As filed with the United States Securities and Exchange Commission on May 17, 2023.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

APPLIED DIGITAL CORPORATION

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Nevada | 7370 | 95-4863690 |

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

3811 Turtle Creek Blvd., Suite 2100,

Dallas, TX 75219

214-427-1704

(Address, including zip code, and telephone number, including area code, of principal executive offices)

Copies to:

Carol Sherman, Esq.

Kelley Drye & Warren LLP

Canterbury Green

201 Broad Street

Stamford, CT 06901

Telephone: (203) 324-1400

Facsimile: (203) 327-2669

Approximate date of proposed sale to public: As soon as practicable on or after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934 (the “Exchange Act”). (Check one):

Large accelerated filer ☐ Accelerated filer ☐

Non-accelerated filer Smaller reporting company

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to section 7(a)(2)(B) of the Securities Act. ☐

| | |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission acting pursuant to said Section 8(a) may determine. |

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION, DATED MAY 17, 2023

PROSPECTUS

$175,000,000

Common Stock

Preferred Stock

Warrants

We may offer from time to time

| | | | | |

| shares of common stock; |

| shares of preferred stock in one or more series; |

| warrants to purchase preferred stock or common stock; or |

| any combination of preferred stock, common stock, or warrants, |

at an aggregate offering price not to exceed $175,000,000.

The number, amount, prices, and specific terms of the securities, and the net proceeds to Applied Digital Corp. will be determined at or before the time of sale and will be set forth in an accompanying prospectus supplement. The net proceeds to us from the sale of securities will be the offering price or the purchase price of those securities less any applicable commission or discount, and less any other expenses we incur in connection with the issuance and distribution of those securities.

This prospectus may not be used for the sale of any securities unless it is accompanied by a prospectus supplement. Any accompanying prospectus supplement may modify or supersede any statement in this prospectus.

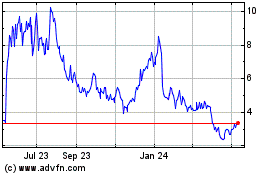

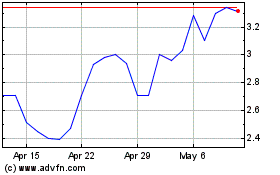

Our common stock is traded on the Nasdaq Global Select Market (“Nasdaq”) under the symbol APLD. On May 11, 2023, the last reported sale price of our common stock on Nasdaq was $3.49 per share. None of the other securities that we may offer under this prospectus are currently publicly traded. Each prospectus supplement will indicate whether the securities offered thereby will be listed on any securities exchange.

The Company currently has currently effective Registration Statements on Form S-3 relating to the resale of its securities by various selling security holders, pursuant to which, to the best of the Company’s knowledge, 54,724,744 shares of our common stock remain available for resale.

We may amend or supplement this prospectus from time to time. You should read this prospectus and any amendments or prospectus supplements carefully before you invest.

Investing in our securities involves significant risks. See “Risk Factors” beginning on page 7, and under similar headings in other documents filed after the date hereof and incorporated by reference into this prospectus and the accompanying prospectus for a discussion of factors that you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is [__], 2023

TABLE OF CONTENTS

Page

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process, pursuant to which we may, from time to time and in one or more offerings, offer and sell or otherwise dispose of the securities covered by this prospectus. You should not assume that the information contained in this prospectus is accurate on any date subsequent to the date set forth on the front cover of this prospectus or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered or securities are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in this prospectus, including the documents incorporated by reference therein, and any applicable supplement in making your investment decision. You should also read and consider the information in the documents to which we have referred you under the caption “Additional Information” and “Incorporation of Certain Information by Reference” in this prospectus.

You should rely only on the information provided in this prospectus and any applicable prospectus supplement, including any documents incorporated by reference into this prospectus or a prospectus supplement. We have not authorized any dealer, salesman or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any of our securities other than the securities covered hereby, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

The Company currently has the following effective registration statements relating to the resale of its securities by various selling security holders, pursuant to which, to the best of the Company’s knowledge, the following shares of our common stock remain available for resale: Registration Statement on Form S-1, Reg. No. 333-258818, 13,500,213 shares and Registration Statement on Form S-1, Reg. No. 333-267478, 41,224,531 shares.

This prospectus contains our trademarks, tradenames and servicemarks and also contains certain trademarks, tradenames and servicemarks of other parties.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. See “Risk Factors” and “Forward-Looking Statements.”

Unless the context indicates otherwise, references in this prospectus to the “Company,” “APLD,” “we,” “us,” “our” and similar terms refer to Applied Digital Corporation and its consolidated subsidiaries.

MARKET AND INDUSTRY DATA

Unless otherwise indicated, information contained in this prospectus, including information incorporated by reference into this prospectus, concerning our industry and the markets in which we operate, including our general expectations, market position, market opportunity, and market size, is based on information from various third-party industry and research sources, as well as assumptions that we have made that are based on those data and other similar sources, and on our knowledge of the markets for our products and services. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. While we believe the market position, market opportunity, and market size information included in this prospectus is generally reliable, information of this sort is inherently imprecise. In addition, projections, assumptions, and estimates of our future performance and the future performance of the industry in which we operate is necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors” and elsewhere in this prospectus and the documents incorporated by reference into this prospectus. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

This prospectus and the documents incorporated by reference herein contain statistical data, estimates, and forecasts that are based on industry publications or reports generated by third-party providers, or other publicly available information, as well as other information based on internal estimates.

PROSPECTUS SUMMARY

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should carefully read the entire prospectus and any applicable prospectus supplement and the documents incorporated by reference before investing in our common stock, including the sections titled “Forward-Looking Statements” and “Risk Factors” provided elsewhere in this prospectus. Some of the statements in this prospectus constitute forward-looking statements. See the section titled “Forward-Looking Statements.” Unless the context otherwise requires, the terms “Applied Digital,” “the company,” “we,” “us” and “our” in this prospectus refer to Applied Digital Corporation and our consolidated subsidiaries.

Our Business

We are a builder and operator of Next-Gen data centers across North America, which provide substantial computing power to high power computing applications such as blockchain infrastructure, nature language processing, and artificial intelligence. We have a colocation business model where customers place hardware they own into our facilities and we provide full operational and maintenance services for a fixed fee. We typically enter into long term fixed rate contracts with our customers.

On April 12, 2022, we effected a one-for-six (1:6) reverse split (the “Reverse Stock Split”) of shares of our common stock, par value $0.001 per share (the “Common Stock”). All references to Common Stock, options to purchase Common Stock, restricted stock units, share data, per share data and related information contained in the condensed consolidated financial statements have been retrospectively adjusted to reflect the effect of the Reverse Stock Split for all periods presented. No fractional shares of Common Stock were issued in connection with the Reverse Stock Split. Any fractional share resulting from the Reverse Stock Split was rounded down to the nearest whole share and the affected holder received cash in lieu of such fractional share.

Hosting Operation

We purchased property in North Dakota on which we constructed our first co-hosting facility. We entered into an Amended and Restated Energy Services Agreement for the purpose of supplying 100 megawatts (“MW”) of electricity to be used by our co-hosting customers at this facility. We also entered into agreements with five customers (JointHash Holding Limited (a subsidiary of GMR), Spring Mud (a subsidiary of GMR), Bitmain Technologies Limited, F2Pool Mining, Inc. and Hashing LLC, ) which utilize the total available energy under the Amended and Restated Energy Services Agreement. The company pays for energy from part of the revenue from customers.

Working with expert advisors in the fields of power, crypto mining operations, procurement, and construction, we have designed a plan for a prefabricated facility and organization within the facility that can be delivered and installed quickly and maximize performance and efficiency of the facility and our customers’ crypto mining equipment. Construction of our first co-hosting facility began in September 2021. On February 2, 2022, we brought our first facility online. It is now fully operational. On November 24, 2021, we entered into a letter of intent to develop a second datacenter facility. On April 13, 2022, the Company entered into a 99-year ground lease in Garden City, TX, with the intent to build our second datacenter facility on this site. On April 25, 2022 the Company began construction on this site. This facility is collocated with a wind farm and upon completion is expected to provide 200 MW of power to hosting customers. The facility is expected to begin operating in calendar Q2 of 2023 and the 200 MW capacity is fully contracted with our customers.

On January 6, 2022, we and Antpool, an affiliate of Bitmain Technologies Holding Company, entered into a Limited Liability Company Agreement of 1.21 Gigawatts, LLC (“1.21 Gigawatts”), pursuant to which we and Antpool contributed $8,000 and $2,000, respectively, and will initially own 80% and 20%, respectively, of 1.21 Gigawatts. 1.21 Gigawatts will develop, acquire, construct, finance, operate, maintain and own one or more Next-Gen datacenters with up to 1.5 gigawatts (“GW”) of capacity for hosting blockchain infrastructure. We are the managing member of 1.21 Gigawatts and are primarily responsible for all site development, construction and the eventual operations of the datacenters. However, certain activities of 1.21 Gigawatts and its subsidiaries require the vote of 90% of the then outstanding units of each such entity. As long as Antpool owns 10% or more of the total issued and outstanding units of 1.21 Gigawatts, Antpool may appoint an individual with industry expertise to serve as an advisor to 1.21 Gigawatts. 1.21 Gigawatts will pay fees to such advisor as reasonably determined by us as managing member. Transfers by members of units of 1.21 Gigawatts are prohibited without approval of 90% of units then outstanding, which consent may be granted or withheld for any reason, and transfers of such units to non-affiliates, after obtaining consent, are subject to a right of first refusal of the other members to purchase some or all of such units. Additionally, Antpool has the right at any time to convert all or any portion of its 1.21 Gigawatts units into a number of shares of Common Stock. The number of shares that Antpool may convert is equal to the capital

contributions of 1.21 Gigawatts made by Antpool divided by $7.50, which will result in an increase in our ownership percentage of 1.21 Gigawatts.

As our co-hosting operations expand, we believe our business structure will become conducive to a REIT structure, comparable to Digital Realty Trust (NYSE: DLR) and Equinix, Inc. (NASDAQ: EQIX), each of which is a traditional datacenter operator, and Innovative Industrial Properties, Inc. (NYSE: IIPR), a specialty REIT that similarly services a new growth industry. We have begun to investigate the possibility, costs and benefits of converting to a REIT structure.

On July 12, 2022, the Company entered into a five-year hosting contract with Marathon Digital Holdings, Inc. ("Marathon") for 270 MW of mining capacity. As a result of this arrangement, the Company will supply Marathon with 90 MW of hosting capacity at its facility in Texas and 180 MW of hosting capacity at its second facility in North Dakota. Marathon has subsequently added 39.6 MW of additional capacity at the Company’s Jamestown, North Dakota facility.

On August 8, 2022, the Company completed the purchase of 40 acres of land in Ellendale, North Dakota, for a total cost of $1 million. The Company took possession of the land on August 15, 2022, built a hosting facility, and began energizing the site on March 4, 2023. Once fully energized, this location will bring the Company to 280 MW of total hosting capacity across its facilities in North Dakota, all of which are contracted out to customers on multi-year terms.

On October 13, 2022, the Company entered into a joint venture agreement with Foundry Technologies, Inc. (“Foundry”) to form SAI Computing, LLC (“SAI”). SAI will provide artificial intelligence and machine learning application customers with access to machines and a hosting environment. The Company is currently expanding capacity at the Jamestown, North Dakota datacenter facility to provide access to SAI and its customers. The Company has an 98% ownership interest in SAI and consolidates the entity.

On December 14, 2022, the Company began construction of its latest specialized processing center, a 5 MW facility next to the Company’s currently operating 100-MW hosting facility in Jamestown, North Dakota. This separate and unique building, designed and purpose-built for Graphics Processing Units (“GPUs”), will sit separate from the Company’s current buildings and plans to host more traditional high performance computing (“HPC”) applications, such as natural language processing, machine learning, and additional HPC developments.

Our Competitive Strengths

Premier strategic partnerships with leading industry participants.

In March 2021, we executed a strategy planning and portfolio advisory services agreement (“Services Agreement”) with GMR Limited, a British Virgin Island limited liability company (“GMR”), Xsquared Holding Limited, a British Virgin Island limited liability company (“SparkPool”) and Valuefinder, a British Virgin Islands limited liability company (“Valuefinder”) and, together with GMR and SparkPool, (the “Service Provider(s)”). Jason Zhang, one of our board members, is the sole equity holder and manager of Valuefinder and a related party. Pursuant to the Services Agreement, the Service Providers agreed to provide cryptoasset mining management and analysis and to assist us in securing difficult to obtain equipment and we agreed to issue 7,440,148 shares of Common Stock to GMR or its designees, 7,440,148 shares of Common Stock to SparkPool or its designees and 3,156,426 shares of Common Stock to Valuefinder or its designees. Each Service Provider has provided such services to us which services commenced in June 2021. Each of these Service Providers assisted in the creation of our crypto mining operations, which we then terminated on March 9, 2022. Each of them also advised us in connection with the design and buildout of our co-hosting operations. GMR and SparkPool have since become customers of our co-hosting operations. As of June 2022, SparkPool ceased all operations and is no longer in a position to provide services under the Services Agreement. On June 2, 2022, SparkPool forfeited 4,965,432 shares of Common Stock back to us.

We believe that our partnerships with GMR, Bitmain and certain other partners have provided, and continue to provide, us with a significant competitive advantage. GMR has also been a proponent of our hosting strategy, having signed a contract for approximately 50% of our 100 MW capacity as part of our hosting operation under development. Bitmain, provides leads for potential hosting customers. SparkPool, GMR, and Bitmain are each strategic equity investors in our company. Each of them also advised us in connection with the design and buildout of our co-hosting operations. GMR, SparkPool and Bitmain have since become customers of our co-hosting operations.

Access to low-cost power with long-term services agreement.

One of the main benefits of our Amended and Restated Electric Service Agreement is the low cost of power for mining. Even prior to the crypto mining restrictions in China, power capacity available for Bitcoin mining was

scarce, especially at scalable sites with over 100 MW of potential capacity. This scarcity of mining power allows us to realize attractive hosting rates in the current market, in particular given our ability to provide long-term (3-5 year) hosting contracts.

Benefits of Next-Gen datacenters compared to traditional datacenters.

Next-Gen datacenters are optimized for large computing power and require more power than traditional datacenters that are optimized for data retention and retrieval. Next-Gen datacenters and traditional datacenters also have very different layouts, internet connection requirements and cooling designs to accommodate different power demands and customer requirements. Traditional datacenters cannot be easily converted to Next-Gen datacenter facilities like ours because of these differences. Geographically, traditional datacenters are at a disadvantage because they require fiber bases, low-latency connections and connection redundancies that are usually found in high-cost areas with high-density populations.

Hosting provides predictable, recurring revenue and cash flow as compared to more volatile mining operations.

As compared to our previous mining operations, co-hosting revenues are less subject to volatility related to the underlying cryptoasset markets. Through our Amended and Restated Electric Service Agreement with a utility in the upper Midwest, we have a contractual ceiling for our energy costs. The Electric Service Agreement has also enabled us to launch our hosting business with long-term customer contracts. Cambridge Bitcoin Electricity Consumption Index reported that as of February 1, 2021 more than 6 GW of Bitcoin was mined in China (or $4.3 billion of power cost, assuming $0.08 per kWh average hosting cost). China has since banned cryptoasset mining related activity. We expect much of the demand for hosting locations previously met in China will move to the United States due to its reliable power options. We intend for the steady cash flows generated by our hosting operations to be reinvested into the hosting business.

Strong management team and board of advisors with deep experience in crypto mining and hosting operations.

We have recently expanded our leadership team by attracting top talent in the hosting space. Recent hires from both publicly traded and private companies have allowed us to build a team capable of designing and constructing hosting facilities. In addition, our board of advisors includes experts in the crypto space, including the co-founders of SparkPool and GMR.

Our Growth Strategies

Leverage partners to grow hosting operations while minimizing risk.

Our strategic partners GMR and Bitmain have entered into hosting contracts with us that will utilize the available capacity from our currently operating 100 MW hosting site, which enabled us to pre-fill our initial site before breaking ground. Beyond their own use of our hosting capabilities, our partners have strong relationships across the cryptocurrency ecosystem, and we believe that we will be able to leverage their networks to identify leads for our expansion of hosting operations. We believe we have sufficient demand to fill our planned hosting expansion.

Secure scalable power sites in areas favorable for crypto mining.

We have developed a pipeline of potential power sources. Our first hosting site in North Dakota is fully operational and our second site in North Dakota began energizing in March 2023. Further, we expect our facility in Garden City, TX to begin energizing during calendar Q2 of 2023. Combined, these facilities will provide total hosting capacity of roughly 500 MW. Through our build-out of our first North Dakota facility and the prior experience our leadership team brings to our initiatives, we believe that we have developed a repeatable power strategy to significantly scale our operations. In addition, we are currently focused on and will continue to target states that have favorable laws and regulations for the crypto mining and HPC application industries, which we believe further minimizes the associated with risks the scaling of our operations.

Vertically integrate power assets.

With recent additions to our management team, we are increasingly looking at various types of power assets to support the growth of our hosting operations. This also includes power generation assets, which longer-term could be used to reduce our cost of power. Our management team has experience not only in evaluating and acquiring power assets, but also in the conversion of power assets to crypto mining/hosting operations and the construction of datacenters with the specific purpose of mining cryptocurrency assets.

Expand into other high computing processing applications and businesses.

While we no longer mine cryptoassets and have no plans to return to crypto mining operations, we see potential value in the ecosystems developing around cryptoassets. We deem the following factors important in making a decision to enter into a particular line of business: advice from securities and regulatory legal counsel about the regulatory framework applicable to such line of business, including the Howey test for whether or not a particular asset could be a security and consequences thereof, as applicable at the time, economic conditions, costs and benefits resulting from investing in a new line of business rather than our current co-hosting business, other costs of establishing such new or additional line of business, investor appetite, and other factors that may arise from time to time which could impact the costs and benefits to us and our stockholders.

Our Company History

Applied Digital Corporation was incorporated in Nevada in May 2001 and conducted business under several names until July 2009, when we filed a Form 15 with the SEC to suspend the registration of Common Stock and our obligations to file annual, quarterly and other periodic reports with the SEC in order to conserve financial and other resources for the continuing development and commercialization of our business. Our Common Stock continued to trade on the OTC Pink Market. In 2021, we changed our name to Applied Blockchain, Inc. and began our current next-gen data center business. On February 2, 2022, we brought our first North Dakota facility online. It is now fully operational. In April 2022, we completed our initial public offering and our Common Stock began trading on The Nasdaq Global Select Market. In November 2022, we changed our name to Applied Digital Corporation.

Our Corporate Information

Our executive office is located at 3811 Turtle Creek Blvd., Suite 2100, Dallas, Texas 75219, and our phone number is (214) 427-1704. Our principal website address is www.applieddigital.com The information on any of our websites is deemed not to be incorporated in this prospectus or to be part of this prospectus.

THE OFFERING

| | | | | |

Common Stock, par value $0.001 per share (the “Common Stock”) | To be set forth in a prospectus supplement |

| | |

| Preferred Stock, par value $0.001 (the “Preferred Stock”) | To be set forth in a prospectus supplement |

| | |

| Warrants | To be set forth in a prospectus supplement |

| Total | $175,000,000 |

| Use of proceeds | Except as otherwise set forth in the applicable prospectus supplement, we expect to use the net proceeds from the sale of our securities to address the Company’s working capital needs. |

| | |

| Nasdaq symbol | APLD |

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in the Exchange Act. We may take advantage of certain of the scaled disclosures available to smaller reporting companies so long as the market value of our voting and non-voting Common Stock held by non-affiliates is less than $250.0 million measured on the last business day of our second fiscal quarter, or our annual revenue is less than $100.0 million during the most recently completed fiscal year and the market value of our Common Stock held by non-affiliates is less than $700.0 million measured on the last business day of our second fiscal quarter.

RISK FACTORS

An investment in our securities involves a high degree of risk and uncertainty. In addition to the other information included in this prospectus or in any applicable prospectus supplement, you should carefully consider each of the risk factors set forth in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q on file with the SEC, which are incorporated by reference into this prospectus, and any subsequent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q or Current Reports on Form 8-K we file after the date of this prospectus. The risks described are not the only ones facing our company. Additional risks not presently known to us or that we presently consider immaterial may also adversely affect our company. If any of the risks described occur, our business, financial condition, results of operations and prospects could be materially adversely affected. In that case, the trading price of our securities could decline, and you could lose all or part or your investment. In assessing these risks, you should also refer to the other information included or incorporated by reference in this prospectus or any applicable prospectus supplement.

Risks Related to Our Securities

Risks Related to our Common Stock

The liquidity of our Common Stock is uncertain; the limited trading volume of the Common Stock may depress the price of such stock or cause it to fluctuate significantly.

Although our Common Stock is listed on Nasdaq, there has been a limited public market for the Common Stock and there can be no assurance that a more active trading market will develop. As a result, shareholders may not be able to sell shares of Common Stock in short time periods, or possibly at all. The absence of an active trading market may cause the price per share of the Common Stock to fluctuate significantly.

Our stock price has been volatile and may continue to be volatile in the future; this volatility may affect the price at which you could sell our Common Stock.

The trading price of our Common Stock has been volatile and may continue to be volatile in response to various factors, some of which are beyond our control. Any of the factors listed below could have a material adverse effect on an investment in our securities:

•actual or anticipated fluctuations in our quarterly financial results or the quarterly financial results of companies perceived to be similar to us;

•changes in the market’s expectations about our operating results;

•relative success of our competitors;

•our operating results failing to meet the expectations of securities analysts or investors in a particular period;

•changes in financial estimates and recommendations by securities analysts concerning us and the market for our co-hosting facilities;

•operating and stock price performance of other companies that investors deem comparable to us;

•our ability to continue to expand our operations;

•changes in laws and regulations affecting our business or our industry;

•commencement of, or involvement in, litigation involving us;

•changes in our capital structure, such as future issuances of securities or the borrowing of additional debt;

•the volume of shares of Common Stock available for public sale pursuant to an effective registration statement or exemption from registration requirements;

•any major change in our board of directors (the “Board”) or management;

•sales of substantial amounts of our Common Stock by our directors, executive officers or significant stockholders or the perception that such sales could occur; and

•general economic and political conditions such as recessions, interest rates, international currency and crypto currency fluctuations and acts of war or terrorism.

Broad market and industry factors may materially harm the market price of our Common Stock irrespective of our operating performance. The stock market in general, and Nasdaq in particular, have experienced price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of the particular companies affected.

The trading prices and valuations of these stocks, and of our Common Stock, may not be predictable. A loss of investor confidence in the market for retail stocks or the stocks of other companies that investors perceive to be similar to us could depress our stock price regardless of our business, prospects, financial conditions or results of operations. A decline in the market price of our Common Stock also could adversely affect our ability to issue additional securities and our ability to obtain additional financing in the future.

We do not expect to declare or pay dividends in the foreseeable future, which may limit the return our shareholders realize on their investment.

We do not expect to declare or pay dividends in the foreseeable future, as we anticipate that we will invest future earnings in the development and growth of our business. Therefore, holders of our Common Stock may not receive any return on their investment in our Common Stock unless and until the value of such Common stock increases and they are able to sell such shares of Common Stock, and there is no assurance that any of the foregoing will occur.

Failure to establish and maintain effective internal control over financial reporting could have a material adverse effect on our business, operating results and stock value.

We are a newly public company and are now required to comply with the SEC’s rules implementing Section 302 of the Sarbanes-Oxley Act (“SOX”), which requires our management to certify financial and other information in our quarterly and annual reports and provide an annual management report on the effectiveness of our internal control over financial reporting. We will not be required to make our first assessment of our internal control over financial reporting until the year following this annual report, (i.e., the fiscal year ending May 31, 2023). To comply with the requirements of being a public company, we will need to upgrade our systems, including information technology, implement additional financial and management controls, reporting systems and procedures and hire additional accounting, finance and legal staff.

We currently have material weaknesses in the design or operation of our internal controls, which could adversely affect our ability to record, process, summarize and report financial data. We have not yet designed and/or implemented user access controls to ensure appropriate segregation of duties that would adequately restrict user and privileged access to the financially relevant systems and data to appropriate personnel. We also do not currently have an internal control system that identifies critical processes and key controls. We are in the process of remediating such material weaknesses and there can be no assurance as to when or if we will fully remediate such material weaknesses.

Our efforts to develop and maintain our internal controls may not be successful, and we may be unable to maintain effective controls over our financial processes and reporting in the future and comply with the certification and reporting obligations under Sections 302 and 404 of SOX. Any failure to maintain effective controls or any difficulties encountered in our implementation or improvement of our internal controls over financial reporting could result in material misstatements that are not prevented or detected on a timely basis, which could potentially subject us to sanctions or investigations by the SEC or other regulatory authorities. Ineffective internal controls could also cause investors to lose confidence in our reported financial information.

You may experience dilution of your ownership interest because of the future issuance of additional equity in our company.

In the future, we may issue additional shares of capital stock in our company, resulting in the dilution of current stockholders’ relative ownership. Our Board and stockholders have approved an employee incentive plan and a non-employee director incentive plan. We have reserved 15,166,666 shares of our Common Stock for future issuance under our plans. Such conversions and issuances would also result in dilution of current stockholders’ relative ownership.

On January 6, 2022, we and Antpool entered into a Limited Liability Company Agreement of 1.21 Gigawatts, LLC pursuant to which we and Antpool will own 80% and 20%, respectively, of 1.21 Gigawatts. Antpool’s interest in each such entity will be convertible by it at any time into a number of shares of our Common Stock equal to Antpool’s capital contribution in connection with the acquisition of such interests divided by $1.25 (or $7.50 after giving effect to the Reverse Stock Split). Antpool’s potential ownership of our Common Stock is dependent on its capital contributions to 1.21 Gigawatts which in turn will depend on which projects are approved by us and Antpool and the costs associated therewith. Accordingly, we cannot predict the amount of Antpool’s potential ownership of our Common Stock.

On January 14, 2022, we granted an aggregate of 1,791,666 restricted stock units (“RSUs”) to three consultants, consisting of 125,000 RSUs to Roland Davidson, who acts as our Executive Vice President of Engineering, 416,666 RSUs to Nick Phillips, our Executive Vice President of Hosting and Public Affairs, and 1,250,000 RSUs to Etienne Snyman, who acts as our Executive Vice President of Power. Subsequently, Mr. Phillips’ 416,666 RSUs were terminated and Mr. Phillips was hired as an employee receiving awards under our employee incentive plan.

We may also issue other securities that are convertible into or exercisable for equity in our company in connection with hiring or retaining employees or consultants, future acquisitions or future sales of our securities.

Provisions in our Articles, our Bylaws, and Nevada law may discourage a takeover attempt even if a takeover might be beneficial to our stockholders.

Provisions contained in our Articles and Bylaws could make it more difficult for a third party to acquire us if we have become a publicly traded company. Provisions of our Articles and Bylaws impose various procedural and other requirements, which could make it more difficult for stockholders to effect certain corporate actions. For example, our Articles authorize our Board to determine the rights, preferences, privileges and restrictions of unissued series of Preferred Stock without any vote or action by our stockholders. Thus, our Board can authorize and issue shares of Preferred Stock with voting or conversion rights that could adversely affect the voting or other rights of holders of our other series of capital stock. These rights may have the effect of delaying or deterring a change of control of our company. Additionally, our Bylaws establish limitations on the removal of directors and on the ability of our stockholders to call special meetings.

For a more complete understanding of these provisions, please refer to the Nevada Revised Statutes and our Articles and Bylaws.

Though we are not currently, in the future we may become subject to Nevada’s control share law. A corporation is subject to Nevada’s control share law if it has more than 200 stockholders, at least 100 of whom are stockholders of record and residents of Nevada, and it does business in Nevada or through an affiliated corporation. The law focuses on the acquisition of a “controlling interest” which means the ownership of outstanding voting shares sufficient, but for the control share law, to enable the acquiring person to exercise the following proportions of the voting power of the corporation in the election of directors: (i) one-fifth or more but less than one-third; (ii) one-third or more but less than a majority; or (iii) a majority or more. The ability to exercise such voting power may be direct or indirect, as well as individual or in association with others.

The effect of the control share law is that the acquiring person, and those acting in association with it, obtains only such voting rights in the control shares as are conferred by a resolution of the stockholders of the corporation, approved at a special or annual meeting of stockholders. The control share law contemplates that voting rights will be considered only once by the other stockholders. Thus, there is no authority to strip voting rights from the control shares of an acquiring person once those rights have been approved. If the stockholders do not grant voting rights to the control shares acquired by an acquiring person, those shares do not become permanent non-voting shares. The acquiring person is free to sell its shares to others. If the buyers of those shares themselves do not acquire a controlling interest, their shares do not become governed by the control share law.

If control shares are accorded full voting rights and the acquiring person has acquired control shares with a majority or more of the voting power, any stockholder of record, other than an acquiring person, who has not voted in favor of approval of voting rights is entitled to demand fair value for the redemption of such stockholder’s shares. Nevada’s control share law may have the effect of discouraging takeovers of the corporation.

In addition to the control share law, Nevada has a business combination law which prohibits certain business combinations between Nevada corporations and “interested stockholders” for two years after the “interested stockholder” first becomes an “interested stockholder,” unless our Board approves the combination in advance or thereafter by both the Board and 60% of the disinterested stockholders. For purposes of Nevada law, an “interested stockholder” is any person who is (i) the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the outstanding voting shares of the corporation, or (ii) an affiliate or associate of the corporation and at any time within the two previous years was the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the then outstanding shares of the corporation. The definition of the term “business combination” is sufficiently broad to cover virtually any kind of transaction that would allow a potential acquirer to use the corporation’s assets to finance the acquisition or otherwise to benefit its own interests rather than the interests of the corporation and its other stockholders.

The effect of Nevada’s business combination law is to potentially discourage parties interested in taking control of us from doing so if it cannot obtain the approval of our Board.

We may not be able to maintain the listing of our Common Stock on Nasdaq, which may adversely affect the flexibility of holders of Common Stock to resell their securities in the secondary market.

Our Common Stock is presently listed on Nasdaq, which requires us to meet certain conditions to maintain our listing status. If the Company is unable to meet the continued listing criteria of Nasdaq and the Common Stock became delisted, trading of the Common Stock could thereafter be conducted in the over-the-counter markets in the OTC Pink, also known as “pink sheets” or, if available, on another OTC trading platform.

We cannot assure you that we will meet the criteria for continued listing, in which case the Common Stock could become delisted. Any such delisting could harm our ability to raise capital through alternative financing sources on terms acceptable to us, or at all, and may result in the loss of confidence in our financial stability by suppliers, customers and employees. Investors would likely find it more difficult to dispose of, or to obtain accurate market quotations for, the Common Stock, as the liquidity that Nasdaq provides would no longer be available to investors. In addition, the failure of our Common Stock to continue to be listed on the Nasdaq could adversely impact the market price for the Common Stock and our other securities, and we could face a lengthy process to re-list the Common Stock, if we are able to re-list the Common Stock.

If securities or industry analysts do not publish research or reports about our business, or if they downgrade their recommendations regarding our Common Stock, its trading price and volume could decline.

We expect the trading market for our Common Stock to be influenced by the research and reports that industry or securities analysts publish about us, our business or our industry. As a new public company, we have only minimal research coverage by securities and industry analysts. If we do not expand securities or industry analyst coverage, or if one or more of these analysts cease coverage of our company or fail to publish reports on us regularly, we could lose visibility in the financial markets, which in turn could cause our stock price or trading volume to decline and our Common Stock to be less liquid. Moreover, if one or more of the analysts who cover us downgrades our stock or publishes inaccurate or unfavorable research about our business, or if our results of operations do not meet their expectations, our stock price could decline.

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended, that involve substantial risks and uncertainties. In some cases you can identify these statements by forward-looking words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “seek,” “should,” “will,” and “would,” or similar words. Statements that contain these words and other statements that are forward-looking in nature should be read carefully because they discuss future expectations, contain projections of future results of operations or of financial positions or state other “forward-looking” information.

These statements are based on our management’s beliefs and assumptions, which are based on currently available information. Our actual results, and the assumptions on which we relied, could prove materially different from our expectations. You are cautioned not to place undue reliance on forward-looking statements. Except as otherwise may be required by law, we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or actual operating results. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to:

•Labor and other workforce shortages and challenges;

•our dependence on principal customers;

•the addition or loss of significant customers or material changes to our relationships with these customers;

•our sensitivity to general economic conditions including changes in disposable income levels and consumer spending trends;

•our ability to timely and successfully build new hosting facilities with the appropriate contractual margins and efficiencies;

•our ability to continue to grow sales in our hosting business;

•volatility of cryptoasset prices

•uncertainties of cryptoasset regulation policy; and

•equipment failures, power or other supply disruptions.

You should carefully review the risks described in “Risk Factors” beginning on page 7 as the occurrence of any of these events could have an adverse effect, which may be material, on our business, results of operations, financial condition or cash flows.

USE OF PROCEEDS

Except as otherwise set forth in the applicable prospectus supplement, we expect to use the net proceeds from the sale of our securities to address the Company’s working capital needs.

DESCRIPTION OF CAPITAL STOCK

The following descriptions are summaries of the material terms of our Articles and our Bylaws.

Reference is made to the more detailed provisions of, and the descriptions are qualified in their entirety by reference to, our Articles and Bylaws, forms of which are filed with the SEC as exhibits to the registration statement of which this prospectus is a part, and applicable law.

We effected a one-for-six reverse stock split in connection with our listing on the Nasdaq Global Select Market pursuant to which holders of our issued and outstanding Common Stock immediately prior to listing our Common Stock on Nasdaq Global Select Market had every six shares of Common Stock reclassified as one share of Common Stock. No fractional shares were issued. We refer to this as the “Reverse Stock Split”.

General

We are authorized to issue 171,666,666 shares of capital stock, $0.001 par value per share, of which 166,666,666 are designated as Common Stock and 5,000,000 are designated as Preferred Stock.

Common Stock

As of May 1, 2023, there were 95,908,964 shares of our Common Stock issued and outstanding and we had (i) 12,958,459 shares reserved for issuance under the 2022 Incentive Plan, (ii) 1,359,229 shares reserved for issuance under the 2022 Non-Employee Director Stock Plan, (iii) 545,836 shares reserved for issuance under restricted stock unit awards to certain consultants and (iii) 4,965,432 shares that were forfeited by Xsquared Holding Limited and returned to the Company and placed in treasury.

Dividend Rights

Subject to preferences that may be applicable to any then outstanding Preferred Stock, holders of our Common Stock are entitled to receive ratably those dividends, if any, as may be declared from time to time by our Board out of legally available funds.

Voting Rights

Each holder of our Common Stock is entitled to one vote for each share owned of record on all matters voted upon by stockholders, subject to any rights of our Preferred Stock, or series of our Preferred stock, to vote together as a single class.

Liquidation Rights

In the event of our liquidation, dissolution or winding-up, the holders of our Common Stock are entitled to share equally and ratably in our assets, if any, remaining after the payment of all of our debts and liabilities and the liquidation preference of any outstanding Preferred Stock.

Other Rights

Our Common Stock has no preemptive rights, no cumulative voting rights and no redemption, sinking fund or conversion provisions.

Preferred Stock

We are authorized to issue 5,000,000 shares of Preferred Stock at $0.001 par value per share. As of the date hereof, 2,120,578 shares of Preferred Stock have been issued and retired, 0 shares of Preferred Stock are outstanding and 2,879,422 shares of Preferred Stock remain available and authorized for issuance.

Each series of Preferred Stock to be issued, if any, will have such number of shares, designations, preferences, powers and qualifications and special or relative rights or privileges as will be determined by our Board, which may include, among others, dividend rights, voting rights, redemption and sinking fund provisions, liquidation preferences, conversion rights and preemptive rights. The rights of the holders of our Common Stock will be subject to the rights of holders of any Preferred Stock outstanding and issued in the future. The issuance of Preferred Stock, while providing desirable flexibility in connection with the possible acquisitions and other corporate purposes, could have the effect of making it more difficult for a third party to acquire, or of discouraging a third party from acquiring, a majority of our outstanding voting stock.

Terms

The specific terms of any Preferred Stock being offered will be described in the prospectus supplement relating to that Preferred Stock. The following summaries of the provisions of the Preferred Stock are subject to, and are qualified in their entirety by reference to, the certificate of designation relating to the particular class or series of Preferred Stock offered with that prospectus supplement for specific terms, including:

•the designation of the Preferred Stock;

•the number of shares of the Preferred Stock being offered, the liquidation preference per share and the offering price of the Preferred Stock;

•the dividend rate(s), period(s) and/or payment date(s) or method(s) of calculating these items applicable to the Preferred Stock

•the place or places where dividends will be paid, whether dividends will be cumulative or noncumulative, and, if cumulative, the date from which dividends on the Preferred Stock will accumulate, if applicable;

•the procedures for any action and remarketing of the Preferred Stock;

•the provision of a sinking fund, if any, for the Preferred Stock;

•the provision for redemption, if applicable, of the Preferred Stock;

•any listing of the Preferred Stock on any securities exchange;

•the terms and conditions, if applicable, upon which the Preferred Stock will be convertible into or exchangeable for Common Stock, and whether at our option or the option of the holder;

•whether the Preferred Stock will rank senior or junior to or on a parity with any other class or series of Preferred Stock;

•the voting rights, if any, of the Preferred Stock;

•any other specific terms, preferences, rights, limitations or restrictions of the Preferred Stock; and

•a discussion of the United States federal income tax considerations applicable to the Preferred Stock.

Series E Preferred Stock

Our Board has created out of the authorized and available shares of our Preferred Stock, a series of convertible redeemable preferred stock, designated as the Series E Redeemable Preferred Stock (the “Series E Preferred Stock”). The following is a brief description of the terms of the Series E Preferred Stock. The Board has authorized the sale of up to 2,000,000 shares of Series E Preferred Stock. The Board may choose, in its sole discretion, to offer an additional 2,000,000 shares of Series E Preferred Stock for sale.

Dividend Rights

The holders of the Series E Preferred Stock shall be entitled to receive, and the Company shall pay, out of legally available funds, dividends on each share of Series E Preferred Stock at an annual rate of 8.0% of the Stated Value (as defined below). Dividends will be declared and accrued monthly. Such dividends shall be payable upon Board approval, which may not be monthly, out of legally available funds in cash or our Common Stock.

Liquidation Rights

Subject to the liquidation preference stated in the ranking section in the Certificate of Designations for the Series E Preferred Stock, Series E Preferred Stock will be entitled to be paid out of the funds and assets available for distribution, an amount per share equal to the “Stated Value,” or $25.00, plus an amount per share that is issuable as the result of accrued or unpaid Dividends. After payment to the holders of our Series E Preferred Stock, the remaining funds and assets available for distribution to our stockholders shall be distributed among the holders of shares of Common Stock, pro rata based on the number of shares of Common Stock held by each such holder.

Redemption Rights

Each holder of shares of Series E Preferred Stock is entitled to redeem any portion of the outstanding Series E Preferred Stock held by such holder at any time in cash or our Common Stock. Additionally, we may redeem a share of Series E Preferred Stock at our option at any time from time to time upon not less than 10 calendar days written notice to the holders prior to the date fixed for redemption thereof, at a redemption price of 100% of the Stated Value of the shares of Series E Preferred Stock to be redeemed plus accrued but unpaid dividends.

Other Rights

Our Series E Preferred Stock has no preemptive rights, no voting rights and no sinking fund or conversion provisions.

Limitations on Liability and Indemnification Matters

Our amended and restated bylaws contain provisions that limit the liability of our directors for monetary damages to the fullest extent permitted by the Nevada Revised Statute, or NRS.

Consequently, our directors will not be personally liable to us or our stockholders for monetary damages for any breach of fiduciary duties as directors, except liability:

•for any breach of the director’s duty of loyalty to us or our stockholders;

•for acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of the law;

•under the NRS for the unlawful payment of dividends; or

•for any transaction from which the director derives an improper personal benefit.

Our Bylaws require us to indemnify our directors and officers to the maximum extent not prohibited by the NRS and allows us to indemnify other employees and agents as set forth in the NRS. Subject to certain limitations, our amended and restated bylaws also require us to advance expenses incurred by our directors and officers for the defense of any action for which indemnification is required or permitted.

We believe that provisions of our amended and restated bylaws are necessary to attract and retain qualified directors, officers, and key employees. We also maintain directors’ and officers’ liability insurance.

The limitation of liability and indemnification provisions in our amended and restated bylaws may discourage stockholders from bringing a lawsuit against our directors and officers for breach of their fiduciary duty. They may also reduce the likelihood of derivative litigation against our directors and officers, even though an action, if successful, might benefit us and other stockholders. Further, a stockholder’s investment may be adversely affected to the extent that we pay the costs of settlement and damage awards against directors and officers as required by these indemnification provisions.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, executive officers, or persons controlling us, we have been informed that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Transfer Agent

The transfer agent and registrar for our Common Stock is Securitize, Inc. (f/k/a Pacific Stock Transfer Company) (the “Common Stock Transfer Agent”). The Common Stock Transfer Agent’s address and phone number is: 6725 Via Austi Pkwy, Suite 300, Las Vegas, Nevada 89119, telephone number: (800) 785-7782.

The transfer agent and registrar for our Series E Preferred Stock is Computershare Trust Company, N.A. (the “Series E Transfer Agent”). The Series E Transfer Agent’s address and phone number is: 150 Royall St., Canton, MA 02021, telephone number: (781) 575-2000.

Listing

Our Common Stock is presently traded on The Nasdaq Global Select Market under the symbol “APLD.”

DESCRIPTION OF WARRANTS

We may issue warrants for the purchase of Preferred Stock, Common Stock or any combination thereof. Warrants may be issued independently or together with any other securities offered in an applicable prospectus supplement and may be attached to or separate from such securities. Warrants may be issued under warrant agreements (each, a “warrant agreement”) to be entered into between us and a warrant agent specified in the applicable prospectus supplement. The warrant agent will act solely as our agent in connection with the warrants of a particular series and will not assume any obligation or relationship of agency or trust for or with any holders or beneficial owners of warrants. The following sets forth certain general terms and provisions of warrants which may be offered. Further terms of the warrants and the applicable warrant agreement will be set forth in the applicable prospectus supplement.

Terms. The prospectus supplement relating to a particular issue of warrants for the purchase of Common Stock or Preferred Stock will describe the terms of the warrants, including the following:

| | | | | | | | | | | |

| | | the title of the warrants; |

| | | | | | | | |

| | the offering price for the warrants, if any; |

| | | | | | | | |

| | the aggregate number of the warrants; |

| | | | | | | | |

| | the designation and terms of the Common Stock or Preferred Stock that may be purchased upon exercise of the warrants; |

| | | | | | | | |

| | if applicable, the designation and terms of the securities that the warrants are issued with and the number of warrants issued with each security; |

| | | | | | | | |

| | if applicable, the date from and after which the warrants and any securities issued with the warrants will be separately transferable; |

| | | | | | | | |

| | the number of shares of Common Stock or Preferred Stock that may be purchased upon exercise of a warrant and the price at which such shares may be purchased upon exercise; |

| | | | | | | | |

| | the dates on which the right to exercise the warrants will commence and expire; |

| | | | | | | | | | | |

| | | if applicable, the minimum or maximum amount of the warrants that may be exercised at any one time; |

| | | | | | | | |

| | the currency or currency units in which the offering price, if any, and the exercise price are payable; |

| | | | | | | | |

| | if applicable, a discussion of material United States federal income tax considerations; |

| | | | | | | | |

| | the antidilution provisions of the warrants, if any; |

| | | | | | | | |

| | the redemption or call provisions, if any, applicable to the warrants; and |

| | | | | | | | |

| | any additional terms of the warrants, including terms, procedures, and limitations relating to the exchange and exercise of the warrants. |

Exercise of Warrants

Each warrant will entitle the holder of warrants to purchase for cash the amount of shares of Preferred Stock or shares of Common Stock at the exercise price as shall in each case be set forth in, or be determinable as set forth in, the prospectus supplement relating to the warrants offered thereby. Warrants may be exercised at any time up to the

close of business on the expiration date set forth in the prospectus supplement relating to the warrants offered thereby. After the close of business on the expiration date the unexercised warrants will become void.

Warrants may be exercised as set forth in the prospectus supplement relating to the warrants offered thereby. Upon receipt of payment and the warrant certificate properly completed and duly executed at the corporate trust office of the warrant agent or any other office indicated in the prospectus supplement, we will, as soon as practicable, forward the shares of Preferred Stock or shares of Common Stock purchasable upon such exercise. If fewer than all of the warrants represented by the warrant certificate are exercised, a new warrant certificate will be issued for the remaining warrants.

PLAN OF DISTRIBUTION

We may sell the securities offered by this prospectus in one or more transactions from time to time:

| | | | | |

| to or through underwriters; |

| | | | | |

| through dealers, agents or institutional investors; |

| | | | | |

| in “at the market offerings” within the meaning of Rule 415(a)(4) of the Securities Act; or |

| | | | | |

| through a combination of these methods. |

We may sell the securities at a fixed price or prices that may change, at prevailing market prices, at prices relating to prevailing market prices or at negotiated prices. Each time we sell securities in a particular offering, we will provide a prospectus supplement or, if required, amend this prospectus, to disclose the following information with respect to that offering:

| | | | | |

| the material terms of the distribution, including the number of shares and the consideration paid; |

| | | | | |

| the identity of any underwriters, dealers, agents or purchasers that will purchase the securities; |

| | | | | |

| the amount of any compensation, discounts or commissions to be received by underwriters, dealers or agents; |

| | | | | |

| the purchase price of the securities being offered and the proceeds we will receive from the sale; |

| | | | | |

| the nature of any transactions by underwriters, dealers or agents during the offering that are intended to stabilize or maintain the market price of our securities; and |

| | | | | |

| the terms of any indemnification provisions. |

Underwriters, dealers, agents or other purchasers may sell the securities at a fixed price or prices that may change, at prices set at or relative to prevailing market prices or at negotiated prices.

We may directly solicit offers to purchase securities and we may make sales of securities directly to institutional investors or others in jurisdictions where we are authorized to do so.

We may offer our Common Stock into an existing trading market on the terms described in the prospectus supplement relating thereto. Underwriters and dealers who may participate in any at-the-market offerings will be described in the prospectus supplement relating thereto.

Underwriters

We may sell all or a portion of the securities offered by this prospectus in one or more transactions to or through underwriters, who may sell the securities to or through dealers. In connection with the sale of our securities, underwriters, dealers or agents may receive compensation from us, or from the purchasers of the securities for whom they may act as agents, in the form of underwriting discounts, concessions or commissions and may also receive commissions from the purchasers for whom they may act as agents. Underwriters, dealers, agents or purchasers that participate in the distribution of the securities, and any broker-dealers or the persons acting on behalf of parties that participate in the distribution of the securities, are underwriters under the Securities Act of 1933, or the Securities Act. Any discounts or commissions they receive and any profit on the resale of the securities they receive constitute underwriting discounts and commissions under the Securities Act. Any person deemed to be an underwriter under

the Securities Act may be subject to statutory liabilities, including those under Sections 11, 12 and 17 of the Securities Act and Rule 10b-5 under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

Only underwriters named in the amended or supplemented prospectus, if any, will be underwriters of the securities offered through that amended prospectus. Any underwriters used in an offering may resell the securities from time to time in one or more transactions, at a fixed public offering price or at varying prices determined at the time of sale. We may offer the securities to the public through underwriting syndicates represented by managing underwriters without a syndicate. Any public offering price and any discounts or concessions allowed or reallowed or paid to dealers may change from time to time.

Agents; Direct Sales

We may designate agents to distribute the securities offered by this prospectus. Unless the applicable prospectus supplement states otherwise, any such agent will act on a best-efforts basis for the period of appointment. We may authorize dealers or other persons acting as our respective agents to solicit offers by institutional investors to purchase the securities from us under contracts that provide for payment and delivery on a future date. We may enter into agreements directly with purchasers that provide for the sale of securities over a period of time by means of draw-downs at our election, which the purchaser would be obligated to accept under specified conditions. Under a draw-down agreement, we may sell securities at a per share purchase price discounted from the market price of our securities. We may also enter into agreements for sales of securities based on combinations of or variations from these methods. We will describe in the applicable prospectus supplement the terms and conditions of any such agreements and any related commissions we will pay. Agents and underwriters may also engage in transactions with us, or perform services for us in the ordinary course of business.

Stabilization Activities

In connection with a firm commitment underwritten offering of our securities, underwriters and purchasers that are deemed to be underwriters under the Securities Act may engage in transactions that stabilize, maintain or otherwise affect the price of the securities. For example, they may:

| | | | | |

| over-allot in connection with the offering, creating a syndicate short position for their own account; |

| | | | | |

| bid for and purchase our securities in the open market to cover short positions or to stabilize the price of the securities; or |

| | | | | |

| reclaim selling concessions allowed for distributing the securities in the offering if the underwriters repurchase previously distributed securities in transactions to cover short positions, stabilization transactions or otherwise. |

Any of these activities may stabilize or maintain the market price above independent market levels. These activities may be conducted only in conjunction with a firm commitment underwritten offering. Underwriters are not required to engage in these activities and may terminate any such activity at any time. In engaging in any such activities, underwriters will be subject to the applicable provisions of the Securities Act and the Exchange Act and the rules and regulations under those acts. Regulation M under the Securities Act, for example, may restrict the ability of any person engaged in the distribution of the securities to engage in market-making activities with respect to the securities, and the anti-manipulation rules under the Exchange Act may also apply to market sales of the securities. These provisions may affect the marketability of the securities and the ability of any person to engage in market-making activities with respect to the securities.

Indemnification

We may agree to indemnify underwriters, dealers, agents or other purchasers against civil liabilities they may incur in connection with the offer and sale of the securities offered by this prospectus, including liabilities under the Securities Act. We may also agree to contribute to payments that these persons may be required to make with respect to these liabilities.

LEGAL MATTERS

The validity of the securities offered in this prospectus is being passed upon for us by Snell & Wilmer LLP, Kelley Drye & Warren LLP and Wick Phillips, LLP have also acted as counsel to us in connection with this offering.

EXPERTS

The consolidated financial statements of Applied Digital Corporation as of May 31, 2022 and May 31, 2021 and for the years ended May 31, 2022 and 2021, incorporated by reference herein and elsewhere in the registration statement, have been audited by Marcum, LLP, an independent registered public accounting firm, as stated in their report, and have been incorporated herein by reference upon their authority as experts in accounting and auditing.

ADDITIONAL INFORMATION

We are required to file periodic reports, proxy statements and other information relating to our business, financial and other matters with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our filings are available to the public over the Internet at the SEC’s web site at http://www.sec.gov. You may also read and copy any document we file with the SEC at, and obtain a copy of any such document by mail from, the SEC’s public reference room located at 100 F Street, N.E., Washington, D.C. 20549, at prescribed charges. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room and its charges.

We have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to our securities described in this prospectus. This prospectus is part of such registration statement. References to the “registration statement” or the “registration statement of which this prospectus is a part” means the original registration statement and all amendments, including all schedules and exhibits. This prospectus does not, and any prospectus supplement will not, contain all of the information in the registration statement because we have omitted parts of the registration statement in accordance with the rules of the SEC. Please refer to the registration statement for any information in the registration statement that is not contained in this prospectus or a prospectus supplement. The registration statement is available to the public over the Internet at the SEC’s web site described above and can be read and copied at the location described above.

Each statement made in this prospectus or any prospectus supplement concerning a document filed as an exhibit to the registration statement is qualified in its entirety by reference to that exhibit for a complete description of its provisions.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to incorporate by reference in this prospectus the information in other documents we file with the SEC. This means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is an important part of this prospectus and prospectus supplement. Information disclosed in documents that we file later with the SEC will automatically add to, update and change information previously disclosed. If there is additional information in a later filed document or a conflict or inconsistency between information in this prospectus or a prospectus supplement and information incorporated by reference from a later filed document, you should rely on the information in the later dated document.

We incorporate by reference the documents listed below (and documents incorporated by reference therein) that we have previously filed, excluding any portions of any that are not deemed “furnished” and not “filed”:

•Our Annual Report on Form 10-K for the fiscal year ended May 31, 2022, filed with the SEC on August 29, 2022;

•Our Quarterly Report on Form 10-Q for the fiscal quarter ended February 28, 2023, filed with the SEC on April 6, 2023;

•Our Quarterly Report on Form 10-Q for the fiscal quarter ended November 30, 2022, filed with the SEC on January 10, 2023;

•Our Quarterly Report on Form 10-Q for the fiscal quarter ended August 31, 2022, filed with the SEC on October 12, 2022;

•Our Current Report on Form 8-K filed with the SEC on June 8, 2022;

•Our Current Report on Form 8-K filed with the SEC on June 14, 2022;

•Our Current Report on Form 8-K filed with the SEC on July 18, 2022 (as to filed portions only);

•Our Current Report on Form 8-K filed with the SEC on July 29, 2022;

•Our Current Report on Form 8-K filed with the SEC on August 5, 2022

•Our Current Report on Form 8-K filed with the SEC on August 12, 2022

•Our Current Report on Form 8-K filed with the SEC on November 14, 2022

•Our Current Report on Form 8-K filed with the SEC on January 6, 2023

•Our Current Report on Form 8-K filed with the SEC on February 21, 2023;

•Our Current Report on Form 8-K filed with the SEC on March 7, 2023;

•Our Current Report on Form 8-K filed with the SEC on May 15, 2023; and

•The description of our Common Stock in our Registration Statement on Form 8-A, filed with the SEC on April 11, 2022, including any amendment or reports filed for the purpose of updating such description.

All documents we file with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after (i) the date of the initial registration statement and prior to effectiveness of the registration statement, and (ii) the date of this prospectus and before the termination or completion of any offering hereunder, shall be deemed to be incorporated by reference into this prospectus from the respective dates of filing of such documents, except that we do not incorporate any document or portion of a document that is “furnished” to the SEC, but not deemed “filed.”