As filed with the Securities and Exchange

Commission on June 21, 2022

Registration No. 333-256197

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post Effective Amendment

No. 2

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

QUEST PATENT RESEARCH CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware |

|

6794 |

|

11-2873662 |

(State or jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification No.) |

411 Theodore Fremd Ave. Suite 206S

Rye, NY 10580-1411

(888) 743-7577

(Address and telephone number of principal executive

offices)

COPIES TO:

Asher S. Levitsky P.C.

Ellenoff Grossman & Schole LLP

1345 Avenue of the Americas, Suite 1100

New York, New York 10105-0302

Telephone: (646) 895-7152

Fax: (646) 895-7238

E-mail: alevitsky@egsllp.com

(Name, address and telephone number of agent for

service)

APPROXIMATE DATE OF PROPOSED SALE TO PUBLIC:

As soon as practicable after this registration

statement becomes effective.

If any securities being registered on this Form

are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered

only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company”

in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non- accelerated filer ☒ |

Smaller reporting company ☒ |

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date

as the Commission, acting pursuant to said Section 8(a) may determine.

The information in

this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the

Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer

to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS, SUBJECT TO

COMPLETION, DATED JUNE , 2022

100,000,000 Shares

Quest Product Research Corporation

OTCQB trading symbol: QPRC

This prospectus relates to

the public offering of an aggregate of 100,000,000 shares of common stock which may be sold from time to time by the selling stockholders

named in this prospectus.

We will not receive any proceeds

from the sale by the selling stockholders of their shares of common stock. We will pay the cost of the preparation of this prospectus,

which is estimated at $25,000.

On June 15, 2022, the

last reported sales price for our common stock on the OTCQB, as reported by OTC Markets, was $[ ] per share. On May

23, 2022, we received notice from OTC Markets Group, that, because the bid price for our common stock had closed below $0.01 per share

for more than 30 consecutive days, we no longer meet the Standards for Continued Eligibility under the OTC listing standards and, if

this deficiency is not met by August 21, 2022, we will be removed from the OTCQB marketplace, in which event our common stock will be

traded on the OTC Pink market. If our stock is not traded on the OTCQB, the selling stockholders will not be able to sell shares of our

common stock pursuant to the prospectus and we will be in breach of our covenants under our agreements with one of the selling shareholders.

On June 2, 2022, our board of directors approved a one-for-100 reverse split, which our board of directors believe would enable us to

become in compliance with the bid price requirements of the OTCQB. The reverse split is subject to stockholder approval at our 2022 annual

meeting, which will be held in July 2022. See “Market for Common Stock and Related Stockholder Matters.”

Investing in shares of

our common stock involves a high degree of risk. You should purchase our common stock only if you can afford to lose your entire investment.

See “Risk Factors,” which begins on page 4.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined whether this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The selling stockholders have

not engaged any underwriter in connection with the sale of their shares of common stock. The selling stockholders may sell shares of common

stock in the public market based on the market price at the time of sale or at negotiated prices or in transactions that are not in the

public market. The selling stockholder may also sell their shares in transaction that are not in the public market in the manner set forth

under “Plan of Distribution.”

The date of this Prospectus is _____________, 2022

TABLE OF CONTENTS

You may only rely on the information contained

in this prospectus or that we have referred you to. We have not authorized anyone to provide you with different information. This prospectus

does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the common stock offered by this prospectus.

This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any common stock in any circumstances in which

such offer or solicitation is unlawful. Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall,

under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus or that

the information contained by reference to this prospectus is correct as of any time after its date.

PROSPECTUS SUMMARY

This summary highlights information contained

elsewhere in this prospectus. This summary does not contain all the information you should consider before investing in the securities.

However, you should read the entire prospectus carefully, including the “Risk Factors,” “Management’s Discussion

and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements, including the notes thereto,

appearing elsewhere in this prospectus.

Our Business

We are an intellectual property asset management

company. Our principal operations include the acquisition, licensing and enforcement of intellectual property rights that are either owned

or controlled by us or one of our wholly-owned subsidiaries. We currently own, control or manage eighteen intellectual property portfolios,

which principally consist of patent rights. As part of our intellectual property asset management activities and in the ordinary course

of our business, it has been necessary for us or the intellectual property owner who we represent to initiate, and it is likely to continue

to be necessary to initiate, patent infringement lawsuits and engage in patent infringement litigation. We anticipate that our primary

source of revenue will come from the grant of licenses to use our intellectual property, including primarily licenses granted as part

of the settlement of patent infringement lawsuits.

Intellectual property monetization includes the

generation of revenue and proceeds from the licensing of patents, patented technologies and other intellectual property rights. Patent

litigation is often, and for us has been, a necessary element of intellectual property monetization where a patent owner, or a representative

of the patent owner, seeks to protect its patent rights against the unlicensed manufacture, sale, and use of the owner’s patent

rights or products which incorporate the owner’s patent rights. In general, we seek to monetize the bundle of rights granted by

the patents through structured licensing and when necessary enforcement of those rights through litigation, although to date all of our

patent license revenues have resulted from litigation. To date all of our revenue from the licensing of our patents has resulted from

litigation commenced by us.

We intend to develop our business by acquiring

intellectual property rights, either in the form of ownership of or an exclusive license to the underlying intellectual property. Our

goal is to enter into agreements with inventors of innovative technologies for which there may be a significant market for products which

use or incorporate the intellectual property. We seek to purchase all of, or interests in, intellectual property in exchange for cash,

securities of our company, the formation or a joint venture or separate subsidiary in which the owner has an equity interest, and/or interests

in the monetization of those assets. Our revenue from this aspect of our business can be generated through licensing and, when necessary,

which is typically the case, litigation. We engage in due diligence and a principled risk underwriting process to evaluate the merits

and potential value of any acquisition, partnership or joint venture. We seek to structure the terms of our acquisitions in a manner that

will achieve the highest risk-adjusted returns possible, in the context of our financial condition. In connection with the acquisition

of intellectual property portfolios, we have granted the party providing the financing an interest in any recovery we have with respect

to the intellectual property purchased with the financing, and we expect that we will have to continue to grant such interests until and

unless we have generated sufficient cash from licensing our intellectual property to enable us to acquire additional intellectual property

portfolios without outside financing. However, we cannot assure you that we will ever generate sufficient revenues to enable us to purchase

additional intellectual property without third-party financing.

It has been necessary to commence litigation in

order to obtain a recovery for past infringement of, or to license the use of, our intellectual property rights. Intellectual property

litigation is very expensive, with no certainty of any recovery. To the extent possible we seek to engage counsel on a contingent fee

or partial contingent fee basis, which significantly reduces our litigation cost, but which also reduces the value of the recovery to

us. We do not have the resources to enable us to fund the cost of litigation. To the extent that we cannot secure counsel on a contingent

basis and cannot fund litigation ourselves, which, considering our financial position, is likely to be the case, we may enter into an

agreement with a third party, such as QPRC Finance LLC (“QFL”), to finance the cost of litigation. In view of our limited

cash and our working capital deficiency, we are not able to institute any monetization program that may require litigation unless we engage

counsel on a fully contingent basis or we obtain funding from third party funding sources. In these cases, counsel may be afforded a greater

participation in the recovery and the third party that funds the litigation would be entitled to participate in any recovery.

February 2021 Agreements with QPRC Finance

LLC (“QFL”) and Intelligent Partners, LLC (“Intelligent Partners”)

On February 22, 2021, we entered into a series

of agreements with QFL and Intelligent Partners. Pursuant to the QFL agreements, QFL agreed to make available to us a financing facility

of: (a) up to $25,000,000 for the acquisition of mutually agreed patent rights that we intend to monetize; (b) up to $2,000,000 for operating

expenses; and (iii) $1,750,000 to fund the cash payment portion of the restructure of our obligations to Intelligent Partners. In return

we transferred to QFL a right to receive a portion of net proceeds generated from the monetization of those patents. These agreements

are described in “Business – Summary of Agreements for QFL.” Pursuant to the agreements with Intelligent Partners, as

the holder of the notes initially issued to United Wireless Holdings, Inc. (“United Wireless”) and transferred to Intelligent

Partners, the notes initially issued to United Wireless were terminated and our obligations were restructured. These agreements are described

under “Business – Summary of Agreements with Intelligent Partners.”

Organization

We were incorporated in Delaware on July 17, 1987

under the name Phase Out of America. On September 21, 1997, we changed our name to Quest Products Corporation, and, on June 6, 2007, we

changed our name to Quest Patent Research Corporation. We have been engaged in the intellectual property monetization business since 2008.

Our executive office is located at 411 Theodore Fremd Ave., Suite 206S, Rye, New York 10580-1411, telephone (888) 743-7577. Our website

is www.qprc.com. Information contained on or derived from our website or any other website does not constitute a part of this prospectus.

References to “we,” “us,”

“our” and word of like import refer to Quest Patent Research Corporation and one or more of its subsidiaries unless the context

specifically states or implies otherwise.

Issuance of Securities to Selling Stockholder

The 100,000,000 shares of common stock offered

by the selling stockholders pursuant to this prospectus represent:

| ● | 50,000,000

shares of common stock that are issuable upon exercise of a warrant that was issued to QFL in connection with a financing pursuant to

a prepaid forward purchase agreement and related agreements that we entered into with QFL on February 22, 2021 as described in “Business

– Summary of Agreements for QFL.” |

| ● | 50,000,000

outstanding shares of common stock that were issued to United Wireless pursuant to a securities

purchase agreement (the “United Wireless Agreement”) dated October 22, 2015 and

related transaction documents, which shares were subsequently transferred by United Wireless

to Andrew Fitton (35,000,000 shares) and Michael R. Carper (15,000,000 shares). See “Business

– Summary of Agreements with Intelligent Partners.” |

The Offering

| Common Stock Offered: |

|

The selling stockholder are offering 100,000,000 shares of common stock, of which 50,000,000 shares are owned by two of the selling stockholders and 50,000,000 shares are issuable upon exercise of a warrant held by the third selling stockholder. See “Selling Stockholders.” |

Outstanding Shares of

Common Stock: |

|

533,334,630 shares* |

| Use

of Proceeds: |

|

We will

not receive any proceeds from the sale of the shares by the selling stockholders.

___________

* Not

including (a) 200,000,000 shares of common stock issuable upon exercise of outstanding options, or (b) 96,246,246 shares of common

stock issuable upon exercise of the purchase option held by one of the selling stockholders. |

SUMMARY FINANCIAL INFORMATION

The following information as of December 31,

2021 and 2020 and for years then ended have been derived from our audited financial statements which appear elsewhere in this prospectus.

The information at March 31, 2022 and for the three months ended March 31, 2022 and 2021 have been derived from our unaudited financial

statements which appear elsewhere in this prospectus.

Summary Statement of Operations Information:

| | |

Three Months Ended

March 31, | | |

Year Ended

December 31, | |

| | |

2022 | | |

2021 | | |

2021 | | |

2020 | |

| Revenues | |

$ | 122,000 | | |

$ | - | | |

$ | 2,050,000 | | |

$ | 5,488,088 | |

| Operating expenses | |

| 657,752 | | |

| 2,293,330 | | |

| 5,163,539 | | |

| 6,206,791 | |

| Loss from operations | |

| (535,752 | ) | |

| (2,293,330 | ) | |

| (3,113,539 | ) | |

| (718,703 | ) |

| Net loss attributable to common stockholders | |

| (162,640 | ) | |

| (5,156,792 | ) | |

| (4,154,799 | ) | |

| (1,312,511 | ) |

| Loss per share (basic and diluted) | |

$ | (0.00 | ) | |

$ | (0.01 | ) | |

$ | (0.01 | ) | |

$ | (0.00 | ) |

| Weighted average shares of common stock outstanding - basic | |

| 533,334,630 | | |

| 446,370,021 | | |

| 511,863,731 | | |

| 383,038,334 | |

| Weighted average shares of common stock outstanding - diluted | |

| 533,334,630 | | |

| 446,370,021 | | |

| 613,878,234 | | |

| 383,038,334 | |

Balance Sheet Information:

| | |

March 31, 2022 | | |

December 31,

2021 | |

| Current assets | |

$ | 296,774 | | |

$ | 277,145 | |

| Working capital deficiency | |

| (8,999,346 | ) | |

| (8,126,204 | ) |

| Accumulated deficit | |

| (25,598,618 | ) | |

| (25,435,978 | ) |

| Stockholders’ deficit | |

| (8,047,284 | ) | |

| (7,926,723 | ) |

RISK FACTORS

An investment in our common stock involves

a high degree of risk. You should carefully consider the risks described below together with all of the other information included in

this prospectus before making an investment decision with regard to our securities. The statements contained in this prospectus include

forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those

set forth in or implied by forward-looking statements. The risks set forth below are not the only risks facing us. Additional risks and

uncertainties may exist that could also adversely affect our business, prospects or operations. If any of the following risks actually

occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock

could decline, and you may lose all or a significant part of your investment.

Risks Relating to our Financial Conditions

and Operations

We have a history of losses and are continuing

to incur losses. During the period from 2008, when we changed our business to become an intellectual property management company,

through March 31, 2022, we generated a cumulative loss of approximately $25.6 million on cumulative revenues of less than $23.5 million,

and our losses are continuing. We did not generate any revenue during the fourth quarter of 2020 or during the first three quarters of

2021. Our total assets were approximately $1.6 million at March 31, 2022, of which approximately $1.3 million represented the book value

of patents we acquired from Intellectual Ventures Assets 181 LLC and Intellectual Ventures Assets 174 LLC in January 2022 and Aawaaz

Inc. (“AI”) in October of 2021. At March 31, 2022, we had a working capital deficiency of approximately $8 million.

We did not generate any revenue during

the fourth quarter of 2020 or the first three quarters of 2021. During the fourth quarter of 2020 and the first three quarters of

2021, we did not generate any revenue. For the three months ended March 31, 2022, we sustained a loss of $163,000 on revenues of $122,000,

and for the years ended December 31, 2021 and 2020, we sustained a net loss of $4.2 million on revenues of $2.1 million and a net loss

of $1.3 million on revenues of $5.5 million, respectively. Because we were in default under our loans to Intelligent Partners (as successor

to United Wireless), with Intelligent Partners having the ability to declare a default on our notes in the principal amount of $4,672,810,

and the possibility of our seeking protection under the Bankruptcy Act if Intelligent Partners sought to exercise any of its rights as

a result of our default, we ceased our monetization activities, since no counsel would represent us on a contingent basis in view of

the default and possible bankruptcy, and we devoted our efforts in negotiating the agreements with QFL and Intelligent Partners. We resumed

our monetization activities following in February 2021 after we entered into our agreements with QFL and Intelligent Partners. However,

the intellectual property monetization cycle is lengthy and may be unsuccessful. Monetization activities initiated may take several quarters

to generate revenues if ever.

Our independent auditors have included

a going concern qualification in their report on our financial statements for the year ended December 31, 2021. Because of our history

of losses, deficiency in stockholders’ equity, working capital deficiency and the uncertainty of generating revenues in the future,

our independent auditors have included a going concern qualification in their report on our financial statements for the year ended December

31, 2021, and our unaudited financial statements for the three months ended March 31, 2022 have a going concern footnote.

We require significant funding in order

to develop our business. Our business requires substantial funding to evaluate and acquire intellectual property rights and to develop

and implement programs to monetize our intellectual property rights, including the prosecution of any litigation necessary to enable

us to monetize our intellectual property rights. Our failure to develop and implement these programs could both jeopardize our relationships

under our existing agreements and could inhibit our ability to generate new business, either through the acquisition of intellectual

property rights or through exclusive management agreements. We cannot be profitable unless we are able to continue to obtain the funding

necessary to develop our business, including litigation to monetize our intellectual property. Although we have an agreement with QFL

which provides a funding line to acquire and monetize intellectual property rights, QFL must approve any intellectual property we acquire

and, if QFL does not fund an intellectual property acquisition, we may not be able to acquire and monetize the intellectual property.

We cannot assure you that we will be able to continue to obtain necessary funding or to develop our business.

The terms of our agreements with QFL

and Intelligent Partners may make it difficult for us to generate cash flow from our operations. Although we have an agreement with

QFL pursuant to which QFL agreed to make available to us a financing facility of (i) up to $25,000,000 for the acquisition of mutually

agreed patent rights that we intend to monetize, of which we have received $2,210,000 as of June 15, 2022; (ii) up to $2,000,000 for

operating expenses from which we may, at our discretion, draw up to $200,000 per calendar quarter, of which we have drawn down $1,400,000

as of June 15, 2022, and (iii) $1,750,000 which was used to fund the cash payment portion of the restructure of our obligations to Intelligent

Partners. Pursuant to the QFL agreement, QFL receive all proceeds payable to us from the monetization of those patents which have been

financed by QFL until QFL has received its negotiated rate of return, then we and QFL share equally in the proceeds from monetization

until QFL has received its investment return and thereafter we receive all of the net proceeds. Pursuant to our restructure agreement

with Intelligent Partners, we have an obligation to pay a non-interest bearing total monetization proceeds obligation (the “TMPO”)

totaling $2,805,000. Under our amended monetization proceeds agreements with Intelligent Partners, we pay Intelligent Partners 60% of

the net monetization proceeds from associated intellectual property portfolios. Further, until we have paid Intelligent Partners a total

of $2,805,000 under all of the monetization proceeds agreements, for net proceeds between $0 and $1,000,000 we are to pay Intelligent

Partners 10% of the net proceeds realized from new assets acquired by us, provided, that, if, in any calendar quarter, our net proceeds

realized exceed $1,000,000, Intelligent Partner’s entitlement for that quarter shall increase to 30% on the portion of net proceeds

in excess of $1,000,000 but less than $3,000,000, and if in the same calendar quarter, net proceeds exceed $3,000,000, Intelligent Partners’

entitlement for that quarter shall increase to 50% on the portion of net proceeds in excess of $3,000,000. These payments come from our

share of the proceeds after QFL has recovered its negotiated rate of return. In these agreements, the monetization proceeds is determined

after payment of contingent legal fees and certain other expenses, including payments due by us to as part of the purchase price for

intellectual property rights. We cannot assure you that, as a result of these provisions, that we will generate any meaningful cash flow

from the intellectual property we acquire. If we do not generate sufficient cash flow from our monetization activities, we may not be

able to fund our operations or continue in business.

If our common stock is removed from the

OTCQB we will be in violation of our covenants under our registration rights agreement with QFL which could result of our being required

to pay damages which we do not have the funds to pay which may result in our seeking protection under the Bankruptcy Act. On May

23, 2022, we received notice from OTC Markets Group, that, because the bid price for our common stock had closed below $0.01 per share

for more than 30 consecutive days, we no longer meet the Standards for Continued Eligibility under the OTC listing standards and, if

this deficiency is not met by August 21, 2022, we will be removed from the OTCQB marketplace, in which event our common stock will be

traded on the OTC Pink market. Our registration rights agreement with QFL provides that, in the event of a failure to comply with certain

covenants, which includes the failure of our common stock to be traded on the OTCQB, in additional to any other remedies available to

QFL, we are to pay to QFL an amount in cash equal to 2.0% of the aggregate value of QFL’s Registrable Securities, as defined in

the Registration Rights Agreement, whether or not included in such registration statement, on each of the following dates: (i) the initial

day of a maintenance failure; (ii) on the 30th day after the date of such a failure and (iii) every 30th day thereafter (prorated for

periods totaling less than thirty (30) days) until such failure is cured. We may not have the funds to make the payment pursuant to the

registration rights agreement, and, if QFL seeks to enforce its rights to the damages, we may seek protection under the Bankruptcy Act.

Further, even if QFL does not seek to enforce it right to damages, it may not make advances to us until and unless our common stock meets

the OTCQB trading requirements.

Our business may be impaired by the effects

of the COVID-19 pandemic and the effects of the response to the pandemic. Although we do not manufacture or sell products, the COVID-19

pandemic and the work shutdown imposed in the United States and other countries to limit the spread of the virus can have a negative impact

on our business. Our revenue is generated almost exclusively from license fees generated from litigation seeking damages for infringement

of our intellectual property rights. The work shutdown affected the court system courts operating on a reduced schedule. As a result,

even though many court are operating on a near normal schedule, patent infringement actions are likely to be lower priority items in allocation

of court resources, with the effect that deadlines are likely to be postponed which delays may give defendants an incentive to delay negotiations

or offer a lower amount than they might otherwise accept. In addition, the effect of the COVID-19 and new variants and subvariants the

public response may adversely affect the financial condition and prospects of defendants and potential defendants, which would make it

less likely that they would be willing to settle our claim.

The COVID-19 pandemic and the response to limit

the spread of the infection may affect the financial condition of financing sources and the willingness of potential financing sources

to provide funding for our litigation. In addition, these factors may affect a law firms’ ability and willingness to provide us

with legal services on a contingent or partial contingent and may result in the impairment or discontinuation of business of or the filing

of a petition under the Bankruptcy Act by or against any defendant or potential defendant.

Further, to the extent that holders of intellectual

property rights see these factors impacting our ability to generate revenue from their intellectual property, they may be reluctant to

sell intellectual property to us on terms which are acceptable to us.

We are dependent upon our chief executive officer.

We are dependent upon Jon Scahill, our chief executive officer and president and sole full-time employee, for all aspects of our business

including locating, evaluating and negotiating and performing due diligence with respect to intellectual property rights from the owners,

managing our intellectual property portfolios, engaging in licensing activities and monetizing the rights through licensing and managing

and monitoring any litigation with respect to our intellectual property as well as defending any actions by potential licensees seeking

a declaratory judgment that they do not infringe. The loss of Mr. Scahill would materially impair our ability to conduct our business.

Although we have an employment agreement with Mr. Scahill, the employment agreement does not ensure that Mr. Scahill will remain with

us.

Any equity funding we obtain may result

in significant dilution to our stockholders. Because of our financial position and our low stock price, our continuing losses and

our negative working capital from operations and the possibility that we may cease to be traded on the OTCQB, we do not expect that we

will be able to obtain any debt financing for our operations. Our stock price has generally been trading at a price which is less than

$0.02 per share for more than the past two years, and recently the closing bid price for our stock has been below $0.01 for a period

of more than 30 days, as a result of which we do not currently meet the OTCQB trading requirements. As a result, it will be very difficult

for us to raise funds in the equity markets. However, in the event that we are able to raise funds in the equity market, the sale of

shares would result in significant dilution to the present stockholders, and even a modest equity investment could result in the issuance

of a very significant number of shares.

Risks Relating to Monetizing our Intellectual

Property Rights

We may not be able to monetize our intellectual

property portfolios. Although our business plan is to generate revenue from our intellectual property portfolios, we have not been

successful in generating any significant positive cash flow from our portfolios, we have not generated any revenues from several of our

intellectual property portfolios and we have ceased allocating resources toward the monetization of several of our portfolios. We cannot

assure you that we will be able to generate any significant revenue from our existing portfolios or that we will be able to acquire new

intellectual property rights that will generate significant revenue.

If we are not successful in monetizing our

portfolios, we may not be able to continue in business. Although we have ownership of some of our intellectual property, we also license

the rights pursuant to agreements with the owners of the intellectual property. If we are not successful in generating revenue for those

parties who have an interest in the results of our efforts, those parties may seek to renegotiate the terms of our agreements with them,

which could both impair our ability to generate revenue from our intellectual property and make it more difficult for us to obtain rights

to new intellectual property rights. If we continue to be unable to generate revenue from our existing intellectual property portfolios

and any new portfolios we may acquire, we may be unable to continue in business.

If we are not successful in patent litigation,

the defendants may seek to have the court award attorneys’ fees to them against us which could result in the bankruptcy of the plaintiff

subsidiary and may result in a default under our agreement QFL. The United States patent laws provide that “the court in exceptional

cases may award reasonable attorney fees to the prevailing party.” Although the patents are owned by our subsidiaries and any judgment

would be awarded against the subsidiaries, the subsidiaries have no assets other than the patent rights. Our funding sources for our patent

litigation do not provide for the funding source to pay any judgment against us. Thus, if any defendants obtain a judgment against one

of our subsidiaries, they may seek to enforce their judgment against the patents owned by the subsidiary or seek to put the subsidiary

into bankruptcy and acquire the patents in the bankruptcy proceeding. As a result, it is possible that an adverse verdict in a petition

for legal fees could result in the loss of the patents owned by the subsidiary and a default under our agreement with QFL.

Our inability to acquire intellectual property

portfolios will impair our ability to generate revenue and develop our business. We do not have the personnel to develop patentable

technology by ourselves. Thus, we need to depend on acquiring rights to intellectual property and intellectual property portfolios from

third parties on an ongoing basis. In acquiring intellectual property rights, there are delays in (i) identifying the intellectual property

which we may want to acquire, (ii) negotiating an agreement with the owner or holder of the intellectual property rights, and (iii) generating

revenue from those intellectual property rights which we acquire. During these periods, we will continue to incur expenses with no assurance

that we will generate revenue. We currently hold intellectual property portfolios from which we have not generated any revenue to date,

and we cannot assure you that we will generate revenue from our existing intellectual property portfolios or any additional intellectual

properties which we may acquire.

We may be unable to enforce our intellectual

property rights unless we obtain third party funding. Because of the expense of litigation and our lack of working capital, we may

be unable to enforce our intellectual property rights unless we obtain the agreement of a third party to provide funding in support of

our litigation. We cannot assure you that QFL or any other funding source provide us the any necessary funding, and the failure to obtain

such funding may impair our ability to monetize our intellectual property portfolio or continue in business.

Because we need to rely on third-party funding

sources to provide us with funds to enforce our intellectual property rights we are dependent upon the perception by potential funding

sources of the value of our intellectual property. Because we do not have funds to pursue litigation to enforce our intellectual property

rights, we are dependent upon the valuation which potential funding sources, which currently is QFL, give to our intellectual property

or any intellectual property we may acquire. In determining whether to provide funding for intellectual property litigation, the funding

sources need to make an evaluation of the strength of our patents, the likelihood of success, the nature of the potential defendants and

a determination as to whether there is a sufficient potential recovery to justify a significant investment in intellectual property litigation.

Typically, such funding sources receive a percentage of the recovery after litigation expenses, and seek to generate a sufficient return

on investment to justify the investment. Under our agreement with QFL, QFL is allocated all of the net proceeds (after allowable expenses)

until it has received a negotiated return. Unless QFL or any other funding source believes that it will generate a sufficient return on

investment, it will not fund litigation. If QFL does not fund our acquisition or monetization of intellectual property we propose to acquire,

we cannot assure you that we will be able to negotiate funding agreements with third party funding sources on terms reasonably acceptable

to us, if at all. Because of our financial condition, we may only be able to obtain funding on terms which are less favorable to us than

we would otherwise be able to obtain.

Although we have a funding agreement with QFL,

there is no assurance that QFL will provide funding for portfolios we are looking to acquire or that we will generate revenue from

any funded litigation. Although the funding source makes its evaluation as to the likelihood of success, patent litigation is very

uncertain, and we cannot assure you that, we will obtain litigation funding or that, if we obtain litigation funding, we will be successful

or that any recovery we may obtain will generate any significant positive cash flow from operations for us.

Because of our financial condition and our

having generated a loss from operations in 2021 and 2020 from our existing portfolios, we may not be able to obtain intellectual property

rights to the most advanced technologies. In order to generate meaningful revenues from intellectual property rights, we need to be

able to identify, negotiate rights to and offer technologies for which there is a developing market. Because of our financial condition

and the terms under which we obtain financing for our litigation, we may be unable to negotiate rights to technology for which there will be a strong developing market, or, if we are able to negotiate agreements for such intellectual property, the terms of our purchase

or license may not be favorable to us. Accordingly, we cannot assure you that we will be able to acquire intellectual property rights

to the technology for which there is a strong market demand.

Potential acquisitions may present risks, and

we may be unable to achieve the financial or other goals intended at the time of any potential acquisition. Our ability to grow depends,

in large part, on our ability to acquire interests in intellectual property, including patented technologies, patent portfolios, or companies

holding such patented technologies and patent portfolios. Accordingly, we intend to engage in acquisitions to expand our intellectual

property portfolios and we intend to continue to explore such acquisitions. Such acquisitions are subject to numerous risks, including

the following:

| ● | our

failure to have sufficient funding to enable us to make the acquisition, together with the terms on which such funding is available,

if at all; |

| ● | our

failure to have sufficient personal to satisfy the seller that we have the personnel to monetize the assets we propose to acquire; |

| ● | dilution

to our stockholders to the extent that we use equity in connection with any acquisition; |

| ● | our

inability to enter into a definitive agreement with respect to any potential acquisition, or if we are able to enter into such agreement,

our inability to consummate the potential acquisition; |

| ● | difficulty

integrating the operations, technology and personnel of the acquired entity; |

| ● | our

inability to achieve the anticipated financial and other benefits of the specific acquisition; |

| ● | difficulty

in maintaining controls, procedures and policies during the transition and monetization process; |

| ● | diversion

of our management’s attention from other business concerns, especially considering that we have only one full-time employee/officer

who is responsible for performing due diligence, negotiating agreements, negotiating funding and implementing a monetization program;

and |

| ● | our

failure, in our due diligence process, to identify significant issues, including issues with respect to patented technologies and intellectual

property portfolios, and other legal and financial contingencies. |

If we are unable to manage these risks and other

risks effectively as part of any acquisition, our business could be adversely affected.

Our acquisition of intellectual property rights

may be time consuming, complex and costly, which could adversely affect our operating results. Acquisitions of patent or other intellectual

property assets, which are and will be critical to the development of our business, are often time consuming, complex and costly to consummate.

We may utilize many different transaction structures in our acquisitions and the terms of such acquisition agreements tend to be heavily

negotiated. As a result, we expect to incur significant operating expenses and may be required to raise capital during the negotiations

even if the acquisition is ultimately not consummated. Even if we are able to acquire particular intellectual property assets, there is

no guarantee that we will generate sufficient revenue related to those intellectual property assets to offset the acquisition costs. We

may also identify intellectual property assets that cost more than we are prepared to spend with our own capital resources. We may incur

significant costs to organize and negotiate a structured acquisition that does not ultimately result in an acquisition of any intellectual

property assets or, if consummated, proves to be unprofitable for us. These higher costs could adversely affect our operating results.

If we acquire technologies that are in the

early stages of market development, we may be unable to monetize the rights we acquire. We may acquire patents, technologies and other

intellectual property rights that are in the early stages of adoption in the commercial, industrial and consumer markets. Demand for some

of these technologies will likely be untested and may be subject to fluctuation based upon the rate at which companies may adopt our intellectual

property in their products and services. As a result, there can be no assurance as to whether technologies we acquire or develop will

have value that we can monetize. It may also be necessary for us to develop additional intellectual property and file new patent applications

as the underlying commercial market evolves, as a result of which we may incur substantial costs with no assurance that we will ever be

able to monetize our intellectual property.

Our intellectual property monetization cycle

is lengthy and costly and may be unsuccessful. We expect to incur significant marketing, legal and sales expenses prior to entering

into monetization events that generate revenue and cash flow from operations for us. We will also spend considerable resources educating

potential licensees on the benefits of entering into an agreement with us that may include a non-exclusive license for future use of our

intellectual property rights. Thus, we may incur significant losses in any particular period before any associated revenue stream begins.

If our efforts to convince potential licensees of the benefits of a settlement arrangement are unsuccessful, we may need to continue with

the litigation process or other enforcement action to protect our intellectual property rights and to realize revenue from those rights.

We may also need to litigate to enforce the terms of existing agreements, protect our trade secrets, or determine the validity and scope

of the proprietary rights of others. Enforcement proceedings are typically protracted and complex. The costs are typically substantial,

and the outcomes are unpredictable. Enforcement actions will divert our managerial, technical, legal and financial resources from business

operations.

We may not be successful in obtaining judgments

in our favor. We have commenced litigation seeking to monetize our intellectual property portfolios and it will be necessary for us

to commence ligation in the future. All litigation is uncertain, and a number of the actions we commenced have been dismissed by the trial

court. We cannot assure you that any litigation will be decided in our favor or that, if damages are awarded or a license is negotiated,

that we will generate any significant revenue from the litigation or that any recovery may be allocated to counsel and third party funding

source which may result in little if any revenue to us.

Our financial condition may cause both intellectual

property rights owners and potential licensees to believe that we do not have the financial resources to commence and prosecute litigation

for infringement. Because of our financial condition, both intellectual property rights owners and potential licensees may believe

that we do not have the ability to commence and prosecute sustained and expensive litigation to protect our intellection rights with the

effect that (i) intellectual property rights owners may be reluctant to grant us rights to their intellectual property and (ii) potential

licensees may be less inclined to pay for license rights from us or settle any litigation we may commence on terms which generate any

meaningful monetization.

Any patents which may be issued to us pursuant

to patent applications which we filed or may file may fail to give us necessary protection. We cannot be certain that patents will

be issued as a result of any pending or future patent applications, or that any of our patents, once issued, will provide us with adequate

protection from competing products. For example, issued patents may be circumvented or challenged, declared invalid or unenforceable,

or narrowed in scope. In addition, since publication of discoveries in scientific or patent literature often lags behind actual discoveries,

we cannot be certain that we will be the first to make additional new inventions or to file patent applications covering those inventions.

It is also possible that others may have or may obtain issued patents that could prevent us from commercializing our products or require

us to obtain licenses requiring the payment of significant fees or royalties in order to enable us to conduct our business. As to those

patents that we may acquire, our continued rights will depend on meeting any obligations to the seller and we may be unable to do so.

Our failure to obtain or maintain intellectual property rights for our inventions would lead to the loss of our investments in such activities,

which would have a material adverse effect on us.

The provisions of Federal Declaratory Judgment

Act may affect our ability to monetize our intellectual property. Under the Federal Declaratory Judgment Act, it is possible for a

party who we consider to be infringing upon our intellectual property to commence an action against us seeking a declaratory judgment

that such party is not infringing upon our intellectual property rights. In such a case, the plaintiff could choose the court in which

to bring the action and we would be the defendant in the action. Common claims for declaratory judgment in patent cases are claims of

non-infringement, patent invalidity and unenforceability. Although the commencement of an action requires a claim or controversy, a court

may find a letter from us to the alleged infringer seeking a royalty for the use of our intellectual property rights to form the basis

of a controversy. In such a case, the plaintiff, rather than we, would choose the court in which to bring the action and the timing of

the action. In addition, when we commence an action as plaintiff, we may be able to enter into a contingent fee arrangement with counsel,

it is possible that counsel may be less willing to accept such an arrangement if we are the defendant. Further, we would not have the

opportunity of choosing against which party to bring the action. An adverse decision in a declaratory judgment action could significantly

impair our ability to monetize the intellectual property rights which are the subject of the litigation. We have been a defendant in one

declaratory judgment action, which resulted in a settlement. We cannot assure you that potential infringers will not be able to use the

Declaratory Judgment Act to reduce our ability to monetize the patents that are the subject of the action.

A 2014 Supreme Court decision could significantly

impair business method and software patents. In June 2014, the United States Supreme Court, in Alice v. CLS Bank, struck down

patents covering a computer-implemented scheme for mitigating “settlement risk” by using a third party intermediary, holding

the patent claims to be ineligible as being drawn to a patent-ineligible abstract idea. The courts have been dealing for many years over

what business methods are patentable. We cannot predict the extent to which the decision in Alice as well as prior Supreme Court

decisions dealing with patents, will be interpreted by courts. To the extent that the Supreme Court decision in Alice gives businesses

reason to believe that business model and software patents are not enforceable, it may become more difficult for us to monetize patents

which are held to be within the ambit of the patents before the Supreme Court in Alice and for us to obtain counsel willing to

represent us on a contingency basis. As a result, the decision in Alice could materially impair our ability to obtain patent rights

and monetize those which we do obtain.

Legislation, regulations or rules related to

obtaining patents or enforcing patents could significantly increase our operating costs and decrease our revenue. We may apply for

patents and may spend a significant amount of resources to enforce those patents. If legislation, regulations or rules are implemented

either by Congress, the United States Patent and Trademark Office, or the courts that impact the patent application process, the patent

enforcement process or the rights of patent holders, these changes could negatively affect our expenses and revenue. For example, new

rules regarding the burden of proof in patent enforcement actions could significantly both increase the cost of our enforcement actions

and make it more difficult to sign licenses without litigation, changes in standards or limitations on liability for patent infringement

could negatively impact our revenue derived from such enforcement actions, and any rules requiring that the losing party pay legal fees

of the prevailing party could also significantly increase the cost of our enforcement actions. United States patent laws were amended

with the enactment of the Leahy-Smith America Invents Act, or the America Invents Act, which took effect on March 16, 2013. The America

Invents Act includes a number of significant changes to U.S. patent law. In general, the legislation attempts to address issues surrounding

the enforceability of patents and the increase in patent litigation by, among other things, establishing new procedures for patent litigation.

For example, the America Invents Act changes the way that parties may be joined in patent infringement actions, increasing the likelihood

that such actions will need to be brought against individual parties allegedly infringing by their respective individual actions or activities.

The America Invents Act and its implementation increases the uncertainties and costs surrounding the enforcement of our patented technologies,

which could have a material adverse effect on our business and financial condition. In addition, the U.S. Department of Justice has conducted

reviews of the patent system to evaluate the impact of patent assertion entities on industries in which those patents relate. It is possible

that the findings and recommendations of the Department of Justice could impact the ability to effectively license and enforce standards-essential

patents and could increase the uncertainties and costs surrounding the enforcement of any such patented technologies.

Proposed legislation may affect our ability

to conduct our business. There are presently pending or proposed a number of laws which, if enacted, may affect the ability of companies

such as us to generate revenue from our intellectual property rights. Typically, these proposed laws cover legal actions brought by companies

which do not manufacture products or supply services but seek to collect licensing fees based on their intellectual property rights and,

if they are not able to enter into a license, to commence litigation. Although a number of such bills have been proposed in Congress,

we do not know which, if any, bills will be enacted into law or what the provisions will be and, therefore, we cannot predict the effect,

if any, that such laws, if passed by Congress and signed by the president, would provide. However, we cannot assure you that legislation

will not be enacted which would impair our ability to operate by making it more difficult for us to commence litigation against a potential

licensee or infringer. To the extent that an alleged infringer believes that we will not prevail in litigation, it would be more difficult

to negotiate a license agreement without litigation.

The unpredictability of our revenues may harm

our financial condition. Our revenues from licensing have typically been lump sum payments entered into at the time of the license,

which may be in connection with the settlement of litigation, and not from licenses that pay an ongoing royalty. Due to the nature of

the licensing business and uncertainties regarding the amount and timing of the receipt of license and other fees from potential infringers,

stemming primarily from uncertainties regarding the outcome of enforcement actions, rates of adoption of our patented technologies, the

growth rates of potential licensees and certain other factors, our revenues, if any, may vary significantly from quarter to quarter, which

could make our business difficult to manage, adversely affect our business and operating results, cause our quarterly results to fall

below market expectations and adversely affect the market price of our common stock.

Our success depends in part upon our ability

to retain the qualified legal counsel to represent us in patent enforcement litigation. The success of our licensing business may

depend upon our ability to retain the qualified legal counsel to prosecute patent infringement litigation. As our patent enforcement actions

increase, it will become more difficult to find the preferred choice for legal counsel to handle all of our cases because many of these

firms may have a conflict of interest that prevents their representation of us or because they are not willing to represent us on a contingent

or partial contingent fee basis.

Our reliance on representations, warranties

and opinions of third parties may expose us to certain material liabilities. From time to time, we rely upon the representations and

warranties of third parties, including persons claiming ownership of intellectual property rights, and opinions of purported experts.

In certain instances, we may not have the opportunity to independently investigate and verify the facts upon which such representations,

warranties and opinions are made. By relying on these representation, warranties and opinions, we may be exposed to liability in connection

with the licensing and enforcement of intellectual property and intellectual property rights which could have a material adverse effect

on our operating results and financial condition.

In connection with patent enforcement actions,

counterclaims may be brought against us and a court may rule against us in counterclaims which may expose us and our operating subsidiaries

to material liabilities. In connection with patent enforcement actions, it is possible that a defendant may file counterclaims against

us or a court may rule that we have violated statutory authority, regulatory authority, federal rules, local court rules, or governing

standards relating to the substantive or procedural aspects of such enforcement actions. In such event, a court may issue monetary sanctions

against us or our operating subsidiaries or award attorney’s fees and/or expenses to the counterclaiming defendant, which could

be material, and if we or our operating subsidiaries are required to pay such monetary sanctions, attorneys’ fees and/or expenses,

such payment could materially harm our operating results, our financial position and our ability to continue in business.

Trial judges and juries may find it difficult

to understand complex patent enforcement litigation, and as a result, we may need to appeal adverse decisions by lower courts in order

to successfully enforce our patents. It is difficult to predict the outcome of patent enforcement litigation at the trial level. It

is often difficult for juries and trial judges to understand complex, patented technologies, and, as a result, there is a higher rate

of successful appeals in patent enforcement litigation than more standard business litigation. Regardless of whether we prevail in the

trial court, appeals are expensive and time consuming, resulting in increased costs and delayed revenue, and attorneys may be less likely

to represent us in an appeal on a contingency basis especially if we are seeking to appeal an adverse decision. Although we may diligently

pursue enforcement litigation, we cannot predict the decisions made by juries and trial courts.

More patent applications are filed each year

resulting in longer delays in getting patents issued by the United States Patent and Trademark Office. We hold a number of pending

patents and may file or acquire rights to additional patent applications. We have identified a trend of increasing patent applications

each year, which we believe is resulting in longer delays in obtaining approval of pending patent applications. The application delays

could cause delays in recognizing revenue, if any, from these patents and could cause us to miss opportunities to license patents before

other competing technologies are developed or introduced into the market.

U.S. Federal courts are becoming more crowded,

and, as a result, patent enforcement litigation is taking longer. Patent enforcement actions are almost exclusively prosecuted in

federal district courts. In May 2017, the United States Supreme Court, in TC Heartland v. Kraft Foods Groups Brands, held that

a corporate defendant may be sued either in its state of incorporation, or where it has committed acts of infringement and has a regular

and established place of business. To the extent that the Supreme Court decision in TC Heartland concentrates patent litigation

in districts within states popular for business incorporation, such as the Federal District Court for the District of Delaware, such courts

may become increasingly crowded. Federal trial courts that hear patent enforcement actions also hear criminal and other civil cases. Criminal

cases always take priority over patent enforcement actions. As a result, it is difficult to predict the length of time it will take to

complete any enforcement action. Moreover, we believe there is a trend in increasing numbers of civil lawsuits and criminal proceedings,

and, as a result, we believe that the risk of delays in patent enforcement actions will have a significant effect on our business in the

future unless this trend changes.

Any reductions in the funding of the United

States Patent and Trademark Office could have an adverse impact on the cost of processing pending patent applications and the value of

those pending patent applications. Our primary assets are our patent portfolios, including pending patent applications before the

United States Patent and Trademark Office. The value of our patent portfolios is dependent upon the issuance of patents in a timely manner,

and any reductions in the funding of the United States Patent and Trademark Office could negatively impact the value of our assets. Further,

reductions in funding from Congress could result in higher patent application filing and maintenance fees charged by the United States

Patent and Trademark Office, causing an unexpected increase in our expenses.

The rapid development of technology may impair

our ability to monetize intellectual property that we own. In order for us to generate revenue from our intellectual property, we

need to offer intellectual property that is used in the manufacture or development of products. Rapid technological developments have

reduced the market for products using less advanced technology. To the extent that technology develops in a manner in which our intellectual

property is not a necessary element or to the extent that others design around our intellectual property, our ability to license our intellectual

property portfolios or successfully prosecute litigation will be impaired. We cannot assure you that we will have rights to intellectual

property for most advanced technology or that there will be a market for products which require our technology.

The intellectual property management business

is highly competitive. A large number of other companies seek to obtain rights to new intellectual property and to market existing

intellectual property. Most of these companies have significantly both greater resources that we have and industry contacts which place

them in a better position to generate new business. Further, our financial position, our lack of executive personnel and our inability

to generate revenue from our portfolio can be used against us by our competitors. We cannot assure you that we will be successful in obtaining

intellectual property rights to new developing technologies.

As intellectual property enforcement litigation

becomes more prevalent, it may become more difficult for us to voluntarily license our intellectual property. We believe that

the more prevalent intellectual property enforcement actions become, the more difficult it will be for us to voluntarily license our intellectual

property rights, and we generally have not been successful in negotiating licenses without litigation. As a result, we may need to increase

the number of our intellectual property enforcement actions to cause infringing companies to license the intellectual property or pay

damages for lost royalties.

Weak global economic conditions may cause potential

licensees to delay entering into licensing agreements, which could prolong our litigation and adversely affect our financial condition

and operating results. Our business depends significantly on strong economic conditions that would encourage potential licensees to

enter into license agreements for our intellectual property rights. The United States and world economies have recently experienced weak

economic conditions and the recent Russian invasion in Ukraine has exacerbated these conditions, including those resulting from inflation

and supply line issues. Uncertainty about global economic conditions poses a risk as businesses may postpone spending in response to tighter

credit, negative financial news and declines in income or asset values. This response could have a material adverse effect on the willingness

of parties infringing on our assets to enter into settlements or other revenue generating agreements voluntarily.

If we are unable to adequately protect our

intellectual property, we may not be able to compete effectively. Our ability to compete depends in part upon the strength

of the intellectual property and intellectual property rights that we own or may hereafter acquire in our technologies, brands and content

and our ability to protect such intellectual property rights. We rely on a combination of patent and intellectual property laws and agreements

to establish and protect our patent, intellectual property and other proprietary rights. The efforts we take to protect our patents, intellectual

property and other proprietary rights may not be sufficient or effective at stopping unauthorized use of our patents, intellectual property

and other proprietary rights. In addition, effective trademark, patent, copyright and trade secret protection may not be available or

cost-effective in every country in which we have rights. There may be instances where we are not able to protect or utilize our patent

and other intellectual property in a manner that maximizes competitive advantage. If we are unable to protect our patent assets and intellectual

property and other proprietary rights from unauthorized use, the value of those assets may be reduced, which could negatively impact our

business. Our inability to obtain appropriate protections for our intellectual property may also allow competitors to enter our markets

and produce or sell the same or similar products as those covered by our intellectual property rights. In addition, protecting our intellectual

property and intellectual property rights is expensive and diverts our critical and limited managerial resources. If any of the foregoing

were to occur, or if we are otherwise unable to protect our intellectual property and proprietary rights, our business and financial results

could be impaired. Commencing legal proceedings to enforce our intellectual property rights is burdensome and expensive. In addition,

our intellectual property rights could be at risk if we are unsuccessful in, or cannot afford to pursue, those proceedings. We also rely

on trade secrets and contract law to protect some of our intellectual property rights. We will enter into confidentiality and invention

agreements with our employees and consultants. Nevertheless, these agreements may not be honored and they may not effectively protect

our right to our un-patented trade secrets and know-how. Moreover, others may independently develop substantially equivalent proprietary

information and techniques or otherwise gain access to our trade secrets and know-how.

Risks Concerning our Common Stock

There is a limited market for our common

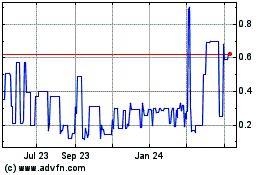

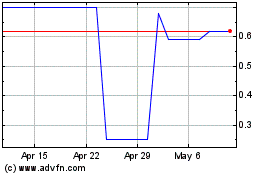

stock, which may make it difficult for you to sell your stock. Our common stock trades on the OTCQB market under the symbol “QPRC.”

The OTCQB market is not a national securities exchange and does not provide the benefits to stockholders which a national exchange provides.

Furthermore, according to the OTC Markets website, the OTCQB “is for early-stage and developing U.S. and international companies.

To be eligible, companies must be current in their reporting and undergo an annual verification and management certification process.

Companies must meet $0.01 bid test and may not be in bankruptcy.” There is a limited trading market for our common stock and our

common stock has frequently traded for less than $0.02. From August 28, 2020 to May 7, 2021 our common stock was delisted from the OTCQB

and traded on the OTC Pink because our stock price fell below $0.01 per share for more than 30 consecutive trading days. On May 23, 2022,

we received notice from OTC Markets Group, that, because the bid price for our common stock had closed below $0.01 per share for more

than 30 consecutive days, we no longer meet the Standards for Continued Eligibility under the OTC listing standards and, if this deficiency

is not met by August 21, 2022, we will be removed from the OTCQB marketplace, in which event our common stock will be traded on the OTC

Pink market. See “Market for Common Stock and Related Stockholder Matters.” Accordingly, there can be no assurance as to

the liquidity of any markets that may develop for our common stock, the ability of holders of our common stock to sell our common stock,

or the prices at which holders may be able to sell our common stock. Further, because of the thin float, the reported bid and asked prices

may have little relationship to the price you would pay if you wanted to buy shares or the price you would receive if you wanted to sell

shares.

Our board of directors has approved a one-for-100

reverse split, which is intended to enable us to retain the listing of our stock on the OTCQB. Although we believe that the one-for-100

reverse split will enable us to maintain our listing on the OTCQB, we cannot assure you that we will obtain stockholder approval or that,

even if stockholder approval is obtained, that the stock price will not decline following the effectiveness of the reverse split or that

such reduction will not be significant or that our stock will meet the requirements for continuing to trade on the OTCQB.

Because our common stock is a penny stock,

you may have difficulty selling our common stock in the secondary trading market. Our common stock fits the definition of a penny

stock and therefore is subject to the rules adopted by the SEC regulating broker-dealer practices in connection with transactions in penny

stocks. The SEC rules may have the effect of reducing trading activity in our common stock making it more difficult for investors to purchase

and sell their shares. The SEC’s rules require a broker or dealer proposing to effect a transaction in a penny stock to deliver

the customer a risk disclosure document that provides certain information prescribed by the SEC, including, but not limited to, the nature

and level of risks in the penny stock market. The broker or dealer must also disclose the aggregate amount of any compensation received

or receivable by him in connection with such transaction prior to consummating the transaction. In addition, the SEC’s rules also

require a broker or dealer to make a special written determination that the penny stock is a suitable investment for the purchaser and

receive the purchaser’s written agreement to the transaction before completion of the transaction. The existence of the SEC’s

rules may result in a lower trading volume of our common stock and lower trading prices. Further, some broker-dealers will not process

transactions in penny stocks. Many brokers do not trade in penny stocks and stock that are not listed on a stock exchange.

Our lack of internal controls over financial

reporting may affect the market for and price of our common stock. Our disclosure controls and our internal controls over financial

reporting are not effective. Since we became engaged in the intellectual property management business in 2008, we have not had the financial

resources or personnel to develop or implement systems that would provide us with the necessary information on a timely basis so as to

be able to implement financial controls. Our continued poor financial condition together with the fact that we have one full time employee,

who is both our chief executive officer and chief financial officer, makes it difficult for us to implement a system of internal controls

over financial reporting, and we cannot assure you that we will be able to develop and implement the necessary controls. The absence of

internal controls over financial reporting may inhibit investors from purchasing our shares and may make it more difficult for us to raise

debt or equity financing.

Our lack of a full-time chief financial officer

could affect our ability to develop financial controls, which could affect the market price for our common stock. We do not have a

full-time chief financial officer. At present, our chief executive officer, who does not have an accounting background, is also acting

as our chief financial officer. We do not anticipate that we will be able to hire a qualified chief financial officer unless our financial

condition improves significantly. The lack of an experienced chief financial officer, together with our lack of internal controls, may

impair our ability to raise money through a debt or equity financing, the market for our common stock and our ability to enter into agreements

with owners of intellectual property rights.

Our stock price may be volatile and your investment

in our common stock could suffer a decline in value. As of the date of this prospectus, there has only been limited trading activity

in our common stock. There can be no assurance that any significant market will ever develop in our common stock. Because of the low public

float and the absence of any significant trading volume, the reported prices may not reflect the price at which you would be able to sell

shares if you want to sell any shares you own or buy shares if you wish to buy share. Further, stocks with a low public float may be more

subject to manipulation than a stock that has a significant public float. The price may fluctuate significantly in response to a number

of factors, many of which are beyond our control. These factors include, but are not limited to, the following, in addition to the risks

described above and general market and economic conditions:

| |

● |

the

possibility that our stock will cease to be traded on the OTCQB and will instead be traded on the OTC Pink market. |

| ● | our

low stock price, which may result in a modest dollar purchase or sale of our common stock having a disproportionately large effect on

the stock price; |

| ● | the

effect of the COVID-19 pandemic and the response to the pandemic on the market both generally and on penny stocks; |

| ● | the

market’s perception as to our ability to generate positive cash flow or earnings from our intellectual property portfolios; |

| ● | changes

in our or securities analysts’ estimate of our financial performance; |

| ● | our

ability or perceived ability to obtain necessary financing for operations and for the monetization of our intellectual property rights; |

| ● | the

market’s perception of the effects of legislation or court decisions on our business; |

| ● | the

market’s perception that a defendant may obtain a judgement against one of our subsidiaries and foreclose on the intellectual property

of such subsidiary, which may result in a default under our agreement with QFL and, even if a default is not claimed, QFL may not provide

financing for us; |

| ● | the

effects or perceived effects of the potential convertibility of convertible notes issued by us; |

| ● | the

results or anticipated results of litigation by or against us; |

| ● | the

anticipated or actual results of our operations; |

| ● | events

or conditions relating to the enforcement of intellectual property rights generally; |

| ● | changes

in market valuations of other intellectual property marketing companies; |

| ● | any