UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2023

Commission File Number: 001-32929

POLYMET MINING CORP.

(Translation of registrant's name into English)

444 Cedar Street, Suite 2060,

St. Paul, MN 55101

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [ X ] Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

EXPLANATORY NOTE

This report on Form 6-K and attached exhibit are incorporated by reference into Registration Statement No. 333-192208 and this report on Form 6-K shall be deemed a part of such registration statement from the date on which this report on Form 6-K is filed, to the extent not superseded by documents or reports subsequently filed or furnished by PolyMet Mining Corp. under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

On July 16, 2023, PolyMet Mining Corp. (the “Company”) entered into a definitive arrangement agreement (the “Arrangement Agreement”) with Glencore AG (“Glencore”) in respect of a plan of arrangement under the Business Corporations Act (British Columbia) (the “BCBCA”). The Arrangement Agreement provides for the terms and conditions pursuant to which Glencore has agreed to acquire all of the outstanding share capital in the Company that is not owned directly or indirectly by Glencore, and provides that the Company’s minority shareholders (i.e. holders of the approximately 17.8%) would receive US$2.11 in cash per Common Share (the “Transaction”).

The terms of the Arrangement Agreement further provide that the Transaction will be implemented by way of a statutory plan of arrangement under the BCBCA (the “Plan of Arrangement”). The Plan of Arrangement and the implementation of the arrangement (the “Arrangement”) is subject to the review and approval of the Supreme Court of British Columbia. In addition, the Arrangement is subject to certain other conditions, including, among other customary closing conditions, (i) approval of sixty-six and two-thirds percent (66-2/3%) of votes cast by shareholders of the Company (including Glencore) (the “Company Shareholders”) at a special meeting of Company Shareholders to be called to consider the Arrangement (the “Special Meeting”) and (ii) approval cast by a majority of the votes of the disinterested Company Shareholders at the Special Meeting (such approvals, the “Requisite Shareholder Approvals”).

The Arrangement Agreement and the Arrangement have been approved by the Board of Directors of the Company (the “Company Board”) and a special committee of the Company comprised solely of independent directors.

The Arrangement Agreement contains customary representations and warranties of the Company, on the one hand, and Glencore, on the other hand. The Company has also agreed to customary covenants regarding the operation of the Company and its subsidiaries prior to the completion of the Arrangement, including covenants not to, during the pendency of the Plan of Arrangement, solicit alternative transactions. The Company has also agreed to notify Glencore if the Company or its subsidiaries receive any inquiry, proposal or offer concerning an alternative transaction (any such inquiry, proposal or offer, an “Acquisition Proposal”).

The Arrangement Agreement contains certain customary mutual termination rights for both the Company and Glencore, including a right to terminate (i) by mutual agreement, (ii) if the Arrangement is not completed by December 31, 2023, subject to certain exceptions pursuant to the terms of the Arrangement Agreement (the “Outside Date”, and such termination right, an “Outside Date Termination Right”), (iii) if any law is enacted that prohibits or makes the consummation of the Arrangement illegal or (iv) if the Requisite Shareholder Approvals are not obtained at the Special Meeting (a “Shareholder No Vote Termination Right”).

The Arrangement Agreement contains customary termination rights for Glencore, including a right to terminate (i) for a breach of any representation and warranty or failure to perform any covenant on the part of the Company, subject to certain qualifications, (ii) if prior to obtaining the Requisite Shareholder Approvals, the Company Board or a committee of the Company Board fails to unanimously recommend or withdraws, amends, modifies or qualifies, in a manner that is adverse to Glencore, its recommendation that the Company Shareholders vote in favor of the Arrangement at the Special Meeting (a “Change in Recommendation”), or states its intention to do any of the foregoing, (iii) if the Company breaches its non-solicitation covenant in any material respect or (iv) if a Material Adverse Effect has occurred.

The Arrangement Agreement contains customary termination rights for the Company, including a right to terminate for a breach of any representation and warranty or failure to perform any covenant on the part of Glencore that would result in the corresponding closing conditions not being satisfied, subject to certain other qualifications.

The Company will pay to Glencore an amount equal to US$12,000,000 (such amount, the “Termination Amount”) under certain circumstances, including if the Arrangement Agreement is terminated (i) in the event that a public Acquisition Proposal is made to the Company or the Company Shareholders prior to the Special Meeting, and (A) (1) either the Company or Glencore has exercised its Outside Date Termination Right or Shareholder No Vote Termination Right, or (2) Glencore has exercised its termination right due to a breach of any representation and warranty or failure to perform any covenant on the part the Company that would result in the corresponding closing condition not being satisfied, subject to certain other qualifications, and (B) the Company has (1) completed any transaction in respect of any Acquisition Proposal within 12 months of the termination of the Arrangement Agreement, or (2) the Company has entered into any definitive agreement in respect of any Acquisition Proposal or the Company Board has recommended any Acquisition Proposal, in each case, within 12 months after the Arrangement Agreement is terminated, and such alternative transaction is subsequently completed; (ii) by Glencore if there is a Change in Recommendation by the Company Board; (iii) by Glencore, if the Company breaches its non-solicitation covenant in any material respect; (iv) by the Company, if the Company board of directors authorizes the Company to enter into a definitive agreement for the implementation of a Superior Proposal; or (v) by the Company or Glencore by exercise of a Shareholder No Vote Termination Right and, at the time of such termination, Glencore was entitled to terminate the Agreement as provided in clause (ii) or clause (iii) above.

On July 17, 2023, the Company also issued a press release (the “Press Release”), which disclosed entry into the Arrangement Agreement. Copies of the Press Release and the Arrangement Agreement filed as Exhibit 99.1 and Exhibit 99.2, respectively.

Concurrently with entry into the Arrangement Agreement, Glencore and all directors and officers of the Company that own Common Shares (each, a “Supporting Company Shareholder”) have entered into voting and support agreements (each, a “Support Agreement”), pursuant to which each such Supporting Company Shareholder has agreed, among other things, to vote their Common Shares in favor of the adoption of the Arrangement Agreement and the Arrangement. The form of the Support Agreements is filed as Exhibit 99.3.

It is expected that, upon completion of the Arrangement, the Company’s securities will be delisted from NYSE American and the Toronto Stock Exchange and will become eligible for termination of registration pursuant to Section 12(g)(4) of the Securities Exchange Act of 1934, as amended, and the Company will submit an application to cease to be a reporting issuer under applicable Canadian securities laws.

SUBMITTED HEREWITH

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

PolyMet Mining Corp. |

| |

(Registrant) |

| |

|

|

| Date: July 17, 2023 |

By: |

/s/ Jonathan Cherry |

| |

|

Jonathan Cherry |

| |

Title: |

Chairman, President and CEO |

|

444 Cedar Street, Suite 2060, St. Paul, MN 55101

Tel: +1 (651) 389-4100

www.polymetmining.com

|

TSX: POM, NYSE American: PLM

PolyMet Enters into Definitive Agreement

for Glencore to Acquire Full Ownership

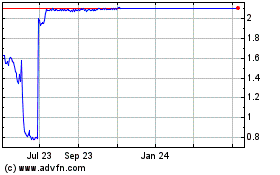

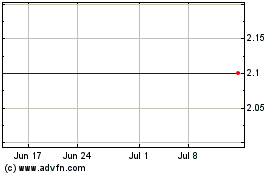

- Transaction provides Minority Shareholders with all-cash consideration of US$2.11 per share and represents a 167% premium to the unaffected closing price on June 30, 2023

- Special meeting of shareholders expected to be held at the end of the third quarter of 2023 or early in the fourth quarter of 2023

St. Paul, Minn., July 17, 2023 - PolyMet Mining Corp. ("PolyMet" or the "company") (TSX: POM; NYSE American: PLM) announced today that, based on the unanimous recommendation of an independent special committee of its board of directors (the "Special Committee"), it has entered into a definitive agreement (the "Agreement") with Glencore AG ("Glencore"), in respect of a transaction whereby Glencore will acquire the approximately 17.8% of the issued and outstanding common shares of the company that Glencore does not currently own (the "Minority Shares") for US$2.11 in cash per share (the "Consideration"), subject to approval by PolyMet shareholders, court approval and other customary closing conditions (the "Transaction").

The Transaction has several benefits for shareholders of PolyMet other than Glencore (the "Minority Shareholders") including:

- Significant Premium: The Consideration represents a 167% premium to the unaffected share price on June 30, 2023, being the last trading day prior to the announcement of Glencore's non-binding proposal to acquire PolyMet.

- Immediate Liquidity and Certainty of Value: All-cash transaction not subject to a financing condition provides certainty of value and immediate liquidity.

- Removal of Uncertainty and Execution Risk: The Transaction daylights value for Minority Shareholders, and removes uncertainty and risk around the development of NewRange and the generally uncertain macroeconomic environment.

- Limited Conditions and Short Timeline to Closing: Upon satisfaction of shareholder approval, court approval, and certain customary closing conditions, the Transaction is expected to close shortly after the shareholder meeting, which is expected to occur in the late third quarter or early fourth quarter.

- Special Committee Formation and Arm's Length Negotiations: The PolyMet Board of Directors (the "Board") established the Special Committee to consider the proposed Transaction, as well as other alternatives, and the Agreement was negotiated at arm's length between the Special Committee, with support from its legal and financial advisors, and Glencore.

- Fairness Opinions and Formal Valuation: Paradigm Capital Inc. ("Paradigm") and Maxit Capital LP ("Maxit") both delivered oral opinions that the consideration to be received by the Minority Shareholders pursuant to the Transaction is fair, from a financial point of view, to such Minority Shareholders. Maxit also conducted a formal valuation, determining the fair market value of the PolyMet common shares, as of July 15, 2023, to be in a range of US$1.40 to US$2.50 per share, placing the Consideration above the mid-point of the range.

- Support and Voting Agreements: All directors and officers owning PolyMet shares have entered into support and voting agreements to vote their PolyMet shares in favor of the Transaction.

Al Hodnik, Lead Independent Director and Chair of the Independent Special Committee, welcomed the Transaction as:

"The necessary next step for advancement of the NewRange Copper Nickel joint venture and the development of strategic minerals vital to our economy's clean energy transformation. The Special Committee strived to maximize value for our Minority Shareholders in light of the uncertain permitting environment and associated judicial outcomes as well as the likely need for further substantial financing to meet the company's obligations to NewRange. The Transaction provides the company's Minority Shareholders with an opportunity to realize an attractive cash premium for their shares with limited closing risk. As such, the Transaction is unanimously recommended by the independent Special Committee of the Company and the Board (excluding conflicted directors). We want to thank our loyal and devoted Minority Shareholders, and in particular our Minnesota stakeholders, who have supported the company for nearly two decades."

Special Committee and Board Approval

The Special Committee was established by the Board to consider the Transaction, as well as other alternatives available to the company and, if it deemed advisable, to negotiate with Glencore. Following a comprehensive evaluation of reasonably available alternatives to the proposal and extensive negotiations with Glencore on price and other terms of the Transaction, the Special Committee unanimously recommended that the Board approve the Transaction. The Board (excluding conflicted directors), having received the unanimous recommendation of the Special Committee, unanimously determined that the Transaction is in the best interests of PolyMet and fair to the Minority Shareholders and recommends that shareholders vote in favor of the Transaction at the special meeting of shareholders to be held to approve the Transaction.

Formal Valuation and Fairness Opinions

In connection with its review of the Transaction, the Special Committee retained Maxit to prepare a formal valuation in accordance with Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions. Maxit delivered an oral opinion to the Special Committee that, as of July 15, 2023, and based on Maxit's analysis and subject to the assumptions, limitations and qualifications to be set forth in Maxit's written valuation, the fair market value of the common shares of PolyMet is in the range of US$1.40 to US$2.50 per share. Maxit also delivered an oral opinion to the Special Committee that, as of July 15, 2023, and subject to the assumptions, limitations and qualifications to be set forth in Maxit's written fairness opinion, the consideration to be received by the Minority Shareholders is fair, from a financial point of view, to such Minority Shareholders.

The company retained Paradigm as its financial advisor in connection with its review of the Transaction. Paradigm delivered an oral opinion to the company, the Special Committee and the Board that, as of July 15, 2023 and subject to the assumptions, limitations and qualifications to be set forth in Paradigm's written fairness opinion, the consideration to be received by the Minority Shareholders pursuant to the Transaction is fair, from a financial point of view, to such Minority Shareholders.

Transaction Details

The Transaction is to be effected by way of a court-approved plan of arrangement under the Business Corporations Act (British Columbia). The consummation of the Transaction is subject to a number of conditions customary to transactions of this nature, including, among others: (i) the approval of two-thirds of votes cast by the company's shareholders (including Glencore) at a special meeting of shareholders; (ii) the approval of a simple majority of the votes cast by disinterested shareholders at such meeting; and (iii) court approval. Completion of the Transaction is not subject to any financing condition.

The company expects to hold the special meeting of shareholders to consider and to vote on the Transaction as early as possible. It is anticipated to occur at the end of the third quarter of 2023 or early in the fourth quarter of 2023. If approved at the meeting, the Transaction is expected to close shortly thereafter, subject to court approval and other customary closing conditions.

Support and Voting Agreements

All directors and officers of the company representing 0.44% of the issued and outstanding common shares have entered into support and voting agreements to vote their PolyMet shares in favor of the Transaction.

Early Warning Disclosure

Glencore currently holds 159,806,774 PolyMet common shares, representing approximately 82.18% of the issued and outstanding common shares. Glencore also holds a purchase warrant (the "2019 Warrant"), pursuant to which Glencore is entitled to purchase 811,190 PolyMet common shares at an exercise price of US$5.87 per share. Assuming exercise of the 2019 Warrant, Glencore would hold a total of 160,617,964 PolyMet common shares, representing approximately 82.25% of the issued and outstanding common shares.

The head office of PolyMet is located at 444 Cedar Street, Suite 2060, St. Paul, Minnesota 55101.

The head office of Glencore is located at Baarermattstrasse 3, CH-6340 Baar, Switzerland.

This disclosure is being provided pursuant to National Instrument 62-103. Persons who wish to obtain a copy of the early warning report to be filed by Glencore in connection with this transaction may obtain a copy of such report from www.sedar.com or by contacting the Glencore contact persons named below.

Advisors

Paradigm is acting as financial advisor to the company and Maxit has been retained by the Special Committee as an independent advisor and valuator.

PolyMet has engaged Farris LLP, as its Canadian counsel and Troutman Pepper Hamilton Sanders LLP, as its U.S. counsel and the Special Committee has engaged Mason Law as its independent legal advisor in connection with the Transaction. Glencore has engaged McCarthy Tétrault LLP, as its Canadian counsel and Weil, Gotshal & Manges LLP, as its U.S. counsel in connection with the Transaction.

Laurel Hill Advisory Group is acting as shareholder communications advisor and proxy solicitation agent to PolyMet.

Additional Information about the Transaction

Further details regarding the terms and conditions of the Transaction are set out in the Agreement, which will be publicly filed by the company under its profiles at www.sedar.com and www.sec.gov. In connection with the Transaction, the company will prepare and mail an information circular to its shareholders. In addition, certain participants in the proposed Transaction (including the company, certain of its affiliates and certain affiliates of Glencore) intend to jointly file a transaction statement on Schedule 13E-3. These documents will be filed with or furnished to the United States Securities and Exchange Commission (the "SEC"). This communication is not a substitute for the information circular or any other document that the company may file with the SEC or send to its shareholders in connection with the proposed Transaction. SHAREHOLDERS ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THESE MATERIALS AND OTHER MATERIALS FILED WITH OR FURNISHED TO THE SEC WHEN THEY BECOME AVAILABLE, AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT POLYMET, THE PROPOSED TRANSACTION AND RELATED MATTERS. In addition to receiving the information circular and Schedule 13E-3 transaction statement by mail, shareholders also will be able to obtain these documents, as well as other filings containing information about PolyMet, the proposed Transaction and related matters, without charge, from www.sedar.com or www.sec.gov.

No Offer or Solicitation

This communication is not a proxy statement or solicitation of proxy, consent or authorization with respect to the proposed Transaction and is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Participants in the Solicitation

The company and certain of its directors, executive officers and other employees, under the SEC's rules, may be deemed to be participants in the solicitation of proxies of the company's shareholders in connection with the proposed Transaction. Additional information regarding the interests of those participants and other persons who may be deemed participants in the proposed Transaction and their respective direct and indirect interests in the proposed Transaction, by security holdings or otherwise, will be included in the information circular and other materials filed with the SEC and/or Canadian securities authorities in connection with the proposed Transaction (if and when they become available).

* * * * *

About PolyMet

PolyMet is a mine development company holding a 50% interest in NewRange Copper Nickel LLC, a joint venture with Teck Resources. NewRange Copper Nickel holds the NorthMet and Mesaba copper, nickel, cobalt and platinum group metal (PGM) deposits, two globally significant clean energy mineral resources located in the Duluth Complex in northeast Minnesota. The Duluth Complex is one of the world's major, undeveloped copper, nickel and PGM metal mining regions. NorthMet is the first large-scale project to have received permits within the Duluth Complex. For more information: www.polymetmining.com.

About Glencore

Glencore is one of the world's largest global diversified natural resource companies and a major producer and marketer of more than 60 commodities that advance everyday life. Through a network of assets, customers and suppliers that spans the globe, Glencore produces, processes, recycles, sources, markets and distributes the commodities that support decarbonisation while meeting the energy needs of today.

With around 140,000 employees and contractors and a strong footprint in over 35 countries in both established and emerging regions for natural resources, our marketing and industrial activities are supported by a global network of more than 40 offices.

Glencore’s customers are industrial consumers, such as those in the automotive, steel, power generation, battery manufacturing and oil sectors. We also provide financing, logistics and other services to producers and consumers of commodities.

Glencore is proud to be a member of the Voluntary Principles on Security and Human Rights and the International Council on Mining and Metals. We are an active participant in the Extractive Industries Transparency Initiative.

We recognise our responsibility to contribute to the global effort to achieve the goals of the Paris Agreement by decarbonising our own operational footprint. We believe that we should take a holistic approach and have considered our commitment through the lens of our global industrial emissions. Against a 2019 baseline, we are committed to reducing our Scope 1, 2 and 3 industrial emissions by 15% by the end of 2026, 50% by the end of 2035 and we have an ambition to achieve net zero industrial emissions by the end of 2050. For more detail see our 2022 Climate Report on the publication page of our website at glencore.com/publications.

Disclaimer

The companies in which Glencore plc directly and indirectly has an interest are separate and distinct legal entities. In this section, “Glencore”, “Glencore group” and “Group” are used for convenience only where references are made to Glencore plc and its subsidiaries in general. These collective expressions are used for ease of reference only and do not imply any other relationship between the companies. Likewise, the words “we”, “us” and “our” are also used to refer collectively to members of the Group or to those who work for them. These expressions are also used where no useful purpose is served by identifying the particular company or companies.

For further information, please contact:

Media

Bruce Richardson, Corporate Communications

Tel: +1 (651) 389-4111

M: +1 (651) 964-9729

Email: brichardson@polymetmining.com

Shareholder Communications

Laurel Hill Advisory Group

North American Toll Free: 1-877-452-7184 (or 416-304-0211 for shareholders outside North America)

Email: assistance@laurelhill.com

Glencore AG

Investors

Martin Fewings

t: +41 41 709 28 80

m: +41 79 737 56 42

Email: martin.fewings@glencore.com

Media

Charles Watenphul

t: +41 41 709 24 62

m: +41 79 904 33 20

Email: charles.watenphul@glencore.com

PolyMet Disclosures

This news release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which include all statements that do not relate solely to historical or current facts, such as statements regarding PolyMet's expectations, intentions or strategies regarding the future, including strategies or plans as they relate to the proposed Transaction. Forward-looking statements are frequently, but not always, identified by words such as "expects," "anticipates," "believes," "intends," "estimates," "potential," "possible," "projects," "plans," and similar expressions, or statements that events, conditions or results "will," "may," "could," or "should" occur or be achieved or their negatives or other comparable words. Forward-looking statements relate to future events or future performance and reflect management's expectations or beliefs regarding future events including, but not limited to, statements with respect to the Transaction and other statements that are not historical facts. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected and are subject to a number of known and unknown risks and uncertainties, including: (i) uncertainties as to the timing of the proposed Transaction; (ii) the risk that the proposed Transaction may not be completed in a timely manner or at all, which may adversely affect PolyMet's business and the price of PolyMet's shares; (iii) the possibility that competing offers or acquisition proposals for PolyMet will be made; (iv) the failure to satisfy any of the conditions to the consummation of the proposed Transaction, including the adoption of the Agreement by PolyMet's shareholders; (v) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the Agreement, including in certain circumstances requiring PolyMet to pay a termination fee; (vi) the effect of the announcement or pendency of the proposed Transaction on PolyMet's stock price, business relationships, operating results and business generally; (vii) risks that the proposed Transaction may disrupt PolyMet's current business plans and operations; (viii) PolyMet's ability to retain and hire key personnel in light of the proposed Transaction; (ix) risks related to diverting management's attention from PolyMet's ongoing business operations; (x) unexpected costs, charges or expenses resulting from the proposed Transaction; (xi) potential litigation relating to the proposed Transaction that could be instituted against parties to the Agreement or other transaction agreements or their respective directors, managers or officers, including the effects of any outcomes of such litigation; and (xii) certain restrictions during the pendency of the Transaction that may impact the Company's ability to pursue certain business opportunities or strategic transactions. All such factors are difficult to predict and are beyond PolyMet's control. While the list of risks and uncertainties presented here is, and the discussion of risks and uncertainties to be presented in the information circular will be, considered representative, no such list or discussion should be considered a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, and legal liability to third parties and similar risks, any of which could have a material adverse effect on the completion of the proposed Transaction and/or PolyMet's consolidated financial condition and results of operations. In light of the significant uncertainties in these forward-looking statements, PolyMet cannot assure you that the forward-looking statements in this communication will prove to be accurate, and you should not regard these statements as a representation or warranty by PolyMet, its directors, officers or employees or any other person that PolyMet will achieve its objectives and plans in any specified time frame, or at all.

The forward-looking statements speak only as of the date they are made. PolyMet undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements.

Specific reference is also made to risk factors and other considerations underlying forward-looking statements discussed in PolyMet's most recent Annual Report on Form 40-F for the fiscal year ended December 31, 2022, and in our other filings with Canadian securities authorities and the U.S. Securities and Exchange Commission.

The Annual Report on Form 40-F also contains the company's mineral resource and other data as required under National Instrument 43-101.

No regulatory authority has reviewed or accepted responsibility for the adequacy or accuracy of this release.

ARRANGEMENT AGREEMENT

POLYMET MINING CORP.

- and -

GLENCORE AG

July 16, 2023

TABLE OF CONTENTS

Page

ARRANGEMENT AGREEMENT

THIS AGREEMENT is made July 16, 2023

between

POLYMET MINING CORP., a corporation existing under the laws of British Columbia

(hereinafter referred to as the "Company")

and

GLENCORE AG, a corporation existing under the laws of Switzerland

(hereinafter referred to as the "Purchaser").

WHEREAS the Purchaser proposes to acquire all of the issued and outstanding Company Shares (as defined herein) other than the Company Shares owned by the Purchaser and its affiliates (as defined below) and, with the Company to concurrently cause the repurchase for cancellation or cancellation of all outstanding Company Options (as defined herein), Company RSUs (as defined herein), Company DSUs (as defined herein), Company Restricted Stock (as defined herein) and Company Bonus Share Entitlements (as defined herein), pursuant to the Arrangement (as defined herein), all as provided for in this Agreement;

AND WHEREAS the Special Committee (as defined herein), has received each of the Valuation (as defined herein) and the Fairness Opinions (as defined herein) and, after consultation with its financial and legal advisors, has unanimously (a) determined that the Arrangement is in the best interests of the Company and is fair to the Company Shareholders (as defined herein), other than the Purchaser; (b) recommended that Company Shareholders vote in favour of the Arrangement Resolution (as defined herein); and (c) recommended that the Company Board (as defined herein): (i) approve the Arrangement; and (ii) recommend that Company Shareholders vote in favour of the Arrangement Resolution;

AND WHEREAS the Company Board has received the Valuation and the Fairness Opinions, and after receiving legal and financial advice and the recommendation of the Special Committee, has unanimously (with those members of the Company Board who are not members of the Special Committee abstaining from voting): (a) determined that the Arrangement is in the best interests of the Company and is fair to the Company Shareholders; and (b) recommended that Company Shareholders vote in favour of the Arrangement Resolution;

AND WHEREAS the Purchaser has entered into the Support Agreements (as defined herein) with the Supporting Company Shareholders (as defined herein);

NOW THEREFORE THIS AGREEMENT WITNESSES that, in consideration of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by each Party, the Parties hereby covenant and agree as follows:

ARTICLE 1 - INTERPRETATION

1.01 Definitions

In this Agreement, unless something in the subject matter or context is inconsistent therewith, the following terms shall have the respective meanings set out below and grammatical variations shall have the corresponding meanings:

"1933 Act" means the U.S. Securities Act of 1933;

"1934 Act" means the U.S. Securities Exchange Act of 1934;

"ABC Violation" means any violation, or activity or conduct which would amount to a violation but for jurisdictional reasons, of any Anti-Corruption Laws, any Anti-Money Laundering Laws or any Trade Sanctions;

"Acceptable Confidentiality Agreement" means a confidentiality agreement between the Company and a third party other than the Purchaser that: (a) is entered into in accordance with Section 6.01(c) and (b) contains terms that are no less restrictive than set out in the form of acceptable confidentiality agreement agreed to by the Company and the Purchaser prior to the execution of this Agreement;

"Acquisition Agreement" has the meaning given to it in Section 6.01(e);

"Acquisition Proposal" means, at any time, whether or not in writing, any:

(a) proposal with respect to: (i) any direct or indirect acquisition by any person or group of persons of Company Shares (or securities convertible into or exchangeable or exercisable for Company Shares) representing 20% or more of the Company Shares then outstanding (assuming, if applicable, the conversion, exchange or exercise of such securities convertible into or exchangeable or exercisable for Company Shares); (ii) any plan of arrangement, amalgamation, merger, share exchange, consolidation, recapitalization, liquidation, dissolution or other business combination in respect of the Company or any of the Company's Subsidiaries; or (iii) any direct or indirect acquisition by any person or group of persons of any assets of the Company and/or any interest in one or more of the Company's Subsidiaries (including shares or other equity interest of the Company's Subsidiaries) that hold an interest, direct or indirect, in JVCo or that individually or in the aggregate constitute or hold 20% or more of the fair market value of the assets of the Company and the Company's Subsidiaries (taken as a whole) based on the most recently publicly filed Financial Statements prior to such time (or any lease, license, royalty, joint venture, long term supply agreement or other arrangement having a similar economic effect to any of the foregoing), whether in a single transaction or a series of related transactions;

(b) inquiry, expression or other indication of interest or offer to, or public announcement of or of an intention to do any of the foregoing;

(c) modification or proposed modification of any such proposal, inquiry, expression or indication of interest, in each case excluding the Arrangement and the other transactions contemplated by this Agreement; or

(d) transaction or agreement which could reasonably be expected to materially impede or delay the completion of the Arrangement;

"Additional Other Filings" has the meaning given to it in Section 5.07;

"affiliate" has the meaning given to it under National Instrument 45-106 - Prospectus Exemptions, provided that, for purposes of this Agreement, unless expressly stated otherwise, a reference to an affiliate of the Purchaser excludes the Company and its Subsidiaries and a reference to an affiliate of the Company excludes the Purchaser or its Subsidiaries that are not also Subsidiaries of the Company;

"Agreement" means this arrangement agreement;

"Annual Financial Statements" means the audited financial statements of the Company as at, and for the years ended, December 31, 2022 and December 31, 2021 including the notes thereto;

"Anti-Corruption Laws" means:

(a) the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions, 1997 (the "OECD Convention");

(b) the U.S. Foreign Corrupt Practices Act of 1977, as amended (the "FCPA");

(c) the UK Bribery Act 2010, Prevention of Corruptions Act 1906 and the 1916 and Public Bodies Corrupt Practices Act 1889; and

(d) any other applicable law (including any: (i) statute, ordinance, rule or regulation; (ii) order of any court, tribunal or any other judicial body; and (iii) rule, regulation, guideline or order of any public body, or any other administrative requirement) which:

(i) prohibits the conferring of any gift, payment or other benefit to any person or any officer, employee, agent or advisor of such person; and/or

(ii) is broadly equivalent to the FCPA and/or the above United Kingdom laws or was intended to enact the provisions of the OECD Convention or which has as its objective the prevention of corruption;

"Anti-Money Laundering Laws" means all laws and regulations related to money laundering and financial record keeping, including related reporting requirements which are applicable to any of the Purchaser, the Company, PolyMet US or JVCo;

"Applicable Pension Legislation" means, at any time, any applicable Canadian or United States federal, state or provincial pension legislation, including all regulations made thereunder and all rules, regulations, rulings, guidelines, directives and interpretations made or issued by any Governmental Entity in Canada or the United States having or asserting jurisdiction in respect thereof;

"Arrangement" means an arrangement under Division 5 of Part 9 of the BCBCA in accordance with the terms and subject to the conditions set out in the Plan of Arrangement, subject to any amendments or variations to the Plan of Arrangement made in accordance with the terms of this Agreement, the Plan of Arrangement and the Interim Order (once issued) or made at the direction of the Court in the Final Order with the prior written consent of the Company and the Purchaser, each acting reasonably;

"Arrangement Resolution" means the special resolution to be considered and, if thought fit, passed by the Company Shareholders at the Company Meeting to approve the Arrangement, to be substantially in the form and content of Schedule B;

"BCBCA" means the Business Corporations Act (British Columbia);

"Benefit Plans" means all employee benefit plans or arrangements that are not Pension Plans, including all profit sharing, savings, supplemental retirement, retiring allowance, severance, pension, deferred compensation, stock, stock option, welfare, bonus, incentive compensation, phantom stock, legal services, supplementary unemployment benefit plans or arrangements and all life, health, dental and disability plans and arrangements in which the employees or former employees of the Company participate or are eligible to participate;

"Board of Managers" means the committee established under Article 5 of the Joint Venture Agreement to manage JVCo;

"Business Day" means any day, other than a Saturday or a Sunday, upon which banks are open for business in the City of Vancouver, Canada and the City of Zurich, Switzerland;

"Change of Recommendation" has the meaning given to it in Section 7.01(c)(i);

"Closing Notice" has the meaning given to it in Section 2.07;

"Code" means the United States Internal Revenue Code of 1986;

"Combination Agreement" means the combination agreement dated as of July 19, 2022 among Teck Resources Limited and the Company, and certain others;

"commercially reasonable efforts" with respect to any Party means the cooperation of such Party and the use by such Party of its reasonable efforts consistent with reasonable commercial practice without payment or incurrence of any material liability or obligation;

"Company" has the meaning given to it in the preamble;

"Company Board" means the board of directors of the Company;

"Company Bonus Share Entitlements" means the right of a director, officer, consultant or key employee of the Company to receive a Company Share upon the achievement of certain milestones pursuant to the Company's bonus share incentive plan adopted by the Company Board on November 5, 2003 and approved by disinterested Company Shareholders, as set out in Exhibit A to Schedule C.

"Company Circular" means the notice of the Company Meeting and accompanying management information circular to be sent to the Company Shareholders in connection with the Company Meeting;

"Company DSUs" means the outstanding deferred share units of the Company granted under the Company Share Compensation Plan;

"Company Meeting" means the special meeting of the Company Shareholders, including any adjournment or postponement thereof, called and held in accordance with the Interim Order for the purpose of considering and, if thought fit, approving the Arrangement Resolution;

"Company Options" means the outstanding options to purchase Company Shares granted under the Company Share Compensation Plan;

"Company Restricted Stock" means the outstanding Company Shares granted as restricted stock under the Company Share Compensation Plan;

"Company RSUs" means the outstanding restricted share units of the Company granted under the Company Share Compensation Plan;

"Company Securityholders" means, collectively, the Company Shareholders, the holders of Company Options, the holders of Company RSUs, the holders of Company DSUs, the holders of Company Restricted Stock and the holders of Company Bonus Share Entitlements;

"Company Share Compensation Plan" means the omnibus share compensation plan as approved by the Company Shareholders on June 16, 2021;

"Company Shareholder Approval" has the meaning given to it in Section 2.02(c);

"Company Shareholders" means the holders of the Company Shares;

"Company Shares" means the common shares of the Company;

"Consideration" has the meaning given to it in the Plan of Arrangement;

"Constating Documents" means notices of articles, articles, articles of incorporation, amalgamation, or continuation, as applicable, by-laws, limited partnership agreement or other constating documents;

"Contracts" means contracts, licences, leases, agreements, obligations, promises, undertakings, understandings, arrangements, documents, commitments, entitlements or engagements to which the applicable person is a party or by which it is legally bound or under which such person has, or will have, any liability or contingent liability (in each case, whether written or oral, express or implied);

"Contractual Arrangements" has the meaning given to it in Section 5.07;

"Court" means the Supreme Court of British Columbia or other competent court, as applicable;

"Depositary" means any trust company, bank or other financial institution agreed to in writing by each of the Parties, each acting reasonably, for the purpose of, among other things, exchanging certificates representing Company Shares for the Consideration in connection with the Arrangement;

"Disclosure Documents" means the Company's management information circular dated April 26, 2023, the Company's annual information form for the year ended December 31, 2022 dated as at March 23, 2023; and the audited consolidated financial statements and accompanying management's discussion and analysis and all interim financial statements, interim management's discussion and analyses and material change reports filed pursuant to applicable Securities Laws since December 31, 2022; any material change report required to be filed under Securities Laws since December 31, 2022; the Company's Annual Report on Form 40-F for the fiscal year ended December 31, 2022; and all other reports filed by the Company pursuant to the 1934 Act since December 31, 2022;

"Disclosure Letter" means the disclosure letter executed by the Company and delivered to and accepted by the Purchaser as of the date of this Agreement;

"Dissent Rights" has the meaning given to it in the Plan of Arrangement;

"Dissenting Holder" has the meaning given to it in the Plan of Arrangement;

"Effective Date" has the meaning given to it in the Plan of Arrangement;

"Effective Time" has the meaning given to it in the Plan of Arrangement;

"Encumbrance" means any hypothec, mortgage, pledge, security interest, encumbrance, lien, charge, deposit arrangement, lease, adverse claim, right of set-off or agreement, trust, deemed trust or any other arrangement or condition that in substance secures payment or performance of an obligation of the Company, PolyMet US or JVCo, statutory and other non-commercial leases or encumbrances and includes the interest of a vendor or lessor under any conditional sale agreement, capital lease or other title retention agreement;

"Environmental Laws" has the meaning given to it in Section (u) of Schedule C;

"Erie Plant" means the taconite concentrator and pellet plant and supporting infrastructure and surrounding lands owned by JVCo located approximately six miles west of the NorthMet Deposit, together with all related property and assets;

"Fairness Opinions" means the opinions of each of Paradigm Capital Inc. and Maxit Capital LP to the effect that, as of the date of such opinion and subject to the assumptions, qualifications and limitations set forth therein, the Arrangement is fair, from a financial point of view, to the Company Shareholders (other than the Purchaser and its affiliates);

"Final Order" means the final order of the Court approving the Arrangement pursuant to Section 291 of the BCBCA, in form and substance acceptable to the Company and the Purchaser, each acting reasonably, as such order may be amended, modified or varied by the Court (with the written consent of both the Company and the Purchaser, each acting reasonably) at any time prior to the Effective Date or, if appealed, then, unless such appeal is withdrawn or denied, as affirmed or as varied on appeal (provided that any such variation is acceptable to both the Company and the Purchaser, each acting reasonably);

"Financial Statements" means the Annual Financial Statements and the Interim Financial Statements;

"Governmental Entity" means: (a) any national, federal, provincial, state, county, municipal, local, tribal or foreign government or any entity exercising executive, legislative, judicial, regulatory, taxing, or administrative functions of or pertaining to government (including the TSX, NYSE American or any other stock exchange); (b) any public international organization; (c) any agency, division, bureau, department, or other political subdivision of any government, entity or organization described in Section (a) or Section (b) above; or (d) any company, business, enterprise, or other entity owned, in whole or in part, or controlled by any government, entity, organization, or other person described in Section (a), Section (b) or Section (c) above exercising executive, legislative, judicial, regulatory, taxing or administrative functions;

"IFRS" means international financial reporting standards, as issued by the International Accounting Standard Board and as adopted in Canada, as in effect from time to time;

"Intellectual Property Rights" has the meaning given to it in (t) of Schedule C;

"Interim Financial Statements" means the interim condensed consolidated financial statements of the Company for the three months ended March 31, 2023, including the notes thereto;

"Interim Order" means the interim order of the Court pursuant to Section 291 of the BCBCA in form and substance acceptable to both the Company and the Purchaser, each acting reasonably, providing for, among other things, the calling and holding of the Company Meeting, as such order may be varied by the Court with the prior written consent of both the Company and the Purchaser, each acting reasonably;

"Investor Rights Agreement" means the investor rights and governance agreement dated as of February 14, 2023 between the Company and the Purchaser;

"Joint Venture Agreement" means the Amended and Restated Limited Liability Company Agreement of JVCo, dated as of February 14, 2023;

"JVCo" means NewRange Copper Nickel LLC, a limited liability company existing under the laws of the State of Delaware;

"knowledge of the Company" means the actual or constructive knowledge of the Chief Executive Officer and/or the Chief Financial Officer of the Company, after due inquiry consistent with such individual position with the Company;

"laws" means any and all applicable laws including all statutes, codes, ordinances, decrees, rules, regulations, municipal by-laws, judicial or arbitral or administrative or ministerial or departmental or regulatory judgments, orders, decisions, rulings or awards, or instruments, and general principles of common law and equity, binding on or affecting the person referred to in the context in which the word is used;

"Lease" has the meaning given to it in Section (m)(vii) of Schedule C;

"Leased Real Property" has the meaning given to it in Section (m)(v) of Schedule C;

"Litigation" has the meaning given to it in Section 5.01(k);

"LLC" has the meaning given to it in Section (h)(i)(A) of Schedule C;

"M3 Technical Report" means the technical report entitled "NorthMet Copper-Nickel Project" dated December 30, 2022 prepared by M3 Engineering & Technology Corp.;

"Material Adverse Effect" means any event, occurrence or condition (or series of related events, occurrences or conditions) which, individually or in the aggregate, could reasonably be expected to have a material adverse effect on or results in a material adverse change in any of the following:

(a) the condition (financial or otherwise), business, assets or results of operations of the Company and its Subsidiaries considered as a whole or JVCo;

(b) the ability of the Company to perform any of its obligations under the terms of this Agreement; and

(c) the validity or enforceability of any of this Agreement or the rights and remedies of the Purchaser under the terms of this Agreement,

except any such effect resulting from or arising in connection with:

(a) any change in IFRS;

(b) any change in the global, national or regional political conditions (including the outbreak of war or acts of terrorism) or in the general economic, business, regulatory, political or market conditions or in the national or global financial or capital markets;

(c) any change in the industry in which the Company and its Subsidiaries or JVCo operates,

provided that for the purposes of Section (b) and Section (c) exceptions above, such effect does not primarily relate to (or have the effect primarily relating to) the Company and its Subsidiaries (considered as a whole) or JVCo or disproportionately adversely affects the Company and its Subsidiaries (considered as a whole) or JVCo compared to other entities operating in the industries in which the Company and its Subsidiaries or JVCo operate;

"Material Agreement" means: (a) those agreements listed on Section (r) of the Disclosure Letter; and (b) those agreements of the Company, PolyMet US or JVCo, the breach, non-performance or cancellation of which or the failure of which to renew could reasonably be expected to have a Material Adverse Effect;

"material fact" has the meaning given to it in the Securities Act;

"Mesaba Project" means the nonferrous mine development project proposed by Teck US in respect of the mining concessions, whether leasehold or fee interests, comprising a portion of the assets contributed by Teck US to JVCo pursuant to the Combination Agreement, as further identified in Section (v) of the Disclosure Letter;

"Mesaba Technical Report" means the technical report entitled "Mesaba Project Form NI 43-101F1 Technical Report, Minnesota, USA" dated November 28, 2022 prepared by Independent Mining Consultants, Inc. and JDS Energy & Mining Inc.;

"MI 61-101" means Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions;

"Mineral Rights" has the meaning given to it in Section (v) of Schedule C;

"Non-Material Subsidiaries" has the meaning given to it in Section (c)(ii) of Schedule C;

"NorthMet Deposit" means the polymetallic copper-nickel-cobalt-platinum group element deposit situated on mineral leases of approximately 4,200 acres located in St. Louis County in northeastern Minnesota, U.S.A., at approximately latitude 47° 36' north, longitude 91° 58' west, about 70 miles north of the City of Duluth and 6.5 miles south of the town of Babbitt, together with all related property and assets but, for the avoidance of doubt, excluding all property and assets included in the Mesaba Project;

"NorthMet Project" means the mining project comprised of the NorthMet Deposit and the Erie Plant;

"NYSE American" means the NYSE American, LLC;

"Outside Date" means December 31, 2023, or such later date as the Parties may agree to in writing;

"Other Filings" has the meaning given to it in Section 5.07;

"Owned Real Property" has the meaning given to it in Section (m)(iv) of Schedule C;

"Parties" means the Purchaser and the Company, and "Party" means either of them;

"Pension Plan" means any plan, program, agreement or arrangement for the purpose of Applicable Pension Legislation or under the Tax Act (whether or not required under such law) that is maintained or contributed to or to which there is or may be an obligation to contribute by the Company, PolyMet US or JVCo in respect of their respective employees or former employees;

"Permit" means any license, permit, certificate, consent, order, grant, approval, classification, registration or other authorization of or from any Governmental Entity;

"Permitted Encumbrances" means the following types of encumbrances: (a) statutory Encumbrances of landlords and Encumbrances of carriers, warehousemen, mechanics, suppliers, material men, repairmen and other Encumbrances imposed by law incurred in the ordinary course of business and Encumbrances for Taxes, assessments or governmental charges or claims, in either case, for sums not yet overdue or being contested in good faith by appropriate proceedings, if such reserve or other appropriate provision, if any, as shall be required by IFRS shall have been made in respect thereof; (b) Encumbrances incurred or deposits made in the ordinary course of business in connection with workers' compensation, unemployment insurance and other types of social security, or to secure the performance of tenders, statutory obligations, surety and appeal bonds, bids, leases, government contracts, performance and return-of-money bonds and other similar obligations (exclusive of obligations for the payment of borrowed money); (c) Encumbrances upon specific items of inventory or other goods and proceeds of any person securing such person's obligations in respect of bankers' acceptances issued or created for the account of such person to facilitate the purchase, shipment or storage of such inventory or other goods; (d) Encumbrances encumbering deposits made to secure obligations arising from statutory, regulatory, contractual or warranty requirements of the Company, PolyMet US or JVCo, including rights of offset and setoff; (e) bankers' liens, rights of setoff and other similar Encumbrances existing solely with respect to cash on deposit in one or more accounts maintained by the Company, PolyMet US or JVCo, in each case granted in the ordinary course of business in favour of the bank or banks with which such accounts are maintained, securing amounts owing to such bank with respect to cash management and operating account arrangements, including those involving pooled accounts and netting arrangements; provided, however, that in no case shall any such Encumbrances secure (either directly or indirectly) the repayment of any debt; (f) leases or subleases (or any Encumbrances related thereto) granted to others that do not materially interfere with the ordinary course of business of the Company, PolyMet US or JVCo; (g) attachment or judgment Encumbrances which are being contested in good faith by appropriate proceedings; (h) easements, rights-of-way, restrictions and other similar charges or encumbrances not materially interfering with the ordinary course of business of the Company, PolyMet US or JVCo; (i) zoning restrictions, licenses, restrictions on the use of real property or minor irregularities in title thereto, which do not materially impair the use of such real property in the ordinary course of business of the Company and its Subsidiaries or JVCo or the value of such real property for the purpose of such business; and (j) Encumbrances securing hedging obligations entered into for bona fide hedging purposes of the Company, PolyMet US or JVCo not for the purpose of speculation;

"person" includes an individual, firm, limited or general partnership, limited liability company, unlimited liability company, limited liability partnership, trust, joint venture, venture capital fund, association, body corporate, corporation, company, unincorporated organization, trustee, estate, executor, administrator, legal representative, government (including any Governmental Entity) or any other entity, whether or not having legal status;

"Plan of Arrangement" means the plan of arrangement substantially in the form and content set out in Schedule A hereto, as amended, modified or supplemented from time to time in accordance with this Agreement or Article 5 of the Plan of Arrangement, or at the direction of the Court in the Final Order, with the consent of the Company and the Purchaser, each acting reasonably;

"PolyMet US" means PolyMet US, Inc., a Delaware corporation;

"Proceeding" means any court, administrative, regulatory or similar proceeding (whether civil, quasi-criminal or criminal), arbitration or other dispute settlement procedure, investigation or inquiry before or by any Governmental Entity, or any claim, action, suit, demand, arbitration, charge, indictment, hearing, demand letter or other similar civil, quasi-criminal or criminal, administrative or investigative matter or proceeding;

"Purchaser" has the meaning given to it in the preamble;

"Regulatory Approvals" means sanctions, rulings, consents, orders, exemptions, permits, waivers, early termination authorizations, clearances, written confirmations of no intention to initiate legal proceedings and other approvals (including the lapse, without objection, of a prescribed time under a statute or regulation that states that a transaction may be implemented if a prescribed time lapses following the giving of notice without an objection being made) of Governmental Entities;

"Representatives" means, collectively, with respect to a Party, that Party's officers, directors, employees, consultants, advisors, agents or other representatives (including lawyers, accountants, investment bankers and financial advisors);

"Sarbanes Oxley Act" means the Sarbanes-Oxley Act of 2002 and all rules and regulations promulgated thereunder;

"Schedule 13E-3" means a Schedule 13E-3 transaction statement under Section 13(e) of the 1934 Act and Rule 13E-3 thereunder;

"SEC" means the U.S. Securities and Exchange Commission;

"Securities Act" means the Securities Act (Ontario) and the rules, regulations and published policies made thereunder;

"Securities Authorities" means the TSX, the Ontario Securities Commission, the SEC, the NYSE American and the applicable securities commissions and other securities regulatory authorities in each of the other provinces and territories of Canada;

"Securities Laws" means the Securities Act, together with all other applicable Canadian provincial and territorial securities laws, rules and regulations and published policies thereunder, the 1933 Act, the 1934 Act and all other applicable U.S. federal and state securities laws and rules and regulations promulgated thereunder, together with the applicable rules of the TSX and NYSE American;

"Special Committee" means the special committee of independent directors of the Company constituted to consider, among other things, the transactions contemplated by this Agreement;

"Subsidiary" has the meaning given to it in National Instrument 45-106 - Prospectus Exemptions, provided that, for purposes of this Agreement, a reference to a Subsidiary of the Purchaser excludes the Company and its Subsidiaries;

"Superior Proposal" means an unsolicited bona fide Acquisition Proposal (provided, however, that for the purposes of this definition, all references to "20%" in the definition of "Acquisition Proposal" shall be changed to "100%") made in writing on or after the date of this Agreement by a third party or parties acting jointly (other than the Purchaser and its affiliates) that: (i) did not result from or involve a breach of Article 6; and (ii) which or in respect of which:

(a) the Company Board (based on, among other things, the recommendation of the Special Committee) has determined in good faith, after consultation with its financial advisors and outside legal counsel, that such Acquisition Proposal would, taking into account all of the terms and conditions of such Acquisition Proposal (including all legal, financial, regulatory and other aspects of such Acquisition Proposal and the person or group of persons making such Acquisition Proposal and their respective affiliates), if consummated in accordance with its terms (but not assuming away any risk of non-completion), result in a transaction which is more favourable to the Company Shareholders from a financial point of view than the Arrangement (taking into account any amendments to this Agreement and the Arrangement proposed by the Purchaser pursuant to Section 6.01(f));

(b) is made available to all of the Company Shareholders on the same terms and conditions;

(c) complies with applicable Securities Laws;

(d) is not subject to any financing condition and in respect of which adequate arrangements have been made to ensure that the required funds will be available to effect payment in full;

(e) is not subject to any due diligence condition or access condition; and

(f) the Company Board (based on, among other things, the recommendation of the Special Committee) has determined in good faith, after consultation with its financial advisors and outside legal counsel, is reasonably capable of being completed in accordance with its terms, without undue delay, taking into account all legal, financial, regulatory and other aspects of such Acquisition Proposal and the person making such Acquisition Proposal;

"Superior Proposal Notice Period" has the meaning given to it in 6.01(f)(ii);

"Support Agreements" means the voting and support agreements dated July 16, 2023 and made between the Purchaser and the Supporting Company Shareholders and other voting and support agreements that may be entered into after the date of this Agreement by the Purchaser and other Company Shareholders, which agreements provide that such Supporting Company Shareholders shall, among other things, vote all Company Shares of which they are the registered or beneficial holder or over which they have control or direction, in favour of the Arrangement and not dispose of their Company Shares;

"Supporting Company Shareholders" means collectively those officers and directors of the Company and other Company Shareholders who have entered into Support Agreements;

"Tax" or "Taxes" means any taxes, duties, fees, premiums, assessments, imposts, levies, and other charges of any kind whatsoever imposed by any Governmental Entity, including all interest, penalties, fines, additions to tax or other additional amounts imposed by any Governmental Entity in respect thereof, and including, but not limited to, those levied on, or measured by, or referred to as, income, gross receipts, profits, windfall, royalty, capital, transfer, land transfer, sales, goods and services, harmonized sales, use, value-added, excise, stamp, withholding, business, franchising, property, development, occupancy, employer health, payroll, employment, health, social services, education and social security taxes, all surtaxes, all customs duties and import and export taxes, countervail and anti-dumping, all licence, franchise and registration fees and all employment insurance, health insurance and Canada, Quebec and other pension plan premiums or contributions imposed by any Governmental Entity, and any transferee or secondary liability in respect of any of the foregoing;

"Tax Act" means the Income Tax Act (Canada);

"Tax Returns" means all returns, reports, declarations, elections, notices, filings, forms, statements and other documents (whether in tangible, electronic or other form) and including any amendments, schedules, attachments, supplements, appendices and exhibits thereto, made, prepared, filed or required to be made, prepared or filed by law in respect of Taxes;

"Teck US" means Teck American Incorporated, a corporation existing under the laws of the State of Washington;

"Termination Amount Event" has the meaning given to it in Section 6.02(a);

"Trade Sanctions" means all laws relating to economic or trade sanctions, including the laws or regulations implemented by the Office of Foreign Assets Controls of the United States Department of the Treasury and any similar laws or regulations in other applicable jurisdictions which are applicable to any of the Purchaser, the Company, PolyMet US or JVCo;

"TSX" means the Toronto Stock Exchange;

"Unconflicted Company Board" means the board of directors of the Company, excluding John Burton, Stephen Rowland and Matthew Rowlinson; and

"Valuation" means the formal valuation prepared by Maxit Capital LP in accordance with the methodology prescribed by MI 61-101.

1.02 Interpretation

The following rules of interpretation shall apply in this Agreement unless something in the subject matter or context is inconsistent therewith:

(a) the singular includes the plural and vice versa;

(b) where a word or phrase is defined, its other grammatical forms have a corresponding meaning;

(c) the headings in this Agreement form no part of this Agreement and are deemed to have been inserted for convenience only and shall not affect the construction or interpretation of any of its provisions;

(d) all references in this Agreement shall be read with such changes in number and gender that the context may require;

(e) references to "Articles," "Sections" and "Recitals" refer to articles, Sections and recitals of this Agreement;

(f) the use of the words "including" or "includes" followed by a specific example or examples shall not be construed as limiting the meaning of the general wording preceding it;

(g) the rule of construction that, in the event of ambiguity, the contract shall be interpreted against the Party responsible for the drafting or preparation of the Agreement, shall not apply;

(h) the words "herein," "hereof" and "hereunder" and other words of similar import refer to this Agreement as a whole and not to any particular Section or other subdivision;

(i) any reference to a statute is a reference to the applicable statute and to any regulations made pursuant thereto and includes all amendments made thereto and in force, from time to time, and any statute or regulation that has the effect of supplementing or superseding such statute or regulation;

(j) unless something in the subject matter or context is inconsistent therewith or unless otherwise provided, any reference to a specific agreement, Contract or document in this Agreement is to that agreement, Contract or document, including all schedules, appendices and exhibits thereto, in its current form or as it may from time to time be amended, supplemented, varied, novated, extended, altered, replaced or changed;

(k) all calculations and computations made pursuant to this Agreement shall be carried out in accordance with IFRS consistently applied to the extent that such principles are not inconsistent with the provisions of this Agreement;

(l) in this Agreement, an agreement, representation or warranty for two or more persons is for the benefit of them jointly and each of them individually and an agreement, representation or warranty by two or more persons binds them jointly and each of them individually. A reference to a group of persons or things is a reference to them jointly or individually; and

(m) the words "written" or "in writing" include printing or any electronic means of communication capable of being visibly reproduced at the point of reception including fax or email.

1.03 Computation of Time

In this Agreement, unless something in the subject matter or context is inconsistent therewith, a "day" shall refer to a calendar day and in calculating all time periods the first day of a period is not included and the last day is included and in the event that any date on which any action is required to be taken hereunder is not a Business Day, such action will be required to be taken on the next succeeding day which is a Business Day.

1.04 Exercise of Rights Under the Joint Venture Agreement

The Company agrees to exercise its rights under the Joint Venture Agreement in such a manner that does not conflict with the provisions of this Agreement or is not for the purpose or with the effect of denying or reducing the rights of the Purchaser under this Agreement, provided that, for the avoidance of doubt, nothing in this Section 1.04 shall require the Company to violate any of its obligations under the Joint Venture Agreement. If the Company determines that compliance with this Agreement could cause the Company to violate any of its obligations under the Joint Venture Agreement, the Company shall promptly (and in any event within two Business Days of making any such determination) provide a notice to the Purchaser with full particulars of the Company's determination with respect to such compliance and shall reasonably consider any advice or recommendations provided by the Purchaser with respect to such compliance.

1.05 Purchaser Action and JVCo

For greater certainty, when determining whether the Company has breached any provision of this Agreement (including assessing whether commercially reasonable efforts have been used), to the extent that any action or omission taken or not taken by JVCo has been authorized or approved by the Board of Managers, and where such authorization or approval has been consented to by a Purchaser nominee on the Board of Managers and the authorized or approved action taken by JVCo directly or indirectly causes the Company to breach this Agreement, such action or omission shall not be considered a breach of this Agreement by the Company and any action by the Company consistent with such authorization or approval shall not constitute a breach of any provision of this Agreement and shall be deemed commercially reasonable action or effort by the Company.

1.06 Currency

Unless otherwise stated, all references in this Agreement to sums of money are expressed in lawful money of the United States and "$" refers to United States dollars.

1.07 Accounting Matters

Unless otherwise stated, all accounting terms used in this Agreement shall have the meanings attributable thereto under IFRS and all determinations of an accounting nature required to be made shall be made in accordance with IFRS consistently applied.

1.08 Schedules

The Schedules to this Agreement, as listed below, are an integral part of this Agreement:

Schedule A Plan of Arrangement

Schedule B Arrangement Resolution

Schedule C Representations and Warranties of the Company

Schedule D Representations and Warranties of the Purchaser

ARTICLE 2 - THE ARRANGEMENT

2.01 Arrangement

The Arrangement shall be implemented in accordance with and subject to the terms and conditions contained in this Agreement and the Plan of Arrangement. From and after the Effective Time, the steps to be carried out pursuant to the Arrangement shall become effective in accordance with the Plan of Arrangement.

2.02 Interim Order

The Company covenants in favour of the Purchaser that, as soon as reasonably practicable after the execution of this Agreement and in any event in sufficient time to hold the Company Meeting in accordance with Section 2.03, the Company will apply for and have the hearing for the Interim Order before the Court pursuant to Section 291 of the BCBCA, respectively, for the Interim Order in a manner and form acceptable to the Purchaser, acting reasonably, which shall provide, among other things:

(a) for the class of persons to whom notice is to be provided in respect of the Arrangement and the Company Meeting and for the manner in which such notice is to be provided;

(b) for the confirming of the record date for the purpose of determining the Company Shareholders entitled to notice of and to vote at the Company Meeting (which date shall be fixed by the Company in consultation with the Purchaser) and that such record date will not change in respect of any adjournment(s) or postponement(s) of the Company Meeting;

(c) that the requisite approval (the "Company Shareholder Approval") for the Arrangement Resolution shall be the affirmative vote of: (i) two-thirds of the votes cast by Company Shareholders, voting together as a single class, present in person or represented by proxy at the Company Meeting; and (ii) a majority of the votes cast by Company Shareholders present in person or represented by proxy at the Company Meeting excluding for this purpose votes attached to the Company Shares held by persons described in item (a), item (b), item (c) and item (d) of Section 8.1(2) of MI 61-101;

(d) that in all other respects, the terms, conditions and restrictions of the Company's Constating Documents, including quorum requirements and other matters, shall apply in respect of the Company Meeting;

(e) for the grant of Dissent Rights only to registered Company Shareholders as contemplated in the Plan of Arrangement;

(f) for notice requirements with respect to the presentation of the application to the Court for the Final Order;

(g) that the Company Meeting may be adjourned or postponed from time to time by the Company in accordance with the terms of this Agreement or as otherwise agreed by the Parties without the need for additional approval by the Court and without the necessity of first convening the meeting or first obtaining any vote of the Company Shareholders respecting the adjournment(s) or postponement(s);

(h) that the deadline for the submission of proxies by Company Shareholders for the Company Meeting shall be 48 hours (excluding Saturdays, Sundays and statutory holidays in Vancouver, British Columbia) prior to the Company Meeting, subject to waiver by the Company in accordance with the terms of this Agreement;

(i) that each Company Shareholder and any other affected person shall have the right to appear before the Court at the hearing of the Court to approve the application for the Final Order so long as they enter a response by the time stipulated in the Interim Order; and

(j) subject to the consent of the Company (such consent not to be unreasonably withheld, conditioned or delayed) the Company shall also request that the Interim Order provide for such other matters as the Purchaser may reasonably require,

and thereafter proceed with such application and diligently pursue obtaining the Interim Order.

2.03 Company Meeting

Subject to the terms of this Agreement and the receipt of the Interim Order, the Company covenants in favour of the Purchaser that the Company shall:

(a) lawfully convene and hold the Company Meeting in accordance with the Interim Order, the Constating Documents of the Company and applicable laws, as soon as reasonably practicable after the Interim Order is issued and, in any event, not later than November 15, 2023, for the purpose of having the Company Shareholders consider the Arrangement Resolution, and will not, unless the Purchaser otherwise consents in writing, adjourn, postpone or cancel the Company Meeting or propose to do any of the foregoing except:

(i) for an adjournment as required for quorum purposes (in which case the Company Meeting will be adjourned and not cancelled) or by applicable law; or

(ii) as required under Section 6.01(h); or

(iii) in the event that the Company or the Purchaser reasonably determines that (x) any of the information relating to the Purchaser included in the Company Circular or the Schedule 13E-3 contains any untrue statement of material fact or omits to state any material fact required to be stated therein or necessary in order to make the statements therein, in light of the circumstances in which they are made, not misleading or (y) such adjournment is necessary or appropriate to address material comments of any Securities Authority in respect of any of the information relating to the Purchaser in the Company Circular or the Schedule 13E-3; provided that the Company and the Purchaser agree to cooperate with one another to make any necessary modifications to the Company Circular or the Schedule 13E-3 and/or address the comments of the applicable Securities Authority as expeditiously as reasonably practicable,