Filed Pursuant to Rule 424(b)(5)

Registration No. 333-238810

PROSPECTUS SUPPLEMENT

$100,000,000 of Common Stock

Pursuant to this prospectus supplement and the accompanying prospectus, we are offering up to $100,000,000 aggregate amount of shares, or Purchase Shares, of our common stock, par value $0.001 per share, or Common Stock, to Aspire Capital Fund, LLC, or Aspire Capital, under a common stock purchase agreement that we entered into with Aspire Capital on May 12, 2022, or the Purchase Agreement.

The shares of Common Stock offered include Purchase Shares in an aggregate offering price of up to $100,000,000, which may be sold from time to time to Aspire Capital over the term of the Purchase Agreement, which expires May 12, 2024. The purchase price for the Purchase Shares will be based upon one of two formulas set forth in the Purchase Agreement depending on the type of purchase notice we submit to Aspire Capital from time to time.

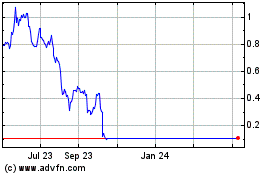

Our Common Stock is listed on The Nasdaq Capital Market under the symbol “ATHX.” The last sale price of our Common Stock on May 11, 2022, as reported by The Nasdaq Capital Market, was $0.58 per share.

Investing in any of our securities involves risk. Please read carefully the section entitled “Risk Factors” beginning on page S-3 of this prospectus supplement and page 1 of the accompanying prospectus. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is May 12, 2022.

TABLE OF CONTENTS

| | | | | |

| Prospectus Supplement | Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus form part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC. This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference herein or therein. The second part, the accompanying prospectus, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. If the description of this offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement, which supersedes the information in the accompanying prospectus. This prospectus supplement contains information about the shares offered in this offering and may add, update or change information in the accompanying prospectus. Before you invest in any of the shares offered under this prospectus supplement, you should carefully read both this prospectus supplement and the accompanying prospectus together with the additional information described under the headings “Where You Can Find More Information” and “Information We Incorporate By Reference.”

You should rely only on the information contained or incorporated by reference in this prospectus supplement and in the accompanying prospectus or in any free writing prospectus that we may provide you. We have not, and Aspire Capital has not, authorized anyone to provide you with different information. No dealer, salesperson or any other person is authorized to give any information or to represent anything not contained in this prospectus supplement and the accompanying prospectus. If anyone provides you with different or additional information, you should not rely on it. You should not assume that the information contained in this prospectus supplement, the accompanying prospectus, any free writing prospectus that we may provide or any document incorporated by reference is accurate as of any date other than the date mentioned on the cover page of these documents. We are not making offers to sell the shares in any jurisdiction in which an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus supplement or the accompanying prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus supplement or the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of Common Stock and the distribution of this prospectus supplement and the accompanying prospectus outside the United States.

References in this prospectus supplement and the accompanying prospectus to the terms “we,” “us,” “our,” “Athersys” or “the Company” or other similar terms mean Athersys, Inc. and its consolidated subsidiaries, unless we state otherwise or the context indicates otherwise.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein contain “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These forward-looking statements relate to, among other things, the timing of initiation of new clinical sites and patient enrollment in our clinical trials, the expected timetable for development of our product candidates, our growth strategy and our future financial performance, including our operations, economic performance, financial condition, prospects and other future events. We have attempted to identify forward-looking statements by using such words as “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “should,” “suggest,” “will” or other similar expressions. These forward-looking statements are only predictions and are largely based on our current expectations.

In addition, a number of known and unknown risks, uncertainties and other factors could affect the accuracy of these statements. Some of the more significant known risks that we face are the risks and uncertainties inherent in the process of discovering, developing and commercializing products that are safe and effective for use as

therapeutics, including the uncertainty regarding market acceptance of our product candidates and our ability to generate revenues. The following risks and uncertainties may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements:

•the possibility of unfavorable results from ongoing and additional clinical trials involving our MultiStem® (invimestrocel) cell therapy, or MultiStem;

•the risk that positive results in a clinical trial may not be replicated in subsequent or confirmatory trials or success in an early stage clinical trial may not be predictive of results in later stage or large scale clinical trials;

•our ability to raise capital to fund our operations, including but not limited to, our ability to access our traditional financing sources and to continue as a going concern;

•our ability to regain compliance with the requirement to maintain a minimum closing bid price of $1.00 per share as set forth in Nasdaq Listing Rule 5550(a)(2);

•the timing and nature of results from MultiStem clinical trials, including the MASTERS-2 Phase 3 clinical trial evaluating the administration of MultiStem for the treatment of ischemic stroke, and the HEALIOS K.K., or Healios, TREASURE clinical trial in Japan, including the timing of the release of data by Healios from its clinical trial;

•our ability to meet milestones and earn royalties under our collaboration agreements, including the success of our collaboration with Healios;

•the success of our MACOVIA clinical trial evaluating the administration of MultiStem for the treatment of acute respiratory distress syndrome, or ARDS, induced by COVID-19 and other pathogens, and the MATRICS-1 clinical trial being conducted with The University of Texas Health Science Center at Houston evaluating the treatment of patients with serious traumatic injuries;

•the possibility that the COVID-19 pandemic could continue to delay clinical site initiation, clinical trial enrollment, regulatory review and potential receipt of regulatory approvals, payments of milestones under our license agreements and commercialization of one or more of our product candidates, if approved;

•the availability of product sufficient to meet commercial demand shortly following any approval;

•the impact on our business, results of operations and financial condition from the ongoing and global COVID-19 pandemic, or any other pandemic, epidemic or outbreak of infectious disease in the United States;

•the possibility of delays in, adverse results of, and excessive costs of the development process;

•our ability to successfully initiate and complete clinical trials of our product candidates;

•the impact of the COVID-19 pandemic on the production capabilities of our contract manufacturing partners and our MultiStem trial supply chain;

•the possibility of delays, work stoppages or interruptions in manufacturing by third parties or us, such as due to material supply constraints, contaminations, operational restrictions due to COVID-19 or other public health emergencies, labor constraints, regulatory issues or other factors that could negatively impact our trials and the trials of our collaborators;

•uncertainty regarding market acceptance of our product candidates and our ability to generate revenues, including MultiStem cell therapy for neurological, inflammatory and immune, cardiovascular and other critical care indications;

•changes in external market factors;

•changes in our industry’s overall performance;

•changes in our business strategy;

•our ability to protect and defend our intellectual property and related business operations, including the successful prosecution of our patent applications and enforcement of our patent rights, and operate our business in an environment of rapid technology and intellectual property development;

•our possible inability to realize commercially valuable discoveries in our collaborations with pharmaceutical and other biotechnology companies;

•our collaborators’ ability to continue to fulfill their obligations under the terms of our collaboration agreements and generate sales related to our technologies;

•the success of our efforts to enter into new strategic partnerships and advance our programs;

•our possible inability to execute our strategy due to changes in our industry or the economy generally;

•changes in productivity and reliability of suppliers;

•the success of our competitors and the emergence of new competitors; and

•the risks described in our Annual Report on Form 10-K for the year ended December 31, 2021, our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2022 and our other filings with the SEC.

Any forward-looking statement you read in this prospectus supplement, the accompanying prospectus or any document incorporated by reference herein or therein reflects our current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our operations, operating results, growth strategy and liquidity. Although we currently believe that the expectations reflected in these forward-looking statements are reasonable, we cannot guarantee our future results, levels of activity or performance. You should not place undue reliance on these forward-looking statements because such statements speak only as of the date when made. We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise, except as otherwise required by law. You are advised, however, to consult any further disclosures we make on related subjects in our reports on Forms 10-Q, 8-K and 10-K furnished to the SEC. You should understand that it is not possible to predict or identify all risk factors. Consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

Any document incorporated by reference in this prospectus supplement and the accompanying prospectus may also contain statistical data and estimates we obtained from industry publications and reports generated by third parties. Although we believe that such publications and reports are reliable, we have not independently verified their data.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights information contained elsewhere or incorporated by reference into this prospectus supplement and the accompanying prospectus. This summary may not contain all of the information that you should consider before investing in our securities. We urge you to read this entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein carefully, including the section entitled “Risk Factors” and the other information included or incorporated by reference into this prospectus supplement and the accompanying prospectus.

The Company

We are a biotechnology company that is focused primarily in the field of regenerative medicine. Our MultiStem cell therapy, a patented and proprietary allogeneic stem cell product candidate, is our lead platform product and is currently in clinical development in several therapeutic and geographic areas. Our most advanced program is an ongoing Phase 3 clinical trial for the treatment of ischemic stroke. Our current clinical development programs are focused on treating neurological conditions, inflammatory and immune disorders, certain pulmonary conditions, cardiovascular disease and other conditions where the current standard of care is limited or inadequate for many patients, particularly in the critical care segment.

Corporate Information

We were incorporated in Delaware and our headquarters are located at 3201 Carnegie Avenue, Cleveland, Ohio 44115. Our telephone number is (216) 431-9900. Our website is http://www.athersys.com. The information accessible through our website is not part of this prospectus supplement or the accompanying prospectus, other than documents that we file with the SEC that are specifically incorporated by reference into this prospectus supplement and the accompanying prospectus.

This Offering

| | | | | |

| Issuer | Athersys, Inc. |

| Common Stock being offered | Up to $100,000,000 aggregate amount of shares of Common Stock. |

| Common Stock to be outstanding after the offering | 292,603,756 shares (as of May 11, 2022), assuming the sale of 35,000,000 Purchase Shares. The number of actual Purchase Shares that may be issued will vary depending on the sales prices under this offering. See “The Aspire Capital Transaction—Purchase of Shares under the Purchase Agreement” below for a description of the share limitation. |

| Manner of offering | Issuance of Purchase Shares to Aspire Capital from time to time, subject to certain minimum stock price requirements, and daily and other caps, for an aggregate offering price of up to $100,000,000. See “The Aspire Capital Transaction” and “Plan of Distribution.” |

| Use of proceeds | We intend to use the net proceeds from this offering for working capital and general corporate purposes to help support the achievement of our operational objectives. See “Use of Proceeds.” |

| Risk factors | An investment in our Common Stock involves a high degree of risk. See “Risk Factors” beginning on page S-3 for a discussion of certain factors that you should consider when evaluating an investment in our Common Stock. |

| NASDAQ symbol | Our Common Stock is listed on The Nasdaq Capital Market, or NASDAQ, under the symbol “ATHX.” |

Unless otherwise indicated, all information in this prospectus supplement excludes:

•a total of 23,276,072 shares of Common Stock authorized and reserved for future issuance under outstanding awards under our equity incentive plans;

•a total of 3,697,587 shares of Common Stock authorized and reserved for future issuance under our equity incentive plans;

•a total of 11,000,000 shares of Common Stock authorized and reserved for future issuance under outstanding inducement awards granted outside of our equity incentive plans; and

•10,000,000 shares of Common Stock authorized and reserved for future issuance upon exercise of warrants held by Healios.

RISK FACTORS

Investing in our Common Stock involves risk. Prior to making a decision about investing in our Common Stock, you should carefully consider the following risk factors, as well as specific risk factors discussed under the heading “Risk Factors” in our most recent Annual Report on Form 10-K and in our most recent Quarterly Reports on Form 10-Q, which are or will be incorporated herein by reference and may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. The risks and uncertainties we have described are not the only risks we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations. If any of these risks actually occurs, our business, results of operations and financial condition could suffer. In that case, the trading price of our Common Stock could decline, and you could lose all or part of your investment.

Risks Related to this Offering and our Common Stock

The sale of our Common Stock to Aspire Capital may cause substantial dilution to our existing stockholders and the sale of the shares of Common Stock acquired by Aspire Capital could cause the price of our Common Stock to decline.

We may sell up to $100,000,000 aggregate amount of shares of our Common Stock to Aspire Capital under the Purchase Agreement. It is anticipated that shares offered to Aspire Capital in this offering will be sold by Aspire Capital over the term of the Purchase Agreement, which expires May 12, 2024. Aspire Capital may ultimately purchase all, some or none of the $100,000,000 aggregate amount of Common Stock that is the subject of this prospectus supplement. Aspire Capital may sell all, some or none of the shares of our Common Stock that it holds or comes to hold under the Purchase Agreement. Sales by Aspire Capital of shares acquired pursuant to the Purchase Agreement under the registration statement, of which this prospectus supplement and the accompanying prospectus form a part, may result in dilution to the interests of other holders of our Common Stock. In addition, the sale of a substantial number of shares of our Common Stock by Aspire Capital in this offering or anticipation of such sales could make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect sales. However, we have the right to control the timing and amount of sales of shares issued to Aspire Capital under the Purchase Agreement, and the Purchase Agreement may be terminated by us at any time, at our discretion, without any penalty or cost to us.

Our management will have broad discretion over the use of the proceeds to us from this offering and may apply it to uses that do not improve our operating results or the value of our securities.

Our management will have broad discretion in the application of the net proceeds from this offering, and investors will be relying solely on such judgment of our management regarding the application of these proceeds. Although we expect to use the net proceeds from this offering for working capital and general corporate purposes, which may include research and development, clinical trial and marketing expenditures, we have not allocated these net proceeds for specific purposes. Investors will not have the opportunity, as part of their investment decision, to assess whether the proceeds are being used appropriately. Our use of the proceeds may not improve our operating results or increase the value of the securities being offered hereby.

USE OF PROCEEDS

We intend to use the net proceeds from this offering for working capital and general corporate purposes to help support the achievement of our operational objectives.

The amount, timing and nature of specific expenditures of net proceeds from this offering will depend on a number of factors, including the timing, scope, progress and results of our research and development efforts and the timing and progress of any collaboration efforts. As of the date of this prospectus supplement, we cannot specify with certainty all of the particular uses of the proceeds from this offering. Accordingly, we will retain broad discretion over the use of such proceeds.

DIVIDEND POLICY

We would have to rely upon dividends and other payments from our wholly-owned subsidiary, ABT Holding Company, to generate the funds necessary to make dividend payments, if any, on our Common Stock. ABT Holding Company, however, is legally distinct from us and has no obligation to pay amounts to us. The ability of ABT Holding Company to make dividend and other payments to us is subject to, among other things, the availability of funds and applicable state laws. However, there are no restrictions, such as government regulations or material contractual arrangements, that restrict the ability of ABT Holding Company to make dividend and other payments to us. We did not pay cash dividends on our Common Stock during the past three years ended December 31, 2021. We do not anticipate that we will pay any dividends on our Common Stock in the foreseeable future. Rather, we anticipate that we will retain earnings, if any, for use in the development of our business.

DILUTION

The sale of our Common Stock to Aspire Capital pursuant to the Purchase Agreement will have a dilutive impact on our stockholders. As a result, our net income/(loss) per share would decrease in future periods and the market price of our Common Stock could decline. In addition, the lower our stock price is at the time we exercise our right to sell shares to Aspire Capital, the more shares of our Common Stock we will have to issue to Aspire Capital pursuant to the Purchase Agreement in order to obtain the full $100,000,000 in gross proceeds and our existing stockholders would experience greater dilution.

After giving effect to the sale of 35,000,000 shares of Common Stock at an assumed offering price of $0.58 per share (the closing price of our Common Stock on May 11, 2022), and after deducting estimated offering expenses payable by us, our pro forma net tangible book value as of March 31, 2022 would have been $20.6 million, or $0.07 per share of Common Stock. This represents an immediate increase in pro forma net tangible book value of $0.07 per share to our existing stockholders and an immediate dilution in pro forma net tangible book value of $0.51 per share to investors participating in this offering.

The following table illustrates this dilution on a per share basis:

| | | | | | | | |

| Assumed offering price per share | | $ | 0.58 | |

| Historical net tangible book value per share as of March 31, 2022 | $ | 0.001 | | |

| Increase in net tangible book value per share attributable to this offering | $ | 0.07 | | |

| Pro forma net tangible book value per share after this offering | | $ | 0.07 | |

| Dilution per share to new investors participating in this offering | | $ | 0.51 | |

The shares of Common Stock sold in this offering, if any, may be sold from time to time at various prices.

Each $0.25 increase in the per share price at which we sell shares to Aspire Capital under the Purchase Agreement from the assumed offering price of $0.58 per share would increase our pro forma net tangible book value by $8.75 million, increase our pro forma net tangible book value per share by $0.03 and increase dilution per share to new investors purchasing shares of Common Stock in this offering by $0.22, assuming that the total dollar amount of shares of Common Stock offered, as set forth on the cover page of this prospectus, remains the same and after deducting estimated aggregate offering expenses payable by us. This information is supplied for illustrative purposes only.

The table and calculations set forth above are based on the number of shares of Common Stock outstanding as of March 31, 2022 and assumes no exercise of any outstanding options or warrants. To the extent that outstanding options or warrants are exercised, new options or other equity grants are issued under or outside of our equity incentive plans or we otherwise issue additional shares of Common Stock in the future, there will be further dilution to new investors participating in this offering.

The above information excludes the following:

•a total of 23,276,072 shares of Common Stock authorized and reserved for future issuance under outstanding awards under our equity incentive plans;

•a total of 3,697,587 shares of Common Stock authorized and reserved for future issuance under our equity incentive plans;

•a total of 11,000,000 shares of Common Stock authorized and reserved for future issuance under outstanding inducement awards granted outside of our equity incentive plans; and

•10,000,000 shares of Common Stock authorized and reserved for future issuance upon exercise of warrants held by Healios.

THE ASPIRE CAPITAL TRANSACTION

General

On May 12, 2022, we entered into the Purchase Agreement, which provides that, upon the terms and subject to the conditions and limitations set forth therein, Aspire Capital is irrevocably committed to purchase up to an aggregate of $100,000,000 of shares of our Common Stock over the 24-month term of the Purchase Agreement, which expires May 12, 2024.

We are filing this prospectus supplement with regard to the offering of our Common Stock consisting of the Purchase Shares that we may sell to Aspire Capital pursuant to the Purchase Agreement.

Concurrently with entering into the Purchase Agreement, we also entered into the Registration Rights Agreement, in which we agreed to file one or more registration statements as permissible and necessary to register under the Securities Act of 1933, as amended, or the Securities Act, the sale of the shares of our Common Stock that may be issued to Aspire Capital under the Purchase Agreement.

Purchase of Shares under the Purchase Agreement

On May 12, 2022, the conditions to the commencement under the Purchase Agreement were satisfied. On any business day over the 24-month term of the Purchase Agreement (until May 12, 2024), we have the right, in our sole discretion, to present Aspire Capital with a purchase notice, or Purchase Notice, directing Aspire Capital to purchase up to 200,000 shares of our Common Stock per trading day. We and Aspire Capital also may mutually agree to increase the number of shares that may be sold to as much as an additional 2,000,000 Purchase Shares per business day. The purchase price, or Purchase Price, of such shares is equal to the lesser of:

•the lowest sale price of our Common Stock on the purchase date on the principal market of the Common Stock, or the Principal Market, during normal trading hours; or

•the arithmetic average of the three lowest closing sale prices for our Common Stock on the Principal Market during the ten consecutive trading days ending on the trading day immediately preceding the purchase date.

The applicable Purchase Price will be determined prior to delivery of any Purchase Notice.

In addition, on any date on which we submit a Purchase Notice to Aspire Capital in an amount of at least 100,000 shares, we also have the right, in our sole discretion, to present Aspire Capital with a volume-weighted average price purchase notice, or a VWAP Purchase Notice, directing Aspire Capital to purchase an amount of stock equal to up to 30% of the aggregate shares of the Common Stock traded on The Nasdaq Capital Market on the next trading day, or the VWAP Purchase Date, subject to a maximum number of shares we may determine, or the VWAP Purchase Share Volume Maximum, and the price set by the Company in the VWAP Purchase Notice, or the VWAP Minimum Price Threshold, which is equal to the greater of (a) 90% of the closing price on the Principal Market on the business day immediately preceding the VWAP Purchase Date or (b) such higher price as set forth by the Company in the VWAP Purchase Notice. The purchase price per Purchase Share pursuant to such VWAP Purchase Notice, or the VWAP Purchase Price, shall be the lower of:

(1)95% of the volume-weighted average price for our Common Stock traded on the Principal Market during normal trading hours:

•on the VWAP Purchase Date, if the aggregate shares traded on the Principal Market have exceeded the VWAP Purchase Share Volume Maximum; or

•for the portion of the VWAP Purchase Date until such time as the sooner to occur of (i) the time at which the aggregate shares traded on the Principal Market has exceeded the VWAP Purchase Share

Volume Maximum or (ii) the time at which the sale price of our Common Stock falls below the VWAP Minimum Price Threshold

or

(2)the closing price on the VWAP Purchase Date.

The Purchase Price will be adjusted for any reorganization, recapitalization, stock dividend, stock split, reverse stock split or other similar transaction occurring during the period(s) used to compute the Purchase Price. We may deliver multiple Purchase Notices and VWAP Purchase Notices to Aspire Capital from time to time during the term of the Purchase Agreement, so long as the most recent purchase has been completed.

The number of Purchase Shares covered by and timing of each Purchase Notice or VWAP Purchase Notice are determined by us, at our sole discretion. The aggregate number of shares that we can sell to Aspire Capital under the Purchase Agreement may in no case exceed 51,587,944 shares of our Common Stock. (which is equal to approximately 19.9% of the common stock outstanding on the date of the Purchase Agreement) (the “Exchange Cap”), unless shareholder approval is obtained to issue more, in which case the Exchange Cap will not apply, unless (i) stockholder approval is obtained to issue more, in which case the Exchange Cap will not apply, or (ii) stockholder approval has not been obtained and at any time the Exchange Cap is reached and at all times thereafter the average price paid for all shares issued under the Purchase Agreement is equal to or greater than $0.5533, a price equal to the lower of (1) the closing sale price for our Common Stock immediately before the execution of the Purchase Agreement and (2) the arithmetic average of the five closing sales prices for our Common Stock immediately before the execution of the Purchase Agreement. The aggregate number of shares that we can sell to Aspire Capital pursuant to this prospectus supplement may in no case exceed 35,000,000 shares of our Common Stock. Aspire Capital has no right to require any sales by us, but is obligated to make purchases from us as we direct in accordance with the Purchase Agreement. There are no limitations on use of proceeds, financial or business covenants, restrictions on future financings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement. We did not pay any additional amounts to reimburse or otherwise compensate Aspire Capital in connection with the transaction.

Minimum Share Price

Under the Purchase Agreement, the Company and Aspire Capital may not effect any sales of shares of our Common Stock on any trading day that the closing sale price of our Common Stock is less than $0.25 per share, or the Floor Price, which shall not be adjusted for any reorganization, recapitalization, stock dividend, stock split, reverse stock split or other similar transaction.

Events of Default

Generally, Aspire Capital will not be obligated to purchase shares of our Common Stock under the Purchase Agreement upon the occurrence of any of the following events of default:

•the effectiveness of any registration statement that is required to be maintained effective pursuant to the terms of the Registration Rights Agreement between us and Aspire Capital lapses for any reason (including, without limitation, the issuance of a stop order) or is unavailable to Aspire Capital for the sale of our shares of Common Stock, and such lapse or unavailability continues for a period of ten consecutive business days or for more than an aggregate of thirty business days in any 365-day period, which is not in connection with a post-effective amendment to any such registration statement or the filing of a new registration statement; provided, however, that in connection with any post-effective amendment to such registration statement or the filing of a new registration statement that is required to be declared effective by the SEC, such lapse or unavailability may continue for a period of no more than thirty consecutive business days, which such period shall be extended for up to an additional thirty business days if we receive a comment letter from the SEC in connection therewith;

•the suspension from trading or failure of our Common Stock to be listed on the Principal Market for a period of three consecutive business days;

•the delisting of our Common Stock from The Nasdaq Capital Market, and our Common Stock is not immediately thereafter trading on the New York Stock Exchange, the NYSE American, The Nasdaq Global Select Market or The Nasdaq Global Market;

•our transfer agent’s failure to issue to Aspire Capital shares of our Common Stock under the Purchase Agreement within five business days after an applicable purchase date that Aspire Capital is entitled to receive;

•any breach by us of the representations, warranties, covenants or other term or condition contained in the Purchase Agreement or any related agreements that could reasonably be expected to have a material adverse effect except, in the case of a breach of a covenant which is reasonably curable, only if such breach continues uncured for a period of at least five business days;

•if we become insolvent or are generally unable to pay our debts as they become due; or

•any participation or threatened participation in insolvency or bankruptcy proceedings by or against us.

Our Termination Rights

The Purchase Agreement may be terminated by us at any time, at our discretion, without any cost to us.

No Short-Selling or Hedging by Aspire Capital

Aspire Capital has agreed that neither it nor any of its agents, representatives and affiliates shall engage in any direct or indirect short-selling or hedging, which establishes a net short position with respect to our Common Stock during any time prior to the termination of the Purchase Agreement.

Effect of Performance of the Purchase Agreement on Our Stockholders

The Purchase Agreement does not limit the ability of Aspire Capital to sell any or all of the $100,000,000 aggregate amount of Common Stock registered in this offering. It is anticipated that shares registered in this offering will be sold over the term of the Purchase Agreement, which expires on May 12, 2024. The sale by Aspire Capital of a significant amount of shares registered in this offering at any given time could cause the market price of our Common Stock to decline or to be highly volatile. Sales to Aspire Capital by us pursuant to the Purchase Agreement also may result in dilution to the interests of other holders of our Common Stock. However, we have the right to control the timing and amount of sales of our shares to Aspire Capital, and the Purchase Agreement may be terminated by us at any time at our discretion without any penalty or cost to us.

Amount of Potential Proceeds to be Received under the Purchase Agreement

Under the Purchase Agreement, we may sell shares of our Common Stock having an aggregate offering price of up to $100,000,000 to Aspire Capital from time to time. The number of shares ultimately offered for sale to Aspire Capital in this offering is dependent upon the number of shares we elect to sell to Aspire Capital under the Purchase Agreement. In addition, Aspire Capital will not be required to buy shares of our Common Stock pursuant to a Purchase Notice that was received by Aspire Capital on any business day on which the last closing trade price of our Common Stock on The Nasdaq Capital Market (or alternative national exchange in accordance with the Purchase

Agreement) is below the Floor Price. The following table sets forth the amount of proceeds we would receive from Aspire Capital from the sale of shares at varying purchase prices:

| | | | | | | | | | | | | | | | | | | | |

Assumed Average Purchase Price | | Proceeds from the Sale of Shares to Aspire Capital Under the Purchase Agreement Registered in this Offering | | Number of Shares to be Issued in this Offering at the Assumed Average Purchase Price(1) | | Percentage of Outstanding Shares After Giving Effect to the Purchased Shares Issued to Aspire Capital(2) |

| $ | 1.00 | | | $ | 35,000,000 | | | 35,000,000 | | | 12.0 | % |

| $ | 2.00 | | | $ | 70,000,000 | | | 35,000,000 | | | 12.0 | % |

| $ | 3.00 | | | $ | 100,000,000 | | | 33,333,333 | | | 11.5 | % |

| $ | 4.00 | | | $ | 100,000,000 | | | 25,000,000 | | | 8.8 | % |

| $ | 5.00 | | | $ | 100,000,000 | | | 20,000,000 | | | 7.2 | % |

__________________

(1)Includes the total number of shares of Common Stock which we would have sold under the Purchase Agreement at the corresponding assumed purchase price set forth in the adjacent column, up to an aggregate purchase price of $100,000,000.

(2)The denominator is based on 257,603,756 shares outstanding as of May 11, 2022, which includes the number of shares set forth in the adjacent column which we would have sold to Aspire Capital. The numerator is based on the number of shares which we may issue to Aspire Capital under the Purchase Agreement (that are the subject of this offering) at the corresponding assumed purchase price set forth in the adjacent column.

DESCRIPTION OF CAPITAL STOCK

We are authorized to issue 600,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par value $0.001 per share.

Common Stock

This section describes the general terms and provisions of our Common Stock. For more detailed information, you should refer to our Certificate of Incorporation and Bylaws, copies of which have been filed with the SEC.

Holders of shares of our Common Stock will be entitled to receive dividends if and when declared by the board of directors from funds legally available therefor, and, upon liquidation, dissolution or winding-up of our company, will be entitled to share ratably in all assets remaining after payment of liabilities. The holders of shares of our Common Stock will not have any preemptive rights, but will be entitled to one vote for each share of Common Stock held of record. Stockholders will not have the right to cumulate their votes for the election of directors. The shares of our Common Stock offered hereby, when issued, will be fully paid and nonassessable.

Preferred Stock

This section describes the general terms and provisions of our preferred stock. For more detailed information, you should refer to our Certificate of Incorporation and Bylaws, copies of which have been filed with the SEC.

Our board of directors is authorized, without action by our stockholders, to designate and issue up to 10,000,000 shares of preferred stock, par value $0.001 per share, in one or more series. The board of directors can fix the rights, preferences and privileges of the shares of each series and any of its qualifications, limitations or restrictions. Our board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of our Common Stock. The issuance of preferred stock, while providing flexibility in connection with possible future financings, acquisitions and other corporate purposes could, under certain circumstances, have the effect of delaying, deferring or preventing a change in control of us and could adversely affect the market price of our Common Stock. We do not have any shares of preferred stock outstanding, and we have no current plans to issue any preferred stock.

Transfer Agent and Registrar

We have appointed Computershare Investor Services as the transfer agent and registrar for our Common Stock.

Listing

Our Common Stock is listed on The Nasdaq Capital Market under the symbol “ATHX.”

CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS FOR NON-U.S. HOLDERS

General

The following is a summary of certain U.S. federal income tax considerations related to the ownership and disposition of our Common Stock by a non-U.S. holder, as defined below, that acquires our Common Stock pursuant to this offering. This discussion assumes that a non-U.S. holder will hold our Common Stock issued pursuant to this offering as a capital asset within the meaning of Section 1221 of the Internal Revenue Code of 1986, as amended (the “Code”) (generally, for investment purposes). This summary does not address all aspects of U.S. federal income taxation that may be relevant to a particular investor in light of the investor’s individual circumstances, and does not purport to be a complete analysis of all the potential tax considerations relating thereto. In addition, this discussion does not address (i) other U.S. federal tax laws, such as estate and gift tax laws, (ii) state, local or non-U.S. tax consequences, (iii) the special tax rules that may apply to certain investors, including, without limitation, banks, insurance companies, financial institutions, controlled foreign corporations, passive foreign investment companies, broker-dealers, traders in securities, grantor trusts, personal holding companies, taxpayers who have elected mark-to-market accounting, tax-exempt entities, regulated investment companies, real estate investment trusts, persons who hold or receive our Common Stock pursuant to the exercise of any employee stock option or otherwise as compensation, entities or arrangements classified as partnerships for U.S. federal income tax purposes or other pass-through entities (or an investor in such entities or arrangements), pension plans, “qualified foreign pension funds” as defined in Section 897(l)(2) of the Code and entities all of the interests of which are held by qualified foreign pension funds or U.S. expatriates and former long-term residents of the United States, (iv) the special tax rules that may apply to an investor that acquires, holds, or disposes of our Common Stock as part of a straddle, hedge, constructive sale, conversion or other integrated or risk reduction transaction, or (v) the impact, if any, of the alternative minimum tax or the Medicare surtax imposed on net investment income.

This summary is based on current provisions of the Code, applicable Treasury regulations promulgated thereunder, judicial opinions, and published rulings of the Internal Revenue Service (the “IRS”), all as in effect on the date of this prospectus and all of which are subject to differing interpretations or change, possibly with retroactive effect. We have not sought, and will not seek, any ruling from the IRS or any opinion of counsel with respect to the tax consequences discussed herein, and there can be no assurance that the IRS will not take a position contrary to the tax consequences discussed below or that any position taken by the IRS would not be sustained.

As used in this discussion, the term “U.S. person” means a person that is, for U.S. federal income tax purposes, (i) a citizen or individual resident of the United States, (ii) a corporation created or organized in the United States or under the laws of the United States or any state thereof or the District of Columbia, (iii) an estate the income of which is subject to U.S. federal income taxation regardless of its source, or (iv) a trust if (A) a court within the United States is able to exercise primary supervision over the administration of the trust and one or more U.S. persons have the authority to control all substantial decisions of the trust, or (B) it has in effect a valid election under applicable Treasury regulations to be treated as a U.S. person. As used in this summary, the term “non-U.S. holder” means a beneficial owner of our Common Stock that is, for U.S. federal income tax purposes, an individual, corporation, estate or trust that is not a U.S. person.

The tax treatment of a partnership (or any other entity or arrangement treated as a partnership for U.S. federal income tax purposes) and each partner thereof will generally depend upon the status and activities of the partnership and such partner. A holder that is treated as a partnership for U.S. federal income tax purposes or a partner in such partnership should consult its own tax advisor regarding the U.S. federal income tax consequences applicable to it and its partners of the ownership and disposition of our Common Stock.

THIS DISCUSSION IS ONLY A SUMMARY OF CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS RELATED TO THE OWNERSHIP AND DISPOSITION OF OUR COMMON STOCK BY NON-U.S. HOLDERS. IT IS NOT TAX ADVICE. EACH PROSPECTIVE INVESTOR SHOULD CONSULT ITS OWN TAX ADVISOR WITH RESPECT TO THE PARTICULAR TAX CONSEQUENCES OF THE OWNERSHIP AND DISPOSITION OF OUR COMMON STOCK, INCLUDING THE APPLICABILITY AND EFFECT OF ANY STATE, LOCAL, AND NON-U.S. TAX LAWS, AS WELL AS U.S. FEDERAL ESTATE AND GIFT TAX LAWS AND ANY APPLICABLE TAX TREATY.

Certain U.S. Federal Income Tax Considerations

Distributions on Common Stock

As discussed under “Dividend Policy” above, we do not anticipate paying dividends. If we pay cash or distribute property to holders of shares of Common Stock, such distributions generally will constitute dividends for U.S. federal income tax purposes to the extent paid from our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. Distributions in excess of current and accumulated earnings and profits will constitute a return of capital that will be applied against and reduce (but not below zero) the non-U.S. holder’s adjusted tax basis in our Common Stock. Any remaining excess will be treated as gain from the sale or exchange of the Common Stock and will be treated as described under “— Gain on Sale, Exchange or Other Taxable Disposition of Common Stock” below.

Dividends paid to a non-U.S. holder that are not effectively connected with the non-U.S. holder’s conduct of a trade or business in the United States generally will be subject to withholding of U.S. federal income tax at a rate of 30% of the gross amount of the dividend or such lower rate as may be specified by an applicable income tax treaty. A non-U.S. holder that wishes to claim the benefit of an applicable tax treaty withholding rate generally will be required to (i) provide to the applicable withholding agent a duly completed and executed IRS Form W-8BEN, or Form W-8BEN-E (or any successor form of the foregoing) certifying under penalties of perjury that such holder is not a U.S. person and is eligible for the benefits of the applicable tax treaty or (ii) if our Common Stock is held through certain foreign intermediaries, satisfy the relevant certification requirements of applicable Treasury regulations. These forms may need to be periodically updated.

A non-U.S. holder eligible for a reduced rate of withholding of U.S. federal income tax pursuant to an income tax treaty may be able to obtain a refund of any excess amounts withheld by timely filing an appropriate claim for refund with the IRS. Non-U.S. holders should consult their own tax advisors regarding their entitlement to benefits under an applicable income tax treaty and the manner of claiming the benefits of such treaty (including, without limitation, the need to obtain a U.S. taxpayer identification number).

Dividends that are effectively connected with a non-U.S. holder’s conduct of a trade or business in the United States (and, if required by an applicable income tax treaty, attributable to a permanent establishment or fixed base maintained by the non-U.S. holder in the United States) generally are subject to U.S. federal income tax on a net income basis at the U.S. federal income tax rates generally applicable to a U.S. person and are not subject to withholding of U.S. federal income tax, provided that the non-U.S. holder establishes an exemption from such withholding by complying with certain certification and disclosure requirements (generally by providing to the applicable withholding agent a duly completed and executed IRS Form W-8ECI (or any successor form thereof)). Any such effectively connected dividends (and, if required, dividends attributable to a U.S. permanent establishment or fixed base) received by a non-U.S. holder that is treated as a foreign corporation for U.S. federal income tax purposes may be subject to an additional branch profits tax at a 30% rate, or such lower rate as may be specified by an applicable income tax treaty.

Gain on Sale, Exchange or Other Taxable Disposition of Common Stock

Subject to the summary below regarding backup withholding and FATCA, any gain recognized by a non-U.S. holder on a sale or other taxable disposition of our Common Stock generally will not be subject to U.S. federal income tax, unless:

(i)the gain is effectively connected with the conduct of a trade or business of the non-U.S. holder in the United States (and, if required by an applicable income tax treaty, is attributable to a U.S. permanent establishment or fixed base of the non-U.S. holder),

(ii)the non-U.S. holder is an individual who is present in the United States for a period or periods aggregating 183 days or more in the taxable year of that disposition, and certain other conditions are met, or

(iii)we are or have been a United States real property holding corporation (a “USRPHC”) for U.S. federal income tax purposes at any time during the shorter of the five-year period ending on the date of disposition or the period that the non-U.S. holder held the Common Stock.

Any gain recognized by a non-U.S. holder that is described in clause (i) of the preceding paragraph generally will be subject to U.S. federal income tax at the income tax rates generally applicable to a U.S. person, and such non-U.S. holder will be required to file a U.S. federal income tax return. Any gain of a non-U.S. holder that is treated as a foreign corporation for U.S. federal income tax purposes that is described in clause (i) above may also be subject to an additional branch profits tax at a 30% rate, or such lower rate as may be specified by an applicable income tax treaty. An individual non-U.S. holder that is described in clause (ii) of such paragraph generally will be subject to a flat 30% tax (or a lower applicable tax treaty rate) on the U.S. source capital gain derived from the disposition, which may be offset by U.S. source capital losses validly claimed during the taxable year of the disposition. With respect to clause (iii) of the preceding paragraph, a U.S. corporation generally is a USRPHC if the fair market value of its U.S. real property interests, as defined in the Code, equals or exceeds 50% of the sum of the fair market value of its worldwide real property interests plus its other assets used or held for use in a trade or business. We believe that we are not currently and do not anticipate becoming a USRPHC. Even if we are or were to become a USRPHC, gain arising from the sale or other taxable disposition by a non-U.S. holder of our Common Stock will not be subject to U.S. federal income tax if our Common Stock is regularly traded on an established securities market and such non-U.S. holder has held at all times during the shorter of the five-year period ending on the date of disposition or the non-U.S. holder’s holding period 5% or less of our Common Stock. If a non-U.S. holder holds or held (at any time during the relevant period) more than 5% of our Common Stock and if we were a USRPHC at any time during the relevant period, such non-U.S. holder generally will be subject to U.S. federal income tax on the net gain derived from a taxable disposition at the income tax rates generally applicable to a U.S. person. Non-U.S. holders are urged to consult their own tax advisors regarding the potential applicability of these rules as well as any income tax treaty in their particular circumstances.

Information Reporting and Backup Withholding

We generally must report annually to the IRS and to each non-U.S. holder of our Common Stock the amount of dividends paid to such holder on our Common Stock, the tax, if any, withheld with respect to those dividends, and such holder’s name and address. Copies of the information returns reporting those dividends and withholding taxes may also be made available to the tax authorities in the country in which the non-U.S. holder is a resident under the provisions of an applicable income tax treaty or agreement. Information reporting also is generally required with respect to the proceeds from sales and other dispositions of our Common Stock to or through the U.S. office (and in certain cases, the foreign office) of a broker, unless the non-U.S. holder establishes that it is not a U.S. person.

Under some circumstances, Treasury regulations require backup withholding of U.S. federal income tax, currently at a rate of 24%, on reportable payments with respect to our Common Stock. A non-U.S. holder generally may eliminate the requirement for backup withholding by providing to the applicable withholding agent certification of its foreign status, under penalties of perjury, on a duly completed and executed IRS Form W-8BEN, IRS Form W-8BEN-E, or other applicable IRS Form W-8 (or any successor form of the foregoing) or by otherwise establishing an exemption. Notwithstanding the foregoing, backup withholding and information reporting may apply if either we or our paying agent has actual knowledge, or reason to know, that a holder is a U.S. person. Backup withholding is not an additional tax. Rather, the amount of any backup withholding will be allowed as a credit against a non-U.S. holder’s U.S. federal income tax liability, if any, and may entitle such non-U.S. holder to a refund, provided that certain required information is timely furnished to the IRS. Non-U.S. holders are urged to consult their own tax advisors regarding the application of backup withholding and the availability of and procedure for obtaining an exemption from backup withholding in their particular circumstances.

FATCA

The Foreign Account Tax Compliance Act provisions of the Hiring Incentives to Restore Employment Act (Sections 1471 to 1474 of the Code) commonly referred to as “FATCA,” and the Treasury regulations and administrative guidance thereunder, generally impose a U.S. federal withholding tax of 30% on certain types of payments, including payments of U.S.- source dividends and payments of gross proceeds from the sale or other

disposition of certain securities producing such U.S.-source dividends made to (i) “foreign financial institutions” unless they agree to collect and disclose to the IRS information regarding their direct and indirect U.S. account holders, and (ii) certain non-financial foreign entities unless they certify certain information regarding their direct and indirect U.S. owners. Additionally, in order to be treated as FATCA compliant, a holder must provide certain documentation (usually an IRS Form W-8BEN or W-8BEN-E) containing information about its identity, its FATCA status and, if required, its direct and indirect U.S. owners. Proposed Treasury regulations have been issued that would eliminate withholding on payments of gross proceeds (but not on payments of dividends). Pursuant to the preamble to the proposed Treasury regulations, we and any withholding agent may (but are not required to) rely on this proposed change to FATCA withholding until the final regulations are issued or the proposed regulations are withdrawn. Foreign financial institutions located in jurisdictions that have an intergovernmental agreement with the United States governing FATCA may be subject to different rules.

We will not pay any additional amounts to non-U.S. holders in respect of any amounts withheld, including pursuant to FATCA. Under certain circumstances, a non-U.S. holder may be eligible for refunds or credits of such taxes. Non-U.S. holders are urged to consult with their own tax advisors regarding the effect, if any, of the FATCA provisions on them based on their particular circumstances.

PLAN OF DISTRIBUTION

We entered into the Purchase Agreement with Aspire Capital on May 12, 2022. The Purchase Agreement provides that, upon the terms and subject to the conditions and limitations set forth therein, Aspire Capital is irrevocably committed to purchase up to an aggregate amount of $100,000,000 of shares of our Common Stock over the 24-month term of the Purchase Agreement, which expires May 12, 2024.

On May 12, 2022, the conditions to the commencement under the Purchase Agreement were satisfied. On any business day over the 24-month term of the Purchase Agreement (until May 12, 2024), we have the right, in our sole discretion, to present Aspire Capital with a Purchase Notice directing Aspire Capital to purchase up to 200,000 Purchase Shares per business day. Aspire Capital will not be required to buy Purchase Shares pursuant to a Purchase Notice that was received by Aspire Capital on any business day on which the last closing trade price of our Common Stock on The Nasdaq Capital Market (or alternative national exchange in accordance with the Purchase Agreement) is below the Floor Price. The Purchase Price per Purchase Share pursuant to such Purchase Notice is the lower of:

•the lowest sale price of our Common Stock on the date of sale; or

•the arithmetic average of the three lowest closing sale prices for our Common Stock during the ten consecutive trading days ending on the trading day immediately preceding the purchase date.

The applicable Purchase Price will be determined prior to delivery of any Purchase Notice.

In addition, on any date on which we submit a Purchase Notice to Aspire Capital for the purchase of at least 100,000 Purchase Shares, we also have the right to present Aspire Capital with a VWAP Purchase Notice directing Aspire Capital to purchase an amount of our Common Stock equal to up to 30% of the aggregate shares of our Common Stock traded on the VWAP Purchase Date, subject to the VWAP Purchase Share Volume Maximum. The VWAP Purchase Price shall be the lesser of the closing sale price on the VWAP Purchase Date or 95% of the volume-weighted average price for our Common Stock traded on (i) the VWAP Purchase Date, if the aggregate shares to be purchased on that date have exceeded the VWAP Purchase Share Volume Maximum, or (ii) the portion of such business day until such time as the aggregate shares to be purchased will equal the VWAP Purchase Share Volume Maximum.

Further, if on the VWAP Purchase Date the sale price of our Common Stock falls below the VWAP Minimum Price Threshold, the VWAP Purchase Price will be determined using the percentage in the VWAP Purchase Notice of the total shares traded for such portion of the VWAP Purchase Date prior to the time that the sale price of our Common Stock fell below the VWAP Minimum Price Threshold and the VWAP Purchase Price will be 95% of the volume-weighted average price of our Common Stock sold during such portion of the VWAP Purchase Date prior to the time that the sale price of our Common Stock fell below the VWAP Minimum Price Threshold.

The number of Purchase Shares covered by and timing of each Purchase Notice or VWAP Purchase Notice are determined by us, at our sole discretion. The aggregate number of shares that we can sell to Aspire Capital under the Purchase Agreement may in no case exceed 35,000,000 shares of our Common Stock. Aspire Capital has no right to require any sales by us, but is obligated to make purchases from us as we direct in accordance with the Purchase Agreement. There are no limitations on use of proceeds, financial or business covenants, restrictions on future financings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement. We did not pay any additional amounts to reimburse or otherwise compensate Aspire Capital in connection with the transaction.

Aspire Capital is an “underwriter” within the meaning of the Securities Act.

Neither we nor Aspire Capital can presently estimate the amount of compensation that any agent will receive. We know of no existing arrangements between Aspire Capital, any other stockholder, broker, dealer, underwriter or agent relating to the sale or distribution of the shares offered by this prospectus supplement. At the time a particular offer of shares is made, a prospectus supplement, if required, will be distributed that will set forth the names of any agents, underwriters or dealers and any other required information.

We will pay all of the expenses incident to the registration, offering and sale of the shares by us to Aspire Capital pursuant to the Purchase Agreement. We have agreed to indemnify Aspire Capital and certain other persons against certain liabilities in connection with the offering of shares of Common Stock offered hereby, including liabilities arising under the Securities Act or, if such indemnity is unavailable, to contribute amounts required to be paid in respect of such liabilities. Aspire Capital has agreed to indemnify us against liabilities under the Securities Act that may arise from certain written information furnished to us by Aspire Capital specifically for use in this prospectus or, if such indemnity is unavailable, to contribute amounts required to be paid in respect of such liabilities.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers and controlling persons, we have been advised that in the opinion of the SEC this indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Aspire Capital and its affiliates have agreed not to engage in any direct or indirect short selling or hedging of our Common Stock during the term of the Purchase Agreement.

We have advised Aspire Capital that it is required to comply with Regulation M promulgated under the Securities Exchange Act of 1934, as amended, or the Exchange Act. With certain exceptions, Regulation M precludes a selling stockholder, any affiliated purchasers and any broker-dealer or other person who participates in the distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase, any security which is the subject of the distribution until the entire distribution is complete. Regulation M also prohibits any bids or purchases made in order to stabilize the price of a security in connection with the distribution of that security. All of the foregoing may affect the marketability of the shares offered by this prospectus.

We may suspend the sale of shares to Aspire Capital pursuant to this prospectus supplement for certain periods of time for certain reasons, including if the prospectus is required to be supplemented or amended to include additional material information.

This offering, as it relates to Aspire Capital, will terminate on the date that all shares offered by this prospectus supplement have been sold to Aspire Capital, or earlier if we exercise our termination rights under the Purchase Agreement under certain circumstances. See “The Aspire Capital Transaction—Our Termination Rights” above for a description of such termination rights.

LEGAL MATTERS

Jones Day will pass upon the validity of the securities being offered hereby.

EXPERTS

The consolidated financial statements of Athersys, Inc. appearing in Athersys, Inc.’s Annual Report (Form 10-K) for the year ended December 31, 2021 have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their report thereon (which contains an explanatory paragraph describing conditions that raise substantial doubt about the Company’s ability to continue as a going concern) included therein, and incorporated herein by reference. Such financial statements are, and audited financial statements to be included in subsequently filed documents will be, incorporated herein by reference in reliance upon the report of Ernst & Young LLP pertaining to such financial statements (to the extent covered by consents filed with the Securities and Exchange Commission) given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the informational reporting requirements of the Exchange Act. We file reports, proxy statements and other information with the SEC. Our SEC filings are available over the Internet at the SEC’s website at http://www.sec.gov.

We make available, free of charge, on our website at http://www.athersys.com, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports and statements as soon as reasonably practicable after they are filed with the SEC. The contents of our and the SEC’s websites are not part of this prospectus supplement or the accompanying prospectus, and the reference to our and the SEC’s websites do not constitute incorporation by reference into this prospectus supplement or the accompanying prospectus of the information contained at those sites, other than documents we file with the SEC that are specifically incorporated by reference into this prospectus supplement and the accompanying prospectus.

INFORMATION WE INCORPORATE BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus supplement and the accompanying prospectus the information in documents we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus supplement and the accompanying prospectus, and information that we file later with the SEC will automatically update and supersede this information. Any statement contained in any document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus supplement and the accompanying prospectus to the extent that a statement contained in or omitted from this prospectus supplement or the accompanying prospectus, or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein or therein, modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement or the accompanying prospectus.

We incorporate by reference the documents listed below and any future documents that we file with the SEC (excluding any portion of such documents that are furnished and not filed with the SEC) under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus supplement until the offering of the securities is terminated:

•our Annual Report on Form 10-K for the year ended December 31, 2021; •our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2022;

•the description of our Common Stock set forth in the registration statement on Form 8-A filed on December 6, 2007, as updated by Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on March 24, 2022, and all amendments and reports filed for the purpose of updating that description. We will not, however, incorporate by reference in this prospectus supplement or the accompanying prospectus any documents or portions thereof that are not deemed “filed” with the SEC, including any information furnished pursuant to Item 2.02 or Item 7.01 of our current reports on Form 8-K unless, and except to the extent, specified in such current reports.

We will provide you with a copy of any of these filings (other than an exhibit to these filings, unless the exhibit is specifically incorporated by reference into the filing requested) at no cost, if you submit a request to us by writing or telephoning us at the following address and telephone number:

| | |

| Athersys, Inc. |

| 3201 Carnegie Avenue |

| Cleveland, Ohio 44115-2634 |

| (216) 431-9900 |

| Attn: Secretary |

Prospectus

35,000,000 Shares

Common Stock

We may from time to time issue up to 35,000,000 shares of our common stock in one or more offerings.

Each time we sell shares of common stock, we will provide the specific terms of the offering in a supplement to this prospectus. You should read this prospectus and the applicable prospectus supplement carefully before you invest in our common stock.

We may sell shares of our common stock directly or to or through underwriters or dealers, and also to other purchasers or through agents. The names of any underwriters or agents that are included in a sale of shares of our common stock to you, and any applicable commissions or discounts, will be stated in an accompanying prospectus supplement.

Investing in our common stock involves risk. Please read carefully the section entitled “Risk Factors” beginning on page 1 of this prospectus. Our common stock is listed on the NASDAQ Capital Market under the symbol “ATHX.” On May 28, 2020, the closing price of our common stock on the NASDAQ Capital Market was $2.78 per share.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is June 9, 2020.

About This Prospectus

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the “SEC,” using a “shelf” registration process. Under this shelf process, we may sell shares of our common stock in one or more offerings.

This prospectus provides you with a general description of the common stock we may offer. Each time we sell shares of our common stock, we will provide a prospectus supplement that will contain specific information about the terms of that offering. For a more complete understanding of the offering of our common stock, you should refer to the registration statement, including its exhibits. The prospectus supplement may also add, update or change information contained in this prospectus. You should read both this prospectus and any prospectus supplement together with additional information under the heading “Where You Can Find More Information” and “Information We Incorporate By Reference.”

We have not authorized anyone to provide you with different information from the information contained or incorporated by reference in this prospectus and in any prospectus supplement or in any free writing prospectus that we may provide you. You should not assume that the information contained in this prospectus, any prospectus supplement, any document incorporated by reference or any free writing prospectus is accurate as of any date, other than the date mentioned on the cover page of these documents. We are not making offers to sell shares of our common stock in any jurisdiction in which an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation.

References in this prospectus to the terms “we,” “us” or “the Company” or other similar terms mean Athersys, Inc. and its consolidated subsidiaries, unless we state otherwise or the context indicates otherwise.

Where You Can Find More Information

We are subject to the informational reporting requirements of the Securities Exchange Act of 1934, or the “Exchange Act.” We file reports, proxy statements and other information with the SEC. Our SEC filings are available at the SEC’s website at http://www.sec.gov. We make available, free of charge, on our website at http://www.athersys.com, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports and statements as soon as reasonably practicable after they are filed with the SEC. The contents of our website are not part of this prospectus, and the reference to our website does not constitute incorporation by reference into this prospectus of the information contained at that site, other than documents we file with the SEC that are incorporated by reference into this prospectus.

Information We Incorporate By Reference

The SEC allows us to “incorporate by reference” into this prospectus the information in documents we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. Any statement contained in any document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in or omitted from this prospectus or any accompanying prospectus supplement, or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein, modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We incorporate by reference the documents listed below and any future documents that we file with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (1) after the date of the initial filing of the registration statement of which this prospectus forms a part prior to the effectiveness of the registration statement and (2) after the date of this prospectus until the offering of the shares of our common stock is terminated:

•our Annual Report on Form 10-K for the year ended December 31, 2019; •our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2020; •the description of our common stock set forth in Exhibit 4.3 to our Annual Report on Form 10-K for the year ended December 31, 2019, which updated the description thereof set forth in our Registration Statement on Form 8-A filed with the SEC on December 6, 2007, and all subsequently filed amendments and reports updating that description. We will not, however, incorporate by reference in this prospectus any documents or portions thereof that are not deemed “filed” with the SEC, including any information furnished pursuant to Item 2.02 or Item 7.01 of our current reports on Form 8-K unless, and except to the extent, specified in such current reports.

We will provide you with a copy of any of these filings (other than an exhibit to these filings, unless the exhibit is specifically incorporated by reference into the filing requested) at no cost, if you submit a request to us by writing or telephoning us at the following address and telephone number:

Athersys, Inc.

3201 Carnegie Avenue

Cleveland, Ohio 44115-2634

Phone: (216) 431-9900

Attention: Secretary

The Company

We are an international biotechnology company that is focused primarily in the field of regenerative medicine. We are committed to the discovery and development of best-in-class therapies designed to extend and enhance the quality of human life and have established a portfolio of therapeutic product development programs to address significant unmet medical needs in multiple disease areas. Our MultiStem cell therapy, a patented and proprietary allogeneic stem cell product, is our lead platform product and is currently in clinical development. Our current clinical development programs are focused on treating critical care and other conditions where current standard of care is limited or inadequate for many patients. These represent major areas of clinical need, as well as substantial commercial opportunities.

Corporate Information

We are incorporated under the laws of the State of Delaware. Our principal executive offices are located at 3201 Carnegie Avenue, Cleveland, Ohio 44115-2634. Our telephone number is (216) 431-9900. Our website is http://www.athersys.com. The information contained on or accessible through our website is not part of this prospectus, other than the documents that we file with the SEC that are specifically incorporated by reference into this prospectus.

Risk Factors

Investing in our common stock involves risk. Prior to making a decision about investing in our common stock, you should carefully consider the specific factors discussed under the heading “Risk Factors” in our most recent annual report on Form 10-K, which is incorporated herein by reference and may be amended, supplemented or superseded from time to time by our quarterly reports on Form 10-Q and other reports we file with the SEC in the future. If any of these risks actually occurs, our business, results of operations and financial condition could suffer. In that case, the trading price of our common stock could decline, and you could lose all or a part of your investment.

Disclosure Regarding Forward-Looking Statements