Vivos Therapeutics, Inc. (“Vivos” or the “Company'') (NASDAQ:

VVOS), a medical technology company focused on developing and

commercializing a suite of innovative diagnostic and treatment

modalities for patients with dentofacial abnormalities and/or mild

to moderate obstructive sleep apnea (OSA) and snoring in adults,

today reported financial results and operating highlights for the

first quarter ended March 31, 2022.

Financial and Operating

Highlights

- Revenue was $3.5 million for the

first quarter of 2022, compared to $3.4 million for the first

quarter of 2021;

- Appliance revenue increased 19% as

Vivos sold 2,965 total oral appliance arches, compared to 2,570 for

the first quarter of 2021;

- Gross profit was $2.4 million for

the first quarter of 2022, compared to gross profit of $2.7 million

for the first quarter of 2021, attributable to higher costs

associated with increased sales volume of our appliances and VIP

enrollments;

- Gross margin was 68% for the first

quarter of 2022, compared to 78% for the first quarter of 2021,

reflecting higher costs associated with appliances and VIP

enrollments;

- Cash and cash equivalents were

$17.8 million at March 31, 2022;

- Operational highlights during the

first quarter of 2022 and subsequent to quarter end included:

- Patients treated with The Vivos

Method totaled approximately 27,000, compared to just over 17,000

as of the first quarter of 2021. Vivos has also trained over 1,500

dentists in the use of The Vivos Method and Vivos’ related

value-added services, compared to just over 1,200 as of the first

quarter of 2021.

- In January 2022, Vivos announced an

18X increase in home sleep tests performed by Vivos-trained

dentists in the fourth quarter of 2021 versus the fourth quarter of

2020.

- Also in January 2022, Vivos filed a

U.S. patent application related to certain new and enhanced

clinical methods and protocols developed within Vivos’ proprietary

Vivos Method treatment for OSA.

- Subsequent to quarter end, in April

Vivos announced the May opening of a third Pneusomnia Sleep Center,

representing joint medical / dental ownership and collaboration

featuring Vivos products and technology in the greater Los Angeles

area. The new facility will join existing Pneusomnia Centers in Del

Mar and Modesto, Calif. The Company expects to open at least four

additional Pneusomnia facilities in 2022.

“While first quarter results were flat compared

to the prior year, we do not believe they reflect improvements that

started in March and are continuing here into the second quarter,”

said R. Kirk Huntsman, CEO. “Despite some January and February

headwinds, as the effects of the pandemic started to wane, March

saw a strong turnaround in key metrics across the board, including

a 28% increase in appliance sales, a 47% increase in home sleep

tests performed by Vivos-trained dentists and exponential growth

across all digital channels from our social media initiatives.”

“In addition, the DSO sales and pilot test

initiatives that we launched in the fourth quarter of 2021 are

exceeding our expectations and creating significant growth

opportunities. Our deep DSO industry relationships and early

success have put us in active discussions for additional pilots

with a number of DSO groups representing well over 5,000 dental

offices in the U.S. and Canada. We consider this a major positive

development that will allow us to scale up the Company much faster

and cost-effectively.”

“In order to position ourselves to fully take

advantage of the significant growth opportunities before us and to

extend our available capital resources, we have proactively made

certain strategic budget and personnel realignments that have

reduced our expenses and allowed us to extend our available

resources, all while bringing on several new seasoned key

executives with deep industry experience and great success scaling

up and operating medical device companies.

“In closing, Vivos continues to make progress

throughout all aspects of our business. As our key initiatives

progress, we expect our recent momentum to be reflected in our

operating results in future quarters, but particularly in the

latter half of this year.”

Vivos encourages investors and other interested

parties to join its quarterly conference call today at 5:00 p.m.

Eastern time (details below), where management will discuss further

details on important topics including: (i) Vivos’ current cash

position and efforts to manage cash flow (ii) the potential

significant impact of Vivos’ DSO sales and marketing campaign

efforts on near-term growth; (iii) recent and anticipated additions

to senior management; (iv) recent Vivos clinical research data and

its implications and (v) and update on Vivos’ marketing strategy

and recent success.

In addition, further information on Vivos’

financial results is included on the attached condensed

consolidated balance sheets and statements of operations, and

additional explanations of Vivos’ financial performance are

provided in the Vivos’ Quarterly Report on Form 10-Q for the three

months ended March 31, 2022, which will be filed with the

Securities and Exchange Commission (“SEC”). The full 10-Q report

will be available on the SEC Filings section of the Investor

Relations section of Vivos’ website at

https://vivos.com/investor-relations.

Business Updates

In January 2022, Vivos announced significant

increases across several key metrics for its SleepImage Home Sleep

Test ring (or HST), including in particular, for the three-months

ended December 31, 2021, versus the three-months ended December 31,

2020: (i) an 18 times increase in the total number of HSTs given

across the VIP network, (ii) a 5.7 times increase in the number of

VIPs administering HSTs and (iii) a 3 times increase in the average

number of HSTs being administered per VIP. Vivos believes this

performance gain in home sleep testing allowed it to renegotiate

its commercial agreement with SleepImage to lower costs and convert

the entire diagnostic program from a loss leader aimed primarily at

stimulating new case starts with sleep apnea treatment using the

Vivos Method to a potential recurring revenue center.

Later in January, Vivos filed a U.S. patent

application related to certain new and enhanced clinical methods

and protocols developed within Vivos’ proprietary Vivos Method

treatment for OSA. The Vivos Method, inclusive of the Vivos System,

seeks to treat dentofacial abnormalities and/or OSA through a

combination of Vivos’ proprietary oral appliances and devices as

well as proprietary clinical methods and protocols. This new patent

application was based on early field data which revealed an

additional 58% average improvement in Apnea Hypopnea Index (AHI)

score reductions in OSA patients who had received treatment with

the Vivos Method where the revised clinical protocols were

implemented.

In March, Vivos announced a rebranding of its

proprietary offering of clinical treatment devices, modalities and

protocols, now called The Vivos Method, to better capture the

multiple ways in which Vivos can help independent dentists treat

their patients. To learn more about The Vivos Method, patients can

visit Vivos’ updated website www.vivos.com to

find:

- Information about OSA and its

corresponding symptoms;

- Testimonials from Vivos-trained

dentists and their patient’s success stories; and

- Opportunities for Vivos

partnerships, FAQs and more.

In addition to simplifying information for

patients visiting the new Vivos website, Vivos now provides

dentists looking to tackle OSA and sleep therapies guidance in

becoming a Vivos Integrated Provider. This turnkey program enables

dentists to elevate patient services and care, while also

increasing the growth potential for practice revenue and

income.

Also in March, Vivos’ Medical Advisory Board

presented new clinical results from retrospective data in patients

using The Vivos Method at the 2022 World Sleep Congress in Rome,

Italy. The World Sleep Congress is one of the largest global

conferences dedicated to sleep medicine research. Dr. Seth Heckman,

MD, gave the presentation to an audience of physicians, dentists,

researchers, and other professionals who gathered to learn about

emerging technologies and therapies within sleep medicine.

Subsequent to quarter end, in April Vivos

announced its medical integration division will open its third U.S.

multidisciplinary sleep apnea clinic (known as a Pneusomnia Sleep

Center) in May 2022 in the greater Los Angeles area. Toluca Lake,

Calif. The new facility will join existing Pneusomnia Centers in

Del Mar and Modesto, Calif. The Center will be a clinician-owned,

Medicare-approved clinic, and will provide a comprehensive array of

services that include The Vivos Method and other treatments for

both adults and children, mandibular advancement devices, laser

treatment, oral myofunctional therapy, home sleep testing and

positive airway pressure (PAP) services.

Conference Call

Vivos senior management will conduct a

conference call today, May 16, 2022 at 5:00 p.m. (Eastern Time) to

review the first quarter results as well as provide an overview of

the Company's recent milestones and growth strategy.

To access the conference call, please dial (888)

256-1007, or for international callers, (720) 543-0214. A replay

will be available shortly after the call and can be accessed by

dialing (844) 512-2921, or for international callers, (412)

317-6671. The passcode for the live call and the replay is 5800759.

The replay will be available until May 30, 2022.

A live webcast of the conference call can be

accessed on Vivos’ website at https://vivos.com/investor-relations.

An online archive of the webcast will be available on the Company’s

website for 30 days following the call.

About Vivos Therapeutics,

Inc.

Vivos Therapeutics Inc. (NASDAQ: VVOS) is a

medical technology company focused on developing and

commercializing innovative diagnostic and treatment methods for

patients suffering from dentofacial abnormalities and/or mild to

moderate sleep apnea (OSA) and snoring in adults. The Vivos Method

represents the first clinically effective non-surgical,

non-invasive, non-pharmaceutical and cost-effective solution and

has proven effective in approximately 27,000 patients treated

worldwide by more than 1,500 trained dentists.

Combining proprietary technologies and

treatments that alter the size, shape and position of the tissues

that comprise a patient’s upper airway, The Vivos Method opens

airway space and may significantly reduce symptoms and conditions

associated with mild to moderate OSA, such as lowering Apnea

Hypopnea Index scores. Vivos also markets and distributes

SleepImage diagnostic technology under its VivoScore program for

Home Sleep Testing in adults and children. The Vivos Integrated

Practice (VIP) program offers dentists training and other

value-added services in connection with using The Vivos Method.

For more information, visit www.vivos.com.

Cautionary Note Regarding

Forward-Looking StatementsThis press release, the

conference call referred to herein, and statements of the Company’s

management made in connection therewith contain “forward-looking

statements” (as defined in Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended) concerning future events, particularly with

respect to the public offering described herein. Words such as

“aim”, “may”, “could”, “should”, “expects”, “projects,” “intends”,

“plans”, “believes”, “predicts”, “anticipates”, “hopes”,

“estimates” and variations of such words and similar expressions

are intended to identify forward-looking statements. These

statements involve known and unknown risks and are based upon

several assumptions and estimates, which are inherently subject to

significant uncertainties and contingencies, many of which are

beyond Vivos’ control. Actual results may differ materially from

those expressed or implied by such forward-looking statements.

Factors that could cause actual results to differ materially

include, but are not limited to, the risk factors described in

Vivos’ filings with the Securities and Exchange Commission (“SEC”).

Vivos’ filings can be obtained free of charge on the SEC's website

at www.sec.gov. Except to the extent required by law, Vivos

expressly disclaims any obligations or undertaking to release

publicly any updates or revisions to any forward-looking statements

contained herein to reflect any change in Vivos' expectations with

respect thereto or any change in events, conditions, or

circumstances on which any statement is based.

Vivos Investor Relations

Contact:Julie GannonInvestor Relations Officer(303)

859-3847jgannon@vivoslife.com

Vivos Media Relations

Contact:Francesca DeMauro / Jenny RoblesKCSA Strategic

Communications(917) 880-9771 / (212) 896-1231fdemauro@kcsa.com /

jrobles@kcsa.com

-Tables Follow-

VIVOS THERAPEUTICS

INC.Unaudited Consolidated Balance

Sheets(In Thousands, Except Per Share

Amounts)

| |

|

March 31, 2022 |

|

|

December 31, 2021 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

17,828 |

|

|

$ |

24,030 |

|

|

Accounts receivable, net of allowance of $181 and $180,

respectively |

|

|

1,002 |

|

|

|

1,203 |

|

|

Tenant improvement allowance receivable |

|

|

516 |

|

|

|

516 |

|

|

Prepaid expenses and other current assets |

|

|

2,255 |

|

|

|

1,575 |

|

| |

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

21,601 |

|

|

|

27,324 |

|

| |

|

|

|

|

|

|

|

|

| Long-term

assets |

|

|

|

|

|

|

|

|

|

Goodwill |

|

|

2,843 |

|

|

|

2,843 |

|

|

Property and equipment, net |

|

|

2,913 |

|

|

|

2,825 |

|

|

Operating lease right-of-use asset |

|

|

1,514 |

|

|

|

- |

|

|

Intangible assets, net |

|

|

331 |

|

|

|

341 |

|

|

Deposits and other |

|

|

354 |

|

|

|

356 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

29,556 |

|

|

$ |

33,689 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

877 |

|

|

$ |

920 |

|

|

Accrued expenses |

|

|

3,172 |

|

|

|

2,853 |

|

|

Contract liabilities |

|

|

2,344 |

|

|

|

2,399 |

|

|

Current portion of long-term debt |

|

|

- |

|

|

|

1,265 |

|

|

Current portion of operating lease liability |

|

|

357 |

|

|

|

72 |

|

|

Other current liabilities |

|

|

101 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

6,851 |

|

|

|

7,509 |

|

| |

|

|

|

|

|

|

|

|

| Long-term

liabilities |

|

|

|

|

|

|

|

|

|

Operating lease liability, net of current portion |

|

|

1,850 |

|

|

|

641 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

8,701 |

|

|

|

8,150 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’

equity |

|

|

|

|

|

|

|

|

|

Preferred Stock, $0.0001 par value per share. Authorized 50,000,000

shares; no shares issued and outstanding |

|

|

- |

|

|

|

- |

|

|

Common Stock, $0.0001 par value per share. Authorized 200,000,000

shares; issued and outstanding 23,012,119 shares as of March 31,

2022 and December 31, 2021 |

|

|

2 |

|

|

|

2 |

|

|

Additional paid-in capital |

|

|

81,991 |

|

|

|

81,160 |

|

|

Accumulated deficit |

|

|

(61,138 |

) |

|

|

(55,623 |

) |

|

Total stockholders’ deficit Total stockholders’ equity |

|

|

20,855 |

|

|

|

25,539 |

|

|

Total liabilities and stockholders’ deficit Total liabilities and

stockholders’ equity |

|

$ |

29,556 |

|

|

$ |

33,689 |

|

|

|

|

|

|

|

|

|

|

|

VIVOS THERAPEUTICS

INC.Unaudited Consolidated Statements of

Operations(In Thousands, Except Per Share

Amounts)

| |

|

Three Months Ended March 31, |

|

| |

|

2022 |

|

|

2021 |

|

|

Revenue |

|

|

|

|

|

|

|

|

|

Product revenue |

|

$ |

1,722 |

|

|

$ |

1,387 |

|

|

Service revenue |

|

|

1,738 |

|

|

|

2,061 |

|

|

Total revenue |

|

|

3,460 |

|

|

|

3,448 |

|

| |

|

|

|

|

|

|

|

|

| Cost of sales (exclusive of

depreciation and amortization shown separately below) |

|

|

1,093 |

|

|

|

758 |

|

| |

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

2,367 |

|

|

|

2,690 |

|

| |

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

General and administrative |

|

|

8,275 |

|

|

|

5,059 |

|

|

Sales and marketing |

|

|

753 |

|

|

|

860 |

|

|

Depreciation and amortization |

|

|

162 |

|

|

|

177 |

|

| |

|

|

|

|

|

|

|

|

|

Total operating expenses |

|

|

9,190 |

|

|

|

6,096 |

|

| |

|

|

|

|

|

|

|

|

|

Operating loss |

|

|

(6,823 |

) |

|

|

(3,406 |

) |

| |

|

|

|

|

|

|

|

|

| Non-operating income

(expense) |

|

|

|

|

|

|

|

|

|

Other expense |

|

|

(38 |

) |

|

|

(1 |

) |

|

PPP loan forgiveness |

|

|

1,287 |

|

|

|

- |

|

|

Other income |

|

|

59 |

|

|

|

8 |

|

| |

|

|

|

|

|

|

|

|

|

Loss before income taxes |

|

|

(5,515 |

) |

|

|

(3,399 |

) |

| Income tax expense |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(5,515 |

) |

|

$ |

(3,399 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss attributable to

common stockholders |

|

$ |

(5,515 |

) |

|

$ |

(3,399 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss per share

attributable to common stockholders (basic and diluted) |

|

$ |

(0.26 |

) |

|

$ |

(0.19 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average number of

shares of Common Stock outstanding (basic and diluted) |

|

|

21,233 |

|

|

|

18,211 |

|

| |

|

|

|

|

|

|

|

|

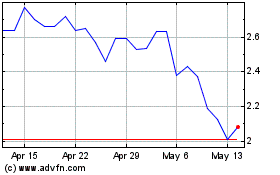

Vivos Therapeutics (NASDAQ:VVOS)

Historical Stock Chart

From Aug 2024 to Sep 2024

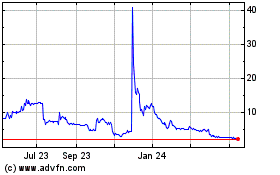

Vivos Therapeutics (NASDAQ:VVOS)

Historical Stock Chart

From Sep 2023 to Sep 2024