NVIDIA Recommends Stockholders Reject ‘Mini-Tender’ Offer by Tutanota LLC

May 27 2022 - 4:20PM

NVIDIA today announced that it recently became aware of an

unsolicited “mini-tender” offer by Tutanota LLC to purchase up to

215,000 shares of NVIDIA common stock, representing significantly

less than 1% of NVIDIA’s outstanding common stock.

The offer price of $210 per share is conditioned on, among other

things, the closing price per share of NVIDIA’s common stock

exceeding $210 per share on the last trading day before the offer

expires. This means that unless Tutanota waives this condition,

NVIDIA stockholders who tender their shares in the offer will

receive a below-market price.

NVIDIA cautions stockholders that Tutanota has stated it expects

to extend the offer for successive periods of 45 to 180 days, in

which case payment would be delayed beyond the scheduled expiration

date of Friday, May 27, 2022. There is no guarantee that the

conditions of the offer will be satisfied.

NVIDIA recommends that stockholders do not tender their shares

in response to Tutanota’s offer because the offer requires that the

closing price per share of NVIDIA’s common stock exceed the offer

price, and the offer is subject to numerous additional conditions,

including Tutanota obtaining financing for the offer. Stockholders

who have already tendered their shares may withdraw them at any

time by providing notice in accordance with the Tutanota offering

documents prior to the expiration of the offer, which is currently

scheduled for 5 p.m. Eastern Daylight Time on Friday, May 27,

2022.

NVIDIA does not endorse Tutanota’s unsolicited mini-tender offer

and is not associated in any way with Tutanota, its mini-tender

offer or its mini-tender offer documents.

A mini-tender offer is an offer that would result in the bidder

holding not more than 5% of a company’s outstanding shares, thereby

avoiding many disclosure and procedural requirements of the U.S.

Securities and Exchange Commission (SEC) that apply to tender

offers that would result in the bidder holding more than 5% of a

company’s outstanding shares. Tutanota has made similar unsolicited

mini-tender offers for stock of other public companies.

The SEC has cautioned investors about these offers, noting that

“some bidders make mini-tender offers at below-market prices,

hoping that they will catch investors off guard if the investors do

not compare the offer price to the current market price.” The SEC’s

guidance to investors on mini-tenders is available at

https://www.sec.gov/reportspubs/investor-publications/investorpubsminitendhtm.html.

NVIDIA encourages brokers and dealers, as well as other market

participants, to review the SEC’s letter regarding broker-dealer

mini-tender offer dissemination and disclosure at

https://www.sec.gov/divisions/marketreg/minitenders/sia072401.htm.

NVIDIA requests that a copy of this news release be included

with all distributions of materials related to Tutanota’s

mini-tender offer related to NVIDIA’s common stock.

About NVIDIANVIDIA‘s (NASDAQ: NVDA) invention

of the GPU in 1999 sparked the growth of the PC gaming market and

has redefined modern computer graphics, high performance computing

and artificial intelligence. The company’s pioneering work in

accelerated computing and AI is reshaping trillion-dollar

industries, such as transportation, healthcare and manufacturing,

and fueling the growth of many others. More information at

https://nvidianews.nvidia.com/.

| For further information,

contact: |

| Simona JankowskiInvestor RelationsNVIDIA

Corporationsjankowski@nvidia.com |

|

Robert SherbinCorporate CommunicationsNVIDIA

Corporationrsherbin@nvidia.com |

| |

|

|

NVIDIA’s business is subject to risks and uncertainties,

including, but not limited to, the impact of global economic

conditions; our reliance on third parties to manufacture, assemble,

package and test our products; the impact of technological

development and competition; development of new products and

technologies or enhancements to our existing product and

technologies; market acceptance of our products or our partners’

products; design, manufacturing or software defects; changes in

consumer preferences or demands; changes in industry standards and

interfaces; unexpected loss of performance of our products or

technologies when integrated into systems; as well as other factors

detailed from time to time in the most recent reports NVIDIA files

with the Securities and Exchange Commission, or SEC, including, but

not limited to, its annual report on Form 10-K and quarterly

reports on Form 10-Q. Copies of reports filed with the SEC are

posted on NVIDIA’s website and are available from NVIDIA without

charge.

© 2022 NVIDIA Corporation. All rights reserved. NVIDIA and the

NVIDIA logo are trademarks and/or registered trademarks of NVIDIA

Corporation in the U.S. and other countries. Other company names

may be trademarks of the respective companies with which they are

associated.

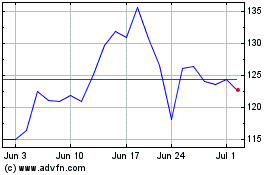

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Apr 2023 to Apr 2024