UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of July 2023

Commission File Number 001-33161

NORTH AMERICAN CONSTRUCTION GROUP LTD.

27287 - 100 Avenue

Acheson, Alberta T7X 6H8

(780) 960-7171

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F o Form 40-F ý

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rue 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

| | | | | | | | |

| No. | | Documents and Exhibit Index |

| | |

| | |

| | |

| | |

| | |

| 99.1 | | |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | |

| NORTH AMERICAN CONSTRUCTION GROUP LTD. |

| |

| By: | /s/ Jason Veenstra |

| Name: | Jason Veenstra |

| Title: | Executive Vice President & Chief Financial Officer |

Date: July 26, 2023

Table of Contents

| | | | | |

Management's Discussion and Analysis | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Interim Consolidated Financial Statements | |

| |

| |

| |

| |

| |

Management’s Discussion and Analysis

For the three and six months ended June 30, 2023

July 26, 2023

The following Management’s Discussion and Analysis ("MD&A") is as of July 26, 2023, and should be read in conjunction with the attached unaudited interim consolidated financial statements and notes that follow for the three and six months ended June 30, 2023, the audited consolidated financial statements and notes that follow for the year ended December 31, 2022, and our annual MD&A for the year ended December 31, 2022.

All financial statements have been prepared in accordance with United States ("US") generally accepted accounting principles ("GAAP"). Except where otherwise specifically indicated, all dollar amounts are expressed in Canadian dollars. The consolidated financial statements and additional information relating to our business, including our most recent Annual Information Form, are available on the Canadian Securities Administrators' SEDAR system at www.sedar.com, the US Securities and Exchange Commission's website at www.sec.gov and our Company website at www.nacg.ca.

A non-GAAP financial measure is generally defined by securities regulatory authorities as one that purports to measure historical or future financial performance, financial position or cash flows, but excludes or includes amounts that would not be adjusted in the most comparable GAAP measures. Non-GAAP financial measures do not have standardized meanings under GAAP and therefore may not be comparable to similar measures presented by other issuers. In our MD&A, we use non-GAAP financial measures such as "adjusted EBIT", "adjusted EBITDA", "adjusted EBITDA margin", "adjusted EPS", "adjusted net earnings", "backlog", "capital additions", "capital expenditures, net", "capital inventory", "capital work in progress", "cash provided by operating activities prior to change in working capital", "cash related interest expense", "combined gross profit", "combined gross profit margin", "equity method investment backlog", "equity investment depreciation and amortization", "equity investment EBIT", "free cash flow", "gross profit margin", "growth capital", "growth spending", "invested capital", "margin", "net debt", "senior debt", "share of affiliate and joint venture capital additions", "sustaining capital", "total capital liquidity", "total combined revenue", "total debt", and "total net working capital (excluding cash)". We provide tables in this document that reconcile non-GAAP measures used to amounts reported on the face of the consolidated financial statements. A summary of our non-GAAP measures is included below under the heading "Non-GAAP financial measures".

| | | | | | | | |

Management's Discussion and Analysis June 30, 2023 | M-1 | North American Construction Group Ltd. |

OVERALL PERFORMANCE

Interim MD&A - Quarter 2 Highlights

| | | | | | | | | | | | | | | | | | | | |

| (Expressed in thousands of Canadian Dollars, except per share amounts) | | Three months ended |

| June 30, |

| | 2023 | | 2022 | | Change |

| Revenue | | $ | 193,573 | | | $ | 168,028 | | | $ | 25,545 | |

Total combined revenue(i) | | 276,953 | | | 227,954 | | | 48,999 | |

| | | | | | |

| Gross profit | | 21,531 | | | 12,440 | | | 9,091 | |

Gross profit margin(i) | | 11.1 | % | | 7.4 | % | | 3.8 | % |

| | | | | | |

Combined gross profit(i) | | 36,194 | | | 21,839 | | | 14,355 | |

Combined gross profit margin(i)(ii) | | 13.1 | % | | 9.6 | % | | 3.5 | % |

| | | | | | |

| Operating income | | 10,270 | | | 6,301 | | | 3,969 | |

| | | | | | |

Adjusted EBITDA(i)(iii) | | 51,833 | | | 41,649 | | | 10,184 | |

Adjusted EBITDA margin(i)(iii) | | 18.7 | % | | 18.3 | % | | 0.5 | % |

| | | | | | |

| Net income | | 12,262 | | | 7,514 | | | 4,748 | |

Adjusted net earnings(i) | | 12,489 | | | 4,717 | | | 7,772 | |

| | | | | | |

| Cash provided by operating activities | | 40,185 | | | 35,485 | | | 4,700 | |

Cash provided by operating activities prior to change in working capital(i) | | 27,145 | | | 33,373 | | | (6,228) | |

| | | | | | |

Free cash flow(i) | | (4,282) | | | 10,393 | | | (14,675) | |

| | | | | | |

| Purchase of PPE | | 38,419 | | | 27,121 | | | 11,298 | |

Sustaining capital additions(i) | | 38,311 | | | 22,341 | | | 15,970 | |

Growth capital additions(i) | | 2,748 | | | — | | | 2,748 | |

| | | | | | |

| Basic net income per share | | $ | 0.46 | | | $ | 0.27 | | | $ | 0.19 | |

Adjusted EPS(i) | | $ | 0.47 | | | $ | 0.17 | | | $ | 0.30 | |

(i)See "Non-GAAP Financial Measures".

(ii)Combined gross profit margin is calculated using combined gross profit over total combined revenue.

(iii)Adjusted EBITDA margin is calculated using adjusted EBITDA over total combined revenue.

Revenue of $193.6 million represented a $25.5 million (or 15%) increase from Q2 2022. Revenue across all major sites in the oil sands region has continued to see year-over-year revenue growth with our heavy equipment fleet at Fort Hills driving the largest increase as the site continues to ramp up. Equipment utilization of 61% benefited from the strong momentum heading into the quarter, a quick spring break up in April, and continued steady demand for heavy equipment but was significantly impacted in June by unusually wet weather as well as a required fleet remobilization in the oil sands region. Maintenance headcount levels have remained consistent which continues to lower equipment repair backlog and increase mechanical availability. The purchase of ML Northern Services Ltd.'s ("ML Northern") fuel and lube fleet, which occurred on October 1, 2022, and DGI Trading had modest impacts on revenue increases with services and sales provided to external customers. Lastly, another ultra-class haul truck was rebuilt, commissioned and sold to the Mikisew North American Limited Partnership ("MNALP"), bringing its haul truck fleet to sixteen.

Combined revenue of $277.0 million represented a $49.0 million (or 21%) increase from Q2 2022. Our share of revenue generated in Q2 2023 by joint ventures and affiliates was $83.4 million compared to $59.9 million in Q2 2022 (an increase of 39%). Consistent with the prior year, top-line performance was driven by the Nuna Group of Companies ("Nuna"), as they continued their project execution at the gold mine in Northern Ontario. The other drivers of the revenue increases were the joint ventures dedicated to the Fargo-Moorhead flood diversion project, which posted solid top-line revenue as the project ramps up, and the aforementioned expanding revenue capacity from rebuilt ultra-class and 240-ton haul trucks directly owned by MNALP.

Adjusted EBITDA of $51.8 million represented an increase of $10.2 million (or 24%) from the Q2 2022 result of $41.6 million, consistent with increases in combined revenue. The adjusted EBITDA margin of 18.7% reflected normal impacts typically incurred in the second quarter during the transition from winter to spring at the mine sites, particularly in Fort McMurray. In addition, the difficult wet conditions in June had a significant impact on margin as low equipment utilization of less than 50% in the month resulted in fixed costs both at the operational sites and corporate facilities becoming a factor in impacting the overall EBITDA margins.

| | | | | | | | |

Management's Discussion and Analysis June 30, 2023 | M-2 | North American Construction Group Ltd. |

Depreciation of our equipment fleet was 12.6% of revenue in the quarter, compared to 15.7% in Q2 2022, benefiting from efficient and productive use of the equipment fleet. Our internal maintenance programs continue to produce low-cost and longer life components which is impacting depreciation rates. In addition to these factors, our lower capital intensive services continue to have noticeable impacts on the depreciation percentage when comparing to previous benchmarks.

General and administrative expenses (excluding stock-based compensation) were $7.2 million, or 3.7% of revenue, compared to $6.9 million, or 4.1% of revenue in Q2 2022. Consistent costs were incurred as increases from ML Northern and cost items impacted by inflation were mostly offset by cost discipline in discretionary areas and incremental G&A recoveries from our joint ventures.

Cash related interest expense (See "Non-GAAP Financial Measures") for the quarter was $7.2 million at an average cost of debt of 6.9%, compared to 5.2% in Q2 2022, as rate increases posted by the Bank of Canada directly impact our Credit Facility and have a delayed impact on the rates for secured equipment-backed financing. Total interest expense was $7.5 million in the quarter, compared to $5.6 million in Q2 2022.

Adjusted EPS of $0.47 on adjusted net earnings of $12.5 million is up 176% from the prior year figure of $0.17 and is consistent with adjusted EBIT performance as tax and interest tracked fairly consistently with the prior year. Weighted-average common shares levels for the second quarters of 2023 and 2022 reflected a decrease at 26,409,357 and 27,968,510, respectively, net of shares classified as treasury shares, due to the share purchases and cancellations which occurred in the third quarter of 2022.

Free cash flow was a use of cash of $4.3 million and was primarily the result of adjusted EBITDA of $51.8 million, as detailed above, offset by sustaining capital additions ($38.3 million) and cash interest paid ($8.4 million). Free cash flow was also impacted by the cash settlement of certain deferred share units ($7.3 million). As stated in the previous disclosures regarding our annual capital spending, our program is front-loaded in the year and the first half spending is considered typical and consistent with the annual sustaining capital range provided.

SIGNIFICANT BUSINESS EVENTS

As announced, and more particularly described, in our July 26, 2023 press release (the "Transaction Press Release"), which is incorporated by reference here in, we signed a definitive share purchase agreement to acquire MacKellar Group, Australia’s largest privately owned mining equipment and services provider, for estimated consideration of $395 million (the "Transaction"). The Transaction is expected to close in the fourth quarter of 2023. Upon the filing of the material change report in respect of the Transaction, such material change report will also be incorporated by reference herein.

| | | | | | | | |

Management's Discussion and Analysis June 30, 2023 | M-3 | North American Construction Group Ltd. |

FINANCIAL HIGHLIGHTS

Three and six months ended June 30, 2023, results

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30, | | June 30, |

| (dollars in thousands, except per share amounts) | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | $ | 193,573 | | | $ | 168,028 | | | $ | 436,178 | | | $ | 344,739 | |

Cost of sales(i) | | 147,690 | | | 129,248 | | | 312,991 | | | 253,316 | |

| Depreciation | | 24,352 | | | 26,340 | | | 60,737 | | | 57,032 | |

| Gross profit | | $ | 21,531 | | | $ | 12,440 | | | $ | 62,450 | | | $ | 34,391 | |

Gross profit margin(i) | | 11.1 | % | | 7.4 | % | | 14.3 | % | | 10.0 | % |

| General and administrative expenses (excluding stock-based compensation) | | 7,170 | | | 6,895 | | | 15,412 | | | 11,850 | |

| Stock-based compensation expense (benefit) | | 4,804 | | | (1,843) | | | 10,741 | | | (566) | |

| Operating income | | 10,270 | | | 6,301 | | | 35,797 | | | 21,943 | |

| Interest expense, net | | 7,511 | | | 5,565 | | | 14,822 | | | 10,247 | |

| Net income | | 12,262 | | | 7,514 | | | 34,108 | | | 21,071 | |

| | | | | | | | |

Adjusted EBITDA(ii) | | 51,833 | | | 41,649 | | | 136,456 | | | 99,389 | |

Adjusted EBITDA margin(ii)(iii) | | 18.7 | % | | 18.3 | % | | 22.8 | % | | 21.4 | % |

| | | | | | | | |

| Per share information | | | | | | | | |

| Basic net income per share | | $ | 0.46 | | | $ | 0.27 | | | $ | 1.29 | | | $ | 0.75 | |

| Diluted net income per share | | $ | 0.42 | | | $ | 0.25 | | | $ | 1.12 | | | $ | 0.69 | |

Adjusted EPS(ii) | | $ | 0.47 | | | $ | 0.17 | | | $ | 1.43 | | | $ | 0.69 | |

(i)The prior year amounts are adjusted to reflect a change in presentation. See "Accounting Estimates, Pronouncements and Measures".

(ii)See "Non-GAAP Financial Measures".

(iii)Adjusted EBITDA margin is calculated using adjusted EBITDA over total combined revenue.

Reconciliation of total reported revenue to total combined revenue

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30, | | June 30, |

| (dollars in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue from wholly-owned entities per financial statements | | $ | 193,573 | | | $ | 168,028 | | | $ | 436,178 | | | $ | 344,739 | |

| Share of revenue from investments in affiliates and joint ventures | | 158,485 | | | 125,774 | | | 347,970 | | | 251,204 | |

| Elimination of joint venture subcontract revenue | | (75,105) | | | (65,848) | | | (186,578) | | | (131,403) | |

Total combined revenue(i) | | $ | 276,953 | | | $ | 227,954 | | | $ | 597,570 | | | $ | 464,540 | |

(i)See "Non-GAAP Financial Measures".Reconciliation of reported gross profit to combined gross profit

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30, | | June 30, |

| (dollars in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Gross profit from wholly-owned entities per financial statements | | $ | 21,531 | | | $ | 12,440 | | | $ | 62,450 | | | $ | 34,391 | |

| Share of gross profit from investments in affiliates and joint ventures | | 14,663 | | | 9,399 | | | 29,482 | | | 19,956 | |

Combined gross profit(i) | | $ | 36,194 | | | $ | 21,839 | | | $ | 91,932 | | | $ | 54,347 | |

(i)See "Non-GAAP Financial Measures".

| | | | | | | | |

Management's Discussion and Analysis June 30, 2023 | M-4 | North American Construction Group Ltd. |

Reconciliation of net income to adjusted net earnings, adjusted EBIT, and adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30, | | June 30, |

| (dollars in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | | $ | 12,262 | | | $ | 7,514 | | | $ | 34,108 | | | $ | 21,071 | |

| Adjustments: | | | | | | | | |

| (Gain) loss on disposal of property, plant and equipment | | (713) | | | 1,087 | | | 500 | | | 1,164 | |

| Stock-based compensation expense (benefit) | | 4,804 | | | (1,843) | | | 10,741 | | | (566) | |

| Loss on equity investment customer bankruptcy claim settlement | | 759 | | | — | | | 759 | | | — | |

| Net realized and unrealized gain on derivative financial instruments | | (1,852) | | | — | | | (4,361) | | | — | |

| Equity investment net realized and unrealized gain on derivative financial instruments | | (1,655) | | | (2,215) | | | (1,221) | | | (2,215) | |

| Tax effect of the above items | | (1,116) | | | 174 | | | (2,760) | | | (138) | |

Adjusted net earnings(i) | 0 | 12,489 | | | 4,717 | | | 37,766 | | | 19,316 | |

| Adjustments: | | | | | | | | |

| Tax effect of the above items | | 1,116 | | | (174) | | | 2,760 | | | 138 | |

| Interest expense, net | | 7,511 | | | 5,565 | | | 14,822 | | | 10,247 | |

| Income tax expense | | 1,757 | | | 1,557 | | | 10,159 | | | 5,201 | |

| Equity earnings in affiliates and joint ventures | | (9,408) | | | (8,335) | | | (18,931) | | | (14,576) | |

Equity investment EBIT(i) | | 9,605 | | | 9,421 | | | 19,569 | | | 17,109 | |

Adjusted EBIT(i) | | 23,070 | | | 12,751 | | | 66,145 | | | 37,435 | |

| Adjustments: | | | | | | | | |

| Depreciation and amortization | | 24,664 | | | 26,572 | | | 61,355 | | | 57,459 | |

Equity investment depreciation and amortization(i) | | 4,099 | | | 2,326 | | | 8,956 | | | 4,495 | |

Adjusted EBITDA(i) | | $ | 51,833 | | | $ | 41,649 | | | $ | 136,456 | | | $ | 99,389 | |

Adjusted EBITDA margin(i)(ii) | | 18.7 | % | | 18.3 | % | | 22.8 | % | | 21.4 | % |

(i)See "Non-GAAP Financial Measures".

(ii)Adjusted EBITDA margin is calculated using adjusted EBITDA over total combined revenue.

A reconciliation of equity earnings in affiliates and joint ventures to equity investment EBIT

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30, | | June 30, |

| (dollars in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Equity earnings in affiliates and joint ventures | | $ | 9,408 | | | $ | 8,335 | | | $ | 18,931 | | | $ | 14,576 | |

| Adjustments: | | | | | | | | |

| Interest (income) expense, net | | (530) | | | 555 | | | (173) | | | 1,312 | |

| Income tax expense | | 722 | | | 480 | | | 846 | | | 1,170 | |

| Loss (gain) on disposal of property, plant and equipment | | 5 | | | 51 | | | (35) | | | 51 | |

Equity investment EBIT(i) | | $ | 9,605 | | | $ | 9,421 | | | $ | 19,569 | | | $ | 17,109 | |

| Depreciation | | $ | 3,919 | | | $ | 2,150 | | | $ | 8,596 | | | $ | 4,143 | |

| Amortization of intangible assets | | 180 | | | 176 | | | 360 | | | 352 | |

Equity investment depreciation and amortization(i) | | $ | 4,099 | | | $ | 2,326 | | | $ | 8,956 | | | $ | 4,495 | |

(i)See "Non-GAAP Financial Measures".Analysis of three and six months ended June 30, 2023, results

Revenue

A breakdown of revenue by source is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30, | | June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Operations support services | | $ | 174,507 | | | $ | 144,720 | | | $ | 403,964 | | | $ | 317,121 | |

| Equipment and component sales | | 14,306 | | | 20,267 | | | 23,665 | | | 24,577 | |

| Construction services | | 4,760 | | | 3,041 | | | 8,549 | | | 3,041 | |

| | $ | 193,573 | | | $ | 168,028 | | | $ | 436,178 | | | $ | 344,739 | |

| | | | | | | | |

Management's Discussion and Analysis June 30, 2023 | M-5 | North American Construction Group Ltd. |

For the three months ended June 30, 2023, revenue was $193.6 million, up from $168.0 million in the same period last year. Revenue across all major oilsands sites has continued to see year-over-year growth with our heavy equipment fleet at Fort Hills driving the largest increase as the site continues to ramp up. Activity was negatively impacted by heavy rainfall in June, however utilization has increased to 61%, up from 59% in the same period last year, as a result of consistent maintenance headcounts resulting in lower maintenance department repair backlog and increasing mechanical availability. The purchase of ML Northern's fuel and lube fleet, which occurred on October 1, 2022, and DGI Trading had modest impacts on revenue with services and sales provided to external customers. Lastly, another ultra-class haul truck was rebuilt for MNALP and commissioned prior to the end of the quarter.

For the six months ended June 30, 2023, revenue was $436.2 million, up from $344.7 million in the same period last year. This increase of 27% reflects the same Q2 factors mentioned above and the strong Q1 performance resulting from high utilization. Q1 2022 was also heavily impacted by shortages in heavy equipment technicians and general workforce availability caused by high case counts of the COVID-19 Omicron variant, while Q1 2023 was not impacted by these factors to the same extent.

Gross profit

A breakdown of cost of sales is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30, | | June 30, |

| (dollars in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Salaries, wages, & benefits | | $ | 69,682 | | | $ | 53,806 | | | $ | 137,706 | | | $ | 113,496 | |

| Repair parts & consumable supplies | | 43,183 | | | 28,978 | | | 92,668 | | | 53,543 | |

| Subcontractor services | | 17,762 | | | 19,835 | | | 50,372 | | | 38,331 | |

| Equipment & component sales | | 10,914 | | | 18,200 | | | 17,643 | | | 23,593 | |

| Third-party rentals | | 3,170 | | | 3,765 | | | 6,867 | | | 11,840 | |

| Fuel | | 1,140 | | | 3,101 | | | 3,785 | | | 9,158 | |

| Other | | 1,839 | | | 1,563 | | | 3,950 | | | 3,355 | |

| | $ | 147,690 | | | $ | 129,248 | | | $ | 312,991 | | | $ | 253,316 | |

For the three months ended June 30, 2023, gross profit was $21.5 million with a 11.1% gross profit margin, up from a gross profit of $12.4 million and gross profit margin of 7.4% in the same period last year. The increase in gross profit is the result of continued improvements to equipment availability in the heavy equipment fleet impacting gross profit and gross margin at all major oilsands sites. In addition to the improved availability, operations at Fort Hills have increased, driven by the expansion of NACG's footprint at that site, resulting in greater efficiencies and improved margin. ML Northern's fuel and lube fleet, purchased on October 1, 2022, and DGI Trading also had a modest impact on revenue with services and sales provided to external customers. For the three months ended June 30, 2023, cost of sales were $147.7 million, up from cost of sales of $129.2 million in the same period last year. When comparing the current quarter to Q2 2022 costs, cost escalations to repair parts and subcontractor labour in the Fort McMurray region were the primary drivers in addition to the overall activity increase.

For the six months ended June 30, 2023, gross profit was $62.5 million, and a 14.3% gross profit margin, up from $34.4 million, and a 10.0% gross profit margin, in the same period last year. For the six months ended June 30, 2023, cost of sales were $313.0 million up from cost of sales of $253.3 million in the same period last year. The gross profit margin was impacted by the Q2 factors discussed above. Gross margin was further impacted in the prior year by workforce availability issues in January due to high COVID-19 Omicron cases and the significant impact of cost inflation and skilled labour shortages in Q2 2022.

For the three months ended June 30, 2023, depreciation was $24.4 million, or 12.6% of revenue, down from $26.3 million, or 15.7% of revenue, in the same period last year. The decreased depreciation percentage in the current quarter is related to the increase of non-equipment related revenue.

For the six months ended June 30, 2023, depreciation was $60.7 million, or 13.9% of revenue, up from $57.0 million, or 16.5% of revenue, in the same period last year. The increase in depreciation for the six months ended June 30, 2023, is driven by an increase to mechanical availability that increased operating hours compared to the prior year. The decrease in depreciation percentage in the current period is largely related to our increase in non-equipment related revenue.

| | | | | | | | |

Management's Discussion and Analysis June 30, 2023 | M-6 | North American Construction Group Ltd. |

Operating income

For the three months ended June 30, 2023, we recorded operating income of $10.3 million, an increase of $4.0 million from the $6.3 million for the same period last year. General and administrative expense, excluding stock-based compensation expense, was $7.2 million (or 3.7% of revenue) for the quarter, higher than the $6.9 million (or 4.1% of revenue) in the prior year. The rise can be attributed to our recent acquisition of ML Northern and increased activity levels. Despite the increase in expenses, our focus on operational efficiency has resulted in a decrease in general and administrative expenses as a percentage of revenue. Stock-based compensation expense increased by $6.6 million compared to the prior year primarily due to the fluctuating share price on the carrying value of our liability classified award plans.

For the six months ended June 30, 2023, we recorded operating income of $35.8 million, an increase of $13.9 million from the $21.9 million for the same period last year. General and administrative expense, excluding stock-based compensation expense was $15.4 million (or 3.5% of revenue) compared to the $11.9 million (or 3.4% of revenue) for the six months ended June 30, 2022. The increased costs reflect the inclusion of ML Northern and increased activity levels. We maintained consistent general and administrative costs as compared to revenue during the six months ended June 30, 2023, compared to the same period last year. Stock-based compensation expense increased by $11.3 million compared to the prior year primarily due to the fluctuating share price on the carrying value of our liability classified award plans.

Non-operating income and expense

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30, | | June 30, |

| (dollars in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Interest expense | | | | | | | | |

| Credit Facility | | $ | 3,752 | | | $ | 1,753 | | | $ | 6,410 | | | $ | 3,182 | |

| Convertible debentures | | 1,727 | | | 1,710 | | | 3,419 | | | 3,402 | |

| Interest on customer supply chain financing | | 920 | | | 282 | | | 2,150 | | | 510 | |

Equipment financing(i) | | 819 | | | 890 | | | 1,625 | | | 1,781 | |

| Mortgage | | 163 | | | 252 | | | 493 | | | 506 | |

| Amortization of deferred financing costs | | 292 | | | 269 | | | 581 | | | 550 | |

| Interest expense | | $ | 7,673 | | | $ | 5,156 | | | $ | 14,678 | | | $ | 9,931 | |

| Other interest (income) expense, net | | (162) | | | 409 | | | 144 | | | 316 | |

| Total interest expense, net | | $ | 7,511 | | | $ | 5,565 | | | $ | 14,822 | | | $ | 10,247 | |

| Equity earnings in affiliates and joint ventures | | $ | (9,408) | | | $ | (8,335) | | | $ | (18,931) | | | $ | (14,576) | |

| Net unrealized (gain) loss on derivative financial instruments | | (1,852) | | | — | | | (4,361) | | | — | |

| Income tax expense | | 1,757 | | | 1,557 | | | 10,159 | | | 5,201 | |

(i)The prior year amounts are adjusted to reflect a change in presentation. See "Accounting Estimates, Pronouncements and Measures".Total interest expense was $7.5 million during the three months ended June 30, 2023, an increase from the $5.6 million recorded in the prior year. During the six months ended June 30, 2023, total interest expense was $14.8 million, an increase from the $10.2 million recorded in the prior year. The increased interest expense is related to interest rate increases on our Credit Facility.

Cash related interest expense for the three months ended June 30, 2023, calculated as interest expense excluding amortization of deferred financing costs of $0.3 million, was $7.2 million and represents an average cost of debt of 6.9% when factoring in the Credit Facility balances during the quarter (compared to 5.2% for the three months ended June 30, 2022). Cash related interest expense for the six months ended June 30, 2023, (excluding amortization of deferred financing cost of $0.6 million) was $14.2 million and represents an average cost of debt of 6.8% (compared to 4.8% for the six months ended June 30, 2022).

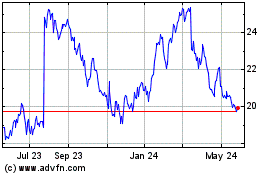

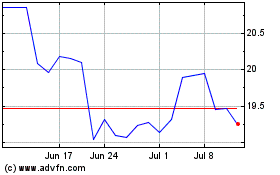

For the three and six months ended June 30, 2023, we recognized an unrealized gain of $1.9 million and $4.4 million, respectively, on a swap agreement (2022 - $nil) based on the difference between the par value of the converted shares and the expected price of the Company’s shares at contract maturity. The agreement is for 200,678 shares at a par value of $14.38, and an additional 458,400 shares at a par value of $18.94 (December 31, 2022 - 200,678 shares at a par value of $14.38, and an additional 152,100 shares at a par value of $17.84). The TSX closing price of the shares as at June 30, 2023, was $25.35 (December 31, 2022 - $18.08).

| | | | | | | | |

Management's Discussion and Analysis June 30, 2023 | M-7 | North American Construction Group Ltd. |

We recorded income tax expense of $1.8 million and $10.2 million for the three and six months ended June 30, 2023, respectively. The increase in tax expense is in line with the increase in income before taxes.

Equity earnings in affiliates and joint ventures

Equity earnings in affiliates and joint ventures was generated by the Nuna Group of Companies and the other joint ventures accounted for using the equity method. Earnings of $9.4 million for the three months ended June 30, 2023, are up from $8.3 million in the same period last year. Continued investment by MNALP in excavators and ultra-class haul trucks has expanded the fleet size, driving higher profits over the same period in 2022. Production at the Fargo-Moorhead flood diversion project has ramped up significantly over the same period in 2022 as the project has entered full operation. Nuna has experienced a reduction in net income over the same period in 2022, driven primarily by a one-time write down of receivables directly related to a customer bankruptcy. This is considered to be non-routine in nature and not representative of the credit risk faced by the Company or any of its equity investees and has been normalized for the purpose of calculating adjusted net earnings.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, 2023 | | Nuna | | MNALP | | Fargo | | Other entities | | Total |

| Revenues | | $ | 50,032 | | | $ | 91,204 | | | $ | 15,265 | | | $ | 1,984 | | | $ | 158,485 | |

| Gross profit | | 6,648 | | | 3,517 | | | 4,201 | | | 297 | | | 14,663 | |

| Income before taxes | | 2,280 | | | 2,769 | | | 4,089 | | | 958 | | | 10,096 | |

| Net income | | $ | 1,635 | | | $ | 2,769 | | | $ | 4,046 | | | $ | 958 | | | $ | 9,408 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, 2022 | | Nuna | | MNALP | | Fargo | | Other entities | | Total |

| Revenues | | $ | 50,402 | | | $ | 66,230 | | | $ | 6,380 | | | $ | 2,762 | | | $ | 125,774 | |

| Gross profit | | 6,727 | | | 1,590 | | | 595 | | | 487 | | | 9,399 | |

| Income before taxes | | 4,350 | | | 1,369 | | | 2,781 | | | 315 | | | 8,815 | |

| Net income | | $ | 3,870 | | | $ | 1,369 | | | $ | 2,781 | | | $ | 315 | | | $ | 8,335 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six months ended June 30, 2023 | | Nuna | | MNALP | | Fargo | | Other entities | | Total |

| Revenues | | $ | 106,609 | | | $ | 209,399 | | | $ | 28,565 | | | $ | 3,397 | | | $ | 347,970 | |

| Gross profit | | 13,695 | | | 7,467 | | | 8,010 | | | 310 | | | 29,482 | |

| Income before taxes | | 7,452 | | | 5,887 | | | 5,539 | | | 900 | | | 19,778 | |

| Net income | | $ | 6,683 | | | $ | 5,887 | | | $ | 5,461 | | | $ | 900 | | | $ | 18,931 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six months ended June 30, 2022 | | Nuna | | MNALP | | Fargo | | Other entities | | Total |

| Revenues | | $ | 92,969 | | | $ | 132,633 | | | $ | 20,423 | | | $ | 5,179 | | | $ | 251,204 | |

| Gross profit | | 14,016 | | | 3,192 | | | 1,801 | | | 947 | | | 19,956 | |

| Income before taxes | | 9,667 | | | 2,779 | | | 2,679 | | | 621 | | | 15,746 | |

| Net income | | $ | 8,497 | | | $ | 2,779 | | | $ | 2,679 | | | $ | 621 | | | $ | 14,576 | |

Net income and comprehensive income

For the three months ended June 30, 2023, we recorded $11.8 million of net income and comprehensive income available to shareholders (basic net income per share of $0.46 and diluted net income per share of $0.42), compared to $7.5 million net income and comprehensive income available to shareholders (basic net income per share of $0.27 and diluted net income per share of $0.25) recorded for the same period last year.

For the six months ended June 30, 2023, we recorded $33.7 million net income and comprehensive income available to shareholders (basic net income per share of $1.29 and diluted net income per share of $1.12), compared to $21.1 million net income and comprehensive income available to shareholders (basic net income per share of $0.75 and diluted net income per share of $0.69) for the same period last year.

| | | | | | | | |

Management's Discussion and Analysis June 30, 2023 | M-8 | North American Construction Group Ltd. |

Reconciliation of basic net income per share to adjusted EPS

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30, | | June 30, |

| (dollars in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | | $ | 12,262 | | | $ | 7,514 | | | $ | 34,108 | | | $ | 21,071 | |

| Interest from convertible debentures (after tax) | | 1,462 | | | — | | | 2,955 | | | 2,919 | |

| Diluted net income available to common shareholders | | $ | 13,724 | | | $ | 7,514 | | | $ | 37,063 | | | $ | 23,990 | |

| | | | | | | | |

Adjusted net earnings(i) | | $ | 12,489 | | | $ | 4,717 | | | $ | 37,766 | | | $ | 19,316 | |

| | | | | | | | |

| Weighted-average number of common shares | | 26,409,357 | | | 27,968,510 | | | 26,412,164 | | | 28,196,369 | |

| Weighted-average number of diluted common shares | | 33,007,609 | | | 29,542,690 | | | 33,007,609 | | | 34,882,824 | |

| | | | | | | | |

| Basic net income per share | | $ | 0.46 | | | $ | 0.27 | | | $ | 1.29 | | | $ | 0.75 | |

| Diluted net income per share | | $ | 0.42 | | | $ | 0.25 | | | $ | 1.12 | | | $ | 0.69 | |

Adjusted EPS(i) | | $ | 0.47 | | | $ | 0.17 | | | $ | 1.43 | | | $ | 0.69 | |

(i)See "Non-GAAP Financial Measures".The table below summarizes our consolidated results for the preceding eight quarters:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| (dollars in millions, except per share amounts) | | Q2

2023 | | Q1

2023 | | Q4

2022 | | Q3

2022 | | Q2

2022 | | Q1

2022 | | Q4

2021 | | Q3

2021 |

| Revenue | | $ | 193.6 | | | $ | 242.6 | | | $ | 233.4 | | | $ | 191.4 | | | $ | 168.0 | | | $ | 176.7 | | | $ | 181.0 | | | $ | 166.0 | |

| Gross profit | | 21.5 | | | 40.9 | | | 42.6 | | | 24.6 | | | 12.4 | | | 22.0 | | | 23.1 | | | 21.7 | |

Adjusted EBITDA(i) | | 51.8 | | | 84.6 | | | 85.9 | | | 60.1 | | | 41.6 | | | 57.7 | | | 56.3 | | | 47.5 | |

| Net income and comprehensive income | | 11.8 | | | 21.9 | | | 26.1 | | | 20.6 | | | 7.5 | | | 13.5 | | | 15.3 | | | 14.0 | |

Basic net income per share(ii) | | $ | 0.46 | | | $ | 0.83 | | | $ | 0.99 | | | $ | 0.75 | | | $ | 0.27 | | | $ | 0.48 | | | $ | 0.54 | | | $ | 0.49 | |

Diluted net income per share(ii) | | $ | 0.42 | | | $ | 0.71 | | | $ | 0.84 | | | $ | 0.65 | | | $ | 0.25 | | | $ | 0.43 | | | $ | 0.48 | | | $ | 0.44 | |

Adjusted EPS(i)(ii) | | $ | 0.47 | | | $ | 0.96 | | | $ | 1.10 | | | $ | 0.65 | | | $ | 0.17 | | | $ | 0.51 | | | $ | 0.59 | | | $ | 0.50 | |

| | | | | | | | | | | | | | | | |

Cash dividend per share(iii) | | $ | 0.10 | | | $ | 0.10 | | | $ | 0.08 | | | $ | 0.08 | | | $ | 0.08 | | | $ | 0.08 | | | $ | 0.04 | | | $ | 0.04 | |

(i)See "Non-GAAP Financial Measures".

(ii)Basic net income, diluted net income, and adjusted earnings per share for each quarter have been computed based on the weighted-average number of shares issued and outstanding during the respective quarter. Therefore, quarterly amounts are not additive and may not add to the associated annual or year-to-date totals.

(iii)The timing of payment of the cash dividend per share may differ from the dividend declaration date.

For a full discussion of the factors that can generally contribute to the variations in our quarterly financial results please see "Financial Highlights" in our annual MD&A for the year ended December 31, 2022.

| | | | | | | | |

Management's Discussion and Analysis June 30, 2023 | M-9 | North American Construction Group Ltd. |

LIQUIDITY AND CAPITAL RESOURCES

Summary of consolidated financial position

| | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | | June 30,

2023 | | December 31, 2022 | | Change |

| Cash | | $ | 21,749 | | | $ | 69,144 | | | $ | (47,395) | |

| Working capital assets | | | | | | |

| Accounts receivable | | $ | 78,916 | | | $ | 83,811 | | | $ | (4,895) | |

| Contract assets | | 10,688 | | | 15,802 | | | (5,114) | |

| Inventories | | 56,169 | | | 49,898 | | | 6,271 | |

| Prepaid expenses and deposits | | 9,526 | | | 10,587 | | | (1,061) | |

| Working capital liabilities | | | | | | |

| Accounts payable | | (80,946) | | | (102,549) | | | 21,603 | |

| Accrued liabilities | | (23,234) | | | (43,784) | | | 20,550 | |

| Contract liabilities | | — | | | (1,411) | | | 1,411 | |

Total net working capital (excluding cash)(i) | | $ | 51,119 | | | $ | 12,354 | | | $ | 38,765 | |

| | | | | | |

| Property, plant and equipment | | 683,822 | | | 645,810 | | | 38,012 | |

| Total assets | | 971,317 | | | 979,513 | | | (8,196) | |

| | | | | | |

Credit Facility(ii) | | 170,000 | | | 180,000 | | | (10,000) | |

Equipment financing(ii)(iii) | | 87,421 | | | 85,931 | | | 1,490 | |

Senior debt(i) | | $ | 257,421 | | | $ | 265,931 | | | $ | (8,510) | |

Convertible debentures(ii) | | 129,750 | | | 129,750 | | | — | |

Mortgage(ii) | | 28,833 | | | 29,231 | | | (398) | |

Total debt(i) | | $ | 416,004 | | | $ | 424,912 | | | $ | (8,908) | |

| Cash | | (21,749) | | | (69,144) | | | 47,395 | |

Net debt(i) | | $ | 394,255 | | | $ | 355,768 | | | $ | 38,487 | |

| Total shareholders' equity | | 336,623 | | | 305,919 | | | 30,704 | |

Invested capital(i) | | $ | 730,878 | | | $ | 661,687 | | | $ | 69,191 | |

(i)See "Non-GAAP Financial Measures".

(ii)Includes current portion.

(iii)The prior year amounts are adjusted to reflect a change in presentation. See "Accounting Estimates, Pronouncements and Measures".

As at June 30, 2023, we had $21.7 million in cash and $98.7 million of unused borrowing availability on the Credit Facility for a total liquidity of $120.4 million (defined as cash plus available and unused Credit Facility borrowings).

Our liquidity is complemented by available borrowings through our equipment leasing partners. As at June 30, 2023, our total capital liquidity was $159.4 million (defined as total liquidity plus unused finance lease and other borrowing availability under our Credit Facility). Borrowing availability under finance lease obligations considers the current and long-term portion of finance lease obligations and financing obligations, including specific finance lease obligations for the joint ventures that we guarantee.

| | | | | | | | | | | | | | |

| (dollars in thousands) | | June 30,

2023 | | December 31, 2022 |

| Credit Facility limit | | $ | 300,000 | | | $ | 300,000 | |

| Finance lease borrowing limit | | 175,000 | | | 175,000 | |

| Other debt borrowing limit | | 20,000 | | | 20,000 | |

| Total borrowing limit | | $ | 495,000 | | | $ | 495,000 | |

Senior debt(i) | | (257,421) | | | (265,931) | |

| Letters of credit | | (31,348) | | | (32,030) | |

| Joint venture guarantees | | (68,615) | | | (53,744) | |

| Cash | | 21,749 | | | 69,144 | |

Total capital liquidity(i) | | $ | 159,365 | | | $ | 212,439 | |

(i)See "Non-GAAP Financial Measures".As at June 30, 2023, we had $4.4 million in trade receivables that were more than 30 days past due, compared to $1.4 million as at December 31, 2022. As at June 30, 2023, and December 31, 2022, we did not have an allowance for credit losses related to our trade receivables as we believe that there is minimal risk in the collection of our trade receivables. We continue to monitor the creditworthiness of our customers. As at June 30, 2023, holdbacks totaled $0.2 million, down from $0.4 million as at December 31, 2022.

| | | | | | | | |

Management's Discussion and Analysis June 30, 2023 | M-10 | North American Construction Group Ltd. |

Capital additions

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation to Statements of Cash Flows | | Three months ended | | Six months ended |

| | June 30, | | June 30, |

| (dollars in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Purchase of PPE | | $ | 38,419 | | | $ | 27,121 | | | $ | 74,915 | | | $ | 52,386 | |

| Additions to intangibles | | — | | | 1,043 | | | 2 | | | 2,616 | |

| Gross capital expenditures | | $ | 38,419 | | | $ | 28,164 | | | $ | 74,917 | | | $ | 55,002 | |

| Proceeds from sale of PPE | | (1,842) | | | (1,527) | | | (3,040) | | | (2,045) | |

Change in capital inventory and capital work in progress(i) | | (3,497) | | | (4,296) | | | (8,626) | | | (5,072) | |

Capital expenditures, net(i) | | $ | 33,080 | | | $ | 22,341 | | | $ | 63,251 | | | $ | 47,885 | |

| Finance lease additions | | 7,979 | | | — | | | 24,999 | | | 8,695 | |

Capital additions(i) | | $ | 41,059 | | | $ | 22,341 | | | $ | 88,250 | | | $ | 56,580 | |

(i)See "Non-GAAP Financial Measures". | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sustaining and growth additions | | Three months ended | | Six months ended |

| | June 30, | | June 30, |

| (dollars in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Sustaining | | $ | 30,332 | | | $ | 22,341 | | | $ | 60,503 | | | $ | 47,885 | |

| Growth | | 2,748 | | | — | | | 2,748 | | | — | |

Capital expenditures, net(i) | | $ | 33,080 | | | $ | 22,341 | | | $ | 63,251 | | | $ | 47,885 | |

| Sustaining | | 7,979 | | | — | | | 24,999 | | | 8,695 | |

| Growth | | — | | | — | | | — | | | — | |

| Finance lease additions | | $ | 7,979 | | | $ | — | | | $ | 24,999 | | | $ | 8,695 | |

| Sustaining | | 38,311 | | | 22,341 | | | 85,502 | | | 56,580 | |

| Growth | | 2,748 | | | — | | | 2,748 | | | — | |

Capital additions(i) | | $ | 41,059 | | | $ | 22,341 | | | $ | 88,250 | | | $ | 56,580 | |

(i)See "Non-GAAP Financial Measures".

Capital additions for the three months ended June 30, 2023, are $41.1 million ($22.3 million in the prior year) and for the six months ended June 30, 2023, are $88.3 million ($56.6 million in the prior year). The current quarter spend was comprised mainly of sustaining capital additions. The majority of our sustaining capital additions were incurred on routine maintenance of the existing fleet as well as smaller heavy equipment for the summer construction season. The growth capital spending relates to the purchase of fuel and lube trucks. The current year also includes the purchase of equipment upon the wind up of the Dene North Site Services ("DNSS") partnership, totaling $2.6 million.

We finance a portion of our heavy construction fleet through finance leases. For the six months ended June 30, 2023, sustaining capital additions financed through finance leases was $25.0 million ($8.7 million for the same period in 2022). Our equipment fleet is currently split among owned (65%), finance leased (32%) and rented equipment (3%).

Summary of capital additions in affiliates and joint ventures

Not included in the reconciliation of capital additions above are capital additions made by our affiliates and joint ventures. The table below reflects our share of such net capital additions (disposals).

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30, | | June 30, |

| (dollars in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Nuna | | $ | 1,429 | | | $ | 2,611 | | | $ | 1,205 | | | $ | 7,479 | |

| MNALP | | 2,778 | | | 11,194 | | | 7,797 | | | 11,193 | |

| Fargo | | 5,056 | | | 162 | | | 7,798 | | | 652 | |

| Other | | (80) | | | 861 | | | (1,351) | | | 1,780 | |

Share of affiliate and joint venture capital additions(i) | | $ | 9,183 | | | $ | 14,828 | | | $ | 15,449 | | | $ | 21,104 | |

Capital additions within the Nuna joint ventures are considered to be sustaining in nature while the capital additions made by the MNALP and Fargo joint ventures were growth in nature, given they represent initial investments.

| | | | | | | | |

Management's Discussion and Analysis June 30, 2023 | M-11 | North American Construction Group Ltd. |

For a complete discussion on our capital expenditures, please see "Liquidity and Capital Resources - Capital Resources" in our most recent annual MD&A for the year ended December 31, 2022.

Summary of consolidated cash flows

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30, | | June 30, |

| (dollars in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Cash provided by operating activities | | $ | 40,185 | | | $ | 35,485 | | | $ | 72,009 | | | $ | 59,670 | |

| Cash used in investing activities | | (39,236) | | | (25,092) | | | (80,153) | | | (51,903) | |

| Cash provided by (used in) financing activities | | 5,558 | | | (18,823) | | | (38,889) | | | (12,667) | |

| Increase (decrease) in cash | | $ | 6,507 | | | $ | (8,430) | | | $ | (47,033) | | | $ | (4,900) | |

Operating activities

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30, | | June 30, |

| (dollars in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

Cash provided by operating activities prior to change in working capital(i) | | $ | 27,145 | | | $ | 33,373 | | | $ | 92,980 | | | $ | 78,227 | |

| Net changes in non-cash working capital | | 13,040 | | | 2,112 | | | (20,971) | | | (18,557) | |

| Cash provided by operating activities | | $ | 40,185 | | | $ | 35,485 | | | $ | 72,009 | | | $ | 59,670 | |

(i)See "Non-GAAP Financial Measures".Cash provided by operating activities for the three months ended June 30, 2023, was $40.2 million, compared to cash provided by operating activities of $35.5 million for the three months ended June 30, 2022. The increase in cash flow in the current period is largely a result of increased net income in the quarter and changes in working capital, offset by a cash settlement of deferred share units. Cash provided by operating activities for the six months ended June 30, 2023, was $72.0 million, compared to cash provided by operating activities of $59.7 million for the six months ended June 30, 2022.

Cash provided by or used in the net change in non-cash working capital specific to operating activities are summarized in the table below:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30, | | June 30, |

| (dollars in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Accounts receivable | | $ | 13,389 | | | $ | (9,455) | | | $ | 4,895 | | | $ | 1,627 | |

| Contract assets | | (949) | | | 796 | | | 5,114 | | | (147) | |

| Inventories | | (2,905) | | | 6,627 | | | (6,271) | | | (2,858) | |

| Contract costs | | — | | | 877 | | | — | | | 1,530 | |

| Prepaid expenses and deposits | | 994 | | | 192 | | | 1,998 | | | 2,642 | |

| Accounts payable | | 5,569 | | | 8,580 | | | (8,103) | | | (2,606) | |

| Accrued liabilities | | (3,054) | | | (4,376) | | | (17,193) | | | (15,915) | |

| Contract liabilities | | (4) | | | (1,129) | | | (1,411) | | | (2,830) | |

| | $ | 13,040 | | | $ | 2,112 | | | $ | (20,971) | | | $ | (18,557) | |

Investing activities

Cash used in investing activities for the three months ended June 30, 2023, was $39.2 million, compared to cash used in investing activities of $25.1 million for the three months ended June 30, 2022. Current period investing activities largely relate to $38.4 million for the purchase of property, plant and equipment, partially offset by $1.8 million cash received on disposal of property, plant and equipment. Prior year investing activities included $27.1 million for the purchase of property, plant and equipment, partially offset by $1.5 million cash received on the disposal of property, plant and equipment.

Cash used in investing activities for the six months ended June 30, 2023, was $80.2 million, compared to cash used in investing activities of $51.9 million for the six months ended June 30, 2022. Current year to date investing activities largely relate to $74.9 million for the purchase of property, plant and equipment, partially offset by $3.0 million in proceeds from the disposal of property, plant and equipment. Prior year investing activities included $52.4

| | | | | | | | |

Management's Discussion and Analysis June 30, 2023 | M-12 | North American Construction Group Ltd. |

million for the purchase of property, plant and equipment, offset by $2.0 million in proceeds from the disposal of property, plant and equipment.

Financing activities

Cash provided by financing activities during the three months ended June 30, 2023, was $5.6 million, which included $40.0 million in proceeds from long-term debt offset by $31.7 million of long-term debt repayments, and dividend payments of $2.6 million. Cash used in financing activities during the three months ended June 30, 2022, was $18.8 million, which included proceeds from long-term debt of $23.4 million, offset by $22.4 million of long-term debt repayments, $17.4 million expended on the share purchase program, and dividend payments of $2.3 million.

Cash used in financing activities during the six months ended June 30, 2023, was $38.9 million, which included $40.0 million in proceeds from long-term debt offset by $73.9 million of long-term debt repayments, and dividend payments of $4.7 million. Cash used in financing activities during the six months ended June 30, 2022, was $12.7 million, which included $43.4 million in proceeds from long-term debt offset by $34.2 million of long-term debt repayments, $18.3 million expended on the share purchase program, and dividend payments of $3.4 million.

Free cash flow

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Six months ended |

| | June 30, | | June 30, |

| (dollars in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Cash provided by operating activities | | $ | 40,185 | | | $ | 35,485 | | | $ | 72,009 | | | $ | 59,670 | |

| Cash used in investing activities | | (39,236) | | | (25,092) | | | (80,153) | | | (51,903) | |

| Capital additions financed by leases | | (7,979) | | | — | | | (24,999) | | | (8,695) | |

| Add back: | | | | | | | | |

Growth capital additions(i) | | 2,748 | | | — | | | 2,748 | | | — | |

Free cash flow(i) | | $ | (4,282) | | | $ | 10,393 | | | $ | (30,395) | | | $ | (928) | |

(i)See "Non-GAAP Financial Measures".Free cash flow was a use of cash of $4.3 million in the quarter. Adjusted EBITDA generated $51.8 million, mentioned above, and when factoring in sustaining capital additions $38.3 million and cash interest paid $8.4 million, positive cash of $5.1 million was generated by the overall business in the quarter.

Free cash flow for the six months ended June 30, 2023, was a use of $30.4 million. Adjusted EBITDA generated $136.5 million, offset by sustaining capital additions of $85.5 million and cash interest paid of $15.3 million, positive cash of $35.7 million was generated in the year.

Contractual obligations

Our principal contractual obligations relate to our long-term debt, finance and operating leases, and supplier contracts. The following table summarizes our future contractual obligations as of June 30, 2023, excluding interest where interest is not defined in the contract (operating leases and supplier contracts). The future interest payments were calculated using the applicable interest rates and balances as at June 30, 2023, and may differ from actual results.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Payments due by fiscal year |

| (dollars in thousands) | | Total | | 2023 | | 2024 | | 2025 | | 2026 | | 2027 and thereafter |

| Credit Facility | | $ | 198,138 | | | $ | 6,230 | | | $ | 12,393 | | | $ | 179,515 | | | $ | — | | | $ | — | |

| Convertible debentures | | 157,842 | | | 3,431 | | | 6,861 | | | 6,861 | | | 59,789 | | | 80,900 | |

Equipment financing(i) | | 92,765 | | | 24,499 | | | 39,491 | | | 12,570 | | | 10,167 | | | 6,038 | |

| Mortgage | | 41,914 | | | 892 | | | 1,783 | | | 1,783 | | | 1,783 | | | 35,673 | |

Operating leases(ii) | | 15,614 | | | 560 | | | 1,013 | | | 1,723 | | | 1,579 | | | 10,739 | |

Non-lease components of lease commitments(iii) | | 25 | | | (14) | | | (28) | | | 7 | | | 7 | | | 53 | |

| Supplier contracts | | 7,840 | | | 7,840 | | | — | | | — | | | — | | | — | |

| Contractual obligations | | $ | 514,138 | | | $ | 43,438 | | | $ | 61,513 | | | $ | 202,459 | | | $ | 73,325 | | | $ | 133,403 | |

(i)Finance leases, included in equipment financing, are net of receivable on heavy equipment operating subleases of $2,249 (2023 - $2,249).

(ii)Operating leases are net of receivables on subleases of $999 (2023 - $333; 2024 - $666).

(iii)Non-lease components of lease commitments are net of receivables on subleases of $53 (2023 - $18; 2024 - $35). These commitments include common area maintenance, management fees, property taxes and parking related to operating leases.

| | | | | | | | |

Management's Discussion and Analysis June 30, 2023 | M-13 | North American Construction Group Ltd. |

Our total contractual obligations of $514.1 million as at June 30, 2023, decreased from $537.5 million as at December 31, 2022, primarily as a result of the decrease to the Credit Facility of $18.0 million, a decrease to supplier contracts of $5.5 million, and a decrease in convertible debentures of $3.4 million, offset by an increase to equipment financing of $3.2 million. We have no off-balance sheet arrangements.

Credit Facility

On September 20, 2022, we entered into an Amended and Restated Credit Agreement (the "Credit Facility") with a banking syndicate that allows borrowing under the revolving loan to $300.0 million, with the ability to increase the maximum borrowings by an additional $50.0 million subject to certain conditions and permits finance lease debt to a limit of $175.0 million. This amended agreement extended the maturity to October 8, 2025, with an option to extend on an annual basis, subject to certain conditions. The amended facility maintains financial covenant thresholds as well as other debt limits.

As at June 30, 2023, the Credit Facility had borrowings of $170.0 million (December 31, 2022 - $180.0 million) and $31.3 million in issued letters of credit (December 31, 2022 - $32.0 million). At June 30, 2023, our unused borrowing availability under the Credit Facility was $98.7 million (December 31, 2022 - $88.0 million).

Under the terms of the Credit Facility the Senior Leverage Ratio is to be maintained at less than or equal to 3.0:1. In the event we enter into a material acquisition, the maximum allowable Senior Leverage Ratio would increase to 3.50:1 for four quarters following the acquisition. The Fixed Charge Coverage Ratio is to be maintained at a ratio greater than 1.15:1.

Financial covenants are to be tested quarterly on a trailing four quarter basis. As at June 30, 2023, we were in compliance with the Credit Facility covenants. We fully expect to maintain compliance with our financial covenants during the subsequent twelve-month period.

For complete discussion on our Credit Facility, including covenants, calculation of the borrowing base, allowable finance lease debt, and our credit rating, see "Liquidity and Capital Resources - Credit Facility" in our most recent annual MD&A.

As disclosed in our Transaction Press Release with respect to our acquisition of MacKellar Group, we have entered into a commitment letter to amend and restate our Credit Facility to a senior revolving credit facility in the maximum amount of $450.0 million. This amended and restated facility is expected to permit finance lease debt to a limit of $300.0 million.

Debt ratings

On June 29, 2023, S&P Global Ratings ("S&P") withdrew our "B+" credit rating at our request. The outlook was "stable" at the time of the withdrawal. For a complete discussion on debt ratings, see "Capital Structure and Securities - Debt Ratings" in our most recent AIF for the year ended December 31, 2022.

Outstanding share data

Common shares

We are authorized to issue an unlimited number of voting common shares and an unlimited number of non-voting common shares. On June 12, 2014, we entered into a trust agreement whereby the trustee may purchase and hold voting common shares, classified as treasury shares on our Consolidated Balance Sheets, until such time that units issued under the equity classified long-term incentive plans are to be settled. Units granted under such plans typically vest at the end of a three-year term.

As at July 21, 2023, there were 27,827,282 voting common shares outstanding, which included 1,087,954 voting common shares held by the trust and classified as treasury shares on our consolidated balance sheets (27,827,282 common shares, including 1,418,362 common shares classified as treasury shares at June 30, 2023).

For a more detailed discussion of our share data, see "Capital Structure and Securities - Capital Structure" in our most recent AIF.

| | | | | | | | |

Management's Discussion and Analysis June 30, 2023 | M-14 | North American Construction Group Ltd. |

Convertible debentures

| | | | | | | | | | | | | | |

| | June 30,

2023 | | December 31, 2022 |

| 5.50% convertible debentures | | $ | 74,750 | | | $ | 74,750 | |

| 5.00% convertible debentures | | 55,000 | | | 55,000 | |

| | $ | 129,750 | | | $ | 129,750 | |

The terms of the convertible debentures are summarized as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Date of issuance | | Maturity | | Conversion price | | Debt issuance costs |

| 5.50% convertible debentures | | June 1, 2021 | | June 30, 2028 | | $ | 24.50 | | | $ | 3,531 | |

| 5.00% convertible debentures | | March 20, 2019 | | March 31, 2026 | | $ | 25.83 | | | $ | 2,691 | |

Interest on the 5.50% convertible debentures is payable semi-annually in arrears on June 30 and December 31 of each year. Interest on the 5.00% convertible debentures is payable semi-annually on March 31 and September 30 of each year.

The conversion price is adjusted upon certain events, including: the subdivision or consolidation of the outstanding Common Shares, certain options, rights or warrants, cash dividends in an amount greater than $0.12 per Common Share for the 5.00% convertible debentures or $0.192 for the 5.50% convertible debentures, other reorganizations such as amalgamations or mergers, etc.

The 5.50% convertible debentures are not redeemable prior to June 30, 2024, except under certain exceptional circumstances. On and after June 30, 2024, and prior to June 30, 2026, the debentures may be redeemed at the option of the Corporation at the redemption price equal to the principal amount of the debentures plus accrued and unpaid interest thereon up to but excluding the date set for redemption provided, among other things, the current market price is at least 125% of the conversion price on the date on which notice of the redemption is given.

The 5.00% convertible debentures are not redeemable by the company.

Both the 5.00% convertible debentures and the 5.50% convertible debentures are redeemable under certain conditions after a change in control has occurred. If a change in control occurs, we are required to offer to purchase all of the convertible debentures at a price equal to 101% of the principal amount plus accrued and unpaid interest to the date of purchase.

Swap Agreement

On October 5, 2022, we entered into a swap agreement on our common shares with a financial institution for investment purposes. During the three and six months ended June 30, 2023, we recognized an unrealized gain of $1,852 and $4,361, respectively, on this agreement based on the difference between the par value of the converted shares and the expected price of our shares at contract maturity. The agreement is for 200,678 shares at a par value of $14.38, and an additional 458,400 shares at a par value of $18.94 (December 31, 2022 - 200,678 shares at a par value of $14.38, and an additional 152,100 shares at a par value of $17.84). The TSX closing price of the shares as at June 30, 2023, was $25.35 (December 31, 2022 - $18.08), resulting in a fair value of $5,139 being recorded to other assets on the Consolidated Balance Sheets as at June 30, 2023. The swap has not been designated as a hedge for accounting purposes and therefore changes in the fair value of the derivative are recognized in the Consolidated Statements of Operations and Comprehensive Income. In Q2 2023, the expected maturity date of this agreement was extended from October 2023 to May 2024. No other terms or conditions changed.

| | | | | | | | |

Management's Discussion and Analysis June 30, 2023 | M-15 | North American Construction Group Ltd. |

Backlog

The following summarizes our non-GAAP reconciliation of backlog as at June 30, 2023:

| | | | | | | | | | | | | | |

| (dollars in thousands) | | June 30,

2023 | | December 31, 2022 |

| Remaining performance obligations per financial statements | | $ | 155,504 | | | $ | 52,526 | |

| Add: undefined committed volumes | | 133,815 | | | 516,311 | |

Backlog(i) | | $ | 289,319 | | | $ | 568,837 | |

Equity method investment backlog(i) | | 632,719 | | | 717,849 | |

Combined Backlog(i) | | $ | 922,038 | | | $ | 1,286,686 | |

(i)See "Non-GAAP Financial Measures".Backlog decreased $279.5 million while combined backlog decreased by $364.6 million on a net basis, during the six months ended June 30, 2023.

Revenue generated from backlog during the six months ended June 30, 2023, was $364.8 million and we estimate that $222.2 million of our backlog reported above will be performed over the balance of 2023 (full year estimate of $587.0 million). For the year ended December 31, 2022, revenue generated from backlog was $433.6 million.

ACCOUNTING ESTIMATES, PRONOUNCEMENTS AND MEASURES

Critical accounting estimates

The preparation of our consolidated financial statements, in conformity with US GAAP, requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and the reported amounts of revenues and expenses during the reporting period. For a full discussion of our critical accounting estimates, see "Critical Accounting Estimates" in our annual MD&A for the year ended December 31, 2022.

Changes in presentation

During the third quarter of 2022, the Company updated the presentation of project and equipment costs within the Consolidated Statement of Operations and Comprehensive Income to be combined as cost of sales. There has been no change in the Company’s accounting policy or change in the composition of the amounts now recognized within cost of sales. The change in presentation had no effect on the reported results of operations. The comparative period has been updated to reflect this presentation change.

During the first quarter of 2023, the Company updated the presentation of finance lease obligations within the Consolidated Balance Sheets to be included in long-term debt. Within the long-term debt note, finance lease obligations, financing obligations, and promissory notes have been combined as equipment financing. Finance lease obligations are the finance lease liabilities recognized in accordance with the Company's lease policy which is disclosed in our Annual Report. Financing obligations arise when the Company finances its owned equipment. There has been no change in the Company’s accounting policy for finance lease obligations or change in the recognition or measurement of the related balances now recognized within long-term debt. The change in presentation had no effect on the reported results of operations. The comparative period has been updated to reflect this presentation change.

Non-GAAP financial measures

We believe that the below non-GAAP financial measures are all meaningful measures of business performance because they include or exclude items that are or are not directly related to the operating performance of our business. Management reviews these measures to determine whether property, plant and equipment are being allocated efficiently.

"Adjusted EBIT" is defined as adjusted net earnings before the effects of interest expense, income taxes, and equity earnings in affiliates and joint ventures, but including the equity investment EBIT from our affiliates and joint ventures accounted for using the equity method.

"Adjusted EBITDA" is defined as adjusted EBIT before the effects of depreciation, amortization, and equity investment depreciation and amortization.

"Adjusted EPS" is defined as adjusted net earnings, divided by the weighted-average number of common shares.

| | | | | | | | |

Management's Discussion and Analysis June 30, 2023 | M-16 | North American Construction Group Ltd. |

"Adjusted net earnings" is defined as net income available to shareholders excluding the effects of unrealized foreign exchange gain or loss, realized and unrealized gain or loss on derivative financial instruments, cash and non-cash (liability and equity classified) stock-based compensation expense, gain or loss on disposal of property, plant and equipment, and certain other non-cash items included in the calculation of net income. These adjustments are tax effected in the calculation of adjusted net earnings.

As adjusted EBIT, adjusted EBITDA, adjusted net earnings and adjusted EPS are non-GAAP financial measures, our computations may vary from others in our industry. These measures should not be considered as alternatives to operating income or net income as measures of operating performance or cash flows and they have important limitations as analytical tools and should not be considered in isolation or as substitutes for analysis of our results as reported under US GAAP. For example, adjusted EBITDA does not:

•reflect our cash expenditures or requirements for capital expenditures or capital commitments or proceeds from capital disposals;

•reflect changes in our cash requirements for our working capital needs;

•reflect the interest expense or the cash requirements necessary to service interest or principal payments on our debt;

•include tax payments or recoveries that represent a reduction or increase in cash available to us; or

•reflect any cash requirements for assets being depreciated and amortized that may have to be replaced in the future.

"Backlog" is a measure of the amount of secured work we have outstanding and, as such, is an indicator of a base level of future revenue potential. We define backlog as work that has a high certainty of being performed as evidenced by the existence of a signed contract or work order specifying expected job scope, value and timing. Backlog, while not a GAAP term is similar in nature and definition to the "transaction price allocated to the remaining performance obligations", defined under US GAAP and reported in "Note 4 - Revenue" in our financial statements. When the two numbers differ, the variance relates to expected scope where we have a contractual commitment, but the customer has not yet provided specific direction. Our equity consolidated backlog is calculated based on backlog amounts from our joint venture and affiliates and taken at our ownership percentage.

"Capital additions" is defined as capital expenditures, net and lease additions.

"Capital expenditures, net" is defined as growth capital and sustaining capital. We believe that capital expenditures, net and its components are a meaningful measure to assess resource allocation.

"Capital inventory" is defined as rotatable parts included in property, plant and equipment held for use in the overhaul of property, plant and equipment.

"Capital work in progress" is defined growth capital and sustaining capital prior to commissioning and not available for use.

"Cash provided by operating activities prior to change in working capital" is defined as cash used in or provided by operating activities excluding net changes in non-cash working capital.

"Cash related interest expense" is defined as total interest expense less amortization of deferred financing costs.

“Combined backlog” is a measure of the total of backlog from wholly-owned entities plus equity method investment backlog.

"Combined gross profit" is defined as consolidated gross profit per the financial statements combined with our share of gross profit from affiliates and joint ventures that are accounted for using the equity method. This measure is reviewed by management to assess the impact of affiliates and joint ventures' gross profit on our adjusted EBITDA margin.

"Equity method investment backlog" is a measure of our proportionate share (based on ownership interest) of backlog from affiliates and joint ventures that are accounted for using the equity method.

"Equity investment depreciation and amortization" is defined as our proportionate share (based on ownership interest) of depreciation and amortization in other affiliates and joint ventures accounted for using the equity method.

| | | | | | | | |

Management's Discussion and Analysis June 30, 2023 | M-17 | North American Construction Group Ltd. |

"Equity investment EBIT" is defined as our proportionate share (based on ownership interest) of equity earnings in affiliates and joint ventures before the effects of gain or loss on disposal of property, plant and equipment, interest expense, and income taxes.

"Free cash flow" is defined as cash from operations less cash used in investing activities including finance lease additions but excluding cash used for growth capital. We believe that free cash flow is a relevant measure of cash available to service our total debt repayment commitments, pay dividends, fund share purchases and fund both growth capital expenditures and potential strategic initiatives.

"Growth capital" and "growth capital additions" are defined as new or used revenue-generating and customer facing assets which are not intended to replace an existing asset and have been commissioned and are available for use. These expenditures result in a meaningful increase to earnings and cash flow potential.

"Invested capital" is defined as total shareholders' equity plus net debt.

"Net debt" is defined as total debt less cash and cash equivalents recorded on the balance sheets. Net debt is used by us in assessing our debt repayment requirements after using available cash.

"Senior debt" is defined as total debt, excluding convertible debentures, deferred financing costs, mortgage related to NACG Acheson Ltd., and debt related to investment in affiliates and joint ventures. Senior debt is used primarily for our bank covenants contained in the Credit Facility agreement.

"Share of affiliate and joint venture capital additions" is defined as our proportionate share (based on ownership interest) of capital expenditures, net and lease additions from affiliates and joint ventures that are accounted for using the equity method.

"Sustaining capital" is defined as expenditures, net of routine disposals, related to property, plant and equipment which have been commissioned and are available for use operated to maintain and support existing earnings and cash flow potential and do not include the characteristics of growth capital.

"Total capital liquidity" is defined as total liquidity plus unused finance lease and other borrowing availability under our Credit Facility.

"Total combined revenue" is defined as consolidated revenue per the financial statements combined with our share of revenue from affiliates and joint ventures that are accounted for using the equity method. This measure is reviewed by management to assess the impact of affiliates and joint ventures' revenue on our adjusted EBITDA margin.

"Total debt" is defined as the sum of the outstanding principal balance (current and long-term portions) of: (i) finance leases; (ii) borrowings under our credit facilities (excluding outstanding Letters of Credit); (iii) convertible unsecured subordinated debentures; (iv) mortgage; (v) promissory notes; and (vi) financing obligations. We believe total debt is a meaningful measure in understanding our complete debt obligations.

Non-GAAP ratios

"Margin" is defined as the financial number as a percent of total reported revenue. We will often identify a relevant financial metric as a percentage of revenue and refer to this as a margin for that financial metric.

"Adjusted EBITDA Margin" is defined as adjusted EBITDA divided by total combined revenue.

"Combined gross profit margin" is defined as combined gross profit divided by total combined revenue.

We believe that presenting relevant financial metrics as a percentage of revenue is a meaningful measure of our business as it provides the performance of the financial metric in the context of the performance of revenue. Management reviews margins as part of its financial metrics to assess the relative performance of its results.

Supplementary Financial Measures

"Gross profit margin" represents gross profit as a percentage of revenue.

"Total net working capital (excluding cash)" represents net working capital, less the cash balance.

INTERNAL SYSTEMS AND PROCESSES

| | | | | | | | |

Management's Discussion and Analysis June 30, 2023 | M-18 | North American Construction Group Ltd. |

Evaluation of disclosure controls and procedures

Our disclosure controls and procedures are designed to provide reasonable assurance that information we are required to disclose is recorded, processed, summarized and reported within the time periods specified under Canadian and US securities laws. They include controls and procedures designed to ensure that information is accumulated and communicated to management, including the Chief Executive Officer and the Executive Vice President & Chief Financial Officer to allow timely decisions regarding required disclosures.

An evaluation was carried out under the supervision of and with the participation of management, including the Chief Executive Officer and the Executive Vice President & Chief Financial Officer of the effectiveness of our disclosure controls and procedures as defined in Rule 13a-15(e) under the US Securities Exchange Act of 1934, as amended, and in National Instrument 52-109 under the Canadian Securities Administrators Rules and Policies. Based on this evaluation, our Chief Executive Officer and the Executive Vice President & Chief Financial Officer concluded that as of June 30, 2023, such disclosure controls and procedures were effective.

Management’s report on internal control over financial reporting

There have been no significant changes to our internal controls over financial reporting ("ICFR") for the three and six months ended June 30, 2023, that have materially affected, or are reasonably likely to affect, our ICFR.

LEGAL AND LABOUR MATTERS

Laws and Regulations and Environmental Matters

Please see "Our Business - Health, Safety and Environmental" in our most recent Annual Information Form for a complete discussion on this topic.

Employees and Labour Relations