Noodles & Company (Nasdaq: NDLS) today announced financial

results for its second quarter ended June 28, 2022.

Key highlights for the second quarter of

2022 versus the second quarter of 2021 include:

- Total revenue increased 4.3% to

$131.1 million from $125.6 million in the second quarter of

2021.

- Comparable restaurant sales

increased 5.1% system-wide, comprised of a 5.1% increase at

company-owned restaurants and a 5.3% increase at franchise

restaurants.

- Company Average Unit Volumes

(“AUV”) of $1.42 million represented a 5.3% increase compared to

the second quarter of 2021 and an 18.3% increase versus the second

quarter of 2019.

- Net income was $1.3 million, or

$0.03 per diluted share, compared to $5.7 million, or $0.12 per

diluted share in the second quarter of 2021.

- Operating margin was 1.4% compared

to 4.9% in the second quarter of 2021.

- Restaurant contribution margin(1)

was 15.5% compared to 18.9% in the second quarter of 2021, which

was inclusive of an approximately 300 bps increase in cost of goods

sold.

- Adjusted EBITDA(1) was $11.2

million, a decrease of $2.6 million compared to the second quarter

of 2021.

- Adjusted net income(1) was $2.4

million, or $0.05 per diluted share compared to adjusted net income

of $6.0 million, or $0.13 per diluted share, in the second quarter

of 2021.

- Three new company-owned restaurants

opened in the second quarter of 2022.

_____________________(1) Restaurant

contribution margin, EBITDA, adjusted EBITDA, and adjusted net

income (loss) are non-GAAP measures. Reconciliations of operating

income (loss) to restaurant contribution margin, net income (loss)

to EBITDA and adjusted EBITDA and net income (loss) to adjusted net

income (loss) are included in the accompanying financial data. See

“Non-GAAP Financial Measures.”

“We are pleased with our second quarter results,

which were highlighted by record level average unit volumes of

$1.42 million, reflecting 5.3% growth over 2021 and an 18.3%

increase over the pre-COVID second quarter of 2019,” said Dave

Boennighausen, Chief Executive Officer of Noodles & Company.

“In addition to strong AUV growth in the second quarter, we

launched Leanguini, which offers 56% less net carbs and 44% more

protein than traditional wheat pasta, and identified multiple

initiatives to yield significant cost of goods savings going

forward. Despite a challenging near-term development environment,

we are targeting to have open 21 to 23 new locations in 2022 and

also continued to make significant progress towards a strong 2023

pipeline that could allow for upside to our 10% annual unit growth

rate target beginning next year.”

Boennighausen continued, “Our second quarter

highlights how strongly Noodles & Company resonates with

today’s consumer. From our recently introduced Leanguini offering

to our zucchini noodle to our artisanal sauces, our menu offers

great variety that is not easy to replicate at home or at other

restaurant competitors. Additionally, our attractive entry level

price point of $7 for multiple dishes and our recently launched

Uncommon Goodness marketing platform showcase the differentiation

of the concept and our strong value proposition, supported by a

robust digital ecosystem, which continues to account for over 50%

of sales and allows us to drive direct consumer engagement.”

Boennighausen concluded, “In addition to our

unit growth goals, we remain confident in our accelerated growth

objectives as AUVs are fast approaching the $1.5 million target and

we can see a clear pathway and progress to a 20% margin by 2024. We

have recently seen key commodity prices such as chicken decline

substantially from record highs, we are implementing important

efficiency initiatives, and our new unit development pipeline is

strengthening with many high-quality opportunities. Finally, our

growth strategy will also be supported by our recently refinanced

credit facility, which allows the Company increased flexibility to

pursue our objectives.”

Second Quarter 2022 Financial

Results

Total revenue grew 4.3% to $131.1 million in the

second quarter of 2022, compared to $125.6 million in the second

quarter of 2021. This growth was due to an increase in system-wide

comparable restaurant sales as well as new restaurant openings,

partially offset by previous restaurant closures and the

refranchising of 15 company-owned restaurants. Refranchising

equated to an approximate $4.1 million decline in sales in the

second quarter of 2022.

In the second quarter of 2022, system-wide

comparable restaurant sales increased 5.1%, comprised of a 5.1%

increase at company-owned restaurants and a 5.3% increase at

franchise restaurants. Comparable restaurant sales reflect

continued momentum in our in-person channels, in addition to price

increases in our core menu. Digital sales during the second quarter

accounted for 51.7% of total revenue. Company average unit volumes

were $1.42 million and increased 5.3% over the second quarter of

2021 and 18.3% compared to the second quarter of 2019.

Operating margin decreased to 1.4% in the second

quarter of 2022 from 4.9% in the second quarter of 2021, primarily

due to increased inflation costs associated with both food and

wages.

Restaurant contribution margin decreased to

15.5% in the second quarter of 2022, compared to 18.9% in the

second quarter of 2021. This decrease was primarily due to an

approximately 300 bps increase in costs of goods sold, due to

overall higher food and ingredient commodity pricing, particularly

with our protein costs, offset slightly by supply chain savings

initiatives.

There were three company-owned restaurant

openings during the second quarter of 2022 and we did not close any

company-owned restaurants. There were 456 restaurants system-wide

at the end of the second quarter 2022, comprised of 363

company-owned restaurants and 93 franchise restaurants.

For the second quarter of 2022, the Company

reported net income of $1.3 million, or $0.03 per diluted share,

compared with net income of $5.7 million in the second quarter of

2021, or $0.12 per diluted share. Income from operations for the

second quarter of 2022 was $1.9 million, compared to income from

operations of $6.2 million in the second quarter of 2021.

Adjusted net income was $2.4 million, or $0.05

per diluted share, in the second quarter of 2022, compared to

adjusted net income of $6.0 million, or $0.13 per diluted share, in

the second quarter of 2021. Adjusted EBITDA decreased 19.0%, or

$2.6 million, to $11.2 million in the second quarter of 2022

compared to the year-earlier period, primarily due to the impact of

inflation on our cost of food and wages.

Credit Facility Amendment:

Subsequent to the end of the second quarter, on

July 27, 2022, the Company amended and restated its Credit

Agreement. Among other things, the amendment upsized the credit

facility from $100.0 million to $125.0 million, eliminated the Term

Loan and principal amortization components of the credit facility,

lowered the spread within the Company’s cost of borrowing, and

enhanced flexibility for certain covenants and restrictions to

further support our accelerated growth objectives.

Liquidity Update:

As of June 28, 2022, the Company had $1.8

million of cash on hand and outstanding debt of $32.2 million under

its Credit Agreement. The amount available for future borrowings

under the Second Amended Credit Facility was $60.9 million. As of

July 27, 2022, the amount available for future borrowings under the

newly amended Credit Agreement was $89.8 million. The Company has

no principal payments due through the 2027 maturity of the newly

amended Credit Agreement.

Business Outlook:

The Company is providing the following

expectations for the fiscal year 2022:

- Third quarter 2022 total revenue of

$125.5 million to $128.5 million;

- Third quarter 2022 comparable

restaurant sales in the low-single digits;

- Third quarter 2022 restaurant level

contribution margin of 15.0% to 15.5%;

- Full year 2022 unit growth of

approximately 5%, versus previous expectations of 8%; and

- Full year 2022 capital expenditures

of $30 to $33 million in 2022, versus a previous range of $30 to

$34 million.

Based on the Company’s strategic framework and

underlying momentum, the Company is reiterating its accelerated

growth objectives. These accelerated growth objectives include the

following:

- System-wide unit growth of at least

10% annually beginning in 2023 on a targeted path to at least 1,500

units;

- Average unit volumes of $1.50

million by 2024; and

- Restaurant contribution margin of

20% by 2024.

Non-GAAP Financial Measures

The Company believes that a quantitative

reconciliation of the Company’s non-GAAP financial measures

guidance to the most comparable financial measures calculated and

presented in accordance with GAAP cannot be made available without

unreasonable efforts. A reconciliation of these non-GAAP

financial measures would require the Company to provide guidance

for various reconciling items that are outside of the Company’s

control and cannot be reasonably predicted due to the fact that

these items could vary significantly from period to period. A

reconciliation of certain non-GAAP financial measures would also

require the Company to predict the timing and likelihood of

outcomes that determine future impairments and the tax benefit

thereof. None of these measures, nor their probable

significance, can be reliably quantified. The non-GAAP financial

measures noted above have limitations as analytical financial

measures, as discussed below in the section entitled “Non-GAAP

Financial Measures.” In addition, the guidance with respect to

non-GAAP financial measures is a forward-looking statement, which

by its nature involves risks and uncertainties that could cause

actual results to differ materially from the Company’s

forward-looking statement, as discussed below in the section

entitled “Forward-Looking Statements.”

Key Definitions

Average Unit Volumes —

represent the average annualized sales of all company-owned

restaurants for a given time period. AUVs are calculated by

dividing restaurant revenue by the number of operating days within

each time period and multiplying by the number of operating days we

have in a typical year. Based on this calculation, temporarily

closed restaurants are excluded from the definition of AUV, however

restaurants with temporarily reduced operating hours are included.

This measurement allows management to assess changes in consumer

traffic and per person spending patterns at our restaurants. In

addition to the factors that impact comparable restaurant sales,

AUVs can be further impacted by effective real estate site

selection and maturity and trends within new markets.

Comparable Restaurant Sales —

represents year-over-year sales comparisons for the comparable

restaurant base open for at least 18 full periods. This measure

highlights performance of existing restaurants, as the impact of

new restaurant openings is excluded. Changes in comparable

restaurant sales are generated by changes in traffic, which we

calculate as the number of entrées sold, or changes in per-person

spend, calculated as sales divided by traffic. Restaurants that

were temporarily closed or operating at reduced hours or dining

capacity due to the COVID-19 pandemic remained in comparable

restaurant sales.

Restaurant Contribution and Restaurant

Contribution Margin — restaurant contribution represents

restaurant revenue less restaurant operating costs, which are costs

of sales, labor, occupancy and other restaurant operating items.

Restaurant contribution margin represents restaurant contribution

as a percentage of restaurant revenue. Restaurant contribution and

restaurant contribution margin are presented because they are

widely-used metrics within the restaurant industry to evaluate

restaurant-level productivity, efficiency and performance.

Management also uses restaurant contribution and restaurant

contribution margin as metrics to evaluate the profitability of

incremental sales at our restaurants, restaurant performance across

periods, and restaurant financial performance compared with

competitors. See “Non-GAAP Financial Measures” below.

EBITDA and Adjusted EBITDA —

EBITDA represents net income (loss) before interest expense,

provision (benefit) for income taxes and depreciation and

amortization. Adjusted EBITDA represents net income (loss) before

interest expense, provision (benefit) for income taxes,

depreciation and amortization, restaurant impairments, closure

costs and asset disposals, acquisition costs and stock-based

compensation expense. EBITDA and Adjusted EBITDA are presented

because: (i) management believes they are useful measures for

investors to assess the operating performance of our business

without the effect of non-cash charges such as depreciation and

amortization expenses and restaurant impairments, asset disposals

and closure costs, and (ii) management uses them internally as a

benchmark for certain of our cash incentive plans and to evaluate

our operating performance or compare performance to that of

competitors. See “Non-GAAP Financial Measures” below.

Adjusted Net Income (Loss) —

represents net income (loss) plus various adjustments and the tax

effects of such adjustments. Adjusted net income (loss) is

presented because management believes it helps convey supplemental

information to investors regarding the Company’s performance,

excluding the impact of special items that affect the comparability

of results in past quarters and expected results in future

quarters. See “Non-GAAP Financial Measures” below.

Conference Call

Noodles & Company will host a conference

call to discuss its second quarter financial results on Wednesday,

July 27, 2022 at 4:30 PM Eastern Time. The conference call can

be accessed live by registering here. While not required, it is

recommended that you join 10 minutes prior to the event start time.

The conference call will also be webcast live from the Company’s

corporate website at investor.noodles.com, under the “Events &

Presentations” page. An archive of the webcast will be available at

the same location on the corporate website shortly after the call

has concluded.

Non-GAAP Financial Measures

To supplement its condensed consolidated

financial statements, which are prepared and presented in

accordance with accounting principles generally accepted in the

United States of America (“GAAP”), the Company uses the following

non-GAAP financial measures: EBITDA, adjusted EBITDA, adjusted net

income (loss), adjusted earnings (loss) per share, net debt,

restaurant contribution and restaurant contribution margin

(collectively, the “non-GAAP financial measures”). The presentation

of this financial information is not intended to be considered in

isolation or as a substitute for, or to be superior to, the

financial information prepared and presented in accordance with

GAAP. The Company uses these non-GAAP financial measures for

financial and operational decision making and as a means to

evaluate period-to-period comparisons. The Company believes that

they provide useful information about operating results, enhance

the overall understanding of past financial performance and future

prospects and allow for greater transparency with respect to key

metrics used by management in its financial and operational

decision making. Adjusted net income (loss) is presented because

management believes it helps convey supplemental information to

investors regarding the Company’s operating performance excluding

the impact of restaurant impairment and closure costs, dead deal or

registration statement costs, severance costs and stock-based

compensation expense and the tax effect of such adjustments.

However, the Company recognizes that non-GAAP financial measures

have limitations as analytical financial measures. The Company

compensates for these limitations by relying primarily on its GAAP

results and using non-GAAP metrics only supplementally. There are

numerous of these limitations, including that: adjusted EBITDA does

not reflect the Company’s capital expenditures or future

requirements for capital expenditures; adjusted EBITDA does not

reflect interest expense or the cash requirements necessary to

service interest or principal payments, associated with our

indebtedness; adjusted EBITDA does not reflect depreciation and

amortization, which are non-cash charges, although the assets being

depreciated and amortized will likely have to be replaced in the

future, and do not reflect cash requirements for such replacements;

adjusted EBITDA does not reflect the cost of stock-based

compensation; adjusted EBITDA does not reflect changes in, or cash

requirements for, our working capital needs; and restaurant

contribution and restaurant contribution margin are not reflective

of the underlying performance of our business because

corporate-level expenses are excluded from these measures. When

analyzing the Company’s operating performance, investors should not

consider non-GAAP financial metrics in isolation or as substitutes

for net income (loss) or cash flow from operations, or other

statement of operations or cash flow statement data prepared in

accordance with GAAP. The non-GAAP financial measures used by the

Company in this press release may be different from the measures

used by other companies.

For more information on the non-GAAP financial

measures, please see the “Reconciliation of Non-GAAP Measurements

to GAAP Results” tables in this press release. These accompanying

tables have more details on the GAAP financial measures that are

most directly comparable to non-GAAP financial measures and the

related reconciliations between these financial measures.

About Noodles & Company

Since 1995, Noodles & Company has been

serving noodles your way, from noodles and flavors that you know

and love, to new ones you’re about to discover for the first time.

From indulgent Wisconsin Mac & Cheese to good-for-you Zoodles,

Noodles serves a world of flavor in every bowl. Made up of over 450

restaurants and approximately 9,000 passionate team members,

Noodles is dedicated to nourishing and inspiring every guest who

walks through the door. To learn more or find the location nearest

you, visit www.noodles.com.

Forward-Looking Statements

In addition to historical information, this

press release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995

that involve risks and uncertainties such as the number of

restaurants we intend to open, projected capital expenditures and

estimates of our effective tax rates. In some cases, you can

identify forward-looking statements by terms such as “may,”

“might,” “will,” “objective,” “intend,” “should,” “could,” “can,”

“would,” “expect,” “believe,” “design,” “estimate,” “predict,”

“potential,” “plan” or the negative of these terms and similar

expressions intended to identify forward-looking statements. These

statements reflect our current views with respect to future events

and are based on currently available operating, financial and

competitive information. Examples of forward-looking statements

include all matters that are not historical facts, such as

statements regarding expectations with respect to unit growth and

planned restaurant opening, projected capital expenditures, and

potential volatility through 2022 due to the current staffing and

supply chain environment, including the potential impact of

commodity and wage inflation. Our actual results may differ

materially from those anticipated in these forward-looking

statements due to reasons including, but not limited to, our

ability to sustain our overall growth, in particular, our digital

sales growth; our ability to open new restaurants on schedule and

cause those newly opened restaurants to be successful; our ability

to achieve and maintain increases in comparable restaurant sales

and to successfully execute our business strategy, including new

restaurant initiatives and operational strategies to improve the

performance of our restaurant portfolio; the success of our

marketing efforts, including our ability to successfully introduce

new products; current economic conditions including any impact from

inflation or an economic recession; price and availability of

commodities and other supply chain challenges; our ability to

adequately staff our restaurants; changes in labor costs; the

impact of the COVID-19 pandemic, including on our revenue and

balance sheets; other conditions beyond our control such as

weather, natural disasters, disease outbreaks, epidemics or

pandemics impacting our customers or food supplies; and consumer

reaction to industry related public health issues and health

pandemics, including perceptions of food safety. For additional

information on these and other factors that could affect the

Company’s forward-looking statements, see the Company’s risk

factors, as they may be amended from time to time, set forth in its

filings with the SEC, included in our most recently filed Annual

Report on Form 10-K, and, from time to time, in our subsequently

filed Quarterly Reports on Form 10-Q. The Company disclaims

and does not undertake any obligation to update or revise any

forward-looking statement in this press release, except as may be

required by applicable law or regulation.

Noodles &

CompanyCondensed Consolidated Statements of

Operations(in thousands, except share and per

share data, unaudited)

| |

|

Fiscal Quarter Ended |

|

Two Fiscal Quarters Ended |

| |

|

June 28,2022 |

|

June 29,2021 |

|

June 28,2022 |

|

June 29,2021 |

| Revenue: |

|

|

|

|

|

|

|

|

|

Restaurant revenue |

|

$ |

128,274 |

|

|

$ |

123,715 |

|

|

$ |

238,235 |

|

|

$ |

231,459 |

|

|

Franchising royalties and fees, and other |

|

|

2,793 |

|

|

|

1,934 |

|

|

|

5,394 |

|

|

|

3,767 |

|

|

Total revenue |

|

|

131,067 |

|

|

|

125,649 |

|

|

|

243,629 |

|

|

|

235,226 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

Restaurant operating costs (exclusive of depreciation and

amortization shown separately below): |

|

|

|

|

|

|

|

|

|

Cost of sales |

|

|

35,664 |

|

|

|

30,805 |

|

|

|

66,435 |

|

|

|

57,782 |

|

|

Labor |

|

|

38,828 |

|

|

|

36,926 |

|

|

|

74,321 |

|

|

|

71,232 |

|

|

Occupancy |

|

|

11,074 |

|

|

|

11,519 |

|

|

|

22,223 |

|

|

|

23,168 |

|

|

Other restaurant operating costs |

|

|

22,792 |

|

|

|

21,082 |

|

|

|

44,658 |

|

|

|

41,287 |

|

|

General and administrative |

|

|

12,744 |

|

|

|

12,978 |

|

|

|

24,584 |

|

|

|

23,907 |

|

|

Depreciation and amortization |

|

|

5,763 |

|

|

|

5,576 |

|

|

|

11,484 |

|

|

|

11,163 |

|

|

Pre-opening |

|

|

353 |

|

|

|

163 |

|

|

|

761 |

|

|

|

221 |

|

|

Restaurant impairments, closure costs and asset disposals |

|

|

1,971 |

|

|

|

390 |

|

|

|

3,360 |

|

|

|

1,621 |

|

|

Total costs and expenses |

|

|

129,189 |

|

|

|

119,439 |

|

|

|

247,826 |

|

|

|

230,381 |

|

| Income (loss) from

operations |

|

|

1,878 |

|

|

|

6,210 |

|

|

|

(4,197 |

) |

|

|

4,845 |

|

| Interest expense, net |

|

|

489 |

|

|

|

498 |

|

|

|

926 |

|

|

|

1,120 |

|

| Income (loss) before

taxes |

|

|

1,389 |

|

|

|

5,712 |

|

|

|

(5,123 |

) |

|

|

3,725 |

|

| Provision for (benefit from)

income taxes |

|

|

44 |

|

|

|

29 |

|

|

|

(39 |

) |

|

|

19 |

|

| Net income (loss) |

|

$ |

1,345 |

|

|

$ |

5,683 |

|

|

$ |

(5,084 |

) |

|

$ |

3,706 |

|

| Earnings (loss) per

Class A and Class B common stock, combined |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.03 |

|

|

$ |

0.12 |

|

|

$ |

(0.11 |

) |

|

$ |

0.08 |

|

|

Diluted |

|

$ |

0.03 |

|

|

$ |

0.12 |

|

|

$ |

(0.11 |

) |

|

$ |

0.08 |

|

| Weighted average shares of

Class A and Class B common stock outstanding,

combined: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

45,881,354 |

|

|

|

45,506,476 |

|

|

|

45,803,927 |

|

|

|

45,303,160 |

|

|

Diluted |

|

|

46,108,720 |

|

|

|

46,246,169 |

|

|

|

45,803,927 |

|

|

|

45,992,119 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noodles &

CompanyCondensed Consolidated Statements of

Operations as a Percentage of

Revenue(unaudited)

| |

|

Fiscal Quarter Ended |

|

Two Fiscal Quarters Ended |

| |

|

June 28,2022 |

|

June 29,2021 |

|

June 28,2022 |

|

June 29,2021 |

| Revenue: |

|

|

|

|

|

|

|

|

|

Restaurant revenue |

|

97.9 |

% |

|

98.5 |

% |

|

97.8 |

% |

|

98.4 |

% |

|

Franchising royalties and fees, and other |

|

2.1 |

% |

|

1.5 |

% |

|

2.2 |

% |

|

1.6 |

% |

|

Total revenue |

|

100.0 |

% |

|

100.0 |

% |

|

100.0 |

% |

|

100.0 |

% |

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

Restaurant operating costs (exclusive of depreciation and

amortization shown separately below):(1) |

|

|

|

|

|

|

|

|

|

Cost of sales |

|

27.8 |

% |

|

24.9 |

% |

|

27.9 |

% |

|

25.0 |

% |

|

Labor |

|

30.3 |

% |

|

29.8 |

% |

|

31.2 |

% |

|

30.8 |

% |

|

Occupancy |

|

8.6 |

% |

|

9.3 |

% |

|

9.3 |

% |

|

10.0 |

% |

|

Other restaurant operating costs |

|

17.8 |

% |

|

17.0 |

% |

|

18.7 |

% |

|

17.8 |

% |

|

General and administrative |

|

9.7 |

% |

|

10.3 |

% |

|

10.1 |

% |

|

10.2 |

% |

|

Depreciation and amortization |

|

4.4 |

% |

|

4.4 |

% |

|

4.7 |

% |

|

4.7 |

% |

|

Pre-opening |

|

0.3 |

% |

|

0.1 |

% |

|

0.3 |

% |

|

0.1 |

% |

|

Restaurant impairments, closure costs and asset disposals |

|

1.5 |

% |

|

0.3 |

% |

|

1.4 |

% |

|

0.7 |

% |

|

Total costs and expenses |

|

98.6 |

% |

|

95.1 |

% |

|

101.7 |

% |

|

97.9 |

% |

| Income (loss) from

operations |

|

1.4 |

% |

|

4.9 |

% |

|

(1.7 |

)% |

|

2.1 |

% |

| Interest expense, net |

|

0.4 |

% |

|

0.4 |

% |

|

0.4 |

% |

|

0.5 |

% |

| Income (loss) before

taxes |

|

1.1 |

% |

|

4.5 |

% |

|

(2.1 |

)% |

|

1.6 |

% |

| Provision for (benefit from)

income taxes |

|

— |

% |

|

— |

% |

|

— |

% |

|

— |

% |

| Net income (loss) |

|

1.0 |

% |

|

4.5 |

% |

|

(2.1 |

)% |

|

1.6 |

% |

_______________________(1) As a percentage of

restaurant revenue.

Noodles &

CompanyConsolidated Selected Balance Sheet Data

and Selected Operating Data(in thousands, except

restaurant activity, unaudited)

| |

|

As of |

| |

|

June 28,2022 |

|

December 28,2021 |

| Balance Sheet

Data |

|

|

|

Total current assets |

|

$ |

20,495 |

|

|

$ |

22,562 |

|

| Total assets |

|

|

338,581 |

|

|

|

341,459 |

|

| Total current liabilities |

|

|

69,967 |

|

|

|

76,582 |

|

| Total long-term debt |

|

|

31,142 |

|

|

|

18,931 |

|

| Total liabilities |

|

|

303,694 |

|

|

|

303,826 |

|

| Total stockholders’

equity |

|

|

34,887 |

|

|

|

37,633 |

|

| |

|

|

|

|

|

|

|

|

| |

|

Fiscal Quarter Ended |

| |

|

June 28,2022 |

|

March 29,2022 |

|

December 28,2021 |

|

September 29,2021 |

|

June 29,2021 |

| Selected Operating

Data |

|

|

| Restaurant Activity: |

|

|

|

|

|

|

|

|

|

|

|

Company-owned restaurants at end of period |

|

|

363 |

|

|

|

360 |

|

|

|

372 |

|

|

|

374 |

|

|

|

374 |

|

|

Franchise restaurants at end of period |

|

|

93 |

|

|

|

93 |

|

|

|

76 |

|

|

|

76 |

|

|

|

77 |

|

| Revenue Data: |

|

|

|

|

|

|

|

|

|

|

|

Company-owned average unit volume |

|

$ |

1,421 |

|

|

$ |

1,249 |

|

|

$ |

1,310 |

|

|

$ |

1,377 |

|

|

$ |

1,350 |

|

|

Franchise average unit volume |

|

$ |

1,276 |

|

|

$ |

1,225 |

|

|

$ |

1,320 |

|

|

$ |

1,347 |

|

|

$ |

1,240 |

|

|

Company-owned comparable restaurant sales |

|

|

5.1 |

% |

|

|

5.3 |

% |

|

|

9.5 |

% |

|

|

15.3 |

% |

|

|

55.7 |

% |

|

Franchise comparable restaurant sales |

|

|

5.3 |

% |

|

|

11.9 |

% |

|

|

20.8 |

% |

|

|

21.0 |

% |

|

|

63.8 |

% |

|

System-wide comparable restaurant sales |

|

|

5.1 |

% |

|

|

6.4 |

% |

|

|

11.2 |

% |

|

|

16.3 |

% |

|

|

56.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliations of Non-GAAP Measurements

to GAAP Results

Noodles &

CompanyReconciliation of Net

Income (Loss) to EBITDA and Adjusted

EBITDA(in thousands, unaudited)

| |

|

Fiscal Quarter Ended |

|

Two Fiscal Quarters Ended |

| |

|

June 28,2022 |

|

June 29,2021 |

|

June 28,2022 |

|

June 29,2021 |

|

Net income (loss) |

|

$ |

1,345 |

|

|

$ |

5,683 |

|

|

$ |

(5,084 |

) |

|

$ |

3,706 |

|

| Depreciation and

amortization |

|

|

5,763 |

|

|

|

5,576 |

|

|

|

11,484 |

|

|

|

11,163 |

|

| Interest expense, net |

|

|

489 |

|

|

|

498 |

|

|

|

926 |

|

|

|

1,120 |

|

| Provision for (benefit from)

income taxes |

|

|

44 |

|

|

|

29 |

|

|

|

(39 |

) |

|

|

19 |

|

| EBITDA |

|

$ |

7,641 |

|

|

$ |

11,786 |

|

|

$ |

7,287 |

|

|

$ |

16,008 |

|

| Restaurant impairments,

closure costs and asset disposals |

|

|

1,971 |

|

|

|

390 |

|

|

|

3,360 |

|

|

|

1,621 |

|

| Stock-based compensation

expense |

|

|

1,499 |

|

|

|

1,611 |

|

|

|

2,668 |

|

|

|

2,413 |

|

| Fees and costs related to

transactions and other acquisition/disposition costs |

|

|

63 |

|

|

|

— |

|

|

|

63 |

|

|

|

— |

|

| Adjusted EBITDA |

|

$ |

11,174 |

|

|

$ |

13,787 |

|

|

$ |

13,378 |

|

|

$ |

20,042 |

|

______________________________EBITDA and

adjusted EBITDA are supplemental measures of operating performance

that do not represent and should not be considered as alternatives

to net income (loss) or cash flow from operations, as determined by

GAAP, and our calculation thereof may not be comparable to that

reported by other companies. These measures are presented because

we believe that investors’ understanding of our performance is

enhanced by including these non-GAAP financial measures as a

reasonable basis for evaluating our ongoing results of

operations.

EBITDA is calculated as net income (loss) before

interest expense, provision for income taxes and depreciation and

amortization. Adjusted EBITDA further adjusts EBITDA to reflect the

eliminations shown in the table above.

EBITDA and adjusted EBITDA are presented

because: (i) we believe they are useful measures for investors

to assess the operating performance of our business without the

effect of non-cash charges such as depreciation and amortization

expenses and restaurant impairments, closure costs and asset

disposals and (ii) we use adjusted EBITDA internally as a

benchmark for certain of our cash incentive plans and to evaluate

our operating performance or compare our performance to that of our

competitors. The use of adjusted EBITDA as a performance measure

permits a comparative assessment of our operating performance

relative to our performance based on our GAAP results, while

isolating the effects of some items that vary from period to period

without any correlation to core operating performance or that vary

widely among similar companies. Companies within our industry

exhibit significant variations with respect to capital structures

and cost of capital (which affect interest expense and income tax

rates) and differences in book depreciation of property, plant and

equipment (which affect relative depreciation expense), including

significant differences in the depreciable lives of similar assets

among various companies. Our management believes that adjusted

EBITDA facilitates company-to-company comparisons within our

industry by eliminating some of these foregoing variations.

Adjusted EBITDA as presented may not be comparable to other

similarly-titled measures of other companies, and our presentation

of adjusted EBITDA should not be construed as an inference that our

future results will be unaffected by excluded or unusual items.

Noodles &

CompanyReconciliation of Net

Income (Loss) to Adjusted Net Income (Loss)(in

thousands, except share and per share data, unaudited)

| |

|

Fiscal Quarter Ended |

|

Two Fiscal Quarters Ended |

| |

|

June 28,2022 |

|

June 29,2021 |

|

June 28,2022 |

|

June 29,2021 |

|

Net income (loss) |

|

$ |

1,345 |

|

|

$ |

5,683 |

|

|

$ |

(5,084 |

) |

|

$ |

3,706 |

|

| Restaurant impairments,

divestitures and closure costs(a) |

|

|

1,009 |

|

|

|

349 |

|

|

|

1,633 |

|

|

|

1,288 |

|

| Fees and costs related to

transactions and other acquisition/disposition costs(b) |

|

|

63 |

|

|

|

— |

|

|

|

63 |

|

|

|

— |

|

| Tax impact of adjustments

above(c) |

|

|

(5 |

) |

|

|

(1 |

) |

|

|

(5 |

) |

|

|

(6 |

) |

| Adjusted net income

(loss) |

|

$ |

2,412 |

|

|

$ |

6,031 |

|

|

$ |

(3,393 |

) |

|

$ |

4,988 |

|

| |

|

|

|

|

|

|

|

|

| Earnings (loss) per

Class A and Class B common stock, combined |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.03 |

|

|

$ |

0.12 |

|

|

$ |

(0.11 |

) |

|

$ |

0.08 |

|

|

Diluted |

|

$ |

0.03 |

|

|

$ |

0.12 |

|

|

$ |

(0.11 |

) |

|

$ |

0.08 |

|

| Adjusted earnings (loss) per

Class A and Class B common stock, combined(d) |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.05 |

|

|

$ |

0.13 |

|

|

$ |

(0.07 |

) |

|

$ |

0.11 |

|

|

Diluted |

|

$ |

0.05 |

|

|

$ |

0.13 |

|

|

$ |

(0.07 |

) |

|

$ |

0.11 |

|

| Weighted average Class A and

Class B common stock outstanding, combined(d) |

|

|

|

|

|

|

|

|

|

Basic |

|

|

45,881,354 |

|

|

|

45,506,476 |

|

|

|

45,803,927 |

|

|

|

45,303,160 |

|

|

Diluted |

|

|

46,108,720 |

|

|

|

46,246,169 |

|

|

|

45,803,927 |

|

|

|

45,992,119 |

|

_____________________________Adjusted net income

(loss) is a supplemental measure of financial performance that is

not required by or presented in accordance with GAAP. We define

adjusted net income (loss) as net income (loss) plus the impact of

adjustments and the tax effects of such adjustments. Adjusted net

income (loss) is presented because management believes it helps

convey supplemental information to investors regarding our

performance, excluding the impact of special items that affect the

comparability of results in past quarters to expected results in

future quarters. Adjusted net income (loss) as presented may not be

comparable to other similarly-titled measures of other companies,

and our presentation of adjusted net income (loss) should not be

construed as an inference that our future results will be

unaffected by excluded or unusual items. Our management uses this

non-GAAP financial measure to analyze changes in our underlying

business from quarter to quarter based on comparable financial

results.

(a) Reflects the adjustment to eliminate

the impact of impairing restaurants, divestiture costs and ongoing

closure costs recognized during the first two quarters of 2022 and

2021. Both periods include ongoing closure costs from restaurants

closed in previous years. These expenses are included in the

“Restaurant impairments, closure costs and asset disposals” line in

the Condensed Consolidated Statements of Operations.

(b) Reflects the adjustments to eliminate

the expenses related to certain corporate transactions.

(c) Reflects the tax impact of the other

adjustments discussed in (a) and (b) above using the estimated

annual effective tax rate. Note that the amounts in 2021 have been

adjusted to reflect the respective effective tax rate.

(d) Adjusted per share amounts are

calculated by dividing adjusted net income (loss) by the basic and

diluted weighted average shares outstanding.

Noodles &

CompanyReconciliation of

Operating Income (Loss) to Restaurant

Contribution (in thousands,

unaudited)

| |

|

Fiscal Quarter Ended |

|

Two Fiscal Quarters Ended |

| |

|

June 28,2022 |

|

June 29,2021 |

|

June 28,2022 |

|

June 29,2021 |

|

Income (loss) from operations |

|

$ |

1,878 |

|

|

$ |

6,210 |

|

|

$ |

(4,197 |

) |

|

$ |

4,845 |

|

| Less: Franchising royalties

and fees, and other |

|

|

2,793 |

|

|

|

1,934 |

|

|

|

5,394 |

|

|

|

3,767 |

|

| Plus: General and

administrative |

|

|

12,744 |

|

|

|

12,978 |

|

|

|

24,584 |

|

|

|

23,907 |

|

|

Depreciation and amortization |

|

|

5,763 |

|

|

|

5,576 |

|

|

|

11,484 |

|

|

|

11,163 |

|

|

Pre-opening |

|

|

353 |

|

|

|

163 |

|

|

|

761 |

|

|

|

221 |

|

|

Restaurant impairments, closure costs and asset disposals |

|

|

1,971 |

|

|

|

390 |

|

|

|

3,360 |

|

|

|

1,621 |

|

| Restaurant contribution |

|

$ |

19,916 |

|

|

$ |

23,383 |

|

|

$ |

30,598 |

|

|

$ |

37,990 |

|

| |

|

|

|

|

|

|

|

|

| Restaurant contribution

margin |

|

|

15.5 |

% |

|

|

18.9 |

% |

|

|

12.8 |

% |

|

|

16.4 |

% |

_____________________________Restaurant

contribution represents restaurant revenue less restaurant

operating costs, which are the cost of sales, labor, occupancy and

other operating items. Restaurant contribution margin represents

restaurant contribution as a percentage of restaurant revenue.

Restaurant contribution and restaurant contribution margin are

non-GAAP measures that are neither required by, nor presented in

accordance with GAAP, and the calculations thereof may not be

comparable to similar measures reported by other companies. These

measures are supplemental measures of the operating performance of

our restaurants and are not reflective of the underlying

performance of our business because corporate-level expenses are

excluded from these measures.

Restaurant contribution and restaurant

contribution margin have limitations as analytical tools and should

not be considered in isolation or as substitutes for analysis of

our results as reported under GAAP. Management does not consider

these measures in isolation or as an alternative to financial

measures determined in accordance with GAAP. However, management

believes that restaurant contribution and restaurant contribution

margin are important tools for investors and other interested

parties because they are widely-used metrics within the restaurant

industry to evaluate restaurant-level productivity, efficiency and

performance. Management also uses these measures as metrics to

evaluate the profitability of incremental sales at our restaurants,

restaurant performance across periods, and restaurant financial

performance compared with competitors.

Contacts:Investor

Relationsinvestorrelations@noodles.com

MediaDanielle

Moorepress@noodles.comSource: Noodles & Company

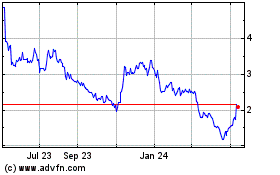

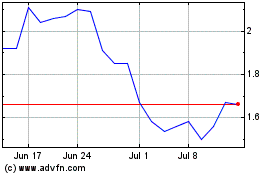

Noodles (NASDAQ:NDLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Noodles (NASDAQ:NDLS)

Historical Stock Chart

From Apr 2023 to Apr 2024