UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 13, 2023 (July 13, 2023)

EDUCATIONAL DEVELOPMENT CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 000-04957 | 73-0750007 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S Employer Identification No.) |

5402 S 122nd E Avenue, Tulsa, Oklahoma 74146

(Address of principal executive offices and Zip Code)

(918) 622-4522

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock, $.20 par value | EDUC | NASDAQ |

| (Title of class) | (Trading symbol) | (Name of each exchange on which registered) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

The information disclosed in these Items 2.02, 7.01 and 9.01, including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or otherwise subject to the liabilities under that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act except as expressly set forth by specific reference in such filing.

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On July 13, 2023, Educational Development Corporation announced, via press release, first quarter fiscal 2024 financial results. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

ITEM 7.01 REGULATION FD DISCLOSURE

On July 13, 2023, Educational Development Corporation announced, via press release, first quarter fiscal 2024 financial results. Educational Development Corporation’s first quarter fiscal 2024 earnings call will be held on Thursday, July 13, 2023 at 3:30 PM CT (4:30 PM ET). A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) EXHIBITS

SIGNATURE

Pursuant to the requirements of the Exchange Act, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Educational Development Corporation

|

| |

|

|

By:

|

/s/ Craig M. White

|

| |

Craig M. White

|

| |

President and Chief Executive Officer

|

| |

|

| |

|

|

Date:

|

July 13, 2023

|

false

0000031667

0000031667

2023-07-13

2023-07-13

EXHIBIT 99.1

PRESS RELEASE

EDUCATIONAL DEVELOPMENT CORPORATION

ANNOUNCES FIRST QUARTER FISCAL YEAR 2024 RESULTS

TULSA, OK, July 13, 2023—Educational Development Corporation (“EDC”, or the “Company”) (NASDAQ: EDUC) (http://www.edcpub.com) today reports financial results for the first quarter for fiscal year 2024.

First Quarter Summary Compared to the Prior Year First Quarter

| |

●

|

Net revenues of $14.5 million, a decrease of $8.7 million, or 37.5%, compared to $23.2 million.

|

| |

●

|

Average active PaperPie brand partners totaled 23,200 compared to 32,200.

|

| |

●

|

Earnings (loss) before income taxes were $(1.2) million, a decrease of $1.5 million compared to $0.3 million.

|

| |

●

|

Net earnings (loss) totaled $(0.9) million, compared to $0.2 million, a decrease of $1.1 million.

|

| |

●

|

Earnings (loss) per share totaled $(0.11), compared to $0.03, on a fully diluted basis.

|

| |

●

|

Inventories - net decreased $8.3 million, from $70.6 million at May 31, 2022, compared to $62.3 million at May 31, 2023.

|

“Our first quarter sales volumes continued to be impacted by high inflation, which has been an ongoing headwind that we expect to continue throughout the remainder of fiscal 2024,” stated Craig White, President and CEO of Educational Development Corporation. “Although our active Brand Partners dropped below 25,000 in February, our Brand Partners at leadership levels remain higher than pre-pandemic numbers and they are the primary drivers for new recruiting and overall sales growth. We continue to make key changes to promote activity and growth with our Brand Partners including lowering our freight charges which we expect will increase the number of smaller orders from customers. These smaller order customers will increase the opportunities to engage new hosts and recruit new brand partners. We believe that spurring sales activity over the summer months, which is traditionally one of our slowest periods of the year, will translate into higher brand partner activity in the Fall, which is our busiest selling season.”

“I remain encouraged by the sales potential for our newest product line SmartLab Toys, as well as the addition of My First Wrap-Ups to our Learning Wrap-Ups product line. Our gross sales of SmartLab Toys in the first quarter, which included only the first thirteen toys released, totaled approximately $1.4 million. We have an additional twenty-five SmartLab Toys and ten new My First Wrap-Ups products scheduled to be released over the next 12 months. Wrap-Ups are an award-winning learning manipulative product line, targeted at the primary education levels, and the addition of My First Wrap-Ups will introduce the product line to children at the pre-school level,” concluded Craig White.

COVID Impacted and Current Year Comparison

Due to the significant positive impact of the COVID-19 pandemic on our business in previous years, we are providing the additional tables below to show pre-COVID, COVID impacted and current financial results for the fiscal first quarter:

RESULTS FOR FISCAL FIRST QUARTER (UNAUDITED)

| |

|

Pre-COVID

|

|

COVID Impacted

|

|

COVID Impacted

|

|

COVID Impacted

|

|

Current Year

|

|

Period

|

|

Q1 FY 2020

|

|

Q1 FY 2021

|

|

Q1 FY 2022

|

|

Q1 FY 2023

|

|

Q1 FY 2024

|

|

Average # of Consultants

|

|

31,600

|

|

33,100

|

|

55,100

|

|

32,200

|

|

23,200

|

|

Net Revenues

|

|

27,587,400

|

|

38,291,700

|

|

40,807,900

|

|

23,160,900

|

|

14,524,000

|

|

Net Earnings (loss)

|

|

1,363,600

|

|

1,931,100

|

|

3,438,100

|

|

215,800

|

|

(872,800)

|

|

After tax profit (loss) %

|

|

4.9%

|

|

5.0%

|

|

8.4%

|

|

0.9%

|

|

(6.0)%

|

PaperPie net revenues decreased $7.4 million, or 37.0%, to $12.6 million during the three months ended May 31, 2023, when compared to $20.0 million during the same period a year ago. The decrease in net revenues was primarily due to the decline in the number of active Brand Partners. The average number of active Brand Partners in the first quarter of fiscal 2024 was 23,200, a decrease of 9,000, or 28.0%, from 32,200 average active brand partners selling in the first quarter of fiscal 2023. We also saw a decline in the percentage of our active Brand Partners selling during this quarter. Our recent change to “$7.00 Flat Rate Shipping”, along with other promotions to spur sales and recruiting, were made to address these issues.

Net revenues from our Publishing division decreased $1.2 million, or 38.7%, to $1.9 million during the three months ended May 31, 2023, when compared to $3.1 million during the same period a year ago. The sales volume decrease was primarily attributed to the discontinuation of offering Usborne Publishing products to our retail customers. Under the terms of our new Agreement, the Company no longer has the rights to distribute Usborne’s products to retail customers. The Company continues to offer Usborne products through our direct sales division, PaperPie.

|

EDUCATIONAL DEVELOPMENT CORPORATION

|

|

|

CONDENSED STATEMENTS OF OPERATIONS (UNAUDITED)

|

|

| |

|

Three Months Ended

May 31,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

NET REVENUES

|

|

$ |

14,524,000 |

|

|

$ |

23,160,900 |

|

| |

|

|

|

|

|

|

|

|

|

EARNINGS (LOSS) BEFORE INCOME TAXES

|

|

|

(1,200,600 |

) |

|

|

285,300 |

|

| |

|

|

|

|

|

|

|

|

|

INCOME TAX EXPENSE (BENEFIT)

|

|

|

(327,800 |

) |

|

|

69,500 |

|

|

NET EARNINGS (LOSS)

|

|

$ |

(872,800 |

) |

|

$ |

215,800 |

|

| |

|

|

|

|

|

|

|

|

|

DIVIDENDS PER SHARE

|

|

$ |

- |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE NUMBER OF

COMMON AND EQUIVALENT SHARES OUTSTANDING:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

8,278,049 |

|

|

|

8,086,427 |

|

|

Diluted

|

|

|

8,278,049 |

|

|

|

8,473,610 |

|

|

EDUCATIONAL DEVELOPMENT CORPORATION

|

|

|

CONDENSED BALANCE SHEETS (UNAUDITED)

|

|

| |

|

May 31,

|

|

|

February 28

|

|

| |

|

2023

|

|

|

2023

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

CASH AND CASH EQUIVALENTS

|

|

$ |

876,100 |

|

|

$ |

689,100 |

|

|

ACCOUNTS RECEIVABLE – net

|

|

|

2,688,900 |

|

|

|

2,906,700 |

|

|

TOTAL INVENTORIES – net

|

|

|

62,324,500 |

|

|

|

63,806,100 |

|

|

OTHER CURRENT ASSETS

|

|

|

806,700 |

|

|

|

869,300 |

|

|

PROPERTY PLANT AND EQUIPMENT – net

|

|

|

29,258,100 |

|

|

|

29,656,400 |

|

|

OTHER NON-CURRENT ASSETS

|

|

|

2,300,300 |

|

|

|

2,009,200 |

|

|

TOTAL ASSETS

|

|

$ |

98,254,600 |

|

|

$ |

99,936,800 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHODLER’S EQUITY

|

|

|

|

|

|

|

|

|

|

ACCOUNTS PAYABLE

|

|

$ |

4,631,000 |

|

|

$ |

3,863,900 |

|

|

LINE OF CREDIT

|

|

|

10,959,200 |

|

|

|

10,634,500 |

|

|

CURRENT MATURITIES OF TERM DEBT

|

|

|

34,456,100 |

|

|

|

34,894,900 |

|

|

OTHER LIABILITIES

|

|

|

4,317,000 |

|

|

|

5,311,700 |

|

|

TOTAL LIABILITIES

|

|

$ |

54,363,300 |

|

|

$ |

54,705,000 |

|

|

TOTAL SHAREHOLDERS’ EQUITY

|

|

|

43,891,300 |

|

|

|

45,231,800 |

|

|

TOTAL LIABILITIES AND SHAREHOLDERS EQUITY

|

|

$ |

98,254,600 |

|

|

$ |

99,936,800 |

|

|

EDUCATIONAL DEVELOPMENT CORPORATION

|

|

|

CONDENSED STATEMENT OF CASH FLOWS (UNAUDITED)

|

|

| |

|

Three Months Ended

May 31,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

$ |

1,177,100 |

|

|

$ |

(2,197,000 |

)

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|

|

(300,900 |

)

|

|

|

(108,800 |

)

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

(689,200 |

)

|

|

|

3,364,000 |

|

| |

|

|

|

|

|

|

|

|

|

NET INCREASE IN CASH AND CASH EQUIVALENTS

|

|

$ |

187,000 |

|

|

$ |

1,058,200 |

|

|

CASH AND CASH EQUIVALENTS-BEGINNING OF PERIOD

|

|

|

689,100 |

|

|

|

361,200 |

|

| |

|

|

|

|

|

|

|

|

|

CASH AND CASH EQUIVALENTS – END OF PERIOD

|

|

$ |

876,100 |

|

|

$ |

1,419,400 |

|

Fiscal 2024 First Quarter Earnings Call

Date: Thursday, July 13, 2023

Time: 3:30 PM CT (4:30 PM ET)

Dial-in number: (888) 396-8049

Conference ID: 62600963

The conference call will be broadcast live and audio replays will be available following the event at www.edcpub.com/investors.

About Educational Development Corporation (EDC)

EDC began as a publishing company specializing in books for children. EDC is the owner and exclusive publisher of Kane Miller Books (“Kane Miller”); Learning Wrap-Ups, maker of educational manipulatives; and SmartLab Toys, maker of STEAM-based toys and games. EDC is also the exclusive United States MLM distributor of Usborne Publishing Limited (“Usborne”) children’s books. EDC-owned products are sold via 4,000 retail outlets and EDC and Usborne products are offered by independent brand partners who hold book showings through social media, book fairs with schools and public libraries, in individual homes, as well as other in-person events and internet sales.

Contact:

Educational Development Corporation

Craig White, (918) 622-4522

Investor Relations:

Three Part Advisors, LLC

Steven Hooser or Jean Marie Young, (214) 872-2710

Cautionary Statement for the Purpose of the “Safe Harbor” Provision of the Private Securities Litigation Reform Act of 1995.

The information discussed in this Press Release includes “forward-looking statements.” These forward-looking statements are identified by their use of terms and phrases such as “may,” “expect,” “estimate,” “project,” “plan,” “believe,” “intend,” “achievable,” “anticipate,” “continue,” “potential,” “should,” “could,” and similar terms and phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve certain assumptions, risks and uncertainties and we can give no assurance that such expectations or assumptions will be achieved. Known and unknown risks, uncertainties and other factors may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, our success in recruiting and retaining new brand partners, our ability to locate and procure desired books, our ability to ship the volume of orders that are received without creating backlogs, our ability to obtain adequate financing for working capital and capital expenditures, economic and competitive conditions, regulatory changes and other uncertainties, the COVID-19 pandemic, as well as those factors discussed in our Annual Report on Form 10-K for the year ended February 28, 2023, all of which are difficult to predict. In light of these risks, uncertainties and assumptions, the forward-looking events discussed may not occur. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements in this paragraph and elsewhere in our Annual Report on Form 10-K for the year ended February 28, 2023 and speak only as of the date of this Press Release. Other than as required under the securities laws, we do not assume a duty to update these forward-looking statements, whether as a result of new information, subsequent events or circumstances, changes in expectations or otherwise.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

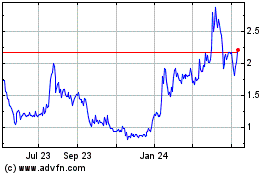

Educational Development (NASDAQ:EDUC)

Historical Stock Chart

From Mar 2024 to Apr 2024

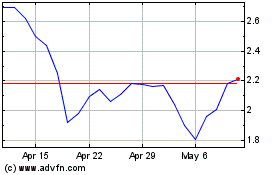

Educational Development (NASDAQ:EDUC)

Historical Stock Chart

From Apr 2023 to Apr 2024