Current Report Filing (8-k)

May 02 2022 - 4:07PM

Edgar (US Regulatory)

0000906709

false

0000906709

2022-04-26

2022-04-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report (Date of earliest event reported):

May 2, 2022 (April 26, 2022)

NEKTAR THERAPEUTICS

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

0-24006 |

|

94-3134940 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

455 Mission Bay Boulevard South

San Francisco, California 94158

(Address of Principal Executive Offices and

Zip Code)

Registrant’s telephone number, including

area code: (415) 482-5300

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the

Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value |

|

NKTR |

|

NASDAQ Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05 Costs Associated with Exit or Disposal

Activities.

On April 26, 2022, duly

authorized officers of Nektar Therapeutics (“Nektar”) approved certain strategic, operational and organizational steps for

Nektar to undertake in connection with a new strategic reorganization plan and cost restructuring plan (together, the “Reorganization

Plans”). Pursuant to the Reorganization Plans, Nektar will focus on its key pipeline programs, NKTR-358 and NKTR-255, and its core

research programs. Nektar has also undertaken certain cost-reduction initiatives, including a reduction in its workforce by approximately

70%.

In connection with these

actions, Nektar expects to take an impairment charge of $150 million to $160 million in total, a substantial portion of which we

expect to recognize during the quarter ending June 30, 2022. The restructuring charge includes: severance and benefits

for approximately 500 employees terminated on April 27, 2022 totaling approximately $30 million to $35 million, our share of future

costs to wind-down the bempegaldesleukin clinical development program totaling approximately $65 million to $75 million, and an

impairment charge associated with the portion of Nektar’s leased office space in one of our facilities in San Francisco,

California that will no longer be occupied. Pursuant to the Reorganization Plans, we expect to exit the leased office space and seek

to sublease the premises. Based on our estimates of current market conditions for

sublease income and our estimated timing of entering into a sublease, we currently estimate that we may recognize an impairment

charge of approximately $40 million to $50 million. The ultimate amount of the impairment charge may differ if the potential

sublease income is higher or lower than our current estimates, if the estimated time to enter into a sublease is different than

expected, or if we are unable to enter into a sublease with acceptable terms.

Item 2.06 Material

Impairments

Please

see the disclosure relating to the estimated impairment charge in connection with the Reorganization Plans set forth under Item 2.05 “Costs

Associated with Exit or Disposal Activities” of this Current Report on Form 8-K, which is incorporated by reference into

this Item 2.06.

Cautionary Note Regarding

Forward-Looking Statements

This

Current Report on Form 8-K contains forward-looking statements which can be identified by words such as: “expect,” “undertake,”

“will,” “may,” “estimate,” “future,” “seek,” and similar references to future

periods. Examples of forward-looking statements include, among others, statements Nektar makes regarding the future development plans

for NKTR-358, NKTR-255 and other drug candidates in research programs, Nektar’s cost-reduction initiatives, and the estimated impairment

charges and costs that Nektar may incur in connection with the reorganization and restructuring activities described above. Forward-looking

statements are neither historical facts nor assurances of future performance. Instead, they are based only on Nektar’s current beliefs,

expectations and assumptions regarding the future of its business, future plans and strategies, anticipated events and trends, the economy

and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks

and changes in circumstances that are difficult to predict and many of which are outside of Nektar’s control. Nektar’s actual

results may differ materially from those indicated in the forward-looking statements. Therefore, these forward-looking statements should

not be relied upon. Important factors that could cause actual results to differ materially from those indicated in the forward-looking

statements include, among others: (i) Nektar’s statements regarding the therapeutic potential of NKTR-358, NKTR-255 and other drug

candidates are subject to change as research and development continue to generate new safety and efficacy data; (ii) NKTR-358, NKTR-255

and Nektar’s other drug candidates are investigational agents and continued research and development for these drug candidates is

subject to substantial risks, including negative safety and efficacy findings in ongoing studies (notwithstanding positive findings in

earlier preclinical and clinical studies); (iii) NKTR-358, NKTR-255 and Nektar’s other drug candidates are in various stages of

clinical development and the risk of failure is high and can unexpectedly occur at any stage prior to regulatory approval; (iv) the timing

of the commencement or end of clinical trials and the availability of clinical data may be delayed or unsuccessful due to challenges caused

by the COVID-19 pandemic, regulatory delays, slower than anticipated patient enrollment, manufacturing challenges, changing standards

of care, evolving regulatory requirements, clinical trial design, clinical outcomes and competitive factors; (v) Nektar may not achieve

the expected costs savings it expects from the restructuring and reorganization; (vi) patents may not issue from Nektar’s patent

applications for its drug candidates, patents that have issued may not be enforceable, or additional intellectual property licenses from

third parties may be required; and (vii) certain other important risks and uncertainties set forth in Nektar’s Annual Report on

Form 10-K filed with the Securities and Exchange Commission on February 28, 2022. Any forward-looking statement made by

us in this Current Report on Form 8-K is based only on information currently available to Nektar and speaks only as of the date on which

it is made. Nektar undertakes no obligation to update any forward-looking statement, whether written or oral, that may be made from time

to time, whether as a result of new information, future developments or otherwise.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

NEKTAR THERAPEUTICS |

| |

|

|

| Date: May 2, 2022 |

By: |

/s/ Mark A. Wilson |

| |

|

Mark A. Wilson |

| |

|

General Counsel and Secretary |

2

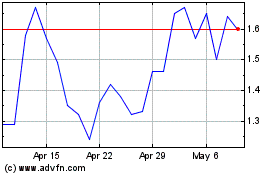

Nektar Therapeutics (NASDAQ:NKTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nektar Therapeutics (NASDAQ:NKTR)

Historical Stock Chart

From Apr 2023 to Apr 2024