Current Report Filing (8-k)

August 15 2022 - 5:34PM

Edgar (US Regulatory)

false

0001334933

0001334933

2022-08-15

2022-08-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

August 15, 2022

Date of Report (Date of earliest event reported)

URANIUM ENERGY CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

001-33706

|

98-0399476

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

1030 West Georgia Street, Suite 1830

Vancouver, British Columbia

|

V6E 2Y3

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(604) 682-9775

Registrant’s telephone number, including area code

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol (s)

|

Name of each exchange on which registered

|

|

Common Stock

|

UEC

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

__________

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On August 15, 2022, Uranium Energy Corp. (the “Company” or “UEC”) entered into a further amending agreement (the “Amending Agreement”) to the previously announced arrangement agreement (the “Arrangement Agreement”) dated June 13, 2022, as amended June 23, 2022 and August 5, 2022, with UEC 2022 Acquisition Corp. (“UEC Acquisition Co.”), a wholly owned subsidiary of UEC, and UEX Corporation (“UEX”), pursuant to which UEC, through UEC Acquisition Co., is to acquire all of the issued and outstanding common shares of UEX (each, a “UEX Share”) by way of a statutory plan of arrangement (the “Arrangement”) under the Canada Business Corporations Act (the “Transaction”).

Under the terms of the Amending Agreement, holders of UEX Shares (the “UEX Shareholders”) will now receive 0.090 of one common share of UEC (a “UEC Share”) in exchange for each UEX Share held, implying consideration of approximately C$0.497 per UEX Share based on the closing price of UEX Shares and UEC Shares on the Toronto Stock Exchange and the NYSE American Exchange, respectively, and the spot exchange rate as of August 12, 2022.

The Amending Agreement also increases the termination fee as provided for under Section 9.6 of the Arrangement Agreement from US$8,800,000 to US$9,000,000 to be paid by UEX to UEC if the Arrangement Agreement, as amended, is terminated in certain specified circumstances. In addition, under the terms of the Amending Agreement, UEX has agreed that UEX will accept proxies for the special meeting of UEX Securityholders to approve the Transaction (the “Meeting”), which will be held at 10:00 a.m. (Vancouver time) on August, 15, 2022, up to the time of the commencement of the Meeting.

The foregoing description of the Amending Agreement does not purport to be complete and is qualified in its entirety by the Amending Agreement, which is filed as Exhibit 10.1 hereto and is incorporate by reference herein.

|

Item 7.01

|

Regulation FD Disclosure

|

On August 15, 2022, the Company issued a joint news release with UEX to announce that they have entered into a further amending agreement (the “Amending Agreement”) to the previously announced arrangement agreement dated June 13, 2022, as amended June 23, 2022 and August 5, 2022, among UEX, UEC and UEC 2022 Acquisition Corp., pursuant to which UEC will acquire all of the issued and outstanding common shares of UEX (“UEX Shares”) by way of a statutory plan of arrangement (the “Arrangement”) under the Canada Business Corporations Act (the “Transaction”).

Under the terms of the Amending Agreement, holders of UEX Shares (“UEX Shareholders”) will now receive 0.090 of one common share of UEC (a “UEC Share”) for each UEX Share held, implying consideration of approximately C$0.497 per UEX Share based on the closing price of UEX Shares and UEC Shares on the Toronto Stock Exchange and the NYSE American Exchange, respectively, and the spot exchange rate as of August 12, 2022. The Amending Agreement also increases the termination fee (to be paid by UEX to UEC if the Transaction is terminated in certain specified circumstances) to U.S.$9 million. In addition, under the terms of the Amending Agreement, UEX has agreed that UEX will accept proxies for the special meeting of UEX Securityholders to approve the Transaction (the “Meeting”), which will be held at 10:00 a.m. (Vancouver time) today, up to the time of the commencement of the Meeting. Other than the foregoing, the terms of the Transaction remain unamended.

-2-

The terms of the Amending Agreement were agreed following receipt by UEX of a competing acquisition proposal on August 8, 2022 for all of the issued and outstanding UEX Shares.

Board of Directors’ Recommendations

The Amending Agreement has been unanimously approved by the Board of Directors of UEX who continue to recommend that UEX Shareholders and holders of options and restricted share units of UEX (collectively, the “UEX Securityholders”) vote in favour of the Transaction. The Amending Agreement has also been unanimously approved by the Board of Directors of UEC.

Transaction Conditions and Timing

Full details of the Transaction are included in the management information circular of UEX dated July 8, 2022 (the “Circular”). The Transaction will be subject to the approval of at least (i) 66 2/3% of the votes cast by UEX Shareholders, and (ii) 66 2/3% of the votes cast by UEX Securityholders, voting together as a single class, at the Meeting, which will continue to be held on Monday, August 15, 2022, at 10:00 a.m. (Vancouver time) at the Metropolitan Hotel, 645 Howe Street, Vancouver, British Columbia.

If the UEX Securityholders approve the Arrangement at the Meeting, it is currently anticipated that the Arrangement will be completed in by the end of August, subject to obtaining court approval, stock exchange approval and certain required regulatory approvals, as well as the satisfaction or waiver of other conditions contained in the Arrangement Agreement.

On completion of the Arrangement, former UEX Shareholders are expected to hold approximately 14.3% (instead of 14.2% as previously disclosed) of the outstanding UEC Shares (on a pro forma ownership basis based on the issued and outstanding UEC Shares as of the date hereof).

None of the securities to be issued pursuant to the Transaction have been or will be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws, and any securities issuable in the Transaction are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant to Section 3(a)(10) of the U.S. Securities Act and applicable exemptions under state securities laws. This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities.

UEX Securityholders who have questions regarding the Transaction should contact Laurel Hill Advisory Group by telephone at 1-877-452-7184 (North American Toll Free) or 1-416-304-0211 (Outside North America), or by email at assistance@laurelhill.com.

-3-

A copy of the news release is attached as Exhibit 99.1 hereto.

|

Item 9.01

|

Financial Statements and Exhibits

|

|

(a)

|

Financial Statements of Business Acquired

|

Not applicable.

|

(b)

|

Pro forma Financial Information

|

Not applicable.

|

(c)

|

Shell Company Transaction

|

Not applicable.

|

Exhibit

|

|

Description

|

| |

|

|

|

10.1

|

|

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document)

|

__________

-4-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

URANIUM ENERGY CORP. |

|

| |

|

|

|

| |

|

|

|

| DATE: August 15, 2022. |

By: |

/s/ Pat Obara |

|

| |

|

Pat Obara, Secretary and |

|

| |

|

Chief Financial Officer |

|

| |

|

|

|

| |

|

|

|

__________

-5-

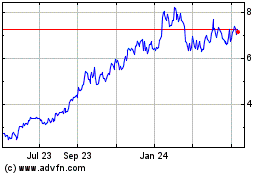

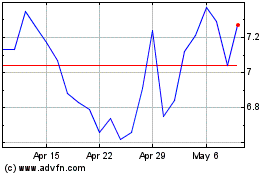

Uranium Energy (AMEX:UEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uranium Energy (AMEX:UEC)

Historical Stock Chart

From Apr 2023 to Apr 2024