0001421461false00014214612023-08-022023-08-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 2, 2023

Intrepid Potash, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-34025 | | 26-1501877 |

(State or other jurisdiction

of incorporation) | | (Commission

file number) | | (IRS employer

identification no.) |

707 17th Street, Suite 4200

Denver, Colorado 80202

(Address of principal executive offices, including zip code)

(303) 296-3006

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 210.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | IPI | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On August 2, 2023, Intrepid Potash, Inc. issued a press release announcing its financial results and operating highlights for the second quarter of 2023. A copy of the press release is furnished as Exhibit 99.1 to this report.

The information furnished under this Item 2.02, including Exhibit 99.1, will not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 and will not be incorporated by reference into any filing under the Securities Act of 1933, except as expressly set forth by specific reference in that filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | | |

| | Press Release of Intrepid Potash, Inc. dated August 2, 2023. |

| 104 | | Cover Page Interactive Data File (embedded with the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | INTREPID POTASH, INC. |

| | | |

| | | |

| Dated: August 2, 2023 | By: | /s/ Matthew D. Preston |

| | | Matthew D. Preston |

| | | Chief Financial Officer |

Intrepid Announces Second Quarter 2023 Results

Denver, CO, August 2, 2023 - Intrepid Potash, Inc. ("Intrepid", the "Company", "we", "us", "our") (NYSE:IPI) today reported its results for the second quarter of 2023.

Key Highlights for Second Quarter 2023

Financial & Operational

•Total sales of $81.0 million, which compares to $91.7 million in the second quarter of 2022, as potash and Trio® average net realized sales prices(1) decreased to $479 and $333 per ton, respectively.

•Net income of $4.3 million (or $0.33 per diluted share), which compares to $23.7 million (or $1.74 per diluted share) in the second quarter of 2022.

•Gross margin of $15.4 million, which compares to $41.8 million in the second quarter of 2022.

•Cash flow from operations of $30.5 million, which compares to $49.1 million in the second quarter of 2022.

•Adjusted EBITDA(1) of $15.8 million, which compares to $41.5 million in the second quarter of 2022.

•Potash and Trio® sales volumes of 79 thousand and 63 thousand tons, respectively, which compares to prior-year figures of 56 thousand and 59 thousand, respectively.

Capital Expenditures

•Incurred capital expenditures of $20.9 million in the second quarter of 2023. We expect full-year 2023 capital expenditures to be between $65 and $75 million.

•Our capital expenditures reflect our direct investments in our potash assets, which will help us meet our goals of maximizing brine availability and underground brine residence time. These investments are expected to drive higher and more consistent potash production.

HB Solar Solution Mine in Carlsbad, New Mexico

◦Phase One of HB Injection Pipeline Project: Installation of the new injection pipeline was successfully completed. The new pipeline is designed to increase our brine injection rates significantly above the rates achieved over the past five years. We anticipate operating at average injection rates of approximately 1,100 gallons per minute, which is approximately 55% higher than our injection rates prior to starting the project.

◦Phase Two of HB Injection Pipeline Project: Phase Two is the installation of an in-line pigging system to clean the pipeline and remove scaling to help ensure

more consistent flow rates. We continue to work through the permitting requirements and anticipate construction beginning by the end of 2023, with commissioning expected in the first quarter of 2024.

◦Eddy Shaft: This project is designed to target already-measured, high-grade brine from an existing mine shaft in the HB cavern system. Key permitting is complete, construction is underway, and we expect the project to be commissioned in the fourth quarter of 2023.

◦Replacement Extraction Well: After the failed extraction well in the fourth quarter of 2022, our plans to drill a newly designed extraction well to replace the IP-30 well are underway, and we have begun the permitting and contracting processes. This new extraction well is designed to have a long-term operational life and will target known, high-grade brine from the HB cavern system.

Solar Solution Mine in Moab, Utah

◦Well 45 and Well 46: We successfully drilled Well 45 (Cavern 4) and Well 46 and commissioned both projects in July 2023. Both projects will help us deliver on our key goals of maximizing brine availability and underground brine residence time, which is expected to drive higher and more consistent production.

East Facility in Carlsbad, New Mexico

◦The first of two new continuous miners was commissioned during the second quarter and we are already seeing higher efficiencies and production in our underground mining operations. The second continuous miner was recently delivered and is expected to be operating in the third quarter of 2023.

Sand Resources at Intrepid South

◦We recently secured the necessary permits for construction, which we expect to start in the fourth quarter of 2023. We continue to target annualized production of approximately one million tons of wet sand which is contingent on receiving an additional air quality permit that would allow us to operate the plant outside daylight hours. If receipt of the additional air quality permit is delayed we plan to operate the plant at reduced rates until permitting is complete.

Liquidity

•As of July 31, 2023, Intrepid had approximately $15.6 million in cash and cash equivalents and $150 million available under its revolving credit facility, for total liquidity of approximately $165.6 million.

•Intrepid maintains an investment account of short-and-long-term fixed income securities that had a balance of approximately $5.8 million as of July 31, 2023.

Consolidated Results, Management Commentary, & Outlook

Intrepid generated second quarter 2023 sales of $81.0 million, a 12% decrease from second quarter 2022 sales of $91.7 million. Consolidated gross margin in the second quarter of 2023 totaled $15.4 million, while net income totaled $4.3 million, or $0.33 per diluted share,

which compares to second quarter 2022 net income of $23.7 million, or $1.74 per diluted share. The Company delivered adjusted EBITDA of $15.8 million in the second quarter of 2023, down from $41.5 million in the same prior year period, with the lower profitability primarily being driven by lower pricing for our key products, as well as an increase in our cost of goods sold. Our net realized sales price for Potash and Trio® averaged $479 and $333 per ton, respectively, in the second quarter of 2023, which compares to $738 and $493 per ton, respectively, in the second quarter of 2022.

Bob Jornayvaz, Intrepid's Executive Chairman and CEO commented: "Our key focus over the last year has been successful project execution, with our growth capital primarily directed to our potash assets to maximize brine availability and residence time underground to improve our brine grade. As we shared in recent press releases, we successfully executed on three of our key growth projects and are already seeing improvements in our injection rates, with production benefits expected next year.

In the second quarter, we delivered strong results, highlighted by potash sales volumes of 79 thousand tons, which represents an approximately 40% increase compared to the second quarter of 2022. Fertilizer pricing continues to drive strong margins for the Company, and our expectation of robust demand underpinned by solid farmer economics was evident in our improved sales volumes in the first half of this year.

Looking ahead, the key theme of agricultural markets enjoying a positive backdrop is still underway, with several key crop futures recently reversing some weakness and again showing strength, particularly when compared to historical levels. For the back half of the year, we believe the combination of supportive crop futures prices and attractive fertilizer pricing will support a strong fall application season in the U.S., with the most recent catalyst being a positive market response to the announcement of a July fill program."

Segment Highlights

Potash

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (in thousands, except per ton data) |

| Sales | | $ | 47,264 | | | $ | 48,827 | | | $ | 99,761 | | | $ | 105,269 | |

| Gross margin | | $ | 12,876 | | | $ | 24,925 | | | $ | 27,304 | | | $ | 53,990 | |

| | | | | | | | |

| Potash sales volumes (in tons) | | 79 | | | 56 | | | 167 | | | 126 | |

| Potash production volumes (in tons) | | 12 | | | 25 | | | 102 | | | 128 | |

| | | | | | | | |

Average potash net realized sales price per ton(1) | | $ | 479 | | | $ | 738 | | | $ | 485 | | | $ | 713 | |

Potash segment sales in the second quarter of 2023 decreased 3% to $47.3 million when compared to the same period in 2022. The lower revenue was driven by a 35% decrease in our average net realized sales price per ton to $479, which compares to $738 per ton in the same prior year period. The lower average net realized sales price per ton in the second quarter of 2023 was partially offset by higher potash sales volumes, which totaled 79 thousand tons, a 41% increase compared to the second quarter of 2022. For the first six months ended June 30, 2023, our potash segment sales decreased 5% to $99.8 million, with our higher sales volumes of 167 thousand tons offsetting a 32% decrease in our average net realized price to $485 per ton.

For the second quarter of 2023, potash segment gross margin totaled $12.9 million, which compares to $24.9 million in the second quarter of 2022, and for the first six months ended June 30, 2023, Potash segment gross margin totaled $27.3 million, which compares to $54.0 million in the prior year period. The lower gross margin figures were driven by an increase in segment cost of goods sold - which was due to higher sales volumes and an increase in our weighted average carrying cost per ton - as well as lower potash pricing in the first half of 2023 compared to the first half of 2022.

Potash production totaled 12 thousand tons in the second quarter of 2023, which compares to 25 thousand tons produced in the same prior year period, while potash production for the first six months ended June 30, 2023 totaled 102 thousand tons, a decrease from 128 thousand tons in the same prior year period.

Trio®

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (in thousands, except per ton data) |

| Sales | | $ | 28,748 | | | $ | 35,467 | | | $ | 59,022 | | | $ | 76,519 | |

| Gross margin | | $ | 1,222 | | | $ | 13,052 | | | $ | 2,674 | | | $ | 29,191 | |

| | | | | | | | |

Trio® sales volume (in tons) | | 63 | | | 59 | | | 128 | | | 131 | |

Trio® production volume (in tons) | | 58 | | | 58 | | | 107 | | | 123 | |

| | | | | | | | |

Average Trio® net realized sales price per ton(1) | | $ | 333 | | | $ | 493 | | | $ | 339 | | | $ | 476 | |

Trio® segment sales of $28.7 million for the second quarter of 2023 were 19% lower compared to the same prior year period. This was primarily driven by a lower average net realized sales price per ton of $333, a decrease of 32% compared to the second quarter of 2022, although this was partially offset by Trio® sales volumes increasing by 7% to 63 thousand tons. For the first six months ended June 30, 2023, our Trio® segment sales decreased 23% to $59.0 million, which was driven by a 29% decrease in our average net realized price to $339 per ton, while our sales volumes were down 2% to 128 thousand tons.

For the second quarter of 2023, Trio® segment gross margin totaled $1.2 million, which compares to $13.1 million in the second quarter of 2022, and for the first six months ended June 30, 2023, Trio® segment gross margin totaled $2.7 million, which compares to $29.2 million in the same prior year period. The lower gross margin figures were primarily driven by an increase in segment cost of goods sold and lower pricing in the first half of 2023 compared to the first half of 2022.

Trio® production totaled 58 thousand tons in the second quarter of 2023 which was the same as the second quarter of 2022, while Trio® production for the first six months ended June 30, 2023 totaled 107 thousand tons, a decrease from 123 thousand tons in the same prior year period. During the first quarter of 2023, our East Facility experienced net unplanned downtime of approximately eight days which was the primary reason for the lower production in the first half of this year.

Oilfield Solutions

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (in thousands) |

| Sales | | $ | 5,111 | | | $ | 7,512 | | | $ | 9,361 | | | $ | 14,512 | |

| Gross margin | | $ | 1,284 | | | $ | 3,834 | | | $ | 1,756 | | | $ | 5,806 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Our Oilfield Solutions segment sales decreased $2.4 million, or 32%, in the second quarter of 2023 compared to the second quarter of 2022, which was primarily driven by a $1.1 million decrease in water sales and a $1.5 million decrease in surface use, rights-of-way and easement revenues. While oil and gas activities near our Intrepid South property remained strong during the second quarter of 2023, we entered into fewer surface use agreements and our water sales decreased owing to the timing of fracs compared to the same prior year period.

Our cost of goods sold decreased $0.1 million, or 4%, for the second quarter of 2023 compared to the same period in 2022. However, the lower segment sales more than offset the decrease in cost of goods sold, and our Oilfield Solutions segment gross margin experienced a decrease of $2.6 million in the second quarter of 2023.

Liquidity

During the second quarter of 2023, cash flow from operations was $30.5 million, while cash used in investing activities was $18.3 million. As of July 31, 2023, we had approximately $15.6 million in cash and cash equivalents, no outstanding borrowings, and $150 million available to borrow under our revolving credit facility, for total liquidity of approximately $165.6 million.

Notes

1 Adjusted net income, adjusted net income per diluted share, adjusted earnings before interest, taxes, depreciation, and amortization (or adjusted EBITDA) and average net realized sales price per ton are non-GAAP financial measures. See the non-GAAP reconciliations set forth later in this press release for additional information.

Unless expressly stated otherwise or the context otherwise requires, references to tons in this press release refer to short tons. One short ton equals 2,000 pounds. One metric tonne, which many international competitors use, equals 1,000 kilograms or 2,204.62 pounds.

Conference Call Information

Intrepid will host a conference call on Thursday, August 3, 2023, at 12:00 p.m. Eastern Time to discuss the results and other operating and financial matters and answer investor questions.

Management invites you to listen to the conference call by using the toll-free dial-in number 1 (888) 210-4149 or toll-in dial-in 1 (646) 960-0145; please use conference ID 9158079. The call will also be streamed on the Intrepid website, intrepidpotash.com. A recording of the conference call will be available approximately two hours after the completion of the call by dialing 1 (800) 770-2030 for toll-free, 1 (647) 362-9199 for toll-in, or at intrepidpotash.com. The replay of the call will require the input of the conference identification number 9158079. The recording will be available through August 10, 2023.

About Intrepid

Intrepid is a diversified mineral company that delivers potassium, magnesium, sulfur, salt, and water products essential for customer success in agriculture, animal feed, and the oil and gas industry. Intrepid is the only U.S. producer of muriate of potash, which is applied as an essential nutrient for healthy crop development, utilized in several industrial applications, and used as an ingredient in animal feed. In addition, Intrepid produces a specialty fertilizer, Trio®, which delivers three key nutrients, potassium, magnesium, and sulfate, in a single particle. Intrepid also provides water, magnesium chloride, brine, and various oilfield products and services. Intrepid serves diverse customers in markets where a logistical advantage exists and is a leader in the use of solar evaporation for potash production, resulting in lower cost and more environmentally friendly production. Intrepid's mineral production comes from three solar solution potash facilities and one conventional underground Trio® mine.

Intrepid routinely posts important information, including information about upcoming investor presentations and press releases, on its website under the Investor Relations tab. Investors and other interested parties are encouraged to enroll at intrepidpotash.com, to receive automatic email alerts for new postings.

Forward-looking Statements

This document contains forward-looking statements - that is, statements about future, not past, events. The forward-looking statements in this document relate to, among other things, statements about Intrepid's future financial performance, cash flow from operations expectations, water sales, production costs, acquisition expectations and operating plans, and its market outlook. These statements are based on assumptions that Intrepid believes are reasonable. Forward-looking statements by their nature address matters that are uncertain. The particular uncertainties that could cause Intrepid's actual results to be materially different from its forward-looking statements include the following:

•changes in the price, demand, or supply of our products and services;

•challenges and legal proceedings related to our water rights;

•our ability to successfully identify and implement any opportunities to grow our business whether through expanded sales of water, Trio®, byproducts, and other non-potassium related products or other revenue diversification activities;

•the costs of, and our ability to successfully execute, any strategic projects;

•declines or changes in agricultural production or fertilizer application rates;

•declines in the use of potassium-related products or water by oil and gas companies in their drilling operations;

•our ability to prevail in outstanding legal proceedings against us;

•our ability to comply with the terms of our revolving credit facility, including the underlying covenants;

•further write-downs of the carrying value of assets, including inventories;

•circumstances that disrupt or limit production, including operational difficulties or variances, geological or geotechnical variances, equipment failures, environmental hazards, and other unexpected events or problems;

•changes in reserve estimates;

•currency fluctuations;

•adverse changes in economic conditions or credit markets;

•the impact of governmental regulations, including environmental and mining regulations, the enforcement of those regulations, and governmental policy changes;

•adverse weather events, including events affecting precipitation and evaporation rates at our solar solution mines;

•increased labor costs or difficulties in hiring and retaining qualified employees and contractors, including workers with mining, mineral processing, or construction expertise;

•changes in the prices of raw materials, including chemicals, natural gas, and power;

•our ability to obtain and maintain any necessary governmental permits or leases relating to current or future operations;

•interruptions in rail or truck transportation services, or fluctuations in the costs of these services;

•our inability to fund necessary capital investments;

•global inflationary pressures and supply chain challenges;

•the impact of global health issues, such as the COVID-19 pandemic, and other global disruptions on our business, operations, liquidity, financial condition and results of operations; and

•the other risks, uncertainties, and assumptions described in Item 1A. Risk Factors of our Annual Report on Form 10-K for the year ended December 31, 2022.

In addition, new risks emerge from time to time. It is not possible for Intrepid to predict all risks that may cause actual results to differ materially from those contained in any forward-looking statements Intrepid may make. All information in this document speaks as of the date of this release. New information or events after that date may cause our forward-looking statements in this document to change. We undertake no obligation to update or revise publicly any forward-looking statements to conform the statements to actual results or to reflect new information or future events.

Contact:

Evan Mapes, CFA, Investor Relations Manager

Phone: 303-996-3042

Email: evan.mapes@intrepidpotash.com

INTREPID POTASH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Sales | | $ | 81,035 | | | $ | 91,740 | | | $ | 167,955 | | | $ | 196,139 | |

| Less: | | | | | | | | |

| Freight costs | | 10,516 | | | 9,227 | | | 22,106 | | | 19,464 | |

| Warehousing and handling costs | | 2,801 | | | 2,204 | | | 5,534 | | | 4,680 | |

| Cost of goods sold | | 52,336 | | | 38,498 | | | 108,581 | | | 83,008 | |

| | | | | | | | |

| | | | | | | | |

| Gross Margin | | 15,382 | | | 41,811 | | | 31,734 | | | 88,987 | |

| | | | | | | | |

| Selling and administrative | | 7,948 | | | 7,218 | | | 16,806 | | | 14,007 | |

| Accretion of asset retirement obligation | | 535 | | | 490 | | | 1,070 | | | 980 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| (Gain) loss on sale of assets | | (7) | | | 1,066 | | | 193 | | | 1,166 | |

| Other operating (income) expense | | (362) | | | 1,242 | | | 1,023 | | | 975 | |

| Operating Income | | 7,268 | | | 31,795 | | | 12,642 | | | 71,859 | |

| | | | | | | | |

| Other Income (Expense) | | | | | | | | |

| | | | | | | | |

| Equity in earnings of unconsolidated entities | | (1,059) | | | — | | | (238) | | | — | |

| Interest expense, net | | — | | | (24) | | | — | | | (57) | |

| Interest income | | 76 | | | 15 | | | 161 | | | 17 | |

| Other income | | 43 | | | 11 | | | 56 | | | 539 | |

| | | | | | | | |

| Income Before Income Taxes | | 6,328 | | | 31,797 | | | 12,621 | | | 72,358 | |

| | | | | | | | |

| Income Tax Expense | | (2,023) | | | (8,089) | | | (3,810) | | | (17,228) | |

| Net Income | | $ | 4,305 | | | $ | 23,708 | | | $ | 8,811 | | | $ | 55,130 | |

| | | | | | | | |

| Weighted Average Shares Outstanding: | | | | | | | | |

| Basic | | 12,766 | | | 13,246 | | | 12,730 | | | 13,203 | |

| Diluted | | 12,855 | | | 13,620 | | | 12,865 | | | 13,690 | |

| Earnings Per Share: | | | | | | | | |

| Basic | | $ | 0.34 | | | $ | 1.79 | | | $ | 0.69 | | | $ | 4.18 | |

| Diluted | | $ | 0.33 | | | $ | 1.74 | | | $ | 0.68 | | | $ | 4.03 | |

INTREPID POTASH, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

AS OF JUNE 30, 2023 AND DECEMBER 31, 2022

(In thousands, except share and per share amounts)

| | | | | | | | | | | | | | |

| | June 30, | | December 31, |

| | 2023 | | 2022 |

| ASSETS | | | | |

| Cash and cash equivalents | | $ | 17,158 | | | $ | 18,514 | |

| Short-term investments | | 3,462 | | | 5,959 | |

| Accounts receivable: | | | | |

| Trade, net | | 23,819 | | | 26,737 | |

| Other receivables, net | | 1,690 | | | 790 | |

| | | | |

| Inventory, net | | 103,966 | | | 114,816 | |

| Prepaid expenses and other current assets | | 3,741 | | | 4,863 | |

| Total current assets | | 153,836 | | | 171,679 | |

| | | | |

| Property, plant, equipment, and mineral properties, net | | 400,627 | | | 375,630 | |

| Water rights | | 19,184 | | | 19,184 | |

| Long-term parts inventory, net | | 24,911 | | | 24,823 | |

| Long-term investments | | 8,614 | | | 9,841 | |

| | | | |

| Other assets, net | | 7,018 | | | 7,294 | |

| Non-current deferred tax asset, net | | 182,076 | | | 185,752 | |

| Total Assets | | $ | 796,266 | | | $ | 794,203 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | |

| | | | |

| Accounts payable | | $ | 12,117 | | | $ | 18,645 | |

| | | | |

| | | | |

| Accrued liabilities | | 14,388 | | | 16,212 | |

| Accrued employee compensation and benefits | | 5,921 | | | 6,975 | |

| | | | |

| | | | |

| Other current liabilities | | 5,798 | | | 7,044 | |

| Total current liabilities | | 38,224 | | | 48,876 | |

| | | | |

| | | | |

| | | | |

| Asset retirement obligation, net of current portion | | 27,634 | | | 26,564 | |

| Operating lease liabilities | | 1,451 | | | 2,206 | |

| Finance lease liabilities | | 1,629 | | | — | |

| Other non-current liabilities | | 1,227 | | | 1,479 | |

| Total Liabilities | | 70,165 | | | 79,125 | |

| | | | |

| Commitments and Contingencies | | | | |

| Common stock, $0.001 par value; 40,000,000 shares authorized; | | | | |

| 12,789,326 and 12,687,822 shares outstanding | | | | |

| at June 30, 2023, and December 31, 2022, respectively | | 13 | | | 13 | |

| Additional paid-in capital | | 662,826 | | | 660,614 | |

| | | | |

| Retained earnings | | 85,274 | | | 76,463 | |

| Less treasury stock, at cost | | (22,012) | | | (22,012) | |

| Total Stockholders' Equity | | 726,101 | | | 715,078 | |

| Total Liabilities and Stockholders' Equity | | $ | 796,266 | | | $ | 794,203 | |

INTREPID POTASH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Cash Flows from Operating Activities: | | | | | | | | |

| Net income | | $ | 4,305 | | | $ | 23,708 | | | $ | 8,811 | | | $ | 55,130 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Depreciation, depletion and amortization | | 8,892 | | | 8,025 | | | 18,183 | | | 16,923 | |

| Accretion of asset retirement obligation | | 535 | | | 490 | | | 1,070 | | | 980 | |

| Amortization of deferred financing costs | | 75 | | | 60 | | | 151 | | | 120 | |

| Amortization of intangible assets | | 80 | | | 81 | | | 161 | | | 161 | |

| Stock-based compensation | | 1,803 | | | 1,391 | | | 3,549 | | | 2,558 | |

| | | | | | | | |

| | | | | | | | |

| (Gain) loss on disposal of assets | | (7) | | | 1,066 | | | 193 | | | 1,166 | |

| Allowance for parts inventory obsolescence | | — | | | 1,600 | | | — | | | 1,600 | |

| | | | | | | | |

| Equity in earnings of unconsolidated entities | | 1,059 | | | — | | | 238 | | | — | |

| Distribution of earnings from unconsolidated entities | | 132 | | | — | | | 452 | | | — | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Trade accounts receivable, net | | 15,391 | | | 18,969 | | | 2,917 | | | 2,770 | |

| Other receivables, net | | (867) | | | (262) | | | (959) | | | (646) | |

| | | | | | | | |

| Inventory, net | | 3,117 | | | (3,606) | | | 10,763 | | | (2,759) | |

| Prepaid expenses and other current assets | | 656 | | | 749 | | | 906 | | | 673 | |

| Deferred tax assets, net | | 2,016 | | | 7,941 | | | 3,676 | | | 16,941 | |

Accounts payable, accrued liabilities, and accrued employee

compensation and benefits | | (2,827) | | | (10,550) | | | (8,132) | | | (11,412) | |

| | | | | | | | |

| Operating lease liabilities | | (408) | | | (438) | | | (809) | | | (1,233) | |

| Other liabilities | | (3,455) | | | (105) | | | (2,222) | | | 257 | |

| Net cash provided by operating activities | | 30,497 | | | 49,119 | | | 38,948 | | | 83,229 | |

| | | | | | | | |

| Cash Flows from Investing Activities: | | | | | | | | |

| Additions to property, plant, equipment, mineral properties and other assets | | (20,895) | | | (15,979) | | | (41,934) | | | (22,774) | |

| | | | | | | | |

| Purchase of investments | | (459) | | | (9,996) | | | (1,415) | | | (10,899) | |

| Proceeds from sale of assets | | 24 | | | 22 | | | 89 | | | 46 | |

| | | | | | | | |

| Proceeds from redemptions/maturities of investments | | 2,500 | | | — | | | 4,000 | | | — | |

| Other investing, net | | 508 | | | — | | | 508 | | | — | |

| | | | | | | | |

| Net cash used in investing activities | | (18,322) | | | (25,953) | | | (38,752) | | | (33,627) | |

| | | | | | | | |

| Cash Flows from Financing Activities: | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Payments of financing lease | | (167) | | | — | | | (210) | | | — | |

| Proceeds from short-term borrowings on credit facility | | — | | | — | | | 5,000 | | | — | |

| Repayments of short-term borrowings on credit facility | | (5,000) | | | — | | | (5,000) | | | — | |

| | | | | | | | |

| Employee tax withholding paid for restricted stock upon vesting | | (298) | | | (1,548) | | | (1,337) | | | (4,362) | |

| | | | | | | | |

| | | | | | | | |

| Proceeds from exercise of stock options | | — | | | 20 | | | — | | | 110 | |

| Net cash used in financing activities | | (5,465) | | | (1,528) | | | (1,547) | | | (4,252) | |

| | | | | | | | |

| Net Change in Cash, Cash Equivalents and Restricted Cash | | 6,710 | | | 21,638 | | | (1,351) | | | 45,350 | |

| Cash, Cash Equivalents and Restricted Cash, beginning of period | | 11,023 | | | 60,858 | | | 19,084 | | | 37,146 | |

| Cash, Cash Equivalents and Restricted Cash, end of period | | $ | 17,733 | | | $ | 82,496 | | | $ | 17,733 | | | $ | 82,496 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

INTREPID POTASH, INC.

UNAUDITED NON-GAAP RECONCILIATIONS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(In thousands)

To supplement Intrepid's consolidated financial statements, which are prepared and presented in accordance with GAAP, Intrepid uses several non-GAAP financial measures to monitor and evaluate its performance. These non-GAAP financial measures include adjusted net income, adjusted net income per diluted share, adjusted EBITDA, and average net realized sales price per ton. These non-GAAP financial measures should not be considered in isolation, or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. In addition, because the presentation of these non-GAAP financial measures varies among companies, these non-GAAP financial measures may not be comparable to similarly titled measures used by other companies.

Intrepid believes these non-GAAP financial measures provide useful information to investors for analysis of its business. Intrepid uses these non-GAAP financial measures as one of its tools in comparing period-over-period performance on a consistent basis and when planning, forecasting, and analyzing future periods. Intrepid believes these non-GAAP financial measures are used by professional research analysts and others in the valuation, comparison, and investment recommendations of companies in the potash mining industry. Many investors use the published research reports of these professional research analysts and others in making investment decisions.

INTREPID POTASH, INC.

UNAUDITED NON-GAAP RECONCILIATIONS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(In thousands)

Adjusted Net Income and Adjusted Net Income Per Diluted Share

Adjusted net income and adjusted net income per diluted share are calculated as net income or income per diluted share adjusted for certain items that impact the comparability of results from period to period, as set forth in the reconciliation below. Intrepid considers these non-GAAP financial measures to be useful because they allow for period-to-period comparisons of its operating results excluding items that Intrepid believes are not indicative of its fundamental ongoing operations.

Reconciliation of Net Income to Adjusted Net Income:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (in thousands) |

| Net Income | $ | 4,305 | | | $ | 23,708 | | | $ | 8,811 | | | $ | 55,130 | |

| Adjustments | | | | | | | |

| | | | | | | |

| | | | | | | |

| (Gain) loss on sale of assets | (7) | | | 1,066 | | | 193 | | | 1,166 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Calculated income tax effect(1) | 2 | | | (277) | | | (50) | | | (303) | |

| Total adjustments | (5) | | | 789 | | | 143 | | | 863 | |

| Adjusted Net Income | $ | 4,300 | | | $ | 24,497 | | | $ | 8,954 | | | $ | 55,993 | |

Reconciliation of Net Income per Share to Adjusted Net Income per Share:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net Income Per Diluted Share | $ | 0.33 | | | $ | 1.74 | | | $ | 0.68 | | | $ | 4.03 | |

| Adjustments | | | | | | | |

| | | | | | | |

| | | | | | | |

| Loss on sale of assets | — | | | 0.08 | | | 0.02 | | | 0.09 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Calculated income tax effect(1) | — | | | (0.02) | | | — | | | (0.02) | |

| Total adjustments | — | | | 0.06 | | | 0.02 | | | 0.07 | |

| Adjusted Net Income Per Diluted Share | $ | 0.33 | | | $ | 1.80 | | | $ | 0.70 | | | $ | 4.10 | |

(1) Assumes an annual effective tax rate of 26% for 2023 and 2022.

INTREPID POTASH, INC.

UNAUDITED NON-GAAP RECONCILIATIONS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(In thousands)

Adjusted EBITDA

Adjusted earnings before interest, taxes, depreciation, and amortization (or adjusted EBITDA) is calculated as net income adjusted for certain items that impact the comparability of results from period to period, as set forth in the reconciliation below. Intrepid considers adjusted EBITDA to be useful, and believe it to be useful for investors, because the measure reflects Intrepid's operating performance before the effects of certain non-cash items and other items that Intrepid believes are not indicative of its core operations. Intrepid uses adjusted EBITDA to assess operating performance.

Reconciliation of Net Income to Adjusted EBITDA:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (in thousands) |

| Net Income | | $ | 4,305 | | | $ | 23,708 | | | $ | 8,811 | | | $ | 55,130 | |

| | | | | | | | |

| | | | | | | | |

| (Gain) loss on sale of assets | | (7) | | | 1,066 | | | 193 | | | 1,166 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Interest expense | | — | | | 24 | | | — | | | 57 | |

| Income tax expense | | 2,023 | | | 8,089 | | | 3,810 | | | 17,228 | |

| Depreciation, depletion, and amortization | | 8,892 | | | 8,025 | | | 18,183 | | | 16,923 | |

| Amortization of intangible assets | | 80 | | | 81 | | | 161 | | | 161 | |

| Accretion of asset retirement obligation | | 535 | | | 490 | | | 1,070 | | | 980 | |

| Total adjustments | | 11,523 | | | 17,775 | | | 23,417 | | | 36,515 | |

| Adjusted EBITDA | | $ | 15,828 | | | $ | 41,483 | | | $ | 32,228 | | | $ | 91,645 | |

INTREPID POTASH, INC.

UNAUDITED NON-GAAP RECONCILIATIONS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(In thousands)

Average Potash and Trio® Net Realized Sales Price per Ton

Average net realized sales price per ton for potash is calculated as potash segment sales less potash segment byproduct sales and potash freight costs and then dividing that difference by the number of tons of potash sold in the period. Likewise, average net realized sales price per ton for Trio® is calculated as Trio® segment sales less Trio® segment byproduct sales and Trio® freight costs and then dividing that difference by Trio® tons sold. Intrepid considers average net realized sales price per ton to be useful, and believe it to be useful for investors, because it shows Intrepid's potash and Trio® average per ton pricing without the effect of certain transportation and delivery costs. When Intrepid arranges transportation and delivery for a customer, it includes in revenue and in freight costs the costs associated with transportation and delivery. However, some of Intrepid's customers arrange for and pay their own transportation and delivery costs, in which case these costs are not included in Intrepid's revenue and freight costs. Intrepid uses average net realized sales price per ton as a key performance indicator to analyze potash and Trio® sales and price trends.

Reconciliation of Sales to Average Net Realized Sales Price per Ton:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, |

| | 2023 | | 2022 |

| (in thousands, except per ton amounts) | | Potash | | Trio® | | Potash | | Trio® |

| Total Segment Sales | | $ | 47,264 | | | $ | 28,748 | | | $ | 48,827 | | | $ | 35,467 | |

| Less: Segment byproduct sales | | 6,158 | | | 1,520 | | | 4,942 | | | 780 | |

| Freight costs | | 3,272 | | | 6,266 | | | 2,563 | | | 5,609 | |

| Subtotal | | $ | 37,834 | | | $ | 20,962 | | | $ | 41,322 | | | $ | 29,078 | |

| | | | | | | | |

| Divided by: | | | | | | | | |

| Tons sold | | 79 | | | 63 | | | 56 | | | 59 | |

| Average net realized sales price per ton | | $ | 479 | | | $ | 333 | | | $ | 738 | | | $ | 493 | |

| | | | | | | | |

| | Six Months Ended June 30, |

| | 2023 | | 2022 |

| (in thousands, except per ton amounts) | | Potash | | Trio® | | Potash | | Trio® |

| Total Segment Sales | | $ | 99,761 | | | $ | 59,022 | | | $ | 105,269 | | | $ | 76,519 | |

| Less: Segment byproduct sales | | 11,500 | | | 2,740 | | | 9,762 | | | 2,216 | |

| Freight costs | | 7,264 | | | 12,952 | | | 5,687 | | | 11,919 | |

| Subtotal | | $ | 80,997 | | | $ | 43,330 | | | $ | 89,820 | | | $ | 62,384 | |

| | | | | | | | |

| Divided by: | | | | | | | | |

| Tons sold | | 167 | | | 128 | | | 126 | | | 131 | |

| Average net realized sales price per ton | | $ | 485 | | | $ | 339 | | | $ | 713 | | | $ | 476 | |

| | | | | | | | |

INTREPID POTASH, INC.

DISAGGREGATION OF REVENUE AND SEGMENT DATA (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2023 |

| Product | | Potash Segment | | Trio® Segment | | Oilfield Solutions Segment | | Intersegment Eliminations | | Total |

| Potash | | $ | 41,106 | | | $ | — | | | $ | — | | | $ | (88) | | | $ | 41,018 | |

Trio® | | — | | | 27,228 | | | — | | | — | | | 27,228 | |

| Water | | 100 | | | 1,474 | | | 2,568 | | | — | | | 4,142 | |

| Salt | | 3,278 | | | 46 | | | — | | | — | | | 3,324 | |

| Magnesium Chloride | | 1,667 | | | — | | | — | | | — | | | 1,667 | |

| Brine Water | | 1,113 | | | — | | | 1,001 | | | — | | | 2,114 | |

| Other | | — | | | — | | | 1,542 | | | — | | | 1,542 | |

| Total Revenue | | $ | 47,264 | | | $ | 28,748 | | | $ | 5,111 | | | $ | (88) | | | $ | 81,035 | |

| | | | | | | | | | |

| | Six Months Ended June 30, 2023 |

| Product | | Potash Segment | | Trio® Segment | | Oilfield Solutions Segment | | Intersegment Eliminations | | Total |

| Potash | | $ | 88,261 | | | $ | — | | | $ | — | | | $ | (189) | | | $ | 88,072 | |

Trio® | | — | | | 56,282 | | | — | | | — | | | 56,282 | |

| Water | | 180 | | | 2,522 | | | 4,187 | | | — | | | 6,889 | |

| Salt | | 6,321 | | | 218 | | | — | | | — | | | 6,539 | |

| Magnesium Chloride | | 2,804 | | | — | | | — | | | — | | | 2,804 | |

| Brine Water | | 2,195 | | | — | | | 1,823 | | | — | | | 4,018 | |

| Other | | — | | | — | | | 3,351 | | | — | | | 3,351 | |

| Total Revenue | | $ | 99,761 | | | $ | 59,022 | | | $ | 9,361 | | | $ | (189) | | | $ | 167,955 | |

INTREPID POTASH, INC.

DISAGGREGATION OF REVENUE AND SEGMENT DATA (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2022 |

| Product | | Potash Segment | | Trio® Segment | | Oilfield Solutions Segment | | Intersegment Eliminations | | Total |

| Potash | | $ | 43,885 | | | $ | — | | | $ | — | | | $ | (66) | | | $ | 43,819 | |

Trio® | | — | | | 34,687 | | | — | | | — | | | 34,687 | |

| Water | | 363 | | | 724 | | | 3,692 | | | — | | | 4,779 | |

| Salt | | 2,658 | | | 56 | | | — | | | — | | | 2,714 | |

| Magnesium Chloride | | 1,199 | | | — | | | — | | | — | | | 1,199 | |

| Brine Water | | 722 | | | — | | | 648 | | | — | | | 1,370 | |

| Other | | — | | | — | | | 3,172 | | | — | | | 3,172 | |

| Total Revenue | | $ | 48,827 | | | $ | 35,467 | | | $ | 7,512 | | | $ | (66) | | | $ | 91,740 | |

| | | | | | | | | | |

| | Six Months Ended June 30, 2022 |

| Product | | Potash Segment | | Trio® Segment | | Oilfield Solutions Segment | | Intersegment Eliminations | | Total |

| Potash | | $ | 95,507 | | | $ | — | | | $ | — | | | $ | (161) | | | $ | 95,346 | |

Trio® | | — | | | 74,303 | | | — | | | — | | | 74,303 | |

| Water | | 1,137 | | | 1,926 | | | 7,880 | | | — | | | 10,943 | |

| Salt | | 5,292 | | | 290 | | | — | | | — | | | 5,582 | |

| Magnesium Chloride | | 2,014 | | | — | | | — | | | — | | | 2,014 | |

| Brine Water | | 1,319 | | | — | | | 1,387 | | | — | | | 2,706 | |

| Other | | — | | | — | | | 5,245 | | | — | | | 5,245 | |

| Total Revenue | | $ | 105,269 | | | $ | 76,519 | | | $ | 14,512 | | | $ | (161) | | | $ | 196,139 | |

INTREPID POTASH, INC.

DISAGGREGATION OF REVENUE AND SEGMENT DATA (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Three Months Ended

June 30, 2023 | | Potash | | Trio® | | Oilfield Solutions | | Other | | Consolidated |

| Sales | | $ | 47,264 | | | $ | 28,748 | | | $ | 5,111 | | | $ | (88) | | | $ | 81,035 | |

| Less: Freight costs | | 4,338 | | | 6,266 | | | — | | | (88) | | | 10,516 | |

Warehousing and handling

costs | | 1,609 | | | 1,192 | | | — | | | — | | | 2,801 | |

| Cost of goods sold | | 28,441 | | | 20,068 | | | 3,827 | | | — | | | 52,336 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Gross Margin | | $ | 12,876 | | | $ | 1,222 | | | $ | 1,284 | | | $ | — | | | $ | 15,382 | |

Depreciation, depletion, and amortization incurred1 | | $ | 6,429 | | | $ | 1,405 | | | $ | 915 | | | $ | 223 | | | $ | 8,972 | |

| | | | | | | | | | |

| Six Months Ended June 30, 2023 | | Potash | | Trio® | | Oilfield Solutions | | Other | | Consolidated |

| Sales | | $ | 99,761 | | | $ | 59,022 | | | $ | 9,361 | | | $ | (189) | | | $ | 167,955 | |

| Less: Freight costs | | 9,343 | | | 12,952 | | | — | | | (189) | | | 22,106 | |

Warehousing and handling

costs | | 3,089 | | | 2,445 | | | — | | | — | | | 5,534 | |

| Cost of goods sold | | 60,025 | | | 40,951 | | | 7,605 | | | — | | | 108,581 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Gross Margin | | $ | 27,304 | | | $ | 2,674 | | | $ | 1,756 | | | $ | — | | | $ | 31,734 | |

Depreciation, depletion, and amortization incurred1 | | $ | 13,482 | | | $ | 2,611 | | | $ | 1,822 | | | $ | 429 | | | $ | 18,344 | |

| | | | | | | | | | |

Three Months Ended

June 30, 2022 | | Potash | | Trio® | | Oilfield Solutions | | Other | | Consolidated |

| Sales | | $ | 48,827 | | | $ | 35,467 | | | $ | 7,512 | | | $ | (66) | | | $ | 91,740 | |

| Less: Freight costs | | 3,682 | | | 5,611 | | | — | | | (66) | | | 9,227 | |

Warehousing and handling

costs | | 1,209 | | | 995 | | | — | | | — | | | 2,204 | |

| Cost of goods sold | | 19,011 | | | 15,809 | | | 3,678 | | | — | | | 38,498 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Gross Margin | | $ | 24,925 | | | $ | 13,052 | | | $ | 3,834 | | | $ | — | | | $ | 41,811 | |

Depreciation, depletion, and amortization incurred1 | | $ | 6,085 | | | $ | 1,042 | | | $ | 803 | | | $ | 176 | | | $ | 8,106 | |

| | | | | | | | | | |

| Six Months Ended June 30, 2022 | | Potash | | Trio® | | Oilfield Solutions | | Other | | Consolidated |

| Sales | | $ | 105,269 | | | $ | 76,519 | | | $ | 14,512 | | | $ | (161) | | | $ | 196,139 | |

| Less: Freight costs | | 7,705 | | | 11,920 | | | — | | | (161) | | | 19,464 | |

Warehousing and handling

costs | | 2,533 | | | 2,147 | | | — | | | — | | | 4,680 | |

| Cost of goods sold | | 41,041 | | | 33,261 | | | 8,706 | | | — | | | 83,008 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Gross Margin | | $ | 53,990 | | | $ | 29,191 | | | $ | 5,806 | | | $ | — | | | $ | 88,987 | |

Depreciation, depletion and amortization incurred1 | | $ | 13,033 | | | $ | 2,050 | | | $ | 1,590 | | | $ | 411 | | | $ | 17,084 | |

(1) Depreciation, depletion, and amortization incurred for potash and Trio® excludes depreciation, depletion, and amortization amounts absorbed in or relieved from inventory.

v3.23.2

Cover

|

Aug. 02, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 02, 2023

|

| Entity Registrant Name |

Intrepid Potash, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-34025

|

| Entity Tax Identification Number |

26-1501877

|

| Entity Address, Address Line One |

707 17th Street, Suite

|

| Entity Address, City or Town |

Denver

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80202

|

| City Area Code |

303

|

| Local Phone Number |

296-3006

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

IPI

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001421461

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

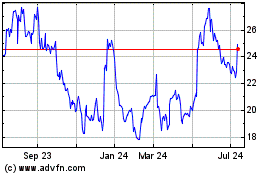

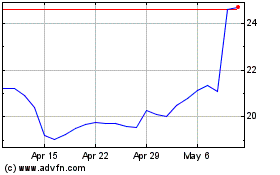

Intrepid Potash (NYSE:IPI)

Historical Stock Chart

From Apr 2024 to May 2024

Intrepid Potash (NYSE:IPI)

Historical Stock Chart

From May 2023 to May 2024