Sparling, who is the sole non-interested director for purposes of the Merger and the Renovo Proposal.

The foregoing description of the Second Amendment, the Purchase Option Agreement, and the Lease does not purport to be complete and is qualified in its entirety by reference to the complete text of Second Amendment which is filed hereto as Exhibit 2.1, to this Current Report on Form 8-K, and the Purchase Option Agreement and the Lease are filed as exhibits to the Second Amendment, all of which are hereby incorporated by reference.

Renovo Promissory Note Addendum

Pursuant to the terms of the Merger Agreement, Renovo loaned $200,000 in principal amount to the Company on October 28, 2022 (“Renovo Loan”), evidenced by a promissory note, dated October 28, 2022, issued by the Company to Renovo. Under the terms of the Renovo Promissory Note, the Renovo Loan bears interest, commencing on the date of the loan, at an initial rate of 6% per annum and the note matures on October 28, 2024.

During the preparation of the audited financial statements for Renovo required as a condition to the closing of the Merger, Accell Audit & Compliance, P.A., an independent registered public accounting firm currently serving as the auditor for both the Company and Renovo, recommended for financial statement purposes that parties consider adding, as an option applicable only in the event the Merger does not close, for the Company to issue shares of its Common Stock to Renovo as payment on the maturity date for amounts owed and outstanding under the Renovo Promissory Note. Based on this recommendation, Renovo and the Company negotiated and entered into an addendum to the Renovo Promissory Note, dated August 18, 2023 (the “Renovo Promissory Note Addendum”) providing that in the event that the Merger does not close, the Company may issue shares of Common Stock to Renovo in order to satisfy its obligations under the Renovo Promissory Note, including accrued interest. For purposes of determining the number of shares of Common Stock to be issued in satisfaction of the Renovo Promissory Note, the value of the Common Stock shall be based on the price of the Common Stock as determined five business days prior to the payment date of the Renovo Loan.

The foregoing description of the Renovo Promissory Note Addendum does not purport to be complete and is qualified in its entirety by reference to the complete text of Renovo Promissory Note Addendum which is filed hereto as Exhibit 10.1, to this Current Report on Form 8-K, and is hereby incorporated by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | KINGFISH HOLDING CORPORATION | |

| | | | |

Date: August 18, 2023 | By: | /s/ Ted Sparling | |

| | Ted Sparling | |

| | | President and Chief Executive Officer | |

| | | | |

nullnull

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

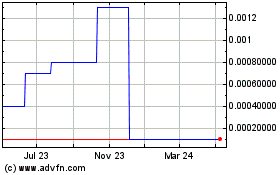

Kingfish (CE) (USOTC:KSSH)

Historical Stock Chart

From Mar 2024 to Apr 2024

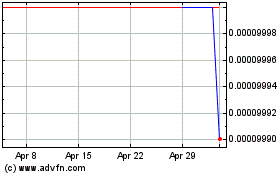

Kingfish (CE) (USOTC:KSSH)

Historical Stock Chart

From Apr 2023 to Apr 2024