Amended Statement of Beneficial Ownership (sc 13d/a)

March 28 2022 - 4:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 7)

Alterity Therapeutics Limited

(Name of Issuer)

Ordinary shares (“Ordinary Shares”)

(Title of Class of Securities)

Q7739U108

(CUSIP Number)

Amit Shashank, Esq.

Life Biosciences LLC

75 Park Plaza, Level 3

Boston, MA 02116

Telephone No.: 857-400-9245

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

March 24, 2022

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of 240.13d-1(e), 240.13d-1(f)

or 240.13d-1(g), check the following box ¨.

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See 240.13d-7(b) for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

SCHEDULE 13D

| CUSIP No. Q7739U108 |

| |

| |

1 |

Names of Reporting Person

Life Biosciences LLC |

| |

| |

2 |

Check the Appropriate Box if a Member of a Group |

| |

|

(a) |

o |

| |

|

(b) |

o |

| |

| |

3 |

SEC Use Only |

| |

| |

4 |

Source of Funds (See Instructions)

WC |

| |

| |

5 |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

| |

| |

6 |

Citizenship or Place of Organization

Delaware |

| |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7 |

Sole Voting Power

238,105,533* |

| |

| 8 |

Shared Voting Power

None |

| |

| 9 |

Sole Dispositive Power

238,105,533* |

| |

| 10 |

Shared Dispositive Power

None |

| |

| |

11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

238,105,533* |

| |

| |

12 |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

| |

| |

13 |

Percent of Class Represented by Amount in Row (11)

9.9%** |

| |

| |

14 |

Type of Reporting Person (See Instructions)

OO |

* The 238,105,533 Ordinary Shares referenced herein

are evidenced by 3,968,425 American Depositary Shares (“ADSs”). Each ADS represents sixty (60) Ordinary Shares.

** This calculation is based on information publicly

provided by the Issuer that 2,406,874,578 Ordinary Shares, including Ordinary Shares evidenced by ADSs, were outstanding as of December

31, 2021.

This Amendment No. 7 to Schedule 13D (the “Amendment”)

is being filed by Life Biosciences LLC, a limited liability company organized under the laws of Delaware (the “Reporting Person”

or “Life”), to amend the Statement on Schedule 13D originally filed with the Securities and Exchange Commission on

April 18, 2019, as amended on December 23, 2019, July 6, 2020, October 23, 2020, November 24, 2020, July 8, 2021 and March 4, 2022 (the

“Schedule 13D”), with respect to the ordinary shares (the “Ordinary Shares”) of Alterity Therapeutics

Limited (the “Issuer”).

Unless specifically amended hereby, the disclosure

set forth in the Schedule 13D shall remain unchanged. Capitalized terms used but not otherwise defined in this Amendment shall have the

meanings set forth in the Schedule 13D.

Item 4. Purpose of the Transaction

Item 4 of the Schedule 13D is hereby

amended and supplemented as follows:

Between March 7, 2022

and March 24, 2022, the Reporting Person disposed of an aggregate of 393,297 ADSs, representing the equivalent of 23,597,820 Ordinary

Shares, pursuant to the 10b5-1 Plan. On March 24, 2022, upon the disposition of all shares subject thereto, the 10b5-1 Plan terminated

in accordance with it terms.

Item 5. Interest in Securities of the Issuer

Item 5 of the Schedule 13D is hereby amended and restated in its entirety

by the following:

(a)–(b)

The Reporting Person is the beneficial owner of 238,105,533 Ordinary Shares of the Issuer evidenced bv 3,968,425 ADSs, representing approximately

9.9% of the outstanding Ordinary Shares of the Issuer based upon 2,406,874,578 Ordinary Shares, including Ordinary Shares evidenced by

ADSs, outstanding as of December 31, 2021.

| (c) | From March 7, 2022 through March 24, 2022, the Reporting Person disposed of 393,297 ADSs, representing

the equivalent of 23,597,820 Ordinary Shares, in a series of transactions pursuant to the 10b5-1 Plan at prices ranging from

$0.7026 to $0.7819 per ADS in open market transactions on the NASDAQ Capital Market. Details

by date, listing the number of ADSs disposed of and the weighted average price per ADS are provided below. The Reporting Person

undertakes to provide, upon request by the staff of the SEC, the Issuer, or a security holder of the Issuer, full information regarding

the number of ADSs sold at each separate price for each transaction. |

| Date | |

ADSs Disposed Of | | |

Weighted Average Price Per ADS | |

| March 7, 2022 | |

| 41,066 | | |

$ | 0.7503 | |

| March 9, 2022 | |

| 30,191 | | |

$ | 0.7505 | |

| March 10, 2022 | |

| 16,921 | | |

$ | 0.7502 | |

| March 15, 2022 | |

| 46,663 | | |

$ | 0.7026 | |

| March 16, 2022 | |

| 91,470 | | |

$ | 0.7064 | |

| March 17, 2022 | |

| 20,690 | | |

$ | 0.7211 | |

| March 18, 2022 | |

| 49,202 | | |

$ | 0.7522 | |

| March 21, 2022 | |

| 8,905 | | |

$ | 0.7596 | |

| March 22, 2022 | |

| 24,263 | | |

$ | 0.7680 | |

| March 23, 2022 | |

| 19,669 | | |

$ | 0.7819 | |

| March 24, 2022 | |

| 44,257 | | |

$ | 0.7806 | |

Except for the foregoing and the disposal of 136,703 ADSs,

representing the equivalent of 8,202,180 Ordinary Shares, between March 2, 2022 through March 4, 2022 in a series of transactions pursuant

to the 10b5-1 Plan at prices ranging from $0.7579 to $0.8202 per ADS as reported on the Reporting Person’s Amendment No. 6 to Schedule

13D filed on March 4, 2022, the Reporting Person has not effected any transactions in Ordinary Shares, including Ordinary Shares evidenced

by ADSs, in the past 60 days.

| (d) | To the knowledge of the Reporting Person, none of the persons set forth on Schedule I hereto has the right to receive or the power

to direct the receipt of dividends from, or the proceeds from the sale of, the foregoing securities. |

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: March 28, 2022

| |

LIFE BIOSCIENCES LLC |

| |

|

|

| |

By: |

/s/Amit Shashank, Esq. |

| |

Name: |

Amit Shashank, Esq. |

| |

Title: |

General Counsel |

Schedule I

DIRECTORS AND EXECUTIVE OFFICERS LIFE BIOSCIENCES

LLC

The operating agreement of Life Biosciences LLC

(the “Company”) provides that the Company’s directors shall constitute the managers for purposes of the Delaware Limited

Liability Company Act and shall have authority to delegate their day-to-day management responsibilities to one or more officers of the

Company. The name, function, citizenship and present principal occupation or employment of each of the Company’s directors and executive

officers are set forth below. Unless otherwise indicated below, (i) each occupation set forth opposite an individual’s name refers

to employment with Life Biosciences Inc. and (ii) the business address of each director and executive officer of the Company is 75 Park

Plaza, Level 3, Boston, MA 02116.

|

Name |

Relationship

to

Life Biosciences LLC |

Present

Principal Occupation |

Citizenship |

| Mehmood Khan, MD |

Executive Chairman |

Executive Chairman |

United States |

| Gerald McLaughlin |

Chief Executive Officer and Director |

Chief Executive Officer |

United States |

| David Sinclair, PhD |

Director |

Professor of Genetics, Harvard Medical School |

Australia |

| Ilan Stern |

Director |

Chief Investment Officer, 166 2nd LLC |

United States |

| Bracken Darrell |

Director |

Chief Executive Officer, Logitech International S.A. |

United States |

| Stuart Gibson |

Director |

Co-Chief Executive Officer, ESR Cayman Limited |

United Kingdom |

| William Sullivan |

Chief Financial Officer |

Chief Financial Officer |

United States |

| Amit Shashank |

General Counsel |

General Counsel |

United States |

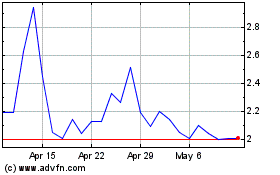

Alterity Therapeutics (NASDAQ:ATHE)

Historical Stock Chart

From Mar 2024 to Apr 2024

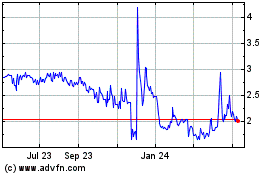

Alterity Therapeutics (NASDAQ:ATHE)

Historical Stock Chart

From Apr 2023 to Apr 2024