Exhibit 99.1

HUADI INTERNATIONAL GROUP CO., LTD.

No. 1688 Tianzhong Street, Longwan District,

Wenzhou, Zhejiang Province

People’s Republic of China 325025

PROXY STATEMENT AND NOTICE OF

ANNUAL MEETING OF SHAREHOLDERS

|

To the shareholders of

Huadi International Group Co., Ltd.

|

|

August 11, 2023

Wenzhou, China

|

To our shareholders:

It is my pleasure to invite you to our 2023 Annual Meeting of Shareholders on September 1, 2023, at 10:00 A.M., Beijing Time (August 31, 2023, at 10:00 P.M., Eastern Time). The meeting will be held at one of our executive offices at No. 1688 Tianzhong Street, Longwan District, Wenzhou, Zhejiang Province, People’s Republic of China.

The matters to be acted upon at the meeting are described in the Notice of Annual Meeting of Shareholders and Proxy Statement.

YOUR VOTE IS VERY IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING OF SHAREHOLDERS, WE URGE YOU TO VOTE AND SUBMIT YOUR PROXY ON THE INTERNET OR BY MAIL. IF YOU ARE A REGISTERED SHAREHOLDER AND ATTEND THE MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE YOUR SHARES IN PERSON. IF YOU HOLD YOUR SHARES THROUGH A BANK OR BROKER AND WANT TO VOTE YOUR SHARES IN PERSON AT THE MEETING, PLEASE CONTACT YOUR BANK OR BROKER TO OBTAIN A LEGAL PROXY. THANK YOU FOR YOUR SUPPORT.

|

|

|

By order of the Board of Directors,

|

| |

|

/s/ Di Wang

|

| |

|

Di Wang

|

| |

|

Chairman of the Board of Directors

|

NOTICE OF THE 2023 ANNUAL MEETING

OF SHAREHOLDERS OF

HUADI INTERNATIONAL GROUP CO., LTD.

|

TIME:

|

|

10 A.M., Beijing Time, on September 1, 2023

(10 P.M., Eastern Time, on August 31, 2023)

|

|

PLACE:

|

|

No. 1688 Tianzhong Street, Longwan District, Wenzhou, Zhejiang Province, People’s Republic of China.

|

ITEMS OF BUSINESS:

(1) The election of five directors, each to serve a term expiring at the Annual Meeting of Shareholders in 2024 or until their successors are duly elected and qualified;

(2) The ratification of the appointment of HTL CPA’S and Business Advisors LLC (“HTL”) as the independent registered public accounting firm of Huadi International Group Co., Ltd. (the “Company”) for the fiscal year ending September 30, 2023;

(3) The transaction of any other business properly coming before the meeting.

|

WHO MAY VOTE:

|

|

You may vote if you were a shareholder of record on August 2, 2023.

|

|

ANNUAL REPORT:

|

|

A copy of our 2022 annual report on Form 20-F is available on the Company’s website at http://ir.huadi.cc/index.html under Financial Info and in print upon request.

|

|

DATE OF MAILING:

|

|

This notice and the proxy statement are first being mailed to shareholders on or about August 11, 2023.

|

|

|

|

By order of the Board of Directors,

|

| |

|

/s/ Di Wang

|

| |

|

Di Wang

|

| |

|

Chairman of the Board of Directors

|

ABOUT THE 2023 ANNUAL MEETING OF SHAREHOLDERS

What am I voting on?

You will be voting on the following:

(1) The election of five directors, each to serve a term expiring at the Annual Meeting of Shareholders in 2024 or until their successors are duly elected and qualified;

(2) The ratification of the appointment of HTL as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2023;

(3) The transaction of any other business properly coming before the meeting.

Who is entitled to vote?

You may vote if you owned ordinary shares of the Company as of the close of business on August 2, 2023. Each ordinary share is entitled to one vote. As of August 2, 2023, we had 14,259,182 ordinary shares outstanding.

How do I vote before the meeting?

If you are a registered shareholder, meaning that you hold your shares in certificate form, you have two voting options:

(1) By Internet, which we encourage if you have Internet access, at the address shown on your proxy card;

(2) By mail, by completing, signing and returning the enclosed proxy card.

If you hold your shares through an account with a bank or broker, your ability to vote by the Internet depends on their voting procedures. Please follow the directions that your bank or broker provides.

May I vote at the meeting?

If you are a shareholder of record, you may vote in person at the meeting. If you hold your shares through an account with a bank or broker, please follow the directions provided to you by your bank or broker. If you wish to vote in person at the meeting, please contact your bank or broker to learn the procedures necessary to allow you to vote your shares in person. Even if you plan to attend the meeting, we encourage you to vote your shares by proxy. You may vote by proxy through the Internet or by mail.

Can I change my mind after I return my proxy?

You may change your vote at any time before the polls close at the conclusion of voting at the meeting. You may do this by (1) signing another proxy card with a later date and returning it to us before the meeting, (2) voting again over the Internet prior to the time of the meeting, or (3) voting at the meeting if you are a registered shareholder or have followed the necessary procedures required by your bank or broker.

What if I return my proxy card but do not provide voting instructions?

Proxies that are signed and returned but do not contain instructions will be voted in favor of Proposals 1 and 2 in accordance with the best judgment of the named proxies on any other matters properly brought before the meeting.

What does it mean if I receive more than one proxy card or instruction form?

It indicates that your ordinary shares are registered differently and are in more than one account. To ensure that all shares are voted, please either vote each account on the Internet, or sign and return all proxy cards. We encourage you to register all your accounts in the same name and address. Those holding shares through a bank or broker should contact their bank or broker and request consolidation.

1

Will my shares be voted if I do not provide my proxy or instruction form?

If you are a registered shareholder and do not provide a proxy, you must attend the meeting in order to vote your shares. If you hold shares through an account with a bank or broker, your shares may be voted even if you do not provide voting instructions on your instruction form. Brokerage firms have the authority to vote shares for which their customers do not provide voting instructions on certain routine matters. The ratification of the appointment of HTL as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2023 is considered a routine matter for which brokerage firms may vote without specific instructions. However, election of directors is no longer considered a routine matter for which brokerage firms may vote without specific instructions. When a proposal is not a routine matter and the brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm cannot vote the shares on that proposal. Shares that a broker is not authorized to vote are counted as “broker non-votes.”

How can I attend the meeting?

The meeting is open to all holders of the Company’s ordinary shares as of August 2, 2023.

May shareholders ask questions at the meeting?

Yes. Representatives of the Company will answer questions of general interest at the end of the meeting. You may also submit questions in advance via email to ir@huadigroup.com. Such questions will also be addressed at the end of the meeting.

How many votes must be present to hold the meeting?

Your shares are counted as present at the meeting if you attend the meeting and vote in person or if you properly return a proxy by internet or mail. In order for us to conduct our meeting, one-third of our outstanding ordinary shares as of August 2, 2023 must be present in person or by proxy. This is referred to as a quorum. Abstentions and broker non-votes will be counted for purposes of establishing a quorum at the meeting. If a quorum is not present or represented, the Chairman of the meeting may, with the consent of the meeting, adjourn the meeting from time to time, without notice other than announcement at the meeting, until a quorum is present or represented.

How many votes are needed to approve the Company’s proposals?

Proposal 1. The nominees receiving the highest number of “For” votes will be elected as directors. This number is called a plurality. Shares not voted will have no impact on the election of directors. The proxy given will be voted “For” each of the nominees for director unless a properly executed proxy card is marked “Withhold” as to a particular nominee or nominees for director.

Proposal 2. The ratification of the appointment of HTL as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2023 requires that a majority of the votes cast at the meeting be voted “For” the proposal. A properly executed proxy card marked “Abstain” with respect to this proposal will not be voted.

2

PROPOSAL ONE

ELECTION OF DIRECTORS

(ITEM 1 ON THE PROXY CARD)

Our Board currently consists of five directors, each serving a one-year term. The existing directors are Mr. Di Wang, Mr. Jueqin Wang, Mr. He Huang, Mr. Jiancong Huang, Mr. Songlin Li. At the Annual Meeting, the shareholders will vote on the reelection of all of the existing directors. All directors will hold office until our next annual meeting of shareholders, at which time shareholders will vote on the election and qualification of their successors.

All shares duly voted will be voted for the election of directors as specified by the shareholders. No proxy may be voted for more people than the number of nominees listed below. Unless otherwise instructed, the proxy holders will vote the proxies received by them FOR the election of each of the nominees named below, all of whom are presently directors. If any nominee is unable or declines to serve as a director at the time of the Annual Meeting, although we know of no reason to anticipate that this will occur, the proxies will be voted for any nominee designated by the present Board to fill the vacancy.

The following paragraphs set forth information regarding the current ages, positions, and business experience of the nominees.

Di Wang

Chairman of the Board of Directors

Age — 77

Director since incorporation in 2020

Mr. Wang has been serving as the Chairman of the Board of Huadi International since inception. Mr. Wang is also the founder and Chairman of the Board of Huadi Steel. Mr. Wang has extensive experience in manufacturing and managing manufacturing plants. He had been the senior management of three manufacturing plants prior to founding Huadi Steel in 1998. He is the leader and member of many industry associations, including being the vice president of the Stainless Steel Branch of China Special Steel Association, the president of Wenzhou Stainless Steel Industry Association, the chair of the Steel Pipe Committee of Zhejiang Metallurgical Industry Association, the representative of the tenth Party Congress of Wenzhou City, member of the second and third CPPCC Standing Committee of Longwan District, Zhejiang Province.

Mr. Wang is nominated to serve another term as a director because, as one of our co-founders, he has significant experience in leading and advising our Company and has more than twenty years of experience in the Stainless Steel industry.

Jueqin Wang

Director

Age — 50

Director since incorporation in 2020

Mr. Wang has been a Director of Huadi International since inception. He is also the President of Huadi Steel, where he started as a sales manager in 1998. He has extensive experience in the steel manufacturing industry. Mr. Wang has also been the Chairman of a leather company in Wenzhou, PRC since 1999. Mr. Wang is a licensed engineer in China.

Mr. Wang is nominated to serve another term as a director because, as one of our co-founders, he has extensive business and management skills and experience in our industry and business.

3

He Huang

Independent Director

Age — 50

Director since 2021

Mr. Huang has been an director of the Company since 2021. Mr. Huang is an Associate Professor of Accounting at Yeshiva University’s Sy Syms School of Business. Mr. Huang’s current teaching interests are managerial accounting and contemporary topics in accounting such as International Financial Reporting Standards (IFRS) and accounting research based on FASB codification and eIFRS. Professor Huang’s research focuses on the impact of external monitoring mechanisms (e.g., securities litigation, shareholder rights, regulations, and hedge fund activism) on firms’ accounting practice, valuation, and internal governance. Professor Huang’s practical expertise covers international investment and trade, accounting information system, accounting-related securities litigation, and entrepreneurial planning. His research has been frequently cited by both the academic and professional communities and has won research grants from the Research Grants Council of Hong Kong. Before joining Yeshiva University, Professor Huang taught accounting courses at University of Houston, Butler University in Indianapolis, and Prairie View A&M University (a Member of Texas A&M University System) in Houston. Professor Huang received a Ph.D. degree in accounting from Bauer College of Business, University of Houston. He received a Master’s Degree in Science from Bauer College of Business, University of Houston. Professor Huang has also earned law degrees from both U.S. and China. We believe Professor He’s expertise in accounting will help us improve our accounting reporting. In addition, the Board believes that Mr. Huang qualifies as a “financial expert” as defined by the SEC rules and therefore appointed him as the chairman of the Audit Committee.

Mr. Huang is nominated to serve another term as a director because of her expertise in US GAAP accounting, and the Board believes that Mr. Huang qualifies as a “financial expert” as defined by the SEC rules.

Jiancong Huang

Independent Director

Age — 60

Director since 2021

Mr. Huang is the Chief Executive Officer and Chairman of the Board of ZK International Group Co., Ltd. (Nasdaq: ZKIN). Mr. Huang has extensive experience in manufacturing industry and held President position in two companies before ZK was founded. He earned his EMBA from Renmin University of China and Engineering Professional Title, and was awarded as Top10 Wenzhou Entrepreneurship and appointed to be the Vice Director of China Construction and Building Standard and Safety Committee. He is also members of National Pipe Standard Committee and National Building Water Supply and Waste Standard Committee. Mr. Huang is an experienced corporate strategist and visionary with decades of experience on corporate management and innovation. He has a systematic ideology on the future of stainless steel pipe in the water and gas supply area. We believe his expertise in the industry and public company experience will help us enhance our corporate governance standard.

Mr. Cao is nominated to serve another term as a director because of his industry expertise and public company experience.

Songlin Li

Independent Director

Age — 54

Director since 2021

Mr. Li is the Chairman of Wenzhou Stainless Steel Industry Association and he has been working as the Chairman of Zhejiang Fengye Group Co., Ltd. since 2002. He is a Stainless Steel Engineer and has over twenty years of working experience in the Stainless Steel Industry. We believe his industry expertise will help contribute to the growth of our company.

Mr. Li is nominated to serve another term as a director because of his working experience in the Stainless Steel Industry.

4

Board Diversity Matrix

This table below provides certain information regarding the diversity of our Board of Directors (the “Board”) as of the date of this proxy statement.

|

Board Diversity Matrix

|

|

Country of Principal Executive Offices

|

China

|

|

Foreign Private Issuer

|

Yes

|

|

Disclosure Prohibited Under Home Country Law

|

No

|

|

Total Number of Directors

|

5

|

| |

Female

|

Male

|

Non-Binary

|

Did Not Disclose

Gender

|

|

Part I: Gender Identity

|

|

Directors

|

0

|

5

|

—

|

—

|

|

Part II: Demographic Background

|

|

Underrepresented Individual in Home Country Jurisdiction

|

—

|

|

LGBTQ+

|

—

|

|

Did Not Disclose Demographic Background

|

—

|

Involvement in Certain Legal Proceedings

To the best of our knowledge, none of our directors or officers has been convicted in a criminal proceeding, excluding traffic violations or similar misdemeanors, nor has any been a party to any judicial or administrative proceeding during the past five years that resulted in a judgment, decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws, except for matters that were dismissed without sanction or settlement. Except as set forth in our discussion in “Related Party Transactions” in our annual report for the fiscal year ended September 30, 2022, our directors and officers have not been involved in any transactions with us or any of our affiliates or associates which are required to be disclosed pursuant to the rules and regulations of the SEC.

Board Leadership Structure

Mr. Di Wang serves as the Chairman of the Board of Directors. In addition, he has served as our Chief Executive Officer since the beginning. As a smaller public company, we believe it is in the company’s best interest to allow the company to benefit from guidance from key members of management in a variety of capacities. We do not have a lead independent director and do not anticipate having a lead independent director because we will encourage our independent directors to freely voice their opinions on a relatively small company board. We believe this leadership structure is appropriate because we are a relatively small public company.

Risk Oversight

Our Board of Directors plays a significant role in our risk oversight. The Board of Directors makes all relevant Company decisions. As such, it is important for us to have our Chief Executive Officer serve on the Board as he plays a key role in the risk oversight of the Company. As a smaller reporting company with a small board of directors, we believe it is appropriate to have the involvement and input of all of our directors in risk oversight matters.

WE RECOMMEND THAT YOU VOTE FOR THE ELECTION OF THE NOMINEES TO THE BOARD OF DIRECTORS.

5

PROPOSAL TWO

RATIFICATION OF THE APPOINTMENT OF HTL

(ITEM 2 ON THE PROXY CARD)

What am I voting on?

A proposal to ratify the appointment of HTL as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2023. The Audit Committee of the Board of Directors has appointed HTL to serve as the Company’s fiscal year 2023 independent registered public accounting firm. Although the Company’s governing documents do not require the submission of this matter to shareholders, the Board of Directors considers it desirable that the appointment of HTL be ratified by shareholders.

Has the Company changed its independent registered public accounting firm during its two most recent fiscal years?

HTL was appointed by the Audit Committee and the Board of Directors of the Company to serve as its independent registered public accounting firm for fiscal years ended September 30, 2023. Audit services provided by TPS Thayer, LLC for fiscal years ended September 30, 2022 and 2021 included the examination of the consolidated financial statements of the Company and services related to periodic filings made with the SEC.

What services does HTL provide?

Audit services provided by HTL for fiscal 2023 will include the examination of the consolidated financial statements of the Company and services related to periodic filings made with the SEC.

Will a representative of HTL be present at the meeting?

A representative of HTL is not expected to be present at the Meeting and therefore will not (i) have the opportunity to make a statement if they so desire or (ii) be available to respond to questions from shareholders.

What if this proposal is not approved?

If the appointment of HTL is not ratified, the Audit Committee of the Board of Directors will reconsider the appointment.

WE RECOMMEND THAT YOU VOTE FOR THE RATIFICATION OF HTL AS THE COMPANY’S FISCAL YEAR 2023 INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

6

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE INFORMATION

What if a nominee is unwilling or unable to serve?

The nominee listed in the Proxy Statement has agreed to serve as a director, if elected. If for some unforeseen reason a nominee becomes unwilling or unable to serve, proxies will be voted for a substitute nominee selected by the Board of Directors.

How are directors compensated?

All directors hold office until the expiration of their respective terms or until their successors have been duly elected and qualified. Officers are elected by and serve at the discretion of the Board of Directors. Employee directors do not receive any compensation for their services. Non-employee directors are entitled to receive a cash fee for serving as directors and may receive option grants from our Company. In addition, non-employee directors are entitled to receive compensation for their actual travel expenses for each Board of Directors meeting attended. We have agreed to pay Di Wang and Jueqin Wangcash compensation of RMB100,000 (approximately $ 25,018) per year. We have also agreeded to pay He Huang, Jiancong Huang and Songlin Li $20,000, $20,000 and $10,000 per year for their service. The salaries are paid yearly with payroll dates at the end of each year.

How does the Board determine which directors are independent?

The Board of Directors reviews the independence of each director yearly. During this review, the Board of Directors considers transactions and relationships between each director (and his or her immediate family and affiliates) and the Company and its management to determine whether any such relationships or transactions are inconsistent with a determination that the director is independent in light of applicable law, listing standards and the Company’s director independence standards. The Company believes that it maintains a majority of independent directors who are deemed to be independent under the definition of independence provided by Nasdaq Listing Rule 5605(a)(2).

Who served on the Audit Committee of the Board of Directors during fiscal year 2022?

The members of the Audit Committee are and were, as of September 30, 2022, He Huang, Songlin Li, Jiancong Huang. Each member of the Audit Committee is independent under the rules of the SEC and the Nasdaq Capital Market. The Board of Directors has determined that Mr. Huang, who is an independent director, is an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K promulgated under the Exchange Act.

What document governs the activities of the Audit Committee?

The Audit Committee acts under a written charter, which sets forth its responsibilities and duties, as well as requirements for the Audit Committee’s composition and meetings. The Audit Committee Charter is available on the Company’s website at http://ir.huadi.cc/index.html under Governance Documents.

How does the Audit Committee conduct its meetings?

During fiscal year 2022, the Audit Committee met with the senior members of the Company’s financial management team and the Company’s independent registered public accounting firm. The Audit Committee’s agenda was established by the Chairman of the Audit Committee. At its meeting, the Audit Committee reviewed and discussed various financial and regulatory issues. The Audit Committee also had private, separate sessions from time to time with representatives of the Company’s independent registered public accounting firm, at which meetings candid discussions of financial management, accounting and internal control issues took place.

Does the Audit Committee review the periodic reports and other public financial disclosures of the Company?

The Audit Committee reviews each of the Company’s interim and annual reports, including Management’s Discussion of Results of Operations and Financial Condition. As part of this review, the Audit Committee discusses the reports with the Company’s management and considers the audit and review reports prepared by the independent registered public accounting firm about the Company’s interim and annual reports, as well as related matters such as the quality (and not just the acceptability) of the Company’s accounting principles, alternative methods of accounting under

7

generally accepted accounting principles and the preferences of the independent registered public accounting firm in this regard, the Company’s critical accounting policies and the clarity and completeness of the Company’s financial and other disclosures.

What is the role of the Audit Committee in connection with the financial statements and controls of the Company?

The Company’s Management has the primary responsibility for the financial statements and internal control over financial reporting. The independent registered public accounting firm has responsibility for the audit of the Company’s financial statements. The responsibility of the Audit Committee is to oversee financial and control matters, among other responsibilities fulfilled by the Audit Committee under its charter. The Audit Committee meets regularly with the independent registered public accounting firm, without the presence of management, to ensure candid and constructive discussions about the Company’s compliance with accounting standards and best practices among public companies comparable in size and scope to the Company. The Audit Committee also regularly reviews with its outside advisors’ material developments in the law and accounting literature that may be pertinent to the Company’s financial reporting practices.

What has the Audit Committee done with regard to the Company’s audited financial statements for fiscal year 2022?

The Audit Committee has:

• reviewed and discussed the audited financial statements with the Company’s management; and

• discussed with TPS Thayer, LLC, the Company’s independent registered public accounting firm for the 2022 fiscal year, the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended.

Has the Audit Committee considered the independence of the Company’s auditors?

The Audit Committee has received from TPS Thayer, LLC the written disclosures and the letter required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, and the Audit Committee has discussed with TPS Thayer, LLC about their independence. The Audit Committee has concluded that TPS Thayer, LLC are independent from the Company and its management.

Has the Audit Committee made a recommendation regarding the audited financial statements for fiscal year 2022?

Based upon its review and the discussions with management and the Company’s independent registered public accounting firm, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements for the Company be included in the Company’s annual report on Form 20-F for fiscal year 2022.

Has the Audit Committee reviewed the fees paid to the independent registered public accounting firm during fiscal year 2022?

The Audit Committee has reviewed and discussed the fees paid to TPS Thayer, LLC during fiscal year 2022 for audit, audit-related, tax and other services, which are set forth below under “Fees Paid to Independent Registered Public Accounting Firm.” The Audit Committee has determined that the provision of non-audit services is compatible with TPS Thayer, LLC independence.

What is the Company’s policy regarding the retention of the Company’s auditors?

The charter of the Audit Committee has a policy regarding the retention of the independent registered public accounting firm that requires pre-approval of all services by the Audit Committee.

8

What role does the Nomination Committee play in selecting nominees to the Board of Directors?

The purpose of the Nomination Committee shall be to review and make recommendations to the Board regarding matters concerning corporate governance; review the composition of and evaluate the performance of the Board; recommend persons for election to the Board and evaluate director compensation; review the composition of committees of the Board and recommend persons to be members of such committees; review and maintain compliance of committee membership with applicable regulatory requirements; and review conflicts of interest of members of the Board and corporate officers. The Nomination Committee’s charter is available on the Company’s website at http://ir.huadi.cc/index.html under Governance and in print upon request. The Nomination Committee of the Company’s Board of Directors was the only entity or person to nominate and/or recommend any of the director nominees.

Are the members of the Nomination Committee independent?

Yes. All members of the Nomination Committee have been determined to be independent by the Board of Directors.

How does the Nomination Committee identify and evaluate nominees for director?

The Nomination Committee considers candidates for nomination to the Board of Directors from a number of sources. The Nomination Committee conducts an annual evaluation of the Board of Directors, identifies, considers, and recommends candidates to fill new positions or vacancies on the Board, and reviews any candidates recommended by stockholders in accordance with the bylaws. The Nomination Committee also evaluates the performance of individual members of the Board eligible for re-election and recommending the director nominees by class for election to the Board by the stockholders at the annual meeting of stockholders.

What are the Nomination Committee’s policies and procedures for considering director candidates recommended by shareholders?

The Nomination Committee will consider all candidates recommended by shareholders. A shareholder wishing to recommend a candidate must submit the following documents to the Secretary of the Company at No. 1688 Tianzhong Street, Longwan District, Wenzhou, Zhejiang Province, People’s Republic of China:

• a recommendation that identifies the name and address of the shareholder and the person to be nominated;

• the written consent of the candidate to serve as a director of the Company, if elected;

• a description of all arrangements between the shareholders and such nominee pursuant to which the nomination is to be made; and

• such other information regarding the nominee as would be required to be included in a proxy statement filed pursuant to the proxy rules of the SEC.

What are the minimum qualifications required to serve on the Company’s Board of Directors?

All members of the Board of Directors must possess the following minimum qualifications as determined by the Nomination Committee:

• A director must demonstrate integrity, accountability, informed judgment, financial literacy, creativity and vision;

• A director must be prepared to represent the best interests of all Company shareholders, and not just one particular constituency;

• A director must have a record of professional accomplishment in his or her chosen field; and

• A director must be prepared and able to participate fully in Board activities, including membership on committees.

If the candidate is to be evaluated by the Nomination Committee, the Secretary will request a detailed resume, an autobiographical statement explaining the candidate’s interest in serving as a director of the Company, a completed statement regarding conflicts of interest, and a waiver of liability for a background check from the candidate.

9

What other considerations does the Nomination Committee consider?

The Nomination Committee believes it is important to have directors from various backgrounds and professions in order to ensure that the Board of Directors has a wealth of experiences to inform its decisions. Consistent with this philosophy, in addition to the minimum standards set forth above, business and managerial experience and an understanding of financial statements and financial matters are very important.

How may shareholders communicate with the members of the Board of Directors?

Shareholders and others who are interested in communicating directly with members of the Board of Directors, including communication of concerns relating to accounting, internal accounting controls or audit matters, or fraud or unethical behavior, may do so by writing to the directors at the following address:

Name of Director or Directors

Huadi International Group Co., Ltd.

No. 1688 Tianzhong Street, Longwan District,

Wenzhou, Zhejiang Province,

People’s Republic of China 325025

Does the Company have a Code of Business Ethics and Conduct?

The Company has adopted a Code of Business Ethics and Conduct, which is applicable to all directors, officers and associates of the Company, including the principal executive officer and the principal financial and accounting officer. The complete text of the Code of Business Ethics and Conduct is available on the Company’s web site at http://ir.huadi.cc/index.html and is also available in print upon request. The Company intends to post any amendments to or waivers from its Code of Business Ethics and Conduct (to the extent applicable to the Company’s principal executive officer and principal financial and accounting officer) at this location on its website.

How often did the Board and the Board committees meet in 2022?

Our Board held no meeting and acted five times by unanimous written consent in lieu of a meeting during the fiscal year ended September 30, 2022. Our Board has an Audit Committee, a Compensation Committee, a Nomination Committee. The Audit Committee held no meeting and acted four times by unanimous written consent during the fiscal year ended September 30, 2022. The Compensation Committee held no meeting and acted zero time by unanimous written consent during the fiscal year ended September 30, 2022. The Nomination Committee held no meeting and acted one time by unanimous written consent during the fiscal year ended September 30, 2022. Each incumbent director attended all of the meetings of the Board of Directors and of the standing committees of which he or she was a member during 2022. The Board invites, but does not require, directors to attend the annual meeting of shareholders.

What are the committees of the Board?

During fiscal year 2022, the Board of Directors had standing Audit, Nomination and Compensation. The members of each of the Committees as of September 30, 2022, their principal functions, and the number of meetings held during the year ended September 30, 2022 are shown below.

Audit Committee

The members of the Audit Committee are:

He Huang, Chairman

Songlin Li

Jiancong Huang

The Audit Committee held no meeting and acted four times by unanimous written consent in lieu of a meeting during the year ended September 30, 2022. The primary responsibility of the Audit Committee is to make such examinations as are necessary to monitor the corporate financial reporting and external audits of the Company and its subsidiaries; to provide to the Board the results of its examinations and recommendations derived therefrom; to outline to the Board improvements made, or to be made, in internal accounting controls; to nominate an independent auditor; and to provide to the Board such additional information and materials as it may deem necessary to make the Board aware of

10

significant financial matters requiring Board attention. The Company believes that each of the members of the Audit Committee is “independent” and that Mr. Huang qualifies as an “audit committee financial expert” in accordance with applicable Nasdaq Capital Market listing standards. The Audit Committee’s charter is available on the Company’s website at http://ir.huadi.cc/index.html under Governance and in print upon request. In carrying out its responsibility, the Audit Committee’s responsibilities include:

1. Reviewing with management and the independent auditor on a continuing basis the adequacy of the Corporation’s system of internal controls (including any significant deficiencies and significant changes in internal controls reported to the Audit Committee by the independent auditor or management), accounting practices, and disclosure controls and procedures (and management reports thereon) of the Corporation and its subsidiaries.

2. Reviewing the independent auditor’s proposed audit scope and approach.

3. Conducting a post-audit review of the financial statements and audit findings, including any significant suggestions for improvement provided to management by the independent auditor.

4. Reviewing the performance of the independent auditor.

5. Recommending the appointment of independent auditor to the Board, setting the independent auditor’s compensation and pre-approving all audit services provided by the independent auditor.

6. Pre-approving all audit and permitted non-audit and tax services to be performed by the independent auditor and establishing policies and procedures for the engagement of the independent auditor to provide permitted non-audit services.

7. Reviewing with management and the independent auditor the annual and quarterly financial statements of the Corporation including (a) the Corporation’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations”; (b) any material changes in accounting principles or practices used in preparing the financial statement prior to the filing of a report on Form 10-K or Form 10- Q with the U.S. Securities and Exchange Commission (“SEC”); and (c) items required by Statement of Auditing Standards 61 and Statement of Auditing Standards 71 in the case of the quarterly statements.

8. Reviewing before release the un-audited quarterly operating results in the Corporation’s quarterly earnings release, financial information and earning guidance provided to analysts.

9. Overseeing compliance with SEC requirements for disclosure of auditor’s services and Audit Committee members and activities;

10. Reviewing management’s monitoring of compliance with the Corporation’s Standards of Business Conduct and with the Foreign Corrupt Practices Act;

11. Reviewing, in conjunction with counsel, any legal matters that could have a significant impact on the Corporation’s financial statements;

12. Providing oversight and review of the Corporation’s asset management policies, including an annual review of the Corporation’s investment policies and performance for cash and short-term investments;

13. If necessary, instituting special investigations and, if appropriate hiring special counsel or experts to assist, for which the Corporation shall provide appropriate funding, as determined by the Committee, for payment of compensation to all advisors hired by the Committee.

14. Reviewing related party transactions for potential conflicts of interest;

15. Obtaining a report from the independent auditor at least annually regarding (a) the independent auditor’s internal quality control procedures, (b) any material issues raised by the most recent internal quality control review, or peer review, of the firm, or by an inquiry or investigation by governmental or professional authorities within the preceding five years respecting one or more independent audits carried out by the firm, (c) any steps taken to deal with such issues, and (d) all relationships between the independent auditor and the Corporation;

11

16. Establishing procedures for the confidential and anonymous receipt, retention and treatment of complaints regarding the Corporation’s accounting, internal controls, and auditing matters;

17. Establishing policies for the hiring of employees and former employees of the independent auditor;

18. Conducting an annual performance evaluation of the Audit Committee and annually evaluate the adequacy of its charter; and,

19. Performing other oversight functions as requested by the full Board.

Compensation Committee

The members of the Compensation Committee are:

Songlin Li, Chairman

Jiancong Huang

He Huang

The Compensation Committee did not hold a meeting or act by unanimous written consent in lieu of a meeting during the year ended September 30, 2022. The Compensation Committee’s charter is available on the Company’s website at http://ir.huadi.cc/index.html under Governance and in print upon request. The Compensation Committee’s responsibilities include:

1. To review and approve annually the corporate goals and objectives applicable to the compensation of the chief executive officer (“CEO”), evaluate at least annually the CEO’s performance in light of those goals and objectives, and determine and approve the CEO’s compensation level based on this evaluation. In determining the long-term incentive component of CEO compensation, the Compensation Committee may consider the Corporation’s performance and relative stockholder return, the value of similar incentive awards given to CEOs at comparable companies and the awards given to the company’s CEO in past years.

2. Reviewing and making recommendations to the Board regarding the compensation policy for executive officers and directors of the Corporation, and such other officers of the Corporation as directed by the Board.

3. Reviewing and making recommendations to the Board regarding all forms of compensation (including all “plan” compensation, as such term is defined in Item 402(a)(7) of Regulation S-K promulgated by the U.S. Securities and Exchange Commission, and all non-plan compensation) to be provided to the executive officers of the Corporation.

4. Reviewing and making recommendations to the Board regarding general compensation goals and guidelines for the Corporation’s employees and the criteria by which bonuses to the Corporation’s employees are determined.

5. Acting as Administrator any Stock Option Plan and administering, within the authority delegated by the Board, any Employee Stock Purchase Plan adopted by the Corporation. In its administration of the plans, the Compensation Committee may, pursuant to authority delegated by the Board, grant stock options or stock purchase rights to individuals eligible for such grants and amend such stock options or stock purchase rights. The Compensation Committee shall also make recommendations to the Board with respect to amendments to the plans and changes in the number of shares reserved for issuance hereunder.

6. Reviewing and making recommendations to the Board regarding other plans that are proposed for adoption or adopted by the Corporation for the provision of compensation to employees of, directors of and consultants to the Corporation.

7. Preparing a report (to be included in the Corporation’s proxy statement) which describes: (a) the criteria on which compensation paid to the Chief Executive Officer for the last completed fiscal year is based; (b) the relationship of such compensation to the Corporation’s performance; and (c) the Compensation Committee’s executive compensation policies applicable to executive officers.

8. Authorizing the repurchase of shares from terminated employees pursuant to the applicable law.

12

The Compensation Committee may not delegate its authority to other persons. Similarly, the Compensation Committee has not engaged a compensation consultant to assist in the determination of executive compensation issues. While the Company’s executives will communicate with the Compensation Committee regarding executive compensation issues, the Company’s executive officers do not participate in any executive compensation decisions.

Nomination Committee

The members of the Nomination Committee are:

Jiancong Huang, Chairman

Songlin Li

He Huang

The Nomination Committee held no meeting and acted one time by unanimous written consent in lieu of a meeting during the fiscal year ended September 30, 2022. The Nomination Committee’s charter is available on the Company’s website at http://ir.huadi.cc/index.html under Governance and in print upon request. All members of the Nomination Committee are independent, as such term is defined by the Nasdaq Capital Market listing standards. The Nomination Committee’s responsibilities include:

1. Reviewing the composition and size of the Board and determining the criteria for membership of the Board, including issues of character, judgment, independence, diversity, age, expertise, corporate experience, length of service, and other commitments outside the Corporation.

2. Conducting an annual evaluation of the Board.

3. Identifying, considering, and recommending candidates to fill new positions or vacancies on the Board, and reviewing any candidates recommended by stockholders in accordance with the bylaws. In performing these duties, the Committee shall have the authority to retain any search firm to be used to identify candidates for the Board and shall have sole authority to approve the search firm’s fees and other retention terms.

4. Evaluating the performance of individual members of the Board eligible for re-election and recommending the director nominees by class for election to the Board by the stockholders at the annual meeting of stockholders.

5. Evaluating director compensation, consulting with outside consultants when appropriate, and making recommendations to the Board regarding director compensation.

6. Reviewing and making recommendations to the Board with respect to a Director Option Plan and any proposed amendments thereto, subject to obtaining stockholder approval of any amendments as required by law or Nasdaq OMX or the NYSE Market LLC Company Guide Rules.

The Board of Directors has determined to provide a process by which shareholders may communicate with the Board as a whole, a Board committee or individual director. Shareholders wishing to communicate with the Board as a whole, a Board committee or an individual member may do so by sending a written communication addressed to the Board of Directors of the Company or to the committee or to an individual director, Huadi International Group Co., Ltd., No. 1688 Tianzhong Street, Longwan District, Wenzhou, Zhejiang Province, People’s Republic of China. All communications will be compiled by the Secretary of the Company and submitted to the Board of Directors or the addressee not later than the next regular Board meeting.

13

MANAGEMENT — BUSINESS HISTORY OF EXECUTIVE OFFICERS

For information as to the ages, positions, and business experience of our Chairman of the Board of Directors, Mr. Di Wang, see the section “Proposal One: Election of Directors” elsewhere in this Proxy Statement.

Huisen Wang

Chief Executive Officer

Age — 65

Mr. Wang has been a Director and the Chief Executive Officer of Huadi International since inception. He is also a director and the General Manager of Huadi Steel since 1998. Prior to that, Mr. Wang was a senior management member at an electric machinery factory. Mr. Wang is a licensed engineer and certified senior manager in China.

Jianping Xiang

Chief Financial Officer

Age — 45

Mr. Jianping Xiang has about two decades of experience serving as the Chief Financial Officer of Huadi Steel Group Limited, a People’s Republic of China’s (the “PRC”) subsidiary wholly owned by the Company since January 1, 2003. He is responsible for supervising and managing the accounting department of Huadi Steel Group Limited. He worked as the Chief Executive Officer of Wenzhou Jianeng Printing Equipment Co., Ltd. from January 2014 to December 2016, during which he was responsible for expansion of market, decision making and review of audit reports. He had been a Managing Accountant of Huadi Steel Group Limited from January 2002 to December 2002, during which he was responsible for budget controlling and contract management. He had been an Assisting Accountant of Huadi Steel Group Limited from September 1999 to December 2001, during which he was responsible for preparation of audit reports and compliance of auditing rules according to PRC law. Mr. Xiang holds a certificate for Intermediate Accountant in PRC since 1999. Mr. Xiang graduated with a master’s degree in Business Administration in Finance from Universidad Catolica San Antonio in 2022 and a bachelor’s degree in Accounting from Jiangxi University of Finance and Economics in 1998.

14

EMPLOYMENT AGREEMENTS WITH THE COMPANY’S

NAMED EXECUTIVE OFFICERS

Under Chinese law, we may only terminate employment agreements without cause and without penalty by providing notice of non-renewal one month prior to the date on which the employment agreement is scheduled to expire. If we fail to provide this notice or if we wish to terminate an employment agreement in the absence of cause, then we are obligated to pay the employee one month’s salary for each year we have employed the employee. We are, however, permitted to terminate an employee for cause without penalty to our Company, where the employee has committed a crime or the employee’s actions or inactions have resulted in a material adverse effect to us.

Our employment agreements with our officers generally provide for employment for a specific term (typically approximately two years at a time) and pay annual salary, health insurance, pension insurance, and paid vacation and family leave time. The agreement may be terminated by either party as permitted by law. In the event of a breach or termination of the agreement by our Company, we may be obligated to pay the employee twice the ordinary statutory rate. In the event of a breach or termination causing loss to our Company by the employee, the employee may be required to indemnify us against loss.

Huisen Wang

We entered into an indefinite employment agreement with Huisen Wang on November 1, 2019. Pursuant to the agreement, Mr. Wang has accepted the position of Chief Executive Officer and we have agreed to pay Mr. Wang an annual salary of RMB 100,000 (approximately US$ 25,018).

Jianping Xiang

We entered into a five-year employment agreement with Jianping Xiang on December 8, 2022. Pursuant to the agreement, Mr. Xiang has accepted the position of Chief Financial Officer and we have agreed to pay Mr. annual compensation of $30,000 in cash and 20,000 shares of the Company’s ordinary shares.

15

SUMMARY COMPENSATION TABLE

The following table presents summary information regarding the total compensation awarded to, earned by, or paid to each of the named executive officers for services rendered to us for the years ended September 30, 2022 and 2021.

|

Name and Principal Position

|

|

Fiscal

Year

|

|

Salary

($)

|

|

Bonus

($)

|

|

Stock

Awards

($)

|

|

All Other

Compensation

($)

|

|

Total

($)

|

|

Jianping Xiang

|

|

2022

|

|

29,417

|

|

—

|

|

—

|

|

—

|

|

29,417

|

|

Chief Financial Officer

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Huisen Wang

|

|

2022

|

|

25,018

|

|

—

|

|

—

|

|

—

|

|

25,018

|

|

Chief Executive Officer

|

|

2021

|

|

25,131

|

|

—

|

|

—

|

|

—

|

|

25,131

|

16

FEES PAID TO INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Audit Fees

TPS Thayer, LLC’s fees for the annual audit of our financial statements for the fiscal years ended September 30, 2022 were $186,000 in total, excluding travel and other out-of-pocket expenses.

Audit-Related Fees

The Company has not paid TPS Thayer, LLC for audit-related services for the fiscal years ended September 30, 2022.

Tax Fees

The Company has not paid TPS Thayer, LLC for tax services for the fiscal years ended September 30, 2022.

All Other Fees

The Company has not paid TPS Thayer, LLC for any other services in fiscal years ended September 30, 2022.

Audit Committee Pre-Approval Policies

Before TPS Thayer, LLC was engaged by the Company to render audit or non-audit services, the engagement was approved by the Company’s audit committee. All services rendered by TPS Thayer, LLC have been so approved.

Percentage of Hours

The percentage of hours expended on the principal accountants’ engagement to audit our consolidated financial statements for 2022 that were attributed to work performed by persons other than TPS Thayer, LLC’s full-time permanent employees was nil.

17

BENEFICIAL OWNERSHIP OF ORDINARY SHARES

The following table sets forth information with respect to beneficial ownership of our ordinary shares as of August 2 2023 by:

• Each person who is known by us to beneficially own 5% or more of our outstanding ordinary shares;

• Each of our current directors and named executive officers; and

• All directors and named executive officers as a group.

The number and percentage of ordinary shares beneficially owned are based on 14,259,182 ordinary shares issued and outstanding as of August 2, 2023. Information with respect to beneficial ownership has been furnished by each director, officer or beneficial owner of more than 5% of our ordinary shares. Beneficial ownership is determined in accordance with the rules of the SEC and generally requires that such person have voting or investment power with respect to securities. In computing the number of ordinary shares beneficially owned by a person listed below and the percentage ownership of such person, ordinary shares underlying options, warrants or convertible securities held by each such person that are exercisable or convertible within 60 days of August 2, 2023 are deemed outstanding, but are not deemed outstanding for computing the percentage ownership of any other person. Except as otherwise indicated in the footnotes to this table, or as required by applicable community property laws, all persons listed have sole voting and investment power for all ordinary shares shown as beneficially owned by them. Unless otherwise indicated in the footnotes, the address for each principal shareholder is in the care of our Company at No. 1688 Tianzhong Street, Longwan District, Wenzhou, Zhejiang Province, People’s Republic of China 325020. As of August 24, 2022, we have 4 shareholders of record.

|

Named Executive Officers and Directors

|

|

Amount of

Beneficial

Ownership(1)

|

|

Percentage

Ownership(2)

|

|

Directors and Named Executive Officers:

|

|

|

|

|

|

|

Di Wang(3)

|

|

8,336,000

|

|

58.46

|

%

|

|

Jueqin Wang(4)

|

|

1,664,000

|

|

11.67

|

%

|

|

Huisen Wang

|

|

0

|

|

0

|

%

|

|

Jianping Xiang

|

|

20,000

|

|

0.14

|

%

|

|

He “Henry” Huang

|

|

2,000

|

|

0.014

|

%

|

|

Songlin Li

|

|

0

|

|

0

|

%

|

|

Jiancong Huang

|

|

0

|

|

0

|

%

|

|

All directors and executive officers as a group (5 persons)

|

|

10,022,000

|

|

70.28

|

%

|

| |

|

|

|

|

|

|

5% Beneficial Owners:

|

|

|

|

|

|

|

Yongqiang Donghai Limited(3)

|

|

8,336,000

|

|

58.46

|

%

|

|

Yongqiang Maituo Limited(4)

|

|

1,664,000

|

|

11.67

|

%

|

18

GENERAL

Compensation Committee Interlocks and Insider Participation

None of the members of the Board of Directors who served on the Compensation Committee during the fiscal year ended September 30, 2022 were officers or employees of the Company or any of its subsidiaries or had any relationship with the Company requiring disclosure under SEC regulations.

Availability of Annual Report to Shareholders

Copies of the Annual Report on Form 20-F for the fiscal year ended September 30, 2022 (without exhibits or documents incorporated by reference), are available without charge to shareholders upon written request to No. 1688 Tianzhong Street, Longwan District, Wenzhou, Zhejiang Province, People’s Republic of China 325020, by calling +86-057786598888 or via the Financial Info at http://ir.huadi.cc/index.html.

Shareholder Proposals

To be considered for inclusion in next year’s Proxy Statement or considered at next year’s annual meeting but not included in the Proxy Statement, shareholder proposals must be submitted in writing no later than March 31, 2024. All written proposals should be submitted to: No. 1688 Tianzhong Street, Longwan District, Wenzhou, Zhejiang Province, People’s Republic of China 325020.

Other Proposed Actions

If any other items or matters properly come before the meeting, the proxies received will be voted on those items or matters in accordance with the discretion of the proxy holders.

Solicitation by Board; Expenses of Solicitation

Our Board of Directors has sent you this Proxy Statement. Our directors, officers and associates may solicit proxies by telephone or in person. We will also reimburse the expenses of brokers, nominees and fiduciaries that send proxies and proxy materials to our shareholders.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting: The Notice & Proxy Statement and the Annual Report are available at No. 1688 Tianzhong Street, Longwan District, Wenzhou, Zhejiang Province, People’s Republic of China 325020 under Annual General Meeting.

19

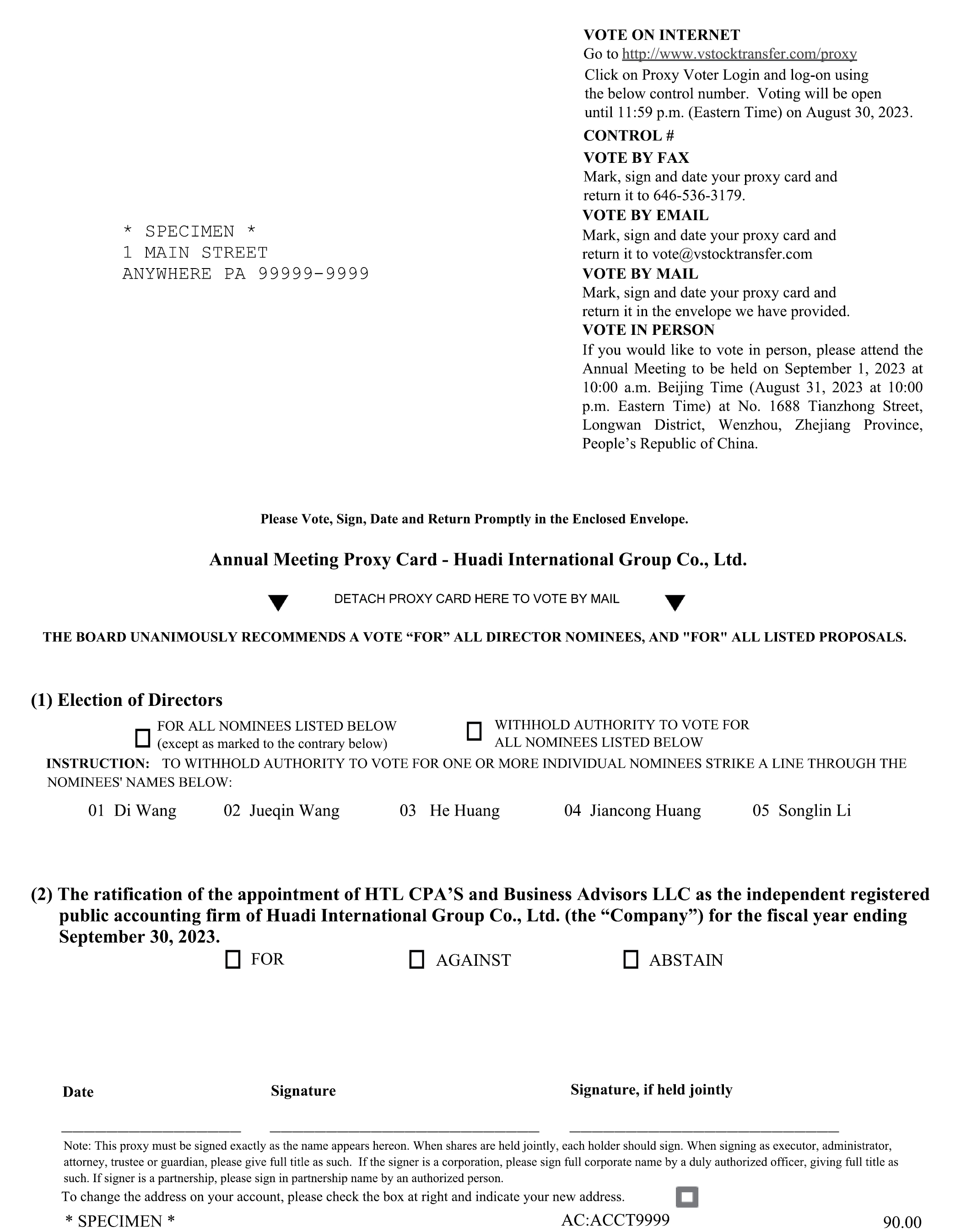

* SPECIMEN * 1 MAIN STREET ANYWHERE PA 99999-9999 VOTE ON INTERNET Go to http://www.vstocktransfer.com/proxy Click on Proxy Voter Login and log-on using the below control number. Voting will be open until 11:59 p.m. (Eastern Time) on August 30, 2023. CONTROL # VOTE BY FAX Mark, sign and date your proxy card and return it to 646-536-3179. VOTE BY EMAIL Mark, sign and date your proxy card and return it to vote@vstocktransfer.com VOTE BY MAIL Mark, sign and date your proxy card and return it in the envelope we have provided. VOTE IN PERSON If you would like to vote in person, please attend the Annual Meeting to be held on September 1, 2023 at 10:00 a.m. Beijing Time (August 31, 2023 at 10:00 p.m. Eastern Time) at No. 1688 Tianzhong Street, Longwan District, Wenzhou, Zhejiang Province, People’s Republic of China. Please Vote, Sign, Date and Return Promptly in the Enclosed Envelope. Annual Meeting Proxy Card - Huadi International Group Co., Ltd. DETACH PROXY CARD HERE TO VOTE BY MAIL THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” ALL DIRECTOR NOMINEES, AND “FOR” ALL LISTED PROPOSALS. (1) Election of Directors WITHHOLD AUTHORITY TO VOTE FOR ALL NOMINEES LISTED BELOW FOR ALL NOMINEES LISTED BELOW (except as marked to the contrary below) INSTRUCTION: TO WITHHOLD AUTHORITY TO VOTE FOR ONE OR MORE INDIVIDUAL NOMINEES STRIKE A LINE THROUGH THE NOMINEES’ NAMES BELOW: 01 Di Wang 02 Jueqin Wang 03 He Huang 04 Jiancong Huang 05 Songlin Li (2) The ratification of the appointment of HTL CPA’S and Business Advisors LLC as the independent registered public accounting firm of Huadi International Group Co., Ltd. (the “Company”) for the fiscal year ending September 30, 2023. FOR AGAINST ABSTAIN Date Signature Signature, if held jointly Note: This proxy must be signed exactly as the name appears hereon. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by a duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by an authorized person. To change the address on your account, please check the box at right and indicate your new address. * SPECIMEN * AC:ACCT9999 90.00

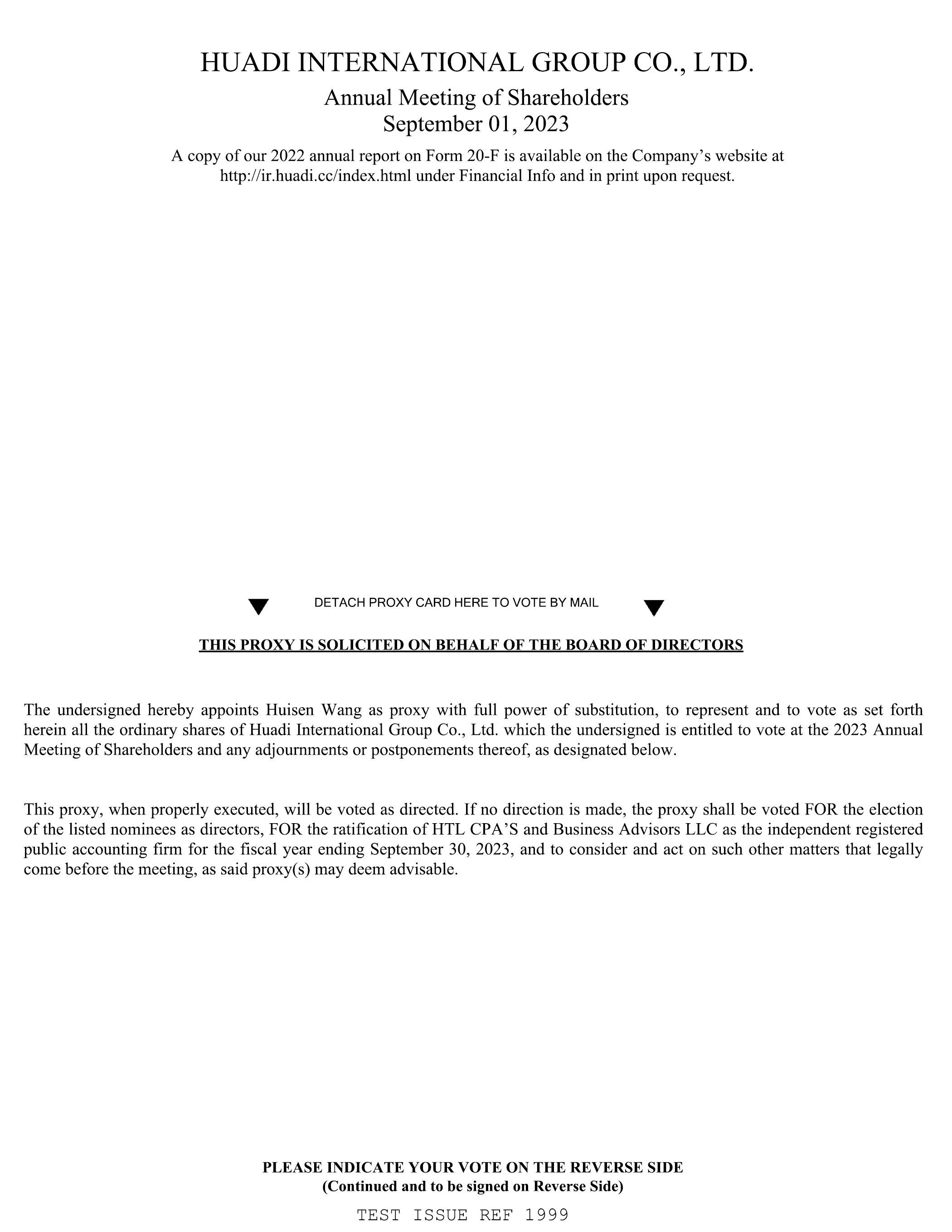

HUADI INTERNATIONAL GROUP CO., LTD. Annual Meeting of Shareholders September 01, 2023 A copy of our 2022 annual report on Form 20-F is available on the Company’s website at http://ir.huadi.cc/index.html under Financial Info and in print upon request. DETACH PROXY CARD HERE TO VOTE BY MAIL THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS The undersigned hereby appoints Huisen Wang as proxy with full power of substitution, to represent and to vote as set forth herein all the ordinary shares of Huadi International Group Co., Ltd. which the undersigned is entitled to vote at the 2023 Annual Meeting of Shareholders and any adjournments or postponements thereof, as designated below. This proxy, when properly executed, will be voted as directed. If no direction is made, the proxy shall be voted FOR the election of the listed nominees as directors, FOR the ratification of HTL CPA’S and Business Advisors LLC as the independent registered public accounting firm for the fiscal year ending September 30, 2023, and to consider and act on such other matters that legally come before the meeting, as said proxy(s) may deem advisable. PLEASE INDICATE YOUR VOTE ON THE REVERSE SIDE (Continued and to be signed on Reverse Side) TEST ISSUE REF 1999