UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH

OF AUGUST 2023

COMMISSION FILE NUMBER 000-51576

ORIGIN AGRITECH

LIMITED

(Translation of registrant's name into English)

No. 21 Sheng Ming Yuan Road, Changping District, Beijing 102206

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange

Act of 1934.

Yes ¨

No x

If "Yes" is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): 82-¨

August 2023 Investor Presentation

Origin Agritech Limited is filing herewith an

investor presentation dated August 2023. See the attached Exhibit 99.1.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

By: |

/s/ Han

Gengchen |

| |

Name: |

Han Gengchen |

| |

Title: |

Chief Executive Officer |

Dated: August 1, 2023

Exhibit Index

The following exhibits are filed as part of this Form 6-K.

Exhibit 99.1

NASDAQ: SEED Investor Presentation August 2023 Origin Agritech

Forward Looking Statements and Disclaimers This communication

contains "forward - looking statements" as defined in the federal securities laws, including Section 27A of the Securities Act of 1933

and Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act

of 1995. Forward - looking statements address expected future business and financial performance and financial condition, and contain

words like "expect," "anticipate," "intend," "plan," "believe," "seek," "will," "would," "target," and similar expressions and variations.

Forward - looking statements address matters that are uncertain. Forward - looking statements are not guarantees of future performance

and are based on assumptions and expectations which may not be realized. They are based on management’s current expectations, assumptions,

estimates and projections about the Company and the industry in which the Company operates but involve a number of risks and uncertainties,

many of which are beyond the Company's control. Some of the important factors that could cause the Company's actual results to differ

materially from those discussed in forward - looking statements are: failure to develop and market new products and optimally manage

product life cycles; ability to respond to market acceptance, rules, regulations and policies affecting our products and operations;

failure to appropriately manage safety and product stewardship issues; changes in laws and regulations or political conditions; global

economic and capital markets conditions, such as inflation, interest and currency exchange rates; business or supply disruptions; natural

disasters and weather events and patterns; ability to protect and enforce the Company's intellectual property rights; and separation

of underperforming or non - strategic assets or businesses. The Company undertakes no duty or obligation to publicly revise or update

any forward - looking statements as a result of future developments, or new information or otherwise, should circumstances change, except

as otherwise required by securities and other applicable laws. Although the Company believes that the expectations expressed in these

forward - looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and actual results

may differ materially from the anticipated results. You are urged to consider these factors carefully in evaluating the forward - looking

statements contained herein and are cautioned not to place undue reliance on such forward - looking statements, which are qualified in

their entirety by these cautionary statements.

Origin Agritech About Us Where we're going CRISPR gene editing

speeding up innovation Using leading tech to create corn varieties to meet customers' needs Future expansion from just seeds to vertically

integrated Ag Co Where we are GMO commercial seed production in 2023 2nd & 3rd generation BT & GT GMO corn in safety certificate

approval process Drought resistance GMO corn in final stage of safety certificate approval Large - scale commercial production of NEC

corn in 2023 How it started Founded in 1997 Heritage in hybrid corn breeding R&D developing GMO seed traits and transgenic technology

Collaborated with Chinese agricultural institutes to leverage their resources 3

The Chinese Food Security Problem Tough Mismatch With 22% of

the world's population but only 10% of the world's arable land, China is the largest corn importer in the world. Dependent on Imports

Recent trade tensions and COVID related supply chain disruptions have prompted the Chinese government to embrace agritech solutions for

food independence. Climate Change Global crop yields could fall about 30% because of climate change, even as food demand is expected

to jump 50% in the coming decades, according to United Nations’ estimates. Inflation Corn prices have risen 100% and fertilizer

prices 230% from pre - pandemic levels. 4

Corn yields are 45% lower in China than the USA China has a

larger corn harvest area than USA but lower production China's past GMO limitations and lower tech family farms are the reason 5

Government GMO corn approval in February 2023 China's historic

agricultural modernization begins... Foreign companies not allowed to sell GMO corn in China 6 4 million mu (660k acres) to be planted

this year 1% of the total corn harvest area. Likely 90%+ GMO within 5 years like with Monsanto in USA. Origin's GMO corn hybrids are

in the national demo plot in 2023 and ready for commercial production

Origin's GMO Portfolio absorb essential nutrients. The use of

phytase corn should also reduce phosphate pollution caused by animal waste and excessive fertilizer use. Phytase Corn Origin's Phytase

corn GMO is the first GMO corn trait to receive biosafety certificate in 2009. Phytase is an enzyme that is added to corn feedstock so

that livestock can Herbicide and Pest Resistance The first and only triple stack GMO corn hybrid entering the national demo plot and

ready for commercial production in 2023. Several elite commercial hybrids in the new variety approval process. Multiple next - generation

GMO traits are in the approval process. Drought Resistance Origin's drought resistance trait is in the final stage of GMO safety certificate

approval. 7

Origin's Solution: 3 Pillars of Agritech Innovation Germplasm

Origin's huge library of thriving hybrid corn varieties are the solid foundation for innovation Huge competitive advantage vs. competition

Gene editing Origin is a leading player in using CRISPR to create innovative new corn varieties Breakthrough technology significantly

increases breeding efficiency GMO traits Origin has all of the major GMO traits integrated into its hybrid corn and awaiting approval

8

Origin's 26 years of R&D on hybrid corn provide a huge competitive

advantage Origin's Germplasm Superiority GMO and Germplasm Go Hand in Hand GMO traits only modify a few genetic traits; the underlying

seed variety needs to be of high quality to ensure a superior product Validated Technology 112 hybrids approved as new varieties in last

26 years 4000 new hybrids being tested across major corn production regions in China each year Origin's hybrids cover all major corn

production regions in China Improving Regulatory Environment Chinese regulators are strengthening IP protection to incentivize innovation

in the agricultural industry, making Origin's germplasm more commercially valuable . Increasing Need for Elite Hybrids Climate change

has made and will continue to make the growing environment harsher, exacerbating the need for elite corn hybrids. 9

Give the customers what they want... Origin's elite hybrid corn

(germplasm) Use CRISPR to turn on & off genes to create what customer wants (i.e. high protein) Contract grow the new NEC variety

for the customer. Corn processing, drying and fulfilment to customer (feedstock company or hog farmer) Integrate GMO traits into new

variety (herbicide and insect resistance) to make corn even better with higher yield 1 0

First example of vertically integrated business model... Our

Innovation is Disrupting a $75B Industry Nutritionally enhanced corn (NEC) eliminates the need for expensive additives in hog feed Doubles

feedstock companies' margins No competition for the product Feedstock in China is a $75 billion market 11

Business Model of Supply Chain With innovation we control more

of the supply chain Grow NEC corn rather than just sell seed Increases our revenue and profit potential F ee d / F oo d P r o c e ss

i n g I n d u s t r y New Hybrid D e v e l o p m e n t Field Grain Production Post Harvest/Storage Trade & T r a n s p o r t 12

*Market size in billions of dollars Expanding to NEC Corn Production,

Dramatically Increases the Market Size $3.5 Hybrid Corn Seed $ 4 . 6 GMO Corn Seed $ 8 3 . 5 Corn Production $ 4 1 7 Feed/Food Industry

13

Initial Rollout of NEC Corn Supply Chain NEC Corn in X i n j

i a n g Growing ~5,000 acres of NEC corn in Xinjiang Grown by Origin's Joint Venture, Baodao Origin Agritech and Livestock Co. Ltd. Will

expand to ~33,000 acres in 2024 Expected to add $8 million revenue in 2023 and $55 million in 2024 Constructing 100,000 - ton corn drying

base in Xinjiang $11.1 million investment funded by JV partner and local banks Expands Origin's market opportunity > 20x $83 billion

market for feedstock In negotiations for similar deals in other provinces Goal is to expand NEC production into all major corn growing

regions 14

*More partnerships in the works! Strategic Alliances National

Maize Improvement Center Henan Agricultural University China Agricultural University China Academy of Agricultural Sciences 15

Equity Snapshot NASDAQ: SEED Stock Price (21 - Jul - 23 ) $4.03

Shares Outstanding 6.2 M Market Capitalization $25M Revenue H1 2023 $9.6 M Growth Rate 42% Operating Income H1 2023 - $.02 M Cash $2.1

M Insider Ownership 14.1% Institutional Ownership 17.5% 1 6 Auditor : B F Borgers CPA PC Legal Counsel : Andrew Hudders at Golenbock

Eiseman Assor Bell & Peskoe LLP

Origin Agritech Investment Highlights Nascent multi - billion

market for GMO corn Leader in gene editing Speeding up the pace of innovation and staying ahead of competitors 1 2 Seeds --- > vertically

integrated corn company 3 NEC corn to drive growth in 2023 Growing 5,000 acres in Xinjiang GMO revenues to kick in Big growth driver

Low - cost structure Should drive significant margin expansion and profitability US traded on NASDAQ Ticker: SEED 4 5 6 7 1 7

You've heard from us. we want to hear from you. Joe Ramelli

, VP of Business Development 310.845.6238 joe@originagritech.com For Mandarin Speakers: Kate Lang +86 186.1839.3368 bing.lang@originseed.com.cn

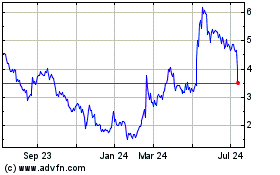

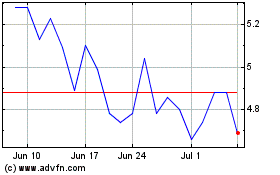

Origin Agritech (NASDAQ:SEED)

Historical Stock Chart

From Mar 2024 to Apr 2024

Origin Agritech (NASDAQ:SEED)

Historical Stock Chart

From Apr 2023 to Apr 2024