0000923571

false

--12-31

US XPRESS ENTERPRISES INC

0000923571

2023-06-30

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

July 5, 2023 (June 30, 2023)

U.S.

Xpress Enterprises, Inc.

(Exact name of Registrant as Specified in its

Charter)

| Nevada |

|

001-38528 |

|

62-1378182 |

(State or other Jurisdiction of

Incorporation or Organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| 4080

Jenkins Road |

|

| Chattanooga,

Tennessee |

37421 |

| (Address of principal executive offices) |

(Zip Code) |

(423)

510-3000

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| |

¨ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

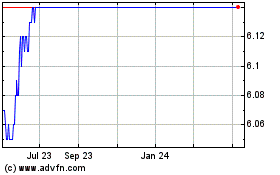

| Class

A Common Stock, par value $0.01 per share |

|

USX |

|

NYSE |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Introductory Note

This Current Report on Form

8-K is being filed in connection with the completion on June 30, 2023 (the “Closing Date”) of the transactions contemplated

by that certain Agreement and Plan of Merger, dated as of March 20, 2023 (the “Merger Agreement”), by and among U.S. Xpress

Enterprises, Inc., a Nevada corporation (“U.S. Xpress” and following the consummation of the Merger, the “Surviving

Corporation”), Knight-Swift Transportation Holdings Inc., a Delaware corporation (“Knight-Swift”), and Liberty Merger

Sub Inc., a Nevada corporation and an indirect wholly owned subsidiary of Knight-Swift (“Merger Subsidiary”). Pursuant to

the Merger Agreement, Merger Subsidiary merged with and into U.S. Xpress (the “Merger”), with U.S. Xpress surviving the Merger

as an indirect subsidiary of Knight-Swift. The Merger was effective at 12:02 Eastern Daylight Time on July 1, 2023 (the “Effective

Time”).

| Item 1.02. | Termination of a Material Definitive Agreement. |

The information provided

in the Introductory Note and Item 2.01 of this Current Report on Form 8-K is incorporated herein by reference.

On the Closing Date, U.S.

Xpress caused to be repaid in full all indebtedness, liabilities and other obligations under, and terminated, the Credit Agreement, dated

as of January 28, 2020, by and among U.S. Xpress and certain of its subsidiaries, as borrowers, certain other of U.S. Xpress’ direct

and indirect wholly owned subsidiaries as guarantors, and Bank of America, N.A., as administrative agent, swingline lender, and L/C issuer.

| Item 2.01. | Completion of Acquisition or Disposition of Assets. |

The information provided

in the Introductory Note of this Current Report on Form 8-K is incorporated herein by reference.

Pursuant

to the terms and conditions of the Merger Agreement, at the Effective Time, each share of Class A common stock of U.S. Xpress, par value

$0.01 per share, issued and outstanding immediately prior to the Effective Time (“Class A common stock”), and each share of

Class B common stock of U.S. Xpress, par value $0.01 per share, issued and outstanding immediately prior to the Effective Time (“Class

B common stock, and collectively with the Class A common stock, the “U.S. Xpress Stock”), other than (a) the shares of U.S.

Xpress Stock held by U.S. Xpress as treasury stock, (b) the shares of U.S. Xpress Stock owned by Knight-Swift, Merger Subsidiary, or any

direct or indirect wholly owned subsidiary of Knight-Swift or Merger Subsidiary (which shares described in the preceding items (a) and

(b) U.S. Xpress refers to collectively as the “Excluded Shares”) and (c) the Rollover Shares (as defined and further

described in the Merger Agreement), were automatically cancelled and converted into the right to receive $6.15 in cash, without interest

(the “Merger Consideration”). The description of the Merger and the Merger Agreement contained in this Item 2.01 does not

purport to be complete and is subject to and qualified in its entirety by reference to the Merger Agreement, which is filed as Exhibit 2.1 to U.S. Xpress’ Current Report on Form 8-K filed on March 21, 2023, and is incorporated herein by reference.

| Item 3.01. | Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

The information provided

in the Introductory Note and Item 2.01 of this Current Report on Form 8-K is incorporated herein by reference.

On June 30, 2023, U.S. Xpress

notified the New York Stock Exchange (the “NYSE”) of the completion of the Merger and requested that NYSE halt trading in

the Class A common stock and file with the Securities and Exchange Commission (the “SEC”) a notification of removal from listing

and registration on Form 25 to affect the delisting from the NYSE of the Class A common stock.

Additionally, the Surviving

Corporation intends to file with the SEC a certification on Form 15 requesting the termination of registration of the Class A common stock

under Section 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the suspension of the U.S.

Xpress’ reporting obligations under Section 13(a) and 15(d) of the Exchange Act.

| Item 3.03. | Material Modification to Rights of Security Holders. |

The information provided

in the Introductory Note, Item 2.01 Item 3.01, Item 5.01 and Item 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

At the Effective Time, the

holders of U.S. Xpress Stock outstanding immediately before the Merger ceased to have any rights as stockholders of U.S. Xpress (other

than their right to receive the Merger Consideration pursuant to and in accordance with the Merger Agreement).

| Item 5.01. | Changes in Control of Registrant. |

The information provided

in the Introductory Note, Item 2.01, Item 3.01 and Item 5.02 of this Current Report on Form 8-K is incorporated herein by reference.

As a result of the completion

of the Merger and at the Effective Time, a change in control of U.S. Xpress occurred and U.S. Xpress became an indirect subsidiary of

Knight-Swift.

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers. |

The information set forth

in the Introductory Note and Item 2.01 of this Current Report on Form 8-K is incorporated herein by reference.

In connection with, and

by virtue of, the completion of the Merger, at the Effective Time, all of the directors of U.S. Xpress ceased to be directors of

U.S. Xpress and members of any committees of U.S. Xpress’ board of directors. In addition, in connection with the completion of the Merger, at the Effective Time, the following officers of U.S. Xpress ceased to be officers of U.S. Xpress:

(i) Max L. Fuller ceased to be the Executive Chairman of U.S. Xpress, (ii) William E. Fuller ceased to be the Chief Executive

Officer of U.S. Xpress, (iii) Eric Peterson ceased to be the Chief Financial Officer and Treasurer of U.S. Xpress, and (iv) Jason Grear ceased to be

the Chief Accounting Officer of U.S. Xpress.

| Item 5.03. | Amendments to Articles of Incorporation or Bylaws; Changes in Fiscal Year. |

Pursuant to the Merger Agreement, at 12:01 a.m. Eastern Daylight Time on July 1, 2023, U.S. Xpress’ then existing articles of incorporation

were amended. A copy of the U.S. Xpress’ Certificate of Amendment is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated

herein by reference.

Pursuant to the Merger Agreement,

at the Effective Time, U.S. Xpress’ then existing articles of incorporation and bylaws were each amended and restated in their entirety.

Copies of the Surviving Corporation’s Fourth Amended and Restated Certificate of Incorporation and Fourth Amended and Restated Bylaws

are filed as Exhibit 3.2 and 3.3, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

On July 5, 2023, U.S. Xpress issued a joint press release with Knight-Swift announcing the completion of the Merger. The

full text of the press release is attached hereto as exhibit 99.1.

| Item 9.01 | Financial Statements and Exhibits. |

(d)

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

U.S.

XPRESS ENTERPRISES, INC. |

| |

|

| |

By:

|

/s/

Nathan Harwell |

| |

Name: |

Nathan Harwell |

| Date:

July 5, 2023 |

Title: |

Executive Vice President, Chief Legal Officer, and Secretary |

Exhibit 3.1

U.S. XPRESS ENTERPRISES, INC.

CERTIFICATE OF AMENDMENT

Article III of

the Corporation’s Third Amended and Restated Articles of Incorporation is hereby amended by adding the following new Section 3.2(i)

thereto:

“(i) Proposed

Transactions. Notwithstanding anything to the contrary in Section 3.2(e) or elsewhere in these Third Amended and Restated

Articles of Incorporation or otherwise, to the extent that (x) the Agreement and Plan of Merger, by and among the Corporation,

Knight-Swift Transportation Holdings Inc. and Liberty Merger Sub Inc., dated as of March 20, 2023 (the “Merger

Agreement”) or the Rollover Agreement, by and among Knight-Swift Transportation Holdings Inc., Liberty Holdings Topco LLC

and the other parties thereto, dated as of March 20, 2023 (the “Rollover Agreement”) entered into in connection

with the Merger Agreement, or (y) any of the transactions contemplated by the Merger Agreement or the Rollover Agreement

(collectively, the “Contemplated Transactions”) or (z) the consideration to be paid to the holders of Class A

Common Stock or Class B Common Stock pursuant to the Merger Agreement or the Rollover Agreement (collectively, the

“Contemplated Consideration”), are inconsistent with Section 3.2(e) or any provisions thereof, Section 3.2(e) or

such provisions thereof, as applicable, shall not apply to the Merger Agreement, the Rollover Agreement, the Contemplated

Transactions or the Contemplated Consideration.”

* * * *

Exhibit 3.2

FOURTH AMENDED AND RESTATED

ARTICLES OF INCORPORATION

OF

U.S. XPRESS ENTERPRISES, INC.

ARTICLE I

NAME

The name of the corporation

is U.S. Xpress Enterprises, Inc. (the “Corporation”).

ARTICLE II

REGISTERED OFFICE

The Corporation may, from

time to time, in the manner provided by law, change the registered agent and registered office within the State of Nevada. The Corporation

may also maintain an office or offices for the conduct of its business, either within or without the State of Nevada.

ARTICLE III

AUTHORIZED CAPITAL STOCK

The total authorized capital

stock of the Corporation shall consist of one thousand (1,000) shares of common stock, $0.01 par value.

ARTICLE IV

DIRECTORS

The members of the governing

board of the Corporation are styled as directors. The Board of Directors shall be elected in such manner as shall be provided in the Fourth

Amended and Restated Bylaws of the Corporation (the “Bylaws”). The number of directors may be changed from time to

time in such manner as shall be provided in the Bylaws of the Corporation.

ARTICLE V

LIMITATION OF LIABILITY

To

the fullest extent permitted by Chapter 78 of the Nevada Revised Statutes, as may be amended from time to time, a director or officer

of the Corporation shall not be liable to the Corporation or its stockholders for monetary or other damages for breach of fiduciary duties

as a director or officer. No repeal, amendment, or modification of this Article V, nor the adoption of any provision of these Fourth Amended

and Restated Articles of Incorporation inconsistent with this Article V, shall directly or indirectly eliminate or reduce the effect of

this Article V with respect to any act or omission of a director or officer of the Corporation occurring prior to such repeal, amendment,

modification, or adoption of an inconsistent provision.

ARTICLE VI

INDEMNIFICATION

Section

6.1. In General. Subject to the case by case determination required to be made under Section 6.3 hereof, the Corporation shall

indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or

proceeding, whether civil, criminal, administrative or investigative (except an action by or in the right of the Corporation) by reason

of the fact that such person is or was a director or officer of the Corporation, or is or was serving at the request of the Corporation

as a director or officer, of its subsidiaries, against expenses (including attorneys’ fees), judgments, fines, and amounts paid

in settlement actually and reasonably incurred in connection with such action, suit, or proceeding if such person: (a) is not liable

for a breach of fiduciary duties that involved intentional misconduct, fraud, or a knowing violation of law; or (b) acted in good faith

and in a manner which he or she reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect

to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful; provided, however,

that the termination of any action, suit, or proceeding by judgment, order, settlement, conviction, or upon a plea of nolo contendere

or its equivalent, shall not, of itself, create a presumption that the person is liable for a breach of fiduciary duties or did not act

in good faith and in a manner which he or she reasonably believed to be in or not opposed to the best interests of the Corporation, or

that, with respect to any criminal action or proceeding, he or she had reasonable cause to believe that his or her conduct was unlawful.

Section

6.2 Derivative Actions. Subject to the case by case determination required to be made under Section 6.3 hereof, the Corporation

shall indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending, or completed action or

suit by or in the right of the Corporation to procure a judgment in its favor by reason of the fact that such person is or was a director,

or officer of the Corporation, or is or was serving at the request of the Corporation as a director or officer of its subsidiaries, against

expenses (including amounts paid in settlement and attorneys’ fees) actually and reasonably incurred in connection with the defense

or settlement of the action or suit if such person: (i) is not liable for a breach of fiduciary duties that involved intentional misconduct,

fraud or a knowing violation of law or (ii) acted in good faith and in a manner that he or she reasonably believed to be in or not opposed

to the best interests of the corporation; provided, however, that such indemnification may not be made for any claim, issue,

or matter as to which such a person has been adjudged by a court of competent jurisdiction, after exhaustion of all appeals, to be liable

to the Corporation or for amounts paid in settlement to the Corporation, unless and only to the extent that the court in which the action

or suit was brought or other court of competent jurisdiction determines upon application that in view of all the circumstances of the

case, the person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper.

Section

6.3. Case-by-Case Determination. Any indemnification under Sections 6.1 and 6.2 hereof, unless ordered by a court, shall be

made by the Corporation only as authorized in the specific case upon a determination that indemnification of the director or officer is

proper in the circumstances because he or she has met the applicable standard of conduct set forth in Section 6.1 or 6.2. Such determination

shall be made: (a) the stockholders; (b) by the Board of Directors by majority vote of a quorum consisting of directors who were not parties

to such act, suit, or proceeding; (c) if such a quorum of disinterested directors so orders, by independent legal counsel in a written

opinion; or (d) if such a quorum of disinterested directors cannot be obtained, by independent legal counsel in a written opinion.

Section

6.4. Mandatory Indemnification. To the extent that a director or officer of the Corporation has been successful on the merits

or otherwise in defense of any action, suit, or proceeding referred to in Sections 6.1 or 6.2, or in defense of any claim, issue, or matter

therein, he or she shall be indemnified by the Corporation against expenses, including attorneys’ fees, actually and reasonably

incurred by him or her in connection with such defense.

Section

6.5. Advancement of Expenses. Expenses incurred in defending a civil or criminal action, suit, or proceeding may be paid by

the Corporation in advance of the final disposition of such action, suit or proceeding as authorized by the Board of Directors in the

specific case upon receipt of an undertaking by or on behalf of the director or officer to repay such amount unless it is ultimately determined

that he is entitled to be indemnified by the Corporation as authorized in this Article VI.

Section

6.6 Other Rights. The indemnification provided by this Article VI does not exclude any other rights to which any director

or officer seeking indemnification may be entitled under any law, Bylaw, agreement, vote of stockholders or disinterested directors

or otherwise, both as to action in his or her official capacity and as to action in another capacity while holding such office. The

indemnification provided by this Article VI shall continue as to a person who has ceased to be a director or officer, and shall

inure to the benefit of the heirs, executors, and administrators of such person. No amendment to repeal of this Article VI shall

apply to or have any effect on, the rights of any director or officer under this Article VI which rights come into existence by

virtue of acts or omissions of such director or officer occurring prior to such amendment or repeal.

Section

6.7. Insurance. The Corporation may purchase and maintain insurance on behalf of any person who is or was a director or officer

of the Corporation, or is or was serving at the request of the Corporation as a director or officer of its subsidiaries against any liability

asserted against him or her and incurred by him or her in any such capacity, or arising out of his or her status as such, whether or not

the Corporation would have the power to indemnify such person against such liability under the provisions of this Article VI.

Section

6.8. Definition of Corporation. For the purposes of this Article VI, references to “the Corporation” include, in

addition to the resulting corporation, all constituent corporations (including any constituent of a constituent) absorbed in consolidation

or merger which, if its separate existence had continued, would have had power and authority to indemnify its directors or officer so

that any person who is or was a director or officer of such constituent corporation, or is or was serving at the request of such constituent

corporation as a director or officer of a subsidiary of such constituent corporation, shall stand in the same position under the provisions

of this Article VI with respect to the resulting or surviving corporation as he or she would have with respect to such constituent corporation

if its separate existence had continued.

Section

6.9. Definition of Subsidiary. For the purposes of this Article VI, references to a “subsidiary” of a person shall

mean (i) a corporation more than 50 percent of the combined voting power of the outstanding voting stock of which is owned, directly or

indirectly, by such person or by one or more other subsidiaries of such person or by such person and one or more other subsidiaries of

such person; (ii) a partnership of which such person or one or more other subsidiaries of such person or such person and one or more other

subsidiaries thereof, directly or indirectly, is the general partner and has the power to direct the policies, management and affairs

of such partnership; (iii) a limited liability company of which such person or one or more other subsidiaries of such person or such person

and one or more other subsidiaries of such person, directly or indirectly, is the managing member and has the power to direct the policies,

management and affairs of such company; and (iv) any other person (other than a corporation, partnership or limited liability company)

in which such person or one or more other subsidiaries of such person or such person and one or more other subsidiaries of such person,

directly or indirectly, has at least a majority ownership or the power to direct the policies, management and affairs thereof (including

by contract).

Section

6.10. Other Definitions. For purposes of this Article VI, references to “other enterprise” shall include employee

benefit plans; references to “fine” shall include any excise tax assessed on a person with respect to an employee benefit

plan; and references to “serving at the request of the Corporation” shall include any service as a director or officer of

the Corporation which imposes duties on, or involves services by, such director or officer with respect to an employee benefit plan, its

participants, or beneficiaries; and a person who acted in good faith and in a manner he or she reasonably believed to be in the interest

of the participants and beneficiaries of an employee benefit plan shall be deemed to have acted in a manner “not opposed to the

best interests of the Corporation” as referred to in this Article VI.

ARTICLE VII

AMENDMENT

The Corporation reserves

the right to amend, alter, change, or repeal any provision contained in these Fourth Amended and Restated Articles of Incorporation in

the manner now or hereafter prescribed by statute, or by these Fourth Amended and Restated Articles of Incorporation.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the undersigned authorized

officer of the Corporation has executed these Fourth Amended and Restated Articles of Incorporation, certifying that the facts herein

stated are true, this 1st day of July, 2023.

| |

|

U.S. Xpress Enterprises, Inc. |

| |

|

|

| |

|

|

| |

By: |

/s/ Nathan Harwell |

| |

Name: |

Nathan Harwell |

| |

Title: |

Executive Vice President, Chief Legal Officer, and Secretary |

[Signature Page to Fourth

Amended and Restated Articles of Incorporation]

Exhibit 3.3

FOURTH

AMENDED AND RESTATED

BYLAWS

OF

U.S. XPRESS ENTERPRISES, INC.

Article

I

Offices

Section 1.01 Offices.

The registered office of U.S. Xpress Enterprises, Inc. (the “Corporation”) shall be National Registered Agents, Inc.,

701 South Carson Street, Suite 200, Carson City, Nevada 89701, USA. The name of its registered agent at such address is National Registered

Agents, Inc. The Corporation may have other offices, both within and without the State of Nevada, as the board of directors of the Corporation

(the “Board of Directors”) from time to time shall determine or the business of the Corporation may require.

Section 1.02 Books

and Records. Any records maintained by the Corporation in the regular course of its business, including its stock ledger,

books of account and minute books, may be maintained on any information storage device or method.

Article

II

Meetings

of the stockholders

Section 2.01 Place

of Meetings. Except as otherwise provided in these Fourth Amended and Restated Bylaws (the “Bylaws”), all

meetings of the stockholders shall be held on such dates and at such times and places, within or without the State of Nevada, as shall

be determined by the Board of Directors and as shall be stated in the notice of the meeting or in waivers of notice thereof. If the place

of any meeting is not so fixed, it shall be held at the registered office of the Corporation in the State of Nevada.

Section 2.02 Annual

Meeting. The annual meeting of stockholders for the election of directors and the transaction of such other proper business

as may be brought before the meeting shall be held on such date after the close of the Corporation’s fiscal year, and at such time,

as the Board of Directors may from time to time determine.

Section 2.03 Special

Meetings. Special meetings of the stockholders, for any purpose or purposes, may be called by the Board of Directors and

shall be called by the president or the secretary upon the written request of a majority of the directors. The request shall state

the date, time, place and purpose or purposes of the proposed meeting.

Section 2.04 Adjournments.

Any meeting of the stockholders, annual or special, may be adjourned from time to time to reconvene at the same or some other place, if

any, and notice need not be given of any such adjourned meeting if the time, place, if any, thereof and the means of remote communication,

if any, are announced at the meeting at which the adjournment is taken. At the adjourned meeting, the Corporation may transact any business

which might have been transacted at the original meeting. If the adjournment is for more than 30 days, a notice of the adjourned meeting

shall be given to each stockholder of record entitled to vote at the meeting. If after the adjournment a new record date is fixed for

stockholders entitled to vote at the adjourned meeting, the Board of Directors shall fix a new record date for notice of the adjourned

meeting and shall give notice of the adjourned meeting to each stockholder of record entitled to vote at the adjourned meeting as of the

record date fixed for notice of the adjourned meeting.

Section 2.05 Notice

of Meetings. Notice of the place, if any, date, hour, the record date for determining the stockholders entitled to vote

at the meeting (if such date is different from the record date for stockholders entitled to notice of the meeting) and means of

remote communication, if any, of every meeting of stockholders shall be given by the Corporation not less than ten days nor more

than 60 days before the meeting (unless a different time is specified by law) to every stockholder entitled to vote at the meeting

as of the record date for determining the stockholders entitled to notice of the meeting. Notices of special meetings shall also

specify the purpose or purposes for which the meeting has been called. Except as otherwise provided herein or permitted by

applicable law, notice to stockholders shall be in writing and delivered personally or mailed to the stockholders at their address

appearing on the books of the Corporation. Without limiting the manner by which notice otherwise may be given effectively to

stockholders, notice of meetings may be given to stockholders by means of electronic transmission in accordance with applicable law.

Notice of any meeting need not be given to any stockholder who shall, either before or after the meeting, submit a waiver of notice

or who shall attend such meeting, except when the stockholder attends for the express purpose of objecting, at the beginning of the

meeting, to the transaction of any business because the meeting is not lawfully called or convened. Any stockholder so waiving

notice of the meeting shall be bound by the proceedings of the meeting in all respects as if due notice thereof had been given.

Section 2.06 List

of Stockholders. The officer of the Corporation who has charge of the stock ledger shall prepare a complete list of the stockholders

entitled to vote at any meeting of stockholders (provided, however, if the record date for determining the stockholders entitled to vote

is less than ten days before the date of the meeting, the list shall reflect the stockholders entitled to vote as of the tenth day before

the meeting date), arranged in alphabetical order, and showing the address of each stockholder and the number of shares of each class

of capital stock of the Corporation registered in the name of each stockholder at least ten days before any meeting of the stockholders.

Such list shall be open to the examination of any stockholder, for any purpose germane to the meeting, on a reasonably accessible electronic

network if the information required to gain access to such list was provided with the notice of the meeting or during ordinary business

hours, at the principal place of business of the Corporation for a period of at least ten days before the meeting. If the meeting is to

be held at a place, the list shall also be produced and kept at the time and place of the meeting the whole time thereof and may be inspected

by any stockholder who is present. If the meeting is held solely by means of remote communication, the list shall also be open for inspection

by any stockholder during the whole time of the meeting as provided by applicable law. Except as provided by applicable law, the stock

ledger of the Corporation shall be the only evidence as to who are the stockholders entitled to examine the stock ledger and the list

of stockholders or to vote in person or by proxy at any meeting of stockholders.

Section 2.07 Quorum.

Unless otherwise required by law, the Corporation’s Articles of Incorporation (the “Articles of Incorporation”)

or these Bylaws, at each meeting of the stockholders, a majority of the outstanding shares of the Corporation entitled to vote at the

meeting, present in person or represented by proxy, shall constitute a quorum. If, however, such quorum shall not be present or represented

at any meeting of the stockholders, the stockholders entitled to vote thereat, present in person or represented by proxy, shall have power

to adjourn the meeting from time to time, in the manner provided in Section 2.04, until a quorum shall be present or represented. A quorum,

once established, shall not be broken by the subsequent withdrawal of enough votes to leave less than a quorum. At any such adjourned

meeting at which there is a quorum, any business may be transacted that might have been transacted at the meeting originally called.

Section 2.08 Conduct

of Meetings. At each meeting of the stockholders, the president or, in his or her absence, any one of the vice presidents,

in order of their seniority, shall act as chairman of the meeting. The secretary or, in his or her absence, any person appointed by the

chairman of the meeting shall act as secretary of the meeting and shall keep the minutes thereof. The order of business at all meetings

of the stockholders shall be as determined by the chairman of the meeting.

Section 2.09 Voting;

Proxies. Unless otherwise required by law or the Articles of Incorporation, the election of

directors shall be decided by a plurality of the votes cast at a meeting of the stockholders by the holders of stock entitled to

vote in the election. Unless otherwise required by law, the Articles of Incorporation or these Bylaws, any matter, other than the

election of directors, brought before any meeting of stockholders shall be decided by the affirmative vote of the majority of shares

present in person or represented by proxy at the meeting and entitled to vote on the matter. Each stockholder entitled to vote at a

meeting of stockholders or to express consent to corporate action in writing without a meeting may authorize another person or

persons to act for such stockholder by proxy, but no such proxy shall be voted or acted upon after three years from its date, unless

the proxy provides for a longer period. A proxy shall be irrevocable if it states that it is irrevocable and if, and only as long

as, it is coupled with an interest sufficient in law to support an irrevocable power. A stockholder may revoke any proxy that is not

irrevocable by attending the meeting and voting in person or by delivering to the secretary of the Corporation a revocation of the

proxy or a new proxy bearing a later date. Voting at meetings of stockholders need not be by written ballot.

Section 2.10 Written

Consent of Stockholders Without a Meeting. Unless otherwise provided in the Articles of Incorporation of the Corporation, any

action required to be taken or which may be taken at any annual or special meeting of stockholders may be taken without a meeting, without

prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed, in person or

by proxy, by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or

take such action at a meeting at which all shares entitled to vote thereon were present and voted in person or by proxy and shall be delivered

to the Corporation as required by law. Prompt notice of the taking of the corporate action without a meeting by less than unanimous written

consent shall be given to those stockholders who have not consented in writing.

Section 2.11 Fixing

the Record Date.

(a) In order that the Corporation

may determine the stockholders entitled to notice of or to vote at any meeting of stockholders or any adjournment thereof, the Board of

Directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted

by the Board of Directors, and which record date shall not be more than 60 nor less than ten days before the date of such meeting. If

the Board of Directors so fixes a date, such date shall also be the record date for determining the stockholders entitled to vote at such

meeting unless the Board of Directors determines, at the time it fixes such record date, that a later date on or before the date of the

meeting shall be the date for making such determination. If no record date is fixed by the Board of Directors, the record date for determining

stockholders entitled to notice of or to vote at a meeting of stockholders shall be at the close of business on the day next preceding

the day on which notice is given, or, if notice is waived, at the close of business on the day next preceding the day on which the meeting

is held. A determination of stockholders of record entitled to notice of or to vote at a meeting of stockholders shall apply to any adjournment

of the meeting; provided, however, that the Board of Directors may fix a new record date for the determination of stockholders

entitled to vote at the adjourned meeting and in such case shall also fix as the record date for stockholders entitled to notice of such

adjourned meeting the same or an earlier date as that fixed for the determination of stockholders entitled to vote therewith at the adjourned

meeting.

(b) In order that the

Corporation may determine the stockholders entitled to consent to corporate action in writing without a meeting, the Board of

Directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is

adopted by the Board of Directors, and which record date shall not be more than ten days after the date upon which the resolution

fixing the record date is adopted by the Board of Directors. If no record date has been fixed by the Board of Directors, the record

date for determining stockholders entitled to consent to corporate action in writing without a meeting: (i) when no prior action by

the Board of Directors is required by law, the record date for such purpose shall be the first date on which a signed written

consent setting forth the action taken or proposed to be taken is delivered to the Corporation by delivery (by hand, or by certified

or registered mail, return receipt requested) to its registered office in the State of Nevada, its principal place of business, or

an officer or agent of the Corporation having custody of the book in which proceedings of meetings of stockholders are recorded; and

(ii) if prior action by the Board of Directors is required by law, the record date for such purpose shall be at the close of

business on the day on which the Board of Directors adopts the resolution taking such prior action.

(c) In order that the Corporation

may determine the stockholders entitled to receive payment of any dividend or other distribution or allotment of any rights or the stockholders

entitled to exercise any rights in respect of any change, conversion or exchange of stock, or for the purpose of any other lawful action,

the Board of Directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the record

date is adopted, and which record date shall be not more than 60 days prior to such action. If no record date is fixed, the record date

for determining stockholders for any such purpose shall be at the close of business on the day on which the Board of Directors adopts

the resolution relating thereto.

Article

III

Board of

directors

Section 3.01 General

Powers. The business and affairs of the Corporation shall be managed by or under the direction of the Board of Directors. The

Board of Directors may adopt such rules and procedures, not inconsistent with the Articles of Incorporation, these Bylaws or applicable

law, as it may deem proper for the conduct of its meetings and the management of the Corporation.

Section 3.02 Number;

Term of Office. Except as otherwise provided by the Articles of Incorporation of the Corporation, until such time as the Board

of Directors determines otherwise, the number of directors shall be no less than one (1). Each director shall hold office until a successor

is duly elected and qualified or until the director’s earlier death, resignation, disqualification or removal.

Section 3.03 Newly

Created Directorships and Vacancies. Any newly created directorships resulting from an increase in the authorized number of

directors and any vacancies occurring in the Board of Directors, maybe filled by the affirmative votes of a majority of the remaining

members of the Board of Directors, although less than a quorum. A director so elected shall be elected to hold office until the earlier

of the expiration of the term of office of the director whom he or she has replaced, a successor is duly elected and qualified or the

earlier of such director’s death, resignation or removal.

Section 3.04 Resignation.

Any director may resign at any time by notice given in writing or by electronic transmission to the Corporation. Such resignation shall

take effect at the date of receipt of such notice by the Corporation or at such later time as is therein specified.

Section 3.05 Regular

Meetings. Regular meetings of the Board of Directors may be held without notice at such times and at such places as may be

determined from time to time by the Board of Directors or its chairman. Notice of regular meetings need not be given, except as otherwise

required by law.

Section 3.06 Special

Meetings. Special meetings of the Board of Directors, for any purpose or purposes, may be called by the president and shall

be called by the president or the secretary upon the written request of a majority of the directors. The request shall state the date,

time, place and purpose or purposes of the proposed meeting.

Section 3.07 Telephone

Meetings. Board of Directors or Board of Directors committee meetings may be held by means of telephone conference or

other communications equipment by means of which all persons participating in the meeting can hear each other and be heard.

Participation by a director in a meeting pursuant to this Section shall constitute presence in person at such meeting.

Section 3.08 Adjourned

Meetings. A majority of the directors present at any meeting of the Board of Directors, including an adjourned meeting, whether

or not a quorum is present, may adjourn and reconvene such meeting to another time and place. At least 24 hours notice of any adjourned

meeting of the Board of Directors shall be given to each director whether or not present at the time of the adjournment, if such notice

shall be given by one of the means specified in Section 3.09 hereof other than by mail, or at least three days notice if by mail. Any

business may be transacted at an adjourned meeting that might have been transacted at the meeting as originally called.

Section 3.09 Notices.

Subject to Section 3.06, Section 3.08 and Section 3.10 hereof, whenever notice is required to be given to any director by applicable law,

the Articles of Incorporation or these Bylaws, such notice shall be deemed given effectively if given in person or by telephone, mail

addressed to such director at such director’s address as it appears on the records of the Corporation, facsimile, e-mail or by other

means of electronic transmission.

Section 3.10 Waiver

of Notice. Whenever the giving of any notice to directors is required by applicable law, the Articles of Incorporation or these

Bylaws, a waiver thereof, given by the director entitled to the notice, whether before or after such notice is required, shall be deemed

equivalent to notice. Attendance by a director at a meeting shall constitute a waiver of notice of such meeting except when the director

attends a meeting for the express purpose of objecting, at the beginning of the meeting, to the transaction of any business on the ground

that the meeting was not lawfully called or convened. Neither the business to be transacted at, nor the purpose of, any regular or special

Board of Directors or committee meeting need be specified in any waiver of notice.

Section 3.11 Organization.

At each meeting of the Board of Directors, the chairman or, in his or her absence, another director selected by the Board of Directors

shall preside. The secretary shall act as secretary at each meeting of the Board of Directors. If the secretary is absent from any meeting

of the Board of Directors, an assistant secretary shall perform the duties of secretary at such meeting; and in the absence from any such

meeting of the secretary and all assistant secretaries, the person presiding at the meeting may appoint any person to act as secretary

of the meeting.

Section 3.12 Quorum

of Directors. The presence of a majority of the Board of Directors shall be necessary and sufficient to constitute a quorum

for the transaction of business at any meeting of the Board of Directors.

Section 3.13 Action

By Majority Vote. Except as otherwise expressly required by these Bylaws, the Articles of Incorporation or by applicable law,

the vote of a majority of the directors present at a meeting at which a quorum is present shall be the act of the Board of Directors.

Section 3.14 Action

Without Meeting. Unless otherwise restricted by the Articles of Incorporation or these Bylaws, any action required or permitted

to be taken at any meeting of the Board of Directors or of any committee thereof may be taken without a meeting if all of the directors

or members of such committee, except to the extent that the consent of a director or committee member is not required by Nevada law, consent

thereto in writing or by electronic transmission, and the writings or electronic transmissions are filed with the minutes of proceedings

of the Board of Directors or committee in accordance with applicable law.

Section 3.15 Committees

of the Board of Directors. The Board of Directors may designate one or more committees, each committee to consist of one

or more of the directors of the Corporation. The Board of Directors may designate one or more directors as alternate members of any

committee, who may replace any absent or disqualified member at any meeting of the committee. If a member of a committee shall be

absent from any meeting, or disqualified from voting thereat, the remaining member or members present at the meeting and not

disqualified from voting, whether or not such member or members constitute a quorum, may, by a unanimous vote, appoint another

member of the Board of Directors to act at the meeting in the place of any such absent or disqualified member. Any such committee,

to the extent permitted by applicable law, shall have and may exercise all the powers and authority of the Board of Directors in the

management of the business and affairs of the Corporation and may authorize the seal of the Corporation to be affixed to all papers

that may require it to the extent so authorized by the Board of Directors. Unless the Board of Directors provides otherwise, at all

meetings of such committee, a majority of the then authorized members of the committee shall constitute a quorum for the transaction

of business, and the vote of a majority of the members of the committee present at any meeting at which there is a quorum shall be

the act of the committee. Each committee shall keep regular minutes of its meetings. Unless the Board of Directors provides

otherwise, each committee designated by the Board of Directors may make, alter and repeal rules and procedures for the conduct of

its business. In the absence of such rules and procedures each committee shall conduct its business in the same manner as the Board

of Directors conducts its business pursuant to this Article III.

Article

IV

Officers

Section 4.01 Positions

and Election. The officers of the Corporation shall be elected by the Board of Directors and shall include a president, a treasurer

and a secretary. The Board of Directors, in its discretion, may also elect a chairman (who must be a director), one or more vice chairmen

(who must be directors) and one or more vice presidents, assistant treasurers, assistant secretaries and other officers. Any individual

may be elected to, and may hold, more than one office of the Corporation.

Section 4.02 Term.

Each officer of the Corporation shall hold office until such officer’s successor is elected and qualified or until such officer’s

earlier death, resignation or removal. Any officer elected or appointed by the Board of Directors may be removed by the Board of Directors

at any time with or without cause by the majority vote of the members of the Board of Directors then in office. The removal of an officer

shall be without prejudice to his or her contract rights, if any. The election or appointment of an officer shall not of itself create

contract rights. Any officer of the Corporation may resign at any time by giving written notice of his or her resignation to the president

or the secretary. Any such resignation shall take effect at the time specified therein or, if the time when it shall become effective

shall not be specified therein, immediately upon its receipt. Unless otherwise specified therein, the acceptance of such resignation shall

not be necessary to make it effective. Should any vacancy occur among the officers, the position shall be filled for the unexpired portion

of the term by appointment made by the Board of Directors.

Section 4.03 The

President. The president shall have general supervision over the business of the Corporation and other duties incident to the

office of president, and any other duties as may be from time to time assigned to the president by the Board of Directors and subject

to the control of the Board of Directors in each case.

Section 4.04 Vice

Presidents. Each vice president shall have such powers and perform such duties as may be assigned to him or her from time to

time by the chairman of the Board of Directors or the president.

Section 4.05 The

Secretary. The secretary shall attend all sessions of the Board of Directors and all meetings of the stockholders and

record all votes and the minutes of all proceedings in a book to be kept for that purpose, and shall perform like duties for

committees when required. He or she shall give, or cause to be given, notice of all meetings of the stockholders and meetings of the

Board of Directors, and shall perform such other duties as may be prescribed by the Board of Directors or the president. The

secretary shall keep in safe custody the seal of the Corporation and have authority to affix the seal to all documents requiring it

and attest to the same.

Section 4.06 The

Treasurer. The treasurer shall have the custody of the corporate funds and securities, except as otherwise provided by the

Board of Directors, and shall keep full and accurate accounts of receipts and disbursements in books belonging to the Corporation and

shall deposit all moneys and other valuable effects in the name and to the credit of the Corporation in such depositories as may be designated

by the Board of Directors. The treasurer shall disburse the funds of the Corporation as may be ordered by the Board of Directors, taking

proper vouchers for such disbursements, and shall render to the president and the directors, at the regular meetings of the Board of Directors,

or whenever they may require it, an account of all his or her transactions as treasurer and of the financial condition of the Corporation.

Section 4.07 Duties

of Officers May be Delegated. In case any officer is absent, or for any other reason that the Board of Directors may deem sufficient,

the president or the Board of Directors may delegate for the time being the powers or duties of such officer to any other officer or to

any director.

Article

V

Stock certificates

and their transfer

Section 5.01 Certificates

Representing Shares. The shares of the Corporation shall not be represented by certificates; provided, that the Board of

Directors may provide by resolution or resolutions after the date hereof that some or all of any or all classes or series of stock

shall be represented by certificates. Certificates for the Corporation’s capital stock, if any, shall be in such form as

required by law and as approved by the Board of Directors. Each certificate, if any, shall be signed in the name of the Corporation

by the president or any vice president and by the secretary, the treasurer, any assistant secretary or any assistant treasurer. Any

or all of the signatures on a certificate may be a facsimile or other electronic format (e.g., PDF). In case any officer, transfer

agent or registrar who shall have signed or whose facsimile signature shall have been placed on any certificate shall have ceased to

be such officer, transfer agent or registrar before the certificate shall be issued, the certificate may be issued by the

Corporation with the same effect as if he or she were such officer, transfer agent or registrar at the date of issue.

Section 5.02 Transfers

of Stock. Stock of the Corporation shall be transferable in the manner prescribed by law and in these Bylaws. Transfers of

stock shall be made on the books of the Corporation only by the holder of record thereof, by such person’s attorney lawfully constituted

in writing and, in the case of certificated shares, upon the surrender of the certificate thereof, which shall be cancelled before a new

certificate or uncertificated shares shall be issued. No transfer of stock shall be valid as against the Corporation for any purpose until

it shall have been entered in the stock records of the Corporation by an entry showing from and to whom transferred. To the extent designated

by the president or any vice president or the treasurer of the Corporation, the Corporation may recognize the transfer of fractional uncertificated

shares, but shall not otherwise be required to recognize the transfer of fractional shares.

Section 5.03 Transfer

Agents and Registrars. The Board of Directors may appoint, or authorize any officer or officers to appoint, one or more transfer

agents and one or more registrars.

Section 5.04 Lost,

Stolen or Destroyed Certificates. The Board of Directors may direct a new certificate or uncertificated shares to be

issued in place of any certificate theretofore issued by the Corporation alleged to have been lost, stolen or destroyed upon the

making of an affidavit of that fact by the owner of the allegedly lost, stolen or destroyed certificate. When authorizing such issue

of a new certificate or uncertificated shares, the Board of Directors may, in its discretion and as a condition precedent to the

issuance thereof, require the owner of the lost, stolen or destroyed certificate, or the owner’s legal representative to give

the Corporation a bond sufficient to indemnify it against any claim that may be made against the Corporation with respect to the

certificate alleged to have been lost, stolen or destroyed or the issuance of such new certificate or uncertificated shares.

Article

VI

Indemnification

OF DIRECTORS AND OFFICERS

The Corporation shall indemnify

its directors and officers to the maximum extent permitted by the Chapter 78 of the Nevada Revised Statutes, as may be amended from time

to time. Indemnification shall be provided unless it is ultimately determined by a court of competent jurisdiction that (i) the indemnified

party did not act in a manner he or she believed in good faith to be in, or not opposed to, the best interests of the Corporation and,

(ii) with respect to any criminal action or proceeding, the indemnified party had no reasonable cause to believe his or her conduct was

lawful. Expenses shall be advanced to an indemnified party upon written confirmation that he or she has not acted in a manner that would

preclude indemnification above and an undertaking to return any advances if it is ultimately determined by a court of competent jurisdiction

that the party is not entitled to indemnification under the standard set forth herein.

Article

VII

General

provisions

Section 7.01 Seal.

The seal of the Corporation shall be in such form as shall be approved by the Board of Directors. The seal may be used by causing it or

a facsimile thereof to be impressed or affixed or reproduced or otherwise, as may be prescribed by law or custom or by the Board of Directors.

Section 7.02 Fiscal

Year. The fiscal year of the Corporation shall be determined by the Board of Directors.

Section 7.03 Voting

Shares in Other Corporations. Unless otherwise directed by the Board of Directors, shares in other corporations which are held

by the Corporation shall be represented and voted only by the president or by a proxy or proxies appointed by him or her.

Section 7.04 Dividends.

Subject to applicable law and the Articles of Incorporation, dividends upon the shares of capital stock of the Corporation may be declared

by the Board of Directors at any regular or special meeting of the Board of Directors. Dividends may be paid in cash, in property or in

shares of the Corporation’s capital stock, unless otherwise provided by applicable law or the Articles of Incorporation.

Section 7.05 Forum

Selection. Unless the Corporation consents in writing to the selection of an alternative forum, the Eighth Judicial District

Court in and for the County of Clark, State of Nevada shall, to the fullest extent permitted by law, be the sole and exclusive forum for:

(a) any derivative action or proceeding brought on behalf of the corporation, (b) any action asserting a claim of breach of a fiduciary

duty owed by any current or former director, officer, other employee, agent or stockholder of the corporation to the corporation or the

corporation’s stockholders, including, without limitation, a claim alleging the aiding and abetting of such a breach of fiduciary

duty, (c) any action asserting a claim arising pursuant to any provision of the NRS, the Articles of Incorporation or these Bylaws (as

each may be amended from time to time) or as to which the NRS confers jurisdiction on the Eighth Judicial District Court in and for the

County of Clark, State of Nevada or (d) any action asserting a claim governed by the internal affairs doctrine or other “internal

action” as defined in Section 78.046 of the NRS. Any person or entity purchasing or otherwise acquiring or holding any interest

in shares of capital stock of the corporation shall be deemed to have notice of and consented to the provisions of this Section 7.05.

Section 7.06 Interpretation.

Unless the context of a Section of these Bylaws otherwise requires, the terms used in these Bylaws shall

have the meanings provided in, and these Bylaws shall be construed in accordance with, the Nevada statutes relating to private corporations,

as found in Chapter 78 of the NRS or any subsequent statute.

Section 7.07 Provisions

contrary to Provisions of Law. Any article, section, subsections, subdivision, sentence, clause, or phrase of these Bylaws

which is contrary or inconsistent with any applicable provisions of law, will not apply so long as such provisions of law remain in effect,

but such result will not affect the validity or applicability of any other portions of these Bylaws, it being hereby declared that these

Bylaws would have been adopted and each article, section, subsection, subdivision, sentence, clause, or phrase thereof, irrespective of

the fact that any one or more articles, sections, subsections, subdivisions, sentences, clauses, or phrase is or are illegal.

Article

VIII

Amendments

Section 8.01 Stockholder

Amendments. These Bylaws may be adopted, amended or repealed by the affirmative vote of not less than a majority of the outstanding

shares of the Corporation entitled to vote.

Section 8.02 Amendments

by Board of Directors. Subject to the right of the stockholders as provided in Section 8.01 of this Article VIII, Bylaws may be adopted,

amended or repealed by the Board of Directors.

Exhibit 99.1

KNIGHT-SWIFT TRANSPORTATION CLOSES ACQUISITION

OF U.S. XPRESS

ENTERPRISES AND PROVIDES UPDATE ON MARKET CONDITIONS

PHOENIX, ARIZONA – July 5, 2023 – Effective July

1, 2023, Knight-Swift Transportation Holdings Inc. (NYSE: KNX) ("Knight-Swift" or the “Company”) closed on the previously-announced

acquisition of U.S. Xpress Enterprises, Inc. ("U.S. Xpress") following the approval by U.S. Xpress’ shareholders on June

29, 2023. Upon completion of the transaction, U.S. Xpress was de-listed from the New York Stock Exchange.

Knight-Swift CEO, Dave Jackson, commented, “We are grateful for

the efforts of so many who worked diligently to bring about such a significant transaction in the truckload industry. Against the current

backdrop of a particularly difficult business environment, the chance to add one of the largest brands in our industry, with significant

opportunity to improve earnings, gain customers and reach more professional drivers, is a compelling part of our plan to drive higher

highs and higher lows across successive truckload freight cycles. As we have engaged with more of the U.S. Xpress organization since the

announcement, we have even more confidence that our combined efforts will lead to achievement of the profitability targets we communicated.

Our cross-functional synergy teams made up of leaders from Knight, Swift, and U.S. Xpress are off to a great start collaborating on plans

to share best practices, improve operations and leverage economies of scale – and now they have the green light to fully engage.

While the truckload part of the organization focuses on achieving the goals we have laid out for U.S. Xpress, our LTL and M&A teams

remain focused on our strategic priority of continuing to build out a nationwide LTL network.”

Knight-Swift also is providing an update on current market conditions

as management anticipates that consolidated second-quarter results will be lower than previously expected. This decline in operating performance

is largely driven by the full truckload market, where persistently soft demand has caused volumes and pricing to be under greater pressure

than originally anticipated, while costs remain stable on a sequential basis. This dynamic is expected to drive an estimated 1,100-1,200

basis point degradation in consolidated operating margins year-over-year for the quarter. The Company expects to update its annual earnings

guidance to reflect the current operating conditions and outlook as well as the inclusion of U.S. Xpress for the back half of the year

in conjunction with its scheduled earnings release and presentation on July 20, 2023.

About U.S. Xpress

U.S. Xpress is based in Chattanooga, Tennessee and generated approximately

$2.2 billion in total operating revenue in 2022 while serving its blue-chip customer base through a network of approximately 14 facilities,

primarily located across the eastern United States. U.S. Xpress’ fleet includes approximately 7,200 tractors and 15,000 trailers,

including tractors provided by approximately 900 independent contractors. The company’s highly skilled workforce includes approximately

7,700 drivers (including independent contractors), 300 maintenance technicians, and 1,900 non-driver employees.

About Knight-Swift

Knight-Swift Transportation Holdings Inc. is one of North America's

largest and most diversified freight transportation companies, providing multiple truckload transportation, less-than-truckload, logistics,

and business services to the shipping and transportation sectors. Knight-Swift uses a nationwide network of business units and terminals

in the United States and Mexico to serve customers throughout North America. In addition to operating the country's largest tractor fleet,

Knight-Swift also contracts with third-party equipment providers to provide a broad range of services to its customers while creating

quality driving jobs for driving associates and successful business opportunities for independent contractors.

Contacts

David Jackson, President and CEO, Adam Miller,

CFO, or Brad Stewart, Investor Relations

(602) 606-6349

Forward Looking

Statements

This communication contains

“forward-looking statements,” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the

Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995 that provides a safe harbor for

forward-looking statements, including statements relating to the completion of the transaction, all statements that do not relate

solely to historical or current facts, and expectations, intentions or strategies regarding the future. These forward-looking

statements are generally denoted by the use of words such as “anticipate,” “believe,” “expect,”

“intend,” “aim,” “target,” “plan,” “continue,” “estimate,”

“project,” “may,” “will,” “should,” “could,” “would,”

“predict,” “potential,” “ongoing,” “goal,” “can,” “seek,”

“designed,” “likely,” “foresee,” “forecast,” “project,”

“hope,” “strategy,” “objective,” “mission,” “continue,”

“outlook,” “potential,” “feel,” and similar expressions. However, the absence of these words or

similar expressions does not mean that a statement is not forward-looking. Statements in this announcement that are forward looking

may include, but are not limited to, statements regarding the benefits of the proposed transaction with U.S. Xpress and the

associated integration plans, expected synergies and revenue opportunities, expected branding, anticipated future operating

performance and results of Knight-Swift, including statements regarding anticipated earnings, margins, and cash flows. By their

nature, all forward-looking statements are not guarantees of future performance or results and are subject to risks and

uncertainties that are difficult to predict and/or quantify. Such risks and uncertainties include, but are not limited to: the risk

that there may be unexpected costs, charges or expenses resulting from the proposed transaction; risks related to the ability of

Knight-Swift to successfully integrate the businesses and achieve the expected synergies and operating efficiencies within the

expected timeframes or at all and the possibility that such integration may be more difficult, time consuming or costly than

expected; risks that the transaction disrupts Knight-Swift’s current plans and operations; risks related to disruption of each

company’s management’s time and attention from ongoing business operations due to the integration; continued and

sufficient availability of capital and financing; the risk that the transaction could have an adverse effect on the ability of

Knight-Swift to retain and hire key personnel, to retain customers and to maintain relationships with its business partners,

suppliers and customers and on its respective operating results and businesses generally; the risk of pending or future litigation

against the parties to the agreement or their respective directors, affiliated persons or officers and/or regulatory actions related

to the transaction, including the effects of any outcomes related thereto; risks related to changes in accounting standards or tax

rates, laws or regulations; risks related to unpredictable and severe or catastrophic events, including but not limited to acts of

terrorism, war or hostilities (including effects of the conflict in Ukraine), cyber-attacks, or the impact of the COVID-19 pandemic

or any other pandemic, epidemic or outbreak of an infectious disease in the United States or worldwide on Knight-Swift’s

business, financial condition and results of operations, as well as the response thereto by the company; and other business effects,

including the effects of industry, market, economic (including the effect of inflation), political or regulatory conditions. Also,

Knight-Swift’s actual results may differ materially from those contemplated by the forward-looking statements for a number of

additional reasons as described in Knight-Swift’s SEC filings, including those set forth in the Risk Factors section and under

any “Forward-Looking Statements” or similar heading in Knight-Swift’s most recently filed Annual Report on Form

10-K for the year ended December 31, 2022, Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2023, and Current

Reports on Form 8-K.

You are

cautioned not to place undue reliance on Knight-Swift’s forward-looking statements. Knight-Swift’s forward-looking statements

are and will be based upon management’s then-current views and assumptions regarding Knight-Swift’s transaction with U.S.

Xpress, future events and operating performance, and are applicable only as of the dates of such statements. Knight-Swift does not assume

any duty to update or revise forward-looking statements, whether as a result of new information, future events, uncertainties or otherwise.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC