0001449792

false

0001449792

2023-08-14

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 14, 2023

PIONEER

POWER SOLUTIONS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-35212 |

|

27-1347616 |

(State

of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

| |

|

|

|

|

400

Kelby Street, 12th Floor

Fort

Lee, New Jersey

(Address

of principal executive offices) |

|

|

|

07024

(Zip

Code) |

(212)

867-0700

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

PPSI |

|

Nasdaq

Stock Market LLC (Nasdaq Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On

August 14, 2023, Pioneer Power Solutions, Inc. issued a press release announcing its financial results for the second fiscal quarter

and six months ended June 30, 2023 and provided a business update. A copy of this press release is furnished as Exhibit 99.1 hereto and

is incorporated herein by reference.

In

accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, that

is furnished pursuant to this Item 2.02 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall

not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended,

or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

PIONEER

POWER SOLUTIONS, inc. |

| |

|

|

| Date:

August 14, 2023 |

By: |

/s/

Walter Michalec |

| |

Name:

|

Walter

Michalec |

| |

Title: |

Chief

Financial Officer |

Exhibit

99.1

Pioneer

Power Increases Revenue 149% during the Second Quarter to a Record $12.1 Million;

Gross

Profit Increases to $2.7 Million, Achieving a 22% Gross Margin

Management

Reiterates Guidance of Full Year Revenue of $42 to $45 Million, Full year positive EPS;

Company

Maintains $33.6 Million Backlog

FORT

LEE, N.J., August 14, 2023 /PRNewswire/ — Pioneer Power Solutions, Inc. (Nasdaq: PPSI) (“Pioneer”, “Pioneer Power”

or the “Company”), a leader in the design, manufacture, service and integration of electrical power systems, distributed

energy resources, power generation equipment and mobile electric vehicle (“EV”) charging solutions, today provided a business

update and announced financial results for the second quarter and six months ended June 30, 2023.

Financial

Highlights for the Second Quarter of 2023:

| |

● |

Second

quarter revenue increased approximately 149% to a record (since divesting the transformer business in 2019) of $12.1 million, as

compared to $4.9 million for the second quarter of 2022. |

| |

● |

Pioneer’s

total backlog at June 30, 2023 was $33.6 million compared to $24.3 million at June 30, 2022, and $37.2 million at December 31, 2022. |

| |

● |

Second

quarter gross profit was $2.7 million, or a 22.4% gross margin, as compared to a gross profit of $63,000, or a 1.3% gross margin,

for the second quarter of 2022. |

| |

● |

Second

quarter total loss from operations was $378,000, which is inclusive of $819,000 in one-time non-cash stock-based compensation, compared

to an operating loss of $2.5 million (inclusive of $658,000 in one-time non-cash stock-based compensation) in the second quarter

of last year. |

| |

● |

Excluding

the one-time non-cash stock-based compensation, Pioneer Power generated income from operations of approximately $441,000 during the

second quarter of 2023, as compared to an operating loss of $1.9 million (excluding one-time non-cash stock-based compensation) during

the second quarter of last year. |

| |

● |

Second

quarter net loss was $319,000, or $(0.03) per basic and diluted share, compared to a net loss of $2.5 million, or $(0.26) per basic

and diluted share, for the same period last year. |

| |

● |

Excluding

one-time non-cash stock-based compensation for both periods, the Company generated approximately $0.05 in earnings per share compared

to $(0.19) of negative earnings per share during the second quarter of 2022. |

| |

● |

The

Company had cash on hand of $9.6 million at June 30, 2023 compared to $10.3 million at December 31, 2022. |

| |

● |

The

Company had $14.2 million of net operating loss carryforwards at June 30, 2023. |

Nathan

Mazurek, Pioneer’s Chairman and Chief Executive Officer, said, “Both our E-Bloc and e-Boost businesses continue to grow at

a rapid pace, with steady margin expansion, supporting our expectations for at least 50% revenue growth and positive earnings per share

for the full-year. Excluding one-time non-cash stock-based compensation, we were profitable during the second quarter, marking the third

consecutive quarter of operational profitability. We are reiterating our full-year guidance and we have significant momentum as we head

into 2024. This progress comes even as we invested approximately $1.4 million in our new e-Boost solutions during the first half of the

year to drive further growth.”

“We

continue to see new and expanding use-cases for E-Bloc, as we provide a flexible solution to enable distributed generation with the use

of renewable energy sources such as solar and convenience EV charging,” continued Mr. Mazurek. “We expect to deliver continued

growth from both E-Bloc and e-Boost in the second-half of 2023 compared to the first half. Our critical power segment, and specifically

e-Boost, should deliver incremental revenue growth in the second half of the year as we continue to invest in this innovative solution

to drive market awareness. We are seeing strong demand from owners of bus fleets, trucks, and autonomous driving solutions. Electrification

initiatives, and the government grants to support fleet electrification, are serving as powerful catalysts for e-Boost.”

Second

Quarter 2023 Financial Results

Revenue

Total

revenue for the three months ended June 30, 2023 was $12.1 million, an increase of approximately 149.4%, as compared to $4.9 million

during the second quarter of last year, primarily due to an increase in sales of our power systems from our T&D Solutions segment

and an increase in sales of our equipment from our Critical Power Solutions segment. Revenue from the T&D Solutions segment increased

approximately 263%, and revenue from the Critical Power segment increased approximately 25% during the second quarter of 2023 as compared

to the same period last year.

Gross

Profit/Margin

Total

gross profit for the second quarter of 2023 was $2.7 million, or a 22.4% gross margin, compared to gross profit of $63,000, or a 1.3%

gross margin, for the same period in 2022. The increase in gross profit and margin is primarily due to higher revenue, driving improved

manufacturing utilization, and a favorable sales mix of higher margin power systems and generation equipment.

Operating

Income (Loss)

For

the three months ended June 30, 2023, loss from operations was $378,000, as compared to an operating loss of $2.5 million during the

second quarter of 2022. Included in the operating loss for the second quarter of 2023 was $819,000 of non-cash stock-based compensation,

as well as continued investment in marketing, manufacturing capacity and inventory to support our strategic initiatives. The second quarter

of 2022 included approximately $658,000 of non-cash stock-based compensation. Excluding the one-time non-cash stock-based compensation

expense, Pioneer Power generated approximately $441,000 in operating income during the second quarter of 2023, compared to a loss from

operations of approximately $1.9 million (excluding one-time non-cash stock-based compensation of $658,000) during the same period last

year.

Net

Income (Loss)

The

Company’s net loss was $319,000, or $(0.03) per basic and diluted share, for the three months ended June 30, 2023, as compared

to a net loss of $2.5 million, or $(0.26) per basic and diluted share, during the three months ended June 30, 2022. Excluding non-cash

stock-based compensation expense, Pioneer generated net income of approximately $500,000, or $0.05 per share, during the second quarter

of 2023.

Year-to-Date

2023 Financial Results

Total

revenue for the six months ended June 30, 2023 was $20.6 million, an increase of 83.9% compared to $11.2 million during the first six

months of last year. Revenue from the T&D Solutions segment increased approximately 139%, and revenue from the Critical Power segment

increased approximately 14% during the first six months of the 2023 as compared to the same period last year.

Gross

profit for the first six months of 2023 was $4.9 million, or a 23.9% gross margin, compared to a gross profit of $986,000, or 8.8% of

revenues, for the same period last year.

Loss

from operations for the first six months of 2023 was $322,000, as compared to an operating loss of $3.3 million during the first six

months of last year. Excluding non-recurring stock-based compensation of $962,000, the Company generated positive income from operations

of $640,000 for the first six months of 2023, compared to a loss from operations of $2.6 million (excluding non-recurring stock-based

compensation of $716,000) during the first six months of last year.

The

Company’s net loss for the first six months of 2023 was $197,000, or $(0.02) per basic and diluted share, compared to a net loss

of $3.3 million, or $(0.34) per basic and diluted share, during the same period of 2022.

Balance

Sheet

At

June 30, 2023, the Company had $9.6 million of cash on hand and working capital of $14.4 million, compared to $10.3 million of cash on

hand and working capital of $14.1 million at December 31, 2022. The Company had no bank debt on the balance sheet at June 30, 2023.

2023

Outlook

Management

reiterated expectations of total revenue between $42 and $45 million in fiscal year 2023, or at least 50% over fiscal year 2022. Management

also expects to generate positive earnings per share for the full fiscal year 2023.

The

foregoing projected outlook constitutes forward-looking information and is intended to provide information about management’s current

expectations for the Company’s 2023 fiscal year. Although considered reasonable as of the date hereof, such outlook and the underlying

assumptions may prove to be inaccurate. Accordingly, actual results could differ materially from the Company’s expectations as

set forth herein. See “Forward-Looking Statements”.

In

preparing the above outlook, the Company assumed, among other things, (i) that the Company’s backlog orders will translate into

recorded sales, (ii) that the Company will be able to satisfactorily complete and deliver all orders and (iii) the timely payment by

customers for all order. This section includes forward-looking statements. See “Forward-Looking Statements”.

Earnings

Conference Call:

Management

will host a conference call today, Monday, August 14, 2023, at 5 p.m. Eastern Time to discuss Pioneer’s 2023 second quarter financial

results with the investment community.

Anyone

interested in participating should call 1-877-300-8521 if calling within the United States or 1-412-317-6026 if calling internationally.

When asked, please reference confirmation code 10181632.

A

replay will be available until August 21, 2023 which can be accessed by dialing 1-844-512-2921 if calling within the United States or

1-412-317-6671 if calling internationally. Please use passcode 10181632 to access the replay.

The

call will also be accompanied live by webcast over the Internet and accessible at https://viavid.webcasts.com/starthere.jsp?ei=1627808&tp_key=3232878469.

About

Pioneer Power Solutions, Inc.

Pioneer

Power Solutions, Inc. is a leader in the design, manufacture, integration, refurbishment, service and distribution of electric power

systems, distributed energy resources, power generation equipment and mobile EV charging solutions for applications in the utility, industrial

and commercial markets. To learn more about Pioneer, please visit its website at www.pioneerpowersolutions.com.

Forward-Looking

Statements:

This

press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995, as amended. Such statements may be preceded by the words “intends,” “may,” “will,” “plans,”

“expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,”

“believes,” “hopes,” “potential” or similar words. Forward-looking statements are not guarantees

of future performance, are based on certain assumptions and are subject to various known and unknown risks and uncertainties, many of

which are beyond the Company’s control, and cannot be predicted or quantified and consequently, actual results may differ materially

from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, risks and

uncertainties associated with (i) the Company’s ability to successfully increase its revenue and profit in the future, (ii) general

economic conditions and their effect on demand for electrical equipment, (iii) the effects of fluctuations in the Company’s operating

results, (iv) the fact that many of the Company’s competitors are better established and have significantly greater resources than

the Company, (v) the Company’s dependence on two customers for a large portion of its business, (vi) the potential loss or departure

of key personnel, (vii) unanticipated increases in raw material prices or disruptions in supply, (viii) the Company’s ability to

realize revenue reported in the Company’s backlog, (ix) future labor disputes, (x) changes in government regulations, (xi) the

liquidity and trading volume of the Company’s common stock, (xii) an outbreak of disease, epidemic or pandemic, such as the global

coronavirus pandemic, or fear of such an event, and (xiii) risks associated with litigation and claims, which could impact our financial

results and condition.

More

detailed information about the Company and the risk factors that may affect the realization of forward-looking statements is set forth

in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual and Quarterly Reports

on Form 10-K and Form 10-Q, respectively. Investors and security holders are urged to read these documents free of charge on the SEC’s

web site at www.sec.gov. The Company assumes no obligation to publicly update or revise its forward-looking statements as a result

of new information, future events or otherwise.

Contact:

Brett

Maas, Managing Partner

Hayden

IR

(646)

536-7331

brett@haydenir.com

Tables

Follow

PIONEER

POWER SOLUTIONS, INC.

Consolidated

Statements of Operations

(In

thousands, except per share data)

(Unaudited)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 (Revised) | | |

2023 | | |

2022 (Revised) | |

| Revenues | |

$ | 12,130 | | |

$ | 4,863 | | |

$ | 20,638 | | |

$ | 11,225 | |

| Cost of goods sold | |

| 9,419 | | |

| 4,800 | | |

| 15,714 | | |

| 10,239 | |

| Gross profit | |

| 2,711 | | |

| 63 | | |

| 4,924 | | |

| 986 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative | |

| 3,089 | | |

| 2,585 | | |

| 5,246 | | |

| 4,331 | |

| Total operating expenses | |

| 3,089 | | |

| 2,585 | | |

| 5,246 | | |

| 4,331 | |

| Loss from operations | |

| (378 | ) | |

| (2,522 | ) | |

| (322 | ) | |

| (3,345 | ) |

| Interest income | |

| (79 | ) | |

| (104 | ) | |

| (132 | ) | |

| (206 | ) |

| Other expense, net | |

| 20 | | |

| 117 | | |

| 7 | | |

| 129 | |

| Loss before income taxes | |

| (319 | ) | |

| (2,535 | ) | |

| (197 | ) | |

| (3,268 | ) |

| Income tax expense | |

| - | | |

| - | | |

| - | | |

| 7 | |

| Net loss | |

$ | (319 | ) | |

$ | (2,535 | ) | |

$ | (197 | ) | |

$ | (3,275 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.03 | ) | |

$ | (0.26 | ) | |

$ | (0.02 | ) | |

$ | (0.34 | ) |

| Diluted | |

$ | (0.03 | ) | |

$ | (0.26 | ) | |

$ | (0.02 | ) | |

$ | (0.34 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 9,908,434 | | |

| 9,727,878 | | |

| 9,838,989 | | |

| 9,684,610 | |

| Diluted | |

| 9,908,434 | | |

| 9,727,878 | | |

| 9,838,989 | | |

| 9,684,610 | |

PIONEER

POWER SOLUTIONS, INC.

Consolidated

Balance Sheets

(In

thousands)

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash | |

$ | 9,624 | | |

$ | 10,296 | |

| Accounts receivable, net | |

| 5,835 | | |

| 11,139 | |

| Inventories | |

| 8,457 | | |

| 8,748 | |

| Prepaid expenses and other current assets | |

| 2,625 | | |

| 2,853 | |

| Total current assets | |

| 26,541 | | |

| 33,036 | |

| Property and equipment, net | |

| 2,383 | | |

| 1,800 | |

| Operating lease right-of-use assets | |

| 1,110 | | |

| 1,450 | |

| Financing lease right-of-use assets | |

| 523 | | |

| 727 | |

| Other assets | |

| 138 | | |

| 162 | |

| Total assets | |

$ | 30,695 | | |

$ | 37,175 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 6,791 | | |

$ | 7,239 | |

| Current portion of operating lease liabilities | |

| 733 | | |

| 703 | |

| Current portion of financing lease liabilities | |

| 192 | | |

| 355 | |

| Deferred revenue | |

| 4,462 | | |

| 10,665 | |

| Total current liabilities | |

| 12,178 | | |

| 18,962 | |

| Operating lease liabilities, non-current portion | |

| 423 | | |

| 797 | |

| Financing lease liabilities, non-current portion | |

| 353 | | |

| 418 | |

| Other long-term liabilities | |

| 57 | | |

| 65 | |

| Total liabilities | |

| 13,011 | | |

| 20,242 | |

| Stockholders’ equity | |

| | | |

| | |

| Preferred stock, $0.001 par value, 5,000,000 shares authorized; none issued | |

| - | | |

| - | |

| Common stock, $0.001 par value, 30,000,000 shares authorized; 9,994,545 and 9,644,545 shares issued and outstanding on June 30, 2023 and December 31, 2022, respectively | |

| 10 | | |

| 10 | |

| Additional paid-in capital | |

| 33,821 | | |

| 32,859 | |

| Accumulated other comprehensive income | |

| - | | |

| 14 | |

| Accumulated deficit | |

| (16,147 | ) | |

| (15,950 | ) |

| Total stockholders’ equity | |

| 17,684 | | |

| 16,933 | |

| Total liabilities and stockholders’ equity | |

$ | 30,695 | | |

$ | 37,175 | |

PIONEER

POWER SOLUTIONS, INC.

Consolidated

Statements of Cash Flows

(In

thousands)

(Unaudited)

| | |

Six Months Ended | |

| | |

June 30, | |

| | |

2023 | | |

2022 (Revised) | |

| Operating activities | |

| | | |

| | |

| Net loss | |

$ | (197 | ) | |

$ | (3,275 | ) |

| Adjustments to reconcile net loss to net cash provided by/ (used in) operating activities: | |

| | | |

| | |

| Depreciation | |

| 227 | | |

| 73 | |

| Amortization of right-of-use financing leases | |

| 205 | | |

| 124 | |

| Amortization of imputed interest | |

| - | | |

| (214 | ) |

| Amortization of right-of-use operating leases | |

| 340 | | |

| 328 | |

| Change in receivable reserves | |

| 44 | | |

| (141 | ) |

| Stock-based compensation | |

| 962 | | |

| 716 | |

| Other | |

| (13 | ) | |

| - | |

| Changes in current operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 5,283 | | |

| (2,642 | ) |

| Inventories | |

| 291 | | |

| (3,987 | ) |

| Prepaid expenses and other assets | |

| 224 | | |

| (67 | ) |

| Income taxes | |

| (4 | ) | |

| 27 | |

| Accounts payable and accrued liabilities | |

| (449 | ) | |

| 1,796 | |

| Deferred revenue | |

| (6,204 | ) | |

| 5,966 | |

| Operating lease liabilities | |

| (343 | ) | |

| (325 | ) |

| Net cash provided by/ (used in) operating activities | |

| 366 | | |

| (1,621 | ) |

| | |

| | | |

| | |

| Investing activities | |

| | | |

| | |

| Purchases of property and equipment | |

| (810 | ) | |

| (174 | ) |

| Net cash used in investing activities | |

| (810 | ) | |

| (174 | ) |

| | |

| | | |

| | |

| Financing activities | |

| | | |

| | |

| Net proceeds from the exercise of options for common stock | |

| - | | |

| 17 | |

| Principal repayments of financing leases | |

| (228 | ) | |

| (136 | ) |

| Net cash used in financing activities | |

| (228 | ) | |

| (119 | ) |

| | |

| | | |

| | |

| Decrease in cash | |

| (672 | ) | |

| (1,914 | ) |

| Cash, beginning of period | |

| 10,296 | | |

| 11,699 | |

| Cash, end of period | |

$ | 9,624 | | |

$ | 9,785 | |

| | |

| | | |

| | |

| Non-cash investing and financing activities: | |

| | | |

| | |

| Acquisition of right-of-use assets and lease liabilities | |

$ | - | | |

$ | 551 | |

v3.23.2

Cover

|

Aug. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 14, 2023

|

| Entity File Number |

001-35212

|

| Entity Registrant Name |

PIONEER

POWER SOLUTIONS, INC.

|

| Entity Central Index Key |

0001449792

|

| Entity Tax Identification Number |

27-1347616

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

400

Kelby Street

|

| Entity Address, Address Line Two |

12th Floor

|

| Entity Address, City or Town |

Fort

Lee

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07024

|

| City Area Code |

(212)

|

| Local Phone Number |

867-0700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

| Trading Symbol |

PPSI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

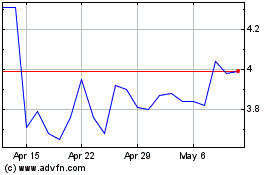

Pioneer Power Solutions (NASDAQ:PPSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

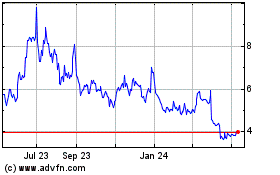

Pioneer Power Solutions (NASDAQ:PPSI)

Historical Stock Chart

From Apr 2023 to Apr 2024