false000108499100010849912022-11-142022-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 14, 2023 NATURAL GAS SERVICES GROUP, INC.

(Exact Name of Registrant as Specified in Charter) | | | | | | | | | | | | | | |

Colorado | | 1-31398 | | 75-2811855 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

404 Veterans Airpark Lane, Suite 300

Midland, TX 79705

(Address of Principal Executive Offices)

(432) 262-2700

(Registrant's Telephone Number, Including Area Code)

N/A

(Former Name or Former Address if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-14(c)).

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, Par Value $0.01 | | NGS | | NYSE |

| | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On August 15, 2023, Natural Gas Services Group, Inc. issued a press release announcing its results of operations for second quarter ended June 30, 2023. The press release issued August 15, 2023 is furnished as Exhibit No. 99.1 to this Current Report on Form 8-K. Natural Gas Services Group's annual report on Form 10-K and its reports on Forms 10-Q and 8-K and other publicly available information should be consulted for other important information about Natural Gas Services Group, Inc.

The information in this Current Report on Form 8-K, including Exhibit No. 99.1 hereto, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liability of that section. The information in this Current Report shall not be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing or document.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The Exhibit listed below is furnished as an Exhibit to this Current Report on Form 8-K.

| | | | | |

| Exhibit No. | Description |

| Press release issued August 15, 2023 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | NATURAL GAS SERVICES GROUP, INC. |

| | | | | |

| Date: | | | | | |

| | | By: | | /s/ Stephen C. Taylor |

| | | | | |

| | | | | Stephen C. Taylor |

| | | | | Interim President & Chief Executive Officer |

| | | | | |

FOR IMMEDIATE RELEASE | NEWS |

August 15, 2023 | NYSE: NGS |

| Exhibit 99.1 |

Natural Gas Services Group, Inc.

Reports Second Quarter 2023 Financial and Operating Results

Second Quarter 2023 Highlights

•Rental revenue of $24.1 million, an increase of 33% when compared to the second quarter of 2022 and 6% when compared to the first quarter of 2023.

•Net income of $504,000, or $0.04 per basic share, as compared to a net loss of $70,000 in the second quarter of 2022 and net income of $370,000 when compared to the first quarter of 2023.

•Adjusted EBITDA of $9.9 million, compared to $6.7 million in the second quarter of 2022 and $7.8 million in the first quarter of 2023. Please see Non-GAAP Financial Measures - Adjusted EBITDA, below.

MIDLAND, Texas August 15, 2023 (GLOBE NEWSWIRE) Natural Gas Services Group, Inc. (“NGS” or the “Company”) (NYSE:NGS), a leading provider of natural gas compression equipment, technology and services to the energy industry, today announced financial results for the three months ended June 30, 2023.

Commenting on the quarter, Stephen C. Taylor our Chairman and Interim President and Chief Executive Officer, added “Total revenue and rental revenue grew when compared to both sequential and year-over-year quarters, Sequentially, our sales revenues declined, but our strategically important rental revenues continued to grow at a brisk pace, reflecting our tenth consecutive quarter of rental revenue growth. Our overall gross margins improved, led by higher rental margins and lower operating expenses and operating income and net income both increased over the comparative quarters. We are starting to see the results of our 2023 capital program in our revenues, margins and bottom lines. The overall environment in our industry continues to be positive and we anticipate further improvement.”

Revenue: Total revenue for the three months ended June 30, 2023 increased 35.3% to $27.0 million from $19.9 million for the three months ended June 30, 2022. This increase was due primarily to an increase in rental revenues. Rental revenue increased 32.9% to $24.1 million in the second quarter of 2023, from $18.1 million in the second quarter of 2022 due to the addition of higher horsepower packages and pricing improvements. As of June 30, 2023, we had 1,249 rented units (372,596 horsepower) compared to 1,281 rented units (311,379 horsepower) as of June 30, 2022, reflecting an 19.7% increase in total horsepower deployed. Sequentially, total revenue increased 1.3% to $27.0 million in the second quarter of 2023 compared to $26.6 million in the first quarter of 2023 primarily due to increases in rental revenues largely offset by a decline in sales revenues.

Gross Margins: Total gross margins, including depreciation increased to $6.5 million for the three months ended June 30, 2023, compared to $3.1 million for the same period in 2022 and $5.1 million for the three months ended March 31, 2023. Total adjusted gross margin, exclusive of depreciation, for the three months ended June 30, 2023, increased to $12.8 million compared to $9.0 million for the same period ended June 30, 2022 and $11.1 million for the first quarter of 2023. These increases are primarily attributable to increased rental revenues and rental gross margin.

Operating Income: Operating income for the three months ended June 30, 2023 was $712,000 compared to $658,000 for the three months ended June 30, 2022 and $402,000 during the first quarter of 2023. Operating income in the three months ending June 30, 2023 was negatively impacted by a $779,000 non cash impairment expense relating to software.

Net Income: Net income for the three months ended June 30, 2023, was $504,000, or $0.04 per basic share compared to a net loss of $70,000 or $0.01 per basic share for the three months ended June 30, 2022. The increase in net income during the second quarter of 2023 was mainly due to increased rental revenue and gross margin partially offset by an increase in selling, general and administrative expenses. Sequentially, net income was $370,000 or $0.03 per basic share during the first quarter of 2023. This sequential improvement of $134,000 was primarily due to higher rental revenue and lower operating costs.

Adjusted EBITDA: Adjusted EBITDA increased 47.4% to $9.9 million for the three months ended June 30, 2023, from $6.7 million for the same period in 2022. This increase was primarily attributable to higher revenues and adjusted gross margins. Sequentially, adjusted EBITDA increased 27.0% to $9.9 million for the three months ended June 30, 2023, compared to adjusted EBITDA of $7.8 million for the three months ended March 31, 2023.

Cash flows: At June 30, 2023, cash and cash equivalents were approximately $4.3 million, while working capital was $18.9 million. For the six months of 2023, cash flows from operating activities were $22.6 million, while cash flows used in investing activities was $93.6 million. Cash flow used in investing activities included $93.5 million in capital expenditures, of which $92.3 million was dedicated to rental capital expenditures.

Debt: Outstanding debt on our revolving credit facility as of June 30, 2023 was $100 million. Our leverage ratio at June 30, 2023 was 2.53 and our fixed charge coverage ratio was 4.17. The company is in compliance with all terms, conditions and covenants of the credit agreement.

Selected data: The tables below show, the six months ended June 30, 2023 and 2022, revenues and percentage of total revenues, along with our gross margin and adjusted gross margin (exclusive of depreciation and amortization), as well as, related percentages of revenue for each of our product lines. Adjusted gross margin is the difference between revenue and cost of sales, exclusive of depreciation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue |

| Three months ended June 30, | | Six months ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (in thousands) |

| Rental | $ | 24,105 | | | 89 | % | | $ | 18,144 | | | 91 | % | | $ | 46,828 | | | 87 | % | | $ | 35,274 | | | 88 | % |

| Sales | 1,595 | | | 6 | % | | 1,292 | | | 7 | % | | 4,587 | | | 9 | % | | 4,184 | | | 10 | % |

| Service & Maintenance | 1,257 | | | 5 | % | | 490 | | | 2 | % | | 2,162 | | | 4 | % | | 804 | | | 2 | % |

| | | | | | | | | | | | | | | |

| Total | $ | 26,957 | | | | | $ | 19,926 | | | | | $ | 53,577 | | | | | $ | 40,262 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross Margin |

| Three months ended June 30, | | Six months ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (in thousands) |

| Rental | $6,579 | | 27% | | $3,078 | | 17% | | $11,724 | | 25% | | $5,142 | | 15% |

| Sales | (345) | | (22)% | | (216) | | (17)% | | (655) | | (14)% | | 619 | | 15% |

| Service & Maintenance | 266 | | 21% | | 246 | | 50% | | 548 | | 25% | | 380 | | 47% |

| Total | $6,500 | | 24% | | $3,108 | | 16% | | $11,617 | | 22% | | $6,141 | | 15% |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Gross Margin (1) |

| Three months ended June 30, | | Six months ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (in thousands) |

| Rental | $ | 12,762 | | | 53 | % | | $ | 8,902 | | | 49 | % | | $ | 23,840 | | | 51 | % | | $ | 16,802 | | | 48 | % |

| Sales | (281) | | | (18) | % | | (148) | | | (11) | % | | (526) | | | (11) | % | | 756 | | | 18 | % |

| Service & Maintenance | 288 | | | 23 | % | | 256 | | | 52 | % | | 584 | | | 27 | % | | 397 | | | 49 | % |

| Total | $ | 12,769 | | | 47 | % | | $ | 9,010 | | | 45 | % | | $ | 23,898 | | | 45 | % | | $ | 17,955 | | | 45 | % |

(1) For a reconciliation of adjusted gross margin to its most directly comparable financial measure calculated and presented in accordance with GAAP, please read “Non-GAAP Financial Measures - Adjusted Gross Margin” below.

Non-GAAP Financial Measure - Adjusted Gross Margin: “Adjusted Gross Margin” is defined as total revenue less cost of sales (excluding depreciation expense). Adjusted gross margin is included as a supplemental disclosure because it is a primary measure used by management as it represents the results of revenue and cost of sales (excluding depreciation expense), which are key operating components. Adjusted gross margin differs from gross margin in that gross margin includes depreciation expense. We believe adjusted gross margin is important because it focuses on the current operating performance of our operations and excludes the impact of the prior historical costs of the assets acquired or constructed that are utilized in those operations. Depreciation expense reflects the systematic allocation of historical property and equipment values over the estimated useful lives.

Adjusted gross margin has certain material limitations associated with its use as compared to gross margin. Depreciation expense is a necessary element of our costs and our ability to generate revenue. Management uses this non-GAAP measure as a supplemental measure to other GAAP results to provide a more complete understanding of the company's performance. As an indicator of operating performance, adjusted gross margin should not be considered an alternative to, or more meaningful than, gross margin as determined in accordance with GAAP. Adjusted Gross margin may not be comparable to a similarly titled measure of another company because other entities may not calculate adjusted gross margin in the same manner.

The following table calculates gross margin, the most directly comparable GAAP financial measure, and reconciles it to adjusted gross margin:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (in thousands) | | (in thousands) |

| Total revenue | $ | 26,957 | | | $ | 19,926 | | | $ | 53,577 | | | 40,262 | |

| Costs of revenue, exclusive of depreciation | (14,188) | | | (10,916) | | | (29,679) | | | (22,307) | |

| Depreciation allocable to costs of revenue | (6,269) | | | (5,902) | | | (12,281) | | | (11,814) | |

| Gross margin | 6,500 | | | 3,108 | | | 11,617 | | | 6,141 | |

| Depreciation allocable to costs of revenue | 6,269 | | | 5,902 | | | 12,281 | | | 11,814 | |

| Adjusted Gross Margin | $ | 12,769 | | | $ | 9,010 | | | $ | 23,898 | | | $ | 17,955 | |

Non-GAAP Financial Measures - Adjusted EBITDA: “Adjusted EBITDA” reflects net income or loss before interest, taxes, depreciation and amortization, non-cash stock compensation expense, severance expenses, impairment of goodwill, increases in inventory allowance and retirement of rental equipment. Adjusted EBITDA is a measure used by management, analysts and investors as an indicator of operating cash flow since it excludes the impact of movements in working capital items, non-cash charges and financing costs. Therefore, Adjusted EBITDA gives the investor information as to the cash generated from the operations of a business. However, Adjusted EBITDA is not a measure of financial performance under accounting principles GAAP, and should not be considered a substitute for other financial measures of performance. Adjusted EBITDA as calculated by NGS may not be comparable to Adjusted EBITDA as calculated and reported by other companies. The most comparable GAAP measure to Adjusted EBITDA is net income (loss).

The following table reconciles our net income, the most directly comparable GAAP financial measure, to Adjusted EBITDA:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (in thousands) | | (in thousands) |

| Net income | $ | 504 | | | $ | (70) | | | $ | 874 | | | $ | 267 | |

| Interest expense | 185 | | | 24 | | | 185 | | | 49 | |

| Income tax benefit | 249 | | | 372 | | | 396 | | | 361 | |

| Depreciation and amortization | 6,418 | | | 6,042 | | | 12,583 | | | 12,103 | |

| Non-cash stock compensation expense | 1,130 | | | 331 | | | 1,617 | | | 754 | |

| Severance expenses | 612 | | | — | | | 1,224 | | | — | |

| Impairment expense | 779 | | | — | | | 779 | | | — | |

| | | | | | | |

| | | | | | | |

| Adjusted EBITDA | $ | 9,877 | | | $ | 6,699 | | | $ | 17,658 | | | $ | 13,534 | |

Conference Call Details: The Company will host its earnings conference call on Tuesday, August 15, 2023, at 10:00am CDT (11:00am EDT). To listen to the call, participants should access the webcast on www.ngsgi.com under the Investor Relations section. To participate, please call (800) 550-9745 using conference ID 167298 approximately five minutes prior to the start of the call. Following the conclusion of the conference call, a recording of the call will be available on the Company’s website.

About Natural Gas Services Group, Inc. (NGS): NGS is a leading provider of gas compression technology and services to the energy industry. The Company manufactures, fabricates, rents, sells, and maintains natural gas compression technology for oil and natural gas upstream providers and midstream facilities. NGS is headquartered in Midland with manufacturing and fabrication facilities located in Tulsa, and Midland. The Company maintains service facilities in major energy producing basins in the U.S. Additional information can be found at www.ngsgi.com.

Cautionary Note Regarding Forward-Looking Statements: Except for historical information contained herein, the statements in this release are forward-looking and made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties, which may cause NGS's actual results in future periods to differ materially from forecasted results. Those risks include, among other things: a prolonged, substantial reduction in oil and natural gas prices which could cause a decline in the demand for NGS's products and services; the loss of market share through competition or otherwise; the introduction of competing technologies by other companies; and new governmental safety, health and environmental regulations which could require NGS to make significant capital expenditures. The forward-looking statements included in this press release are only made as of the date of this press release, and NGS undertakes no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances. A discussion of these factors is included in the Company's most recent Annual Report on Form 10-K, as well as the Company’s Form 10-Q for the quarterly period ended June 30, 2023, as filed with the Securities and Exchange Commission.

| | | | | |

For More Information, Contact: | Anna Delgado, Investor Relations |

| (432) 262-2700 Anna.Delgado@ngsgi.com |

| www.ngsgi.com |

| | | | | | | | | | | |

NATURAL GAS SERVICES GROUP, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands, except par value) (unaudited) |

| | | |

| June 30,

2023 | | December 31, 2022 |

ASSETS | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 4,286 | | | $ | 3,372 | |

| Trade accounts receivable, net of allowance for doubtful accounts of $466 and $338, respectively | 20,872 | | | 14,668 | |

| Inventory | 27,960 | | | 23,414 | |

| Federal income tax receivable (Note 4) | 11,538 | | | 11,538 | |

| Prepaid income taxes | 10 | | | 10 | |

| Prepaid expenses and other | 1,446 | | | 1,145 | |

| Total current assets | 66,112 | | | 54,147 | |

| Long-term inventory, net of allowance for obsolescence of $40 and $120, respectively | 2,157 | | | 1,557 | |

| Rental equipment, net of accumulated depreciation of $187,580 and $177,729, respectively | 326,691 | | | 246,450 | |

| Property and equipment, net of accumulated depreciation of $17,533 and $16,981, respectively | 21,382 | | | 22,176 | |

| Right of use assets - operating leases, net of accumulated amortization $815 and $721, respectively | 310 | | | 349 | |

| | | |

| Intangibles, net of accumulated amortization of $2,322 and $2,259, respectively | 837 | | | 900 | |

| Other assets | 4,996 | | | 2,667 | |

Total assets | $ | 422,485 | | | $ | 328,246 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current Liabilities: | | | |

| Accounts payable | $ | 28,603 | | | $ | 6,481 | |

| Accrued liabilities | 18,492 | | | 23,726 | |

| | | |

| | | |

| Current operating leases | 133 | | | 155 | |

| Deferred income | — | | | 37 | |

| Total current liabilities | 47,228 | | | 30,399 | |

| Long-term debt | 100,011 | | | 25,000 | |

| Deferred income tax liability | 40,194 | | | 39,798 | |

| Long-term operating leases | 177 | | | 194 | |

| Other long-term liabilities | 3,290 | | | 2,779 | |

| Total liabilities | 190,900 | | | 98,170 | |

| Commitments and contingencies | | | |

| Stockholders’ Equity: | | | |

| Preferred stock, 5,000 shares authorized, no shares issued or outstanding | — | | | — | |

| Common stock, 30,000 shares authorized, par value $0.01; 13,688 and 13,519 shares issued, respectively | 136 | | | 135 | |

Additional paid-in capital | 116,045 | | | 115,411 | |

| Retained earnings | 130,408 | | | 129,534 | |

| | | |

| | | |

| Treasury shares, at cost, 1,310 shares | (15,004) | | | (15,004) | |

| Total stockholders' equity | 231,585 | | | 230,076 | |

| Total liabilities and stockholders' equity | $ | 422,485 | | | $ | 328,246 | |

| | | | | | | | | | | | | | | | | | | | | | | |

NATURAL GAS SERVICES GROUP, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except earnings per share) (unaudited) |

| | | |

| Three months ended | | Six months ended |

| June 30, | | June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | |

| Rental income | $ | 24,105 | | | $ | 18,144 | | | $ | 46,828 | | | $ | 35,274 | |

| Sales | 1,595 | | | 1,292 | | | 4,587 | | | 4,184 | |

| Service and maintenance income | 1,257 | | | 490 | | | 2,162 | | | 804 | |

| Total revenue | 26,957 | | | 19,926 | | | 53,577 | | | 40,262 | |

| Operating costs and expenses: | | | | | | | |

| Cost of rentals, exclusive of depreciation stated separately below | 11,343 | | | 9,242 | | | 22,988 | | | 18,472 | |

| Cost of sales, exclusive of depreciation stated separately below | 1,876 | | | 1,440 | | | 5,113 | | | 3,428 | |

| Cost of service and maintenance, exclusive of depreciation stated separately below | 969 | | | 234 | | | 1,578 | | | 407 | |

| Selling, general and administrative expenses | 4,860 | | | 2,310 | | | 9,422 | | | 4,811 | |

| Depreciation and amortization | 6,418 | | | 6,042 | | | 12,583 | | | 12,103 | |

| Impairment expense | 779 | | | — | | | 779 | | | — | |

| | | | | | | |

| Retirement of rental equipment | — | | | — | | | — | | | 1,512 | |

| Total operating costs and expenses | 26,245 | | | 19,268 | | | 52,463 | | | 39,221 | |

| Operating income | 712 | | | 658 | | | 1,114 | | | 1,041 | |

| Other income (expense): | | | | | | | |

| Interest expense | (185) | | | (24) | | | (185) | | | (49) | |

| Other income (expense), net | 226 | | | (332) | | | 341 | | | (364) | |

| Total other income (expense), net | 41 | | | (356) | | | 156 | | | (413) | |

| Income before provision for income taxes | 753 | | | 302 | | | 1,270 | | | 628 | |

| Income tax benefit | (249) | | | (372) | | | (396) | | | (361) | |

| Net income (loss) | $ | 504 | | | $ | (70) | | | $ | 874 | | | $ | 267 | |

| Earnings (loss) per share: | | | | | | | |

| Basic | $ | 0.04 | | | $ | (0.01) | | | $ | 0.07 | | | $ | 0.02 | |

| Diluted | $ | 0.04 | | | $ | (0.01) | | | $ | 0.07 | | | $ | 0.02 | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 12,292 | | | 12,305 | | | 12,253 | | | 12,421 | |

| Diluted | 12,394 | | | 12,305 | | | 12,374 | | | 12,528 | |

| | | | | | | | | | | |

NATURAL GAS SERVICES GROUP, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) (unaudited) |

| Six months ended |

| June 30, |

| 2023 | | 2022 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net income | $ | 874 | | | $ | 267 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 12,583 | | | 12,103 | |

| Amortization of debt issuance costs | 184 | | | 24 | |

| Deferred income tax expense | 396 | | | 356 | |

| Stock-based compensation | 1,617 | | | 754 | |

| Bad debt allowance | 128 | | | — | |

| | | |

| Impairment expense | 779 | | | — | |

| Gain on sale of assets | (206) | | | (151) | |

| | | |

| Loss (gain) on company owned life insurance | (80) | | | 557 | |

| | | |

| | | |

Changes in operating assets and liabilities: | | | |

| Trade accounts receivables | (6,332) | | | (1,472) | |

| Inventory | (4,438) | | | 803 | |

| | | |

| Prepaid expenses and prepaid income taxes | (301) | | | (748) | |

| Accounts payable and accrued liabilities | 16,888 | | | 2,298 | |

| | | |

| Deferred income | (37) | | | (1,312) | |

| | | |

| Other | 588 | | | (231) | |

| | | |

| NET CASH PROVIDED BY OPERATING ACTIVITIES | 22,643 | | | 13,248 | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Purchase of rental equipment, property and other equipment | (93,479) | | | (19,173) | |

| Purchase of company owned life insurance | (329) | | | (236) | |

| Proceeds from sale of property and equipment | 231 | | | 224 | |

| | | |

| | | |

| NET CASH USED IN INVESTING ACTIVITIES | (93,577) | | | (19,185) | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| Proceeds from loan | 75,011 | | | — | |

| | | |

| Payments of other long-term liabilities, net | (50) | | | (2) | |

| Payments of debt issuance cost | (2,131) | | | — | |

| | | |

| | | |

| Purchase of treasury shares | — | | | (6,660) | |

| Taxes paid related to net share settlement of equity awards | (982) | | | (515) | |

| | | |

| NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES | 71,848 | | | (7,177) | |

| NET CHANGE IN CASH AND CASH EQUIVALENTS | 914 | | | (13,114) | |

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | 3,372 | | | 22,942 | |

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 4,286 | | | $ | 9,828 | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | | | |

| Interest paid | $ | 1,966 | | | $ | 25 | |

| | | |

| NON-CASH TRANSACTIONS | | | |

| | | |

| | | |

| | | |

| Right of use asset acquired through an operating lease | $ | 63 | | | $ | 91 | |

| Transfer of rental equipment to inventory | $ | 708 | | | $ | — | |

v3.23.2

Cover Page

|

Nov. 14, 2022 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 14, 2023

|

| Entity Registrant Name |

NATURAL GAS SERVICES GROUP, INC.

|

| Entity Incorporation, State or Country Code |

CO

|

| Entity File Number |

1-31398

|

| Entity Tax Identification Number |

75-2811855

|

| Entity Address, Address Line One |

404 Veterans Airpark Lane, Suite 300

|

| Entity Address, City or Town |

Midland

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

79705

|

| City Area Code |

432

|

| Local Phone Number |

262-2700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, Par Value $0.01

|

| Trading Symbol |

NGS

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001084991

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

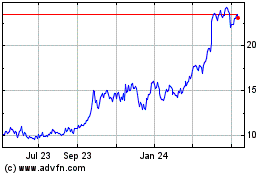

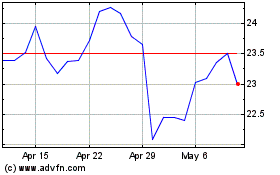

Natural Gas Services (NYSE:NGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Natural Gas Services (NYSE:NGS)

Historical Stock Chart

From Apr 2023 to Apr 2024