Newtek Business Services Corp. (“Newtek” or the “Company”) (Nasdaq:

NEWT), an internally managed business development company (“BDC”),

announced today its financial and operating results for three and

six months ended June 30, 2022.

Barry Sloane, Chairman, President and Chief Executive Officer

said, “We are very pleased to report our results for the second

quarter 2022. We are proud to have been able to deliver what we

believe are strong results that meet our earnings and dividends

forecasts. Furthermore, we were able to grow SBA 7(a) loan fundings

by 112.8%, to a record $200.6 million, and increase loan units

funded by 154%, for the three months ended June 30, 2022. In

addition, we funded $62.0 million of SBA 7(a) loans in July 2022.

We are particularly proud because we believe that these record loan

fundings were accomplished without reducing the credit quality of

our borrowers; to the contrary, we believe that we tightened credit

standards which resulted in a reduced approval-rate percentage of

loans presented to the loan committee. Our year-over-year

comparables across some of our metrics, however, were down, even

though we posted strong results. We believe this decline was

primarily attributable to the fact the first two quarters of 2021

earnings materially benefited from Paycheck Protection Program

("PPP") fee income. As previously stated, this PPP fee income is

non-recurring, and has since been replaced with earnings from our

core and growing business lines and activities. We firmly believe

that our trajectory and growth will allow us to ultimately surpass

the earnings achieved during the PPP and pandemic-affected

environment, and that our business operations and strategy,

including the pending acquisition of the National Bank of New York

City ("NBNYC"), which remains subject to regulatory approvals, and

becoming a publicly traded bank holding company, is occurring at an

advantageous time." Second Quarter 2022 Financial

Highlights

- Total investment income of $19.2 million for the three

months ended June 30, 2022; a decrease of (47.5)% compared to total

investment income of $36.6 million for the three months ended

June 30, 2021. Second quarter 2021 total investment income included

$25.5 million of fee income from the PPP which, as previously

disclosed, is not recurring.

- Net investment income (loss) of $(2.3) million, or $(0.09)

per share, for the three months ended June 30, 2022, which

represents a (113.0)% decrease, on a per share basis, compared to

net investment income of $15.5 million, or $0.69 per share,

for the three months ended June 30, 2021. Second quarter 2021 net

investment income included $25.5 million of fee income from

the PPP which, as previously disclosed, is not recurring.

- Adjusted net investment income ("ANII")1 of $18.1 million,

or $0.75 per share, for the three months ended June 30, 2022; a

decrease of (37.5)%, on a per share basis, compared to ANII of

$27.0 million, or $1.20 per share, for the three months ended

June 30, 2021. Second quarter 2021 ANII included $25.5 million

of fee income from the PPP which, as previously disclosed, is not

recurring.

- Debt-to-equity ratio of 1.31x at June 30, 2022; proforma

debt-to-equity ratio was 1.15x after taking into account the sales

of government-guaranteed portions of SBA 7(a) loans prior to June

30, 2022, which sales settled subsequent to the balance sheet

date.

- Total investment portfolio increased by 8.8% to

$757.1 million at June 30, 2022, from $696.1 million at

June 30, 2021.

- Net asset value (“NAV”) of $394.5 million, or $16.31 per

share, at June 30, 2022 compared to NAV of $16.38 per share at

June 30, 2021.

2022 Financial Highlights For the Six Months Ended June

30, 2022

- Total investment income of $39.6 million for the six

months ended June 30, 2022; a decrease of (44.5)% over total

investment income of $71.3 million for the six months ended

June 30, 2021 which included $49.7 million of fee income from

the PPP, which, as previously disclosed, is not recurring.

- Net investment income (loss) of $(1.3) million, or $(0.05)

per share, for the six months ended June 30, 2022, which represents

a (103.6)% decrease, on a per share basis, compared to net

investment income of $30.7 million, or $1.37 per share, for the six

months ended June 30, 2021, which included $49.7 million of

fee income from the PPP which, as previously disclosed, is not

recurring.

- ANII1 of $35.3 million, or $1.46 per share, for the six

months ended June 30, 2022; a decrease of (35.1)%, on a per share

basis, compared to ANII of $50.5 million, or $2.25 per share,

for the six months ended June 30, 2021, which included

$49.7 million of fee income from the PPP which, as previously

disclosed, is not recurring.

- ANII of $1.46 per share for the six months ended June 30, 2022

was greater than the midpoint of our previously issued ANII

forecast, for the six months ended June 30, 2022, of $1.40 per

share to $1.50 per share.

Additional Second Quarter

Highlights

- On June 1, 2022, at a special meeting of shareholders, Newtek

shareholders overwhelmingly approved a proposal authorizing the

Company’s Board of Directors to discontinue the Company’s election

to be regulated as a BDC under the Investment Company Act of 1940,

as amended (subject to certain regulatory approvals and closing

conditions described in the Company’s Proxy Statement dated May 2,

2022) (the “Proposal”). As previously disclosed in a Form 8-K, 89%

of the votes cast at the Special Meeting were in favor of the

Proposal.

2022 Dividend Declarations & Payments

- On June 30, 2022, the Company paid a second quarter 2022

cash dividend of $0.75 per share to shareholders of record as of

June 20, 2022, which represented a 7.1% increase over the

second quarter 2021 dividend of $0.70 per share.

- The Company has paid and declared dividends totaling $1.40 per

share for the first and second quarters of 2022, which represents a

16.7% increase over dividends paid in the first and second quarters

of 2021.

- The Company forecasts paying a third quarter 2022 and fourth

quarter 2022 total dividend in a range of $1.00 per share to $1.50

per share, which dividends are expected to be paid by December 31,

2022, subject to Board approval, and is currently forecasting a

full year 2022 dividend of between $2.40 per share and $2.90 per

share.2

Lending Highlights

- Newtek Small Business Finance, LLC (“NSBF”) funded a record

$200.6 million of SBA 7(a) loans during the three months ended June

30, 2022; a 112.8% increase over the $94.3 million of SBA 7(a)

loans funded for the three months ended June 30, 2021.

- NSBF funded a record $363.9 million in SBA 7(a) loans for the

six months ended June 30, 2022, which represents an 83.2% increase

over $198.6 million SBA 7(a) loan fundings for the six months ended

June 30, 2021.

- NSBF funded $62.0 million SBA 7(a) loans during July 2022.

- NSBF forecasts funding approximately $750 million of SBA 7(a)

loans for the full year 2022, which would represent a 33.8%

increase over $560.6 million of SBA 7(a) loans funded in 2021.

- Newtek Business Lending ("NBL"), forecasts closing

approximately $150 million SBA 504 loans for the full year 2022,

which would represent a 66.5% increase over $90.1 million of SBA

504 closings in 2021.

Mr. Sloane continued, “We are exceptionally pleased with our

quarterly and first half of 2022 performance, in particular given

the market headwinds that publicly traded companies are facing,

which are out of anyone's control. Our weighted average net

gain-on-sale price for the second quarter 2022, which reflects

lagging prime rate increases and other capital market pressures,

decreased by 2.5% over the first quarter of 2022, however our core

business operations were able to make up for the decline by NSBF

funding 330 SBA 7(a) loan units in the second quarter 2022,

compared to 130 SBA 7(a) loan units in the same period last year.

Over our 24-year operating history, we believe that Newtek has

demonstrated its ability to push itself through high-rate,

low-rate, good credit and poor credit environments, and we believe

that it has been able to outperform market participants and

competitors. Being able to meet and exceed the midpoint of our ANII

targets, even with a 2.5% reduction in weighted average net

gain-on-sale pricing for the quarter, is evidence of such

resilience. Moreover, we are pleased to report that our borrowers

are currently above a 98% currency ratio in our accrual loan

portfolio as of June 30, 2022, and remain confident in the manner

in which we manage our relationships with our borrowers and work

with them to offer the best business and finance solutions

available in the market. In addition, I want to commend Newtek’s

senior management team and all staff for being able to deliver

these strong results while simultaneously positioning the Company

for what we believe will be a transition into owning a federally

chartered bank, NBNYC (subject to regulatory approvals and closing

conditions), which we contracted to purchase slightly over one year

ago, and converting Newtek into a bank holding company. We recently

received what we believe is an overwhelming shareholder response at

our special meeting of shareholders where 89% of Newtek’s

shareholders voting at the meeting gave Newtek’s board of directors

authorization to discontinue Newtek’s election as a BDC. I have a

tremendous appreciation for all of the work our staff has done

during the ongoing regulatory application process and to prepare

for the closing of the NBNYC acquisition, while simultaneously

working tirelessly to deliver above-average results to shareholders

during one of the most challenging market environments we have

experienced in the last decade. We continue to believe that the

required regulatory approvals will be forthcoming within the third

quarter of 2022.”

Mr. Sloane further commented, “In a separate press release,

issued today, we forecasted our total dividends for the second half

of 2022 in a range of $1.00 per share to $1.50 per share, which are

expected to be paid by December 31, 2022, and out of taxable income

as they always have been paid, subject to Board

approval. Newtek has paid a total of $1.40 per share in

dividends year to date through June 30, 2022, and we are currently

forecasting a full year 2022 dividend of between $2.40 per share

and $2.90 per share. We also provided the markets with an

illustration of certain financial targets for Newtek for 2023 as a

bank holding company, including from an earnings projection and

capital-level basis, if we were to receive regulatory approvals and

close the acquisition. This illustration can be found on our

corporate website at www.newtekone.com in the ‘Investor Relations’

section under ‘Events and Presentations’ and is titled ‘July 2022

Illustration of the NBNYC Acquisition and Conversion of Newtek

Business Services Corp. to a Bank Holding Company’. We would like

to note that management is even more confident in its decision to

acquire a bank and convert to a bank holding company given the

change in climate for interest rates, commercial finance, quality

spreads, and the hopeful and anticipated targets for capitalization

and earnings.”

Mr. Sloane concluded, “Through this new pending structure, in

addition to lowering our cost of capital and supporting our overall

growth, we believe our ability to deliver superior products as a

bank holding company and bank, and satisfy our client’s needs, will

be materially enhanced, helping us improve the business prospects

of independent business owners through our technology-enabled bank

in a significant way. We believe the process of acquiring NBNYC has

illuminated how advanced our two-decade-long history of

establishing people, processes, and technology is, and may allow us

to unlock shareholder value by potentially creating joint ventures

with, and licensing our technology to, other market participants

and distributing our technology to other financial institutions,

including but not limited to community banks, regional banks and

credit unions, which we believe could place us in an position to

monetize our technological assets and processes. During our

earnings conference call we will discuss the NewtekOne DashboardTM,

which we will be positioning as “The Newtek AdvantageTM”, which we

believe will allow us to offer our future banking clientele the

relationships, analytics, software, and transactional capability

that other banks simply do not offer. We will discuss this and our

financial and operating results on our earnings conference call

tomorrow morning at 8:30 am ET, along with what we believe are a

plethora of opportunities ahead for our organization.”

Second Quarter 2022 Conference Call and

Webcast

A conference call to discuss second quarter 2022 results will be

hosted by Barry Sloane, President, Chairman and Chief Executive

Officer, and Nicholas Leger, Chief Accounting Officer, tomorrow,

Thursday, August 4, 2022 at 8:30 a.m. ET.

Please note, to attend the conference call or webcast,

participants should register online at

http://investor.newtekbusinessservices.com/events-and-presentations.

To receive a dial-in number, participants are requested to register

one day in advance or at a minimum 15 minutes before the start of

the call. The corresponding presentation will be available in the

‘Events & Presentations’ section of the Investor Relations

portion of Newtek’s website at

http://investor.newtekbusinessservices.com/events-and-presentations.

A replay of the call with the corresponding presentation will be

available on Newtek’s website shortly following the live

presentation and will be available for a period of 90 days.

1Use of Non-GAAP Financial Measures -

Newtek Business Services Corp. and Subsidiaries

In evaluating its business, Newtek considers and uses ANII as a

measure of its operating performance. ANII includes short-term

capital gains from the sale of the guaranteed portions of SBA 7(a)

loans and conventional loans, and beginning in 2016, capital gain

distributions from controlled portfolio companies, which are

reoccurring events. The Company defines ANII as net investment

income (loss) plus net realized gains recognized from the sale of

guaranteed portions of SBA 7(a) loan investments, less realized

losses on non-affiliate investments, plus the net realized gains on

controlled investments, plus or minus the change in fair value of

contingent consideration liabilities, plus loss on extinguishment

of debt, plus or minus an adjustment for gains or losses on

derivative transactions.

We do not designate derivatives as hedges to qualify for hedge

accounting and therefore any net payments under, or fluctuations in

the fair value of, our derivatives are recognized currently in our

GAAP income statement. However, fluctuations in the fair value of

the related assets are not included in our income statement. We

consider the gain or loss on our hedging positions related to

assets that we still own as of the reporting date to be “open

hedging positions.” While recognized for GAAP purposes, we exclude

the results on the hedges from ANII until the related asset is sold

and/or the hedge position is “closed,” whereupon they would then be

included in ANII in that period. These are reflected as “adjustment

for realized gain/(loss) on derivatives” for purposes of computing

ANII for the period. Management believes that excluding these

specifically identified gains and losses associated with the open

hedging positions adjusts for timing differences between when we

recognize changes in the fair values of our assets and changes in

the fair value of the derivatives used to hedge such assets.

The term ANII is not defined under U.S. generally accepted

accounting principles, or U.S. GAAP, and is not a measure of

operating income, operating performance or liquidity presented in

accordance with U.S. GAAP. ANII has limitations as an analytical

tool and, when assessing the Company’s operating performance,

investors should not consider ANII in isolation, or as a substitute

for net investment income, or other consolidated income statement

data prepared in accordance with U.S. GAAP. Among other

things, ANII does not reflect the Company’s actual cash

expenditures. Other companies may calculate similar measures

differently than Newtek, limiting their usefulness as comparative

tools. The Company compensates for these limitations by

relying primarily on its GAAP results supplemented by ANII.

Reconciliation tables showing the adjustments made to net

investment income to determine NII are attached to this press

release.

2 Note Regarding Dividend

PaymentsAmount and timing of dividends, if any, remain

subject to the discretion of the Company's Board of Directors. The

Company's Board of Directors expects that it will maintain its

status as a BDC and regulated investment company ("RIC") in the

near term, and therefore expects to maintain a dividend policy with

the objective of making quarterly distributions in an amount that

approximates 90 - 100% of the Company's annual taxable income. The

determination of the tax attributes of the Company's distributions

is made annually as of the end of the Company's fiscal year based

upon its taxable income for the full year and distributions paid

for the full year.

Newtek Business Services Corp., Your Business Solutions

Company®, is an internally managed BDC, which along with its

controlled portfolio companies, provides a wide range of business

and financial solutions under the Newtek® brand to the small- and

medium-sized business (“SMB”) market. Since 1999, Newtek has

provided state-of-the-art, cost-efficient products and services and

efficient business strategies to SMB relationships across all 50

states to help them grow their sales, control their expenses and

reduce their risk.

Newtek’s and its portfolio companies’ products and services

include: Business Lending, SBA Lending Solutions, Electronic

Payment Processing, Technology Solutions (Cloud Computing, Data

Backup, Storage and Retrieval, IT Consulting), eCommerce, Accounts

Receivable Financing & Inventory Financing, Insurance

Solutions, Web Services, and Payroll and Benefits Solutions.

Newtek® and Your Business Solutions Company®, are registered

trademarks of Newtek Business Services Corp.

Note Regarding Forward Looking

StatementsThis press release contains certain

forward-looking statements. Words such as “believes,” “intends,”

“expects,” “projects,” “anticipates,” “forecasts,” “goal” and

“future” or similar expressions are intended to identify

forward-looking statements. All forward-looking statements involve

a number of risks and uncertainties that could cause actual results

to differ materially from the plans, intentions and expectations

reflected in or suggested by the forward-looking statements. Such

risks and uncertainties include, among others, include our ability

to close the pending acquisition of the National Bank of New York

City (the “Transaction”), obtain required regulatory approvals for

the pending Transaction, the timing of the closing of the

Transaction, the timing of the Company’s discontinuance from

regulation as a BDC under the 1940 Act, projections concerning or

considering the pending Transaction, the timing of our our ability

to originate new investments, achieve certain margins and levels of

profitability, the availability of additional capital and the

ability to maintain certain debt to asset ratios, intensified

competition, operating problems and their impact on revenues and

profit margins, anticipated future business strategies and

financial performance, anticipated future number of customers,

business prospects, legislative developments and similar matters.

Risk factors, cautionary statements and other conditions, which

could cause Newtek’s actual results to differ from management’s

current expectations, are contained in Newtek’s filings with the

Securities and Exchange Commission and available through

http://www.sec.gov/. Newtek cautions you that forward-looking

statements are not guarantees of future performance and that actual

results or developments may differ materially from those projected

or implied in these statements.

SOURCE: Newtek Business Services Corp.

Investor Relations & Public

RelationsContact: Jayne Cavuoto Telephone: (212) 273-8179

/ jcavuoto@newtekone.com

|

NEWTEK BUSINESS SERVICES CORP. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF ASSETS AND

LIABILITIES(In Thousands, except for Per Share

Data) |

| |

June 30, 2022 |

|

December 31, 2021 |

|

ASSETS |

(Unaudited) |

|

|

| Investments, at fair

value |

|

|

|

|

SBA unguaranteed non-affiliate investments (cost of $470,399 and

$431,970, respectively; includes $312,677 and $344,266,

respectively, related to securitization trusts) |

$ |

459,981 |

|

$ |

424,417 |

|

SBA guaranteed non-affiliate investments (cost of $26,595 and

$65,728, respectively) |

|

28,192 |

|

|

72,970 |

|

Controlled investments (cost of $165,273 and $157,289,

respectively) |

|

267,924 |

|

|

260,398 |

|

Non-control investments (cost of $1,000 and $1,000,

respectively) |

|

1,000 |

|

|

1,000 |

| Total investments at fair

value |

|

757,097 |

|

|

758,785 |

| Cash |

|

4,165 |

|

|

2,397 |

| Restricted cash |

|

121,861 |

|

|

184,463 |

| Broker receivable |

|

78,721 |

|

|

44,537 |

| Due from related parties |

|

841 |

|

|

4,395 |

| Servicing assets, at fair

value |

|

31,820 |

|

|

28,008 |

| Right of use assets |

|

6,695 |

|

|

7,310 |

| Other assets |

|

25,097 |

|

|

26,666 |

|

Total assets |

$ |

1,026,297 |

|

$ |

1,056,561 |

| |

|

|

|

|

LIABILITIES AND NET ASSETS |

|

|

|

| Liabilities: |

|

|

|

|

Bank notes payable |

$ |

127,414 |

|

$ |

50,000 |

|

2024 Notes (par: $38,250 and $38,250 as of June 30, 2022 and

December 31, 2021) |

|

37,790 |

|

|

37,679 |

|

2025 6.85% Notes (par: $0 and $15,000 as of June 30, 2022 and

December 31, 2021) |

|

— |

|

|

14,545 |

|

2025 5.00% Notes (par: $30,000 and $0 as of June 30, 2022 and

December 31, 2021) |

|

29,187 |

|

|

— |

|

2026 Notes (par: $115,000 and $115,000 as of June 30, 2022 and

December 31, 2021) |

|

112,487 |

|

|

112,128 |

|

Notes payable - Securitization trusts (par: $207,582 and $249,750

as of June 30, 2022 and December 31, 2021) |

|

204,690 |

|

|

246,250 |

|

Notes payable - related parties |

|

200 |

|

|

11,450 |

|

Due to related parties |

|

855 |

|

|

1,490 |

|

Lease liabilities |

|

8,323 |

|

|

9,056 |

|

Deferred tax liabilities |

|

12,793 |

|

|

12,733 |

|

Due to participants |

|

83,050 |

|

|

146,225 |

|

Derivative instruments |

|

— |

|

|

183 |

|

Accounts payable, accrued expenses and other liabilities |

|

14,976 |

|

|

10,935 |

|

Total liabilities |

|

631,765 |

|

|

652,674 |

| |

|

|

|

| Commitment and

contingencies |

|

|

|

| Net assets: |

|

|

|

|

Preferred stock (par value $0.02 per share; authorized 1,000

shares, no shares issued and outstanding) |

|

— |

|

|

— |

|

Common stock (par value $0.02 per share; authorized 200,000 shares,

24,187 and 24,159 issued and outstanding, respectively) |

|

480 |

|

|

483 |

|

Additional paid-in capital |

|

368,934 |

|

|

367,663 |

|

Accumulated undistributed earnings |

|

25,118 |

|

|

35,741 |

|

Total net assets |

|

394,532 |

|

|

403,887 |

|

Total liabilities and net assets |

$ |

1,026,297 |

|

$ |

1,056,561 |

| Net asset value per common

share |

$ |

16.31 |

|

$ |

16.72 |

|

NEWTEK BUSINESS SERVICES CORP. AND

SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED) |

|

(In Thousands, except for Per Share Data) |

| |

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Investment income |

|

|

|

|

|

|

|

|

From non-affiliate investments: |

|

|

|

|

|

|

|

|

Interest income - PPP loans |

$ |

— |

|

|

$ |

25,512 |

|

|

$ |

— |

|

|

$ |

49,720 |

|

|

Interest income - SBA 7(a) loans |

|

8,032 |

|

|

|

6,248 |

|

|

|

15,111 |

|

|

|

12,197 |

|

|

Servicing income |

|

3,175 |

|

|

|

2,787 |

|

|

|

6,356 |

|

|

|

5,527 |

|

|

Other income |

|

2,368 |

|

|

|

1,269 |

|

|

|

3,947 |

|

|

|

2,383 |

|

| Total investment income from

non-affiliate investments |

|

13,575 |

|

|

|

35,816 |

|

|

|

25,414 |

|

|

|

69,827 |

|

|

From non-control investments: |

|

|

|

|

|

|

|

|

Interest income |

|

— |

|

|

|

124 |

|

|

|

— |

|

|

|

248 |

|

|

Dividend income |

|

21 |

|

|

|

21 |

|

|

|

43 |

|

|

|

47 |

|

| Total investment income from

non-control investments |

|

21 |

|

|

|

145 |

|

|

|

43 |

|

|

|

295 |

|

|

From controlled investments: |

|

|

|

|

|

|

|

|

Interest income |

|

670 |

|

|

|

576 |

|

|

|

1,334 |

|

|

|

1,109 |

|

|

Dividend income |

|

4,960 |

|

|

|

51 |

|

|

|

12,784 |

|

|

|

51 |

|

| Total investment income from

controlled investments |

|

5,630 |

|

|

|

627 |

|

|

|

14,118 |

|

|

|

1,160 |

|

| Total investment income |

|

19,226 |

|

|

|

36,588 |

|

|

|

39,575 |

|

|

|

71,282 |

|

| Expenses: |

|

|

|

|

|

|

|

|

Salaries and benefits |

|

4,499 |

|

|

|

5,926 |

|

|

|

9,608 |

|

|

|

10,376 |

|

|

Interest |

|

5,828 |

|

|

|

4,968 |

|

|

|

10,495 |

|

|

|

10,040 |

|

|

Depreciation and amortization |

|

60 |

|

|

|

79 |

|

|

|

123 |

|

|

|

164 |

|

|

Professional fees |

|

1,512 |

|

|

|

859 |

|

|

|

2,813 |

|

|

|

2,047 |

|

|

Origination and loan processing |

|

1,882 |

|

|

|

2,998 |

|

|

|

4,336 |

|

|

|

5,969 |

|

|

Origination and loan processing - related party |

|

5,239 |

|

|

|

4,510 |

|

|

|

9,268 |

|

|

|

7,653 |

|

|

Loss on extinguishment of debt |

|

417 |

|

|

|

— |

|

|

|

417 |

|

|

|

955 |

|

|

Other general and administrative costs |

|

2,043 |

|

|

|

1,706 |

|

|

|

3,796 |

|

|

|

3,341 |

|

| Total expenses |

|

21,480 |

|

|

|

21,046 |

|

|

|

40,856 |

|

|

|

40,545 |

|

| Net investment income

(loss) |

|

(2,254 |

) |

|

|

15,542 |

|

|

|

(1,281 |

) |

|

|

30,737 |

|

| Net realized and unrealized

gains (losses): |

|

|

|

|

|

|

|

|

Net realized gain on non-affiliate investments - SBA 7(a)

loans |

|

19,891 |

|

|

|

11,414 |

|

|

|

35,186 |

|

|

|

18,807 |

|

|

Net realized gain on derivative transactions |

|

— |

|

|

|

— |

|

|

|

445 |

|

|

|

— |

|

|

Net unrealized appreciation (depreciation) on SBA guaranteed

non-affiliate investments |

|

(4,917 |

) |

|

|

(1,983 |

) |

|

|

(5,645 |

) |

|

|

2,410 |

|

|

Net unrealized appreciation (depreciation) on SBA unguaranteed

non-affiliate investments |

|

(872 |

) |

|

|

198 |

|

|

|

(2,862 |

) |

|

|

1,585 |

|

|

Net unrealized appreciation (depreciation) on controlled

investments |

|

1,566 |

|

|

|

(7,920 |

) |

|

|

(458 |

) |

|

|

(5,545 |

) |

|

Change in deferred taxes |

|

886 |

|

|

|

1,356 |

|

|

|

(57 |

) |

|

|

723 |

|

|

Net unrealized appreciation (depreciation) on non-control

investments |

|

— |

|

|

|

(3 |

) |

|

|

— |

|

|

|

524 |

|

|

Net unrealized appreciation (depreciation) on derivative

transactions |

|

— |

|

|

|

(37 |

) |

|

|

183 |

|

|

|

(37 |

) |

|

Net unrealized depreciation on servicing assets |

|

(781 |

) |

|

|

(1,193 |

) |

|

|

(2,340 |

) |

|

|

(1,706 |

) |

| Net realized and unrealized

gains |

$ |

15,773 |

|

|

$ |

1,832 |

|

|

$ |

24,452 |

|

|

$ |

16,761 |

|

| Net increase in net assets

resulting from operations |

$ |

13,519 |

|

|

$ |

17,374 |

|

|

$ |

23,171 |

|

|

$ |

47,498 |

|

|

Net increase in net assets resulting from operations per share |

$ |

0.56 |

|

|

$ |

0.77 |

|

|

$ |

0.96 |

|

|

$ |

2.12 |

|

|

Net investment income (loss) per share |

$ |

(0.09 |

) |

|

$ |

0.69 |

|

|

$ |

(0.05 |

) |

|

$ |

1.37 |

|

|

Dividends and distributions declared per common share |

$ |

0.75 |

|

|

$ |

0.70 |

|

|

$ |

1.40 |

|

|

$ |

1.20 |

|

|

Weighted average number of shares outstanding |

|

24,157 |

|

|

|

22,524 |

|

|

|

24,156 |

|

|

|

22,431 |

|

NEWTEK BUSINESS SERVICES CORP. AND

SUBSIDIARIESNON-GAAP FINANCIAL

MEASURES-ADJUSTED NET INVESTMENT INCOME

RECONCILIATION:

| |

|

Six months ended |

|

|

|

Six months ended |

|

|

| (in thousands, except per

share amounts) |

|

June 30, 2022 |

|

Per share |

|

June 30, 2021 |

|

Per share |

|

Net investment income (loss) |

|

$ |

(1,281 |

) |

|

$ |

(0.05 |

) |

|

$ |

30,737 |

|

$ |

1.37 |

| Net realized gain on

non-affiliate investments - SBA 7(a) loans |

|

|

35,186 |

|

|

|

1.46 |

|

|

|

18,807 |

|

|

0.84 |

| Adjustment for realized gain

on derivatives (1) |

|

|

1,010 |

|

|

|

0.04 |

|

|

|

— |

|

|

— |

| Loss on debt

extinguishment |

|

|

417 |

|

|

|

0.02 |

|

|

|

955 |

|

|

0.04 |

|

Adjusted Net investment income |

|

$ |

35,332 |

|

|

$ |

1.46 |

|

|

$ |

50,499 |

|

$ |

2.25 |

Note: Amounts may not foot due to rounding

(1) The following is a reconciliation of GAAP net realized

gain/(loss) on derivative transactions to our adjustment for

realized gain/(loss) on derivatives on closed transactions

presented in the computation of ANII in the preceding tables:

| |

|

Six months ended |

|

|

|

Six months ended |

|

|

| (in thousands, except per

share amounts) |

|

June 30, 2022 |

|

Per share |

|

June 30, 2021 |

|

Per share |

|

Net realized gain on derivatives |

|

$ |

445 |

|

$ |

0.02 |

|

$ |

— |

|

$ |

— |

| Hedging realized adjustment on

hedging positions closed during current period |

|

|

565 |

|

|

0.02 |

|

|

— |

|

|

— |

|

Adjustment for realized gain on derivatives |

|

$ |

1,010 |

|

$ |

0.04 |

|

$ |

— |

|

$ |

— |

Note: Amounts may not foot due to rounding

NEWTEK BUSINESS SERVICES CORP. AND

SUBSIDIARIESNON-GAAP FINANCIAL

MEASURES-ADJUSTED NET INVESTMENT INCOME

RECONCILIATION:

| |

|

Three months ended |

|

|

|

Three months ended |

|

|

| (in thousands, except per

share amounts) |

|

June 30, 2022 |

|

Per share |

|

June 30, 2021 |

|

Per share |

|

Net investment income (loss) |

|

|

(2,254 |

) |

|

|

(0.09 |

) |

|

$ |

15,542 |

|

$ |

0.69 |

| Net realized gain on

non-affiliate investments - SBA 7(a) loans |

|

|

19,891 |

|

|

|

0.82 |

|

|

|

11,414 |

|

|

0.51 |

| Loss on debt

extinguishment |

|

|

417 |

|

|

|

0.02 |

|

|

|

— |

|

|

— |

|

Adjusted Net investment income |

|

$ |

18,054 |

|

|

$ |

0.75 |

|

|

$ |

26,956 |

|

$ |

1.20 |

Note: Amounts may not foot due to rounding

NEWTEK BUSINESS SERVICES CORP. AND

SUBSIDIARIESDEBT-TO-EQUITY RATIO - ACTUAL AT JUNE 30, 2022

| (in

thousands): |

|

|

|

|

Actual Debt-to-Equity Ratio at June 30, 2022 |

|

|

|

|

Total senior debt |

|

$ |

518,446 |

|

| Total

equity |

|

$ |

394,532 |

|

|

Debt-to-equity ratio - actual |

|

1.31x |

|

|

|

|

|

|

NEWTEK BUSINESS SERVICES CORP. AND

SUBSIDIARIESDEBT-TO-EQUITY RATIO - PROFORMA AT JUNE 30, 2022

| (in

thousands): |

|

|

|

|

Broker receivable, including premium income receivable |

|

$ |

78,721 |

|

|

| Less:

realized gain on sale included in broker receivable |

|

|

(6,589 |

) |

|

| Broker

receivable |

|

|

72,132 |

|

|

|

|

|

|

|

| 90%

advance rate on SBA guaranteed non-affiliate portions of loans

sold, not settled |

|

$ |

64,919 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Proforma debt adjustments at June 30, 2022: |

|

|

|

| Total

senior debt |

|

$ |

518,446 |

|

|

| Proforma

adjustment for broker receivable |

|

|

(64,919 |

) |

|

| Total

proforma debt |

|

$ |

453,527 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Proforma Debt-to-Equity ratio at June 30,

2022: |

|

|

|

| Total

proforma debt |

|

$ |

453,527 |

|

|

| Total

equity |

|

$ |

394,532 |

|

|

|

Debt-to-equity ratio - proforma |

|

1.15x |

|

|

|

|

|

|

|

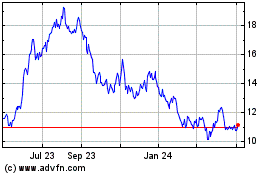

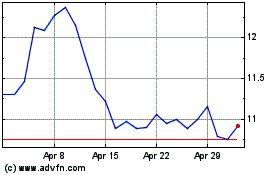

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Mar 2024 to Apr 2024

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Apr 2023 to Apr 2024