As filed with the Securities and Exchange Commission on July 28, 2023.

Registration No. 333-272946

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

__________________________________________

Longeveron Inc.

(Exact name of registrant as specified in its charter)

__________________________________________

| Delaware | | 2834 | | 47-2174146 |

| (State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification No.) |

1951 NW 7th Avenue, Suite 520

Miami, Florida 33136

Telephone: (305) 909-0840

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

__________________________________________

Wa’el Hashad

Chief Executive Officer

Longeveron Inc.

1951 NW 7th Avenue, Suite 520

Miami, Florida 33136

Telephone: (305) 909-0840

(Name, address, including zip code, and telephone number, including area code, of agent for service)

__________________________________________

With a copy to:

|

Jennifer Minter, Esq.

Richard DiStefano, Esq.

Adam G. Wicks, Esq.

Buchanan Ingersoll & Rooney PC

Union Trust Building

501 Grant Street, Suite 200

Pittsburgh, PA 15219

Telephone: (412) 562-8800

|

|

Spencer G. Feldman, Esq.

Olshan Frome Wolosky LLP

1325 Avenue of the Americas, 15th Floor

New York, NY 10019

Telephone: (212) 451-2300

|

__________________________________________

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

| Non-accelerated filer | | ☒ | | Smaller reporting company | | ☒ |

| | | | | Emerging growth company | | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

__________________________________________

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

EXPLANATORY NOTE

The prospectus accompanying this registration statement is being used to register and offer transferable Subscription Rights to purchase shares of Class A common stock and the shares of Class A common stock issuable upon the exercise of such Subscription Rights, to existing holders of common stock of the registrant (and holders of warrants exercisable for common stock), the placement by R.F. Lafferty, the Dealer Manager of any unsubscribed shares of Class A common stock registered hereunder, for an additional period of up to 45 days following expiration of the offering, as well as the potential resale by our principal stockholders and certain of our directors and executive officers of transferable Subscription Rights during the period for which the transferable Subscription Rights may be transferred in accordance with the terms of the Rights Offering.

We will not receive any proceeds from any sale of Subscription Rights undertaken by our principal stockholders and such directors and executive officers.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Preliminary Prospectus Subject to Completion, Dated July 28, 2023

Transferable Subscription Rights to purchase shares of Class A common stock

at $ per share and shares of Class A common stock

issuable upon exercise of Subscription Rights or subsequent placement

We are distributing to holders (such holders, including holders who may acquire rights by purchasing them from others, referred to in this registration statement as “holders” or “you”) of our Class A common stock, Class B common stock (together, our “common stock”) and holders of warrants exercisable for our Class A common stock (the “Participating Warrants”), at no charge, transferable subscription rights (the “Subscription Rights”) to purchase up to $30.0 million of our Class A common stock. We refer to the offering that is the subject of this prospectus as the “Rights Offering”. In the Rights Offering, you will receive, on August 18, 2023, the record date of the Rights Offering (the “Record Date”), five Subscription Rights for every share of common stock beneficially owned or share of Class A common stock underlying a Participating Warrant owned and settled by 5:00 p.m., Eastern Time, on August 16, 2023.

Each Subscription Right consists of a basic subscription right and an over-subscription privilege. Each Subscription Right will entitle the holder to purchase one share of Class A common stock, at a subscription price per share equal to $ . Once the Rights Offering has commenced, the Subscription Rights will be transferable until the expiration of the Rights Offering. We have applied to list such rights for trading on The Nasdaq Capital Market (“Nasdaq”) under the symbol “LGVNR.” We will not commence this offering until the Subscription Rights are approved for listing by Nasdaq.

In the event that holders exercise Subscription Rights for in excess of the aggregate maximum exercise amount of $30.0 million, the amount subscribed for by each holder will be proportionally reduced, based on the amount subscribed for (not including any over-subscription privilege subscribed for). If you exercise your basic subscription right in full, and any portion of the shares of Class A common stock available under the terms of the Rights Offering remain unsubscribed, you will be entitled to an over-subscription privilege to purchase a portion of the unsubscribed shares of Class A common stock at the subscription price, subject to proportional reduction if required among those who properly exercised their over-subscription privilege based on the amount of their over-subscription commitment. Once made, all exercises of rights are irrevocable.

You may only purchase the number of shares of Class A common stock purchasable upon exercise of the number of basic subscription rights distributed to you in the Rights Offering, subject to proration as described herein, plus the over-subscription privilege, if any. Accordingly, the number of shares of Class A common stock that you may purchase in the Rights Offering is limited by the number of shares of our common stock you held or would have held upon full exercise of Participating Warrants held on the Record Date and by the extent to which other stockholders exercise their basic subscription rights and over-subscription privileges, which we cannot determine prior to completion of the Rights Offering.

The Subscription Rights will expire if they are not exercised by 5:00 p.m., Eastern Time, on September 21, 2023, unless the Rights Offering is extended or earlier terminated by us. If we elect to extend the Rights Offering, we will issue a press release announcing the extension no later than 9:00 a.m., Eastern Time, on the next business day after the most recently announced Expiration Date of the Rights Offering. We may extend the Rights Offering for a period not to exceed 30 days in our sole discretion. All subscription payments will be deposited into an escrow account maintained by the Subscription Agent for the benefit of the holders exercising their subscriptions under the Rights Offering, and if the Rights Offering is not completed for any reason all funds will be promptly returned to such subscribers in the amounts advanced in connection with their respective exercises.

We have engaged R.F. Lafferty & Co., Inc. (“R.F. Lafferty”) as the dealer-manager for the Rights Offering. If the Rights Offering is not fully subscribed following expiration of the Rights Offering, R.F. Lafferty has additionally agreed to use its best efforts to place any of the unsubscribed shares of Class A common stock registered hereunder at the subscription price for an additional period of up to 45 days. The number of shares of Class A common stock that may be sold by us hereunder during this 45 day period will depend upon the number of shares of Class A common stock that remain available hereunder following the subscription and exercise of Subscription Rights.

You should carefully consider whether to exercise your Subscription Rights prior to the expiration of the Rights Offering. All exercises of Subscription Rights are irrevocable, even if the Rights Offering is extended by our Board of Directors for a period of 30 days.

__________________________________________

Table of Contents

If we amend the Rights Offering to allow for an extension of the Rights Offering for a period of more than 30 days or make a fundamental change to the terms of the Rights Offering set forth in this prospectus, you may cancel your subscription and receive a prompt refund of any money you have advanced. Our Board of Directors may cancel the Rights Offering at any time prior to the expiration of the Rights Offering for any reason. In the event the Rights Offering is canceled, all subscription payments received by the Subscription Agent will be promptly returned, without interest.

This prospectus may be used to cover sales of Subscription Rights by our principal stockholders and certain of our directors and executive officers as provided for herein. None of our principal stockholders or such directors or executive officers have entered into any binding commitment or agreement to subscribe for or sell Subscription Rights received in this Rights Offering. We will not receive any proceeds from any sale of Subscription Rights by our principal stockholders and such directors and executive officers. See “Principal Stockholder, Director and Executive Officer Information” and “Plan of Distribution”.

In the event that the exercise by a stockholder of the basic subscription right or the over-subscription privilege could, as determined in our sole discretion, potentially result in a limitation on our ability to use net operating losses, tax credits and other tax attributes, under the Internal Revenue Code of 1986, as amended, and rules promulgated by the Internal Revenue Service, we may, but are under no obligation to, reduce the exercise by such stockholder of the basic subscription right or the over-subscription privilege to such number of shares of Class A common stock as in our sole discretion determine to be advisable in order to preserve our ability to use the tax attributes. If the amount of Subscription Rights that you exercise is so limited, any amount not used for purchases also will be refunded.

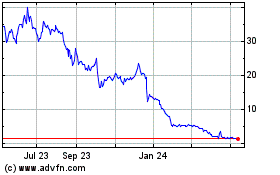

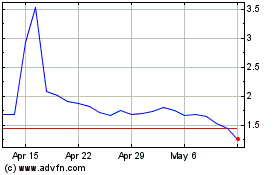

Our Board of Directors is making no recommendation regarding your exercise of the Subscription Rights. Shares of our Class A common stock are traded on The Nasdaq Capital Market under the symbol “LGVN”. On July 13, 2023, the closing sales price for our Class A common stock was $3.35 per share. The shares of Class A common stock issued in the Rights Offering will also be traded on Nasdaq under the same symbol.

|

|

|

Per Share

|

|

Total(1)

|

|

Subscription price

|

|

$

|

|

|

$

|

30,000,000

|

|

Dealer-manager fees and expenses(2)

|

|

$

|

|

|

$

|

|

|

Proceeds to us, before expenses

|

|

$

|

|

|

$

|

|

__________________________________________

We are an “emerging growth company” under the federal securities laws and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary — Implications of Being an Emerging Growth Company and a Smaller Reporting Company.”

The exercise of your Subscription Rights for shares of our Class A common stock involves a high degree of risk. See “Risk Factors” beginning on page 18 of this prospectus, as well as the risk factors and other information in any documents we incorporate by reference into this prospectus, to read about important factors you should consider before exercising your Subscription Rights.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

If you have any questions or need further information about the Rights Offering, please call Okapi Partners LLC, our information agent for the Rights Offering, at (844) 201-1170 or email at info@okapipartners.com.

The date of this prospectus is , 2023

Table of Contents

i

Table of Contents

About This Prospectus

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission. You should rely only on the information contained in this prospectus or any related prospectus supplement. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The information contained in this prospectus is accurate only on the date of this prospectus. Our business, financial condition, results of operations and prospects may have changed since such date. Other than as required under the federal securities laws, we undertake no obligation to publicly update or revise such information, whether as a result of new information, future events or any other reason. This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below. You should read this prospectus in its entirety before making an investment decision. You should also read and consider the information in the documents to which we have referred you in the section of the prospectus entitled “Where You Can Find More Information.”

This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any of our securities other than the securities covered hereby, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about, and to observe, any restrictions as to the offering and the distribution of this prospectus applicable to those jurisdictions.

Industry and Market Data

This prospectus includes industry data and forecasts that we obtained from industry publications and surveys, public filings and internal company sources. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of the included information. Statements as to our market position and market estimates are based on independent industry publications, government publications, third party forecasts, management’s estimates and assumptions about our markets and our internal research. While we are not aware of any misstatements regarding the market, industry or similar data presented herein, such data involve risks and uncertainties and are subject to change based on various factors, including those discussed under the headings “Risk Factors” and “Cautionary Statement Concerning Forward-Looking Statements” in this prospectus.

This prospectus contains references to trademarks, trade names and service marks belonging to other entities. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

ii

Table of Contents

PROSPECTUS SUMMARY

This summary highlights, and is qualified in its entirety by, the more detailed information and financial statements included elsewhere in this prospectus. This summary does not contain all of the information that may be important to you in making your investment decision. You should read this entire prospectus carefully, especially the “Risk Factors” section beginning on page 18, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Risk Factors” and our audited financial statements, unaudited financial statements and related notes thereto, which are incorporated by reference into this prospectus. In this prospectus, except as otherwise indicated, “Longeveron,” the “Company,” “we,” “our,” and “us” refer to Longeveron Inc., a Delaware corporation.

Business Overview

We are a clinical stage biotechnology company developing regenerative medicines to address unmet medical needs. The Company’s lead investigational product is Lomecel-B™. Lomecel-B™ has multiple modes of action that include pro-vascular, pro-regenerative, and anti-inflammatory mechanisms, promoting tissue repair and healing with broad potential applications across a spectrum of disease areas. We are currently pursuing three pipeline indications: Hypoplastic Left Heart Syndrome (HLHS), Aging-related Frailty, and Alzheimer’s disease (AD). Our mission is to advance Lomecel-B™ and other cell-based product candidates into pivotal Phase 3 trials, with the goal of achieving regulatory approvals, subsequent commercialization, and broad use by the healthcare community.

With respect to HLHS, we are exploring the possibility that Lomecel-B™ when administered directly to the myocardium of affected infants can improve outcomes in this devastating rare pediatric disease. The standard of care in HLHS is a series of three reconstructive surgeries, typically at 10 days, 4 months, and approximately 4 years of life. Despite these life-saving surgical interventions, it is estimated that only 50 to 60 percent of affected individuals survive until adolescence. The pro-vascular, pro-regenerative and anti-inflammatory properties of Lomecel-B™ may improve the function of the right ventricle in these infants. A previous Longeveron Phase 1 open-label study (ELPIS I)1 indicated that such a benefit may exist when outcomes were compared to historical controls. Longeveron is currently conducting a controlled study to determine the actual benefit of Lomecel-B™ in these patients.

As of July 1, 2023, we have completed four U.S. clinical studies of Lomecel-B: Phase 1 AD, Phase 1 HLHS, Phase ½ Aging-related frailty (“HERA Trial”) and Phase 2b Aging-related frailty.1 We currently have three clinical trials actively enrolling patients: Phase 2a HLHS (“ELPIS II” trial), Phase 2a AD and Japan Phase 2 study in Japanese patients with Aging-related frailty. Additionally, we sponsor a registry in The Bahamas under the approval and authority of the National Stem Cell Ethics Committee. The Bahamas Registry Trial administers Lomecel-B to eligible participants at two private clinics in Nassau for a variety of indications. While Lomecel-B is considered an investigational product in The Bahamas, under the approval terms from the National Stem Cell Ethics Committee, we are permitted to charge a fee to participate in the Registry Trial.

Since our founding in 2014, we have focused the majority of our time and resources on the following: organizing and staffing our company, building, staffing and equipping a cGMP manufacturing facility with research and development labs, business planning, raising capital, establishing our intellectual property portfolio, generating clinical safety and efficacy data in our selected disease conditions and indications, and developing and expanding our manufacturing processes and capabilities.

We manufacture all of our own product candidates for clinical trials. In 2017, we opened a manufacturing facility comprised of eight clean rooms, two research and development laboratories, and warehouse and storage space. We have supply contracts with multiple third parties for fresh bone marrow, which we use to produce our product candidate for clinical testing and research and development. From time to time, we enter into contract development and manufacturing contracts or arrangements with third parties who seek to utilize our product development capabilities.

1

Table of Contents

Since the time that we became a publicly traded company in February 2021, we have sold 4,079,288 shares of Class A common stock through our IPO and a December 2021 private issuance of public equity (PIPE) offering, and warrants to purchase 1,169,288 shares of Class A common stock at an initial exercise price of $17.50 per share, for aggregate gross proceeds of $49.6 million prior to discounts, commissions and other offering expenses.

When appropriate funding opportunities arise, we routinely apply for grant funding to support our ongoing research and since 2016 we have received approximately $16.0 million in grant awards ($11.9 million of which has been directly awarded to us and is recognized as revenue when the performance obligations are met) from the National Institute on Aging (NIA) of the National Institutes of Health (NIH), the National Heart Lung and Blood Institute (NHLBI) of the NIH, the Alzheimer’s Association, and the Maryland Stem Cell Research Fund (MSCRF) of the Maryland Technology Development Corporation, or TEDCO.

Implication of Being an Emerging Growth Company and Smaller Reporting Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended, or the JOBS Act. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year following the fifth anniversary of the completion of our initial public offering, (2) the last day of the fiscal year in which we have total annual gross revenues of at least $1.235 billion, (3) the date on which we are deemed to be a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which would occur if the market value of our Class A common stock held by non-affiliates exceeded $700.0 million as of the last business day of our most recently completed second fiscal quarter or (4) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period. An emerging growth company may take advantage of specified reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company, we may (i) reduce our executive compensation disclosure; (ii) present only two years of audited financial statements, plus unaudited condensed financial statements for any interim period, and correspondingly reduced. Management’s Discussion and Analysis of Financial Condition and Results of Operations disclosure; (iii) avail ourselves of the exemption from the requirement to obtain an attestation and report from our auditors on the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; and (iv) not require stockholder non-binding advisory votes on executive compensation or golden parachute arrangements.

We have availed ourselves in this prospectus of the reduced reporting requirements described above. As a result, the information that we provide stockholders may be less comprehensive than what you might receive from other public companies. When we are no longer deemed to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act discussed above. We have elected to avail ourselves of the exemption that allows emerging growth companies to extend the transition period for complying with new or revised financial accounting standards. This election is irrevocable.

We are also currently a “smaller reporting company” as defined in the Exchange Act. We may continue to be a smaller reporting company even after we are no longer an emerging growth company. We may take advantage of certain of the scaled disclosures available to smaller reporting companies and will be able to take advantage of these scaled disclosures for so long as our public float is less than $250.0 million measured on the last business day of our second fiscal quarter, or our annual revenue is less than $100.0 million during the most recently completed fiscal year and our public float is less than $700.0 million measured on the last business day of our second fiscal quarter. In the event that we are still considered a “smaller reporting company,” at such time as we cease being an “emerging growth company,” the disclosure we will be required to provide in our SEC filings will increase but will still be less than it would be if we were not considered either an “emerging growth company” or a “smaller reporting company.” Specifically, similar to “emerging growth companies,” “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, only being required to provide two years of audited financial statements in annual reports. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze our results of operations and financial prospects.

2

Table of Contents

Summary of Clinical Development Strategy

Our core strategy is to become a world-leading regenerative medicine company through the development and commercialization of novel cell therapy products for unmet medical needs, with a focus on HLHS. Key elements of our current business strategy are as follows.

• Focus on the execution of ELPIS II, a Phase 2 randomized controlled trial set forth in greater detail below, to measure the efficacy of Lomecel-B in HLHS. This trial is ongoing and is being conducted in collaboration with the National Heart, Lung, and Blood Institute through grants from the NIH.

• Continue to develop our existing international programs. We have selected Japan as our first non-U.S. territory for a randomized, double-blinded, placebo-controlled clinical trial to evaluate Lomecel-B for Aging-related frailty with the aim of receiving approval under the Act on the Safety of Regenerative Medicine (ASRM) based on previous clinical data from non-Japanese as well as this Phase 2 study in Japan. We may explore conditional or full approval in Japan of Lomecel-B under the Pharmaceuticals and Medical Devices Act (PMDA) for the treatment of Aging-Related Frailty in the future. We may also explore other indications in Japan, and potentially pursue Aging-related frailty and other indications in additional international locations for further development and commercialization.

• Continue to pursue the therapeutic potential of Lomecel-B™ in Alzheimer’s disease (AD). We have previously conducted a small Phase 1b study in which it appeared that a single dose of Lomecel-B™ may preserve cognition in patients with mild AD as compared to those who received placebo treatment. We are now conducting a small multiple-dose Phase 2 randomized placebo-controlled study in mild AD patients to determine the safety of administering up to four doses of Lomecel-B™ in this aged population. In addition to establishing safety for further investigation, we will endeavor to measure any positive effects of Lomecel-B™ in mild AD patients through a combination of cognitive and imaging endpoints as well as to determine the extent of target engagement by Lomecel-B™ in this patient population.

• Expand our manufacturing capabilities to commercial-scale production.

• Collaborative arrangements and out-licensing opportunities. We will be opportunistic and consider entering into co-development, out-licensing, or other collaboration agreements for the purpose of eventually commercializing Lomecel-B™ and other products domestically and internationally if appropriate approvals are obtained.

• Product candidate development pipeline through internal research and development and in-licensing. Through our research and development program, and through strategic in-licensing agreements, or other business development arrangements, we intend to actively explore promising potential additions to our pipeline.

• Continue to expand our intellectual property portfolio. Our intellectual property is vitally important to our business strategy, and we take significant steps to develop this property and protect its value. Results from our ongoing research and development efforts are intended to add to our existing intellectual property portfolio.

Risks of Investing

Investing in our securities involves substantial risks. Potential investors are urged to read and consider the risk factors relating to an investment in the Class A common stock set forth under “Risk Factors” in this prospectus as well as other information we include in this prospectus.

Corporate Information

We were initially formed as a Delaware limited liability company in October 2014. As part of our initial public offering in February 2021, Longeveron LLC converted into a Delaware corporation pursuant to a statutory conversion, and changed its name to Longeveron Inc. Additional information about us is included in documents incorporated by reference in this prospectus. See “Where You Can Find More Information, Incorporation of Certain Information by Reference”. Our principal executive offices are located at 1951 NW 7th Avenue, Suite 520, Miami, Florida 33136 and our telephone number is (305) 909-0840. Our website address is www.longeveron.com. The information contained in, or accessible through, our website does not constitute a part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

3

Table of Contents

SUMMARY OF THE OFFERING

The following summary describes the principal terms of the Rights Offering, but is not intended to be complete. See the information under the heading “The Rights Offering” in this prospectus for a more detailed description of the terms of the Rights Offering.

Securities Offered

We are distributing, at no charge, to holders of our Class A common stock, Class B common stock (together, our “common stock”), and holders of outstanding warrants exercisable for our Class A common stock (the “Participating Warrants”), transferable Subscription Rights to purchase up to $30.0 million of our Class A common stock. Holders of our common stock will receive five transferable Subscription Rights for each share of common stock owned, and holders of Participating Warrants will receive five Subscription Rights for each share of Class A common stock they would own upon full exercise of the Participating Warrants owned and settled, by 5:00 p.m., Eastern Time, on August 16, 2023.

Subscription Right

Each Subscription Right entitles the holder to purchase one share of our Class A common stock for $ per whole share of Class A common stock. Once the Rights Offering has commenced, the Subscription Rights will be transferable until the expiration of the Rights Offering. We have applied to list such rights for trading on Nasdaq under the symbol “LGVNR”. We will not commence this offering until the Subscription Rights are approved for listing by Nasdaq.

Basic Right and Over-Subscription Privilege

The basic subscription right will entitle the holder to purchase, subject to proration, one share of our Class A common stock at a subscription price of $ per share.

If you fully exercise your basic subscription right, and aggregate basic subscription rights are exercised for an amount less than $30.0 million in the aggregate, you may also exercise an over-subscription privilege to purchase additional shares of Class A common stock that remain unsubscribed at the expiration of the Rights Offering, subject to the availability and pro rata allocation of shares among stockholders exercising this over-subscription privilege.

Record Date

August 18, 2023.

Expiration Date of the Rights Offering

5:00 p.m., Eastern Time, on September 21, 2023 (referred to herein as the “Expiration Date”).

Subscription Price

$ per share, payable in cash. To be effective, any payment related to the exercise of a right must clear prior to the expiration of the Rights Offering.

Placement Period Following Expiration of Rights Offering

In the event that the Rights Offering is not fully subscribed as of the time of its expiration, R.F. Lafferty has agreed to use its best efforts to place any unsubscribed shares of the Class A common stock registered hereunder, at the subscription price, for an additional period of up to 45 days. The number of shares of Class A common stock that may be sold by us during this period will depend upon the number of shares that remain available following the subscription and the exercise of Subscription Rights by our common stockholders and holders of Participating Warrants. No assurance can be given that any unsubscribed shares of Class A common stock will be sold during this period.

4

Table of Contents

Use of Proceeds

We are conducting the Rights Offering, and the placement of any unsubscribed shares of Class A common stock thereafter, to provide funding for our ongoing clinical and regulatory development of Lomecel-B™ for the treatment of several disease states and indications, including HLHS, and the ongoing and prospective clinical studies of Lomecel-B™ with respect to Aging-related Frailty study being conducted in Japan, capital expenditures, working capital; and the balance, if any, for other general corporate purposes. We will not receive any proceeds from sales of Subscription Rights undertaken by our principal stockholders, directors and executive officers. See “Use of Proceeds” for a more detailed description of the intended use of proceeds from the Rights Offering.

Transferability of Rights

The Subscription Rights will be transferable during the course of the subscription period. The Class A common stock underlying the Subscription Rights may not be transferred separately. We have applied to list such rights for trading on Nasdaq under the symbol “LGVNR”. We will not commence this offering until the Subscription Rights are approved for listing by Nasdaq. The Subscription Rights are a new issue of securities with no prior trading market, and we cannot provide you any assurances as to the liquidity of the trading market for the Subscription Rights or the market value of the rights.

This prospectus may be used to cover sales of Subscription Rights by our principal stockholders and certain of our directors and executive officers, as provided for herein. None of our principal stockholders or such directors or executive officers have entered into any binding commitment or agreement to subscribe for or sell Subscription Rights received in this Rights Offering. We will not receive any proceeds from any sale of Subscription Rights by our principal stockholders or such directors and executive officers.

If you are a registered holder of our common stock or Participating Warrants and do not wish to exercise your Subscription Rights, you may instruct the Subscription Agent to sell all or a portion of your Subscription Rights by following the instructions in the Transferable Subscription Rights Certificate that will be provided to you (your “Rights Certificate”). If you wish to transfer all or a portion of your Subscription Rights, you and your transferee may submit a simultaneous instruction to the Subscription Agent to transfer your Subscription Rights and to exercise such transferred Subscription Rights on behalf of the transferee by following the instructions in your Rights Certificate. The Subscription Agent must receive such simultaneous transfer and exercise instruction by 5:00 p.m., Eastern Time, on the Expiration Date.

The Subscription Agent will only facilitate sales of Subscription Rights until 5:00 p.m., Eastern Time, five business days prior to September 21, 2023, the Expiration Date (as it may be extended). Therefore, if you wish to sell, subdivide or transfer (without simultaneous exercise) your Subscription Rights, the Subscription Agent must receive your instruction by 5:00 p.m., Eastern Time, on September 14, 2023. Neither we nor the Subscription Agent shall have any liability to a transferee or transferor of Subscription Rights if Rights Certificates are not received in time for exercise prior to the Expiration Date or subdivision or transfer (without simultaneous exercise) prior to September 14, 2023, five business days prior to September 21, 2023, the Expiration Date (as it may be extended).

Medallion Guarantee May Be Required

Unless your Rights Certificate provides that the shares of Class A common stock are to be delivered to you as record holder of those rights, or you are an eligible institution, your signature on a Rights Certificate must be guaranteed by an eligible institution, such as a member firm of a registered national securities exchange or a member of the Financial Industry Regulatory Authority, Inc., or a commercial bank or trust company having an office or correspondent in the United States, subject to standards and procedures adopted by the subscription agent.

Shares Outstanding Before the Rights Offering

6,311,725 shares of our Class A common stock, 14,855,539 shares of our Class B common stock, and warrants exercisable for 1,271,399 shares of Class A common stock at a weighted average exercise price of $17.26, as of July 13, 2023. Holders of Class A common stock generally have rights identical to holders of Class B common stock, except that holders of Class A common stock are entitled to one vote per share and holders of Class B common stock are entitled to five votes per share. The holders of Class B common stock may convert each share of Class B common stock into one share of Class A common stock at any time at the holder’s option. Class B common stock is not publicly tradable.

5

Table of Contents

Shares Outstanding After the Rights Offering

Assuming shares of our Class A common stock are issued in the Rights Offering through the exercise of Subscription Rights, and no Participating Warrants are exercised, we anticipate that shares of our Class A common stock, and 14,855,539 shares of our Class B common stock, will be outstanding following the completion of the Rights Offering.

U.S. Federal Income Tax Considerations

For U.S. federal income tax purposes, we do not believe you should recognize income or loss in connection with the receipt or exercise of Subscription Rights in the Rights Offering, but the receipt and exercise of the Subscription Rights is unclear in certain respects. You should consult your tax advisor as to the tax consequences of the Rights Offering in light of your particular circumstances. For a more detailed discussion, see “Material U.S. Federal Income Tax Consequences” on page 51. You are urged to consult your own tax advisor as to your particular tax consequences resulting from the receipt and the disposition or exercise of Subscription Rights and the receipt, ownership and disposition of Common Stock.

Extension, Cancellation and Amendment

We reserve the option to extend the offering period for exercising your Subscription Rights for a period not to exceed 30 days, although we do not presently intend to do so. If we elect to extend the expiration of the Rights Offering period, we will issue a press release announcing the extension no later than 9:00 a.m., Eastern Time, on the next business day after the most recently announced expiration of the Rights Offering. We will extend the duration of the Rights Offering as required by applicable law or regulation and may choose to extend the offering if we decide to give investors more time to exercise their Subscription Rights in the Rights Offering.

The Board may cancel the Rights Offering at any time before its expiration for any reason. If the Rights Offering is canceled, we will issue a press release notifying stockholders of the cancellation and all subscription payments received by the Subscription Agent will be promptly returned, without interest or penalty. However, if the Rights Offering is terminated, and you have purchased Subscription Rights in the open market, you will not receive any refund with respect to such purchase.

The Board also reserves the right to amend the terms of the Rights Offering for any reason, including, without limitation, in order to increase participation in the Rights Offering. Such amendments may include a change in the subscription price, although no such change is presently contemplated.

If we should make any fundamental change to the terms set forth in this prospectus, we will file a post-effective amendment to the registration statement in which this prospectus is included, offer potential purchasers who have subscribed for rights the opportunity to cancel such subscriptions and issue a refund of any money advanced by such stockholder or Participating Warrant holder and recirculate an updated prospectus after the post-effective amendment is declared effective with the SEC. In addition, upon such event, we may extend the Expiration Date of the Rights Offering period to allow holders of rights ample time to make new investment decisions and for us to recirculate updated documentation. Promptly following any such occurrence, we will issue a press release announcing any changes with respect to the Rights Offering and the new Expiration Date.

Procedures for Exercising Rights

To exercise your Subscription Rights, you must complete the Rights Certificate and deliver to the Subscription Agent, together with full payment for all the Subscription Rights you elect to exercise under the basic subscription right and over-subscription privilege, before the expiration of the offering period. See the section entitled “The Rights Offering — Methods for Exercising Subscription Rights” for detailed information on the procedure and requirements for exercising your Subscription Rights. You may deliver the documents and payments by mail or commercial carrier. If regular mail is used for this purpose, we recommend using registered mail, properly insured, with return receipt requested.

If you are a beneficial owner of shares that are registered in the name of a broker, dealer, bank or other nominee, you should instruct your record holder to exercise, sell or transfer your Subscription Right on your behalf and deliver all required documents and payment before the expiration of the offering period.

6

Table of Contents

Participation of Certain Warrant Holders

Holders of our warrants to purchase Class A common stock (the “Participating Warrants”) have the contractual right to participate in the Rights Offering, including holders of warrants issued to underwriters in February 2021 and to placement agents and investors in December 2021. Each such eligible warrant holder will receive five Subscription Rights for each share of Common Stock that such warrant holder’s warrant is exercisable for (or, as referred to elsewhere herein, for each share that such warrant holder is deemed to own). A total of 6,356,995 Subscription Rights will be issued to these warrant holders. Holders of certain warrants issued to investors in December 2021 (referred to as the “PIPE Warrants”) also have rights to a downward adjustment in the exercise price for 1,169,288 of these warrants if the deemed subscription price is below the current warrant exercise price. See “Description of Capital Stock — Outstanding Warrants — Class A Common Stock Warrants Issued to Participants in February and December 2021 Offerings.”

No Revocation

All exercises of Subscription Rights are irrevocable, even if you later learn information that you consider to be unfavorable to the exercise of your Subscription Right, or if the market price of Common Stock falls below the subscription price, or if the Rights Offering is extended by the Board of Directors. You should not exercise your Subscription Right unless you are certain that you wish to purchase shares at a subscription price of $ per share.

Risk Factors

Since our inception, we have incurred substantial losses. We will need the funding sought under this prospectus to remain a going concern, maintain operations, and to continue our current and planned clinical trial activity. Our business and our ability to execute our business strategy are subject to a number of risks of which you should be aware before you decide to buy our securities. In particular, you should carefully consider all of the risks which are discussed more fully in “Risk Factors” beginning on page 18 of this prospectus and those incorporated by reference from our filings with the Securities and Exchange Commission.

Dividend Policy

We have never declared or paid any dividends to the holders of our Class A common stock and we do not expect to pay cash dividends in the foreseeable future. We currently intend to retain any earnings for use in connection with the operation of our business and for general corporate purposes.

|

Nasdaq Symbol for Class A common stock

|

|

LGVN

|

|

Transfer Agent and Subscription Agent

|

|

Colonial Stock Transfer Company, Inc.

|

|

Information Agent

|

|

Okapi Partners LLC

|

The number of shares of our Class A common stock outstanding prior to and immediately after this offering, as set forth above, excludes the following potentially dilutive securities as of July 13, 2023:

• 1,271,399 shares issuable upon the exercise of outstanding warrants at a weighted average exercise price as of July 13, 2023 of $17.26 per share. As noted elsewhere in this prospectus, holders of PIPE Warrants also have rights to a downward adjustment in the exercise price for 1,169,288 of these warrants if the deemed subscription price is below the current warrant exercise price.

• 102,754 shares issuable upon the vesting of RSUs under the Company’s 2021 Incentive Award Plan.

• 125,000 shares issuable upon the vesting of Performance Share Units (PSUs) under the Company’s 2021 Incentive Award Plan.

• 401,681 stock options outstanding with an average exercise price as of July 13, 2023 of $6.07 issuable under the Company’s 2021 Incentive Award Plan.

7

Table of Contents

Questions and Answers About the Rights Offering

The following are examples of what we anticipate will be common questions about the Rights Offering. The answers are based on selected information included elsewhere in this prospectus. The following questions and answers do not contain all of the information that may be important to you and may not address all of the questions that you may have about the Rights Offering. This prospectus and the documents incorporated by reference into this prospectus contain more detailed descriptions of the terms of the Rights Offering and provide additional information about us and our business, including potential risks related to the Rights Offering, the shares of Class A common stock offered hereby, and our business. We urge you to read this entire prospectus and the documents incorporated by reference into this prospectus.

Why are we conducting the Rights Offering?

We are conducting the offering to raise capital that we intend to use to continue our clinical trial pipeline and for general corporate purposes. See “Use of Proceeds” section for additional detail.

What is the Rights Offering?

We are distributing to holders of our common stock and Participating Warrants, at no charge, transferable Subscription Rights to purchase shares of Class A common stock. On the Record Date, August 18, 2023, you will receive five Subscription Rights for each whole share of common stock owned, and five Subscription Rights for every share of Class A common stock you would own upon full exercise of Participating Warrants you hold, as of 5:00 p.m., Eastern Time, on August 16, 2023. Each Subscription Right will entitle the holder to a basic subscription right and an over-subscription privilege.

What is the basic subscription right?

A basic subscription right will entitle you to purchase one share of Class A common stock, at the subscription price, for each share of common stock or Participating Warrant held by you as of 5:00 p.m., Eastern Time, on August 16, 2023. If you owned 100 shares of common stock as of that time, on the Record Date you will receive 500 Subscription Rights. You may exercise all or a portion of your basic subscription rights or you may choose not to exercise any basic subscription rights at all.

If you are a record holder or hold Participating Warrants, the number of Class A common shares you may purchase pursuant to your basic subscription right is indicated on the Rights Certificate. If you hold your shares in the name of a broker, dealer, bank, or other nominee who uses the services of the Depository Trust Company, or DTC, you will not receive a Rights Certificate. Instead, DTC will issue five Subscription Rights to your nominee record holder for each share of our common stock that you own as of the Record Date. If you are not contacted by your nominee, you should contact your nominee as soon as possible.

If sufficient shares of Class A common stock are available, we will seek to honor your basic subscription right request in full. In the event that holders exercise basic subscription rights for amounts in excess of $30.0 million, the amount subscribed for by each person will be proportionally reduced, based on the amount subscribed for by each person (not including any over-subscription privilege subscribed for).

See “The Rights Offering — Limitation on the Purchase of Shares of Class A Common Stock” for a description of certain limitations on purchase.

What is the over-subscription privilege?

If you exercise your basic subscription right in full, you may also choose to exercise your over-subscription privilege to purchase shares of Class A common stock in the event that the other holders do not purchase through the exercise of their basic subscription right, and which remain available under the Rights Offering. You should indicate on your Rights Certificate, or the form provided by your nominee if your shares are held in the name of a nominee, the aggregate amount you would like to apply to purchase shares of Class A common stock pursuant to your over-subscription privilege.

8

Table of Contents

If sufficient shares of Class A common stock are available, we will seek to honor your over-subscription request in full. To the extent the number of unsubscribed shares of Class A common stock is insufficient to satisfy all of the properly exercised over-subscription privilege requests, the available shares will be prorated among those who properly exercised their over-subscription privilege in proportion to their respective over-subscription commitment. See “The Rights Offering — Limitation on the Purchase of Shares of Class A common stock” for a description of certain limitations on purchase.

To properly exercise your over-subscription privilege, you must deliver to the Subscription Agent the subscription payment related to your over-subscription privilege before the Rights Offering expires. See “The Rights Offering — The Subscription Rights — Over-Subscription Privilege.” To the extent you properly exercise your over-subscription privilege for a number of shares of Class A common stock that exceeds the number of unsubscribed shares of Class A common stock available to you, any excess subscription payments will be promptly returned to you after the expiration of the Rights Offering, without interest or penalty.

To the extent the aggregate subscription price of the maximum number of unsubscribed shares of Class A common stock available to you pursuant to the over-subscription privilege is less than the amount you actually paid in connection with the exercise of the over-subscription privilege, you will be allocated only the number of unsubscribed shares available to you, and any excess subscription payments received by the Subscription Agent will be returned, without interest or penalty.

The Subscription Agent will determine the over-subscription allocation based on the formula described above and will notify rights holders of the number of shares allocated to each holder exercising the over-subscription privilege as promptly as may be practicable after the allocations are completed.

Will fractional shares be issued upon exercise of Subscription Rights?

No. We will not issue fractional shares of Class A common stock in the Rights Offering. Any excess subscription payments received by the Subscription Agent will be promptly returned after expiration of the Rights Offering, without interest or penalty.

What effect will the Rights Offering have on our outstanding Class A common stock?

6,311,725 shares of our Class A common stock, 14,855,539 shares of our Class B common stock, and Participating Warrants exercisable for 1,271,399 shares of Class A common stock at a weighted average exercise price of $17.26, were outstanding as of July 13, 2023. Based on the foregoing, and assuming no other transactions by us involving our Class A common stock prior to the expiration of the Rights Offering (including no exercise of Participating Warrants), and the Rights Offering is fully subscribed for the maximum number of shares of Class A common stock available, approximately shares of our Class A common stock will be issued and outstanding. The exact number of shares of Class A common stock that we will issue in the Rights Offering will depend on the subscription price and the number of shares of Class A common stock subscribed for. The Rights Offering will have no impact on the number of shares of Class B common stock outstanding.

How was the subscription price formula determined?

A committee consisting solely of independent members of our Board of Directors determined the subscription price taking into consideration, among other things, the following factors:

• the current and historical trading prices of our Class A common stock on Nasdaq;

• the price at which stockholders might be willing to participate in the Rights Offering;

• our need for additional capital and liquidity;

• the cost of capital from other sources;

• our business prospects and general conditions of the securities markets; and

• comparable precedent transactions, including the percentage of shares offered, the terms of the Subscription Rights being offered, the subscription price and the discount that the subscription price represented to the immediately prevailing closing prices for those offerings.

9

Table of Contents

In conjunction with the review of these factors, the independent committee reviewed our history and prospects, including our past and present earnings and cash requirements, our prospects for the future, the outlook for our industry and our current financial condition. The independent committee believes that the subscription price should be designed to provide an incentive to our current stockholders to participate in the Rights Offering and exercise their basic subscription right and their over-subscription privilege.

The subscription price does not necessarily bear any relationship to any established criteria for value. You should not consider the subscription price as an indication of actual value of Longeveron or our Class A common stock. We cannot assure you that the market price of our Class A common stock will not decline during or after the Rights Offering. You should obtain a current price quote for our Class A common stock before exercising your Subscription Rights and make your own assessment of our business and financial condition, our prospects for the future, and the terms of the Rights Offering. Once made, all exercises of Subscription Rights are irrevocable.

Am I required to exercise all of the basic subscription rights I receive in the Rights Offering?

No. You may exercise any number of your basic subscription rights, or you may choose not to exercise any basic right. If you do not exercise any basic subscription right, the number of shares of our Class A common stock you own will not change. However, if you choose not to exercise your basic subscription right in full, your proportionate ownership interest in our Company will decrease. If you do not exercise your basic subscription right in full, you will not be entitled to exercise your over-subscription privilege.

How soon must I act to exercise my Subscription Rights?

If you received a Rights Certificate and elect to exercise any or all of your Subscription Rights, the Subscription Agent must receive your completed and signed Rights Certificate and payment for both your basic subscription right and any over-subscription privilege you elect to exercise before the Rights Offering expires on September 21, 2023, at 5:00 p.m. Eastern Time. If you hold your shares in the name of a broker, dealer, custodian bank, or other nominee, your nominee may establish a deadline before the expiration of the Rights Offering by which you must provide it with your instructions to exercise your Subscription Rights, along with the required subscription payment.

If I do not exercise my Subscription Rights, may I sell my Subscription Rights?

Yes. The Subscription Rights will be transferable during the course of the Subscription Period. We have applied to list such rights for trading on Nasdaq under the symbol “LGVNR”. We will not commence this offering until the Subscription Rights are approved for listing by Nasdaq. The Subscription Rights are a new issue of securities with no prior trading market, and we cannot provide you any assurances as to the liquidity of the trading market for the Subscription Rights or the market value of the rights. Therefore, we cannot assure you that you will be able to sell any of your Subscription Rights or as to the value you may receive in a sale. The Class A common stock underlying the Subscription Rights may not be transferred separately.

If you are a registered holder of our common stock or Participating Warrants and do not wish to exercise your Subscription Rights, you may instruct the Subscription Agent to sell all or a portion of your Subscription Rights by following the instructions in your Rights Certificate. The Subscription Agent will only facilitate sales of Subscription Rights until 5:00 p.m., Eastern Time, five business days prior to September 21, 2023, the Expiration Date (as it may be extended). Therefore, if you wish to sell your subscription rights, the Subscription Agent must receive your instruction by 5:00 p.m., Eastern Time, on September 14, 2023.

This prospectus also covers the possible sale by the Company’s principal stockholders and certain of the Company’s directors and executive officers identified herein of up to 77,594,345 Subscription Rights. The individuals identified may sell some, all, or none of the Subscription Rights distributed to them.

If I do not exercise my Subscription Rights, may I transfer my Subscription Rights?

Yes. The Subscription Rights will be transferable during the course of the Subscription Period. As a result, you may transfer your Subscription Rights during the course of the Subscription Period if you do not want to purchase any shares of our Class A common stock.

10

Table of Contents

If you are a registered holder of our common stock or Participating Warrants and do not wish to exercise your Subscription Rights, you may instruct the Subscription Agent to transfer all or a portion of your Subscription Rights. If you wish to transfer all or a portion of your Subscription Rights, you and your transferee may submit a simultaneous instruction to the Subscription Agent to transfer your Subscription Rights and to exercise such transferred Subscription Rights on behalf of the transferee by following the instructions in your Rights Certificate. The Subscription Agent must receive such simultaneous transfer and exercise instruction by 5:00 p.m., Eastern Time, on the Expiration Date. The Subscription Agent will only facilitate subdivisions or transfers (without simultaneous exercise) of the physical Subscription Rights until 5:00 p.m., Eastern Time, five business days prior to September 21, 2023, the Expiration Date (as it may be extended). Therefore, if you wish to subdivide or transfer (without simultaneous exercise) your Subscription Rights, the Subscription Agent must receive your instruction by 5:00 p.m., Eastern Time, on September 14, 2023. Neither we nor the Subscription Agent shall have any liability to a transferee or transferor of Subscription Rights if Rights Certificates are not received in time for exercise prior to the Expiration Date or subdivision or transfer (without simultaneous exercise) five business days prior to the Expiration Date (as it may be extended).

This prospectus also covers the possible sale by the Company’s principal stockholders and certain of the Company’s directors and executive officers identified herein of up to 77,594,345 Subscription Rights. The individuals identified may sell some, all, or none of the Subscription Rights distributed to them.

Is there a minimum subscription required to complete the Rights Offering?

There is no individual minimum purchase requirement in the Rights Offering, and no minimum subscription required for the Rights Offering.

Are there any conditions to completing the Rights Offering?

There are no conditions to completion.

If the Rights Offering is not completed, will my subscription payment be refunded to me?

Yes. The Subscription Agent will hold all funds it receives in escrow until completion of the Rights Offering. If the Rights Offering is not completed, the Subscription Agent will return promptly, without interest, all subscription payments. We reserve the right to terminate the offering at any time if, due to market conditions or otherwise, the Board of Directors deems it advisable not to proceed with the Rights Offering.

Will our directors and executive officers participate in the Rights Offering or have the ability to sell their subscription rights?

To the extent they hold common stock as of the Record Date, our directors and executive officers will be entitled to participate in the Rights Offering on the same terms applicable to our stockholders and warrant holders receiving Subscription Rights. None of our directors or executive officers have entered into any binding commitment or agreement to exercise Subscription Rights received in the Rights Offering, but some have given indications they intend to participate in the Rights Offering at varying levels, though there can be no assurances any of our principal stockholders, directors and executive officers will participate in the Rights Offering. This prospectus may be used to cover the sales of Subscription Rights by our principal stockholders and certain of our directors and executive officers as provided for herein. None of our principal stockholders or such directors and executive officers have entered into any binding commitment or agreement to sell Subscription Rights received in this Rights Offering. Our principal stockholders are Joshua M. Hare, co-founder, Chief Science Officer and Chairman, and Donald M. Soffer, co-founder and former member of our Board of Directors. Dr. Hare has indicated an intention to participate in the Rights Offering but has made no commitment to do so. See “Principal Stockholder, Director and Executive Officer Information”.

Will holders of our equity awards to employees, officers and directors receive rights in the Rights Offering?

Holders of our equity awards to employees, officers and directors, including outstanding stock options, will not receive rights in the Rights Offering in connection with such equity awards, but will receive Subscription Rights in connection with any shares of our common stock held as of the Record Date.

11

Table of Contents

Will holders of our warrants be permitted to participate in the Rights Offering?

Holders of our warrants to purchase Class A common stock have the contractual right to participate in the Rights Offering, including holders of warrants issued to investors in February and December 2021. As of July 13, 2023, such eligible holders held warrants to purchase 1,271,399 shares of Class A common stock.

Has the Board of Directors made a recommendation to stockholders regarding the Rights Offering?

No. Our Board of Directors is not making a recommendation regarding your exercise of the Subscription Rights. Holders who exercise Subscription Rights will incur investment risk on new money invested. We cannot predict the price at which our shares of Class A common stock will trade after the Rights Offering. On July 13, 2023 the closing price of our Class A common stock was $3.35 per share. The market price for our Class A common stock may be above the subscription price or may be below the subscription price. If you exercise your Subscription Rights, you may not be able to sell the underlying shares of our Class A common stock in the future at the same price or a higher price. You should make your decision based on your assessment of our business and financial condition, our prospects for the future, the terms of the Rights Offering and the information contained in this prospectus. See “Risk Factors” for discussion of some of the risks involved in investing in our securities.

How do I exercise my Subscription Rights?

If you are a stockholder of record (meaning you hold your shares of our common stock or Participating Warrants in your name and not through a broker, dealer, bank, or other nominee) and you wish to participate in the Rights Offering, you must deliver a properly completed and signed Rights Certificate, together with payment of the subscription price for both your basic subscription right and any over-subscription privilege you elect to exercise, to the Subscription Agent before 5:00 p.m. Eastern Time, on September 21, 2023. If you are exercising your Subscription Rights through your broker, dealer, bank, or other nominee, you should promptly contact your broker, dealer, bank, or other nominee and submit your subscription documents and payment for the shares of Class A common stock subscribed for in accordance with the instructions and within the time period provided by your broker, dealer, bank or other nominee.

What if my shares are held in “street name”?

If you hold your shares of our common stock in the name of a broker, dealer, bank, or other nominee, then your broker, dealer, bank, or other nominee is the record holder of the shares you own. The record holder must exercise, transfer or sell the Subscription Rights on your behalf. Therefore, you will need to have your record holder act for you. If you wish to participate in Rights Offering and purchase shares of Class A common stock, please promptly contact the record holder of your shares. We will ask the record holder of your shares, who may be your broker, dealer, bank, or other nominee, to notify you of Rights Offering.

What form of payment is required?

You must timely pay the full subscription price for the full number of shares you wish to acquire pursuant to the exercise of Subscription Rights by delivering to the Subscription Agent a cashier’s check drawn on a U.S. bank, or wire transfer. If you send payment by personal uncertified check, payment will not be deemed to have been delivered to the Subscription Agent until the check has cleared. As such, any payments made by personal check should be delivered to the Subscription Agent no fewer than three business days prior to the Expiration Date. If you send a payment that is insufficient to purchase the number of shares you requested, or if the number of shares of Class A common stock you requested is not specified in the forms, the payment received will be applied to exercise your Subscription Rights to the fullest extent possible based on the amount of the payment received.

When will I receive my new shares of Class A common stock?

The Subscription Agent will arrange for the issuance of the Class A common stock promptly after the expiration of the Rights Offering, payment for the shares of Class A common stock subscribed for has cleared, and all prorating calculations and reductions contemplated by the terms of the Rights Offering have been effected. All shares that you purchase in the Rights Offering will be issued in book-entry, or uncertificated, form meaning that you will receive a

12

Table of Contents

direct registration (DRS) account statement from our Subscription Agent reflecting ownership of these securities if you are a holder of record of shares. If you hold your shares in the name of a broker, dealer, bank, or other nominee, DTC will credit your account with your nominee with the securities you purchase in the Rights Offering.

After I send in my payment and Rights Certificate to the Subscription Agent, may I cancel my exercise of Subscription Rights?

No. Exercises of Subscription Rights are irrevocable unless the Rights Offering is terminated, even if you later learn information that you consider to be unfavorable to the exercise of your Subscription Rights. You should not exercise your Subscription Rights unless you are certain that you wish to participate in the Rights Offering.

How much will the Company receive from the Rights Offering?

Assuming the Rights Offering is fully subscribed for $30.0 million, we estimate that the net proceeds from the Rights Offering will be approximately $ million, after deducting fees and expenses payable to the dealer-manager, and after deducting other expenses payable by us.

What are the limitations on the exercise of the basic subscription right and over-subscription privilege?

In the event that holders exercise basic subscription rights for amounts in excess of $30.0 million, the amount subscribed for by each person will be proportionally reduced, based on the amount subscribed for by each holder pursuant to their basic subscription right (i.e. not including any over-subscription privilege subscribed for).

In the event that the exercise by a holder of the basic subscription right or the over-subscription privilege could, as determined by Longeveron in its sole discretion, potentially result in a limitation on the Company’s ability to use net operating losses, tax credits and other tax attributes, which we refer to as the “Tax Attributes,” under the Internal Revenue Code of 1986, as amended, which we refer to as the “Code”, and rules promulgated by the Internal Revenue Service, Longeveron may, but is under no obligation to, reduce the exercise by such stockholder of the basic subscription right or the over- subscription privilege to such number of shares of Class A common stock as Longeveron in its sole discretion shall determine to be advisable in order to preserve its ability to use the Tax Attributes. If the amount of Subscription Rights that you exercise is so limited, any amount not used for purchases also will be refunded. See also “The Rights Offering — Limitation on the Purchase of Shares of Class A Common Stock”.

Are there risks in exercising my Subscription Rights?

Yes. The exercise of your Subscription Rights involves risks. Exercising your Subscription Rights involves the purchase of additional shares of our Class A common stock and you should consider this investment as carefully as you would consider any other investment. We cannot assure you that the market price of our Class A common stock will exceed the subscription price, nor can we assure you that the market price of our Class A common stock will not further decline after the Rights Offering. We also cannot assure you that you will be able to sell shares of our Class A common stock purchased in the Rights Offering at a price equal to or greater than the subscription price. In addition, you should carefully consider the risks described under the heading “Risk Factors” for discussion of some of the risks involved in investing in our securities.

Can the Board of Directors terminate or extend the Rights Offering?

Yes. Our Board of Directors may decide to terminate the Rights Offering prior to the expiration of the Rights Offering. We also have the right to extend the Rights Offering for a period not to exceed 30 days. We do not presently intend to extend the Rights Offering. We will notify stockholders if the Rights Offering is terminated or extended by issuing a press release. In the event that we decide to extend the Rights Offering and you have already exercised your Subscription Rights, your subscription payment will remain with the Subscription Agent until such time as the Rights Offering closes or is terminated.

Our Board of Directors also reserves the right to amend or modify the terms of the Rights Offering in its sole discretion. If we should make any fundamental changes to the terms of the Rights Offering set forth in this prospectus, we will file a post-effective amendment to the registration statement in which this prospectus is included, offer potential purchasers who have subscribed for rights the opportunity to cancel such subscriptions and issue a

13

Table of Contents

refund of any money advanced by such stockholder and recirculate an updated prospectus after the post-effective amendment is declared effective by the SEC. In addition, upon such event, we may extend the Expiration Date of the Rights Offering to allow holders of rights ample time to make new investment decisions and for us to recirculate updated documentation. Promptly following any such occurrence, we will issue a press release announcing any changes with respect to the Rights Offering and the new Expiration Date. The terms of the Rights Offering cannot be modified or amended after the Expiration Date of the Rights Offering. Although we do not presently intend to do so, we may choose to amend or modify the terms of the Rights Offering for any reason, including, without limitation, in order to increase participation in the Rights Offering. Such amendments or modifications may include a change in the subscription price, although no such change is presently contemplated. If we should make any fundamental changes to the terms set forth in this prospectus, we will file a post-effective amendment to the registration statement in which this prospectus is included, offer potential purchasers who have subscribed for rights the opportunity to cancel such subscriptions and issue a refund of any money advanced by such stockholder or eligible warrant holder and recirculate an updated prospectus after the post-effective amendment is declared effective with the SEC.

If the Rights Offering is not completed or is terminated, will my subscription payment be refunded to me?