0001536394

false

0001536394

2023-07-14

2023-07-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

July 14, 2023

(Date of earliest event reported)

U.S. Lighting Group, Inc.

(Exact name of registrant as specified in its charter)

| Florida |

|

000-55689 |

|

46-3556776 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

1148 E 222nd Steet, Euclid, Ohio 44117

(Address of principal executive offices) (Zip Code)

216-896-7000

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter). ☐

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Alumni Capital

On July 14, 2023, US Lighting Group, Inc. (“USLG”

or “we”) entered into a common stock purchase agreement (the “purchase agreement”) with Alumni Capital

LP (“Alumni”) pursuant to which Alumni agreed to purchase up to $1.0 million of our common stock (the “Alumni

shares”), subject to the terms of the purchase agreement. The purchase agreement will expire on the earlier of March 31, 2024

or when Alumni has purchased the full $1.0 million of our stock. In the purchase agreement, we agreed to file a registration statement

to register the resale of the Alumni shares, and to use our best efforts to cause the registration statement to be declared effective

and remain effective until the Alumni shares have been sold. Once the registration statement is effective, we may request that Alumni

purchase shares of our stock, subject to the limitations discussed below and included in the purchase agreement. We have not yet sold

any stock to Alumni pursuant to the purchase agreement.

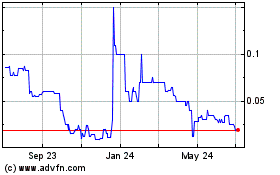

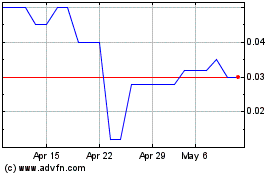

The per share purchase price that Alumni will pay for our shares pursuant

to the purchase agreement is based on the trading price of our shares and is equal to 80% of the lowest traded price of our stock during

the six business days prior to the date the sale of the shares closes. The closing will occur no more than six business days after we

request the sale. Within one business day of the closing, Alumni will then pay to us an amount equal to the per share purchase price multiplied

by the number of shares that we delivered to Alumni (less a $5,000 clearing fee).

There are limitations on the number of shares we can request that Alumni

purchase. The amount we request must have an aggregate value of at least $20,000 and cannot exceed $500,000. In addition, we cannot request

that Alumni purchase shares if: (a) the volume-weighted average price of our stock is at or below $0.01 during the previous six business

days; or (b) the requested purchase of shares would cause Alumni to beneficially own more than 4.99% of our outstanding shares of

common stock. Given these limitations, on July 14, 2023 we could not request that Alumni purchase more than 5.1 million shares for a total

of approximately $300,000.

When we entered into the purchase agreement, we also issued a common

stock purchase warrant (the “warrant”) to Alumni to purchase up to 6,666,667 shares of our common stock (the “warrant

shares”). The warrant has a term of five years and will expire on July 14, 2028. The warrant exercise price is variable and

is equal to $15.0 million divided by the number of our outstanding shares of common stock at the time of exercise. On July 14, 2023, the

exercise price was $0.147. Alumni may exercise the warrant on a cashless basis if we do not maintain an effective registration statement

for the resale of the warrant shares.

Loans from Officers

Although USLG is generating revenues and achieved a profit for the

first quarter of 2023, we experienced capital shortages while expanding Cortes Campers production this spring. To help address these capital

needs, Anthony R. Corpora, our chief executive officer, and Michael A. Coates, corporate controller, generously volunteered to take out

personal loans and make those funds available to USLG.

On May 24, 2023, Mr. Corpora obtained a personal loan in the original

principal amount of $97,920 from Pinnacle Bank and provided these funds to USLG to support the company’s operations. Mr. Corpora

executed an unsecured promissory note payable to Pinnacle Bank evidencing the loan in the original principal amount of $97,920, bearing

annual interest of 14.49%, and with 84 monthly payments of $1,861.63 commencing on June 25, 2023 with the final payment on May 25, 2030

(the “Pinnacle note”).

On May 4, 2023, Mr. Coates obtained a personal loan in the

original principal amount of $50,000 less an origination fee of $1,745 from Cross River Bank and provided these funds to USLG to

support the company’s operations. Mr. Coates executed a loan agreement and promissory note payable to Cross River Bank

evidencing the loan in the original principal amount of $50,000, bearing annual interest of 11.42%, and with 59 monthly payments of

$1,097.62 commencing on June 3, 2023 with a final payment of $1,104.58 on June 3, 2028 (the “Cross River

note”).

On July 17, 2023, we entered into unsecured “pass-through”

promissory notes with Messer. Corpora and Coates that provide for repayment to them on the same terms as the Pinnacle and Cross River

notes, without markup or profit (the “officer notes”).

The purchase agreement and warrant with Alumni and the officers notes

with Messer. Corpora and Coates are filed as exhibits to this Current Report on Form 8-K. The descriptions above are qualified in

their entirety by reference to the full text of these documents.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant.

The disclosure included under Item 1.01 above regarding the officer

notes with Messer. Corpora and Coates is incorporated by reference to this Item 2.03.

Item 3.02 Unregistered Sales of Equity Securities.

The disclosure included under Item 1.01 above concerning the Alumni

warrant is incorporated by reference to this Item 3.02. The issuances of the warrant to Alumni was exempt from registration under Section 4(a)(2)

of the Securities Act of 1933.

Item 9.01 Financial Statements and Exhibits.

| Exhibit 10.1 |

Common Stock Purchase Agreement between US Lighting Group, Inc. and Alumni Capital LP dated July 14, 2023 |

| Exhibit 10.2 |

Common Stock Purchase Warrant issued by US Lighting Group, Inc. to Alumni Capital LP on July 14, 2023 for 6,666,667 Shares |

| Exhibit 10.3 |

Unsecured Promissory Note issued by US Lighting Group, Inc. to Anthony R. Corpora on July 17, 2023 in the original principal amount of $97,920 |

| Exhibit 10.4 |

Unsecured Promissory Note issued by US Lighting Group, Inc. to Michael A. Coates on July 17, 2023 in the original principal amount of $50,000 |

| Exhibit 104 |

Cover

Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

US Lighting Group, Inc. |

| |

|

| Dated July 17, 2023 |

/s/ Anthony R. Corpora |

| |

By Anthony R. Corpora |

| |

Chief Executive Officer |

3

Exhibit 10.1

COMMON STOCK PURCHASE AGREEMENT

This Common Stock Purchase

Agreement (the “Agreement”), dated as of July 14, 2023 (the “Execution Date”), is entered into between US Lighting

Group, Inc., a Florida corporation (the “Company”), and Alumni Capital LP, a Delaware limited partnership (the “Investor”).

RECITALS:

WHEREAS, upon the terms and

subject to the conditions contained herein, the Investor shall be obligated to purchase up to One Million Dollars ($1,000,000) of Common

Stock after a Registration Statement is declared effective by the Securities and Exchange Commission, pursuant to the terms and subject

to the conditions set forth in this Agreement;

NOW THEREFORE, in consideration

of the foregoing recitals, which shall be considered an integral part of this Agreement, the covenants and agreements set forth hereafter,

and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Company and the Investor hereby

agree as follows:

SECTION I

DEFINITIONS

For all purposes of and under

this Agreement, the following terms shall have the respective meanings below, and such meanings shall be equally applicable to the singular

and plural forms of such defined terms.

“Business Day” shall mean

any day on which the Principal Market for the Common Stock is open for trading from the hours of 9:30 am until 4:00 pm eastern time.

“Closing Date”

shall mean a date that is no later than six (6) Business Days after the Purchase Notice Date.

“Commitment Period” shall

mean the period beginning on the Execution Date and ending on the expiration of this Agreement.

“Common Stock” means the

Company’s common stock and any other class of securities into which such securities may hereafter be reclassified or changed.

“Principal Market” shall

mean the New York Stock Exchange, the NYSE Amex, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market

or the OTC Markets, whichever is the market on which the Common Stock is listed.

“Purchase Notice” shall

mean the written notice sent to the Investor by the Company stating the number of shares of Common Stock that the Company intends to sell

to the Investor pursuant to the terms of this Agreement.

“Purchase Notice Limit”

shall mean the maximum amount of Common Stock the Company may request the Investor to purchase up to an amount equal to five-hundred thousand

dollars ($500,000).

“Investment Amount” shall

mean the Common Stock in a Purchase Notice multiplied by: (i) eighty percent (80%) of the lowest traded price of the Common Stock six

Business Days prior to the Closing Date.

“Registration Statement”

shall have the meaning set forth in Section 7.1 below.

“Securities” shall mean,

collectively, the Common Stock issued pursuant to the terms of this Agreement.

SECTION II

PURCHASE AND SALE OF SECURITIES

2.1 PURCHASE AND SALE

OF SECURITIES. Subject to the terms and conditions set forth herein, upon delivery of a Purchase Notice the Company shall sell to

the Investor, and the Investor shall purchase from the Company, a number of shares of Common Stock having an aggregate value of One Million

Dollars ($1,000,000).

2.2 DELIVERY OF PURCHASE

NOTICES. Subject to the terms and conditions herein, including without limitation Section 7 below, and from time to time during the

Commitment Period, the Company may, in its sole discretion, deliver a Purchase Notice to the Investor which states the amount of Securities

which the Company intends to sell to the Investor on a Closing, provided that each Closing shall not exceed the Purchase Notice Limit.

No Purchase Notice shall be sent if the volume-weighted average price of Securities is at or below $0.01 during the six Business Days

prior to the delivery of a Purchase Notice. The Purchase Notice shall be in the form attached hereto and incorporated herein by reference.

During the Commitment Period, the Company shall not submit a Purchase Notice until the previous Closing has been completed. No Purchase

Notice will be made in an amount less than twenty thousand dollars ($20,000) or greater than the Purchase Notice Limit.

2.3 MECHANICS OF PURCHASE

OF SECURITIES BY INVESTOR. The Closing of a Purchase Notice shall occur no later than the six (6) Business Days following receipt

of Securities by Investor’s custodian (the “Purchase Notice Date”). The Investor shall deliver the Investment Amount

(less $5,000 for clearing fees) by wire transfer of immediately available funds to an account designated by the Company one (1) Business

Day after the Closing Date. In addition, on or prior to such Closing, each of the Company and Investor shall deliver to each other all

documents, instruments and writings required to be delivered or reasonably requested by either of them pursuant to this Agreement in order

to implement and effect the transactions contemplated herein.

2.4 LIMITATION ON

AMOUNT OF OWNERSHIP. Notwithstanding anything to the contrary in this Agreement, in no event shall the Investor be entitled to purchase

that number of Securities, which when added to the sum of the number of Common Stock beneficially owned (as such term is defined under

Section 13(d) and Rule 13d-3 of the 1934 Act), by the Investor, would exceed 4.99% of the Common Stock outstanding on the Purchase Notice

Date, as determined in accordance with Rule 13d-1(j) of the 1934 Act.

SECTION III

INVESTOR’S REPRESENTATIONS, WARRANTIES AND

COVENANTS

The Investor represents and warrants the following

to the Company:

3.1 INTENT. The Investor is entering into

this Agreement for its own account and the Investor has no present arrangement (whether or not legally binding) at any time to sell the

Securities to or through any Person in violation of the Securities Act or any applicable state securities laws; provided, however, that

the Investor reserves the right to dispose of the Securities at any time in accordance with federal and state securities laws applicable

to such disposition.

3.2 NO LEGAL ADVICE FROM THE COMPANY. The

Investor acknowledges that it has had the opportunity to review this Agreement and the transactions contemplated by this Agreement with

its own legal counsel and investment and tax advisors. The Investor is relying solely on such counsel and advisors and not on any statements

or representations of the Company or any of its representatives or agents for legal, tax or investment advice with respect to this investment,

the transactions contemplated by this Agreement or the securities laws of any jurisdiction.

3.3 NO

SHORT SALES. No short sales shall be permitted by the Investor or its affiliates during the Commitment Period.

3.4 ACCREDITED INVESTOR. The

Investor is an accredited investor as defined in Rule 501(a)(3) of Regulation D, and the Investor has such experience in business and

financial matters that it is capable of evaluating the merits and risks of an investment in Securities. The Investor acknowledges that

an investment in the Securities is speculative and involves a high degree of risk.

3.5 AUTHORITY.

The Investor has the requisite power and authority to enter into and perform its obligations under the Agreement and to consummate the

transactions contemplated hereby and thereby. The execution and delivery of the Agreement and the consummation by it of the transactions

contemplated hereby and thereby have been duly authorized by all necessary action and no further consent or authorization of the Investor

is required. The Agreement to which it is a party has been duly executed by the Investor, and when delivered by the Investor in accordance

with the terms hereof, will constitute the valid and binding obligation of the Investor enforceable against it in accordance with its

terms, subject to applicable bankruptcy, insolvency, or similar laws relating to, or affecting generally the enforcement of, creditors’

rights and remedies or by other equitable principles of general application.

3.6 NOT

AN AFFILIATE. The Investor is not an officer, director or “affiliate” (as that term is defined in Rule 405 of the Securities

Act) of the Company.

SECTION IV

REPRESENTATIONS AND WARRANTIES OF THE COMPANY

Except as disclosed on the

Company’s SEC Documents, the Company represents and warrants to the Investor that:

4.1 ORGANIZATION AND

QUALIFICATION. The Company is a corporation duly organized and validly existing in good standing under the laws of the State of Florida,

and has the requisite corporate power and authorization to own its properties and to carry on its business as now being conducted. Both

the Company and the companies it owns or controls (“Subsidiaries”) are duly qualified to do business and are in good standing

in every jurisdiction in which its ownership of property or the nature of the business conducted by it makes such qualification necessary,

except to the extent that the failure to be so qualified or be in good standing would not have a Material Adverse Effect. As used in this

Agreement, “Material Adverse Effect” means a change, event, circumstance, effect or state of facts that has had or is reasonably

likely to have, a material adverse effect on the business, properties, assets, operations, results of operations, financial condition

or prospects of the Company and its Subsidiaries, if any, taken as a whole, or on the transactions contemplated hereby or by the agreements

and instruments to be entered into in connection herewith, or on the authority or ability of the Company to perform its obligations under

the Agreement.

4.2 AUTHORIZATION;

ENFORCEMENT; COMPLIANCE WITH OTHER INSTRUMENTS.

| |

i. |

The Company has the

requisite corporate power and authority to enter into the Agreement and to issue the Securities in accordance with the terms

hereof. |

| |

|

|

| |

ii. |

The execution and delivery

of the Agreement by the Company and the consummation by it of the transactions contemplated hereby and thereby, including without limitation

the issuance of the Securities pursuant to this Agreement, have been duly and validly authorized by the Company’s Board of Directors

and no further consent or authorization is required by the Company, its Board of Directors, or its shareholders. |

| |

iii. |

The Agreement has been duly and validly executed and delivered by the Company. |

| |

|

|

| |

iv. |

The Agreement constitutes

the valid and binding obligations of the Company enforceable against the Company in accordance with its terms, except as such enforceability

may be limited by general principles of equity or applicable bankruptcy, insolvency, reorganization, moratorium, liquidation or similar

laws relating to, or affecting generally, the enforcement of creditors’ rights and remedies. |

4.3 ISSUANCE OF SECURITIES.

The Company has reserved the amount of Securities included in the Company’s registration statement for issuance pursuant to the

Agreement, which have been duly authorized and reserved (subject to adjustment pursuant to the Company’s covenant set forth in Section

5.5 below) pursuant to this Agreement. Upon issuance in accordance with this Agreement, the Securities, will be validly issued,

fully paid for and non-assessable and free from all taxes, liens and charges with respect to the issuance thereof. In the event the Company

cannot register a sufficient number of Securities for issuance pursuant to this Agreement, the Company will use its best efforts to authorize

and reserve for issuance the number of Securities required for the Company to perform its obligations hereunder as soon as reasonably

practicable.

4.4 INSURANCE.

Each of the Company’s Subsidiaries are insured by insurers of recognized financial responsibility against such losses and risks

and in such amounts as management of the Company reasonably believes to be prudent and customary in the businesses in which the Company

and its Subsidiaries are engaged. Neither the Company nor any of its Subsidiaries has been refused any insurance coverage sought or applied

for and neither the Company nor its Subsidiaries has any reason to believe that it will not be able to renew its existing insurance coverage

as and when such coverage expires or to obtain similar coverage from similar insurers as may be necessary to continue its business at

a cost that would not have a Material Adverse Effect.

4.5 DILUTIVE EFFECT.

The Company understands and acknowledges that the number of Securities issuable upon purchases pursuant to this Agreement will increase

in certain circumstances including, but not necessarily limited to, the circumstance wherein the trading price of the common stock declines

during the Commitment Period. The Company’s executive officers and directors have studied and fully understand the nature of the

transactions contemplated by this Agreement and recognize that they have a potential dilutive effect on the shareholders of the Company.

The Board of Directors of the Company has concluded, in its good faith business judgment, and with full understanding of the implications,

that such issuance is in the best interests of the Company. The Company specifically acknowledges that, subject to such limitations as

are expressly set forth in the Agreement, its obligation to issue Securities after providing a Purchase Notice pursuant to this Agreement

is absolute and unconditional regardless of the dilutive effect that such issuance may have on the ownership interests of other shareholders

of the Company.

SECTION V

COVENANTS OF THE COMPANY

5.1 BEST EFFORTS.

The Company shall use all commercially reasonable efforts to timely satisfy each of the conditions set forth in this Agreement.

5.2 REPORTING STATUS.

Until one of the following occurs, the Company shall file all reports required to be filed with the SEC pursuant to the 1934 Act, and

the Company shall not terminate its status, or take an action or fail to take any action, which would terminate its status as a reporting

company under the 1934 Act: (i) this Agreement terminates pursuant to Section 6 and the Investor has the right to sell

all of the Securities without restrictions pursuant to Rule 144 promulgated under the 1933 Act, or such other exemption, or (ii) the date

on which the Investor has sold all the Securities.

5.3 USE OF PROCEEDS.

The Company will use the proceeds from the sale of the Securities for general corporate and working capital purposes and acquisitions

or assets, businesses or operations or for other purposes that the Board of Directors, in good faith deem to be in the best interest of

the Company.

5.4 FINANCIAL INFORMATION.

During the Commitment Period, the Company agrees to make available to the Investor via EDGAR or other electronic means the following documents

and information on the forms set forth: (i) within five (5) Business Days after the filing thereof with the SEC, a copy of its Annual

Reports on Form 10-K, its Quarterly Reports on Form 10-Q, any Current Reports on Form 8-K and any Registration Statements or amendments

filed pursuant to the 1933 Act; (ii) copies of any notices and other information made available or given to the shareholders of the Company

generally, contemporaneously with the making available or giving thereof to the shareholders; and (iii) within two (2) calendar days of

filing or delivery thereof, copies of all documents filed with, and all correspondence sent to, the Principal Market, any securities exchange

or market, or the Financial Industry Regulatory Association, unless such information is material nonpublic information.

5.5 RESERVATION OF

SECURITIES. The Company shall take all action necessary to at all times have authorized, and reserved the amount of Securities included

in the Company’s registration statement for issuance pursuant to the Agreement. In the event that the Company determines that it

does not have a sufficient number of common stock to reserve and keep available for issuance as described, the Company shall use all commercially

reasonable efforts to increase the number of common stock by seeking shareholder approval.

5.6 LISTING. The

Company shall maintain the listing of the common stock on the Principal Market and each other national securities exchange and automated

quotation system, if any, upon which common stock are then listed (subject to official notice of issuance) and shall maintain, such listing

of all common stock from time to time issuable under the terms of the Agreement. Neither the Company nor any of its Subsidiaries shall

take any action which would be reasonably expected to result in the delisting or suspension of the common stock on the Principal Market

(excluding suspensions of not more than one (1) Business Day resulting from business announcements by the Company). The Company shall

promptly provide to the Investor copies of any notices it receives from the Principal Market regarding the continued eligibility of the

common stock for listing on such automated quotation system or securities exchange. The Company shall pay all fees and expenses in connection

with satisfying its obligations under this Section 5.6.

5.7 CORPORATE EXISTENCE.

The Company shall use all commercially reasonable efforts to preserve and continue the corporate existence of the Company.

5.8 NOTICE OF CERTAIN

EVENTS AFFECTING REGISTRATION; SUSPENSION OF RIGHT TO SUBMIT A PURCHASE NOTICE. The Company shall promptly notify the Investor upon

the occurrence of any of the following events in respect of a Registration Statement or related prospectus in respect of an offering of

the Securities: (i) receipt of any request for additional information by the SEC or any other federal or state governmental authority

during the period of effectiveness of the Registration Statement for amendments or supplements to the Registration Statement or related

prospectus; (ii) the issuance by the SEC or any other federal or state governmental authority of any stop order suspending the effectiveness

of any Registration Statement or the initiation of any proceedings for that purpose; (iii) receipt of any notification with respect to

the suspension of the qualification or exemption from qualification of any of the Securities for sale in any jurisdiction or the initiation

or notice of any proceeding for such purpose; (iv) the happening of any event that makes any statement made in such Registration Statement

or related prospectus or any document incorporated or deemed to be incorporated therein by reference untrue in any material respect or

that requires the making of any changes in the Registration Statement, related prospectus or documents so that, in the case of a Registration

Statement, it will not contain any untrue statement of a material fact or omit to state any material fact required to be stated therein

or necessary to make the statements therein not misleading, and that in the case of the related prospectus, it will not contain any untrue

statement of a material fact or omit to state any material fact required to be stated therein or necessary to make the statements therein,

in the light of the circumstances under which they were made, not misleading; and (v) the Company’s reasonable determination that

a post-effective amendment or supplement to the Registration Statement would be appropriate, and the Company shall promptly make available

to Investor any such supplement or amendment to the related prospectus.

5.9 TRANSFER AGENT.

The Company shall deliver instructions to its transfer agent to issue Securities to the Investor that are issued to the Investor pursuant

to the Agreement.

5.10 ACKNOWLEDGEMENT OF

TERMS. The Company hereby represents and warrants to the Investor that: (i) it is voluntarily entering into this Agreement of its

own freewill, (ii) it is not entering this Agreement under economic duress, (iii) the terms of this Agreement are reasonable and fair

to the Company, and (iv) the Company has had independent legal counsel of its own choosing review this Agreement, advise the Company with

respect to this Agreement, and represent the Company in connection with this Agreement.

SECTION VI

EXPIRATION

This Agreement shall expire

either upon:

6.1 when the Investor has

purchased One Million Dollars ($1,000,000) of Securities pursuant to this Agreement; or

6.2 March 31, 2024

Any and all Securities,

or penalties, if any, due under this Agreement shall be immediately payable and due upon expiration of this Agreement.

SECTION VII

CONDITIONS TO THE INVESTOR’S OBLIGATION TO

PURCHASE COMMON STOCK

The Company shall not be entitled to deliver any

Purchase Notice to the Investor, and the Investor shall have no obligation to accept or close upon any Purchase Notice, unless each of

the following conditions has been satisfied as of the date of such Purchase Notice:

7.1 REGISTRATION STATEMENT.

The Company shall file a registration statement for the resale of the Securities not later than twenty (20) Business Days following the

Execution Date (the “Filing Date”), which shall be filed on such form as the Company can qualify to use (the parties understanding

that the Form S-3 is preferable to the Form S-1) as set forth in this section (the “Registration Statement”). The term “Registration

Statement” shall include any prospectus, amendments and supplements to such registration statement or prospectus, including pre-

and post-effective amendments, all exhibits thereto, and all material incorporated by reference or deemed to be incorporated by reference

in such registration statement. If Form S-3 is not available for the registration of the resale of Securities hereunder, the Company shall

(i) register the resale of the Securities on another appropriate form and (ii) undertake to register the Securities on Form S-3 as soon

as such form is available, provided that the Company shall maintain the effectiveness of the Registration Statement then in effect until

such time as a registration statement on Form S-3 covering the Registrable Securities has been declared effective by the U.S. Securities

and Exchange Commission (the “Commission”). The Company shall use best efforts to cause a Registration Statement filed under

this Agreement to be declared effective under the Securities Act of 1933 (the “Securities Act”) as soon as possible after

its filing, and shall use its best efforts to keep such Registration Statement continuously effective under the Securities Act until all

Securities have been sold, thereunder or pursuant to Rule 144. The Company shall immediately notify the Investor in writing of the effectiveness

of a Registration Statement on the same Business Day that the Company telephonically confirms effectiveness with the Commission (the “Effective

Date”), which shall be the date requested for effectiveness of such Registration Statement. The Company shall, by 9:30 a.m. Eastern

Time on the Business Day after the Effective Date, file a final Prospectus with the Commission as required by Rule 424. The Registration

Statement covering the resale of the Securities shall have been declared effective under the Securities Act by the SEC and stay effective

at all times during the Commitment Period.

7.2 LISTING. The Common

Stock shall be listed or quoted on the Principal Market, trading in the Common Stock shall not have been within the last 365 days suspended

by the SEC or the Principal Market for one or more Business Days, and all Securities to be issued by the Company to the Investor pursuant

to this Agreement shall have been, approved for listing or quotation on the Principal Market in accordance with the applicable rules and

regulations of the Principal Market.

7.3 REPRESENTATIONS AND

WARRANTIES. The representations and warranties of the Company shall be true and correct in all material aspects as of the date hereof

and as of the Execution Date as though made at that time and the Company shall have performed, satisfied and complied with the covenants,

agreements and conditions required by the Agreement to be performed, satisfied, or complied with by the Company at or prior to the Execution

Date.

SECTION IX

INDEMNIFICATION

In consideration of the mutual

obligations set forth in the Agreement, the Company (the “Indemnitor”) shall defend, protect, indemnify and hold harmless

the Investor and all of the Investor’s shareholders, officers, directors, employees, counsel, and direct or indirect investors and

any of the foregoing person’s agents or other representatives (including, without limitation, those retained in connection with

the transactions contemplated by this Agreement) (collectively, the “Indemnitees”) from and against any and all actions, causes

of action, suits, claims, losses, costs, penalties, fees, liabilities and damages, and reasonable expenses in connection therewith (irrespective

of whether any such Indemnitee is a party to the action for which indemnification hereunder is sought), and including reasonable attorneys’

fees and disbursements (the “Indemnified Liabilities”), incurred by any Indemnitee as a result of, or arising out of, or relating

to (I) any misrepresentation or breach of any representation or warranty made by the Indemnitor in the Agreement, Registration Statement

or any other certificate, instrument or document contemplated hereby or thereby; (II) any breach of any covenant, agreement or obligation

of the Indemnitor contained in the Agreement or any other certificate, instrument or document contemplated hereby or thereby; or (III)

any cause of action, suit or claim brought or made against such Indemnitee by a third party and arising out of or resulting from the execution,

delivery, performance or enforcement of the Agreement or any other certificate, instrument or document contemplated hereby or thereby,

except insofar as any such misrepresentation, breach or any untrue statement, alleged untrue statement, omission or alleged omission is

made in reliance upon and in conformity with information furnished to Indemnitor which is specifically intended for use in the preparation

of any such Registration Statement, preliminary prospectus, prospectus or amendments to the prospectus or any such cause of action, suit

or claim arises out of any Indemnitee’s willful misconduct or gross negligence. To the extent that the foregoing undertaking by

the Indemnitor may be unenforceable for any reason, the Indemnitor shall make the maximum contribution to the payment and satisfaction

of each of the Indemnified Liabilities which is permissible under applicable law. The indemnity provisions contained herein shall be in

addition to any cause of action or similar rights Indemnitor may have, and any liabilities the Indemnitor or the Indemnitees may be subject

to.

SECTION X

GOVERNING LAW; DISPUTES SUBMITTED TO ARBITRATION

10.1 LAW GOVERNING

THIS AGREEMENT. This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware without regard

to principles of conflicts of laws. Any action brought by either party against the other concerning the transactions contemplated by this

Agreement shall be brought only in the state or federal courts located in Wilmington, Delaware. The parties to this Agreement hereby irrevocably

waive any objection to jurisdiction and venue of any action instituted hereunder and shall not assert any defense based on lack of jurisdiction

or venue or based upon forum non conveniens. The parties executing this Agreement and other agreements referred to herein or

delivered in connection herewith on behalf of the Company agree to submit to the in personam jurisdiction of such courts and hereby irrevocably

waive trial by jury. The prevailing party shall be entitled to recover from the other party its reasonable attorney’s fees

and costs. In the event that any provision of this Agreement or any other agreement delivered in connection herewith is invalid or unenforceable

under any applicable statute or rule of law, then such provision shall be deemed inoperative to the extent that it may conflict therewith

and shall be deemed modified to conform with such statute or rule of law. Any such provision which may prove invalid or unenforceable

under any law shall not affect the validity or enforceability of any other provision of any agreement. Each party hereby irrevocably waives

personal service of process and consents to process being served in any suit, action or proceeding in connection with this Agreement by

mailing a copy thereof via registered or certified mail or overnight delivery (with evidence of delivery) to such party at the address

in effect for notices to it under this Agreement and agrees that such service shall constitute good and sufficient service of process

and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any other manner permitted

by law.

10.2 LEGAL FEES; AND

MISCELLANEOUS FEES. Except as otherwise set forth in the Agreement, each party shall pay the fees and expenses of its advisers, counsel,

the accountants and other experts, if any, and all other expenses incurred by such party incident to the negotiation, preparation, execution,

delivery and performance of this Agreement. Any attorneys’ fees and expenses incurred by either the Company or the Investor in connection

with the preparation, negotiation, execution and delivery of any amendments to this Agreement or relating to the enforcement of the rights

of any party, after the occurrence of any breach of the terms of this Agreement by another party or any default by another party in respect

of the transactions contemplated hereunder, shall be paid on demand by the party which breached this Agreement and/or defaulted, as the

case may be. The Company shall pay all stamp and other taxes and duties levied in connection with the issuance of any Securities.

10.3 SURVIVAL.

The representations and warranties of the Company and the Investor contained in this Agreement shall survive the Closing and the expiration

of this Agreement.

10.4 PRICING OF SECURITIES.

For purposes of this Agreement, the Investment Amount shall be as reported by Investor absent demonstrable error.

SECTION XI

NON-DISCLOSURE OF NON-PUBLIC INFORMATION

The Company shall not disclose

non-public information to the Investor.

Your signature on this Signature

Page evidences your agreement to be bound by the terms and conditions of this Agreement as of the date first written above. The undersigned

signatory hereby certifies that he has read and understands this Agreement, and the representations made by the undersigned in this Agreement

are true and accurate, and agrees to be bound by its terms.

| COMPANY: |

|

| |

|

|

| US LIGHTING GROUP, INC. |

|

| |

|

|

| By: |

/s/ Anthony Corpora |

|

| Name: |

Anthony Corpora |

|

| Title: |

Chief Executive Officer |

|

| INVESTOR: |

|

| |

|

|

| ALUMNI CAPITAL LP |

|

| |

|

|

| By: Alumni Capital GP LLC, its General Partner |

|

| |

|

|

| By: |

/s/ Ashkan Mapar |

|

| Name: |

Ashkan Mapar |

|

| Title: |

General Partner |

|

| |

|

|

| By: Alumni Capital Management LLC, its Investment Manager |

| |

|

|

| By: |

/s/ Ashkan Mapar |

|

| Name: |

Ashkan Mapar |

|

| Title: |

Portfolio Manager |

|

PURCHASE NOTICE

Date __________

ALUMNI CAPITAL LP,

This is to inform you that

as of today the Company hereby elects to exercise its right pursuant to this Agreement to sell you __________ Securities.

Regards,

US Lighting Group, Inc.

__________________

9

Exhibit 10.2

NEITHER THIS SECURITY

NOR THE SECURITIES AS TO WHICH THIS SECURITY MAY BE EXERCISED HAVE BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE

SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES

ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD, EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT

AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS AS EVIDENCED BY A LEGAL OPINION OF COUNSEL TO THE TRANSFEROR TO SUCH EFFECT, THE

SUBSTANCE OF WHICH SHALL BE REASONABLY ACCEPTABLE TO THE COMPANY. THIS SECURITY AND THE SECURITIES ISSUABLE UPON EXERCISE OF THIS SECURITY

MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT OR OTHER LOAN SECURED BY SUCH SECURITIES.

COMMON STOCK PURCHASE

WARRANT

US LIGHTING GROUP,

INC.

Warrant Shares: 6,666,667

Date of Issuance: July

14, 2023 (the “Issuance Date”)

THIS

COMMON STOCK PURCHASE WARRANT (the “Warrant”) certifies that, for value received (in connection with the common stock purchase

agreement July 14, 2023, in the amount of $1,000,000 by the Company (as defined below) to the Investor (as defined below)) (the “Agreement”),

ALUMNI CAPITAL LP (the “Investor” and including any permitted and registered assigns, the “Holder”), is entitled,

upon the terms and subject to the limitations on exercise and the conditions hereinafter set forth, at any time during the Exercise Period,

to purchase from US LIGHTING GROUP, INC., a Florida corporation (the “Company”), up to $1,000,000 dollars of Common Stock

(as defined below) (the “Warrant Shares”) at the Exercise Price per share then in effect. The number of Warrant Shares for

which this Warrant may be exercised is subject to adjustment in accordance with the terms hereof.

Capitalized

terms used in this Warrant shall have the meanings set forth in the Agreement unless otherwise defined in the body of this Warrant or

in Section 14 below. For purposes of this Warrant, the term “Exercise Price” shall mean an amount per share equal

to the “Valuation Cap,” as defined below, subject to adjustment as provided herein (including, but not limited to cashless

exercise), and the term “Exercise Period” shall mean the period commencing on the Issuance Date and ending on 5:00 p.m. Eastern

Time on the five-year anniversary of such date.

1. EXERCISE

OF WARRANT.

(a) Mechanics

of Exercise. Subject to the terms and conditions hereof, the rights represented by this Warrant may be exercised in whole or

in part at any time or times during the Exercise Period by delivery of a written notice, in the form attached hereto as Exhibit A (the

“Exercise Notice”), of the Holder’s election to exercise this Warrant. The Holder shall not be required to deliver

the original Warrant in order to effect an exercise hereunder. Partial exercises of this Warrant resulting in purchases of a portion

of the total number of Warrant Shares available hereunder shall have the effect of lowering the outstanding number of Warrant Shares purchasable

hereunder in an amount equal to the applicable number of Warrant Shares purchased. On or before the second Trading Day (the “Warrant

Share Delivery Date”) following the date on which the Company shall have received the Exercise Notice, which Exercise Notice must

be received by the Company prior to 11 a.m., New York, New York time to count as received on such date, and upon receipt by the Company

of payment to the Company of an amount equal to the applicable Exercise Price multiplied by the number of Warrant Shares as to which all

or a portion of this Warrant is being exercised (the “Aggregate Exercise Price” and together with the Exercise Notice, the

“Exercise Delivery Documents”) in cash or by wire transfer of immediately available funds (or by cashless exercise if permitted

under the terms of this Warrant, in which case there shall be no Aggregate Exercise Price provided), the Company shall (or shall direct

its transfer agent to) issue and dispatch by overnight courier to the address as specified in the Exercise Notice, a certificate, registered

in the Company’s share register in the name of the Holder or its designee, for the number of shares of Common Stock to which the

Holder is entitled pursuant to such exercise. Upon delivery of the Exercise Delivery Documents, the Holder shall be deemed for all corporate

purposes to have become the holder of record of the Warrant Shares with respect to which this Warrant has been exercised, irrespective

of the date of delivery of the certificates evidencing such Warrant Shares. If this Warrant is submitted in connection with any exercise

and the number of Warrant Shares represented by this Warrant submitted for exercise is greater than the number of Warrant Shares being

acquired upon an exercise, then the Company shall as soon as practicable and in no event later than three Business Days after any exercise

and at its own expense, issue a new Warrant (in accordance with Section 6) representing the right to purchase the number of Warrant

Shares purchasable immediately prior to such exercise under this Warrant, less the number of Warrant Shares with respect to which this

Warrant is exercised.

If

the Company fails to cause its transfer agent to transmit to the Holder the respective shares of Common Stock by the respective Warrant

Share Delivery Date, then the Holder will have the right to rescind such exercise in Holder’s sole discretion. Without in any way

limiting the Holder’s right to pursue other remedies, including actual damages and/or equitable relief, the parties agree that if

delivery of the Common Stock issuable upon conversion of this Warrant is not delivered by the Warrant Share Delivery Date the Company

shall pay to the Holder $1,000 per day, for each day beyond the Warrant Share Delivery Date that the Company fails to deliver such Common

Stock (unless such failure results from war, acts of terrorism, an epidemic, or natural disaster). Such amount shall be paid to

Holder in cash by the fifth day of the month following the month in which it has accrued. The Company agrees that the right to exercise

is a valuable right to the Holder. The damages resulting from a failure, attempt to frustrate, interference with such exercise right are

difficult if not impossible to qualify. Accordingly, the parties acknowledge that the liquidated damages provision contained in

this Section 1(a) are justified.

If,

at any time during the Exercise Period, there is no effective registration statement of the Company covering the Holder’s immediate

resale of the Warrant Shares without any limitations, then the Holder may elect to receive Warrant Shares pursuant to a cashless exercise,

in lieu of a cash exercise, equal to the value of this Warrant determined in the manner described below (or of any portion thereof remaining

unexercised) by surrender of this Warrant and a Notice of Exercise, in which event the Company shall issue to Holder a number of Common

Stock computed using the following formula:

X = Y (A-B)

A

| Where |

X = |

the number of Shares to be issued to Holder. |

| |

|

|

| |

Y = |

the number of Warrant Shares that the Holder elects to purchase

under this Warrant (at the date of such calculation). |

| |

|

|

| |

A = |

the Market Price (at the date of such calculation). |

| |

|

|

| |

B = |

Exercise Price (as adjusted to the date of such calculation). |

(b) No

Fractional Shares. No fractional shares shall be issued upon the exercise of this Warrant as a consequence of any adjustment

pursuant hereto. All Warrant Shares (including fractions) issuable upon exercise of this Warrant may be aggregated for purposes of determining

whether the exercise would result in the issuance of any fractional share. If, after aggregation, the exercise would result in the issuance

of a fractional share, the Company shall, in lieu of issuance of any fractional share, pay to the Holder otherwise entitled to such fraction

a sum in cash equal to the product resulting from multiplying the then-current fair market value of a Warrant Share by such fraction.

(c) Holder’s

Exercise Limitations. The Company shall not effect any exercise of this Warrant, and a Holder shall not have the right to exercise

any portion of this Warrant, to the extent that after giving effect to issuance of Warrant Shares upon exercise as set forth on the applicable

Notice of Exercise, the Holder (together with the Holder’s Affiliates, and any other persons acting as a group together with the

Holder or any of the Holder’s Affiliates), would beneficially own in excess of the Beneficial Ownership Limitation, as defined below.

For purposes of the foregoing sentence, the number of shares of Common Stock beneficially owned by the Holder and its Affiliates shall

include the number of shares of Common Stock issuable upon exercise of this Warrant with respect to which such determination is being

made, but shall exclude the number of shares of Common Stock which would be issuable upon (i) exercise of the remaining, non-exercised

portion of this Warrant beneficially owned by the Holder or any of its Affiliates and (ii) exercise or conversion of the unexercised or

non-converted portion of any other securities of the Company (including without limitation any other Common Stock Equivalents) subject

to a limitation on conversion or exercise analogous to the limitation contained herein beneficially owned by the Holder or any of its

Affiliates. Except as set forth in the preceding sentence, for purposes of this paragraph (c), beneficial ownership shall be calculated

in accordance with Section 13(d) of the Exchange Act, it being acknowledged by the Holder that the Company is not representing to the

Holder that such calculation is in compliance with Section 13(d) of the Exchange Act and the Holder is solely responsible for any schedules

required to be filed in accordance therewith. To the extent that the limitation contained in this paragraph applies, the determination

of whether this Warrant is exercisable (in relation to other securities owned by the Holder together with any affiliates) and of which

portion of this Warrant is exercisable shall be in the sole discretion of the Holder, and the submission of a Notice of Exercise shall

be deemed to be the Holder’s determination of whether this Warrant is exercisable (in relation to other securities owned by the

Holder together with any Affiliates) and of which portion of this Warrant is exercisable, in each case subject to the Beneficial Ownership

Limitation, and the Company shall have no obligation to verify or confirm the accuracy of such determination.

For

purposes of this Section 1(c), in determining the number of outstanding shares of Common Stock, a Holder may rely on the number

of outstanding shares of Common Stock as reflected in (A) the Company’s most recent periodic or annual report filed with the Securities

Exchange Commission, as the case may be, (B) a more recent public announcement by the Company or (C) a more recent written notice by the

Company or its transfer agent setting forth the number of shares of Common Stock outstanding. Upon the request of a Holder, the Company

shall within two Trading Days confirm to the Holder the number of shares of Common Stock then outstanding. In any case, the number of

outstanding shares of Common Stock shall be determined after giving effect to the conversion or exercise of securities of the Company,

including this Warrant, by the Holder or its affiliates since the date as of which such number of outstanding shares of Common Stock was

reported. The “Beneficial Ownership Limitation” shall be 9.99% of the number of shares of the Common Stock outstanding immediately

after giving effect to the issuance of shares of Common Stock issuable upon exercise of this Warrant. The limitations contained in this

paragraph shall apply to a successor Holder of this Warrant.

2. ADJUSTMENTS.

The Exercise Price and the number of Warrant Shares shall be adjusted from time to time as follows:

(a) Distribution

of Assets. If the Company shall declare or make any dividend or other distribution of its assets (or rights to acquire its assets)

to holders of shares of Common Stock, by way of return of capital or otherwise (including without limitation any distribution of cash,

stock or other securities, property or options by way of a dividend, spin off, reclassification, corporate rearrangement or other similar

transaction) (a “Distribution”), at any time after the issuance of this Warrant, then, in each such case:

(i) any

Exercise Price in effect immediately prior to the close of business on the record date fixed for the determination of holders of shares

of Common Stock entitled to receive the Distribution shall be reduced, effective as of the close of business on such record date, to a

price determined by multiplying such Exercise Price by a fraction (i) the numerator of which shall be the Closing Sale Price of the shares

of Common Stock on the Trading Day immediately preceding such record date minus the value of the Distribution (as determined in good faith

by the Company’s Board of Directors) applicable to one share of Common Stock, and (ii) the denominator of which shall be the Closing

Sale Price of the shares of Common Stock on the Trading Day immediately preceding such record date; and

(ii) the

number of Warrant Shares shall be increased to a number of shares equal to the number of shares of Common Stock obtainable immediately

prior to the close of business on the record date fixed for the determination of holders of shares of Common Stock entitled to receive

the Distribution multiplied by the reciprocal of the fraction set forth in the immediately preceding clause (i); provided, however, that

in the event that the Distribution is of shares of common stock of a company (other than the Company) whose common stock is traded on

a national securities exchange or a national automated quotation system (“Other Shares of Common Stock”), then the Holder

may elect to receive a warrant to purchase Other Shares of Common Stock in lieu of an increase in the number of Warrant Shares, the terms

of which shall be identical to those of this Warrant, except that such warrant shall be exercisable into the number of shares of Other

Shares of Common Stock that would have been payable to the Holder pursuant to the Distribution had the Holder exercised this Warrant immediately

prior to such record date and with an aggregate exercise price equal to the product of the amount by which the exercise price of this

Warrant was decreased with respect to the Distribution pursuant to the terms of the immediately preceding clause (i) and the number of

Warrant Shares calculated in accordance with the first part of this clause (ii).

(b)

Subdivision or Combination of Common Stock. If the Company at any time on or after the Issuance Date subdivides (by any stock split,

stock dividend, recapitalization or otherwise) one or more classes of its outstanding shares of Common Stock into a greater number of

shares, the number of Warrant Shares will be proportionately increased. If the Company at any time on or after the Issuance Date combines

(by reverse stock split, combination or otherwise) one or more classes of its outstanding shares of Common Stock into a smaller number

of shares, the number of Warrant Shares will be proportionately decreased. Any adjustment under this Section 2(b) shall become effective

at the close of business on the date the subdivision or combination becomes effective. Such adjustment shall be made successively whenever

any event covered by this Section 2(b) shall occur.

3. FUNDAMENTAL

TRANSACTIONS. If, at any time while this Warrant is outstanding, (i) the Company effects any merger of the Company with or into

another entity and the Company is not the surviving entity (such surviving entity, the “Successor Entity”), (ii) the Company

effects any sale of all or substantially all of its assets in one or a series of related transactions, (iii) any tender offer or exchange

offer (whether by the Company or by another individual or entity, and approved by the Company) is completed pursuant to which holders

of Common Stock are permitted to tender or exchange their shares of Common Stock for other securities, cash or property and the holders

of at least 50% of the Common Stock accept such offer, or (iv) the Company effects any reclassification of the Common Stock or any compulsory

share exchange pursuant to which the Common Stock is effectively converted into or exchanged for other securities, cash or property (other

than as a result of a subdivision or combination of shares of Common Stock) (in any such case, a “Fundamental Transaction”),

then, upon any subsequent exercise of this Warrant, the Holder shall have the right to receive the number of shares of Common Stock of

the Successor Entity or of the Company and any additional consideration (the “Alternate Consideration”) receivable upon or

as a result of such reorganization, reclassification, merger, consolidation or disposition of assets by a holder of the number of shares

of Common Stock for which this Warrant is exercisable immediately prior to such event (disregarding any limitation on exercise contained

herein solely for the purpose of such determination). For purposes of any such exercise, the determination of the Exercise Price shall

be appropriately adjusted to apply to such Alternate Consideration based on the amount of Alternate Consideration issuable in respect

of one share of Common Stock in such Fundamental Transaction, and the Company shall apportion the Exercise Price among the Alternate Consideration

in a reasonable manner reflecting the relative value of any different components of the Alternate Consideration. If holders of Common

Stock are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the Holder shall be

given the same choice as to the Alternate Consideration it receives upon any exercise of this Warrant following such Fundamental Transaction.

To the extent necessary to effectuate the foregoing provisions, any Successor Entity in such Fundamental Transaction shall issue to the

Holder a new warrant consistent with the foregoing provisions and evidencing the Holder’s right to exercise such warrant into Alternate

Consideration.

4. NON-CIRCUMVENTION.

The Company covenants and agrees that it will not, by amendment of its certificate of incorporation, bylaws or through any reorganization,

transfer of assets, consolidation, merger, scheme of arrangement, dissolution, issue or sale of securities, or any other voluntary action,

avoid or seek to avoid the observance or performance of any of the terms of this Warrant, and will at all times in good faith carry out

all the provisions of this Warrant and take all action as may be required to protect the rights of the Holder. Without limiting the generality

of the foregoing, the Company (i) shall not increase the par value of any shares of Common Stock receivable upon the exercise of this

Warrant above the Exercise Price then in effect, (ii) shall take all such actions as may be necessary or appropriate in order that the

Company may validly and legally issue fully paid and non-assessable shares of Common Stock upon the exercise of this Warrant, and (iii)

shall, for so long as this Warrant is outstanding, have authorized and reserved, free from preemptive rights, three times the number of

shares of Common Stock issuable under the Warrant, or as otherwise required under the Agreement, to provide for the exercise of the rights

represented by this Warrant (without regard to any limitations on exercise).

5. WARRANT

HOLDER NOT DEEMED A STOCKHOLDER. Except as otherwise specifically provided herein, this Warrant, in and of itself, shall not

entitle the Holder to any voting rights or other rights as a stockholder of the Company. In addition, nothing contained in this Warrant

shall be construed as imposing any liabilities on the Holder to purchase any securities (upon exercise of this Warrant or otherwise) or

as a stockholder of the Company, whether such liabilities are asserted by the Company or by creditors of the Company.

6. REISSUANCE.

(a) Lost,

Stolen or Mutilated Warrant. If this Warrant is lost, stolen, mutilated or destroyed, the Company will, on such terms as to

indemnity or otherwise as it may reasonably impose (which shall, in the case of a mutilated Warrant, include the surrender thereof), issue

a new Warrant of like denomination and tenor as this Warrant so lost, stolen, mutilated or destroyed.

(b) Issuance

of New Warrants. Whenever the Company is required to issue a new Warrant pursuant to the terms of this Warrant, such new Warrant

shall be of like tenor with this Warrant, and shall have an issuance date, as indicated on the face of such new Warrant which is the same

as the Issuance Date.

7. TRANSFER.

(a) Notice

of Transfer. The Holder agrees to give written notice to the Company before transferring this Warrant or transferring any Warrant

Shares of such Holder’s intention to do so, describing briefly the manner of any proposed transfer. Promptly upon receiving such

written notice, the Company shall present copies thereof to the Company’s counsel. If the proposed transfer may be effected without

registration or qualification (under any federal or state securities laws), the Company, as promptly as practicable, shall notify the

Holder thereof, whereupon the Holder shall be entitled to transfer this Warrant or to dispose of Warrant Shares received upon the previous

exercise of this Warrant, all in accordance with the terms of the notice delivered by the Holder to the Company; provided, however, that

an appropriate legend may be endorsed on this Warrant or the certificates for such Warrant Shares respecting restrictions upon transfer

thereof necessary or advisable in the opinion of counsel and satisfactory to the Company to prevent further transfers which would be in

violation of Section 5 of the Securities Act and applicable state securities laws; and provided further that the prospective transferee

or purchaser shall execute the Assignment of Warrant attached hereto as Exhibit B and such other documents and make such representations,

warranties, and agreements as may be required solely to comply with the exemptions relied upon by the Company for the transfer or disposition

of the Warrant or Warrant Shares.

(b) If

the proposed transfer or disposition of this Warrant or such Warrant Shares described in the written notice given pursuant to this Section

7 may not be effected without registration or qualification of this Warrant or such Warrant Shares, the Holder will limit its activities

in respect to such transfer or disposition as are permitted by law.

(c) Any

transferee of all or a portion of this Warrant shall succeed to the rights and benefits of the initial Holder of this Warrant under the

Agreement (registration rights, expenses, and indemnity).

8. NOTICES.

Whenever notice is required to be given under this Warrant, unless otherwise provided herein, such notice shall be given in accordance

with the notice provisions contained in the Agreement. The Company shall provide the Holder with prompt written notice (i) immediately

upon any adjustment of the Exercise Price, setting forth in reasonable detail, the calculation of such adjustment and (ii) at least 10

days prior to the date on which the Company closes its books or takes a record (A) with respect to any dividend or distribution upon the

shares of Common Stock, (B) with respect to any grants, issuances or sales of any stock or other securities directly or indirectly convertible

into or exercisable or exchangeable for shares of Common Stock or other property, pro rata to the holders of shares of Common Stock or

(C) for determining rights to vote with respect to any Fundamental Transaction, dissolution or liquidation, provided in each case that

such information shall be made known to the public prior to or in conjunction with such notice being provided to the Holder.

9. AMENDMENT

AND WAIVER. The terms of this Warrant may be amended or waived (either generally or in a particular instance and either retroactively

or prospectively) only with the written consent of the Company and the Holder.

10. GOVERNING

LAW. This Warrant shall be governed by and interpreted in accordance with the laws of the State of Delaware without regard to

the principles of conflicts of law (whether of the State of Delaware or any other jurisdiction).

11. ARBITRATION.

Any disputes, claims, or controversies arising out of or relating to this Warrant, or the transactions, contemplated thereby, or the breach,

termination, enforcement, interpretation, or validity thereof, including the determination of the scope or applicability of this Warrant

to arbitrate, shall be referred to and resolved solely and exclusively by binding arbitration to be conducted before the Judicial Arbitration

and Mediation Service (“JAMS”), or its successor pursuant the expedited procedures set forth in the JAMS Comprehensive Arbitration

Rules and Procedures (the “Rules”), including Rules 16.1 and 16.2. The arbitration shall be held in Wilmington, Delaware,

before a tribunal consisting of three (3) arbitrators each of whom will be selected in accordance with the “strike and rank”

methodology set forth in Rule 15. Either party to this Warrant may, without waiving any remedy under this Warrant, seek from any federal

or state court sitting in the State of Delaware any interim or provisional relief that is necessary to protect the rights or property

of that party, pending the establishment of the arbitral tribunal. The costs and expenses of such arbitration shall be paid via equal

split by the parties, with all such costs and expenses, including reasonable attorneys’ fees, to be awarded to the prevailing party

in such arbitration. The arbitrators’ decision must set forth a reasoned basis for any award of damages or finding of liability.

The arbitrators’ decision and award will be made and delivered as soon as reasonably possible and in any case within sixty (60)

days’ following the conclusion of the arbitration hearing and shall be final and binding on the parties and may be entered by any

court having jurisdiction thereof.

12. JURY

TRIAL WAIVER. THE COMPANY AND THE HOLDER HEREBY WAIVE A TRIAL BY JURY IN ANY ACTION, PROCEEDING OR COUNTERCLAIM BROUGHT BY EITHER

OF THE PARTIES HERETO AGAINST THE OTHER IN RESPECT OF ANY MATTER ARISING OUT OF OR IN CONNECTION WITH THIS WARRANT.

13. ACCEPTANCE.

Receipt of this Warrant by the Holder shall constitute acceptance of and agreement to all of the terms and conditions contained herein.

14. CERTAIN

DEFINITIONS. For purposes of this Warrant, the following terms shall have the following meanings:

(a) “Nasdaq”

means www.Nasdaq.com.

(b) “Closing

Sale Price” means, for any security as of any date, (i) the last closing trade price for such security on the Trading Market, or,

if the Trading Market begins to operate on an extended hours basis and does not designate the closing trade price, then the last trade

price of such security prior to 4:00 p.m., New York time, as reported by Nasdaq (or applicable Trading market), or (ii) if the foregoing

does not apply, the last trade price of such security in the over-the-counter market for such security as reported by Nasdaq (or applicable

Trading market), or (iii) if no last trade price is reported for such security by Nasdaq (or applicable Trading market), the average of

the bid and ask prices of any market makers for such security as reported by the OTC Markets. If the Closing Sale Price cannot be calculated

for a security on a particular date on any of the foregoing bases, the Closing Sale Price of such security on such date shall be the fair

market value as mutually determined by the Company and the Holder. All such determinations to be appropriately adjusted for any stock

dividend, stock split, stock combination or other similar transaction during the applicable calculation period.

(c) “Common

Stock” means the Company’s common stock, $0.0001 par value per share, and any other class of securities into which such securities

may hereafter be reclassified or changed.

(d) “Common

Stock Equivalents” means any securities of the Company that would entitle the holder thereof to acquire at any time Common Stock,

including without limitation any debt, preferred stock, rights, options, warrants or other instrument that is at any time convertible

into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock.

(e) “Trading

Market” means the NASDAQ Capital Market or any of the following markets or exchanges on which the Company’s Common Stock is

listed or quoted for trading on the applicable date: (i) the NASDAQ Global Market; (ii) the NASDAQ Select Market; (iii) the NYSE American;

(iv) the New York Stock Exchange; and (v) the OTC Markets (or any successors to any of the foregoing).

(f) “Market

Price” means the highest traded price of the Common Stock during the ten (10) Trading Days prior to the date of the respective Exercise

Notice.

(g) “Trading

Day” means (i) any day on which the Common Stock is listed or quoted and traded on its Trading Market, (ii) if the Common Stock

is not then listed or quoted and traded on any national securities exchange, then a day on which trading occurs on any over-the-counter

markets, or (iii) if trading does not occur on the over-the-counter markets, any Business Day.

(h)

“Valuation Cap” means $15,000,000 divided by the current outstanding share count of the Company the Business Day prior to

Exercise Notice as reported by the Company’s transfer agent.

IN WITNESS WHEREOF, the Company

has caused this Warrant to be duly executed as of the Issuance Date set forth above.

| |

US LIGHTING GROUP, INC. |

|

| |

|

|

|

| |

By: |

/s/ Anthony Corpora |

|

| |

Name: |

Anthony Corpora |

|

| |

Title: |

Chief Executive Officer |

|

| |

|

|

|

| |

Agreed and Accepted: |

|

| |

|

|

|

| |

ALUMNI CAPITAL LP |

|

| |

|

|

| |

By: Alumni Capital GP LLC, its General Partner |

|

| |

|

|

|

| |

By: |

/s/ Ashkan Mapar |

|

| |

Name: |

Ashkan Mapar |

|

| |

Title: |

General Partner |

|

EXHIBIT A

EXERCISE NOTICE

(To be executed by the

registered holder to exercise this Common Stock Purchase Warrant)

The

Undersigned holder hereby exercises the right to purchase _________________ of the shares of Common Stock (“Warrant

Shares”) of __________, a __________ corporation (the “Company”), evidenced by the attached copy of the Common Stock

Purchase Warrant (the “Warrant”). Capitalized terms used herein and not otherwise defined shall have the respective meanings

set forth in the Warrant.

| 1. |

Form

of Exercise Price. The Holder intends that payment of the Exercise Price shall be made as (check one): |

| |

☐ |

a cash exercise with respect to _________________ Warrant Shares; or |

| |

☐ |

by cashless exercise pursuant to the Warrant. |

| 2. |

Payment

of Exercise Price. If cash exercise is selected above, the holder shall pay the applicable Aggregate Exercise Price in the

sum of $___________________ to the Company in accordance with the terms of the Warrant. |

| 3. |

Delivery

of Warrant Shares. The Company shall deliver to the holder __________________ Warrant Shares in accordance with the

terms of the Warrant. |

Date:

(Print Name of

Registered Holder)

| By: _________________________________________ |

|

| |

|

| Name:_______________________________________ |

|

| |

|

| Title:________________________________________ |

|

EXHIBIT B

ASSIGNMENT OF WARRANT

(To be signed only upon

authorized transfer of the Warrant)

For

Value Received, the undersigned hereby sells, assigns, and transfers unto ____________________ the right to purchase _______________

shares of common stock of __________ to which the within Common Stock Purchase Warrant relates and appoints ____________________, as attorney-in-fact,

to transfer said right on the books of __________ with full power of substitution and re-substitution in the premises. By accepting

such transfer, the transferee has agreed to be bound in all respects by the terms and conditions of the within Warrant.

| Date: |

|

|

| |

|

|

| |

|

|

| (Signature) * |

|

|

| |

|

|

| |

|

|

| (Name) |

|

|

| |

|

|

| |

|

|

| (Address) |

|

|

| |

|

|

| |

|

|

| (Social Security or Tax

Identification No.) |

|

|

| * | The signature on this Assignment of Warrant must correspond

to the name as written upon the face of the Common Stock Purchase Warrant in every particular without alteration or enlargement or any

change whatsoever. When signing on behalf of a corporation, partnership, trust or other entity, please indicate your position(s) and

title(s) with such entity. |

10

Exhibit 10.3

Unsecured Promissory Note

Euclid, Ohio

July 17, 2023

For

Value Received, US Lighting Group, Inc., a Florida corporation (the “USLG”), promises to pay to Anthony R. Corpora

(the “Corpora”), a resident of the State of Ohio, in lawful money of the United States of America, the principal sum

of $97,920 with interest as provided for in this unsecured promissory note (this “Note”).

Background. On May 24,

2023, Corpora obtained a personal loan in the original principal amount of $97,920 from Pinnacle Bank and provided these funds to USLG

to support the company’s operations (the “Pinnacle Loan”). On May 19, 2023, Corpora executed an unsecured promissory

note payable to Pinnacle Bank evidencing the Pinnacle Loan, a copy of which is attached to this Note (the “Pinnacle Note”).

The Pinnacle Note is in the original principal amount of $97,920, bears annual interest of 14.49%, with 84 monthly payments of $1,861.63

commencing on June 25, 2023 with the final payment on May 25, 2030. The Pinnacle Note may be prepaid at any time without penalty.