0001157762

false

0001157762

2023-08-11

2023-08-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 11, 2023

China Automotive Systems, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

000-33123 |

33-0885775 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

No. 1 Henglong Road, Yu Qiao Development Zone

Shashi District, Jing Zhou City

Hubei Province

The People's Republic of China

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including

area code (86) 27-8757 0027

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock, $0.0001 par value |

CAAS |

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 2.02 |

Results of Operations and Financial Condition |

On August 11, 2023, China Automotive Systems,

Inc. issued a press release announcing financial results for the quarter ended June 30, 2023. The press release is attached as Exhibit

99.1 to this Current Report on Form 8-K.

The information in this Item 2.02 and in Exhibit

99.1 attached to this Form 8-K is furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section.

| Item 9.01 |

Financial Statements and Exhibits |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

China Automotive Systems, Inc. |

| |

(Registrant) |

| |

|

|

| Date: August 11, 2023 |

By: |

/s/ Hanlin Chen |

| |

|

Hanlin Chen |

| |

|

Chairman |

Exhibit

99.1

China

Automotive Systems Reports 90.0% Increase in Net Income Per Share

to $0.57 in the First Six Months of 2023

WUHAN,

China, August 11, 2023 -- China Automotive Systems, Inc. (NASDAQ: CAAS) ("CAAS" or the "Company"), a

leading power steering components and systems supplier in China, today announced its unaudited financial results for the second quarter

and six months ended June 30, 2023.

Second

Quarter 2023 Highlights

| |

● |

Net sales rose 8.1% year-over-year

to $137.4 million from $127.2 million in the second quarter of 2022. |

| |

● |

Gross profit was $22.7 million, which is stable

to $22.7 million in the second quarter of 2022. |

| |

● |

Income from operations was $7.8 million, compared

to income from operations of $7.2 million in the second quarter of 2022. |

| |

● |

Net income attributable to

parent company’s common shareholders was $10.5 million, or diluted earnings per share of $0.35, compared to net income attributable

to parent company’s common shareholders of $9.4 million, or diluted earnings per share of $0.31 in the second quarter of 2022 |

First

Six Months of 2023 Highlights

| |

● |

Net sales grew by 6.1% year-over-year

to $279.7 million, compared to $263.6 million in the first six months of 2022. |

| |

● |

Gross profit increased by 18.4% year-over-year

to $44.3 million, compared to $37.4 million in the first six months of 2022. |

| |

● |

Income from operations rose

by 171.9% year-over-year to $15.5 million compared to income from operations of $5.7 million in the first six months of 2022. |

| |

● |

Net income attributable to

parent company’s common shareholders was $17.3 million, compared to net income attributable to parent company’s common

shareholders of $9.4 million in the first six months of 2022; |

| |

● |

Diluted earnings per share

attributable to parent company’s common shareholders increased by 90.0% year-over-year to $0.57, compared to diluted earnings

per share attributable to parent company’s common shareholders of $0.30 in the first six months of 2022. |

| |

● |

Cash and cash equivalents, and pledged cash were

$125.5 million, or approximately $4.16 per share, as of June 30, 2023. |

Mr. Qizhou Wu, Chief Executive Officer

of CAAS, commented, “Our revenue growth accelerated in the second quarter. Most of our divisions reported higher sales and most

encouragingly, net sales of our advanced electric power steering (“EPS”) grew by 28.4% year-over-year.”

“According

to statistics from the China Association of Automobile Manufacturers, overall automobile sales in China increased by 17.9% year-over-year

in the second quarter of 2023 with passenger vehicles sales rising by 19.3% year-over-year and commercial vehicle sales up 10.1% year-over-year.

For the six months ended June 30, 2023, overall car sales increased by 9.8% year-over-year as passenger vehicle sales grew 8.8% year-over-year

and commercial vehicle sales grew by 15.8% year-over-year.”

“Chinese

GDP growth rate for the first half of 2023 was 5.5% year-over-year. The Chinese government recently announced a plan to increase economic

growth through policy changes and incentives. The automobile, housing and real estate, tourism and other services sectors were highlighted

as key parts of this plan. We are hopeful that new changes and forthcoming policies can help boost consumer confidence and further improve

the automotive market,” Mr. Wu concluded.

Mr.

Jie Li, Chief Financial Officer of CAAS, commented, “We maintained a strong balance sheet with cash and cash equivalents plus pledged

cash of $125.5 million, with working capital of $153.3 million at June 30, 2023. In the first six months of 2023, we used approximately

$5.4 million to acquire property, plant and equipment. During the second quarter, we also managed cost reductions by reducing spending

in selling, and general and administrative, and research and development expenses.”

Second Quarter

of 2023

Net

sales increased by 8.1% year-over-year to $137.4 million in the second quarter of 2023, compared to $127.2 million in the second quarter

of 2022. Net sales of traditional steering products and parts increased by 1.1% year-over-year to $95.8 million for the second quarter

of 2023, compared to $94.8 million for the same quarter in 2022. Net sales of EPS products rose 28.4% year-over-year to $41.6 million

from $32.4 million for the same period in 2022. EPS product sales were 30.3% of the total net sales for the second quarter of 2023, compared

to 25.5% for the same period in 2022. Export net sales to North American customers decreased by 24.5% year-over-year to $28.9 million

in the second quarter of 2023, compared to $38.3 million in the second quarter of 2022. North American sales declined due to less demand

and the effects of foreign exchange fluctuations. Sales in Brazil rose 43.5% year-over-year to $12.2 million in the second quarter of

2023 from $8.5 million in the second quarter of 2022.

Gross

profit was $22.7 million, which is stable to $22.7 million in the second quarter of 2022. Gross margin in the second quarter of 2023

was 16.5%, compared to 17.9% in the second quarter of 2022. The decrease in gross margin was mainly due to the changes in the product

mix.

Gain

on other sales was $0.7 million, compared to $2.1 million in the second quarter of 2022.

Selling

expenses decreased by 6.7% year-over-year to $3.8 million compared to $4.1 million in the second quarter of 2022, primarily due to lower

marketing and office expenses. The appreciation of the USD against RMB also affected expense levels. Selling expenses represented 2.8%

of net sales in the second quarter of 2023, compared to 3.2% in the second quarter of 2022.

General and administrative

expenses (“G&A expenses”) decreased by 6.9% year-over-year to $5.3 million compared to $5.7 million in the second quarter

of 2022, primarily due to reversal of credit losses and the impact of appreciation of the USD against the RMB. G&A expenses represented

3.9% of net sales in the second quarter of 2023, compared to 4.5% of net sales in the second quarter of 2022.

Research

and development expenses (“R&D expenses”) decreased by 16.2% year-over-year to $6.6 million compared to $7.9 million

in the second quarter of 2022. R&D expenses represented 4.8% of net sales in the second quarter of 2023 compared to 6.2% in the second

quarter of 2022.

Other

income, net was $2.0 million for the second quarter of 2023, compared to $2.8 million for the three months ended June 30, 2022.

Income

from operations was $7.8 million in the second quarter of 2023, compared to income from operations of $7.2 million in the second quarter

of 2022. The increase was primarily due to lower operating costs.

Interest

expense was $0.3 million in the second quarter of 2023, compared to $0.4 million in the second quarter of 2022.

Net

financial income was $4.0 million in the second quarter of 2023, compared to net financial income of $2.5 million in the second quarter

of 2022. The change in net financial income was primarily due to the appreciation of the USD against RMB.

Income

before income tax expenses and equity in earnings of affiliated companies was $13.4 million in the second quarter of 2023, compared to

income before income tax expenses and equity in earnings of affiliated companies of $12.2 million in the second quarter of 2022.

Net

income attributable to parent company’s common shareholders was $10.5 million in the second quarter of 2023, compared to net income

attributable to parent company’s common shareholders of $9.4 million in the second quarter of 2022. Diluted earnings per share

was $0.35 in the second quarter of 2023, compared to $0.31 per share in the second quarter of 2022.

The

weighted average number of diluted common shares outstanding was 30,189,537 in the second quarter of 2023, compared to 30,849,009 in

the second quarter of 2022.

First

Six Months of 2023

Net

sales increased by 6.1% year-over-year to $279.7 million in the first six months of 2023, compared to $263.6 million in the first six

months of 2022. Six-month gross profit was $44.3 million, compared to $37.4 million in the corresponding period last year. Six-month

gross margin was 15.9%, compared with 14.2% in the first six months of 2022. Gain on other sales was $1.4 million in the first six months

of 2023, compared to $3.0 million in the corresponding period last year. Income from operations was $15.5 million in the first six months

of 2023, compared with income from operations of $5.7 million in the first six months of 2022.

Net

income attributable to parent company’s common shareholders was $17.3 million in the first six months of 2023, compared to net

income attributable to parent company’s common shareholders of $9.4 million in the corresponding period in 2022. Diluted earnings

per share increased by 90.0% year-over-year to $0.57 in the first six months of 2023, compared to diluted earnings per share of $0.30

in the first six months of 2022.

Balance

Sheet

As

of June 30, 2023, total cash and cash equivalents, and pledged cash were $125.5 million, total accounts receivable including notes receivable,

were $234.0 million, accounts payable including notes payable, were $216.7 million and short-term loans were $38.5 million. Total parent

company stockholders' equity was $317.8 million as of June 30, 2023, compared to $311.7 million as of December 31, 2022.

Business

Outlook

Management

has reiterated its revenue guidance for the full year 2023 of $560.0 million. This target is based on the Company's current views on

operating and market conditions, which are subject to change.

Conference

Call

Management

will conduct a conference call on August 11, 2023 at 8:00 A.M. EDT/8:00 P.M. Beijing Time to discuss these results. A question and answer

session will follow management's presentation. To participate, please see the dial-in information below, enter the call 10 minutes before

the call start time and ask to be connected to the "China Automotive Systems" conference call:

Phone Number:

+1-888-506-0062 (North America)

Phone Number:

+1-973-528-0011 (International)

Mainland China

Toll Free: +86-400-120-3199

Code: 235847

A replay of

the call will be available on the Company’s website under the investor relations section.

About China

Automotive Systems, Inc.

Based

in Hubei Province, the People’s Republic of China, China Automotive Systems, Inc. is a leading supplier of power steering components

and systems to the Chinese automotive industry, operating through eight Sino-foreign joint ventures. The Company offers a full range

of steering system parts for passenger automobiles and commercial vehicles. The Company currently offers four separate series of power

steering with an annual production capacity of over 6 million sets of steering gears, columns and steering hoses. Its customer base is

comprised of leading auto manufacturers, such as China FAW Group, Corp., Dongfeng Auto Group Co., Ltd., BYD Auto Company Limited, Beiqi

Foton Motor Co., Ltd. and Chery Automobile Co., Ltd. in China, and Fiat Chrysler Automobiles (“FCA”) and Ford Motor Company

in North America. For more information, please visit: http://www.caasauto.com.

Forward-Looking

Statements

This

press release contains statements that are “forward-looking statements” as defined under the Private Securities Litigation

Reform Act of 1995. Forward-looking statements represent our estimates and assumptions only as of the date of this press release. Our

actual results may differ materially from the results described in or anticipated by our forward-looking statements due to certain risks

and uncertainties. As a result, the Company’s actual results could differ materially from those contained in these forward-looking

statements due to a number of factors, including those described under the heading “Risk Factors” in the Company’s

Annual Report on Form 10-K as filed with the Securities and Exchange Commission on March 30, 2023, and in documents subsequently filed

by the Company from time to time with the Securities and Exchange Commission. Any of these factors and other factors beyond our control,

could have an adverse effect on the overall business environment, cause uncertainties in the regions where we conduct business, cause

our business to suffer in ways that we cannot predict and materially and adversely impact our business, financial condition and results

of operations. A prolonged disruption or any further unforeseen delay in our operations of the manufacturing, delivery and assembly process

within any of our production facilities could continue to result in delays in the shipment of products to our customers, increased costs

and reduced revenue. We expressly disclaim any duty to provide updates to any forward-looking statements made in this press release,

whether as a result of new information, future events or otherwise.

For

further information, please contact:

Jie

Li

Chief

Financial Officer

China

Automotive Systems, Inc.

jieli@chl.com.cn

Kevin

Theiss

Awaken

Advisors

+1-212-521-4050

Kevin@awakenlab.com

-Tables Follow –

China Automotive

Systems, Inc. and Subsidiaries

Condensed Unaudited

Consolidated Statements of Operations and Comprehensive Income

(In thousands

of USD, except share and per share amounts)

| | |

Three Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| Net product sales ($13,194 and $9,158 sold to related parties for the three months ended June 30, 2023 and 2022) | |

$ | 137,410 | | |

$ | 127,161 | |

| Cost of products sold ($7,311 and $6,496 purchased from related parties for the three months ended June 30, 2023 and 2022) | |

| 114,692 | | |

| 104,450 | |

| Gross profit | |

| 22,718 | | |

| 22,711 | |

| Gain on other sales | |

| 742 | | |

| 2,105 | |

| Less: Operating expenses | |

| | | |

| | |

| Selling expenses | |

| 3,794 | | |

| 4,068 | |

| General and administrative expenses | |

| 5,271 | | |

| 5,662 | |

| Research and development expenses | |

| 6,606 | | |

| 7,886 | |

| Total operating expenses | |

| 15,671 | | |

| 17,616 | |

| Income from operations | |

| 7,789 | | |

| 7,200 | |

| Other income, net | |

| 1,963 | | |

| 2,804 | |

| Interest expense | |

| (276 | ) | |

| (370 | ) |

| Financial income, net | |

| 3,963 | | |

| 2,543 | |

| Income before income tax expenses and equity in earnings of affiliated companies | |

| 13,439 | | |

| 12,177 | |

| Less: Income taxes expense | |

| 1,487 | | |

| 3,156 | |

| Add: Equity in (loss)/earnings of affiliated companies | |

| (484 | ) | |

| 914 | |

| Net income | |

| 11,468 | | |

| 9,935 | |

| Less: Net income attributable to non-controlling interests | |

| 995 | | |

| 500 | |

| Accretion to redemption value of redeemable non-controlling interests | |

| (7 | ) | |

| (7 | ) |

| Net income attributable to parent company’s common shareholders | |

$ | 10,466 | | |

$ | 9,428 | |

| Comprehensive income: | |

| | | |

| | |

| Net income | |

$ | 11,468 | | |

$ | 9,935 | |

| Other comprehensive income: | |

| | | |

| | |

| Foreign currency translation loss, net of tax | |

| (16,886 | ) | |

| (19,055 | ) |

| Comprehensive loss | |

| (5,418 | ) | |

| (9,120 | ) |

| Comprehensive loss attributable to non-controlling interests | |

| (80 | ) | |

| (642 | ) |

| Accretion to redemption value of redeemable non-controlling interests | |

| (7 | ) | |

| (7 | ) |

| Comprehensive loss attributable to parent company | |

$ | (5,345 | ) | |

$ | (8,485 | ) |

| | |

| | | |

| | |

| Net income attributable to parent company’s common shareholders per share - | |

| | | |

| | |

| | |

| | | |

| | |

| Basic | |

$ | 0.35 | | |

$ | 0.31 | |

| Diluted | |

$ | 0.35 | | |

$ | 0.31 | |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding - | |

| | | |

| | |

| Basic | |

| 30,185,702 | | |

| 30,847,706 | |

| Diluted | |

| 30,189,537 | | |

| 30,849,009 | |

China Automotive

Systems, Inc. and Subsidiaries

Condensed Unaudited

Consolidated Statements of Operations and Comprehensive Income

(In thousands

of USD, except share and per share amounts)

| | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| Net product sales ($26,770 and $20,162 sold to related parties for the six months ended June 30, 2023 and 2022) | |

$ | 279,653 | | |

$ | 263,557 | |

| Cost of products sold ($14,326 and $14,036 purchased from related parties for the six months ended June 30, 2023 and 2022) | |

| 235,317 | | |

| 226,112 | |

| Gross profit | |

| 44,336 | | |

| 37,445 | |

| Gain on other sales | |

| 1,395 | | |

| 3,036 | |

| Less: Operating expenses | |

| | | |

| | |

| Selling expenses | |

| 7,178 | | |

| 8,380 | |

| General and administrative expenses | |

| 10,024 | | |

| 10,416 | |

| Research and development expenses | |

| 12,996 | | |

| 16,023 | |

| Total operating expenses | |

| 30,198 | | |

| 34,819 | |

| Income from operations | |

| 15,533 | | |

| 5,662 | |

| Other income, net | |

| 3,465 | | |

| 6,323 | |

| Interest expense | |

| (525 | ) | |

| (772 | ) |

| Financial income, net | |

| 3,541 | | |

| 4,558 | |

| Income before income tax expenses and equity in earnings of affiliated companies | |

| 22,014 | | |

| 15,771 | |

| Less: Income taxes expense | |

| 2,316 | | |

| 4,114 | |

| Add: Equity in loss of affiliated companies | |

| (347 | ) | |

| (1,573 | ) |

| Net income | |

| 19,351 | | |

| 10,084 | |

| Less: Net income attributable to non-controlling interests | |

| 2,050 | | |

| 700 | |

| Accretion to redemption value of redeemable non-controlling interests | |

| (15 | ) | |

| (15 | ) |

| Net income attributable to parent company’s common shareholders | |

$ | 17,286 | | |

$ | 9,369 | |

| Comprehensive income: | |

| | | |

| | |

| Net income | |

$ | 19,351 | | |

$ | 10,084 | |

| Other comprehensive income: | |

| | | |

| | |

| Foreign currency translation loss, net of tax | |

| (12,332 | ) | |

| (17,618 | ) |

| Comprehensive income/(loss) | |

| 7,019 | | |

| (7,534 | ) |

| Comprehensive income/(loss) attributable to non-controlling interests | |

| 1,241 | | |

| (353 | ) |

| Accretion to redemption value of redeemable non-controlling interests | |

| (15 | ) | |

| (15 | ) |

| Comprehensive income/(loss) attributable to parent company | |

$ | 5,763 | | |

$ | (7,196 | ) |

| | |

| | | |

| | |

| Net income attributable to parent company’s common shareholders per share - | |

| | | |

| | |

| | |

| | | |

| | |

| Basic | |

$ | 0.57 | | |

$ | 0.30 | |

| Diluted | |

$ | 0.57 | | |

$ | 0.30 | |

| Weighted average number of common shares outstanding - | |

| | | |

| | |

| Basic | |

| 30,185,702 | | |

| 30,849,730 | |

| Diluted | |

| 30,191,309 | | |

| 30,850,859 | |

China Automotive

Systems, Inc. and Subsidiaries

Condensed Unaudited

Consolidated Balance Sheets

(In thousands

of USD unless otherwise indicated)

| | |

June 30, 2023 | | |

December 31, 2022 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 95,620 | | |

$ | 121,216 | |

| Pledged cash | |

| 29,921 | | |

| 37,735 | |

| Accounts and notes receivable, net - unrelated parties | |

| 217,493 | | |

| 214,308 | |

| Accounts and notes receivable, net - related parties | |

| 16,547 | | |

| 10,016 | |

| Inventories | |

| 100,262 | | |

| 112,236 | |

| Other current assets | |

| 28,063 | | |

| 25,207 | |

| Total current assets | |

| 487,906 | | |

| 520,718 | |

| Non-current assets: | |

| | | |

| | |

| Property, plant and equipment, net | |

| 99,347 | | |

| 106,606 | |

| Land use rights, net | |

| 9,080 | | |

| 9,555 | |

| Long-term investments | |

| 62,179 | | |

| 59,810 | |

| Other non-current assets | |

| 26,065 | | |

| 17,663 | |

| Total assets | |

$ | 684,577 | | |

$ | 714,352 | |

| | |

| | | |

| | |

| LIABILITIES, MEZZANINE EQUITY AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Short-term loans | |

$ | 38,457 | | |

$ | 45,671 | |

| Accounts and notes payable-unrelated parties | |

| 205,951 | | |

| 218,412 | |

| Accounts and notes payable-related parties | |

| 10,762 | | |

| 16,695 | |

| Accrued expenses and other payables | |

| 45,972 | | |

| 48,311 | |

| Other current liabilities | |

| 33,458 | | |

| 35,106 | |

| Total current liabilities | |

| 334,600 | | |

| 364,195 | |

| Long-term liabilities: | |

| | | |

| | |

| Long-term tax payable | |

| 8,781 | | |

| 15,805 | |

| Other non-current liabilities | |

| 6,761 | | |

| 6,937 | |

| Total liabilities | |

$ | 350,142 | | |

$ | 386,937 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Mezzanine equity: | |

| | | |

| | |

| Redeemable non-controlling interests | |

| 598 | | |

| 582 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock, $0.0001 par value - Authorized - 80,000,000 shares; Issued – 32,338,302 and 32,338,302 shares as of June 30, 2023 and December 31, 2022, respectively | |

$ | 3 | | |

$ | 3 | |

| Additional paid-in capital | |

| 63,731 | | |

| 63,731 | |

| Retained earnings- | |

| | | |

| | |

| Appropriated | |

| 11,851 | | |

| 11,851 | |

| Unappropriated | |

| 264,460 | | |

| 247,174 | |

| Accumulated other comprehensive income | |

| (14,936 | ) | |

| (3,413 | ) |

| Treasury stock – 2,152,600 and 2,152,600 shares as of June 30, 2023 and December 31, 2022, respectively | |

| (7,695 | ) | |

| (7,695 | ) |

| Total parent company stockholders’ equity | |

| 317,414 | | |

| 311,651 | |

| Non-controlling interests | |

| 16,423 | | |

| 15,182 | |

| Total stockholders’ equity | |

| 333,837 | | |

| 326,833 | |

| Total liabilities, mezzanine equity and stockholders’ equity | |

$ | 684,577 | | |

$ | 714,352 | |

China Automotive

Systems, Inc. and Subsidiaries

Condensed Unaudited

Consolidated Statements of Cash Flows

(In thousands

of USD unless otherwise indicated)

| | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income | |

$ | 19,351 | | |

$ | 10,084 | |

| Adjustments to reconcile net income from operations to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 9,528 | | |

| 12,012 | |

| (Reversal)/provision of credit losses | |

| (459 | ) | |

| 527 | |

| Deferred income taxes | |

| 237 | | |

| 2,945 | |

| Equity in loss of affiliated companies | |

| 347 | | |

| 1,573 | |

| Loss on fixed assets disposals | |

| 15 | | |

| 46 | |

| (Increase)/decrease in: | |

| | | |

| | |

| Accounts and notes receivable | |

| (18,323 | ) | |

| (4,333 | ) |

| Inventories | |

| 8,355 | | |

| 896 | |

| Other current assets | |

| (904 | ) | |

| (1,218 | ) |

| Increase/(decrease) in: | |

| | | |

| | |

| Accounts and notes payable | |

| (10,323 | ) | |

| (6,156 | ) |

| Accrued expenses and other payables | |

| (604 | ) | |

| (2,643 | ) |

| Long-term taxes payable | |

| (5,268 | ) | |

| (2,809 | ) |

| Other current liabilities | |

| (2,004 | ) | |

| 3,560 | |

| Net cash (used in)/provided by operating activities | |

| (52 | ) | |

| 14,484 | |

| Cash flows from investing activities: | |

| | | |

| | |

| (Increase)/decrease in demand loans included in other non-current assets | |

| (14 | ) | |

| 291 | |

| Cash received from property, plant and equipment sales | |

| 582 | | |

| 572 | |

| Payments to acquire property, plant and equipment (including $2,022 and $2,143 paid to related parties for the six months ended June 30, 2023 and 2022, respectively) | |

| (5,438 | ) | |

| (7,881 | ) |

| Payments to acquire intangible assets | |

| (2,361 | ) | |

| (41 | ) |

| Investment under the equity method | |

| (7,729 | ) | |

| (5,480 | ) |

| Purchase of short-term investments | |

| (40,491 | ) | |

| (59,758 | ) |

| Proceeds from maturities of short-term investments | |

| 30,822 | | |

| 45,150 | |

| Cash received from long-term investment | |

| 583 | | |

| 2,704 | |

| Net cash used in investing activities | |

| (24,046 | ) | |

| (24,443 | ) |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from bank loans | |

| 34,280 | | |

| 35,852 | |

| Repayments of bank loans | |

| (39,836 | ) | |

| (32,916 | ) |

| Repayments of the borrowing for sale and leaseback transaction | |

| — | | |

| (1,130 | ) |

| Repurchase of common shares | |

| — | | |

| (196 | ) |

| Net cash (used in)/ provided by financing activities | |

| (5,556 | ) | |

| 1,610 | |

| Effects of exchange rate on cash, cash equivalents and pledged cash | |

| (3,756 | ) | |

| (7,327 | ) |

| Net decrease in cash, cash equivalents and pledged cash | |

| (33,410 | ) | |

| (15,676 | ) |

| Cash, cash equivalents and pledged cash at beginning of the period | |

| 158,951 | | |

| 159,498 | |

| Cash, cash equivalents and pledged cash at end of the period | |

$ | 125,541 | | |

$ | 143,822 | |

v3.23.2

Cover

|

Aug. 11, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 11, 2023

|

| Entity File Number |

000-33123

|

| Entity Registrant Name |

China Automotive Systems, Inc.

|

| Entity Central Index Key |

0001157762

|

| Entity Tax Identification Number |

33-0885775

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

No. 1 Henglong Road, Yu Qiao Development Zone

|

| Entity Address, Address Line Two |

Shashi District

|

| Entity Address, Address Line Three |

Jing Zhou City

|

| Entity Address, City or Town |

Hubei Province

|

| Entity Address, Country |

CN

|

| City Area Code |

86

|

| Local Phone Number |

27-8757 0027

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value

|

| Trading Symbol |

CAAS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

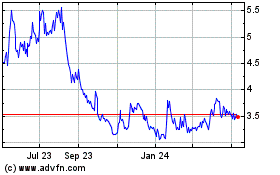

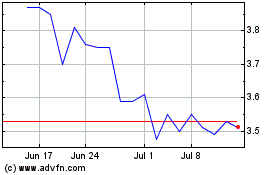

China Automotive Systems (NASDAQ:CAAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

China Automotive Systems (NASDAQ:CAAS)

Historical Stock Chart

From Apr 2023 to Apr 2024