Form 8-K - Current report

August 07 2023 - 4:05PM

Edgar (US Regulatory)

0001600132

false

0001600132

2023-08-03

2023-08-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

August 3, 2023

Bellerophon Therapeutics, Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

001-36845 |

|

47-3116175 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

20 Independence Boulevard, Suite 402

Warren, New Jersey |

|

07059 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (908) 574-4770

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, $0.01 par value per share |

|

BLPH |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

¨ Emerging

growth company

| ¨ | If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On August 3, 2023,

Bellerophon Therapeutics, Inc. (the “Company”) entered into a transition and separation agreement with Peter Fernandes,

the Company’s Chief Executive Officer (the “Fernandes Separation Agreement”), and a transition and separation agreement

with Parag Shah, the Company’s Vice President of Business Operations (the “Shah Separation Agreement” and, together

with the Fernandes Separation Agreement, the “Separation Agreements”), which provide for, respectively, Mr. Fernandes’

and Mr. Shah’s separation of employment, the payment of separation pay as described below and the performance of certain duties

as may be reasonably requested by the Company during a transition period. The Fernandes Separation Agreement is effective November 15,

2023 (the “Fernandes Separation Date”) and the Shah Separation Agreement is effective August 31, 2023 (the “Shah

Separation Date”), in either case unless such date is extended by the Company in its discretion.

Under the Fernandes Separation

Agreement, the Company has agreed to provide Mr. Fernandes with (i) a lump sum payment in cash, in an aggregate amount equal

to twelve (12) months of his base salary as of the Fernandes Separation Date, subject to applicable taxes and withholdings, payable as

follows: (a) $205,950 payable in a single lump sum on the Fernandes Separation Agreement’s Effective Date, (b) $102,975

payable in a single lump sum on August 31, 2023, and (c) $102,975 payable in a single lump sum on the first regularly scheduled

payroll date for the Company following the Fernandes Separation Agreement’s Supplemental Release Effective Date or such later date

in the event that Mr. Fernandes’ final day of employment is, in the Company’s discretion, extended beyond November 15,

2023, and (ii) reimbursement on each his behalf of his portion of monthly premiums for group medical insurance coverage under COBRA

until the earlier of the date that is six (6) months after the Fernandes Separation Date and the date on which he becomes eligible

to receive the same or substantially similar group health insurance coverage through another employer; provided, that Mr. Fernandes

does not revoke the Fernandes Separation Agreement in writing during the seven (7) day period after the Fernandes Separation Date.

The Fernandes Separation Agreement further provides that through the transition period beginning on August 3, 2023 and continuing

through the Fernandes Separation Date, Mr. Fernandes will continue to be employed by the Company “at-will” and will perform

such transition duties as may be reasonably requested by the Company during such transition period. The Fernandes Separation Agreement

also contains a release of claims by Mr. Fernandes, subject to customary exceptions, and covenants not to solicit or disparage and

to cooperate with the Company.

Under the Shah Separation

Agreement, the Company has agreed to provide Mr. Shah with (i) a lump sum payment in cash, in an aggregate amount equal to twelve

(12) months of his base salary as of the Shah Separation Date, subject to applicable taxes and withholdings, payable as follows: (a) $140,600

payable in a single lump sum on Shah Separation Agreement’s Effective Date, and (b) (1) $140,600 payable in a single lump

sum on the first regularly scheduled payroll date after the Shah Separation Agreement’s Supplemental Release Effective Date, provided

that August 31, 2023 is Mr. Shah’s final day of employment or (2) in the event that Mr. Shah’s final day

of employment is, in the Company’s discretion, extended beyond August 31, 2023, $70,300 payable in a single lump sum on the

first regularly scheduled payroll date after August 31, 2023 and an additional $70,300 payable in a single lump sum on the first

regularly scheduled payroll date following the Shah Separation Agreement’s Supplemental Release Effective Date, and (ii) reimbursement

on each his behalf of his portion of monthly premiums for group medical insurance coverage under COBRA until the earlier of the date that

is six (6) months after the Shah Separation Date and the date on which he becomes eligible to receive the same or substantially similar

group health insurance coverage through another employer; provided, that Mr. Shah does not revoke the Shah Separation Agreement

in writing during the seven (7) day period after the Shah Separation Date. The Shah Separation Agreement further provides that through

the transition period beginning on August 3, 2023 and continuing through the Shah Separation Date, Mr. Shah will continue to

be employed by the Company “at-will” and will perform such transition duties as may be reasonably requested by the Company

during such transition period. The Shah Separation Agreement also contains a release of claims by Mr. Shah, subject to customary

exceptions, and covenants not to solicit or disparage and to cooperate with the Company.

The foregoing summaries

of the principal terms of the Separation Agreements do not purport to be complete and are qualified in their entirety by reference to

the complete text of the Separation Agreements, copies of which will be attached as exhibits to the Company’s Quarterly Report on

Form 10-Q for the quarter ended September 30, 2023.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | BELLEROPHON

THERAPEUTICS, INC. |

| | |

| Date: August 7,

2023 | By: |

/s/

Peter Fernandes |

| | |

Name: Peter Fernandes |

| | |

Title: Chief Executive Officer |

v3.23.2

Cover

|

Aug. 03, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 03, 2023

|

| Entity File Number |

001-36845

|

| Entity Registrant Name |

Bellerophon Therapeutics, Inc.

|

| Entity Central Index Key |

0001600132

|

| Entity Tax Identification Number |

47-3116175

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

20 Independence Boulevard

|

| Entity Address, Address Line Two |

Suite 402

|

| Entity Address, City or Town |

Warren

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07059

|

| City Area Code |

908

|

| Local Phone Number |

574-4770

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

BLPH

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Bellerophon Therapeutics (NASDAQ:BLPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

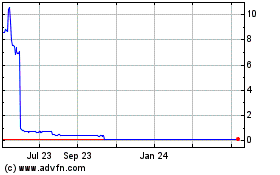

Bellerophon Therapeutics (NASDAQ:BLPH)

Historical Stock Chart

From Apr 2023 to Apr 2024