0001498067

false

Q2

--12-31

0001498067

2023-01-01

2023-06-30

0001498067

2023-08-17

0001498067

2023-06-30

0001498067

2022-12-31

0001498067

2022-01-01

2022-06-30

0001498067

2023-04-01

2023-06-30

0001498067

2022-04-01

2022-06-30

0001498067

us-gaap:CommonStockMember

2022-12-31

0001498067

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001498067

CTGL:StockToBeIssuedMember

2022-12-31

0001498067

us-gaap:RetainedEarningsMember

2022-12-31

0001498067

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001498067

us-gaap:CommonStockMember

2023-03-31

0001498067

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001498067

CTGL:StockToBeIssuedMember

2023-03-31

0001498067

us-gaap:RetainedEarningsMember

2023-03-31

0001498067

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001498067

2023-03-31

0001498067

us-gaap:CommonStockMember

2021-12-31

0001498067

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001498067

CTGL:StockToBeIssuedMember

2021-12-31

0001498067

us-gaap:RetainedEarningsMember

2021-12-31

0001498067

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001498067

2021-12-31

0001498067

us-gaap:CommonStockMember

2022-03-31

0001498067

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001498067

CTGL:StockToBeIssuedMember

2022-03-31

0001498067

us-gaap:RetainedEarningsMember

2022-03-31

0001498067

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-03-31

0001498067

2022-03-31

0001498067

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001498067

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001498067

CTGL:StockToBeIssuedMember

2023-01-01

2023-03-31

0001498067

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001498067

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-03-31

0001498067

2023-01-01

2023-03-31

0001498067

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001498067

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001498067

CTGL:StockToBeIssuedMember

2023-04-01

2023-06-30

0001498067

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001498067

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-04-01

2023-06-30

0001498067

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001498067

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001498067

CTGL:StockToBeIssuedMember

2022-01-01

2022-03-31

0001498067

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001498067

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-03-31

0001498067

2022-01-01

2022-03-31

0001498067

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001498067

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001498067

CTGL:StockToBeIssuedMember

2022-04-01

2022-06-30

0001498067

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001498067

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-04-01

2022-06-30

0001498067

us-gaap:CommonStockMember

2023-06-30

0001498067

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001498067

CTGL:StockToBeIssuedMember

2023-06-30

0001498067

us-gaap:RetainedEarningsMember

2023-06-30

0001498067

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0001498067

us-gaap:CommonStockMember

2022-06-30

0001498067

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001498067

CTGL:StockToBeIssuedMember

2022-06-30

0001498067

us-gaap:RetainedEarningsMember

2022-06-30

0001498067

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-06-30

0001498067

2022-06-30

0001498067

CTGL:CannovationCenterIsraelLtdMember

CTGL:CitrineGlobalIsraelLtdMember

2020-08-20

0001498067

CTGL:CannovationCenterIsraelLtdMember

CTGL:BeezzHomeTechnologiesLtdMember

2020-08-20

0001498067

CTGL:CannovationCenterIsraelLtdMember

CTGL:GoldenHoldingsNetoLtdMember

2020-08-20

0001498067

CTGL:CannovationCenterIsraelLtdMember

CTGL:CitrineGlobalIsraelLtdMember

2021-08-09

0001498067

CTGL:IBOTIsraelBotanicalsLtdMember

2021-11-01

2021-11-30

0001498067

CTGL:IBOTIsraelBotanicalsLtdMember

2022-11-01

2022-11-30

0001498067

2022-06-10

2022-06-10

0001498067

CTGL:SRAccordLtdMember

us-gaap:LineOfCreditMember

CTGL:CannovationCenterIsraelLtdMember

2023-03-06

0001498067

CTGL:SRAccordLtdMember

us-gaap:LineOfCreditMember

CTGL:CannovationCenterIsraelLtdMember

2023-03-06

2023-03-06

0001498067

CTGL:SRAccordLtdMember

us-gaap:LineOfCreditMember

CTGL:CannovationCenterIsraelLtdMember

2023-03-07

2023-03-07

0001498067

2023-03-07

2023-03-07

0001498067

us-gaap:LineOfCreditMember

CTGL:CannovationCenterIsraelLtdMember

2023-06-30

0001498067

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

CTGL:OptionToPurchaseMyPlantSharesMember

2023-06-30

0001498067

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

CTGL:OptionToPurchaseMyPlantSharesMember

2023-06-30

0001498067

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

CTGL:OptionToPurchaseMyPlantSharesMember

2023-06-30

0001498067

us-gaap:FairValueMeasurementsRecurringMember

CTGL:OptionToPurchaseMyPlantSharesMember

2023-06-30

0001498067

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

2023-06-30

0001498067

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

2023-06-30

0001498067

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

2023-06-30

0001498067

us-gaap:FairValueMeasurementsRecurringMember

2023-06-30

0001498067

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

CTGL:FairValueOfConvertibleComponentinConvertibleNotesMember

2023-06-30

0001498067

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

CTGL:FairValueOfConvertibleComponentinConvertibleNotesMember

2023-06-30

0001498067

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

CTGL:FairValueOfConvertibleComponentinConvertibleNotesMember

2023-06-30

0001498067

us-gaap:FairValueMeasurementsRecurringMember

CTGL:FairValueOfConvertibleComponentinConvertibleNotesMember

2023-06-30

0001498067

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

CTGL:OptionToPurchaseMyPlantSharesMember

2022-12-31

0001498067

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

CTGL:OptionToPurchaseMyPlantSharesMember

2022-12-31

0001498067

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

CTGL:OptionToPurchaseMyPlantSharesMember

2022-12-31

0001498067

us-gaap:FairValueMeasurementsRecurringMember

CTGL:OptionToPurchaseMyPlantSharesMember

2022-12-31

0001498067

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

2022-12-31

0001498067

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

2022-12-31

0001498067

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001498067

us-gaap:FairValueMeasurementsRecurringMember

2022-12-31

0001498067

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

CTGL:FairValueOfConvertibleComponentinConvertibleNotesMember

2022-12-31

0001498067

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

CTGL:FairValueOfConvertibleComponentinConvertibleNotesMember

2022-12-31

0001498067

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

CTGL:FairValueOfConvertibleComponentinConvertibleNotesMember

2022-12-31

0001498067

us-gaap:FairValueMeasurementsRecurringMember

CTGL:FairValueOfConvertibleComponentinConvertibleNotesMember

2022-12-31

0001498067

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001498067

us-gaap:FairValueInputsLevel3Member

2023-01-01

2023-06-30

0001498067

us-gaap:FairValueInputsLevel3Member

2023-06-30

0001498067

CTGL:EmployeesAndDirectorsMember

2022-12-31

0001498067

CTGL:EmployeesAndDirectorsMember

2023-01-01

2023-06-30

0001498067

CTGL:EmployeesAndDirectorsMember

2023-06-30

0001498067

CTGL:ExercisePriceOneMember

2023-06-30

0001498067

CTGL:ExercisePriceOneMember

2023-01-01

2023-06-30

0001498067

CTGL:ExercisePriceTwoMember

2023-06-30

0001498067

CTGL:ExercisePriceTwoMember

2023-01-01

2023-06-30

0001498067

CTGL:ExercisePriceThreeMember

2023-06-30

0001498067

CTGL:ExercisePriceThreeMember

2023-01-01

2023-06-30

0001498067

CTGL:ExercisePriceFourMember

2023-06-30

0001498067

CTGL:ExercisePriceFourMember

2023-01-01

2023-06-30

0001498067

us-gaap:GeneralAndAdministrativeExpenseMember

2023-04-01

2023-06-30

0001498067

us-gaap:GeneralAndAdministrativeExpenseMember

2023-01-01

2023-06-30

0001498067

CTGL:CannasoulPurPlantandProfMeiriMember

CTGL:MyPlantBioLtdMember

2022-12-30

0001498067

CTGL:SharePurchaseAndOptionAgreementMember

CTGL:MyPlantBioLtdMember

CTGL:MyPlantSharesMember

2022-12-30

2022-12-30

0001498067

CTGL:SharePurchaseAndOptionAgreementMember

CTGL:MyPlantBioLtdMember

2022-12-30

2022-12-30

0001498067

CTGL:SharePurchaseAndOptionAgreementMember

CTGL:MyPlantBioLtdMember

CTGL:ShareholdersOptionMember

2022-12-30

2022-12-30

0001498067

CTGL:SharePurchaseAndOptionAgreementMember

CTGL:MyPlantBioLtdMember

CTGL:MyPlantOptionMember

2022-12-30

2022-12-30

0001498067

CTGL:SharePurchaseAndOptionAgreementMember

CTGL:MyPlantBioLtdMember

2022-12-30

0001498067

CTGL:SharePurchaseAndOptionAgreementMember

CTGL:MyPlantBioLtdMember

srt:MaximumMember

2022-12-30

0001498067

CTGL:ShareholdersOptionMember

2022-12-30

0001498067

CTGL:ShareholdersOptionMember

2023-06-30

0001498067

CTGL:ShareholdersOptionMember

us-gaap:MeasurementInputExpectedDividendRateMember

2022-12-30

0001498067

CTGL:ShareholdersOptionMember

us-gaap:MeasurementInputExpectedDividendRateMember

2023-06-30

0001498067

CTGL:ShareholdersOptionMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-12-30

0001498067

CTGL:ShareholdersOptionMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-06-30

0001498067

CTGL:ShareholdersOptionMember

us-gaap:MeasurementInputExpectedTermMember

2022-12-30

2022-12-30

0001498067

CTGL:ShareholdersOptionMember

us-gaap:MeasurementInputExpectedTermMember

2023-01-01

2023-06-30

0001498067

CTGL:ShareholdersOptionMember

us-gaap:MeasurementInputOptionVolatilityMember

2022-12-30

0001498067

CTGL:ShareholdersOptionMember

us-gaap:MeasurementInputOptionVolatilityMember

2023-06-30

0001498067

CTGL:ShareholdersOptionMember

us-gaap:MeasurementInputSharePriceMember

CTGL:MyPlantBioLtdMember

2022-12-30

0001498067

CTGL:ShareholdersOptionMember

us-gaap:MeasurementInputSharePriceMember

CTGL:MyPlantBioLtdMember

2023-06-30

0001498067

CTGL:ShareholdersOptionMember

us-gaap:MeasurementInputOptionVolatilityMember

CTGL:MyPlantBioLtdMember

2022-12-30

0001498067

CTGL:ShareholdersOptionMember

us-gaap:MeasurementInputOptionVolatilityMember

CTGL:MyPlantBioLtdMember

2023-06-30

0001498067

CTGL:MyPlantSharesMember

2022-12-30

0001498067

2022-12-30

0001498067

CTGL:ConvertibleNotePurchaseAgreementMember

CTGL:LendingLPsMember

2023-01-30

0001498067

CTGL:ConvertibleNotePurchaseAgreementMember

CTGL:LendingLPsMember

2023-01-30

2023-01-30

0001498067

CTGL:CitrineSALHiTech7LPMember

2022-09-30

0001498067

CTGL:CitrineSALHiTech7LPMember

2022-09-30

2022-09-30

0001498067

CTGL:LendingLPsMember

2023-05-09

2023-05-09

0001498067

CTGL:LendingLPsMember

2023-05-09

0001498067

CTGL:CitrineSALHiTech7LPMember

2023-01-30

0001498067

CTGL:ConvertibleNotePurchaseAgreementMember

CTGL:CitrineSALHiTech7LPMember

2023-01-30

0001498067

2023-01-30

2023-01-30

0001498067

us-gaap:WarrantMember

2023-01-30

0001498067

srt:MinimumMember

2023-01-01

2023-06-30

0001498067

us-gaap:WarrantMember

2023-01-01

2023-06-30

0001498067

us-gaap:MeasurementInputExpectedDividendRateMember

2023-01-30

0001498067

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-01-30

0001498067

us-gaap:MeasurementInputExpectedTermMember

2023-01-30

2023-01-30

0001498067

us-gaap:MeasurementInputOptionVolatilityMember

2023-01-30

0001498067

us-gaap:MeasurementInputSharePriceMember

2023-01-30

0001498067

us-gaap:MeasurementInputExercisePriceMember

2023-01-30

0001498067

us-gaap:MeasurementInputExpectedDividendRateMember

2023-06-30

0001498067

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-06-30

0001498067

us-gaap:MeasurementInputExpectedTermMember

2023-01-01

2023-06-30

0001498067

us-gaap:MeasurementInputOptionVolatilityMember

2023-06-30

0001498067

us-gaap:MeasurementInputSharePriceMember

2023-06-30

0001498067

us-gaap:MeasurementInputExercisePriceMember

2023-06-30

0001498067

CTGL:WarrantAMember

us-gaap:MeasurementInputExpectedDividendRateMember

2023-01-30

0001498067

CTGL:WarrantAMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-01-30

0001498067

CTGL:WarrantAMember

us-gaap:MeasurementInputExpectedTermMember

2023-01-30

0001498067

CTGL:WarrantAMember

us-gaap:MeasurementInputOptionVolatilityMember

2023-01-30

0001498067

CTGL:WarrantAMember

us-gaap:MeasurementInputSharePriceMember

2023-01-30

0001498067

CTGL:WarrantAMember

us-gaap:MeasurementInputExercisePriceMember

2023-01-30

0001498067

CTGL:WarrantAMember

2023-01-30

0001498067

CTGL:WarrantBMember

us-gaap:MeasurementInputExpectedDividendRateMember

2023-01-30

0001498067

CTGL:WarrantBMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-01-30

0001498067

CTGL:WarrantBMember

us-gaap:MeasurementInputExpectedTermMember

2023-01-30

0001498067

CTGL:WarrantBMember

us-gaap:MeasurementInputOptionVolatilityMember

2023-01-30

0001498067

CTGL:WarrantBMember

us-gaap:MeasurementInputSharePriceMember

2023-01-30

0001498067

CTGL:WarrantBMember

us-gaap:MeasurementInputExercisePriceMember

2023-01-30

0001498067

CTGL:WarrantBMember

2023-01-30

0001498067

CTGL:SRAccordLtdMember

us-gaap:LineOfCreditMember

CTGL:CannovationCenterIsraelLtdMember

2023-06-30

0001498067

CTGL:SRAccordLtdMember

us-gaap:LineOfCreditMember

CTGL:CannovationCenterIsraelLtdMember

us-gaap:SubsequentEventMember

2023-08-01

2023-08-01

0001498067

CTGL:LenderMember

2023-03-07

2023-03-07

0001498067

CTGL:ConsultantMember

2023-03-18

2023-03-18

0001498067

CTGL:ConsultantMember

2023-05-25

2023-05-25

0001498067

CTGL:LendingLPsMember

2023-06-26

0001498067

CTGL:LendingLPsMember

2023-06-26

2023-06-26

0001498067

us-gaap:RelatedPartyMember

2023-01-01

2023-06-30

0001498067

us-gaap:RelatedPartyMember

2022-01-01

2022-06-30

0001498067

us-gaap:RelatedPartyMember

2023-04-01

2023-06-30

0001498067

us-gaap:RelatedPartyMember

2022-04-01

2022-06-30

0001498067

us-gaap:RelatedPartyMember

us-gaap:ResearchAndDevelopmentExpenseMember

2023-01-01

2023-06-30

0001498067

us-gaap:RelatedPartyMember

us-gaap:ResearchAndDevelopmentExpenseMember

2022-01-01

2022-06-30

0001498067

us-gaap:RelatedPartyMember

us-gaap:ResearchAndDevelopmentExpenseMember

2023-04-01

2023-06-30

0001498067

us-gaap:RelatedPartyMember

us-gaap:ResearchAndDevelopmentExpenseMember

2022-04-01

2022-06-30

0001498067

us-gaap:RelatedPartyMember

us-gaap:GeneralAndAdministrativeExpenseMember

2023-01-01

2023-06-30

0001498067

us-gaap:RelatedPartyMember

us-gaap:GeneralAndAdministrativeExpenseMember

2022-01-01

2022-06-30

0001498067

us-gaap:RelatedPartyMember

us-gaap:GeneralAndAdministrativeExpenseMember

2023-04-01

2023-06-30

0001498067

us-gaap:RelatedPartyMember

us-gaap:GeneralAndAdministrativeExpenseMember

2022-04-01

2022-06-30

0001498067

us-gaap:RelatedPartyMember

2023-06-30

0001498067

us-gaap:RelatedPartyMember

2022-12-31

0001498067

CTGL:MsElhararSofferMember

2023-03-16

2023-03-16

0001498067

CTGL:IlanitHalperinMember

2023-03-16

2023-03-16

0001498067

us-gaap:SubsequentEventMember

us-gaap:LineOfCreditMember

CTGL:CannovationCenterIsraelLtdMember

2023-07-30

2023-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

utr:sqft

iso4217:ILS

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-Q

MARK

ONE

☒

Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for

the Quarterly Period ended June 30, 2023; or

☐

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for

the transition period from ________ to ________

Commission

file number 000-55680

CITRINE

GLOBAL, CORP

(Exact

name of registrant as specified in its charter)

| Delaware |

|

68-0080601 |

| (State

or other jurisdiction of |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Identification

No.) |

| 5

Golden Beach, Ceasarea Israel |

|

3088900 |

| (Address

of principal executive offices) |

|

Zip

Code |

+

(972) 9 855 1422

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☐ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As

of August 17, 2023, there were outstanding 965,479,039 shares of the registrant’s common stock, par value $0.0001 per share.

CITRINE

GLOBAL, CORP

Form

10-Q

June

30, 2023

CITRINE

GLOBAL, CORP.

CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS

AS

OF JUNE 30, 2023

CITRINE

GLOBAL, CORP.

CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS

AS

OF JUNE 30, 2023

U.S.

DOLLARS IN THOUSANDS

TABLE

OF CONTENTS

CITRINE

GLOBAL, CORP.

CONDENSED

CONSOLIDATED BALANCE SHEETS

(U.S.

dollars in thousands, except share and per share data)

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | | |

| | |

| Current Assets | |

| | | |

| | |

| Cash and cash equivalents | |

| 30 | | |

| 77 | |

| Prepaid expenses | |

| 401 | | |

| 88 | |

| Other current assets | |

| 17 | | |

| 20 | |

| Total Current assets | |

| 448 | | |

| 185 | |

| | |

| | | |

| | |

| Non-current assets | |

| | | |

| | |

| Investments valued under the measurement alternative | |

| 822 | | |

| 894 | |

| Property and equipment, net | |

| 218 | | |

| 230 | |

| Total non-current assets | |

| 1,040 | | |

| 1,124 | |

| Total assets | |

| 1,488 | | |

| 1,309 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Deficit | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Short term loans | |

| - | | |

| 82 | |

| Credit facility | |

| 53 | | |

| - | |

| Accounts payable and accrued expenses | |

| 452 | | |

| 247 | |

| Accrued compensation | |

| 1,610 | | |

| 1,476 | |

| Total current liabilities | |

| 2,115 | | |

| 1,805 | |

| | |

| | | |

| | |

| Non-current liability | |

| | | |

| | |

| |

| | | |

| | |

| Convertible component in convertible notes | |

| 125 | | |

| 161 | |

| | |

| | | |

| | |

| Convertible notes | |

| 2,020 | | |

| 1,814 | |

| | |

| | | |

| | |

| Total liabilities | |

| 4,260 | | |

| 3,780 | |

| | |

| | | |

| | |

| Stockholders’ Deficit | |

| | | |

| | |

| Common stock, par value $0.0001 per share, 1,500,000,000 shares authorized at June 30, 2023 and December 31, 2022; 965,479,039 and 943,703,873 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively | |

| 96 | | |

| 94 | |

| Additional paid-in capital | |

| 24,892 | | |

| 23,248 | |

| Stock to be issued | |

| 39 | | |

| 474 | |

| Accumulated deficit | |

| (27,930 | ) | |

| (26,402 | ) |

| Accumulated other comprehensive income | |

| 131 | | |

| 115 | |

| Total stockholders’ deficit | |

| (2,772 | ) | |

| (2,471 | ) |

| Total liabilities and stockholders’ deficit | |

| 1,488 | | |

| 1,309 | |

The

accompanying notes are an integral part of the condensed consolidated financial statements.

CITRINE

GLOBAL, CORP.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(U.S.

dollars in thousands, except share and per share data)

| | |

| | |

| | |

| | |

| |

| | |

Six months ended | | |

Three months ended | |

| | |

June 30 | | |

June 30 | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| | |

| | |

| | |

| | |

| |

| Research and development expenses | |

| (57 | ) | |

| (56 | ) | |

| (28 | ) | |

| (31 | ) |

| Marketing, general and administrative expenses | |

| (1,024 | ) | |

| (669 | ) | |

| (535 | ) | |

| (355 | ) |

| Operating loss | |

| (1,081 | ) | |

| (725 | ) | |

| (563 | ) | |

| (386 | ) |

| Financing expenses, net: | |

| | | |

| | | |

| | | |

| | |

| Income (expenses) related to convertible loan terms | |

| (429 | ) | |

| 7 | | |

| (100 | ) | |

| 386 | |

| Other financing expenses, net | |

| (18 | ) | |

| (17 | ) | |

| (13 | ) | |

| (6 | ) |

| Financing income (expenses), net | |

| (447 | ) | |

| (10 | ) | |

| (113 | ) | |

| 380 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to common stockholders | |

| (1,528 | ) | |

| (735 | ) | |

| (676 | ) | |

| (6 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per common stock (basic and diluted) | |

| -

* | | |

| -

* | | |

| -

* | | |

| -

* | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic weighted average number of shares of common stock outstanding | |

| 956,404,305 | | |

| 942,568,006 | | |

| 960,039,479 | | |

| 942,568,006 | |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive loss: | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (1,528 | ) | |

| (735 | ) | |

| (676 | ) | |

| (6 | ) |

| Other comprehensive income (loss) attributable to foreign currency translation | |

| 16 | | |

| 1 | | |

| 6 | | |

| (5 | ) |

| Comprehensive loss | |

| (1,512 | ) | |

| (734 | ) | |

| (670 | ) | |

| (11 | ) |

The

accompanying notes are an integral part of the condensed consolidated financial statements.

CITRINE

GLOBAL, CORP.

CONDENSED

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ DEFICIT

(U.S.

dollars in thousands, except share and per share data)

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

Common stock | | |

Additional paid-in | | |

Stock to be | | |

Accumulated | | |

Accumulated

other comprehensive | | |

Total stockholders’ | |

| | |

Stock | | |

Amount | | |

capital | | |

issued | | |

deficit | | |

income | | |

deficit | |

| BALANCE AT DECEMBER 31, 2022 | |

| 943,703,873 | | |

| 94 | | |

| 23,248 | | |

| 474 | | |

| (26,402 | ) | |

| 115 | | |

| (2,471 | ) |

| CHANGES DURING THE PERIOD OF THREE MONTHS ENDED MARCH 31, 2023: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of shares under share purchase agreement (note 4) | |

| 9,259,250 | | |

| 1 | | |

| 443 | | |

| (444 | ) | |

| - | | |

| - | | |

| - | |

| Issuance of shares for credit facility | |

| 3,232,016 | | |

| -

* | | |

| 123 | | |

| - | | |

| - | | |

| - | | |

| 123 | |

| Share based compensation to service providers | |

| 283,900 | | |

| -

* | | |

| -

* | | |

| 4 | | |

| - | | |

| - | | |

| 4 | |

| Warrants issued in connection with convertible notes | |

| - | | |

| - | | |

| 268 | | |

| - | | |

| - | | |

| - | | |

| 268 | |

| Share based compensation | |

| - | | |

| - | | |

| 269 | | |

| - | | |

| - | | |

| - | | |

| 269 | |

| Other comprehensive income | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 10 | | |

| 10 | |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| (852 | ) | |

| - | | |

| (852 | ) |

| BALANCE AT MARCH 31, 2023 (unaudited) | |

| 956,479,039 | | |

| 95 | | |

| 24,351 | | |

| 34 | | |

| (27,254 | ) | |

| 125 | | |

| (2,649 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of shares for services | |

| 9,000,000 | | |

| 1 | | |

| 332 | | |

| - | | |

| - | | |

| - | | |

| 333 | |

| Share based compensation to service providers | |

| - | | |

| - | | |

| - | | |

| 5 | | |

| - | | |

| - | | |

| 5 | |

| Share based compensation | |

| - | | |

| - | | |

| 209 | | |

| - | | |

| - | | |

| - | | |

| 209 | |

| Other comprehensive income | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 6 | | |

| 6 | |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| (676 | ) | |

| - | | |

| (676 | ) |

| BALANCE AT JUNE 30, 2023 (unaudited) | |

| 965,479,039 | | |

| 96 | | |

| 24,892 | | |

| 39 | | |

| (27,930 | ) | |

| 131 | | |

| (2,772 | ) |

CITRINE

GLOBAL, CORP.

CONDENSED

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ DEFICIT

(U.S.

dollars in thousands, except share and per share data

| | |

Common stock | | |

Additional paid-in | | |

Stock to be | | |

Accumulated | | |

Accumulated

other comprehensive | | |

Total stockholders’ | |

| | |

Stock | | |

Amount | | |

capital | | |

issued | | |

deficit | | |

income | | |

deficit | |

| BALANCE AT DECEMBER 31, 2021 | |

| 942,568,006 | | |

| 94 | | |

| 22,073 | | |

| 44 | | |

| (23,757 | ) | |

| 106 | | |

| (1,440 | ) |

| CHANGES DURING THE PERIOD OF THREE MONTHS ENDED MARCH 31, 2022: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Extinguishment of convertible note | |

| - | | |

| - | | |

| (162 | ) | |

| - | | |

| - | | |

| - | | |

| (162 | ) |

| Warrants issued in connection with convertible notes | |

| - | | |

| - | | |

| 100 | | |

| - | | |

| - | | |

| - | | |

| 100 | |

| Share based compensation | |

| - | | |

| - | | |

| 32 | | |

| - | | |

| - | | |

| - | | |

| 32 | |

| Other comprehensive income | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 6 | | |

| 6 | |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| (729 | ) | |

| - | | |

| (729 | ) |

| BALANCE AT MARCH 31, 2022 (unaudited) | |

| 942,568,006 | | |

| 94 | | |

| 22,043 | | |

| 44 | | |

| (24,486 | ) | |

| 112 | | |

| (2,193 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share based compensation | |

| - | | |

| - | | |

| 35 | | |

| - | | |

| - | | |

| - | | |

| 35 | |

| Other comprehensive income | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (5 | ) | |

| (5 | ) |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| (6 | ) | |

| - | | |

| (6 | ) |

| BALANCE AT JUNE 30, 2022 (unaudited) | |

| 942,568,006 | | |

| 94 | | |

| 22,078 | | |

| 44 | | |

| (24,492 | ) | |

| 107 | | |

| (2,169 | ) |

The

accompanying notes are an integral part of the condensed consolidated financial statements.

CITRINE

GLOBAL, CORP.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(U.S.

dollars in thousands, except share and per share data)

| | |

2023 | | |

2022 | |

| | |

Six months ended | |

| | |

June 30, | |

| | |

2023 | | |

2022 | |

| | |

(Unaudited) | |

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| | | |

| | |

| Net loss | |

| (1,528 | ) | |

| (735 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 1 | | |

| 1 | |

| Finance expenses, net | |

| 2 | | |

| 6 | |

| Financial expenses with respect to convertible notes and loans | |

| 467 | | |

| (8 | ) |

| Share based payment | |

| 487 | | |

| 67 | |

| Fair value adjustment of option to purchase MyPlant shares | |

| 73 | | |

| - | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Prepaid expenses and other current assets | |

| 33 | | |

| 20 | |

| Accounts payable and accrued expenses | |

| 368 | | |

| 336 | |

| Net cash used in operating activities | |

| (97 | ) | |

| (313 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| | |

| | | |

| | |

| Purchase of property and equipment | |

| - | | |

| (4 | ) |

| Net cash used in investing activities | |

| - | | |

| (4 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | | |

| | |

| Proceeds from issuance of convertible notes | |

| - | | |

| 180 | |

| Proceeds under credit facility | |

| 51 | | |

| - | |

| Net cash provided by financing activities | |

| 51 | | |

| 180 | |

| | |

| | | |

| | |

| Effect of exchange rates on cash and cash equivalents | |

| (1 | ) | |

| (6 | ) |

| | |

| | | |

| | |

| Net decrease in cash and cash equivalents | |

| (47 | ) | |

| (143 | ) |

| | |

| | | |

| | |

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH AT BEGINNING OF PERIOD | |

| 77 | | |

| 280 | |

| | |

| | | |

| | |

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH AT END OF PERIOD | |

| 30 | | |

| 137 | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Non-cash transactions: | |

| | | |

| | |

| Fair value of convertible component in convertible loan | |

| - | | |

| (48 | ) |

| Warrants issued in connection with convertible notes | |

| (268 | ) | |

| (100 | ) |

| Issuance of shares for credit facility | |

| 123 | | |

| - | |

| Extinguishment of convertible notes and loans | |

| (83 | ) | |

| (162 | ) |

| Issuance of shares for future services | |

| 222 | | |

| - | |

The

accompanying notes are an integral part of the condensed consolidated financial statements.

CITRINE

GLOBAL, CORP.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

NOTE

1 - GENERAL

Citrine

Global, Corp. (“Citrine Global” or the “Company”) was incorporated under the laws of the State of Delaware on

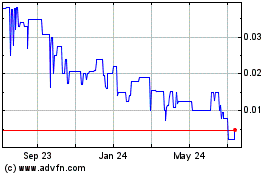

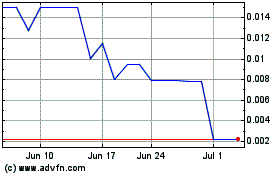

May 26, 2010. The Company’s common stock is traded in the United States on the OTCQB market under the ticker symbol “CTGL.”

On

June 3, 2020 the Company established a wholly owned new Israeli subsidiary: CTGL – Citrine Global Israel Ltd, (the “Israeli

Subsidiary”).

On

July 21, 2020, the Israeli Subsidiary began to work with certain Company shareholders, Beezz Home Technologies Ltd. (“Beezzhome”),

in which Ora Elharar Soffer, the Company’s chairperson and CEO holds shares, and Golden Holdings Neto Ltd., in which Ilan Ben-Ishai,

a former director of the Company, holds shares, have been working towards establishing an Operational Innovation Center focuses on plant

based wellness and pharma products and solutions. The Company’s Board of Directors approved the Israeli Subsidiary to proceed with

preparations for entering into an agreement to incorporate a new company, named Cannovation Center Israel Ltd. (“Cannovation”),

with Beezz Home Technologies Ltd. and Golden Holdings Neto Ltd., and to accept limitations on the Israeli Subsidiary’s rights in

the Cannovation Center if and as mandated under Israeli regulations on the involvement of foreign entities. On August 20, 2020, the Israeli

Subsidiary, Beezz Home Technologies Ltd., and Golden Holdings Neto Ltd. incorporated Cannovation. Israeli Subsidiary holds 60% of Cannovation’s

shares, while each of Beezz Home Technologies Ltd. and Golden Holdings Neto Ltd. holds 20% of its shares.

On

August 4, 2020, the Board of the Company approved for the Company and its Israeli Subsidiary to proceed with preparations for investing

in iBOT Israel Botanicals Ltd., (an affiliate) an Israeli nutritional supplements’ company developing and manufacturing botanical

formulas and nutritional supplements for custom & contract manufacturing for leading botanical companies (“iBOT”). The

principal shareholders and control persons of iBOT are the Company’s Chief Executive Officer, President and Chairperson. iBOT has

a manufacturing facility for a wide range of botanical formulations. iBOT’s manufacturing facility is approved by the Israeli Ministry

of Health and is GMP-certified, ISO 9001-certified and HACCP certified by IQC. On August 4, 2020, the Board of Directors approved for

the Company and Citrine Global Israel to proceed with preparations for investing in iBOT. On August 9, 2021, through the 60% owned subsidiary

Cannovation Center Israel, the Company entered into an agreement with iBOT pursuant to which iBOT agreed to manufacture a line of nutritional

supplements for Cannovation Center Israel, including packaging and storage.

In

November 2021, iBOT granted to Citrine Global Group, a pre-emption right to any equity or equity linked securities that iBOT proposes

to issue to an unrelated third party with aggregate gross proceeds to iBot exceeding $1 million or which will result in a change in control

in iBOT following such issuance, then iBOT is to give to the Citrine Global Group written notice of such proposed issuance and the relevant

terms thereof and the Citrine Global Group shall have ten (10) days thereafter to determine if it elects to purchase a minimum of 51%

of the proposed issuance on the price and other terms specified in the notice sent by iBOT (the “Pre-Emption Right”). If

the Citrine Global Group elects to exercise the Pre-Emption Right, such purchase is to take place at no more than 90 days following the

expiration of the 10 day notice period to the Citrine Global Group. Any iBOT securities of the Pre-Emption Right that Citrine Global

Group elects to not purchase are to be sold by not later than 90 days following the end of the Citrine Global Group’s notice period

and if such shares are not sold to such third party within the 90 day period, the Pre-Emption right shall apply to any subsequent proposed

issuance. The preemption right does not apply to certain specified exceptions.

In

November 2022 the Company and iBOT agreed to extend to March 31, 2023 the pre-emption right previously granted to the Company with respect

to any equity or equity linked securities that iBOT proposes to issue to an unrelated third party with aggregate gross proceeds to iBOT

exceeding $1 million or which will result 51% in a change in control in iBOT following such issuance. In March 2023, the Company and

iBOT agreed to further extend to December 31, 2023 such right.

CITRINE

GLOBAL, CORP.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

Stock

split

On

June 10, 2022, certain of the Company’s stockholders representing more than 50% of the Company’s outstanding share capital

(the “Majority Consenting Stockholders”) approved an amendment to the Company’s Certificate of Incorporation (the “Reverse

Stock Split Certificate of Amendment”) in order to effect a reverse stock split of the Company’s common stock pursuant to

a range of between 50-to-1 and 700-to-1 (the “Reverse Stock Split”). Pursuant to the Reverse Stock Split, each fifty or seven

hundred shares of common stock (or any whole number within such range), as shall be determined by the Board at a later time, will be

automatically converted, without any further action by the stockholders, into one share of common stock. No fractional shares of common

stock will be issued as the result of the Reverse Stock Split. Instead, each stockholder of the Company will be entitled to receive one

share of common stock in lieu of the fractional share that would have resulted from the Reverse Stock Split. The Reverse Stock Split

Certificate of Amendment will be effective upon receipt of approval from the Financial Industry Regulatory Authority (“FINRA”)

and the filing with the Secretary of the State of Delaware, both of which were not completed as of the date of the approval of the financial

statements.

Financial

support

The

Company has not yet to generate revenues and is dependent on raising funds from its current shareholders or from other sources. On April

13, 2021, Citrine S A L, on behalf of itself and its affiliates and related parties, has furnished the Company with an irrevocable letter

of obligation to financially support the Company until June 30, 2022. On March 17, 2022, Citrine S A L Investment & Holding Ltd.

extended this support through June 30, 2023. On August 14, 2022, Citrine S A L Investment & Holding Ltd. further extended this support

through June 30, 2024.

In

addition, on March 6, 2023 Cannovation and S.R. Accord Ltd., an Israeli company (“Lender”), entered into an 18-month credit

facility agreement (the “Credit Facility”) pursuant to which Lender has committed to fund Cannovation in an aggregate amount

of 3,000,000 NIS (approximately $857,000), as needed. At the time of each draw down, Cannovation and Lender will determine the maturity

date of the loan. All amounts drawn under the Credit Facility will bear interest at an monthly rate of 1.7%. Cannovation has the right

to pre-pay the entire amount outstanding under the Credit Facility at any time. As security for any loans under the Credit Facility,

Cannovation granted the Lender a first priority lien on its rights to the 125,000 sq ft (11,687 sq meters) of industrial land in Yerucham.

The lien will become effective only if Cannovation utilizes the Credit Facility. If the market value of the Premises is less than the

amount outstanding under the Credit Facility, then Lender will be entitled to additional security including additional shares of Citrine

Global common stock, on such terms and conditions as the parties may agree. As additional security for any payments due to Lender, (i)

the Israeli Subsidiary, (ii) Beezzhome and (iii) Netto Holdings, an unaffiliated entity under the partial control of Ilan Ben Ishay,

a director on the board of Cannovation, as well as each of Ms. Elharar Soffer and Mr. Ben Ishay have, in their personal capacities, provided

guarantees for the repayment of any amounts that may be owing to Lender under the Credit Facility. The Company, CTGL – Citrine

Global Israel Ltd. and Cannovation have agreed to indemnify Ms. Elharar Soffer and Mr. Ben Ishay for any losses they incur as a result

of the personal guarantees.

On

March 7, 2023, the Company issued to the Lender and a consultant 3,232,016

shares of the Company’s common stock as a commitment fee in respect of the provision of the Credit Facility (valuated at

$123

thousand). As of the date of this report, Cannovation utilized $51,000

of the credit line and has requested from the Lender an additional drawdown of $120,000 which is as of the date of this report is

being processed.

The

Company has no significant firm commitments that require it to remit cash and can control the level of expenses it incurs. Based on the

Company’s current cash balances, and the access to the Credit Facility noted above, management believes the Company will have sufficient

funds for its plans for the next twelve months from the issuance of these financial statements. As the Company is embarking on its business

plan, it is incurring losses. It cannot determine with reasonable certainty when and if it will have sustainable profits.

CITRINE

GLOBAL, CORP.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

NOTE

2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND BASIS OF PRESENTATION

Unaudited

Interim Financial Statements

The

accompanying unaudited condensed consolidated financial statements include the accounts of the Company and its subsidiary, prepared in

accordance with accounting principles generally accepted in the United States of America (“GAAP”) and with the instructions

to Form 10-Q. In the opinion of management, the financial statements presented herein have not been audited by an independent registered

public accounting firm but include all material adjustments (consisting of normal recurring adjustments) which are, in the opinion of

management, necessary for a fair statement of the financial condition, results of operations and cash flows for the six and three months

ended June 30, 2023. However, these results are not necessarily indicative of results for any other interim period or for the year ended

December 31, 2023.

Certain

information and footnote disclosures normally included in financial statements in accordance with generally accepted accounting principles

have been omitted pursuant to the rules of the U.S. Securities and Exchange Commission (“SEC”). These financial statements

should be read in conjunction with the financial statements and notes thereto contained in the Company’s Annual Report on Form

10-K for the year ended December 31, 2022.

Use

of Estimates

The

preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements

and the reported amounts of expenses during the reporting periods. Significant estimates include fair value estimates of derivative liabilities

and assets. Actual results could differ from those estimates.

Fair

value

Fair

value of certain of the Company’s financial instruments including cash, accounts payable, accrued expenses, and other accrued liabilities

approximate cost because of their short maturities. The Company measures and reports fair value in accordance with Accounting Standards

Codification (“ASC”) 820, “Fair Value Measurements and Disclosure,” which defines fair value, establishes a framework

for measuring fair value in accordance with generally accepted accounting principles and expands disclosures about fair value measurements.

Fair

value, as defined by ASC 820, is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction

between market participants at the measurement date. The fair value of an asset should reflect its highest and best use by market participants,

principal (or most advantageous) markets, and an in-use or an in-exchange valuation premise. The fair value of a liability should reflect

the risk of nonperformance, which includes, among other things, the Company’s credit risk.

Valuation

techniques are generally classified into three categories: (i) the market approach; (ii) the income approach; and (iii) the cost approach.

The selection and application of one or more of the techniques may require significant judgment and are primarily dependent upon the

characteristics of the asset or liability, and the quality and availability of inputs. Valuation techniques used to measure fair value

under ASC 820 must maximize the use of observable inputs and minimize the use of unobservable inputs. ASC 820 also provides fair value

hierarchy for inputs and resulting measurement as follows:

CITRINE

GLOBAL, CORP.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

NOTE

2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND BASIS OF RESENTATION (cont.)

Fair

value (cont.)

Level

1: Quoted prices (unadjusted) in active markets that are accessible at the measurement date for identical assets or liabilities.

Level

2: Quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in

markets that are not active; inputs other than quoted prices that are observable for the asset or liability; and inputs that are derived

principally from or corroborated by observable market data for substantially the full term of the assets or liabilities; and

Level

3: Unobservable inputs for the asset or liability that are supported by little or no market activity, and that are significant to the

fair values.

Fair

value measurements are required to be disclosed by the level within the fair value hierarchy in which the fair value measurements in

their entirety fall. Fair value measurements using significant unobservable inputs (in level 3 measurements) are subject to expanded

disclosure requirements including a reconciliation of the beginning and ending balances, separately presenting changes during the period

attributable to the following: (i) total gains or losses for the period (realized and unrealized), (ii) segregating those gains or losses

included in earnings, and (iii) a description of where those gains or losses included in earning are reported in the statement of operations.

The

Company’s financial assets and liabilities that are measured at fair value on a recurring basis by level within the fair value

hierarchy are as follows:

SCHEDULE

OF FINANCIAL ASSETS AND LIABILITIES MEASURED AT FAIR VALUE ON A RECURRING BASIS

| | |

| | |

| | |

| | |

| |

| | |

Balance as of June 30, 2023 | |

| | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| | |

US$ in thousands | |

| | |

| | |

| | |

| | |

| |

| Assets: | |

| | | |

| | | |

| | | |

| | |

| Option to Purchase MyPlant shares | |

| - | | |

| - | | |

| 218 | | |

| 218 | |

| Total assets | |

| - | | |

| - | | |

| 218 | | |

| 218 | |

| | |

| | | |

| | | |

| | | |

| | |

| Liabilities: | |

| | | |

| | | |

| | | |

| | |

| Fair value of convertible component in convertible notes | |

| - | | |

| - | | |

| 125 | | |

| 125 | |

| Total liabilities | |

| - | | |

| - | | |

| 125 | | |

| 125 | |

CITRINE

GLOBAL, CORP.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

NOTE

2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND BASIS OF RESENTATION (cont.)

| | |

| | |

| | |

| | |

| |

| | |

Balance as of December 31, 2022 | |

| | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| | |

US$ in thousands | |

| Assets: | |

| | |

| | |

| | |

| |

| Option to Purchase MyPlant shares | |

| - | | |

| - | | |

| 291 | | |

| 291 | |

| Total assets | |

| - | | |

| - | | |

| 291 | | |

| 291 | |

| Liabilities: | |

| | | |

| | | |

| | | |

| | |

| Convertible component in convertible notes | |

| - | | |

| - | | |

| 161 | | |

| 161 | |

| Total liabilities | |

| - | | |

| - | | |

| 161 | | |

| 161 | |

The

following table presents the changes in fair value of the level 3 assets and liabilities for the period ended June 30, 2023:

SCHEDULE

OF CHANGES IN FAIR VALUE OF LEVEL 3 ASSETS AND LIABILITIES

| | |

Changes in Fair value | |

| | |

US$ in thousands | |

| Assets: | |

| | |

| Outstanding at December 31, 2022 | |

| 291 | |

| Changes in fair value | |

| 73 | |

| Outstanding at June 30, 2023 | |

| 218 | |

| | |

Changes in Fair value | |

| | |

US$ in thousands | |

| Liabilities: | |

| | |

| Outstanding at December 31, 2022 | |

| 161 | |

| Initial recognition of convertible component as part of convertible notes issued | |

| 8 | |

| Changes in fair value | |

| (44 | ) |

| Outstanding at June 30, 2023 | |

| 125 | |

Credit

line issuance costs

Costs

associated with entering into a revolving line of credit or revolving-debt arrangement are costs incurred in exchange for access to capital.

These fees are paid regardless of whether the funds are ever drawn down. Such costs are recorded as such on the balance sheet as prepaid

expenses. Upon drawing down a portion of the credit line, the applicable portion of the costs related to that draw down is presented

as a direct deduction from the carrying value of the debt when drawn and amortized as finance expenses using the effective interest method.

Recent

Accounting Pronouncements

New

pronouncements issued but not effective as of June 30, 2023 are not expected to have a material impact on the Company’s consolidated

financial statements.

CITRINE

GLOBAL, CORP.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

NOTE

3 – STOCK OPTIONS

On

March 5, 2023, the Board of the Company determined that in the event that the Company’s stock is listed on the Nasdaq Stock Market,

then one half of the awarded but unvested option grants made in each of August 2021 and in August 2022, including to officers, directors,

will immediately vest at such time. In addition, the Board also determined to provide that following the termination of services by an

officer, director or a selected service provider for any reason other than cause, such person shall have a one year period from the date

of termination to exercise any option that was vested at the time of the termination of services.

The

following table presents the Company’s stock option activity for employees and directors of the Company for the year ended June

30, 2023:

SCHEDULE

OF STOCK OPTION ACTIVITY

| | |

Number of Options | | |

Weighted Average Exercise Price ($) | |

| Outstanding at December 31, 2022 | |

| 122,529,342 | | |

| 0.026 | |

| Granted | |

| - | | |

| - | |

| Exercised | |

| - | | |

| - | |

| Forfeited or expired | |

| - | | |

| - | |

| Outstanding at June 30, 2023 | |

| 122,529,342 | | |

| 0.026 | |

| Number of options exercisable at June 30, 2023 | |

| 48,744,870 | | |

| 0.037 | |

The

stock options outstanding as of June 30, 2023, have been separated into exercise prices, as follows:

SCHEDULE

OF STOCK OPTIONS OUTSTANDING

| Exercise price | | |

Stock options outstanding | | |

Weighted average remaining contractual life – years | | |

Stock options vested | |

| $ | | |

As of June 30, 2022 | |

| | 0.0011 | | |

| 46,762 | | |

| 3.50 | | |

| 46,762 | |

| | 0.02 | | |

| 42,415,560 | | |

| 2.11 | | |

| 10,603,890 | |

| | 0.022 | | |

| 47,128,400 | | |

| 2.11 | | |

| 11,782,101 | |

| | 0.05 | | |

| 32,938,620 | | |

| 3.55 | | |

| 26,312,117 | |

| | | | |

| 122,529,342 | | |

| 2.89 | | |

| 48,744,870 | |

Compensation

expense recorded by the Company in respect of its stock-based compensation awards for the six and three months ended June 30, 2023 were

$478 thousands and $209 thousands, respectively, and are included in General and Administrative expenses in the Statements of Operations.

CITRINE

GLOBAL, CORP.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

NOTE

4 - INVESTMENTS VALUED UNDER THE MEASUREMENT ALTERNATIVE

| |

A. |

On December 30, 2022, the Company, MyPlant Bio Ltd., a company

incorporated under the laws of the State of Israel (“MyPlant”), Cannasoul Analytics Ltd., a company incorporated under the

laws of Israel (“Cannasoul”), and PurPlant Inc., a company duly incorporated under the laws of Canada (“PurPlant”)

(Cannasoul and PurPlant are collectively referred to as the “Shareholders”), and Professor Dedi Meiri, an Israeli individual

(“Prof Meiri”) entered into the Share Purchase and Option Agreement (the “Share Purchase and Option Agreement”)

for the purchase by the Company of up to 55% of MyPlant’s issued and outstanding share capital on a fully diluted basis |

The

Company purchased from the Shareholders an aggregate of 15,211 ordinary shares of MyPlant (the “MyPlant Shares”) representing,

on a fully diluted basis, 10% of the outstanding MyPlant Shares, in consideration for the payment of $444,444 by the issuance by the

Company to the selling Shareholders of an aggregate of 9,259,250 shares of the Company’s common stock.

In

addition, under the Share Purchase and Option Agreement, the Company granted an option by the MyPlant shareholders to purchase an additional

35% of MyPlant Shares, on a fully diluted basis (the “Shareholders Option”), in consideration of $1,555,556

payable by the issuance of up to 32,407,417

shares of our common stock to the MyPlant shareholders,

and a separate option by MyPlant to purchase an additional 10% of the MyPlant Shares, on a fully diluted basis (the “MyPlant Option”),

in consideration of $444,444,

which is payable, in the Company’s sole discretion, in cash or in the issuance to MyPlant of up to 9,259,250

shares of our common stock.

Said

options are exercisable through September 30, 2023 (the “Option Expiry Date”). If both the shareholders Option and the Company

Options are exercised, the Company will hold 55% of MyPlant Shares, on a fully diluted basis. Under the Share Purchase and Option Agreement,

the Company is authorized to continue its due diligence through the Option Expiry Date. The number of shares is subject to adjustment

in respect of any stock split or other recapitalization of the Company.

The

transactions under the Share Purchase and Option Agreement are based on a MyPlant company valuation of approximately $4.45 million. The

Company is authorized at any time on or before the Option Expiry Date to obtain an independent third-party valuation of MyPlant. If it

is determined by such third party valuation that the MyPlant valuation is less than $4.45 million then the consideration payable in respect

of the exercise price of the options will be accordingly adjusted, provided however that in any case MyPlant’s valuation in the

transaction shall not be below US$1,000,000.

The

options to purchase MyPlant shares were also accounted using the measurement alternative. Since the options’ value are subject

to the changes in Citrine shares’ value, there are indicators to a change in the options’ value at each reporting date, and

therefore the following valuation method was implemented.

CITRINE

GLOBAL, CORP.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

NOTE

4 - INVESTMENT VALUED UNDER THE MEASUREMENT ALTERNATIVE (continue)

Fair

Value Proportional Allocation

The

Company estimated the fair value of Shareholders Option using the Monte Carlo option pricing model using the following weighted average

assumptions:

SCHEDULE

OF FAIR VALUE OF SHAREHOLDERS OPTION USING VALUATION ASSUMPTIONS

| | |

December 30, 2022 | | |

June 30, 2023 | |

| Dividend yield | |

| 0 | % | |

| 0 | % |

| Risk-free interest rate | |

| 4.71 | % | |

| 5.27 | % |

| Expected term (years) | |

| 0.78 | | |

| 0.25 | |

| Company’s volatility | |

| 114.80 | % | |

| 36.97 | % |

| MyPlant share price (U.S. dollars) | |

| 10.04 | | |

| 10.04 | |

| MyPlant volatility | |

| 55.29 | % | |

| 67.55 | % |

| Alternative investment measurement input | |

| 55.29 | % | |

| 67.55 | % |

The

fair value of the Shareholders Option as of December 30, 2022 and June 30, 2023 was estimated at $291 thousands and $355 thousands, respectively.

Based

on the above, the fair value proportion allocation as of December 30, 2022 was as follows:

SCHEDULE

OF FAIR VALUE PROPORTION ALLOCATION

| | |

December 30, 2022 | |

| Shareholders option | |

$ | 291 | |

| MyPlant’s shares | |

| 153 | |

| | |

$ | 444 | |

Under

the Share Purchase and Option Agreement, MyPlant granted to the Company the exclusive right to utilize MyPlant’s activities as

specified in the agreement, including without limitation, the screening platforms using cell line models for certain diseases and conditions

to detect effective plant materials and/or other substances for the treatment of these conditions and a and a right of first opportunity

to commercialize intellectual property developed by MyPlant that is in the Company’s (or its subsidiaries’) field of business,

provided that, if by December 31, 2023 the Company does not exercise either of the Shareholders Option or the MyPlant Option and/or enter

into a service agreement with MyPlant, then the exclusive rights shall terminate but the right of first opportunity to commercialize

intellectual property developed by MyPlant shall continue thereafter until June 31, 2024, unless such rights have been extended beyond

such date under the terms to be agreed in the service agreement entered into by the Company and Citrine Global. In addition, under the

Share Purchase and Option Agreement, Cannasoul, MyPlant’s majority Shareholder, agreed to not compete with MyPlant’s activities.

The

Company was granted observer rights on the MyPlant board of Directors (the “MyPlant Board”). Following the exercise by Citrine

Global of the Shareholders Option, the MyPlant Board shall be comprised of four (4) directors of which MyPlant will be authorized to

designate two of such directors.

CITRINE

GLOBAL, CORP.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

NOTE

5 – CONVERTIBLE NOTES

| |

A. |

On

January 30, 2023 the Company and each of Citrine High Tech 7 LP (“LP 7”), Citrine 8 LP (“LP 8 “) and Citrine

9 LP (“LP 9”; together with LP 7 and LP 8, the “Lending LP”), the lending entities under and parties to the

Convertible Note Purchase Agreement entered into by the Company and several related parties in April 2020, as subsequently amended

(the “CL Agreement”), have entered into an agreement (the “Agreement”) pursuant to which they have agreed

to extend the maturity date on all outstanding convertible loans in the principal amount of $1,800,000 under the CL Agreement to

May 31, 2024. |

In

addition, under the Agreement the Company and the Lending LPs have also agreed that if the Company’s common stock is listed on

the Nasdaq Stock Market, then the Company, in its sole discretion, shall determine to convert, in whole or in part, the outstanding amount

of the above mentioned notes to shares of the Company’s common stock at a conversion price equal to the price paid by the public

investors for the common stock in the offering accompanying the listing.

The

Company concluded that the above mentioned change in terms constitutes a trouble debt restructuring, due to its financial condition and

the relief that the abovementioned changes provided.

Therefore,

the Company concluded that the change in terms should be accounted for as a modification. A new effective interest rate was established

based on the carrying value of the debt and the revised cash flows.

On

September 30, 2022, the Company received a loan from Citrine S A L Hi Tech 7 LP, an Israeli limited partnership and an affiliated entity,

in the principal amount of $80,000. The loan bear interest at 12% per annum and was originally scheduled to mature on December 15, 2022,

but the maturity date was extended to May 31, 2024. The principal and interest payment on the loan are to be made in New Israeli Shekels

(NIS) at the exchange rate which was in effect on the date on which the loan was advanced.

On

May 9, 2023, the Company’s Board determined to provide that until the earlier of the satisfaction in full of the convertible loans

or the termination of the exercise period of the warrants for an aggregate of 62,178,554

shares previously issued to the Lending LPs (the

“Warrants”), if the Company’s common stock were to be listed on the Nasdaq Stock Market and the per share public price

of the offering accompanying such listing is less than the then current exercise price of the Warrants, then the Warrant exercise price

shall be adjusted to that of the public offering price, provided that if such listing and accompanying offering do not occur by June

30, 2023, then the exercise price of the Warrants shall remain at its then current exercise price or may be adjusted to a lower exercise

price as determined by Company’s Board and in agreement with the Lending LPs. As the offering

has not been achieved by June 26, 2023, the Board decided that the Warrant exercise price shall remain unchanged at $0.05 and also provide

that the upon the implementation of the reverse split, the Warrants per share exercise price would be unaffected by the reverse split

and would remain at $0.05 though the number of warrant shares would be subject to the reverse stock split.

| |

B. |

On

January 30, 2023 Citrine S A L Hi Tech 7 LP agreed to change the terms of this loan, which amounted to $83,000 (including accrued

interest) such that such terms shall be adjusted on a pro-rata basis, to those terms applicable to the Company’s convertible

notes then outstanding under the Convertible Note Agreement (as detailed in note 5 A above). |

As

provided for under the terms of the Convertible Note Agreement, Citrine 7 will be issued 6,666,667 warrants for shares of common stock,

where the Series A and B warrants are exercisable through August 9, 2027 at an exercise price of $0.05 per share.

The

Company concluded that the change in term does not constitute a trouble debt restructuring. Thereafter, the Company applied the guidance

in ASC 470-50, Modifications and Extinguishments. The accounting treatment is determined by whether terms of the new debt and original

debt are substantially different.

Since

the original and new debt instruments are substantially different, the original debt was derecognized and the new debt was recorded at

fair value, with the difference recognized as an extinguishment loss.

The

extinguishment resulted in a loss of $266 thousands, included in the statements of operations as “Expenses related to convertible

loan terms”.

The

components of the new loan were valuated as follows:

Conversion

feature

In

accordance with ASC 815-15-25 the conversion feature was considered a liability classified embedded derivative instrument, and is to

be recorded at its fair value separately from the convertible notes, within non-current liabilities in the Company’s balance sheet.

The conversion component is then remeasured at fair value at each reporting period with the resulting gains or losses shown in the statements

of operations.

CITRINE

GLOBAL, CORP.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

NOTE

5 – CONVERTIBLE NOTES

The

fair value of the convertible component was estimated by third party appraiser as weighted average of the two possible scenarios of the

total convertible notes amount conversion (20% probability for scenario 1 and 80% probability for scenario 2):

The

scenario in which the convertible loan would be converted prior to its maturity (scenario 1) was estimated by the appraiser using the

Black-Scholes option pricing model, to compute the fair value of the derivative and to market the fair value of the derivative at each

balance sheet date. The following are the data and assumptions used as of issuance dates and as of the balance sheet date:

SCHEDULE

OF FAIR VALUE OF CONVERTIBLE FEATURE USING VALUATION ASSUMPTIONS

| | |

January 30, 2023 | |

| Dividend yield (%) | |

| 0 | % |

| Risk-free interest rate (%) | |

| 4.56 | % |

| Expected term (years) | |

| 1.33 | |

| Volatility | |

| 123.5 | % |

| Share price (U.S. dollars) | |

| 0.044 | |

| Exercise price (U.S. dollars) | |

| 0.05 | |

The

scenario in which the Company would raise at least $5 million prior to conversion of the convertible loan (scenario 2) was estimated

by the appraiser at no fair value since it was estimated that along with such raise the convertible loans would be converted at market

price.

The

fair value of the convertible component was estimated by the third-party appraiser after giving effect to the weighted average of the

two possible scenarios as of issuance dates was $8 thousands.

Warrants

The

fair value of the warrants as of January 30, 2023 was estimated at $268 thousands using the Black-Scholes option-pricing model and is

presented within the consolidated statements of changes in shareholders equity (deficit).

The

following are the data and assumptions used:

SCHEDULE

OF FAIR VALUE DATA AND ASSUMPTIONS OF WARRANTS

| Warrants A | |

| |

| Dividend yield (%) | |

| 0 | % |

| Risk-free interest rate (%) | |

| 3.75 | % |

| Expected term (years) | |

| 4.36 | |

| Volatility | |

| 160.5 | % |

| Share price (U.S. dollars) | |

| 0.044 | |

| Exercise price (U.S. dollars) | |

| 0.05 | |

| Fair value of the conversion feature (U.S. dollars in thousands) | |

| 134 | |

| Warrants B | |

| |

| Dividend yield (%) | |

| 0 | % |

| Risk-free interest rate (%) | |

| 3.75 | % |

| Expected term (years) | |

| 4.36 | |

| Volatility | |

| 160.5 | % |

| Share price (U.S. dollars) | |

| 0.044 | |

| Exercise price (U.S. dollars) | |

| 0.05 | |

| Fair value of the conversion feature (U.S. dollars in thousands) | |

| 134 | |

CITRINE

GLOBAL, CORP.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

NOTE

5 – CONVERTIBLE NOTES

| |

C. |

As

of June 30, 2023, the fair value of the convertible component was estimated by third party appraiser as weighted average of the two

possible scenarios of the total convertible notes amount conversion (20% probability for scenario 1 and 80% probability for scenario

2): |

The

scenario in which the convertible loans would be converted prior to its maturity (scenario 1) was estimated by the appraiser using the

Black-Scholes option pricing model, to compute the fair value of the derivative and to market the fair value of the derivative at each

balance sheet date. The following are the data and assumptions used as of the balance sheet date:

| | |

June 30, 2023 | |

| Dividend yield | |

| 0 | % |

| Risk-free interest rate | |

| 5.27 | % |

| Expected term (years) | |

| 0.92 | |

| Volatility | |

| 108.62 | % |

| Share price (U.S. dollars) | |

| 0.04 | |

| Exercise price (U.S. dollars) | |

| 0.05 | |

| Fair value of the conversion feature (U.S. dollars in thousands) | |

| 627 | |

| Weighted fair value based on scenario probability (U.S. dollars in thousands) | |

| 125 | |

The

scenario in which the Company would raise at least $5 million prior to conversion of the convertible loan (scenario 2) was estimated

by the appraiser at no fair value since it was estimated that along with such raise the convertible loans would be converted at market

price.

The

fair value of the convertible component was estimated by the third-party appraiser after giving effect to the weighted average of the

two possible scenarios as of June 30, 2023 was $125 thousands.

CITRINE

GLOBAL, CORP.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

NOTE

6 – OTHER EVENTS DURING THE PERIOD

| |

A. |

On

March 6, 2023 Cannovation and S.R. Accord Ltd., an Israeli company (“Lender”), entered into an 18-month credit facility